The Impact of the COVID-19 Pandemic on the Development of Electromobility in Poland. The Perspective of Companies in the Transport-Shipping-Logistics Sector: A Case Study

Abstract

:1. Introduction

- macroeconomic environment—the COVID-19 pandemic on one hand reduced the purchasing power of consumers and on the other contributed to a significant drop in oil prices and thus reduced the difference in maintenance cost of electric vehicles and combustion vehicles. This change may have affected the sales of electric vehicles [22,23],

- electric vehicle offers—the pandemic caused factories to close and stopped assembly lines around the world. As the automotive industry prepares to reopen, some are prioritising EV production either to meet expected strong demand or to meet regulatory requirements such as the European Union’s stringent CO2 target [22,25,26,27],

- determine the potential for electric cars among the surveyed companies and to identify the demand for such vehicles,

- identify factors which in the period of the COVID-19 pandemic had an impact on the potential and real need to purchase electric cars by companies in the TSL sector,

- to indicate the impact of the identified factors on the development of electromobility among companies from the TSL sector.

2. The COVID-19 Pandemic and the Development of Electromobility in Poland

2.1. Electromobility in a Sustainable Transport Concept

2.2. Impact of COVID-19 on the Evolution of the Electric Vehicle Market

- the specific type of vehicle in a given model has a strong influence on the technolo-gical performance and reliability of the vehicle,

- the lack of and high cost of effective manufacturer support in the event of repair needs,

- the development of ICT support is indispensable for the further integration of electric HGVs into daily business of transport companies,

- limited production and availability, especially of heavy electric freight vehicles,

- the need for new investment and adaptation of existing infrastructure.

