Energy Transition in Non-Euro Countries from Central and Eastern Europe: Evidence from Panel Vector Error Correction Model

Abstract

:1. Introduction

2. Literature Review

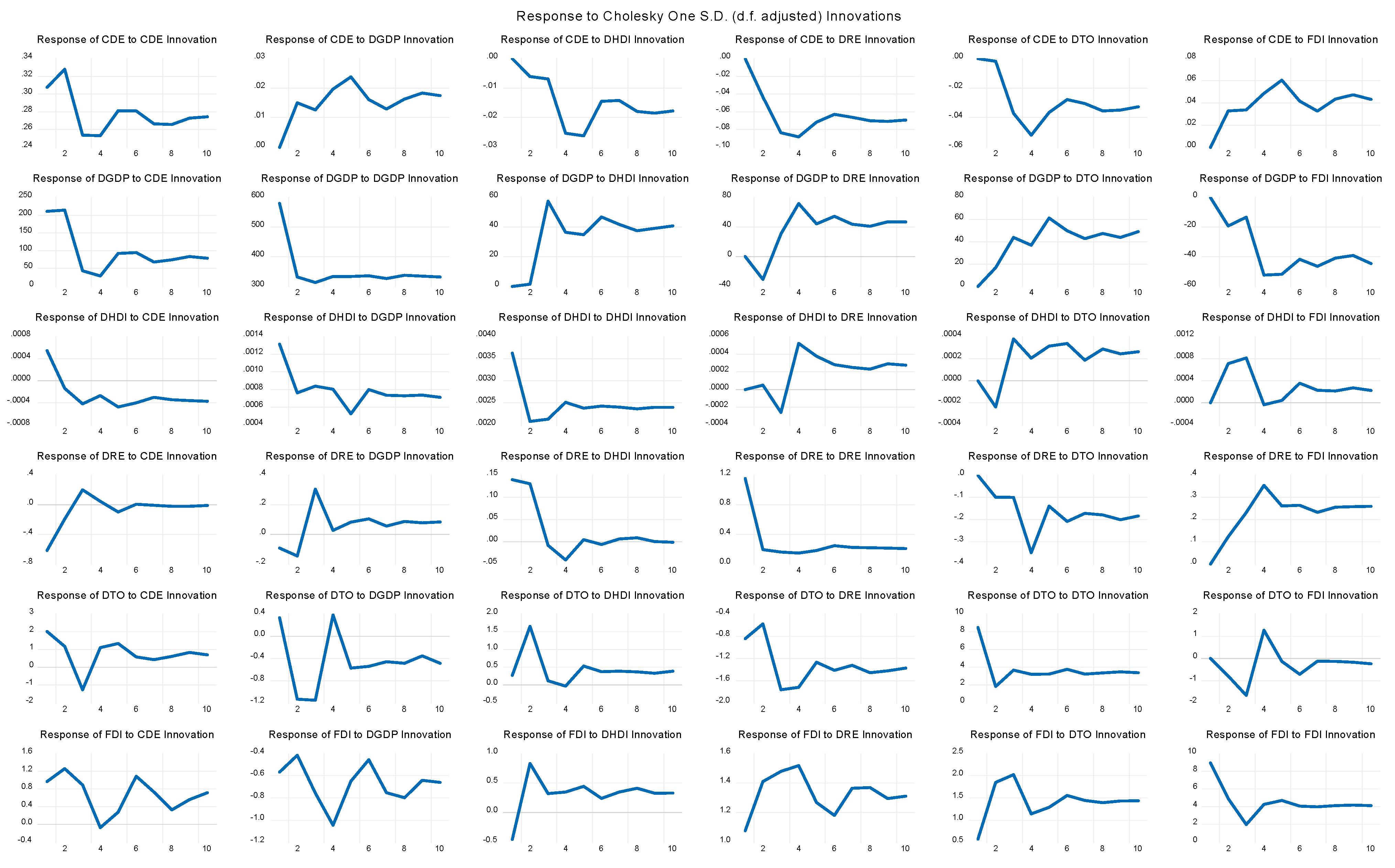

3. Data and Methodology

3.1. Methodology

3.1.1. Testing Stationarity for Panel Data

3.1.2. Panel Cointegration

3.1.3. Granger Causality

3.1.4. Panel DOLS Estimates

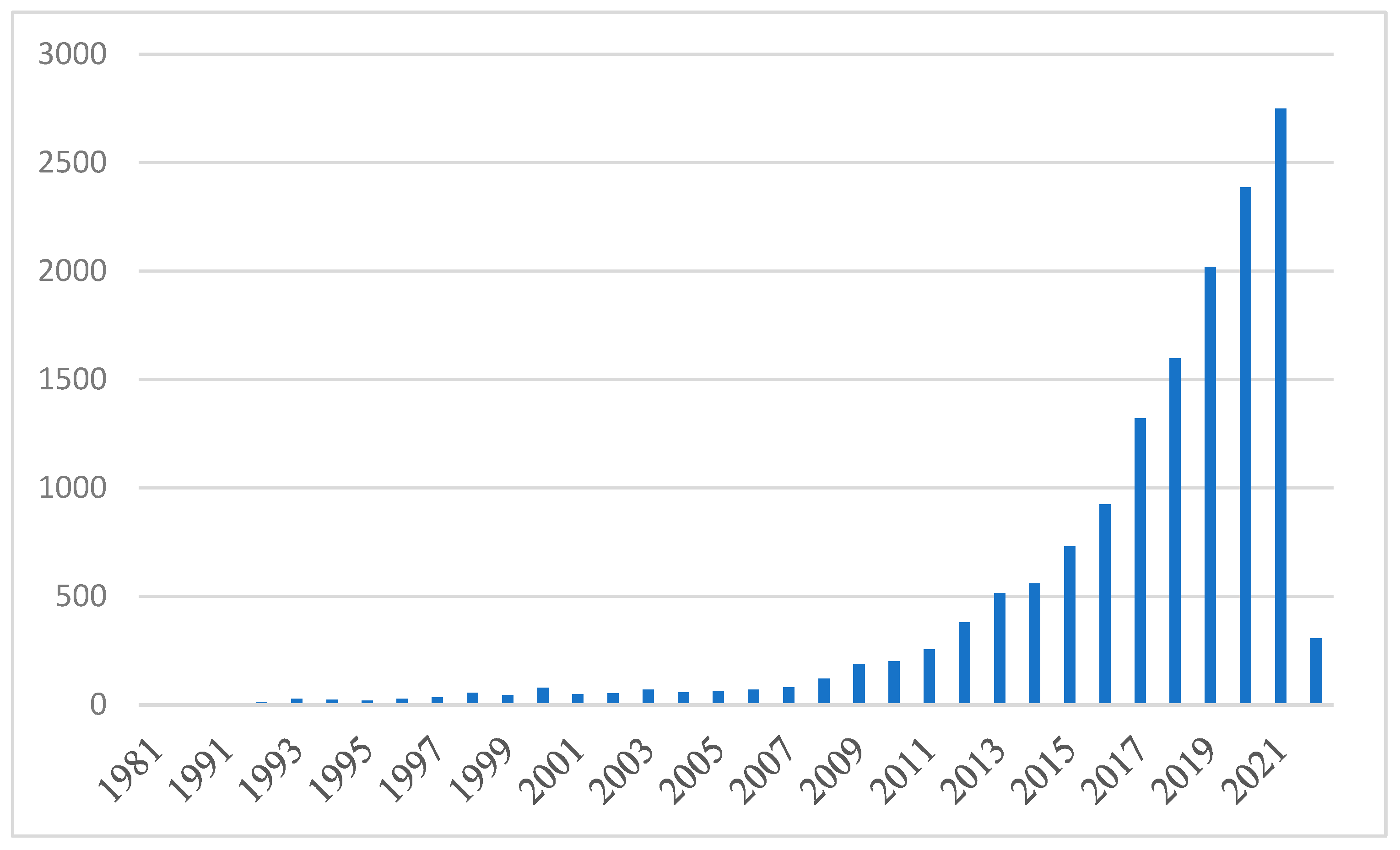

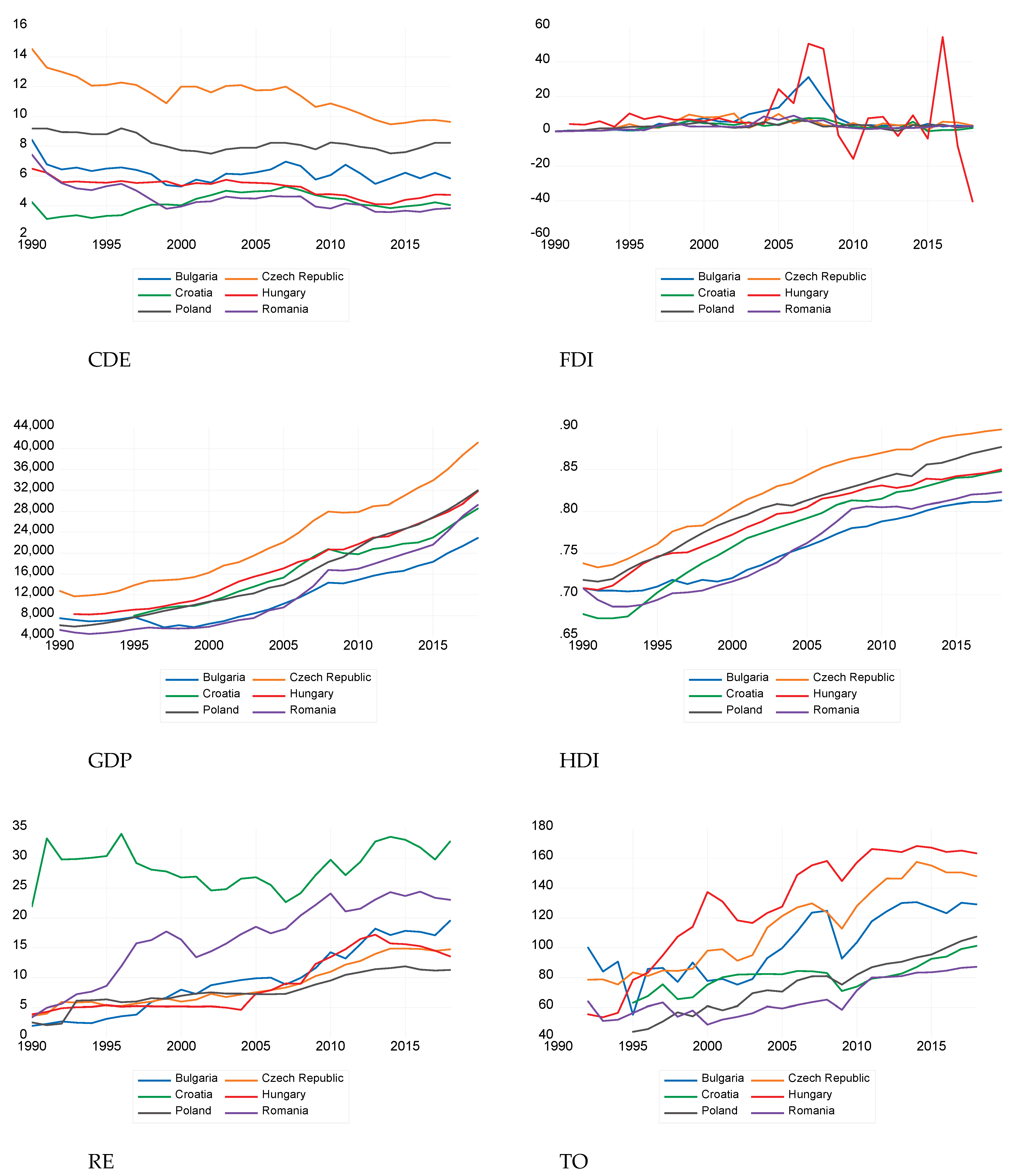

3.2. Data

4. Empirical Results

| Country | H0 | Trace Statistics | Prob. | Country | H0 | Trace Statistics | Prob. |

|---|---|---|---|---|---|---|---|

| Bulgaria | None | 60.3246 | 0.0960 * | Hungary | None | 81.52 | 0.0008 *** |

| At most 1 | 27.93 | 0.6262 | At most 1 | 52.79 | 0.0039 | ||

| Czech Republic | None | 50.14 | 0.4076 | Poland | None | 81.22 | 0.0009 *** |

| At most 1 | 30.46 | 0.4752 | At most 1 | 34.58 | 0.2626 | ||

| Croatia | None | 67.60 | 0.0235 ** | Romania | None | 77.39 | 0.0024 *** |

| At most 1 | 35.95 | 0.2081 | At most 1 | 38.06 | 0.1407 |

18.7188391542 × DRE(−1) + 1.5830023031 × DTO(−1) − 1.14517261031 × FDI(−1) − 7.13699144353) −

0.036777319216 × D(CDE(−1)) − 0.304188452533 × D(CDE(−2)) − 2.6766w8886627 × 10−6 × D(DGDP(−1)) −

3.61670141248 × 10−5 × D(DGDP(−2)) + 0.365300917573 × D(DHDI(−1)) + 2.35080335289 × D(DHDI(−2)) +

0.0549792019336 × D(DRE(−1)) + 0.0182998305835 × D(DRE(−2)) + 0.00767258447886 × D(DTO(−1)) +

