Whole Life Cycle Cost Analysis of Transmission Lines Using the Economic Life Interval Method

Abstract

:1. Introduction

- (1)

- Static and dynamic transmission line economic life calculation models are developed, considering the life cycle cost of transmission lines.

- (2)

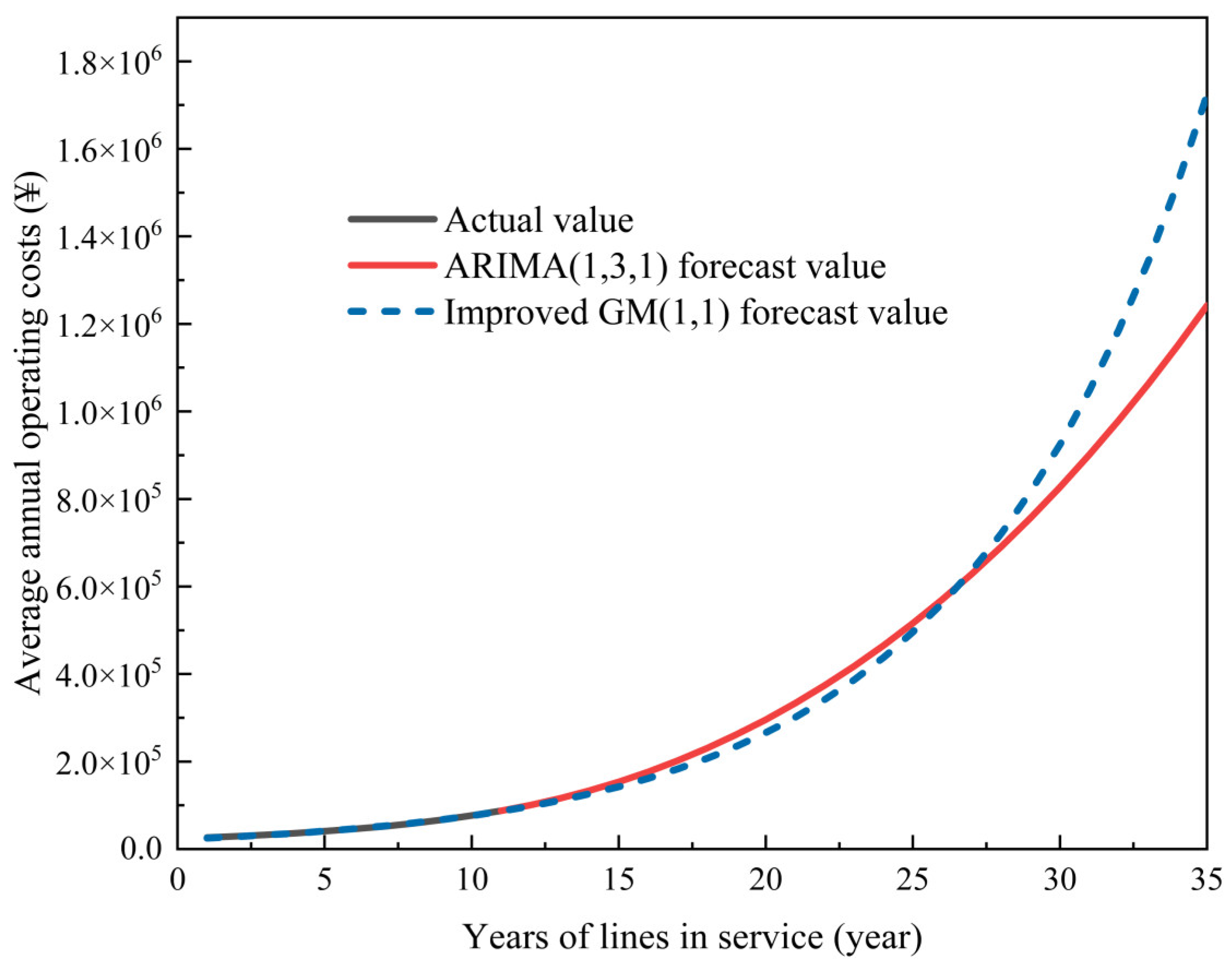

- Cost data are forecasted even with limited samples based on the improved GM (1,1) model.

