1. Introduction

Solar photovoltaic (PV) generation is one of the main technologies for decentralizing and decarbonizing energy systems. To date, PV panels are a settled and approved solution for detached houses, while PV solutions for multi-unit buildings have been relatively limited. Recent studies focus mainly on PV usage in single residential buildings [

1] as well as commercial buildings [

2,

3]. Although distributed renewable energy sources (DRESs) have been widely approved at the residential scale, especially in detached houses, the lack of a legal framework prevents the installation of PV panels and battery energy storage systems (BESSs) in buildings that are composed of several apartment units. The primary reason for the low uptake of sharing DRESs in multi-unit buildings is the lack of regulations to ensure that electricity tax, grid rent, and settlements are in line [

4]. Recent studies related to PV panel allocation in multi-unit buildings have focused more on evaluating the technical performance [

5] and analyzing the economic and technical feasibility of PV panels in microgrids [

6,

7]. However, shared DRESs, including PV panels and BESSs, in multi-unit buildings have not been investigated well.

Given that the units of multi-unit buildings are occupied by different groups of residents, e.g., tenants and unit owners with different preferences, the process of sharing energy from shared DRESs between these groups can be unjust and challenging. For instance, from the perspective of investing in shared DRESs, some residents could not afford the investment economically, or there might be a group of residents, such as tenants, who want to enjoy the benefits of shared DRESs for a short period because long-term investment is not affordable for them. In this regard, this study proposes an energy-sharing model that enables efficient, fair, and equitable allocation and distribution of energy, costs, and benefits in multi-unit buildings, considering different groups of residents.

Energy justice provides an effective decision-making tool that helps stakeholders, e.g., consumers and producers, to make more rational energy decisions [

8]. In recent years, scholars have reached a joint definition of energy justice in which the costs and benefits of energy services are fairly distributed, and equitable energy decision-making is provided [

9]. In general, energy justice addresses the equitable sharing of energy, costs, and benefits and identifies injustices within energy systems [

8,

9]. Energy justice integrates three different, but interconnected principles that include distributive justice, procedural justice, and recognition justice [

10]. Each principle relates to a particular aspect of justice that complements each other. Distributive justice refers to whether all groups share equally in specific services and goods. Procedural justice deals with the equitable participation of stakeholders in decision-making processes. Recognition of justice gives attention to the demands and rights of different groups in society, especially underrepresented or vulnerable groups, to decrease social inequalities [

10]. The value of energy justice has not been studied within the concept of energy sharing in multi-unit buildings. Therefore, a set of steps has to be formulated to enable a fair and just energy-sharing system in multi-unit buildings where different groups of residents can participate and gain benefit from the shared DRESs in their building. Applying the principles of energy justice in energy-sharing models removes or reduces barriers to the active participation of end customers (consumers/prosumers) in the future smart and decentralized energy grid.

In this paper, a new fair energy sharing model (FESM) is proposed, which focuses on energy allocation and trading inside different multi-unit buildings, considering energy justice principles. The basis for our definition of FESM is a network behind the meter in which the shared systems (PV panels and BESSs) can be owned by the main owner of a multi-unit building or a group of residents living in the building. Although FESM and community-based microgrids have similarities in their configurations (e.g., both rely on centralized renewable sources), they have an important difference. In community microgrids, shared DRESs are located in front of the meter that are controlled by utility companies (i.e., they are controlled in an aggregate manner) that incur extra costs for the users who use the shared systems (e.g., there will be administrative costs) [

11]. Since users of community DRESs do not own DRESs, they are deprived of having access to any of the tax credits and incentives of DRESs. However, in FESM, shared DRESs are installed behind the meter and are not controlled by utility companies; hence, additional costs are eliminated for users. Moreover, users in FESM can own a portion of DRESs and take advantage of the tax benefits.

