Demand Response Implementation: Overview of Europe and United States Status

Abstract

1. Introduction

1.1. Contextualization and Background

1.2. Motivation and Contributions

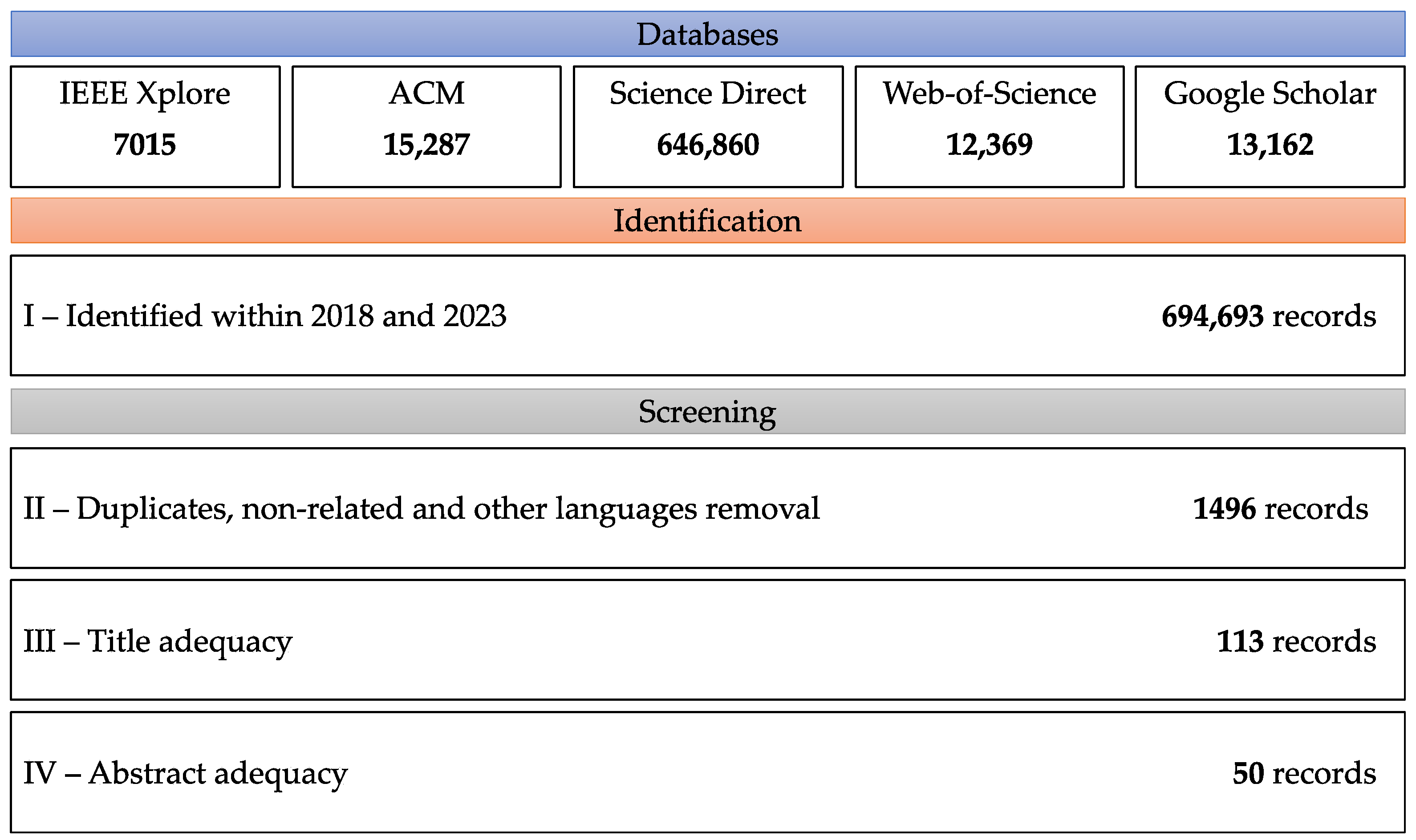

2. Literature Review Methodology

- To include:

- Describe any important DR program and related consumer concepts, such as demand side management processes and consumer flexibility for the Europe or US power and energy system.

- Relevant documents on DR or related concepts use keywords deemed important by the authors.

- Market analysis or case studies within the scope of Europe or US power and energy system flexibility status.

- To exclude:

- Full paper access denied.

- Written in a language other than English or Portuguese.

3. Europe

- Denmark, Sweden, and the United Kingdom have the ancillary services market open to all the participants, but the wholesale and balancing markets are only open to retailers.

- France has most ancillary service markets open to all participants, but unlike the previously stated members, the wholesale and balancing markets are open to all, and the existence of aggregators is allowed.

