Do High Fuel Prices Pose an Obstacle to Economic Growth? A Study for Poland

Abstract

:1. Introduction

- Rising oil prices influence the marginal costs of production. The prices of finished goods are rising, and the economic growth is declining.

- Changing forces in the global economy: oil exporters gain from rising oil prices, while importers lose.

- Changes in the labor market: seeking savings in industries sensitive to fuel price increases.

- General uncertainty manifesting itself in a reduction in the dynamics of new investments.

2. Materials and Methods

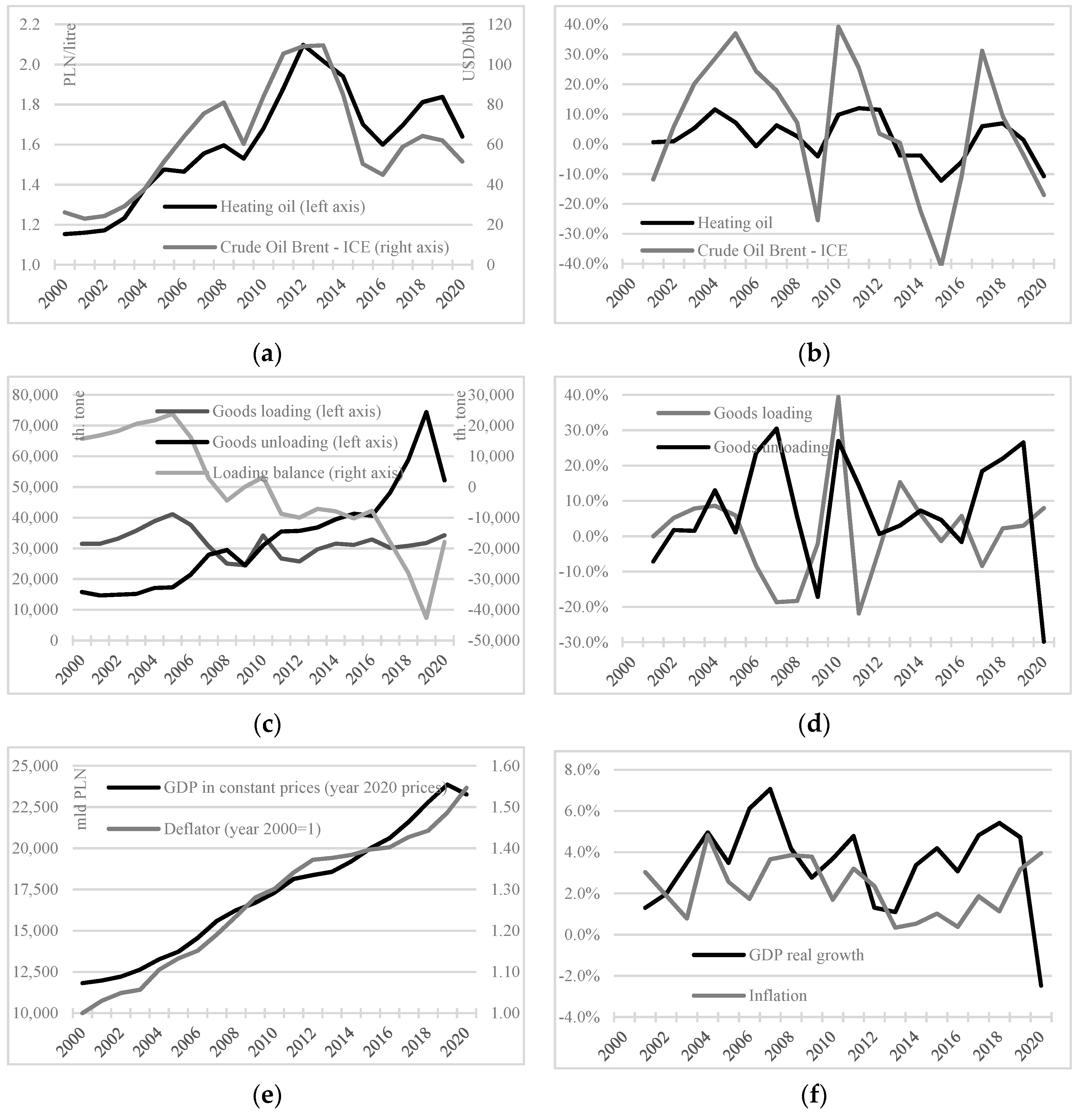

- Wholesale fuel oil prices were accepted as an energy price variable. As the energy market is a highly correlated market, the prices of energy from individual sources tend to follow a consistent trend over a long-term period. Furthermore, the market may be considered to be a global market, as domestic prices are strongly correlated with world energy market prices. For this reason, it is sufficient to include one selected representative of the market in the model. The choice fell on fuel oil which, along with black oil, is the key fuel used in maritime transport.

- As a variable representing trade, loading and unloading in Polish seaports was accepted. Maritime transport is the elementary branch related to the international exchange of goods. It transports products of key importance to the economy: crude oil, liquefied gas, metal ores, coal, agricultural produce, vehicles, general cargo, and many others. According to the estimates by Eurostat, shipping handles 77% of European foreign trade and 35% of all trade (in value terms) between the EU Member States. In Polish conditions, the volume of cargo in Polish seaports is several hundred times greater than in Polish airports. All of this points to the key importance of maritime transport in the economy.

- As a variable reflecting the state of the economy, gross domestic product (GDP) at constant prices was selected. Gross domestic product is the most important economic variable. The strength of the economy and the standard of living of the population may be assessed on its basis, and its structure is indicative of the country’s level of technological advancement.

- The deflator was accepted as a variable representing the price level. In economic analyses, the most popular price measures include CPI, PPI, and, precisely, the deflator. The advantage of the deflator lies in the fact that it takes into account the level and variations in the prices of all the products that were traded in the economy at a given time. In general, as in the case of energy prices, inflation indices show a very strong positive correlation, so it is sufficient to include one of them in the model.

