A Method for the Modified Estimation of Oil Shale Mineable Reserves for Shale Oil Projects: A Case Study

Abstract

:1. Introduction

2. Materials and Methods

- Analysis of oil shale properties and characteristics, including calorific value, ash content, oil content, and semicoke.

- Analysis of the correlation coefficient (Figure 2) for oil content vs. semicoke “(A)” and oil shale conditional organic mass vs. ash content “(B)” with the help of a peer-reviewed database (Appendix A) of oil shale deposits around the world.

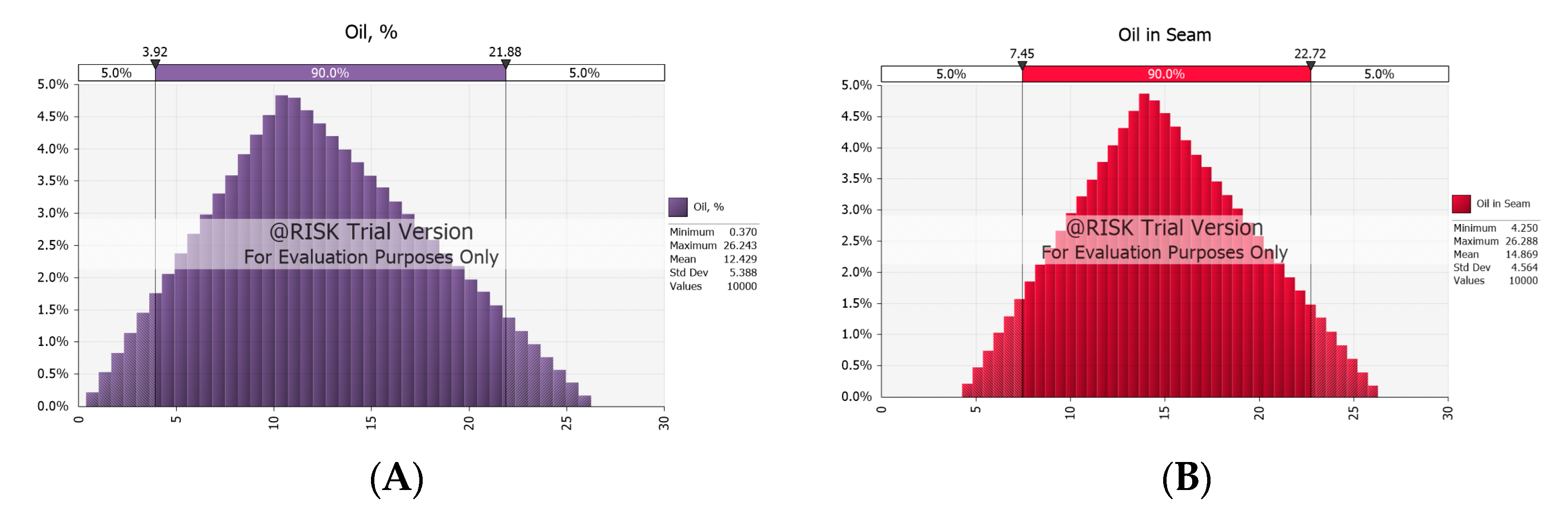

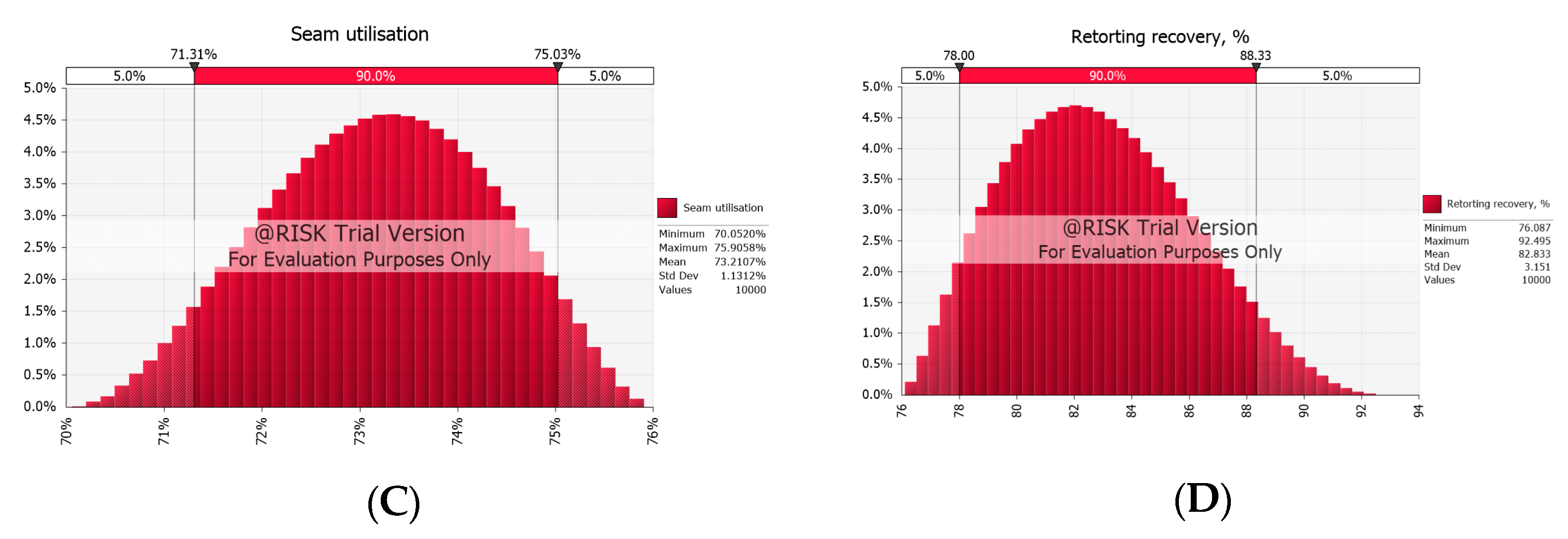

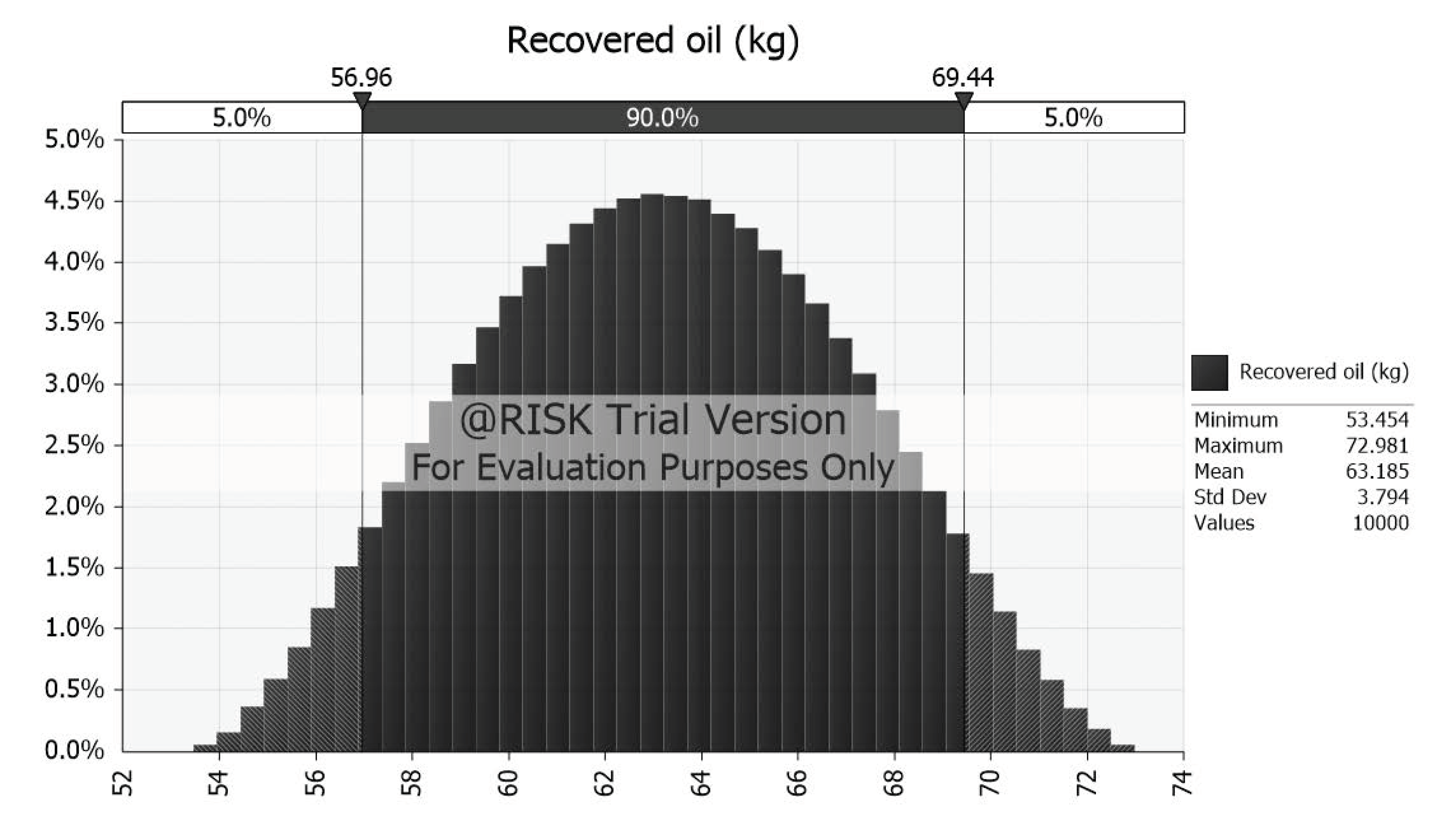

- Stochastic modelling with the help of Monte Carlo simulation considering

- Oil content and conditional organic mass distributions;

- Estimation of the variability of the oil content and the productive oil shale seam thickness;

- Estimation of recovered oil from the commercial oil shale seam with variation of oil in the seam, the seam utilisation factor, and processing recoveries.

