Abstract

The increasing penetration of Distributed Energy Resources (DERs) in Distribution Systems (DSs) has motivated studies on Virtual Power Plants (VPPs). However, few studies have jointly assessed the sizing and economic attractiveness of VPPs from the entrepreneur’s perspective and the potential benefits and impacts on power systems while maintaining the scope to DSs. This study proposes a methodology for sizing VPPs and simulating their economic optimal dispatch and economic attractiveness with a focus on the entrepreneur’s viewpoint. In addition, it also evaluates VPPs’ potential benefits and impacts on a DS or Transmission System (TS) while considering the interface between the Distribution System Operator (DSO) and the Transmission System Operator (TSO). The methodology employs optimization to minimize the Net Present Cost (NPC) of the project, in relation to sizing the DERs, and to obtain the economic optimal dispatch of the BESSs that comprise the VPP. Moreover, a power flow analysis and probabilistic reliability assessment are used to evaluate the benefits and impacts on the power system. The methodology was applied to a case study involving Photovoltaic (PV) systems and Battery Energy Storage Systems (BESSs) used by aggregated medium voltage consumers, which configure Technical Virtual Power Plants (TVPPs) participating in Demand Response (DR) via incentives, with a network model of the Brazilian National Interconnected System (SIN) adapted from the 2030 Ten-Year Energy Expansion Plan (PDE) of the Energy Research Office (EPE), along with data from the Geographic Database of the Distribution Utility (BDGD). The results indicate the economic attractiveness of DERs according to the premises adopted and indicate improvements in TS reliability indexes with the possibility of TVPPs’ dispatch after transmission contingencies.

1. Introduction

1.1. Background

A Virtual Power Plant (VPP) can be defined as an aggregation of Distributed Energy Resources (DERs) capable of participating in electricity markets and providing services to the electrical system [1,2].

The economic dispatch imbued in the VPP concept implies having at least one type of dispatchable resource among the DERs.

Unlike microgrids, VPPs are not necessarily limited to a particular geographic area in which a set of DERs is located, but can combine resources from different areas, connected to different distribution substations and located in different municipalities [1,2].

DERs, when aggregated by VPPs, gain visibility into wholesale electricity markets, such as energy, capacity, and ancillary services, and can constitute resources for the planning and operation of Distribution Systems (DSs) and Transmission Systems (TSs) [1].

VPPs rely significantly on smart metering and information technology for their operations [1]. Information communication technologies can drive modern Demand-side-Management (DSM), including the VPP scheme managing and controlling DERs to maximize benefits to the Distribution System Operator (DSO) and the consumers [3].

In price-based Demand Response (DR), signaling to the consumer can be done, for example, through energy consumption or demand tariffs with value distinctions throughout the day, on different types of day (such as working days, Saturday, and Sunday), and throughout the year (such as the summer and winter seasons). Incentive-based DR refers to the possibility of receiving revenue by the consumer as a result of responding to demand control mechanisms by the DSO or Transmission System Operator (TSO) [4].

The focus of this work is a Technical Virtual Power Plant (TVPP), i.e., a type of aggregation in which there is a characterization of benefits for the electrical grid as a product, given the geographical arrangement of DERs, which results in local influences [5] that allow the TVPPs to constitute a planning and operational resource for the electrical system, and, thus, participate in electricity markets.

Possible services that a TVPPs can offer include (i) reducing demand, providing operational flexibility, and allowing postponing or avoiding investments in network expansions and reinforcements; (ii) network congestion management; (iii) ancillary services; and (iv) balancing the energy portfolio for Balancing Responsible Parties (BRPs).

1.2. Literature Review

Ref. [6] found that few works in the literature have sought to address the problem of the operational capacity of aggregated DERs aiming to participate in distributed energy marketplaces considering network constraints in the context of interactions between the TSO and DSO. The authors proposed a methodology for modeling and characterizing DERs flexibility that includes the Battery Energy Storage Systems (BESSs), identifying capacity, ramp, duration, and cost as key metrics, and incorporates an analysis using Optimal Power Flow (OPF) with a representation of active and reactive power, as applied to a conceptual test system. The authors present a potential use case in a distribution marketplace environment where aggregators exchange information with the DSO to plan their market participation.

Ref. [5] discussed the volatility and limited predictability of loads and the generation of DERs, which would make the capacity of the TVPP uncertain, and proposed the Robust Capability Curve (RCC) method to determine the curve capacity of the TVPP. This was associated with OPF based on a linearized network model and applied to a case study using the IEEE 13-bus model.

Ref. [7] indicated that, although VPPs can be a flexible source for the power system, their inclusion in planning has rarely been considered in academic works. They also stated the importance of establishing flexibility indexes for the system.

The results of the work in [8] highlighted the strong interaction between voltage support and reactive power in the local network and market participation at a systemic level to increase the versatility of the VPP in order to maximize its revenue. This is particularly relevant in the context of the operation of DSs and emerging markets for DERs, which are subject to local network restrictions. The interaction of DERs with the local network is of great interest to a VPP, as it constitutes a possible additional revenue stream, and a VPPs’s ability to participate in multiple markets is considered.