- Germany has ancillary services, wholesale, and balancing markets open only to retailers.

- Hungary has one DR company on the wholesale and eight VPPs.

- Latvia has wholesale open.

- Poland has two programs in ancillary services open to qualified large consumers only.

- Slovenia has the ancillary service and the balancing markets open but not the wholesale. Aggregation is restricted in this country.

4. United States

- Energy Service—Demand resources deliver a quantity of electricity, measured in MWh;

- Capacity Service—Demand resources are required as a means of managing demand over a defined period, measured in MW;

- Reserve Service—Demand resources are obligated to be available to produce reduction upon deployment period;

- Regulation Service—Demand Resource fluctuates load in response to real-time signals from the System Operator. These resources are subject to dispatch continuously during the commitment period.

- Baseline Type I (interval meter)—based on Demand Resource’s historical interval meter data (may include other variables such as weather and calendar data);

- Baseline Type II (non-interval meter)—based on statistical sampling to estimate the usage of a Demand Resource, considering that an interval metering is not available on the entire aggregated population;

- Maximum Base Load—based on Demand Resource’s ability to maintain usage at or below a specified level during a DR event;

- Meter Before/Meter after—based on a comparison between electricity demand over a specified period preceding deployment and similar readings during the sustained response;

- Metering Generator Output—considers the Demand Reduction Value as the output of a generator located behind the Demand Resource’s revenue meter.

5. Future Perspectives

6. Comparative Analysis

7. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Sachs, J.; Kroll, C.; Lafortune, G.; Fuller, G.; Woelm, F. The Sustainable Development Goals Report 2022; Department of Economic and Social Affairs: New York, NY, USA, 2022; p. 64. [Google Scholar]

- Ramos, D.; Faria, P.; Vale, Z.; Correia, R. Short Time Electricity Consumption Forecast in an Industry Facility. IEEE Trans. Ind. Appl. 2022, 58, 123–130. [Google Scholar] [CrossRef]

- Lin, C.-C.; Saponara, S.; Stanelyte, D.; Radziukyniene, N.; Radziukynas, V. Overview of Demand-Response Services: A Review. Energies 2022, 15, 1659. [Google Scholar] [CrossRef]

- Nouri, A.; Khadem, S.; Mutule, A.; Papadimitriou, C.; Stanev, R.; Cabiati, M.; Keane, A.; Carroll, P. Identification of Gaps and Barriers in Regulations, Standards, and Network Codes to Energy Citizen Participation in the Energy Transition. Energies 2022, 15, 856. [Google Scholar] [CrossRef]

- Rouzbahani, H.M.; Karimipour, H.; Lei, L. Optimizing Scheduling Policy in Smart Grids Using Probabilistic Delayed Double Deep Q-Learning (P3DQL) Algorithm. Sustain. Energy Technol. Assess. 2022, 53, 102712. [Google Scholar] [CrossRef]

- Silva, C.; Faria, P.; Vale, Z. Rating the Participation in Demand Response Programs for a More Accurate Aggregated Schedule of Consumers after Enrolment Period. Electronics 2020, 9, 349. [Google Scholar] [CrossRef]

- Kok, C.; Kazempour, J.; Pinson, P. A DSO-Level Contract Market for Conditional Demand Response. In Proceedings of the 2019 IEEE Milan PowerTech, IEEE, Milan, Italy, 23–27 June 2019; pp. 1–6. [Google Scholar]

- Rossi, M.; Migliavacca, G.; Viganò, G.; Siface, D.; Madina, C.; Gomez, I.; Kockar, I.; Morch, A. TSO-DSO coordination to acquire services from distribution grids: Simulations, cost-benefit analysis and regulatory conclusions from the SmartNet project. Electr. Power Syst. Res. 2020, 189, 106700. [Google Scholar] [CrossRef]

- Rodríguez, R.; Negrete-Pincetic, M.; Olivares, D.; Lorca, Á.; Figueroa, N. The Value of Aggregators in Local Electricity Markets: A Game Theory Based Comparative Analysis. Sustain. Energy Grids Netw. 2021, 27, 100498. [Google Scholar] [CrossRef]

- European Parliament. Directive (EU) 2019/944 on Common Rules for the Internal Market for Electricity. Off. J. Eur. Union 2019, 50, 18. [Google Scholar]

- Silva, C.; Faria, P.; Vale, Z.; Corchado, J.M. Demand Response Performance and Uncertainty: A Systematic Literature Review. Energy Strategy Rev. 2022, 41, 100857. [Google Scholar] [CrossRef]

- IEA. Demand Response; IEA: Paris, France, 2022; Available online: https://www.iea.org/reports/demand-response (accessed on 17 February 2023).