0.00238641318271 × D(DTO(−2)) − 0.00221982795193 × D(FDI(−1)) − 0.00344475574056 × D(FDI(−2)) −

0.0529420314058.

5. Conclusions

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Vasile, V. Romania: A country under permanent public sector reform. In Public Sector Shock; Edward Elgar Publishing: Cheltenham, UK, 2013. [Google Scholar]

- Zaman, G.; Vasile, V. Economic-financial and social vulnerabilities of Romania in the period 2013–2020. Procedia Econ. Financ. 2014, 15, 4–18. [Google Scholar] [CrossRef] [Green Version]

- Cătălin, V.M. Changes of EU industrial policy and its effects on Romania’s industrial paradigm. Industrija 2016, 44, 197–210. [Google Scholar] [CrossRef] [Green Version]

- Iacob, L.Ș.V.; Dumbravă, Ș.G. The analysis of the main aspects regarding the industrial activity in Romania. Rev. Română Stat.-Supl. Nr 2020, 3, 40–54. [Google Scholar]

- Varblane, U.; Vahter, P. An analysis of the economic convergence process in the transition countries. Univ. Tartu Econ. Bus. Work. Pap. 2005, 2005, 37. [Google Scholar] [CrossRef] [Green Version]

- Manta, O. Competitiveness, Entrepreneurship and Economic Convergence (CEEC); LAP LAMBERT Academic Publishing: Riga, Latvia, 2020. [Google Scholar]

- Manta, O. The Eurozone in the context of national unity and the principles of global democratic society. J. Lib. Conștiință 2018, 6, 454–492. [Google Scholar]