- Analysis of the correlation coefficient for oil content vs. calorific value from the peer-reviewed database.

- Stochastic modelling for variations in oil content distribution at the particular calorific value.

3. Results

3.1. The Case Study Mine

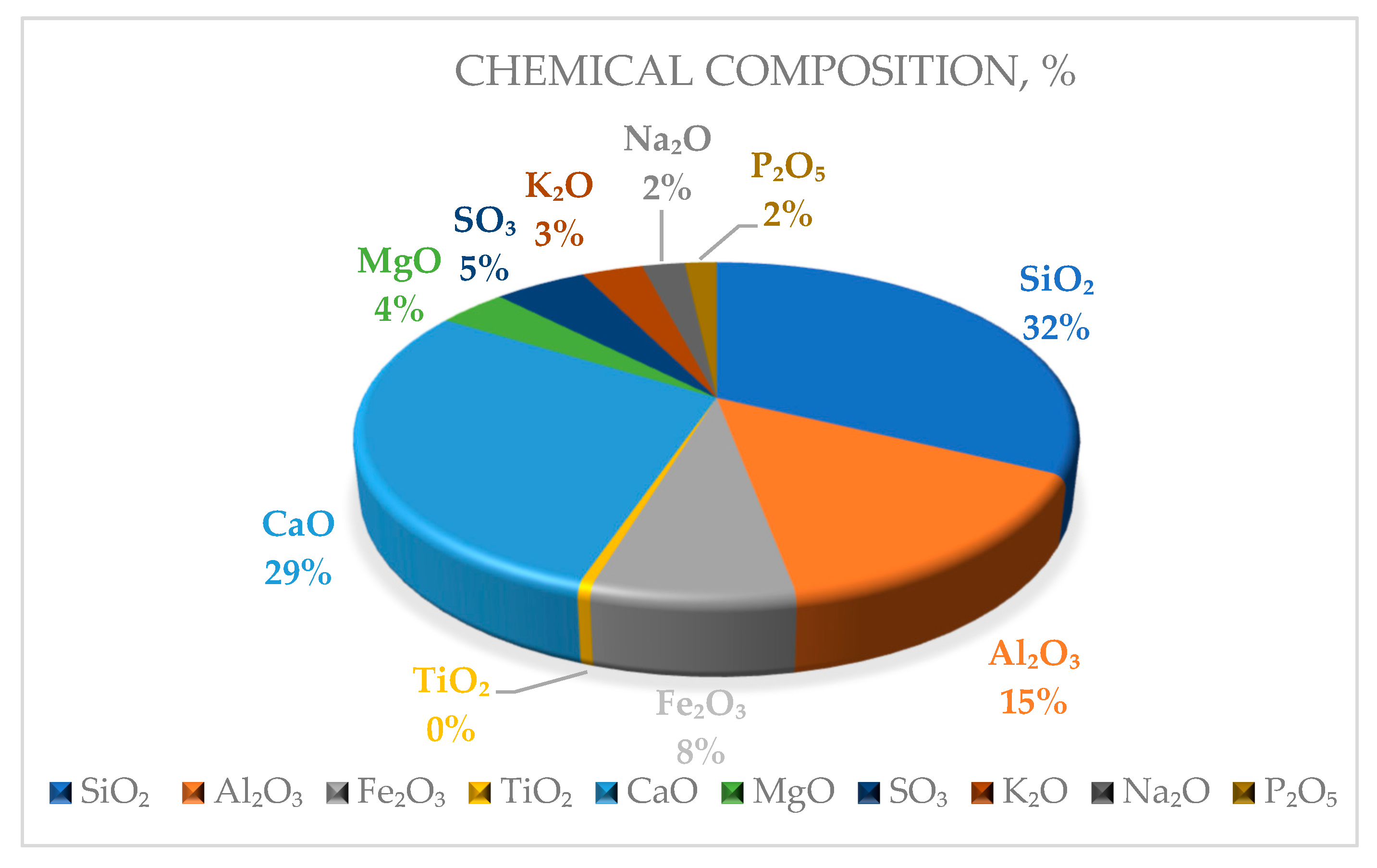

3.2. Analysis of Oil Shale Seam Properties

3.3. Monte Carlo Simulation

4. Discussion

5. Conclusions

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

Correction Statement

Appendix A

| # | Name | Ash, % | Conditional Organic Mass, % | Oil, % | Semicoke, % |

| 1 | Olenyek (Russia, Yakutia) | 6.9 | 87.7 | ||

| 2 | Kvarntorp (Sweden) | 79 | 20.0 | 6.7 | 86.4 |

| 3 | Kukersite (Estonia) | 46.5 | 35.5 | 23.3 | 71.0 |

| 4 | Tetraspis (Estonia) | 79 | 15.2 | 6.4 | 89.9 |

| 5 | Ashinsk (Russia, Bashkiria) | 69.7 | 14.8 | 6.3 | 90.2 |

| 6 | Turovo (Byelorussia) | 70.1 | 17.2 | 8.6 | 87.1 |

| 7 | Lyuban (Byelorussia) | 71.1 | 11.7 | 6.3 | 90.2 |

| 8 | Ukhta (Russia, Komyi) | 76.4 | 10.6 | 4.3 | 94.6 |

| 9 | Chernozatonsk (Kazakhstan) | 36.2 | 54.0 | 22.8 | 57.4 |

| 10 | Lemeza (Russia, Bashkiria) | 72.1 | 27.7 | ||

| 11 | Selenyakh (Russia, Yakutia) | 53.7 | 11.9 | ||

| 12 | Antrim (USA) | 82.6 | 16.7 | 3.7 | 90.4 |

| 13 | Westwood (Geat Britain, Scotland) | 77.8 | 19.0 | 8.2 | 86.6 |

| 14 | New Glasgow (Canada) | 76.9 | 18.8 | 5.3 | 88.7 |

| 15 | Nova Scotia (Canada) | 62.4 | 34.4 | 18.8 | 77.7 |

| 16 | Ermelo (South Africa) | 44 | 54.2 | 17.6 | 75.6 |

| 17 | Kenderlyk, the Kalyn-Kara seam (Kazakhstan) | 51.6 | 48.4 | 9.7 | 70.0 |

| 18 | Kenderlyk, the Karaungur seam (Kazakhstan) | 76.4 | 21.7 | 13.6 | 76.7 |

| 19 | Kenderlyk, the Saikan seam (Kazakhstan) | 77.2 | 22.0 | ||

| 20 | Ust-Kamenogorsk (Kazakhstan) | 74 | 22.8 | 8.0 | 84.0 |

