Abstract

One of the conditions behind the development of any company is its capability of meeting the constantly changing challenges posed by the surrounding environment. Photovoltaics in Poland has been a boom industry in recent years. On 1 April 2022, new changes in photovoltaics came into force. A very short transition time will bring about serious problems to companies dealing in the photovoltaics branch since it has had an exceptionally short time to sufficiently prepare for the changes. The article presents results of a questionnaire-based survey conducted among 394 companies dealing in fitting photovoltaic installations in Poland. The subjects were selected for participation according to the purposive sample principle. The aim of the article was to present and analyze the entrepreneurs’ opinions concerning prospects for development in the nearest year to come. The alterations to the system of support of prosumers, which entered into force on 1 April 2022, will limit the interest in photovoltaic installations, which in turn will cause significant changes in the functioning of companies dealing in this business. Consequently, companies must make every effort to monitor and to interpret the events in their environment, to take appropriate actions to survive. About 80% of the companies will tend to use quality as a key differentiator in a crowded market. Firms adapt to the new situation and initiate both reactive and proactive responses. Almost 60% of the enterprises attach great importance to analyses of their competitors’ activities. Enterprises are aware of trends appearing on the market. A total of 28.9% of the surveyed enterprises consider the possibility of introducing new services (e.g., exploitation services) or new products (e.g., photovoltaic roofing-tiles or energy storage). It should be noted that the survey had been completed one week before the military conflict in Ukraine started. This poses limitations to the conclusions, which are too early to assess.

1. Introduction

The power industry has undergone considerable changes in recent years, including, among others, technological and legislative ones [1,2,3,4,5]. The fundamental global trend has advanced the departure from high-emission sources [4,5,6,7]. The climatic policy being implemented (assuming, among others, reduction in the emission of greenhouse gases) is resulting in transformations in the structure of energy production: by 2030, the amount of energy produced from renewable sources will have increased considerably [1,4,5]. Among the basic elements impacting on the changes observed in Poland, one can point to the following: safety regarding power production in the country, demand for power, energy production potential of coal-based power stations, EU directives concerning CO2 emissions and renewable energy sources, as well as transfer capacity of energy networks. According to forecasts, most of the energy obtained from renewable resources in Poland will come from biomass, solar energy, wind and heat pumps. The production of electric energy by individual sources will be influenced by both global trends relating to the power industry sector and strategies of energy producers that will be implemented [2,8,9,10,11]. Obviously, the development of the power industry sector in Poland and Europe will additionally be affected by the war in Ukraine. The European Commission has just put forward a plan for the European Union to stay independent from Russia in the domain of resources provided by this country: the REPowerEU relies on investments in power industry effectiveness and new installations of renewable energy sources.

Recent years have seen expansion of photovoltaic technologies [8,10,12,13]. Lowering of the costs of installing panels, coupled with improvement in their effectiveness [14,15], has brought about a rapid growth in application of this technology, along with the development of which the role of smaller energy production units of local character is growing. The photovoltaics sector in Poland owes its dynamic development to prosumers, while the increasing trend that has been observed in recent months has been a result of, among others, the decision on terminating the current so-called discount system. On 1 April 2022, a new clearing system came into effect. It differs completely from the one to date and the changes will affect only new prosumers. This caused a stir on the market and made potential prosumers, who had been undecided until then, make speedy investment decisions. According to the Energy Market Agency, at the end of November 2021, there were 791 thousand prosumers producing power from solar energy in Poland. Out of 7.1 GW of the power generated, as much as 5.4 GW came from these prosumers’ micro-installations [16].

Persons who had had their installation connected to the network by 31 March 2022 are entitled to benefit from the old (more favorable) clearing system for 15 years. In compliance with the discount system, the prosumer receives the surplus of generated energy that they did not use within the given year at the ratio 1:0.8 in the case of micro-installations of the generating capacity up to 10 kW and 1:0.7 regarding those exceeding 10 kW, respectively. With reference to the energy redelivered to the prosumer, the latter does not pay any distribution fees. To new prosumers, the current system is less advantageous. The changes will, among others, cause prolongation of the period of return and, additionally, prosumers will be put at a greater investment risk. Beginning from 1 April 2022 until 30 June 2022, new prosumers will be cleared according to the former regulations in force. Starting from 30 June 2022, they will automatically be subject to the net-billing system. Prosumers who have a micro-PV installation connected to the network after 31 March 2022 will be covered with the net-billing system automatically and the energy that is supplied by them into the system by 30 June 2022, but which is not consumed, will add to their prosumer’s deposit. In this period, the price of electric energy introduced by the prosumer into the network will be set at the level of the monthly market price. This will continue so until 1 July 2024.

The article presents results of a questionnaire-based survey conducted among companies dealing in fitting photovoltaic installations and running their businesses based in Poland. The initial study was carried out between 20 December 2021 and 15 February 2022. The aim of the article was to present and analyze the entrepreneurs’ opinions concerning prospects for development in the nearest year to come. On the basis of the literature of the subject, which was analyzed, research hypotheses were formulated. They were subject to verification in the examination executed for the needs of the article. The authors accepted the following main hypothesis: The alterations to the system of support of prosumers, which entered into force on 1 April 2022 will limit the interest in photovoltaic installations, which in turn will cause significant changes in the functioning of companies dealing in this business. The complex character of the presented hypothesis required formulating partial hypotheses being a detailed treatment of the main assumption.

2. Literature Review

Over several recent years, there has been conducted a series of studies on evaluating the site selection process for photovoltaic plants and impacts of various factors. In the medium to long term, many countries aim at low-carbon electricity transition, relying mainly on renewable solar energy and wind farms for power generation [17,18,19,20,21,22]. Regional suitability for solar energy is taken into consideration [23]. The generation potential depends on land suitability, including geographical factors (e.g., elevation, slope, land use, urban extent, population distribution, and proximity to the power grid), meteorological factors (e.g., solar irradiation, average temperature, and weather patterns) [23,24,25,26] or location factors (e.g., distance to urban areas, distance to main roads, and distance to power lines) [27]. The land potential causes distribution and differences in the concentration of deployed solar PV plants [28,29]. The production and installation of PV systems have an environmental impact [30]. The main constraints for PV system deployment are landscape deterioration and undesirable impacts on biodiversity [23,31,32].

PV systems can contribute to sustainable energy production in many regions in the European Union [23]. Castillo, Silva and Lavalle examined the potential of European regions regarding solar power generation. They created a European suitability map for the PV system deployment [23]. Shahnazi and Shabani examined spatial spillover of renewable energy production from one country to another. The results revealed that an increase in the average of neighboring countries’ renewable energy production increased the renewable energy production of a given country [33]. Elshurafa, Farag and Hobbs detailed three blind spots in energy transition policy. Policy support may: create demand that outstrips the domestic industries capacity in supply chains, underestimate the declining pace of costs of a new technology, and underestimate innovation potential in technologies [34].

Not all of the suitable areas can be utilized because of low economic feasibility (e.g., land cost, construction cost, initial investment, total revenue, maintenance cost, outage cost, distance to urban areas, distance to main roads, and distance to power lines) [24,27,35,36]. A simple explanation would relate differences in the concentration of deployed solar PV plants to the lower intensity of solar radiation in the northern regions of Europe. The examples of Poland and Germany demonstrate how a relevant policy has stimulated PV growth even in regions with moderate solar energy resources [37,38,39,40]. PV markets have evolved very unevenly across the EU countries over the past 20 years due to the list of laws, regulations, ordinances, and legislative framework in the form of tax incentives, rebates, and subsidies [41,42,43]. Government policies and public engagement campaigns can positively impact solar prosumerism [44]. Public support from structural funds enables member states to create new and renovate existing renewable energy source installations [45]. Stability of public support is very important. It offers predictability and security for investment in the renewable energy sector [46,47,48].

Germany and Spain were the first countries that supported the diffusion of PV technology on a larger scale by implementing effective feed-in tariff (FiT). Towards the end of the 2000s, both countries started to restrict their support policy. In 2008, Spain drastically reduced the tariffs and introduced a limit of supported installations. The regulatory changes introduced in Spain in 2012 to combat the tariff deficit and the instability in the electricity supply system created an unattractive market for investors. After a period of solar power development, a governmental decision changed the legislative framework, causing the activity to decrease. Renewable energy installations plateaued [47,48,49].