- Marelli, E.; Parisi, M.L.; Signorelli, M. Economic convergence in the EU and Eurozone. J. Econ. Stud. 2019, 46, 1332–1344. [Google Scholar] [CrossRef]

- Głodowska, A.; Pera, B. On the relationship between economic integration, business environment and real convergence: The experience of the CEE countries. Economies 2019, 7, 54. [Google Scholar] [CrossRef] [Green Version]

- Ioan, B.; Mozi, R.M.; Lucian, G.; Gheorghe, F.; Horia, T.; Ioan, B.; Mircea-Iosif, R. An empirical investigation on determinants of sustainable economic growth. Lessons from Central and Eastern European Countries. J. Risk Financ. Manag. 2020, 13, 146. [Google Scholar] [CrossRef]

- Munteanu, I.; Grigorescu, A.; Condrea, E.; Pelinescu, E. Convergent insights for sustainable development and ethical cohesion: An empirical study on corporate governance in Romanian public entities. Sustainability 2020, 12, 2990. [Google Scholar] [CrossRef] [Green Version]

- Matei, M. Foreign Direct Investments. Functions and Evolutions; Expert Publishing House: Bucharest, Romania, 2004. [Google Scholar]

- Surugiu, M.R.; Surugiu, C. International trade, globalization and economic interdependence between European countries: Implications for businesses and marketing framework. Procedia Econ. Financ. 2015, 32, 131–138. [Google Scholar] [CrossRef] [Green Version]

- Comes, C.A.; Bunduchi, E.; Vasile, V.; Stefan, D. The impact of foreign direct investments and remittances on economic growth: A case study in Central and Eastern Europe. Sustainability 2018, 10, 238. [Google Scholar] [CrossRef] [Green Version]

- Çela, A.; Hysa, E.; Voica, M.C.; Panait, M.; Manta, O. Internationalization of Large Companies from Central and Eastern Europe or the Birth of New Stars. Sustainability 2021, 14, 261. [Google Scholar] [CrossRef]

- Zaman, G.; Vasile, V.; Matei, M.; Croitoru, C.; Enescu, G. Some challenging (macro) economic aspects of FDI in Romania. Rev. Romana Econ. 2011, 33, 21–58. [Google Scholar]

- Chivu, L.; Ciutacu, C.; Georgescu, G. Deindustrialization and Reindustrialization in Romania; Palgrave Macmillan: London, UK, 2017. [Google Scholar]

- Ciutacu, C.; Chivu, L. Romania’s Deindustrialisation. From the “Golden Age” to the “Iron Scrap Age”. Procedia Econ. Financ. 2015, 22, 209–215. [Google Scholar] [CrossRef] [Green Version]

- Zaman, G.; Vasile, V. Macroeconomic impact of FDI in Romania. Procedia Econ. Financ. 2012, 3, 3–11. [Google Scholar] [CrossRef] [Green Version]

- Morina, F.; Ergün, U.; Hysa, E. Understanding Drivers of Renewable Energy Firm’s Performance. Environ. Res. Eng. Manag. 2021, 77, 32–49. [Google Scholar] [CrossRef]

- Platon, V.; Manea, G.; Antonescu, D. Disparităţi Regionale şi Dezvoltarea Industrială în România; Institutul de Economie a Industriei: Academia, Română, 1998. [Google Scholar]

- Chivu, L.; Ciutacu, C.; Georgescu, G. Descompunerea şi Recompunerea Structurilor Industriale din România; Centrul de informare și Documentare Economică: București, Romania, 2016. [Google Scholar]

- Vasile, V.; Balan, M. Impact of greenhouse effect gases on climatic changes. Measurement indicators and forecast models. Ann. Univ. Apulensis Ser. Oeconom. 2008, 2, 1–19. [Google Scholar]

- Andrei, J.V.; Mieila, M.; Panait, M. The impact and determinants of the energy paradigm on economic growth in European Union. PLoS ONE 2017, 12, e0173282. [Google Scholar] [CrossRef] [Green Version]

- Anghelache, C.; Anghel, M.G. Analysis of Romania’s strategy of alignment with the EU environmental directives. Rom. Stat. Rev. Suppl. 2017, 65, 116–127. [Google Scholar]

- Bucur, C.; Tudorică, B.G.; Oprea, S.V.; Nancu, D.; Duşmănescu, D.M. Insights Into Energy Indicators Analytics Towards European Green Energy Transition Using Statistics and Self-Organizing Maps. IEEE Access 2021, 9, 64427–64444. [Google Scholar] [CrossRef]

- Popescu, G.H.; Mieila, M.; Nica, E.; Andrei, J.V. The emergence of the effects and determinants of the energy paradigm changes on European Union economy. Renew. Sustain. Energy Rev. 2018, 81, 768–774. [Google Scholar] [CrossRef]

- Zaharia, M.; Pătrașcu, A.; Gogonea, M.R.; Tănăsescu, A.; Popescu, C. A cluster design on the influence of energy taxation in shaping the new EU-28 economic paradigm. Energies 2017, 10, 257. [Google Scholar] [CrossRef] [Green Version]

- Simionescu, M. The nexus between economic development and pollution in the European Union new member states. The role of renewable energy consumption. Renew. Energy 2021, 179, 1767–1780. [Google Scholar] [CrossRef]

- Wang, Q.; Li, S.; Li, R.; Jiang, F. Underestimated impact of the COVID-19 on carbon emission reduction in developing countries–a novel assessment based on scenario analysis. Environ. Res. 2023, 204, 111990. [Google Scholar] [CrossRef]

- Mentel, G.; Tarczyński, W.; Dylewski, M.; Salahodjaev, R. Does Renewable Energy Sector Affect Industrialization-CO2 Emissions Nexus in Europe and Central Asia? Energies 2022, 15, 5877. [Google Scholar] [CrossRef]

- Morina, F.; Ergün, U.; Balomenou, C. The Impact of Renewable Energy Policies and Financial Development on CO2 Emissions and Economic Growth in EU Countries. In The Changing Financial Landscape; Springer: Cham, Switzerland, 2021; pp. 97–107. [Google Scholar]

- Adebayo, T.S.; Rjoub, H.; Akadiri, S.S.; Oladipupo, S.D.; Sharif, A.; Adeshola, I. The role of economic complexity in the environmental Kuznets curve of MINT economies: Evidence from method of moments quantile regression. Environ. Sci. Pollut. Res. 2021, 1–13. [Google Scholar] [CrossRef]

- Albulescu, C.T.; Boatca-Barabas, M.E.; Diaconescu, A. The asymmetric effect of environmental policy stringency on CO2 emissions in OECD countries. Environ. Sci. Pollut. Res. 2022, 29, 27311–27327. [Google Scholar] [CrossRef]

- Al-Mulali, U.; Ozturk, I.; Solarin, S.A. Investigating the environmental Kuznets curve hypothesis in seven regions: The role of renewable energy. Ecol. Indic. 2016, 67, 267–282. [Google Scholar] [CrossRef]

- Khan SA, R.; Zaman, K.; Zhang, Y. The relationship between energy-resource depletion, climate change, health resources and the environmental Kuznets curve: Evidence from the panel of selected developed countries. Renew. Sustain. Energy Rev. 2016, 62, 468–477. [Google Scholar] [CrossRef]

- Panait, M.; Voica, M.C.; Rădulescu, I. Approaches regarding environmental Kuznets curve in the European Union from the perspective of sustainable development. Appl. Ecol. Environ. Res. 2019, 17, 6801–6820. [Google Scholar] [CrossRef]

