Coupling Chemical Heat Pump with Nuclear Reactor for Temperature Amplification by Delivering Process Heat and Electricity: A Techno-Economic Analysis

Abstract

:1. Introduction

2. Methodology

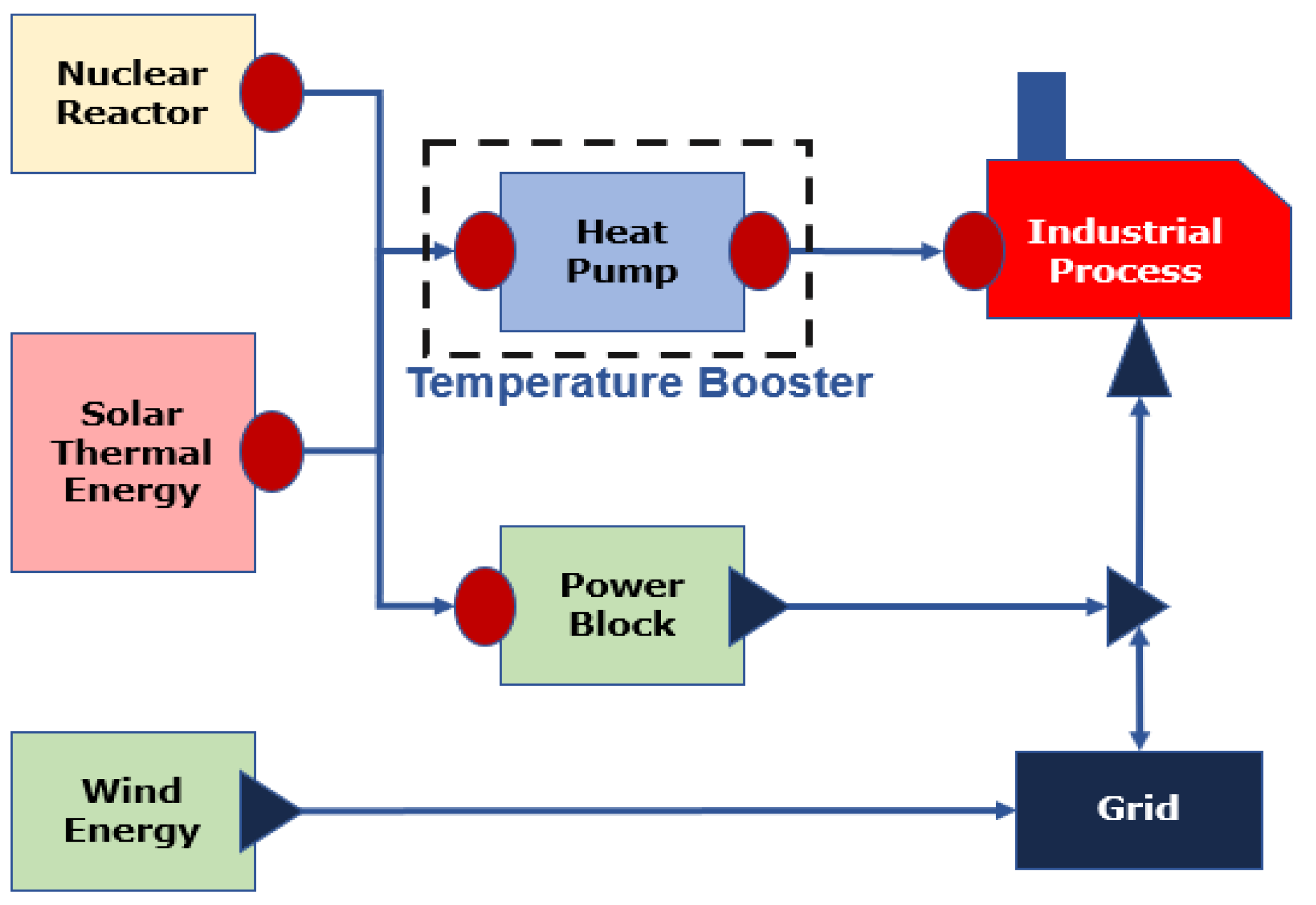

2.1. Baseline ChHP Coupled SMR System

2.2. Assessment of Capital Cost of System

2.3. Economic Indicator Estimates

2.3.1. Payback Period

2.3.2. Net Present Value

2.3.3. Discounted Cash Flow Rate of Return

2.3.4. Levelized Cost of Energy

2.4. Study Approach and Assessment Scenarios

3. Results and Discussion

3.1. Economic Indicators Analysis

3.2. Parametric Study on Overnight Capital Cost of Advanced SMR

3.3. Impact of Increased Carbon Taxes

4. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

Nomenclature

| average annuity | USD | |

| A | annuity | USD |

| AHT | heat transfer area | m2 |

| C | rate | - |

| CC | contingency cost rate | - |

| CF | capacity factor | - |

| c0 | costs | USD |

| DCFR | discounted cash flow rate of return | - |

| DD&E | detailed design and engineering rate | - |

| d | depreciation rate | - |

| E | energy | MWh |

| Fuelspec | specific fuel cost | |

| i | discount rate | - |

| k | thermal conductivity | W m−1 K−1 |

| LCOE | levelized cost of energy | USD MW−1 h−1 |

| L | length | m |

| NPV | net present worth | USD |

| N | time period | yr |

| n | number or magnitude | - |

| O&Mfix | fixed operations and maintenance | |

| O&Mspec | specific operation and maintenance | |

| OCC | overnight capital cost | |

| PBP | payback period | yr |

| PWF | present worth factor | - |

| p | portion | - |

| r | rate | - |

| rec | recovered cost from salvaged equipment | USD |

| SP | selling price of utility | USD MW−1 h−1 |

| SCC | specific capital cost | USD kWe |

| annual investment | USD | |

| V | fixed capital investment | USD |

| WACC | weighted average capital cost | - |

| Greek Letters | ||

| Δ | change or difference | - |

| first law thermodynamic efficiency | - | |

| tax rate | - | |

| Subscript/Superscript | ||

| bed | bed | |

| construction | ||

| cf | annual cash flow | |

| d | debt | |

| eq | equity | |

| e | electricity | |

| inf | inflation | |