Campoccia, Dusonchet, Telaretti and Zizzo highlighted the main differences in the implementation of the feed-in tariff support policies adopted for PV systems in six countries (France, Germany, Greece, Italy, Spain and the UK) [49]. Atsu et al. discussed the state of solar PV in Hungary, considering available government support in terms of policies, targets, and the conducive environment for exploiting solar PV [50]. Janda examined the Slovak electricity market with a focus on photovoltaic energy [51]. Zdonek et al. presented the program subsidizing prosumer photovoltaic sources in Poland [52]. Green and Staffell discussed the contribution of taxes, subsidies, and regulations to British electricity decarbonization [53]. Briguglio and Formosa presented the subsidy scheme by the government of Malta, launched with a view to encouraging PV installation by households [54].

Deploying large amounts of PV as an intermittent energy source has put stress on the electricity grid [55]. Ensuring power system reliability (power distribution grids) under high penetrations of variable renewable energy is extremely important in order to formulate realistic solar PV targets and strategies [56,57,58]. Growing shares of renewable energy sources in the electricity system increase the need for flexible balancing of supply-dependent feed-in of renewable energy sources and time-varying demand. Besides flexible, conventional technologies and demand responses, storage is an important option [18]. A discussion about new options for storage technologies is emerging [59,60].

3. The Development of Photovoltaics in Poland

The advantageous conditions of the development of the photovoltaic energy generation system in Poland stem from a number of factors [15,16,37,38,52,61,62], among others: a rise in the ecological consciousness of Poles, the popularity of photovoltaic-generated energy with prosumers, support obtained by the latter within the Regional Operational Programs, the Infrastructure and Environment Program, as well as the government-launched program “My Power” (addressed to individual prosumers). However, even at the current rate of development, photovoltaics is not the only or sufficient solution allowing realization of the goals set by the EU to achieve by 2030. On the other hand, due to the short investment cycle, it is possible—within a relatively short period—to raise the share of energy obtained from renewable sources. The increase in the power capacity of photovoltaic farms will serve this purpose in the nearest years to come in the first place.

According to Solar Power Europe, in the year 2020, Poland took the fourth place in the EU (following Germany, the Netherlands and Spain) regarding accretion of the installed power of PV. In turn, analyses of the Institute for Renewable Energy showed that in the same year the number of people employed full time in the national PV sector amounted to 14.5 thousand, while the number of part-time workers in other forms of temporary employment reached 21 thousand (in total 35.5 thousand employees). The workers of the photovoltaics branch thus constitute a considerable group of stakeholders who are keen on developing the sector [16].

