Integration of European Electricity Balancing Markets

Abstract

:1. Introduction

2. European Commission Regulations on the Electricity Market Integration

- Regulation 1222/2015/EC of 24 July 2015 establishing a guideline on capacity allocation and congestion management [13]: This regulation includes detailed provisions on cross-zonal capacity (CZC) allocation and congestion management. The most remarkable provisions are the following:

- (a)

- The introduction of the flow-based transmission capacity calculation methodology. It is noted that in specific cases, if required, the net transmission capacity-based methodology can apply. The core advantage of the former is that it takes into account the physical flows on the interconnections, which are being calculated in accordance with the physical laws (Kirchhoff’s Laws) [14]. In other words, physical flows on interconnectors are different from the respective scheduled commercial power exchanges in the sense that, in reality, electricity flows from an exporting market area to an importing one through different paths (interconnectors) and not directly through the interconnector connecting such market areas (there is a distinction between the physical and economic perspectives). For example, in a highly meshed network as is the European one, a scheduled commercial exchange between Germany and France will partially flow directly between the two countries since the other portion will go through the routes Netherlands-Belgium-France, Switzerland-France and Switzerland-Italy-France. Hence, it becomes apparent that the latter methodology (net transmission capacity-based) fails in meshed electricity networks since it ignores the physical perspective;

- (b)

- The adoption of the implicit capacity allocation approach. In accordance with this allocation approach, the capacity between two market areas is allocated based on the market price difference between such market areas, and a netting of the flows in opposite directions may be achieved;

- (c)

- The definition of capacity calculation regions (CCRs) is geographic areas in which a coordinated capacity calculation is applied. According to [15], eight CCRs have been defined: Baltic (Poland, Lithuania, Estonia, and Latvia), Core (France, Belgium, The Netherlands, Germany, Austria, Czech Republic, Slovakia, Poland, Croatia, Hungary, and Romania), Greece-Italy, Hansa (The Netherlands, Germany, Poland, and Denmark), Italy North (Italy North, France, and Austria), Nordic (Sweden, Finland, and Denmark), South East Europe (Romania, Bulgaria, and Greece), and South West Europe (France, Spain, and Portugal).

- Regulation 2017/2195/EC of 23 November 2017 establishing a guideline on electricity balancing [16]: This regulation refers to the balancing markets and outlines the requirements that shall be met towards the integration of this market segment, namely: (a) the definition of common rules for the procurement and the settlement of balancing reserves (frequency containment reserves (FCR), automatic frequency restoration reserves (aFRR), manual frequency restoration reserves (mFRR), and replacement reserves (RR)); (b) the definition of standard balancing products to be exchanged between European market areas; (c) the establishment of common clearing platforms for the activation of balancing energy from aFRR, mFRR, and RR.

- Regulation 2017/1485/EC of 2 August 2017 establishing a guideline on electricity transmission system operation [17]: This regulation includes all the technical and operational guidelines that the European TSOs shall meet in order to ensure the normal functioning of their system networks and, consequently, the continuous supply of electricity.

3. Electricity Balancing Market Integration

3.1. High-Level Architecture of the Balancing Market

- (a)

- The balancing capacity market, which includes all the required actions taken proactively by a TSO in order to reserve well in advance enough balancing capacity from the balance service providers (BSPs) so as to be able to cover, in real-time, its imbalance needs by activating such reserves. In other words, the TSO secures the availability of BSPs that may be requested in real-time, if needed, to provide balancing energy. According to Regulation 2017/1485/EC [17], there are the following four types of balancing capacity:

- FCR, also called a primary control reserve;

- aFRR, also called a secondary control reserve;

- mFRR, also called a fast tertiary control reserve or load-following reserve in the U.S.;

- RR, also called slow tertiary control reserve.

- (b)

- The balancing energy market, which includes all the required actions taken by a TSO in order to activate the capacity reserved in the balancing capacity market. Depending on the magnitude and direction (short or long) of the system imbalance (being the difference between demand and supply at each dispatch period), the TSO activates the appropriate volume of balancing energy. In general, in the case of a system shortage, upward balancing energy orders (BEOs) are activated, whereas in the case of a system surplus, downward BEOs are accepted for activation. The acceptance of the BEOs is based on their respective offer prices, and the general rule is that the upward orders with the lowest price and the downward orders with the highest price are accepted first to cover the system imbalance needs. Notably, the TSO compensates the BSPs for the provision of upward balancing energy while, on the other hand, BSPs pay back the TSO for the provision of downward balancing energy. Regarding the activation sequence of the reserves (Figure 2), the following is valid:

- FCR constitutes the fastest balancing service to face a disturbance between supply and demand. It is activated within seconds (up to 30 s) after the appearance of the disturbance, and it is automatically provided through the kinetic energy of the connected generators. Its core objective is to stabilize the grid frequency to a new acceptable level close to the respective nominal frequency (50 Hz). It is noted that in the case of interconnected power systems, all systems jointly contribute to the provision of such a service. FCR is also called “primary reserve” in other ancillary services markets;

- aFRR is utilized for the full restoration of the nominal grid frequency, and it is activated for up to 5–7.5 min after a disturbance. Unlike FCR, in the case of interconnected power systems, aFRR is activated only in the power system where the imbalance is experienced. aFRR is also called “secondary reserve” in other markets and “regulation” in the U.S. RTOs;

- mFRR is utilized to release aFRR and it is activated for up to 12.5–15 min after a disturbance; mFRR can be included in the broader scope of tertiary control and can also be named “fast tertiary reserve” or “load-following reserve” [20]. mFRR is used for “load following” purposes, i.e., it helps to manage the system load and RES injection variability and uncertainty for timeframes that exceed 10 min [21];

- RR is utilized to release or support the required level of FRR potential, so that the latter is available for future imbalances, and it is activated from 30 min to 60 min after a disturbance. RR is also included in the broader scope of tertiary control and can be named “slow tertiary reserve” or “contingency reserve”.

- (c)

- The imbalance settlement is an ex-post process that allocates the costs derived from the operation of the balancing capacity and balancing energy markets to the balance responsible parties (BRPs), for example, to retailers with non-dispatchable load portfolios or to RES aggregators with non-dispatchable RES portfolios, based on the concept of balance responsibility. BRPs are entities that undertake the responsibility for settling the imbalances between their market schedules, as obtained from the clearing of the respective spot markets (day-ahead and intra-day) and the metered/allocated production (for RES aggregators) or consumption (for retailers). Such imbalances are penalized, and they are settled at the imbalance price. In general, BRPs with a short position pay to the TSO the respective amounts, while BRPs with a long position get paid by the TSO. There are several imbalance settlement schemes, such as single pricing (which is the preferred scheme for the European Commission [16]), dual pricing, as well as variations of these with additive cost components. A detailed analysis follows in Section 3.2.

