The Cost to Consumers of Carbon Capture and Storage—A Product Value Chain Analysis

Abstract

:1. Introduction

2. Methodology

- Quantifying the cost increase through the value chain, assuming full cost pass-through;

- Quantifying the changes in GHG emissions by determining the emissions factors associated with the basic product and its end-use;

- Identifying actors in the product value chain that play key roles in enabling the implementation of CCS as a mitigation measure.

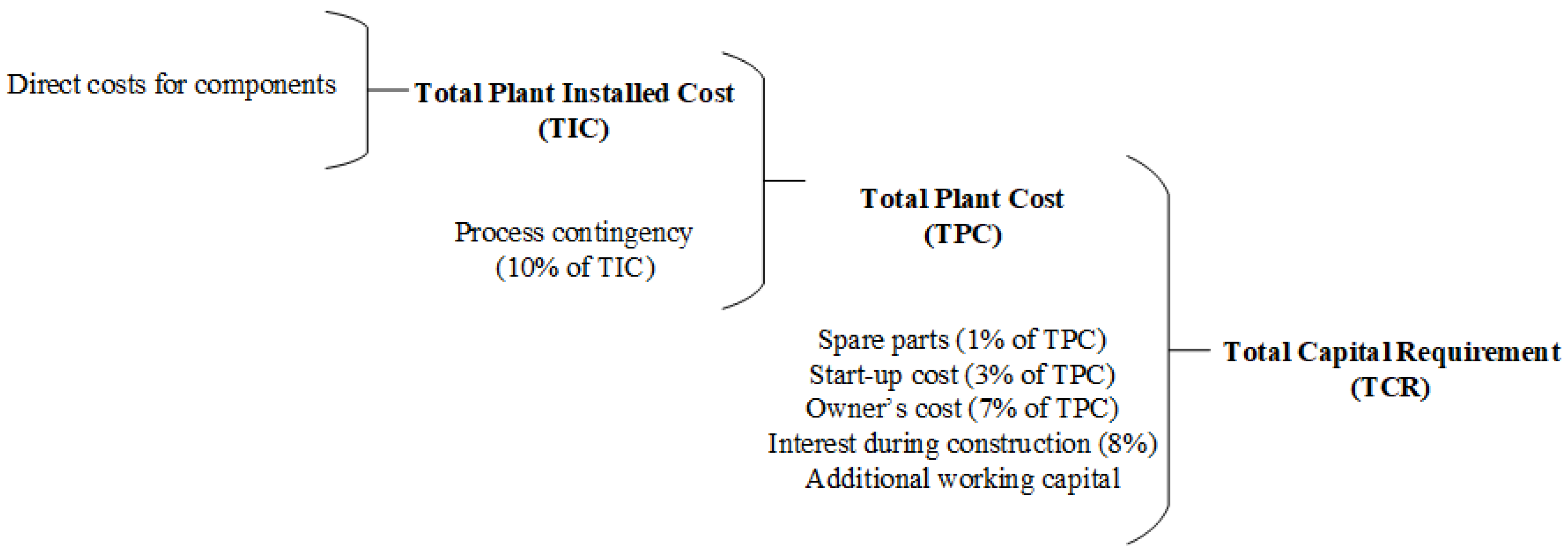

2.1. Cost Evaluation

2.2. Emissions Factor Evaluation

2.3. CCS Configuration and CCS Chain

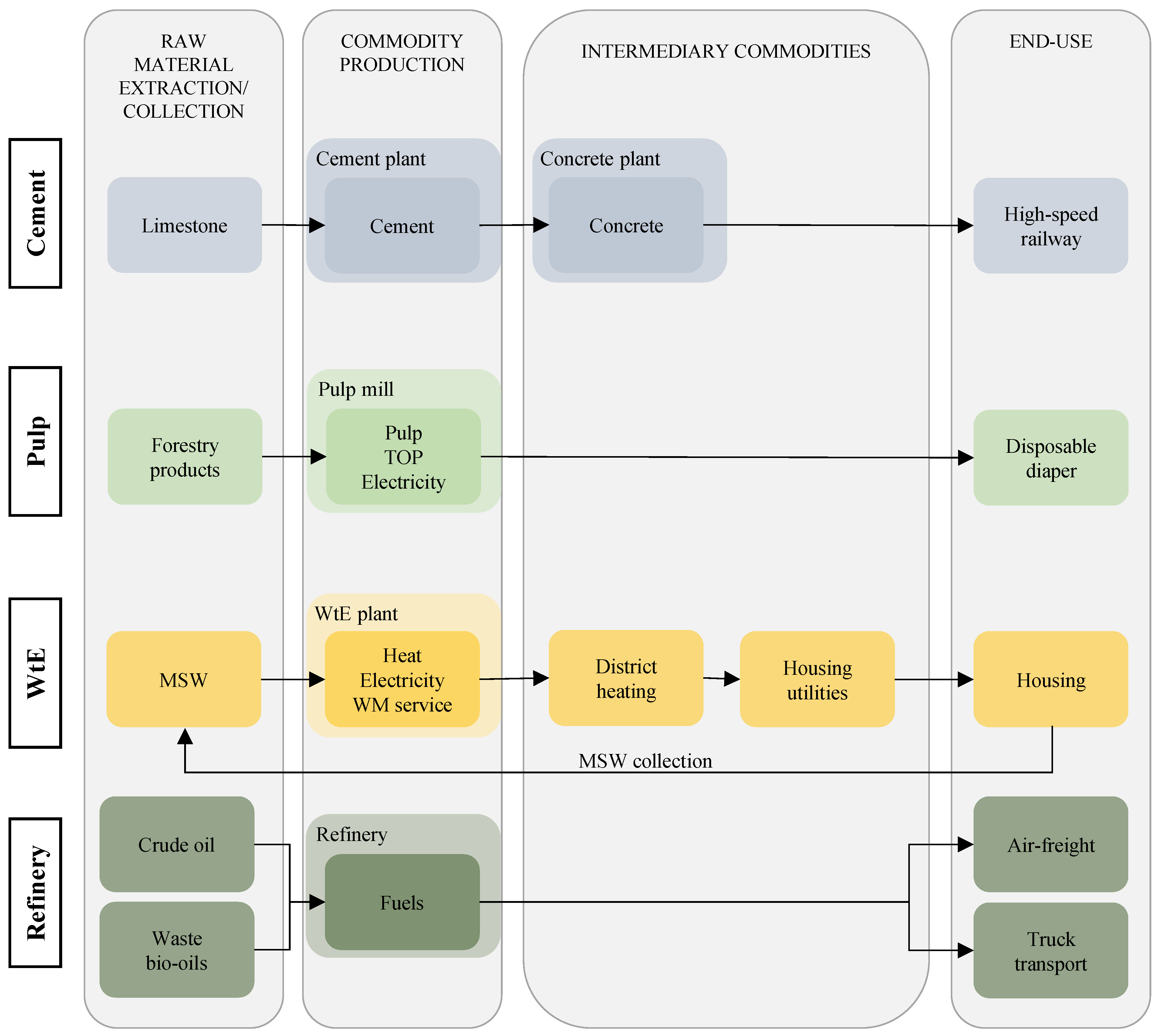

2.4. Product Value Chains

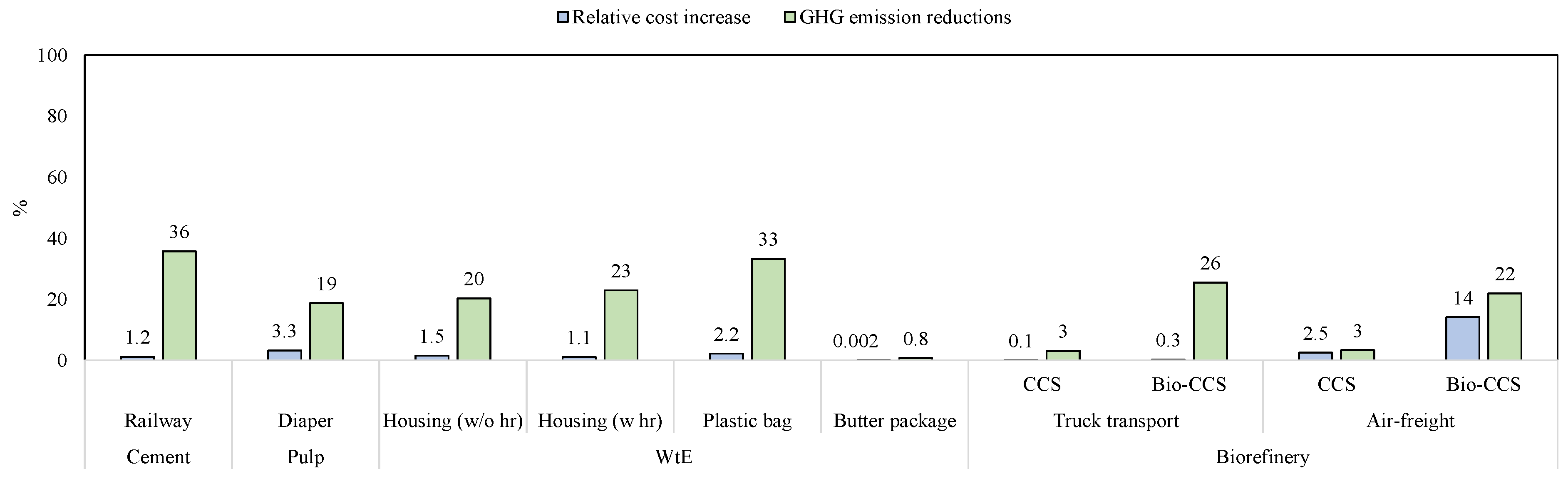

3. Results

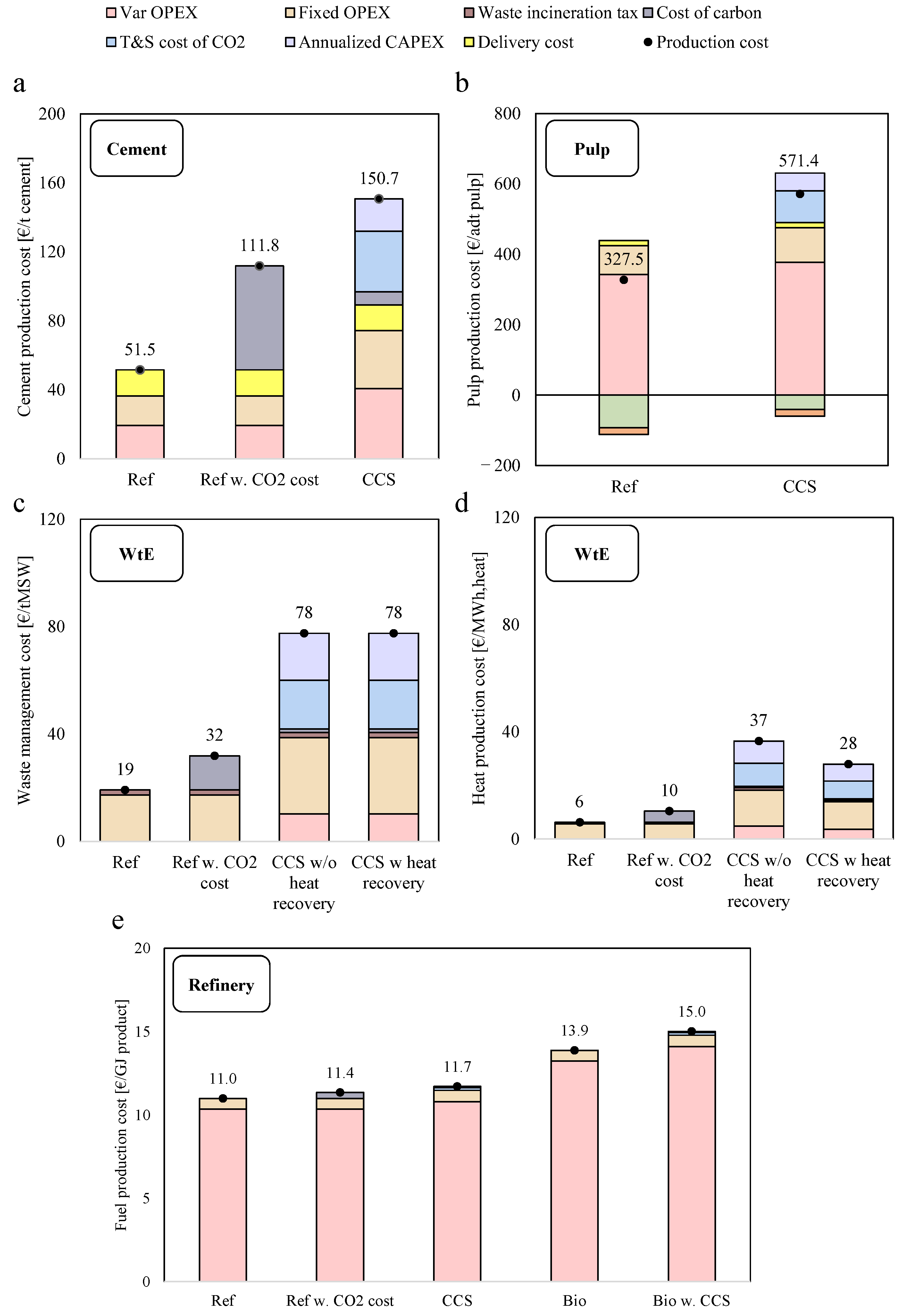

3.1. Cost Break-Down

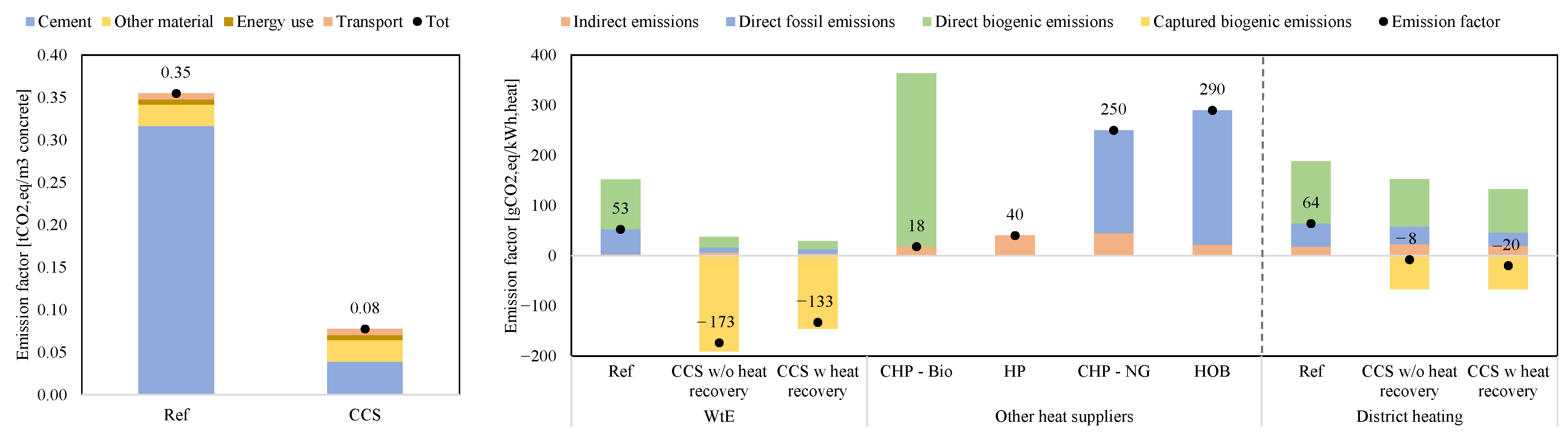

3.2. Life-Cycle Emissions

4. Discussion

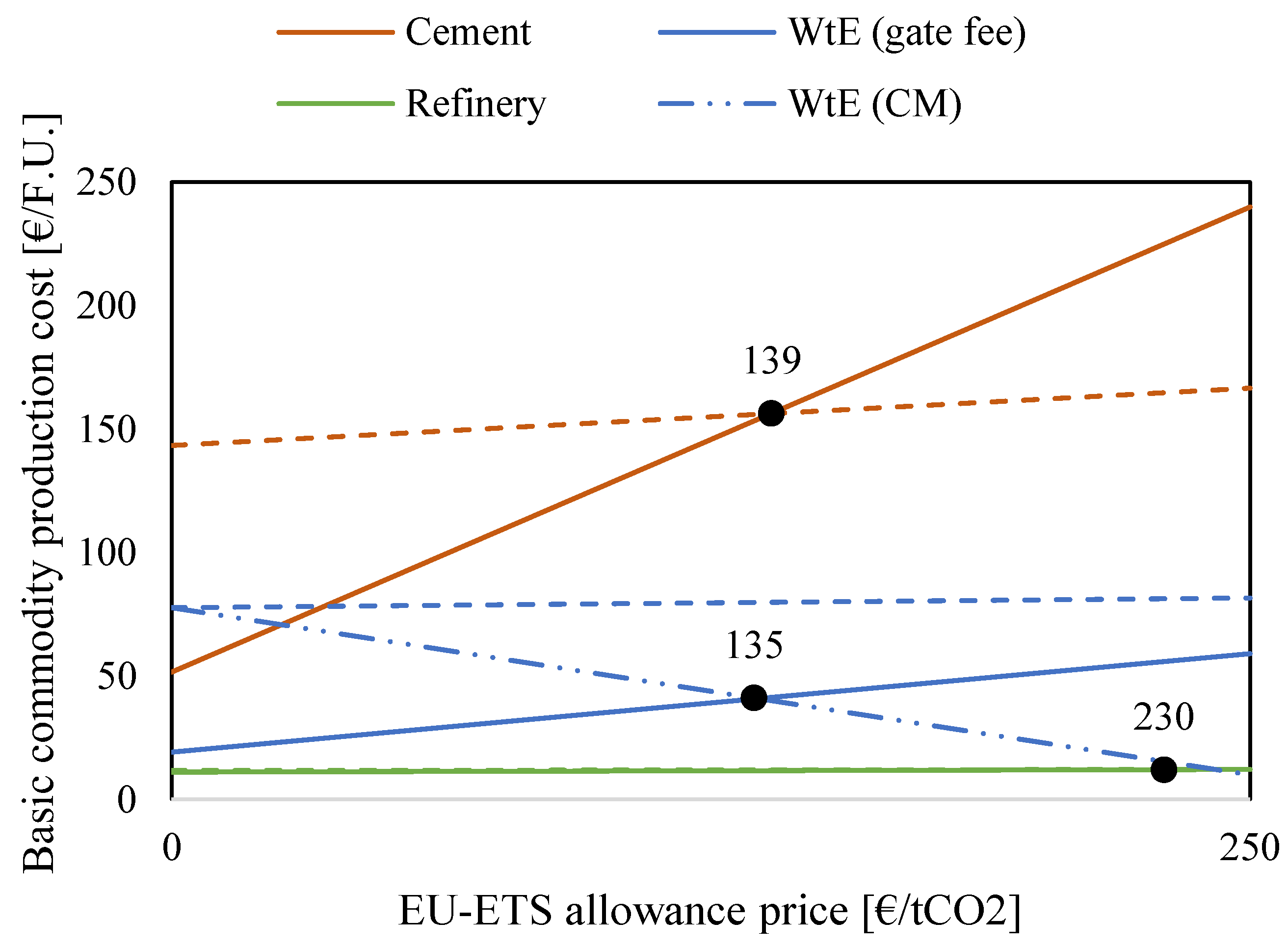

4.1. Low-Carbon Products and Added Value

4.1.1. Profit Margins and Full Cost Pass-Through