After allocating shared DRESs and energy to the residents by the energy management operator (EMO) of the buildings, energy trading is enabled in FESM with expected prominent benefits such as cost-savings and carbon footprint reduction. The EMO of the buildings monitors and controls the trading stage and computes the trading price. During the energy trading process, the interests of sellers and buyers are protected, and they are given the opportunity to determine the amount of energy they want to sell and buy based on certain factors, such as priority factors, or after seeing the price. The priority factor is defined as one of the main elements of FESM to retain the fairness and interests of both buyers and sellers during energy trading. Justice and fairness are analyzed in energy allocation and trading processes according to the main principles of energy justice. These analyzes help to understand that justice can be defined differently for each building according to the building conditions (e.g., resident preferences, types of residents, etc.). Moreover, the revenue of the shared DRESs’ users living in the multi-unit buildings are examined under different energy allocation processes. The experimental results show that our method is highly beneficial for all participants as their revenue increases dramatically compared to the baseline methods.

The main contributions of this work are as follows:

We present a novel fair energy sharing framework FESM plus two different applications of it. In FESM energy demand of buildings is supplied by shared distributed renewable energy sources, including PV panels and battery energy storage systems. FESM is a behind-the-meter network that enables energy allocation and trading inside the buildings.

To the best of our knowledge, this work is the first to apply the main principles of energy justice, including procedural justice, recognition justice, and distributive justice, in a systematic way in the design of energy allocation and trading processes to create justice and fairness. Moreover, we propose a novel priority factor to prioritize users to secure fair sharing of energy generated by shared DRESs for residents.

A new and simple pricing mechanism is proposed that increases the profits for sellers and decreases the cost for buyers, and makes the overall operation of the system simple.

The rest of the paper is organized as follows. In the following section, first, we present a brief overview of the shared renewable energy system in multi-unit buildings by discussing the status quo of energy sharing in four countries, including Germany, Austria, France, and Norway. Then, fairness in energy sharing is reviewed, and we discuss how energy justice principles can be applied in an energy-sharing process. The details of the FESM network are presented in

Section 3; then, the strategies for energy trading for all participants, such as sellers, buyers, and energy management operators, are summarized in

Section 4.

Section 5 presents comprehensive experimental results, and the paper is concluded in

Section 6.

3. Proposed FESM Framework

We assume a building that has an owner who can be a legal entity such as a person, a company, a municipality, or a cooperative, etc. The energy-sharing model is decided by the owner of the building. The energy-sharing model is the basis for energy allocation and trading. The energy allocation and trading processes in the building are handled by EMO, who could be the owner of the building, a third party, or consortium of residents, etc. The building is comprised of N units denoted by the set . Each unit has an owner and can be occupied by the owner, called unit-owner, or a tenant. Let , where and , and , where and , be the sets of unit-owners and tenants, respectively, who live in the building. Each unit is characterized by a set of parameters, such as the area of the unit and the number of members living in the unit, that can be input into the sharing model. The building can be equipped with a number of PV panels that belong to the set . PV panels have an owner that can be the owner of the building, a third party, or a legal entity formed by residents who each own a share. Depending on the sharing model, the residents can lease a share of the PV panels from the owner. Since PV panels may produce more energy than residents need during some time slots in a day, a set of BESSs are shared between residents of buildings. Similar to PV panels, each BESS has an owner that can be the owner of the building or a group of residents. Both unit owners and tenants can lease a share of BESSs. Residents can trade their excess energy generated by PV panels inside the building.

In FESM, the allocation process refers to the step where the EMO of the building allocates a fair share of energy generated from PV panels or the energy saved into the shared batteries to the residents of the building. The unequal sharing model proposed by the RME proposal [

18] (see

Section 2.1) is used for the allocation process in the building. Compared with other sharing models, the unequal sharing model allows the owner of the building to allocate a fair and different share of energy (i.e.,

, where

is the total generation of PV panels) or capacity of BESSs (i.e.,

, where

is the total capacity of BESS) to the residents. The allocated share (

) can vary between the residents participating in the sharing solution as long as

, and can be based on different factors, such as the resident’s need or the amount the resident invests in DRESs, etc. In the allocation process, recognition justice will be achieved when all groups of residents, including tenants, unit owners, low-income families, etc., have the opportunity to exploit the building’s DRESs. In the building, a fair share of energy can be allocated to each unit of the building based on factors such as the area of the unit, family members living in the unit, etc. Hence, in this case, distributive justice will be achieved by distributing energy generated by DRESs among the units based on unit characteristics. In other cases, residents can invest in DRESs based on their ability to pay. In this situation, distributive justice is realized by allocating energy to the residents in proportion to the cost that they have invested in DRESs. Moreover, in the energy allocation process, residents can participate in decision-making in which, for example, they can decide whether to invest in DRESs or pay only for their consumption. Therefore, procedural justice will also be fulfilled in the allocation process.

