3.1. Legislation

The key legal act for wind energy in Poland is the Act of February 20, 2015 on renewable energy sources (RESs) [

46]. This act implements the Directive of the European Parliament and Council 2009/28/EC of 23 April 2009 [

47] on the promotion of the use of energy from renewable sources into the Polish legal order, amending and subsequently repealing Directives 2001/77/EC [

48] and 2003/30/EC [

49].

The RES Act regulates, inter alia, the rules and conditions for carrying out activities in the field of generating electricity from renewable energy sources, including wind energy; mechanisms and instruments supporting the production of electricity in RES installations, including the auction support system and the support system in the form of certificates of origin and the rules for issuing guarantees of origin for electricity generated in RES installations. Importantly, within the meaning of the Act on RES, a RES installation is, e.g., a wind farm (because it is a separate set of devices used to generate energy from RES). Moreover, the issue of connecting RES installations to the power grid is regulated by the Act of April 10, 1997, the Energy Law [

50]. Thus, it can be said that the RES Act, supplemented with the provisions of the Energy Law, shapes the legal framework for the operation of onshore wind energy in Poland.

The first windmills were placed in Poland in 2001, but the years 2008–2016 were the period of constant growth of wind power. Until July 16, 2016, i.e., the entry into force of the act on investments in wind farms [

51] (the so-called distance act), establishing the 10H rule, according to which wind farms cannot be located at a shorter distance than 10 times the total height of the turbine from residential buildings (or mixed-use buildings that include a residential function). In addition, the location of wind farms with a capacity greater than the capacity of micro-installations has become possible only on the basis of the Local Spatial Development Plan (MPZP). The legislator argued that it was based on proven Bavarian solutions [

52], but did not take into account the basic issue, namely that the distance rule in Germany applies to compact buildings, while in Poland, scattered buildings dominate. The Polish legislator did not provide for another issue: the distance act deprived the communes of planning powers and resulted in the loss of investment areas.

The crowning argument for the introduction of this regulation were social protests and the claim that wind farms were built without any supervision. While it is possible to agree with the fact that in the case of the construction of the first wind farms, no clear regulations existed yet, it should be emphasized that it was a temporary state. The regulations specifying the conditions for the foundation of wind farms have been successively detailed. As a result, the foundation of a wind farm is subject to a number of requirements, resulting from, inter alia, construction law. Investors in the initial phase of the so-called development are required to obtain the appropriate legal title to the land, which will enable construction work and then the exploitation of all elements of the wind farm. Thus, also the transmission infrastructure, power stations, access roads, maneuvering and assembly yards, etc.

Environmental protection requirements are a separate issue. Obtaining a decision on the environmental conditions of an investment in wind farms is often associated with the need to conduct an environmental impact assessment of a given enterprise (the so-called EIA). The EIA [

53] is a procedure assessing the impact of a planned project on the environment, which includes the verification of the environmental impact report, obtaining the required opinions and approvals and ensuring the possibility of public participation in the procedure. Ultimately, the 10H rule, in practice, has inhibited the development of onshore wind energy in the last five years.

Unlike onshore wind energy, the separation of offshore wind energy is only just beginning. The regulatory framework for the development of offshore wind energy in the Baltic Sea is contained in the Act on the Promotion of Electricity Generation in Offshore Wind Farms. The act was processed for over two years and although its adoption was considered a historical fact, in April, offshore entrepreneurs reported the need to amend the act adopted in February 2021 [

54] to the need to correlate the investment support time with the duration of the permits, limiting the costs of extending the permit after the support period, clarifying the mechanism preventing over-support, shortening the procedures resulting from geological and mining law, as well as making the level of protection specified by the legislator more flexible for investment.

The regulation of the Minister of Climate and Environment of March 30, 2021 [

55] determined the maximum price for electricity generated in an offshore wind farm and fed into the grid in PLN per 1 MWh, which is the basis for the settlement of the right to negative coverage, has already been issued, but a number of other offshore implementing regulations are still pending. The regulation in question was adopted with limited optimism, as the proposed price (less than PLN 320/MWh) is not satisfactory for investors.