2.3. The Impact of the COVID-19 Pandemic on the Development of Charging Infrastructure

3. The COVID-19 Pandemic and the Development of Electromobility in the TSL

3.1. Materials and Methods

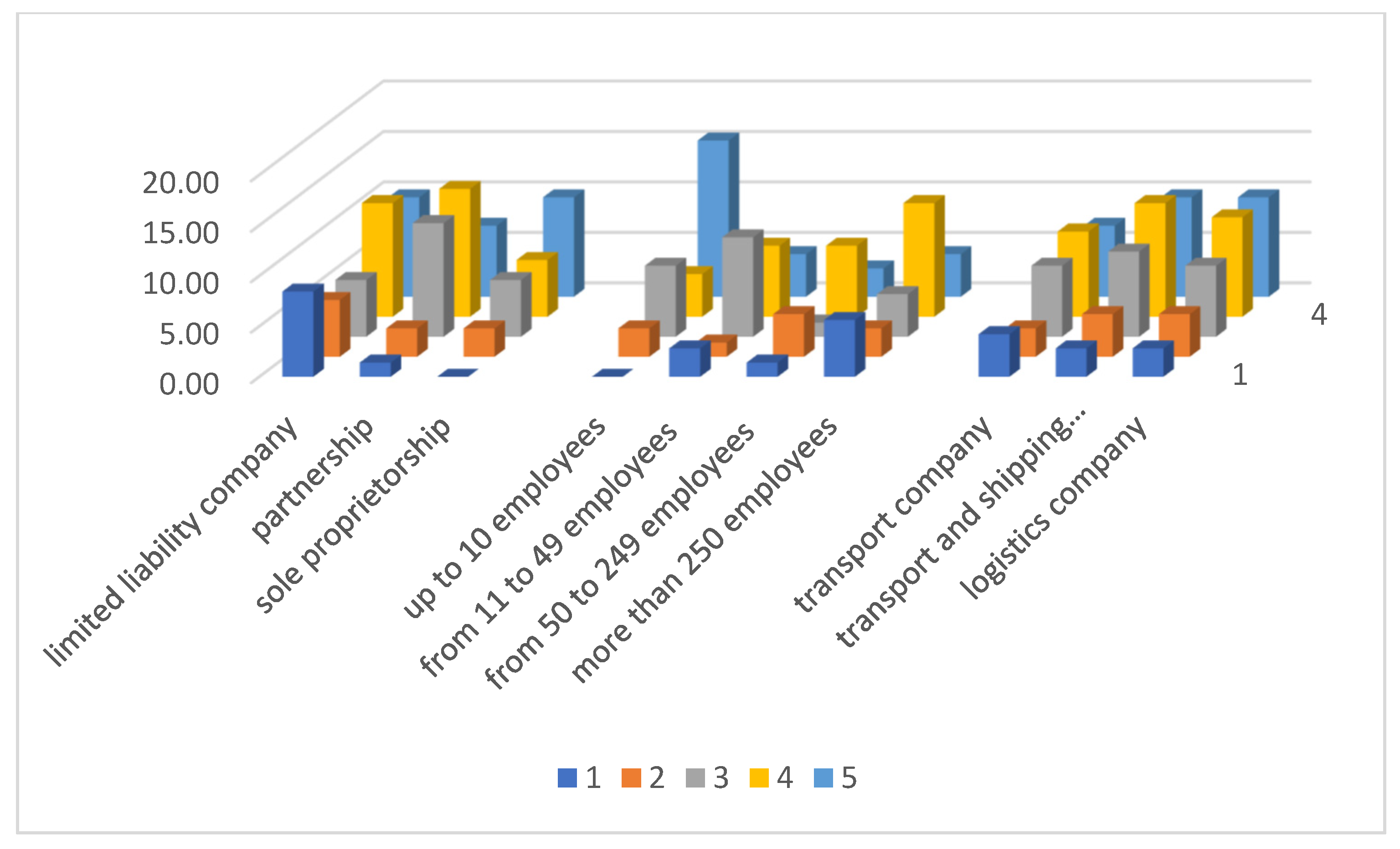

3.2. Profile of Study Participants

4. Test Results

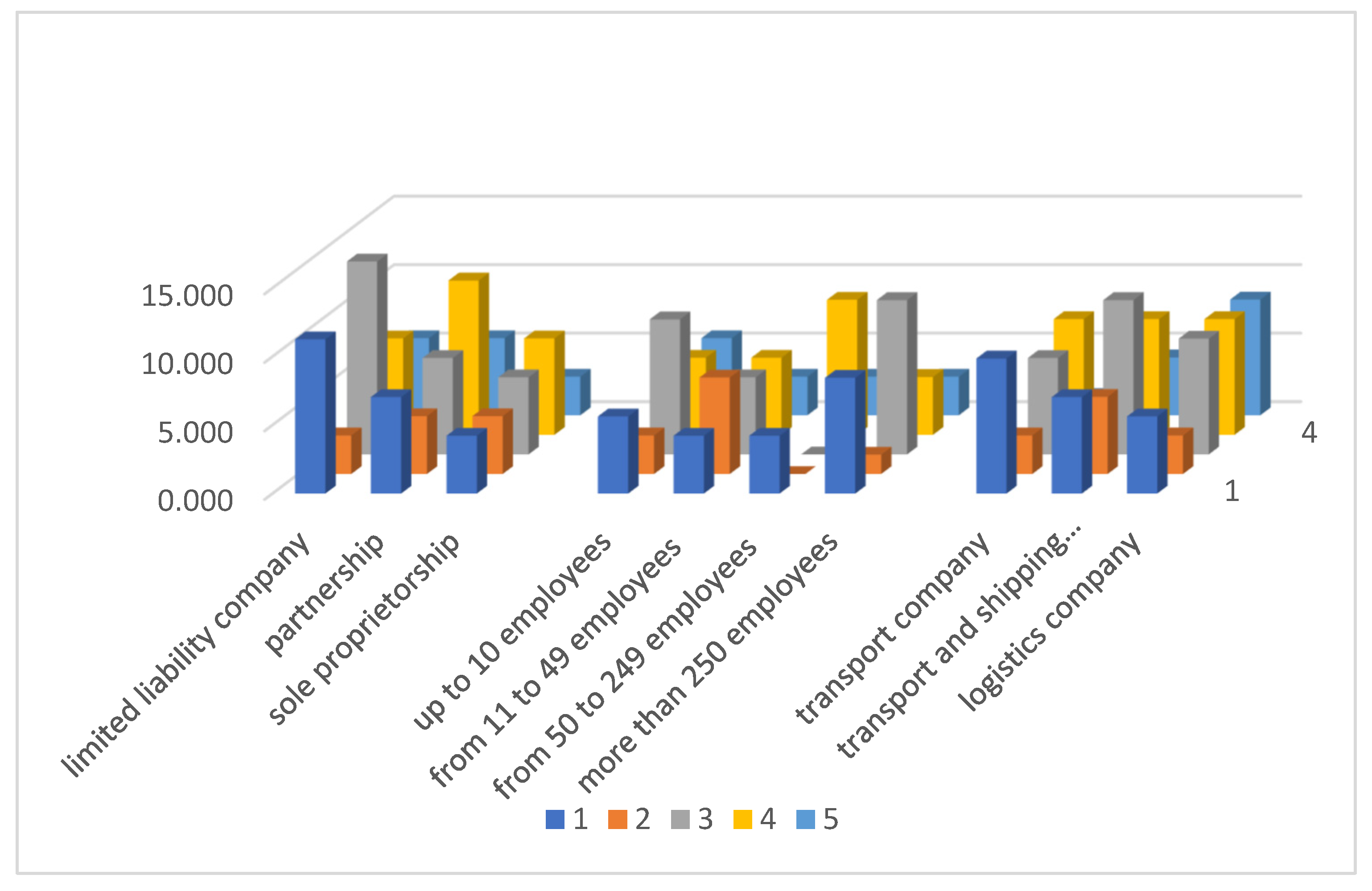

4.1. Impact of the COVID-19 Pandemic on the Purchase of Electric Vehicles

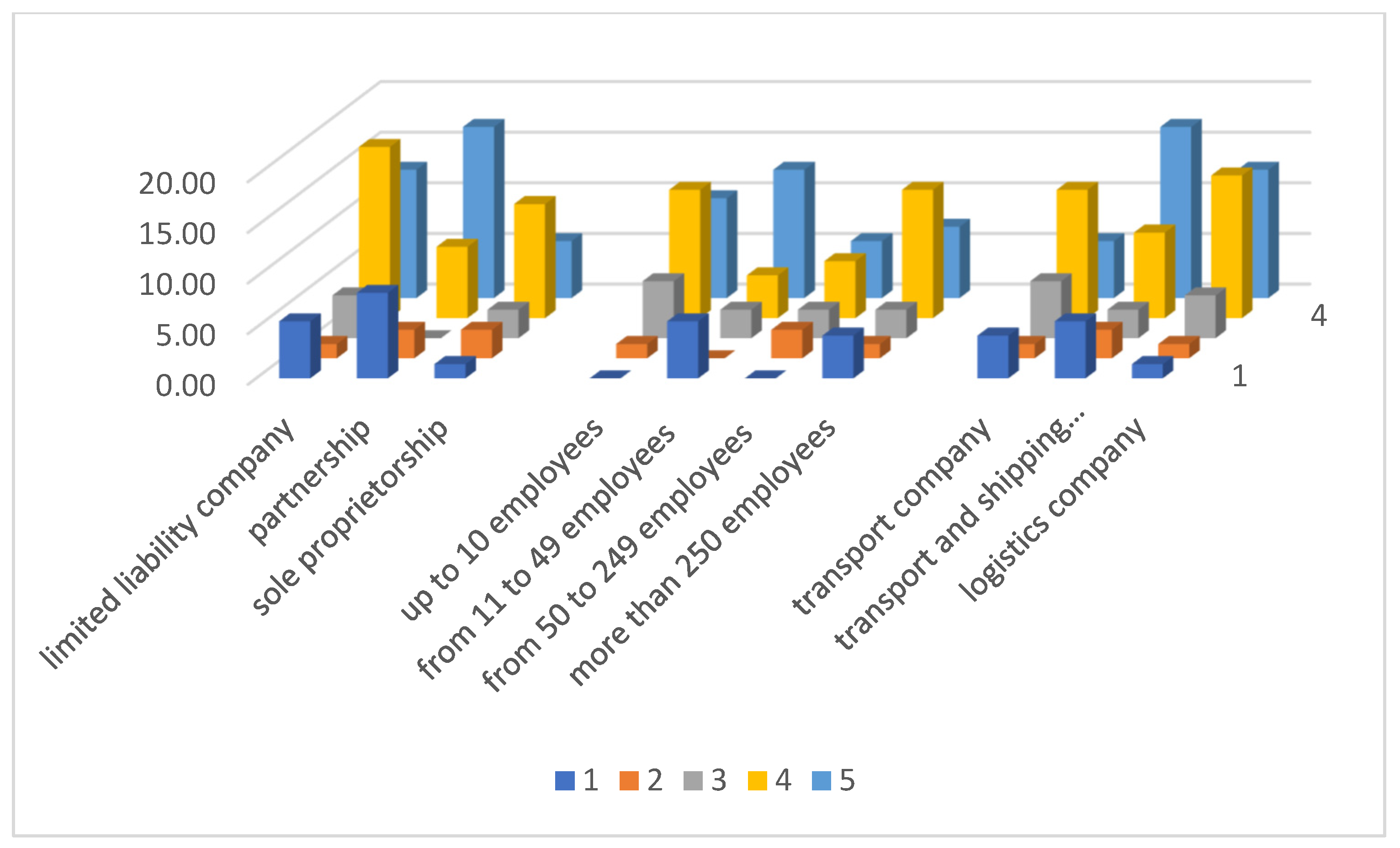

4.2. Influence of Selected Factors on the Purchase of an Electric Vehicle by Companies in the TSL Sector