3.2. Design Variables for Balancing Market Harmonization and Integration

- Dispatch period: the time-interval (usually quarter-hourly) over which the BEOs are activated [26];

- Imbalance settlement period: the time-interval (hourly, half-hourly, or quarter-hourly) over which the BRP imbalances are calculated and settled [26]. For example, Greece, Germany, Belgium, The Netherlands, Austria, Slovakia, Hungary, and Romania apply a quarter-hourly imbalance settlement period [28]. While France and Ireland are the only control areas to apply a half-hourly settlement period, while the Nordic countries and Spain apply an hourly settlement period [28]. It is noted that the shorter the imbalance settlement period, the more challenging it is for BRPs to be balanced, and hence accurate forecasting processes shall be developed;

- Balancing products: there are three types of balancing products, namely, FCR, FRR (with manual and automatic activation), and RR, for which different procurement processes and system/zonal requirements may be defined;

- Timings of the balancing market: the timings include the gate opening and closure times for the submission of BEOs by BSPs and imbalance needs by TSOs as well as the appropriate coordination with the clearing timings of the spot markets (day-ahead and intra-day markets);

- Procurement mechanism: BSPs provide balancing services to the TSO through bidding in the balancing market using specific types of balancing products. Another way for procuring balancing services is the bilateral contracting between the TSOs and the BSPs;

- Reserve requirements: they constitute the required amount of power capacity that must be reserved in advance in order for a TSO to safeguard the generation/demand balance and the normal operation of the power system in real-time. For each of the above-defined balancing products, a different quantification method applies [29]. However, the exact quantification method per reserve type has been homogenized by ENTSO-E in the Regulation 2017/1485/EC (Article 153 for FCR, Article 157 for FRR and Article 160 for RR) [17];

- Order specifications: the BSPs shall submit BEOs respecting the order submission rules, such as the maximum and minimum order price limits, volume, location, activation time, activation duration and activation method. Obviously, in a coupled balancing market such requirements must be aligned between the involved TSOs (control areas), otherwise no coupling can be performed;

- Activation mechanism: it constitutes the process followed by a TSO for the activation of BEOs. There exist the following two main mechanisms: (a) pro-rata activation, where a TSO activates reserves to cover an imbalance in proportion to the size of the contracted reserves of each BSP; (b) merit-order activation, where a TSO covers its imbalance needs with the cheapest BEOs submitted by the BSPs. The former mechanism does not provide a signal of balancing prices, while the latter requires the existence of standard products [30,31]. The Regulation 2017/2195/EC [16] follows the second market-based approach. An additional factor for this variable is the time of activation. Notably, it is useful to distinguish between reactive and proactive activation. On one hand, reactive activation pursues curative objectives such as containing frequency deviation or restoring the frequency (FCR and FRR are principally deemed reactive processes since they observe the imbalance status and employ reserves to contain and restore the frequency) [32,33]. On the other hand, proactive activation follows preventive objectives such as reducing the future imbalance, creating reserve margins, or relieving congestion (RR can be classified as a proactive process);

- Balancing energy pricing mechanism: it constitutes the method used by a TSO for settling the activated BEOs. There are the following two pricing mechanisms, namely: (a) pay-as-bid pricing and (b) marginal pricing. With marginal pricing, all accepted BEOs are remunerated with the order price of the last (marginal) BEO activated from a merit order list. The main advantage of the pay-as-bid mechanism is the fact that the BSPs receive the price they bid, while the disadvantageous point is the lack of a clear market reference price. On the other hand, the marginal mechanism provides a transparent price derivation and imbalance price calculation, but it may lead to higher procurement costs and imbalance settlement prices [34]. In the marginal pricing scheme, the balancing energy prices can be regarded as an index of the very short-term marginal cost of increasing/decreasing production to achieve system balancing, thus it can provide the economic signals to potential investors of flexible resources for the expected revenues from providing frequency-response and flexibility services to the TSO. All European TSOs follow the marginal pricing scheme based on the provisions of Article 30 of Regulation 2017/2195/EC [16];

- Imbalance volume calculation methodology: the methodology through which imbalance volumes of BRPs are quantified varies across European TSOs. According to [35,36], there are the following three methodologies for the calculation of the imbalance volumes: (a) the first one considers that all generation and consumption resources are included in the same balance perimeter, thus they are part of the same BRP. Meaning that this BRP is responsible over the whole portfolio (both energy production and consumption), and that consumption imbalances could be offset by production imbalances (indicatively, this scheme is followed in France, Germany, Belgium, the Netherlands, and Poland [28]); (b) The second one under which all generation resources constitute one balance perimeter and all consumption resources constitute another balance perimeter, without having the possibility to net the imbalances among each other (indicatively, this scheme is followed in Spain, Norway, Finland, Sweden, and Denmark [28]). (c) each generating unit constitutes a separate balance perimeter of the BRP and all consumption resources constitute a distinct balance perimeter of the BRP (indicatively, this scheme is followed in Italy and Greece [28]);

- Imbalance pricing mechanism: the method used by a TSO to calculate the imbalance settlement price for a given imbalance settlement period, at which all debits/credits between BRPs and the TSO will be settled. This calculation is based on the prices of the upward and downward BEOs activated to cover the imbalance for the concerned imbalance settlement period. The controversial point in this variable is whether the imbalance settlement prices for a given position in the system (either short or long) shall be identical (single imbalance pricing) or not (dual imbalance pricing) [37,38]. In the former mechanism, as shown in Table 1, only one imbalance settlement price is derived, which applies to all BRPs, independently of their respective individual positions, and it is equal to the price that occurred for the dominant direction of the system imbalance. To be more precise, if the system is short, then the imbalance settlement price is equal to the price of the marginally accepted upward BEO for markets with marginal pricing or the average price of all accepted upward BEOs for markets with pay-as-bid pricing (Pup in Table 1). In the same vein, if the system is long, then the imbalance settlement price is equal to the price of the marginally accepted downward BEO for markets with marginal pricing or the average price of all accepted downward BEOs for markets with pay-as-bid pricing (Pdn in Table 1).

- (a)

- BRPs with the short position pay the price of the marginally accepted upward BEO or the average price of all accepted upward BEOs (Pup in Table 2) and BRPs with long position get paid at the price of the marginally accepted downward BEO or at the average price of all accepted downward BEOs (Pdn in Table 2);

- (b)

- BRPs with the opposite position against the system position pay or get paid at the price of the day-ahead market [39] (PDAM in Table 3), while BRPs with the same position against the system position pay or get paid at the price of the marginally accepted upward or downward BEO or at the average price of all accepted upward or downward BEOs (Pup and Pdn in Table 3).

- Timing of settlement: the frequency (weekly or monthly) and time of financial settlement between the TSOs and BSPs for the provided balancing services and between the TSOs and BRPs for the imbalances of the latter;