4.1.2. Comparison of Industries and Cross-Value Chain Collaboration

4.2. Policies and Business Models for Negative Emissions

5. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

Appendix A

Appendix A.1. Commodity Costs and Prices

| Commodity | Cost/Price | Unit | References |

|---|---|---|---|

| Cement chain | |||

| Limestone | 3 | €/t | [9] |

| Pulp chain | |||

| Round wood | 40 | €/m3 | [6] |

| Tall oil pitch | 500 | €/t | [14] |

| WtE chain | |||

| Plastic bag b | 0.67 | €/bag | [51] |

| Butter package b | 2.7 | €/butter package | [52] |

| Refinery chain | |||

| Crude oil | 61.4 a | US$/barrel | [53] |

Appendix A.2. Cement Chain

| Cement Plant Specifications | |||

| Thermal energy requirement * | 3025 | MJ/t cement | [9] |

| Fuel mix | |||

| Coal | 49 | % of energy supplied | [54] |

| Petcoke | 23 | % of energy supplied | [54] |

| Fuel oil | 1 | % of energy supplied | [54] |

| Alternative fuel a | 15 | % of energy supplied | [54] |

| Biomass | 11 | % of energy supplied | [54] |

| Material Composition | Material Used in the Railway | Emissions Factor | ||||