- There is no a priori distinction between endogenous and exogenous variables.

- There are no justifiable constraints on the estimated model parameters, including, in particular, the assumption that some parameters must equal zero.

- There is no strict and primary economic theory for modelling which the model is built on.

- —vector of the observations of the current values of the variables,

- Dt—vector of deterministic model variables (e.g., a deterministic trend, deterministic seasonality, the mean of the process),

- A0—matrix of parameters that are positioned by non-stochastic variables,

- Ai—parameter matrices with lagged vector variables Yt,

- —vector of stationary random disturbances.

- Heating oil prices (in PLN/l),

- Seaport cargoes (in thousand tons),

- Unloading in seaports (in thousand tons),

- Gross domestic product (PLN billion, constant 2020 prices),

- Deflator (year 2000 = 1).

- d(Heating oil),

- d(Load),

- d(Unload),

- GDP R/R,

- Inflation R/R.

- —vector of observations of the current values of variables,

- Dt—vector of deterministic model variables,

- Γ0—parameter matrix with vector variables Dt,

- B—parameter matrix with unlagged vector variables Yt,

- Γi—parameter matrices with lagged variables Yt,

- ξt—random disturbance vector of the structural model.

3. Results

3.1. Formation of the Variables Analyzed

3.2. Model Approach to the Interaction between Fuel Prices, Maritime Transport, Economic Growth and Inflation

- Fuel prices do not affect the volume of loading at Polish seaports (response of Load to Oil, response of d(Load) to d(Oil)). Thus, what Poland dispatches by sea depends on other factors. The current loading balance is very unfavorable for Poland, which may suggest domestic production being unattractive to foreign buyers.

- Fuel prices have a negative yet weak impact (on the verge of statistical significance) on unloading in Polish seaports (response of Unload to Oil, response of d(Unload) to d(Oil)). Over the period covered by the study, unloading in Polish seaports was growing very dynamically, but it was noted that unloading dynamics were highest in the period of fuel price stabilization (2012–2019). A combination of the results from Section 3.1 and the impulse response function suggests that for a good result in terms of dynamizing unloading, it is sufficient for prices not to increase, so stabilizing them on a high level is not an obstacle.