Ref. [9] presented a generic optimization method to evaluate the suitability of power system generation, incorporating an aggregated probabilistic model representing several Active Distribution Networks (ADNs) in the form of a VPP and using a linearized network model. The authors evaluated reliability indexes such as Loss of Load Expectation (LOLE) and Loss of Load Frequency (LOLF) and proposed indexes to quantify different performance aspects of the VPP. The method was implemented on a DS test system with four buses and on the IEEE 69-bus model, using sequential Monte Carlo simulation techniques.

According to Ref. [10], a key concept and requirement for the operational and effective implementation of a large number of DERs, which includes power sources and DR to enable flexibility and services to the grid, is the aggregation of DERs. This aggregation function and the functions necessary to enable network services are provided by Distributed Energy Resource Management Systems (DERMSs). The mentioned report provides a guide for developing a functional specification for DERMSs and a description of the network services that aggregated DERs can provide to DSs and TSs, or at market levels. It also deals with implementation issues, interoperability requirements, and communication and information infrastructure. The approach is extended to VPP control systems.

According to [11], retailers can bring together dispersed consumers and generators, acting as a link between them and the wholesale market. The authors analyzed the economic foundations of aggregators, evaluating the factors that determine aggregators’ roles in electrical systems in different technological and regulatory scenarios. Considering the regulatory and technological contexts, the authors identified three main value categories created by aggregators: fundamental aggregation, transient aggregation, and opportunistic aggregation.

Fundamental aggregation has systemic value, which is inherent to the aggregator’s function, regardless of regulatory and technological particularities and the consumers’ level of knowledge, and it tends to be permanent. Transient aggregation contributes to improving the performance of the electrical system. However, it tends to decline with technological, regulatory, or system management improvements. In turn, opportunistic aggregation has individual value for the aggregating agent and results from regulatory or market design failures. If strong economies of scale and scope are present, a centralized aggregator, such as the system operator, could be the most efficient industry structure [11].

In Brazil, the social participation process TS n° 011/2021 of the National Electric Energy Agency (ANEEL) [12] aimed to obtain subsidies for the elaboration of regulatory model proposals for the insertion of DERs, including DR, VPPs, and microgrids, based on the investigation of regulatory models that could be applied in the Brazilian electrical sector. Such models should be based on best international practices and consider the potential impacts on the electricity sector [2,12].

The Energy Research Office (EPE) in Brazil has conducted studies on the economic attractiveness of Behind-the-Meter (BTM) batteries for the Ten-Year Energy Expansion Plan (PDE) 2032 [13]. However, only captive consumers not participating in the free contracting environment (ACL) have been considered, and a scheme with both Photovoltaic (PV) systems and BESS BTM for MV consumers, as proposed in this work, has not been evaluated.

1.3. Research Gap and Motivation

To the best of the authors’ knowledge, the methodologies proposed in the literature related to power systems do not include a joint assessment of the economic attractiveness of investment in DERs, sizing, and the optimal economic dispatch of TVPPs, and an assessment of the technical impacts on a DS and TS, as proposed in this work. The specific contributions of this paper are outlined in more detail in Section 1.4.

Previous works [14,15,16] inspired the present study, which proposes a methodology for TVPPs sizing and simulating their optimal economic dispatch and economic attractiveness, with a focus on the entrepreneur’s point of view. In addition, we propose a system to evaluate the potential benefits and impacts of a TVPP on a DS, TS, or both, considering the interface between the DSO and TSO. The system also considers possible synergies that allow the DSO to capture benefits for the power system in its relationship with the TVPPs, which can be offered to the TSO in the form of network services, for example, through DR via incentives for the consumers participating in TVPP.

1.4. Contribution

The contributions of this work are as follows:

- We propose a methodology for TVPP sizing and simulating their optimal economic dispatch and economic attractiveness, with a focus on the entrepreneur’s point of view, in addition to evaluating potential benefits and impacts of the TVPP on the DS or TS;

- The methodology can help entrepreneurs to establish sustainable business cases as aggregators, involving the deployment or operation of aggregated DERs in the form of a TVPP, which exchanges information with the DSO or TSO and can receive directions from the operator in order to participate in electricity markets;

- In case of the deployment of DERs by the consumers themselves, the methodology can help a centralized aggregator such as the DSO to evaluate potential benefits and impacts of coordinating the aggregated DERs on the DS or TS;

- Our proposal for DERs sizing and simulating the optimal economic dispatch of TVPPs complements other works, which focused on the functional specification of DERMSs, including requirements for interoperability and the communication infrastructure;

- The proposed methodology allows for quantifying potential synergies between DERs, the DSO, and TSO, allowing for the evaluation of the VPP business model as an opportunity for aggregation with systemic value.

The proposed methodology was applied to a case study based on computational simulations, with DERs composed of PV systems and BESSs installed in Medium Voltage (MV) consumers aggregated as a TVPP participating in DR via incentives, with a Brazilian National Interconnected System (SIN) network model adapted from the PDE 2030 from the EPE and the use of data from the Geographic Database of the Distribution Utility (BDGD).