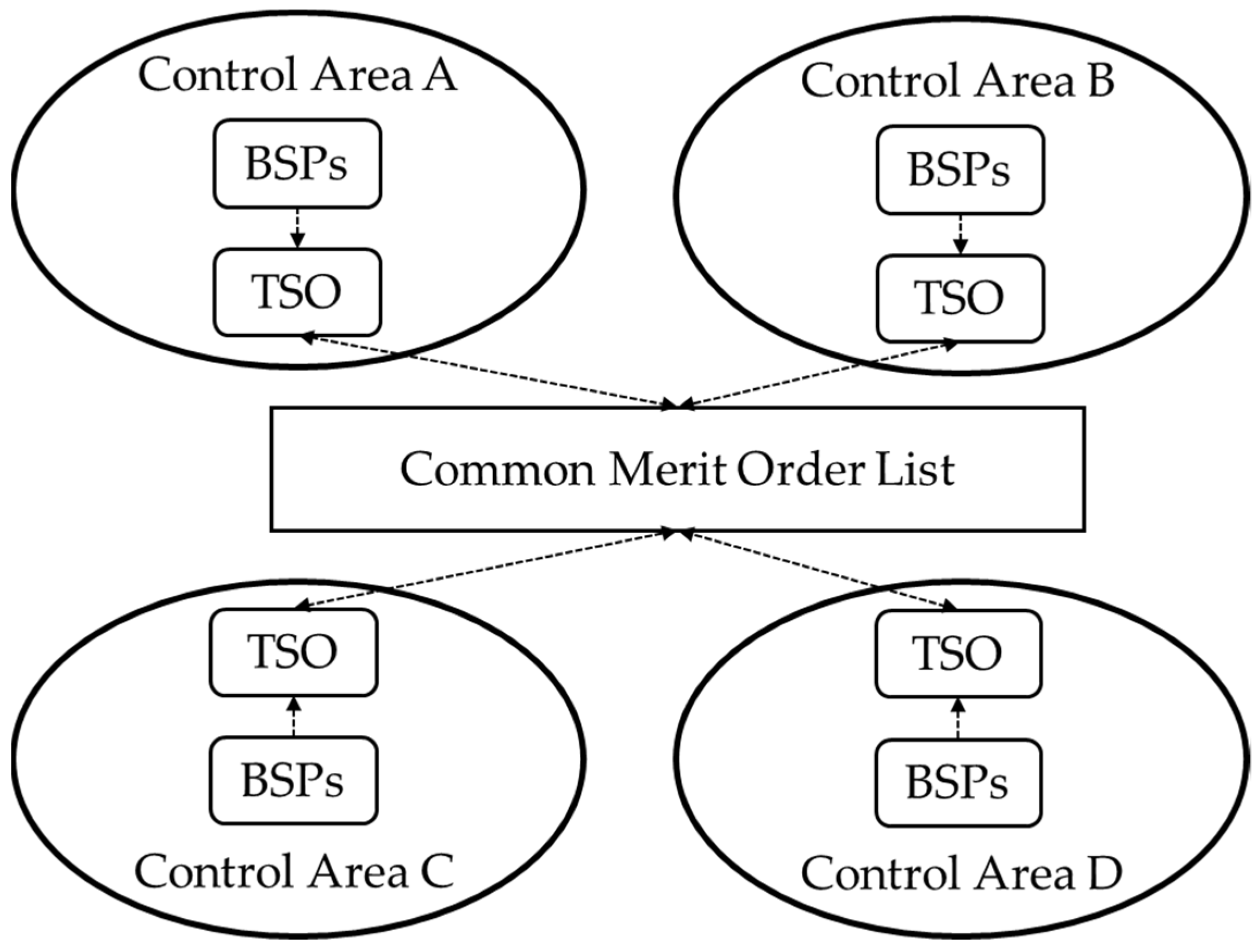

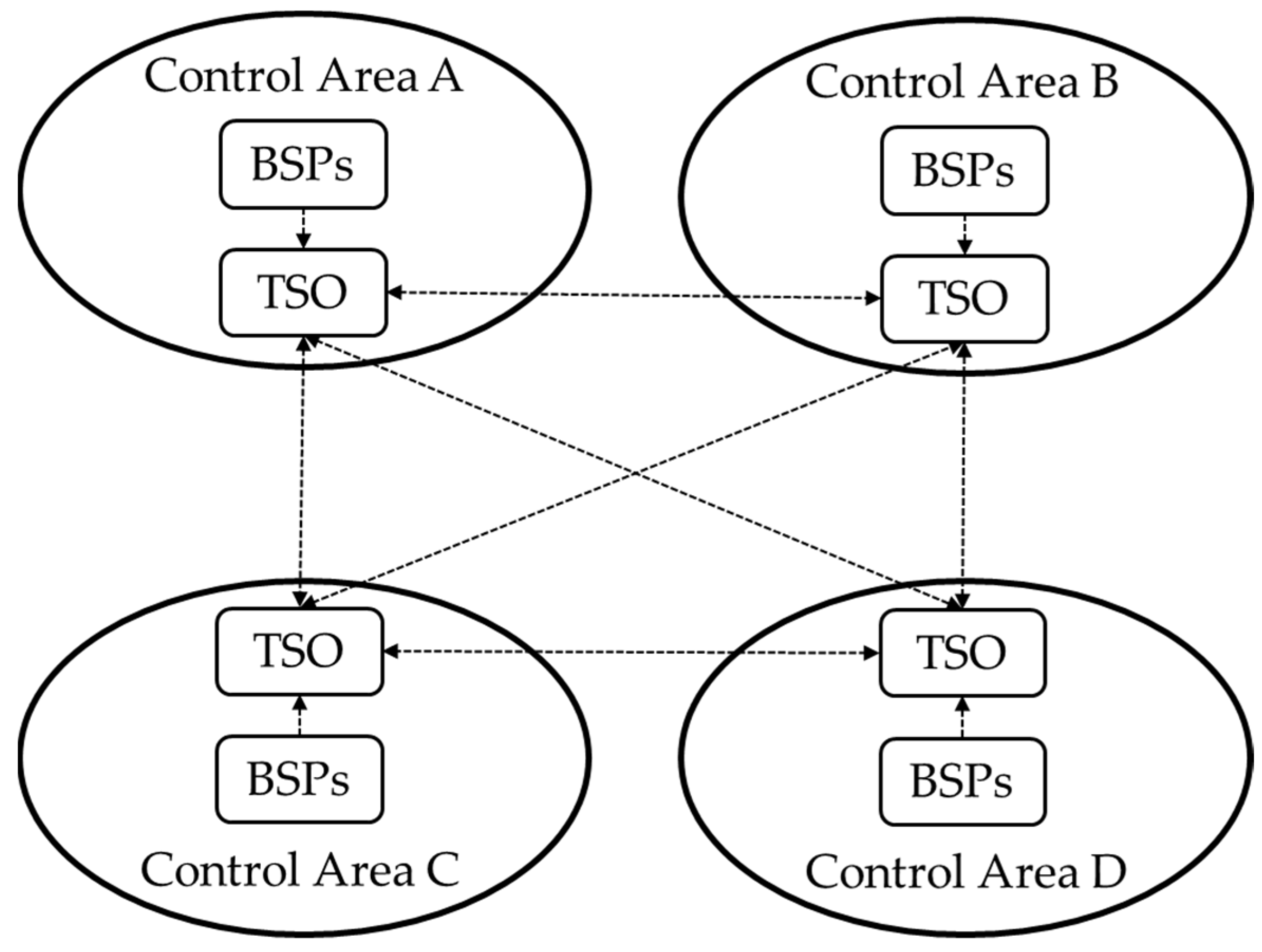

- Integration model: There are the following three integration models for the balancing markets: (a) the BSP-TSO model; (b) the TSO-TSO with a common merit order list; (c) the TSO-TSO without a common merit order list. The preferable integration model in the Regulation 2017/2195/EC is the TSO-TSO with common merit order list. Detailed provisions on each of the above integration models are provided in Section 3.3.2, Section 3.3.3 and Section 3.3.4 below.

3.3. Main Balancing Market Integration Models

3.3.1. Imbalance Netting

- The TSO A pays to the TSO B the amount 30 × EUR 25 = EUR +750;

- The financial benefits for TSO A amount to EUR 2700−EUR 750 = EUR 1950;

- The financial losses for TSO B amount to EUR 750−EUR 1200 = EUR −450;

- The increase in the overall welfare amounts to EUR 1950−EUR 450 = EUR 1500.

3.3.2. BSP-TSO Model

- (a)

- BSPs are permitted to participate only in one balancing market by explicitly declaring their preference. In principle, BSPs tend to participate in balancing markets with high balancing energy prices for profit maximization purposes. Of course, this strategy results in higher balancing energy prices in the control areas with low balancing energy prices;

- (b)

- BSPs are permitted to participate in more than one balancing market. This case poses challenging tasks to the respective TSOs since they have to deal with high uncertainties regarding the availability and activation of BEOs so as to cover their imbalance needs. Consequently, strict and concrete allocation processes must be defined.

