1. Introduction

Due to the COVID-19 pandemic, the global energy supply chain has been reforming at an accelerated pace. Energy is the basic material condition for human society to survive and develop. It is a matter of national security and long-term stability, involving the comprehensive development of national strategies. In modern society, the energy industry is concerned with the reconstruction of the world order, so promoting the transformation of the energy structure has now become the consensus of the international community and the energy industry [

1,

2,

3]. Against the backdrop of increased uncertainty in the world economy, the ability of China’s energy sector to ensure supply chain security and stability will have a decisive impact on whether China’s economy can achieve sustainable development. As a major energy-demanding country, the national government has continuously provided preferential policies for relevant enterprises, emphasizing “Internet+” and intelligent energy enterprises. General Secretary Xi Jinping also proposed to promote the energy industry revolution, build intelligent energy systems, and strengthen new energy consumption and reserves, thus continuously optimizing the energy industry supply chain, promoting the further transformation and upgrading of the industrial structure of China’s energy development, and supporting the subsequent energy development. Digital industrialization refers to the provision of digital technologies, products, services, infrastructure, and solutions for the digital development of industries as well as various economic activities that are completely dependent on digital technologies and data elements [

4,

5]. In the historical process of upgrading the energy industry, the technological revolution has been the decisive factor [

6,

7]. With the wide application of new-generation information technology, the energy supply chain has gradually developed into a digital supply chain with the deep integration of digital technology. The deep integration of digital technology in the energy industry empowers the transformation and upgrading of the traditional energy industry. By empowering the supply chain with new features such as big data support and networked sharing, the transparency of information is enhanced for all aspects of the supply chain and promotes the efficient operation of the energy supply chain. Therefore, under the current situation, studying the relationship between digital industrialization and the energy supply chain is in line not only with the future trend of digital economy development but also with providing a decision-making reference to further promote the development of the digital economy, the transformation and upgrading of energy industry structure, and supply chain efficiency.

With the deepening effect of digital industry on global economic development, theoretical innovations in the field of the digital economy have been increasing in China. Among them, research related to the upgrading of the energy industry in the context of digital industrialization has been a research focus of scholars [

8,

9,

10,

11]. It was found that digital industrialization helps stimulate industrial structure optimization [

3,

12,

13], which is important for the energy industry [

14,

15]. Thus, this article reviews the following four facets found in the literature:

First, regarding the impact of digital industrialization on the energy industry, the existing literature focuses on three aspects: intelligent change in the energy industry, the reform of energy-related enterprises, and the impact on other industries. (1) During crisis situations, emerging digital technologies are relevant in dealing with supply chain disruptions [

16]. Some scholars focused their research on the impact of epidemic outbreaks, particularly on the supply chain [

17]. Digitizing supply chains and networks reduces design complexity and improves energy industry connectivity and resource flows, which helps to manage existing energy strategic relationships while identifying new possible ones [

18]. In terms of digital industrialization promoting the intelligent transformation of the energy industry, digital transformation is crucial to the high-quality development of the energy industry. The realization of the digital industrialization of the energy industry can effectively boost the transformation and innovation of the energy supply chain and promote the realization of digital intelligence [

19,

20]. Digital industrialization is also the key to realize the “double carbon” era and accelerate the digital and intelligent transformation of the energy system [

9,

10]. (2) The COVID-19 crisis triggered supply chain disruptions that made it challenging for firms to continue operating, especially SMEs [

21]. In these highly competitive but poorly supported business environments, the energy industry needs to generate relevant innovations and technologies to improve its performance and competitiveness [

21,

22]. COVID-19 has fast-tracked the ongoing digitalization trends, so more industry players are now aware of the urgency of investing in new technologies [

23,

24,

25]. Digital industrialization affects the reform of energy-related enterprises, and digitalization profoundly affects the business model, organizational management, resource allocation, and business evolution of the energy industry [

14,

15,

26]. (3) The digital transformation of enterprises has created workforce issues in the supply chain to reduce overall expenditures [

