1. Introduction

The Intergovernmental Panel on Climate Change set a 2030 goal of 50% worldwide carbon reduction as a first step toward limiting global warming to 1.5 °C, above which more catastrophic climate change impacts are expected [

1]. The Paris Climate Agreement, agreed to by 196 nations in 2015, established a less ambitious plan to limit greenhouse gas emissions to limit global warming to 2.0 °C [

2], but the progress toward even this weak goal is not being made. In 2021, global greenhouse gas emissions were the highest of all time [

3]. The following year (2022) is certain to have even bigger increases, especially because of the Russian invasion of Ukraine, which has increased coal consumption [

4].

In parallel to desires to reduce global greenhouse gas emissions, the United Nations has established goals to achieve sustainability with equity [

5]. With over 2 billion people without access to the economic engine that reliable energy brings [

6], there is ample opportunity to integrate equity concerns into potential solutions for the developing world.

1.1. Energy Access

Although access to electricity in emerging markets is improving globally, Africa’s progress is lagging. According to the 2019 Tracking SDG 7: Energy Progress Report [

6], sub-Saharan Africa accounts for 68 percent of the global energy access deficit. In 2017, 573 million people in this location still lacked any access to electricity. By 2030, it is estimated that 90 percent of the global population without access to electricity will be concentrated in the region [

6]. Furthermore, there is similar potential to right inequities related to participation by underserved communities in sustainability-related initiatives. For example, a 2021 report by the US EPA documents the disproportionately low participation of diverse people in the clean energy workforce and the inequitable energy cost burden on the poor [

7]. Likewise, a 2020 UN report documents mixed progress in equity worldwide [

8]. Group-based inequalities are declining in some parts of the world and worsening in others. Income inequality is decreasing between countries but is still greater than inequalities present in individual countries. A recent study by Munoz has highlighted how adoption of renewable energy can exacerbate energy inequality [

9].

There are a few stories that highlight early steps in advancing clean energy in low-income communities, wherever they are. PowerGen, a main developer for such projects, has provided power to more than 50,000 Africans who previously lacked electricity [

10]. As of 2021, micro grid projects in India and Indonesia have recently brought power to over 100,000 people [

11]. The World-Bank-funded Nigerian Electrification Project is bringing power to nearly 500,000 people [

12].

However, the micro-grids bringing power to communities gaining access to electricity for the first time have required recipient communities to pay unit energy costs reaching as high as USD 1.00–1.50 per kWh. This rate would be considered exorbitant in the developed world [

13]. A more recent 2020 pricing for mini-grids noted typical unit energy costs of 0.49 USD/kWh [

14]. Despite these high prices, people receiving the power are paying for it [

15].

1.2. Productive Use of Energy to Add Value to Micro- and Mini-Grids

There is a better way. A 2018 report by USAID-NREL emphasized the importance of adding income-generating systems to micro-grids to improve the affordability of power. The income derived from the value-added systems helps to pay for a portion of the micro- or mini-grid. As a result, the unit price of energy for the recipient community can be reduced. This notion of adding income-generating systems to mini- and micro-grids has been termed the productive use of energy (PUE) [

16].

A 2021 study developed by Power Renewable Energy Opportunities (PREO) provides some tangible benefits for PUE in sub-Saharan Africa [

17]. A Rockefeller report likewise documented results from specific projects in helping to improve the affordability of solar micro grids in Africa [

18].

Power Africa has engaged in a massive effort to bring PUE-enhanced micro-grids to up to 66 million people in sub-Saharan Africa [

19]. To do so, they have developed a productive use of energy toolbox that includes country-specific catalogs of PUE [

20], all of which aim to strengthen local economies. Included in its PUE portfolio are agricultural processing technologies, food refrigeration and dryers, livestock and aquaculture solutions, pumping solutions for clean water, and solar-powered irrigation systems for agricultural use. This effort is a step forward, but it still is not easily scalable.

Even more important, however, is the question of how to actualize investment in the PUE-enhanced micro-grids. The World Bank’s Energy Sector Management Assistance Program (ESMAP) documents that investment in these grids is the weak link, and at least USD 220 billion is needed to provide power access to nearly all the powerless people in Africa.

There are no easy solutions to address this basic challenge from both development and investment standpoints. However, a 2019 NREL study suggested the use of ‘bundling’ for addressing both [

13]. Bundling relies upon common designs and processes that can be replicated for any site in such a way as to render efficiencies of scale to bring costs down. Two types of bundling were identified. The first is operational bundling, associated with the use of common processes to reduce development and operating costs. Included in operational bundling are: common designs and engineering, easing the pathways for acquiring equipment and contracts; common installation and commissioning processes; common operational and maintenance processes to reduce variability relative to O&M costs; standardized contracting to reduce variability relative to costs and performance; common productive use of energy (PUE) elements to enable communities to include similar economic assets in micro grids; common performance monitoring; and reporting connecting to a common database to enable ‘learning’ from all projects to improve future ones.

Another type of bundling is financial bundling, whereby multiple projects are aggregated into a single portfolio and the benefits and risks are blended, yielding greater opportunity for investment. Financial bundling includes pooled funds for micro-grid operations and growth and for the purchase of electrical devices within a micro- or mini-grid to both create a demand for electricity, which ideally better correlates load with supply. The authors suggested that financial bundling could enable crowdfunding to render more investment.

One example of financial bundling was put forward by Cross Boundary Energy Finance in 2020. They proposed a model in which, post-construction, the micro- or mini-grid asset is purchased by a single-asset company. The revenues, risks, and costs are uniform with this strategy [

21].

Sun Exchange offers another example of financial bundling. It utilizes electronic outreach to crowdsource funding from anyone in the world at any scale in solar projects for schools, businesses, and other organizations. Prospective investors can purchase solar cells or panels for specific projects, allocating funds from their personal ‘digital wallet’ managed by Sun Exchange. Then, after installation, the recipient organizations pay back the individual investors for the clean energy purchased from the solar cells they own. This payment is delivered to the investors’ digital wallets [

22].