| 21 | Pashin (Russia, Perm District) | 73.4 | 26.5 | 6.0 | 86.4 |

| 22 | Glen Davis (Australia) | 51.6 | 48.4 | 30.9 | 64.1 |

| 23 | Puertollano (Spain) | 63 | 35.0 | 17.8 | 78.4 |

| 24 | Irati (Brazil) | 64.2 | 34.0 | 10.8 | 82.6 |

| 25 | Otain (France) | 73.7 | 19.8 | 8.2 | 87.2 |

| 26 | St.-Hilaire (France) | 69.3 | 27.3 | 9.5 | 85.9 |

| 27 | Cerro Largo (Uruguay) | 78.4 | 21.6 | 4.2 | 81.6 |

| 28 | Verkhnetutonchansk (Russia, Krasnoyarsk District) | 31.2 | 63.3 | ||

| 29 | Omolon, Astronomicheskaya River region (Russia) | 78.3 | 21.5 | ||

| 30 | Omolon, Levyi Kedon River region (Russia) | 82.2 | 17.6 | ||

| 31 | Bogoslov, seam II (Russia, Yekaterinburg District) | 36.1 | 60.9 | 21.9 | 62.8 |

| 32 | Alyouisk (Russia, Irkutsk District) | 60.8 | 38.9 | 9.2 | 81.7 |

| 33 | Budagovo, (Russia, Irkutsk District) | 45.6 | 25.2 | ||

| 34 | Budagovo, humic sapropelite (Russia, Irkutsk District) | 28.5 | 68.6 | 5.2 | 72.0 |

| 35 | Budagovo, humic sapropelite (Russia, Irkutsk District) | 52 | 42.8 | 18.9 | 72.1 |

| 36 | Bouinsk (Russia, Tatarstan) | 65 | 24.0 | 8.5 | 76.9 |

| 37 | Voronye-Voloskovsk (Russia, Vyatka District) | 75.3 | 20.1 | 5.7 | 87.5 |

| 38 | Würtenberg (Germany) | 70.8 | 9.5 | 4.5 | 94.0 |

| 39 | Sysol, Ibsk deposit (Russia, Komyi) | 72.7 | 21.4 | 7.7 | 76.8 |

| 40 | Kashpir (Russia, the Volga oil shale basin) | 58.2 | 30.5 | 12.0 | 79.8 |

| 41 | Kimmeridge (Great Britain, England) | 37.7 | 59.8 | 25.5 | 60.2 |

| 42 | Levosviyazh (Russia, Tatarstan) | 68.3 | 23.4 | 8.8 | 81.4 |

| 43 | Manturovo (Russia, Nyzni Novgorod district) | 57.3 | 39.2 | 12.9 | 72.0 |

| 44 | ObshchiSyrt, seam P3A (Russia, the Volga oil shale basin) | 56.2 | 33.8 | 11.6 | 73.7 |

| 45 | Perelyub-Blagodatsk (Russia, the Volga oil shale basin) | 47.2 | 45.6 | ||