The case study was carried out with TVPPs located in a real location, considering local data from the solar source, tariffs, and load curves. The probabilistic reliability assessment of the TS allowed for the comparison of TVPP alternatives through reliability indexes, which could be calculated in a systemic or stratified manner.

The results indicate the economic attractiveness of DERs according to the premises adopted and demonstrated improvements in TS reliability indexes with the possibility of TVPPs dispatch after transmission contingencies.

1.5. Paper Organization

2. Materials and Methods

2.1. Methodology

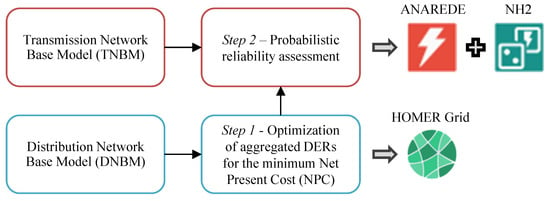

Figure 1 illustrates the methodological steps and the simulation tools.

Figure 1.

Methodological steps and simulation tools.

HOMER Grid is an economic optimization and sizing simulation tool for DERs installed BTM which was developed by HOMER Energy (by UL) [17]. The present work proposes a new use of the HOMER Grid tool to simulate aggregated DERs as a TVPP.

Network Analysis Program (ANAREDE) [18] is a power flow simulation tool developed by the Electric Power Research Center (CEPEL). It was used in this work to prepare a converged Bulk-Power System (BPS) power flow case, which is imported as a reliability base case into the Composite Reliability Analysis and Operational Reserve Calculation Program (NH2) [19,20] simulation tool, also developed by the CEPEL, to carry out reliability simulations.

As a premise, the proposed methodology considers that the DS (Distribution Network Base Model (DNBM)) is modeled as a load with a radial configuration connection to the TS (Transmission Network Base Model (TNBM)).

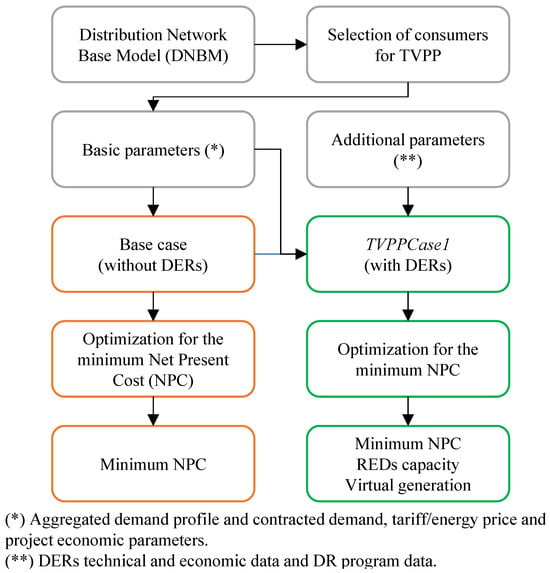

Figure 2 details Step 1 of the methodology.

Figure 2.

Step 1 of the methodology.

Step 1 of the methodology considers consumer data obtained from the DNBM and consists of the following:

- Sizing the DERs aggregated capacity () and optimizing the project Net Present Cost (NPC) to the minimum NPC ();

- Obtaining the dispatchable DR potential of the TVPPs (virtual generation).

The NPC of a project or system is the present value of all the investment, installation, and operational costs minus the present value of all the revenues over the project’s lifetime [21]. The DERs, which a TVPP comprises, are simulated in HOMER Grid in an aggregated form.

The HOMER Grid [21] optimization and sensitivity analysis algorithms facilitates the evaluation of possible DERs configurations in the face of (i) a high number of technological options; (ii) complexity of tariff structures; (iii) variations in costs; and (iv) the availability of energy resources.

The HOMER Optimizer is the proprietary derivative-free optimization algorithm used in the HOMER Grid, which seeks the minimum cost system [21]. Examples of decision variables in the optimization process are [21] (i) PV system capacity; (ii) number of batteries; (iii) converter size; (iv) BESS dispatch strategy; and (v) maximum demand from the grid.

In this work, we propose the sizing of the aggregate capacity of DERs through optimization for the minimum NPC of the project, based on input data and problem constraints, taking into account the DERs capacities and the dispatch curve of the dispatchable DER(s) as decision variables.

In Step 1, the optimization for considers the basic and complementary parameters indicated in Figure 2, with and the dispatch curve of the dispatchable DERs as decicion variables.

A base case (BaseCase) without DERs and a case with DERs were simulated, obtaining a virtual generation potential of the TVPPs.

In this work, for simplicity, we disregarded the possible increase in virtual generation due to the reduction in technical losses in the DS during DR events downstream of the TVPPs aggregation buses in the TNBM.

Optionally, to evaluate the technical impacts of the TVPP on the DS voltages and technical losses, power flow simulations may be conducted with the simulation tool Open Distribution System Simulator (OpenDSS) considering TVPP penetration [16].

