Abstract

A business model is a “formula” for generating value in a company, and is considered a conceptual object that is part of a company’s intangible resources. It is a company’s unique recipe for sales, cost-effectiveness in operational terms as well as investment, and the financing of operations, both in the short and long term. Due to new challenges, such as sustainable development, faced by enterprises, as well as the new ways of creating and delivering value, such as the closed-loop economy, new concepts of business models are emerging. Presently, there are many different forms of decomposition of a company’s assets that will contribute to the process of creating more sustainable business models to ensure the achievement of cohesion in the financial, environmental and social areas. The purpose of this paper is to present the theoretical assumptions and practical solutions in the field of creating sustainable business models for enterprises by decomposing assets and changing their way of functioning to increase efficiency for stakeholders. The applied research method is based on statistical analysis, with the main focus on the analysis of the correlation between the prices of shares of a parent company and the prices of shares of a company separated from the existing structures.

1. Introduction

The concept of a “business model” is gaining popularity among managers, management practitioners and theorists, and is widely considered in the research [1,2,3,4,5,6,7]. Zott and Amit [3] claim that a company’s business model can be considered a system of interdependent activities that go beyond the main company and extend its boundaries. According to Osterwalder et al., business models can help companies understand, communicate and share, change, measure, simulate and learn more about their business [6]. Following the concept of Osterwalder et al., a business model is a concept representing a set of elements, deadlines and relations that express the business logic of a given company [7]. Tecee, in turn, describes a business model as the design or architecture of the mechanisms used by a company to create, deliver and capture value [5]. In such terms, the essence of a business model is to determine how the company delivers value to customers, encourages customers to pay for that value, and converts those payments into profit. Therefore, a business model is a representation of the conduct of business and is a reflection of the strategy pursued by a company [8]. However, according to Shafer et al. [1], a business model is not a strategy, although it facilitates the analysis, testing and validation of a company’s strategic choices. These two similar concepts, business model and strategy, are distinguished by Romero [9], who points out that a business model explains what a company does, while a strategy organized why a company does what it does.

The current globalisation of markets and the constantly emerging new social challenges that require companies to maintain and strengthen their competitiveness encourage the search for new ways to create multiple values for customers. Additionally, the constant changeability of the business environment makes it necessary for companies to adapt, extend, adjust models and, above all, implement new business models, increasing their expressive power by incorporating new concepts, symbols and artefacts. To stand out, enterprises must, on the one hand, build unique business models and, on the other hand, skillfully implement them through dynamically organize strategies. Modern companies use the transformation of business models to maximise the result (with the assumed standard of value offered to a customer) by looking for opportunities to reduce costs [10], increase revenue and improve business efficiency. Hamel emphasises the importance of innovation and radical change in that area, which is necessary for wealth creation in the years to come [11]. Similarly, [12] points to a culture of open innovation that reduces differences within companies and increases the likelihood of success of a business model. Additionally, it is postulated that the innovation mechanism of a business model should be based on establishing relationships with external technology partners to help companies that are open to innovation achieve even more [13].

Innovation activities undertaken to create new value can be classified as a new area of innovation that leads to the creation of new business models. The framework within which that value is created is related to sustainable development, corporate social responsibility, digital transformation, the closed-loop economy or the sharing economy [9]. Having performed a thorough analysis and verification of the aforementioned concepts, it can be concluded that the time has come to link and merge those concepts into one coherent model, which can be referred to as a sustainable business model.

A sustainable business model (SBM) is a business model that contributes to sustainable development by ensuring a competitive advantage through the superior value offered to customers [14]. Here, the definition of SBM refers to all business activities that draw attention to the three pillars of sustainable development (profit, people, planet—3P) [15,16]. SBM, within the concept of sustainability, defines a company’s ability to constantly learn, adapt and grow, organized, reconstruct and reorient. The creation of such a model requires the company to integrate the key strategic factors that constitute the business model towards sustainability In the economic, environmental and social areas [17]:

- Economic sustainability—requires increasing the profitability of a company through the efficient use of resources (people, raw materials, finance), effective projects and undertakings, good management, planning and control;

- Environmental sustainability—requires avoiding harmful and irreversible consequences for the natural environment through the efficient use of natural resources, promoting renewable resources, soil conservation, water conservation and skilful waste management;

- Social sustainability—requires responding to the needs of society, including all other stakeholders.

According to Jablonski [18], this approach can offer an important space for companies to search for such business solutions that, on the one hand, will allow them to achieve satisfactory financial results, and on the other hand, will guarantee meeting the expectations of stakeholder groups. The result of implementing a sustainable business model is a financial and social dividend generated by a company. A financial dividend refers to the distribution by the company of the generated profit to the shareholders according to their shareholding structure, while a social dividend is related to the social value created for the benefit of the stakeholders, and is based on the intellectual and social capital created for them [18].

In their study, Burhan et al. [15] identify SBM with the Circular Business Model (CBM). Bocken et al. [19] indicate that a circular business model (CBM) is a type of sustainable business model, but it is more focused on closing the loop of resources and reducing the generation of unnecessary waste. Upward et al. developed the term SBM by formulating the concept of a Strongly Sustainable Business Model (SSBM), which should ensure ethical and right decisions (choosing “the right” things to do) and actions (doing “the right” things) [20]. An interesting approach to sustainable business models is also presented by Joyce and Paquin in their study, as part of which they created the Triple Layered Business Model Canvas tool to better understand how a company generates multiple types of value—economic, environmental and social [21].

The transformation towards a sustainable business model involves developing offers of value that involve value for many stakeholders at the same time, including customers, shareholders, suppliers and business partners, as well as the environment and society [22,23]. Thus, Dobrowolski et al. formulated a broader definition of a business model [24]. According to them, a business model represents the way in which a company operates, the type of delivered business value and the method of its settlement and presentation to all stakeholders of the company. In that sense, Evans et al. described sustainable business models as those that [25]:

- Include economic, social and environmental benefits conceptualised as forms of value;

- Require a system of sustainable flow of values between many stakeholders, including the natural environment and society as key stakeholders;

- Require a value network with a new purpose, design and management;

- Require systemic consideration of the interests and responsibilities of stakeholders, with responsibility for mutual value creation;

- Internalise externalities through product and service systems that enable innovation towards sustainable business models.

Therefore, new business models, from the perspective of sustainable development, take into account the synchronisation of multiple values (economic, social and environmental) and are anchored together with all aspects of multiple values [26]. Thus, they are a modification of the concept of a conventional business model, with certain features and objectives [27].

Currently, more and more companies include as part of the “triple bottom line” “green innovations” in their business model, considering them new business opportunities around which they can build a sustainable competitive advantage. Climate change has become one of the most financially significant environmental issues faced by investors [28]. Presently, a large group of the surveyed investors (70%) expect a more clear association of financial results with a company’s business model, within which financial and non-financial contributions are processed into results and passed on to customers in exchange for money [29]. Additionally, investor interest and modelling of the correlation between non-financial data and long-term commercial success are booming. Investors pay more and more attention to the issues of environmental, social and corporate governance management (ESG) [30]. Information about a company’s business model contributes to a better understanding of the company’s operations, and makes it possible to forecast future business performance in a better way [31]. A business model emphasizes the issue of value in a special way; therefore, it is considered that information on the method of its implementation should be presented in the financial statements, which, subordinated to the business model, will play the role of an effective tool for measuring the achievements of the entity. In the opinion of Nielsen and Bukh, a business model should play an important role in the financial statements, constituting a bridge between the company and investors and their information expectations in relation to the company [32]. Thus, a business model supports the preparation of investors’ decisions. Dobrowolski et al. point to two functions of a business model in that area: a preventive function, which manifests itself in identifying threats to the realisation of goals and tasks, as well as the preparation of activities to reduce business risk, and a standardisation function, the purpose of which is to develop mechanisms to facilitate decision-making and the implementation of tasks [24].

As mentioned earlier, there is a growing need for companies to act more responsibly and to address issues such as climate change more urgently. Investment in developing countries—even in the least developed ones—is more and more often considered a business opportunity [33]. Based on the OECD report [33], the economic case for pursuing Sustainable Development Goals (SDGs) is sound and represents a smart decision. Incorporating the requirements of sustainable development into a business model brings companies success, profit, and a positive return on invested capital in terms of reduced risk [34], the diversification of markets and portfolio, higher revenue, lower costs [35] and better product value. Konar and Cohen studied the impacts of legally emitted toxic substances on the intangible assets of publicly listed companies. They demonstrated that a reduction in the emission of toxic substances results in an increase in market value [36]. Mollet et al. [37], on the other hand, focused on differentiating risk and return between sustainable and conventional investments. Based on the results of their study, “green” companies strengthen their brand, improve their growth, achieve positive effects in relations with investors by ensuring added value for them, raise funds more easily and achieve higher rates of return [35,38,39].

The Indicated Increase In environmental and social awareness Influences the way of conduct and attitudes towards sustainable investing. Investors around the world show a positive approach towards the transition to a balanced portfolio. There are several reasons for investors to invest in a sustainable way, the most important of which is the use of a broader range of criteria to make investment decisions, which helps investors avoid the risks affecting long-term investment returns that cannot be detected using financial analysis [40].

Almost two-thirds of people (60%) believe that their individual investment choices can contribute to building a more sustainable world [41]. The 2019 Schroders Global Investor Study (GIS) report shows that more than half of investors (57%), when choosing a product, will always take into account factors related to socially responsible investing by adopting so-called sustainable investing strategies. Additionally, 60% of investors agree that the greater allocation of capital to socially responsible funds would be facilitated by changes in regulations and the better use of independent ratings organized sustainable investing [41].

It seems that the main motivation for people to Invest In a sustainable way Is the desire to use their savings to make a positive impact on the world. The above fact was intensified by the global COVID-19 pandemic—since the pandemic, more people claim that they are aware of the urgency of environmental issues. At a global level, more than 55% of people state that environmental and social issues are “much more important” or “more important” than before the pandemic [42].

The power of sustainable investing is based on tradition, responsibility and performance. Unsurprisingly, environmental disasters (e.g., oil spills, emissions scandals) and human rights scandals are among the main reasons for investors to withdraw from investments (60% and 59% of investors, respectively, declared that they would withdraw from investment if a company in their portfolio was responsible for such an event) [42]. With the need to reduce the negative impact on the natural environment, the divestment campaign is becoming more and more popular—a social movement for fossil fuels, which encourages institutional and private investors to sell shares in companies that use fossil fuels in energy production or industry [43,44,45,46,47]. Condemning oil, gas and coal companies results in a kind of stigmatisation and delegitimisation of their social, political and economic licence to operate. The above has led to questioning the business models of companies and considering them unsustainable [48], but not everyone agrees on that. Treating the divestment of fossil fuels investment as a strategy has been criticised, called naive, and accused of not solving the problem and likely to do more harm than good [49,50]. However, this does not change the fact that investment pressure, e.g., in the case of the power sector, continues to grow—it is additionally intensified by regulatory uncertainty and price volatility in the industry [28].

Disinvestment has the potential to become a breakthrough innovation, playing an important role in the rapid decarbonisation of the global economy [51], especially among developed countries [45,52,53,54,55]. While oil and gas may not be directly affected by divestment, coal may already be affected due to perceived financial risk [56]. More and more insurance companies are withdrawing shares and bonds from coal investments; more and more of them refuse to underwrite new coal projects, making them uninsurable [57].