5. Discussion

6. Conclusions, Limitations and Suggestions for Future Research

- -

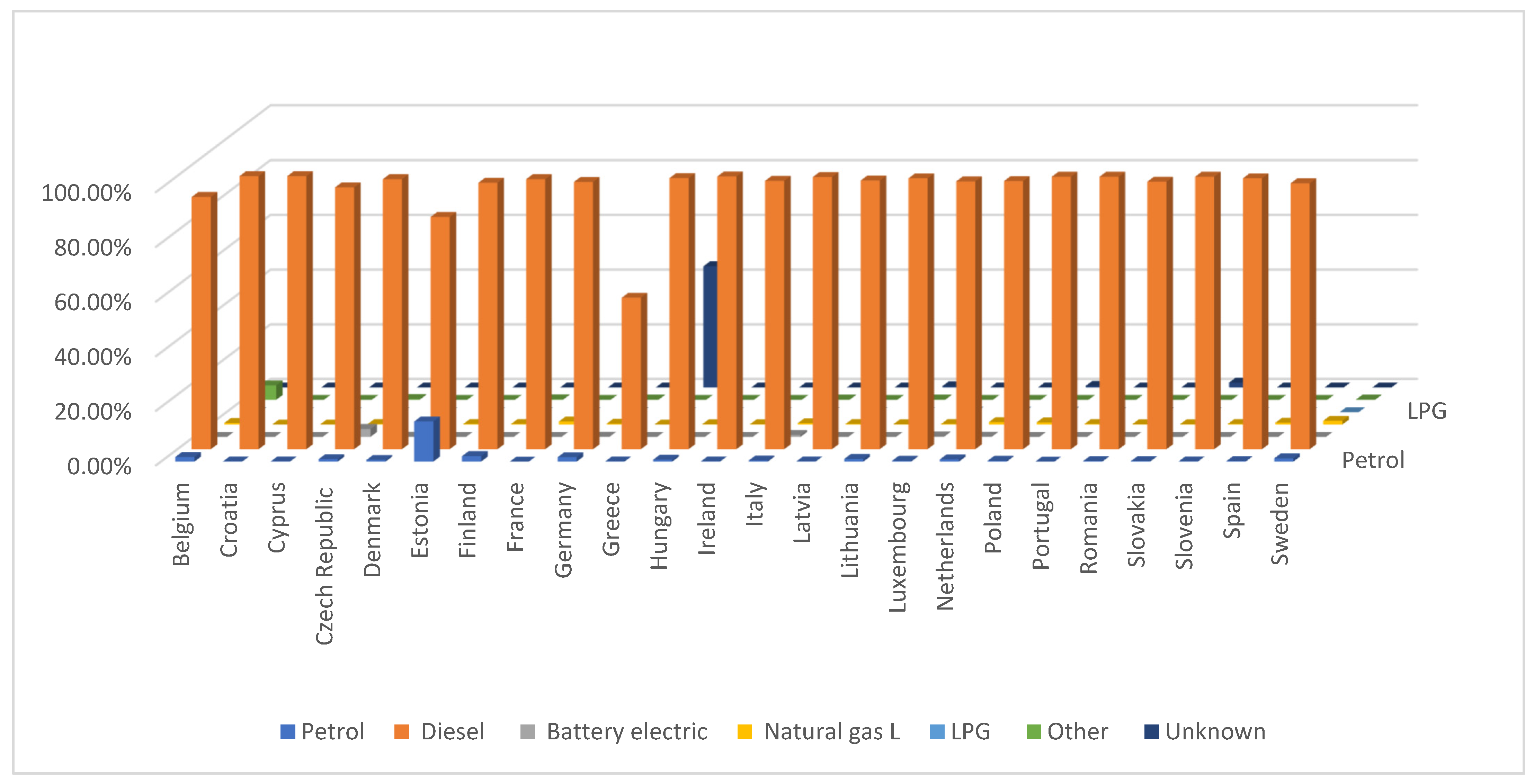

- Diesel-powered vehicles dominate among companies in the TSL sector. Electric vehicles constitute a small percentage of all vehicles. Their number in the general structure of trucks increased despite the COVID-19 pandemic. An important aspect related to the development of electric vehicles is conducting research projects with the participation of companies from the TSL sector.