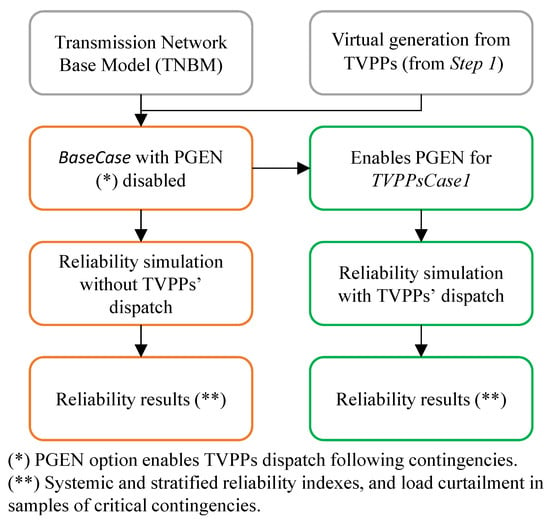

Figure 3 details Step 2 of the methodology.

Figure 3.

Step 2 of the methodology.

Step 2 of the methodology consists of the probabilistic reliability assessment [20] of the TS considering the possibility of dispatching active power from the TVPPs (virtual generations) as corrective measures following transmission contingencies by the OPF of the NH2 reliability model [19,20].

The ANAREDE power flow simulation tool is used to prepare a converged BPS power flow case from a given database, which is imported as a reliability base case into the NH2 reliability simulation tool.

The probabilistic reliability assessment with the NH2 simulation tool, based on the state enumeration method, makes use of the power flow to assess the adequacy of the system’s contingency states at a given load scenario and the OPF for the application of corrective measures [19].

The active power dispatch of the TVPPs was considered among the corrective measures following transmission contingencies. In the base case (BaseCase), the dispatch of the TVPPs was not enabled (the active power redispatch (PGEN) function of the NH2’s OPF was disabled). In the case of TVPPsCase1, the dispatch of the TVPPs was enabled (the PGEN function of the NH2’s OPF was enabled). The reliability results of both cases were compared.

2.2. Case Study

The case study in Brazil considered three fictitious TVPPs, each located in a municipality in the region of a distribution utility in the state of São Paulo (SP).

The TVPPs were as follows:

- , located in the municipality of Mogi das Cruzes;

- , located in the municipality of São José dos Campos;

- , located in the municipality of Taubaté.

Each TVPP was composed of randomly selected MV consumers, with a level of participation adopted so that the sum of the maximum demands of consumers aggregated by the TVPP () corresponded to 30% of the sum of maximum demands of the MV consumers in each municipality.

This 30% level of TVPP penetration was estimated based on prospective test simulations using the IEEE 8500-node test feeder [22] and the OpenDSS simulation tool, which did not result in reverse flows in the distribution substation nor increased technical losses in the DS, as presented in [15].

Table 1 presents information about the TVPPs considered in the case study.

Table 1.

Information about the TVPPs considered in the case study. Based on [23,24].

The typical load curve of an MV consumer was obtained from the aggregated MV load curve of the distribution utility’s 2019 periodic tariff revision, with monthly seasonality according to maximum monthly demand data obtained from the BDGD [23].

It was assumed that the consumers drawn for the TVPPs could enter the ACL to establish a Power Purchase Agreement (PPA). A flat energy consumption cost from the grid was considered equal to the average difference settlement price (PLD) for the period from January 2014 to April 2019, which was equal to R$ 326.25/MWh [25] with additional tax rates as estimated for the distribution system use tariff (TUSD) [15].

Additionally, the consumers drawn for the TVPPs were subjected to the Brazilian TUSD green tariff and the self-production of energy (APE) modality for the reference year 2021 [26].

The taxes to be added to the TUSD were estimated as follows: ICMS 18%, PIS 0.87%, and COFINS 3.96%. The contracted demand was considered equal to the maximum demand, 2021 national holidays were used, and the green tariff flag was adopted.

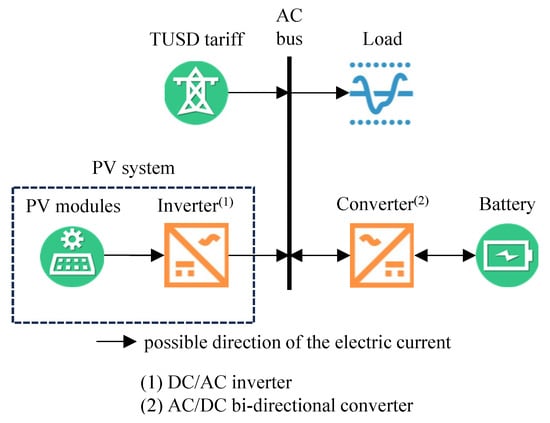

Figure 4 shows the DERs diagram per consumer participating in the TVPP.

Figure 4.

DER diagram per consumer participating in the TVPP.

The PV system comprised PV modules and the DC/AC inverter. The DC/AC inverter was implicitly modeled in the HOMER Grid [21].

The battery was connected to the AC bus through an AC/DC bi-directional converter for both rectification and inversion [27]. Battery charging was carried out via the PV system or the grid.

Table 2 presents typical PV system costs for capacity samples.

Table 2.

Typical PV system costs for capacity samples. Based on [14,28].

The HOMER Grid simulation tool constructs a piecewise linear curve of CAPEX or the replacement cost from sample data of cost(s) per capacity of PV systems. The replacement cost is considered equal to CAPEX [21].

