Techno–Economic and Risk Evaluation of Combined Cycle Propulsion Systems in Large Container Ships

Abstract

:1. Introduction

- A comprehensive economic evaluation is performed using the net present value (NPV), payback period (PP), and the internal rate of return (IRR) to evaluate the capital, operating, and maintenance costs of combined gas and steam cycle propulsion systems that are fueled by marine diesel oil (MDO) or liquified natural gas (LNG) in a large container ship. A two-stroke diesel engine that is fueled by MDO is also evaluated for comparison.

- A sensitivity analysis and risk evaluation are conducted to examine the effects of the fuel cost, capital cost, and hull fouling resistance on the results of the economic evaluation.

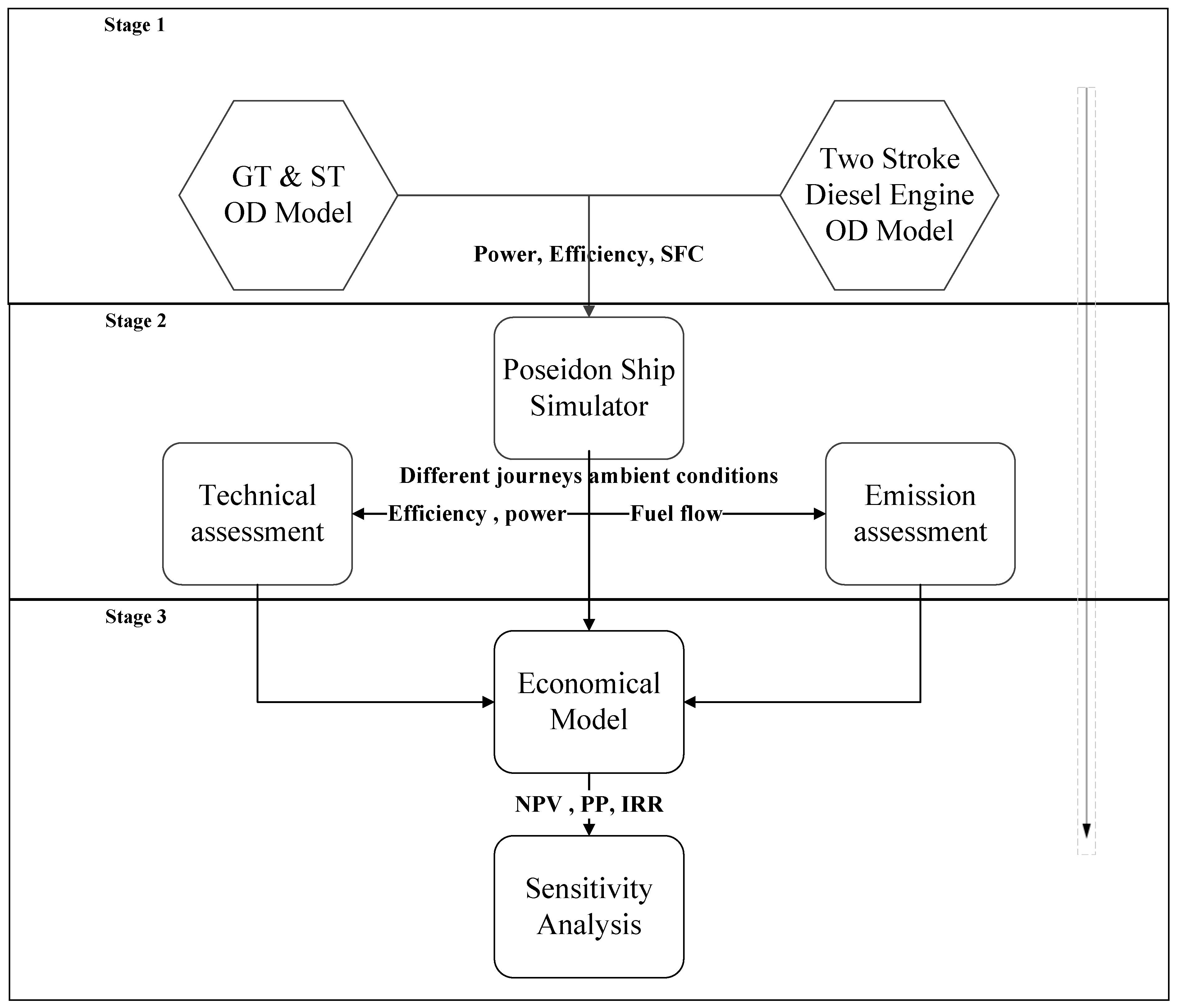

2. Methodology

2.1. Stage 1

Gas and Steam Turbine and Two-Stroke Diesel Engine Models

2.2. Stage Two Models

2.3. Stage Three Models

Economic Model

- The capital cost includes the installation cost of the propulsion systems.