3.3.3. TSO-TSO with Common Merit Order List

3.3.4. TSO-TSO without Common Merit Order List

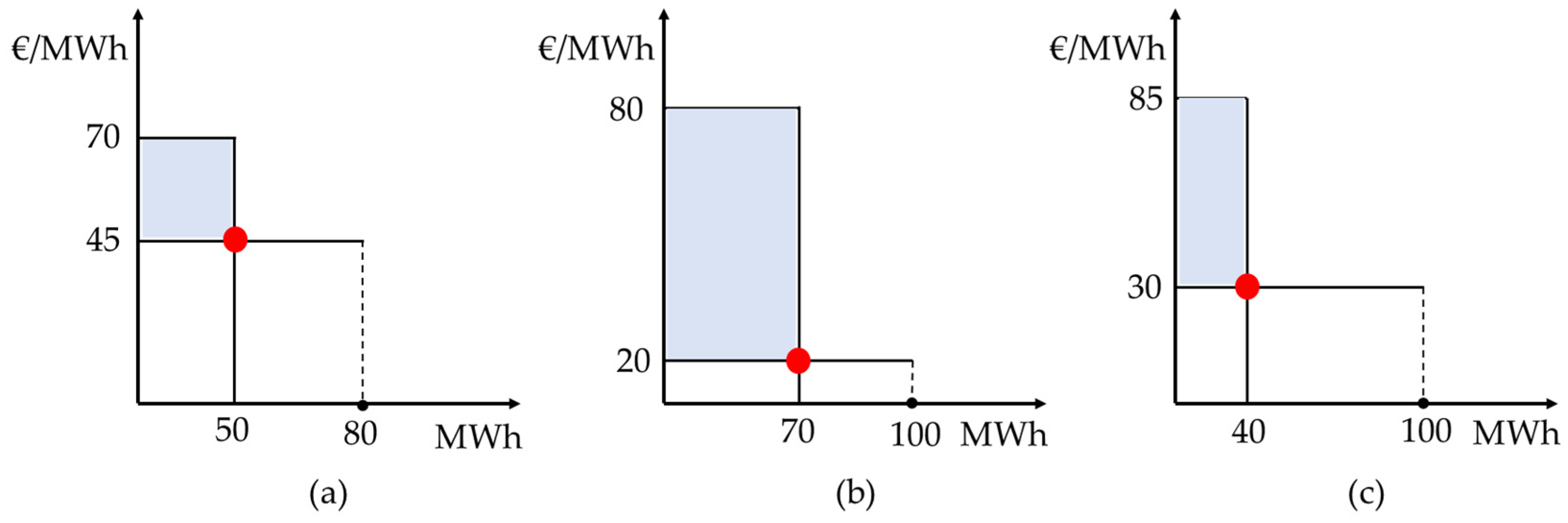

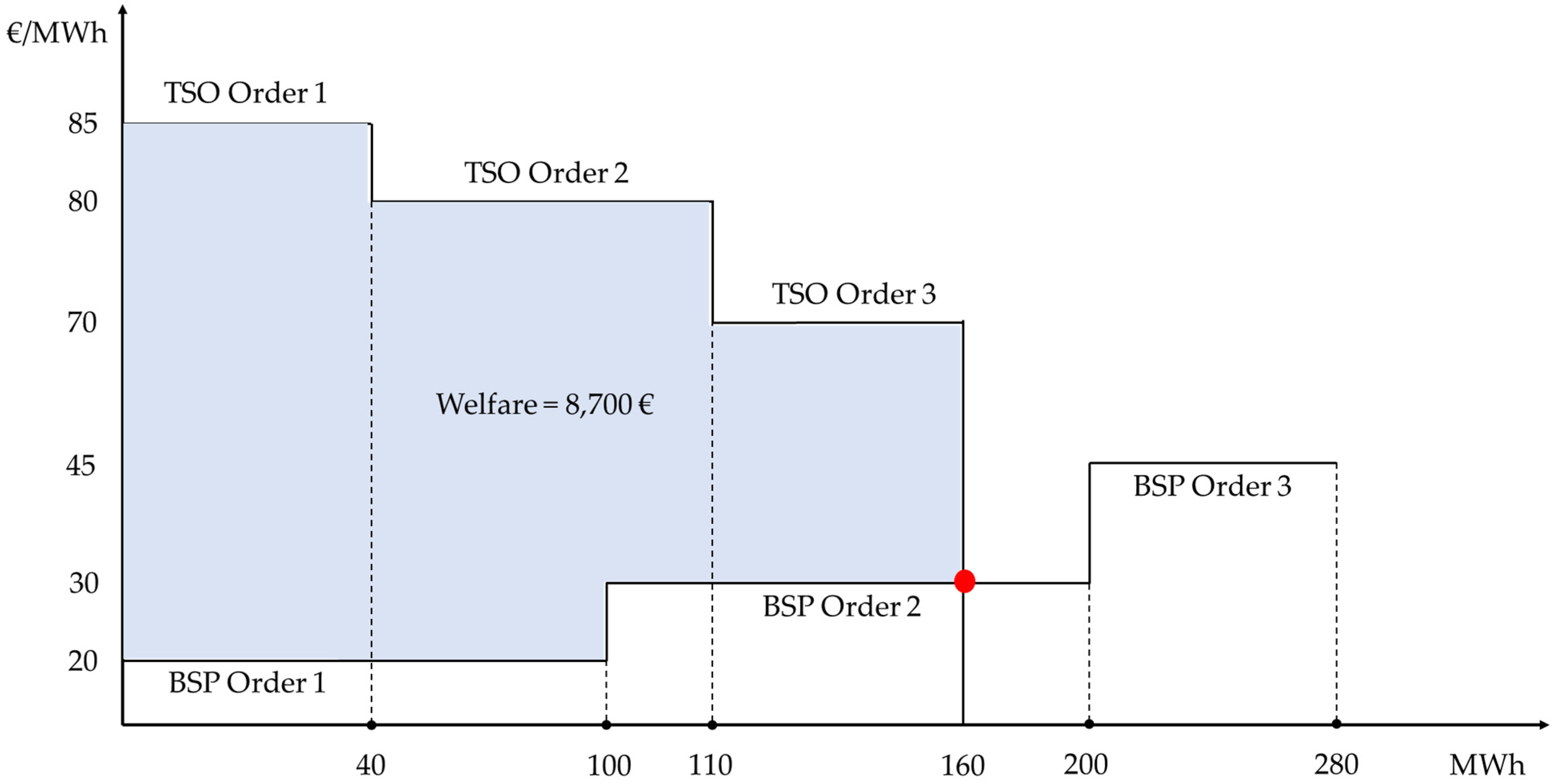

4. Example of Three Integrated Balancing Markets with Common Merit Order List

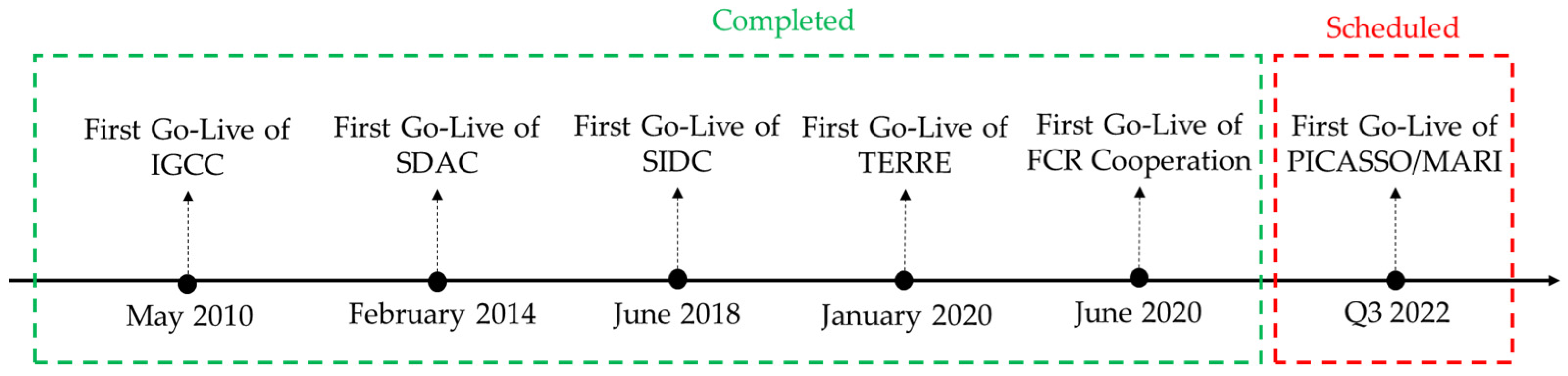

5. European Balancing Market Integration Projects

5.1. Introduction

- FCR cooperation;