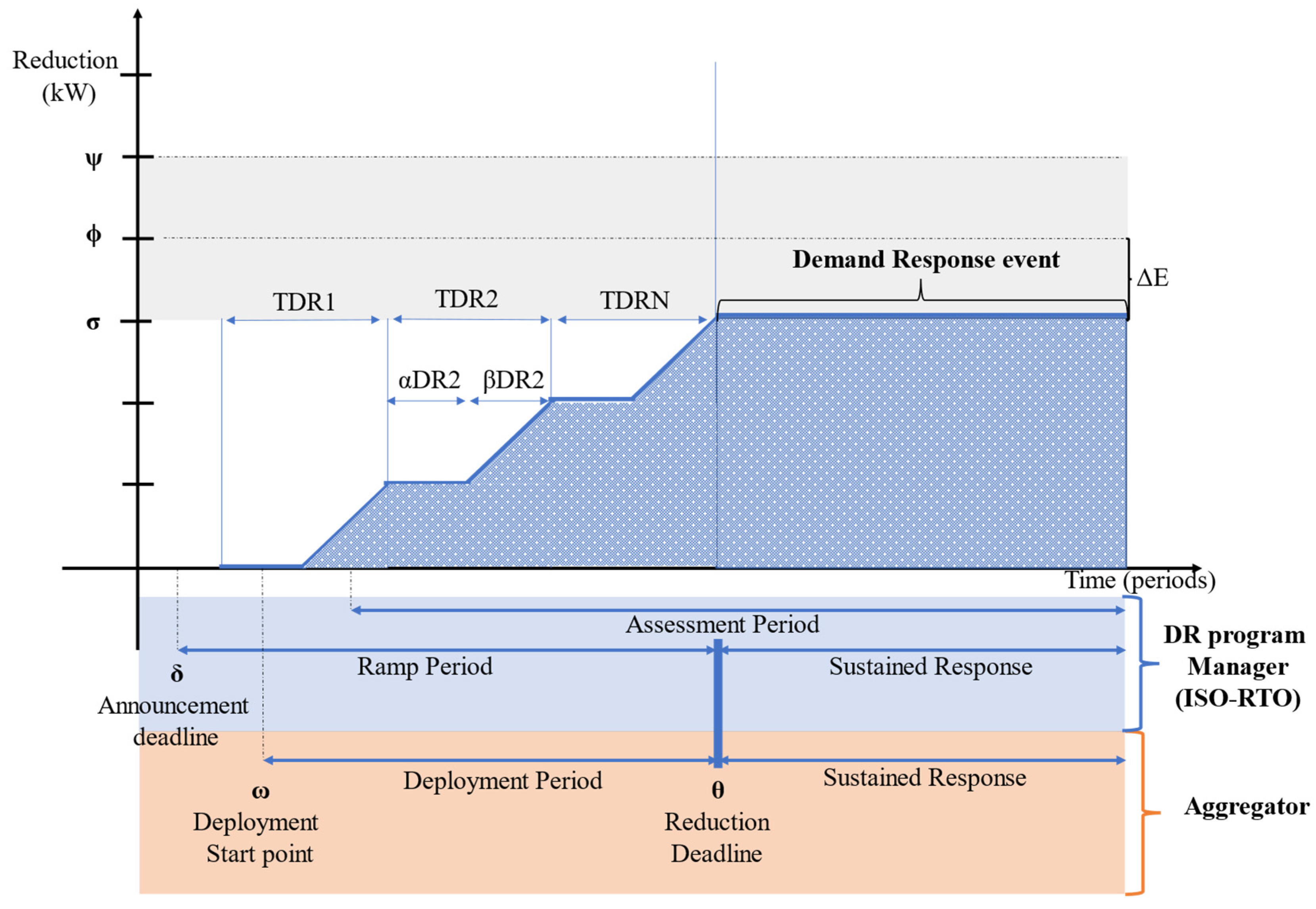

- Abrishambaf, O.; Faria, P.; Vale, Z. Ramping of Demand Response Event with Deploying Distinct Programs by an Aggregator. Energies 2020, 13, 1389. [Google Scholar] [CrossRef]

- Estebsari, A.; Mazzarino, P.R.; Bottaccioli, L.; Patti, E. IoT-Enabled Real-Time Management of Smart Grids with Demand Response Aggregators. IEEE Trans. Ind. Appl. 2022, 58, 102–112. [Google Scholar] [CrossRef]

- Faria, P.; Vale, Z. Application of Distinct Demand Response Program during the Ramping and Sustained Response Period. Energy Rep. 2022, 8, 411–416. [Google Scholar] [CrossRef]