| j | plant operation year index | |

| k | plant construction year index | |

| th | thermal | |

| v | investment | |

| Abbreviations | ||

| ChHP | Chemical Heat Pump | |

| EIA | Energy Information Administration | |

| FOAK | First-of-a-Kind | |

| GHG | Greenhouse gases | |

| IES | Integrated Energy System | |

| INRES | Integrated Nuclear-Renewable Energy Systems | |

| MACRS | Modified Accelerated Cost Recovery System | |

| NHES | Nuclear Hybrid Energy System | |

| NOAK | Nth-of-a-Kind | |

| SMR | Small Modular Reactor | |

References

- Bragg-Sitton, S.M.; Boardman, R.; Rabiti, C.; O’Brien, J. Reimagining future energy systems: Overview of the US program to maximize energy utilization via integrated nuclear-renewable energy systems. Int. J. Energy Res. 2020, 44, 8156–8169. [Google Scholar] [CrossRef]

- Bragg-Sitton, S.M.; Boardman, R.; Rabiti, C.; Kim, J.S.; McKellar, M.; Sabharwall, P.; Chen, J.; Cetiner, M.S.; Harrison, T.J.; Qualls, A.L. Nuclear-Renewable Hybrid Energy Systems: 2016 Technology Development Program Plan. 2016. Available online: https://doi.org/10.2172/1333006 (accessed on 21 November 2021).

- MIT. The Future of Nuclear Energy in a Carbon-Constrained World. 2018. Available online: https://energy.mit.edu/research/future-nuclear-energy-carbon-constrained-world/ (accessed on 21 November 2021).

- McMillan, C.A.; Boardman, R.; McKellar, M.; Sabharwall, P.; Ruth, M.; Bragg-Sitton, S. Generation and Use of Thermal Energy in the U.S. Industrial Sector and Opportunities to Reduce its Carbon Emissions. 2016. Available online: https://doi.org/10.2172/1334495 (accessed on 21 November 2021).

- Wongsuwan, W.; Kumar, S.; Neveu, P.; Meunier, F. A review of chemical heat pump technology and applications. Appl. Therm. Eng. 2001, 21, 1489–1519. [Google Scholar] [CrossRef]

- Arjmand, M.; Liu, L.; Neretnieks, I. Exergetic efficiency of high-temperature-lift chemical heat pump (CHP) based on CaO/CO2and CaO/H2O working pairs. Int. J. Energy Res. 2013, 37, 1122–1131. [Google Scholar] [CrossRef]

- Sabharwall, P.; Wendt, D.; Utgikar, V.P. Application of Chemical Heat Pumps for Temperature. 2013. Available online: https://doi.org/10.2172/1104502 (accessed on 21 November 2021).

