Total Cost of Ownership of Light Commercial Electrical Vehicles in City Logistics

Abstract

:1. Introduction

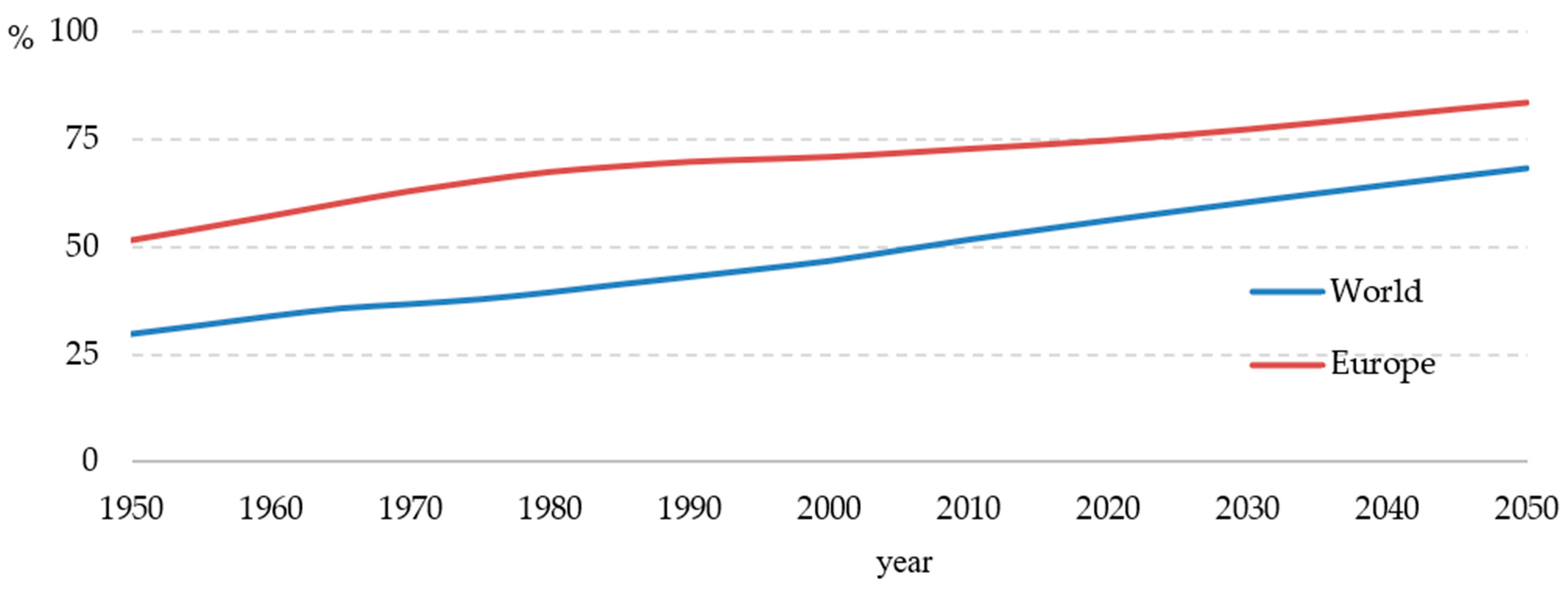

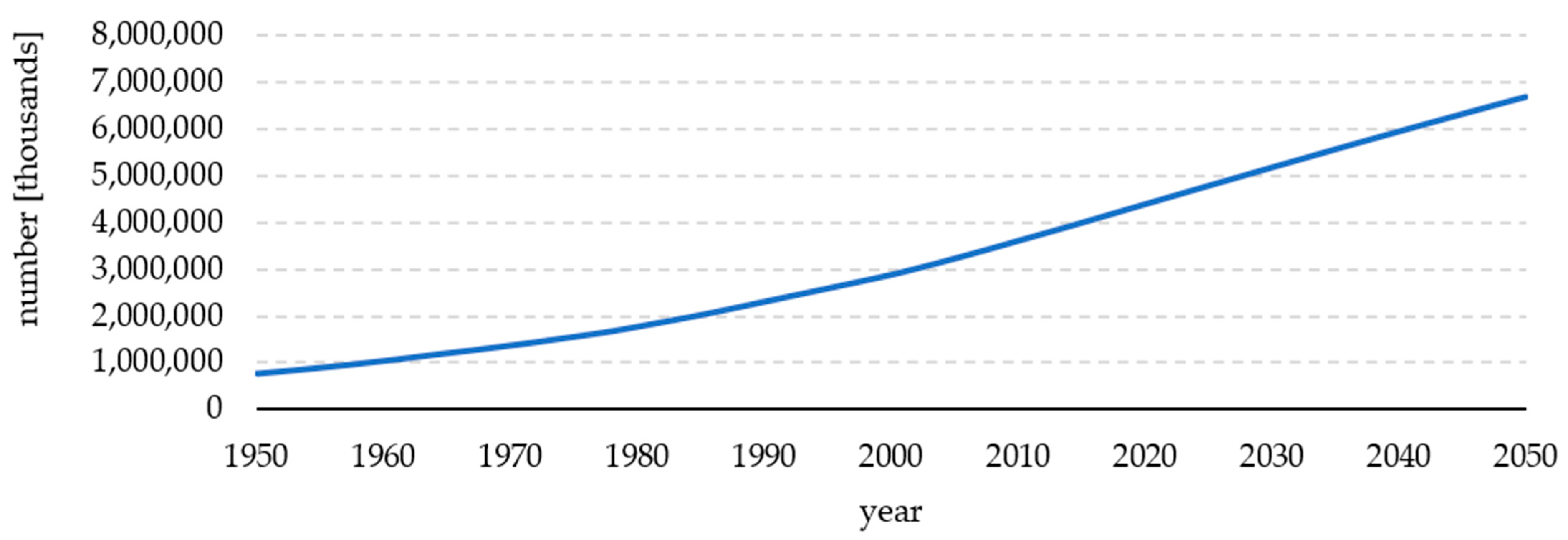

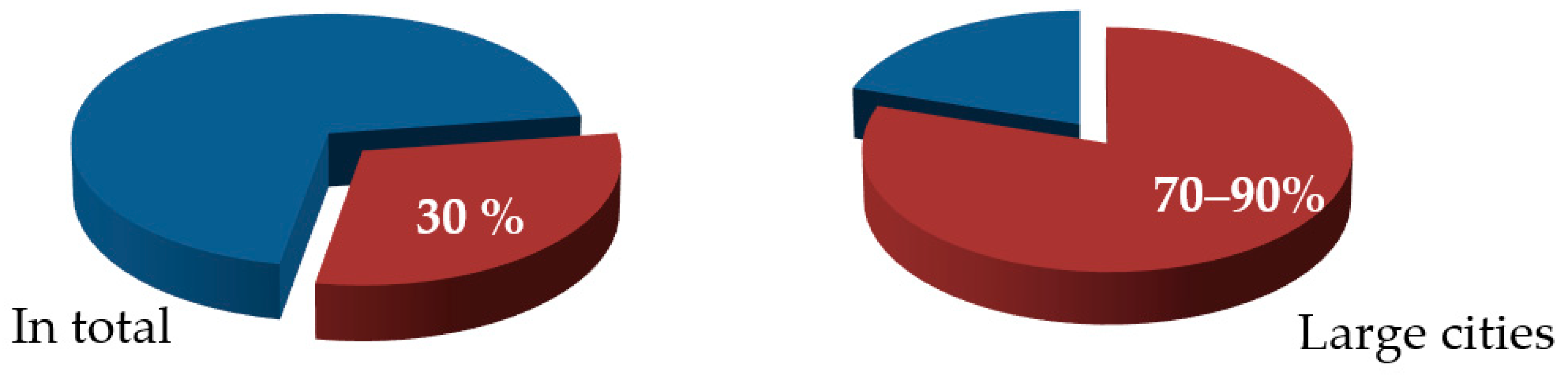

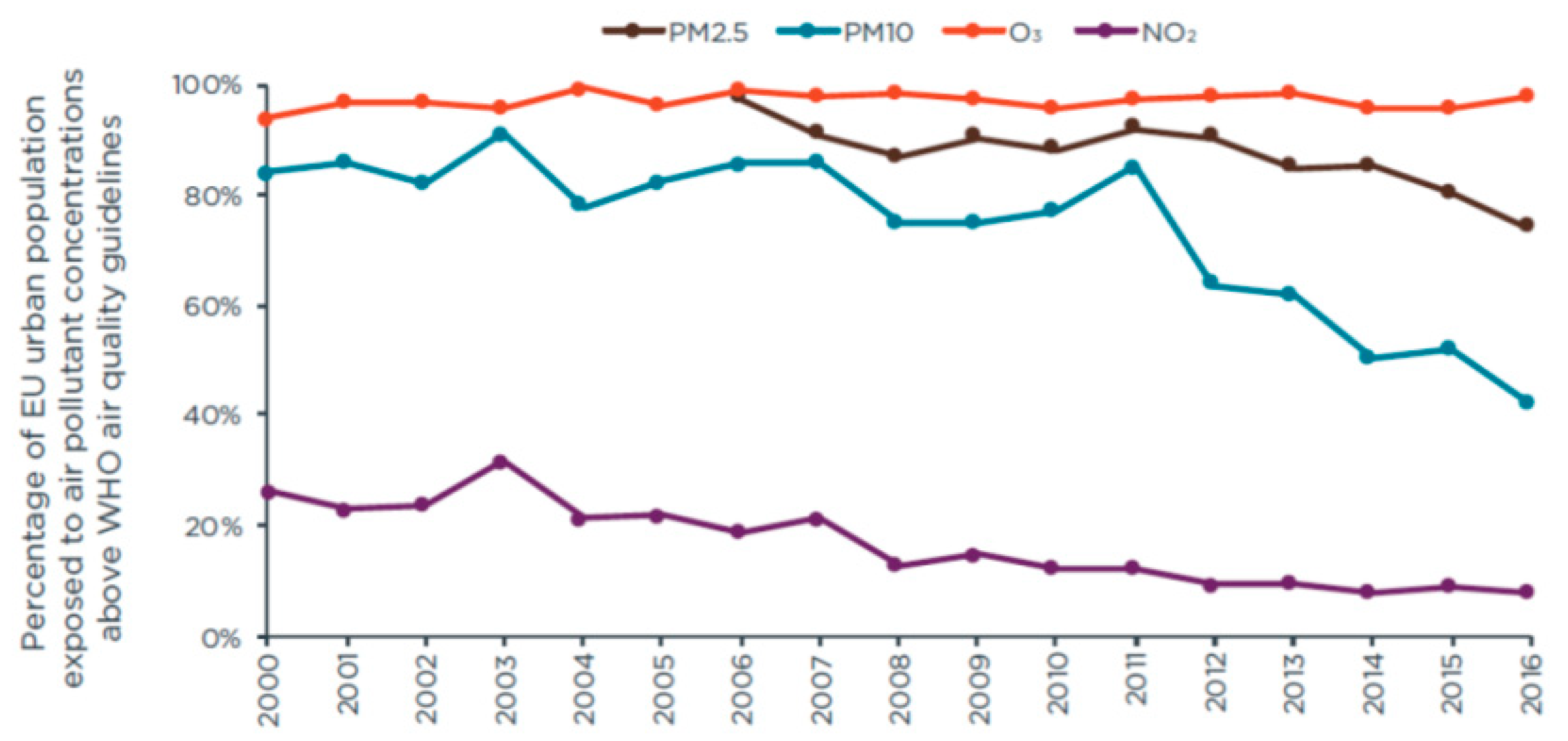

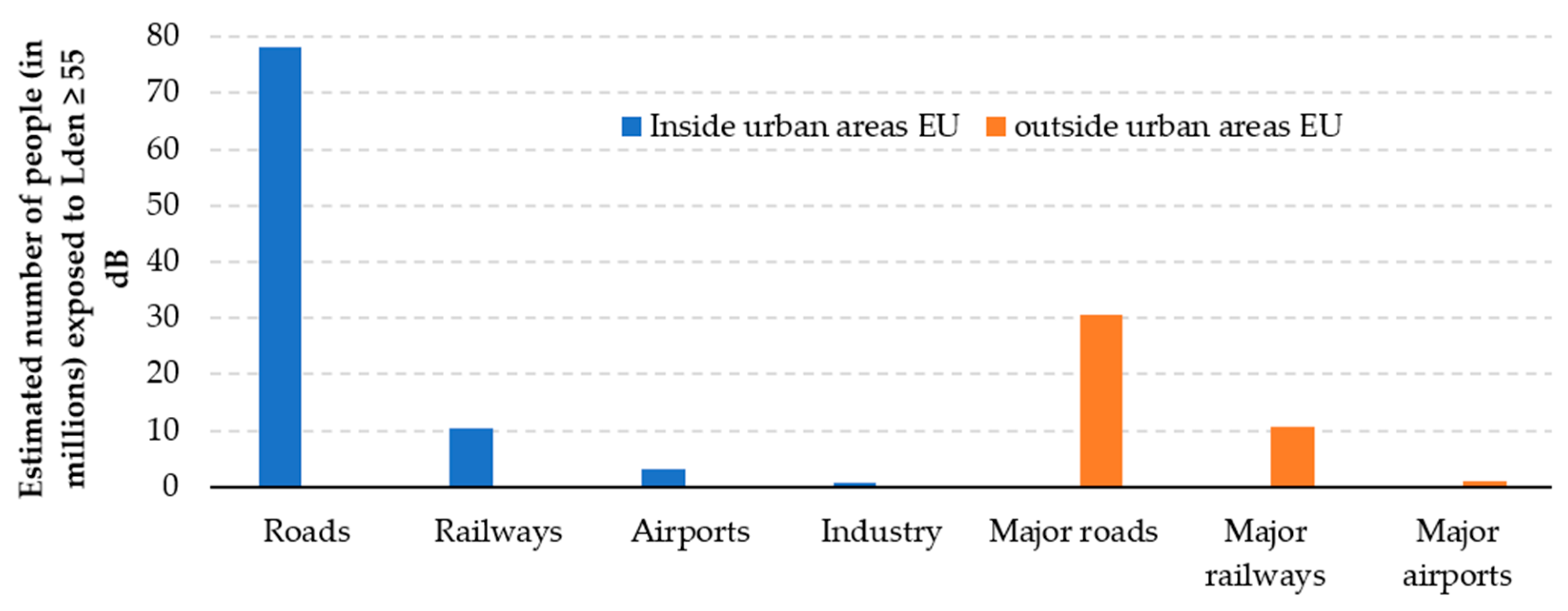

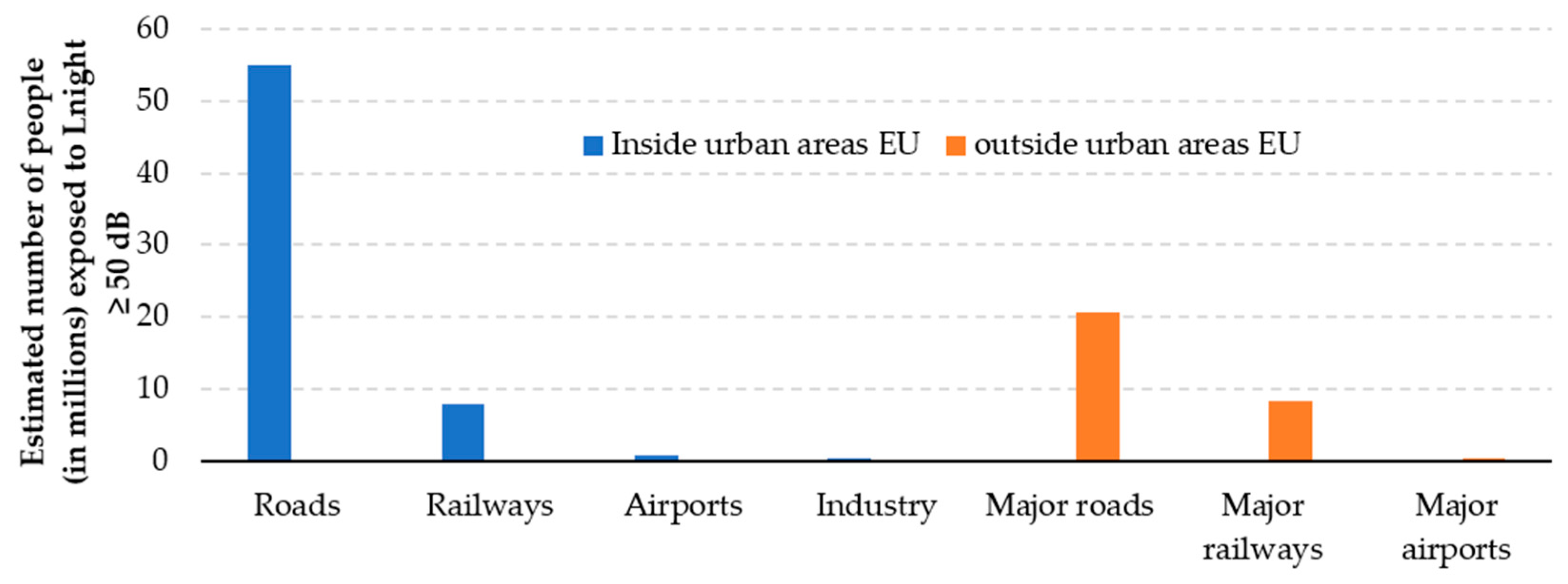

