Abstract

The research problem addressed in this article concerns the formation of a business model in an energy company as a consequence of the European Green Deal. The paper seeks answers to three questions: (1) What is the significance of the European Green Deal for the business model of the examined energy company? (2) Which elements of the business model of the studied energy company take the form of sustainable ones? (3) In what direction is the business model of the analysed energy company evolving? The subject of the study is the business model of the Tauron Capital Group. The business model is analysed in the context of the requirements for climate protection formulated in the European Green Deal. A single case study was used. As a result of the study, two research statements were adopted: (1) Economic regulations in the area of the European Green Deal lead to changes in the business model of the examined energy company. (2) The examined energy company through the implementation of sustainable business practices aims to achieve sustainable production. The current activities of the Tauron Capital Group are focused on improving energy efficiency, circular economy principles and renewable energy sources.

1. Introduction

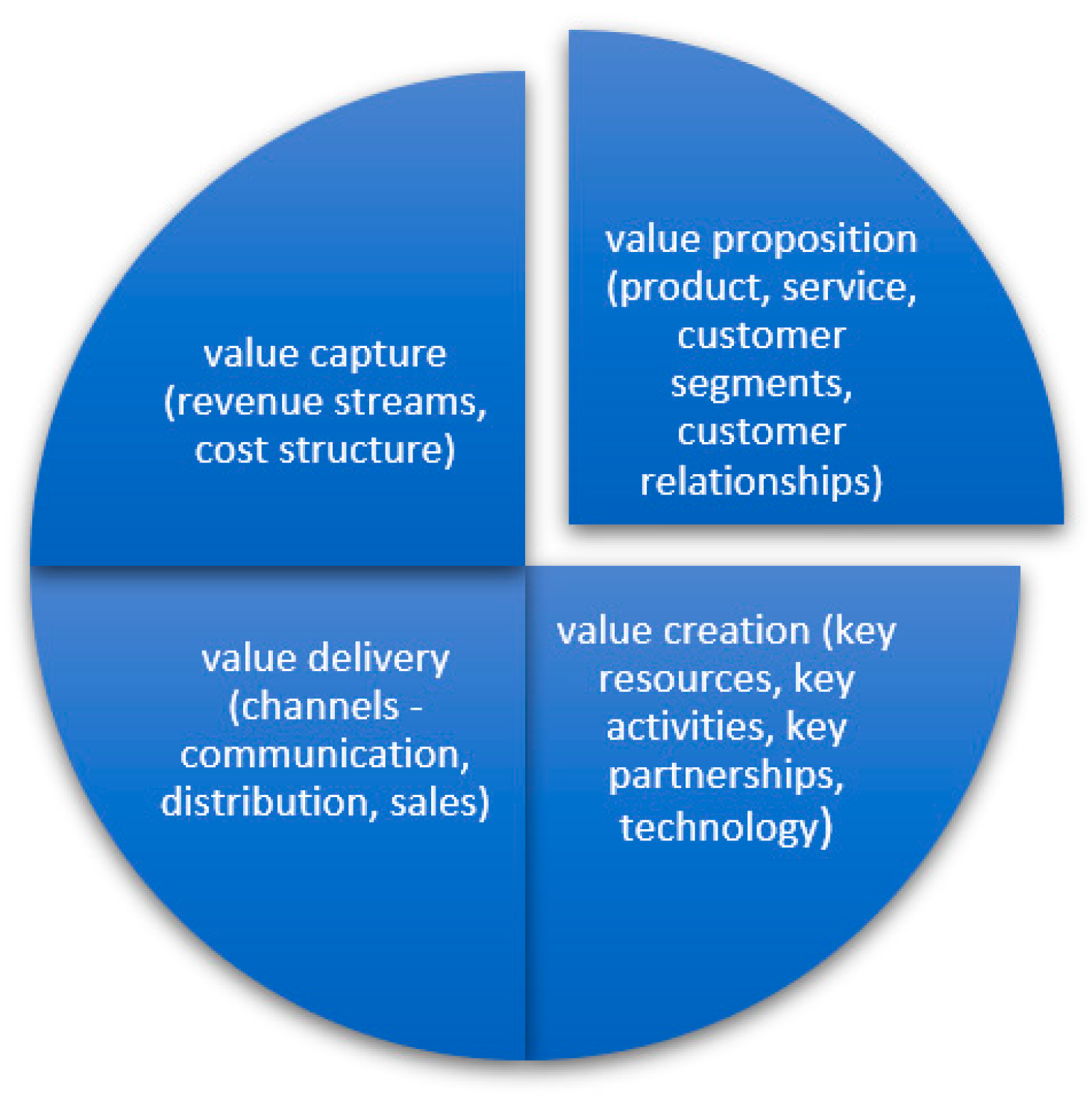

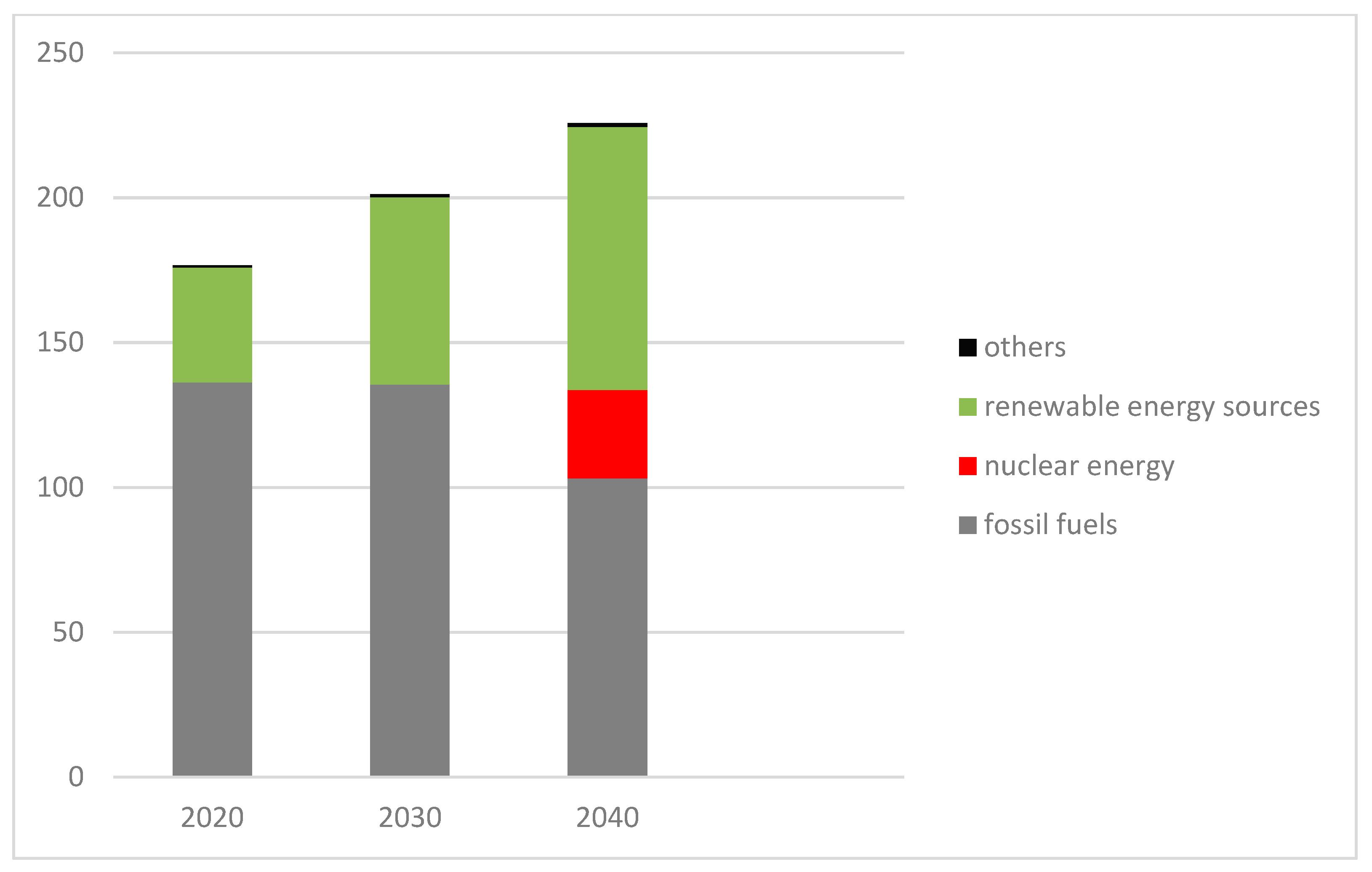

1.1. Traditional Business Models

Every company has a specific business model [1]. The model is an expression of the company’s business logic. The business model adopted by the enterprise is its answer to the questions of value delivered to customers, the ways of delivering it and the financial consequences [2]. In a market economy, the business model may thus constitute the competitive advantage of a given company [1,3]. The business model is formulated by the company’s management based on their own experience and their assumptions about customers’ expectations [1,4]. The business model is about how to create value, how to deliver it to customers and how to capture value [1]. Value proposition and value communication can also be added [5]. However, communicating value can be considered together with delivering value. Hence, business models are defined as “simplified representations of the value proposition, value creation and delivery, and value capture elements and the interactions between these elements within an organisational unit” [6] (p. 402). The business model can be represented as a circle, as in Figure 1.