There has also been a significant increase in withdrawal and a reduction in banks’ involvement in financing investments in fossil fuels due to the high level of risk [58,59,60]. Following the analyses of contemporary trends in disinvestment and reducing operational and investment risk, the creation of new business models based on the separation of risky businesses based on fossil fuels from the rest of the portfolio is also indicated. Such activities are a response to market expectations, and are gaining popularity not only in Europe but also worldwide [61,62,63,64,65,66]. The above indicated separation mechanism is based on moving coal assets to a separate entity and isolating them from those with lower emissions, i.e., gas or zero-emission technologies such as RES (Renewable Energy Sources). According to the report [62], both worlds of energy (conventional and renewable) offer many opportunities for market development and growth; however, they are significantly different in terms of value drivers, competitors, processes, risk, capital costs, skills, investors and success factors. To be able to fully focus on the different challenges related to new energy and conventional energy in a targeted manner, the separation of assets seems justified. Analyses indicate numerous benefits of such solutions [61,62,67]. Separating the businesses, on the one hand, ensures energy security for the period of energy transition (coal assets), and on the other hand, facilitates the emergence of new, more resilient business profiles, more focused on distribution and on the generation of renewable energy, with easier access to external financing. The current changes in business models of companies also have an impact on the scenery from the perspective of investors. The analysis in [62] indicates that asset reorganisation provides a clearer and brighter focus, and will enable investors to more easily identify opportunities and threats within a concentrated portfolio. As a result of the opportunity/risk ratio, it is possible to attract new investors who are looking for a particular opportunity/risk ratio.

Within the business practice of creating new business models, there are a number of asset allocation methods, which will be presented in part two of the study.

2. Materials and Methods

2.1. Theoretical Background

There are many different forms of decomposing company assets, closely related to the mergers and acquisitions (M&A) market. Diversifying a portfolio through mergers or acquisitions makes it possible for companies to look into a future filled with technology and structurally different business models. Disinvestment, spin-offs, carve-outs and tracking stock, presented in this part of the paper, are the most important methods of separating organisational units and taking advantage of them. Each action will be briefly discussed in the next part of the study.

Divestment means selling part of a company’s assets to a strategic investor or “market”, i.e., to all investors who decide to respond to the sale offer. Divestment is the opposite of investment and, from an ethical point of view, as mentioned earlier, it can be treated as the disposal of shares, bonds or investment funds that are unethical or morally ambiguous [68]. Currently, disinvestment is also an increasingly popular way [69] of increasing the value of a company [70]. One of the most common reasons for divestment, based on the adopted objective of this publication, is the desire to focus on a specific segment of activity, disposing of non-key assets. Companies review their strategies and more and more eagerly make binding decisions to divest assets that do not match their core business. Disinvestment is less and less often perceived as a corrective measure due to previous strategic decisions, performed to correct past strategic mistakes. Nowadays, it is a “proactive strategic choice” with the purpose of achieving precise production goals [71], which, among the possible strategies to stimulate the reconfiguration process, becomes a fruitful prospect [71,72]. Strategy researchers present divestment as a multidimensional and complex event that can have a critical impact on the performance of a company [73,74,75]. Hamilton pointed out that companies that undertake divestment are much larger and grow faster than those that do not divest [70]. Moreover, the company’s situation usually improves after divestment—operating margin, return on capital and share prices all increase. However, as Lin and Rozeff [76] and Klein [77] report, the rate of return is higher only for divestments when the selling company discloses to the public the price received for the divested assets and the reason for the divestment. Furthermore, as reported by [78], returns are higher in the case of larger divestments that are tax- or regulator-friendly, and that lead to improved industrial concentration.

A specific example of divestment, according to Peruffo, Pirolo and Neni [79], ensuring the streamlining and reorientation of activities and the adjustment of a portfolio structure [80] is spin-off. For the enterprise sector, spin-off is one of the forms of implementing new projects [81], but mainly projects of a specific nature. In a broad sense related to business issues, the term spin-off is used to refer to an entity created by spinning off/separating from a parent company to undertake activities that were difficult or impossible within that framework [82,83]. The result of spin-off is the transfer of shares of the newly formed entity to the shareholders of the parent company, with a simultaneous listing of it on the stock exchange [84]. Spin-offs are popular because many investors, managers and management boards believe that certain businesses can be valued more highly if they are owned and managed separately, rather than as part of the same company [85]. The broadly understood method of development or restructuring of the company through spin-off makes sense if, as a consequence of such activities, the most important effects that should be achieved by separating an organised part of the enterprise occur. In the literature on the subject, the effects are grouped based on their characteristics into strategic, financial and operational. It seems that the main purpose of spin-off is to achieve strategic and financial effects. Reiner and Rorres indicate that in the case of strategic effects [86]:

- The management of the separated company can focus their full attention on implementing a particular centralised strategy;

- The management has greater autonomy of action in relation to the separated company (it is possible to cooperate with the parent company as well as with competitors);

- There is a slight loss of synergy effects due to the previous cooperation of the separated units, concerning, e.g., the partial overlapping of groups of suppliers or customers.

The financial effects, in turn, are as follows [86]:

- The separated entities follow different financial accounting rules and use different performance measurement indicators;

- There is an increase in the efficiency of capital use within one type of business;

- Different types of activities are characterised by different capital requirements, as well as different expectations of investors;

- Different types of activities attract different groups of investors because they involve different areas of the economy or different stages of development.

Generally, parent companies undertake spin-off operations to be able to handle a more competitive environment. Based on Peruffo et al., small businesses with a simple structure can quickly adapt to changes in the environment because they are closer to the market and quickly learn about new opportunities. Additionally, in small companies, it is easier to use and manage business relationships by performing various functions. Typically, entities separated through spin-offs have a simple and decentralised structure, are rarely diversified, and are always focused on a specific business activity [79].

The second main reason for spin-off is the problems arising in the unit that negatively affect other parts of the company. Nowadays, these are mainly related to activities involving fossil fuels and the willingness of companies to diversify their operational, investment and financial risks. Spin-off divestments allow companies to reduce risk. Moreover, the separated entity is able to compete as an independent company in a new competitive environment [79].

Typical forms of spin-off include split-up, in the case of which the divided company loses its legal personality and new economic entities are created instead, and split-off, where some, but not all, shareholders of the parent company receive shares in the newly established company in response to the relinquishment of shares in the parent company [84,87].

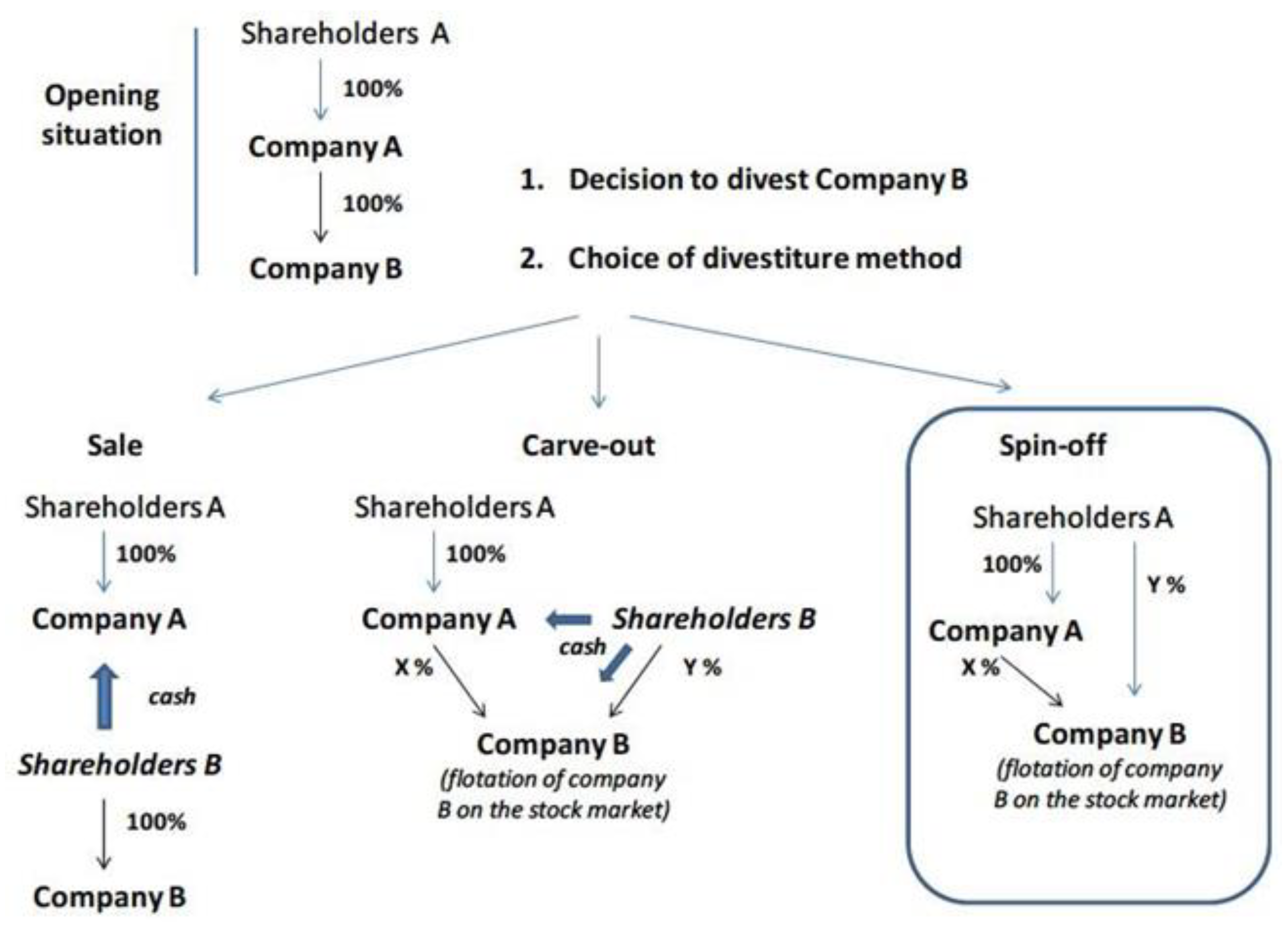

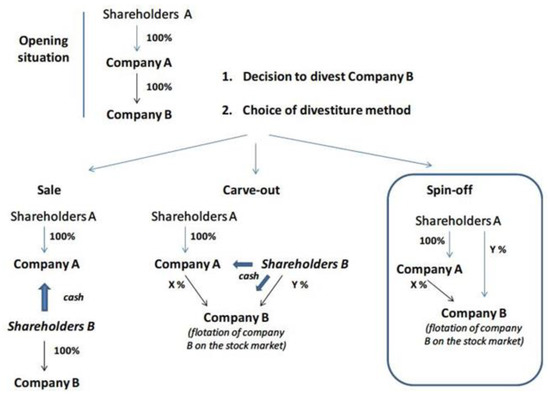

Equity carve-out is a form of transaction as part of which the parent company makes the subsidiary public while retaining control of it. In comparison, in the case of spin-off, to achieve tax benefits the new entity needs to become independent of the parent company [84]. The differences between the discussed divestment methods are presented in Figure 1.

Figure 1.

Differences between disinvestment methods. Source: based on [88].