The EU’s objective is to accomplish climate neutrality ultimately by 2050 throughout the EU. An intermediate step to achieving this goal is the introduction of the Fit for 55 package which consists of thirteen legislative proposals. Subsequently, they became part of the new European legal order with the adoption by the EU of the Climate Law, which officially entered into force on 29 July 2021 [

56]. The intention is to reduce the carbon footprint of the European economy by at least 55% by 2030. The reference is the emission level in 1990. The Fit for 55 legislative process will last until 2023. The changes included in the Fit for 55 have yet to be approved by the individual EU countries and the European Parliament. Therefore, the new guidelines may not become applicable until 2024. The actions taken by the EU as part of the Fit for 55 package are to contribute to sustainable economic growth, reduce the use of fossil fuels, and popularize renewable energy sources that will enable the introduction of new technologies and infrastructure development. The most important assumptions of the Fit for 55 are: (a) the establishment of the Social Climate Fund, financed, inter alia, from the budget, which is to counteract energy poverty and increase the Modernization Fund for the energy transformation, excluding investments related to fossil fuels, including gas; (b) the revision of the Energy Tax Directive [

57] by taxing all fossil fuels—now reduced rates or exemptions apply; (c) reducing energy use in Europe through, among others, the idea of the thermal modernization of public sector buildings—each year, 3% of these buildings are to be modernized in terms of energy efficiency; (d) accelerating the transition to a greener energy system with an increased target, whereby 40% of energy should be produced from renewable sources by 2030; (e) changes in Emissions Trading (EU ETS)—a proposal to tighten the emission reduction targets under the so-called Effort Sharing Regulation [

58], (d) stricter CO

2 emission standards for passenger cars and vans by requiring a 55% reduction in average emissions from new cars from 2030 and 100% from 2035 compared to 2021 levels—all new cars registered from 2035 will be emission-free; (e) by 2035, achieving climate neutrality in the sectors of land use, forestry, and agriculture, by 2030, 3 billion trees are to be planted in the EU.

Unfortunately, the latest ideas and regulations of the Polish government, as a consequence of the current deep energy crisis, resulting in an act which regulates coal prices [

59] and the act that subsidizes the purchase of coal [

60], to discourage the replacement of non-ecological solid fuel stoves and the transition to green energy for households, are strongly at odds with the fit assumptions.

According to the recent legal regulations of 5 July 2022 [

61] on the amendment to the act [

51], a new wind farm may be located only on the basis of the MPZP. The aim and assumptions of the draft act making the distance act more flexible are very good, but in the proposed form, they may not fulfill their function. The multitude of procedures that will have to be met by both municipalities and investors is disappointing. However, there will be even more bureaucracy and competence disputes. The assessment of the effects of the regulation of this project indicates that in just two years, the increase in the installed capacity for new wind farms is 500 MW, which, in the opinion of the market, is an unrealistic assumption. In view of the fact that Poland, despite its undisputed potential, is a country with the lowest share of renewable energy sources in the energy mix in Europe, the project requires significant correction. Nevertheless, solutions such as making the 10H principle more flexible and introducing certified units servicing wind farms should be appreciated.

When analyzing the structure of sources from which renewable energy is produced in Poland, presented in [

62], together with the development prospects, it can be concluded that it has a high growth potential. The production of energy from the sun and wind, as well as liquid biofuels, biogas, and geothermal sources is of particular importance. The authors of the study indicate that it is favored by geographic and atmospheric conditions. Therefore, it seems indisputable to create favorable legal conditions for investing in RESs.

A very large number of organizations declared that they submitted comments in the public consultation process. One can get the impression that the Ministry of Development, Labor, and Technology wants to introduce solutions liberalizing the current regulations, but without solutions that will actually allow to achieve the assumed goal.