Figure 1.

Business model components. Prepared on the basis of [5] (p. 24), [6] (p. 402), [7] (p. 43), [8] (pp. 16–19), [9] (p. 9, 12). The figure was created using the program Microsoft® Word for Microsoft 365 MSO.

Value proposition refers to the products and services offered by a company [2,9]. It is addressed to a specific customer segment and concerns the benefits that a company offers to its customers [8]. Value proposition is also the establishment of a specific type of relationship between a company and its customer segment (e.g., personal, automated). [8]. The value proposition stage seeks answers to questions about value, i.e., what value is being delivered and to whom it is being delivered [9]. Value creation is rooted in a company’s potential, in its resources, activities, established partnerships and the characteristics of its technology and products. Value creation is the creative combination of what a company’s employees can do and what the company has at its disposal [5,8,9]. In the value creation phase, the question of how companies capture value by expanding new business opportunities, generating new revenue streams or conquering new markets is sought [9]. Delivering value is how a company interacts with its customers [2]. It describes how, through communication, distribution and sales channels, the value generated is delivered to the target market segment [5,8]. The type of channel determines the complexity of the product and its added value [10]. The way value is delivered to customers must be tailored to customer preferences [1]. This stage seeks to answer the question of how value is delivered to the company’s customers [9]. Value capture, on the other hand, is a company’s ability to profit from the value that has been created [5]. Value capture takes place in the market [11]. Value capture is the revenue stream generated by a business and its cost structure [2]. The value capture stage seeks answers to two basic questions, i.e., how the company generates revenue and how it captures value from other companies [9]. In business management, the category of value therefore becomes crucial. Value is considered both from the perspective of the customer, as well as a specific organizational architecture or economic dimension [12].