- -

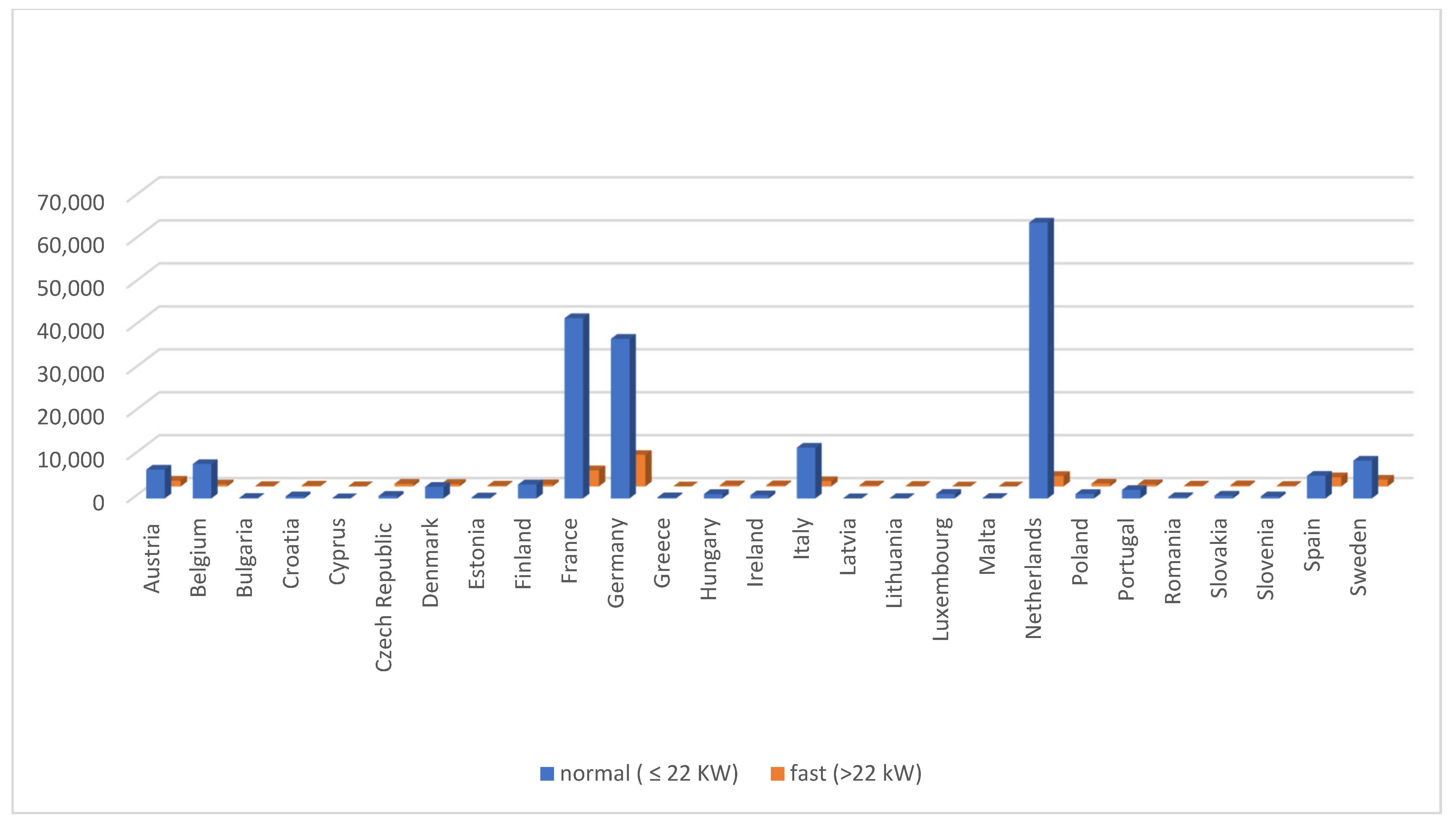

- The number of publicly available charging points has not changed. The increase was significant especially in 2020. However, the number of charging points from the point of view of TSL companies is insufficient. For this group of vehicle users, fast charging points on motorways and expressways are the most important.

- -

- In the studied group of entities, few entrepreneurs had electric vehicles and few were interested in purchasing them. Taking into account the scope of operations, undoubtedly, companies carrying out international transport must take into account the legal regulations in other countries on limiting CO2 emissions. Moreover, companies operating on the market for more than 10 years may plan to replace their fleet with new vehicles adapted to meet the restrictive requirements. Lack of interest in electric vehicles among the surveyed entrepreneurs results from, among other things, low levels of knowledge of electromobility and lack of awareness of the benefits of electric vehicles or incentive systems for their purchase.

- -

- An important factor which influences the decision not to purchase electric vehicles is the still insufficient number of charging points, including fast charging points. Taking into account the fact that Polish carriers carry out transport all over Europe, the lack of availability of charging infrastructure is a significant argument discouraging companies from replacing their fleets of vehicles.

- -

- Of great importance for TSL sector entities is the situation in the energy sector, including instability of electricity prices. Entrepreneurs point to two important issues that concern the energy sector. On one hand, Fit for 55, which will affect costs in the energy sector, which may be partly transferred to the transport sector, and on the other hand, the issues of decarbonisation, or problems related to incurring penalties by Poland for coal mining in the Turów mine,

- -

- The economic situation of the country, compared with the development of charging infrastructure and uncertainty of energy prices, was not so important for the surveyed companies in the period of the COVID-19 pandemic. As can be seen, the period of the COVID-19 pandemic even influenced its development thanks to the increase in online shopping, which affected mainly small entrepreneurs delivering in agglomerations. Nevertheless, the share of electric vehicles in the fleets of Polish companies increased only slightly during this period.