Table 3 presents typical BESSs costs.

Table 3.

Typical BESS costs, based on [14,29,30,31].

For batteries, the capital or replacement cost curve was constructed by the HOMER Grid simulation tool from cost sample(s) for quantity(s) of a given type of battery with a specified energy storage capacity to make up a specific total energy storage capacity. The converter for a BESS can be modeled as a specific component, and its cost curve was constructed in an analogous way to that of PV systems [21].

The replacement cost of the batteries and converter were considered equal to the respective CAPEX.

The simulations in Step 1 were conducted with annual time series of the load curve, solar irradiance, and ambient temperature with a time step adapted to 15 min. Solar irradiance and ambient temperature data were obtained from the National Aeronautics and Space Administration (NASA) Prediction of Worldwide Energy Resource (POWER) database for coordinates −23.25, −45.75, in decimal degrees. The project’s real discount rate was equal to 5.77% per year, and its useful life was 20 years [15].

The demand reduction incentive adopted was equal to R$ 1.96/kW, which was calculated based on the reference unit variable cost (CVU) of R$ 511.15/MWh in [25], adding the same tax rates adopted for the TUSD tariff, over a project lifetime of 20 years. The demand reduction bid corresponded to 75% of the MV consumers (aggregated) maximum demand.

A duration of 3 h per DR event was considered, with 48 events per year on random working days, starting between 10:01 and 18:00, and an hourly interval corresponding to the heavy load of the SIN in the period from November to March [15,32].

The demand reduction bid, obtained through the BESSs dispatch, the number of DR events per year, and the duration of the events were obtained using a heuristic method and test simulations in which it was verified that participation in DR resulted in a lower than the without participation in DR for the adopted incentive value.

The TNBM was prepared with the ANAREDE simulation tool based on the power flow database of the PDE 2030 of the EPE, for the year 2030, peak load level, and humid North Brazilian region as the generation scenario [24]. Single and double transmission contingencies were considered for the reliability assessment with the NH2 simulation tool, with typical data on failure rates and average repair times for lines and transformers obtained from reliability database (BDConf) (1999–2003) [33].

3. Results

3.1. Step 1

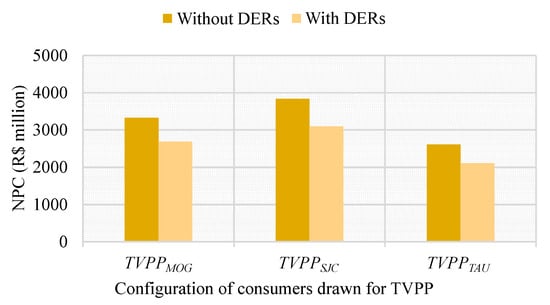

Figure 5 shows the of the TVPPs.

Figure 5.

Minimum NPC.

For the TVPP configurations evaluated, the with PV systems and BESSs was lower than without these DERs, demonstrating that the option of investing in DERs is economically advantageous. The reduction in with DERs compared with the without DERs was 19.2%, 19.3%, and 19.2%, respectively, for MV consumers selected for , , and . It is noteworthy that the configuration with PV systems and BESSs resulted in a lower for all TVPPs when compared to a configuration with only PV systems.

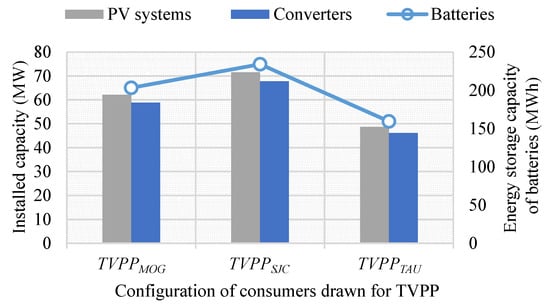

Figure 6 shows the aggregated capacity of DERs of the TVPPs.

Figure 6.

Aggregated capacity of DERs of the TVPPs.

Table 4 presents the virtual generation potential of the TVPPs.

Table 4.

Virtual generation potential of the TVPPs.

3.2. Step 2

Table 5 presents the systemic reliability indexes.

Table 5.

Systemic reliability indexes.

There was no variation in the Loss of Load Probability (LOLP), LOLE, LOLF, and Loss of Load Duration (LOLD) in TVPPsCase1 compared with BaseCase.

There was a 18.05% reduction in the Expected Power Not Supplied (EPNS), Expected Energy Not Supplied (EENS), and severity index (SI) in TVPPsCase1 compared with BaseCase.

Regarding the stratification of reliability indexes due to failure modes, there was a 38.47% reduction in the EENS of the overload failure mode, which varied from 3.10989 × 10 MWh/year in BaseCase to 1.91338 × 10 MWh/year in TVPPsCase1.

Table 6 presents the EENS by base voltage.

Table 6.

EENS by base voltage.

Table 7 presents the SI by base voltage.

Table 7.

SI by base voltage.

Regarding the stratification of reliability indexes by the base voltage, there was a reduction in the EENS and SI for the base voltages of 138 kV and 88 kV for TVPPsCase1 compared with BaseCase.

