Analysis of Net-Metering and Cross-Subsidy Effects in South Korea: Economic Impact across Residential Customer Groups by Electricity Consumption Level

Abstract

1. Introduction

- This study is the first to quantitatively analyze the cross-subsidy effect of self-consumption PVs between customers, which means that non-PV adopters financially support the network cost that the PV adopters should have paid for from the perspective of their electricity consumption level (usage tiers).

- The results in this study are based on comprehensive real data sets that represent the key characteristics of electricity demand, self-consumption, and the PV installation level of residential customers in South Korea.

- Alternative policies are suggested to simultaneously mitigate the side effects of self-consumption PVs under net-metering scheme and meet the environmental goal of deploying self-consumption PVs.

2. Data

2.1. Korea’s Electricity Billing System

2.2. Residential Tariff Description

2.3. Customer Load and PV Generation Profile

2.3.1. Customer Load

2.3.2. PV Installation Level

2.3.3. PV Generation

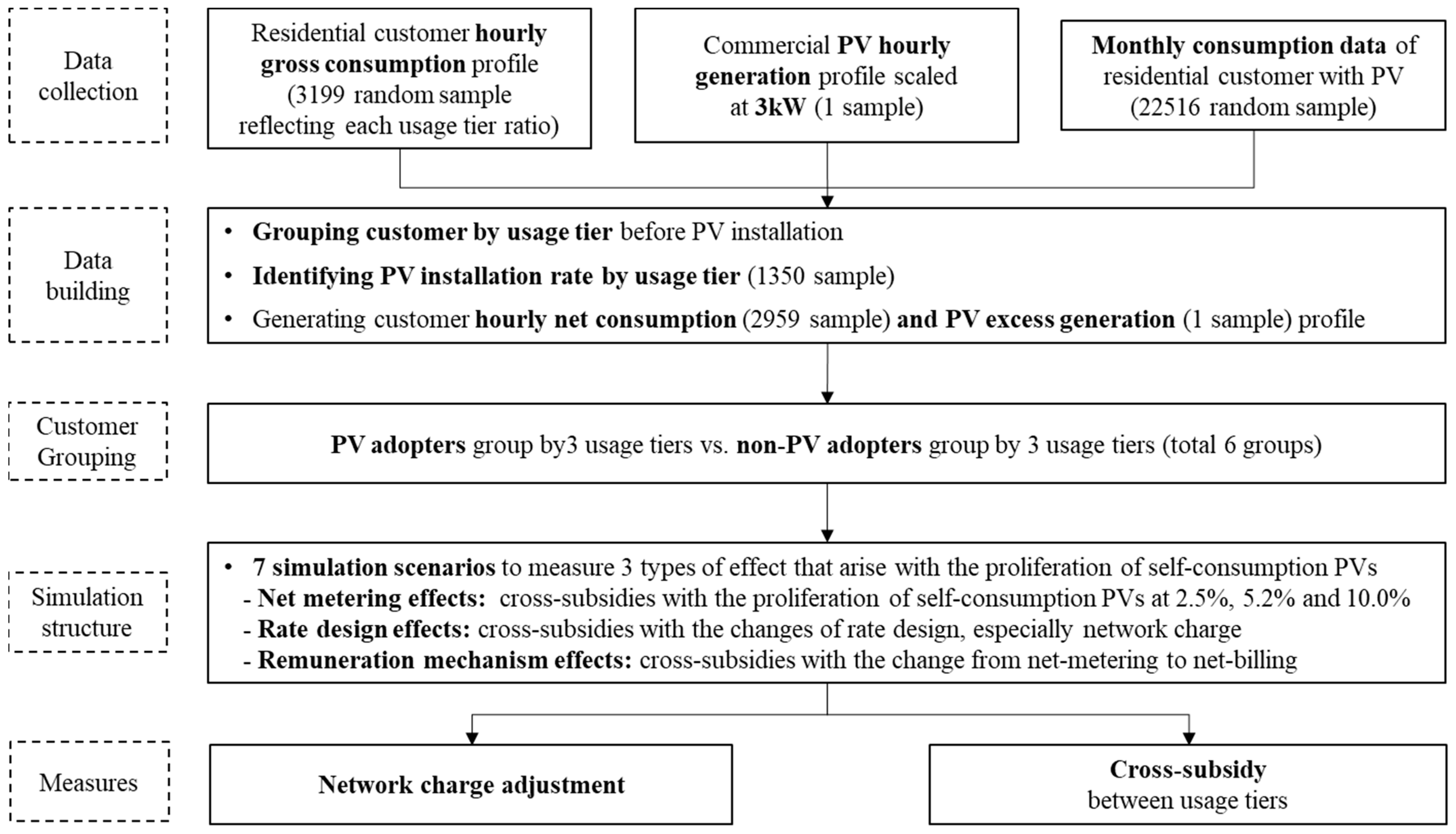

3. Simulation Structure and Measures

3.1. Scenario

3.1.1. Net-Metering Scenario

3.1.2. Alternative Scenarios

3.2. Measure

3.2.1. Network Charge Adjustment

3.2.2. Cross-Subsidy

4. Results and Interpretations

4.1. Effect of PV Penetration (Scenario 1–4)

4.2. Effect of Network Charge Design (Scenario 2 and 5–6)

4.3. Effect of PV Adoption Level by Usage Tiers (Scenario 2 and 7–8)

5. Policy Implications and Conclusions

- Under the inclining block rate, the asymmetric remuneration mechanism of net-metering for self-consumption PVs and the existence of quasi-fixed demand charge will cause unintended cross-subsidies from lower usage customers—typically the economically underprivileged—to higher usage customers (Table 5). In particular, from the perspective of demand charge, the marginal benefits of every kWh for PV adopters in usage tier 1 are almost zero.