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Conflicts of Interest

References

- Sektor Elektromobilności w Niemczech, Raport Sektorowy; Polska Agencja Inwestycji i Handlu: Warsaw, Poland, 2018.

- Płachciak, A. Origin of the Idea of Sustainable Development. Economics 2011, 5, 231–248. [Google Scholar]

- Brożyna, A.; Kozioł, W. Prognozy wyczerpywania bazy zasobów kopalin–teoria i praktyka. Przegląd Górniczy 2014, 4, 86–89. [Google Scholar]

- Smil, V. Energy In The Twentieth Century: Resources, Conversions, Costs, Uses, And Consequences. Annu. Rev. Energy Environ. 2000, 25, 21–51. [Google Scholar] [CrossRef] [Green Version]

- The History of The Electric Car. Department of Energy. 15 September 2004. Available online: https://www.energy.gov/articles/history-electric-car (accessed on 28 January 2022).

- Grauers, A.; Sarasini, S.; Karlström, M. Why Electromobility and What Is It? In System Perspectives on Electromobility 2013; Sandén, B., Ed.; Chalmers University of Technology: Göteborg, Sweden, 2013; pp. 10–21. Available online: https://publications.lib.chalmers.se/records/fulltext/211430/local_211430.pdf (accessed on 14 December 2021).

- Gajewski, J.; Paprocki, W.; Pieriegud, J. (Eds.) Elektromobilność w Polsce na tle Tendencji Europejskich i Globalnych; Centrum Myśli Strategicznej, CeDeWu: Warsaw, Poland, 2019; Available online: https://fundacjacms.pl/wp-content/uploads/2019/08/elektromob_internet.pdf (accessed on 14 December 2021).

- Kowalski, D.J.; Depta, A. Sustainable Development in Electromobility; Zeszyty Naukowe Politechniki Łódzkiej nr 1228, Organizacja i Zarządzanie z 73; Wydawnictwo Politechniki Łódzkiej: Łódź, Poland, 2019; pp. 69–78. [Google Scholar] [CrossRef]

- Energy, Transport and Environment Statistic, Eurostat 2020. Available online: https://ec.europa.eu/eurostat/web/products-statistical-books/-/KS-DK-20-001 (accessed on 14 December 2021).

- European Environment Agency. CO2 Performance of New Passenger Cars in Europe. Available online: https://www.eea.europa.eu/ims/co2-performance-of-new-passenger (accessed on 14 December 2021).

- Global EV Outlook 2021, Accelerating Ambitions Despite the Pandemic. 2021. Available online: https://iea.blob.core.windows.net/assets/ed5f4484-f556-4110-8c5c-4ede8bcba637/GlobalEVOutlook2021.pdf (accessed on 14 December 2021).

- Global EV Outlook 2020, Entering the Decade of Electric Drive? 2020. Available online: https://www.iea.org/reports/global-ev-outlook-2020.pdf (accessed on 14 December 2021).

- Floty Samochodów Kluczem do Elektromobilności. Podsumowanie Stanu i Potencjału Rozwoju Rynku Samochodów Elektrycznych w Polsce Oraz Podejście msp do Elektromobilności. PKO Leasing, Czerwiec 2020. Available online: https://masterlease.pl/wp-content/uploads/2021-06-floty-samochodow-kluczem-do-elektromobilnosci-raport.pdf (accessed on 14 December 2021).

- Plan Rozwoju Elektromobilności w Polsce, Ministerstwo Energii, Warszawa, Wrzesień 2016. Available online: https://www.teraz-srodowisko.pl/media/pdf/aktualnosci/2580-Plan-Rozwoju-Elektromobilnosci.pdf (accessed on 14 December 2021).

- Stark, A. (Ed.) Analysis of Electromobility in Six Countries—Where to Invest Next. Available online: https://www.spotlightmetal.com/analysis-of-electromobility-in-six-countries-where-to-invest-next-a-718387/ (accessed on 14 December 2021).

- Jaworski, J. Electromobility development in selected European countries in the light of available tax concessions. Eur. J. Serv. Manag. 2018, 28, 187–192. [Google Scholar] [CrossRef]

- Auvinen, H.; Jarvi, T.; Kloetzke, M.; Kugler, U.; Bühe, J.A.; Heinl, F.; Kurte, J.; Esser, K. Electromobility scenarios: Research findings to inform policy. Transp. Res. Procedia 2016, 14, 2564–2573. [Google Scholar] [CrossRef] [Green Version]

- European Vehicle Market Statistics, Pocketbook 2020/21, icct. 2020. Available online: http://eupocketbook.org/wp-content/uploads/2020/12/ICCT_Pocketbook_2020_Web.pdf (accessed on 14 December 2021).

- Regulation (Eu) 2019/1242 Of The European Parliament And Of The Council of 20 June 2019 Setting CO2 Emission Performance Standards for New Heavy-Duty Vehicles and Amending Regulations (EC) No 595/2009 and (EU) 2018/956 of the European Parliament and of the Council and Council Directive 96/53/EC. L 198/202. Available online: http://data.europa.eu/eli/reg/2019/1242/oj (accessed on 14 November 2021).

- Napędzamy Polską Przyszłość. Perspektywy Elektryfikacji Samochodów Dostawczych i Ciężarowych w Polsce, Fundacja Promocji Pojazdów Elektrycznych, Warszawa, Październik 2021. Available online: https://chronmyklimat.pl/media/espada/filesupload/articles/files-1326/perspektywy-elektryfikacji-samochodow-ciezarowych-i-dostawczych-w-polsce.pdf (accessed on 14 December 2021).

- Wells, P. Sustainable business models and the automotive industry: A commentary. IIMB Manag. Rev. 2013, 25, 228–239. [Google Scholar] [CrossRef] [Green Version]

- Gersdorf, T.; Hensley, R.; Hertzke, P.; Schaufuss, P. Electric Mobility after the Crisis: Why an Auto Slowdown Wan’t Hurt EU Demand. 16 September 2020. Available online: https://www.mckinsey.com/industries/automotive-and-assembly/our-insights/electric-mobility-after-the-crisis-why-an-auto-slowdown-wont-hurt-ev-demand (accessed on 14 November 2021).