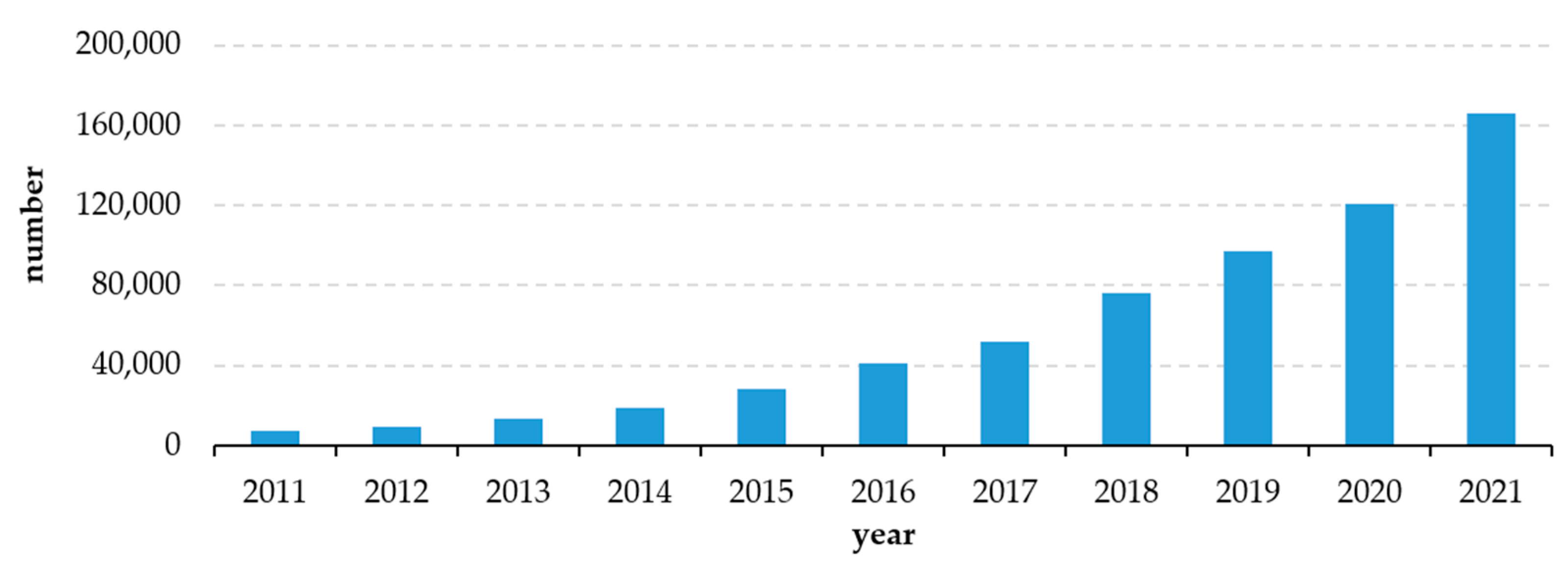

1.1. Environmental Hazards in Urban Areas Generated by Transport

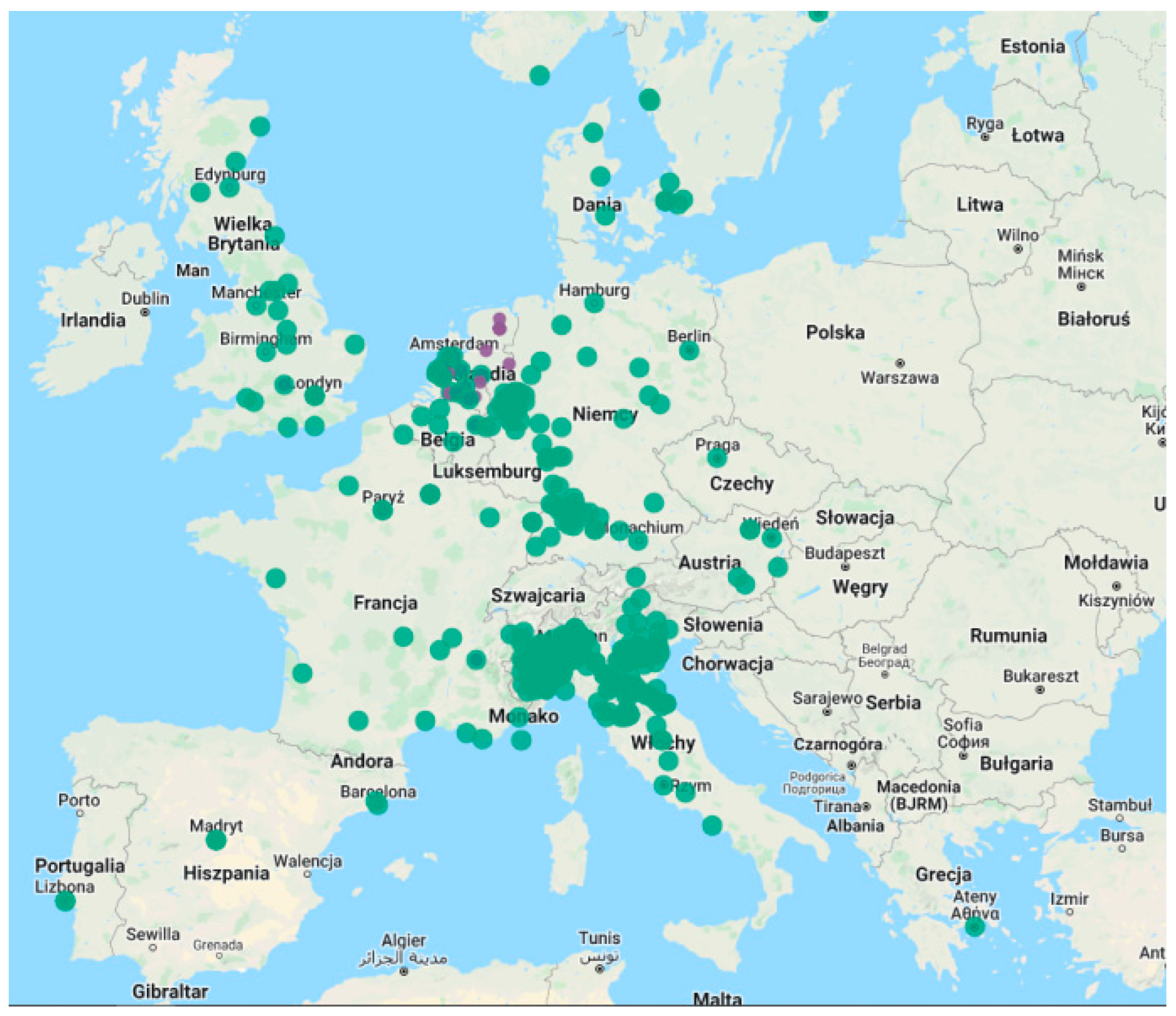

1.2. The Policy of the European Union in the Context of the Electromobility of Utility Vehicles

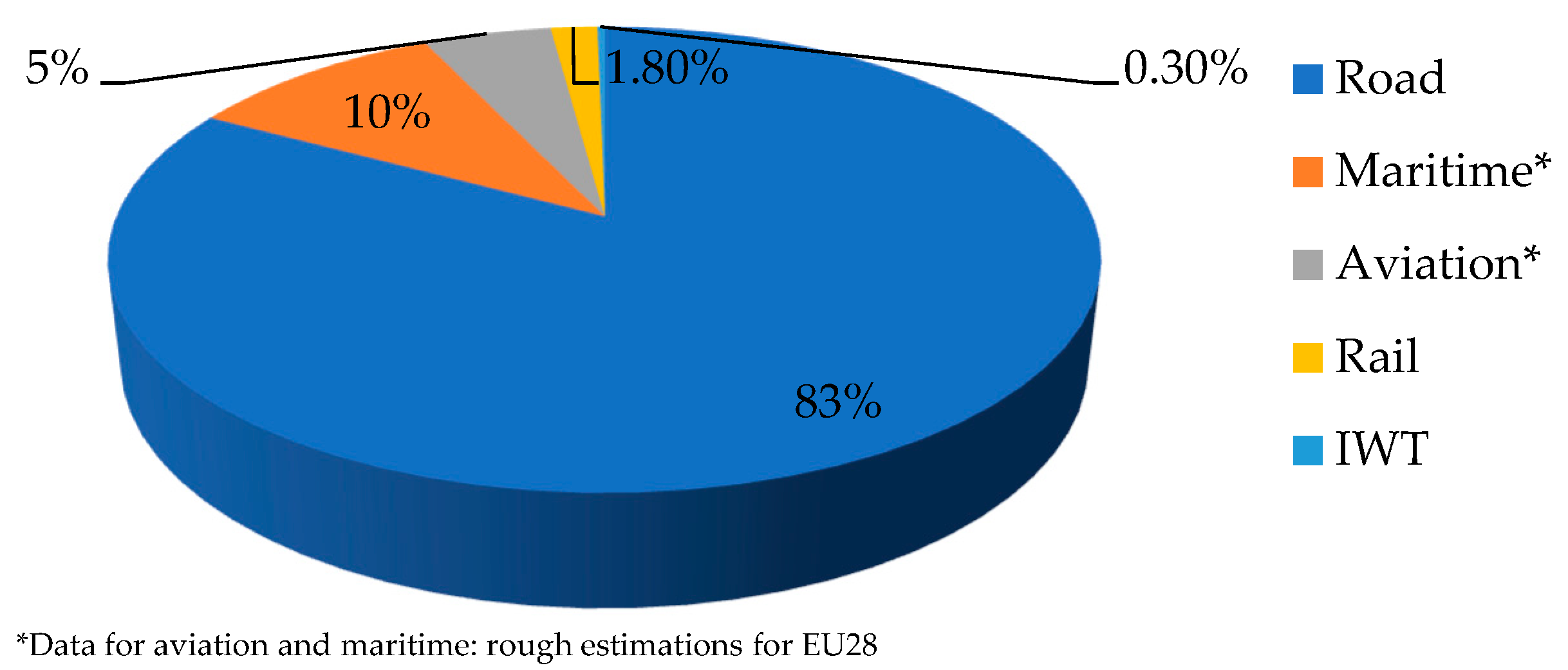

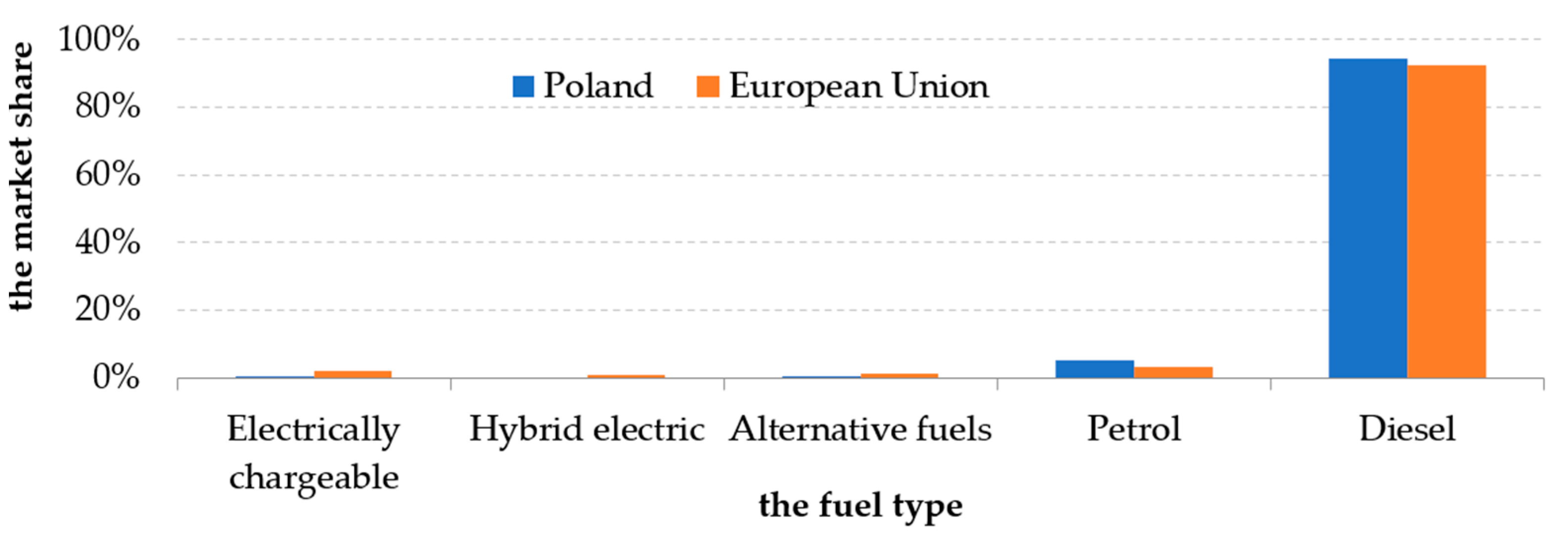

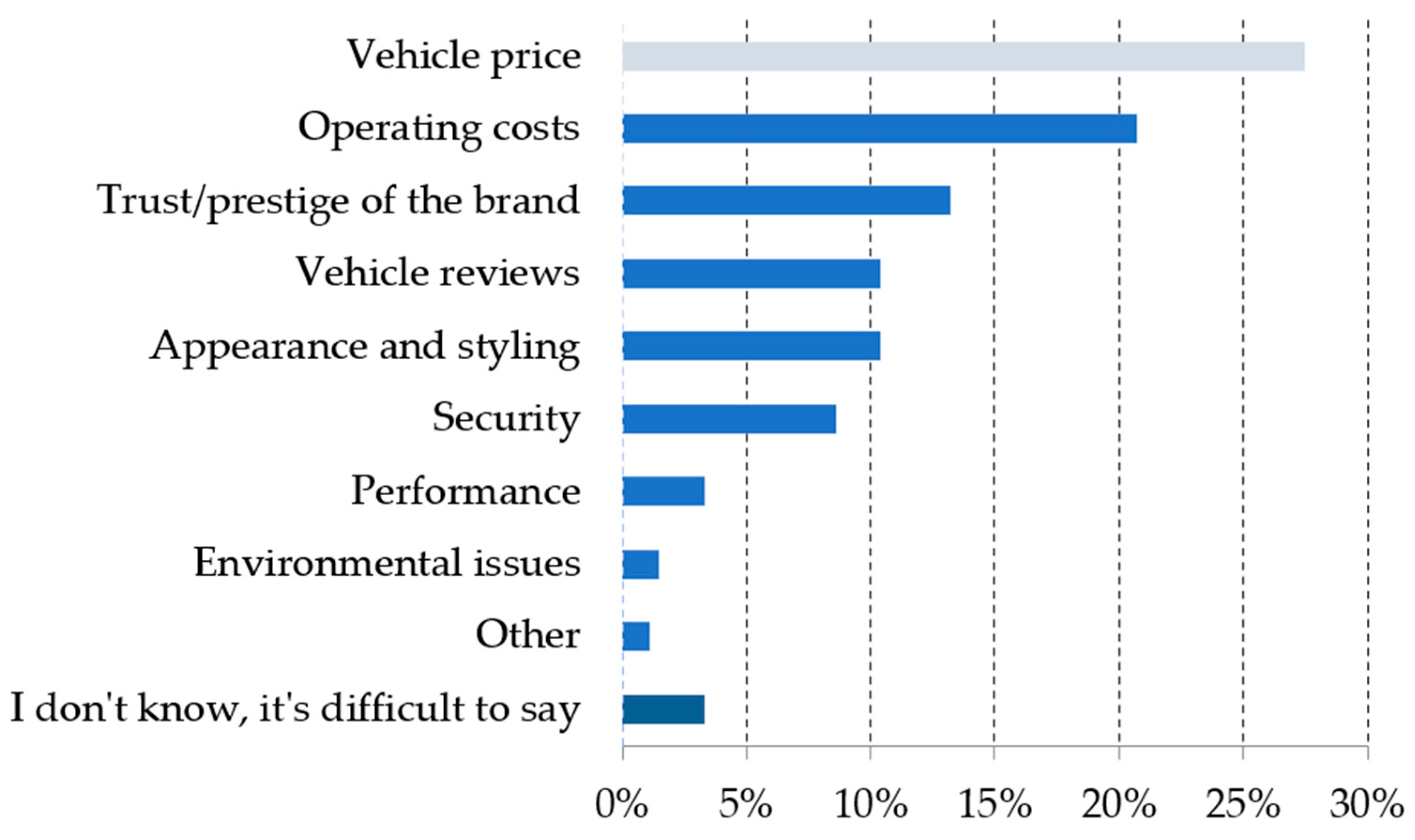