- Chen, Y.; Chen, Z.; Xu, P.; Li, W.; Sha, H.; Yang, Z.; Li, G.; Hu, C. Quantification of Electricity Flexibility in Demand Response: Office Building Case Study. Energy 2019, 188, 116054. [Google Scholar] [CrossRef]

- Li, Y.; Wang, C.; Li, G.; Chen, C. Optimal Scheduling of Integrated Demand Response-Enabled Integrated Energy Systems with Uncertain Renewable Generations: A Stackelberg Game Approach. Energy Convers. Manag. 2021, 235, 113996. [Google Scholar] [CrossRef]

- Shakeri, M.; Pasupuleti, J.; Amin, N.; Rokonuzzaman, M.; Low, F.W.; Yaw, C.T.; Asim, N.; Samsudin, N.A.; Tiong, S.K.; Hen, C.K.; et al. An Overview of the Building Energy Management System Considering the Demand Response Programs, Smart Strategies and Smart Grid. Energies 2020, 13, 3299. [Google Scholar] [CrossRef]

- Paterakis, N.G.; Erdinç, O.; Catalão, J.P.S. An Overview of Demand Response: Key-Elements and International Experience. Renew. Sustain. Energy Rev. 2017, 69, 871–891. [Google Scholar] [CrossRef]

- IEA. Global Energy and Climate Model; IEA: Paris, France, 2022; Available online: https://www.iea.org/reports/global-energy-and-climate-model (accessed on 17 February 2023).

- Huang, W.; Zhang, N.; Kang, C.; Li, M.; Huo, M. From Demand Response to Integrated Demand Response: Review and Prospect of Research and Application. Prot. Control. Mod. Power Syst. 2019, 4, 12. [Google Scholar] [CrossRef]

- Hainsch, K.; Löffler, K.; Burandt, T.; Auer, H.; Crespo del Granado, P.; Pisciella, P.; Zwickl-Bernhard, S. Energy Transition Scenarios: What Policies, Societal Attitudes, and Technology Developments Will Realize the EU Green Deal? Energy 2022, 239, 122067. [Google Scholar] [CrossRef]

- Brown, M.A.; Chapman, O. The Size, Causes, and Equity Implications of the Demand-Response Gap. Energy Policy 2021, 158, 112533. [Google Scholar] [CrossRef]

- Rouzbahani, H.M.; Karimipour, H.; Lei, L. A Review on Virtual Power Plant for Energy Management. Sustain. Energy Technol. Assess. 2021, 47, 101370. [Google Scholar] [CrossRef]

- Judge, M.A.; Khan, A.; Manzoor, A.; Khattak, H.A. Overview of Smart Grid Implementation: Frameworks, Impact, Performance and Challenges. J. Energy Storage 2022, 49, 104056. [Google Scholar] [CrossRef]

- EED. Directive 2012/27/EU of the European Parliament and of the Council of 25 October 2012 on Energy Efficiency. 2012, pp. 1–56. Available online: https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=CELEX:02012L0027-20210101 (accessed on 17 February 2023).

- Zancanella, P.; Bertoldi, P.; Kiss, B. Demand Response Status in EU Member States, EUR 27998 EN; Publications Office of the European Union: Luxembourg, 2016. [Google Scholar] [CrossRef]

- Zalzar, S.; Bompard, E.F. Assessing the Impacts of Demand-Side Flexibility on the Performance of the Europe-Wide Integrated Day-Ahead Electricity Market. In Proceedings of the 2019 International Conference on Smart Energy Systems and Technologies (SEST), Porto, Portugal, 9–11 September 2019; pp. 1–6. [Google Scholar]

- Clastres, C.; Rebenaque, O.; Jochem, P. Provision of Demand Response by French Prosumers with Photovoltaic-Battery Systems in Multiple Markets. Energy Syst. 2021. [Google Scholar] [CrossRef]

- Ribeiro, C.; Pinto, T.; Vale, Z.; Baptista, J. Dynamic Remuneration of Electricity Consumers Flexibility. Energy Rep. 2022, 8, 623–627. [Google Scholar] [CrossRef]

- Müller, T.; Möst, D. Demand Response Potential: Available When Needed? Energy Policy 2018, 115, 181–198. [Google Scholar] [CrossRef]

- Freire-Barceló, T.; Martín-Martínez, F.; Sánchez-Miralles, Á. A Literature Review of Explicit Demand Flexibility Providing Energy Services. Electr. Power Syst. Res. 2022, 209, 107953. [Google Scholar] [CrossRef]

- Yang, X.; He, H.; Zhang, Y.; Chen, Y.; Weng, G. Interactive Energy Management for Enhancing Power Balances in Multi-Microgrids. IEEE Trans. Smart Grid 2019, 10, 6055–6069. [Google Scholar] [CrossRef]