After the allocation step, energy trading takes place in one step, where local energy is traded between the residents of the building. During energy trading, justice is realized so that participants, including sellers, buyers, and the EMO of the building, can participate in decision-making processes (procedural justice), and all groups of residents have the opportunity to participate in energy trading (recognition justice) and gain financial benefit by selling or buying excess energy from DRESs (distributive justice). The following sections discuss the fair energy allocation and trading processes within the proposed framework for two different multi-unit buildings, i.e., Building A and B, illustrating two different approaches to applying the principles of energy justice. These two approaches will be experimentally compared with regard to distributive justice, recognition justice, and procedural justice.

3.1. Building A

Building A has an owner who is a person. This building consistents of units identified by the set such that , , and and of the units, where and , are occupied by unit-owners and tenants, respectively. Building A is equipped with P rooftop PV panels and B BESSs funded by the owner of the building. The EMO of Building A is the building owner who allocates a fair share of DRESs and energy generated by the PV panels to each unit of the building. After the allocation process, energy trading managed by the EMO of the building takes place in one step, where the local surplus energy is traded between the building occupants. The possible ways of allocating energy in Building A are discussed in the following.

Energy allocation: In building A, the EMO of the building allocates a certain share of PV panels and BESSs to each unit of the building, giving all residents the opportunity to enjoy the benefits of shared DRESs in their building. The allocation process in Building A is based on the unequal sharing model [

18]. In this regard, the EMO of the building allocates

of PV panels (i.e.,

) and BESSs (i.e.,

), where

is based on the area of unit

i and the number of family members living in the unit. The PV panel share (

) and BESS share (

) for the

ith unit in Building A are computed as follows:

where

and

are the total area of the PV panels and the area of the

ith unit in Building A, respectively.

and

are the number of members who live in unit

i and the total number of residents living in Building A, respectively. In the above equations,

is a weight factor that gives importance to the number of family members living in a unit and the area of the unit while allocating PV panels and BESSs. In this work, the value of

is set to 0.5 to give equal importance to both numbers of family members and the area of the unit. In Equation (

2),

is the total capacity of the building’s battery.

If the shared PV panels in building A generate

amount of energy at time slot

t, unit

i will receive

share of energy according to the following equation:

In Building A, residents can decide whether to lease their share or just pay for their consumption. The latter is most suitable for temporary residents, such as tenants or residents who cannot afford the lease cost. leasing PV panels/BESSs allows residents to sell the remaining energy from their share; otherwise, the remaining energy belongs to the building owner. The lease cost for a resident who leases a share of a PV panel is computed as a certain percentage of the benefit that the resident gain by using the PV panel. The percentage value is defined by the building owner and should not be set too high to avoid loss of benefit. Hence, the value is set to 10%.

3.2. Building B

Similar to Building A, Building B has an owner who is a person and acts as the EMO of the building. We assume that Building B does not possess PV panels and BESSs. Hence, a group of or all building residents decide to install PV panels on the roof of the building with the permission of the building owner. In this case, residents who cooperate to buy PV panels or BESSs are considered owners of PV panels or BESS, respectively. Building B has units; let , where , be the set of the units. In the building, there are and units, where and , that are occupied by unit-owners and tenants.

Energy allocation: In Building B,

of unit-owners buy PV panels for the building. Let

be the set of such unit-owners such that

, where

. A number of those unit-owners (i.e.,

of

, where

) live in the building, and the rest (i.e.,

) rent their units. In this building, the EMO of the building defines an ownership concept to distribute energy to unit-owner

i, where

, based on the size of the unit owner’s investment in PV panels. Given that the ownership factor varies for each unit-owner

i, the EMO of the building follows the unequal sharing model [

18] for allocating the energy generation of the PV panels in the building. The ownership factor (

) for the

ith unit-owner who owns a share of PV panels and lives in Building B, where

, is equal to the ratio of the cost (

) that is invested by the unit-owner to the total cost (

), and can be written as follows:

In addition, the amount of energy

that the

ith unit-owner in Building B will receive is computed as follows:

where

is the amount of energy generated by the PV panels in Building B at time slot

t.

