Iraq Oil Industry Infrastructure Development in the Conditions of the Global Economy Turbulence

Abstract

:1. Introduction

- Oil industry infrastructure is a group of branches and activities that determine the production of oil and oil products and their processing and logistics to consumers. It is necessary to separate the functioning for the oil and gas industry of Iraq into macro-, meso- and microlevels, which made it possible to come to the following conclusions:

- -

- At the microlevel (individual oil companies), the infrastructure is determined by a set of facilities;

- -

- At the mesolevel (individual territories, districts), by groups of branches and institutions for regulation;

- -

- At the macrolevel (individual states), by general conditions of economic activity. The market infrastructure seems to be more complex in terms of its structure, which can be the subject of individual studies.

- 3.

- Infrastructural facilities of the oil industry are production facilities (production infrastructure) and domestic as well as socio-cultural and residential facilities (social infrastructure). Production infrastructure performs the function of direct support of the material production process. Social infrastructure includes industries that are indirectly related to the production process (medical facilities, educational institutions, cultural institutions, residential buildings, etc.) [22].

2. Methodology

2.1. Methods of Research on the Development of the Infrastructure of the Oil Industry in Iraq

- The differentiated composition of the oil industry infrastructure leads to the need for information richness in various other branches and sectors of the economy, while we focus on the production and transport components as priority infrastructure for the oil industry in Iraq.

- -

- “Rigid” (production, transport, social);

- -

- “Soft” (institutional and information) [14].

- -

- Increasing the total financing volume;

- -

- Regulating the ratio of public and private capital;

- -

- Setting the ratio of new construction and restoration (modernization) of existing facilities;

- -

- Reasonable location of new oil industry infrastructure facilities [47].

2.2. Formation of a Balanced Scorecard

- (1)

- Prospects—the main projections of activity in which the strategy is decomposed in order to be implemented. In the BSC, the prospects are reflected in the form of strategic projections (maps). Usually, four basic strategic projections are used, but their number can be increased in accordance with the strategy specifics.

- (2)

- Strategic goals, which are formulated in accordance with the strategy directions and refer to one of the strategic maps of the system. By nature, they are a decomposition of the main goal of the socio-economic system in a certain key area of activity.

- (3)

- Indicators, which are measurable summaries of goals, i.e., quantifiable categories that reflect progress towards a strategic goal. Indicators imply certain actions necessary to achieve the goal and indicate how the strategy will be implemented at the operational level. The indicators are designed to bring complex and often vague goals into a more specific and understandable framework. At the same time, their system allows viewing the current situation in a strategic perspective.

- (4)

- Target values—the values of indicators that must be achieved over a certain period.

- (5)

- Cause–effect relations link strategic goals (or indicators) into an integral chain in such a way that the achievement of one of them determines progress in achieving the other.

- (6)

- Strategic initiatives—programs and projects that contribute to the achievement of strategic goals.

2.3. Methods of Forming a Comprehensive System of Indicators for the Development of the Infrastructure of the Oil Industry

- (1)

- For each factorial feature, the sum of ranks assigned by all the experts is determined:

- (2)

- The total sum of ranks is calculated:

- (3)

- The average sum of ranks of factors is determined:

- (4)

- The sum of squares of deviations of the sums of ranks of factor attributes from the average sum is determined:

3. Results

3.1. The Impact of the “Path-Dependence” Concept on the Iraqi Oil Industry’s Infrastructure

- -

- Threats of terrorism, security, oil theft;

- -

- Insufficient capacity and energy efficiency of ports and railways;

- -

- Instability of logistics, disruption of supply chains.

- -

- Insufficient extracting and refining capacities;

- -

- Obsolescence of technologies, insufficiency of production capacities;

- -

- Attraction of foreign investments.

- -

- Security threats related to terrorism and theft of oil during transportation through pipelines, causing damage to transport infrastructure facilities and preventing their normal functioning;

- -

- Insufficient throughput capability of ports and railways as a result of destruction during wars and sanctions and the need for significant investment in rehabilitation and reconstruction;

- -

- Instability of transportation due to its insecurity and low level of centralized management, as well as maintenance.

- -

- Openness and use of technologies and experience of foreign companies through investments;

- -

- Consideration of interests of the Iraqi people in terms of domestic energy supply and improved welfare through the redistribution of income from oil exports.

- -

- Completion and improvement of legislative and strategic documents;

- -

- Establishment and maintenance of relevant institutions and organizations;

- -

- Development and maintenance of organizational and economic mechanisms to attract investments and redistribution of oil revenues.

- -

- Need for substantial investments into technologically obsolete and inadequate infrastructure;

- -

- Different interests in different territories;

- -

- The high corruption level;

- -

- Opportunities for foreign companies to develop oil fields while ensuring national energy security and improving the living standards of Iraqi citizens.

- Iraq’s dependence on oil and gas revenues mainly to replenish the general budget in view of underdeveloped oil and gas production infrastructure, which makes the Iraqi economy vulnerable to crisis in the event of low prices.

- The Iraqi oil industry’s production infrastructure (both upstream and downstream) has been repeatedly damaged by wars and international sanctions that have affected both refineries and wells.

- Technological obsolescence of refineries in Iraq and their insufficient production capacity have led to an inability to meet domestic demand for petroleum products and the need for imports.

- Failure to properly dispose of oil wastes results in environmental pollution.