- Lebrouhi, B.E.; Schall, E.; Lamrani, B.; Chaibi, Y.; Kousksou, T. Energy Transition in France. Sustainability 2022, 14, 5818. [Google Scholar] [CrossRef]

- Khojasteh, M.; Faria, P.; Vale, Z. A Robust Model for Aggregated Bidding of Energy Storages and Wind Resources in the Joint Energy and Reserve Markets. Energy 2022, 238, 121735. [Google Scholar] [CrossRef]

- Report from the Commission to the European Parliament, the Council, the European Economic and Social Committee and the Committee of the Regions State of the Energy Union 2022 (Pursuant to Regulation (EU) 2018/1999 of the Governance of the Energy Union and Climate Action). Available online: https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=CELEX%3A52022DC0547&qid=1666595113558 (accessed on 15 February 2023).

- Joint Communication to the European Parliament, the Council, the European Economic And Social Committee and the Committee of the Regions EU External Energy Engagement in a Changing World. Available online: https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=JOIN%3A2022%3A23%3AFIN (accessed on 14 February 2023).

- Jørgensen, J.M.; Sørensen, S.H.; Behnke, K.; Eriksen, P.B. EcoGrid EU—A prototype for European Smart Grids. In Proceedings of the 2011 IEEE Power and Energy Society General Meeting, Detroit, MI, USA, 24–29 July 2011; pp. 1–7. [Google Scholar] [CrossRef]

- Venizelou, V.; Psara, K.; Pitsiladis, G.; Barrachina, P.; Stott, R.; Pieper, N.; Diewald, D.; Agtzidis, D.; Nechifor, S.; Scutaru, M.; et al. Plan for the Deployment of the DRIMPAC Solution and Required Equipment to Pilot Premises. Available online: https://www.drimpac-h2020.eu/wp-content/uploads/2022/11/D4.5-%E2%80%93-Plan-for-the-deployment-of-the-DRIMPAC-solution-and-required-equipment-to-pilot-premises.pdf (accessed on 15 February 2023).

- INTERRFACE. Existing Tools and Services Report. Available online: http://www.interrface.eu/sites/default/files/publications/INTERRFACE-D2.2_v1.0.pdf (accessed on 13 February 2023).

- Katsanou, E.; Chounti, M.; Eleftherios, M.; Athanasios, B.; Katerina, V.; Greenwood, D.; Huo, D.; Santos, M.; Rodríguez, M.; Papadaskalopoulos, D.; et al. MERLON Holistic Performance Evaluation, Impact Assessment and Cost-Benefit Analysis. Available online: https://www.merlon-project.eu/_files/ugd/43aa36_30313ad4405048ed8a37ee6c3c5f7f96.pdf (accessed on 15 February 2023).

- Sanchez, R. Flexibility Elements Identification and Characterization. Available online: https://cordis.europa.eu/project/id/863819/results (accessed on 13 February 2023).

- INTERFLEX. INTERFLEX Summary Report. Available online: https://interflex-h2020.com/wp-content/uploads/2019/11/Interflex-Summary-report-2017-2019.pdf (accessed on 13 February 2023).

- Canelas, C.; Bonsfills, M.; Esquerra, A.; Jofra, P.; Serarols, A. Deliverable D3.2 Consumer Engagement Strategies Guidelines. Guidelines on How to Reach and Retain End-Users in Demand Response Mechanisms. 2022. Available online: https://www.sender-h2020.eu/wp-content/uploads/2022/06/D32.pdf (accessed on 15 February 2023).

- Bakirtzis, E.; Oureilidis, K.; Forouli, A.; Mezghani, I.; Papavasileiou, A.; Candido, L.; Pichet, R.; Ferrer, E.; Delgado, E.; Nikos, A.; et al. Flexibility-Related European Electricity Markets: Modus Operandi, Proposed Adaptations and Extensions and Metrics Definition. Available online: https://www.fever-h2020.eu/data/deliverables/FEVER_D4.1_-_Flexibility_related_European_electricity_markets.pdf (accessed on 15 February 2023).

- Al-Saadi, M.; Silva, N.; Pastor, R.; Coa, Y.; Luís, G. TSO Balancing Markets Requirements for EC Flexibility Services. Available online: https://cordis.europa.eu/project/id/870146/results (accessed on 16 February 2023).

- Cai, J.; Braun, J.E. Assessments of Demand Response Potential in Small Commercial Buildings across the United States. Sci. Technol. Built Environ. 2019, 25, 1437–1455. [Google Scholar] [CrossRef]

- Glick, R.; Danny, J.; Clements, A.; Christie, M.; Philips, W. 2021 Assessment of Demand Response and Advanced Metering. Available online: https://ferc.gov/media/2021-assessment-demand-response-and-advanced-metering (accessed on 14 February 2023).