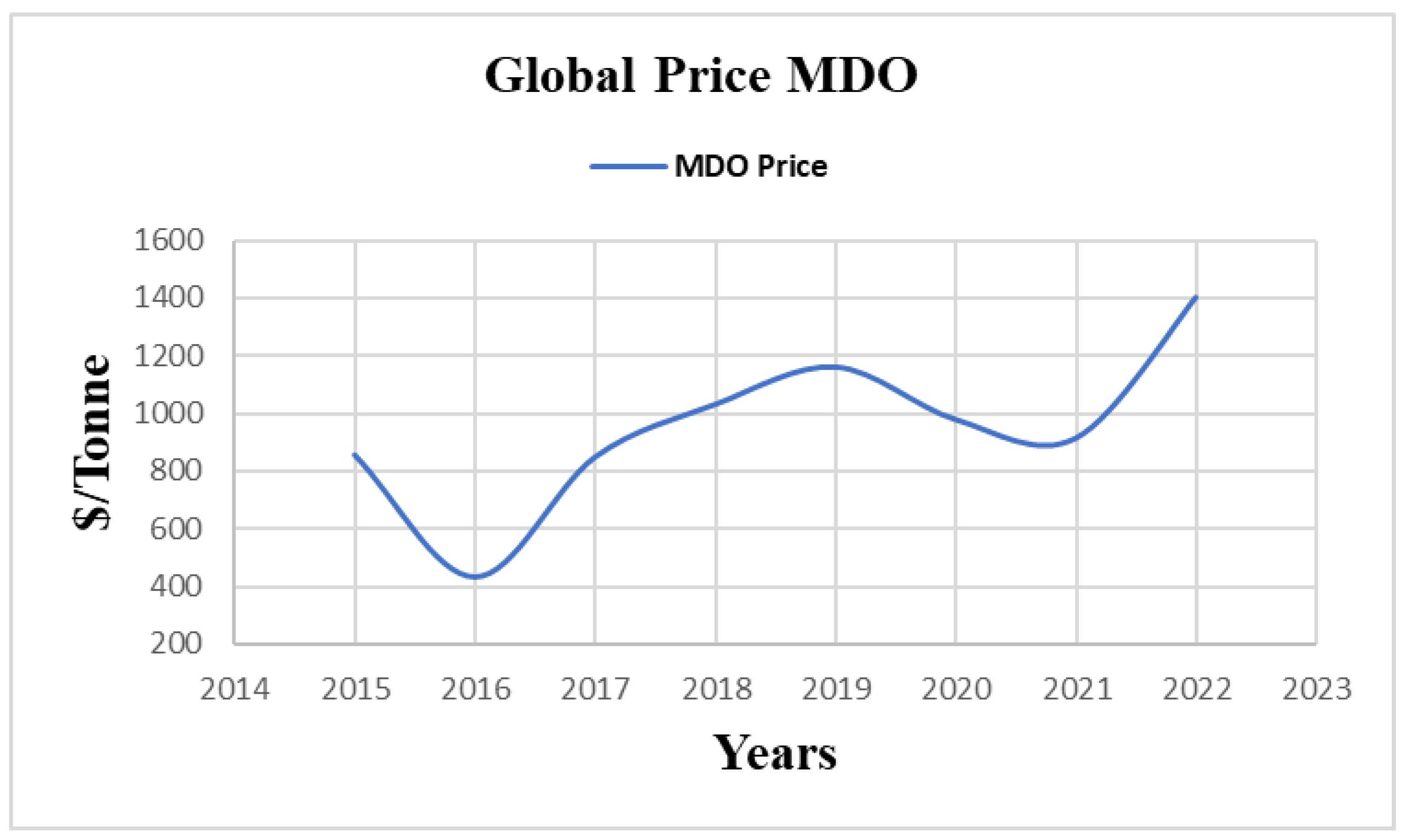

- The maintenance and operating costs consider the fuel cost of the voyage.

- A sensitivity analysis and risk evaluation were performed to examine the effects of the fuel cost, capital cost, and hull fouling resistance on the economic analysis.

3. Results and Discussion

3.1. Economic Analysis

- An intercooler/reheater (I/R) ELNG CCGT with a single heat recovery steam generator (HRSG).

- A simple CCGT and an I/R CCGT with an HRSG that was fueled by LNG or MDO.

- A two-stroke diesel engine that was fueled by MDO.