- International Grid Control Cooperation (IGCC);

- Platform for the International Coordination of Automated Frequency Restoration and Stable System Operation (PICASSO);

- Manually Activated Reserves Initiative (MARI);

- Trans European Replacement Reserves Exchange (TERRE);

5.2. Balancing Market Initiatives

5.2.1. FCR Cooperation

5.2.2. International Grid Control Cooperation (IGCC)

5.2.3. Platform for the International Coordination of Automated Frequency Restoration and Stable System Operation (PICASSO)

5.2.4. Manually Activated Reserves Initiative (MARI)

5.2.5. Trans European Replacement Reserves Exchange (TERRE)

5.2.6. Exchange and Sharing of Reserves

6. Existing Literature in Balancing Market Integration

7. Conclusions

Author Contributions

Funding

Conflicts of Interest

Abbreviations

| ACER | Agency for the Coopeartion of Energy Regulators |

| aFRR | Automatic frequency restoration reserve |

| AGC | Automatic generation control |

| BEO | Balancing energy order |

| BESS | Battery energy storage system |

| BM | Balancing market |

| BRP | Balance responsible party |

| BSP | Balance service provider |

| CA | Control area |

| CCR | Capacity calculation region |

| CMOL | Common merit order list |

| CZC | Cross-zonal capacity |

| DAM | Day-ahead market |

| DC | Direct current |

| EC | European Commission |

| ENTSO-E | European Network of Transmission System Operators for Electricity |

| EUPHEMIA | European Hybrid Electricity Market Integration Algorithm |

| FCR | Frequency containment reserve |

| IEM | Internal Energy Market |

| IGCC | International Grid Control Cooperation |

| IDM | Intra-day market |

| JAO | Joint allocation office |

| LP | Linear programming |

| mFRR | Manual frequency restoration reserve |

| MARI | Manually Activated Reserves Initiative |

| MILP | Mixed integer linear programming |

| MRC | Multi regional coupling |

| NEMOs | Nominated electricity market operators |

| NLP | Non-linear programming |

| NRA | National regulatory authorities |

| OCGT | Open cycle gas turbine |

| PICASSO | Platform for the International Coordination of Automated Frequency Restoration and Stable System Operation |

| RES | Renewable energy sources |

| RR | Replacement reserve |

| RTO | Regional transmission operator |

| SDAC | Single day-ahead coupling |

| SIDC | Single intra-day coupling |

| TERRE | Trans European Replacement Reserves Exchange |

| TSO | Transmission system operator |

| XBID | Cross-border intra-day |

References

- European Parliament. Internal Energy Market. Available online: https://bit.ly/3H1mUR2 (accessed on 3 January 2022).

- European Commission. Directive 96/92/EC of the European Parliament and of the Council of 19 December 1996 Concerning Common Rules for the Internal Market in Electricity. Available online: https://bit.ly/3H4clg3 (accessed on 3 January 2022).

- European Commission. Directive 2003/54/EC of the European Parliament and of the Council of 26 June 2003 Concerning Common Rules for the Internal Market in Electricity and Repealing Directive 96/92/EC. Available online: https://bit.ly/32xcJVj (accessed on 3 January 2022).

- European Commission. Regulation (EC) No 1228/2003 of the European Parliament and of the Council of 26 June 2003 on Conditions for Access to the Network for Cross-Border Exchanges in Electricity. Available online: https://bit.ly/3fXCIrX (accessed on 3 January 2022).

- European Commission. Directive 2009/72/EC of the European Parliament and of the Council of 13 July 2009 Concerning Common Rules for the Internal Market in Electricity and Repealing Directive 2003/54/EC. Available online: https://bit.ly/3r0EsXH (accessed on 3 January 2022).

- European Commission. Regulation (EC) No 713/2009 of the European Parliament and of the Council of 13 July 2009 Establishing an Agency for the Cooperation of Energy Regulators. Available online: https://bit.ly/348wS4e (accessed on 3 January 2022).

- European Commission. Regulation (EC) No 714/2009 of the European Parliament and of the Council of 13 July 2009 on Conditions for Access to the Network for Cross-Border Exchanges in Electricity and Repealing Regulation (EC) No 1228/2003. Available online: https://bit.ly/3H7kqR1 (accessed on 3 January 2022).

- European Wind Energy Association. Creating the Internal Energy Market in Europe. Available online: https://bit.ly/3qZdrDX (accessed on 3 January 2022).

- Vandezande, L. Design and Integration of Balancing Markets in Europe. Ph.D. Thesis. Available online: https://bit.ly/33Js8CF (accessed on 3 January 2022).

- Oksanen, M.; Karjalainen, R.; Viljainen, S.; Kuleshov, D. Electricity Markets in Russia, the US, and Europe. In Proceedings of the 6th International Conference on the European Energy Market, Leuven, Belgium, 27–29 May 2009; pp. 1–7. [Google Scholar] [CrossRef]

- AEMO. The National Electricity Market. Available online: https://bit.ly/3J1ABAb (accessed on 10 February 2022).

- Li, Y.; Chang, Y.; Hoong, C.F.; Sharma, S. Business Model and Market Design for ASEAN Electricity Market Integration: Principles, Practicalities, and Conditions for Success. ERIA Research Project Report 2015–2016. Available online: https://bit.ly/362qw7B (accessed on 10 February 2022).

- ENTSO-E. Commission Regulation (EU) 1222/2015 of 24 July 2015 Establishing a Guideline on Capacity Allocation and Congestion Management. Available online: https://bit.ly/3H4EZNR (accessed on 3 January 2022).

- Kurzidem, M. Analysis of Flow-Based Market Coupling in Oligopolistic Power Markets. Ph.D. Thesis. Available online: https://bit.ly/3u0DY60 (accessed on 3 January 2022).

- ENTSO-E. Capacity Calculation Regions. Available online: https://bit.ly/3sv6SbY (accessed on 3 January 2022).

- ENTSO-E. Commission Regulation (EU) 2017/2195 of 23 November 2017 Establishing a Guideline on Electricity Balancing. Available online: https://bit.ly/3fY3gtc (accessed on 3 January 2022).

- ENTSO-E. Commission Regulation (EU) 2017/1485 of 2 August 2017 Establishing a Guideline on Electricity Transmission System Operation. Available online: https://bit.ly/3GvtP3C (accessed on 3 January 2022).

- ENTSO-E. Electricity Balancing in Europe. Available online: https://bit.ly/3oKxXqC (accessed on 3 January 2022).

- Vandezande, L.; Meeus, L.; Belmans, R.; Saguan, M.; Glachant, J.M.; Rious, V. Lacking Balancing Market Harmonisation in Europe: Room for Trader Profits at the Expense of Economic Efficiency? HAL 2009. post-print. Available online: https://bit.ly/3uM0waX (accessed on 3 January 2022).