- The need to restore or reconstruct existing facilities of the production infrastructure and create new ones in the oil industry requires attracting new investments, which requires further improvement in legislation in the oil and gas sector.

- -

- Solve the problem of self-sufficiency of the Iraqi economy in petroleum products;

- -

- Improve the structure of exports due to partial replacement of crude oil with petroleum products;

- -

- Develop petrochemical and gas chemical processing facilities in the oil and gas production areas.

- -

- Helps in meeting domestic demand for petroleum products;

- -

- Increases national income due to the development of oil and gas processing and petrochemical industries;

- -

- Creates new jobs, raises incomes and improves the quality of living for Iraqi people;

- -

- Leads to great demand for and improvement in skills of Iraqi technical and engineering personnel, the introduction of modern technology and transfer of best production and organizational practices.

- No in-house servers. Servers are provided by a foreign country.

- The broad-band Internet is provided by foreign countries. Internet used in Iraq is provided by Airthink or from Turkey, Kuwait and the UAE. There are about 13 Internet providers in Iraq, with only two of them being Iraqi.

- The Ministry of Communications fully controls the Internet and shuts it down for one or two days if there are events such as demonstrations in Iraq. In addition, the Internet is turned off for three hours during exam periods in schools.

- Internet quality is mainly poor due to low speeds and intermittent power supply.

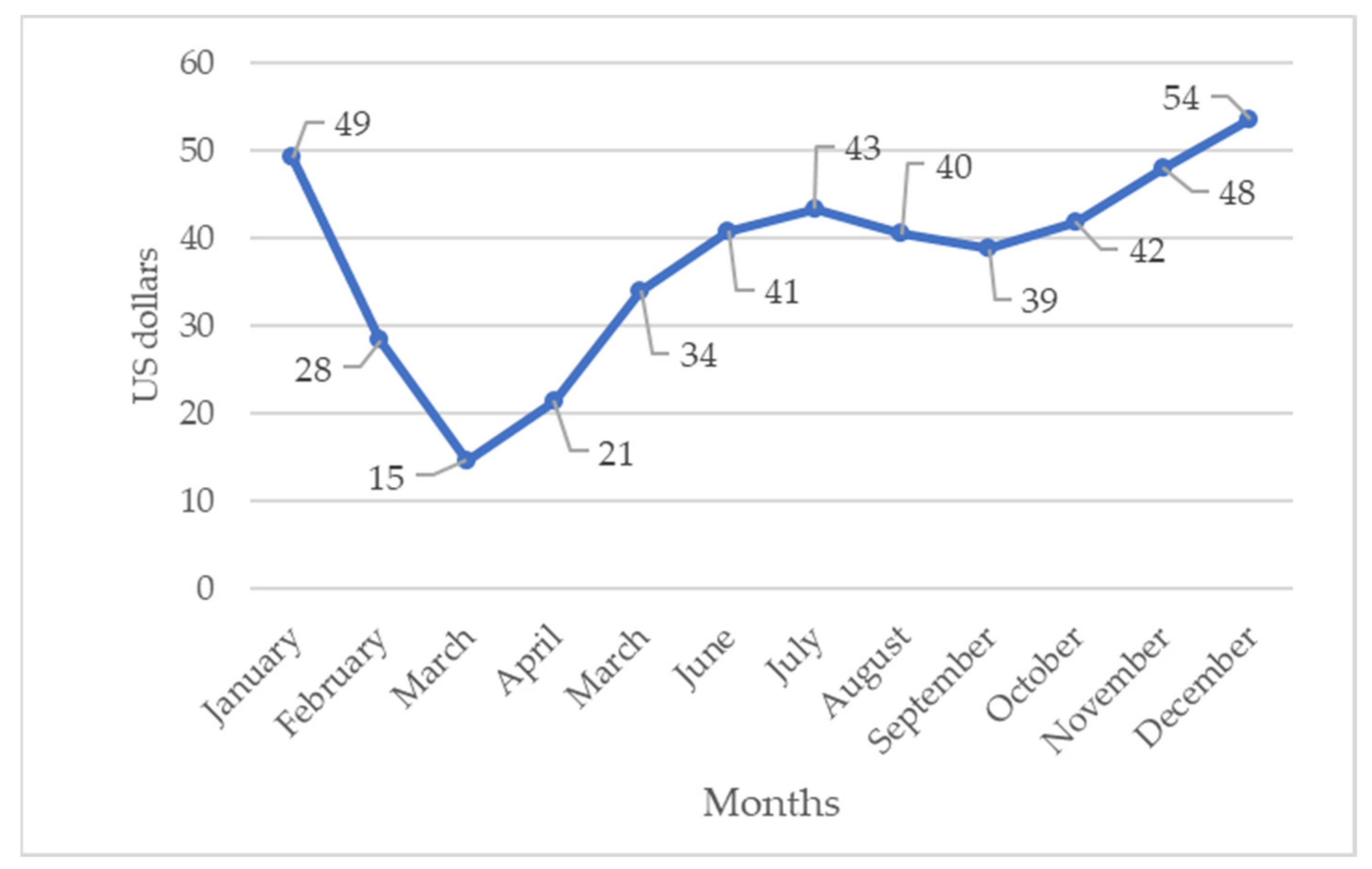

- High price of the Internet, viz., minimum USD 25 per month

- Insufficient area of the mobile communication network coverage. All this causes unstable and low-speed mobile Internet and poor telephone service.