3.2. The First Scenario

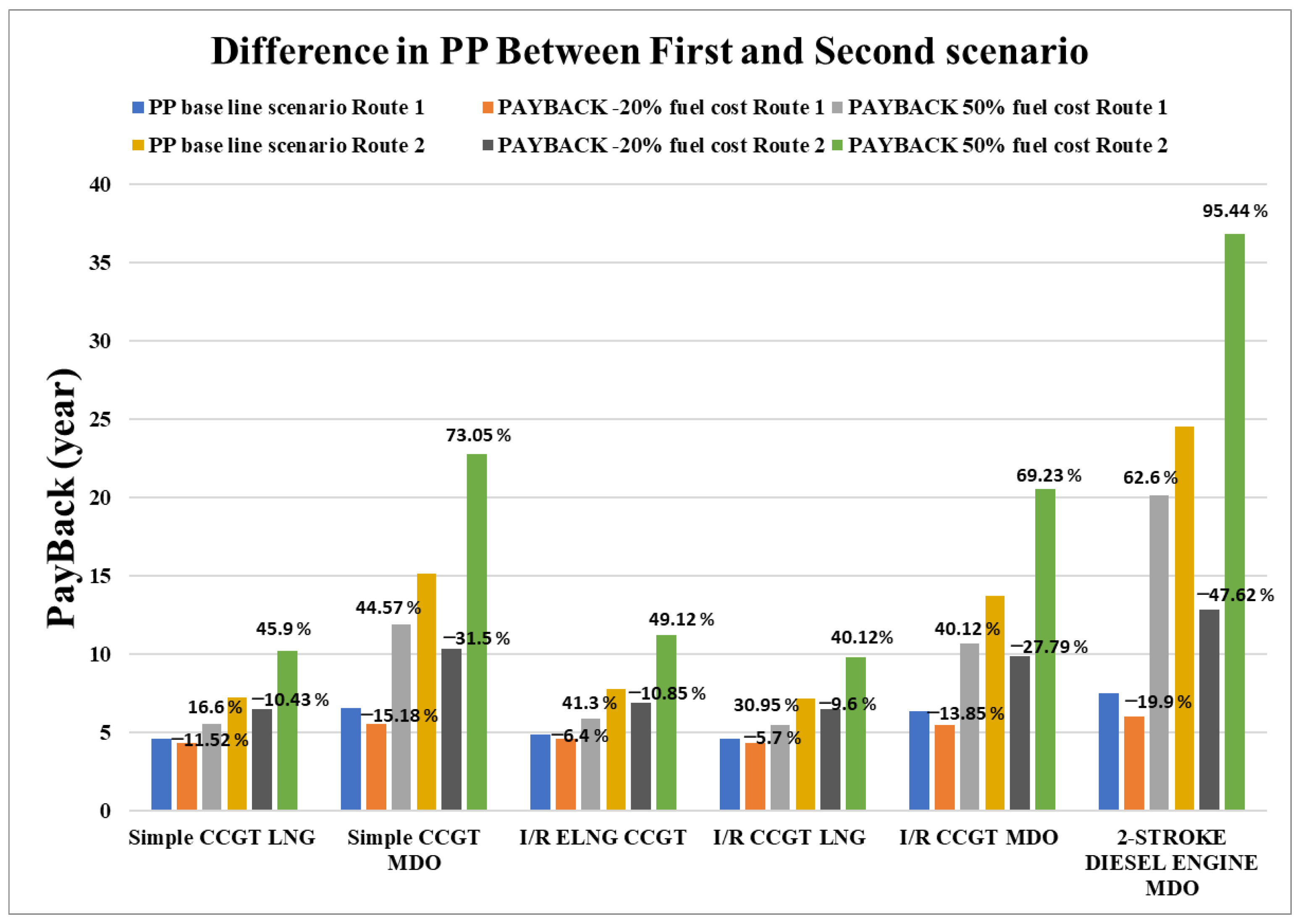

3.3. The Second Scenario

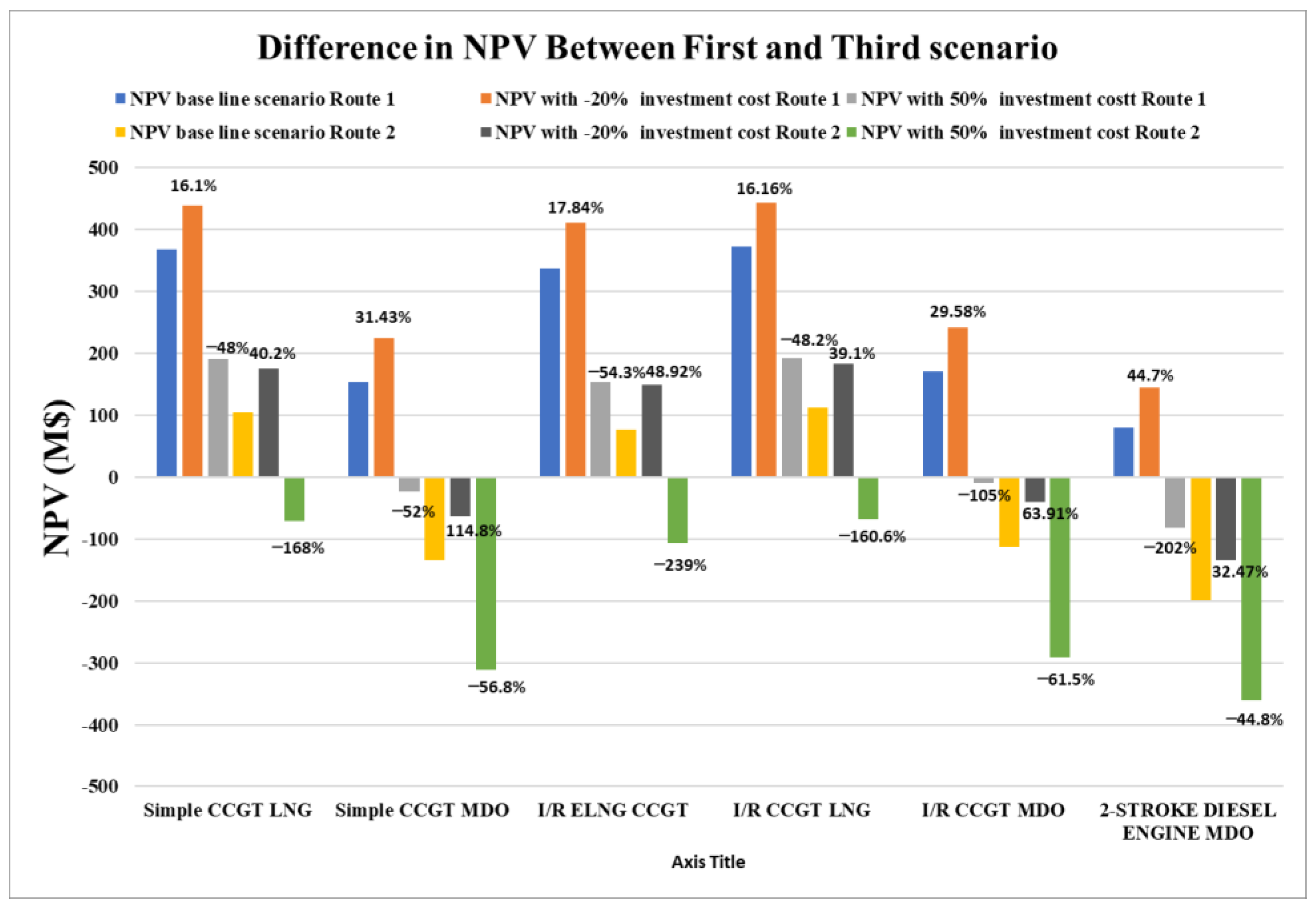

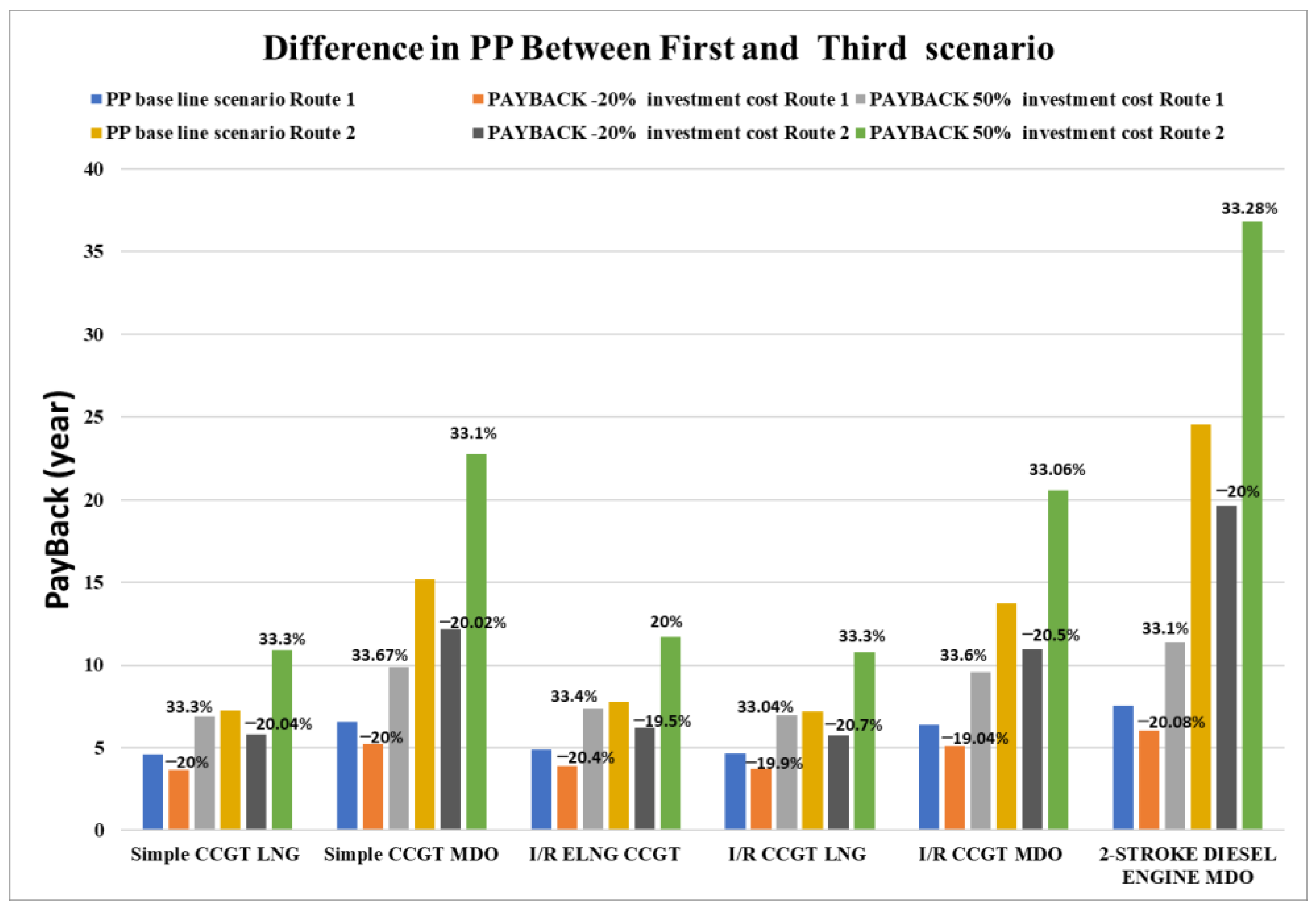

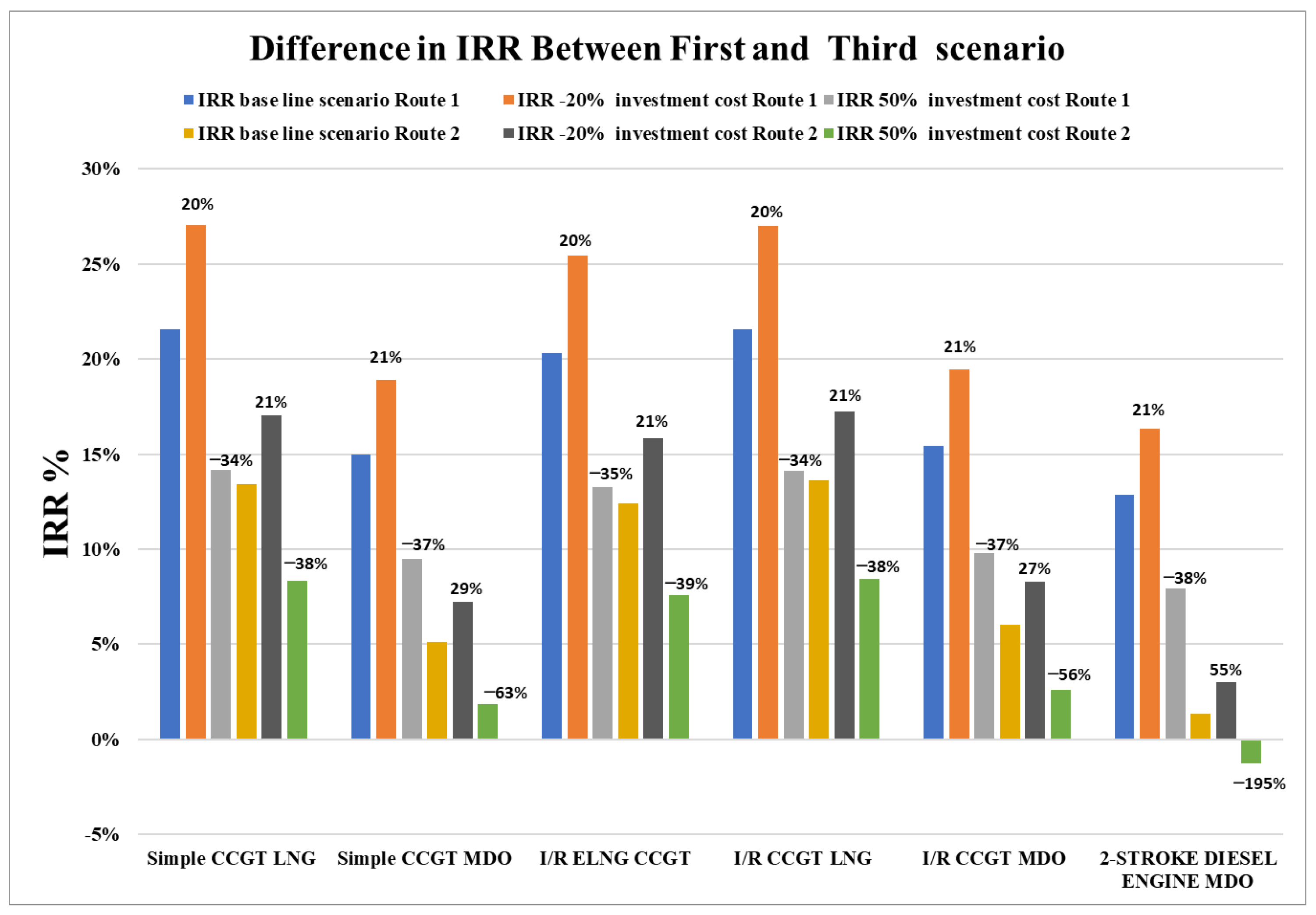

3.4. The Third Scenario

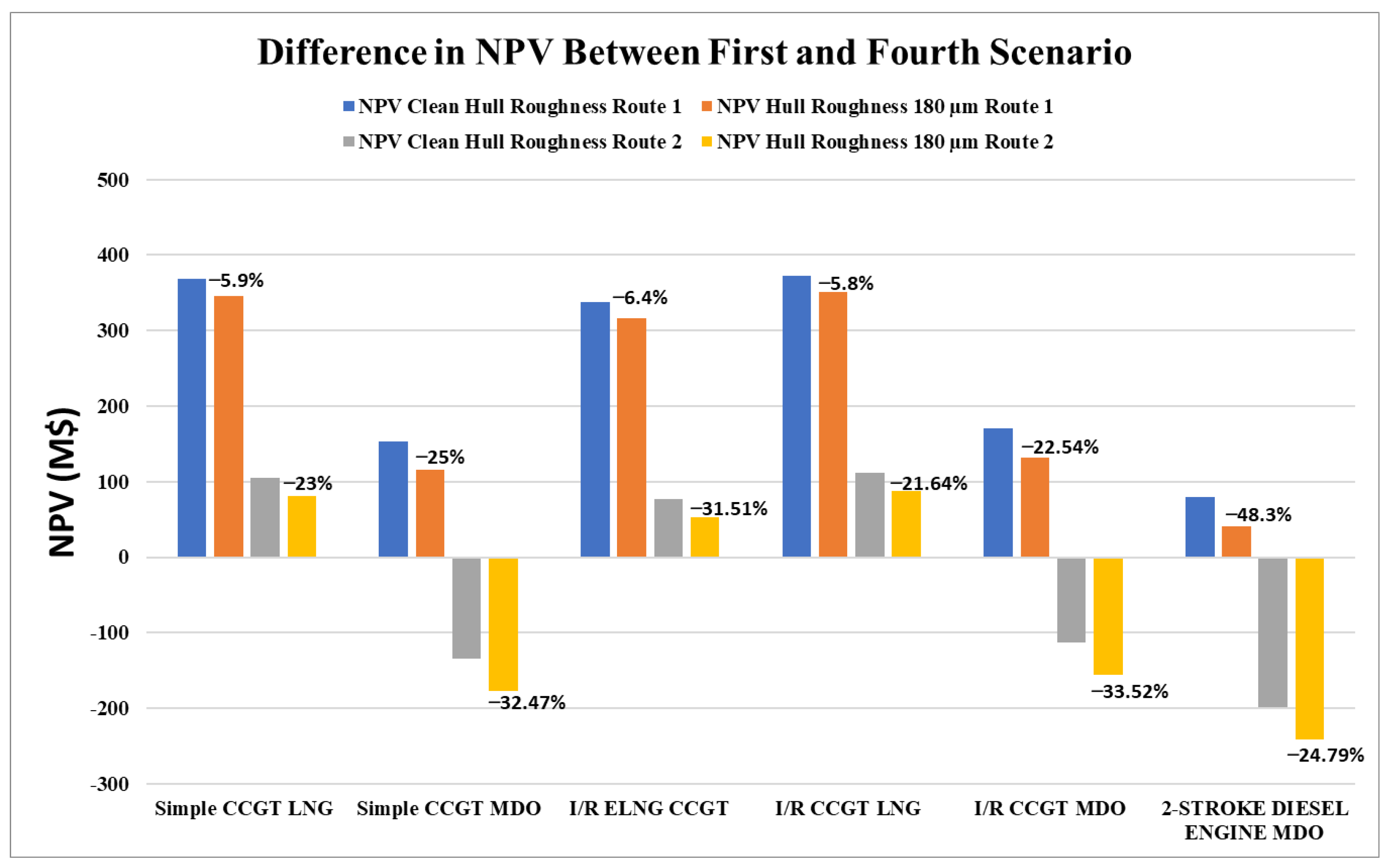

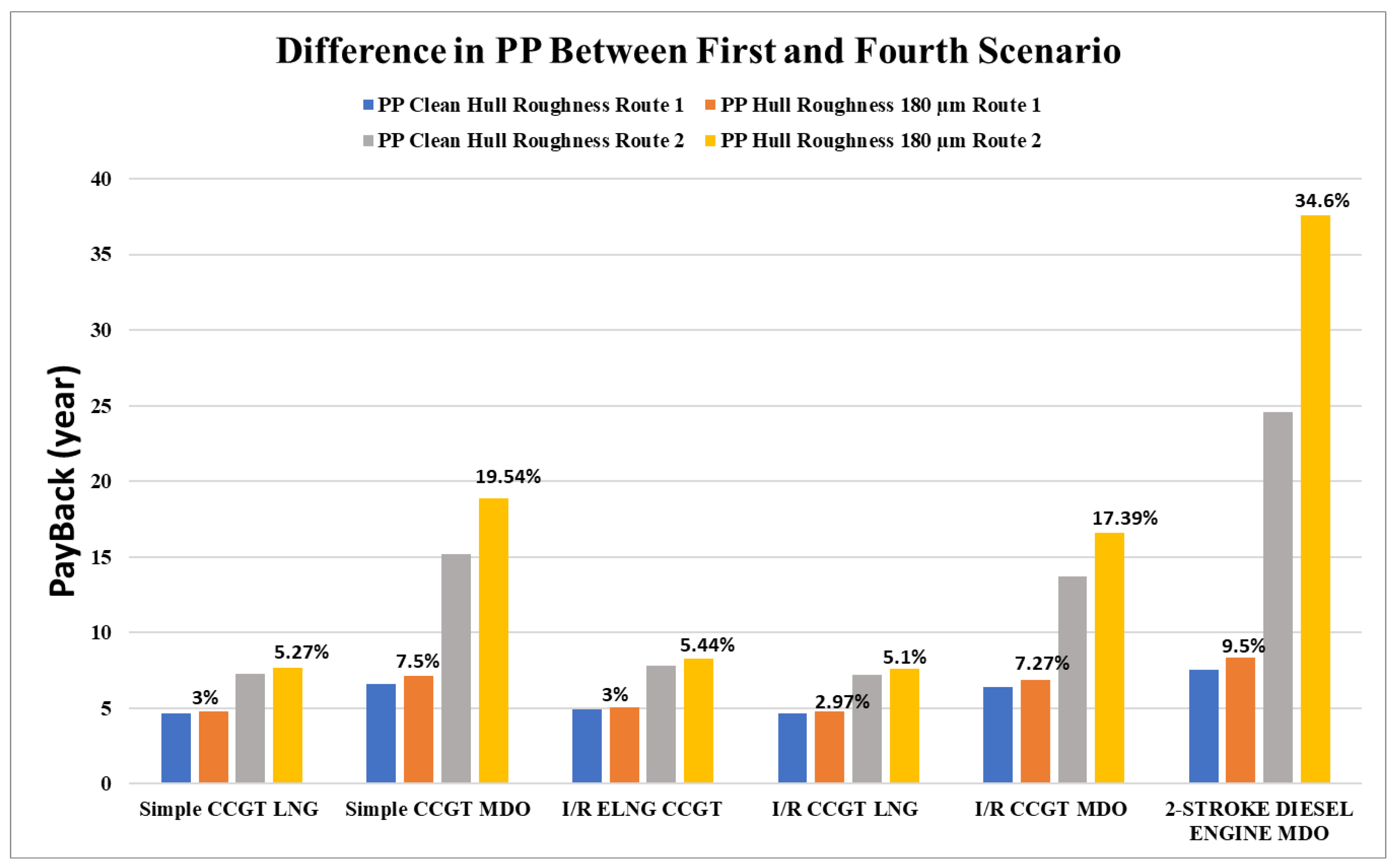

3.5. The Fourth Scenario

4. Conclusions

- Various economic aspects were investigated considering two international shipping routes. The simulated routes were assumed to be direct routes and the stability of the ship was not considered in the analyses. The results indicated that the profitability of Route 1 depends significantly on fuel cost and consumption.