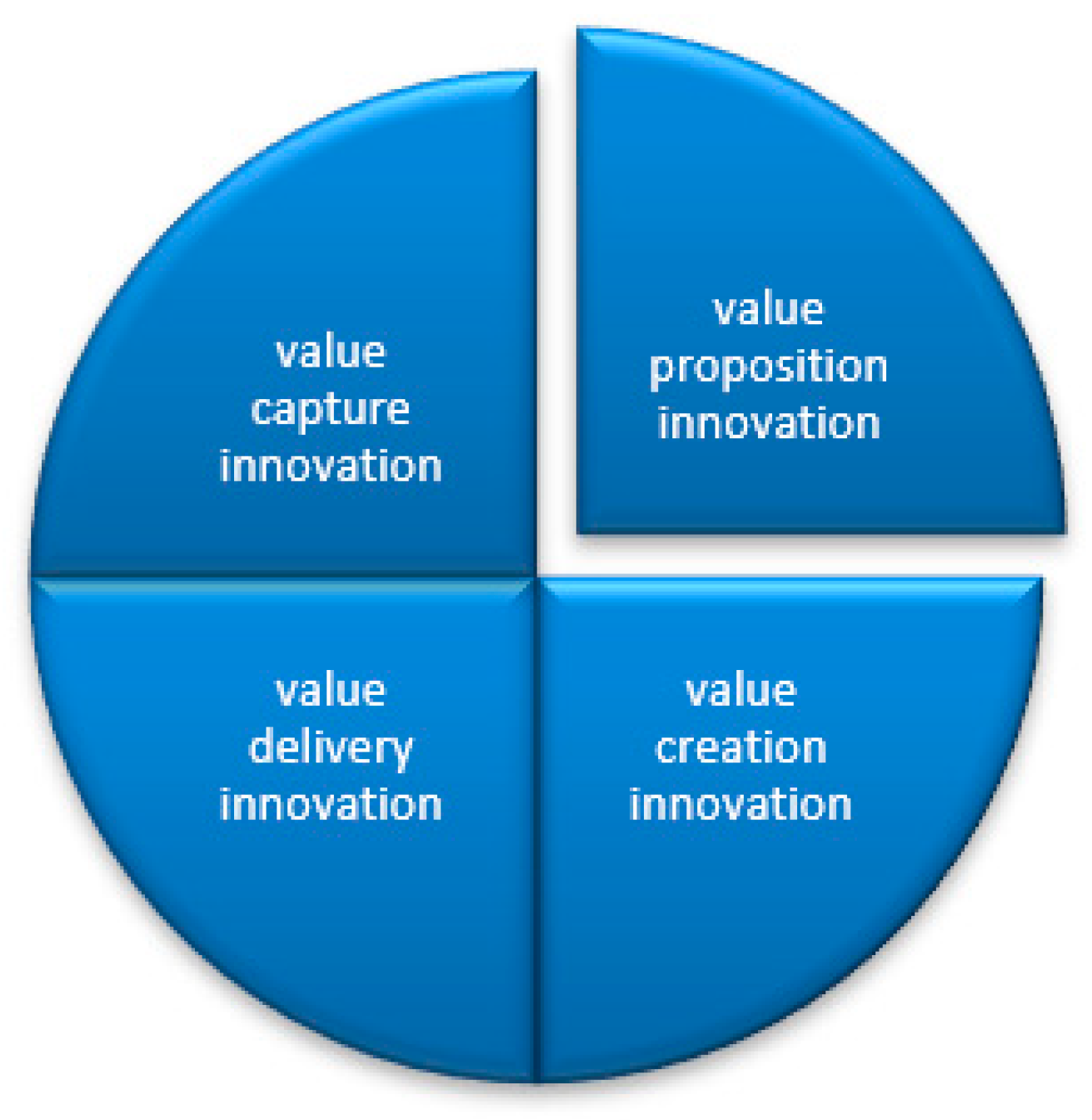

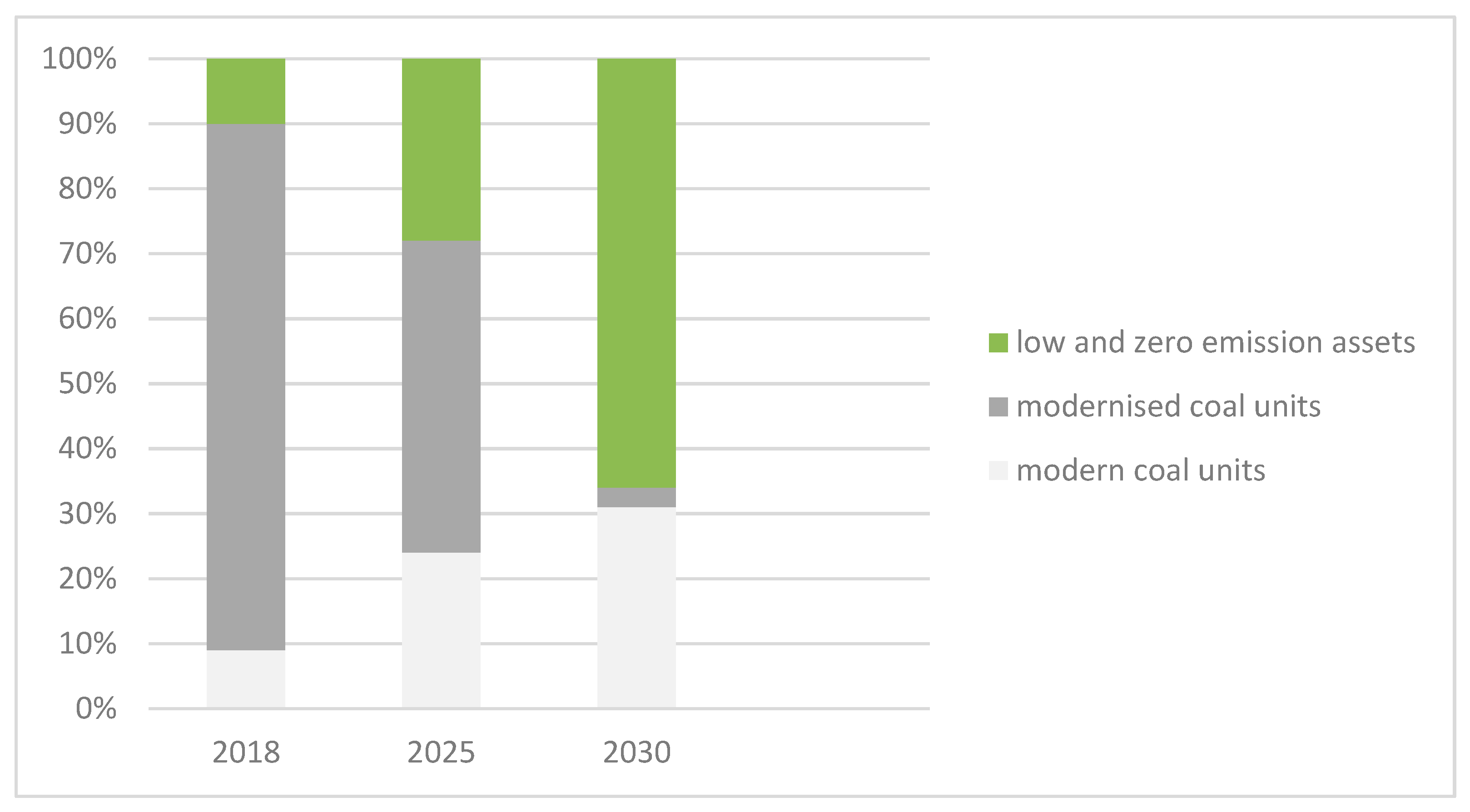

1.2. Business Model Innovation

The shape of business models is influenced by technological progress. It often results in changes to existing business models [10]. Technological change stimulates the creation of new solutions, new products or a different perspective on the process of satisfying customer needs [1]. Technological progress has an impact on innovation processes taking place in enterprises. However, not only the ability to absorb new technological solutions, but also the ability to generate not only product innovation, but also process and organisational innovation is important. Nowadays, the company’s focus on innovation is the key to gaining a competitive advantage on the market. It allows the company to stand out in a highly competitive environment [13]. The survival of a company in the marketplace is determined by its ability to adapt its business model to changing environmental conditions, to modify it or to replicate it [3]. Nowadays, the absorptive capacity and the organizational learning of enterprises are important [14]. Companies must constantly evolve and adapt to the changing environment [15]. As a result, in many companies, traditional business models are transforming and taking the form of innovative business models. The transformation may concern the whole business model or its individual elements or their combination [6]. Innovation can therefore be about proposing value or/and creating value or/and delivering value or/and capturing value, as shown in Figure 2.

Figure 2.

Business model innovation components. The figure was created using Microsoft® Word for Microsoft 365 MSO.

Innovation in the area of value proposition can concern both products and services. It includes technological innovations as well as new ways of offering existing products and services [8]. Very often the same product offered on the market in a different way can bring different effects to the company, often more beneficial [3,16]. Innovation can also relate to a new, more efficient way of segmenting customers, or customer relationships, e.g., through automation [8]. In the case of innovation in the area of value creation, new ways of managing resources or improving the efficiency of key activities should be mentioned. At this point, it should be added that the position of a given enterprise in the supply chain and the degree of its integration are important for the creation of business model innovations [17]. This is about the freedom with which a company can shape its own business model. Inter-organisational cooperation is also important in creating business model innovations [18]. Together with partners, a new business model innovation can be developed. As far as innovations in the area of providing value are concerned, they may refer to new shaping of sales channel types (direct, indirect) or innovative ways of after-sales service [8]. In the case of innovations in the area of value capture, these may concern new ways of generating revenue streams, as well as a shift from a cost-oriented to a value-oriented business model [8].

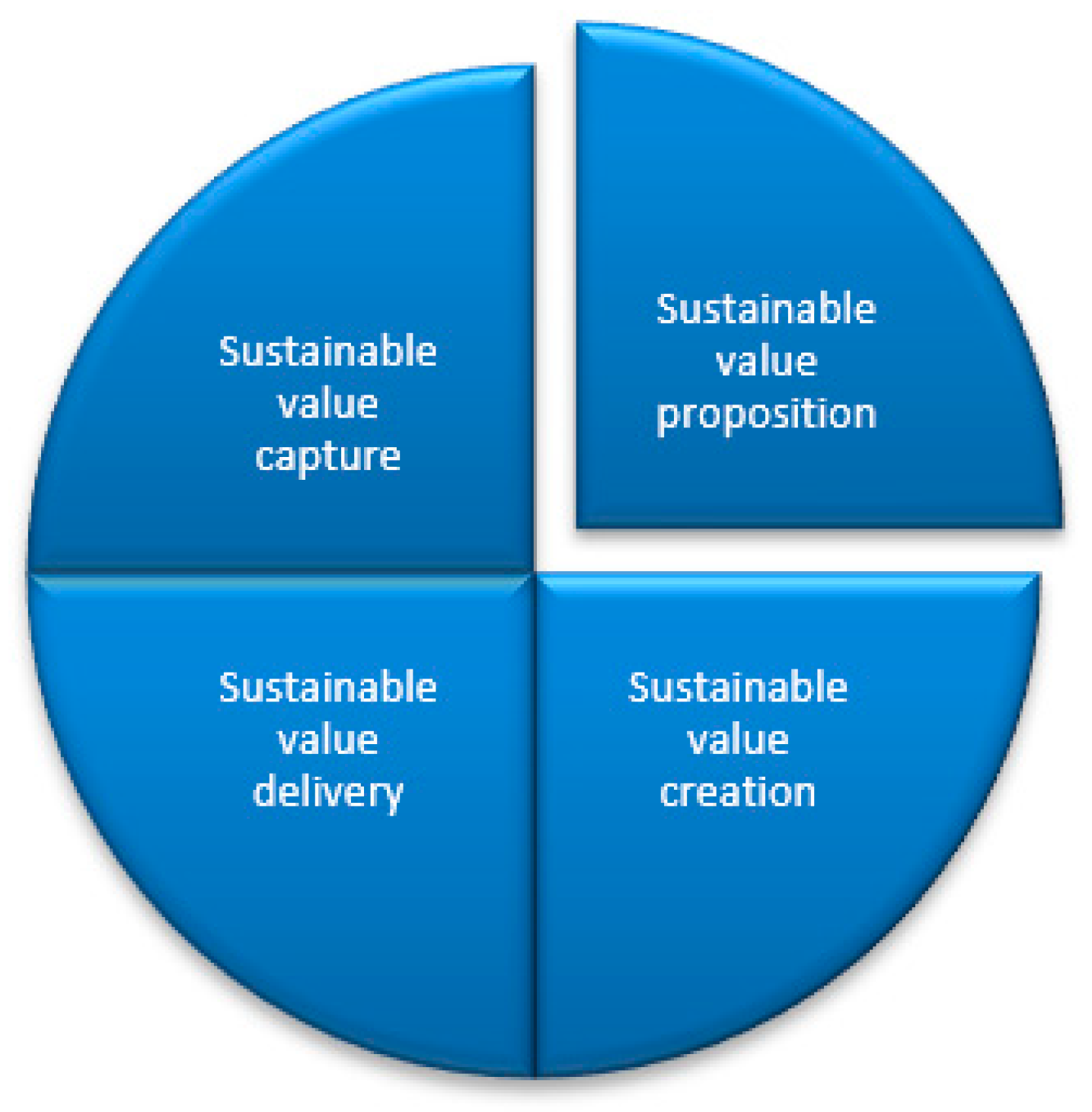

1.3. Sustainable Business Models

Business model innovation can contribute to the implementation of sustainable business practices within a company [19]. Sustainable business practices are related to the concept of sustainable development. Sustainable development is a process in which meeting the needs of society today does not limit its ability to meet its needs in the future [20]. The economic process in an enterprise should therefore be organised in such a way that the exploitation of the natural environment does not limit its possibilities of development in the future. In such a model of enterprise development, the technologies used, investment directions or exploitation of resources should be sustainable [21]. Businesses are also increasingly focusing on socially acceptable and socially desirable innovations [22]. The company’s processes cannot therefore be considered in isolation from the fundamental objectives of a sustainable economy, and the company should take into account the interests of a wide range of stakeholders in its activities [21,23,24]. This assumes that stakeholders co-create the value generated by the company [25]. In such a defined environment, the concept of sustainable production emerges. It is based on a combination of three elements, i.e., human, production, and objectives [21]. The concept of sustainable production emphasises the improvement of people’s quality of life, the wise use of natural resources and the achievement of environmental and social goals in addition to economic ones [21]. By way of analogy, the concept of sustainable service provision can be formulated, where the human element is also combined with the services provided and the achievement of economic, environmental and social goals. Under such conditions, a sustainable business model emerges. The literature points out that, thanks to sustainable business models, the basic assumptions of the sustainable development concept can be transferred to the economy [21]. Defining the concept of a sustainable business model, one can therefore assume that it is oriented towards active management of an enterprise with the participation of many stakeholders. Its basis is the creation of value for stakeholders [6]. Such a business model combines business goals (profits) with protecting the interests of people and the planet [26]. A sustainable business model takes a long-term view [6].