2. Background

An alternative bundling and PUE strategy is posited here. The posed approach is reliant upon the rapidly burgeoning cryptocurrency transaction and processing industry for what we are terming ‘impact mining’. The elements of this strategy include:

A common PUE that adds economic value to micro- and mini-grids through off-grid power usage; namely 100% renewably powered Bitcoin mining;

A digital energy financial transaction technology by which energy use at community and individual energy-user levels is monitored and measured and then aggregated over discrete periods of time (hourly, daily, weekly, etc.); payment from energy user to energy provider(s)/investors can be made automatically using the Bitcoin Lightning Network; leveraging either local currency or Bitcoin as the transaction currency start and endpoints;

An automated and smart contracting vehicle that enables investment from one or thousands of crowd funders (termed ‘impact miners’ here) to a specific project, with terms agreeable to all parties.

In what follows, we review the potential for attaching 100% renewably powered Bitcoin mining as a PUE for solar micro- and mini-grids. To set the stage for this, a brief background on Bitcoin, with the pros and cons associated with its adoption, on the mining aspect of Bitcoin, likewise with pros and cons established, and on its use in financial transactions is provided.

- A.

Bitcoin basics

Bitcoin is a form of decentralized cryptocurrency, reliant on a peer-to-peer network called the blockchain to record transactions. It is not tied to any regulatory authority [

23]. Blockchain is associated with what are called hash functions, which provide a unique record of and authenticate every financial transaction. When each transaction is verified as unique, it is sent to join a “block” of other transitions. At this stage, it becomes impossible to modify. Blockchain represents the assemblage of these blocks.

Blockchain uses many voluntary computer servers to validate Bitcoin network transactions based upon cryptography. These transactions are said to be irreversible. They cannot be undone or changed [

24].

All Bitcoin transactions are documented and public, even though the people involved in processing the transactions are anonymous. It is virtually impossible to hack the system, unlike the data breaches that have increasingly been seen with traditional financial transaction companies [

24]. When Bitcoin is bought, sold, or transacted, no personal information (passwords, credit card numbers, addresses, etc.) is transmitted [

24].

In the Bitcoin network, each computer/server performing hashes is referred to as a node, of which there now are over 100,000 worldwide, thus insuring robustness. If one of the nodes fails, any among the rest can perform the necessary functions. Data security is ensured by the fact that a person interested in hacking the system for information does not know which node or nodes will be called upon for specific hashes [

24]. Other cryptocurrencies are not tied to hardware processing (and thus energy use) and are generally deemed less secure than Bitcoin. It is for this reason that Bitcoin has continued to be the dominant cryptocurrency in the world.

Bitcoin has been suggested to be an equalizing economic force for the world. After its inception, it was hailed as “offering a vision of money free from central bank and intermediaries’ control.” The place of the dollar and RMD as currencies of exchange worldwide preference the monetary policies of, respectively, the US and China. This absence of ownership of currency is especially important for developing countries, where many borrowers borrow heavily using US currency even with non-US lenders. That so much debt worldwide is in terms of US dollars makes the US Fed policy more powerful internationally than it would otherwise be. A Bitcoin currency, in contrast, will not, at least theoretically, provide privilege to the nation on top of the financial hierarchy.

Others have suggested that Bitcoin and other cryptocurrencies can be a more direct asset to the poor. The total amount of money crossing country boundaries is ‘taxed’ considerably by banks for the service of transferring money. This tax is called a remittance. According to a report by the World Bank, around USD 630 billion worth of remittances are paid each year throughout the world. Furthermore, the tax for prices for sending remittances has been documented to exceed 16% [

25]. Even when loans are accessible and lenders meet all credit requirements, small business loans often have interest rates greater than 20 percent [

26]. Therefore the U.N. Sustainable Development Goals has set a 2030 target for remittances to under 3 percent [

6].

Digital finance (DeFi) enables anyone anywhere in the world to provide and receive loans, often leveraging smart contracts with terms that are automatically executed without the requirement of an intermediary. DeFi has led to lower interest rates [

27].

DeFi is especially exciting for providing unbanked people access to capital. Worldwide, the number of such people is estimated to exceed 1.7 billion adults. The World Bank and other organizations interested in mitigating poverty have long advocated financial inclusion as a pillar of economic development. DeFi eliminates or reduces bank touches and thus reduces costs. Plus, the process can be simple, as people can access the system through a simple internet connection [

28].

Beyond just lower transaction fees and easier loan repayments, technology-supporting DeFi can simplify the process for making loans and donations. Individual donors can specify conditions (the “Directed” part) attached to their donation or investment (“Cash”). Technology can then automatically match donors to recipients (charities, social entrepreneurs). Furthermore, these “Directed Cash flows promote accountability and transparency: after receipt, a validation flows backwards to return to the donor so that the donor receives a report of how their donation was spent” [

29].

On the negative side, the largest problem for Bitcoin is the significant fluctuation in its value with time. While high volatility can be an asset for investment, it is not an asset to an exchange, where consumers want to be sure that they do not incur losses caused by transitory currency fluctuations [

30]. A recent study found significantly higher instability and irregularity in cryptocurrencies than with stock markets, for example [

31]. Howson and de Vries suggest that because of the volatility, poor and vulnerable communities are disproportionately affected. As well, there are other actors who have taken advantage of economic instabilities, weak regulations, and access to cheap energy to mine Bitcoin, often impacting local access to energy [

32].

Unfortunately, Bitcoin requires a significant amount of hash calculations to make the peer-to-peer financial transactions, with each calculation consuming power. Each Bitcoin miner generates as much heat as a portable heater, therefore requiring more power expenditures to cool the machines [

33]. Today the amount of energy being used to power Bitcoin worldwide is 138 terawatt-hours annually, more than the entire country of Argentina, with a population 45 million [

34]. These problems are particularly illuminated in a recent review paper by Khezami et al. [

35].