- Anser, M.K.; Yousaf, Z.; Nassani, A.A.; Abro MM, Q.; Zaman, K. International tourism, social distribution, and environmental Kuznets curve: Evidence from a panel of G-7 countries. Environ. Sci. Pollut. Res. 2020, 27, 2707–2720. [Google Scholar] [CrossRef] [PubMed]

- Sharif, A.; Afshan, S.; Chrea, S.; Amel, A.; Khan, S.A.R. The role of tourism, transportation and globalization in testing environmental Kuznets curve in Malaysia: New insights from quantile ARDL approach. Environ. Sci. Pollut. Res. 2020, 27, 25494–25509. [Google Scholar] [CrossRef] [PubMed]

- Sharma, G.D.; Tiwari, A.K.; Erkut, B.; Mundi, H.S. Exploring the nexus between non-renewable and renewable energy consumptions and economic development: Evidence from panel estimations. Renew. Sustain. Energy Rev. 2021, 146, 111152. [Google Scholar] [CrossRef]

- Wang, Q.; Zhang, F.; Li, R. Revisiting the environmental kuznets curve hypothesis in 208 counties: The roles of trade openness, human capital, renewable energy and natural resource rent. Environ. Res. 2023, 216, 114637. [Google Scholar] [CrossRef]

- Li, R.; Yang, T.; Wang, Q. Does income inequality reshape the environmental Kuznets curve (EKC) hypothesis? A nonlinear panel data analysis. Environ. Res. 2023, 216, 114575. [Google Scholar]

- Balsalobre-Lorente, D.; Ibáñez-Luzón, L.; Usman, M.; Shahbaz, M. The environmental Kuznets curve, based on the economic complexity, and the pollution haven hypothesis in PIIGS countries. Renew. Energy 2022, 185, 1441–1455. [Google Scholar] [CrossRef]

- Wang, Q.; Wang, L.; Li, R. Trade protectionism jeopardizes carbon neutrality–Decoupling and breakpoints roles of trade openness. Sustain. Prod. Consum. 2023, 35, 201–215. [Google Scholar] [CrossRef]

- Li, R.; Wang, Q.; Liu, Y.; Jiang, R. Per-capita carbon emissions in 147 countries: The effect of economic, energy, social, and trade structural changes. Sustain. Prod. Consum. 2021, 27, 1149–1164. [Google Scholar] [CrossRef]

- Zaman, G.; Grădinaru, G.; Neagoe, I. The impact of the COVID-19 crisis on the manifestation of the rebound effect in energy consumption. Rom. J. Econ. 2020, 50, 29–46. [Google Scholar]

- Armeanu, D.Ş.; Gherghina, Ş.C.; Pasmangiu, G. Exploring the causal nexus between energy consumption, environmental pollution and economic growth: Empirical evidence from central and Eastern Europe. Energies 2019, 12, 3704. [Google Scholar] [CrossRef] [Green Version]

- Przychodzen, W.; Przychodzen, J. Determinants of renewable energy production in transition economies: A panel data approach. Energy 2020, 191, 116583. [Google Scholar] [CrossRef]

- Marinaș, M.C.; Dinu, M.; Socol, A.G.; Socol, C. Renewable energy consumption and economic growth. Causality relationship in Central and Eastern European countries. PLoS ONE 2018, 13, e0202951. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Butnaru, G.I.; Haller, A.P.; Clipa, R.I.; Ștefănică, M.; Ifrim, M. The nexus between convergence of conventional and renewable energy consumption in the present European Union states. Explorative study on parametric and semi-parametric methods. Energies 2020, 13, 5272. [Google Scholar] [CrossRef]

- Ćetković, S.; Buzogány, A. The political economy of EU climate and energy policies in Central and Eastern Europe revisited: Shifting coalitions and prospects for clean energy transitions. Politics Gov. 2019, 7, 124. [Google Scholar] [CrossRef] [Green Version]

- Lee, J.W. The contribution of foreign direct investment to clean energy use, carbon emissions and economic growth. Energy Policy 2013, 55, 483–489. [Google Scholar] [CrossRef]

- Sbia, R.; Shahbaz, M.; Hamdi, H. A contribution of foreign direct investment, clean energy, trade openness, carbon emissions and economic growth to energy demand in UAE. Econ. Model. 2014, 36, 191–197. [Google Scholar] [CrossRef] [Green Version]

- Tang, C.F.; Tan, B.W. The impact of energy consumption, income and foreign direct investment on carbon dioxide emissions in Vietnam. Energy 2015, 79, 447–454. [Google Scholar] [CrossRef]

- Rahman, H.U.; Ghazali, A.; Bhatti, G.A.; Khan, S.U. Role of economic growth, financial development, trade, energy and FDI in environmental Kuznets curve for Lithuania: Evidence from ARDL bounds testing approach. Eng. Econ. 2020, 31, 39–49. [Google Scholar] [CrossRef] [Green Version]

- Halicioglu, F. An econometric study of CO2 emissions, energy consumption, income and foreign trade in Turkey. Energy Policy 2009, 37, 1156–1164. [Google Scholar] [CrossRef] [Green Version]

- Mukhopadhyay, K. Trade and the Environment: Implications for Climate Change. Decision 2009, 36, 0304–0941. [Google Scholar]

- Dogan, E.; Turkekul, B. CO2 emissions, real output, energy consumption, trade, urbanization and financial development: Testing the EKC hypothesis for the USA. Environ. Sci. Pollut. Res. 2016, 23, 1203–1213. [Google Scholar] [CrossRef] [PubMed]

- Jebli, M.B.; Youssef, S.B.; Ozturk, I. Testing environmental Kuznets curve hypothesis: The role of renewable and non-renewable energy consumption and trade in OECD countries. Ecol. Indic. 2016, 60, 824–831. [Google Scholar] [CrossRef]

- Destek, M.A.; Sinha, A. Renewable, non-renewable energy consumption, economic growth, trade openness and ecological footprint: Evidence from organisation for economic Co-operation and development countries. J. Clean. Prod. 2020, 242, 118537. [Google Scholar] [CrossRef]

- Sims, C.A. Macroeconomics and reality. Econom. J. Econom. Soc. 1980, 48, 1–48. [Google Scholar] [CrossRef] [Green Version]

- Sun, L.; Ford, J.L.; Dickinson, D.G. Bank loans and the effects of monetary policy in China: VAR/VECM approach. China Econ. Rev. 2010, 21, 65–97. [Google Scholar] [CrossRef]

- Dickey, D.A.; Fuller, W.A. Distribution of the estimators for autoregressive time series with a unit root. J. Am. Stat. Assoc. 1979, 74, 427–431. [Google Scholar]

- Costantini, V.; Martini, C. The causality between energy consumption and economic growth: A multi-sectoral analysis using non-stationary cointegrated panel data. Energy Econ. 2010, 32, 591–603. [Google Scholar] [CrossRef] [Green Version]

- Levin, A.; Lin, C.F.; Chu, C.S.J. Unit root tests in panel data: Asymptotic and finite-sample properties. J. Econom. 2002, 108, 1–24. [Google Scholar] [CrossRef]

- Im, K.S.; Pesaran, M.H.; Shin, Y. Testing for unit roots in heterogeneous panels. J. Econom. 2003, 115, 53–74. [Google Scholar] [CrossRef]

- Breitung, J. The Local Power of Some Unit Root Tests for Panel Data; Emerald Group Publishing Limited: Bingley, UK, 2001. [Google Scholar]