- IRC. North American Wholesale Electricity Demand Response Program Comparison. 2018. Available online: https://www.naesb.org//misc/dsm_matrix_print_format.pdf (accessed on 14 February 2023).

- Goldberg, M.; Agnew, G.K. Measurement and Verification for Demand Response National Forum of the National Action Plan on Demand Response; Technical Report; LBNL: Berkeley, CA, USA, 2013. Available online: https://www.ferc.gov/sites/default/files/2020-04/napdr-mv.pdf (accessed on 10 February 2023).

- Clean Energy. Building a Clean Energy Economy: A Guidebook to the Inflation Reduction Act’s Investments in Clean Energy and Climate Action Clean Energy. 2023. Available online: https://www.nahma.org/wp-content/uploads/2022/12/Inflation-Reduction-Act-Guidebook.pdf (accessed on 24 January 2023).

- U.S. Department of Energy DOE. Announces $45 Million for Next-Generation Cyber Tools to Protect the Power Grid. Available online: https://www.energy.gov/articles/doe-announces-45-million-next-generation-cyber-tools-protect-power-grid (accessed on 24 January 2023).

- U.S. Energy Information Administration. Battery Storage Capacity Will Increase Significantly by 2025. Available online: https://www.eia.gov/todayinenergy/detail.php?id=54939# (accessed on 24 January 2023).

- Trabish, H.K. 3 Big Advances Coming as Distributed Energy Resources Take Newer, Bigger Roles in 2023. Available online: https://www.utilitydive.com/news/three-big-advances-coming-as-distributed-energy-resources-take-bigger-role/639483/ (accessed on 24 January 2023).

- Dive, U. 2023 Outlook: US Power Sector Trends to Watch. Available online: https://www.utilitydive.com/news/2023-us-power-sector-trends-renewables-reliability-FERC-cybersecurity-hydrogen-nuclear-storage-EVs/640307/ (accessed on 24 January 2023).

- The Biden-Harris Electric Vehicle Charging Action Plan. Available online: https://www.whitehouse.gov/briefing-room/statements-releases/2021/12/13/fact-sheet-the-biden-harris-electric-vehicle-charging-action-plan/ (accessed on 24 January 2023).

- Australian Energy Market Operator. Virtual Power Plant Consumer Insights Interim Report. Available online: https://aemo.com.au/-/media/files/initiatives/der/2021/csba-vpp-customer-insights-study-report-feb-2021.pdf (accessed on 20 February 2023).

- Matthews, T.; Hirve, M.; Pan, Y.; Dang, D.; Rawar, E.; Daim, T.U. Tesla Energy. In Innovation Management in the Intelligent World; Daim, T.U., Meissner, D., Eds.; Technology and Innovation Studies; Springer International Publishing: Cham, Switzerland, 2020; pp. 233–249. [Google Scholar]

- Stem, Inc. Announces South America’s First Virtual Power Plant and Completes First Smart Energy Storage Project in Chile|Stem|Global Leader in AI-Driven Clean Energy Solutions & Services. Available online: https://www.stem.com/stem-announces-south-america-first-vpp-and-first-chile-smart-energy-storage/ (accessed on 7 February 2023).

- Office of Governor Roy Cooper. North Carolina Deep Decarbonization Pathways Analysis Least Cost Carbon Reduction Policies in PJM. 2023. Available online: https://governor.nc.gov/nc-pathways-report/open (accessed on 16 February 2023).

| Ref. | DR Players | Europe | United States | Network Management | DR Initiatives | DR Market Analysis |

|---|---|---|---|---|---|---|

| [21] | x | x | x | |||

| [22] | x | x | x | |||

| [23] | x | x | x | |||

| [24] | x | x | x | x | ||

| [3] | x | x | x | x | ||

| [25] | x | x | ||||

| This work | x | x | x | x | x | x |

| TOPIC | Status |

|---|---|

| Smart Grids | More efforts |

| Digitalization | More efforts |

| Electricity Sector | More efforts needed |

| Buildings | Not on track |

| Electric Vehicles | On track |

| Solar PV | More efforts needed |

| Heat Pumps | More efforts needed |

| Min. Eligible Resource Size | Min. Reduction Amount | Agg. Allowed | Response Required | Trigger Logic | Total DR Contribution Limit (%) | Min. Sustained Response Period | Max. Sustained Response Period | Max. Deployments per Availability Window | Obligation Period | Availability Window | Demand Resource Availability Measurement | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Capacity | 100 kW – 1 MW | 1 kW – 500 kW | Yes (12) No (1) | Mandatory | Operational (8) Other (5) | - | - (8) 5 min–4 h (5) | - (5) 3 h–24 h (8) | - (8) 1–8 (5) | All year (1) ERS Periods Awarded (4) Seasonal (6) Schedule (1) - (1) | All hours (1) ERS Periods Awarded (4) Seasonal (6) Schedule (1) - (1) | Annual test (1) Calculated after the commitment period (4) Daily update (1) Telemetry (2) - (3) |