1.3. Light Commercial Vehicle (N1) Market in the European Union

2. Methodology

2.1. Assumptions for TCO Model Used for the Research

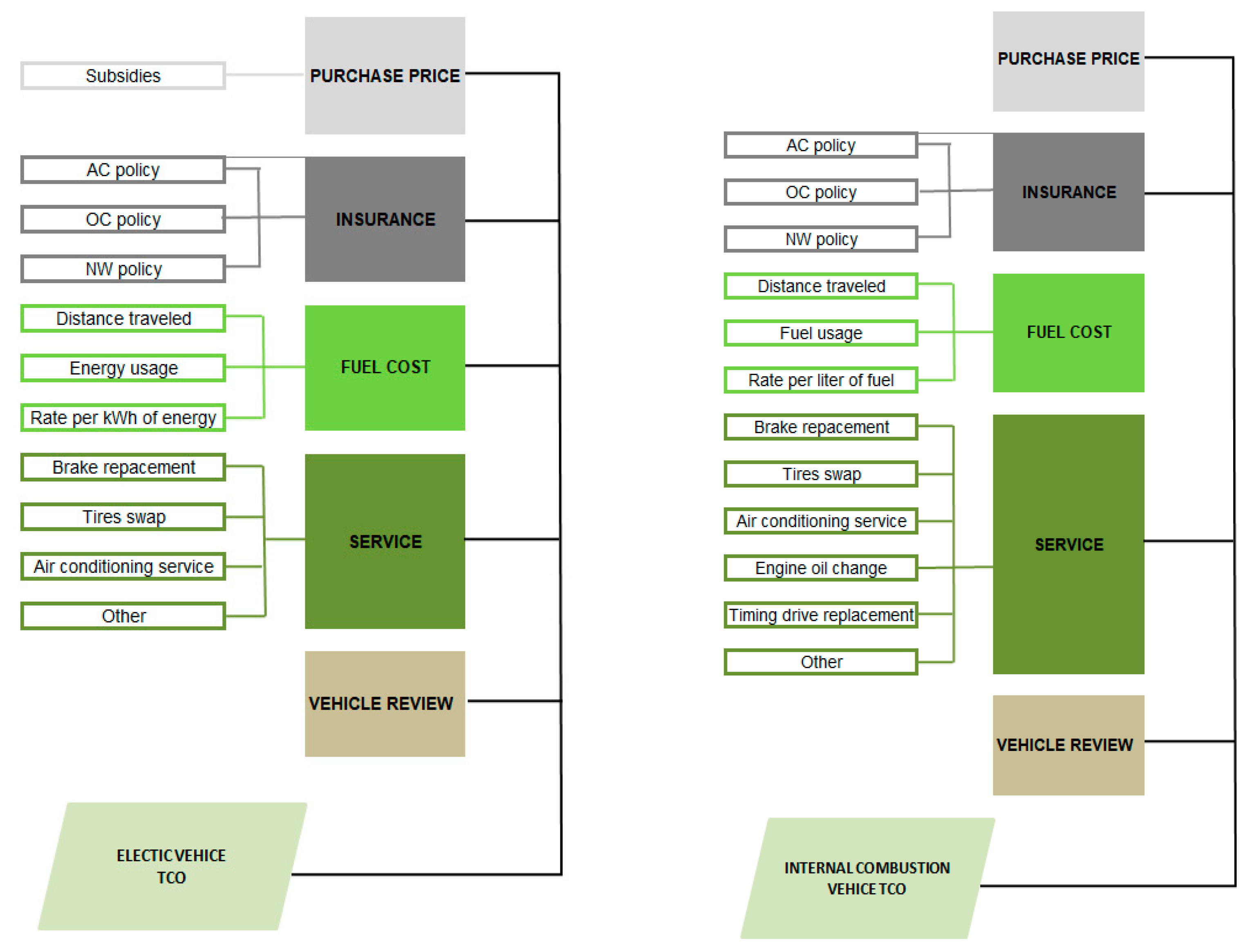

2.2. Costs Considered in the Analysis

- −

- one-off costs: purchase of vehicle, administrative costs, costs of adapting the vehicle to fleet;

- −