However, there has been improvement. In 2022, the Bitcoin Mining Council reported that 58.4% of the total energy consumption associated with bitcoin mining was from sustainable sources: an increase of 59% from the prior year [

36]. In this vein, large-scale Bitcoin miners are now investing in renewable energy micro-grids to wholly support mining operations. For example, Orcutt describes the development of a 1400 MW wind farm in west Texas, USA, where the wind resource leads to a high wind-farm capacity factor, optimized to provide power exclusively to miners [

37]. Hirtenstein describes a 900 MW wholly wind-powered Bitcoin mining facility [

38]. Malfuzi et al. describes research using a renewably powered solid oxide fuel cell to power mining operations. Nearly all the scenarios they considered yielded negative economic impact [

39].

Still others see the technology behind Bitcoin as an enabling force to fight climate change. The ‘distributed ledger technologies’ (DLT) are noted as being capable of providing transparent accounting of energy and carbon use. With this technology, a digital token is envisioned to commercially incentivize and finance a global decarbonized economy to ensure that polluters, rather than governments, fund carbon reduction [

40].

Square’s establishment of the Bitcoin Clean Energy Initiative (BTCEI) goes even further. It espouses the opportunity presented by mining to accelerate the worldwide transition to renewables by serving as a complementary technology for clean energy production and storage. While solar and wind energy are now the least expensive energy sources worldwide, both suffer from intermittency. BTCEI sees miners as a flexible load option that could potentially help solve much of these intermittency and congestion problems, allowing grids to experience deeper renewable energy penetration. The BTCEI alludes to the possibilities of leveraging mining as a complement to renewable-energy micro-grids [

41].

Recent work by Bastian-Pinto et al. offers a more thorough perspective. They simulated the inclusion of mining into a wind-powered micro-grid. The scenario they considered was to optimally switch the generated power from the wind farm to the grid (community members) or to the mining operations, depending upon the relative future prices of electricity and Bitcoins. Their results show that the option to switch outputs significantly increases the generator’s revenue while simultaneously decreasing the risk of the micro-grid [

42].

- B.

Bitcoin mining profitability

What does 138 terawatt-hours per year for worldwide Bitcoin mining translate to in terms of the economic value that can be derived from the mining of Bitcoin? This annual energy demand is associated with a worldwide power requirement of 15.7 GW. This much power translates into a worldwide Bitcoin hash rate of 200 EH/s. Given BTC pricing (1 December 2022), this translates to about 9 billion USD/year in total income, assuming no energy cost. At 0.05 USD/kWh, the total income earned is 6.07 billion USD/year. At 0.10 USD/kWh, the annual total income earned is just over USD 3 billion.

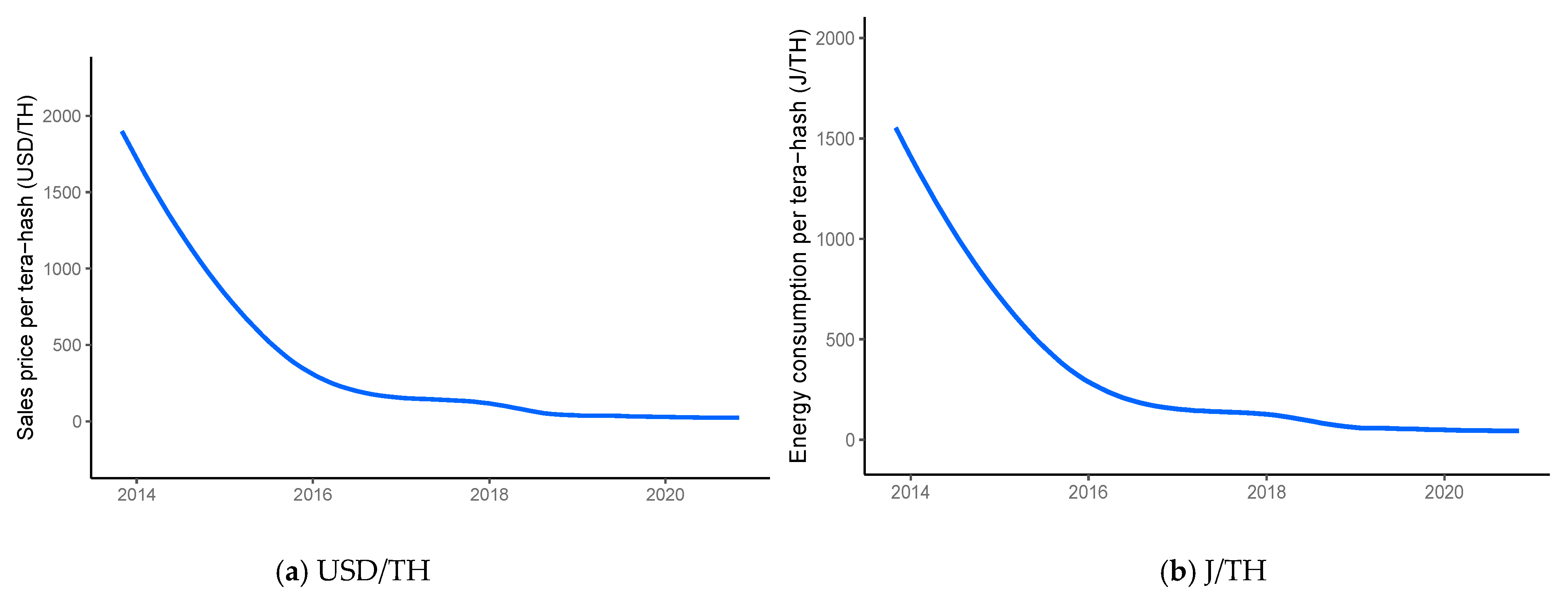

The income earned per hash, however, has been on the decline, as shown in

Figure 1a below. That the mining profitability per hash has declined significantly since 2015 is clear. At the same time, the energy efficiency of mining has improved considerably over the same time, as shown in

Figure 2. The latest and greatest miner, the Antminer S19 xp-Hydro has a documented energy efficiency of 27,000 MH/Joule. Thus, while the profitability of mining per hash has declined, the energy use per hash has declined even more. Thus, the cost to mine, assuming little change in energy cost over this time, has also declined. Mining profitability is, until very recently, perhaps as strong as it ever has been.