Table 8 presents the load curtailment for the contingency samples with the five most significant load curtailment reductions in TVPPsCase1 compared with BaseCase, which corresponds to double transmission contingencies.

Table 8.

Load curtailment for the contingency samples with the five most significant load curtailment reductions.

The most significant load curtailment reduction in TVPPsCase1 compared with BaseCase was 66.0 MW. The total redispatched power of the TVPPs ranged from 54.3% to 71.8% of the total virtual generation potential for the five contingencies presented in Table 8.

4. Conclusions

This work presents a methodology applied to a case study using the Brazilian SIN. It makes use of optimization for for sizing DERs for sets of MV consumers that make up TVPPs participating in DR via incentives. In addition, it obtains the potential for the virtual generation of the TVPPs and uses a probabilistic reliability assessment to verify the potential benefits of these TVPPs as dispatchable resources following transmission contingencies for the reliability of the TS.

The benefits of the proposed work include (i) helping entrepreneurs to establish sustainable business cases as aggregators or helping the DSO as a centralized aggregator coordinating DERs developed by the consumers themselves to evaluate potential benefits and impacts on the DS or TS; (ii) our proposal for sizing DERs and simulating the optimal economic dispatch of TVPPs complements other works focused on the functional specification of DERMSs, including requirements for interoperability and the communication infrastructure; and (iii) the proposed methodology allows for quantifying potential synergies between DERs, the DSO, and TSO, allowing for the evaluation of the VPP business model as an opportunity for aggregation with systemic value.

A limitation of this work is the adoption of a typical peak load and generation scenario for the transmission system modeling (TNBM) due to the database and the reliability simulation tool considered in the case study. Future work should consider the stochastic analysis of demand and renewable-based generation scenarios for a more robust reliability analysis of the transmission system.

The configuration of DERs with PV systems and BESSs resulted in a lower than the configurations with only PV systems or without DERs, demonstrating the economic attractiveness of TVPPs. The amount of reduction in dispatchable aggregated demand obtained with the TVPPs resulted in improvements in the reliability of the TS, which was verified through the reduction in the EPNS, EENS, and SI, and a reduction in the amount of load shedding in the most critical contingencies compared with a base case (BaseCase) without a TVPPs.

Studies conducted by the EPE in Brazil on the economic attractiveness of a BESS BTM for the PDE 2032 (horizon planning up to year 2032) [13] demonstrated the partial economic attractiveness of this application, but only with a significant reduction in BESS costs. However, only captive consumers not participating in the ACL were considered, and a scheme with both PV systems and BESS BTM for MV consumers, as proposed in this work, has not been evaluated. The results of the case study in this work indicated the economic attractiveness of PV systems and the BESS scheme for MV consumers with current BESS costs, illustrating how synergies between PV systems and a BESS can be captured with a comprehensive methodology using optimization tools.

In this way, it is possible to characterize and quantify potential flexibility and the provision of ancillary services based on the aggregation of DERs in distribution systems such as TVPPs, thus streamlining the interaction between entrepreneurs, the DSOs, TSOs, and other stakeholders in terms of flexible transmission system planning.

Author Contributions

Conceptualization, M.S.V., D.S.R., G.M.J. and M.E.M.U.; methodology, M.S.V. and D.S.R.; software, M.S.V.; validation, M.S.V. and D.S.R.; formal analysis, M.S.V. and D.S.R.; writing—original draft preparation, M.S.V.; writing—review and editing, D.S.R., G.M.J. and M.E.M.U.; supervision, M.S.V. and D.S.R. All authors have read and agreed to the published version of the manuscript.

Funding

This study was developed within the scope and with the sponsorship of the Research and Technological Development Program of the Electric Energy Sector regulated by the National Electric Energy Agency (ANEEL) as part of the R&D project (code Aneel PD 0068-48/2020), named Integrated and Flexible Planning of Transmission Systems. This study was financed in part by the Coordenação de Aperfeiçoamento de Pessoal de Nível Superior—Brasil (CAPES)—Finance Code 001.

Institutional Review Board Statement

Not applicable.

Data Availability Statement

Data are contained within the article.

Conflicts of Interest

The authors declare no conflict of interest. The funders had no role in the design of the study; in the collection, analyses, or interpretation of data; in the writing of the manuscript; or in the decision to publish the results.

Abbreviations

The following abbreviations are used in this manuscript:

| ACL | Free contracting environment |

| ADN | Active Distribution Network |

| ANAREDE | Network Analysis Program |

| ANEEL | National Electric Energy Agency |

| APE | Self-production of energy |

| BDGD | Geographic Database of the Distribution Utility |

| BDConf | Reliability database |

| BESS | Battery Energy Storage System |

| BPS | Bulk-Power System |

| BRP | Balancing Responsible Party |

| BTM | Behind-the-Meter |

| CEPEL | Electric Power Research Center |

| CVPP | Commercial Virtual Power Plant |

| CVU | Unit variable cost |

| DER | Distributed Energy Resource |

| DERMS | Distributed Energy Resource Management System |

| DG | Distributed Generation |

| DNBM | Distribution Network Base Model |

| DR | Demand Response |

| DS | Distribution System |

| DSM | Demand-side Management |

| DSO | Distribution System Operator |

| EENS | Expected Energy Not Supplied |

| EPE | Energy Research Office |

| EPNS | Expected Power Not Supplied |

| ESS | Energy Storage System |

| FRVPP | Flexi-Renewable Virtual Power Plant |

| LOLD | Loss of Load Duration |

| LOLE | Loss of Load Expectation |

| LOLF | Loss of Load Frequency |

| LOLP | Loss of Load Probability |

| NASA | National Aeronautics and Space Administration |

| NH2 | Composite Reliability Analysis and Operational Reserve Calculation Program |