- Iraq does not produce equipment for information systems, but purchases it from foreign countries. Software is also purchased from foreign countries.

- A preliminary review of the main trends in the global oil refining industry development in relation to innovation and application for the Iraq oil refineries infrastructure development;

- General description of the oil refining industry in the Republic of Iraq;

- Review of the problems and prospects for the development of the oil refining industry in the Republic of Iraq;

- Rationale for the project of refinery construction, refinery infrastructure and determination of their location;

- Determination of the goals, objectives of the project, key stakeholders of the projects and the project team formation;

- Calculation of technical and economic indicators of the project;

- Scheduling of the main stages of the project, completion periods matching;

- Selection of vendors and contractors, awarding contracts;

- Project budget establishment and sources of financing determination;

- Calculation of integral indicators of the project economic efficiency;

- Project risks analysis and elaboration of mitigation measures;

- Project planning and progress monitoring.

- -

- The touchy economic situation in the Republic of Iraq;

- -

- Dependence on external suppliers of basic oil products;

- -

- Cash outflow for the purchase of petroleum products;

- -

- The country’s underemployed population.

- -

- A well-developed petroleum products consumer market in the country and throughout the world;

- -

- A well-developed transport system (roads and railways, port);

- -

- The availability of land resources sufficient to allocate a site for refinery construction, laying an oil pipeline and a product pipeline;

- -

- The possibility of connection to the main oil pipeline;

- -

- The possibility of obtaining state limits for providing the refinery with raw materials, i.e., oil.

- Implementation of the state-of-the-art technologies and equipment that allow processing all after-products formed in the production of motor fuels into high-value-added, commercially successful products;

- Involvement of natural gas and coal in the production cycle as a raw material other than oil in order to achieve maximum business profitability and reduce price risks in the mineral market;

- Production of all components necessary for the production of finished products at the enterprise.

- Availability of well-developed transport infrastructure for supplying the refinery with raw materials and the shipment of finished products;

- Proximity of large markets for commercial products;

- Convenience of the products’ export in terms of transport infrastructure: a short transportation leg and availability of well-developed transport infrastructure that can ensure the high profitability of export deliveries;

- Favorable environmental situation in close proximity to the proposed site: the absence of business entities, whose synergistic impact on the region’s ecosystem can lead to deterioration in the environmental situation in the nearby settlements and water bodies.

- The proximity of high-quality, well-developed and large-scale social and educational infrastructure.

3.2. Development of the Strategic Development Scorecard of the Iraq Oil Industry

- (1)

- Aggregation: it is advisable to use the maximum possible level of subsystems consolidation.

- (2)

- The selection of representative indicators: it is necessary to determine the variables that provide reliable informational characteristics of the subsystems state.

- (3)

- “Compression”: it is advisable to identify indicators that reflect the influence of the main factors in development and functioning of the subsystems.

- (4)

- Vulnerability hotspot approach: the most vulnerable hotspots in a given system should be identified and appropriate indicators defined.

- (5)

- The averaged value of several indicators: if it is necessary to consider a number of indicators representing in some respect diverse aspects of the question of assessing the reference point, an index that provides an averaged description of the situation can be determined.

- (6)

- Indicator with the lowest value: if the satisfaction of the reference point depends on the acceptable state of each of several indicators, the indicator with the lowest value can be taken as the representative.

3.3. The Project Approach in the Management of Infrastructure Development Based on the Model of the System of Strategic Development Indicators

3.4. Comprehensive Assessment of the Effectiveness of Projects for the Development of the Infrastructure of the Oil Industry in Iraq

- The choice of the nomenclature of assessment indicators. The indicators used to assess the infrastructural components are determined by the specifics of the infrastructure.

- Ranking of assessment indicators. The ranking involves the evaluation of the importance of the criteria, allowing for a targeted policy on the creation of modern infrastructure of the oil industry. The importance of the indicators is determined by the introduction of special weighting indicators, the values of which are based on expert assessments.

- Selection of the comparison base. The study showed that in modern conditions the elements of the best world infrastructure should act as a basis for comparison (the approach currently used, based only on compliance with the best domestic standard, no longer meets the requirements of the oil industry infrastructure development).

- Calculating partial indicators of the technical level.

- 5.

- Calculating partial indicators of the cost of creating the components of the infrastructure.

- 6.

- Determination of the weighting coefficients of indicators characterizing the costs of the infrastructure of the oil industry.

- 7.

- Calculating the general indicators of the technical level and costs for the infrastructure of the oil industry.

- 8.

- Calculating a competitiveness indicator.

- -

- Coefficient of change in the share of workers employed in conditions that do not meet sanitary and hygienic standards ():

- -

- Coefficient of change in the number of employees subject to training, retraining or advanced training ():

4. Discussion of the Results

- Production infrastructure:

- -

- Damage resulting from wars and international sanctions that have affected both refineries and wells;

- -

- Technological obsolescence of oil refineries and insufficient production capacity;

- -

- Pollution of the environment in the absence of effective technologies for the disposal of oil wastes [61];

- -

- Insufficient investments for the restoration, reconstruction of existing production infrastructure facilities and creation of new ones in view of inadequate legislation;

- Transport infrastructure:

- -

- Insufficient throughput capacity of ports and railroads as a result of destructions;

- -

- Instability of transportation due to its insecurity and low level of service.