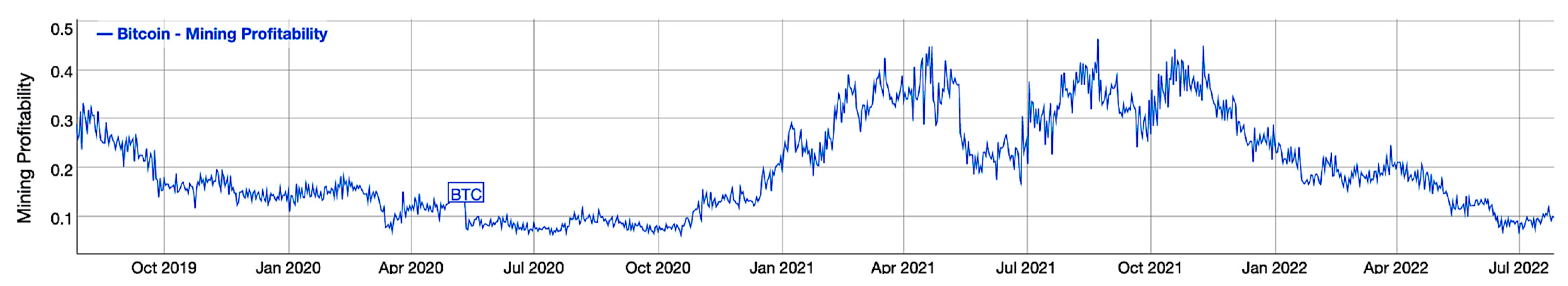

Recent profitability trends show greater risk over relatively short periods of time.

Figure 2 demonstrates this. The reward per tera-hash in US dollars is shown in this plot. The reward saw highs on the order of 0.45 USD/Th/day and lows on the order of 0.1 USD/Th in 2022, a fourfold-plus difference. Nevertheless, even the low reward rate of 0.1 USD/Th/day for the best mining technology in the world—currently the Antminer S19 xp-Hydro (255 Th/)—yields a simple payback of just over one year for a mining investment.

The future market for mining is likely secure. Removing the large dip in 2021 when the Chinese government disallowed Bitcoin mining in China overnight, one can see a consistent increase in world total hash rate over time (see

Figure 3). Plus, the development of the Lightning Network has been crucial for enabling Bitcoin to emerge as a financial transaction vehicle [

45,

46]. Fundamentally, this network enables millions of two-party financial exchanges at any time. Moreover, it allows transactions between parties not on the blockchain network. Last of all, like Bitcoin itself, this network relies upon blockchains of miners to process transactions. Thus, it offers transparency, permanent documentation, and anonymity. However, this benefit does come with some risk from hacking, as noted in the research of Lee and Kim [

47].

This network has enabled greater adoption of Bitcoin payment transaction pathways. Twitter, Starbucks, Twitch, Whole Foods, Microsoft, Wikipedia, AT&T, Overstock, PayPal, Home Depot, Burger King, KFC, Subway, Pizza Hut, Virgin Galactic, and AMC are among the early adopters of Bitcoin as a payment agency. This trend virtually guarantees greater adoption and thus an increased need for mining.

3. Opportunities and Needs

The Introduction established the importance of PUE strategies for improving the investment worthiness of solar mini- and micro-grids. It also established the importance of leveraging common processes for investment, solar mini- and micro-grid design and installation, and operations. Included in this notion of bundling are common PUE strategies, strategies that can easily be replicated in new solar mini- and micro-grids. Power Africa’s handbook of PUE solutions offers a means for such bundling, but there is a large gap between the handbook solutions and replication of the individual solutions in new communities.

In the

Section 2, a potentially easily scalable PUE based upon inclusion of Bitcoin mining operations in solar mini- and micro-grids was posed. The remainder of this section sought to establish this as a believable option, given trends associated with the increasing numbers of financial transactions requiring the use of Bitcoin (and thus increased Bitcoin mining) and the decarbonization of Bitcoin mining. It also illuminated the potential risk in including Bitcoin mining as a PUE strategy. This risk inevitably is associated with the fluctuating cost of Bitcoin and, thus, the rewards realized from Bitcoin mining.

In what follows, we seek to answer these questions. Can inclusion of Bitcoin mining as a PUE in solar mini- and micro-grids improve investment worthiness? If so, what mining requirements must be in place to mitigate the risk associated with fluctuating Bitcoin pricing and mining rewards? Furthermore, if scenarios can be established where integration of mining into mini- and micro-grids improves the investment worthiness, how might the recipient community gain the most benefit? Frankly, no other research that we know of has investigated these questions.

The following sections seek to answer these questions. In

Section 4, we develop a model to evaluate the potential. In

Section 5, we apply the model to different scenarios in both developing and developed countries. In

Section 6, we present the results of these scenarios. Finally, in

Section 7, we summarize the most important results and use these results to answer the questions just posed.

4. Model to Demonstrate the Potential of Impact Mining to Seed Solar Mini- and Micro-Grids

In this context, we examine as a common PUE strategy for micro- and mini-grids the inclusion of Bitcoin mining operations in several locations worldwide now being considered by the authors for pilot projects. The aim in presenting these emerging pilots is to demonstrate the potential economic value and economic risk of attaching Bitcoin mining to solar mini- and micro-grids. The following describes the assumptions employed and the generalized model used to predict this potential value.

4.1. Assumptions

Several fundamental assumptions guide the solution posed. First, the processes developed by ‘on-the-ground’ organizations already successful in developing micro-grids are considered essential. Organizations like Princeton Power Systems, Powerhive, and GivEnergy, among many others, know their clients and have already refined the processes to work with local villages and communities to gain buy-in for, develop, and install micro-grids. Organizations like these simply need access to funding.