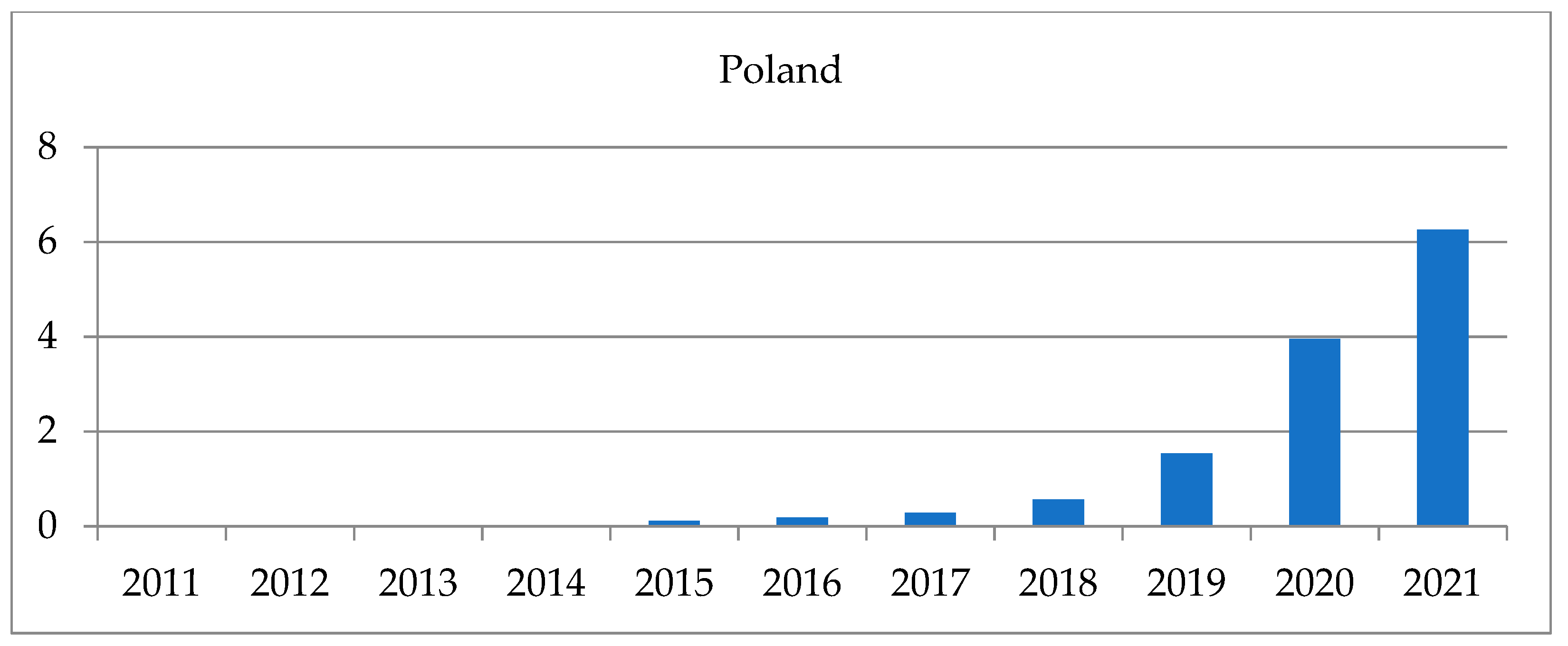

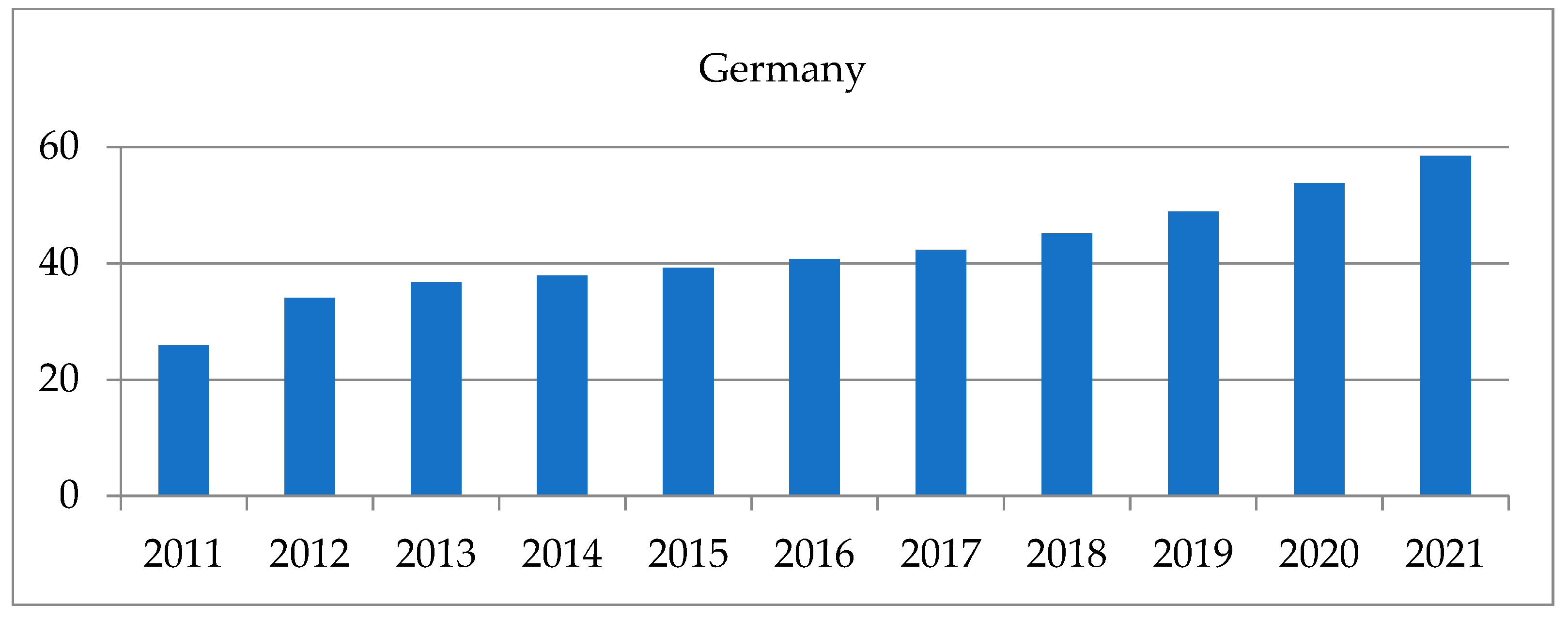

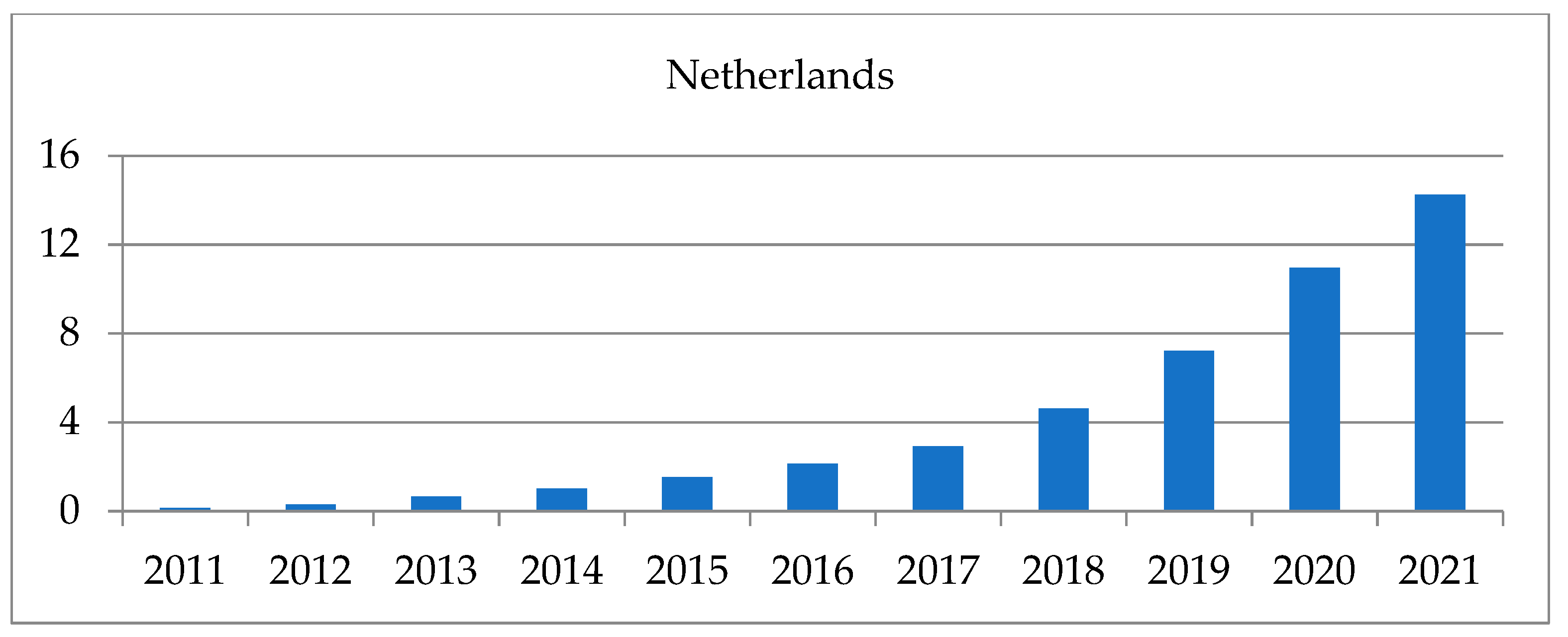

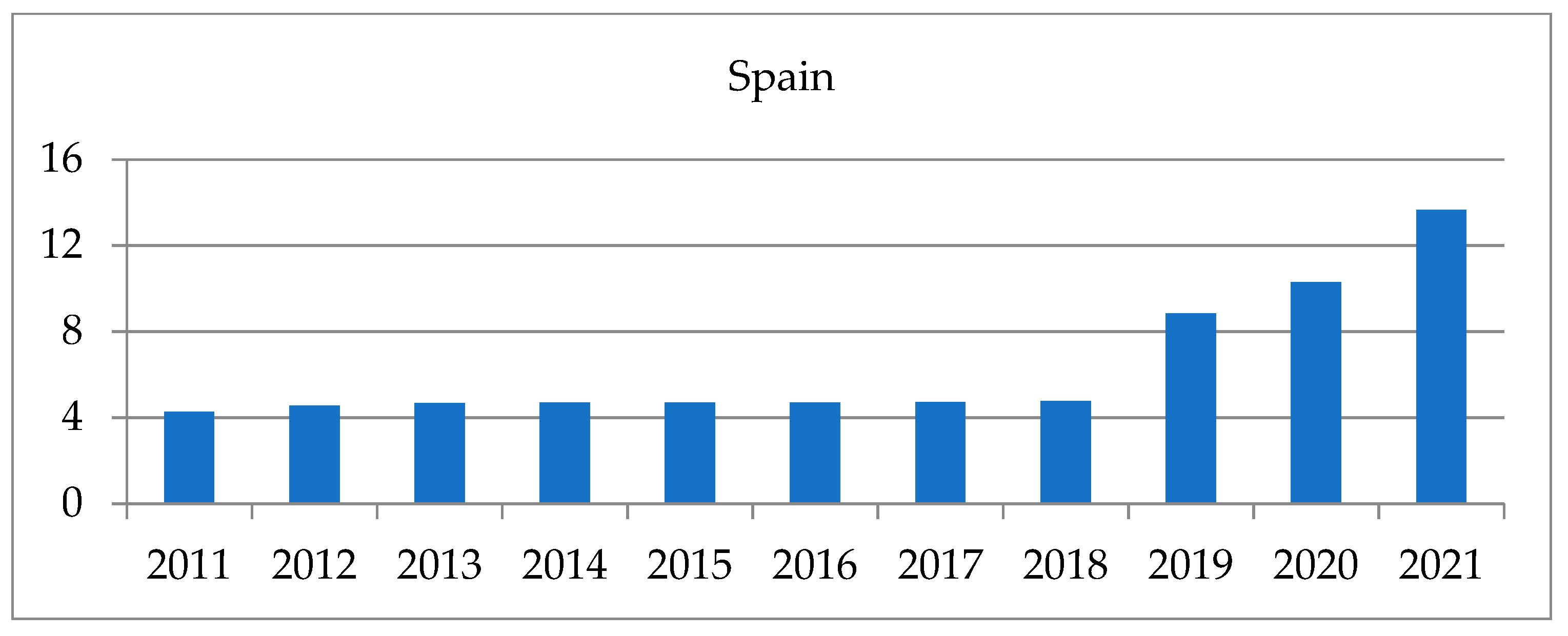

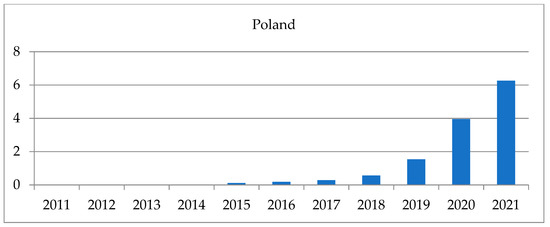

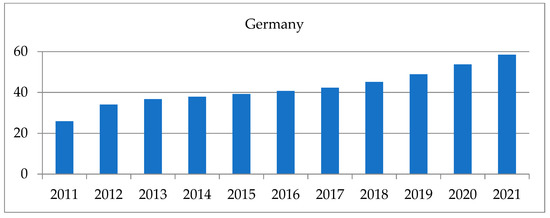

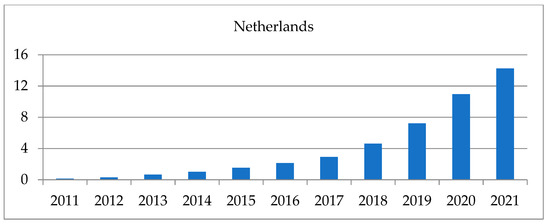

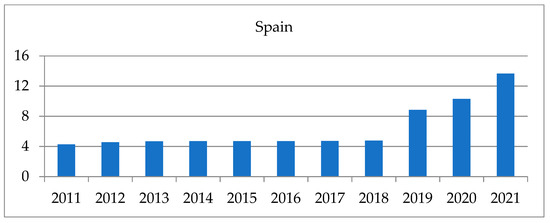

According to the International Renewable Energy Agency, the total installed power capacity of solar PVs in Germany was 58.459 GW in 2021. In the same year (2021), the total installed power capacity of solar PVs in Poland was 6.257 GW (the Netherlands 14.249 GW, Spain 13.648 GW) [63]. Figure 1, Figure 2, Figure 3 and Figure 4 present the total installed power capacity of solar PVs in Germany, Poland, the Netherlands and Spain. The current population of Germany is 83.3 million people (Poland 37.8 million, the Netherlands 17.1 million, and Spain 46.8 million).

Figure 1.

Installed capacity (GW): solar photovoltaic trends in Poland.

Figure 2.

Installed capacity (GW): solar photovoltaic trends in Germany.

Figure 3.

Installed capacity (GW): solar photovoltaic trends in the Netherlands.

Figure 4.

Installed capacity (GW): solar photovoltaic trends in Spain.

In Poland, the largest share in the market falls to PV micro-installations. In 2020, they made 77% of the installed power of the whole PV-power-generating system. The observed growth of the market is clearly visible in the sector of prosumers, as well as in that of photovoltaic farms. By 2022, the number of the employed in companies installing the systems had been growing steadily. Photovoltaic installations have been producing energy for the system and their owners expect it to be collected and used. At the same time, they acquire the sense of fulfilling a civic duty—the generation of clean energy. Nevertheless, there appear problems related to the electric power network such as, among others, the poor potential of available connections and overlong waiting to have conditions of connection issued. Operators invariably refuse to connect successive solar farms to the power network, the cause of it being not only inefficient networks, but also reservation of networks for planned projects which, instead of being put to realization, are ditched. Investors are facing greater and greater difficulty obtaining permits to connect their installations to the power network. The problem concerns not only photovoltaic installations, but also wind parks, and affects both large companies and individual prosumers. Those projects that have had the conditions of connection granted, yet have not been implemented finally, heavily restrict the access to the network to other users. This seriously hampers the development of the photovoltaics in Poland.

New principles of clearing the energy produced by micro-installations started binding from 1 April 2022, whereas net-billing is due to take effect in July 2022. The Association of Photovoltaics Branch Poland PV (APB) reports that as of mid-November 2021, there were 21.6 thousand firms officially registered as manufacturers of photovoltaic installations, the sector itself providing employment to about 120 thousand people [62]. The association forecasts that the changes in the regulations, which are unfavorable to new prosumers, being introduced along with the change in the act on renewable energy sources, will prove of serious consequence to the market of companies dealing in installation of PV systems. The APB Poland PV assesses that 13.5 thousand firms will be liquidated and that nearly 87 thousand workplaces will be lost within four successive years [62]. The main incentive to have a PV installation fitted will still remain the prospect of rising energy prices. This typically results in PV installations being competitive as a source of heating in comparison with gas or other solid fuels.

4. The Development of Competences of a PV Panels Fitter

A reliable confirmation of competences in the area of fitting and servicing photovoltaic panels is the certificate of an authorized fitter of photovoltaic panels, issued by the Office of Technical Supervision. The Renewable Energy Sources authorization in the field of fitting photovoltaic panels confirms fitters’ competences and qualifications. It is also advantageous to candidates who apply to be recruited for the job. The employer is then sure that employees holding the Renewable Energy Sources certificate possess a suitable range of knowledge and skills in the sphere of operating and fitting of photovoltaic panels. Moreover, holding the certificate confirming the competences frequently makes the basic criterion behind the choice of the company which undertakes to install the system in the case of both public and private commissions. Investors are more willing to cooperate with firms which are able to prove the competences of their employees.