- recurring costs: the purchase of vehicle insurance, vehicle’s technical inspections, operating budget (e.g., car wash);

- −

- variable costs: electric power (fuel), maintenance service, repair of damages not subject to insurance.

- −

- avoidable costs: public parking fees, clean transport zone entry fees, costs of saved time (ability to use bus lanes).

2.3. One-Off Costs

- (1)

- without the consideration of any additional funding,

- (2)

- with the consideration of a maximum amount of additional funding, i.e., PLN 70,000.

2.4. Recurring Costs

2.5. Variable Costs

3. Case Study—Analysis of Scenarios

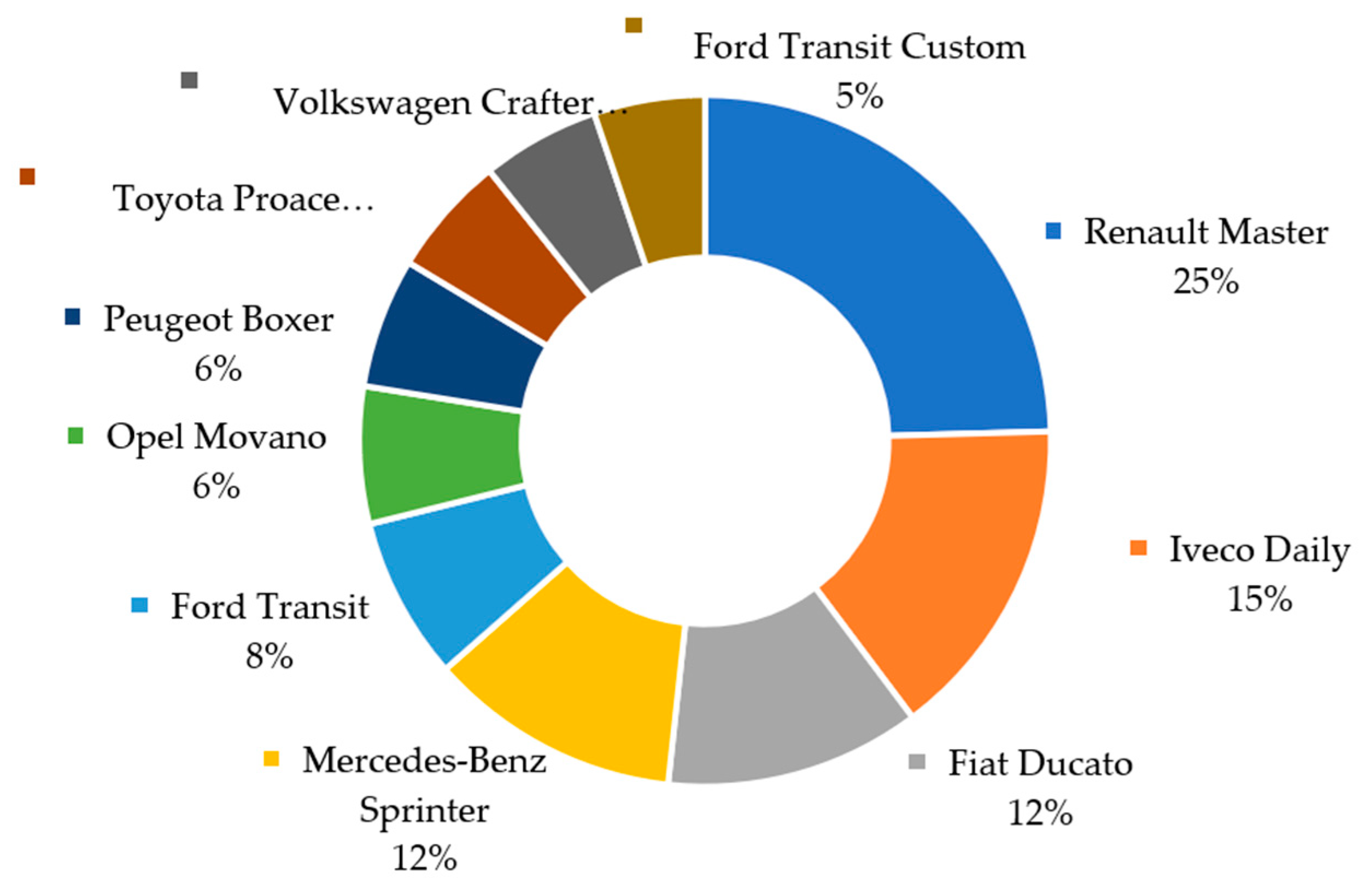

3.1. Selection of Vehicles for Analysis

- ✓

- variant 1—vehicle with an electric motor,

- ✓

- variant 2—vehicle with a diesel engine.