2. State of the Art

3. Methodology

3.1. Theoretical Analysis of Transmission Lines’ Economic Life Modeling

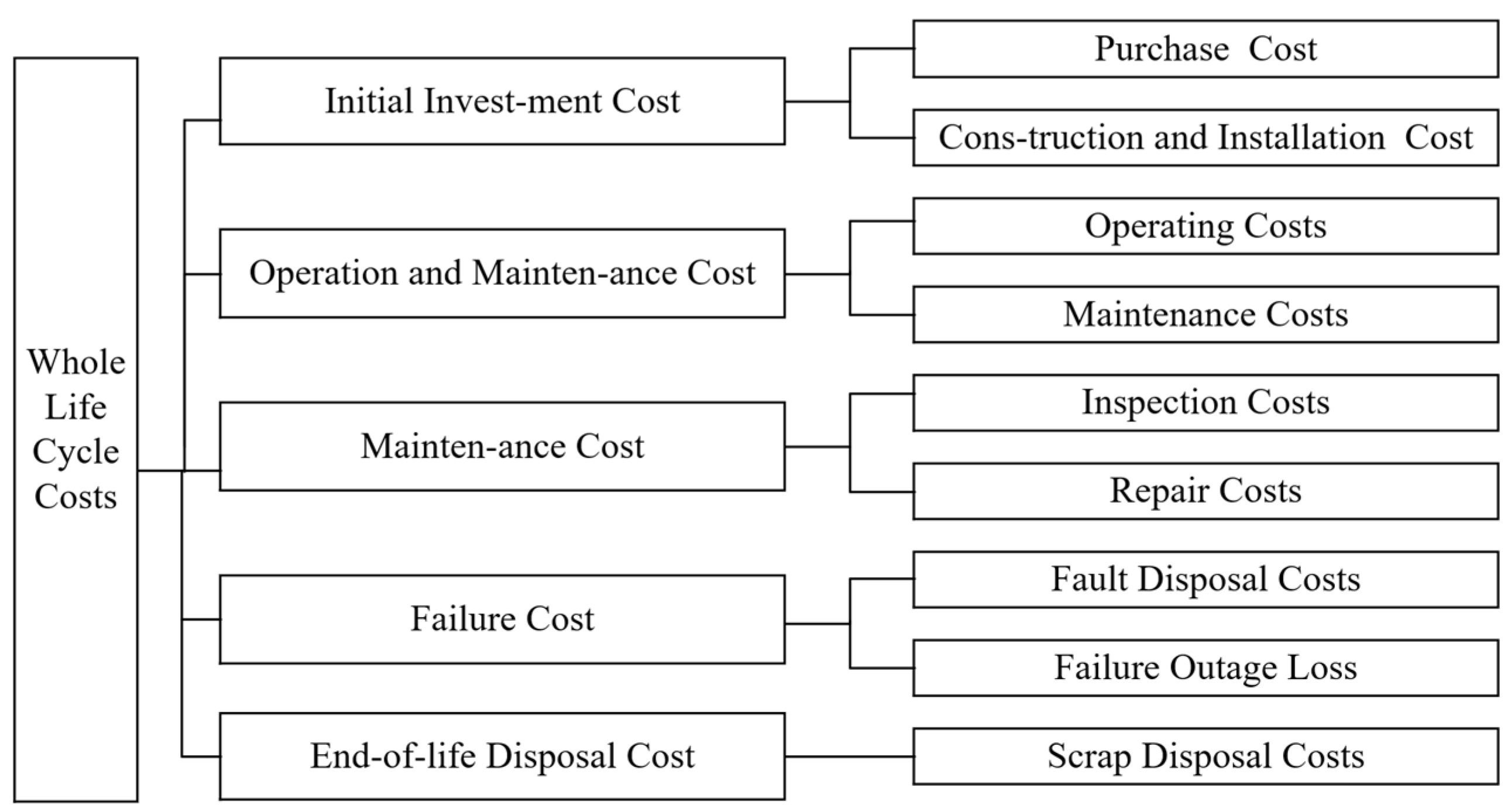

3.1.1. Transmission Line Life Cycle Costs

3.1.2. The Economic Lifetime of Transmission Lines

3.2. Transmission Line Economic Life Model

3.2.1. Static Transmission Line Economic Life Model

3.2.2. Dynamic Transmission Line Economic Life Model

3.2.3. Updated Decision-Making Model

3.3. Improved GM (1,1) Cost Forecasting Model

3.4. Cost Range Calculation Based on Variation Coefficients

4. Results Analysis

4.1. Data

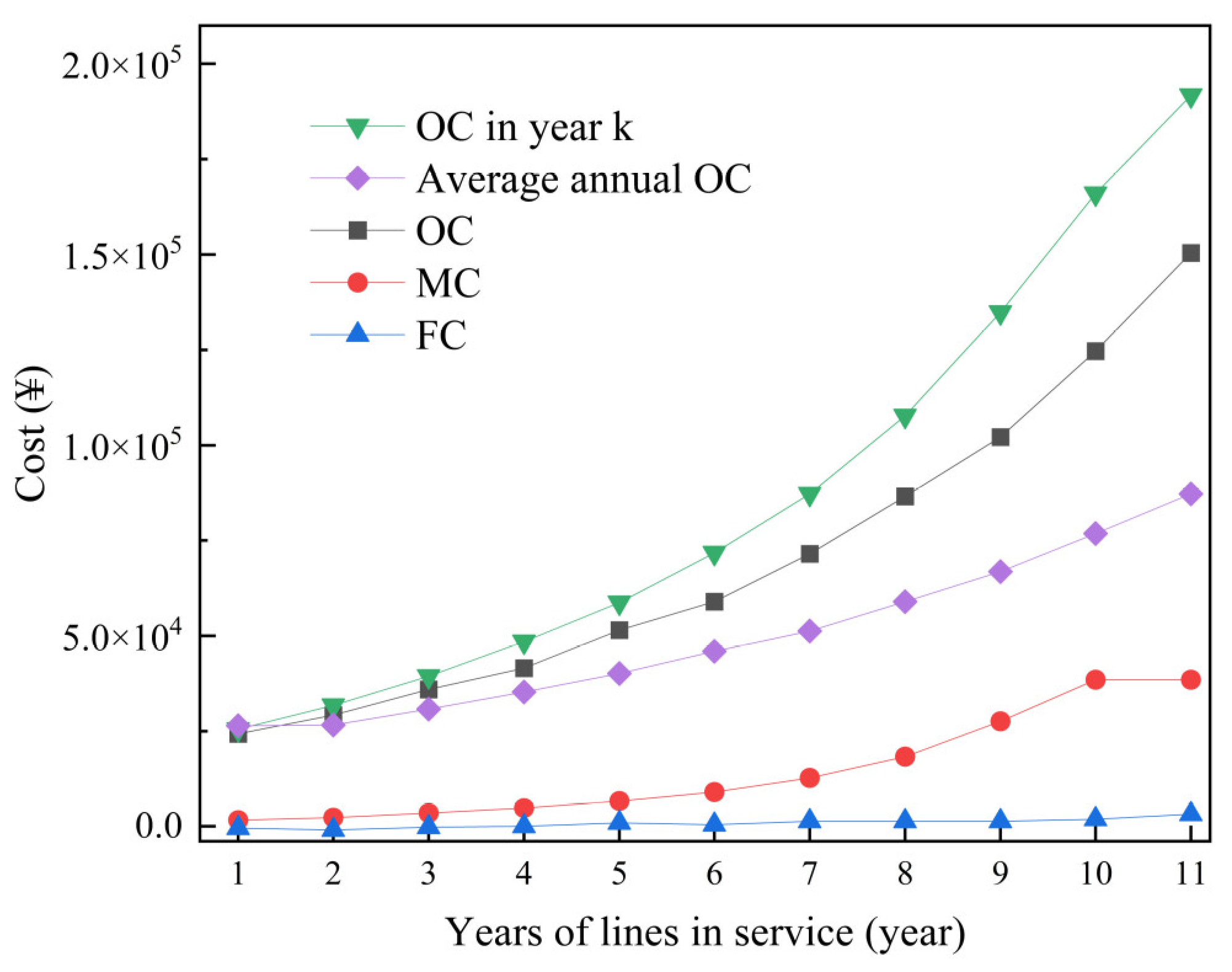

4.2. Improved GM (1,1) Cost Forecasting Results

4.3. Transmission Line Economic Life Interval Results

5. Discussion

6. Conclusions

- The improved GM (1,1) forecasting model can be better applied to line operating cost forecasting.

- The proposed economic life interval calculation model effectively considers the uncertainty of costs incurred during operation.

- Expanding economic life from a fixed value to an interval reduces the impact of cost fluctuations on calculating economic life, enhancing practical guidance.