As it follows from the considerations presented in the preceding section, adjustment of workers (fitters) to challenges of the dynamically changing job market is inevitable and holding Renewable Energy Sources authorization will turn out insufficient. It will become a necessity to reskill (retrain) or upskill workers [64,65]. Reskilling is a process of acquiring skills or qualifications in a different field with the aim to getting another position or changing work. In turn, upskilling is a process of raising the skills already held by the employee and adjusting them to current situation in the job market as well as challenges or changes in the given branch.

Upskilling is vital for many reasons. Among them, there are the following ones:

- Tasks to be performed in individual workplaces are changing faster than ever before;

- Workers are willing to develop, since development translates into workers’ greater satisfaction, and a greater satisfaction with work can raise productivity levels, workers’ morale and motivation;

- Organizations are helped to be competitive;

- Employee turnover diminishes;

- The need to apply external recruitment decreases.

Nowadays, enterprises based in the European Union, in particular, have many tools of developing human resources at their disposal. Authorities of member states, perceiving the tendency and significance of the human factor both in the company and economy as a whole, allot large sums to developing this domain. Likewise, numerous schemes and subsidies are designed for this purpose. A perfect example here is the EU program “Human Capital” which meets the needs of entrepreneurs regarding the development of human resources in their businesses. In this way, institutions and organizations based in the EU member states, including Poland, open to new challenges and possibilities. There exist six main goals of the program, of which the following seem the most relevant from the point of view of photovoltaic panel fitters [66]:

- Adaptation of companies to changes going on in the economy;

- Rise in territorial cohesion, which influences blurring of borders, a faster flow of information and goods.

In many sectors of economy, achieving the other of the above-mentioned goals raises the possibilities of cooperation between companies. In the case of territorial cohesion, firms do not have to control non-economic factors and the choice of business partners is carried out in a situation of tight competition.

Companies that do not possess competences that are broader than the basic realization of PV installations in the prosumer sector will face difficulty surviving in the market. Experts observe that transition of part of specialists from the photovoltaics branch to organizations developing in other segments of the market (e.g., B2B, professional agricultural farms) appears a good solution to broadening the skills held. Interventionary studies involving animals or humans, and other studies that require ethical approval, must list the authority that provided approval and the corresponding ethical approval code.

5. Materials and Methods

The examination included companies dealing in fitting photovoltaic panels in Poland. At the outset, initial work was undertaken to highlight areas for consideration. At this stage, the empirical data-gathering process included in-depth individual interviews (3 interviews) and an analysis of newspaper articles. A preliminary contextual interview took place in November 2021. The pilot study took place at the beginning of December 2021 (20 respondents via CAWI).

There are many types of business registers. Usually, they are maintained for various purposes by the state authorities. The problem is access to address data of enterprises (contact details). The primary source of contact details was data base oferteo.pl of the companies operating in Poland [67]. Business register oferteo.pl from which companies are drawn is comprehensive and up-to-date. At this stage, the targeted prospect list was built. The subjects (companies dealing in fitting photovoltaic panels in Poland) were selected for participation according to the purposive sample principle, which means selection of elements characterized by some specific property. In compliance with the Code List of Classification of Business Activities in Poland (PKD 2007), they are companies belonging in Class 43.21.Z. The administrative division of Poland includes 16 voivodships (provinces). Companies of different sizes and from 16 voivodships were selected to ensure variation in the purposive sampling. Participants were contacted initially via email or telephone. Because of lockdown and social distancing, the sample was collected through an online survey.