|---|---|---|---|---|---|---|

| Concrete | 83 | wt% | [55] | - | tCO2,eq/m3concrete | Own calculations |

| Steel products * | 5 | wt% | [55] | - | tCO2,eq/tsteel | ecoinvent database |

| Asphalt | 4 | wt% | [55] | - | tCO2,eq/tasphalt | ecoinvent database |

| Cement | 3 | wt% | [55] | - | tCO2,eq/tcement | Own calculations |

| Additional limestone | 2 | wt% | [55] | - | tCO2,eq/tlimestone | ecoinvent database |

Appendix A.3. Pulp Chain

| Material Composition | Material Use per Diaper | Emission Factor | ||||

|---|---|---|---|---|---|---|

| Fluff pulp | 12.7 | g | [56] | - | kgCO2,eq/kg | Own calculations |

| Non-wovens | 9.53 | g | [56] | - | kgCO2,eq/kg | ecoinvent database |

| LDPE film | 18.8 | g | [56] | - | kgCO2,eq/kg | ecoinvent database |

| Elastics | 0.02 | g | [56] | - | kgCO2,eq/kg | ecoinvent database |

| SAP | 15.15 | g | [56] | - | kgCO2,eq/kg | ecoinvent database |

| Adhesive | 0.95 | g | [56] | - | kgCO2,eq/kg | ecoinvent database |

Appendix A.4. WtE Chain