- CCGT cycles that are fueled by MDO are not desirable owing to the higher fuel costs and consumption compared to those that are fueled by LNG. The LNG-fueled CCGTs were more economically viable than the MDO-fueled two-stroke diesel engine as well. The I/R ELNG CCGT, and simple and I/R CCGTs that are fueled by LNG have significant potential as profitable low-risk investments.

- A sensitivity analysis and risk evaluation were performed to examine the effects of the fuel cost, capital cost, and hull fouling resistance on the economic analysis. A total of four scenarios were used to comprehensively analyze the profit and risk that is associated with each propulsion system. The first scenario represented the baseline scenario, with no changes in the fuel cost, capital cost, and hull fouling resistance; the second scenario examined the effect of changes in the fuel cost; the third scenario examined the effect of changes in the capital cost; and the fourth scenario examined the effect of changes in the hull fouling resistance. The results revealed that fuel and capital costs have a significant influence on the overall economic profit.

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Makarova, I.; Gubacheva, L.; Makarov, D.; Buyvol, P. Economic and environmental aspects of the development possibilities for the northern sea route. Transp. Res. Procedia 2021, 57, 347–355. [Google Scholar] [CrossRef]

- Andrikopoulos, A.; Merika, A.; Merikas, A.; Tsionas, M. The dynamics of fleet size and shipping profitability: The role of steel-scrap prices. Marit. Policy Manag. 2020, 47, 985–1009. [Google Scholar] [CrossRef]

- Zhang, G.; Yan, H.; Li, T.; Zhu, Y.; Zhou, S.; Feng, Y.; Zhou, W. Relation analysis on emission control and economic cost of SCR system for marine diesels. Sci. Total Environ. 2021, 788, 147856. [Google Scholar] [CrossRef]

- Baumler, R.; Arce, M.C.; Pazaver, A. Quantification of influence and interest at IMO in Maritime Safety and Human Element matters. Mar. Policy 2021, 133, 104746. [Google Scholar] [CrossRef]

- International Marine Organization. Revised Marpol Annex VI: Regulations for the Prevention of Air Pollution from Ships and NOx Technical Code 2008; International Government Publication; Inter-Governmental Maritime: London, UK, 2009. [Google Scholar]