3.2. Wind Conditions in Poland

Most renewable energy sources come from the sun as the primary energy source: solar radiation, wind energy, biomass, and water. The rest of the energy comes from the Earth—geothermal energy, and from the Moon—wave and tidal energy. The forms of solar radiation conversion are: photothermal (direct heat production), photovoltaic (direct electricity production), and photobiochemical (chemical bond energy) conversion. They require special devices and lead to more unstable forms of energy.

Wind energy is one of the energies that come from the sun. It is formed due to the uneven heating of the Earth’s surface by the Sun. As a result, constantly moving systems of highs and baric lows, atmospheric fronts appear in the atmosphere. These constant movements of the air around the globe cause the wind. The speed and direction of the wind usually have a clearly defined diurnal and annual character and are strictly dependent on the climatic zones. The wind reaches its maximum speed in the midday hours, then it begins to fall to its minimum value at night near the ground. In most parts of Europe, wind speeds reach their maximum values from January to February, and their minimum in summer. In winter, wind speeds in Poland reach an average of about 150–170% of the average annual speed, while in summer it is about 50–70% [

63].

The wind speed increases with altitude and is proportional to the second power of relative altitude. The speed increase depends on the roughness of the substrate and the vertical air temperature distribution. A flat area covered with grassy vegetation is an example of a terrain with a zero roughness class (see

Table 6). It can then be said that the wind speed at the selected height is almost the same throughout the area. Numerous terrain obstacles, in the form of buildings or trees, in the path of air masses, cause a rapid reduction in wind speed and an increase in turbulence. The change of the wind speed above the ground occurs only up to a certain relative height, referred to as the gradient wind height. It means that above this height, the wind speed does not depend on the degree of roughness. The energy of the wind depends on its speed in the third power.

The total potential of wind on Earth cannot be fully utilized, if only because of the variability of wind power and direction. The sum of wind energy per 1 m

2 in Poland annually amounts to 1000–1500 kWh/year, depending on the location (mountains, coast). This value is analogous to that in Germany, the Netherlands, France, England, Denmark, and Sweden. According to the expertise of the EC BREC Institute for Renewable Energy [

64], the size of the technical potential of RESs in Poland is approximately 2.5 thousand PJ/year, including 36 PJ/year coming from wind energy.

There are favorable conditions for the development of wind energy in Poland. According to the Global Wind Atlas [

65], compiled by the International Renewable Energy Agency (IRENA) [

16], the country’s wind speed in most areas is adequate for the installation of wind turbines. As shown in

Figure 9, at a height of 100 m (usually at this height there are nacelles of wind turbines), the wind speed in almost all of Poland oscillates around 7–8 m/s. The atlas makes it possible to estimate the wind speed in a given area and at a selected altitude from 10 to 200 m with an accuracy of 1 km. However, according to previous similar maps, such an estimate could be made with an accuracy of 10 km.

Wind parks are usually built in rural areas due to the best ground roughness class, i.e., in open areas with as few obstacles as possible, which creates good wind conditions. When locating a wind farm, it is necessary to take into account, in addition to wind conditions, other conditions, such as: flight and migration routes for birds, ornithological analyses, analyses of the occurrence and existence of bats, the criteria taking into account residential buildings, forest land, water reservoirs, areas related to nature protection and landscape, areas attractive for tourists, spa areas, the presence of other wind turbines in the vicinity, cultural and landscape conditions, as well as the presence of infrastructure related to roads, airports, railways, and power networks.

Many studies or even scientific publications in Poland still refer to the outdated wind map (see

Figure 9). Wind speed measurements and tests were made by the Institute of Meteorology and Water Management (IMiGW) on the basis of measurement data from 1971–2001 [

63] by prof. Halina Lorenc. However, they are not quite correct results due to the fact that: the measurement methodology, assuming measuring the wind speed eight times a day, is insufficient and can only be an approximation of this value; anemometers were placed too low, at a height of 10–20 m, with the use of weak equipment (gradient masts with a height of 40–120 m are recommended [

67]); meteorological stations are usually located in the vicinity of cities and housing estates, while wind farms are not built in such places due to the high roughness class of the terrain and in mountainous regions, measuring stations were placed in valleys near human settlements, which lowered the results for higher, more windy areas [

68].