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Zhao, F.; Xue, L.; Zhu, J.; Chen, D.; Fang, J.; Wu, J. A novel investment strategy for renewable-dominated power distribution networks. Front. Energy Res. 2023, 10, 968944. [Google Scholar]

- Li, Z.; Xu, Y.; Wang, P.; Xiao, G. Coordinated preparation and recovery of a post-disaster Multi-energy distribution system considering thermal inertia and diverse uncertainties. Appl. Energy 2023, 336, 120736. [Google Scholar] [CrossRef]

- dos Santos, C.H.F.; Abdali, M.H.; Martins, D.; Alexandre, C.B.A. Geometrical motion planning for cable-climbing robots applied to distribution power lines inspection. Int. J. Syst. Sci. 2021, 52, 1646–1663. [Google Scholar] [CrossRef]

- Huang, W.; Zhang, N.; Yang, J.; Wang, Y.; Kang, C. Optimal Configuration Planning of Multi-Energy Systems Considering Distributed Renewable Energy. IEEE Trans. Smart Grid 2019, 10, 1452–1464. [Google Scholar] [CrossRef]

- Li, Z.; Xu, Y.; Wang, P.; Xiao, G. Restoration of Multi-Energy Distribution Systems with Joint District Network Reconfiguration by A Distributed Stochastic Programming Approach. IEEE Trans. Smart Grid 2023. early access. [Google Scholar] [CrossRef]