- Shu, G.; Liang, Y.; Wei, H.; Tian, H.; Zhao, J.; Liu, L. A review of waste heat recovery on two-stroke IC engine aboard ships. Renew. Sustain. Energy Rev. 2013, 19, 385–401. [Google Scholar] [CrossRef]

- Wang, Z.; Zhang, X.; Guo, J.; Hao, C.; Feng, Y. Particle Emissions from a Marine Diesel Engine burning two kinds of Sulphur Diesel Oils with an EGR & Scrubber System: Size, Number & Mass. Process Saf. Environ. Prot. 2022, 163, 94–104. [Google Scholar] [CrossRef]

- Kumar, J.; Kumpulainen, L.; Kauhaniemi, K. Technical design aspects of harbour area grid for shore to ship power: State of the art and future solutions. Int. J. Electr. Power Energy Syst. 2019, 104, 840–852. [Google Scholar] [CrossRef]

- Deng, J.; Wang, X.; Wei, Z.; Wang, L.; Wang, C.; Chen, Z. A review of NOx and SOx emission reduction technologies for marine diesel engines and the potential evaluation of liquefied natural gas fuelled vessels. Sci. Total Environ. 2021, 766, 144319. [Google Scholar] [CrossRef]

- Alzayedi, A.M.T.; Sampath, S.; Pilidis, P. Techno-Environmental Evaluation of a Liquefied Natural Gas-Fuelled Combined Gas Turbine with Steam Cycles for Large Container Ship Propulsion Systems. Energies 2022, 15, 1764. [Google Scholar] [CrossRef]

- Alzayedi, A.M.T.; Batra, A.; Sampath, S.; Pilidis, P. Techno-Environmental Mission Evaluation of Combined Cycle Gas Turbines for Large Container Ship Propulsion. Energies 2022, 15, 4426. [Google Scholar] [CrossRef]

- Talluri, L.; Nalianda, D.K.; Kyprianidis, K.G.; Nikolaidis, T.; Pilidis, P. Techno economic and environmental assessment of wind assisted marine propulsion systems. Ocean. Eng. 2016, 121, 301–311. [Google Scholar] [CrossRef] [Green Version]

- Talluri, L.; Nalianda, D.K.; Giuliani, E. Techno economic and environmental assessment of Flettner rotors for marine propulsion. Ocean Eng. 2018, 154, 1–15. [Google Scholar] [CrossRef] [Green Version]

- Doulgeris, G.; Korakianitis, T.; Pilidis, P.; Tsoudis, E. Techno-economic and environmental risk analysis for advanced marine propulsion systems. Appl. Energy 2012, 99, 1–12. [Google Scholar] [CrossRef]

- Nikolaidis, T. The Turbomatch Scheme for Aero/Industrial Gas Turbine Engine; The TURBOMATCH MANUAL is the copyright of Cranfield University; Cranfield University: Cranfield, UK, 2015. [Google Scholar]

- Bowden, B.S.; Davison, N.J. Resistance Increments due to Hull Roughness Associated with form Factor Extrapolation Methods; NPL: Phoenix, AZ, USA, 1974. [Google Scholar]

- Fetnstein, S.P.; Lander, D.M. A Better Understanding of Why Npv Undervalues Managerial Flexibility. Eng. Econ. 2007, 47, 418–435. [Google Scholar] [CrossRef]

- Alrashed, M.; Nikolaidis, T.; Pilidis, P.; Alrashed, W.; Jafari, S. Economic and environmental viability assessment of NASA’s turboelectric distribution propulsion. Energy Rep. 2020, 6, 1685–1695. [Google Scholar] [CrossRef]

- Pra, A.; Pettenella, D. Investment returns from hybrid poplar plantations in northern Italy between 2001 and 2016: Are we losing a bio-based segment of the primary economy. Ital. Rev. Agric. Econ. 2019, 74, 49–71. [Google Scholar] [CrossRef]

- Borden, B.T. Math behind Financial Aspects of Partnership Distribution Waterfalls. Available online: http://ssrn.com/abstract=2519258%0AElectronic (accessed on 21 April 2022).

- Fikri, M.; Hendrarsakti, J.; Sambodho, K.; Felayati, F.; Octaviani, N.; Giranza, M.; Hutomo, G. Estimating Capital Cost of Small Scale LNG Carrier. In Proceedings of the 3rd International Conference on Marine Technology—SENTA, Surabaya, Indonesia, 5–6 December 2018; Volume 1, pp. 225–229. [Google Scholar] [CrossRef]

- Lazard. Lazard’s Levelised Cost of Energy Analysis. Lazard.Com. 2017. 0–21. Available online: https://www.lazard.com/perspective/levelized-cost-of-energy-2017/ (accessed on 21 April 2022).

- Breeze, P. The Cost of Power Generation. Business Insight. 2010. Available online: http://lab.fs.uni-lj.si/kes/erasmus/TheCostofPowerGeneration.pdf (accessed on 21 April 2022).

- Spees, K.; Newell, S.A.; Carlton, R.; Zhou, B.; Pfeifenberger, J.P. Cost of New Entry Estimates for Combustion-Turbine and Combined-Cycle Plants in PJM; PJM Interconnection, L.L.C.: Norristown, PA, USA, 2011; Available online: https://www.brattle.com/wp-content/uploads/2017/10/6068_cost_of_new_entry_estimates_for_combustion_turbine_and_combined_cycle_plants_in_pjm.pdf (accessed on 21 April 2022).

- Seebregts, A.J. Gas-Fired Power. IEA ETSAP—Technology Brief E02—April 2010. Available online: http://www.iea-etsap.org/web/E-TechDS/PDF/E02-gas_fired_power-GS-AD-gct.pdf (accessed on 21 April 2022).