27]. COVID-19 has impacted digitalization worldwide. The growth rate of SMEs has increased significantly, which is entirely due to the advent of digital technology [

28]. Some researchers believe that COVID-19 is forcing enterprises and other traditional manufacturers to realize the benefits of digitalization. Digital industrialization improves the efficiency of information exchange and competition in the energy industry by influencing the development of other industries. The digital industrialization of energy enterprises is a new industry and a new business model, following the collision and integration of IT and enterprises in the industry, which can effectively improve the efficiency and reliability of the whole industry. Digitization is an effective way to promote the comprehensive competitiveness of the energy industry and strengthen energy competition [

9,

29]. The utilization of relevant digital technologies can stimulate the productivity of digital processes by converting all paper documents into electronic documents using the various e-services available throughout the country [

30]. Digital industrialization allows SMEs to address labor issues, manage operational costs, reduce overall expenses, and address COVID-19 challenges [

27]. The use of emerging technologies can stimulate productivity, as SMEs can digitize their processes, convert all their paper documents into electronic documents, and migrate to e-commerce services [

30]. This can also help alleviate challenges and reduce lengthy administrative procedures. Digital industrialization offers new opportunities within the global economy, with a greater impact on SMEs and the IT ecosystem.

Second, regarding the impact of digital information technology on the energy industry, some scholars believe that digital information has become a characteristic of current development and that it will promote the change of the energy industry and empower the low-carbon transformation of cities, while others believe that digital industrialization disturbs the balance of the energy industry. The core insistence of digital technology is to introduce digital transformation through the Internet [

31], design corporate operations, reduce budget shortfalls, send digital standard information through smartphones, increase the utilization of the Internet, and make people aware of Internet facilities. On the one hand, the future of the energy industry should be led by digital information technology, giving full play to the advantages of the digital economy, accelerating the digital and intelligent transformation of the energy industry, and improving the stability and competitiveness of the supply chain [

32]. Digital technologies are now considered key to sustaining productivity and other downstream activities [

33]. Many studies proved that artificial intelligence and other digital technologies can improve social capital and increase supply chain productivity [

18]. In addition, some proposed adopting practices and restructuring supply chains to account for the carbon emissions related to digital technologies [

34,

35]. Digital technologies also help to align environmental resources. Digital information technology promotes energy-efficiency improvement, green-technology progress, and industrial-structure upgrades to empower urban low-carbon transformation [

9,

10,

36] and improve the structure of the energy sector [

37]. On the other hand, digital information technology developments are disrupting the industry and putting the ecosystem in the innovation spotlight, so the energy sector is under pressure to nurture and manage the ecosystem in the innovation process [

38,

39]. Although companies see the short-term benefits of digital technologies, they remain skeptical about their usefulness after the pandemic [

40]. It is relevant that attacks related to digital technologies, such as artificial intelligence, machine learning, and 5G networks, have increased significantly [

41]. Many plants use automated technology with the workforce located off-site, while the shop floor is connected to digital technology, which exposes energy plants to cyber-attacks.

Third, regarding the impact of digital services on the energy sector, scholars argue that digital services will drive economic growth in the energy sector. In the context of carbon neutrality, digital services empower countries to achieve net-zero growth in carbon emissions [

29]. Research suggests a combination of servitization and digitalization, that is, the adoption of smart servitization and digital servitization for other smart connected products to provide advanced services to customers in the COVID-19 era [

25,

42]. Advanced services provided through a digitally based servitization model are more likely to perform better in a disruptive situation such as a pandemic than vendors who limit themselves to basic services [

42]. The use of platforms provided by digital services is cost-effective and often yields greater efficiency than traditional methods of information exchange [

43]. Digital services have become the key to economic growth in the energy sector, which is significant for countries’ economic growth as well as for combating climate warming. In the current digital era, the energy industry is facing a transformation dilemma, so more and more energy companies are pushing to transform the core of their value creation from providing energy products to providing energy services; the core of such energy services is data services or data application services [

44,

45].