- Fuel prices clearly have a negative impact on the future economic growth (response of GDP to Oil, response of d(GDP) to d(Oil)). This result does not contradict the one obtained in Section 3.1, where it was noted that an average economic growth dynamic during a period of rapid fuel price increases and fuel price stabilization is equally high. Lower fuel prices may affect dynamic economic growth, although these are not an absolute cause of it.

- Changes in fuel prices affect inflation fairly quickly and, as expected, their impact is positive (response of Deflator to Oil, response of Inflation to d(Oil)).

- a positive effect of economic growth on fuel price increases (response of d(Oil) to d(GDP)),

- a positive impact of economic growth on unloading in Polish seaports (response of Unload to GDP, response of d(Unload) to d(GDP)),

- a negative impact of inflation on unloading in Polish seaports (response of Unload to Deflator, response of d(Unload) to Inflation),

- a negative impact of inflation on the economic growth (response of GDP to Deflator, response of d(GDP) to Inflation),

- a positive effect of the economic growth on inflation (response of Deflator to GDP, response of Inflation to d(GDP)).

4. Discussion

5. Conclusions

- low fuel prices are not a prerequisite for a country’s development. A country, even an oil importer, may develop under conditions of higher fuel prices;

- panic over high fuel prices only further fuels the inflationary spiral;

- fiscal policy should not be a short-term search for opportunities to slow down inflationary processes but, above all, to take care of sufficiently rapid economic growth, as well as the current and future condition of public finances.

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Cashin, P.; Liang, H.; McDermott, C.J. How persistent are shocks to world commodity prices? IMF Staff Pap. 2000, 47, 177–217. [Google Scholar]

- Sarmah, A.; Bal, D.P. Does Crude Oil Price Affect the Inflation Rate and Economic Growth in India? A New Insight Based on Structural VAR Framework. Indian Econ. J. 2021, 69, 123–139. [Google Scholar] [CrossRef]

- Bobai, F.D. An analysis of the relationship between petroleum prices and inflation in Nigeria. Int. J. Bus. Commer. 2012, 1, 1–7. [Google Scholar]

- Huntington, H.G. The Economic Consequences of Higher Crude Oil Prices; Energy Modeling Special Report, 9. Energy Modeling Forum workshop (February 8, 2005); Marymount University, Ballston Campus: Arlington, VA, USA, 2005. [Google Scholar]

- Peker, O.; Mercan, M. The inflationary effect of price increases in oil products in Turkey. Ege Acad. Rev. 2011, 11, 553–562. [Google Scholar]

- Sek, S.K.; Teo, X.Q.; Wong, Y.N. A comparative study on the effects of oil price changes on inflation. Procedia Econ. Financ. 2015, 26, 630–636. [Google Scholar] [CrossRef]

- Taghizadeh-Hesary, F.; Yoshino, N.; Mohammadi Hossein Abadi, M.; Farboudmanesh, R. Response of macro variables of emerging and developed oil importers to oil price movements. J. Asia Pac. Econ. 2016, 21, 91–102. [Google Scholar] [CrossRef]

- Chou, K.W.; Tseng, Y.H. Oil price pass-through into CPI inflation in Asian emerging countries: The discussion of dramatic oil price shocks and high oil price periods. Br. J. Econ. Financ. Manag. Sci. 2011, 2, 1–13. [Google Scholar]

- Cunado, J.; Gracia, F.P. Do oil price shocks matter? Evidence for some European countries. Energy Econ. 2003, 25, 137–154. [Google Scholar] [CrossRef]

- Du, L.; He, Y.; Chu, W. The relationship between oil price shocks and China’s macro-economy: An empirical analysis. Energy Policy 2010, 38, 4142–4151. [Google Scholar] [CrossRef]

- Le Blanc, M.; Chinn, M. Do High Oil Price Presage Inflation? The Evidence from G-5 Countries; Working Paper, WP1021; Santa Cruz Center for International Economics: Santa Cruz, CA, USA, 2004. [Google Scholar]

- Guney, P.O.G.E.; Hasanov, M. The effects of oil prices changes on output growth and inflation: Evidence from Turkey. J. Econ. Behav. Stud. 2013, 5, 730–739. [Google Scholar] [CrossRef]

- Long, S.; Liang, J. Asymmetric and nonlinear pass-through of global crude oil price to China’s PPI and CPI inflation. Econ. Res.-Ekon. Istraživanja 2018, 31, 240–251. [Google Scholar] [CrossRef]

- Abu-Bakar, M.; Masih, M. Is the Oil Price Pass-through to Domestic Inflation Symmetric or Asymmetric? New Evidence from India Based on NARDL. 2018. Available online: https://mpra.ub.uni-muenchen.de/87569/ (accessed on 1 May 2022).