- Lewicki, W.; Drożdż, W.; Wróblewski, P.; Żarna, K. The Road to Electromobility in Poland: Consumer Attitude Assessment. Eur. Res. Stud. J. 2021, 24, 28–39. [Google Scholar] [CrossRef]

- Nundy, S.; Ghosh, A.; Mesloub, A.; Albaqawy, G.A.; Alnaim, M.M. Impact of COVID-19 pandemic on socio-economic, energy-environment and transport sector globally and sustainable development goal (SDG). J. Clean. Prod. 2021, 312, 127705. [Google Scholar] [CrossRef]

- Elektromobilność w Polsce i w Europie, Mubi News. Available online: https://mubi.pl/dokumenty/elektromobilnosc-w-polsce-i-europie.pdf (accessed on 7 October 2021).

- European Commission. Roadmap to a Single European Transport Area–Towards a Competitive and Resource Efficient Transport System; European Commission: Brussels, Belgium, 2011; Available online: http://eur-lex.europa.eu/LexUriServ/LexUriServ.do?uri=COM:2011:0144:FIN:EN:PDF (accessed on 21 October 2021).

- Wen, W.; Yang, S.; Zhou, P.; Ga, S.Z. Impacts of COVID-19 on the electric vehicle industry: Evidence from China. Renew. Sustain. Energy Rev. 2021, 144, 111024. [Google Scholar] [CrossRef]

- Bal, F.; Vleugel, J. The impact of hybrid engines on fuel consumption and emissions of heavy-duty trucks. WIT Trans. Ecol. Environ. 2017, 224, 203–212. Available online: https://www.witpress.com/Secure/elibrary/papers/ESUS17/ESUS17019FU1.pdf (accessed on 14 December 2021).

- Ghandriz, T.; Jacobson, B.; Laine, L.; Hellgren, J. Impact of automated driving systems on road freight transport and electrified propulsion of heavy vehicles. Transp. Res. Part C 2020, 115, 102610. [Google Scholar] [CrossRef]

- Vehicles in Use Europe 2022, acea, Jaunary 2022. Available online: https://www.acea.auto/files/ACEA-report-vehicles-in-use-europe-2022.pdf (accessed on 14 December 2021).

- Jak COVID-19 Wpłynie na Rozwój Samochodów Elektrycznych i Autonomicznych. 2020. Available online: https://knaufautomotive.com/pl/jak-covid-19-wplynie-na-rozwoj-samochodow-elektrycznych-i-autonomicznych/ (accessed on 14 December 2021).

- Membrillo-Hernández, J.; Lara-Prieto, V.; Caratozzolo, P. Sustainability: A Public Policy, a Concept, or a Competence? Efforts on the Implementation of Sustainability as a Transversal Competence throughout Higher Education Programs. Sustainability 2021, 13, 13989. [Google Scholar] [CrossRef]

- Report of the World Commission on Environment and Development Our Common Future. ONZ 1987, 10, 1–300.

- Siemiński, J.L. Idea “Rozwoju Zrównoważonego i Trwałego” Obszarów Wiejskich w Polsce na tle Innych Koncepcji. Ujęcie Planistyczne (Część I); Infrastruktura i Ekologia Terenów Wiejskich: Kraków, Poland, 2008; Volume 2, pp. 7–20. Available online: http://www.infraeco.pl/pl/art/a_15178.htm (accessed on 14 December 2021).

- James, P. Urban Sustainability in Theory and Practice: Circles of Sustainability; Routledge: London, UK, 2014; Available online: https://www.taylorfrancis.com/books/mono/10.4324/9781315765747/urban-sustainability-theory-practice-paul-james (accessed on 14 December 2021).

- Burchard-Dziubińska, M.; Rzeńca, A.; Drzazga, D. Zrównoważony Rozwój-Naturalny Wybór; Wydawnictwo Uniwersytetu Łódzkiego: Łódź, Poland, 2014. [Google Scholar]

- Litman, T.; Burwell, D. Issues in Sustainable Transportation. Int. J. Glob. Environ. Issues 2006, 6, 331–347. Available online: https://www.vtpi.org/sus_iss.pdf (accessed on 14 December 2021). [CrossRef]

- Motowidlak, U. Rozwój transport a paradygmat zrównoważonego rozwoju, Studia Ekonomiczne. Zesz. Nauk. Uniw. Ekon. W Katowicach 2017, 337, 138–152. Available online: https://www.ue.katowice.pl/fileadmin/user_upload/wydawnictwo/SE_Artyku%C5%82y_321_340/SE_337/10.pdf (accessed on 14 December 2021).

- Borys, T. Pomiar zrównoważonego rozwoju transportu. In Ekologiczne Problemy Zrównoważonego Rozwoju; Kiełczewski, D., Dobrzyńska, B., Eds.; Wyższej Szkoły Ekonomicznej w Białymstoku: Białystok, Poland, 2009. [Google Scholar]

- Schaumann, H. Development of a Concept for Inner-City Delivery & Supply Utilising Electromobility. In Efficiency and Logistics; Clausen, U., Hompel, M., Klumpp, M., Eds.; Springer-Verlag: Berlin, Germany, 2013; pp. 121–127. [Google Scholar]

- Scheffels, G.; Alexander Stark, A. Electromobility: Definition, Vehicles and Future. Available online: https://www.spotlightmetal.com/electromobility-definition-vehicles-and-future-a-810482/ (accessed on 14 December 2021).