Colla [89] lists three main differences between spin-offs and carve-outs. First is the distribution of shares to the shareholders of the parent company rather than to the public. Second, carve-out implies an inflow of capital, whereas spin-off involves only a redistribution of shares. Only to the extent that the shares are sold by the shareholders of the parent company to third parties do they generate cash inflow, as emphasised also by Damodaran [84]. Third, spin-offs are more costly in terms of the disclosure of information and other expenses related to Initial Public Offering. Among the main reasons for carve-outs, Damodaran indicates many similarities with other types of divestment, i.e., the desire to control one segment and the focus on the core business—the units operating outside the core area become semi-independent companies [84]. Damodaran claims that carve-out is a way of slicing conglomerates into pieces, with an immediate, positive reaction from the markets to the announcement [84]. As studies show, this reaction is greater when more proceeds from the carve-out are recorded in the parent company, and more positive if the parent company returns cash to shareholders [90]. Analyses of the operating performance of the companies that underwent carve-outs confirm that entities separated in that way grow faster than the average company in the industry, and invest more than them [91].

In the second half of the 1990s, tracking stock shares became popular, as these represent specific parts of a company [84] and can be treated as pseudo divestment. While spin-offs and carve-outs break the old company into two separate entities with clear boundaries, index shares leave the company as one combined business for legal and operational purposes [92]. Damodaran [84], Logue, Seward and Walsh [93], as well as Billett and Mauer [94], discuss the motives for issuing tracking stocks. They give two main reasons: when close cooperation with the parent company is advantageous (integrity is conducive to maintaining value) and when the company wants to maintain full control of its entity. Damodaran additionally points out that the second motive may be related to the fact that a given branch offers products or services that are difficult to replace [84]. Empirical evidence does not provide a credible answer to the question of whether the operating results of the entities covered by the tracking stock shares are better than before their issue. Earlier research has established that tracking stock announcements result in positive excess returns [94,95,96,97,98]. However, there are studies that suggest that control by a parent company may create a conflict of interest between the shareholders of the parent company and the shareholders of the separated entity [84]. In addition, some analyses of post-issuance market performance suggest that adopting tracking stocks does not increase the transparency of the company’s earnings, and large positive returns from the announcement period occur for events that result in the elimination of the tracking stock structure [99]. The above indicates that tracking stocks do not perform as well as their spin-off and carve-out counterparts [92].

The presented cases of the decomposition of company assets, although they pursue common goals, differ in four basic cases [84]:

- Cash flow is not only ensured by a spin-off transaction. In a classic divestment, assets are sold and cash goes to the parent company. In the case of equity carve-out, cash is credited to the parent company or the separated entity. The issuance of tracking stocks generates cash for the parent company or is done on a cashless basis;

- Full control over the separated entity is retained only in the case of tracking stocks. The holders of new shares do not obtain voting rights. After divestment, the parent company loses complete control over the separated assets. In the case of spin-off transactions, the loss of control by the parent company is conditioned by the reduction in the ownership of the separated entity to the level of more than 20%. In the case of equity carve-out, the parent company usually retains control, but the holders of the new shares have voting rights;

- The tax effect occurs in the case of spin-offs and tracking stock. In the case of divestment, the sale of assets results in a capital gain, which is subject to taxation. Equity carve-out transactions are tax-free, provided that it is the separated entity that issues the shares and receives the proceeds from their issue;

- The impact on shareholders is the strongest in the case of divestment and spin-offs. Bondholders may be disadvantaged if the proceeds from the divestment are invested in shares or when, as a result of spin-off, the parent company retains only a minority share in the separated entity. Equity carve-out determines control over the separated assets. The issue of tracking stock shares protects the holders of new shares—in the event of liquidation, they are at the end of the queue for the company’s assets.

Based on the Global Divestiture Survey [100], corporate divestment plans resulted in activity in the field of global M&A transactions exceeding USD 3 trillion in 2019. The COVID-19 pandemic forced declines in both the value and volume of transactions [101]. As economies around the world were adversely affected by the restrictions and corporations faced a sudden and dramatic shift in their markets, the value of global transactions fell by 71% in June 2020. Today, corporate strategies have shifted from a rapid response to those changes towards efforts to rebuild and develop in the “new reality”. Downward trends can become unique opportunities, and mergers and acquisitions (M&A) can be an effective tool for companies to reinvent themselves in different market conditions. In the current conditions, divesting part of the business can be a powerful defensive tool for companies that want to build portfolio resilience.

2.2. Research Method

The conducted analyses were based on two research methods. The first one was to review global methods of creating new, sustainable business models. It provided an outline of how restructuring efforts are being used to support corporate and environmental goals in today’s era.

The second method, the statistical part of the analysis, focused on correlations taking into account the time shift between the prices of shares of a parent company and the prices of shares of a company separated from the structure of assets. The main objective was to answer the question of whether the disinvestment process brought the desired effect, i.e., the separation of specific assets from a parent company and their consolidation in a new entity.

Based on that, the following research hypothesis can be proposed: There is no significant correlation between the share prices of parent companies and the share prices of separated companies. This hypothesis suggests that the movements in share prices of the parent and separated entities are independent of each other. By examining the correlation between these two sets of share prices, it is possible to assess the degree of association or lack thereof, which would provide insights into the potential interdependence or autonomy of their price dynamics.

The study employed two distinct methodologies: the classical method and a cross-correlation analysis. In the classical method, the investigation centres on the r-Pearson correlation at t = 0, which quantifies the linear association between the prices of shares pertaining to the parent company and the separated entity. By evaluating the correlation at a specific time, it facilitates the assessment of the degree of concordance or disparity in price movements between the two entities. This analytical approach yields immediate insights into the interrelationship of share prices between the parent company and the separated entity.

In the cross-correlation analysis, a more comprehensive investigation of the relationship between the two time series was conducted. This analysis involved applying a specific function, denoted as function 1, to calculate the cross-correlation between the two time series, X and Y. The function incorporates a parameter, d, which represents the time delay between the two series. In the case under study, the time delay was set at ±1, meaning the correlation between the parent company’s share prices and the separated entity’s share prices with a time shift of one unit forward or backward. By varying the time delay, it is possible to explore how the correlation between the two entities changes over different time periods. This approach allows for a more nuanced understanding of the relationship between the share prices of the parent company and the separated entity, capturing potential lagged effects or lead-lag dynamics.

The purpose of cross-correlation was to verify whether there was no time delay Δt in the Pearson correlation (whether the correlation did not increase with the shift in the time series in the pair under study). The measure is often used when analysing risk for investment portfolios, taking into account the dynamics of the correlation between the share prices of the entities under study in identical time series [102,103].

3. Results and Discussion

The purpose of disinvestment and asset restructuring is to create business models with features of sustainable development. Such changes apply to virtually all industries that want to stand out in the direction of innovativeness of their operation, and, at the same time, want to make investors interested in the implemented processes. The specificity of some industries, especially in the area of energy or mining, particularly determines strategic changes and imposes specific actions characterised by the pursuit of long-term value realisation in a dynamic and changing business environment.

In the case of the energy industry, the so-called restructuring of assets towards the separation of conventional fossil fuel-based power generation from renewable energy based on renewable sources can be noticed. The above is the basis of a strategic shift that fits in with climate protection and the implementation of broadly understood environmental and social policy. It is gaining importance among financial investors and shareholders, who are more willing to engage capital not only to multiply it in the economic sense, but also in accordance with the current policy of decarbonisation and social responsibility.

On the other hand, in the mining industry, noticeable asset restructuring is evolving towards the creation of business models and separation of operations related to raw materials in order to serve new technologies, innovation or sustainable development. The focus on rare earth resources, copper, molybdenum, manganese, etc., is resulting in projects involving such deposits being transferred to separate entities while leaving traditional mining based on iron ore, zinc and lead or coal in the current forms of operation. The purpose of such asset cleansing is also to attract investors who are more focused on future technologies—sustainability and efficiency in economic, but also social and environmental, terms.

Observing such changes is an interesting starting point for the discussion of whether such restructuring in the aforementioned industries actually helps the business, separates the risks associated with existing activities, and attracts new investors who are more willing to engage in new, innovative projects involving technology development. Finally, the issue of whether the separated entities act differently on the capital markets than the companies or organisational structures from which they originate becomes important.

To confirm the general conclusions and the above theses, two cases in the energy industry (Siemens AG and Siemens Energy (Munich, Germany), E.ON and Uniper (Düsseldorf, Germany)) and two cases in the mining industry (BHP Billiton and South32 (Perth, Australia), Hochschild Mining (London, UK) and Aclara Resources (Concepción, Chile)) have been analysed.

3.1. M&A during the Energy Transition—Siemens AG and Siemens Energy

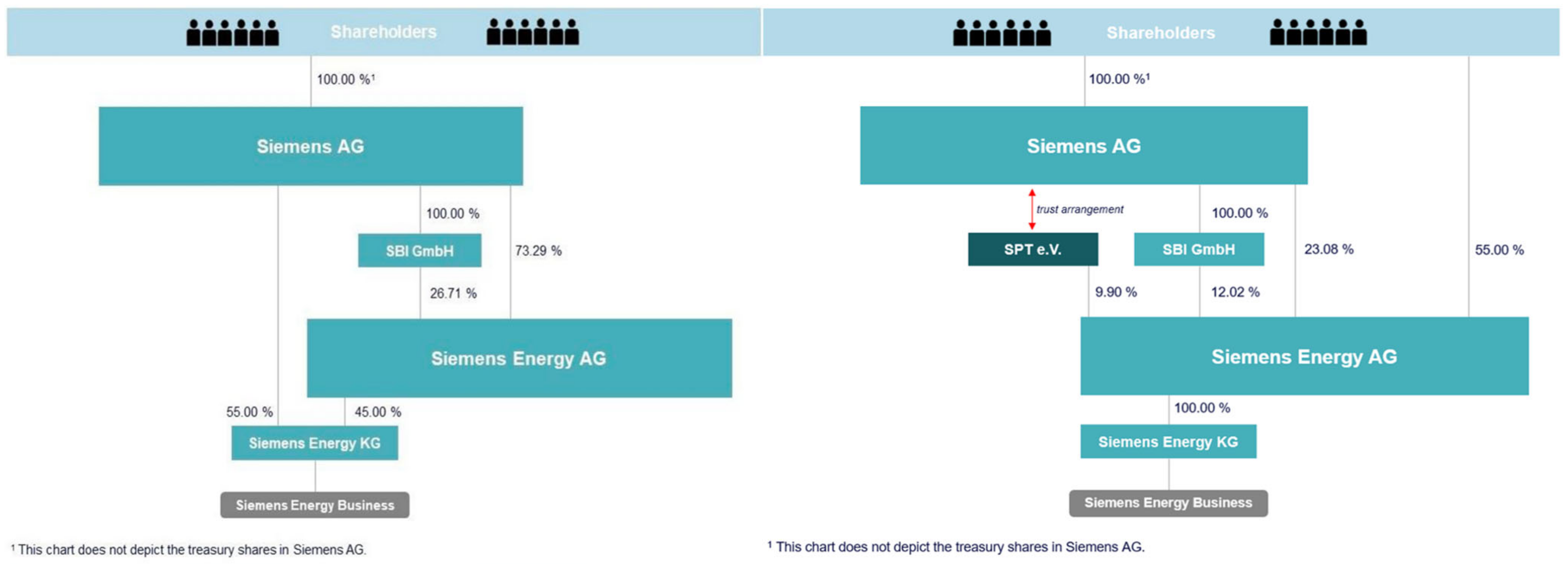

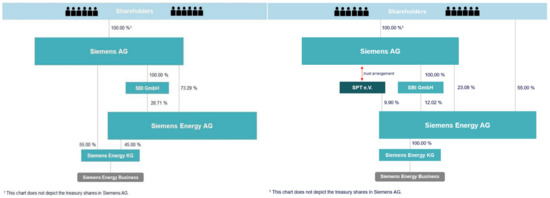

The first stage in the spin-off of Siemens Energy was the creation of the holdings of Siemens AG and SBI GmbH within Siemens Energy AG, to remain after the spin-off [104]. The shares held by SBI GmbH and part of the shares held by Siemens AG were transferred to Siemens Energy KG by means of a capital increase in kind. In return, SBI and Siemens AG received the shares in Siemens Energy resulting from the capital increase, thus ensuring that the value of the shares and the contribution matched. Following the registration of the capital increases, Siemens AG held 73.3% of the shares, with the remaining 26.7% held by SBI GmbH.