- -

- Social infrastructure:

- -

- Inadequate medical care for potential workforce in oil industry;

- -

- Lack of national qualified personnel in the field of oil and gas production and management of oil companies, which is not compensated by national educational institutions.

- The technological infrastructure is of great significance for the competitiveness of the Iraqi oil industry. Technological efficiency, including the assessment of modernity, competitiveness and patentability, must be included in the assessment of the efficiency of the ongoing programs and projects.

- The social and environmental components are of utmost importance for the development of the modern oil industry as well. When evaluating efficiency, it is necessary to take into account these types of infrastructures and efficiencies.

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Fomenko, N.M.; Al Mashhadani, M.D.H. The role of innovations and problems of development of the oil industry in Iraq. Econ. Entrep. 2019, 110, 128–132. [Google Scholar]

- Kasaev, E.O. Prospects of the Russian Oil Business in Iraq. Institute of the Middle East. 2017. Available online: http://www.iimes.ru/?p=32917 (accessed on 16 July 2022).

- Ra’ed, M.J.; Keating, C.B. Fragility of oil as a critical infrastructure problem. Int. J. Crit. Infrastruct. Prot. 2014, 7, 86–99. [Google Scholar] [CrossRef]

- Dong, J.; Asif, Z.; Shi, Y.; Zhu, Y.; Chen, Z. Climate Change Impacts on Coastal and Offshore Petroleum Infrastructure and the Associated Oil Spill Risk: A Review. J. Mar. Sci. Eng. 2022, 10, 849. [Google Scholar] [CrossRef]

- Kasaev, E.O. On the Situation in the Oil Sector of Iraq. Institute of the Middle East. Available online: http://www.iimes.ru/?p=30514 (accessed on 16 July 2022).

- Mohammed, I.M.M.; Pisengolts, V.M. The activities of the oil companies of Iraq and their role in the world economy. Management 2019, 7, 38–46. [Google Scholar] [CrossRef]

- Collins, R.D.; Selin, N.E.; De Weck, O.L.; Clark, W.C. Using inclusive wealth for policy evaluation: Application to electricity infrastructure planning in oil-exporting countries. Ecol. Econ. 2017, 133, 23–34. [Google Scholar] [CrossRef]

- OPEC: Iraq. Iraq Facts and Figures. Available online: https://www.opec.org/opec_web/en/about_us/164.htm (accessed on 16 July 2022).

- Subkhankulova, R.R. About the Oil and Gas Industry of Iraq; Institute of the Middle East: Washington, DC, USA, 2016; 98p. [Google Scholar]

- Jin, C.; Zhang, Z. Regarding the role of oil & gas industry on social infrastructure development in Azerbaijan and the solution of ecological problems. IOP Conf. Ser. Earth Environ. Sci. 2018, 189, 052004. [Google Scholar] [CrossRef]

- BP. Statistical Review of World Energy 2020. Available online: https://www.bp.com/content/dam/bp/business-sites/en/global/corporate/pdfs/energy-economics/statistical-review/bp-stats-review-2020-full-report.pdf (accessed on 16 July 2022).

- Cherepovitsyn, A.; Tsvetkova, A.; Komendantova, N. Approaches to assessing the strategic sustainability of high-risk offshore oil and gas projects. J. Mar. Sci. Eng. 2020, 12, 1–31. [Google Scholar] [CrossRef]

- Iraq Oil, Gas, Electricity, Alternatives, Renewables Analysis and Data from the EIU. Available online: https://www.eiu.com/industry/energy/middle-east-and-africa/iraq (accessed on 16 July 2022).

- Media: Iraq Will Build a New Oil Refinery. Available online: https://tass.ru/ekonomika/14014227?ysclid=l5pnzb7bfk76324807&utm_source=yandex.ru&utm_medium=organic&utm_campaign=yandex.ru&utm_referrer=yandex.ru (accessed on 6 July 2022).

- Bloomberg: Russia Pushes Iraq out of the Asian Oil Market—News—Mir–Kommersant (kommersant.ru). Available online: https://www.kommersant.ru/doc/5424098?ysclid=l6s0quhups289256043 (accessed on 16 July 2022).

- Alves, A.C. Chinese economic statecraft: A comparative study of China’s oil-backed loans in Angola and Brazil. J. Curr. Chin. Aff. 2013, 42, 99–130. [Google Scholar] [CrossRef]

- De Paula, G.M.; Avellar, A.P. Reforms and infrastructure regulation in Brazil: The experience of ANTT and ANTAQ. Q. Rev. Econ. Financ. 2008, 48, 237–251. [Google Scholar] [CrossRef]

- Amann, E.; Baer, W.; Trebat, T.; Lora, J.V. Infrastructure and its role in Brazil’s development process. Q. Rev. Econ. Financ. 2016, 62, 66–73. [Google Scholar] [CrossRef]

- Iraq Balks at Greater Chinese Control of Its Oilfields|Reuters. Available online: https://www.reuters.com/business/energy/iraq-balks-greater-chinese-control-its-oilfields-2022-05-17/ (accessed on 16 July 2022).