To calculate the sample size, one may use a margin of error 5%, confidence level of 95%, population size of 21,600, population proportion of 50%. The minimum recommended sample size is 378.

The main survey was carried out between 20 December 2021 and 15 February 2022, that is, in the period in which firms were still busy fitting installations in compliance with the old regulations, ones that are more favorable to prosumers. At that time, the demand considerably exceeded the supply and entrepreneurs did not have time to ponder on what awaited them beyond 1 April 2022. They did not have time, either, to fill in survey questionaries, which caused retrieving correctly filled questionaries to be more difficult. Many entrepreneurs did not respond to mail with the request to participate in the survey at all. Those who responded but rejected to take part most often excused themselves saying they lacked time to provide the necessary data, and also that they were not sure what they should expect after 1 April. Eventually, there were 394 enterprises that took part in the survey.

The research results were subject to statistical analysis with the use of STATISTICA package. Cronbach’s coefficient alpha was used to calculate the internal consistency and reliability [68].

The following main hypothesis was accepted:

Changes in the system of support for prosumers, which will come into effect beginning with 1 April 2022, will restrict the interest in photovoltaics, which in turn will result in significant alterations in the functioning of companies dealing in the PV branch.

The complex character of the presented hypothesis required formulating partial hypotheses. They referred to plans of entrepreneurs for the coming year.

H1.

Enterprises will be adapting to the situation on the current basis, in response to arising trends;

H2.

A substantial number of the enterprises are considering the possibility of entirely changing the profile of their activity in the coming year and their choices depend on the size of the enterprise;

H3.

A considerable number are considering the possibility of expanding the type of business activity they run in the coming year, and still their choices depend on the size of the company;

H4.

Some of the companies are considering the possibility of closing down or suspending the business activity they run;

H5.

A considerable number of the companies will tend to apply the strategy of price competitiveness. However, additionally, they will take advantage of characteristics other than price-related, which influence making decisions concerning realization of their services.

6. Results

The research covered enterprises that deal in fitting photovoltaic panels in Poland. Among the surveyed firms, there were 14 micro-enterprises (employing up to 9 workers) and 380 small enterprises (between 10 and 49 employees). As far as the age of the companies is concerned, it needs mentioning that they are chiefly young businesses: 70% of them have been on the market for three years at the longest.

The overall instrument had acceptable reliability:

- The profile of business activity in the nearest year, five items, Cronbach’s alpha = 0.70;

- The importance of a business strategy, four items, Cronbach’s alpha = 0.86.

The change in the system of settlement of prosumers’ payment, taking effect on 1 April 2022, will impact on behaviors of the examined enterprises in a variety of ways. In order to verify the main hypothesis, selected research results were presented below in the context of verifying individual partial hypotheses. In the perspective of the nearest year, 39.4% of the examined companies (Table 1) declare to maintain the profile of their business activity in the market to date, without introducing changes. It seems that larger enterprises, having at their disposal a diversified range of products (heat pumps, energy storages, and car chargers), will be able to keep up their activity profile without the necessity of making significant alterations. Obviously, they hold a considerable advantage over smaller businesses. On the other hand, small local fitters who are subcontractors providing services for larger companies or acting on their own account (without a department responsible for organization of trading) face a much harder challenge. Then, 20.8% of the examined firms anticipate no possibility of maintaining the character of their business activity in the market to date without introducing alterations, whereas 39.8% of the respondents do not know whether or not they will keep their activity up to date. This confirms Hypothesis H1. Enterprises will be adapting to the situation on the current basis, in response to arising trends.

Table 1.

The profile of business activity in the nearest year 1.

The companies perceive the need of introducing changes in their activity in the nearest year to come in connection with limitation of the demand for their services. In the open question, the respondents pointed out that a reduction in employment would be inevitable and so would lowering of the employees’ wages.

Merely 1.8% of the respondents consider the possibility of a total change in the basic activity profile (Table 1). A total of 28.9% of the companies consider the possibility of expanding the type of activity. It can be observed that clients are increasingly interested in heat pumps, energy storages and electric car chargers; hence, many enterprises respond to the customers’ requirements and are preparing to service new products, among others, through development of employees’ skills regarding these products. In the open question, part of the respondents declared that their companies intended to expand the activity through, for instance, offering exploitation services. Others were going to include, for example, photovoltaic roofing tiles or energy storages. A total of 28.9% of the enterprises consider the possibility of broadening the type of activity in the nearest year (Table 1). The obtained results prove the partial Hypotheses H1 and H2 right.

Still, many entrepreneurs are not yet able to determine how their situation will look in a year’s time and whether they will be forced to suspend their activity or even liquidate their business (Table 1). It seems that firms which will have to close down are those that offer a narrow range of fitting services or ones that exclusively took advantage of the rise in the demand from individual clients, and will not be capable of adjusting to the changing conditions. This confirms Hypothesis H4.

Making use of the potential of fitters to perform new tasks will be possible primarily if there appears a suitable system of incentives for clients (this refers to, among others, energy storage). Part of those who presently deal professionally in fitting photovoltaic systems exclusively will have to broaden the range of their service or to take up a completely different activity.

57.9% of the enterprises attach great importance to analyses of their competitors’ activities as far as the nearest year is concerned (Table 2). Companies active in the area of fitting PV installations make a narrow segment of the market. The foundation of achieving and then strengthening and maintaining information advantage follows on the current basis and adjusting to trends appearing in the branch.

Table 2.

The importance of a business strategy 1 (seven-point scale ranges from insignificant to very important: 1—insignificant, 7—very important).

The development of a company depends primarily on the profits which it obtains. Therefore, a proper price strategy is one of the basic and, at the same time the most relevant, elements of planning. For about 60% of the examined, offering lower prices of services in comparison with those put up by the competition will be of fairly great importance (Table 2).

The signals obtained from the market point to part of the fitted photovoltaic installations in Poland being made of components of improper quality or which are not fitted properly. In some cases, it is the result of a lack of competences, but in others, it results from the fitting firms’ approach to obtain fast and easy profit at the cost of quality of the service. Around 80% of the surveyed enterprises pointed to the significance of a higher quality of services in comparison with that of the competition and this within the year to come (Table 2). The strategy of quality advantage includes actions investing the firm’s offer with a greater value due to the quality of its services and products that is higher than the average.

The strategy of market niche consists of finding (or creating) a gap and filling it. The enterprise applying this strategy addresses its offer to a fairly narrow target group and focuses on a specific assortment. Nearly 30% of the respondents attach importance to looking for market niches within the nearest year to come (Table 2). Part of the fitting firms intend to introduce photovoltaic roofing tiles or energy storage into their offers. Additionally, some of the companies plan to concentrate on installations for industrial plants, hotels, and agricultural holdings in view of the fact that energy prices for businesses are higher than those for individual clients and, additionally, companies are burdened with the capacity fee. About 40% of the respondents do not pay too much attention to looking for market niches, however.

The obtained results confirm partial Hypothesis H5. A considerable percentage (60%) of the companies will tend to apply the pricing strategy. They will offer services to a broad set of customers at a low price. However, additionally, they will take advantage of characteristics other than price-related (e.g., higher quality of services). A large proportion (79.9%) of the companies will tend to use quality as a key differentiator in a crowded market.

7. Discussion and Conclusions

Every research has its limitations. Survey limitations can be further categorized into the following groups:

- Representativeness. Participation in the survey was voluntary. The quality of the results depended on the willingness of enterprises to cooperate. Many entrepreneurs did not respond to mail with the request to participate in the survey at all. This limits representativeness.

- Time constraints. Because a survey collects data at a single point in time, it is difficult to measure changes in the population. It should be noted that the survey was carried out one week before the military conflict in Ukraine started. It significantly limits the conclusions that can be drawn from collected data.