- Maddala, G.S.; Wu, S. A comparative study of unit root tests with panel data and a new simple test. Oxf. Bull. Econ. Stat. 1999, 61, 631–652. [Google Scholar] [CrossRef]

- Choi, I. Unit root tests for panel data. J. Int. Money Financ. 2001, 20, 249–272. [Google Scholar] [CrossRef]

- Hadri, K. Testing for stationarity in heterogeneous panel data. Econom. J. 2000, 3, 148–161. [Google Scholar] [CrossRef]

- Phillips, P.C.; Perron, P. Testing for a unit root in time series regression. Biometrika 1988, 75, 335–346. [Google Scholar] [CrossRef]

- Pedroni, P. Critical values for cointegration tests in heterogeneous panels with multiple regressors. Oxf. Bull. Econ. Stat. 1999, 61, 653–670. [Google Scholar] [CrossRef]

- Pedroni, P. Fully modified OLS for the heterogeneous cointegrated panels. Adv. Econom. 2000, 15, 93–130. [Google Scholar]

- Mahmoodi, M. The relationship between economic growth, renewable energy, and CO2 emissions: Evidence from panel data approach. Int. J. Energy Econ. Policy 2017, 7, 96. [Google Scholar]

- Kao, C.; Chiang, M.H.; Chen, B. International R&D spillovers: An application of estimation and inference in panel cointegration. Oxf. Bull. Econ. Stat. 1999, 61, 691–709. [Google Scholar]

- Persyn, D.; Westerlund, J. Error-correction–based cointegration tests for panel data. STATA J. 2008, 8, 232–241. [Google Scholar] [CrossRef] [Green Version]

- Westerlund, J. New simple tests for panel cointegration. Econom. Rev. 2005, 24, 297–316. [Google Scholar] [CrossRef]

- Westerlund, J.; Edgerton, D.L. A simple test for cointegration in dependent panels with structural breaks. Oxf. Bull. Econ. Stat. 2008, 70, 665–704. [Google Scholar] [CrossRef]

- Nkalu, C.N.; Ugwu, S.C.; Asogwa, F.O.; Kuma, M.P.; Onyeke, Q.O. Financial development and energy consumption in Sub-Saharan Africa: Evidence from panel vector error correction model. Sage Open 2020, 10, 2158244020935432. [Google Scholar] [CrossRef]

- Luetkepohl, H. Vector Autoregressive Models (Working Paper ECO 2011/30). European University Institute. 2011. Available online: https://cadmus.eui.eu/bitstream/handle/1814/19354/ECO_2011_30.pdf (accessed on 20 March 2022).

- Granger, C. Some recent development in a concept of causality. J. Econom. 1988, 39, 199–211. [Google Scholar] [CrossRef]

- Johansen, S. Statistical analysis of cointegration vectors. J. Econ. Dyn. Control. 1988, 12, 231–254. [Google Scholar] [CrossRef]

- Engle, R.F.; Granger, C.W. Co-integration and error correction: Representation, estimation, and testing. Econom. J. Econom. Soc. 1987, 251–276. [Google Scholar] [CrossRef]

- Johansen, S.; Juselius, K. Testing structural hypotheses in a multivariate cointegration analysis of the PPP and the UIP for UK. J. Econom. 1992, 53, 211–244. [Google Scholar] [CrossRef]

- Obi, P.; Sil, R.; Abuizam, R. Tourism stocks, implied volatility and hedging: A vector error correction study. J. Account. Financ. 2015, 15, 30–39. [Google Scholar]

- Kuo, C.Y. Does the vector error correction model perform better than others in forecasting stock price? An application of residual income valuation theory. Econ. Model. 2016, 52, 772–789. [Google Scholar] [CrossRef]

- Saikkonen, P. Asymptotically efficient estimation of cointegration regressions. Econom. Theory 1991, 7, 1–21. [Google Scholar] [CrossRef]

- Pesaran, M.H.; Shin, Y.; Smith, R.P. Pooled mean group estimation of dynamic heterogeneous panels. J. Am. Stat. Assoc. 1999, 94, 621–634. [Google Scholar] [CrossRef]

- Chiang, M.H.; Kao, C. Nonstationary Panel Time Series Using NPT 1.3—A User Guide; Center for Policy Research, Syracuse University: Syracuse, NY, USA, 2002. [Google Scholar]

- Breitung, J.; Pesaran, M.H. Unit roots and cointegration in panels. In The Econometrics of Panel Data; Springer: Berlin/Heidelberg, Germany, 2008; pp. 279–322. [Google Scholar]

- Leitão, N.C. Economic growth, carbon dioxide emissions, renewable energy and globalization. Int. J. Energy Econ. Policy 2014, 4, 391–399. [Google Scholar]

- Long, X.; Naminse, E.Y.; Du, J.; Zhuang, J. Nonrenewable energy, renewable energy, carbon dioxide emissions and economic growth in China from 1952 to 2012. Renew. Sustain. Energy Rev. 2015, 52, 680–688. [Google Scholar] [CrossRef]

- Adams, S.; Nsiah, C. Reducing carbon dioxide emissions; Does renewable energy matter? Sci. Total Environ. 2019, 693, 133288. [Google Scholar] [CrossRef] [PubMed]

- Liu, X.; Zhang, S.; Bae, J. The impact of renewable energy and agriculture on carbon dioxide emissions: Investigating the environmental Kuznets curve in four selected ASEAN countries. J. Clean. Prod. 2017, 164, 1239–1247. [Google Scholar] [CrossRef]

- Wang, Z.; Jebli, M.B.; Madaleno, M.; Doğan, B.; Shahzad, U. Does export product quality and renewable energy induce carbon dioxide emissions: Evidence from leading complex and renewable energy economies. Renew. Energy 2021, 171, 360–370. [Google Scholar] [CrossRef]

- Wiser, R.H.; Pickle, S.J. Financing investments in renewable energy: The impacts of policy design. Renew. Sustain. Energy Rev. 1998, 2, 361–386. [Google Scholar] [CrossRef]

- Bergmann, A.; Hanley, N.; Wright, R. Valuing the attributes of renewable energy investments. Energy Policy 2006, 34, 1004–1014. [Google Scholar] [CrossRef]

- Ozorhon, B.; Batmaz, A.; Caglayan, S. Generating a framework to facilitate decision making in renewable energy investments. Renew. Sustain. Energy Rev. 2018, 95, 217–226. [Google Scholar] [CrossRef]

- Chien, T.; Hu, J.L. Renewable energy: An efficient mechanism to improve GDP. Energy Policy 2008, 36, 3045–3052. [Google Scholar] [CrossRef]

- Al-Mulali, U.; Fereidouni, H.G.; Lee, J.Y.; Sab, C.N.B.C. Examining the bi-directional long run relationship between renewable energy consumption and GDP growth. Renew. Sustain. Energy Rev. 2013, 22, 209–222. [Google Scholar] [CrossRef]

- Amri, F. The relationship amongst energy consumption (renewable and non-renewable), and GDP in Algeria. Renew. Sustain. Energy Rev. 2017, 76, 62–71. [Google Scholar] [CrossRef]

- Azam, A.; Rafiq, M.; Shafique, M.; Zhang, H.; Yuan, J. Analyzing the effect of natural gas, nuclear energy and renewable energy on GDP and carbon emissions: A multi-variate panel data analysis. Energy 2021, 219, 119592. [Google Scholar] [CrossRef]