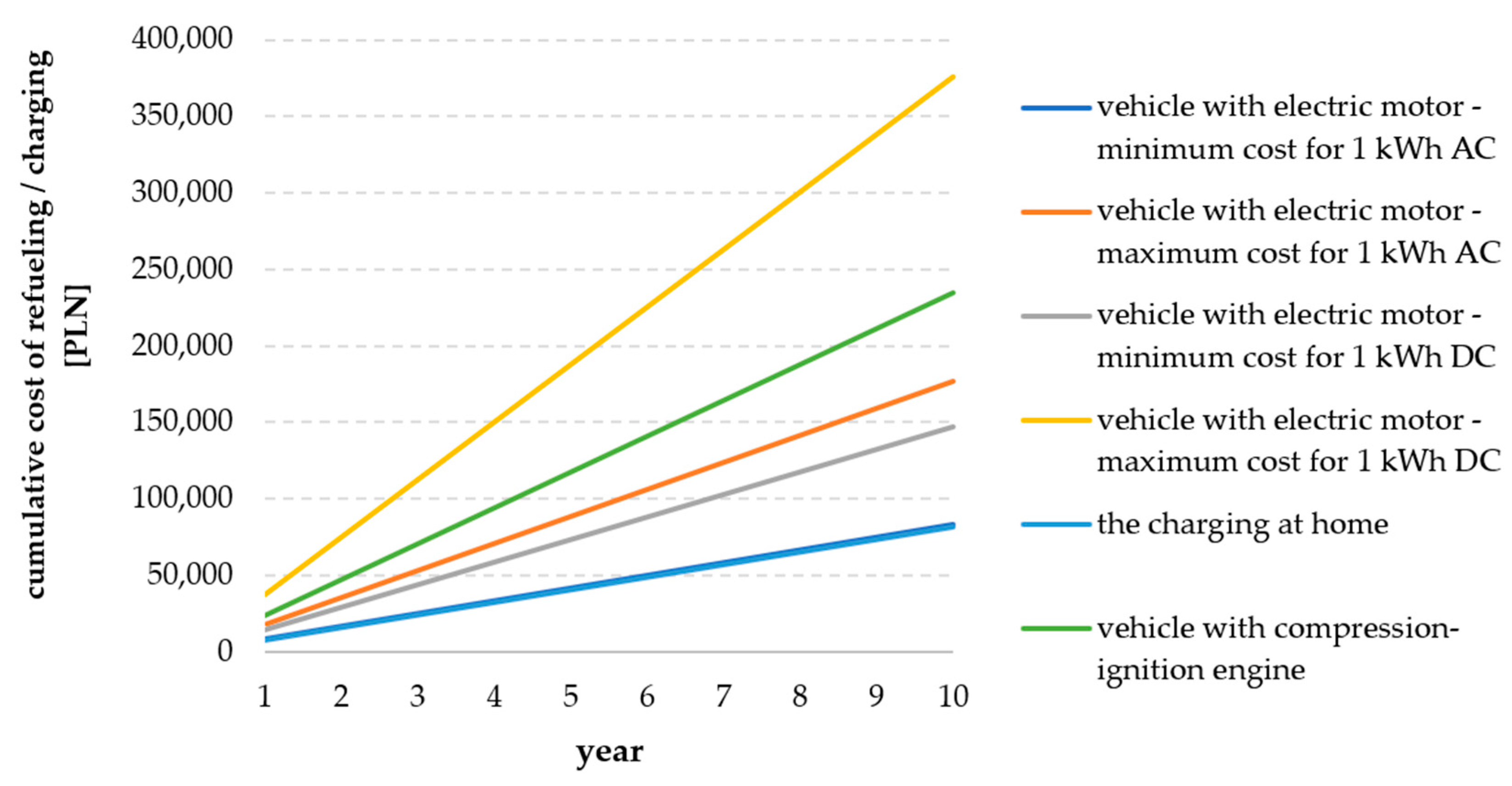

3.2. Analysed Scenarios for Electric Vehicles

- A.

- Without any refund for the purchase of an electric vehicle

- −

- Scenario A1—the electric vehicle is recharged only at home via an electrical socket;

- −

- Scenario A2—the electric vehicle is recharged only at public AC charging stations (the lowest price for 1 kWh was included in the calculations);

- −

- Scenario A3—the electric vehicle is recharged only at public AC charging stations (the maximum price for 1 kWh was included in the calculations);

- −

- Scenario A4—the electric vehicle is recharged only at public DC charging stations (the lowest price for 1 kWh was included in the calculations);

- −

- Scenario A5—the electric vehicle is recharged only at public DC charging stations (the maximum price for 1 kWh was included in the calculations);

- B.

- With the consideration of a maximum possible refund for the purchase of an electric vehicle (PLN 70,000)

- −

- Scenario B1—the electric vehicle is recharged only at home via an electrical socket;

- −

- Scenario B2—the electric vehicle is recharged only at public AC charging stations (the lowest price for 1 kWh was included in the calculations);

- −

- Scenario B3—the electric vehicle is recharged only at public AC charging stations (the maximum price for 1 kWh was included in the calculations);

- −

- Scenario B4—the electric vehicle is recharged only at public DC charging stations (the lowest price for 1 kWh was included in the calculations);

- −

- Scenario B5—the electric vehicle is recharged only at public DC charging stations (the maximum price for 1 kWh was included in the calculations);

3.3. Results of Analysis

- A.

- Without any refund for the purchase of an electric vehicleFigure 16. Total cost of ownership of vehicle during the whole operating period (vehicle is recharged only at home via an electrical socket—Scenario A1).Figure 16. Total cost of ownership of vehicle during the whole operating period (vehicle is recharged only at home via an electrical socket—Scenario A1).Figure 17. Total cost of ownership of vehicle during the whole operating period—electric vehicle is recharged only at public AC charging stations (the lowest price for 1 kWh was included in the calculations—Scenario A2).Figure 17. Total cost of ownership of vehicle during the whole operating period—electric vehicle is recharged only at public AC charging stations (the lowest price for 1 kWh was included in the calculations—Scenario A2).Figure 18. Total cost of ownership of vehicle during the whole operating period—electric vehicle is recharged only at public AC charging stations (the highest price for 1 kWh was included in the calculations—Scenario A3).Figure 18. Total cost of ownership of vehicle during the whole operating period—electric vehicle is recharged only at public AC charging stations (the highest price for 1 kWh was included in the calculations—Scenario A3).Figure 19. Total cost of ownership of vehicle during the whole operating period—electric vehicle is recharged only at public DC charging stations (the lowest price for 1 kWh was included in the calculations—Scenario A4).Figure 19. Total cost of ownership of vehicle during the whole operating period—electric vehicle is recharged only at public DC charging stations (the lowest price for 1 kWh was included in the calculations—Scenario A4).Figure 20. Total cost of ownership of vehicle during the whole operating period—electric vehicle is recharged only at public DC charging stations (the highest price for 1 kWh was included in the calculations—Scenario A5).Figure 20. Total cost of ownership of vehicle during the whole operating period—electric vehicle is recharged only at public DC charging stations (the highest price for 1 kWh was included in the calculations—Scenario A5).

- B.

- With the consideration of a maximum possible refund for the purchase of an electric vehicleFigure 21. Total cost of ownership of vehicle during the whole operating period (vehicle is recharged only at home via an electrical socket—Scenario B1).Figure 21. Total cost of ownership of vehicle during the whole operating period (vehicle is recharged only at home via an electrical socket—Scenario B1).Figure 22. Total cost of ownership of vehicle during the whole operating period—electric vehicle is recharged only at public AC charging stations (the lowest price for 1 kWh was included in the calculations—Scenario B2).Figure 22. Total cost of ownership of vehicle during the whole operating period—electric vehicle is recharged only at public AC charging stations (the lowest price for 1 kWh was included in the calculations—Scenario B2).Figure 23. Total cost of ownership of vehicle during the whole operating period—electric vehicle is recharged only at public AC charging stations (the highest price for 1 kWh was included in the calculations—Scenario B3).Figure 23. Total cost of ownership of vehicle during the whole operating period—electric vehicle is recharged only at public AC charging stations (the highest price for 1 kWh was included in the calculations—Scenario B3).Figure 24. Total cost of ownership of vehicle during the whole operating period—electric vehicle is recharged only at public DC charging stations (the lowest price for 1 kWh was included in the calculations—Scenario B4).Figure 24. Total cost of ownership of vehicle during the whole operating period—electric vehicle is recharged only at public DC charging stations (the lowest price for 1 kWh was included in the calculations—Scenario B4).Figure 25. Total cost of ownership of vehicle during the whole operating period—electric vehicle is recharged only at public DC charging stations (the highest price for 1 kWh was included in the calculations—Scenario B5).Figure 25. Total cost of ownership of vehicle during the whole operating period—electric vehicle is recharged only at public DC charging stations (the highest price for 1 kWh was included in the calculations—Scenario B5).

4. Results

5. Conclusions

Author Contributions

Funding

Conflicts of Interest

References

- United Nations. Departament of Economic and Social AFFairs. 2018 Revision of World Urbanization Prospects. Available online: https://www.un.org/development/desa/publications/2018-revision-of-world-urbanization-prospects.html (accessed on 20 April 2022).

- European Commission. The 2018 Ageing Report: Economic and Budgetary Projections for the EU Member States (2016–2070). Available online: https://ec.europa.eu/info/sites/info/files/economy-finance/ip079_en.pdf (accessed on 11 March 2022).

- European Commission. Sustainable Transport. Search This Website Internalisation of Transport External Costs. Available online: https://ec.europa.eu/transport/themes/sustainable-transport/internalisation-transport-external-costs_en (accessed on 10 May 2022).

- Hartgen, D.; Fields, G. Gridlock and Growth: The effect of Traffic Congestion on Regional Economic Performance. Policy Summary of Study (No. 371), Reason Foundation. 2009. Available online: http://66.113.237.135/Projects/National/USA/cong_region_performance/2009-06-22_Final_Summary_PS371.pdf (accessed on 18 April 2021).