- To mitigate the cross-subsidy effect on customers that is caused by the proliferation of self-consumption PVs, it is necessary to increase the proportion of fixed-charges in the network charge and change the rate design in a way that conforms more to the cost-causality principle. For example, the cross-subsidy effect can be reduced by up to 25% in the Korean market by simply increasing the proportion of demand charges in the network charge.

- The cross-subsidy effect can be alleviated by changing the deployment policy for self-consumption PVs even under the current rate design. Targeted deployment to increase the PV adoption level of customers in usage tier 1 who have a relatively low impact on missing network revenue after PV installation could contribute to reducing the cross-subsidy effect as much as network charge redesign.

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Castaneda, M.; Jimenez, M.; Zapata, S.; Franco, C.J.; Dyner, I. Myths and facts of the utility death spiral. Energy Policy 2017, 110, 105–116. [Google Scholar] [CrossRef]

- BNEF. 1H 2020 LCOE Update–Renewables Chase Plunging Commodity Prices; BNEF: New York, NY, USA, 2020. [Google Scholar]

- IRENA. Renewable Power Generation Costs in 2019; IRENA: Anu Dhabi, United Arab Emirates, 2020. [Google Scholar]

- IEA. Renewables 2019; Analysis and Forecast to 2024; IEA: Paris, France, 2019. [Google Scholar]

- Satchwell, A.; Mills, A.; Barbose, G. Regulatory and ratemaking approaches to mitigate financial impacts of net-metered PV on utilities and ratepayers. Energy Policy 2015, 85, 115–125. [Google Scholar] [CrossRef]

- Eid, C.; Guillén, P.F.; Marín, P.F.; Hakvoort, R. The economic effect of electricity net-metering with solar PV: Consequences for network cost recovery, cross subsidies and policy objectives. Energy Policy 2014, 75, 244–254. [Google Scholar] [CrossRef]

- Ruester, S.; Schwenen, S.; Batlle, C.; Pérez-Arriaga, I. From distribution networks to smart distribution systems: Rethinking the regulation of European electricity DSOs. Util. Policy 2014, 31, 229–237. [Google Scholar] [CrossRef]