| Housing Utility Use per Year | Use per Household and Year | Emissions Factor | ||||

|---|---|---|---|---|---|---|

| Waste | 461.5 | kg | [64] | - | tCO2,eq/tMSW | Own calculations |

| Heat | 9300 | kWh | [65] | - | tCO2,eq/kWhheat | Own calculations |

| Electricity | 6925 | kWh | [66] | 0.365 | tCO2,eq/kWhel | Swedish Environmental Protection Agency [67] |

| Water | 4378 | m3 | [66] | - | tCO2,eq/kg | ecoinvent database |

Appendix A.5. Refinery Chain

Appendix A.6. Life-Cycle Emissions

Appendix A.6.1. Intermediary Commodities

Appendix A.6.2. End-Uses

References

- Intergovernmental Panel on Climate Change. Global Warming of 1.5 °C. Available online: https://www.ipcc.ch/sr15/ (accessed on 10 February 2020).

- Buck, H.; Carton, W.; Lund, J.; Markusson, N. Why Residual Emissions Matter Right Now. Nat. Clim. Change 2023, 13, 351–358. [Google Scholar] [CrossRef]

- EU Emissions Trading System (EU ETS). Available online: https://climate.ec.europa.eu/eu-action/eu-emissions-trading-sys4tem-eu-ets_en (accessed on 13 April 2023).