Second, it is assumed that there will be future value in Bitcoin mining. The rate of increase in transactions based upon Bitcoin provides confidence in the future value of mining. Nevertheless, the analysis that follows considers both the high and low rewards from Bitcoin mining that was shown in

Figure 2 (e.g., 0.1 and 0.45 USD/Th/day, respectively). These rewards coincide with the rewards associated with mining in, respectively, August of 2022 and October of 2021. Thus, the investment worthiness of impact mining for different reward scenarios is considered.

Third, power for the mining operation will only come from renewable power sources. This is especially relevant to micro-grids added to existing utility grids. Here, we are only seeking carbon-free solutions for Bitcoin mining.

Fourth, the investors own the micro-grid with included mining operations over the investment period, and that the investment is made by impact investors. Thus, the interest rate is expected to be anywhere from 0–3%. That this is feasible derives from the fact that Bitcoin and cryptocurrency businesses have acquired significant wealth in a short time. There is real benefit to having Bitcoin and cryptocurrency be seen as a force of good in terms of cementing Bitcoin as a worldwide currency. Thus, there is very strong interest by Bitcoin-related businesses to make highly visible impact investments.

Last, after the investment period (from 3–10 years depending upon the product and the goals for the micro-grid), ownership of the micro-grid transitions to the recipient village or community. This means that the community will be able to expand the power available to them to do with as they deem fit. The investment period will then be associated with community development efforts, whereby the community will receive guidance about what they might do with the additional power originally powering the miners.

4.2. Generalized Model

In this section, a general model needed to validate the potential for Bitcoin mining as a productive use of energy to improve the investment worthiness of solar mini- or micro-grids anywhere in the world is described. The model generally considers the local solar resource needed to develop an optimal solar sizing and rewards for mining in these grids. The mini- and micro-grid connection to the community is likewise defined. The following details the model process employed.

- a.

Solar and Demand Modeling.

For any site, the local solar resource and weather conditions are needed, respectively, to estimate the solar irradiation flux and to assess the cooling requirements for mining operations. The Department of Energy’s Energy Plus program features weather files that are available for many worldwide locations [

49]. The metadata for the ‘epw’ files is available from the US Department of Energy [

50]

The generalized model process must also account for the mining hardware employed and the rewards derived from mining. Considered are different BTC mining rigs, ranging from the S9 (14 Th/s) device that was unveiled in 2017 to an S19 pro (140 Th/s) and finally to the present state of the art, namely an S19 xp hydro miner (255 Th/s). The former has nearly lost any value for Bitcoin mining unless the energy cost is close to free and if it is donated. Here, we are looking at this technology as a potential donation, a feasible assumption because active miners with this equipment are happy to see them emerge for a higher purpose. The mid-range miner, because the recent reduction in mining rewards has seen the purchase price drop immensely, has units now available for nearly USD 4000 (December 2022). It may even be possible to acquire these units at substantially lower costs for active miners who have seen the value of these units decline substantially, but who might be excited to see them be used for social impact. Last, the high-end S19 xp hydro unit currently costs more than USD 9000, much lower than its cost one year ago.

For all the scenarios considered later, the only differentiators are the size of the micro-grid and the type of solar system (fixed or 1-axis tracking, depending upon the scenario). The latter is considered for community-scale solar systems; otherwise, fixed-tilt systems are considered. Battery storage is considered in some cases. In some other cases, a biomass generator is considered as a potential add-on to the micro-grid to account for extended cloudy periods. In all cases, PVWatts [

51] is used to estimate the hourly solar production per each kW of solar capacity, depending upon the type of solar installation assumed.

In this work, demand loads need to be established for the various communities. Here, several impact-mining scenarios are focused on improving existing micro-grids or on establishing new micro-grids to meet community load in “new to power” villages in Africa. The per household loads tend to be small and present mostly in the evening. NREL’s rural Africa demand profile is used for these cases [

52]. Such data are generally available hourly for a typical day. Thus, for these cases, the model developed unfortunately does not account for daily and seasonal variation in energy use by the communities considered.

The miner demand in the models will be constant power if there is sufficient supply of power available from the solar PV system, generator, or batteries. For now, it is assumed that no additional power, other than what is already present in a miner or miners, is required to cool them.

- b.

Investment Modeling.

Two options for investment exist. In the first option, the impact miner invests in all the systems present in a project. These systems include the solar micro- or mini-grid, as well as the miners. The intent for this option is for the impact miner investor to couple the economic assets from the miners with the mini- or micro-grid to improve the investment worthiness of the project.

The second is for the impact miner to invest only in the Bitcoin mining equipment, then pay for the energy supplied to the miner. This type of investment option may make sense for existing solar micro-grids, where there might be substantial curtailment of the solar resource. For example, in Nigeria, new under-grid mini-grids have been developed to accommodate a nonreliable, government-run electrical grid system [

53]. These ‘behind the meter’ mini-grids are developed to ensure a nearly 100% reliable electrical supply, but curtailment in this type of grid can be more than 60%. Bringing in mining operations to utilize this wasted renewable energy can reduce or eliminate this curtailment and generate income. Miners would pay for electricity at a rate low enough that they can still earn a profit, or at a rate nearly equal to the mining rewards they earn, minus the investment payback for the miners themselves. In either case, this income can lower costs for energy users and improve the investment worthiness of the project.

There are open-source tools to optimize micro-grids. NREL’s REopt is most prominent [

54]. However, the addition of miners in the mini- or micro-grid, along with the desire to meet both short-term and longer-term community goals for power, requires a new optimizer. The following optimization process is employed for developing this new tool.

Define community goals for power in the short term and in the long term (post-investment period).

Define the initial community load.

Define the miner load needed to improve investment and meet long-term community needs.

Define the optimization parameter and constraints.

Implement the optimization.