| Energy | 100 kW – 1 MW | 10 kW – 100 kW | Yes (13) No (2) | Mandatory (8) Voluntary (6) | Operational (6) Other (9) | - | 5 min–4 h (6) - (7) EDR offer (1) Offer (1) | 4 h (2) - (6) Based on offer (1) Based on capacity (1) Dep. window (3) EDR Offer (1) Schedule (1) | - (10) 1 (1) 12 (1) Based on offer (1) Based on component (1) EDR offer (1) | - (3) All hours (1) Based on component (1) EDR offer (1) Schedule (6) Seasonal (3) | - (3) All hours (1) Based on capacity (1) Dep. window (1) EDR offer (1) Schedule (7) Seasonal (1) | - (4) As bid (1) Annual test (1) Daily update (1) ICCP (1) Offers (4) Telemetry (3) |

| Min. Eligible Resource Size | Min. Reduction Amount | Agg. Allowed | Response Required | Trigger Logic | Total DR Contribution Limit (%) | Min. Sustained Response Period | Max. Sustained Response Period | Max. Deployments per Availability Window | Obligation Period | Availability Window | Demand Resource Availability Measurement | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Regulation | 100 kW – 1 MW | 100 kW – 1 MW | Yes (3) No (2) | Mandatory | Automatic (1) Operational (2) Other (2) | - (4) 25% (1) | - (3) 1 h (2) | - (3) Dep. window (1) Schedule (1) | - | All hours (1) Schedule (4) | Schedule | ICCP (1) Telemetry (3) Offers (1) |

| Reserve | 100 kW – 10 MW | 100 kW – 10 MV | Yes (9) No (5) | Mandatory | Operational (6) Other (8) | - (9) 50% (1) 33% (1) 25% (1) 40% of spin requirement for DDr (2) | 1 h (5) - (9) | - (9) Dep. window (2) Schedule (2) 30 min (1) | - | Contract (2) Schedule (7) - (2) All hours (2) Between arming and disarming (1) | - (3) Contract (2) Schedule (9) | Actual, offered and armed volumes reported (1) ICCP (1) Offers (4) Telemetry (8) |

| Advance Notification(s) | Ramp Period | Sustained Response Period | |

|---|---|---|---|

| Capacity | None (7) Day-ahead (3) 5 min–2 h (2) Defined in Market Rules (1) | 5 min–2 h (8) Effectively Instantaneous (2) Resource-Specific (1) Included in energy market offer (1) N/A (1) | As Dispatched/Recalled (7) 5 min–8 h (6) |

| Energy | None (2) Day ahead (9) 5 min–2 h (4) | 5 min–2 h (9) Based on Resource Parameters (1) Startup time and ramp rate included in energy market offer (1) Resource Specific (2) | As Scheduled/Dispatched (9) 5 min–4 h (6) |

| Regulation | None (2) Day ahead (2) 5 min (1) | Effectively Immediate (4) 4 s (1) | As Scheduled/Dispatched (4) 10 s to 60 min (1) |

| Reserve | None (5) Day-ahead (4) 5 min–2 h (4) real-time (1) | Ramp rate include in the energy offer (1) 0.2 s–30 min (13) | As directed (1) As dispatched (8) 5 min–1 h (5) |

| Performance Evaluation Type | Service Type | |||

|---|---|---|---|---|

| Energy | Capacity | Reserves | Regulation | |

| Baseline Type-I | ✓ | ✓ | ✓ | |

| Baseline Type-II | ✓ | ✓ | ✓ | ✓ |

| Maximum Base Load | ✓ | ✓ | ✓ | |

| Meter Before/Meter After | ✓ | ✓ | ✓ | |

| Metering Generator | ✓ | ✓ | ✓ | ✓ |

| Baseline Information (Baseline Window and Calculation Type) | Real-Time Telemetry | After-the-Fact Metering | Performance Window | Measurement Type | |

|---|---|---|---|---|---|

| Baseline Type -I | Model built using historical meter data (12+ months of historical data) | Yes (5) No (12) | Yes (15) Optional (2) | Sustained Response Period (11) Event-dependent, as specified in Notification instructions (2) Sustained Response period or optionally Deployment Period (Participant Selection (2) 5 min and hourly (2) | 15-min Interval Data Recorder (6) 5-min interval load (2) Hourly metered load (4) Actual vs Setpoint (2) Customer/Resource specific (1) |