- Adekoya, O.B.; Olabode, J.K.; Rafi, S.K. Renewable energy consumption, carbon emissions and human development: Empirical comparison of the trajectories of world regions. Renew. Energy 2021, 179, 1836–1848. [Google Scholar] [CrossRef]

- Wang, Z.; Bui, Q.; Zhang, B.; Nawarathna CL, K.; Mombeuil, C. The nexus between renewable energy consumption and human development in BRICS countries: The moderating role of public debt. Renew. Energy 2021, 165, 381–390. [Google Scholar] [CrossRef]

- Hashemizadeh, A.; Ju, Y. Optimizing renewable energy portfolios with a human development approach by fuzzy interval goal programming. Sustain. Cities Soc. 2021, 75, 103396. [Google Scholar] [CrossRef]

- Sebri, M.; Ben-Salha, O. On the causal dynamics between economic growth, renewable energy consumption, CO2 emissions and trade openness: Fresh evidence from BRICS countries. Renew. Sustain. Energy Rev. 2014, 39, 14–23. [Google Scholar] [CrossRef] [Green Version]

- Zeren, F.; Akkuş, H. The relationship between renewable energy consumption and trade openness: New evidence from emerging economies. Renew. Energy 2020, 147, 322–329. [Google Scholar] [CrossRef]

- Wang, Q.; Zhang, F. Free trade and renewable energy: A cross-income levels empirical investigation using two trade openness measures. Renew. Energy 2021, 168, 1027–1039. [Google Scholar] [CrossRef]

- Agrawal, G. Foreign direct investment and economic growth in BRICS economies: A panel data analysis. J. Econ. Bus. Manag. 2015, 3, 421–424. [Google Scholar] [CrossRef] [Green Version]

- Zivot, E.; Andrews, D.W.K. Further evidence on the great crash, the oil-price shock, and the unit-root hypothesis. J. Bus. Econ. Stat. 2002, 20, 25–44. [Google Scholar] [CrossRef]

- Kwiatkowski, D.; Phillips, P.C.; Schmidt, P.; Shin, Y. Testing the null hypothesis of stationarity against the alternative of a unit root: How sure are we that economic time series have a unit root? J. Econom. 1992, 54, 159–178. [Google Scholar] [CrossRef]

- Mahadevan, R.; Asafu-Adjaye, J. Energy consumption, economic growth and prices: A reassessment using panel VECM for developed and developing countries. Energy Policy 2007, 35, 2481–2490. [Google Scholar] [CrossRef]

- MacKinnon, J.G.; Haug, A.A.; Michelis, L. Numerical distribution functions of likelihood ratio tests for cointegration. J. Appl. Econom. 1999, 14, 563–577. [Google Scholar] [CrossRef]

- Amri, K. Is there causality relationship between economic growth and income inequality?: Panel data evidence from Indonesia. Eurasian J. Econ. Financ. 2018, 6, 8–20. [Google Scholar] [CrossRef]

- Narayan, P.K.; Smyth, R. What determines migration flows from low-income to high-income countries? An empirical investigation of Fiji–Us migration 1972–2001. Contemp. Econ. Policy 2006, 24, 332–342. [Google Scholar] [CrossRef]

- Alam, M.; Rabbani, M.R.; Tausif, M.R.; Abey, J. Banks’ performance and economic growth in India: A panel cointegration analysis. Economies 2021, 9, 38. [Google Scholar] [CrossRef]

- Kurtovic, S.; Siljkovic, B.; Milanovic, M. Long-term impact of foreign direct investment on reduction of unemployment: Panel data analysis of the Western Balkans countries. J. Appl. Econ. Bus. Res. 2015, 5, 112–129. [Google Scholar]

- Ahmed, K.; Long, W. Environmental Kuznets curve and Pakistan: An empirical analysis. Procedia Econ. Financ. 2012, 1, 4–13. [Google Scholar] [CrossRef] [Green Version]

- Asumadu-Sarkodie, S.; Owusu, P.A. Carbon dioxide emissions, GDP, energy use and population growth: A multivariate and causality analysis for Ghana, 1971–2013. Environ. Sci. Pollut. Res. 2016, 23, 13508–13520. [Google Scholar] [CrossRef]

- Chang, C.-C. A multivariate causality test of carbon dioxide emissions, energy consumption and economic growth in China. Appl. Energy 2010, 87, 3533–3537. [Google Scholar] [CrossRef]

- Grossman, G.; Krueger, A. Environmental Impacts of a North American Free Trade Agreement; National Bureau of Economic Research: Cambridge, MA, USA, 1991; p. w3914.

- Panayotou, T. Empirical Tests and Policy Analysis of Environmental Degradation at Different Stages of Economic Development; International Labour Organization: Geneva, Switzerland, 1993. [Google Scholar]

- Mohiuddin, O.; Asumadu-Sarkodie, S.; Obaidullah, M. The relationship between carbon dioxide emissions, energy consumption, and GDP: A recent evidence from Pakistan. Cogent Eng. 2016, 3, 1210491. [Google Scholar] [CrossRef]

- Tucker, M. Carbon dioxide emissions and global GDP. Ecol. Econ. 1995, 15, 215–223. [Google Scholar] [CrossRef]

- Chaabouni, S.; Saidi, K. The dynamic links between carbon dioxide (CO2) emissions, health spending and GDP growth: A case study for 51 countries. Environ. Res. 2017, 158, 137–144. [Google Scholar] [CrossRef] [PubMed]

- Cederborg, J.; Snöbohm, S. Is There a Relationship between Economic Growth and Carbon Dioxide Emissions? 2016. Available online: https://www.diva-portal.org/smash/get/diva2:1076315/FULLTEXT01.pdf (accessed on 20 March 2022).

- Esty, D.C. Bridging the trade-environment divide. J. Econ. Perspect. 2001, 15, 113–130. [Google Scholar] [CrossRef] [Green Version]

- Mukhopadhyay, K. Trade and Environment in Thailand: An Emerging Economy; Serials Publications: New Delhi, India, 2007. [Google Scholar]

- Ertugrul, H.M.; Cetin, M.; Seker, F.; Dogan, E. The impact of trade openness on global carbon dioxide emissions: Evidence from the top ten emitters among developing countries. Ecol. Indic. 2016, 67, 543–555. [Google Scholar] [CrossRef] [Green Version]

- Dauda, L.; Long, X.; Mensah, C.N.; Salman, M.; Boamah, K.B.; Ampon-Wireko, S.; Dogbe, C.S.K. Innovation, trade openness and CO2 emissions in selected countries in Africa. J. Clean. Prod. 2021, 281, 125143. [Google Scholar] [CrossRef]

- Mahmood, H.; Maalel, N.; Zarrad, O. Trade openness and CO2 emissions: Evidence from Tunisia. Sustainability 2019, 11, 3295. [Google Scholar] [CrossRef] [Green Version]

- Shahbaz, M.; Tiwari, A.K.; Nasir, M. The effects of financial development, economic growth, coal consumption and trade openness on CO2 emissions in South Africa. Energy Policy 2013, 61, 1452–1459. [Google Scholar] [CrossRef] [Green Version]

- Greenhouse Gas Emissions; United States Environmental Protection Agency: Washington, DC, USA, 2019.