- Schaube, F.; Koch, L.; Wörner, A.; Müller-Steinhagen, H. A thermodynamic and kinetic study of the de- and rehydration of Ca(OH)2 at high H2O partial pressures for thermo-chemical heat storage. Thermochim. Acta 2012, 538, 9–20. [Google Scholar] [CrossRef]

- Matsuda, H.; Ishizu, T.; Lee, S.K.; Hasatani, M. Kinetic Study of Ca (OH) _2/CaO Reversible Thermochemical Reaction for Thermal Energy Storage by Means of Chemical Reaction. Kagaku Kogaku Ronbunshu 1985, 11, 542. [Google Scholar] [CrossRef]

- Dai, L.; Long, X.-F.; Lou, B.; Wu, J. Thermal cycling stability of thermochemical energy storage system Ca(OH)2/CaO. Appl. Therm. Eng. 2018, 133, 261–268. [Google Scholar] [CrossRef]

- Schmidt, M.; Gutierrez, A.; Linder, M. Thermochemical energy storage with CaO/Ca(OH)2 – Experimental investigation of the thermal capability at low vapor pressures in a lab scale reactor. Appl. Energy 2017, 188, 672–681. [Google Scholar] [CrossRef]

- Schmidt, M.; Szczukowski, C.; Roßkopf, C.; Linder, M.; Wörner, A. Experimental results of a 10 kW high temperature thermochemical storage reactor based on calcium hydroxide. Appl. Therm. Eng. 2014, 62, 553–559. [Google Scholar] [CrossRef]

- Criado, Y.A.; Alonso, M.; Abanades, J.C.; Anxionnaz-Minvielle, Z. Conceptual process design of a CaO/Ca(OH)2 thermochemical energy storage system using fluidized bed reactors. Appl. Therm. Eng. 2014, 73, 1087. [Google Scholar] [CrossRef]

- Schaube, F.; Kohzer, A.; Schütz, J.; Wörner, A.; Müller-Steinhagen, H. De- and rehydration of Ca(OH)2 in a reactor with direct heat transfer for thermo-chemical heat storage. Part A: Experimental results. Chem. Eng. Res. Des. 2013, 91, 856–864. [Google Scholar] [CrossRef]

- Funayama, S.; Takasu, H.; Zamengo, M.; Kariya, J.; Kim, S.T.; Kato, Y. Composite material for high-temperature thermochemical energy storage using calcium hydroxide and ceramic foam. Energy Storage 2019, 1, e53. [Google Scholar] [CrossRef]

- Gupta, A.; Armatis, P.D.; Sabharwall, P.; Fronk, B.M.; Utgikar, V. Thermodynamics of Ca(OH)2/CaO reversible reaction: Refinement of reaction equilibrium and implications for operation of chemical heat pump. Chem. Eng. Sci. 2021, 230, 116227. [Google Scholar] [CrossRef]

- Gupta, A.; Armatis, P.D.; Sabharwall, P.; Fronk, B.M.; Utgikar, V. Energy and exergy analysis of Ca(OH)2/CaO dehydration-hydration chemical heat pump system: Effect of reaction temperature. J. Energy Storage 2021, 39, 102633. [Google Scholar] [CrossRef]

- Criado, Y.A.; Alonso, M.; Abanades, J.C. Enhancement of a CaO/Ca(OH)2 based material for thermochemical energy storage. Sol. Energy 2016, 135, 800–809. [Google Scholar] [CrossRef]

- Yan, J.; Zhao, C. First-principle study of CaO/Ca(OH)2 thermochemical energy storage system by Li or Mg cation doping. Chem. Eng. Sci. 2014, 117, 293–300. [Google Scholar] [CrossRef]

- Sakellariou, K.G.; Karagiannakis, G.; Criado, Y.A.; Konstandopoulos, A.G. Calcium oxide based materials for thermochemical heat storage in concentrated solar power plants. Sol. Energy 2014, 122, 215–230. [Google Scholar] [CrossRef]

- Roßkopf, C.; Haas, M.; Faik, A.; Linder, M.; Wörner, A. Improving powder bed properties for thermochemical storage by adding nanoparticles. Energy Convers. Manag. 2014, 86, 93–98. [Google Scholar] [CrossRef]