In the second stage, Siemens AG spun off its remaining shares in the limited partnership Siemens Energy KG and its remaining shares in General Partner GmbH to Siemens Energy AG by means of an absorption-type spin-off in accordance with the Transformation Act (UmwG). In exchange for the spin-off, Siemens shareholders received Siemens Energy shares corresponding to their shares in Siemens AG. The May 2020 resolution, adopted by the shareholders of Siemens Energy AG, accepted an additional capital increase in exchange for an in-kind contribution. Thus, after the spin-off of Siemens Energy AG, the Future Siemens group owned 45% of the shares and Siemens shareholders owned 55%. Additionally, in connection with the de-merger, Siemens AG transferred to SPT e.V. shares in Siemens Energy AGH representing 9.9% of the share capital (Figure 2).

Figure 2.

The spin-off process of Siemens Energy AG. Source: based on [104].

The assets transferred by Siemens AG to Siemens Energy AG as part of the de-merger consisted primarily of [62]:

- Fractional shares in the limited partnership constituting a proportional part of the fixed capital of Siemens Energy KG of 55% of the fixed capital of Siemens Energy KG;

- 13,750 shares held by Siemens AG in General Partner GmbH, which corresponds to a proportional part of the share capital of General Partner GmbH of 55%.

3.2. De-Merger of Uniper and E.ON

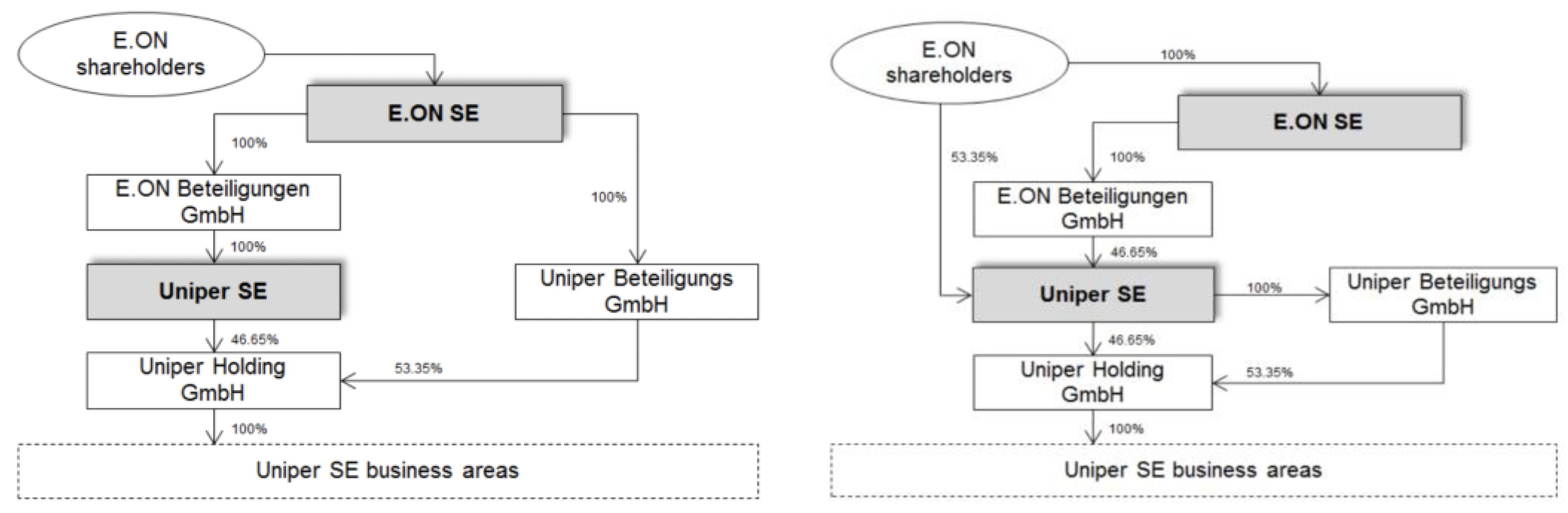

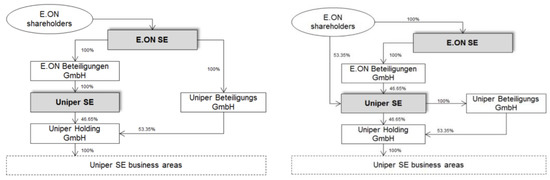

Before the division process of the E.ON Beteiligungen GmbH group, E.ON SE held 100% shares in Uniper, which, in turn, held 46.65% shares in Uniper Holding GmbH, the remaining shares belonging to Uniper Beteiligungen GmbH—another subsidiary within the E.ON SE group (Figure 3).

Figure 3.

Uniper’s spin-off process from E.ON. Source: based on [62].

As in the case of Siemens, E.ON, in accordance with the Transformation Act (UmwG), exercised the option of transferring 100% of the shares of Uniper Beteiligungen GmbH to Uniper SE by way of de-merger by absorption, as a result of which the remaining 53.35% was transferred directly to Uniper SE. The new shares, as payment for the de-merger, were transferred to the shareholders of E.ON SE at a ratio of 10:1—E.ON SE shareholders received 1 Uniper SE share in exchange for 10 E.ON SE shares. The new Uniper SE shares were issued through a capital increase to implement the de-merger. Once the de-merger came into force, E.ON SE shareholders held 53.35% of Uniper SE shares and E.ON SE held 46.65% of the shares indirectly through E.ON Beteiligungen GmbH. As a result, the shareholders of E.ON SE remain fully involved in the activities of the Uniper Group, which was separated after the de-merger—directly through their share in Uniper SE and indirectly through their share in E.ON SE.

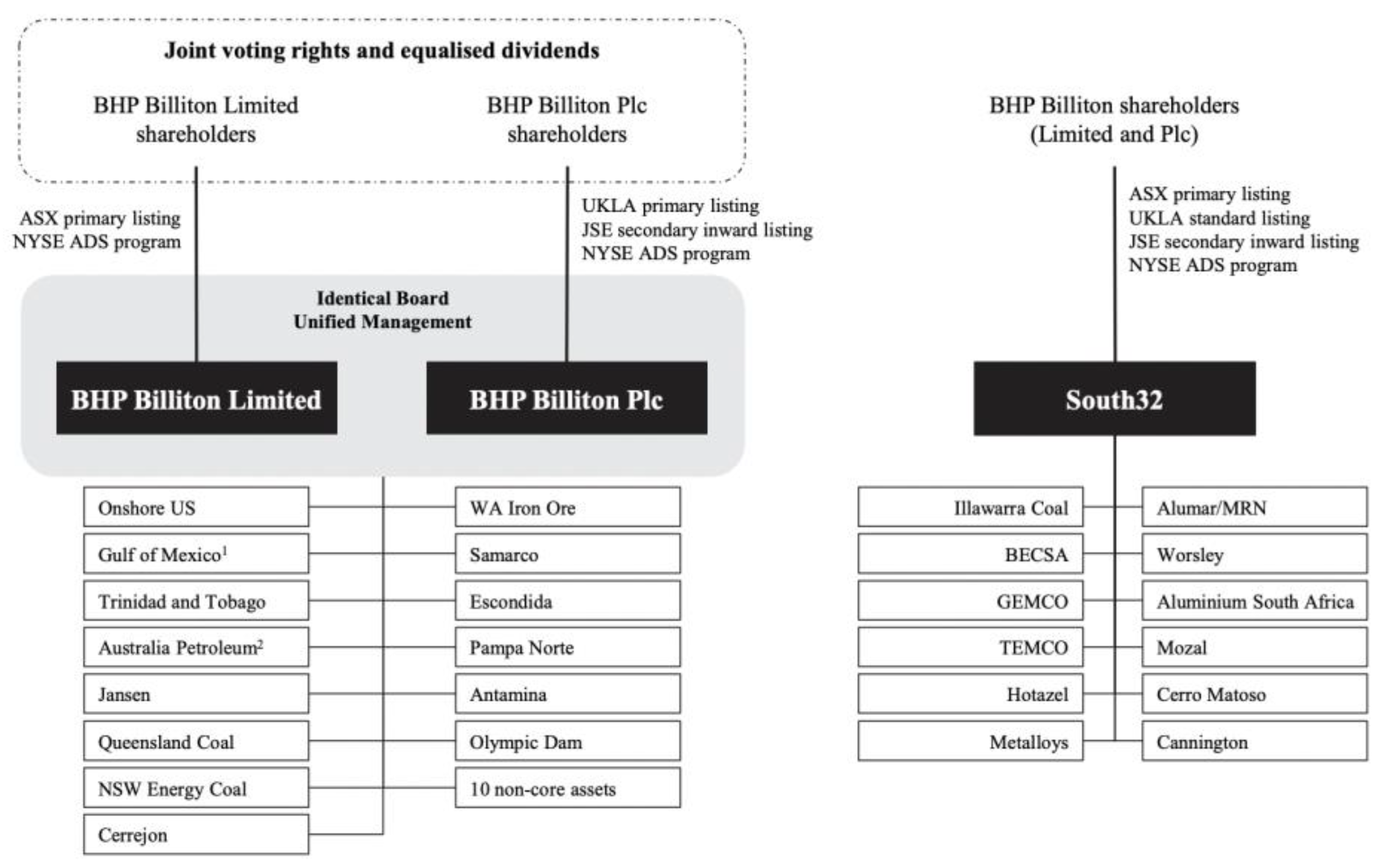

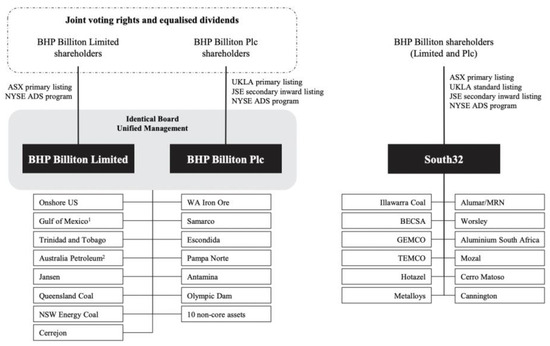

3.3. Australian Spin-Off BHP Billiton and South32

The process of spinning off South32 was divided into two main stages, the first being the pooling of assets owned by various subsidiaries of BHP Billiton Limited and BHP Billiton Plc [105]. The consolidated assets were transferred to South32, a subsidiary of BHP Billiton Limited, and this company was the spin-off entity to BHP Billiton shareholders. The second stage was the spin-off process—BHP Billiton Plc took over 40% of the shares of South32 (Figure 4). BHP Billiton Limited and BHP Billiton Plc transferred their shares in South32 to their shareholders through the payment of dividends.