- Churchill, S.A.; Inekwe, J.; Ivanovski, K.; Smyth, R. The environmental Kuznets curve in the OECD: 1870–2014. Energy Econ. 2018, 75, 389–399. [Google Scholar] [CrossRef]

- Zakarya, G.Y.; Mostefa, B.; Abbes, S.M.; Seghir, G.M. Factors affecting CO2 emissions in the BRICS countries: A panel data analysis. Procedia Econ. Financ. 2015, 26, 114–125. [Google Scholar] [CrossRef] [Green Version]

- Le, H.P.; Ozturk, I. The impacts of globalization, financial development, government expenditures, and institutional quality on CO2 emissions in the presence of environmental Kuznets curve. Environ. Sci. Pollut. Res. 2020, 27, 22680–22697. [Google Scholar] [CrossRef] [PubMed]

- Alotaibi, A.A.; Alajlan, N. Using Quantile Regression to Analyze the Relationship between Socioeconomic Indicators and Carbon Dioxide Emissions in G20 Countries. Sustainability 2021, 13, 7011. [Google Scholar] [CrossRef]

- Ribeiro, H.V.; Rybski, D.; Kropp, J.P. Effects of changing population or density on urban carbon dioxide emissions. Nat. Commun. 2019, 10, 1–9. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Neumayer, E. The human development index and sustainability—A constructive proposal. Ecol. Econ. 2001, 39, 101–114. [Google Scholar] [CrossRef]

- Suri, V.; Chapman, D. Economic growth, trade and energy: Implications for the environmental Kuznets curve. Ecol. Econ. 1998, 25, 195–208. [Google Scholar] [CrossRef]

- Hossain, M.S. Panel estimation for CO2 emissions, energy consumption, economic growth, trade openness and urbanization of newly industrialized countries. Energy Policy 2011, 39, 6991–6999. [Google Scholar] [CrossRef]

- Nahman, A.; Antrobus, G. Trade and the environmental Kuznets curve: Is southern Africa a pollution haven? S. Afr. J. Econ. 2005, 73, 803–814. [Google Scholar] [CrossRef]

- Jorgenson, A.K. Does foreign investment harm the air we breathe and the water we drink? A cross-national study of carbon dioxide emissions and organic water pollution in less-developed countries, 1975 to 2000. Organ. Environ. 2007, 20, 137–156. [Google Scholar] [CrossRef]

- Jorgenson, A.K. The transnational organization of production, the scale of degradation, and ecoefficiency: A study of carbon dioxide emissions in less-developed countries. Hum. Ecol. Rev. 2009, 16, 64–74. [Google Scholar]

- Bakhsh, K.; Rose, S.; Ali, M.F.; Ahmad, N.; Shahbaz, M. Economic growth, CO2 emissions, renewable waste and FDI relation in Pakistan: New evidences from 3SLS. J. Environ. Manag. 2017, 196, 627–632. [Google Scholar] [CrossRef]

| Variable | Description | Period | Source |

|---|---|---|---|

| CDE | Carbon dioxide emissions are the result of burning fossil fuels and the manufacturing of cement. | 1990–2018 | https://data.worldbank.org/indicator/EN.ATM.CO2E.PC |

| FDI | Net inflows represent the inward direct investment. | 1990–2018 | https://data.worldbank.org/indicator/BX.KLT.DINV.WD.GD.ZS |

| GDP | Gross domestic product (GDP) is reported to the size of the population. | 1990–2018 | https://data.worldbank.org/indicator/NY.GDP.PCAP.PP.CD |

| RE | Renewable energy consumption represents the share of renewable energy from the total consumption. | 1990–2018 | https://data.worldbank.org/indicator/EG.FEC.RNEW.ZS |

| HDI | HDI is a composite index of human development. | 1990–2018 | https://databank.worldbank.org/Human-development-index/id/363d401b |

| TO | Trade represents exports and imports as a share of GDP. | 1990–2018 | https://data.worldbank.org/indicator/NE.TRD.GNFS.ZS |

| Statistics | CDE | FDI | GDP | RE | HDI | TO |

|---|---|---|---|---|---|---|

| Mean | 6.65 | 4.61 | 15738.71 | 15.37 | 0.78 | 91.73 |

| Min. | 3.12 | −40.33 | 4504.19 | 1.92 | 0.90 | 43.72 |

| Max. | 14.54 | 54.24 | 41134.09 | 34.13 | 0.67 | 168.24 |

| Std. Dev. | 2.64 | 8.41 | 8156.46 | 8.75 | 0.06 | 32.84 |

| Variables | Levin—Lin and Chu | ADF—Fisher Chi-Square | PP—Fisher Chi-Square | |||

|---|---|---|---|---|---|---|

| Statistic | Prob. | Statistic | Prob. | Statistic | Prob. | |

| CDE | ||||||

| Level | −3.33 | 0.0004 *** | 28.26 | 0.0051 *** | 26.85 | 0.0081 *** |

| FDI | ||||||

| Level | 2.93 | 0.0017 *** | 26.74 | 0.0084 *** | 26.21 | 0.0100 *** |

| GDP | ||||||

| Level | 12.74 | 1.0000 | 0.02 | 1.0000 | 0.00011 | 1.0000 |

| First Difference | −15.99 | 0.0000 *** | 191.88 | 0.0000 *** | 224.66 | 0.0000 *** |

| RE | ||||||

| Level | 3.82 | 0.9999 | 1.04 | 1.0000 | 0.83 | 1.0000 |

| First Difference | −11.81 | 0.0000 *** | 133.81 | 0.0000 *** | 140.26 | 0.0000 *** |

| HDI | ||||||

| Level | 12.49 | 1.0000 | 0.05 | 1.0000 | 0.01 | 1.0000 |

| First Difference | −3.01 | 0.0013 *** | 20.7 | 0.0500 ** | 34.51 | 0.0006 *** |

| TO | ||||||

| Level | 4.27 | 1.0000 | 1.13 | 1.0000 | 0.71 | 1.0000 |

| First Difference | −11.33 | 0.0000 *** | 127.37 | 0.0000 *** | 127.09 | 0.0000 *** |

| Statistic | Prob. | Weighted Statistic | Prob. | |

|---|---|---|---|---|

| Panel v | 1.5383 | 0.0620 * | 0.9761 | 0.1645 |

| Panel ρ | −0.3419 | 0.3662 | −0.0299 | 0.4881 |

| Panel pp | −4.7129 | 0.0000 *** | −3.4082 | 0.0003 *** |

| Panel ADF | −4.7182 | 0.0000 *** | −0.5951 | 0.2759 |

| Group ρ | 0.8096 | 0.7909 | ||

| Group pp | −4.1510 | 0.0000 *** | ||

| Group ADF | −4.1261 | 0.0000 *** |

| t-Statistic | Prob. | |

|---|---|---|

| ADF | −4.9895 | 0.0000 *** |

| Residual Variance | 0.1034 | |

| Residual Variance | 0.0982 |

| Cointegrating Equation: | CointEquation (1) | |||||

|---|---|---|---|---|---|---|

| CDE(−1) | 1.0000 | |||||

| DGDP(-1) | −0.0048 (0.0032) [−1.4880] | |||||

| DHDI(−1) | −5.8374 (520.478) [−0.011] | |||||

| DRE(−1) | 18.7188 (2.3329) [8.0239] | |||||

| DTO(−1) | 1.5830 (0.4041) [3.9176] | |||||

| FDI(−1) | −1.1452 (0.2967) [−3.8605] | |||||

| C | −7.1369 | |||||

| Error Correction: | D(CDE) | D(GDP) | D(HDI) | D(RE) | D(DTO) | D(FDI) |

| CointEq1 | −0.0515 (0.0017) [−3.0841] | 4.8829 (3.3478) [248.4671] | −1.64 × 10− 6 (2.1 × 10− 5) [−0.0776] | −0.0402 (0.0072) [−5.6028] | −0.0824 (0.0477) [−1.7279] | 0.1244 (0.0493) [2.5221] |