- Caternì, A.; Cascetta, E.; Luca, S. A random utility model for park & carsharing services and the pure preference for electric vehicles. Transp. Policy 2016, 48, 49–59. [Google Scholar] [CrossRef]

- Lara, F.F.; Marx, R. Comparative positioning between Brazilian subsidiaries and Europeanmatrices on Electromobility and carsharing technologies. Res. Transp. Bus. Manag. 2018, 27, 67–74. [Google Scholar] [CrossRef]

- Ceschin, F.; Vezzoli, C. The role of public policy in stimulating radical environmental impact reduction in the automotive sector: The need to focus on product-service system innovation. Int. J. Automot. Technol. Manag. 2010, 10, 321–341. [Google Scholar] [CrossRef] [Green Version]

- MacDougall, W. Electromobility in Germany: Vision 2020 and Beyond; German Trade & Invest Issue: Bonn, Germany, 2013. [Google Scholar]

- Elektromobilność, Polskie Stowarzyszenie Elektromobilności. Available online: http://www.psem.pl/elektromobilnosc.html (accessed on 14 November 2021).

- Osorio-Tejada, J.; Llera, E.; Scarpellini, S. LNG: An Alternative Fuel For Road Freight Transport In Europe. WIT Press 2015, 168, 235–246. [Google Scholar] [CrossRef] [Green Version]

- Navas-Anguita, Z.; Garcia-Gusano, D.; Irbarren, D. A review of techno-economic data for road transportation fuels. Renew. Sustain. Energy Rev. 2019, 112, 11–26. [Google Scholar] [CrossRef]

- Muratori, M.; Smith, S.J.; Kyle, P.; Link, R.; Mignone, B.; Kheshgi, H. Role of the Freight Sector in Future Climate Change Mitigation Scenarios. Environ. Sci. Technol. 2017, 51, 3526–3533. [Google Scholar] [CrossRef] [PubMed]

- Wang, Z.; Ahmen, Z.; Zhang, B.; Wang, B. The nexus between urbanization, road infrastructure, and transport energy demand: Empirical evidence from Pakistan. Environ. Sci. Pollut. Res. 2019, 26, 34884–34895. [Google Scholar] [CrossRef] [PubMed]

- Cantarero, M.M.V. Decarbonizing the transport sector: The promethean responsibility of Nicaragua. J. Environ. Manag. 2019, 245, 311–321. [Google Scholar] [CrossRef] [PubMed]

- Skrứcańy, T.; Kendra, M.; Stopla, O.; Milojević, S.; Figlus, T.; Csiszăr, C. Impact of the Electric Mobility Implementation on the Greenhouse Gases Production in Central European Countries. Sustainability 2019, 11, 4948. [Google Scholar] [CrossRef] [Green Version]

- Helgeson, B.; Peter, J. The role of electricity in decarbonizing European road transport—Development and assessment of an integrated multi-sectoral model. Appl. Energy 2020, 262, 114365. [Google Scholar] [CrossRef] [Green Version]

- Quak, H.; Nesterova, N.; Roijen, T.; Dong, Y. Zero emission city logistics: Current practices in freight electromobility and feasibility in the near future. Transp. Res. Procedia 2016, 14, 1506–1515. [Google Scholar] [CrossRef] [Green Version]

- Geronikolos, I.; Potoglou, D. An exploration of electric-car mobility in Greece: A stakeholders’ perspective. Case Stud. Transp. Policy 2021, 9, 906–912. [Google Scholar] [CrossRef]

- Vehicles in Use Europe 2021, Acea. Jaunary 2021. Available online: https://www.acea.auto/files/report-vehicles-in-use-europe-january-2021-1.pdf (accessed on 14 December 2021).

- Połom, M. E-revolution in post-communist country? A critical review of electric public transport development in Poland. Energy Res. Soc. Sci. 2021, 80, 102227. [Google Scholar] [CrossRef]

- Transport Wyniki Działalności w 2017 r; GUS: Warsaw, Poland, 2018.

- Transport Wyniki Działalności w 2018 r; GUS: Warsaw, Poland, 2019.

- Transport Wyniki Działalności w 2019 r; GUS: Warsaw, Poland, 2020.

- Transport Wyniki Działalności w 2020 r; GUS: Warsaw, Poland, 2021.

- Gryz, J.; Podraza, A.; Ruszel, M. Bezpieczeństwo Energetyczne. Koncepcje, Wyzwania, Interesy; PWE: Warsaw, Poland, 2018. [Google Scholar]

- Strategia na Rzecz Odpowiedzialnego Rozwoju do Roku 2020 (z Perspektywą do Roku 2030 r); Dokument Przyjęty Uchwałą Rady Ministrów w Dniu 14 Lutego 2017 r; Rady Ministrów: Warsaw, Poland, 2017.

- Barometr Nowej Mobilności 2020/2021; PESA: Warsaw, Poland, 2020.

- Licznik Elektromobilności, Sierpień 2021. Available online: https://pspa.com.pl/wp-content/uploads/2021/09/licznik_elektromobilnosci_2021-08_A4_PL.jpg (accessed on 18 November 2021).

- E-taryfa. Nowa Energia dla Elektromobilności; Ministerstwo Klimatu i Środowiska: Warsaw, Poland, 2020. [Google Scholar]

- Drożdż, W. The development of electromobility in Poland. Virtual Econ. 2019, 2, 61–69. [Google Scholar] [CrossRef]

- Pagany, R.; Camargo, L.; Dorner, W. A review of spatial localization methodologies for the electric vehicle charging infrastructure. Int. J. Sustain. Transp. 2019, 13, 433–449. [Google Scholar] [CrossRef] [Green Version]

- Funke, S.Ă.; Gnann, T.; Plötz, P. Addressing the Different Needs for Charging Infrastructure: An Analysis of Some Criteria for Charging Infrastructure Set-up. In E-Mobility in Europe; Filho, W.L., Kotter, R., Eds.; Trends and Good Practice; Springer: Berlin/Heidelberg, Germany, 2015; pp. 73–90. [Google Scholar] [CrossRef]

- Matejun, M. Metodyka badań ankietowych w naukach o zarządzaniu-ujęcie modelowe. In Współczesne Problemy Rozwoju Metodologii Zarządzania; Lisiński, M., Ziębicki, B., Eds.; Fundacja Uniwersytetu Ekonomicznego w Krakowie: Kraków, Poland, 2016; pp. 341–354. [Google Scholar]

- Harpe, S.E. How to analyze Likert and other rating scale data. Curr. Pharm. Teach. Learn. 2015, 7, 836–850. [Google Scholar] [CrossRef]

- Chen, Y.-P. Do the Chi-Square Test and Fisher’s Exact Test Agree in Determining Extreme for 2 × 2 Tables? Am. Stat. 2011, 64, 239–245. [Google Scholar] [CrossRef]

- Miesięczny Indeks Koniunktury, Polski Instytut Ekonomiczny, Październik 2021. Available online: https://pie.net.pl/wp-content/uploads/2021/10/MIK_10-2021.pdf (accessed on 18 November 2021).