Figure 4.

The spin-off process of South32 from the BHP Billiton group. (1) Gulf of Mexico core assets comprise Atlantis, Mad Dog and Shenzi. (2) Australia Petroleum core assets comprise Bass Strait, North West Shelf, Pyrenees and Macedon. Source: based on [105].

As a result, South32 became a separate legal entity listed on the ASX and the LSE and JSE. Each shareholder of BHP Billiton, other than non-qualifying shareholders, will receive one South32 share for each BHP Billiton Limited or BHP Billiton Plc share held at the date of registration of the de-merger.

3.4. De-Merger Process of Hochschild Mining and Rare-Earth Aclara Resources

The process of separating Aclara was dictated by the desire of the Hochschild Mining group to spin-off a project involving the production of rare earth metal concentrate by a processing plant fed with clays from nearby deposits. For that purpose, the Hochschild group established Aclara Resources, a company based in Canada. The investment in the form of the Aclara project, held in the Chilean company REE UNO SpA, was transferred to Aclara Resources [106]. In total, 80% of Aclara’s shares were paid out as dividends to the holders of ordinary shares of the Hochschild Group. After the completion of the IPO, Aclara became an independent company listed on the Toronto Stock Exchange. The ratio of Aclara shares covered by the de-merger to the number of ordinary shares of the Group was 70,606,502 to 513,875,563. Therefore, the shareholders entitled to dividends from the distribution received 0.1374 Aclara shares for each ordinary share of the Group. The de-merger dividend amounted to a total of CAD 120,031,053 (equivalent to USD 94,945,000) based on an offer price of CAD 1.70 per Aclara share. HM Holdings retained 20% of Aclara’s shares. Upon completion of the de-merger, the Group retained a 20% stake in Aclara Resources Inc. (Figure 5).

Figure 5.

Aclara’s spin-off process from Hochschild Mining. Source: based on [106].

3.5. Cross-Correlation Analysis of the Behaviour of Share Price of Companies and Their Spin-Offs

The correlation analysis was conducted for the maximum listing period of spin-offs on stock exchanges. In the case of the cross-examination of share prices, a shift by one sample should be understood as a shift by one day relative to the x axis. A positive shift (positive relative to the x axis) indicates how the price of the daughter company affects (correlates with) the price of the shares of the parent company. Otherwise, there is a negative shift (negative relative the x axis)—indicating how the prices of the shares of the parent company affect (correlate with) the prices of the shares of the daughter company in relation to the examined shift. Four pairs of companies, listed in Table 1, were subjected to the analysis, in accordance with the principle that the pair “company subject to de-merger–spin-off” is listed on the same stock exchange.

Table 1.

Summary of the results of Pearson cross-correlation analysis of pairs of companies and their spin-offs.

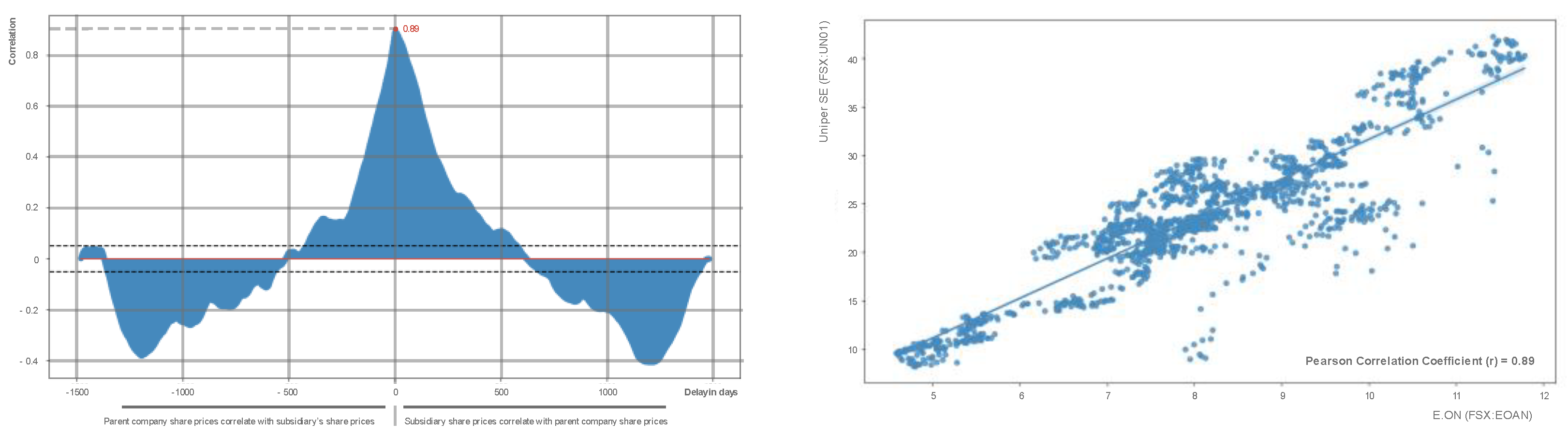

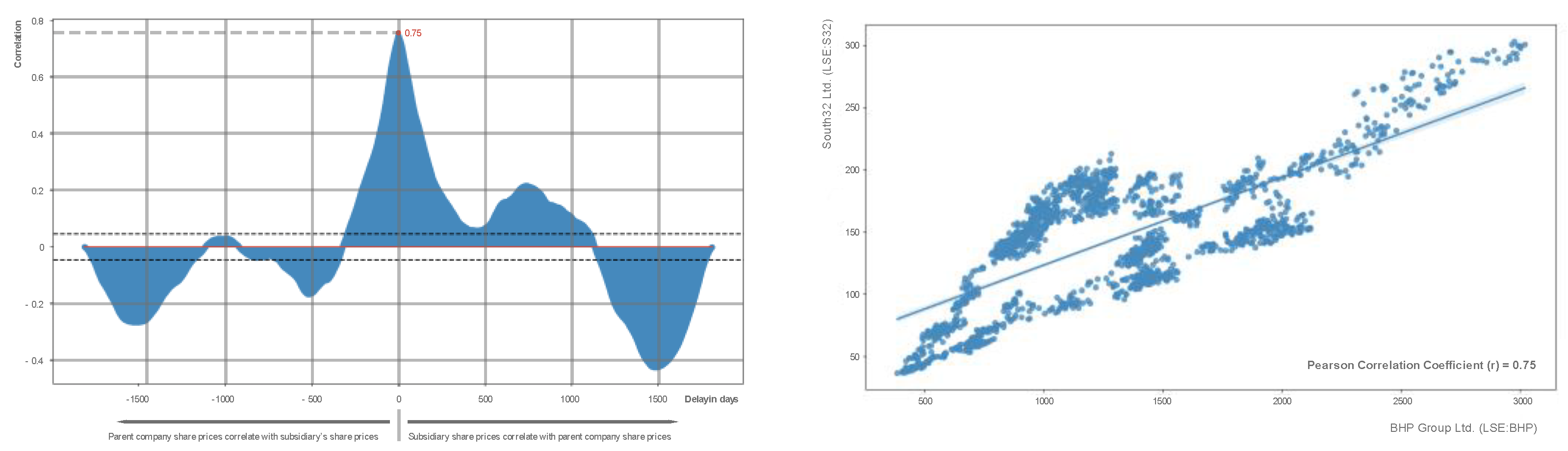

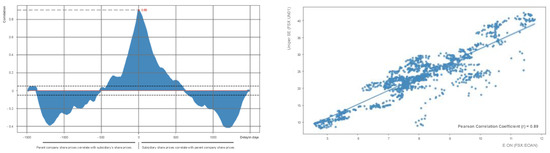

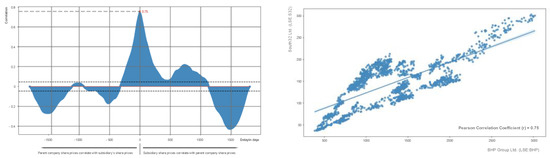

Based on the analysis, for pairs of companies 1 and 2, Pearson correlation showed the highest value at point 0 and decreased on each subsequent day of the shift by Δt, which means that the adopted coefficient correctly describes the level of impact of the parent company’s share prices on the daughter company’s share prices, as presented in Figure 6 and Figure 7.

Figure 6.

Cross-correlation for the pair E.ON (FSX: EOAN)–Uniper SE (FSX: UN01). Source: own elaboration.

Figure 7.

Cross-correlation for the pair BHP Billiton–South32. Source: own elaboration.