- Izdebski, M.; Jacyna-Golda, I.; Golebiowski, P.; Golda, P.; Pyza, D.; Zak, J. Decision Problems in Designing Database Architecture for the Assessment of Logistics Services. Sci. J. Sil. Univ. Technol. Ser. Transp. 2020, 108, 53–72. [Google Scholar] [CrossRef]

- Ministry of the Environment. Energy Saving Trust—Leaseplan.pl. Ecology in Car Fleets. Available online: https://docplayer.pl/2732049-Ekologia-we-flotach-samochodowych-make-a-green-move-greenplan-there-is-a-lot-to-be-won.html (accessed on 7 November 2022).

- Europejska Agencja Środowiska. Airquality in Europe—2017 Report. Available online: https://www.eea.europa.eu/publications/air-quality-in-europe-2017 (accessed on 5 May 2022).

- WHO. Ambient Air Pollution: A Global Assessment of Exposure and Burden of Disease. Available online: https://www.who.int/phe/publications/air-pollution-global-assessment (accessed on 29 March 2022).

- Europejska Agencja Środowiska. Signals 2016—Towards Clean and Smart Mobility. Available online: https://www.eea.europa.eu/publications/signals-2016 (accessed on 16 May 2022).

- European Parliament and Council of the European Union. Directive of the European Parliament and of the Council on the Limitation of Emissions of Certain Pollutants into the Air from Medium Combustion Plants SWD(2013) 532 Final Dated 18/12/2013. Available online: https://eur-lex.europa.eu/ (accessed on 24 April 2022).

- Gmobility. Available online: https://gmobility.eu/air-quality-and-local-pollutants-part-1/ (accessed on 17 May 2022).

- World Health Organization. Data and Statistics. Available online: http://www.euro.who.int/en/health-topics/environment-and-ealth/noise/data-and-statistics (accessed on 9 April 2022).

- Europejska Agencja Środowiska. Data and Maps. Available online: https://www.eea.europa.eu/data-and-maps (accessed on 14 May 2022).

- European Environment Agency. Environmental noise in Europe—2020, Report No 22/2019. Available online: https://www.eea.europa.eu/publications/environmental-noise-in-europe (accessed on 7 November 2022).

- European Commission. Handbook on the External Costs of Transport VERSION 2019—1.1. Available online: https://op.europa.eu/o/opportal-service/download-handler?identifier=9781f65f-8448-11ea-bf12-01aa75ed71a1&format=pdf&language=en&productionSystem=cellar&part= (accessed on 16 April 2022).

- European Parliament. Communication from the Commission to the European Parliament, the Council, the European Economic and Social Committee and the Committee of the Regions Sustainable and Smart Mobility Strategy—Putting European Transport on Track for the Future COM/2020/789 Final. Available online: https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=CELEX%3A52020DC0789 (accessed on 7 November 2022).

- European Parliament. Alternative Fuel Infrastructures for Heavy-Duty Vehicles. Available online: https://www.europarl.europa.eu/RegData/etudes/STUD/2021/690888/IPOL_STU(2021)690888_EN.pdf (accessed on 9 March 2022).

- European Cyclists’ Federation. Available online: https://ecf-com.translate.goog/news-and-events/news/low-emission-zones-european-success-story?_x_tr_sl=auto&_x_tr_tl=pl&_x_tr_hl=pl (accessed on 17 April 2022).

- Urban Access Regulations in Europe. Available online: https://urbanaccessregulations.eu/userhome/map (accessed on 3 April 2022).

- European Automobile Manufacturers’ Association. Available online: https://www.acea.auto/files/ACEA_vans_by_fuel_type_full-year_2020.pdf (accessed on 17 March 2022).

- Polski Związek Przemysłu Motoryzacyjnego. Available online: https://www.pzpm.org.pl (accessed on 7 November 2022).

- Zaniewska-Zielińska, D. Problemy rozwoju elektromobilności w Polsce. Eur. Reg. 2018, 2, 63–78. [Google Scholar]

- Krawiec, S.; Krawiec, K. Rozwój elektromobilności w Polsce. uwarunkowania, cele i bariery. Zesz. Nauk. Uniw. Ekon. W Katowicach 2017, 332, 17–24. [Google Scholar]

- Nikołajewka, A.; Adey, P.; Cresswell, T.; Lee, J.Y.; Nóvoa, A.; Temenos, C. Commoning mobility: Towards a new politics of mobility transitions. Trans. Inst. Br. Geogr. 2019, 44, 346–360. [Google Scholar]

- Correa, D.F.; Beyer, H.L.; Fargionec, J.E.; Hill, J.D.; Possingham, H.P.; Thomas-Hall, S.R.; Schenka, P.M. Towards the implementation of sustainable biofuel production systems. Renew. Sustain. Energy Rev. 2019, 107, 250–263. [Google Scholar] [CrossRef]

- Standing, C.; Standing, S.; Biermann, S. The implications of the sharing economy for transport. Transp. Rev. 2018, 39, 226–242. [Google Scholar] [CrossRef]

- Pisonia, E.; Christidis, P.; Thunis, P.; Trombetti, M. Evaluating the impact of “Sustainable Urban Mobility Plans” on urban background air quality. J. Environ. Manag. 2019, 231, 249–255. [Google Scholar] [CrossRef]

- Sendek-Matysiak, E. Najważniejsze bariery rozwoju elektromobilności w Polsce. Przegląd Komun. 2020, 3, 8–14. [Google Scholar]

- Polskie Stowarzyszenie Paliw Alternatywnych. Barometr Nowej Mobilności 2020/21. Available online: https://pspa.com.pl/wp-content/uploads/2022/01/barometr_nowej_mobilnosci_2021_raport.pdf (accessed on 3 June 2022).

- Thiel, C.; Perujo, A.; Mercier, A. Cost and CO2 aspects of future vehicle options in Europe under new energy policy scenarios. Energy Policy 2010, 38, 7142–7151. [Google Scholar] [CrossRef]

- Weiss, M.; Patel, M.; Junginger, M. On the electrification of road transport—Learning rates and price forecasts for hybrid-electric and battery-electric vehicles. Energy Policy 2012, 48, 374–393. [Google Scholar] [CrossRef]

- Lee, H.; Lovellette, G. Will Electric Cars Transform the US Vehicle Market? s.l., Energy Technology Innovation Policy Research Group. 2011. Available online: https://www.belfercenter.org/sites/default/files/legacy/files/Lee%20Lovellette%20Electric%20Vehicles%20DP%202011%20web.pdf (accessed on 7 November 2022).

- Crist, P. Electric Vehicles Revisited—Costs, Subsidies and Prospects. In Proceedings of the International Transport Forum, Paris, France, 6 March 2012. [Google Scholar]

- Palencia, J.; Furubayashi, T.; Nakata, T. Techno-economic assessment of lightweight and zero emission vehicles deployment in the passenger car fleet of developing countries. Appl. Energy 2014, 123, 129–142. [Google Scholar] [CrossRef]

- Wu, G.; Inderbitzin, A.; Bening, C. Total cost of ownership of electric vehicles compared to conventional vehicles: A probabilistic analysis and projection across market segments. Energy Policy 2015, 80, 196–214. [Google Scholar] [CrossRef]

- Ellram, L.; Siferd, S. Total cost of ownership: A key concept in strategic cost management decisions. J. Bus. Logist. 1988, 1, 55–80. [Google Scholar]

- Redelbach, M.; Friendrich, H. Competitive Cost Analysis of Alternative Powertrain Technologies. In Proceedings of the International Advanced Mobility Forum 2012 (IAMF), Geneva, Switzerland, 7–8 March 2012. Research Gate. [Google Scholar]

- Hurkens, K.; van der Valk, W.; Wynstra, F. Total cost of ownership in the services sector: A case study. J. Supply Chain Manag. 2006, 42, 27–37. [Google Scholar] [CrossRef]

- Lebeau, K.; Lebeau, P.; Macharis, C.; Mierlo, J.V. How expensive are electric vehicles? A total cost of ownership analysis. World Electr. Veh. J. 2013, 6, 996–1007. [Google Scholar] [CrossRef]

- Macharis, C.; Lebeau, P.; Van Mierlo, J.; Lebeau, K. Electric versus conventional vehicles for logistics: A total cost of ownership. In Proceedings of the 2013 World Electric Vehicle Symposium and Exhibition (EVS27), Barcelona, Spain, 17–20 November 2013; pp. 1–10. [Google Scholar]

- Hagman, J.; Ritzen, S.; Janhager, J.; Susilo, Y. Total cost of ownership and its potential implications for battery electric vehicle diffusion. Res. Transp. Bus. Manag. 2016, 18, 11–17. [Google Scholar] [CrossRef] [Green Version]

- Plotz, P.; Gnann, T.; Wietschel, M. Total Ownership Cost Projection for the German Electric Vehicle’ with Implications for its Future Power and Electricity Demand, 7th Conference on Energy Economics and Technology Infrastructure for the Energy Transformation. 2021. Available online: https://www.researchgate.net/publication/267825503_Total_Ownership_Cost_Projection_for_the_German_Electric_Vehicle_Market_with_Implications_for_its_Future_Power_and_Electricity_Demand (accessed on 3 March 2022).