- Uduma, K.; Arciszewski, T. Sustainable Energy Development: The Key to a Stable Nigeria. Sustainability 2010, 2, 1558–1570. [Google Scholar] [CrossRef] [Green Version]

- Williams, P.J.; Reeder, M.; Pekney, N.J.; Risk, D.; Osborne, J.; McCawley, M. Atmospheric impacts of a natural gas development within the urban context of Morgantown, West Virginia. Sci. Total Environ. 2018, 639, 406–416. [Google Scholar] [CrossRef] [PubMed]

- Pashkova, E.V.; Al-Khalidi, H.I.H. The role of the oil industry in the economic and political development of Iraq. Bull. Peoples’ Friendsh. Univ. Russ. Int. Relat. Ser. 2014, 3, 110–114. [Google Scholar]

- Rabbani, A.; Zamani, M.; Yazdani-Chamzini, A.; Zavadskas, E.K. Proposing a new integrated model based on sustainability balanced scorecard (SBSC) and MCDM approaches by using linguistic variables for the performance evaluation of oil producing companies. Expert Syst. Appl. 2014, 41, 7316–7327. [Google Scholar] [CrossRef]

- Andrade Arteaga, C.; Rodríguez-Rodríguez, R.; Alfaro-Saiz, J.-J.; Verdecho, M.-J. An ANP-Balanced Scorecard Methodology to Quantify the Impact of TQM Elements on Organisational Strategic Sustainable Development: Application to an Oil Firm. Sustainability 2020, 12, 6207. [Google Scholar] [CrossRef]

- Perminova, O.M.; Lobanova, G.A. A logistic approach to establishing balanced scorecard of Russian oil-producing service organizations. Acta Logist. 2018, 5, 1–6. [Google Scholar] [CrossRef]

- Al-Qubaisi, S.S.; Ajmal, M. Determinants of operational efficiency in the oil and gas sector: A Balanced scorecards perspective. Benchmarking Int. J. 2018, 25, 3357–3385. [Google Scholar] [CrossRef]

- Lin, W.C. Maritime Environment Assessment and Management Using through Balanced Scorecard by Using DEMATEL and ANP Technique. Int. J. Environ. Res. Public Health. 2022, 19, 2873. [Google Scholar] [CrossRef]

- Mager, V.E.; Horoshilova, O.V.; Kavyrshina, O.A.; Desyatirikova, E.N.; Belousov, V.E. Information Analysis and Synthesis of Organizational Structure of the Unique Project. In Proceedings of the 2018 IEEE International Conference” Quality Management, Transport and Information Security, Information Technologies” (IT&QM&IS), Saint Petersburg, Russia, 24–28 September 2018; pp. 128–131. [Google Scholar] [CrossRef]

- Borisov, A.I.; Pesterev, A.P.; Vasilyeva, A.I.; Gabyshev, I.N.; Nektegyaev, G.G. Ecological engineering as an effective method of ensuring company ecological safety. IOP Conf. Ser. Earth Environ. Sci. 2019, 315, 022084. [Google Scholar] [CrossRef]

- Glushchenko, V.V. Formation of the Concept of the State’s Transition to Activity in the Conditions of a New Technological Order. Int. J. Sci. Adv. (IJSCIA) 2021, 2, 641. [Google Scholar] [CrossRef]

- Samigulina, G.A.; Samigulina, Z.I. Development of theoretical foundations for the creation of intelligent technology based on a unified artificial immune system for complex objects control of the oil and gas industry. J. Phys. Conf. Ser. 2021, 2094, 032038. [Google Scholar] [CrossRef]

- Asmara, Y.P.; Kurniawan, T. Corrosion prediction for corrosion rate of carbon steel in oil and gas environment: A review. Indones. J. Sci. Technol. 2018, 3, 64–74. [Google Scholar] [CrossRef]

- Lucas, H., Jr. Performance evaluation and monitoring. ACM Comput. Surv. (CSUR) 1971, 3, 79–91. [Google Scholar] [CrossRef]

- Patel, H.; Salehi, S.; Ahmed, R.; Teodoriu, C. Review of elastomer seal assemblies in oil & gas wells: Performance evaluation, failure mechanisms, and gaps in industry standards. J. Pet. Sci. Eng. 2019, 179, 1046–1062. [Google Scholar] [CrossRef]

- Zhou, X.; Yuan, Q.; Zhang, Y.; Wang, H.; Zeng, F.; Zhang, L. Performance evaluation of CO2 flooding process in tight oil reservoir via experimental and numerical simulation studies. Fuel 2019, 236, 730–746. [Google Scholar] [CrossRef]

- Sujatha, S.; Rajamohan, N.; Vasseghian, Y.; Rajasimman, M. Conversion of waste cooking oil into value-added emulsion liquid membrane for enhanced extraction of lead: Performance evaluation and optimization. Chemosphere 2021, 284, 131385. [Google Scholar] [CrossRef] [PubMed]

- Yun, W.; Chang, S.; Cogswell, D.A.; Eichmann, S.L.; Gizzatov, A.; Thomas, G.; Wang, W. Toward reservoir-on-a-chip: Rapid performance evaluation of enhanced oil recovery surfactants for carbonate reservoirs using a calcite-coated micromodel. Sci. Rep. 2020, 10, 1–12. [Google Scholar] [CrossRef] [PubMed]

- Semenova, T.; Al-Dirawi, A. Economic Development of the Iraqi Gas Sector in Conjunction with the Oil Industry. Energies 2022, 15, 2306. [Google Scholar] [CrossRef]

- Maryam, B.; Haikin, M.M. Features of state regulation of the oil and gas complex of the Islamic Republic of Iran. Econ. Entrep. 2017, 86, 98–101. [Google Scholar]

- Iraq Oil Production News. Iraq Business News (iraq-businessnews.com). Available online: https://www.iraq-businessnews.com/tag/oil-production/ (accessed on 16 July 2022).