One of the numerous facts concerning the irregularities in the IMiGW map are the results of the wind tests in Lower Silesia in the Sudetes. The area of the Sudety Foothills on the map of the IMiGW has been classified as an area with unfavorable wind conditions. Meanwhile, winds in Lower Silesia blow at a height of 100 m at a speed of 5 to over 7 m/s, and even 9 m/s (the area around Wałbrzych and Jelenia Góra). Favorable wind conditions also prevail in the vicinity of Lubawka. The entire range of the Sudety Fault is very well suited for this type of investment. This is evidenced by the preserved map from 1931, according to which there were about 600 windmills in Lower Silesia. The energy potential of wind in mountain areas is similar to that of the coast.

Due to inaccurate measurements, investors should conduct their own wind speed tests (unfortunately at their own expense, which is one of the factors discouraging investment) before starting the construction of the wind park. Failure to conduct such research and to follow the IMiGW map may result in overestimation of the expected energy production, and if in reality the wind conditions are much weaker—investment will not be profitable. Reliable assessment of wind resources is possible only thanks to many years of observation. When measurements are carried out over a period of up to one year, they can cause an error of 20% calculated in relation to the annual efficiency determined on the basis of several years of measurements, e.g., the average wind speed in Łeba was 3.9 m/s in 1966, and in 1989—6.2 m/s.

3.3. Perspectives—Wind Energy

Unlike onshore wind farms, the possibilities for offshore wind power in Poland are just beginning. The legal framework for the development of offshore wind energy in the Baltic Sea is contained in the Act on the Promotion of Electricity Generation in Offshore Wind Farms [

54].

There are two strategic national Polish documents, the aim of which is to outline the desired directions of the electricity transformation and to define the goals to be achieved in the perspective of the next one or two decades. The first one is the National Energy and Climate Plan [

38] (KPEiK) for the years 2021–2030, developed by the Polish government, in accordance with the requirements of the EU climate policy. Work on the KPEiK was led alongside with the work on the draft of the second strategic document, namely the Polish Energy Policy until 2040 (PEP2040) [

41], which was finally adopted by the Polish government in February 2021. The KPEiK does not distinguish between onshore and offshore wind energy, nevertheless careful analysis of this document allows to estimate the government’s plans for the development of onshore wind energy. General plans for the development of wind energy have been juxtaposed in

Figure 10. There is a clear intention visible to gradually replace onshore generation capacity with offshore wind power. It is expected that the first offshore wind farm will be included in the electricity balance around the year 2025. The Polish coastline makes it possible to implement further installations at sea, but the possibility of balancing them in the national energy system will be of key importance for investors. These sources are planned to be responsible for the largest amount of electricity produced from RESs by 2040. According to the projections for the National Energy and Climate Plan, the achievable capacity of offshore wind installations is expected to increase to approx. 3.8 GW in 2030 and approx. 8 GW in 2040. Moreover, it is predicted that in the medium term, the increase in the share of onshore wind energy in the energy balance will be less dynamic than in previous years. A significant obstacle in the use of onshore wind energy is the lack of dependence between their work and energy demand, therefore the pace of their development should depend on the costs and balancing possibilities According to the projections, the KPEiK envisages an increase of capacity available in onshore wind installations to around 9.6 GW by 2030 and a maintenance of this volume until 2040.