The photovoltaic industry is heavily affected by the government policies and subsidies. Previous research shows that government policies and public support can positively impact photovoltaic market growth. However, little is known about the PV installers’ strategies. This article seeks to fill an important research gap. How does regulatory uncertainty in the photovoltaics shape firms’ market strategies? The change in the regulations of settling prosumers’ accounts, which took effect on 1 April 2022, indicated hampering the development of prosumer-based photovoltaics in the country. The regulations raise a good deal of concern among enterprises dealing in the photovoltaics branch. Recent years have seen a boom in the market of photovoltaic installations on an unprecedented scale. Still, the boom may get rapidly hampered because of the new regulations. The changes to legislative framework play an important role in investment decisions. Some of solar installers are considering closing down their business. This is a relevant matter regarding the labor market. Enterprises that deal in fitting photovoltaic panels profit from the assembly and maintenance of products and the provision of services.

The study identifies firms’ strategies. It confirms empirically that they will tend to apply the strategy of price competitiveness. However, additionally, they will take advantage of characteristics other than price-related (e.g., higher quality of services). Firms adapt to the new situation and initiate both reactive and proactive responses. Almost 60% of the enterprises attach great importance to analyses of their competitors’ activities as far as the nearest year is concerned. Enterprises take actions adjusting to trends appearing in the branch. A total of 28.9% of the surveyed enterprises consider the possibility of introducing new services (e.g., exploitation services) or new products (e.g., photovoltaic roofing-tiles or energy storage).

The changes in the system of support for prosumers will greatly restrict the interest in photovoltaics among individual clients. On the other hand, the interest in renewable energy sources is growing among companies. The industry is going through a process of transformation in the power generation system. Some enterprises are beginning to launch photovoltaic farms. The cement group Lafarge, for example, has informed about its plans concerning this. The group leased the grounds of its former cement plant in Wierzbica to the large developer Qair Poland which is building a solar power plant of 30 MW there. Lafarge will be receiving the whole energy generated by the farm, which will satisfy about 10% of the group’s needs.

The variables affecting the development of enterprises dealing in the photovoltaics branch include non-renewable energy prices. Gas and electricity prices have increased hugely in Poland over the past few months. This creates chances for the development of photovoltaics. As the study shows, enterprises will be adapting to the situation on the current basis, in response to arising trends.

The integration of photovoltaics into the energy system is constrained by currently installed infrastructure. Implications for policy making and support schemes for PV in combination with storage units are derived. To offset surpluses or deficits during periods with fluctuating sunshine, storage capacities are needed. It can be observed that clients are increasingly interested in energy storage; hence many enterprises respond to the customers’ requirements and are preparing to service new products, among others, through development of employees’ skills regarding these products.

The photovoltaic industry is unique because it is sensitive to inventory fluctuations and geo-political tensions. The military conflict in Ukraine may to a considerable degree accelerate the transformation in the power industry in Poland. Right now, the politicians’ attention is focused on Poland achieving independence regarding energy sources. This creates chances for the development of photovoltaics. At the same time, it needs underlining, the war is changing the job market in Poland. For many years now, Ukrainian citizens have comprised the largest group of foreign workers who are employed in Poland. Some of them (including those employed in the PV sector) have decided to return to their mother land, which has caused, among others, delays in construction of photovoltaic farms in Poland. The PV sector is still a male-dominant industry. Due to mandatory conscription of men in Ukraine, the majority of refugees are women and children.

The COVID pandemic and military conflict in Ukraine have revealed the need to address heavy energy dependencies on third countries. China dominates nearly all aspects of solar PV manufacturing and use. This can cause PV projects in Europe to be delayed or cancelled. Towards the end of 2022, there is going to be presented the strategy of development of photovoltaics in the European Union [69]. The new strategy is expected to concentrate on a greater use of the system of photovoltaic components manufactured in the EU and to point to tools which will contribute to acceleration of making investments in photovoltaics. This is a relevant matter regarding job creation and bringing added value to European regions. This requires engagement in the development of qualified workforce (e.g., programs of reskilling and upskilling workforce).

The signaled course of development taken by photovoltaics in the case of enterprises and individual clients includes, among others, a greater interest in energy storages. Enterprises use the energy generated by day on the simultaneous basis and energy storages could perform the role of collectors to use it at a later time. Some companies will obviously find it profitable to charge the storages at night when the rate is lower and with the surplus of energy generated by their photovoltaic system during the day.

Photovoltaics definitely will not satisfy the needs of all clients. Despite the global drive towards renewable energy, its development is hampered by, among others, the lack of readiness on the part of citizens to pay for renewable energy and by difficulty in connecting successive installations of renewable energy resources to the network. Are we ready to bear extra costs in return for energy from renewable sources? Do we pay attention to the role of the distribution network in the development and using energy from renewable energy sources? Too high voltages in local distribution grids, which cause cutting off installations of renewable energy resources, high losses in connection with energy transfer, or a shortage of mechanisms to regulate voltages, will only augment in the future due to the growing power as well as the volume of energy from renewable sources generated by dispersed producers in particular.

Small and medium-sized enterprises are perceived as those which are quick to react to such changes. Still, it is only too obvious that a very short transition time will bring about serious problems to companies dealing in the photovoltaics branch since it has had an exceptionally short time to sufficiently prepare for the changes. This will translate into liquidation of many workplaces. The alterations will affect not only fitters of photovoltaic installations, but also consumers of electric energy who should also adapt to the changes which will be going on in the power industry. This concerns, among others, receivers’ conscious decisions with reference to the part of day when they will use a larger amount of energy, which must be taken into account in the developmental plans of the photovoltaics in Poland, as well as should lead to a suitable preparation in order to benefit from advantages offered by the system and neutralize potential threats.

The observations made upon carrying out the survey among entrepreneurs who deal in the photovoltaics branch, on the one hand delineate the perspectives of development of this branch in Poland; on the other hand, require conducting further research into this domain.

Not all problems can be predicted. For this reason, reactive management is inevitable in some situations. According to the results of the study, enterprises will be adapting to the situation on the current basis, in response to arising trends. Future research should pay greater attention to the environment that encourages or hampers enterprises’ activities (push and pull factors). The authors recommend that further research should be pursued in this field in order to improve current understanding of the resilience of how enterprises learn from crisis events, how they update their strategy, and how they incorporate changes into their business model to be strengthened out of the crisis.

Author Contributions

Conceptualization, M.S. and A.S.-D.; methodology, M.S. and A.S.-D.; software, M.S.; formal analysis, M.S.; writing—original draft preparation, review and editing, M.S. and A.S.-D.; visualization, M.S. and A.S.-D. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Any participation in a research study was voluntary. The survey was anonymous.

Data Availability Statement

Not applicable.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Güney, T. Solar energy and sustainable development: Evidence from 35 countries. Int. J. Sustain. Dev. World Ecol. 2022, 29, 187–194. [Google Scholar] [CrossRef]

- Baskutis, S.; Baskutiene, J.; Navickas, V.; Bilan, Y.; Cieśliński, W. Perspectives and Problems of Using Renewable Energy Sources and Implementation of Local “Green” Initiatives: A Regional Assessment. Energies 2021, 14, 5888. [Google Scholar] [CrossRef]

- Brodny, J.; Tutak, M. Analyzing Similarities between the European Union Countries in Terms of the Structure and Volume of Energy Production from Renewable Energy Sources. Energies 2020, 13, 913. [Google Scholar] [CrossRef] [Green Version]

- Renewable Energy Directive II (RED II). Directive (EU) 2018/2001 of the European Parliament and of the Council of 11 December 2018 on the Promotion of the Use of Energy from Renewable Sources. Available online: https://eur-lex.europa.eu/eli/dir/2018/2001/oj (accessed on 2 January 2022).

- Proposal for a Directive of the European Parliament and of the Council amending Directive (EU) 2018/2001 of the European Parliament and of the Council, Regulation (EU) 2018/1999 of the European Parliament and of the Council and Directive 98/70/EC of the European Parliament and of the Council as Regards the Promotion of Energy from Renewable Sources, and Repealing Council Directive (EU) 2015/652. The Revision of the RED II. Available online: https://ec.europa.eu/info/sites/default/files/amendment-renewable-energy-directive-2030-climate-target-with-annexes_en.pdf (accessed on 2 January 2022).