In all scenarios, a genetic algorithm optimization is employed [

55]. A population for each generation of 25 is established. Additionally, to enable the solution to reach an optimal condition, 250 generations without improvement in the result is permitted before the optimization is stopped.

5. Case Studies

Table 1 summarizes the context for each of the impact-mining scenarios considered here, identifying the community/city/village, their present context, their short-term power needs, and the long-term interest, something that few of the communities have had the luxury to consider. While impact mining has the potential to increase the investment-worthiness of solar mini- and micro-grid projects, the continued presence of impact mining post-investment payback is up to the recipient community, as in general they would be the owners of the mini- or micro-grid at this time. They can choose to purchase new miners to generate income for their communities, or discontinue the mining entirely, using the now lower-cost power originally dedicated to mining for other purposes. These other purposes could include increasing power for community members, dedicating power to new “Productive Use of Energy” technologies and systems, and more. The investment period will thus coincide with planning for power use and life in the community after the impact-mining investment period.

In general, these scenarios were selected because they: (i). represent active potential sites for actual projects with on-the-ground partners; (ii). collectively offer differences in terms of the available solar resource (sub-Saharan Africa, South Asia, Midwest USA, and the Middle East); (iii). offer differences in mining technology, with consideration of donated S9 Bitcoin miners, medium-range and relatively low-cost S19 pro miners, and the current state of the art; namely S19 xp hydro miners; and (iv). offer variation relative to the value derived by the community.

Scenarios 1 and 2 look at adding medium-range, relatively low-cost Bitcoin miners to an existing solar micro-grid in a small village in Ghana. The evening dominant power use of this community results in significant curtailment of solar energy production, as the micro-grid is over-sized to sustain access to power during the so-called rainy season. In this case, an impact miner would pay for the use of this power for each kWh consumed by the miner. The income derived from the power sales to the miner would be used to reduce the price of power paid for by the villagers. The only difference between these cases is the inclusion of batteries in the investment for Scenario 2.

Scenario 3 is for a similar-sized village in Liberia currently without access to electricity and with a serious food scarcity problem during the rainy season, where on average more than half of the food grown locally spoils or is eaten by pests. In this scenario, high-end S19 xp hydro miners are considered to help improve the investment worthiness of a solar micro-grid to primarily meet lighting loads in the village, along with a cooling load for a new refrigerated food storage building. The short-term power goal for this village is to meet the community loads with affordably priced power. For the long term, the aim would be to shift use of the power initially supporting mining functions to provide low-cost power for other needs defined by the village.

Scenario 4 considers a similar situation to Scenario 3, except in a different location (Afghanistan), where the solar resource is less. The area targeted is representative of an area historically controlled by the Taliban, where villagers have negligible economic opportunity. Energy is central to creating such opportunities.

Scenario 5 focuses on a solar mini-grid optimized to support only Bitcoin mining for the US Midwest. The income derived from mining every year pays for operations and maintenance, as well as loan payback. The remaining mining income can potentially create a cash flow into a green bank, which could be used and controlled by the recipient communities to invest in themselves.

Last, Scenario 6 showcases yet another socially beneficial pilot currently being engaged in, this time to reduce the energy burden associated with low-income residents in a developed-world context. A case in the US is considered in this context simply because of the significant footprint of Bitcoin mining in the US (37% of the world’s Bitcoin mining is now in the US). The US federal home weatherization program facilitated through the Home Weatherization Assistance Program (HWAP) has typically subsidized energy reduction in such residences to reduce the energy burden [

56]. If solar could be added to such residences, energy costs could be reduced substantially more. Here, donated S9 Bitcoin miners and a roof-mounted solar system to power these are added to the residences to generate mining income to help pay back the investment. Additionally, the heat output from the miners is assumed to support water heating all year round. After the loan is paid off, ideally in a short period of time, the house would ‘own’ the solar micro-grid. As a result, long-term energy burden reduction would be assured, all while realizing significant savings during the payback from the water-heating benefit provided by the miner(s).

Table 2 shows the optimization parameter, constraints (if any), and the case-specific assumptions, including cost assumptions, for each of the scenarios analyzed. The pricing assumptions included capital costs for the Bitcoin mining rigs, solar and battery micro-grids, and the income derived from sales (power, food, and water). Typical operation and maintenance costs (20 USD/kW for solar PV systems, 10 USD/kWh for batteries, and 25 USD/kW for bitcoin miners) are employed, citing references for solar PV and battery systems [

57] and Bitcoin mining rigs [

58]. The loads prescribed to meet community needs are also specified via plots for each of the scenarios where such data are relevant.

Most importantly, in this table, as this study examines the potential for impact mining to improve the investment worthiness for the systems considered in each of the scenarios, a realistic bound on the rewards from mining is set. The maximum bound for the reward is set to the maximum (bullish) reward for USD/Th/day from

Figure 2 (0.45 USD/Th/day). The minimum bound for the reward is set to the minimum (bearish) reward in the same figure (0.10 USD/Th/day). It is emphasized that this minimum reward coincides with the lowest Bitcoin price for nearly a decade. It is unlikely that mining income will stay at this level, especially given the trend associated with increased use of the Bitcoin Lighting Network.

In Scenarios 1 and 2, the optimization is that mining never interrupts the community load. The aim of the optimization is to lower the cost per kWh for community members the most. The investment is not worth doing unless it has a positive impact on the villagers. In Scenario 2, in contrast to Scenario 1, the impact miners would also provide the investment needed for batteries to increase the duty cycle of the miners.

In Scenarios 3 and 4, the optimization focuses on minimizing the investment return period. Considered in both scenarios is the addition of biomass generators to deal with extended periods of cloudiness. In addition, in both cases, the power cost to the community is designed to be small, 0.10 USD/kWh, relative to what they would pay were Bitcoin miners not included in the project. Furthermore, the micro-grid is expected to meet the community load at least 90% of the time. Thus, power for the community would be prioritized over directing power to the mining operations.