The enforcement of offshore wind energy in the Polish area of the Baltic Sea is the second strategic project defined under the specific objective No. 6: “Development of renewable energy sources” of the Polish Energy Policy until 2040 (PEP2040) [

41]. The quantitative goals of PEP2040 assume an increase in the share of renewable energy sources in all sectors and technologies. In 2030, the share of renewable energy in the gross final energy consumption is to be min. 23%, including no less than 32% in the electricity sector, and approx. 40% in 2040, which is to be achieved mainly through the development of wind and photovoltaic energy. Offshore wind energy is expected to play a particularly important role in accomplishing the Polish RES goal. The energy policy assumes the potential of offshore wind energy at the level of 5.9 GW of the installed capacity by 2030 and at the level of approx. 11 GW by 2040 (see

Figure 11).

Achieving the indicated objectives within the scope of offshore wind farms will allow them to produce electricity at the level of approx. 24 TWh by 2030 and approx. 39.4 TWh by 2040.

According to the plan, the evaluation and revision of the KPEiK will take place in 2023. Considering that the KPEiK and PEP2040 should form a coherent whole, it should be assumed that, in particular, the PEP2040 will be subject to significant modifications in the near future. Undoubtedly, the intention is to gradually replace the land-based generation capacities with offshore wind power [

15], with planned funds for investments in offshore wind farms amounting to PLN 130 billion [

69].