- Khalyasmaa, A.I.; Uteuliyev, B.A.; Tselebrovskii, Y.V. Methodology for Analysing the Technical State and Residual Life of Overhead Transmission Lines. IEEE Trans. Power Deliv. 2021, 36, 2730–2739. [Google Scholar] [CrossRef]

- Xu, N.; Chen, M.; Liu, Z.; Nie, J.; Wang, Y.; Song, S. The Security Effectiveness Assessment of Power Grid Assets Based on Life Cycle. In Proceedings of the 4th International Conference on Advances in Energy Resources and Environment Engineering, Chengdu, China, 7–9 December 2018; IOP Publishing Ltd.: Bristol, UK, 2019; p. 062031. [Google Scholar]

- Zhang, Y.; Zhao, Q.; Ao, J.; Wang, Z.; Wang, Y. Full life-cycle economic evaluation of integrated energy system with hydrogen storage equipment. E3S Web Conf. 2022, 338, 01018. [Google Scholar] [CrossRef]

- Chen, X.; Ou, Y. Carbon emission accounting for power transmission and transformation equipment: An extended life cycle approach. Energy Rep. 2023, 10, 1369–1378. [Google Scholar] [CrossRef]

- Zang, L.; Xiao, B.; Ma, J.; Liu, Y.; Tian, P.; Zhang, L. Research on the cost effectiveness of carbon emission reduction in the full life cycle of electric vehicles based on grey prediction. MATEC Web Conf. 2022, 355, 02031. [Google Scholar] [CrossRef]