Average

| |||||

| Best matching event days and day preceding event day from prior 12 months | |||||

| Actual metered load to control group sample average | |||||

| Compare metered interval load during the deployment to the load of the 15-min prior to issuance of deployment | |||||

| 5-min load data of qualifying days: 90 % of the prior qualifying baseline + 10% of the previous qualifying day | |||||

For each baseline day type, calculate the rolling average of a 5-min load from the most recent days on which the resource was not dispatched:

| |||||

| Customer/Resource Specific | |||||

| Weekdays: Hourly simple average of the 5 highest total event period load days in CBL Window (10 previous weekdays within the last 30 days, subject to exclusion rules --> exclude day preceding event/holiday and curtailment events) Weekends: Hourly simple average of the 2 highest total event period load days in CBL Window (previous 3 weekends—same day type (no exclusions)) | |||||

| Hourly average based on high 4 of 5 days weekdays and high 2 of 3 for Saturday or Sun/Holidays (45 days) | |||||

| Alternative calculations as long as it will significantly improve accuracy compared to standard method | |||||

| Avg. hourly integrated DR load for the same hours in the last 30 calendar days when the resource was not dispatched, adjusted when events accur | |||||

| Baseline Type II | Baseline window/Calculation Type define for other resources, as approved on a case by case basis | Yes (1) No (5) | Yes (5) Optional (1) | Sustained Response Period (5) Event-dependent (1) | Statistical equivalent of 5 min or hourly metered load (5) Customer/Resource Specific (1) |

| Customer/Resource Specific | |||||

| Simple Average (45 Days) --> (exclude the 10 most recent non-event, like days) | |||||

| Approved on case by case basis or may use published deemed savings study |

| Baseline Information (Baseline Window and Calculation Type) | Real-Time Telemetry | After-the-Fact Metering | Performance Window | Measurement Type | |

|---|---|---|---|---|---|

| Maximum Base Load | Average Coincident Load (ACL): Avg. of the top 20 out of the top 40 coincident peak hours from the Prior Equivalent Capability Period. Coincident peak hours exclude DR events. Capacity only. | Yes (2) No (4) | Yes (5) No (1) | Sustained Response Period (5) Event-dependent (1) | SCADA or Meter 15-min data vs. max. baseload 5-min interval load Customer/Resource Specific Hourly meter data Av. performance window |

| Meter Before/Meter after | Single Reading 0.2 s after frequency drops to 5.9 Hz for LSSi and 10 min ater Directive for SUP Meter read before deployment Unit special processing—sustained response period (1 h) Unit Special processing—deployment (1 min) Unit Special processing—2 s Scan Rate following signal | Yes (7) No (4) | Yes (9) Yes, interval meter data is collected (1) No (1) | Sustained Response Period (10) Any hours obligated in Reg.-Up or Reg.-Down (1) | 5-min interval load (1) Actual vs. Setpoint (2) Telemetry (2) Customer/Resource Specific (1) Host load forecast—integrated 1-min meter data (1) Instant. load (1) Avg. performance window (3) |

| Meter read before deployment and sustained through the deployment (For Spin/Non-Spin no-pay calculation) | |||||

| Actual telemetered load vs. 5-min average telemetered load prior to event | |||||

| Actual telemetered load vs. dispatched set point (45 s) | |||||

| Single reading (Meter read before deployment) | |||||

| 1-min data (before deployment + Host Load Zone Forecast) | |||||

| Metering Generation Output | Difference between actual metered output during event and generator’s typical use hour (calculated via 10-in-10 baseline) (Typical use baseline—45 Days) | No | Yes, interval meter data is collected | Sustained Response Period | 5-Min load |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Silva, C.; Faria, P.; Vale, Z. Demand Response Implementation: Overview of Europe and United States Status. Energies 2023, 16, 4043. https://doi.org/10.3390/en16104043

Silva C, Faria P, Vale Z. Demand Response Implementation: Overview of Europe and United States Status. Energies. 2023; 16(10):4043. https://doi.org/10.3390/en16104043

Chicago/Turabian StyleSilva, Cátia, Pedro Faria, and Zita Vale. 2023. "Demand Response Implementation: Overview of Europe and United States Status" Energies 16, no. 10: 4043. https://doi.org/10.3390/en16104043

APA StyleSilva, C., Faria, P., & Vale, Z. (2023). Demand Response Implementation: Overview of Europe and United States Status. Energies, 16(10), 4043. https://doi.org/10.3390/en16104043