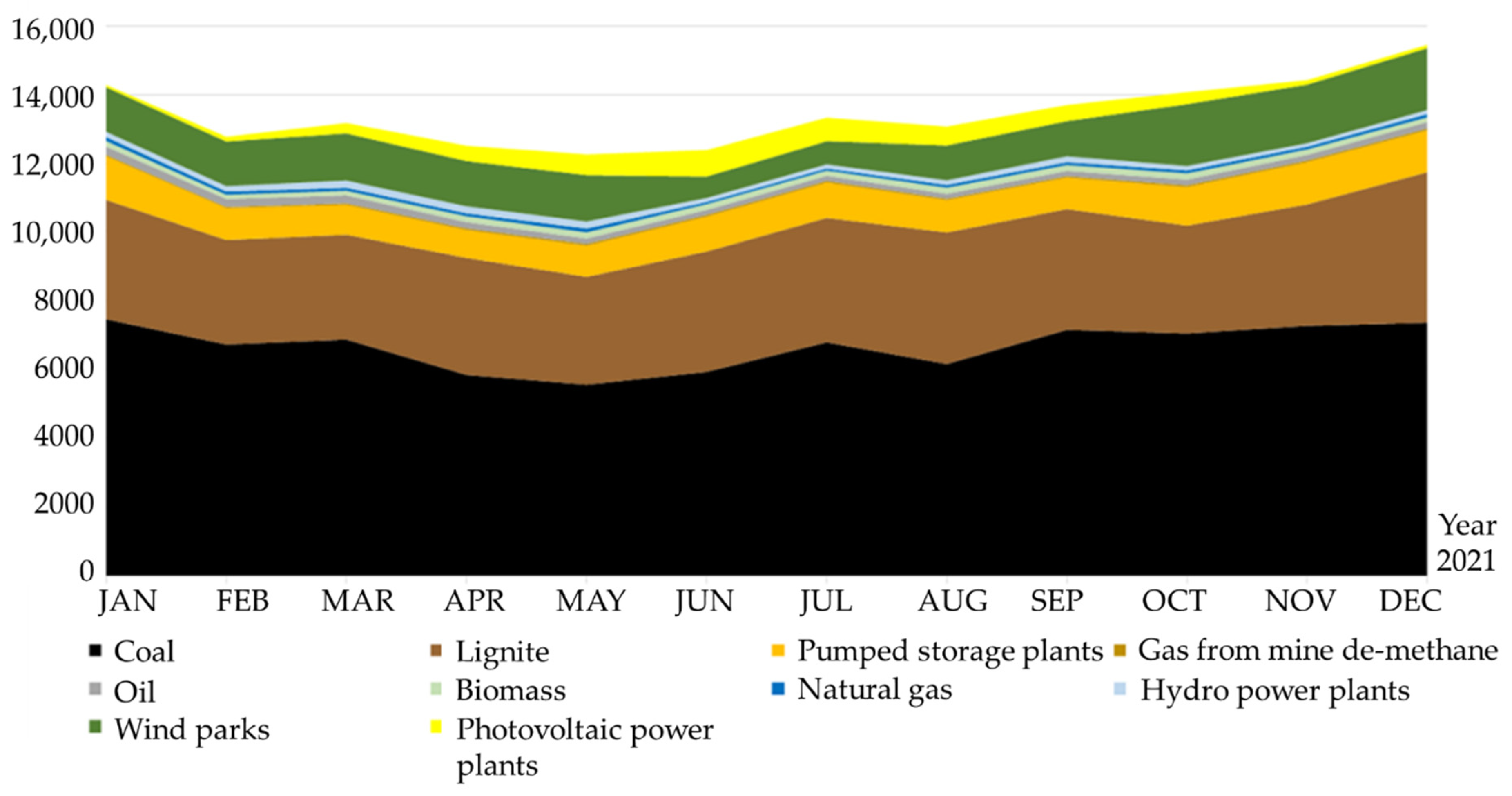

The Polish power system definitely requires a thorough transformation. The country’s energy mix, approximately 70% based on coal [

69], does not meet the requirements of modern times and the ambitious plans declared by all political forces to build a modern welfare state. A necessary measure to achieve this goal is competitively priced energy, especially as domestic consumption is systematically growing year by year. The import of energy is also growing. Another factor accelerating the pace of the inevitable transformation is the European Union’s climate policy, which is increasingly focused on reducing CO

2 emissions and building a zero-emission circular economy.

The current price of energy is approx. PLN 300/MWh, while wind investors have proposed approx. PLN 200/MWh in previous auctions. With the use of the current technological potential, it is possible to go down to 150 PLN/MWh. While in 2016, one could have doubts as to the profitability of investing in wind energy (at the energy prices at that time), today we cannot afford to limit its development. Its dynamic development is of a key interest—1 GW of installed capacity in the wind is currently over PLN 20/MWh in savings for the end-user, the consumer [

69]. Cheap energy is of core importance for the competitiveness of the Polish economy, where 80% of exports go to the EU market.

The authors of the PEP2040 assumed the price of CO₂ emission allowances at EUR 30/ton in 2030 [

41], which was already exceeded in December 2020. Moreover, the price forecast for 2040 (EUR 40) was reached at the beginning of the second quarter of 2021. Therefore, it is clear that the assumptions of the PEP2040 have become outdated. In addition, the upward trend will continue to increase, the latest forecasts say EUR 70/ton of CO₂ by 2030 [

69]. Assuming this rate, with the emission ratio of 0.76 tons of CO₂/MWh and the exchange rate of 4.7 PLN/EUR, the allowances themselves will cost over PLN 250/MWh.

The assumptions for offshore wind farms by 2030 (5.9 GW) are very realistic, however, 11 GW in 2040 is an underestimation—due to the dynamics of the development and technological progress. In other countries, a significant acceleration of such investments and an increase in plans is observed comparing to previous estimates. Think tanks indicate the potential of the Polish part of the Baltic Sea at the level of 28–45 GW by 2050. Assuming conservative estimates, it could be at least 14–15 GW of installed capacity by 2040 [

69]. Think tanks also emphasize that it is possible to move away from coal more quickly, drawing the prospect of a two times faster departure from coal in the power sector than assumed in the PEP2040. In fact, the potential seems to be much greater in both onshore and offshore wind farms—needless to say that, based on the existing and planned auctions, 10.5–11 GW of onshore capacity will be contracted. Therefore, the PEP2040 created in 2018–2019 does not sufficiently take into account the current realities in the field of energy prices, and thus the growing competitiveness of wind energy. The McKinsey & Company report [

70] also indicates that the share of wind energy in Poland’s energy mix in 2050 could be as high as 73%, with a 2.5-fold increase in energy demand.