In practice, the creation of a sustainable business model in a company or the transformation of the current business model into a sustainable one requires the adaptation of all elements of the business model to the concept of sustainable development-assessment through the prism of the three p’s (people, planet, profit) [9]. We can speak of a sustainable business model when value proposition, value creation, value delivery and value capture are sustainable, as in Figure 3.

Figure 3.

Sustainable Business Model components. The figure was created using Microsoft® Word for Microsoft 365 MSO.

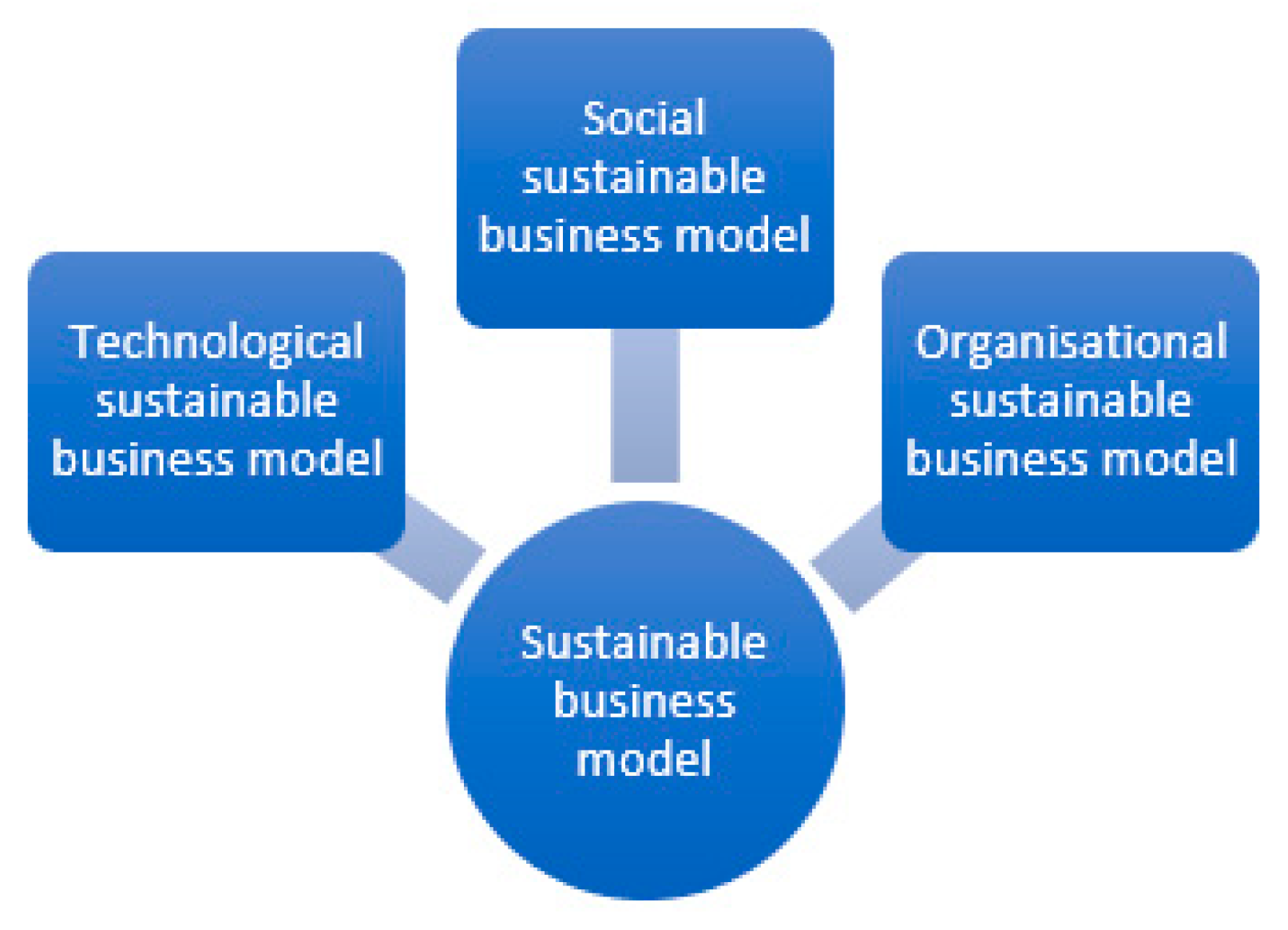

The implementation of sustainable business models in companies is linked to technological, social and organisational innovation [26]. Thus, three groups of sustainable business model can be distinguished, namely, technological, social and organisational, as in Figure 4 [7].

Figure 4.

Sustainable business model types. Prepared on the basis of [7] (p. 48). The figure was created using Microsoft® Word for Microsoft 365 MSO.

Technological sustainable business models are related to material and energy efficiency and concern activities aimed at maximising this efficiency. They also include waste management and, more specifically, value creation from this process. These models also focus on renewable energy sources and natural processes. Primarily they concern their use in production or services [7]. In practice, the implementation of technological sustainable business models in a company means reducing the consumption of energy and natural resources, as well as reducing the environmental impact of its activities [20]. In companies, measures are introduced to improve resource efficiency, use renewable energy, refocus production, reduce carbon emissions, invest in renewable energy or recycle [20,27]. In the case of socially sustainable business models, the emphasis is on the social aspects of the operation of the company. Examples include activities aimed at protecting the health of consumers or their welfare. Other examples include activities relating to consumer education and responsible distribution and promotion. Socially sustainable business models are also about product-oriented processes and product usability [7]. Within organisational sustainable business models, examples include social enterprises, hybrid businesses and open innovation [7].

In practice, companies can implement sustainable business practices to a greater or lesser extent in some areas of their operations [20]. In this case, one cannot speak of a sustainable business model, but rather of certain modifications of traditional business models, or the development of a business model innovation. However, such actions are the beginning of a much bigger transformation of the business model. Sustainable development policies change business models in a complex way and are associated with significant financial outlays [27].

1.4. European Green Deal and the Operation of Energy Companies

Sustainable business practices are, on the one hand, a response to changes in societal expectations or technological progress and, on the other hand, they are created as a consequence of specific economic regulations adopted by public institutions [28]. Economic regulation is defined by a standard and applies to a whole range of issues relating to the conduct of business. It includes control over various aspects of the business [29]. Economic regulation includes the policies of the regulator in which it uses policy instruments. Policy instruments can take very different forms. They include hard law, soft law, incentives, information policies, directions for change (roadmaps), etc. [26]. Economic regulation may restrict certain activities of businesses [30]. Economic regulation can also spur companies to take action in line with the regulator’s expectations [26]. Economic regulations may lead market actors to undertake specific investment activities. Such regulation affects the efficiency of economic activity and the distribution of its profits. It can also contribute to the improvement of general economic conditions [31]. From this perspective, economic regulation is seen as a response to social demand. This is because society expects the regulator to correct inefficient and/or unfair market practices [31]. The task of economic regulation is thus to protect society. Economic regulation can, for example, address environmental issues [32]. As a result of climate change and environmental degradation, the European Commission has taken such action. It has adopted a package of economic regulations. The aim of the adopted package is to reduce and then eliminate net greenhouse gas emissions. The package of legislative proposals points to EU climate, energy, transport and taxation policies [28]. The following economic regulations and initiatives are of particular importance for the operation of energy companies: European Climate Law; European Industrial Strategy; Roadmap for a Circular Economy; Clean, Affordable and Secure Energy [33]. European climate law has taken the form of Regulation of the European Parliament and of the Council establishing the framework for achieving climate neutrality [34]. It adopts the main and intermediate climate targets. According to the main objective, by 2050 at the latest, the European Union should achieve climate neutrality, understood as reducing greenhouse gas emissions to net zero. Thereafter, the European Union will aim to achieve negative greenhouse gas emissions. According to the intermediate 2030 climate targets, the European Union and the Member States will reduce greenhouse gas emissions by at least 55% by 2030 compared to 1990 levels [34]. The European industrial strategy assigns European industry a leading role in environmental and digital transformation. The strategy aims to make European industry a global reference in achieving climate neutrality and digitalisation [33]. The roadmap for a circular economy covers three key areas. These are: circularity in production processes, sustainable product design, empowerment of individual and public end-users (i.e., consumers and public purchasers) [33]. Clean Energy is a programme of measures for the transition to a low-carbon economy. In the European Union, three quarters of greenhouse gas emissions are currently linked to energy production and consumption. EU member states have therefore been obliged to profoundly transform the energy sector towards decarbonisation. Emphasis is placed on the expansion of offshore wind farms, the production of hydrogen from renewable energy sources and the integration of energy systems [35]. The aim of the European Green Deal is therefore to transform the European Union into a modern, resource-efficient and competitive economy. The European Union is committed to decoupling economic growth from resource consumption [28].