| 46 | Simbirsk (Russia, the Volga oil shale basin) | 62 | 31.9 | 9.2 | 81.2 |

| 47 | Kharanor (Russia, Chita District) | 76.4 | 23.6 | 6.4 | 88.0 |

| 48 | Khakhareisk, boghead (Russia, Irkutsk District) | 42.3 | 34.5 | ||

| 49 | Khakhareisk, oil shale (Russia, Irkutsk District) | 43.9 | 56.1 | 11.4 | 76.9 |

| 50 | Chagan (Russia, Orenburg District) | 35.7 | 56.7 | 24.9 | 56.0 |

| 51 | Sysol, Poingsk region (Russia, Komyi) | 66.8 | 27.9 | ||

| 52 | Savelyev (Russia, the Volga oil shale basin) | 61.4 | 27.8 | 10.5 | 80.5 |

| 53 | Yarenga (Russia, Komyi) | 22.4 | 76.0 | 32.6 | 43.2 |

| 54 | Nebi Musa (Jordan) | 63.1 | 22.0 | 13.6 | 80.4 |

| 55 | Olenyek, boghead (Russia, Jakutia) | ||||

| 56 | Timahdit (Morocco) | 68.8 | 23.1 | 5.6 | 92.9 |

| 57 | Um-Barek (Israel) | 57.2 | 24.7 | 6.4 | 88.4 |

| 58 | Efyie (Israel) | 56.1 | 23.9 | 7.6 | 87.9 |

| 59 | Baisun (Uzbekistan) | 55.2 | 38.0 | 13.5 | 73.3 |

| 60 | Eastern Chandyr (Uzbekistan) | 66.1 | 18.8 | 5.0 | 85.0 |

| 61 | Eastern Urtabulak (Uzbekistan) | 53.9 | 39.8 | 10.6 | 72.3 |

| 62 | Kapali (Uzbekistan) | 60.1 | 29.7 | 7.6 | 83.8 |

| 63 | Kultak-Zevardy (Uzbekistan) | 62.6 | 22.8 | 6.2 | 83.0 |

| 64 | Pamuk (Uzbekistan) | 63.7 | 15.6 | 3.7 | 87.3 |

| 65 | Sangruntau (Uzbekistan) | 74.8 | 23.9 | 6.1 | 84.9 |

| 66 | Todinsk (Uzbekistan) | 65.7 | 27.8 | ||

| 67 | Shurasan (Uzbekistan) | 63.2 | 9.5 | 3.5 | 93.5 |

| 68 | Bulgary (Tadjikistan) | 62.8 | 29.1 | ||

| 69 | Garibak (Tadjikistan) | 51.2 | 48.6 | 16.5 | 78.4 |

| 70 | Kulyiali (Tadjikistan) | 77.3 | 22.6 | 3.1 | 91.6 |

| 71 | Lyangar (Tadjikistan) | 88.6 | 11.3 | ||

| 72 | Tereklitau (Tadjikistan) | 75.9 | 16.4 | 6.6 | 85.8 |

| 73 | Yarmuk (Syria) | 59.5 | 5.4 | ||

| 74 | Boltysh (Ukraine) | 61.5 | 34.9 | 17.5 | 72.9 |

| 75 | Green River, Rifle, Colorado (USA) | 60.3 | 20.6 | 13.7 | 80.3 |

| 76 | Green River, Utah (USA) | 61.6 | 19.4 | 11.5 | 82.9 |

| 77 | Borov Dol (Bulgaria) | 77 | 19.7 | 8.2 | 88.0 |

| 78 | Pirin (Bulgaria) | 60.9 | 34.5 | 13.9 | 72.8 |

| 79 | Mandra (Bulgaria) | 58.7 | 27.7 | 18.0 | 77.0 |

| 80 | Menilitic (Ukraine) | 79.6 | 19.9 | ||

| 81 | Gurkovo (Bulgaria) | 83.3 | 10.8 | 4.2 | 91.7 |

| 82 | Krasava (Bulgaria) | 75.5 | 10.9 | 5.3 | 91.2 |

| 83 | Koprinka (Bulgaria) | 83.3 | 15.6 | 6.0 | 88.3 |

| 84 | Novodmitrovo (Ukraine) | 74.1 | 21.1 | 5.1 | 86.3 |

| 85 | Nevada (USA) | 46.2 | 53.2 | ||

| 86 | Orepuki (New Zealand) | 32.7 | 65.6 | 24.8 | 57.6 |

| 87 | Condor (Australia) | 64.5 | 33.0 | 6.2 | 83.6 |

| 88 | Aleksinac (Yugoslavia) | 79 | 18.2 | 10.3 | 79.9 |

| 89 | Mae Sot (Thailand) | 68 | 21.0 | 26.1 | 66.3 |

| 90 | Pula (Hungary) | 56 | 33.2 | ||

| 91 | Tremembé-Taubaté paper shale (Brasil) | 60.3 | 39.5 | 21.1 | 71.7 |

| 92 | Tremembé-Taubaté lumpy shale (Brasil) | 82.3 | 17.4 | 4.0 | 89.4 |

| 93 | Guandun (China) | 72.1 | 25.9 | ||

| 94 | Huadian (China) | 73.7 | 20.3 | 9.5 | 82.9 |

| 95 | Fu Shun (China) | 75.4 | 21.2 | 7.8 | 84.7 |

| 96 | Maomin (China) | 73.4 | 25.2 | 8.8 | 84.1 |

| Average | 63.93 | 29.0 | 11.86 | 79.07 | |

| Min | 22.40 | 5.40 | 3.10 | 25.20 | |

| Max | 88.60 | 76.00 | 45.60 | 94.60 |

References

- Dyni, J.R. Geology and Resources of Some World Oil-Shale Deposits. Oil Shale 2003, 20, 193–252. [Google Scholar] [CrossRef]