- IEA Greenhouse Gas R&D Programme (IEA GHG). CO2 Capture in the Cement Industry, 2008/3. July 2008. Available online: https://ieaghg.org/docs/General_Docs/Reports/2008-3.pdf (accessed on 20 January 2023).

- IEAGHG. Deployment of CCS in the Cement Industry, 2013/19. December 2013. Available online: https://ieaghg.org/docs/General_Docs/Reports/2013-19.pdf (accessed on 20 January 2023).

- Onarheim, K.; Santos, S.; Kangas, P.; Hankalin, V. Performance and cost of CCS in the pulp and paper industry part 2: Economic feasibility of amine-based post-combustion CO2 capture. Int. J. Greenh. Gas Control 2017, 66, 60–75. [Google Scholar] [CrossRef]

- Stede, J.; Pauliuk, S.; Hardadi, G.; Neuhoff, K. Carbon Pricing of Basic Materials: Incentives and Risks for the Value Chain and Consumers. SSRN Electron. J. 2021, 189, 107168. [Google Scholar] [CrossRef]

- Klement, J.; Rootzén, J.; Normann, F.; Johnsson, F. Supply Chain Driven Commercialisation of Bio Energy Carbon Capture and Storage. Front. Clim. 2021, 3, 615578. [Google Scholar] [CrossRef]

- Rootzén, J.; Johnsson, F. Managing the costs of CO2 abatement in the cement industry. Clim. Policy 2017, 17, 781–800. [Google Scholar] [CrossRef]

- Rootzén, J.; Johnsson, F. Paying the full price of steel—Perspectives on the cost of reducing carbon dioxide emissions from the steel industry. Energy Policy 2016, 98, 459–469. [Google Scholar] [CrossRef]

- Subraveti, S.G.; Rodr, E.; Ram, A.; Roussanaly, S. Is Carbon Capture and Storage (CCS) Really So Expensive? An Analysis of Cascading Costs and CO2 Emissions Reduction of Industrial CCS Implementation on the Construction of a Bridge. Environ. Sci. Technol. 2023, 57, 2595–2601. [Google Scholar] [CrossRef] [PubMed]

- Warringa, G.; Waste Incineration under the EU ETS An assessment of Climate Benefits. Zero Wate Eur. 2021. Available online: www.cedelft.eu (accessed on 20 January 2023).

- Deng, H.; Roussanaly, S.; Skaugen, G. Techno-economic analyses of CO2 liquefaction: Impact of product pressure and impurities Analyses. Int. J. Refrig. 2019, 103, 301–315. [Google Scholar] [CrossRef]

- IEAGHG. Techno-Economic Evaluation of Retrofitting CCS in a Market Pulp Mill and an Integrated Pulp and Board Mill, Report: 2016/10; IEAGHG: Cheltenham, UK, 2016. [Google Scholar]

- European Commission. Commission Delegated Decision (EU) 2019/708, supplementing Directive 2003/87/EC of the European Parliament and of the Council concerning the determination of sectors and subsectors deemed at risk of carbon leakage for the period 2021 to 2030. Off. J. Eur. Union 2019, 5, 20–26. [Google Scholar]

- Allocation to Industrial Installations. Available online: https://ec.europa.eu/clima/eu-action/eu-emissions-trading-system-eu-ets/free-allocation/allocation-industrial-installations_en (accessed on 14 June 2022).

- European Parliament. Climate Change: Deal on a More Ambitious Emissions Trading System (ETS)|News|European Parliament. 2023. Available online: https://www.europarl.europa.eu/news/en/press-room/20221212IPR64527/climate-change-deal-on-a-more-ambitious-emissions-trading-system-ets (accessed on 30 May 2023).

- Climact. Is the Eu Ets Proposal Fit For 55%?—An Analysis of the Commision’s Proposal for the EU ETS Revision. January 2022. Available online: https://climact.com/wp-content/uploads/2022/01/Climact-ETS-report-220125.pdf (accessed on 27 April 2023).

- Garðarsdóttir, S.Ó.; Normann, F.; Skagestad, R.; Johnsson, F. Investment costs and CO2 reduction potential of carbon capture from industrial plants—A Swedish case study. Int. J. Greenh. Gas Control 2018, 76, 111–124. [Google Scholar] [CrossRef]

- UNFCCC. Reporting and Accounting of LULUCF Activities under the Kyoto Protocol|UNFCCC. Available online: https://unfccc.int/topics/land-use/workstreams/lulucf-under-the-kyoto-protocol/reporting-and-accounting-of-lulucf-activities-under-the-kyoto-protocol (accessed on 27 April 2023).

- Onarheim, K.; Santos, S.; Kangas, P.; Hankalin, V. Performance and costs of CCS in the pulp and paper industry part 1: Performance of amine-based post-combustion CO2 capture. Int. J. Greenh. Gas Control 2017, 59, 58–73. [Google Scholar] [CrossRef]

- Beiron, J.; Normann, F.; Johnsson, F. A techno-economic assessment of CO2 capture in biomass and waste-fired combined heat and power plants—A Swedish case study. Int. J. Greenh. Gas Control 2022, 118, 103684. [Google Scholar] [CrossRef]

- Biermann, M.; Langner, C.; Roussanaly, S.; Normann, F.; Harvey, S. The role of energy supply in abatement cost curves for CO2 capture from process industry—A case study of a Swedish refinery Citation for the original published paper (version of record): The role of energy supply in abatement cost curves for CO2 capt. Appl. Energy 2022, 319, 119273. [Google Scholar] [CrossRef]

- IOGP. The Potential for CCS and CCU in Europe—Report to the Thirty Second Meeting of the European Gas Regulatory Forum 5–6 June 2019; IOGP: London, UK, 2019. [Google Scholar]