The investment cost (

) of unit-owner

i per day in Building B is given by the following Equation.

where

is the period of time it will take the unit-owner

i to pay off the total cost of the PV panel share. Similar to Building A, the lease cost for the tenant who leases a share of PV panels from their unit owner is a certain percentage of the tenant’s benefit and is set to 10%.

Residents of Building B can also contribute to buying BESSs for the building. Let us assume there are

unit-owners who pay for a share of BESSs, and

, where

, is the set of such unit-owners. The ownership factor

for the

jth unit-owner who owns a share of BESSs, where

, is computed as follows:

In addition, the share of BESS

that is allocated to the

jth unit-owner in Building B is:

Generally speaking, residents can charge their share of the battery. If some residents have available capacity in the battery, they can allow other residents to use their capacity at a specific time slot in a day until an agreed-upon time.

Regarding investing in PV panels and BESSs, there are some situations that should be taken into consideration. In Building B, unit owners who do not live in the building and own a share of PV panels or BESSs can lease a part of their share to their tenant. In this case, tenants benefit from energy generated by PV panels by paying for their energy consumption or a fee in excess of their housing rent. In the latter case, tenants can sell the excess energy from their share of PV panels. There might be residents who do not have the opportunity to use PV panels/BESSs in the building. Examples can be tenants whose unit-owners do not invest in PV panels/BESSs, residents who cannot afford the investment cost, residents who just moved into the building and want to own a share of PV panels and there is no available space on the roof of the building for installing PV panels, etc. This issue of fairness is outside the scope of this paper.

3.3. Overview of Fair Local Energy Trading in FESM

Regardless of the group of the building, the EMO of the building has the duty to fulfill the energy demand of all residents. The residents with extra and lack of energy are considered sellers and buyers, respectively. A non-cooperative game takes place between buyers and sellers separately to adjust their energy demand through the game. In contrast to cooperative energy trading games in which participants try to maximize social benefit via cooperation based on a particular agreement, in non-cooperative games, participants compete to maximize their own financial benefits (i.e., sellers and buyers compete to maximize their benefits and minimize their costs, respectively) [

30]. Hence, defining the energy trading price is important in effective energy trading and fair distribution of profit. In this paper, it is assumed energy trading takes place inside the building as depicted in