- The Team of Economic Advisors (TOR). The Electromobility in Poland, Development Prospects, Opportunities and Threats. 2017. Available online: https://netprstorage.s3.eu-west-1.amazonaws.com/6/3006/1137349/raport_elektromobilnosc.pdf?response-content-disposition=inline&X-Amz-Algorithm=AWS4-HMAC-SHA256&X-Amz-Date=20221109T211953Z&X-Amz-SignedHeaders=host&X-Amz-Expires=1800&X-Amz-Credential=AKIAUOC4YS7FFVDQ7L33%2F20221109%2Feu-west-1%2Fs3%2Faws4_request&X-Amz-Signature=9ab6f55c3b57f2ae32fcc2478c0b5997b05f184be64b833f51385941fafc2983 (accessed on 7 November 2022).

- Innogy Polska. The Highway to Electromobility. 2017. Available online: https://docplayer.pl/54141438-Autostrada-do-elektromobilnosci-czy-jestesmy-gotowi-na-samochody-elektryczne.html (accessed on 7 November 2022).

- Sendek-Matysiak, E.; Grysa, K. Assessment of the Total Cost of Ownership of Electric Vehicles In Poland. Energies 2021, 14, 4806. [Google Scholar]

- Szymaniak, W. Ocena opłacalności samochodu elektrycznego w porównaniu z samochodem benzynowym. Deb. Nauk. Stud. Wyższej Szkoły Bank. 2020, 20. Available online: https://www.wydawnictwo.wsb.pl/sites/wydawnictwo.wsb.pl/files/czasopisma-tresc/07_Szymaniak.pdf (accessed on 7 November 2022).

- Szumska, E.; Pawełczyk, M. TCO comparison for city buses equipped with hybrid and conventional propulsion drive. Pr. Nauk. Politech. Warsz. Transp. 2017, 118, 277–285. [Google Scholar]

- Szumska, E.; Jurecki, R.; Pawełczyk, M. Assessment of Total Costs of Ownership for Midsize Passenger Cars with Conventional and Alternative Drive Trains. Commun.—Sci. Lett. Univ. Zilina 2019, 21, 21–27. [Google Scholar] [CrossRef]

- Infor.pl, Odliczenie 100% VAT od Samochodów a Ewidencja Przebiegu (Kilometrówka). Available online: https://ksiegowosc.infor.pl/podatki/vat/odliczanie-i-zwrot-podatku/699780,Odliczenie-100-VAT-od-samochodow-a-ewidencja-przebiegu-kilometrowka.html (accessed on 8 March 2022).

- Kancelaria Sejmu, R.P. Ustawa z Dnia 15/02/1992 r. o Podatku Dochodowym od Osób Prawnych. Available online: https://isap.sejm.gov.pl/isap.nsf/DocDetails.xsp?id=wdu19920210086 (accessed on 7 November 2022).

- Narodowy Fundusz Ochrony Środowiska i Gospodarki Wodnej. eVAN—Funding for the Purchase of an Electric Van (N1). Available online: https://www.nfosigw.gov.pl (accessed on 17 April 2022).

- Rozporządzenie Ministra Infrastruktury z Dnia 29 Września 2004 r. w Sprawie Wysokości Opłat Związanych z Prowadzeniem stacji Kontroli Pojazdów Oraz Przeprowadzaniem Badań Technicznych Pojazdów. Available online: https://isap.sejm.gov.pl/isap.nsf/DocDetails.xsp?id=WDU20042232261 (accessed on 1 June 2022).

- Renault.pl. Cars. Available online: https://www.renault.pl/ (accessed on 20 May 2022).

- Palmer, K.J.; Tate, E.; Wadud, Z.; Nellthorp, J. Total cost of ownership and market share for hybrid and electric vehicles in the UK, US and Japan. Appl. Energy 2018, 209, 108–119. [Google Scholar] [CrossRef]

- Pyza, D.; Gołda, P.; Sendek-Matysiak, E. Use of hydrogen in public transport systems. J. Clean. Prod. 2022, 335, 130247. [Google Scholar] [CrossRef]

| Electric Vehicle | Combustion Powered Vehicle | |

|---|---|---|

| Annual service | ||

| Oil change | No | Yes |

| Oil filter change | No | Yes |

| Air filter change | No | Yes |

| Cabin air filter change | Yes | Yes |

| General diagnostics | Yes | Yes |

| Maintenance service | ||

| Valvetrain elements replacement | No | Yes |

| Clutch replacement | No | Yes |

| Replacement/cleaning of spark plugs | No | Yes |

| Replacement of belts | No | Yes |

| Replacement of seals | No | Yes |

| Replacement of traction battery | Yes (if efficiency falls below 70%) | No |

| Replacement of brake pads and disks | Yes (ca. every 80,000 km) | Yes |

| Replacement of operating fluids | Yes | Yes |

| Incidental service | ||

| Turbocharger failure | No | Yes |

| Cylinder head gasket damage | No | Yes |

| DPF filter replacement | No | Yes |

| Gearbox damage | No | Yes |

| Failure of accessories | Yes | Yes |

| Cost of Refuelling | ||

|---|---|---|

| Diesel | 78.29 | |

| Cost of Charging | ||

| Operator | Type of charging | |

| AC | DC | |

| Greenway | 45.24–58.68 | 49.05–97.73 |

| PKN Orlen | 34.40 | 60.86–73.03 |

| EV+ | 28.20–50.93 | 64.44–100.02 |

| PGE Nowa Era | 27.92 | 49.40–51.91 |

| REVNET | 30.74 | 64.44 |

| Lotos | 59.00 | 59.00 |

| GO + Eauto | 32.43 | 57.28 |

| TAURON | 34.12–36.94 | 71.24–82.70 |

| IONITY | - | 53.70–125.30 |

| charging at home | 27.21 | - |

| Parameters | Variant 2 | Variant 1 |

|---|---|---|

| Kerb weight [kg] | 1757 | 1969 |

| Loading capacity [kg] | 1043 | 1131 |

| Total length [m] | 5.05 | 5.07 |

| Total width [m] | 2.07 | 2.07 |

| Type of “fuel” | diesel oil | electricity |

| Average consumption of diesel oil [L]/electricity [kWh] needed to cover a distance of 100 km | 9.20 | 35.80 |

| Maximum power [kW] | 74 | 56 |

| Maximum torque [Nm] | 285 | 225 |

| Maximum speed [km/h] | 135 | 100 |

| Acceleration to 100 km/h [s] | 21.50 | 22 |

| Maximum range [km] | 1012 | 117 |

| Cost of purchase of vehicle [PLN] * | 168,313 | 317,586 |

| Price of 1 L of diesel oil/1 kWh [PLN] * | 8.51 | 0.76 |

| Mileage [km/year] | 30,000 | 30,000 |

| Analysed period [years] | 10 | 10 |

| BEV Charging Method | With Compression Ignition Engine | |

|---|---|---|

| w/o Refund | Max Refund | |

| at home via electrical socket | −0.8 | −14.8 |

| public AC charging stations (lowest price for 1 kWh considered in the calculations) | −0.4 | −14.4 |

| public AC charging stations (highest price for 1 kWh considered in the calculations) | 18.3 | 4.29 |

| public DC charging stations (lowest price for 1 kWh considered in the calculations) | 12.3 | −1.7 |

| public DC charging stations (highest price for 1 kWh considered in the calculations) | 58.2 | 44.2 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Sendek-Matysiak, E.; Pyza, D.; Łosiewicz, Z.; Lewicki, W. Total Cost of Ownership of Light Commercial Electrical Vehicles in City Logistics. Energies 2022, 15, 8392. https://doi.org/10.3390/en15228392

Sendek-Matysiak E, Pyza D, Łosiewicz Z, Lewicki W. Total Cost of Ownership of Light Commercial Electrical Vehicles in City Logistics. Energies. 2022; 15(22):8392. https://doi.org/10.3390/en15228392

Chicago/Turabian StyleSendek-Matysiak, Ewelina, Dariusz Pyza, Zbigniew Łosiewicz, and Wojciech Lewicki. 2022. "Total Cost of Ownership of Light Commercial Electrical Vehicles in City Logistics" Energies 15, no. 22: 8392. https://doi.org/10.3390/en15228392

APA StyleSendek-Matysiak, E., Pyza, D., Łosiewicz, Z., & Lewicki, W. (2022). Total Cost of Ownership of Light Commercial Electrical Vehicles in City Logistics. Energies, 15(22), 8392. https://doi.org/10.3390/en15228392