- Akimochkin, I.V. Prospects for the development of oil and gas transportation. Territ. Neftegaz 2012, 10, 74–77. [Google Scholar]

- Antonyuk, V.S.; Bulikeeva, A.Z. Social infrastructure in the system of regional infrastructure. Bull. Tyumen State Univ. 2013, 11, 31–39. [Google Scholar]

- Movchan, I.; Yakovleva, A.; Movchan, A.; Shaygallyamova, Z. Early assessment of seismic hazard in terms of Voronezh massif-Moscow Depression contact. Min. Miner. Depos. 2021, 15, 62–70. [Google Scholar] [CrossRef]

- Ministry of Oil of the Republic of Iraq. Available online: http://oil.gov.iq (accessed on 7 July 2022).

- Iraq Has Received a Proposal to Resume the Iraq–Aqaba Oil Pipeline Construction Project. Neftegaz.RU—24 March 2016. Available online: https://neftegaz.ru/amp/news/transport-and-storage/221804-irak-poluchil-predlozhenie-o-vozobnovlenii-proekta-stroitelstva-magistralnogo-nefteprovoda-irak-akab/ (accessed on 5 July 2022).

- World Development Indicators. Available online: https://datacatalog.worldbank.org/dataset/world-development-indicators (accessed on 2 July 2022).

- ITU. Measuring Digital Development: Facts and Figures. 2020. Available online: https://www.itu.int/en/ITU-D/Statistics/Pages/facts/default.aspx (accessed on 6 July 2022).

- Polterovich, V.M.; Popov, V.V.; Tonis, A.S. Ekonomicheskaya Politika, Kachestvo Institutov Imekhanizmy [Economic Policy, the Quality of Institutions and the Mechanisms of the Resource Curse]. In Resursnogo Proklyatiya; HSE: Moscow, Russia, 2007; 101p. [Google Scholar]

- Kozlov, A.V.; Teslya, A.B.; Chernogorsky, S.A. A game-theoretic model of state investments in the creation of territories of advanced development in the regions of mineral resource specialization. J. Min. Inst. 2018, 234, 673. [Google Scholar] [CrossRef]

- Semenova, T. Value Improving Practices in Production of Hydrocarbon Resources in the Arctic Regions. J. Mar. Sci. Eng. 2022, 10, 187. [Google Scholar] [CrossRef]

- The Global Information Technology Report. 2016. Available online: https://www.weforum.org/reports/the-global-information-technology-report-2016 (accessed on 16 July 2022).

- Basher, M.A. Iraq: Modern economy, tasks and prospects. Asia Afr. Today 2019, 5, 69–73. [Google Scholar] [CrossRef]

- Ismael, T.Y.; Ismael, J.S. Iraq in the Twenty-First Century: Regime Change and the Creation of a Failed State; Routledge: New York, NY, USA, 2015; 310p. [Google Scholar]

- Kaplan Robert, S.; Norton David, P. Balanced Scorecard: From Strategy to Action; Olymp-Business CJSC: Moscow, Russia, 2005; 320p. [Google Scholar]

- Kovalsky, E.R.; Gromtsev, K.V. Development of the technology of laying the developed space during excavation. J. Min. Inst. 2022, 254, 202–209. [Google Scholar] [CrossRef]

- Ahmed, Z.A.; Pavlyuchenko, D.A.; Kobel, I.V. Prospects for the use of solar energy in Iraq. Bull. Kazan State Energy Univ. 2020, 12, 63–70. [Google Scholar]

- Lukutin, B.V.; Hamid, K. Photovoltaic power plants with electrochemical and thermal energy storage in Iraq. Izv. Tomsk Polytech. Univ. Georesource Eng. 2021, 332, 174–183. [Google Scholar]

- Al Bairmani, A.G.; Yakimovich, B.A.; Kuvshinov, V.V. Use of solar generation in the power supply system of Iraq. Power Plants Technol. 2019, 5, 69–73. [Google Scholar]

- Al-Rufai, F.M.; Abdali, L.M.; Kuvshinov, V.V.; Yakimovich, B.A. Assessment of the potential of wind energy resources in the south of Iraq. Bull. IzhSTU Named M.T. Kalashnikov 2020, 23, 105–113. [Google Scholar] [CrossRef]

- Abramovich, B.N.; Bogdanov, I.A. Improving the efficiency of autonomous electrotechnical complexes of oil and gas enterprises. J. Min. Inst. 2021, 249, 408–416. [Google Scholar]