- Pandey, A.; Shettigar, J. Relationship between crude oil price, money supply and inflation in India. Int. J. Adv. Res. Manag. Soc. Sci. 2016, 5, 20–31. [Google Scholar]

- Newbery, D.M. Power Markets and Market Power. Energy J. 1995, 16, 39–66. [Google Scholar] [CrossRef]

- Federal Energy Regulatory Commission. A Handbook of Energy Market Basics; Energy Primer Staff Report; Federal Energy Regulatory Commission: Washington, DC, USA, 2020. [Google Scholar]

- MacKay, A.; Mercadal, I. Deregulation, Market Power, and Prices: Evidence from the Electricity Sector; Working Paper 21-095; Harvard Business School: Boston, MA, USA, 2021. [Google Scholar]

- Brown, S.P.; Yücel, M.K. Energy prices and aggregate economic activity: An interpretative survey. Q. Rev. Econ. Financ. 2002, 42, 193–208. [Google Scholar] [CrossRef]

- Tang, W.; Wu, L.; Zhang, Z. Oil price shocks and their short-and long-term effects on the Chinese economy. Energy Econ. 2010, 32, S3–S14. [Google Scholar] [CrossRef] [Green Version]

- Varghese, G. Inflationary effects of oil price shocks in Indian economy. J. Public Aff. 2017, 17, e1614. [Google Scholar] [CrossRef]

- Blanchard, O.J.; Gali, J. The Macroeconomic Effects of Oil Shocks: Why Are the 2000s So Different from the 1970s? National Bureau of Economic Research Working Paper Series No. 13368; National Bureau of Economic Research: Cambridge, MA, USA, 2007. [Google Scholar]

- Kilian, L. The Economic Effects of Energy Price Shocks. J. Econ. Lit. 2008, 46, 871–909. [Google Scholar] [CrossRef]

- Levent, A.; Acar, M. Economic Impact of Oil Price Shocks on the Turkish Economy in the Coming Decades: A Dynamic CGE Analysis. Energy Policy 2011, 39, 1722–1731. [Google Scholar]

- Cermáková, K.; Hromada, E. Change in the Affordability of Owner-Occupied Housing in the Context of Rising Energy Prices. Energies 2022, 15, 1281. [Google Scholar] [CrossRef]

- Hromada, E.; Cermáková, K. Financial unavailability of housing in the Czech Republic and recommendations for its solution. Int. J. Econ. Sci. 2021, X, 47–58. [Google Scholar] [CrossRef]

- Taghizadeh-Hesary, F.; Yoshino, N.; Abdoli, G.; Farzinvash, A. An Estimation of the Impact of Oil Shocks on Crude Oil Exporting Economies and Their Trade Partners. Front. Econ. China 2013, 8, 571–591. [Google Scholar]

- Taghizadeh-Hesary, F.; Yoshino, N. Monetary Policies and Oil Price Determination: An Empirical Analysis. OPEC Energy Rev. 2014, 38, 1–20. [Google Scholar] [CrossRef]

- Taghizadeh-Hesary, F.; Yoshino, N. Impact of Expansionary Monetary Policy on Crude Oil Prices. In Monetary Policy and the Oil Market; Springer: Tokyo, Japan, 2016; pp. 7–27. [Google Scholar]

- Yoshino, N.; Taghizadeh-Hesary, F. Monetary Policy and Oil Price Fluctuations Following the Subprime Mortgage Crisis. Int. J. Monet. Econ. Financ. 2014, 7, 157–174. [Google Scholar] [CrossRef]