- Global CCS Institute. Technology Readiness and Costs of CCS Technology Readiness; Global CCS Institute: Melbourne, Australia, 2021. [Google Scholar]

- Knoope, M.M.J.; Ramírez, A.; Faaij, A.P.C. The influence of uncertainty in the development of a CO2 infrastructure network. Appl. Energy 2015, 158, 332–347. [Google Scholar] [CrossRef]

- Decarre, S.; Berthiaud, J.; Butin, N.; Guillaume-combecave, J. CO2 maritime transportation. Int. J. Greenh. Gas Control 2010, 4, 857–864. [Google Scholar] [CrossRef]

- Astrup, T.F.; Tonini, D.; Turconi, R.; Boldrin, A. Life cycle assessment of thermal Waste-to-Energy technologies: Review and recommendations. Waste Manag. 2015, 37, 104–115. [Google Scholar] [CrossRef]

- Roussanaly, S.; Berghout, N.; Fout, T.; Garcia, M.; Gardarsdottir, S.; Nazir, S.M.; Ramirez, A.; Rubin, E.S. Towards improved cost evaluation of Carbon Capture and Storage from industry. Int. J. Greenh. Gas Control 2021, 106, 103263. [Google Scholar] [CrossRef]

- Renova. Årsredovisning 2021 Renova Miljö AB. 2021, pp. 1–28. Available online: https://goteborg.se/wps/PA_Pabolagshandlingar/file?id=37526 (accessed on 15 January 2023).

- Jafri, Y.; Ahlström, J.M.; Furusjö, E.; Harvey, S.; Pettersson, K.; Svensson, E.; Wetterlund, E. Double Yields and Negative Emissions? Resource, Climate and Cost Efficiencies in Biofuels with Carbon Capture, Storage and Utilization. Front. Energy Res. 2022, 10, 797529. [Google Scholar] [CrossRef]

- Ahlström, J.; Jafri, Y.; Wetterlund, E.; Furusjö, E. Sustainable aviation fuels—Options for negative emissions and high carbon efficiency. Int. J. Greenh. Gas Control. 2022, 125, 1–26. [Google Scholar] [CrossRef]

- European Commission. Competitiveness of the European Cement and Lime Sectors. 2018, p. 312. Available online: https://www.wifo.ac.at/jart/prj3/wifo/resources/person_dokument/person_dokument.jart?publikationsid=61003&mime_type=application/pdf (accessed on 8 September 2020).

- Broberg, T.; Dijkgraaf, E.; Meens-Eriksson, S. Burn or let them bury? The net social cost of producing district heating from imported waste. Energy Econ. 2022, 105, 105713. [Google Scholar] [CrossRef]

- Market Data|Nord Pool. Available online: https://www.nordpoolgroup.com/en/Market-data1/Dayahead/Area-Prices/SE/Yearly/?view=table (accessed on 3 May 2023).

- Årsmedelspriser Motorbränslen—Svenska Petroleum och Biodrivmedel Institutet. Available online: http://207.154.197.103/statistik/priser/mer-prisstatistik/arsmedelspriser-motorbranslen/ (accessed on 12 April 2023).

- Jet Fuel—Monthly Price (Euro per Gallon)—Commodity Prices—Price Charts, Data, and News—IndexMundi. Available online: https://www.indexmundi.com/commodities/?commodity=jet-fuel&months=60¤cy=eur (accessed on 12 April 2023).

- ETSAP. Oil Refineries. IEA ETSAP—Technol. Br. 2014, 1–11. Available online: https://iea-etsap.org/E-TechDS/PDF/P04_OilRef_KV_Apr2014_GSOK.pdf (accessed on 5 March 2023).

- Building Materials and Components Statistics: June 2021—GOV.UK. Available online: https://www.gov.uk/government/statistics/building-materials-and-components-statistics-june-2021 (accessed on 22 June 2022).

- Statistics|Eurostat. Available online: https://ec.europa.eu/eurostat/databrowser/view/nrg_pc_205/default/table?lang=en (accessed on 14 June 2022).

- Skogsindustrierna. Så Går Det för Skogsindustrin. Skogsindustrierna, Nr 1, 2022-03-09. 2022. Available online: https://www.skogsindustrierna.se/siteassets/dokument/sa-gar-det-for-skogsindustrin/2022/sa_gar_det_for_skogsindustrin_090322.pdf (accessed on 26 May 2023).

- Allocation to the Aviation Sector. Available online: https://climate.ec.europa.eu/eu-action/eu-emissions-trading-system-eu-ets/free-allocation/allocation-aviation-sector_en (accessed on 26 May 2023).

- Bocken, N.M.P.; Short, S.W.; Rana, P.; Evans, S. A literature and practice review to develop sustainable business model archetypes. J. Clean. Prod. 2014, 65, 42–56. [Google Scholar] [CrossRef]

- Löfgren, Å.; Rootzén, J. Brick by brick: Governing industry decarbonization in the face of uncertainty and risk. Environ. Innov. Soc. Transit. 2021, 40, 189–202. [Google Scholar] [CrossRef]

- Clift, R.; Wright, L. Relationships Between Environmental Impacts and Added Value Along the Supply Chain. Technol. Forecast. Soc. Change 2000, 65, 281–295. [Google Scholar] [CrossRef]

- Neuhoff, K.; Ritz, R.A. Carbon Cost Pass-Through in Industrial Sectors; Cambridge Working Papers in Economics; Energy Policy Research Group, University of Cambridge: Cambridge, UK, 2019. [Google Scholar]

- Zetterberg, L.; Johnsson, F.; Möllersten, K. Incentivizing BECCS—A Swedish Case Study. Front. Clim. 2021, 3, 685227. [Google Scholar] [CrossRef]

- Rickels, W.; Proelß, A.; Geden, O.; Burhenne, J.; Fridahl, M. Integrating Carbon Dioxide Removal into European Emissions Trading. Front. Clim. 2021, 3, 690023. [Google Scholar] [CrossRef]

- 2050 Long-Term Strategy. Available online: https://ec.europa.eu/clima/eu-action/climate-strategies-targets/2050-long-term-strategy_en (accessed on 30 August 2022).