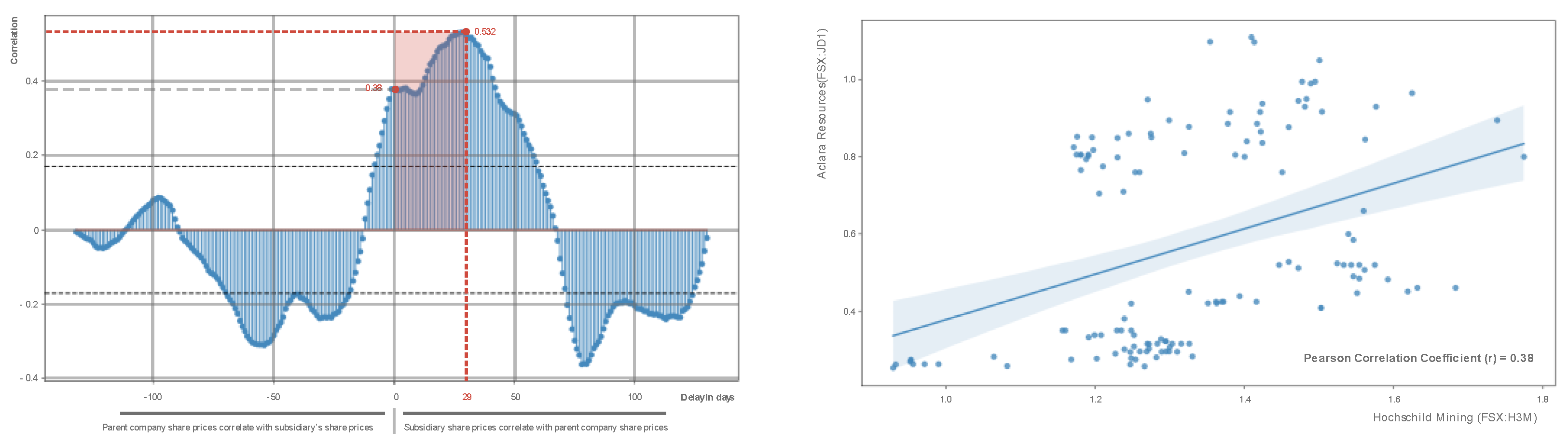

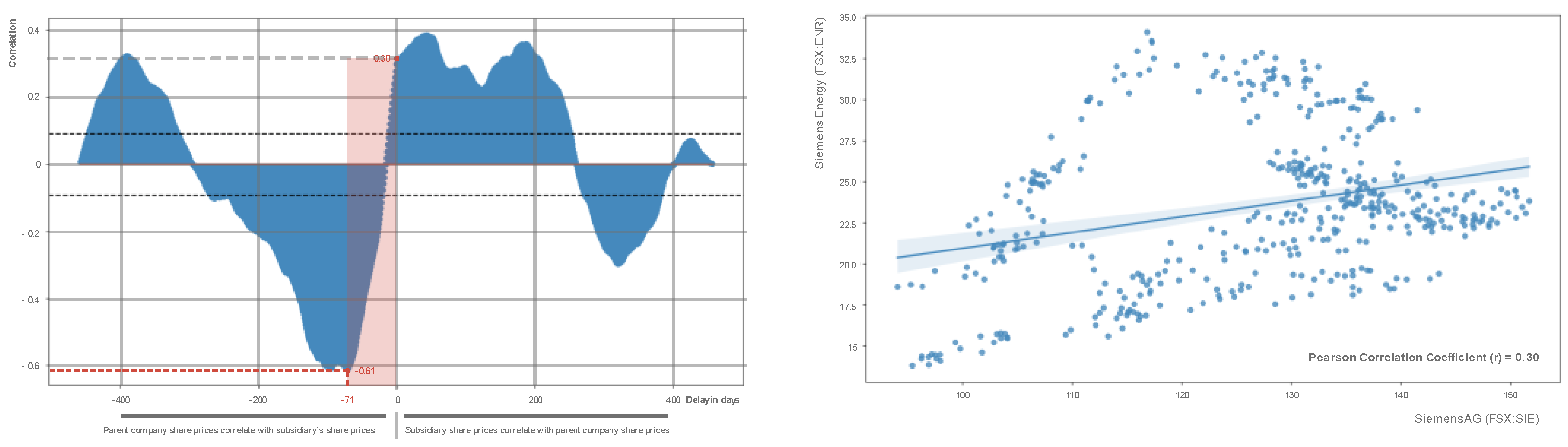

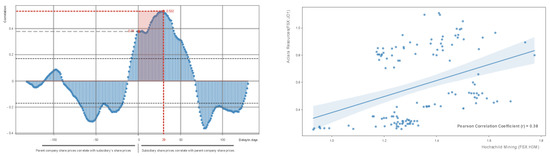

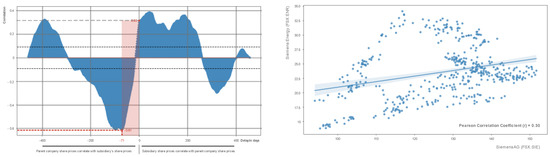

For pairs of companies 3 and 4, cross-correlation showed that point 0 was not where the Pearson correlation had the highest value.

The share prices of Hochschild Mining and the spin-off Aclara Resources correlated most strongly with the share prices of the parent company if there was a delay of approximately one month (maximum correlation value = 0.532 for Δt = 29 days), and this is a positive correlation, which means that the increase in the share prices of the parent company correlates with the increase in the share prices of the daughter company, as presented in Figure 8.

Figure 8.

Cross-correlation for the pair Hochschild Mining–Aclara Resources. Source: own elaboration.

The share prices of Siemens AG and the spin-off Siemens Energy (Figure 9) correlated most strongly with the share prices of the daughter company if there was a delay of more than two months (maximum correlation value = −0.61 for Δt = 71 days), and this is a negative correlation (an increase in the share prices of the parent company correlates with a decrease in the share prices of the daughter company or vice versa).

Figure 9.

Cross-correlation for the pair Siemens AG–Siemens Energy. Source: own elaboration.

The high Pearson correlation and cross-correlation values indicate that the separation of companies does not make each company’s share prices independent of each other, which is one of the main reasons why companies choose to divest in various ways. The essence of the de-merger and the change in business models is to make the “slimmed-down” business more acceptable to investors, to create a better perception on capital markets in terms of valuation and capital raising opportunities, as well as to separate the risks related to existing activities.

The share prices of the companies under study correlated with each other both at time 0 (pair 1 and 2) and with a delay (pair 3 and 4), assuming high correlation values (>50%). Given that correlation does not imply causality, at this stage of the study, it is not possible to determine what factors contribute to the high or low level of correlation, and why in the case of Siemens and Hochschild Mining the strongest correlation occurs with a delay.

In the examined cases, however, there is a correlation related to the reaction to spin-off in the initial period of stock exchange listing (no longer than 2 years) when the prices of the shares of the separated company do not behave identically to the prices of the shares of the parent company. The reason for the above may be the public announcement of the disinvestment and the transition period for the migrated assets, during which the company separated from the structure continues to use the resources of the parent company [107]. In the case of this type of spin-off, where correlation occurs with a significant delay, the task of the management is to gradually reduce their participation in the management of the separated company, so as not to create a “business-as-usual” situation that makes the separation from the asset structure no longer effective [75].

The obtained results of the study give room for further discussion related to the effectiveness of the spin-off process in mining and energy companies. The first question that arises after the correlation analysis is: Why do the share prices of the separated companies continue to behave in a similar way? Is the delayed reaction of share prices related to the nature of the spun-off entity and to the industry average, Tobin’s Q [108], as a measure of the long-term profitability of the sector? Do companies consider share price reaction delays in their business models, treating them as a predictor of strategic decision-making? The answers to these questions will help us to understand the essence of asset separation, especially in the energy and mining industries—specifically in terms of the strategic nature of operations, and also in the context of ESG management. The premise for the present study was the assessment of whether the separation of assets coincides with the companies’ stated intentions, i.e., the separation of risks from existing activities. For this purpose, a method of simple cross-correlation of share prices that has not been previously used for this purpose was applied. According to previous similar studies on the financial effects of divestment [52], divestment transactions not only yield higher risk-adjusted returns, but also reduce the exposure of investment portfolios to carbon dioxide emissions [55]. Additionally, stricter divestment approaches, excluding more fossil fuel-related stocks, have higher risk-adjusted returns and a lower carbon intensity than less strict approaches [52]. Linn and Rozeff’s analyses [76] prove that the announcement effects of voluntary spin-offs tend to increase the stock price of the announcing companies. However, other studies indicate that while on average the initial announcement of a sell-off results in a significant positive excess return, not all divestment announcements are accompanied by positive price movements [77].

As presented in the introduction and in this section, the various conducted studies show the economic arguments consisting of a direct comparison of investment portfolios with and without fossil fuels and assessing whether this affects the results. Some analyses point to the positive financial effects of divestment, others point to the risks and uncertainties involved, but all studies prove the essentially near-zero risk of staying out of the biggest fossil fuel companies, while staying in fossil fuels may be more of a risk given the existence of a “carbon bubble” and the valuation of fossil fuel stocks based on unused fuel reserves [53,54,55].

4. Conclusions

Over the past decade, global economies have seen a large increase in divestment activity. Companies are eliminating entities unrelated to their core business at a record pace. This is driven by the desire to achieve both financial and strategic outcomes [79,86]. A strong focus on one’s own products and sectors, the mitigation of risks, the stimulation of long-term value creation potential and the desire to attract new investors—these are just some of the determinants indicating that the asset decomposition market is likely to continue its growth dynamics. The turbulence in the macro-environment triggered by financial crises, the COVID-19 pandemic and geopolitical situations has imposed the need to reorient business thinking. The current business environment requires more strategic capital transactions and decisions to make current and future business models resilient to changing environmental conditions. That issue imposes the need to consider and take seriously the environmental, social and governance (ESG) aspects [30]. As the reports presented in the publication and the authors quoted in the article show, the assessment of the ethical, social and environmental impact of investment decisions and strong corporate social responsibility become extremely important when choosing the targets of disinvestment [28,29,33,34,42,43,44,45,51,52].

The purpose of the article was to respond to the current challenges of sustainable development and the needs of stakeholders by creating new sustainable business models. In the article, examples of pairs of companies are presented: E.ON and Uniper SE, BHP Billiton and South32 Ltd., Hochschild Mining and Aclara Resources, and Siemens AG and Siemens Energy. The presented research is an attempt to formulate a correlation between the market behaviour of the parent company and the subsidiary separated from its assets. Based on the obtained results, in the studied cases, there is a noticeable reaction to divestment only in the short-term perspective (up to 2 years): the share prices of the spun-off companies behave differently from those of the parent companies, so it can be assumed that, from the point of view of potential financial effects, the separation of the risk related to the present activity makes sense only in the short term. In the longer term, the fuel and energy market (examined through the prism of four pairs of companies) does not perceive such transactions as financial benefits, questioning the effectiveness of the spin-off transaction. The inconclusive results provide a wide field for further research and analysis in this area.

The obtained results of the study give room for further discussions related to the effectiveness of the spin-off process in mining and energy companies. The first questions that arise after the correlation analysis is: Why do the share prices of the separated companies continue to behave in a similar way? Is the delayed reaction of share prices related to the nature of the spun-off entity and to the industry average, Tobin’s Q [108], as a measure of the long-term profitability of the sector? Do companies consider share price reaction delays in their business models, treating them as a predictor of strategic decision-making? The answers to these questions will help us to understand the essence of asset separation, especially in the energy and mining industries—specifically in terms of the strategic nature of operations, and also in the context of ESG management.

The analyses proposed in the study contribute to the discussion of the implementation of sustainable business models, and support analysts and practitioners with a tool to explore their impacts and effects at the micro level. This study generates various relevant implications for stakeholders as well. The implications for stakeholders in the context of sustainable business models work in several ways. When a company spins off a separate entity with a specific focus on sustainability, it allows for greater agility and specialisation in addressing environmental and social concerns. By separating a sustainable business unit through a spin-off, stakeholders can ensure that dedicated resources are allocated specifically to sustainability-related goals. This allows for better resource management and allocation, as the spin-off can prioritize investments and efforts towards sustainable practices, research, and development. A spin-off focused on sustainability can attract investors and stakeholders who are specifically interested in supporting and participating in sustainable initiatives. This targeted approach can foster engagement and collaboration, creating a community of stakeholders with shared sustainability values and goals. Sustainable business models often incorporate risk management strategies related to environmental, social, and governance factors. This can help stakeholders mitigate risks associated with climate change, regulatory compliance, reputational damage, and other sustainability-related issues. However, in the cases analyzed, the markets still combine the activities of the parent company and the company spun off from the structure. Initial enthusiasm in the long term does not find its way into market prices.

Despite the academic and practical relevance of this study, we observed some limitations. Further research and supplementation with the issues listed below are required.

The set of the studied entities should be expanded. The results would have been more meaningful if the case study had included more global companies, rather than being limited to four pairs of companies. In subsequent studies, it would be interesting to divide the analysed cases according to the country in which the entities operate, and to compare their characteristics and the political–social–economic climate of the given countries (the level of advancement of the implementation of the principles of sustainable development). It is worth emphasising, however, that the trend of creating sustainable business models through the separation of assets is relatively new; therefore, the main limitation, but also a research opportunity, is the fact that, at least for now, there are not many transactions of that type, and there is currently no detailed history of such companies, so the number of case studies, at least for the moment, may be limited to some extent.

An important aspect also seems to be the extension of the research period. The authors consider the hypothesis that a broader time perspective may affect the results of such types of analyses. There is a possibility that daughter companies separated from the structure of the parent company need more time to “become independent” than the period considered in this study.

Finally, consideration should also be given to including in the analysis companies in which actual changes in ownership structure are evident. The authors suspect that the obtained results (the share prices of parent and separated companies behave in a similar way) may be due to the parent company still being in control of the spin-off company, which is noticed by investors. The fact that they are dealing with the same entity, only separated by capital, may mean that the assumed goals of disinvestment have not been achieved.

The growing popularity of creating sustainable business models through separation using various methods of disinvestment, e.g., spin-off, the identified challenges and the ways of dealing with them presented above, as well as the obtained results of the analysis, which imply the formulation of new research hypotheses, encourage the authors to continue their scientific work in that field.