Fourth, regarding the impact of digital infrastructure on the energy industry, scholars believe that the construction of digital infrastructure will support the development of the energy industry, which is proposed to strengthen the construction of digital infrastructure, so the digital economy has become an important driving force for high-quality economic development [

46]. The adoption of digital infrastructure is effective in improving supply chain visibility and addressing other adversities [

18,

47]. The extensive penetration and application process of digital infrastructure construction in other industrial sectors stimulates innovation in the energy industry [

37]. Digital systems in smart cities and infrastructure serve to modernize the new energy industry [

38]. Digitization makes infrastructure and cities “smarter”. The use of physical space and energy; the transmission of information; the management of users, assets and processes; and the operations of businesses and enterprises have been progressively digitized [

48]. Strengthening digital infrastructure is an important way to achieve green and low-carbon energy development [

49].

The existing research results expanded the research horizon in the field of digital economy and energy, provided a rich theoretical and practical basis for the formulation of China’s energy policy, and made important contributions to promoting the upgrading of China’s energy industry as well as China’s digital transformation, but there are still the following shortcomings: (1) Most of the current studies involve the overall impact of the digital economy on the energy industry, but there is little in the literature based on theoretical models and empirical analysis to study the impact of digital industrialization development on the length of the supply chain in the energy industry. (2) There are relatively few studies in the literature that consider the nonlinear impact of digital industrialization on the energy supply chain. (3) The analysis of the heterogeneous impact of digital industrialization on the energy industry is not rich enough.