- Vogl, V.; Åhman, M.; Nilsson, L.J. Assessment of hydrogen direct reduction for fossil-free steelmaking. J. Clean. Prod. 2018, 203, 736–745. [Google Scholar] [CrossRef]

- Romson, Å.; Boberg, N.; Eriksson, F.A.; Herlaar, S.; Sanctuary, M. Svenska MiljöEmissionsData (SMED). Försäljningseffekter av Skatt på Plastpåsar; Sveriges Meteorologiska och Hydrologiska Institut: Norrköping, Sweden, 2022.

- SCB. Livsmedelsförsäljningstatistik 2019. Available online: https://www.scb.se/hitta-statistik/statistik-efter-amne/handel-med-varor-och-tjanster/inrikeshandel/livsmedelsforsaljning-fordelad-pa-varugrupper/pong/publikationer/livsmedelsforsaljningsstatistik-2019/ (accessed on 3 February 2023).

- World Bank. Commodity Price Data (The Pink Sheet). Available online: https://www.worldbank.org/en/research/commodity-markets (accessed on 9 October 2022).

- iRootzén, J.; Johnsson, F. CO2 emissions abatement in the Nordic carbon-intensive industry—An end-game in sight? Energy 2015, 80, 715–730. [Google Scholar] [CrossRef]

- Caspersson, J. Trafikverket. Underlagsrapport: Klimat Och Energi. Framtagen i Samband Med Regeringsuppdraget Angående Nya Stambanor för Höghastighetståg 2020/2021. Borlänge, Sweden. 2021. Available online: https://bransch.trafikverket.se/contentassets/60ecb96cb94a4cac994aae8bea032992/18-maj-2021/klimat-och-energi.pdf (accessed on 7 July 2022).

- Mendoza, J.M.F.; D’Aponte, F.; Gualtieri, D.; Azapagic, A. Disposable baby diapers: Life cycle costs, eco-efficiency and circular economy. J. Clean. Prod. 2019, 211, 455–467. [Google Scholar] [CrossRef]

- Eurostat. Municipal Waste Statistics. Available online: https://ec.europa.eu/eurostat/statistics-explained/index.php?title=Municipal_waste_statistics#cite_note-1 (accessed on 7 July 2022).

- Waste Prevention and Management—Environment—European Commission. Available online: https://ec.europa.eu/environment/green-growth/waste-prevention-and-management/index_en.htm (accessed on 14 April 2023).

- Vela, I.C.; Vilches, T.B.; Berndes, G.; Johnsson, F.; Thunman, H. Co-recycling of natural and synthetic carbon materials for a sustainable circular economy. J. Clean. Prod. 2022, 365, 132674. [Google Scholar] [CrossRef]

- Confederation of European Waste-to-Energy Plants (CEWEP). Waste-to-Energy Climate Roadmap—The Path to Carbon Negative. 2022. Available online: https://www.cewep.eu/wte-climate-roadmap/ (accessed on 3 February 2023).

- Genomsnittlig Bostadsarea per Person Efter Region, Hushållstyp Och Boendeform. År 2012—2021. PxWeb. Available online: https://www.statistikdatabasen.scb.se/pxweb/sv/ssd/START__HE__HE0111__HE0111A/HushallT23/ (accessed on 14 March 2023).

- Antal Hushåll Och Genomsnittligt Antal Personer per Hushåll efter Region, Boendeform Och Lägenhetstyp (Exklusive Småhus). År 2012—2021. PxWeb. Available online: https://www.statistikdatabasen.scb.se/pxweb/sv/ssd/START__HE__HE0111__HE0111A/HushallT30/ (accessed on 14 March 2023).

- Boendeutgift per Hushåll och antal Hushåll efter Region och Upplåtelseform. År 2020–2021. PxWeb. Available online: https://www.statistikdatabasen.scb.se/pxweb/sv/ssd/START__HE__HE0202/HE0202T02N/ (accessed on 14 March 2023).

- Naturvårdsverket. Kommunalt Avfall. 2020; pp. 7–8. Available online: https://www.naturvardsverket.se/vagledning-och-stod/avfall/kommunalt-avfall/ (accessed on 3 March 2023).

- Energistatistik för Flerbostadshus. Available online: https://www.energimyndigheten.se/statistik/den-officiella-statistiken/statistikprodukter/energistatistik-for-flerbostadshus/ (accessed on 14 March 2023).

- Persson, M.L.; Dahlin, H.; Sjöqvist, D.; Ulaner, M.; Wiederholm, J. Nils Holgerssons Underbara Resa Genom Sverige—En Avgiftsstudie för 2021; Mari-Louise Persson, Riksbyggen samt Ordförande i Nils Holgersson-Gruppen: Stockholm, Sweden, 2021. [Google Scholar]

- Energiföretagen. Miljövärdering av Fjärrvärme. 2022. Available online: https://www.energiforetagen.se/statistik/fjarrvarmestatistik/miljovardering-av-fjarrvarme/ (accessed on 1 March 2023).

- Civancik-uslu, D.; Puig, R.; Hauschild, M.; Fullana-i-palmer, P. Life cycle assessment of carrier bags and development of a littering indicator. Sci. Total Environ. 2019, 685, 621–630. [Google Scholar] [CrossRef] [PubMed]

- Kan, M.; Miller, S.A. Environmental impacts of plastic packaging of food products. Resour. Conserv. Recycl. 2022, 180, 106156. [Google Scholar] [CrossRef]

- Van Dyk, S.; Saddler, J. Progress in Commercialization of Biojet/Sustainable Aviation Fuels (SAF): Technologies, Potential and Challenges; IEA Bioenergy Technology Collaboration Programme: Paris, France, 2021. [Google Scholar]

- EU. Directive (EU) 2018/2001 of the European Parliament and of the Council of 11 December 2018 on the promotion of the use of energy from renewable sources. Off. J. Eur. Union 2018. Available online: https://eur-lex.europa.eu/legal-content/EN/TXT/PDF/?uri=CELEX:32018L2001 (accessed on 7 May 2023).