Author Contributions

Conceptualisation, A.K.; methodology, T.L.; software, T.L.; validation, S.L.; formal analysis, S.L.; investigation, S.L.; resources, S.L.; data curation, T.L.; writing—original draft preparation, S.L.; writing—review and editing, M.S.; visualisation, A.K.; supervision, M.S.; project administration, T.L.; funding acquisition, A.K. All authors have read and agreed to the published version of the manuscript.

Funding

This research was prepared as part of AGH University of Science and Technology in Poland, scientific subsidy under number: 16.16.100.215.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Shafer, S.M.; Smith, H.J.; Linder, J.C. The power of business models. Bus. Horiz. 2005, 48, 199–207. [Google Scholar] [CrossRef]

- Zott, C.; Amit, R. The fit between product market strategy and business model: Implications for firm performance. Strateg. Manag. J. 2008, 29, 1–26. [Google Scholar] [CrossRef]

- Zott, C.; Amit, R. Business model design: An activity system perspective. Long Range Plan. 2010, 43, 216–226. [Google Scholar] [CrossRef]

- Betz, F. Strategic business models. Eng. Manag. J. 2002, 14, 21–27. [Google Scholar] [CrossRef]

- Teece, D. Business Models, Business Strategy and Innovation. Long Range Plan. 2010, 43, 172–194. [Google Scholar] [CrossRef]

- Osterwalder, A.; Pigneur, Y. An eBusiness Model Ontology for modeling eBusiness. In Proceedings of the 15th Bled Electronic Commerce Conference—eReality: Constructing the eEconomy, Bled, Slovenia, 17–19 June 2002. [Google Scholar]

- Osterwalder, A.; Pigneur, Y. Business Model Generation: A Handbook for Visionaries, Game Changers, and Challengers; John Wiley & Sons: Hoboken, NJ, USA, 2010. [Google Scholar]

- Casadesus-Masanell, R.; Ricart, J. From Strategy to Business Models and onto Tactics. Long Range Plan. 2010, 43, 195–215. [Google Scholar] [CrossRef]

- Romero, M.C.; Lara, P.; Villalobos, J. Evolution of the Business Model: Arriving at Open Business Model Dynamics. J. Open Innov. Technol. Mark. Complex. 2021, 7, 86. [Google Scholar] [CrossRef]

- Gorevaya, E.; Khayrullina, M. Evolution of Business Models: Past and Present Trends. Procedia Econ. Financ. 2015, 27, 344–350. [Google Scholar] [CrossRef][Green Version]

- Hamel, G. Leading the Revolution; Harvard Business School Press Series; Harvard Business School Press: Brighton, MA, USA, 2000. [Google Scholar]

- Berglund, H.; Sandström, C. Business model innovation from an open systems perspective: Structural challenges and managerial solutions. Int. J. Prod. Dev. 2013, 18, 274–285. [Google Scholar] [CrossRef]

- Chesbrough, H.; Schwartz, K. Innovating business models with co-development partnerships. Res. Technol. Manag. 2007, 50, 55–59. [Google Scholar] [CrossRef]

- Lüdeke-Freund, F. Towards a Conceptual Framework of Business Models for Sustainability. In Proceedings of the ERSCP-EMSU Conference 2010, Delft, The Netherlands, 25–29 October 2010. [Google Scholar]

- Burhan; Ciptomulyono, U.; Singgih, M.L.; Baihaqi, I. Sustainable Business Model Innovations in the Value Uncaptured Manufacturing Industry: Fitting Gains—Gain Creators. Sustainability 2021, 13, 5647. [Google Scholar] [CrossRef]

- Breuer, H.; Fichter, K.; Lüdeke-Freund, F.; Tiemann, I. Sustainability-oriented business model development: Principles, criteria and tools. Int. J. Entrep. Ventur. 2018, 10, 256–286. [Google Scholar] [CrossRef]

- Abidin, N.Z.; Pasquire, C.L. Revolutionize value management: A mode towards sustainability. Int. J. Proj. Manag. 2007, 25, 275–282. [Google Scholar] [CrossRef]

- Jabłoński, A. Modele zrównoważonego biznesu—Miejsce i rola w koncepcji zarządzania strategicznego. In Zarządzanie Strategiczne. Quo Vadis? Krupski, R., Ed.; Wydawnictwo Wałbrzyskiej Wyższej Szkoły Zarządzania i Przedsiębiorczości: Wałbrzych, Poland, 2013; Volume 2, pp. 283–295. [Google Scholar]

- Bocken, N.; Strupeit, L.; Whalen, K.; Nußholz, J. A Review and Evaluation of Circular Business Model Innovation Tools. Sustainability 2019, 11, 2210. [Google Scholar] [CrossRef]

- Upward, A.; Jones, P. An Ontology for Strongly Sustainable Business Models: Defining an Enterprise Framework Compatible with Natural and Social Science. Organ. Environ. 2015, 29, 97–123. [Google Scholar] [CrossRef]

- Joyce, A.; Paquin, R.L. The triple layered business model canvas: A tool to design more sustainable business models. J. Clean. Prod. 2016, 135, 1474–1486. [Google Scholar] [CrossRef]

- Hatch, M.J. Organization Theory. Modern, Symbolic, and Postmodern Perspectives, 4th ed.; Oxford University Press: Oxford, UK, 2018. [Google Scholar]

- Baldassarre, B.; Calabretta, G.; Bocken, N.; Jaskiewicz, T. Bridging sustainable business model innovation and user-driven innovation: A process for sustainable value proposition design. J. Clean. Prod. 2017, 147, 175–186. [Google Scholar] [CrossRef]

- Dobrowolski, Z.; Sułkowski, Ł. Business Model Canvas and Energy Enterprises. Energies 2021, 14, 7198. [Google Scholar] [CrossRef]

- Evans, S.; Vladimirova, D.; Holgado, M.; Van Fossen, K.; Yang, M.; Silva, E.; Barlow, C. Business model innovation for sustainability: Towards a unified perspective for creation of sustainable business models. Bus. Strat. Environ. 2017, 26, 597–608. [Google Scholar] [CrossRef]

- Šimberová, I.; Kita, P. New Business Models Based on Multiple Value Creation for the Customer: A Case Study in the Chemical Industry. Sustainability 2020, 12, 3932. [Google Scholar] [CrossRef]

- Geissdoerfer, M.; Vladimirova, D.; Evans, S. Sustainable business model innovation: A review. J. Clean. Prod. 2018, 198, 401–416. [Google Scholar] [CrossRef]

- Labatt, S.; White, R.R. Carbon Finance. The Financial Implications of Climate Change; John Wiley & Sons, Inc.: Hoboken, NJ, USA, 2007. [Google Scholar]

- Karwowski, M. Model Biznesu w Sprawozdaniu Finansowym. Ograniczenia Informacyjne; Oficyna Wydawnicza SGH: Warszawa, Poland, 2018. [Google Scholar]

- Getting on the Right Track: How to Demonstrate the Value of Sustainable Business to Investors, Corporate Citizenship—Report, October 2016. Available online: https://corporate-citizenship.com/wp-content/uploads/Getting-on-the-right-track_How-to-demonstrate-the-value-of-sustainable-business-to-investors.pdf (accessed on 21 November 2022).

- Mechelli, A.; Cimini, R.; Mazzocchetti, F. The usefulness of the business model disclosure for investors’ judgements in financial entities. A European study. Rev. Contab. 2017, 20, 1–12. [Google Scholar] [CrossRef]

- Nielsen, C.; Bukh, P.N. What constitutes a business model: The perception of financial analysts. Int. J. Learn. Intellect. Cap. 2011, 8, 256–271. [Google Scholar] [CrossRef]

- OECD. Development Co-Operation Report 2016: The Sustainable Development Goals as Business Opportunities; OECD Publishing: Paris, France, 2016; Available online: https://www.oecd.org/dac/development-co-operation-report-2016.htm (accessed on 12 January 2023).

- Kruse, C.; Lundbergh, S. The governance of corporate sustainability. Rotman Int. J. Pension Manag. 2010, 3, 46–51. [Google Scholar]

- International Finance Corporation. The Business Case for Sustainability. 2012. Available online: https://www.ifc.org/wps/wcm/connect/d76678af-6fc5-4e8f-a73f-5a0126c8b12d/Business%2BCase%2Bfor%2BSustainability.pdf?MOD=AJPERES&CVID=jzuj03D (accessed on 14 December 2022).

- Konar, S.; Cohen, M.A. Does the market value environmental performance? Rev. Econ. Stat. 2001, 83, 281–289. [Google Scholar] [CrossRef]

- Mollet, J.C.; Ziegler, A. Socially Responsible Investing and Stock Performance: New Empirical Evidence for the US and European Stock Markets. Rev. Financ. Econ. 2014, 23, 208–216. [Google Scholar] [CrossRef]

- Klassen, R.D.; McLaughlin, C.P. The impact of environmental management on firm performance. Manag. Sci. 1996, 42, 1199–1214. [Google Scholar] [CrossRef]

- Lorenc, S.; Kustra, A. Wzrost wartości rynkowej przedsiębiorstw górniczych jako efekt prowadzenia polityki zrównoważonego rozwoju. Przegląd Górniczy. 2015, 8, 40–44. [Google Scholar]

- Kocmanová, A.; Dočekalová, M.P.; Meluzín, T.; Škapa, S. Sustainable Investing Model for Decision Makers (Based on Research of Manufacturing Industry in the Czech Republic). Sustainability 2020, 12, 8342. [Google Scholar] [CrossRef]

- Schroders Report, Are People Compelled to Invest Sustainably? Sydney. 2019. Available online: https://www.schroders.com/en/sysglobalassets/_global-shared-blocks/gis-2019/au/sch055_049_global_investor_survey_sustainability_fa1_lr.pdf (accessed on 14 November 2022).

- Schroders Report, Więcej niż zysk: Inwestowanie Zgodnie z ideą Zrównoważonego Rozwoju. 2021. Available online: https://www.schroders.com/pl/pl/private-investor/wiadomosci/global-investor-study/2021-findings/sustainability-report/#sc-art-4 (accessed on 15 November 2022).

- Healy, N.; Debski, J. Fossil fuel divestment: Implications for the future of sustainability discourse and action within higher education. Local Environ. 2017, 22, 699–724. [Google Scholar] [CrossRef]

- Ayling, J. A Contest for Legitimacy: The Divestment Movement and the Fossil Fuel Industry. Law Policy 2017, 39, 349–371. [Google Scholar] [CrossRef]

- Ayling, J.; Gunningham, N. Non-state governance and climate policy: The fossil fuel divestment movement. Clim. Policy 2017, 17, 131–149. [Google Scholar] [CrossRef]

- Dordi, T.; Weber, O. The Impact of Divestment Announcements on the Share Price of Fossil Fuel Stocks. Sustainability 2019, 11, 3122. [Google Scholar] [CrossRef]

- Paum, A. Stranded Assets: What Next? 2015. Available online: https://www.slideshare.net/MarcellusDN/hsbc-report-stranded-assets-whats-next (accessed on 21 January 2023).

- Kiyar, D.; Wittneben, B.B.F. Carbon as Investment Risk—The Influence of Fossil Fuel Divestment on Decision Making at Germany’s Main Power Providers. Energies 2015, 8, 9620–9639. [Google Scholar] [CrossRef]

- Devinney, T. The Guardian’s Fossil Fuel Divestment Campaign Could Do More Harm than Good. Available online: https://theconversation.com/the-guardians-fossil-fuel-divestment-campaign-could-do-more-harm-than-good-39000 (accessed on 14 January 2022).