- Pashkevich, M.A.; Bykova, M.V. Methodology for thermal desorption treatment of local soil pollution by oil products at the facilities of the mineral resource industry. J. Min. Inst. 2022, 253, 49–60. [Google Scholar] [CrossRef]

| Item No. | Level | Interpretation of Infrastructure | Examples |

|---|---|---|---|

| 1 | Microlevel (individual oil companies) | Complex of facilities | LUKOIL infrastructure: booster pump stations, cluster pump stations, refineries, oil pipelines, etc. |

| 2 | Mesolevel (individual territories, districts) | Complex of industries and institutions performing regulation functions | Port of Mina Al Bakr: 2 berths and 4 tankers for transportation of oil to foreign countries |

| 3 | Macrolevel (states) | General conditions of economic activity | Oil pipeline system in Iraq: Kirkuk–Ceyhan pipeline, Kirkuk–Tripoli pipeline |

| Production | Transportation | Social | Information | Institutional |

|---|---|---|---|---|

| Pumping units, control stations, metering units, transformer substations, water injection unit, etc. | Tanks for the storage of oil, oil pipelines, tankers, etc. | Residential buildings, medical facilities, educational institutions, etc. | Project documentation (general layouts of the project development), systems and procedures for collection, storage, analysis and transfer of information, etc. | Oil and Gas Law, Complex National Strategy for the Development of Energy Sector in Iraq, Oil Ministry, Iraqi National Oil Company |

| “Rigid” infrastructure | “Soft” infrastructure | |||

| No. p/p | Capacity, Thousand Barrels/Day | |||||

|---|---|---|---|---|---|---|

| 2016 | 2017 | 2018 | 2019 | 2020 | ||

| 1 | Baiji | 310 | No data | 23 | 38 | 53 |

| 2 | Basra | 210 | 210 | 210 | 280 | 280 |

| 3 | Daura | 140 | 140 | 140 | 140 | 140 |

| 4 | Kirkuk | 30 | 30 | 30 | 30 | 30 |

| 5 | Saynia | 30 | 30 | 30 | 30 | 30 |

| 6 | Najaf | 30 | 30 | 30 | 30 | 30 |

| 7 | Samava | 30 | 30 | 30 | 30 | 30 |

| 8 | Nasiriya | 30 | 30 | 30 | 30 | 30 |

| 9 | Missan | 30 | 30 | 30 | 30 | 30 |

| 10 | Divaniya | 20 | 20 | 20 | 20 | 20 |

| 11 | Hadita | 16 | 16 | 16 | 16 | 16 |

| 12 | Cayara | 14 | 14 | 14 | 14 | 14 |

| 13 | Cask | 10 | No data | 5 | 7 | 7 |

| 14 | Kar | No data | 10 | 80 | 80 | 80 |

| 15 | Bazyan | No data | 4 | 38 | 38 | 38 |

| Total | 900 | 594 | 726 | 813 | 828 | |

| No. p/p | Field Name | Achieved Production Volume, Thousand Barrels Per Day | Estimated Production Volume, Thousand Barrels Per Day | Ratio of Estimated Volume to Achieved Volume |

|---|---|---|---|---|

| 1 | West Qurna | 300 | 700 | 2.3 |

| 2 | Majnoon | 100 | 600 | 6 |

| 3 | Eastern Baghdad | 20 | 120 | 6 |

| 4 | Nahr Omar | 1 | 500 | 500 |

| Total | 421 | 1920 | 4.6 |

| Refinery Location | Refinery Name | Passport Capacity, Thousand Barrels/Day |

|---|---|---|

| North of Iraq | Badges | 310 |

| Kirkuk | 30 | |

| Al Jazeera | 20 | |

| Haditlia | 16 | |

| Erbil | 16 | |

| Slemani | 10 | |

| Kassak | 10 | |

| Najaf | 30 | |

| Muthanna | 30 | |

| Divaniya | 10 | |

| South of Iraq | Basra | 140 |

| Maysan | 30 | |

| Descars | 30 | |

| Kurdistan | Kalak | 96 |

| Bazian | 66 | |

| Total Iraq (with Kurdistan) | 1054 | |

| No. p/p | Name of Indicator | Unit of Measurement | Indicator Value, 2019 |

|---|---|---|---|

| 1 | Length of oil pipelines | km | 6300 |

| 2 | Throughput capacity of oil pipelines | million tons/year | 500 |

| 3 | Length of oil product pipelines | km | 1700 |

| 4 | Pipeline throughput | million tons/year | 9.8 |

| No. p/p | Country | Fixed Telephone Lines per 100 People 2020 | Fixed Broadband Internet Users Per 100 People 2016 | Mobile Broadband Internet Users Per 100 People, 2016 | Number of Mobile Subscribers Per 100 People, 2016 | Secure Internet Servers Per 1 Million Population, 2020 |

|---|---|---|---|---|---|---|

| 1 | Iraq | 7.0 | 11.7 | 39.8 | 95.0 | 18.0 |

| 2 | Iran | 37.3 | 9.5 | 10.7 | 87.8 | 2422.0 |

| 3 | Russia | 20.7 | 17.5 | 65.8 | 155.1 | 13,348.0 |

| 4 | USA | 33.8 | 31.1 | 102.7 | 110.2 | 140,308.0 |

| 5 | Saudi Arabia | 16.0 | 23.4 | 99.0 | 179.6 | 229.0 |

| 6 | Qatar | 16.3 | 9.9 | 73.0 | 145.8 | 433.0 |

| Strategic Projections (by Type of Infrastructure) | Objective | Indicators | Target Values | Programs, Events |

|---|---|---|---|---|

| Production infrastructure | Increase in oil production | Crude oil production volume, million barrels per day | 9500 | Exploration and development of undeveloped deposits |