- Proposal for a Regulation of the European Parliament and of the Council on Ensuring a Level Playing Field for Sustainable Air Transport. Available online: https://eur-lex.europa.eu/legal-content/EN/TXT/HTML/?uri=CELEX:52021PC0561 (accessed on 15 March 2023).

- Excise Duty on Energy. Available online: https://taxation-customs.ec.europa.eu/taxation-1/excise-duties/excise-duty-energy_en (accessed on 15 March 2023).

- European Commission. Reducing CO2 Emissions from Heavy-Duty Vehicles. Available online: https://climate.ec.europa.eu/eu-action/transport-emissions/road-transport-reducing-co2-emissions-vehicles/reducing-co2-emissions-heavy-duty-vehicles_en (accessed on 10 May 2023).

- Van der Meulen, S.; Grijspaardt, T.; Mars, W.; van der Geest, W.; Roest-Crollius, A.; Kiel, J. Cost Figures for Freight Transport—Final Report; Netherlands Institute for Transport Policy Analysis (Kim): Zoetermeer, The Netherlands, 2020. [Google Scholar]

- Edwards, R.; Larivé, J.-F.; Beziat, J.-C. Well-to-Wheels Analysis of Future Automotive Fuels and Power Trains in the European Context; European Commission Joint Research Centre, Institute for Energy: Washington, DC, USA, 2011. [Google Scholar]

| Industry | Commodity | Functional Unit |

|---|---|---|

| Cement | Cement Concrete | t cement m3 concrete |

| Pulp | Pulp | ADt pulp |

| WtE | Heat Waste management | MWhheat t MSW |

| Refinery | Fuel | GJfuel |

| General Assumptions | Cement Plant | Kraft Pulp Mill | WtE Plant | Refinery |

|---|---|---|---|---|

| Installed capacity | 1.5 Mt cement | 0.8 MADt pulp | 0.55 Mt MSW d | 11.4 Mt crude oil |

| Average capacity utilisation rate (%) | 91.3 [29] | 95.9 [29] | 97.3 e | 86.9 [23] |

| Discount rate (%) | 8 | 8 | 8 | 8 |

| Economic life-time (years) | 25 | 25 | 25 | 25 |

| Reference plant and CCS configuration | [5] | [14] | [22,30] | [31,32] |

| Economic Parameters | ||||

| Delivery cost | 15 €/t of cement [5] | 15 €/t of ADt pulp | - | 4.1 €/GJ liquid fuel [31] |

| Average market price per reference unit | 64 €2020 per tonne of cement a [33] | 1099 €2021 per tonne of air-dried market pulp c | 49.3 € per tMSW f [34] 20.6 € per MWhel [35] 15 € per MWhheat g [22] | 19.8 €/GJdiesel i [36] 13.4 €/GJjet fuel [37] |

| OPEX | ||||

| Electricity price (€/MWh b) | 81.9 € b | 81.9 € b | 20.6 € h [35] | 81.9 € b |

| Natural gas price | - | - | ||

| MEA price (€/t) | 1620 | 1620 | 1620 | 1620 |

| Fixed OPEX | [4] | [14] | 6% of TCR | [23,38] |

| Industry | Cement | Pulp | WtE | Refinery | |

|---|---|---|---|---|---|

| CO2 capture cost excl. transportation and storage | 77 | 73 | 91 | 89 | €/tCO2 |

| Commodity | Case | EF | Biogenic Emissions | Negative Emissions | ||

|---|---|---|---|---|---|---|

| Cement | Cement | Ref CCS Ref CCS | 0.75 0.09 0.35 0.08 | 0.05 0.01 - - | - 0.05 - - | tCO2eq/t cement tCO2eq/t cement tCO2eq/m3 concrete tCO2eq/m3 concrete |

| Concrete | ||||||

| Pulp | Pulp | Ref CCS | 0.10 −2.0 | 2.72 0.61 | - 2.11 | tCO2eq/ADt pulp tCO2eq/ADt pulp |

| WtE | Heat | Ref CCS w. heat recovery CCS w/o heat recovery Ref CCS w. heat recovery CCS w/o heat recovery | 0.05 −0.12 −0.09 0.19 −0.28 −0.28 | 0.10 0.015 0.011 0.35 0.035 0.035 | - 0.13 0.10 - 0.32 0.32 | tCO2eq/MWhheat tCO2eq/MWhheat tCO2eq/MWhheat tCO2eq/t MSW tCO2eq/t MSW tCO2eq/t MSW |

| Waste management | ||||||

| Refinery | Products | Ref CCS Bio Bio-CCS | 12.2 9.2 10 7.8 | - - 0.87 0.10 | - - - 0.77 | kgCO2eq/GJproduct kgCO2eq/GJproduct kgCO2eq/GJproduct kgCO2eq/GJproduct |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Hörbe Emanuelsson, A.; Johnsson, F. The Cost to Consumers of Carbon Capture and Storage—A Product Value Chain Analysis. Energies 2023, 16, 7113. https://doi.org/10.3390/en16207113

Hörbe Emanuelsson A, Johnsson F. The Cost to Consumers of Carbon Capture and Storage—A Product Value Chain Analysis. Energies. 2023; 16(20):7113. https://doi.org/10.3390/en16207113

Chicago/Turabian StyleHörbe Emanuelsson, Anna, and Filip Johnsson. 2023. "The Cost to Consumers of Carbon Capture and Storage—A Product Value Chain Analysis" Energies 16, no. 20: 7113. https://doi.org/10.3390/en16207113

APA StyleHörbe Emanuelsson, A., & Johnsson, F. (2023). The Cost to Consumers of Carbon Capture and Storage—A Product Value Chain Analysis. Energies, 16(20), 7113. https://doi.org/10.3390/en16207113