| NPC | Net Present Cost |

| OpenDSS | Open Distribution System Simulator |

| OPF | Optimal Power Flow |

| PDE | Ten-year energy expansion plan |

| PGEN | Active power re-dispatch |

| PLD | Difference settlement price |

| POWER | Prediction of Worldwide Energy Resource |

| PPA | Power Purchase Agreement |

| PV | Photovoltaic |

| PVDG | Photovoltaic Distributed Generation |

| RCC | Robust Capability Curve |

| SP | São Paulo |

| SI | Severity index |

| SIN | National Interconnected System |

| TNBM | Transmission Network Base Model |

| TS | Transmission System |

| TSO | Transmission System Operator |

| TVPP | Technical Virtual Power Plant |

| TUSD | Distribution system use tariff |

| T&D | Transmission an Distribution |

| Fictitious TVPP located in the municipality of Mogi das Cruzes | |

| Fictitious TVPP located in the municipality of São José dos Campos | |

| Fictitious TVPP located in the municipality of Taubaté | |

| VPP | Virtual Power Plant |

References

- Nosratabadi, S.M.; Hooshmand, R.A.; Gholipour, E. A comprehensive review on microgrid and virtual power plant concepts employed for distributed energy resources scheduling in power systems. Renew. Sustain. Energy Rev. 2017, 67, 341–363. [Google Scholar] [CrossRef]

- National Electric Energy Agency (ANEEL). Technical Note n° 0076/2021-SRD/ANEEL; National Electric Energy Agency (ANEEL): Brasilia, Brazil, 2021. (In Portuguese) [Google Scholar]

- Said, D. A Survey on Information Communication Technologies in Modern Demand-Side Management for Smart Grids: Challenges, Solutions, and Opportunities. IEEE Eng. Manag. Rev. 2023, 51, 76–107. [Google Scholar] [CrossRef]

- Viana, M.S.; Manassero, G.; Udaeta, M.E. Analysis of demand response and photovoltaic distributed generation as resources for power utility planning. Appl. Energy 2018, 217, 456–466. [Google Scholar] [CrossRef]

- Tan, Z.; Zhong, H.; Xia, Q.; Kang, C.; Wang, X.S.; Tang, H. Estimating the Robust P-Q Capability of a Technical Virtual Power Plant Under Uncertainties. IEEE Trans. Power Syst. 2020, 35, 4285–4296. [Google Scholar] [CrossRef]

- Riaz, S.; Mancarella, P. Modelling and Characterisation of Flexibility from Distributed Energy Resources. IEEE Trans. Power Syst. 2022, 37, 38–50. [Google Scholar] [CrossRef]

- Seyyedi, A.Z.G.; Nejati, S.A.; Parsibenehkohal, R.; Hayerikhiyavi, M.; Khalafian, F.; Siano, P. Bi-level sitting and sizing of flexi-renewable virtual power plants in the active distribution networks. Int. J. Electr. Power Energy Syst. 2022, 137, 107800. [Google Scholar] [CrossRef]

- Naughton, J.; Wang, H.; Riaz, S.; Cantoni, M.; Mancarella, P. Optimization of multi-energy virtual power plants for providing multiple market and local network services. Electr. Power Syst. Res. 2020, 189, 106775. [Google Scholar] [CrossRef]

- Bagchi, A.; Goel, L.; Wang, P. Generation Adequacy Evaluation Incorporating an Aggregated Probabilistic Model of Active Distribution Network Components and Features. IEEE Trans. Smart Grid 2018, 9, 2667–2680. [Google Scholar] [CrossRef]

- IEEE Std 2030.11-2021; IEEE Guide for Distributed Energy Resources Management Systems (DERMS) Functional Specification. IEEE: New York, NY, USA, 2021.