- Bakirtzis, E.A.; Chatzigiannis, D.I.; Ntomaris, A.V.; Simoglou, C.K.; Biskas, P.N.; Labridis, D.P.; Bakirtzis, A.G. Determination of load-following reserves in power systems with high wind penetration: An application to the Greek power system. In Proceedings of the 2014 Power Systems Computation Conference, Wroclaw, Poland, 18–22 August 2014. [Google Scholar] [CrossRef]

- U.S. Department of Energy. Electric Market and Utility Operation Terminology. Available online: https://bit.ly/3urNvmP (accessed on 3 January 2022).

- ENTSO-E. Enhancing Regional Cooperation. Available online: https://bit.ly/3JpUtx0 (accessed on 6 January 2022).

- CIGRE. Harmonization and Integration of National Balancing Markets in Europe–Regulatory Challenges. Available online: https://bit.ly/3r0fF6b (accessed on 6 January 2022).

- Doorman, G.; van der Veen, R. An analysis of design options for markets for cross-border balancing of electricity. Util. Policy 2013, 27, 39–48. [Google Scholar] [CrossRef]

- Rebours, Y.; Kirschen, D.; Trotignon, M. Fundamental Design Issues in Markets for Ancillary Services. Electr. J. 2007, 20, 26–34. [Google Scholar] [CrossRef]

- van der Veen, R.A.C.; Hakvoort, R.A. The electricity balancing market: Exploring the design challenge. Util. Policy 2016, 43, 186–194. [Google Scholar] [CrossRef] [Green Version]

- Röben, F. Comparison of European Power Balancing Markets—Barriers to Integration. In Proceedings of the 15th International Conference on the European Energy Market (EEM), Lodz, Poland, 27–29 June 2018; pp. 1–6. [Google Scholar] [CrossRef]

- ENTSO-E. Survey on Ancillary Services Procurement, Balancing Market Design 2020. Available online: https://bit.ly/3J4NPvN (accessed on 6 January 2022).

- Frunt, J.; Kling, W.; van den Bosch, P. Classification and quantification of reserve requirements for balancing. Electr. Power Syst. Res. 2010, 80, 1528–1534. [Google Scholar] [CrossRef]

- Meeus, L. The Evolution of Electricity Markets in Europe. Available online: https://bit.ly/3tWhMKd (accessed on 8 January 2022).

- Avramiotis-Falireas, I.; Zolotarev, P.; Ahmadi-Khatir, A.; Zima, M. Analysis and Comparison of Secondary Frequency Control Reserve Activation Rules: Pro-rata vs. Merit Order. In Proceedings of the 2014 Power Systems Computation Conference, Wroclaw, Poland, 18–22 August 2014; pp. 1–7. [Google Scholar] [CrossRef]

- Håberg, M. Optimal Activation and Congestion Management in the European Balancing Energy Market. Ph.D. Thesis. Available online: https://bit.ly/3KLFQWc (accessed on 8 January 2022).

- Håberg, M.; Doorman, G. Classification of balancing markets based on different activation philosophies: Proactive and reactive designs. In Proceedings of the 13th International Conference on the European Energy Market (EEM), Porto, Portugal, 6–9 June 2016; pp. 1–5. [Google Scholar] [CrossRef]

- European Commission. Impact Assessment. Available online: https://bit.ly/32A9sEI (accessed on 8 January 2022).

- Vandezande, L.; Meeus, L.; Belmans, R. The Next Step in the Central Western European Electricity Market: Cross-Border Balancing. Available online: https://bit.ly/3fY7qkO (accessed on 8 January 2022).

- van der Veen, R.A.C.; Abbasy, A.; Hakvoort, R.A. A Comparison of Imbalance Settlement Designs and Results of Germany and The Netherlands. Available online: https://bit.ly/3IAP0Tt (accessed on 8 January 2022).

- Ntomaris, A.; Marneris, I.; Biskas, P.; Bakirtzis, A. Optimal participation of RES aggregators in electricity markets under main imbalance pricing schemes: Price taker and price maker approach. Electr. Power Syst. Res. 2022, 206, 107786. [Google Scholar] [CrossRef]

- Vandezande, L.; Meeus, L.; Belmans, R.; Saguan, M.; Glachant, J. Well-functioning balancing markets: A prerequisite for wind power integration. Energy Policy 2010, 38, 3146–3154. [Google Scholar] [CrossRef] [Green Version]

- Morales, J.M.; Conejo, A.J.; Madsen, H.; Pinson, P.; Zugno, M. Integrating Renewables in Electricity Markets; International Series in Operations Research & Management Science; Springer: Boston, MA, USA, 2014. [Google Scholar] [CrossRef]

- Nordic TSOs Report. Analysing Different Alternatives for Single Pricing Model Implementation Timeline. Available online: https://bit.ly/3rtcrYZ (accessed on 8 January 2022).

- Frontier Economics and Consentec. Benefits and Practical Steps towards the Integration of Intraday Electricity Markets and Balancing Mechanisms. Available online: https://bit.ly/3oKUWSt (accessed on 9 January 2022).

- ERGEG. Revised ERGEG Guidelines of Good Practice for Electricity Balancing Markets Integration (GGP-EBMI). Available online: https://bit.ly/3Jo3DtO (accessed on 9 January 2022).

- van der Veen, R.A.C.; Abbasy, A.; Hakvoort, R.A. A Qualitative Analysis of Main Cross-Border Balancing Arrangements. In Proceedings of the 7th International Conference on the European Energy Market, Madrid, Spain, 23–25 June 2010; pp. 1–6. [Google Scholar] [CrossRef] [Green Version]

- Van der Veen, R.A.C.; Abbasy, A.; Hakvoort, R.A. An Agent-Based Analysis of Main Cross-Border Balancing Arrangements for Northern Europe. In Proceedings of the IEEE Trondheim PowerTech, Trondheim, Norway, 19–23 June 2011; pp. 1–8. [Google Scholar] [CrossRef]

- Zani, A.; Rossi, S.; Migliavacca, G.; Auer, H. Toward the Integration of Balancing Markets. In Proceedings of the 12th International Conference on the European Energy Market (EEM), Lisbon, Portugal, 19–22 May 2015; pp. 1–5. [Google Scholar] [CrossRef]

- Esterl, T.; Kaser, S.; Zani, A. Harmonization Issues for Cross-Border Balancing Markets: Regulatory and Economic Analysis. In Proceedings of the 13th International Conference on the European Energy Market (EEM), Porto, Portugal, 6–9 June 2016; pp. 1–5. [Google Scholar] [CrossRef]

- Zolotarev, P. Social Welfare of Balancing Markets. In Proceedings of the 14th International Conference on the European Energy Market (EEM), Dresden, Germany, 6–9 June 2017; pp. 1–6. [Google Scholar] [CrossRef]

- Regelleistung. Information on Grid Control Cooperation and International Development. Available online: https://bit.ly/3tYKMAZ (accessed on 9 January 2022).

- Contu, M.; Allella, F.; Carlini, E.M.; Montone, S.; Pascucci, A.; Michi, L.; Pecoraro, G. The European Electricity Balancing Platforms and the Imbalance Netting Process: Terna’s Participation in the International Grid Control Cooperation. In Proceedings of the AEIT International Annual Conference (AEIT), Florence, Italy, 18–20 September 2019; pp. 1–6. [Google Scholar] [CrossRef]

- Avramiotis-Falireas, I.; Margelou, S.; Zima, M. Investigations on a Fair TSO-TSO Settlement for the Imbalance Netting Process in European Power System. In Proceedings of the 15th International Conference on the European Energy Market (EEM), Lodz, Poland, 27–29 June 2018; pp. 1–6. [Google Scholar] [CrossRef]

- ACER. Implementation Framework for the European Platform for the Exchange of Balancing Energy from Frequency Restoration Reserves with Manual Activation. Available online: https://bit.ly/36aQmGM (accessed on 10 February 2022).