- Hughes, L.; Bell, J. Compensating customer-generators: A taxonomy describing methods of compensating customer-generators for electricity supplied to the grid. Energy Policy 2006, 34, 1532–1539. [Google Scholar] [CrossRef]

- Darghouth, N.R.; Barbose, G.; Wiser, R. The impact of rate design and net metering on the bill savings from distributed PV for residential customers in California. Energy Policy 2011, 39, 5243–5253. [Google Scholar] [CrossRef]

- Darghouth, N.R.; Wiser, R.; Barbose, G. Customer economics of residential photovoltaic systems: Sensitivities to changes in wholesale market design and rate structures. Renew. Sust. Energ. Rev. 2016, 54, 1459–1469. [Google Scholar] [CrossRef]

- Comello, S.; Reichelstein, S. Cost competitiveness of residential solar PV: The impact of net metering restrictions. Renew. Sust. Energ. Rev. 2017, 75, 46–57. [Google Scholar] [CrossRef]

- Bertsch, V.; Geldermann, J.; Lühn, T. What drives the profitability of household PV investments, self-consumption and self-sufficiency? Appl. Energy 2017, 204, 1–15. [Google Scholar] [CrossRef]

- Solano, J.C.; Brito, M.C.; Caamaňo-Martín, E. Impact of fixed charges on the viability of self-consumption photovoltaics. Energy Policy 2018, 122, 322–331. [Google Scholar] [CrossRef]

- Iglesias, C.; Vilaça, P. On the regulation of solar distributed generation in Brazil: A look at both sides. Energy Policy 2022, 167, 113091. [Google Scholar] [CrossRef]

- Alahmed, A.S.; Tong, L. On net energy metering X: Optimal prosumer decision, social welfare, and cross-subsidies. IEEE Trans. Smart Grid 2022. [Google Scholar] [CrossRef]

- Yamamoto, Y. Pricing electricity from residential photovoltaic systems: A comparison of feed-in tariffs, net metering, and net purchase and sale. Solar Energy 2012, 86, 2678–2685. [Google Scholar] [CrossRef]

- Cohen, R.; Khermouch, G. The giant headache that is net energy metering. Electr. J. 2013, 26, 5–7. [Google Scholar]

- Janko, S.A.; Arnold, M.R.; Johnson, N.G. Implications of high-penetration renewables for ratepayers and utilities in the residential solar photovoltaics (PV) market. Appl. Energy 2016, 180, 37–51. [Google Scholar] [CrossRef]

- Costello, K.W.; Hemphill, R.C. Electric Utilities’ ‘Death Spiral’: Hyperbole or reality. Electr. J. 2014, 27, 7–26. [Google Scholar] [CrossRef]

- Kind, P. Disruptive Challenges: Financial Implications and Strategic Response to a Changing Retail Electric Business; EEI: Washington, DC, USA, 2013. [Google Scholar]

- Laws, N.D.; Epps, B.P.; Perterson, S.O.; Laser, M.S.; Wanjiru, G.K. On the utility death spiral and the impact of utility rate structures on the adoption of residential solar photovoltaics and energy storage. Appl. Energy 2017, 185, 627–641. [Google Scholar] [CrossRef]

- Muaafa, M.; Adjali, I.; Bean, P.; Fuentes, R.; Kimbrought, S.O.; Murphy, F.H. Can adoption of rooftop solar panels trigger a utility death spiral? A tale of two US cities. Energy Res. Soc. Sci. 2017, 34, 154–162. [Google Scholar] [CrossRef]

- Borenstein, S. The economics of fixed cost recovery by utilities. Electr. J. 2016, 29, 5–12. [Google Scholar] [CrossRef]

- Olivia, H.S.; MacGill, I.; Passey, R. Assessing the short-term revenue impacts of residential PV systems on electricity customers, retailers and network service providers. Renew. Sust. Energ. Rev. 2016, 54, 1494–1505. [Google Scholar] [CrossRef]