The war in Ukraine has undermined the energy security of the whole of Europe which, in turn, disrupted the sense of independence and stability. In response to the threats, the European Commission presented the proposed solutions contained in the RePowerUE document [

71]. Set out on 47 pages and in a series of accompanying documents, the plan has a dual purpose: to make Europe independent of Russian fossil fuels as soon as possible, ideally by 2027, while at the same time accelerating its green transition. The EU wants to go even further and faster, requiring the “mobilization at the level of the war economy”. For the plan to work, significant additional investments of EUR 210 billion will be needed between now and 2027.

As a consequence of the Russian aggression against Ukraine, the goal of the Polish government has also become to achieve independence from fuel supplies from Russia, which requires updating Poland’s energy policy. Due to the enormous potential of offshore wind energy, it can be assumed that the goals set for this technology will be increased.

3.4. Perspectives–Energy to Heat

What has been happening, among others, in Scandinavia since the 1950s, may begin in Poland in the coming years, and that concerns transforming green energy into green heat. This may occur due to the fact that many modern companies, which have their roots in developed countries in Western Europe, are opening branches in Poland. The experience of companies such as Eurowind Energy Ltd gained in recent years, on the implementation of modern energy systems in various European countries, allowed them to initiate a very innovative project in Poland. The idea of transforming electricity into heat arose as a result of bureaucratic problems related to the connection of the newly built wind farm to the municipal grid. The local administration quickly became interested in the idea of generating green heat and finally agreed to implement it. Thus, as has happened, a pioneering project was born out of a limitation and may turn out to be one of the most important paths of development in Poland in the current legal and infrastructural regulations.

The planned investment in Heat Energy Plant Ltd (ZEC) in Wałcz, is based on the cooperation with the Danish investor Eurowind Energy Ltd, which will build a wind farm and photovoltaic farm within a radius of 30 km from Wałcz, supplying the KR2 boiler houses in Wałcz with a direct power line. Green energy from RES farms will be sent directly to the boiler house in Wałcz with a private off-grid network, where 100% of it will be converted into thermal energy while using an electrode boiler.

The electrode boiler is made of a cylindrical high-pressure tank to which electricity is supplied. The supply voltage of the 10 MW boiler in question is 10–11 kV. The temperature in the boiler circuit is 130 °C/95 °C. The heart of the electrode boiler is an open vessel in which high voltage electrodes are immersed. As the electrodes are lowered into the reservoir and the water flow is adjusted, the heat output of the source increases. Importantly, unlike fossil fuel fired boilers, in these boilers the production efficiency is practically independent of the load on the device. At half power and full power load, it is at a similar level and amounts to 99.8%. This means that 99.8 MWh of heat will be sent from 100 MWh of electricity transmitted from the wind farm to the Wałcz district heating network. for comparison, the efficiency of coal boilers is 84% and gas boilers 95%.

In electrode boilers, the quality requirements of water in circulation are very high, e.g., the water must be fully demineralized, the electrical conductivity must be <1 µs/cm (continuously monitored) and for efficiency improvement, there is nitrogen in the boiler instead of air. The high water quality regime makes the individual boiler short circuits the most effective (see

Figure 12). Thanks to this, a dedicated water treatment plant does not have to be large and the costs of water preparation are lower. The basis of the station is the reverse osmosis process, thanks to which the almost complete demineralization takes place. If the programmed value of the electrical conductivity of the water in the boiler circuit is exceeded, the discharge process is automatically started by means of the water drain and the treated water is injected from the station. The water that enters the upper vessel is heated by the flow of the current between the electrodes. The throttle valve regulates the flow of water from the upper vessel to the lower part of the tank, from where it is pumped out to the heat exchanger. Once the heat is collected by the network water circuit, the boiler water goes back to the vessel with electrodes. Due to its relatively small volume, the boiler also functions as an expansion vessel.

Example of an installed 10 MW electrode boiler from Parat in Denmark is presented in

Figure 13.