- Li, N.; Wang, X.; Zhu, Z.; Wang, Y.; Han, J.; Xu, R. The Research on the LCC Modelling and Economic Life Evaluation of Power Transformers. IOP Conf. Ser. Mater. Sci. Eng. 2019, 486, 012030. [Google Scholar] [CrossRef]

- Wang, J.; Fu, L. Power transformer life analysis based on Lambert W function. J. Phys. Conf. Ser. 2022, 2221, 012009. [Google Scholar] [CrossRef]

- Hu, B.; Chen, Q.; Rao, W.; Qiao, J. Economic Life Prediction of Transformer Based on Repairing Profit and Decommissioning Profit. J. Phys. Conf. Ser. 2019, 1314, 012113. [Google Scholar] [CrossRef]

- Wang, Y.; Wang, S. Life prediction of power Internet of Things equipment based on improved genetic algorithm. In Proceedings of the International Conference on Cloud Computing, Internet of Things, and Computer Applications (CICA 2022), Luoyang, China, 28 July 2022; Powell, W., Tolba, A., Eds.; SPIE: Bellingham, WA, USA, 2022; p. 81. [Google Scholar]

- Yang, Y.; Chen, Y.; Shi, J.; Liu, M.; Li, C.; Li, L. An improved grey neural network forecasting method based on genetic algorithm for oil consumption of China. J. Renew. Sustain. Energy 2016, 8, 024104. [Google Scholar] [CrossRef]

- Yue, Z.; Diyi, S. Oil-gas Cost in The Declining Period Predicting Model Based on Self-adaptive GM(1, 1,λ). In Proceedings of the 2021 6th International Conference on Intelligent Computing and Signal Processing (ICSP), Xi’an, China, 9–11 April 2021; IEEE: Piscataway, NJ, USA, 2021; pp. 69–72. [Google Scholar]

- Liu, D.; Li, G.; Chanda, E.K.; Hu, N.; Ma, Z. An improved GM (1.1) model with background value optimization and Fourier-series residual error correction and its application in cost forecasting of coal mine. Gospod. Surowcami Miner. Miner. Resour. Manag. 2019, 35, 75–98. [Google Scholar]

- Fekri, M.N.; Ghosh, A.M.; Grolinger, K. Generating Energy Data for Machine Learning with Recurrent Generative Adversarial Networks. Energies 2019, 13, 130. [Google Scholar] [CrossRef]

- Awad, A.S.A.; EL-Fouly, T.H.M.; Salama, M.M.A. Optimal ESS Allocation and Load Shedding for Improving Distribution System Reliability. IEEE Trans. Smart Grid 2014, 5, 2339–2349. [Google Scholar] [CrossRef]

| Year | Actual Value (CNY) | Forecast Value (CNY) | Relative Standard Deviation |