- Matheson, S.G.; Sorby, L.A. Proposals for the reporting of oil shale resources in Queensland, Australia. Fuel 1990, 69, 1073–1208. [Google Scholar] [CrossRef]

- Veiderma, M. Estonian Oil Shale-Resources and Usage. Oil Shale 2003, 20, 295–303. [Google Scholar] [CrossRef]

- Kuzmiv, I.; Fraiman, J. Technical-Economic Parameters of the New Oil Shale Mining—Chemical Complex in Northeast Estonia. Energy Sources 2006, 28, 681–693. [Google Scholar] [CrossRef]

- Golubjev, N. Solid Oil Shale Heat Carrier Technology for Oil Shale Retorting. Oil Shale 2003, 20, 324–332. [Google Scholar] [CrossRef]

- Dupre, K.; Ryan, E.M.; Suleimenov, A.; Goldfarb, J.L. Experimental and Computational Demonstration of a Low-Temperature Waste to By-Product Conversion of U.S. Oil Shale Semi-Coke to a Flue Gas Sorbent. Energies 2018, 11, 3195. [Google Scholar] [CrossRef]

- He, W.; Tao, S.; Hai, L.; Tao, R.; Wei, X.; Wang, L. Geochemistry of the Tanshan Oil Shale in Jurassic Coal Measures, Western Ordos Basin: Implications for Sedimentary Environment and Organic Matter Accumulation. Energies 2022, 15, 8535. [Google Scholar] [CrossRef]

- Reinsalu, E.; Valgma, I.; Väli, E. Usage of Estonian Oil Shale. Oil Shale 2008, 25, 101–114. [Google Scholar]

- Valgma, I.; Reinsalu, E.; Sabanov, S.; Karu, V. Quality Control of Oil Shale Production in Estonian Mines. Oil Shale 2010, 27, 239–249. [Google Scholar] [CrossRef]

- Sabanov, S.; Mukhamedyarova, Z. Prospectivity analysis of oil shales in Kazakhstan. Oil Shale 2020, 37, 269–280. [Google Scholar] [CrossRef]

- Golistyn, M.; Dumler, L.; Orlov, I. Geology of Coal and Oil Shales Deposits in USSR; Nedra: Moscow, Russia, 1973; Volume 5. (In Russian) [Google Scholar]

- Zelenin, N.; Ozerov, I. Handbook on Oil Shales (Spravochnik po Gorjuchim slantsam); Nedra: Leningrad, Russia, 1983. (In Russian) [Google Scholar]

- Speirs, J.; McGlade, C.; Slade, R. Uncertainty in the availability of natural resources: Fossil fuels, critical metals and biomass. Energy Policy 2015, 87, 654–664. [Google Scholar] [CrossRef]

- Li, J.; Yang, Q.; Liu, Y.-Q. Mapping of Petroleum and Minerals Reserves and Resources Classification Systems. In Proceedings of the International Field Exploration and Development Conference, Chengdu, China, 23–25 September 2020; pp. 3405–3416. [Google Scholar]

- Biglarbigi, K.; Crawford, P.; Carolus, M.; Dean, C. Rethinking World Oil-Shale Resource Estimates. In Proceedings of the SPE Annual Technical Conference and Exhibition, Florence, Italy, 20–22 September 2010. [Google Scholar]

- Knaus, E.; Killen, J.; Biglarbigi, K.; Crawford, P. An Overview of Oil Shale Resources. In Oil Shale: A Solution to the Liquid Fuel Dilemma; American Chemical Society: Washington, DC, USA, 23 February 2010. [Google Scholar] [CrossRef]

- McGlade, C.E. A review of the uncertainties in estimates of global oil resources. Energy 2012, 47, 262–270. [Google Scholar] [CrossRef]

- Xu, Y.; Lun, Z.; Pan, Z.; Wang, H.; Zhou, X.; Zhao, C.; Zhang, D. Occurrence space and state of shale oil: A review. J. Pet. Sci. Eng. 2022, 211, 110183. [Google Scholar] [CrossRef]

- Smith, J.L. Estimating the future supply of shale oil: A Bakken case study. Energy Econ. 2018, 69, 395–403. [Google Scholar] [CrossRef]