- Roßkopf, C.; Afflerbach, S.; Schmidt, M.; Görtz, B.; Kowald, T.; Linder, M.; Trettin, R. Investigations of nano coated calcium hydroxide cycled in a thermochemical heat storage. Energy Convers. Manag. 2015, 97, 94–102. [Google Scholar] [CrossRef]

- Gupta, A.; Armatis, P.D.; Sabharwall, P.; Fronk, B.M.; Utgikar, V. Kinetics of Ca(OH)2 decomposition in pure Ca(OH)2 and Ca(OH)2-CaTiO3 composite pellets for application in thermochemical energy storage system. Chem. Eng. Sci. 2021, 246, 116986. [Google Scholar] [CrossRef]

- Spoelstra, S.; Haije, W.; Dijkstra, J. Techno-economic feasibility of high-temperature high-lift chemical heat pumps for upgrading industrial waste heat. Appl. Therm. Eng. 2002, 22, 1619–1630. [Google Scholar] [CrossRef]

- Karaca, F.; Kıncay, O.; Bolat, E. Economic analysis and comparison of chemical heat pump systems. Appl. Therm. Eng. 2002, 22, 1789–1799. [Google Scholar] [CrossRef]

- Bayon, A.; Bader, R.; Jafarian, M.; Fedunik-Hofman, L.; Sun, Y.; Hinkley, J.; Miller, S.; Lipiński, W. Techno-economic assessment of solid–gas thermochemical energy storage systems for solar thermal power applications. Energy 2018, 149, 473–484. [Google Scholar] [CrossRef]

- Boldon, L. PhD Thesis, Rensselaer Polytechnic Institute. 2015. Available online: https://ui.adsabs.harvard.edu/abs/2015PhDT.......258B (accessed on 1 March 2022).

- Boldon, L.M.; Sabharwall, P. Small modular reactor: First-of-a-Kind (FOAK) and Nth-of-a-Kind (NOAK) Economic Analysis. 2014. Available online: https://www.osti.gov/biblio/1167545/ (accessed on 1 March 2022).

- Sabharwall, P.; Bragg-Sitton, S.; Boldon, L.; Blumsack, S. Nuclear Renewable Energy Integration: An Economic Case Study. Electr. J. 2015, 28, 85–95. [Google Scholar] [CrossRef]

- Alonso, G.; Bilbao, S.; del Valle, E. Economic competitiveness of small modular reactors versus coal and combined cycle plants. Energy 2016, 116, 867–879. [Google Scholar] [CrossRef]

- Armatis, P.D.; Sabharwall, P.; Gupta, A.; Utgikar, V.; Fronk, B.M. Transient Effects and Material Challenges in Developing Chemical/Absorption Heat Pumps for Nuclear Energy Thermal Storage and Upgrade. Energy Resour. Technol. 2022. Submitted. [Google Scholar]

- Richards, J.; Sabharwall, P.; Memmott, M. Economic comparison of current electricity generating technologies and advanced nuclear options. Electr. J. 2017, 30, 73–79. [Google Scholar] [CrossRef]

- Stewart, W.; Shirvan, K. Capital cost estimation for advanced nuclear power plants. Renew. Sustain. Energy Rev. 2022, 155, 111880. [Google Scholar] [CrossRef]

- Armatis, P.D.; Gupta, A.; Sabharwall, P.; Utgikar, V.; Fronk, B.M. A chemical-absorption heat pump for utilization of nuclear power in high temperature industrial processes. Int. J. Energy Res. 2021, 45, 14612–14629. [Google Scholar] [CrossRef]

- CG Thermal, Graphite & SIC Heat Exchangers | Fluoropolymers. Available online: https://cgthermal.com/ (accessed on 1 March 2022).

- Linder, M.; Roßkopf, C.; Schmidt, M.; Wörner, A. Thermochemical Energy Storage in kW-scale based on CaO/Ca(OH)2. Energy Procedia 2014, 49, 888–897. [Google Scholar] [CrossRef]

- Peters, M.S.; Timmerhaus, K.; West, R.E. Plant Design and Economics for Chemical Engineers, 5th ed.; McGraw-Hill: New York, NY, USA, 2003. [Google Scholar]

- IRS. How to Depreciate Property. Available online: https://www.irs.gov/publications/p946 (accessed on 1 March 2022).

- Aldersey-Williams, J.; Rubert, T. Levelised cost of energy—A theoretical justification and critical assessment. Energy Policy 2018, 124, 169–179. [Google Scholar] [CrossRef]

- EIA, U.S. EIA, U.S. Energy Information Administration. Available online: https://www.eia.gov/index.php (accessed on 1 March 2022).