- N-SIDE. MARI Algorithm Design Principles. Available online: https://bit.ly/3hWgyqZ (accessed on 10 February 2022).

- ENTSO-E. Frequency Containment Reserves (FCR). Available online: https://bit.ly/3nYmfYP (accessed on 10 January 2022).

- Tennet. The FCR Cooperation Reaches the Next Milestone in the Development of the Largest FCR Market in Europe. Available online: https://bit.ly/3G2xC8j (accessed on 10 January 2022).

- Next Kraftwerke. What is Frequency Containment Reserve (FCR)? Available online: https://bit.ly/3H5DUWh (accessed on 10 January 2022).

- Swissgrid. New Members Join International FCR Cooperation. Available online: https://bit.ly/35hanuy (accessed on 10 January 2022).

- ENTSO-E. Imbalance Netting. Available online: https://bit.ly/3r1mTXF (accessed on 10 January 2022).

- ENTSO-E. Platform for the International Coordination of Automated Frequency Restoration and Stable System Operation (PICASSO). Available online: https://bit.ly/3AxicYM (accessed on 10 January 2022).

- ENTSO-E. Automatic Frequency Restoration Reserve Process Implementation Guide. Available online: https://bit.ly/3r29Xk5 (accessed on 10 January 2022).

- ENTSO-E. Explanatory Note for the Calculation of Frequency Restoration Control Error Target Parameter for LFC Blocks of Synchronous Area Continental Europe. Available online: https://bit.ly/3u3AqzZ (accessed on 10 January 2022).

- Suman, M.; Venu Gopala Rao, M.; Naga Kumar, G.R.S.; Chandra Sekhar, O. Load Frequency Control of Three-Unit Interconnected Multimachine Power System with PI and Fuzzy Controllers. In Proceedings of the International Conference on Advances in Electrical Engineering (ICAEE), Vellore, India, 9–11 January 2014; pp. 1–5. [Google Scholar] [CrossRef]

- Kaur, H.; Kumar, P.; Sinha, S.K.; Tayal, V.K. Automatic Generation Control Using PSO Optimized PI and Optimal Fuzzy Controller. In Proceedings of the Annual IEEE India Conference (INDICON), New Delhi, India, 17–20 December 2015; pp. 1–6. [Google Scholar] [CrossRef]

- ENTSO-E. Survey on Ancillary Services Procurement, Balancing Market Design 2019. Available online: https://bit.ly/3G0TUHD (accessed on 10 January 2022).

- PICASSO Stakeholder Workshop Q&A Document. Available online: https://bit.ly/3r42hxX (accessed on 10 January 2022).

- aFRR-Platform Accession Roadmap. Available online: https://bit.ly/3J6HkZh (accessed on 10 January 2022).

- ENTSO-E. Manually Activated Reserves Initiative. Available online: https://bit.ly/3H4o6mI (accessed on 10 January 2022).

- mFRR-Platform Accession Roadmap. Available online: https://bit.ly/3uCdqrM (accessed on 10 January 2022).

- ENTSO-E. Trans European Replacement Reserves Exchange (TERRE). Available online: https://bit.ly/3KJ7lQ6 (accessed on 10 January 2022).

- ELEXON. Project MARI. Available online: https://bit.ly/3k9A5a1 (accessed on 11 January 2022).

- ENTSO-E. Operational Reserve Ad Hoc Team Report. Available online: https://bit.ly/3HAzdUA (accessed on 11 January 2022).

- Zani, A.; Migliavacca, G. Pan-European Balancing Market: Benefits for the Italian Power System. In Proceedings of the AEIT Annual Conference, Trieste, Italy, 19 September 2014; Available online: https://bit.ly/2F4WOhz (accessed on 11 January 2022).

- Frade, P.M.S.; Shafie-khah, M.; Santana, J.J.E.; Catalao, J.P.S. Cooperation in ancillary services: Portuguese strategic perspective on replacement reserves. Energy Strategy Rev. 2019, 23, 142–151. Available online: https://bit.ly/39AnCV4 (accessed on 11 January 2022). [CrossRef]

- Gebrekiros, Y.; Doorman, G. Balancing Energy Market Integration in Northern Europe—Modeling and Case Study. In Proceedings of the IEEE Power and Energy Society General Meeting, National Harbor, MD, USA, 27–31 July 2014; Available online: https://bit.ly/2sqdmOu (accessed on 11 January 2022).

- Farahmand, H.; Doorman, G. Balancing market integration in the Northern European continent. Appl. Energy 2012, 96, 316–326. [Google Scholar] [CrossRef]

- Abbasy, A.; van der Veen, R.A.C.; Hakvoort, R.A. Effect of Integrating Regulating Power Markets of Northern Europe on Total Balancing Costs. In Proceedings of the IEEE Bucharest PowerTech, Bucharest, Romania, 28 June–2 July 2009; pp. 1–7. [Google Scholar] [CrossRef]

- Abbasy, A.; van der Veen, R.A.C.; Hakvoort, R.A. Possible Effects of Balancing Market Integration on Performance of the Individual Markets. In Proceedings of the 8th International Conference on the European Energy Market (EEM), Zagreb, Croatia, 25–27 May 2011; pp. 608–613. [Google Scholar] [CrossRef]

- Jeriha, J.; Lakic, E.; Gubina, A.F. Innovative Solutions for Integrating the Energy Balancing Market (mFFR). In Proceedings of the 16th International Conference on the European Energy Market, Ljubljana, Slovenia, 18–20 September 2019; Available online: https://bit.ly/2Qr2Oq0 (accessed on 12 January 2022).

- Kannavou, M.; Zampara, M.; Capros, P. Modelling the EU Internal Electricity Market: The PRIMES-IEM Model. Energies 2019, 12, 2887. Available online: https://bit.ly/2syiNL9 (accessed on 12 January 2022). [CrossRef] [Green Version]

- Bellenbaum, J.; Weber, C.; Doorman, G.; Farahmand, H. Balancing Market Integration-Model-Based Analysis of Potential Cross-Border Reserve Exchange Between Norway and Germany. In Proceedings of the 15th International Conference on the European Energy Market (EEM), Lodz, Poland, 27–29 June 2018; pp. 1–5. [Google Scholar]

- European Commission. Impact Assessment on European Electricity Balancing Market. Available online: https://bit.ly/3r3TRXt (accessed on 14 January 2022).

- Newbery, D.; Strbac, G.; Viehoff, I. The benefits of integrating European electricity markets. Energy Policy 2016, 94, 253–263. [Google Scholar] [CrossRef] [Green Version]

- ACER/CEER. Annual Report on the Results of Monitoring the Internal Electricity and Natural Gas Markets in 2013. Available online: https://bit.ly/3AHG4sH (accessed on 14 January 2022).

- Roumkos, C.; Biskas, P.; Marneris, I. Modeling Framework Simulating the TERRE Activation Optimization Function. Energies 2020, 13, 2966. [Google Scholar] [CrossRef]

- Roumkos, C.; Biskas, P.N.; Marneris, I. Manual Frequency Restoration Reserve Activation Clearing Model. Energies 2021, 14, 5793. [Google Scholar] [CrossRef]

- European Commission. Study of the Interactions and Dependencies of Balancing Markets, Intraday Trade and Automatically Activated Reserves. Available online: https://bit.ly/3HcIodS (accessed on 14 January 2022).