- Gong, X.; Tian, Y.; McVay, D.A.; Ayers, W.B.; Lee, W.J. Assessment of Eagle Ford Shale Oil and Gas Resources. In Proceedings of the SPE Unconventional Resources Conference, Calgary, AL, Canada, 5–7 November 2013. [Google Scholar] [CrossRef]

- Misund, B.; Osmundsen, P. Valuation of proved vs. probable oil and gas reserves. Cogent Econ. Financ. 2017, 5, 1385443. [Google Scholar] [CrossRef]

- Brandt, A. Converting Oil Shale to Liquid Fuels: Energy Inputs and Greenhouse Gas Emissions of the Shell in Situ Conversion Process. Environ. Sci. Technol. 2008, 42, 7489–7495. [Google Scholar] [CrossRef]

- Kang, Z.; Zhao, Y.; Yang, D. Review of oil shale in-situ conversion technology. Appl. Energy 2020, 269, 115121. [Google Scholar] [CrossRef]

- Malozyomov, B.V.; Martyushev, N.V.; Kukartsev, V.V.; Tynchenko, V.S.; Bukhtoyarov, V.V.; Wu, X.; Tyncheko, Y.A.; Kukartsev, V.A. Overview of Methods for Enhanced Oil Recovery from Conventional and Unconventional Reservoirs. Energies 2023, 16, 4907. [Google Scholar] [CrossRef]

- Wang, H.; Su, J.; Zhu, J.; Yang, Z.; Meng, X.; Li, X.; Zhou, J.; Yi, L. Numerical Simulation of Oil Shale Retorting Optimization under In Situ Microwave Heating Considering Electromagnetics, Heat Transfer, and Chemical Reactions Coupling. Energies 2022, 15, 5788. [Google Scholar] [CrossRef]

- Yaritani, H.; Matsushima, J. Analysis of the Energy Balance of Shale Gas Development. Energies 2014, 7, 2207–2227. [Google Scholar] [CrossRef]

- Shi, H.; Zhao, H.; Zhou, J.; Yu, Y. Experimental investigation on the propagation of hydraulic fractures in massive hydrate-bearing sediments. Eng. Fract. Mech. 2023, 289, 109425. [Google Scholar] [CrossRef]

- Manjunath, G.L.; Liu, Z.; Jha, B. Multi-stage hydraulic fracture monitoring at the lab scale. Eng. Fract. Mech. 2023, 289, 109448. [Google Scholar] [CrossRef]

- Raukas, A.; Punning, J.-M. Environmental problems in the Estonian oil shale industry. Energy Environ. Sci. 2009, 2, 723–728. [Google Scholar] [CrossRef]

- Birdwell, J.E.; Washburn, K.E. Rapid Analysis of Kerogen Hydrogen-to-Carbon Ratios in Shale and Mudrocks by Laser-Induced Breakdown Spectroscopy. Energy Fuels 2015, 29, 6999–7004. [Google Scholar] [CrossRef]

- Reinsalu, E. Mining Engineering Handbook ‘Eesti mäendus III’; Tallinn University of Technology, Department of Mining: Tallinn, Estonia, 2019; pp. 126–127. ISBN 9789949430970. Available online: https://digikogu.taltech.ee/et/item/b19567af-1af8-4301-8606-089bedb5e9f8 (accessed on 15 August 2019).

- Urov, K.; Sumberg, A. Characteristics of Oil Shales and Shale-Like Rocks of Known Deposits and Outcrops. Oil Shale 1999, 16, 1–64. [Google Scholar] [CrossRef]

- Aarna, I. Developments in production of synthetic fuels out of Estonian oil shale. Energy Environ. 2011, 22, 541–552. [Google Scholar] [CrossRef]

- Ots, A. Oil Shale Fuel Combustion: Properties. Power Plants. Boiler’s Design. Firig. Mineral Matter Behavior and Fouling. Heat Transfer. Corrosion and Wear; Tallinna Raamatutrükikoda: Tallinn, Estonia, 2006; ISBN 9949137101/9789949137107. [Google Scholar]

- Alar Konist, A.; Loo, L.; Valtsev, A.; Maaten, B.; Siirde, A.; Neshumayev, D.; Tõnu Pihu, T. Calculation of the Amount of Estonian Oil Shale Products from Combustion in Regular and Oxy-Fuel Mode in a CFB Boiler. Oil Shale 2014, 31, 211–224. [Google Scholar] [CrossRef]

- Wang, X.; Xiong, J.; Xie, J. Evaluation of Measurement Uncertainty Based on Monte Carlo Method. MATEC Web Conf. 2018, 206, 04004. [Google Scholar] [CrossRef]

- Ni, Y. Practical Evaluation of Uncertainty in Measurement, 5th ed.; China Zhijian Publishing House, Standards Press of China: Beijing, China, 2015; pp. 35–54. [Google Scholar]

- Pyrcz, M.J.; Deutsch, C.V. Geostatistical Reservoir Modeling; Oxford University Press: New York, NY, USA, 2014. [Google Scholar]