| Capacity of oil refineries, thousand barrels per day | 1000 | Establishment of an industrial park near Basra | ||

| Increasing the capacity of refineries | Number of oil refineries in Iraq | 16 | ||

| Transport infrastructure | Increase in the number of equipped ports | Number of equipped ports for tankers, units | 7 | Construction of an oil refinery in Basra |

| Construction of new pipelines | Length of pipelines, km | 7000 | Expansion of the Northern and Southern transport systems. | |

| Throughput capacity of oil pipelines, million tons/year | 750 | |||

| Communication of 2 systems (North and South) into a single network. | ||||

| Technological infrastructure | Increasing the capacity of refineries Implementation of advanced technologies in oil production and refining Improving the Competitiveness of Iraq’s Oil Industry Infrastructure | hydrotreating power, % | 95 | Implementation of advanced technologies at the enterprises of the oil and petrochemical industry |

| Reforming capacity, % | 90 | |||

| Cracking power, % | 90 | |||

| Competitiveness indicator, unit share | 1.1 | Implementation of an integrated approach to evaluating the effectiveness of projects, including economic, technological, social, environmental types of efficiency | ||

| Socio-ecological infrastructure | Reduced gas flaring and carbon dioxide emissions | Volume of flared gas, billion cubic meters/year | 7.3 | Investing in the processing of associated petroleum gas |

| The amount of carbon dioxide generated as a result of burning natural gas, billion tons | 14.5 | |||

| Increasing the number of students for the oil industry, % | 20 | Monitoring compliance with technical specifications in the production and processing of oil Growth in the number of higher educational institutions providing training and advanced training for specialists for the oil industry |

| Types of Efficiency | Criteria for Evaluating Effectiveness in Points | Criteria Weight | The Name of Indicators | Weight of Indicators | Points | Characteristics of Indicators | Recommended values of Indicators in Points |

|---|---|---|---|---|---|---|---|

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 |

| Technological () | 8.2 | Competitiveness () | 0.40 | 10 5 0 | Competitiveness indicator () > 1 = 1 < 1 | = 10 | |

| 0.25 | Novelty () | 0.35 | 10 7 3 0 | Fundamentally new technologies related to the sixth or fifth technological paradigm Improved technologies related to the sixth or fifth technological mode Technical solution in the field of the sixth or fifth technological order Solution may degrade known technology | 7 | ||

| Patentability () | 0.25 | 10 7 3 0 | There is a patent Application submitted Application not submitted search for analogues The issue of patenting was not considered | 7 | |||

| Economic () | 9.25 | 0.25 | Net present value () | 0.25 | 10 5 0 | Net present value (NPV) > 0 NPV = 0 NPV < 0 | = 10 |

| Yield index () | 0.25 | 10 5 0 | Yield index (YI) > 1 YI = 1 YI < 1 | = 10 | |||

| Internal rate of return () | 0.25 | 10 5 0 | More bank interest on deposits Equal to bank interest on deposits Less banking interest on deposits | = 10 | |||

| Payback period () | 0.25 | 10 7 3 0 | Up to 3 years Up to 7 years Up to 10 years Over 10 years | 7 | |||

| Ecological () | 8.5 | 0.25 | Reducing the negative impact of processes () | 0.40 | 10 5 0 | No harmful effects Minor harmful effects Significant negative impact | = 10 |

| Environmental Compliance () | 0.30 | 10 5 0 | Full compliance with environmental regulations Minor deviation Significant deviation | = 10 | |||

| Costs for ensuring environmental friendliness and improving work safety () | 0.30 | 10 5 0 | Sufficient costs for ensuring environmental friendliness and improving work safety Slight lack of funds Extremely under-invested | 5 | |||

| Social () | 6.25 | 0.25 | Increasing the number of jobs in the region () | 0.30 | 10 7 5 0 | Significantly increase work places Slight increase Fixed quantity Decrease | 3 |

| Improvement in working conditions () | 0.30 | 10 5 0 | Coefficient value changes in the proportion of workers employed in conditions that do not meet sanitary and hygienic standards > 0 Coefficient value = 0 < 0 | 5 | |||

| Increasing the level of education of employees () | 0.25 | 10 5 0 | The value of the coefficient of change in the number of employees subject to training, > 0 Coefficient value = 0 Coefficient value < 0 | 10 | |||

| Improving the health of workers and the public () | 0.15 | 10 5 0 | Reducing the incidence of the population as a result of the project Constant level of morbidity of the population as a result of the project implementation Increasing incidence | 5 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

AL-Saadi, T.; Cherepovitsyn, A.; Semenova, T. Iraq Oil Industry Infrastructure Development in the Conditions of the Global Economy Turbulence. Energies 2022, 15, 6239. https://doi.org/10.3390/en15176239

AL-Saadi T, Cherepovitsyn A, Semenova T. Iraq Oil Industry Infrastructure Development in the Conditions of the Global Economy Turbulence. Energies. 2022; 15(17):6239. https://doi.org/10.3390/en15176239

Chicago/Turabian StyleAL-Saadi, Tahseen, Alexey Cherepovitsyn, and Tatyana Semenova. 2022. "Iraq Oil Industry Infrastructure Development in the Conditions of the Global Economy Turbulence" Energies 15, no. 17: 6239. https://doi.org/10.3390/en15176239