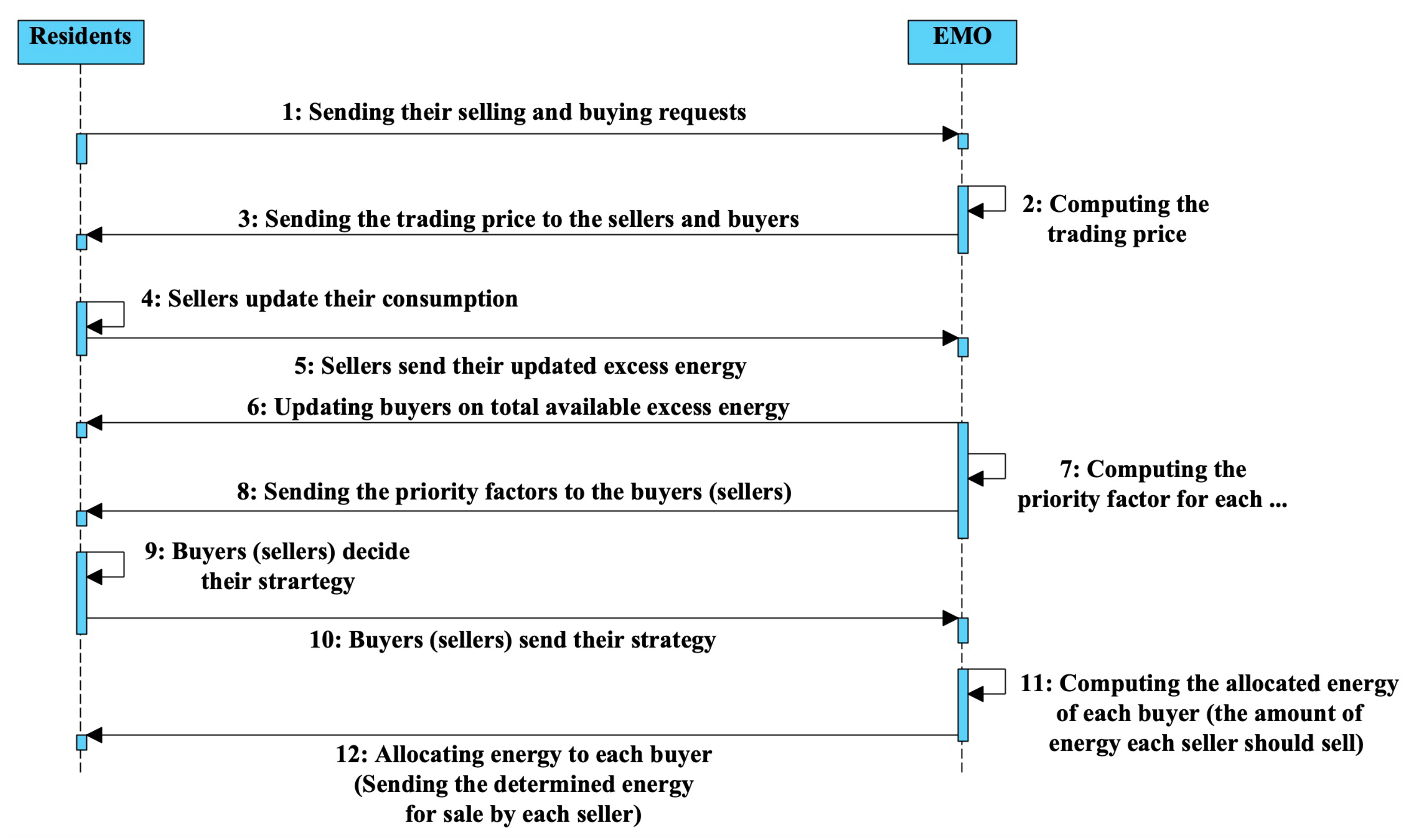

Figure 1.

As seen from

Figure 1, first, residents send their selling and buying requests to the EMO of the building. The EMO of the building then decides the trading price in a way that benefits sellers and buyers. The trading price should be bound by the grid buying and selling prices. By considering this, both sellers and buyers prefer to trade energy in the building rather than in the main grid. When seeing the trading price, each seller is allowed to decide its strategy by adjusting its consumption to maximize its own benefit. The sellers then update the EMO on their excess energy, and the buyers are notified by the EMO. In the next step, the EMO calculates the priority factor for each buyer or seller depending on the situation (i.e., buyers are prioritized when the total energy demand of buyers is higher than the total excess energy, and sellers are prioritized in the opposite situation). The EMO considers the priority factor for the purpose of obtaining a fair and stable energy trading system. The priority factor of a buyer/seller is calculated based on the number of times the buyer/seller contributed as seller and buyer in the previous energy trading steps until now, the ownership factor of the buyer, the number of family members of the buyer, the area of the buyer’s unit, and the amount of energy the seller want to sell. In this trading model, a participant with a higher priority factor can trade more energy than other participants. The priority factors are sent by the EMO to the corresponding buyers or sellers. Depending on the situation, the buyer (seller) decides on how much energy to buy (sell) to maximize its benefits based on the buyer’s (seller’s) priority factor and the updated total excess energy available in the building (the total energy demand of buyers). After receiving the strategies, the EMO allocates a specific amount of energy to each buyer (seller) based on the buyer’s (seller’s) strategy, the priority factor of the buyer (seller), and the total energy demand (excess energy). If, after the trading process, there is still excess energy in the building, the energy is fed into the main grid, typically based on a pre-set feed-in tariff, or if there is still unsatisfied demand, it is fulfilled by the main grid at market price.