| Exogenous Variable | Endogenous Variable | |||||

|---|---|---|---|---|---|---|

| D(CDE) | D(GDP) | D(HDI) | D(RE) | D(DTO) | D(FDI) | |

| Coint Equation1 | −0.0051 (0.0017) [−3.0841] | 4.8829 (3.3478) [1.4585] | −1.64 × 10−6 (2.1 × 10−5) [−0.0776] | −0.04016 (0.0072) [−5.6028] | −0.0824 (0.0477) [−1.7279] | 0.1244 (0.0493) [2.5221] |

| D(CDE(−1)) | −0.0368 (0.0976) [−0.3769] | 248.4671 (195.680) [1.2698] | −0.0017 (0.0012) [−1.3588] | −0.1181 (0.4189) [−0.2819] | 3.6178 (2.7857) [1.2987] | 2.8008 (2.8837) [0.9713] |

| D(CDE(−2)) | −0.3042 (0.0939) [−3.2395] | −333.9738 (188.348) [−1.7891] | −0.0028 (0.0012) [−2.3785] | 0.6752 (0.4033) [1.6742] | −5.5992 (−2.6813) [−2.0882] | 2.4260 (2.7757) [0.8740] |

| D(DGDP(−1)) | 2.68 × 10−6 (4.7 × 10−5) [−00575] | −0.4135 (0.0933) [−4.4307] | 5.82 × 10−8 (5.9 × 10−7) [0.0988] | −0.0005 (0.0002) [−2.3940] | −0.0036 (0.0013) [−2.7187] | −0.0001 (0.0014) [0.0908] |

| D(DGDP(−2)) | −3.62 × 10−5 (4.7 × 10−5) 0.7695 | −0,2302 (0.0943) [−2.4414] | 4.45 × 10−8 (5.9 × 10−7) [0.0749] | 0.0003 (0.0002) [1.3632] | −0.0039 (0.0013) [−2.9463] | −0.0003 (0.0014) [2.5059] |

| D(DHDI(−1)) | 0.3653 (6.6272) [0.055] | 880.0882 (13292.9) [0.0662] | −0.4109 (0.0838) [4.9025] | 32.8285 (28.4614) [1.1534] | 439.2954 (189.238) [2.3214] | 253.3226 (195.897) [1.2931] |

| D(DHDI(−2)) | 2.3508 (6.2056) [0.3788] | 14215.29 (12447.3) [1.1420] | −0.1535 (0.0785) [−1.9553] | 9.0937 (26.6509) [0.3412] | 128.2871 (177.200) [0.7239] | −90.3354 (183.435) [−0.4925] |

| D(DRE(−1)) | 0.0549 (0.0259) [2.1169] | −114.6060 (52.0921) [−2.20007] | −2.42 × 10−5 (0.0003) [−0.0737] | −0.1032 (0.1115) [−0.9255] | 1.2879 (0.7416) [1.7367] | −1.4869 (0.7677) [−1.9369] |

| D(DRE(−2)) | 0.0183 (0.0154) [1.1895] | −53.2202 (30.8580) [−1.7247] | −0.0004 (0.0002) [−2.0982] | −0.0482 (0.0661) [−0.6990] | 0.5235 (0.4393) [1.1916] | −0.6676 (0.4548) [−1.4681] |

| D(DTO(−1)) | 0.0077 (0.0036) [2.1605] | −5.6168 (7.1232) [−0.7885] | 3.07 × 10−5 (4.5 × 10−5) [−0.6829] | 0.0509 (0.0153) [3.3385] | −0.6435 (0.1014) [6.3461] | −0.0157 (0.1049) [−0.1500] |

| D(DTO(−2)) | 0.0024 (0.0030) [0.7887] | −1.7762 (6.0692) [−0.2927] | 1.89 × 10−5 (3.8 × 10−5) [0.4928] | 0.0412 (0.0129) [3.1681] | −0,2096 (0.0864) [−2.4260] | 0.0892 (0.0894) [0.9971] |

| D(FDI(−1)) | −0.0022 (0.0032) [−0.7048] | 3.4302 (6.3176) [0.5429] | 7.73 × 10−5 (4 × 10−5) [1.9399] | −0.0322 (0.0135) [−2.3842] | −0.1827 (0.8994) [−2.0317] | −0.3090 (0.0931) [−3.3195] |

| D(FDI(−2)) | −0.0034 (0.0037) [−0.9358] | 3.8556 (7.3837) [0.5222] | 8.2 × 10−5 (4.7 × 10−5) [1.7619] | −0.0196 (0.0158) [−1.2378] | −0.3528 (0.1051) [−3.3562] | −0.4176 (0.1088) [−3.8379] |

| C | −0.0529 (0.0271) [−1.9551] | 100.8955 (54.3167) [1.8575] | −0.0003 (0.0003) [−0.9836] | 0.0348 (0.1163) [0.2992] | 0.8974 (0.7733) [1.1606] | 0.0652 (0.8005) [0.0814] |

| Dependent Variable | Dependent Variable Excluded | |||||

|---|---|---|---|---|---|---|

| D(CDE) | D(DGDP) | D(DHDI) | D(DRE) | D(DTO) | D(FDI) | |

| D(CDE) | 0.6442 (0.7246) | 0.1457 (0.9297) | 4.5015 (0.1053) | 5.5941 (0.0610) | 0.9698 (0.6157) | |

| D(DGDP) | 4.8957 (0.086) | 1.3649 (0.5054) | 5.0669 (0.0795) | 0.7405 (0.6906) | 0.3883 (0.8235) | |

| D(DHDI) | 7.3905 (0.0248) | 0.0116 (0.9942) | 6.776 (0.0338) | 2.2274 (0.3283) | 4.7151 (0.0947) | |

| D(DRE) | 2.9003 (0.2345) | 11.2895 (0.0035) | 1.3317 (9.5138) | 12.5853 (0.0018) | 5.7075 (0.0576) | |

| D(DTO) | 6.1459 (0.0463) | 11.9063 (0.0026) | 5.4011 (0.0672) | 3.0412 (0.2186) | 11.5568 (0.0031) | |

| D(FDI) | 1.6775 (0.4322) | 0.0729 (0.9642) | 2.4250 (0.2975) | 3.8757 (0.1440) | 2.3225 (0.3131) | |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Apostu, S.A.; Panait, M.; Balsalobre-Lorente, D.; Ferraz, D.; Rădulescu, I.G. Energy Transition in Non-Euro Countries from Central and Eastern Europe: Evidence from Panel Vector Error Correction Model. Energies 2022, 15, 9118. https://doi.org/10.3390/en15239118

Apostu SA, Panait M, Balsalobre-Lorente D, Ferraz D, Rădulescu IG. Energy Transition in Non-Euro Countries from Central and Eastern Europe: Evidence from Panel Vector Error Correction Model. Energies. 2022; 15(23):9118. https://doi.org/10.3390/en15239118

Chicago/Turabian StyleApostu, Simona Andreea, Mirela Panait, Daniel Balsalobre-Lorente, Diogo Ferraz, and Irina Gabriela Rădulescu. 2022. "Energy Transition in Non-Euro Countries from Central and Eastern Europe: Evidence from Panel Vector Error Correction Model" Energies 15, no. 23: 9118. https://doi.org/10.3390/en15239118