- Locatelli, G.; Bingham, C.; Mancini, M. Small modular reactors: A comprehensive overview of their economics and strategic aspects. Prog. Nucl. Energy 2014, 73, 75–85. [Google Scholar] [CrossRef]

- Nuclear Energy Institute. Cost Competitiveness of Micro-Reactors for Remote Markets. Available online: https://www.nei.org/resources/reports-briefs/cost-competitiveness-micro-reactors-remote-markets (accessed on 1 March 2022).

| Category | Assumed Total Capital Investment % | Adjusted Total Capital Investment % |

|---|---|---|

| Purchased Equipment | 50 | 46.29 |

| Equipment Installation | 10 | 9.25 |

| Instrumentation | 6 | 5.55 |

| Piping | 8 | 7.40 |

| Electrical | 3 | 2.77 |

| Buildings | 2 | 1.85 |

| Yard Improvements | 2 | 1.85 |

| Service Facilities | 8 | 7.40 |

| Land | 1 | 0.92 |

| Engineering and Supervision | 5 | 4.62 |

| Construction Expenses | 5 | 4.62 |

| Legal Expenses | 1 | 0.92 |

| Contractor’s Fee | 2 | 1.85 |

| Contingency | 5 | 4.62 |

| Region | 2021 Industrial Natural Gas Price (USD/MMBtu) | 2021 Electricity Data (USD/MWh) |

|---|---|---|

| California | 9.06 | 66.5 |

| Midwest | 6.07 | 57.7 |

| Northwest | 8.15 | 59.78 |

| New England | 9.68 | 47.75 |

| Southwest | 5.62 | 64.78 |

| PJM | 6.67 | 42.55 |

| Parameters | Assumed Values | References |

|---|---|---|

| Overnight Cap Cost | USD4637/kWe | Sabharwall et al. [29] |

| Capacity Factor | 90% | Sabharwall et al. [29] |

| Lifetime | 60 years | Sabharwall et al. [29], Alonso et al. [30] |

| Variable O&M Cost | USD0.486/MWhe | Sabharwall et al. [29] |

| Fixed O&M Cost | USD19,500,000/year | Sabharwall et al. [29] |

| Fuel Cost | USD0 (included in O&M) | Sabharwall et al. [29] |

| Construction Period | 3 (60%, 20%, 20%) | Alonso et al. [30] |

| CO2 Tax | USD150/ton | Locatelli et al. [41] |

| Depreciation | Variable | MACRS Method [37] |

| Corporate Tax Rate | 21% | Nuclear Energy Institute [42] |

| Inflation Rate | 1.1% | MIT report [3] |

| Cost of Debt | 4% | Sabharwall et al. [29] |

| Debt Portion | 30% | Sabharwall et al. [29] |

| Regions | SMR | NHES-1 | NHES-2 | NHES-3 | NHES-4 |

|---|---|---|---|---|---|

| California | 4 | 5 | 3 | 2 | 1 |

| Midwest | 4 | 5 | 3 | 2 | 1 |

| Northwest | 5 | 4 | 3 | 2 | 1 |

| New England | 5 | 1 | 2 | 3 | 4 |

| Southwest | 3 | 5 | 4 | 2 | 1 |

| PJM | 5 | 1 | 2 | 3 | 4 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Gupta, A.; Sabharwall, P.; Armatis, P.D.; Fronk, B.M.; Utgikar, V. Coupling Chemical Heat Pump with Nuclear Reactor for Temperature Amplification by Delivering Process Heat and Electricity: A Techno-Economic Analysis. Energies 2022, 15, 5873. https://doi.org/10.3390/en15165873

Gupta A, Sabharwall P, Armatis PD, Fronk BM, Utgikar V. Coupling Chemical Heat Pump with Nuclear Reactor for Temperature Amplification by Delivering Process Heat and Electricity: A Techno-Economic Analysis. Energies. 2022; 15(16):5873. https://doi.org/10.3390/en15165873

Chicago/Turabian StyleGupta, Aman, Piyush Sabharwall, Paul D. Armatis, Brian M. Fronk, and Vivek Utgikar. 2022. "Coupling Chemical Heat Pump with Nuclear Reactor for Temperature Amplification by Delivering Process Heat and Electricity: A Techno-Economic Analysis" Energies 15, no. 16: 5873. https://doi.org/10.3390/en15165873