- Sims, C.A. Interpreting the Macroeconomic Time Series Facts: The Effects of Monetary Policy. Eur. Econ. Rev. 1992, 36, 975–1000. [Google Scholar] [CrossRef]

- Romer, C.D.; Romer, D.H. Does Monetary Policy Matter? A New Test in the Spirit of Friedman and Schwartz. NBER Macroecon. Annu. 1989, 4, 121–184. [Google Scholar] [CrossRef]

- Yoshino, N.; Taghizadeh-Hesary, F.; Hassanzadeh, A.; Prasetyo, A.D. Response of Stock Markets to Monetary Policy: The Tehran Stock Market Perspective. J. Comp. Asian Dev. 2014, 13, 517–545. [Google Scholar] [CrossRef]

- Yoshino, N.; Taghizadeh-Hesary, F. Effectiveness of the Easing of Monetary Policy in the Japanese Economy, Incorporating Energy Prices. J. Comp. Asian Dev. 2015, 14, 227–248. [Google Scholar] [CrossRef] [Green Version]

- Bernanke, B.S.; Gertler, M.; Watson, M. Systematic Monetary Policy and the Effects of Oil Price Shocks. Brook. Pap. Econ. Act. 1997, 1, 91–157. [Google Scholar] [CrossRef]

- Barsky, R.B.; Kilian, L. Do We Really Know that Oil Caused the Great Stagflation? A Monetary Alternative. In NBER Macroeconomics Annual 2001; Bernanke, B.S., Rogoff, K., Eds.; MIT Press: Cambridge, MA, USA, 2002; pp. 137–183. [Google Scholar]

- Leduc, S.; Sill, K. A Quantitative Analysis of Oil-Price Shocks, Systematic Monetary Policy, and Economic Downturns. J. Monet. Econ. 2004, 51, 781–808. [Google Scholar] [CrossRef]

- Hamilton, J.D.; Herrera, A.M. Oil Shocks and Aggregate Macroeconomic Behavior: The Role of Monetary Policy. J. Money Credit. Bank. 2004, 36, 265–286. [Google Scholar] [CrossRef]

- Korhonen, I.; Ledyaeva, S. Trade Linkages and Macroeconomic Effects of the Price of Oil. Energy Econ. 2010, 32, 848–856. [Google Scholar] [CrossRef]

- Jiménez-Rodríguez, R.; Sánchez, M. Oil Price Shocks and Real GDP Growth: Empirical Evidence for Some OECD Countries; European Central Bank Working Paper Series, No. 362; European Central Bank: Frankfurt, Germany, 2004. [Google Scholar]

- Kilian, L. A Comparison of the Effects of Exogenous Oil Supply Shocks on Output and Inflation in the G7 Countries. J. Eur. Econ. Assoc. 2008, 6, 78–121. [Google Scholar] [CrossRef]

- Bednár, O.; Cecrdlová, A.; Kaderábková, B.; Režábek, P. Energy Prices Impact on Inflationary Spiral. Energies 2022, 15, 3443. [Google Scholar] [CrossRef]

- Przekota, G.; Szczepańska-Przekota, A. Pro-Inflationary Impact of the Oil Market—A Study for Poland. Energies 2022, 15, 3045. [Google Scholar] [CrossRef]

- Sims, C.A. Macroeconomics and reality. Econometrica 1980, 48, 1–48. [Google Scholar] [CrossRef]

- Kusideł, E. Modelowanie Wektorowo-Autoregresyjne VAR. Metodologia i Zastosowanie w Badaniach Ekonomicznych; Absolwent Publisher: Łódź, Poland, 2000. [Google Scholar]

- Phillips, P.C.B. Understanding Spurious Regressions in Econometrics. J. Econom. 1986, 33, 311–340. [Google Scholar] [CrossRef]

- Enders, W. Applied Econometric Time Series; John Wiley & Sons: New York, NY, USA, 2004. [Google Scholar]

- Osińska, M. Ekonometria Współczesna; Dom Organizatora: Toruń, Poland, 2007. [Google Scholar]

- Darby, M.R. The price of oil and world inflation and recession. Am. Econ. Rev. 1982, 72, 738–751. [Google Scholar]