- Venkatraman, A.; Thatte, A.A.; Xie, L. A smart meter data-driven distribution utility rate model for networks with prosumers. Util. Policy 2021, 70, 101212. [Google Scholar] [CrossRef]

- Clastres, C.; Percebois, J.; Rebenaque, C.; Solier, B. Cross subsidies across electricity network users from renewable self-consumption. Util. Policy 2019, 59, 100925. [Google Scholar] [CrossRef]

- Kubli, M. Squaring the sunny circle? On balancing distributive justice of power grid costs and incentives for solar prosumers. Energy Policy 2018, 114, 173–188. [Google Scholar] [CrossRef]

- Nikolaidis, A.I.; Charalambous, C.A. Hidden financial implications of the net energy metering practice in an isolated power system: Critical review and policy insights. Renew. Sust. Energ. Rev. 2018, 77, 706–717. [Google Scholar] [CrossRef]

- Picciariello, A.; Vergara, C.; Reneses, J.; Frías, P.; Söder, L. Electricity distribution tariffs and distributed generation: Quantifying cross-subsidies from consumers to prosumers. Util. Policy 2015, 37, 25–33. [Google Scholar] [CrossRef]

- Burger, S.; Knittel, C.; Pérez-Arriaga, I. Quantifying the Distributional Impacts of Rooftop Solar PV Adoption under Net Energy Metering; MIT CEEPR: Cambridge, MA, USA, 2020. [Google Scholar]

- Ansarin, M.; Ghiassi-Farrokhfal, Y.; Ketter, W.; Collins, J. Cross-subsidies among residential electricity prosumers from tariff design and metering infrastructure. Energy Policy 2020, 145, 111736. [Google Scholar] [CrossRef]

- Fikru, M.G.; Canfield, C.I. A generic economic framework for electric rate design with prosumers. Solar Energy 2020, 211, 1325–1334. [Google Scholar] [CrossRef]

- KEPCO. Available online: https://cyber.kepco.co.kr/ckepco/front/jsp/CY/E/E/CYEEHP00209.jsp (accessed on 4 January 2023).

- KEPCO. Statics of Electric Power in Korea 2019; KEPCO: Naju, Republic of Korea, 2020. [Google Scholar]

- Deng, G.; Newton, P. Assessing the impact of solar PV on domestic electricity consumption: Exploring the prospect of rebound effects. Energy Policy 2017, 110, 313–324. [Google Scholar] [CrossRef]

- Havas, L.; Ballweg, J.; Penna, C.; Race, D. Power to change: Analysis of household participation in a renewable energy and energy efficiency programme in Central Australia. Energy Policy 2015, 87, 325–333. [Google Scholar] [CrossRef]

- KPX (Korea Power Exchnage). Available online: https://epsis.kpx.or.kr/epsisnew/selectEkpoBftChart.do?menuId=020100&locale=eng (accessed on 4 January 2023).

- Chung, M.H. Comparison of economic feasibility for efficient peer-to-peer electricity trading of PV equipped residential house in Korea. Energies 2020, 13, 3568. [Google Scholar] [CrossRef]

- Hledik, R. Rediscovering residential demand charges. Electr. J. 2014, 27, 82–96. [Google Scholar] [CrossRef]

| Component | Description | Unit |

|---|---|---|

| Demand charge | Factor to recover fixed costs related to electric power faciclities such as transmission and distribution network | kW |

| Energy charge | Factor to recover variable costs such as fuel costs incurred in proportion to the amount of electricity consumption | kWh |

| CCEC | The sum of Renewable Portfolio Standards (RPS) cost, Emission Trading System (ETS) cost and so on | kWh |

| FCPAR | Factor to reflect changes in international fuel prices, mainly liquified natual gas (LNG), on a quarterly basis | kWh |

| Average Monthly Consumption | Sample (Residential Customers) | Population (Residential Customers) | |||