- Tollefson, J. Reality check for fossil-fuel divestment. Nature 2015, 521, 16–17. [Google Scholar] [CrossRef]

- Alexander, S.; Nicholson, K.; Wiseman, J. Fossil Free: The Development and Significance of the Fossil Fuel Divestment Movement; MSSI Issues Paper No. 3; Melbourne Sustainable Society Institute, The University of Melbourne: Melbourne, Australia, 2014. [Google Scholar]

- Hunt, C.; Weber, O. Fossil fuel divestment strategies: Financial and carbon related consequences. Organ. Environ. 2018, 32, 41–61. [Google Scholar] [CrossRef]

- Monasterolo, I.; Battiston, S.; Janetos, A.C.; Zheng, Z. Vulnerable yet relevant: The two dimensions of climate-related financial disclosure. Clim. Chang. 2017, 145, 495–507. [Google Scholar] [CrossRef]

- Dorsey, E.; Mott, R.N. Philanthropy Rises to the Fossil Divest-Invest Challenge. Available online: https://www.huffingtonpost.com/ellen-dorsey/philanthropy-rises-to-the_b_4690774.html (accessed on 18 January 2023).

- Weber, O.; Hunt, C. Want a Richer Pension? Divest of Fossil Fuels. Available online: https://theconversation.com/want-a-richer-pension-divest-of-fossil-fuels-93850 (accessed on 17 January 2023).

- Ansar, A.; Caldecott, B.; Tilbury, J. Stranded Assets and the Fossil Fuel Divestment Campaign: What Does Divestment Mean for the Valuation of Fossil Fuel Assets; Smith School of Enterprise and the Environment, University of Oxford: Oxford, UK, 2013. [Google Scholar]

- Harrell, C.; Bosshard, P. Insuring Coal no More: An Insurance Scorecard on Coal and Climate Change. Available online: https://unfriendcoal.com/scorecard/ (accessed on 16 November 2022).

- Stanway, D. Nearly All Development Banks Committed to Cutting Coal Investment, Data Shows. Available online: https://www.reuters.com/business/sustainable-business/nearly-all-development-banks-committed-cutting-coal-investment-data-shows-2021-11-02/ (accessed on 25 January 2023).

- George, S. Europe’s Biggest Banks Failing to End Coal Financing Despite Net-Zero Climate Pledges, Report Finds. Available online: https://www.edie.net/news/7/Europe-s-biggest-banks-failing-to-end-coal-financing-despite-net-zero-climate-pledges--report-finds--/ (accessed on 25 January 2023).

- Bergman, N. Impacts of the Fossil Fuel Divestment Movement: Effects on Finance, Policy and Public Discourse. Sustainability 2018, 10, 2529. [Google Scholar] [CrossRef]

- Czyżak, P.; Kukuła, W. Monopol Węglowy z Problemami. Analiza Restrukturyzacji Polskiego Sektora Energetycznego, ClientEarth & Instrat 2020. Available online: https://instrat.pl/wp-content/uploads/2020/11/CE_Instrat_Monopol-weglowy-z-problemami_23.11.2020.pdf (accessed on 26 January 2023).

- Joint Spin-off Report of the Boards of Management of E.ON SE, Düsseldorf and Uniper SE, Düsseldorf. 2018. Available online: https://www.uniper.energy/sites/default/files/2022-05/EON_joint_spin-off_report_EN.pdf (accessed on 26 January 2023).

- Unicredit, E. ON: A Closer Look at the Uniper Spin-Off. 2016. Available online: https://www.research.unicredit.eu/DocsKey/credit_docs_2016_154520.ashx?EXT=pdf&KEY=n03ZZLYZf5nemXA3J7CyxiYupcODapkKcuajVCK8N8M= (accessed on 26 January 2023).

- Reuters. Polish Utilities May Consider German-Style Reorganization: Minister, 12 March 2020. Available online: https://www.reuters.com/article/us-climate-change-poland/polish-utilities-may-consider-german-style-reorganization-minister-idUSKBN20Z2HD (accessed on 26 January 2023).

- Evraz to Complete Spinoff of Coal Business by December 2021. Available online: https://interfax.com/newsroom/top-stories/72405/ (accessed on 26 January 2023).

- Anglo American Completes Demerger of Thungela Thermal Coal Business. Available online: https://www.angloamerican.com/media/press-releases/2021/07-06-2021 (accessed on 26 January 2023).

- Coal Spin-Off Plan Positive for Polish Utilities. Available online: https://www.fitchratings.com/research/corporate-finance/coal-spin-off-plan-positive-for-polish-utilities-22-04-2021 (accessed on 26 January 2023).

- What Is Fossil Fuel Divestment? Available online: https://gofossilfree.org/divestment/what-is-fossil-fuel-divestment/ (accessed on 28 January 2023).

- Sarda, D.; Rimner, M. M&A Due Diligence What Corporates Can Learn from Private Equity. Available online: https://kipdf.com/ma-due-diligence-what-corporates-can-learn-from-private-equity_5ada5c797f8b9a547a8b45a4.html (accessed on 28 January 2023).

- Hamilton, R.T.; Chow, Y.K. Why managers divest—Evidence from New Zealand’s largest companies. Strat. Manag. J. 1993, 14, 479–484. [Google Scholar] [CrossRef]

- Moschieri, C.; Mair, J. Adapting for innovation: Including divestitures in the debate. LRP 2011, 44, 4–25. [Google Scholar] [CrossRef]

- Brunetta, F.; Peruffo, E. May parents inherit from heirs? Towards an understanding of the parent-spun-off relationship. Am. J. Appl. Sci. 2014, 11, 921–928. [Google Scholar] [CrossRef][Green Version]

- Brauer, M. What have we acquired and what should we acquire in divestiture research? A review and research agenda. J. Manag. 2006, 32, 751–785. [Google Scholar] [CrossRef]

- Peruffo, E.; Oriani, R.; Perri, A. Information Asymmetries, Family Ownership and Divestiture Financial Performance: Evidence from Western European Countries. Corp. Ownersh. Control. 2014, 11, 44–57. [Google Scholar] [CrossRef]

- Semadeni, M.; Cannella, A. Examining the performance effects of the post spin-off links to parent firms: Should the apron strings be cut? Strateg. Manag. J. 2011, 32, 1083–1098. [Google Scholar] [CrossRef]

- Linn, S.; Rozeff, M. The Effect of Voluntary Spin-Offs on Stock Prices: The Energy Hypothesis. Adv. Financ. Plan. forecast. 1985, 1, 265–292. [Google Scholar]

- Klein, A. The Timing and Substance of Divestiture Announcements: Individual, Simultaneous and Cumulative Effects. J. Financ. 1986, 41, 685–696. [Google Scholar] [CrossRef]

- Veld, C.; Veld-Merkoulova, Y. Value creation through spin offs: A review of the empirical evidence. Int. J. Manag. Rev. 2009, 11, 407–420. [Google Scholar] [CrossRef]

- Peruffo, E.; Pirolo, L.; Nenni, M.E. Spin-off and innovation in the pharmaceutical industry. Int. J. Eng. Bus. Manag. 2014, 6, 1–7. [Google Scholar] [CrossRef]

- Bowman, E.; Singh, H. Corporate restructuring: Reconfiguring the firm. Strateg. Manag. J. 1993, 14, 5–14. [Google Scholar] [CrossRef]

- Block, Z.; MacMillan, I. Corporate Venturing. Creating New Business within the Firm; Harvard Business School Press: Brighton, MA, USA, 1995; pp. 29–30. [Google Scholar]

- Tamowicz, P. Przedsiębiorczość Akademicka. Spółki Spin-Off w Polsce, 1st ed.; PARP: Warszawa, Poland, 2006; pp. 9–13. [Google Scholar]

- Cleyn, S.; Braet, J. The evolution of spin-off ventures: An integrated model. J. Innov. Technol. Manag. 2010, 07, 53–70. [Google Scholar] [CrossRef]

- Damodaran, A. Applied Corporate Finance. A User’s Manual; Wiley: New York, NY, USA, 2006. [Google Scholar]

- Wachtell, Lipton, Rosen & Katz, Spin-Off Guide 2020. Available online: https://www.wlrk.com/wp-content/uploads/2020/05/Spin-Off-Guide-2020.pdf (accessed on 31 January 2023).

- Reiner, P.; Torres, A. Is it time to spin-off? McKinsey Q. 2002, 1, 10–12. [Google Scholar]

- Kot, M.; Skonieczny, J. Spin-off Jako Narzędzie Komercjalizacji Innowacji; Politechnika Wrocławska: Wrocław, Poland, 2009. [Google Scholar]

- Navatte, P. Schier Guillaume: Spin offs. Accounting and Financial Issues across the Literature. Account. Audit. Control 2017, 23, 97–125. [Google Scholar]

- Colla, P.; Ippolito, F.; Talamanco, A. Second Events in Equity Carve-Outs. 2008. Available online: https://www.researchgate.net/publication/228735187_Second_Events_in_Equity_Carve-Outs (accessed on 11 June 2023).

- Schipper, K.; Smith, A. A comparison of equity carve-outs and seasoned equity offerings: Share price effects and corporate restructuring. J. Fin. Econ. 1986, 15, 153–186. [Google Scholar] [CrossRef]

- Miles, J.; Woolridge, J. Spin-Offs and Equity Carve-Outs, 1st ed.; Financial Executives Res Found: New York, NY, USA, 1999. [Google Scholar]

- Billett, M.; Vijh, A. The wealth effects of tracking stock restructurings. J. Financ. Res. 2004, 27, 559–583. [Google Scholar] [CrossRef]

- Logue, D.; Seward, J.; Walsh, J. Rearranging residual claims: A case for targeted stock. Financ. Manag. 1996, 25, 43–61. [Google Scholar] [CrossRef]

- Billett, M.; Mauer, D. Diversification and the value of internal capital markets: The case of tracking stock. J. Bank. Financ. 2000, 24, 1457–1490. [Google Scholar] [CrossRef]

- D’Souza, J.; Jacob, J. Why firms issue targeted stock. J. Financ. Econ. 2000, 56, 459–483. [Google Scholar] [CrossRef]

- Elder, J.; Westra, P. The reaction of share prices to tracking stock announcements. J. Econ. Financ. 2000, 24, 36–55. [Google Scholar] [CrossRef]

- Zuta, S. Diversification Discount and Targeted Stock: Theory and Empirical Evidence; University of Maryland: College Park, MD, USA, 1997. [Google Scholar]

- Badreddine, M. Restructuring via Tracking Stocks Issuance: The Hidden Side of Growth: Case of American Listed Companies. J. Financ. Stud. Res. 2014, 2014, 234358. [Google Scholar] [CrossRef][Green Version]

- Vijh, A.; Billett, M. The Market Performance of Tracking Stocks; Indiana University Kelley School of Business Research Paper Series; Indiana University Kelley School of Business: Bloomington, IN, USA, 2001. [Google Scholar]

- Doyle, A.; Macmillan, I. Global Divestiture Survey. Defensive M&A for a Resilient Portfolio. Deloitte, 2020. Available online: https://www2.deloitte.com/pl/pl/pages/mergers-and-acquisitions/articles/dezinwestycje-i-ich-rola-w-nowej-normalnosci.html (accessed on 2 February 2023).