- Deutsch, C.V.; Journel, A.G. GSLIB: Geostatistical Software Library and User’s Guide; Oxford University Press: New York, NY, USA, 1998. [Google Scholar]

- Chile, J.P.; Delfiner, P. Geostatistics: Modeling Spatial Uncertainty, 2nd ed.; Wiley Series in Probability and Statistics; John Wiley & Sons: Hoboken, NJ, USA, 2012. [Google Scholar]

- Clark, C.E. The PERT model for the distribution of an activity. Oper. Res. 1962, 10, 405–406. [Google Scholar] [CrossRef]

- Lambrigger, D.D.; Shevchenko, P.V.; Wüthrich, M.V. The quantification of operational risk using internal data, relevant external data and expert opinion. J. Oper. Risk 2007, 2, 3–27. [Google Scholar] [CrossRef]

- Karwanski, M.; Grzybowska, U. Modeling Correlations in Operational Risk. Acta Phys. Pol. A 2018, 133, 1402–1407. [Google Scholar] [CrossRef]

- Sabanov, S. Comparison of Unconfined Compressive Strengths and Acoustic Emissions of Estonian Oil Shale And Brittle Rocks. Oil Shale 2018, 35, 26–38. [Google Scholar] [CrossRef]

| Layer Name | Layer, m | Thickness, m | MJ/kg | Oil, % | kcal/kg | OM, % | UCS, MPa | Density, t/m3 |

|---|---|---|---|---|---|---|---|---|

| F3 | 0.38 | 3.86 | 2.72 | 4.86 | 650 | 7.31 | 25.00 | 1.73 |

| F2.3/F3 | 0.15 | 3.48 | 0.16 | 0.28 | 38 | 0.42 | 67.00 | 2.12 |

| F2.3 | 0.19 | 3.33 | 2.80 | 5.00 | 669 | 7.52 | 24.00 | 1.72 |

| F2/F2.3 | 0.16 | 3.14 | 0.18 | 0.32 | 43 | 0.48 | 65.00 | 2.10 |

| F2 | 0.24 | 2.98 | 3.34 | 5.96 | 798 | 8.98 | 26.00 | 1.51 |

| F1 | 0.45 | 2.74 | 8.29 | 14.80 | 1981 | 22.28 | 24.00 | 1.51 |

| E | 0.55 | 2.29 | 11.75 | 20.98 | 2808 | 31.58 | 18.00 | 1.28 |

| D/E | 0.06 | 1.74 | 2.47 | 4.41 | 590 | 6.64 | 67.00 | 2.10 |

| D | 0.08 | 1.68 | 7.43 | 13.27 | 1776 | 19.97 | 29.00 | 1.59 |

| C/D | 0.28 | 1.60 | 0.00 | 0.00 | 0 | 0.00 | 82.00 | 2.45 |

| C | 0.31 | 1.32 | 11.38 | 20.32 | 2720 | 30.58 | 26.00 | 1.38 |

| B/C | 0.15 | 1.01 | 2.82 | 5.04 | 674 | 7.58 | 75.00 | 2.10 |

| B | 0.44 | 0.86 | 17.42 | 31.11 | 4163 | 46.81 | 40.00 | 1.22 |

| A1/B | 0.20 | 0.42 | 0.22 | 0.39 | 52 | 0.59 | 65.00 | 2.25 |

| A1 | 0.06 | 0.22 | 5.84 | 10.43 | 1396 | 15.69 | 26.00 | 1.42 |

| A/A1 | 0.03 | 0.16 | 2.44 | 4.36 | 583 | 6.56 | 32.00 | 2.10 |

| A | 0.13 | 0.13 | 11.27 | 20.13 | 2694 | 30.29 | 32.00 | 1.37 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Sabanov, S.; Qureshi, A.R.; Dauitbay, Z.; Kurmangazy, G. A Method for the Modified Estimation of Oil Shale Mineable Reserves for Shale Oil Projects: A Case Study. Energies 2023, 16, 5853. https://doi.org/10.3390/en16165853

Sabanov S, Qureshi AR, Dauitbay Z, Kurmangazy G. A Method for the Modified Estimation of Oil Shale Mineable Reserves for Shale Oil Projects: A Case Study. Energies. 2023; 16(16):5853. https://doi.org/10.3390/en16165853

Chicago/Turabian StyleSabanov, Sergei, Abdullah Rasheed Qureshi, Zhaudir Dauitbay, and Gulim Kurmangazy. 2023. "A Method for the Modified Estimation of Oil Shale Mineable Reserves for Shale Oil Projects: A Case Study" Energies 16, no. 16: 5853. https://doi.org/10.3390/en16165853

APA StyleSabanov, S., Qureshi, A. R., Dauitbay, Z., & Kurmangazy, G. (2023). A Method for the Modified Estimation of Oil Shale Mineable Reserves for Shale Oil Projects: A Case Study. Energies, 16(16), 5853. https://doi.org/10.3390/en16165853