|---|---|---|---|---|---|

| Proportion | Monthly Consumption | Proportion | Monthly Consumption | ||

| Usage tier 1 | Below 200 kWh | 40.3% | 110.56 | 40.4% | 101.50 |

| Usage tier 2 | 200~400 kWh | 48.9% | 277.09 | 48.4% | 299.28 |

| Usage tier 3 | Above 400 kWh | 10.8% | 511.74 | 11.4% | 533.30 |

| Scenarios | Rate Structure | Residential PV Penetration | Number of PV Adopters by Usage Tiers (1:2:3) | Network Charge Structure | Missing Network Revenue Recovery | ||

|---|---|---|---|---|---|---|---|

| S1 | demand, energy | 0% | n.a. | demand, energy | n.a. | ||

| S2 | demand, energy | 2.5% | 12 | 51 | 11 | demand, energy | energy charge |

| S3 | demand, energy | 5.0% | 23 | 102 | 23 | demand, energy | energy charge |

| S4 | demand, energy | 10.0% | 47 | 203 | 46 | demand, energy | energy charge |

| S5 | demand, energy | 2.5% | 12 | 51 | 11 | demand | energy charge |

| S6 | demand, energy, capacity | 2.5% | 12 | 51 | 11 | demand | capacity charge |

| S7 | demand, energy | 2.5% | 22 | 43 | 9 | demand, energy | energy charge |

| S8 | demand, energy | 2.5% | 37 | 30 | 7 | demand, energy | energy charge |

| S1 | S2 | S3 | S4 | |

|---|---|---|---|---|

| PV penetration | 0.00% | 2.50% | 5.00% | 10.00% |

| Missing network revenue | ||||

| - with current rate design | - | 2.07% | 4.20% | 8.43% |

| - with 100% volumetric network charge | - | 2.80% | 5.64% | 11.20% |

| Usage Tier | PV Adoption | S1 | S2 | S3 | S4 | |||

|---|---|---|---|---|---|---|---|---|

| Network Charge Distribution | Network Charge Distribution | Cross-Subsidy | Network Charge Distribution | Cross-Subsidy | Network Charge Distribution | Cross-Subsidy | ||

| 1 | PV adopters | 0.1891% | 0.1080% | −0.0811% | 0.2069% | −0.1584% | 0.4260% | −0.3267% |

| Non-PV adopters | 19.2589% | 19.6525% | 0.3936% | 19.8985% | 0.8158% | 20.4023% | 1.7070% | |

| Sub-total | 19.4480% | 19.7604% | 0.3124% | 20.1054% | 0.6574% | 20.8282% | 1.3803% | |

| 2 | PV adopters | 1.8310% | 0.5266% | −1.3044% | 1.0496% | −2.5555% | 2.0998% | −5.0779% |

| Non-PV adopters | 50.2572% | 51.4411% | 0.1839% | 50.8696% | 2.3865% | 49.6181% | 4.7076% | |

| Sub-total | 52.0882% | 51.9677% | −0.1204% | 51.9193% | −0.1689% | 51.7179% | −0.3703% | |

| 3 | PV adopters | 1.0726% | 0.3967% | −1.6760% | 0.8006% | −1.4615% | 1.6202% | −2.9238% |

| Non-PV adopters | 27.3912% | 27.8752% | 0.4839% | 27.1747% | 0.9730% | 25.8337% | 1.9138% | |

| Sub-total | 28.4638% | 28.2718% | −0.1920% | 27.9753% | −0.4885% | 27.4539% | −1.0100% | |

| Usage Tier | Change of Annual Network Charge per Household * (USD) | Shift to PV Adopter Group, % of Consumption in Scenario 1 | |||||

|---|---|---|---|---|---|---|---|

| PV Adopters | Non-PV Adopter | ||||||

| Demand Charge | Energy Charge | Total | Demand Charge | Energy Charge | Total | ||