- Tatom, J.A. Energy Prices and Short-Run Economic Performance. Fed. Reserve Bank St. Louis Rev. 1981, 63, 3–17. [Google Scholar] [CrossRef] [Green Version]

- Burbidge, J.; Harrison, A. Testing for the effect of oil price rises using vector autoregressions. Int. Econ. Rev. 1984, 25, 459–484. [Google Scholar] [CrossRef]

- Gisser, M.; Goodwin, T.H. Crude oil and the macroeconomy: Tests of some popular notions. J. Money Credit. Bank. 1986, 18, 95–103. [Google Scholar] [CrossRef]

- Hamilton, J.D. Oil and the macroeconomy since World War II. J. Political Econ. 1983, 91, 228–248. [Google Scholar] [CrossRef]

- Loungani, P. Oil price shocks and the dispersion hypothesis. Rev. Econ. Stat. 1986, 68, 536–539. [Google Scholar] [CrossRef]

- Finn, M.G. Perfect Competition and the Effects of Energy Price Increases on Economic Activity. J. Money Credit. Bank. 2000, 32, 400–416. [Google Scholar] [CrossRef]

- Davis, S.J.; Haltiwanger, J. Sectoral job creation and destruction responses to oil price changes. J. Monet. Econ. 2001, 48, 465–512. [Google Scholar] [CrossRef]

- Bernanke, B. Irreversibility, Uncertainty, and Cyclical Investment. Q. J. Econ. 1983, 98, 85–106. [Google Scholar] [CrossRef]

- Dixit, A.K.; Pindyck, R.S. Investment under Uncertainty; Princeton University Press: Princeton, NJ, USA, 1984. [Google Scholar]

- Hamilton, J.D. A neoclassical model of unemployment and the business cycle. J. Political Econ. 1988, 96, 593–617. [Google Scholar] [CrossRef]

- Hamilton, J.D. What is an oil shock? J. Econom. 2003, 113, 363–398. [Google Scholar] [CrossRef]

- Lee, K.; Ni, S. On the Dynamic Effects of Oil Price Shocks: A Study Using Industry Level Data. J. Monet. Econ. 2002, 49, 823–852. [Google Scholar] [CrossRef] [Green Version]

- Pierce, J.L.; Enzler, J.J. The effects of external inflationary shocks. Brook. Pap. Econ. Act. 1974, 1974, 13–61. [Google Scholar] [CrossRef]

- Mork, K.A. Energy prices, inflation, and economic activity: Editor’s overview. In Energy Prices, Inflation, and Economic Activity; Mork, K.A., Ed.; Ballinger Publishing: Cambridge, MA, USA, 1981. [Google Scholar]

- Buno, M.; Sachs, J. Input Price Shocks and the Slowdown in Economic Growth: The Case of U.K. Manufacturing. Rev. Econ. Stud. 1982, 49, 679–705. [Google Scholar]

- Mork, K.A. Oil and the macroeconomy when prices go up and down: An extension of Hamilton’s results. J. Political Econ. 1989, 97, 740–744. [Google Scholar] [CrossRef]

- Lee, K.; Ni, S.; Ratti, R.A. Oil shocks and the macroeconomy: The role of price variability. Energy J. 1995, 16, 39–56. [Google Scholar] [CrossRef]

- Hamilton, J.D. This is what happened to the oil price macroeconomy relationship. J. Monet. Econ. 1996, 38, 215–220. [Google Scholar] [CrossRef]

- Adelman, A. The real Oil problem. Regulation 2004, 27, 16–21. [Google Scholar]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Przekota, G. Do High Fuel Prices Pose an Obstacle to Economic Growth? A Study for Poland. Energies 2022, 15, 6606. https://doi.org/10.3390/en15186606

Przekota G. Do High Fuel Prices Pose an Obstacle to Economic Growth? A Study for Poland. Energies. 2022; 15(18):6606. https://doi.org/10.3390/en15186606

Chicago/Turabian StylePrzekota, Grzegorz. 2022. "Do High Fuel Prices Pose an Obstacle to Economic Growth? A Study for Poland" Energies 15, no. 18: 6606. https://doi.org/10.3390/en15186606