- Yang, M.; Liu, Y.; Tian, J.; Cheng, F.; Song, P. Dynamic Evolution and Regional Disparity in Carbon Emission Intensity in China. Sustainability 2022, 14, 4052. [Google Scholar] [CrossRef]

- Lew, G.; Sadowska, B.; Chudy-Laskowska, K.; Zimon, G.; Wójcik-Jurkiewicz, M. Influence of Photovoltaic Development on Decarbonization of Power Generation—Example of Poland. Energies 2021, 14, 7819. [Google Scholar] [CrossRef]

- Hołuj, A.; Ilba, M.; Lityński, P.; Majewski, K.; Semczuk, M.; Serafin, P. Photovoltaic Solar Energy from Urban Sprawl: Potential for Poland. Energies 2021, 14, 8576. [Google Scholar] [CrossRef]

- Keeley, A.R.; Komatsubara, K.; Managi, S. The value of invisibility: Factors affecting social acceptance of renewable energy. Energy Sources Part B Econ. Plan. Policy 2021, 1–20. [Google Scholar] [CrossRef]

- Franco, A.C.; Franco, L.S. Photovoltaic solar energy and environmental impacts in the industrial sector: A critical overview of barriers and opportunities. Energy Sources Part A Recovery Util. Environ. Eff. 2021, 1–13. [Google Scholar] [CrossRef]

- Donald, J.; Axsen, J.; Shaw, K.; Robertson, B. Sun, wind or water? Public support for large-scale renewable energy development in Canada. J. Environ. Policy Plan. 2021, 24, 1–19. [Google Scholar] [CrossRef]

- Brock, A.; Sovacool, B.K.; Hook, A. Volatile Photovoltaics: Green Industrialization, Sacrifice Zones, and the Political Ecology of Solar Energy in Germany. Ann. Am. Assoc. Geogr. 2021, 111, 1756–1778. [Google Scholar] [CrossRef]

- Esmaeilion, F.; Ahmadi, A.; Aliehyaei, M. Low-grade heat from solar ponds: Trends, perspectives, and prospects. Int. J. Ambient. Energy 2021, 1–30. [Google Scholar] [CrossRef]

- Duran, A.S.; Atasu, A.; Van Wassenhove, L.N. Cleaning after solar panels: Applying a circular outlook to clean energy research. Int. J. Prod. Res. 2021, 60, 211–230. [Google Scholar] [CrossRef]

- Rataj, M.; Berniak-Woźny, J.; Plebańska, M. Poland as the EU Leader in Terms of Photovoltaic Market Growth Dynamics—Behind the Scenes. Energies 2021, 14, 6987. [Google Scholar] [CrossRef]

- Rynek Fotowoltaiki w Polsce 2021. Available online: https://www.ieo.pl/pl/aktualnosci/1538-rynek-fotowoltaiki-w-polsce-2021 (accessed on 10 January 2022).

- Böcker, B.; Steffen, B.; Weber, C. Photovoltaics and storage plants: Efficient capacities in a system view. Sol. Energy Storage 2015, 209–223. [Google Scholar] [CrossRef]

- Böcker, B.; Weber, C. A Primer about Storage in Bottom-Up Models of Future Energy Systems. Fundamentals of Storage Operation and Investment in Competitive Long-Term Equilibria. HEMF Working Paper 02. 2020. Available online: https://ssrn.com/abstract=3673110 (accessed on 17 April 2022). [CrossRef]

- Che, X.J.; Zhou, P.; Chai, K.H. Regional policy effect on photovoltaic (PV) technology innovation: Findings from 260 cities in China. Energy Policy 2022, 162, 112807. [Google Scholar] [CrossRef]

- Jia, F.; Sun, H.; Koh, L. Global solar photovoltaic industry: An overview and national competitiveness of Taiwan. J. Clean. Prod. 2016, 126, 550–562. [Google Scholar] [CrossRef]

- Marsillac, E. Exploiting end-of-use and end-of-life photovoltaic options to support renewable energy market growth. In Proceedings of the IEEE 48th Photovoltaic Specialists Conference (PVSC), Fort Lauderdale, FL, USA, 20–25 June 2021; pp. 2643–2645. [Google Scholar]

- Goodrich, A.C.; Powell, D.M.; James, T.L.; Woodhouse, M.; Buonassisi, T. Assessing the drivers of regional trends in solar photovoltaic manufacturing. Energy Environ. Sci. 2013, 6, 2811–2821. [Google Scholar] [CrossRef] [Green Version]

- Castillo, C.P.; Silva, F.B.; Lavalle, C. An assessment of the regional potential for solar power generation in EU-28. Energy Policy 2016, 88, 86–99. [Google Scholar] [CrossRef]

- Heo, J.; Song, K.; Han, S.; Lee, D.E. Multi-channel convolutional neural network for integration of meteorological and geographical features in solar power forecasting. Appl. Energy 2021, 295, 117083. [Google Scholar] [CrossRef]

- Heo, J.; Moon, H.; Chang, S.; Han, S.; Lee, D.-E. Case Study of Solar Photovoltaic Power-Plant Site Selection for Infrastructure Planning Using a BIM-GIS-Based Approach. Appl. Sci. 2021, 11, 8785. [Google Scholar] [CrossRef]

- Settou, B.; Settou, B.; Gouareh, A.; Negrou, B.; Mokhtara, C.; Messaoudi, D. A high-resolution geographic information systemanalytical hierarchy process-based method for solar PV power plant site selection: A case study Algeria. Clean Technol. Environ. Policy 2021, 23, 219–234. [Google Scholar] [CrossRef]

- Effat, H.A. Selection of potential sites for solar energy farms in Ismailia Governorate, Egypt using SRTM and multicriteria analysis. Int. J. Adv. Remote Sens. GIS 2013, 2, 205–220. [Google Scholar]

- Warneryd, M.; Karltorp, K. The role of values for niche expansion: The case of solar photovoltaics on large buildings in Sweden. Energy. Sustain. Soc. 2020, 10, 1–13. [Google Scholar] [CrossRef] [Green Version]

- Palm, A. Local factors driving the diffusion of solar photovoltaics in Sweden: A case study of five municipalities in an early market. Energy Res. Soc. Sci. 2016, 14, 1–12. [Google Scholar] [CrossRef]

- Backes, J.G.; D’Amico, A.; Pauliks, N.; Guarino, S.; Traverso, M.; Brano, V.L. Life Cycle Sustainability Assessment of a dish-Stirling Concentrating Solar Power Plant in the Mediterranean area. Sustain. Energy Technol. Assess. 2021, 47, 101444. [Google Scholar] [CrossRef]

- Graebig, M.; Bringezu, S.; Fenner, R. Comparative analysis of environmental impacts of maize–biogas and photovoltaics on a land use basis. Sol. Energy 2010, 84, 1255–1263. [Google Scholar] [CrossRef]

- Klugmann-Radziemska, E.; Kuczyńska-Łażewska, A. The use of recycled semiconductor material in crystalline silicon photovoltaic modules production-A life cycle assessment of environmental impacts. Sol. Energy Mater. Sol. Cells 2020, 205, 110259. [Google Scholar] [CrossRef]

- Shahnazi, R.; Shabani, Z.D. Do renewable energy production spillovers matter in the EU? Renew. Energy 2020, 150, 786–796. [Google Scholar] [CrossRef]

- Elshurafa, A.M.; Farag, H.M.; Hobbs, D.A. Blind spots in energy transition policy: Case studies from Germany and USA. Energy Rep. 2019, 5, 20–28. [Google Scholar] [CrossRef]

- Kengpol, A.; Rontlaong, P.; Tuominen, M. Design of a Decision Support System for Site Selection Using Fuzzy AHP: A Case Study of Solar Power Plant in North Eastern Parts of Thailand. In Proceedings of the 2012 PICMET’12: Technology Management for Emerging Technologies, Vancouver, BC, Canada, 29 July–2 August 2012; pp. 734–743. [Google Scholar]

- Kim, S.; Lee, Y.; Moon, H.R. Siting criteria and feasibility analysis for PV power generation projects using road facilities. Renew. Sustain. Energy Rev. 2018, 81, 3061–3069. [Google Scholar] [CrossRef]