| 1 | −0.10 | −7.35 | −7.46 | 0.00 | 0.37 | 0.37 | 0.54% |

| 2 | −9.85 | −18.36 | −28.21 | 0.00 | 0.94 | 0.94 | 1.60% |

| 3 | −43.48 | −24.30 | −67.79 | 0.00 | 1.73 | 1.73 | 1.30% |

| Usage Tier | S2 | S5 | S6 | ||||

|---|---|---|---|---|---|---|---|

| Network Charge Distribution | Cross-Subsidy | Network Charge Distribution | Cross-Subsidy | Network Charge Distribution | Cross-Subsidy | ||

| PV adopters | 1 | 0.1080% | −0.0811% | 0.1740% | −0.0151% | 0.1775% | −0.0116% |

| 2 | 0.5266% | −1.3044% | 0.8794% | −0.9515% | 0.9087% | −0.9223% | |

| 3 | 0.3967% | −0.6760% | 0.5190% | −0.5537% | 0.5239% | −0.5487% | |

| Sub-total | 1.0313% | −2.0614% | 1.5724% | −1.5203% | 1.6101% | −1.4826% | |

| Non-PV adopter | 1 | 19.6525% | 0.3936% | 19.5703% | 0.3114% | 19.6658% | 0.4069% |

| 2 | 51.4411% | 1.1839% | 51.1252% | 0.8680% | 51.0829% | 0.8257% | |

| 3 | 27.8752% | 0.4839% | 27.7321% | 0.3409% | 27.6412% | 0.2500% | |

| Sub-total | 98.9687% | 2.0614% | 98.4276% | 1.5203% | 98.3899% | 1.4826% | |

| Usage Tier | S7 | S8 | |||||

|---|---|---|---|---|---|---|---|

| Customer Number | Network Charge Distribution | Cross-Subsidy | Customer Number | Network Charge Distribution | Cross-Subsidy | ||

| PV adopters | 1 | 22 | 0.1970% | −0.1512% | 37 | 0.2976% | −0.2912% |

| 2 | 43 | 0.4427% | −1.0858% | 30 | 0.3031% | −0.7577% | |

| 3 | 9 | 0.3272% | −0.5385% | 7 | 0.2491% | −0.4238% | |

| Sub-total | 74 | 0.9678% | −1.7755% | 74 | 0.8497% | −1.4727% | |

| Non-PV adopter | 1 | 1170 | 19.4339% | 0.3350% | 1155 | 19.1324% | 0.2732% |

| 2 | 1404 | 51.5820% | 1.0223% | 1417 | 51.8794% | 0.8520% | |

| 3 | 311 | 28.0163% | 0.4182% | 313 | 28.1385% | 0.3475% | |

| Sub-total | 2885 | 99.0322% | 1.7755% | 2885 | 99.1503% | 1.4727% | |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Kim, J.; Baek, K.; Lee, E.; Kim, J. Analysis of Net-Metering and Cross-Subsidy Effects in South Korea: Economic Impact across Residential Customer Groups by Electricity Consumption Level. Energies 2023, 16, 717. https://doi.org/10.3390/en16020717

Kim J, Baek K, Lee E, Kim J. Analysis of Net-Metering and Cross-Subsidy Effects in South Korea: Economic Impact across Residential Customer Groups by Electricity Consumption Level. Energies. 2023; 16(2):717. https://doi.org/10.3390/en16020717

Chicago/Turabian StyleKim, Junhyung, Keon Baek, Eunjung Lee, and Jinho Kim. 2023. "Analysis of Net-Metering and Cross-Subsidy Effects in South Korea: Economic Impact across Residential Customer Groups by Electricity Consumption Level" Energies 16, no. 2: 717. https://doi.org/10.3390/en16020717

APA StyleKim, J., Baek, K., Lee, E., & Kim, J. (2023). Analysis of Net-Metering and Cross-Subsidy Effects in South Korea: Economic Impact across Residential Customer Groups by Electricity Consumption Level. Energies, 16(2), 717. https://doi.org/10.3390/en16020717