- Burger, S.; Chaves-Ávila, J.P.; Batlle, C.; Pérez-Arriaga, I.J. A review of the value of aggregators in electricity systems. Renew. Sustain. Energy Rev. 2017, 77, 395–405. [Google Scholar] [CrossRef]

- National Electric Energy Agency (ANEEL). Social Participation Process TS 011/2021; National Electric Energy Agency (ANEEL): Brasilia, Brazil, 2021. (In Portuguese) [Google Scholar]

- Energy Research Office (EPE). Studies of the 2032 Ten-Year Energy Expansion Plan: Micro and Mini Distributed Generation & Batteries Studies of the 2032 Ten-Year Energy Expansion Plan; Energy Research Office (EPE): Rio de Janeiro, Brazil, 2022. [Google Scholar]

- Viana, M.S.; Ramos, D.S.; Rodrigues, F.M.; Ribeiro, R.G. Distributed energy resources and the planning of flexible transmission systems: A study on virtual power plants in the National Interconnected System (SIN). In Proceedings of the XIII Brazilian Energy Planning Congress (CBPE), Itajubá, Brazil, 24–26 August 2022. (In Portuguese). [Google Scholar]

- Viana, M.S.; Ramos, D.S. R&D Project Integrated and Flexible Planning of Transmission Systems. Computational Simulations Involving Power Flow and Reliability Studies to Characterize and Quantify Flexibility Potential and Provision of Ancillary Services from Distribution Systems, for DSO/TSO Interaction and Aggregator’s Potential. Technical Report. 2022. (In Portuguese) [Google Scholar]

- Viana, M.S.; Manassero, G.; Ramos, D.S. Analysis of the economic attractiveness and technical impacts of a VPP (Virtual Power Plant) with storage devices activated via price signals. In Energy Storage. Systematic Approaches Related to Power Electrical Systems, 1st ed.; Paco Editorial: Jundiaí, Brazil, 2020; Chapter 13. (In Portuguese) [Google Scholar]

- Homer Energy. Homer Grid. Versão 1.8.7. 2021. Available online: https://www.homerenergy.com/ (accessed on 12 July 2021).

- Electric Power Research Center (CEPEL). Network Analysis Program (ANAREDE). Version 11.05.05. User Manual; Electric Power Research Center (CEPEL): Rio de Janeiro, Brazil, 2021. (In Portuguese) [Google Scholar]

- Electric Power Research Center (CEPEL). Composite Reliability Analysis and Operational Reserve Calculation Program (NH2). Version 12.2.0. User Manual; Electric Power Research Center (CEPEL): Rio de Janeiro, Brazil, 2021. (In Portuguese) [Google Scholar]

- IEEE Power & Energy Society. Composite Power System Reliability; Technical Report PES-TR99; IEEE: New York, NY, USA, 2022. [Google Scholar]

- Homer Energy. Homer Grid Online User Manual. HOMER Grid 1.8; Homer Energy: Boulder, CO, USA, 2021. [Google Scholar]

- Arritt, R.F.; Dugan, R.C. The IEEE 8500-node test feeder. In Proceedings of the 2010 IEEE PES Transmission and Distribution Conference and Exposition: Smart Solutions for a Changing World, New Orleans, LA, USA, 19–22 April 2010; pp. 1–6. [Google Scholar] [CrossRef]

- National Electric Energy Agency (ANEEL). Distribution Utility Geographic Database (BDGD)—2018; National Electric Energy Agency (ANEEL): Brasilia, Brazil, 2018. [Google Scholar]

- Energy Research Office (EPE). Database for National Interconnected System (SIN) Electrical Simulations. Power Flow Database. Ref. 18/01/2021; Energy Research Office (EPE): Brasilia, Brazil, 2021. (In Portuguese) [Google Scholar]

- National Electric Energy Agency (ANEEL). Techical Note n° 054/2019-SRG/ANEEL; National Electric Energy Agency (ANEEL): Brasilia, Brazil, 2021. (In Portuguese) [Google Scholar]

- National Electric Energy Agency (ANEEL). Homologatory Resolution n° 2,964, of 21 October 2021; National Electric Energy Agency (ANEEL): Brasilia, Brazil, 2021. (In Portuguese) [Google Scholar]

- International Electrotechnical Commission. Electropedia: The World’s Online Electrotechnical Vocabulary. AC/DC Converter; International Electrotechnical Commission: Geneva, Switzerland, 1998. [Google Scholar]

- Law 14,300/2022; Analysis of the Legal Framework for Distributed Generation. Greener: Sydney, Australia, 2022. (In Portuguese)

- Ramos, D.S.; Alonso, R.H.; Bolanos, J.R.M.; Viana, M.S. R&D Project Study of the Technical and Economic Impact of Mini Distributed Generation and Storage System on CUASO’s Grid (Economic Perspective). Technical Report. 2020. (In Portuguese) [Google Scholar]

- Greener; Newcharge. Strategic Study: Storage Market; Greener: Sydney, Australia, 2021. (In Portuguse) [Google Scholar]

- Castro, R.D.d. Energy Storage in Brazil: Economic feasibility of behind-the-meter applications. In Energy Storage. Systematic Approaches Related to Power Electrical Systems, 1st ed.; Paco Editorial: Jundiaí, Brazil, 2020; Chapter 13. (In Portuguese) [Google Scholar]

- National Electric System Operator (ONS). Grid Procedures. Submodule 4.4. Consolidation of Load Forecast for Electrical Energy Programming. Operational; National Electric System Operator (ONS): Brasilia, Brazil, 2021. (In Portuguese) [Google Scholar]

- National Electric System Operator (ONS); Universidade Federal de Santa Catarina. BDConf System. Volume I: Probabilistic Performance Indicators of the National Interconnected System (SIN) Generation and Transmission Components; National Electric System Operator (ONS): Brasilia, Brazil, 2006. [Google Scholar]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).