In Scenario 5, the income generated for a green bank for the recipient community is to be maximized, given a 10-year return on investment. The impact investors’ investment would be paid back through mining rewards alone. After the 10-year investment period, the community would own all systems. The assumption here for the Midwest US community is that the mining operations will be present in the low- to moderate-income (LMI) community receiving the green bank funding. As such, this community is eligible for a sizable tax credit up to 60% recently made available by the US government through the Inflation Reduction Act (IRA) [

59]. It specifically creates a 40% investment tax credit for solar or wind projects located in a low-income community and 20% for facilities part of low-income residential housing or low-income economic benefit projects [

60]. As a result of this policy, there is real opportunity to invest in community solar projects in such communities. Unfortunately, the potential to get a solar farm approved and tied into the grid within the time window afforded by the IRA is almost impossible. For example, in the US Northeast PJM utility grid system, there is a backlog of projects awaiting approval for grid tie-in [

61]. Proposals have been waiting a year and often longer for even consideration by the PJM. The time lag between project proposal to completion is now on the order of seven years.

An impact solar-mining farm, where the solar system would effectively be ‘behind the meter’, makes immediate sense for the US site. This type of installation does not require authorization from the grid manager. Moreover, any excess solar produced from a solar farm powering a mining operation would be able to access the required net-metering purchases from the utility provider at a rate that now ranges from 0.07–0.08 USD/kWh.

Last, for this scenario, the solar/battery system depreciation amount is (1–0.5× investment tax credit). Both this value and the mining investment can be depreciated at a rate of approximately 30%.

Last of all, in Scenario 6, the simple payback is again the optimization parameter to yield the biggest impact on energy cost as quickly as possible. The optimization parameters include solar and battery capacity. This scenario considers a single donated Bitcoin miner.

6. Results

Table 3 presents the results for each of the scenarios. Included in the optimization are the best values for the parameters defined in

Table 2 and the optimal fitness value.

In Scenario 1, the addition of a relatively low-cost single S19 pro miner to an existing solar micro-grid, where the impact miner pays 0.10 USD/kWh for the energy used for mining, yields very little benefit for the community. The income derived from selling the sporadic excess solar production is insufficient to offer any benefit to the community. Consequently, the duty cycle for Bitcoin mining, independent of the number of miners used, is very low (0.048). The economic payback for investors, who also want to see social benefit, is small.

In Scenario 2, additional battery storage is included in the impact-mining investment to effectively spread out the excess solar production to enable higher mining duty cycles. At the same time, a higher mining duty cycle means that there are more energy payments made to the community for the mining energy used. This income is considered to reduce the cost of power for community members, which is exactly what happens here. The optimal condition is associated with the use of two medium-end S19 pro miners and the addition of 103 kWh of battery storage. The simple payback for investment for bullish and bearish scenarios for mining are, respectively, 4.67 and 57 years—quite a difference. Both are associated with a mining duty cycle of 0.4 and payments made to the community for mining power of 0.10 USD/kWh. The income received by the community for mining energy use has a gigantic effect on the energy affordability within the community—reducing the power purchase price from 0.45 USD/kWh to 0.243 USD/kWh. If the payment for mining energy to the community were to be cut in half, the community energy pricing could still be reduced substantially to 0.33 USD/kWh, but the risk to the investor would be lessened. For bullish and bearish mining-reward scenarios, the simple payback for this case reduces to 4.1 and 26 years, respectively.

In Scenario 3, whether a micro-grid optimized to meet both community and mining load yields less risk for the impact mining investment is tested. The results strongly show how the risk to the investment has been mitigated. First, the community load is shown to be met, but with the community paying 0.10 USD/kWh instead of the typical new-to-power community rate of 0.45 USD/kWh, were the micro-grid to be present without parallel mining operations. A total of five miners are considered here. For this case, the bullish and bearish mining simple paybacks are 1.04 and 4.74 years, respectively, owing to a mining duty cycle of 84%. The required solar capacity, battery capacity, and biomass generator are, respectively, 12.1 kW, 162 kWh, and 8.9 kW. Furthermore, this scenario relies upon the present state of the art in mining technology. This equipment yields the best investment payback and community result, and it represents roughly a twofold increase in power capacity relative to the baseline grid needed to simply meet the initial community load. Thus, at the end of the investment period, the community will have control of more than two times the size of the micro-grid that would have been developed for them without the miners.

Scenario 4 considers the same premise as Scenario 3, with the only difference being a location with a lesser solar resource and a community power load that is nearly all in the evening hours. For this case, the baseline micro-grid (without mining) is associated with a solar capacity of 50 kW and a battery capacity of 258 kWh. Assuming a community energy payment of 0.10 USD/kWh, the payback period of 27.8 years represents a nonviable impact investment. The investment results associated with the inclusion of miners are far better. For 2, 5, 10, and 20 miners, the respective bullish/bearish simple paybacks are, respectively, 3.71/14.6, 2.7/12.2, 2.33/11.7, and 2.14/11.1 years. The lower solar resource increases the payback period compared to Scenario 3. The bearish payback period is, however, still within the realm of impact investment, especially with a greater number of miners, but the size of the micro-grid increases as the number of miners increases. Two miners effectively double the size of the base micro-grid. Five miners more than triples it. Twenty miners are associated with 10 times more capacity than the base micro-grid.

Scenario 5 seeks to show the potential of a mining-dedicated solar micro-grid from generating a source of income that an underserved and under-resourced community could use in the form of a green bank for self-investment. An impact investment framework is employed, where the investment is recovered over a 10-year span. In both cases, a 4 MW solar micro-grid is assumed. The results are very good. For the US Midwest site, a bullish scenario yields an annual income stream of USD 2.1 million per year, while in the bearish scenario, there would still be a USD 155,000 annual income stream. The positive income stream in this case for the low mining income scenario is completely a consequence of the progressive federal policy to advance renewable energy in LMI communities. The income flow without the generous investment tax credit would be −USD 0.42 million per year. Finally, for Scenario 5, after the investment period, after operating costs are considered, the community would have access to an income stream of USD 1.2 million even in the bearish scenario through the remainder of life of the solar farm.