- Fedele, A.; Benedettto, G.D.; Pascucci, A.; Pecoraro, G.; Allella, F.; Carlini, E.M. European Electricity Market Integration: The Exchange of Manual Frequency Restoration Reserves among Terna and the Other TSOs. In Proceedings of the AEIT International Annual Conference (AEIT), Catania, Italy, 23–25 September 2020; pp. 1–5. [Google Scholar] [CrossRef]

- Marneris, I.G.; Roumkos, C.G.; Biskas, P.N. Towards Balancing Market Integration: Conversion Process for Balancing Energy Offers of Central-Dispatch Systems. IEEE Trans. Power Syst. 2020, 35, 293–303. [Google Scholar] [CrossRef]

- Escudero Concha, C.; de Haan, J.E.S.; Virag, A.; Gibescu, M.; Kling, W.L. Towards a Pan-European Energy Balancing Market: Exercise on Coupling the United Kingdom and Continental Europe. In Proceedings of the 11th International Conference on the European Energy Market (EEM), Krakow, Poland, 28–30 May 2014; pp. 1–5. [Google Scholar] [CrossRef]

- Dallinger, B.; Auer, H.; Lettner, G. Impact of harmonised common balancing capacity procurement in selected Central European electricity balancing markets. Appl. Energy 2018, 222, 351–368. [Google Scholar] [CrossRef]

- Casimir, L.; Clemens, G. New Cross-Border Electricity Balancing Arrangements in Europe. Available online: https://bit.ly/35mj9Yf (accessed on 20 January 2022).

- Baldursson, F.; Lazarczyk, E.; Ovaere, M.; Proost, S. Cross-Border Exchange and Sharing of Generation Reserve Capacity. Energy J. 2018, 39, 39. [Google Scholar] [CrossRef]

- ACER. Market Monitoring Report 2020–Electricity Wholesale Market Volume. Available online: https://bit.ly/3nWYEYL (accessed on 17 January 2022).

| Single Pricing Mechanism | System Short | System Long |

|---|---|---|

| BRP short | Pup | Pdn |

| BRP long | Pup | Pdn |

| Dual Pricing Mechanism | System Short | System Long |

|---|---|---|

| BRP short | Pup | Pup |

| BRP long | Pdn | Pdn |

| Dual Pricing Mechanism | System Short | System Long |

|---|---|---|

| BRP short | Pup | PDAM |

| BRP long | PDAM | Pdn |

| Control Area | CA1 | CA2 | CA3 |

|---|---|---|---|

| TSO Orders | |||

| Price [EUR/MWh] | 70 | 80 | 85 |

| Quantity [MWh] | 50 | 70 | 40 |

| BSP BEOs | |||

| Price [EUR/MWh] | 45 | 20 | 30 |

| Quantity [MWh] | 80 | 100 | 100 |

| Order ID | Control Area | Price [EUR/MWh] | Quantity [MWh] |

|---|---|---|---|

| 1 | 2 | 20 | 100 |

| 2 | 3 | 30 | 100 |

| 3 | 1 | 45 | 80 |

| Order ID | Control Area | Price [EUR/MWh] | Quantity [MWh] |

|---|---|---|---|

| 1 | 3 | 85 | 40 |

| 2 | 2 | 80 | 70 |

| 3 | 1 | 70 | 50 |

| Ref. | Markets | Methodology | Modeling | Network CONSTRAINTS | Products Exchanged and Related Platforms | Imbalance Netting? | Integration Model | Case Study/Analysis Period | Balancing Cost Reduction [mEUR & %] |

|---|---|---|---|---|---|---|---|---|---|

| [71] | BM | Simulation | LP | Flow-based | Balancing energy from secondary and tertiary reserves (PICASSO and MARI) | Yes | TSO-TSO with CMOL | Italy, Austria, and Slovenia (one year) | 82.8 mEUR 60% |

| [72] | BM | Data analysis | - | - | RR (TERRE) | No | TSO-TSO with CMOL | Portugal, Spain, France (three years) | 13.4 mEUR 30% |

| [73] | BM | Simulation | MILP | NTC-based | Balancing energy | Yes | BSP-TSO | Nordic, Germany, The Netherlands (one year) | 26.1 mEUR 75% |

| [74] | DAM, BM | Simulation | MILP | NTC-based | Balancing capacity and energy | Yes | TSO-TSO with CMOL | Nordic, Germany, The Netherlands (one year) | 204 mEUR 75% |

| [75] | BM | Simulation | - | NTC-based | Balancing capacity and energy | Yes | TSO-TSO with CMOL | Nordic, Germany, The Netherlands (one year) | 80 mEUR 44.5% |

| [76] | BM | Simulation | - | - | Balancing energy from secondary reserves (PICASSO) | No | BSP-TSO | Norway, The Netherlands | - |

| [78] | DAM, IDM, BM | Simulation | MILP | Flow-based | Balancing capacity and energy | - | - | All EU Member States (one year) | 5800 mEUR 76% |

| [79] | DAM, BM | Simulation | - | NTC-based | aFRR (PICASSO) | - | - | Norway, Germany (three years) | - |

| [80] | BM | Simulation | NLP | NTC-based | Balancing energy from tertiary reserves (MARI and TERRE) | No | - | Great Britain, France (one year) | - |

| BM | Simulation | NLP | NTC-based | Balancing energy from tertiary reserves (MARI and TERRE) | Yes | - | Nordic (one year) | - | |

| [81] | DAM, IDM, BM | Data analysis | - | - | Balancing energy | - | - | Selected interconnectors (one year) | 1300 mEUR 41% |

| [83] | BM | Simulation | MILP | NTC-based | RR (TERRE) | Yes | TSO-TSO with CMOL | All countries participating in TERRE project | - |

| [84] | BM | Simulation | MILP | NTC-based | mFRR (MARI) | Yes | TSO-TSO with CMOL | All countries participating in MARI project | - |

| [85] | BM | Simulation | - | NTC-based | Balancing energy | Yes | TSO-TSO with CMOL | Belgium, France (one day) | 0.05 mEUR 6% |

| [86] | BM | Simulation | LP | NTC-based | mFRR (MARI) | No | - | Italy | - |

| [87] | BM | Simulation | MILP | NTC-based | RR (TERRE) | No | - | Greece | - |

| [88] | BM | Simulation | - | - | Primary reserves | - | - | United Kingdom, Continental Europe | - |

| [89] | BM | Simulation | MILP | Flow-based | aFRR and mFRR (PICASSO and MARI) | No | TSO-TSO with CMOL | Austria, Belgium, Germany, The Netherlands (one year) | - |

| [90] | DAM, BM | Simulation | MILP | NTC-based | aFRR and mFRR (PICASSO and MARI) | Yes | TSO-TSO with CMOL | Austria, Germany, Switzerland (one year) | - |

| [91] | BM | Simulation | - | - | aFRR (PICASSO) | - | - | Belgium, France, Germany, The Netherlands, Portugal, Spain (one year) | - |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Roumkos, C.; Biskas, P.N.; Marneris, I.G. Integration of European Electricity Balancing Markets. Energies 2022, 15, 2240. https://doi.org/10.3390/en15062240

Roumkos C, Biskas PN, Marneris IG. Integration of European Electricity Balancing Markets. Energies. 2022; 15(6):2240. https://doi.org/10.3390/en15062240

Chicago/Turabian StyleRoumkos, Christos, Pandelis N. Biskas, and Ilias G. Marneris. 2022. "Integration of European Electricity Balancing Markets" Energies 15, no. 6: 2240. https://doi.org/10.3390/en15062240

APA StyleRoumkos, C., Biskas, P. N., & Marneris, I. G. (2022). Integration of European Electricity Balancing Markets. Energies, 15(6), 2240. https://doi.org/10.3390/en15062240