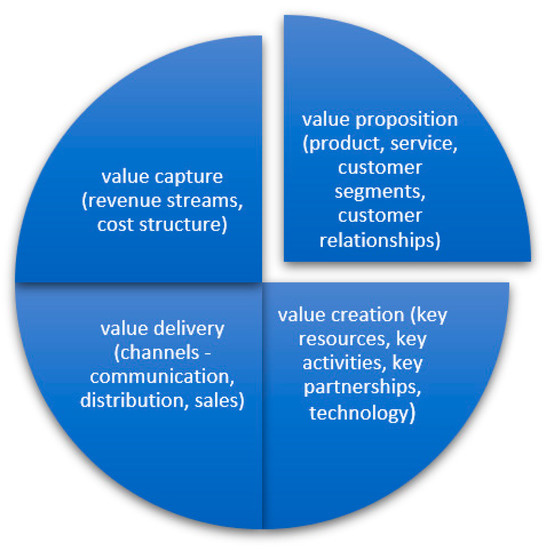

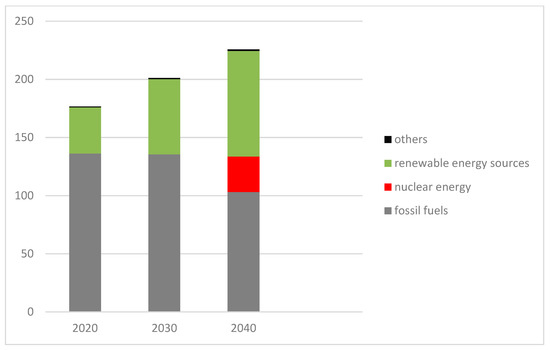

As a result of adopted economic regulations, the energy sector in Poland is undergoing transformation. Currently, the basis for electricity production is lignite and hard coal, which is obtained from domestic resources (Scheme 1). However, the ongoing transformation of the Polish power sector results in an increase in the share of renewable energy sources in electricity production. This assumes ensuring competitiveness of the economy and energy efficiency. The Polish energy policy also draws attention to the need to reduce the environmental impact of the energy sector. The National Energy and Climate Plan also emphasises the need to make optimal use of the country’s own energy resources. According to the National Energy and Climate Plan, coal will continue to play a significant role in the structure of energy carriers. The government assumes the diversification of energy carriers. This diversification will take place through a continuous increase in the share of renewable energy sources (mainly wind energy and photovoltaics) in the energy balance and the introduction of nuclear energy to this balance [36]. The energy transformation in Poland is to be low-carbon in nature. It is to be based on innovation, social acceptability and respect for the environment and the climate. It assumes an active role for the end user and national industry [37]. Energy and climate documents prepared at the Polish level are consistent with the basic assumptions of energy policy formulated by the European Union [36]. Within these objectives, mention should be made of “strengthening energy security, increasing energy efficiency, building a stable and efficient internal market, decarbonising, increasing energy generation from renewable sources, and developing innovation in the energy sector” [36] (p. 9).

Scheme 1.

Gross electricity production by fuel in Poland (TWh). Prepared on the basis of [37] (p. 193). The graph was created using Microsoft® Word for Microsoft 365 MSO.

From a European perspective, Poland’s specific energy and climate objectives and actions may be evaluated differently [38]. However, their implementation will result in a radical change in the way business is conducted in energy companies in Poland. Measures in the field of the European Green Deal directly translate into activities undertaken in enterprises aimed at changing existing business models. These models adapt many sustainable business practices.

2. Materials and Methods

The research strategy adopted in this paper is a qualitative case study [39]. Its use was determined by an interest in a specific case rather than by methodological motives [40]. “A case study examines a phenomenon in its natural setting […]” [41] (p. 370). Both the actual phenomenon and the contextual conditions of that phenomenon are important in a case study [42]. A thorough knowledge and understanding of the phenomenon/case under study is provided by properly posed research questions and a well-formulated research problem [40].

The study issue conceptualised in the paper concerns the shaping of the business model in an energy company as a consequence of the establishment of the European Green Deal. The research problem focuses on determining the significance of the European Green Deal for the formation of the business model in an energy company. The study seeks answers to the questions:

- -

- What is the significance of the European Green Deal for the business model of the studied energy company?

- -

- Which elements of the business model of the studied energy company take the form of sustainable ones?

- -

- In what direction is the business model of the energy company evolving?

The following research statements were adopted:

- -

- Economic regulations in the area of the European Green Deal lead to changes in the business model of the studied energy company,

- -

- The studied energy company through the implementation of sustainable business practices aims to achieve sustainable production.

The subject of the research is the business model of the Tauron Capital Group. The business model is analysed in the context of the requirements for climate protection formulated in the European Green Deal.

The study used a single case [42]. The aim here is to seek an idiographic understanding of the phenomenon under study [43]. The use of a single case study is intended to deepen the understanding of the case [40]. The investigations conducted in the article focus on determining the significance of the European Green Deal for shaping the business model in the Tauron Capital Group. The Tauron Capital Group is an energy company operating in Poland, where ownership and control is concentrated around the Polish State Treasury (directly and indirectly) [44]. The Tauron Capital Group is the third largest power producer in Poland and the leader in terms of the number of distribution customers and the volume of distributed energy [45].

The research method used in the article is the analysis of documents and websites. With emphasis on understanding the phenomenon under study, a qualitative assessment of the collected empirical material was carried out [43,46]. The data used in the study were obtained from different categories of empirical materials (documents, website content) generally available on the Tauron Capital Group website and on the websites of European institutions, as well as on the websites of Polish public institutions.

3. Results

The Tauron Capital Group is a vertically integrated energy company. Within the capital group there are autonomous companies with a dominant entity (Tauron Polska Energia S.A., Katowice, Poland). The group’s business model consists of all elements of the value chain (Table 1). This model includes the following: extraction of raw material for energy production and energy production and distribution, as well as sales to end customers. The Tauron Group’s business model is complemented by an ecosystem of innovation and new business development. The activities in this area are closely linked to the energy sector. The Tauron Capital Group builds value thanks to the effect of scale and synergy. The effect of scale results from the size of the conducted business activities. The synergy effect is a consequence of the cooperation between the links in the value chain. Within the group, business areas have been singled out and assigned specific roles and responsibilities. A management unit, seven business areas and support units have been identified [47].

Table 1.

Tauron Capital Group—business model.

The Tauron Group’s business model is based on six pillars, i.e., a holistic approach to value creation, environmental protection, customer focus, ethics, decision-making efficiency, employee knowledge and qualifications [45]. One of the pillars of the Tauron Group’s business model is environmental protection. This pillar is a response to the economic regulations contained in the European Green Deal. These largely concern the restrictions imposed on coal-fired power generation due to its negative impact on the environment. As a result, the Tauron Group is implementing a number of sustainable business practices to build a sustainable future which takes into account not only economic but also social interests [45]. In this area, the Tauron Group is taking a number of actions, as demonstrated by the so-called Green Tauron Return [45]. These result from the Tauron Group’s strategy and policies for the environment and climate (Table 2) [45,47,48,49,50,51,52,53].

Table 2.

Tauron Capital Group strategy and policies for the environment and climate.