Last of all, in Scenario 6, we see that donated older-model miners added to a low-income residence can render a simple payback of 3.56 and 7.5 years for bullish and bearish mining scenarios, respectively. As well, the resident of the house could derive annual water-heating savings of 212 USD/year from the heating collected from the miners during the payback period. This is about a 15% reduction in overall energy cost. Additionally, post-investment after the removal of the miners, residents would reduce their energy costs by approximately USD 1300 per year through the use of solar to support the residence load and through net-metering energy sales back to the grid. This translates roughly to a 75% reduction in energy cost. The energy burden associated with the house becomes almost negligible. The time to get to this very exciting impact could easily be reduced through allocation of HWAP funds to the project.

7. Conclusions

This study has envisioned the possibility of impact mining to seed solar micro-grids to impact communities beneficially. It has demonstrated that inclusion of Bitcoin mining operations in solar mini- and micro-grids can improve their investment worthiness, albeit with some risk associated with fluctuating rewards earned from Bitcoin mining. At the same time, some scenarios considered have shown significant community benefit, including lower power rates over the life of the micro-grid, increased low-cost power after investment payback, and establishment of a green bank from profits derived from mining to enable self-investment in their own communities. A bullish Bitcoin-mining rewards consideration makes all such investments almost automatic. A bearish Bitcoin-mining rewards structure still enables an impact investment (longer-term investment periods) to achieve community benefits, and especially so in new-to-power solar micro-grids and in low- to moderate-income communities in the US with access to very generous solar incentives. For example, for a bearish mining reward, the impact solar-mining micro-grid scenario considered in Liberia renders a payback period of 4.74 years with a community energy cost requirement of only 0.10 USD/kWh, well below the typical 0.49 USD/kWh for new-to-power solar micro-grid communities. Even more impactful, after the loan is paid back, the community will have access to more than two times more power than a normal micro-grid will offer. They will own the micro-grid and will have ownership of how the load allocated to mining can be used. It will be their choice alone to continue mining for the income derived or to add other loads to aid their community’s economic development.

Overall, the scenarios, which represent active pilots for the authors, have informed the following conclusions relative to the guiding questions for this research. First, the inclusion of Bitcoin mining as a PUE in solar mini- and micro-grids can, under the right circumstances, improve the investment worthiness of such grids.

However, some conditions lead to neutral to negative PUE impact only. For example, Bitcoin mining reliant only on excess power generation from solar mini- and micro-grids offers only neutral to negative economic benefit even in a bullish mining-rewards scenario (Scenarios 1 and 2). Additionally, reliance on older Bitcoin-mining technologies offers little economic benefit unless the heating provided by the miner(s) can be used productively (Scenario 7).

On the other hand, impact mining reliant on the use of state-of-the-art mining hardware offers economic value to communities even in bullish mining-rewards scenarios (Scenarios 4,5). Benefits can be derived both in a developing- and developed-world context.

There are numerous limitations of the research that must be explored further. For example, mining rewards per hash are certain to decrease with time. First, reliance upon a fixed hardware for mining will render lower rewards over the life of an investment. For example, the S9 miner, which was introduced in 2017, has retained little value after five years relative to Bitcoin mining unless they are a donated asset and unless the energy cost for the mining operation is zero (e.g., the mining income is only used to benefit the recipient community). The reality is that investment periods longer than five years will likely require re-investment in new mining hardware after four or five years, even when purchasing the best available mining hardware at a project inception.

Second, the model developed to evaluate the potential of inclusion of Bitcoin mining as a PUE in solar mini- and micro-grids needs more accurate consideration of the variability of Bitcoin pricing and its impact on mining and mining hardware, such as described by Prat and Walter [

61].

Third, the ability to bring mining to different places in the world is not assured. For example, cryptocurrency transactions are now banned in the Cemac zone (Cameroon, Central African Republic, Congo, Gabon, and Equatorial Guinea) in Africa. This decision results from a desire to “guarantee financial stability and preserve customer deposits” [

62]. The fact is that Bitcoin mining rewards generate Bitcoin, not local currency. If the impact miner owns the mining asset, and they are located outside of the location where cryptocurrency transactions are not permitted, this is not a problem. They will be able to collect the rewards and either store them or convert them into local currency. However, if the mining asset is owned by an organization within the cryptocurrency-banned region, then a solution is needed to convert earned Bitcoin into local currency, and at little cost.

Last of all, the ability to transport Bitcoin miners into different locations worldwide is also not assured. Several countries have banned or restricted Bitcoin mining [

63,

64]. However, this has occurred because Bitcoin mining was riding on the existing grid. Large mining operations could not be supported by the local grid system. Even if the miners can be transported into a country, the cost of transport can be exorbitant, especially if transporting in small quantities [

65].

However, the potential impact is worth moving forward. In

Section 2, the total worldwide mining power demand was stated to be in the range of 15.7 GW. What if a small fraction of this power could be used to seed solar micro-grids?

The US NREL established a typical load profile for a rural village of 100 households (~450 people) in sub-Saharan Africa gaining access to power for the first time through a solar micro-grid. Assumed is a load profile that meets all household power needs, along with power needs in one school and two small businesses. A daily village-level total energy demand of 54 kWh is estimated, translating into an average power demand of 2.25 kW or 0.005 kW/person.

If solar/miner micro-grids could be established, where the power allocated to mining within a community would be three times the original community demand, the effective mining load per person would be 0.015 kW. If 100% of the mining load worldwide were to be allocated toward mining to seed village micro-grids, over 1 billion people could be given access to power for the first time. Plus, in five years, the mining operations could be moved elsewhere. Another 1 billion people could be impacted.

Utopian. Yes. But unrealistic? No. Bitcoin advocates want to see this currency emerge as the world currency. They want it to be seen as a force for good.