- Paska, J.; Surma, T.; Terlikowski, P.; Zagrajek, K. Electricity generation from renewable energy sources in Poland as a part of commitment to the polish and EU energy policy. Energies 2020, 13, 4261. [Google Scholar] [CrossRef]

- Szeląg-Sikora, A.; Sikora, J.; Niemiec, M.; Gródek-Szostak, Z.; Suder, M.; Kuboń, M.; Malik, G. Solar Power: Stellar Profit or Astronomic Cost? A Case Study of Photovoltaic Installations under Poland’s National Prosumer Policy in 2016–2020. Energies 2021, 14, 4233. [Google Scholar] [CrossRef]

- Šúri, M.; Huld, T.A.; Dunlop, E.D.; Ossenbrink, H.A. Potential of solar electricity generation in the European Union member states and candidate countries. Sol. Energy 2007, 81, 1295–1305. [Google Scholar] [CrossRef]

- Wen, D.; Gao, W.; Qian, F.; Gu, Q.; Ren, J. Development of solar photovoltaic industry and market in China, Germany, Japan and the United States of America using incentive policies. Energy Explor. Exploit. 2021, 39, 1429–1456. [Google Scholar] [CrossRef]

- Rodrigues, S.; Torabikalaki, R.; Faria, F.; Cafôfo, N.; Chen, X.; Ivaki, A.R.; Morgado-Dias, F.J.S.E. Economic feasibility analysis of small scale PV systems in different countries. Sol. Energy 2016, 131, 81–95. [Google Scholar] [CrossRef]

- Pyrgou, A.; Kylili, A.; Fokaides, P.A. The future of the Feed-in Tariff (FiT) scheme in Europe: The case of photovoltaics. Energy Policy 2016, 95, 94–102. [Google Scholar] [CrossRef]

- Kazak, J.K.; Kamińska, J.A.; Madej, R.; Bochenkiewicz, M. Where renewable energy sources funds are invested? spatial analysis of energy production potential and public support. Energies 2020, 13, 5551. [Google Scholar] [CrossRef]

- Wuebben, D.; Peters, J.F. Communicating the Values and Benefits of Home Solar Prosumerism. Energies 2022, 15, 596. [Google Scholar] [CrossRef]

- Blanco-Díez, P.; Díez-Mediavilla, M.; Alonso-Tristán, C. Review of the legislative framework for the remuneration of photovoltaic production in Spain: A case study. Sustainability 2020, 12, 1214. [Google Scholar] [CrossRef] [Green Version]

- Fernández-González, R.; Arce, E.; Garza-Gil, D. How political decisions affect the economy of a sector: The example of photovoltaic energy in Spain. Energy Rep. 2021, 7, 2940–2949. [Google Scholar] [CrossRef]

- Ibarloza, A.; Heras-Saizarbitoria, I.; Allur, E.; Larrea, A. Regulatory Cuts and Economic and Financial Performance of Spanish Solar Power Companies: An Empirical Review. Renew. Sustain. Energy Rev. 2018, 92, 784–793. [Google Scholar] [CrossRef]

- Gürtler, K.; Postpischil, R.; Quitzow, R. The Dismantling of Renewable Energy Policies: The Cases of Spain and the Czech Republic. Energy Policy 2019, 133, 110881. [Google Scholar] [CrossRef]

- Campoccia, A.; Dusonchet, L.; Telaretti, E.; Zizzo, G. An analysis of feed’in tariffs for solar PV in six representative countries of the European Union. Sol. Energy 2014, 107, 530–542. [Google Scholar] [CrossRef]

- Atsu, D.; Seres, I.; Farkas, I. The state of solar PV and performance analysis of different PV technologies grid-connected installations in Hungary. Renew. Sustain. Energy Rev. 2021, 141, 110808. [Google Scholar] [CrossRef]

- Janda, K. Slovak electricity market and the price merit order effect of photovoltaics. Energy Policy 2018, 122, 551–562. [Google Scholar] [CrossRef]

- Zdonek, I.; Tokarski, S.; Mularczyk, A.; Turek, M. Evaluation of the Program Subsidizing Prosumer Photovoltaic Sources in Poland. Energies 2022, 15, 846. [Google Scholar] [CrossRef]

- Green, R.; Staffell, I. The contribution of taxes, subsidies, and regulations to British electricity decarbonization. Joule 2021, 5, 2625–2645. [Google Scholar] [CrossRef]

- Briguglio, M.; Formosa, G. When households go solar: Determinants of uptake of a Photovoltaic Scheme and policy insights. Energy Policy 2017, 108, 154–162. [Google Scholar] [CrossRef]

- Hoppmann, J.; Huenteler, J.; Girod, B. Compulsive policy-making—The evolution of the German feed-in tariff system for solar photovoltaic power. Res. Policy 2014, 43, 1422–1441. [Google Scholar] [CrossRef]

- Hartvigsson, E.; Odenberger, M.; Chen, P.; Nyholm, E. Estimating national and local low-voltage grid capacity for residential solar photovoltaic in Sweden, UK and Germany. Renew. Energy 2021, 171, 915–926. [Google Scholar] [CrossRef]

- Gupta, R.; Pena-Bello, A.; Streicher, K.N.; Roduner, C.; Farhat, Y.; Thöni, D.; Patel, M.K.; Parra, D. Spatial analysis of distribution grid capacity and costs to enable massive deployment of PV, electric mobility and electric heating. Appl. Energy 2021, 287, 116504. [Google Scholar] [CrossRef]

- Sodano, D.; DeCarolis, J.F.; de Queiroz, A.R.; Johnson, J.X. The symbiotic relationship of solar power and energy storage in providing capacity value. Renew. Energy 2021, 177, 823–832. [Google Scholar] [CrossRef]

- Zach, K.A.; Auer, H. Contribution of bulk energy storage to integrating variable renewable energies in future European electricity systems. Wiley Interdiscip. Rev. Energy Environ. 2016, 5, 451–469. [Google Scholar] [CrossRef]

- Haas, R.; Kemfert, C.; Auer, H.; Ajanovic, A.; Sayer, M.; Hiesl, A. On the economics of storage for electricity: Current state and future market design prospects. Wiley Interdiscip. Rev. Energy Environ. 2022, e431. [Google Scholar] [CrossRef]

- Gnatowska, R.; Moryń-Kucharczyk, E. The Place of Photovoltaics in Poland’s Energy Mix. Energies 2021, 14, 1471. [Google Scholar] [CrossRef]

- Czeka nas Rok Fotowoltaicznej Rewolucji. Czy Branża Go Przetrwa? Available online: https://wysokienapiecie.pl/43644-czeka-nas-rok-fotowoltaicznej-rewolucji-czy-branza-go-przetrwa/ (accessed on 4 January 2022).

- International Renewable Energy Agency. Available online: https://irena.org/solar (accessed on 16 April 2022).

- Certyfikacja OZE w Zakresie Paneli Fotowoltaicznych. Available online: https://coch.pl/2020/08/certyfikacja-oze-w-zakresie-paneli-fotowoltaicznych/ (accessed on 20 January 2022).

- Ki-Chan, K.; Hornsby, J.S.; Enriquez, J.L.; Bae, Z.; El Tarabishy, A. Humane Entrepreneurial Framework: A model for effective corporate entrepreneurship. J. Small Bus. Manag. 2021, 59, 397–416. [Google Scholar]

- Ciekanowski, Z. Kapitał ludzki najistotniejszym elementem w organizacji. Zesz. Nauk. Uniw. Przyr. Humanist. W Siedlcach 2014, 101, 135–148. [Google Scholar]

- The Primary Source of Contact Details. Available online: https://www.oferteo.pl (accessed on 10 October 2021).

- Tavakol, M.; Dennick, R. Making sense of Cronbach’s alpha. Int. J. Med. Educ. 2011, 2, 53–55. [Google Scholar] [CrossRef]

- EU Solar Energy Strategy. European Commission 2022. Available online: https://ec.europa.eu/info/law/better-regulation/have-your-say/initiatives/13338-EU-solar-energy-strategy_en (accessed on 15 April 2022).

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).