- Jodat, A. Exergoeconomic analysis of gas turbines cogeneration systems. J. Eng. Appl. Sci. 2016, 11, 2545–2550. [Google Scholar]

- Di Lorenzo, G.; Pilidis, P.; Witton, J.; Probert, D. Monte-Carlo simulation of investment integrity and value for power-plants with carbon-capture. Appl. Energy 2012, 98, 467–478. [Google Scholar] [CrossRef]

- Goldstein, L.; Hedman, B.; Knowles, D.; Freedman, S.I.; Woods, R. Gas-Fired Distributed Energy Resource Technology Characterizations; Gas Research Institute: Des Plaines, IL, USA; National Renewable Energy Laboratory (NREL): Golden, CO, USA, 2003; p. 226.

- Construction Costs for Most Power Plant Types Have Fallen in Recent Years—Today in Energy—U.S. Energy Information Administration (EIA). Available online: https://www.eia.gov/todayinenergy/detail.php?id=31912 (accessed on 21 April 2022).

- California ISO. Variable Operations and Maintenance Cost. 2018. Available online: www.caiso.com (accessed on 21 April 2022).

- Jeong, B.; Jang, H.; Zhou, P.; Lee, J.-u. Investigation on marine LNG propulsion systems for LNG carriers through an enhanced hybrid decision making model. J. Clean. Prod. 2019, 230, 98–115. [Google Scholar] [CrossRef]

- Korberg, A.D.; Brynolf, S.; Grahn, M.; Skov, I.R. Techno-economic assessment of advanced fuels and propulsion systems in future fossil-free ships. Renew. Sustain. Energy Rev. 2021, 142, 110861. [Google Scholar] [CrossRef]

- Aurecon. 2019 Costs and Technical Parameter Review. 2019, p. 57. Available online: https://www.aemo.com.au/-/media/Files/Electricity/NEM/Planning_and_Forecasting/Inputs-Assumptions-Methodologies/2019/Aurecon-2019-Cost-and-Technical-Parameters-Review-Draft-Report.PDF (accessed on 21 April 2022).

- LNG as Marine Fuel—DNV. Available online: https://www.dnv.com/maritime/insights/topics/lng-as-marine-fuel/current-price-development-oil-and-gas.html (accessed on 21 April 2022).

- Han, T.C.; Wang, C.M. Shipping bunker cost risk assessment and management during the coronavirus oil shock. Sustainability 2021, 13, 4998. [Google Scholar] [CrossRef]

- Container Shipping Rates | What Are the Costs in 2021? | MoveHub. Available online: https://www.movehub.com/advice/international-container-shipping-costs/ (accessed on 21 April 2022).

- Dinu, O.; Ilie, A.M. Maritime vessel obsolescence, life cycle cost and design service life. IOP Conf. Ser. Mater. Sci. Eng. 2015, 95, 012067. [Google Scholar] [CrossRef]

| Engine | Fuel |

|---|---|

| Simple CCGT | LNG/MDO |

| Intercooler/reheater CCGT | LNG/MDO |

| ELNG intercooler/reheater CCGT | LNG |

| Component | Diesel Engine | Simple CCGT | I/R CCGT | I/R ELNG CCGT |

|---|---|---|---|---|

| Diesel engine ($/kW) | 460 | — | — | — |

| CCGT ($/kW) | — | 862.5 | 862.5 | 862.5 |

| Gear box (million $) | — | 1.5 | 1.5 | 1.5 |

| Second combustor ($/MW) | — | — | 80,000 | 80,000 |

| Intercooler ($/MW) | — | — | 20,000 | 20,000 |

| Heat exchanger ($/MW) | — | — | — | 150,000 |

| Total capital cost (million $) | 25.760 | 49.8 | 55.4 | 63.8 |

| Installation cost | 30% | 30% | 30% | 30% |

| O&M costs | 2.5% | 4% | 4% | 4% |

| Ship cost (million $) | 176.9 | 176.9 | 176.9 | 176.9 |

| Fuel | Price ($/tonne) |

|---|---|

| LNG | 500 |

| MDO | 887 |

| Simple LNG | Simple MDO | I/R ELNG | I/R LNG | I/R MDO | Two-Stroke Diesel | |

|---|---|---|---|---|---|---|

| NPV | $367,960,759.11 | $153,733,476.41 | $338,162,288.79 | $372,233,784.20 | $170,879,982.89 | $79,740,967.16 |

| PP | 4.62 years | 6.57 years | 4.91 years | 4.61 years | 6.39 years | 7.56 years |

| IRR | 22% | 15% | 20% | 22% | 15% | 13% |

| Simple LNG | Simple MDO | I/R ELNG | I/R LNG | I/R MDO | Two-Stroke Diesel | |

|---|---|---|---|---|---|---|

| NPV | $104,994,834.90 | $−133,881,155.79 | $76,700,960.45 | $111,717,948.74 | $−112,301,091.44 | $−198,630,055.28 |

| PP | 7.27 years | 15.18 years | 7.80 years | 7.19 years | 13.72 years | 24.55 years |

| IRR | 13% | 5% | 12% | 14% | 6% | 12% |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Alzayedi, A.M.T.; Sampath, S.; Pilidis, P. Techno–Economic and Risk Evaluation of Combined Cycle Propulsion Systems in Large Container Ships. Energies 2022, 15, 5178. https://doi.org/10.3390/en15145178

Alzayedi AMT, Sampath S, Pilidis P. Techno–Economic and Risk Evaluation of Combined Cycle Propulsion Systems in Large Container Ships. Energies. 2022; 15(14):5178. https://doi.org/10.3390/en15145178

Chicago/Turabian StyleAlzayedi, Abdulaziz M. T., Suresh Sampath, and Pericles Pilidis. 2022. "Techno–Economic and Risk Evaluation of Combined Cycle Propulsion Systems in Large Container Ships" Energies 15, no. 14: 5178. https://doi.org/10.3390/en15145178