3.4. The Proposed Energy Trading Model

In this section, the proposed local energy trading inside the building is described in detail.

Let denote the energy demand of the ith resident at time slot t. Moreover, resident i can have a share in BESSs and of energy saved in the battery during a given time interval of the day. After allocating energy to all residents based on their share of PV panels or ownership factors, if , the resident i needs to buy energy from sellers inside the building. Let be the set of residents who act as buyers at time slot t. If for some residents in the building, then these residents are considered sellers. Let be the set of such sellers in the building at time slot t.

In the first stage, buyers send their buying demand to the EMO of the building. The energy demand of buyer

is given by:

and the total energy demand of all buyers in the building at time slot

t is

The excess energy of the

ith seller after fulfilling its essential needs is equal to its minimum consumption at time slot

t, i.e.,

, is

and the total excess energy from solar panels at time slot

t is given by

According to Step 4 in

Figure 1, sellers have the opportunity to manage their energy consumption. This means that the seller

intends to adjust its consumption

s.t.

and sells its surplus energy (

) to the neighboring buyers via the proposed energy trading model. In this regard, the updated excess energy of the

ith seller after settling its energy consumption is as follows:

and consequently, the total excess energy available in the building at time slot

t is updated as follows:

Following that, available energy in the building is traded between participants. Finally, after energy trading is completed, if there are still residents with unsatisfied demand, the energy demand is purchased from the main grid via the EMO of the building. In contrast, the EMO sells the extra energy to the main grid.

6. Conclusions

In this paper, a fair energy sharing framework (FESM) is proposed to enable fair and reliable energy allocation and trading in multi-unit buildings. Two different specializations of the framework, referred to as Buildings A and B, that followed different energy-sharing models, are presented. An energy management operator is used for each multi-unit building to coordinate the energy allocation and trading processes among all residents in the building. The processes of energy allocation and trading in our sharing model show that residents receive and trade energy fairly using the characteristics of a unit or ownership factor and priority. To certify fairness between buyers and sellers in all trading stages, this work gives both groups the opportunity to decide on their strategy by participating in a non-cooperative game to increase their financial profit. A simple trading price mechanism is proposed to maximize the profits of sellers and buyers and simplify the trading stages. The efficiency of our method is verified in comparison with the baseline methods on real data from Austin, Texas. The results illustrate high financial profit for sellers and low costs for buyers during the day.

We also analyzed justice in the proposed energy allocation and trading processes for both cases of the framework with respect to the main principles of energy justice. From the recognition justice perspective, justice is achieved when the sharing models ensure the accessibility to the benefits of shared DRESs in the buildings for different groups of residents. For example, recognition justice is realized in the proposed sharing models by giving tenants and low-income families the opportunity to use the DRESs of their building via renting or investing in a share of PV panels/BESSs individually or in cooperation with neighbors or paying for their consumption. Justice as distribution in the sharing models results in fair distribution of cost, benefits, and energy. To reach distributive justice in the proposed sharing models, for example, some factors, such as the unit characteristics, ownership factor, and priority factor, are utilized to perform a fair distribution of energy and benefits among residents during both energy allocation and trading. Procedural justice enables all stakeholders in the sharing model to participate in making decisions on the distribution of cost/benefits, accessing the shared DRESs, etc. Procedural justice is achieved in the proposed sharing models by enabling residents to decide how to use the shared DRESs of their building (i.e., the residents can rent or invest in a share of the DRESs) and their buying or selling strategy. In sum, analyzing the main principles of energy justice in this work is useful in understanding that justice principles have to be applied in the design of energy-sharing models in the first step. These principles can be applied in different ways, and depending on the context or situation justice’s definition can be different. Applying the energy justice principles in the proposed sharing models motivates the residents to use the shared DRESs of their building, which leads to high financial benefits for the building.

Future research could explore how to achieve trust among participants and how much information they should share during energy trading. Future research might also be to develop the proposed framework into an interactive tool for exploring and comparing the effects of different approaches to energy justice. It may also be relevant to study how errors in intraday (<1 h) forecasting of PV power generation may influence the trading results on seller profit and buyer cost.