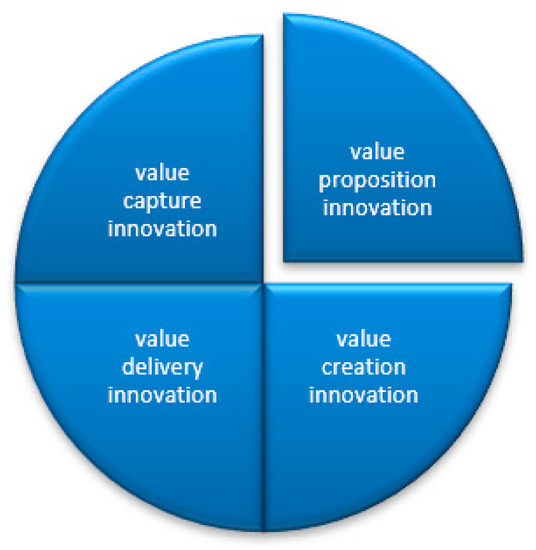

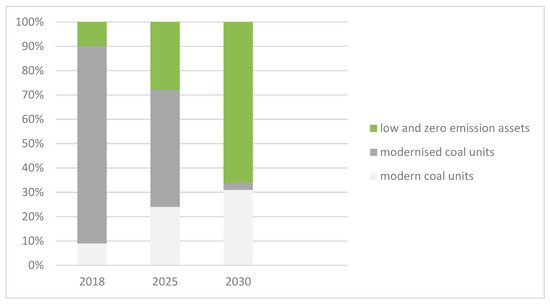

The development of renewable energy sources should be emphasized first. The Tauron Group is investing significant financial resources in the development of wind and photovoltaic power plants. Hydroelectric power plants are being modernised. Distribution network modernization and expansion programs are carried out on an ongoing basis. These activities are aimed at reducing losses in energy distribution and increasing the possibility of connecting more renewable sources (including prosumer sources) to the network. Thanks to prosumer installations, the number of dispersed electricity producers is increasing. The Tauron Group has also launched modern units—coal, gas and steam—with high energy efficiency based on the latest technological developments. Ultimately, they will replace more emission-generating assets based on traditional technologies. The Tauron group also undertakes activities consisting of the modernization of traditional coal units. Obviously, these are the units which can be modernised from a technological point of view. Inefficient coal units are to be withdrawn. As a result of these actions, by 2030 there will be a change in the energy mix of the Tauron Group (Scheme 2). This change will be radical. As recently as 2018, the Tauron Group’s energy mix was dominated by modernised coal units. In 2030, it is expected that low- and zero-emission assets will dominate the Tauron Group’s energy mix. Consequently, there will be a shift in the value chain of where revenues are generated. By 2030, the Tauron Group also plans to reduce carbon dioxide emissions by more than 50% compared to 2018. Measures are also being taken to treat flue gases and wastewater [45]. The Tauron Group also strives to organise production processes in such a way as to minimise the generation of waste. The Tauron Group has introduced the principles of circular economy. These principles apply mainly to the initial stages of the value chain. The idea is to give waste a usable value and turn it into products. For example, the aim is to fully utilise combustion waste (ash, slag) and mining waste (waste rock). These are used, for example, in construction. Installations are also being built to capture and use coal bed methane [45]. The Tauron Group also takes measures to protect water resources. Emphasis is placed on saving water in technological processes. Moreover, thanks to hydroelectric power plants, water is stored during significant precipitation and released during droughts [45]. Currently, the Tauron Group is also working on developing energy storage technologies based on electrochemical cells and hydrogen. In the case of hydrogen, this involves both its production and its storage. For hydrogen production, excess electricity from renewable energy sources will be used [45].

Scheme 2.

Tauron Group’s energy mix-forecast. Prepared on the basis of [54]. The graph was created using Microsoft® Word for Microsoft 365 MSO.

4. Discussion

Addressing the issue of the mutual relations between the Tauron Group’s business model and the European Green Deal, it is first necessary to refer to the current situation. The business model of the Tauron Group, due to its complexity, would be difficult to clearly assign to one of the analysed categories, i.e., traditional business model, innovative business model, sustainable business model. The activities of the Tauron Group include all the elements of the value chain of an energy company. Therefore, we have here the following activities: mining, generation, heat, which are based mainly on traditional technological and organisational solutions. The energy mix of the Tauron Group is dominated by modernized coal units [45,47,54,55]. This mix does not differ from the energy mix of Poland [37]. It should be noted, however, that elements of innovation and examples of sustainable business practices can also be found here. Thus, in the case of energy production, besides coal, biomass is also used, which is an example of renewable energy sources. The principles of a circular economy are also applied, and air and water pollution is reduced. In the case of distribution, trade and sales, both traditional and modern technological and organisational solutions are used. The distribution network undergoes continuous modernisation, its task being not only to supply energy but also to receive it from prosumer installations. The development of renewable energy sources, on the other hand, fits into the concept of sustainable development and is an example of sustainable business practices. In addition, the business model is based on an innovative division of roles and responsibilities among the entities comprising the Tauron Group, assigning them well-defined process competencies [45,47,54,55]. It follows from the above description that the Tauron Group’s business model is innovative in nature, where sustainable business practices are introduced. The business model of the Tauron Group is also subject to continuous transformation. In addition to technological progress, the transformation of the Tauron Group’s business model is influenced by the European Green Deal. The European climate law and the energy policy of the Polish state are of particular importance here. The current business model of the Tauron Group is under increasing pressure from environmental standards and high CO2 emission charges as well as changes in the market for sources of financing. Financial and public institutions are reluctant to engage in financing coal technologies. It is relatively easy to obtain financing for renewable energy sources. As a result, the Tauron Group is allocating more and more capital expenditure to the development of zero-emission technologies and to the modernisation and expansion of the distribution network as well as the implementation of circular economy principles. A modern distribution network is necessary to develop prosumer electrical installations [45,47,54,55]. With the development of prosumer installations, the architecture of the business model is changing, as energy consumers also become energy producers [56]. Implementation of the principles of a circular economy involves both giving use value to waste and creating closed circuits in cooling installations in power stations. At the same time, the economy decarbonization policy leads to the gradual abandonment of old coal units. In the 2030 context, the Tauron Group’s energy mix will be dominated by low- and zero-emission assets [45,47,54,55]. This direction of changes in the energy mix of the Tauron Group may be strengthened by the implementation of the document adopted by the Polish government: “Transformation of the electricity sector in Poland. Separation of coal production assets from companies with State Treasury shareholding”. According to the Polish government, energy groups with State Treasury shareholding should focus on low- and zero-emission investments. To this end, assets associated with electricity generation in conventional coal units are to be spun off from energy groups controlled by the Polish state. A new entity will be established to which these assets will be transferred, i.e., the National Energy Security Agency [57]. The Tauron Group’s business model is therefore evolving towards a technologically sustainable business model in the area of energy efficiency, waste management and renewable energy sources [7]. The Tauron Group’s Green Return strategy is part of the green business model concept [27]. However, for the Tauron Group’s business model to become sustainable, each of its elements must be sustainable in three dimensions, i.e., people, planet, profit [9]. This applies to the entire value chain of the Tauron Group. In addition, it is worth noting here some findings from the literature. Creating a sustainable business model should become a part of the companies’ development strategy [21]. Companies implementing sustainable development models should constantly seek a balance between the principles of sustainability, the principles of the circular economy and social inclusion for value creation [20,23]. The important issues here are those concerning the company itself, as well as consumers and the wider environment [23]. However, the development of new sustainable technologies alone will not solve the problems of climate change and energy security. The development of new technologies should go hand in hand with the development of sustainable business practices. Sustainable business practices must be compatible with the concept of sustainable development, but at the same time they should ensure that the company can make a profit [24]. At this point, attention must also be drawn to the economic viability of sustainable business models for energy companies. The success of these models depends on their ability to generate profit [24]. A business model in a market economy should therefore build a company’s financial position [58].