|---|---|---|---|

| 1 | 26,600 | 24,963.94 | 0.061506 |

| 2 | 29,400 | 28,275.13 | 0.038261 |

| 3 | 32,700 | 32,025.50 | 0.020627 |

| 4 | 36,500 | 36,273.32 | 0.006210 |

| 5 | 40,900 | 41,084.57 | 0.004513 |

| 6 | 46,000 | 46,533.97 | 0.011608 |

| 7 | 51,900 | 52,706.17 | 0.015533 |

| 8 | 58,900 | 59,697.05 | 0.013532 |

| 9 | 67,200 | 67,615.19 | 0.006178 |

| 10 | 77,000 | 76,583.58 | 0.005408 |

| 11 | 87,400 | 86,741.52 | 0.007534 |

| Year | Variation Coefficient | Fluctuation | |||

|---|---|---|---|---|---|

| 12 | 0.33 | 5.51 | 20.13 | [18.89, 21.37] | [14.62, 25.63] |

| 13 | 0.33 | 6.46 | 23.83 | [22.37, 25.28] | [17.36, 30.29] |

| 14 | 0.32 | 7.58 | 28.15 | [26.44, 29.85] | [20.57, 35.72] |

| 15 | 0.32 | 8.87 | 33.18 | [31.18, 35.17] | [24.31, 42.04] |

| 16 | 0.32 | 10.37 | 39.03 | [36.70, 41.36] | [28.66, 49.40] |

| 17 | 0.31 | 12.11 | 45.84 | [43.11, 48.56] | [33.73, 57.94] |

| 18 | 0.31 | 14.12 | 53.74 | [50.56, 56.92] | [39.62, 67.86] |

| 19 | 0.31 | 16.45 | 62.92 | [59.22, 66.62] | [46.47, 79.37] |

| 20 | 0.31 | 19.15 | 73.56 | [69.25, 77.87] | [54.41, 92.70] |

| 21 | 0.31 | 22.26 | 85.89 | [80.88, 90.90] | [63.62, 108.15] |

| 22 | 0.30 | 25.86 | 100.16 | [94.34, 105.98] | [74.30, 126.02] |

| 23 | 0.30 | 30.02 | 116.68 | [109.92, 123.43] | [86.66, 146.70] |

| 24 | 0.30 | 34.82 | 135.78 | [127.94, 143.61] | [100.96, 170.59] |

| 25 | 0.30 | 40.35 | 157.84 | [148.77, 166.92] | [117.49, 198.20 |

| 26 | 0.30 | 46.73 | 183.33 | [172.82, 193.84] | [136.60, 230.02] |

| 27 | 0.30 | 54.08 | 212.74 | [200.58, 224.91] | [158.66, 266.83] |

| 28 | 0.30 | 62.55 | 246.67 | [232.60, 260.75] | [184.13, 309.22] |

| 29 | 0.29 | 72.29 | 285.79 | [269.53, 302.06] | [213.50, 358.09] |

| 30 | 0.29 | 83.51 | 330.87 | [312.08, 349.66] | [247.37, 414.38] |

| 31 | 0.29 | 96.40 | 382.80 | [361.11, 404.49] | [286.39, 479.20] |

| 32 | 0.29 | 111.23 | 442.57 | [417.55, 467.60] | [331.34, 553.80] |

| 33 | 0.29 | 128.27 | 511.36 | [482.50, 540.23] | [383.09, 639.64] |

| 34 | 0.29 | 147.85 | 590.49 | [557.23, 623.76] | [442.64, 738.35] |

| 35 | 0.29 | 170.34 | 681.48 | [643.15, 719.81] | [511.14, 851.82] |

| Static Economic Life | Dynamic Economic Life | |||||

|---|---|---|---|---|---|---|

| Guarantee degree | ||||||

| Annual cost | CNY 1,117,956 | [1,115,718, 1,120,195] | [1,115,718, 1,120,195] | CNY 1,746,679 | [1,744,863, 1,748,494] | [1,738,610, 1,754,747] |

| Economic life | 24 | 24 | [24, 25] | 24 | 24 | 24 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zeng, W.; Fan, J.; Zhang, W.; Li, Y.; Zou, B.; Huang, R.; Xu, X.; Liu, J. Whole Life Cycle Cost Analysis of Transmission Lines Using the Economic Life Interval Method. Energies 2023, 16, 7804. https://doi.org/10.3390/en16237804

Zeng W, Fan J, Zhang W, Li Y, Zou B, Huang R, Xu X, Liu J. Whole Life Cycle Cost Analysis of Transmission Lines Using the Economic Life Interval Method. Energies. 2023; 16(23):7804. https://doi.org/10.3390/en16237804

Chicago/Turabian StyleZeng, Wenhui, Jiayuan Fan, Wentao Zhang, Yu Li, Bin Zou, Ruirui Huang, Xiao Xu, and Junyong Liu. 2023. "Whole Life Cycle Cost Analysis of Transmission Lines Using the Economic Life Interval Method" Energies 16, no. 23: 7804. https://doi.org/10.3390/en16237804

APA StyleZeng, W., Fan, J., Zhang, W., Li, Y., Zou, B., Huang, R., Xu, X., & Liu, J. (2023). Whole Life Cycle Cost Analysis of Transmission Lines Using the Economic Life Interval Method. Energies, 16(23), 7804. https://doi.org/10.3390/en16237804