- Senderek-Matysiak, E.; Łosiewicz, Z. Analysis of the Development of the Electromobility Market in Poland in the Context of the Implemented Subsidies. Energies 2021, 14, 222. [Google Scholar] [CrossRef]

- Wagner, M.; Schönsteiner, K.; Hamacher, T. Impacts of Photovoltaics and Electromobilityon the Singaporean Energy Sector. Energy Procedia 2012, 25, 126–134. [Google Scholar] [CrossRef] [Green Version]

- Higureas-Castillo, E.; Liébana-Cabanillas, F.J.; Muñoz-Leira, F.; García-Maroto, I. Evaluating consumer attitudes toward electromobility and the moderating effect of perceived consumer effectiveness. J. Retail. Cust. Serv. 2019, 51, 387–398. [Google Scholar] [CrossRef]

- Anable, J.; Lane, B.; Keley, T. An Evidence Base Review of Public Attitudes to Climate Change and Transport Behaviour; The Department for Transport: Warsaw, Poland, 2006. [Google Scholar]

- Krause, R.M.; Carley, S.R.; Lane, B.W.; Graham, J.D. Perception and reality: Public knowledge of plug-in electric vehicles in 21 U.S. cities. Energy Policy 2013, 63, 433–440. [Google Scholar] [CrossRef]

- Raczyński, A.; Malinowska, M.; Pokorska, A. Analiza uwarunkowań rozwoju elektromobilności w przewozie ładunków. Probl. Transp. I Logistyki 2018, 12, 73–84. [Google Scholar]

- Dulak, M.; Musiałek, P. (Eds.) Z Prądem czy pod Prąd? Perspektywy Rozwoju Elektromobilności w Polsce; Klub Jagielloński: Kraków, Poland, 2018. [Google Scholar]

- Osiecko, K.; Zimon, D.; Płaczek, E.; Prokopiuk, J. Factors that influence the expansion of electric delivery vehicles and trucks in EU countries. J. Environ. Manag. 2021, 296, 113177. [Google Scholar] [CrossRef]

- Chiaramonti, D.; Maniatris, K. Security of supply, strategic storage and COVID19: Which lessons learnt for renewable and recycled carbon fuels, and their future role in decarbonizing transport? Appl. Energy 2020, 271, 115216. [Google Scholar] [CrossRef]

- Świtała, M.; Łukasiewicz, A. Road Freight Transport Companies Facing The COVID-19 Pandemic. Gospod. Mater. Logistyka 2021, 5, 8–16. [Google Scholar] [CrossRef]

- Qiu, W.; Rutherford, S.; Mao, A.; Chu, C. The Pandemic and its Impacts. Health Cult. Soc. 2017, 9–10, 3–11. [Google Scholar] [CrossRef]

- Seberini, A.; Tokovska, M. Impact of the COVID-19 Pandemic on Changing the Content of Social Media Advertising. Studio Ecol. Bioethicae 2021, 19, 61–71. [Google Scholar] [CrossRef]

- Krajewski, M.; Frączkowik, M.; Kubacka, M.; Rogowski, Ł. The bright side of the crisis. The positive aspects of the COVID-19 pandemic according to the Poles. Eur. Soc. 2020, 23, S777–S790. [Google Scholar] [CrossRef]

| Sustainability | ||

|---|---|---|

Social dimension:

| The economic dimension:

| Environmental dimension:

|

| Demographic Characteristics | Participation | Percentage (%) |

|---|---|---|

| The legal and organisational form of the company | ||

| corporation | 29 | 40.85 |

| partnership | 25 | 35.21 |

| sole proprietorship | 17 | 23.94 |

| Scope of action | ||

| logistics company | 24 | 33.80 |

| transport and shipping company | 26 | 36.62 |

| transport company | 21 | 29.58 |

| Range of action | ||

| national | 33 | 46.48 |

| international | 38 | 53.52 |

| Period of operation | ||

| up to 10 years | 32 | 45.07 |

| over 10 years | 39 | 54.93 |

| Number of employees | ||

| up to 10 | 21 | 29.58 |

| 11 to 49 | 18 | 25.35 |

| from 50 to 249 | 12 | 16.90 |

| above 249 | 20 | 28.17 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Figura, J.; Gądek-Hawlena, T. The Impact of the COVID-19 Pandemic on the Development of Electromobility in Poland. The Perspective of Companies in the Transport-Shipping-Logistics Sector: A Case Study. Energies 2022, 15, 1461. https://doi.org/10.3390/en15041461

Figura J, Gądek-Hawlena T. The Impact of the COVID-19 Pandemic on the Development of Electromobility in Poland. The Perspective of Companies in the Transport-Shipping-Logistics Sector: A Case Study. Energies. 2022; 15(4):1461. https://doi.org/10.3390/en15041461

Chicago/Turabian StyleFigura, Janusz, and Teresa Gądek-Hawlena. 2022. "The Impact of the COVID-19 Pandemic on the Development of Electromobility in Poland. The Perspective of Companies in the Transport-Shipping-Logistics Sector: A Case Study" Energies 15, no. 4: 1461. https://doi.org/10.3390/en15041461