5. Conclusions

The Tauron Group’s business model includes the extraction of raw materials for energy production, energy generation, energy distribution and sales [47]. Its energy mix is dominated by coal units [54]. The European Green Deal, which emphasizes the climate neutrality of the economy, is therefore of key importance for the functioning of the Tauron Group. This is due to the European Union’s policy in the area of reducing greenhouse gas emissions, the programs for the ecological transformation of enterprises, the activities for the development of a circular economy and the action programs for the production of clean energy [33,34,35]. The Tauron Group’s response to the assumptions of the European Green Deal is the Tauron Green Return. As a result of the adoption of Tauron’s Green Return, there are changes in the group’s business model. Renewable energy sources are being developed. Actions aimed at changing the energy mix are being taken in the Tauron Group. Sustainable business practices are also being implemented [45]. In the Tauron Group, sustainable business practices occur in greater or lesser intensity in each element of the business model. In the case of the value proposition, the Tauron Group is developing energy production from renewable sources. It also offers a service to connect prosumer installations to the grid. When it comes to value creation, the key resources and activities are gradually related to low- and zero-carbon assets. Examples include the development of wind and photovoltaic power plants, the modernisation of hydroelectric power plants or the implementation of circular economy principles (e.g., reducing waste generation, saving water in technological processes). Energy consumers are becoming key partners thanks to prosumer installations. The Tauron Group also uses modern environmentally-friendly technologies in its production processes. As for the value delivery in the area of distribution, the distribution network is being modernized and extended in order to increase its efficiency and to be able to connect more renewable sources to the network. In terms of sales, energy consumers are becoming both producers and consumers of energy through prosumer installations. In the case of value capture, the share of revenues from the sale of energy obtained from renewable energy sources in the Tauron Group’s revenues is systematically increasing [45]. Therefore, it can be assumed that currently the Tauron Group’s business model is innovative in nature with elements of sustainable business practices. However, the Tauron Group’s business model is evolving towards a technologically sustainable business model. This is supported by the actions taken by the company within the Green Tauron Return [45]. These activities result both from initiatives taken at the Tauron Group level and from economic regulations adopted at the European and, consequently, national level. These regulations force energy companies to improve their energy efficiency; they also translate into better waste management and expansion of renewable energy sources. In addition, attention should be drawn to the announcements made by the Polish Government with a view to separating coal production assets from state-owned companies. [57]. The implementation of these announcements would undoubtedly contribute to faster changes in the Tauron Group’s business model.

At this point, however, the question must be asked about the profitability of a technologically sustainable business model in the case of the Tauron Group. A far-reaching expansion of renewable energy sources and a radical change in the energy mix will entail huge costs. The profitability of the newly created business model will therefore depend on many factors that are not within the competence of the Tauron Group, such as legal solutions, technological progress and the availability and cost of acquiring new technical solutions. A full evaluation of the newly created business model of the Tauron Group will therefore be possible in a decade’s perspective.

One should also pay attention to the limitations of the conducted research. On the one hand, they result from the qualitative approach used in the research, which does not allow generalizations to be made. On the other hand, the research focuses on the significance of the European Green Deal for the shaping of the business model in the Tauron Capital Group. At this point, however, it should be noted that the European Green Deal strategy is relatively new, and the Tauron Capital Group has been taking environmentally-friendly action for a long time. Nevertheless, the European Green Deal strategy has consolidated the directions of changes undertaken in the Tauron Capital Group.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Not applicable.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Teece, D.J. Business Models, Business Strategy and Innovation. Long Range Plan. 2010, 43, 172–194. [Google Scholar] [CrossRef]

- Osterwalder, A.; Pigneur, Y.; Tucci, C.L. Clarifying Business Models: Origins, Present, and Future of the Concept. CAIS 2005, 16, 1. [Google Scholar] [CrossRef]

- Baden-Fuller, C.; Mangematin, V. (Eds.) Introduction: Business Models and Modelling Business Models. In Advances in Strategic Management; Emerald Group Publishing Limited: Bingley, UK, 2015; Volume 33, pp. xi–xxii. ISBN 978-1-78560-463-8. [Google Scholar]

- Sun, S.L.; Xiao, J.; Zhang, Y.; Zhao, X. Building Business Models through Simple Rules. MBR 2018, 26, 361–378. [Google Scholar] [CrossRef]

- Rayna, T.; Striukova, L. 360° Business Model Innovation: Toward an Integrated View of Business Model Innovation: An Integrated, Value-Based View of a Business Model Can Provide Insight into Potential Areas for Business Model Innovation. Res.-Technol. Manag. 2016, 59, 21–28. [Google Scholar] [CrossRef]

- Geissdoerfer, M.; Vladimirova, D.; Evans, S. Sustainable Business Model Innovation: A Review. J. Clean. Prod. 2018, 198, 401–416. [Google Scholar] [CrossRef]

- Bocken, N.M.P.; Short, S.W.; Rana, P.; Evans, S. A Literature and Practice Review to Develop Sustainable Business Model Archetypes. J. Clean. Prod. 2014, 65, 42–56. [Google Scholar] [CrossRef]

- Osterwalder, A.; Pigneur, Y.; Clark, T. Business Model Generation: A Handbook for Visionaries, Game Changers, and Challengers; Wiley: Hoboken, NJ, USA, 2010; ISBN 978-0-470-87641-1. [Google Scholar]

- Aagaard, A. Identifying Sustainable Business Models Through Sustainable Value Creation. In Sustainable Business Models. Innovation, Implementation and Success; Aagaard, A., Ed.; Palgrave Macmillan: Cham, Switzerland, 2019; pp. 1–24. [Google Scholar]

- Slávik, Š.; Bednár, R. Analysis of Business Models. JOC 2014, 6, 19–40. [Google Scholar] [CrossRef]

- Falencikowski, T.; Nogalski, B. Przechwytywanie Wartości w Modelu Biznesu Sieci Przedsiębiorstw—Osnowa Teoretyczna i Przypadki Praktyczne. In Zarządzanie Strategiczne. Strategie Sieci i Przedsiębiorstw w Sieci; Krupski, R., Ed.; Prace Naukowe Wałbrzyskiej Wyższej Szkoły Zarządzania i Przedsiębiorczości; Wałbrzyska Wyższa Szkoła Zarządzania i Przedsiębiorczości: Wałbrzych, Poland, 2015; Volume 32, pp. 109–120. [Google Scholar]

- Fielt, E. Conceptualising Business Models: Definitions, Frameworks and Classifications. J. Bus. Models 2014, 1, 85–105, Inaugural issue. [Google Scholar] [CrossRef]

- Schiavi, G.S.; Behr, A. Emerging Technologies and New Business Models: A Review on Disruptive Business Models. INMR 2018, 15, 338–355. [Google Scholar] [CrossRef]

- Stelmaszczyk, M.; Pierścieniak, A.; Krzysztofek, A. Managerial Energy in Sustainable Enterprises: Organizational Wisdom Approach. Energies 2021, 14, 2367. [Google Scholar] [CrossRef]

- Peñarroya-Farell, M.; Miralles, F. Business Model Dynamics from Interaction with Open Innovation. JOItmC 2021, 7, 81. [Google Scholar] [CrossRef]

- Husin, S.S.; Rahman, A.A.A.; Mukhtar, D.; Nawi, N.C. A Systematic Literature Review on Business Model Innovation: Industrial, Methodology & Positioning Gaps. Int. J. Innov. 2020, 10, 20. [Google Scholar]

- Kringelum, L.B.; Normann Kristiansen, J.; Næs Gjerding, A. Business Model Implications of Industry Path Dependency. J. Bus. Models 2021, 9, 20–28. [Google Scholar] [CrossRef]

- Da Silva, C.M. From One Context to Another: How Business Models Emerge. J. Bus. Models 2021, 9, 8–12. [Google Scholar] [CrossRef]

- Panda, B.K. Application of Business Model Innovation for New Enterprises: A Case Study of Digital Business Using a Freemium Business Model. J. Manag. Dev. 2020, 39, 517–524. [Google Scholar] [CrossRef]

- Jonker, J.; Faber, N. Organizing for Sustainability: A Guide to Developing New Business Models; Springer International Publishing: Cham, Switzerland, 2021; ISBN 978-3-030-78156-9. [Google Scholar]

- Agwu, U.J.; Bessant, J. Sustainable Business Models: A Systematic Review of Approaches and Challenges in Manufacturing. Rev. Adm. Contemp. 2021, 25, e200202. [Google Scholar] [CrossRef]

- Wit, B.; Dresler, P.; Surma-Syta, A. Innovation in Start-Up Business Model in Energy-Saving Solutions for Sustainable Development. Energies 2021, 14, 3583. [Google Scholar] [CrossRef]

- Wells, P.E. Business Models for Sustainability; Edward Elgar Publishing: Cheltenham, UK, 2013; ISBN 978-1-78100-153-0. [Google Scholar]

- Larsson, M. The Business of Global Energy Transformation: Saving Billions through Sustainable Models; Springer: Berlin/Heidelberg, Germany, 2012; ISBN 978-1-137-02449-7. [Google Scholar]

- Freudenreich, B.; Lüdeke-Freund, F.; Schaltegger, S. A Stakeholder Theory Perspective on Business Models: Value Creation for Sustainability. J. Bus. Ethics 2020, 166, 3–18. [Google Scholar] [CrossRef]

- Wasserbaur, R.; Sakao, T. Analysing Interplays between PSS Business Models and Governmental Policies towards a Circular Economy. Procedia CIRP 2018, 73, 130–136. [Google Scholar] [CrossRef]

- Sommer, A. Managing Green Business Model Transformations; Springer Science & Business Media: Berlin/Heidelberg, Germany, 2012; ISBN 978-3-642-28848-7. [Google Scholar]

- Europejski Zielony Ład. Aspirowanie do Miana Pierwszego Kontynentu Neutralnego dla Klimatu. Available online: https://ec.europa.eu/info/strategy/priorities-2019-2024/european-green-deal_pl (accessed on 3 April 2022).

- Posner, R.A. Theories of Economic Regulation. Bell J. Econ. Manag. Sci. 1974, 5, 335–358. [Google Scholar] [CrossRef]

- Viscusi, W.K.; Harrington, J.E., Jr.; Sappington, D.E.M. Economics of Regulation and Antitrust, 5th ed.; MIT Press: Cambridge, MA, USA, 2018; ISBN 978-0-262-03806-5. [Google Scholar]

- Braunerhjelm, P.; Desai, S.; Eklund, J.E. Regulation, Firm Dynamics and Entrepreneurship. Eur. J. Law Econ. 2015, 40, 1–11. [Google Scholar] [CrossRef]

- Djankov, S.; La Porta, R.; Lopez-de-Silanes, F.; Shleifer, A. The Regulation of Entry. Q. J. Econ. 2002, 117, 1–37. [Google Scholar] [CrossRef]

- Europejski Zielony Ład. Available online: https://www.consilium.europa.eu/pl/policies/green-deal/ (accessed on 3 April 2022).

- Rozporządzenie Parlamentu Europejskiego i Rady (UE) 2021/1119 z Dnia 30 Czerwca 2021 r. w Sprawie Ustanowienia ram na Potrzeby Osiągnięcia Neutralności Klimatycznej i Zmiany Rozporządzeń (WE) nr 401/2009 i (UE) 2018/1999 (Europejskie prawo o klimacie); 2021; L. 243. Available online: https://eur-lex.europa.eu/legal-content/PL/TXT/?uri=OJ:L:2021:243:TOC (accessed on 2 April 2022).

- Czysta Energia. Available online: https://www.consilium.europa.eu/pl/policies/clean-energy/ (accessed on 3 April 2022).

- Ministerstwo Energii Krajowy Plan Na Rzecz Energii i Klimatu Na Lata 2021–2030. Założenia i Cele Oraz Polityki i Działania. PROJEKT—w. 3.1 z 04.01.2019. Available online: https://energy.ec.europa.eu/system/files/2019-02/poland_draftnecp_0.pdf (accessed on 29 March 2022).

- Obwieszczenie Ministra Klimatu I Środowiska z Dnia 2 Marca 2021 r. w Sprawie Polityki Energetycznej Państwa Do 2040 r. Monitor Polski. Dziennik Urzędowy Rzeczypospolitej Polskiej, Warszawa, Dnia 10 Marca 2021 r. Poz. 264, Załącznik. Available online: https://isap.sejm.gov.pl/isap.nsf/download.xsp/WMP20210000264/O/M20210264.pdf (accessed on 30 March 2022).

- Perissi, I.; Jones, A. Investigating European Union Decarbonization Strategies: Evaluating the Pathway to Carbon Neutrality by 2050. Sustainability 2022, 14, 4728. [Google Scholar] [CrossRef]

- Metody Badań Jakościowych; Denzin, N.K., Lincoln, Y.S., Eds.; PWN: Warszawa, Poland, 2014; ISBN 978-83-01-15879-8. [Google Scholar]

- Stake, R.E. Jakościowe Studium Przypadku. In Metody Badań Jakościowych; Denzin, N.K., Lincoln, Y.S., Eds.; PWN: Warszawa, Poland, 2014; Volume 1, pp. 623–654. ISBN 978-83-01-15877-4. [Google Scholar]

- Benbasat, I.; Goldstein, D.K.; Mead, M. The Case Research Strategy in Studies of Information Systems. MIS Q. 1987, 11, 369–386. [Google Scholar] [CrossRef]

- Yin, R.K. Case Study Research: Design and Methods; SAGE: Thousand Oaks, CA, USA, 2009; ISBN 978-1-4129-6099-1. [Google Scholar]

- Babbie, E. Podstawy Badań Społecznych; PWN: Warszawa, Poland, 2009; ISBN 978-83-01-15155-3. [Google Scholar]

- Ministerstwo Aktywów Państwowych. Transformacja Sektora Elektroenergetycznego w Polsce. Wydzielenie Wytwórczych Aktywów Węglowych ze Spółek z Udziałem Skarbu Państwa (Dokument Pdf). Available online: https://www.gov.pl/web/aktywa-panstwowe/program-transformacji-sektora-elektroenergetycznego (accessed on 7 May 2022).

- Tauron. Skonsolidowany Raport Roczny Grupy Kapitałowej TAURON za 2020 r. Sprawozdanie Na Temat Informacji Niefinansowych Grupy Kapitałowej Tauron Za 2020 Rok. Available online: https://raport.tauron.pl/centrum-dokumentow/ (accessed on 22 March 2022).

- Silverman, D. Interpretacja Danych Jakościowych; PWN: Warszawa, Poland, 2009; ISBN 978-83-01-15158-4. [Google Scholar]

- Tauron. Skonsolidowany Raport Roczny Grupy Kapitałowej TAURON za 2020 r. Sprawozdanie Zarządu z Działalności Tauron Polska Energia S.A. Oraz Grupy Kapitałowej Tauron Za Rok Obrotowy. 2020. Available online: https://raport.tauron.pl/centrum-dokumentow/ (accessed on 22 March 2022).

- Tauron. Polityka Klimatyczna. Available online: https://raport.tauron.pl/zrownowazony-rozwoj/srodowisko-naturalne-i-klimat/polityka-klimatyczna-grupy-tauron/ (accessed on 15 May 2022).

- Tauron Polityka Klimatyczna Grupy TAURON (Dokument Pdf). Available online: https://www.tauron.pl/tauron/o-tauronie/tauron-dla-otoczenia/polityka-klimatyczna-grupy-tauron (accessed on 15 May 2022).

- Tauron. Polityka Środowiskowa. Available online: https://raport.tauron.pl/zrownowazony-rozwoj/srodowisko-naturalne-i-klimat/polityka-srodowiskowa-grupy-tauron/ (accessed on 15 May 2022).

- Tauron. Polityka Środowiskowa Grupy TAURON (Dokument Pdf). Available online: https://www.tauron.pl/tauron/o-tauronie/tauron-dla-otoczenia/polityka-srodowiskowa-grupy-tauron (accessed on 15 May 2022).

- Tauron. Strategia Grupy Tauron Na Lata 2016–2025. Aktualizacja Kierunków Strategicznych. (Dokument Pdf). Available online: https://www.tauron.pl/tauron/relacje-inwestorskie/informacje-o-spolce/strategia-korporacyjna (accessed on 15 May 2022).

- Strategia Grupy TAURON Na Lata 2016–2025. Available online: https://www.tauron.pl/ (accessed on 15 May 2022).

- Tauron Zielony Zwrot. Prognoza Zmiany Miksu Energetycznego Grupy Tauron. Available online: https://www.tauron.pl/tauron/o-tauronie/tauron-dla-otoczenia/zielony-zwrot (accessed on 30 March 2022).

- Tauron. Model Biznesowy. Available online: https://raport.tauron.pl/ (accessed on 3 April 2022).

- Proka, A.; Beers, P.J.; Loorbach, D. Transformative Business Models for Sustainability Transitions. In Sustainable Business Models: Principles, Promise, and Practice; Moratis, L., Melissen, F., Idowu, S.O., Eds.; Springer: Berlin/Heidelberg, Germany, 2018; pp. 19–39. [Google Scholar]

- Uchwała w Sprawie Przyjęcia Dokumentu: Transformacja sektora elektroenergetycznego w Polsce. Wydzielenie wytwórczych aktywów węglowych ze spółek z udziałem Skarbu Państwa”—Kancelaria Prezesa Rady Ministrów—Portal Gov.pl. Available online: https://www.gov.pl/web/premier/uchwala-w-sprawie-przyjecia-dokumentu-transformacja-sektora-elektroenergetycznego-w-polsce-wydzielenie-wytworczych-aktywow-weglowych-ze-spolek-z-udzialem-skarbu-panstwa (accessed on 9 May 2022).

- Tallman, S.; Luo, Y.; Buckley, P.J. Business Models in Global Competition. Glob. Strategy J. 2018, 8, 517–535. [Google Scholar] [CrossRef]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).