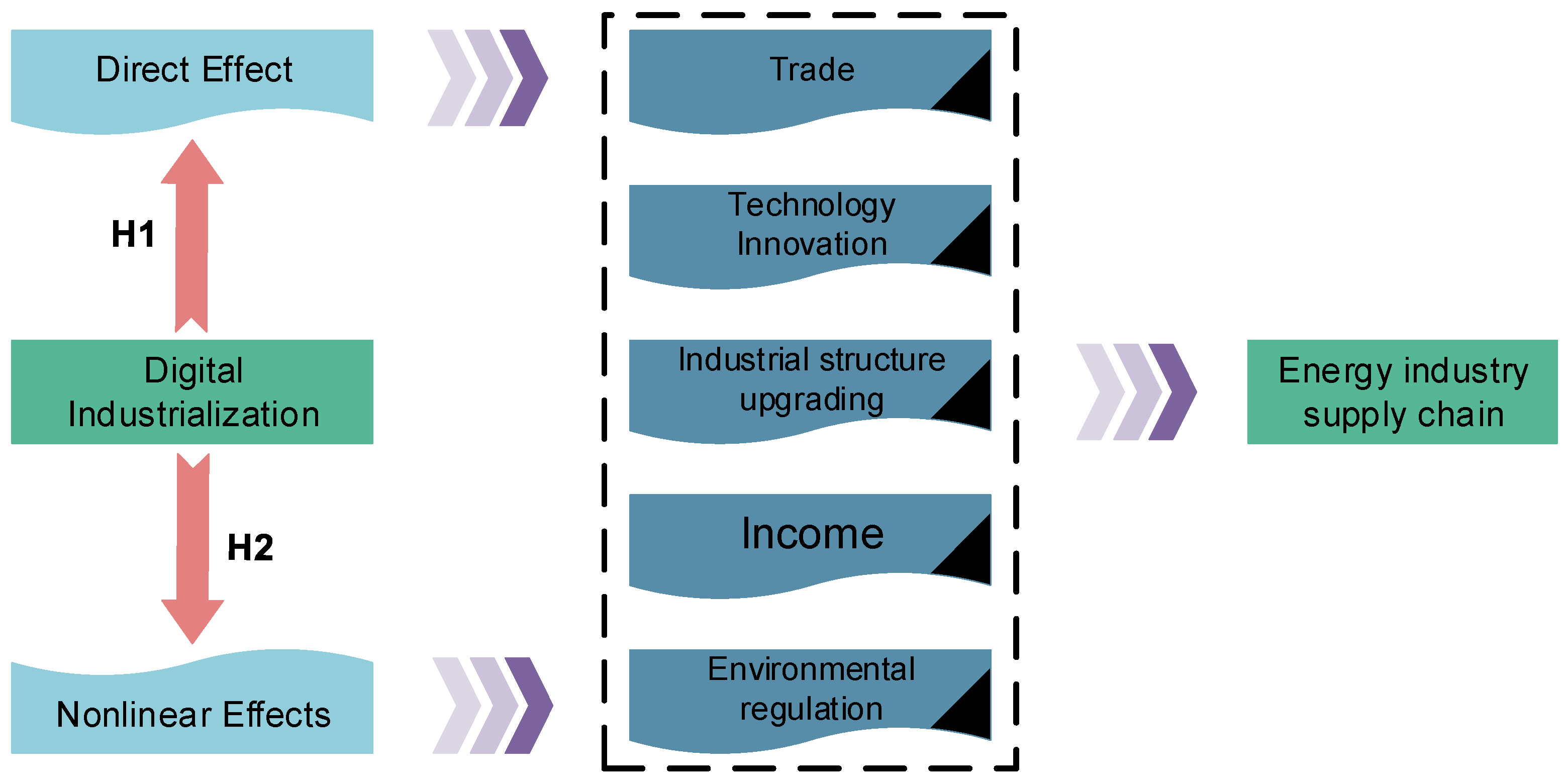

Compared with the existing studies, the marginal contributions of this paper are mainly in the following aspects: (1) Drawing on the existing literature, we construct indicators of the digital industrialization and supply chain length of the energy industry from the provincial natural gas level and study the correlation between them to make up for the research deficiencies. (2) In terms of research methodology, the panel threshold regression model is used to analyze the impact of the digital industrialization level on energy supply chain length, to make up for the lack of analysis of nonlinear effects in the existing literature. (3) This article studies the heterogeneous effects at the levels of segmented industries, time, and regions and further deepens the analysis of the inner mechanism of digital industrialization for the digital empowerment of supply chain length in the energy industry, which makes this paper’s research more policy-relevant and enriches the related research theories. Based on our research contributions, the results show that there are multiple threshold effects of digital industrialization level on energy supply chain length. Meanwhile, there are differences in the impact of digital industrialization on the energy supply chain from sub-sectors, regional development differences, and different development periods. This is crucial to the current realization of “double carbon” and energy security.

The remainder of the article is organized as follows.

Section 2 investigates the theoretical basis and proposes hypotheses.

Section 3 introduces the econometric model and data. Empirical results are presented and analyzed in

Section 4.

Section 5 builds the mechanism test and

Section 6 concludes the article and gives policy suggestions.

4. Results

4.1. Benchmark Model Estimation

4.1.1. Testing

Before the regression analysis, in order to avoid spurious regression, the panel data are first tested for stationarity. LLC is used to test whether the data have a unit root, and basically the test results significantly reject the null hypothesis, so the model does not have unit root. Then, the panel cointegration test is used to determine whether there is a long-run equilibrium between the variables, which shows that there is a long-run equilibrium relationship between each variable’s energy supply chain length and digital industrialization. The above tests indicate that the research panel data possess smoothness, which improves the reliability of the regression results. The test results are shown in

Table 2. Meanwhile, the White test and BP test found that there is heteroskedasticity in the data, and we corrected the data by using the weighted least squares (WLS) method.

Figure 5 represents the LR statistics of the threshold estimation with the level of digital industrialization (

addvaluerate) as the core variable. The vertical axis represents the value of the likelihood ratio function, and the dashed line represents the threshold value at the 95% confidence level. Among them, the confidence intervals of the first threshold of supply chain length, the confidence interval of the second threshold of supply chain length, and the confidence interval of the third threshold of supply chain length are represented in

Figure 5. According to the likelihood ratio test formula proposed by Hansen, when

, the original hypothesis is rejected. When

, the critical value of the LR statistic is 7.35. According to

Figure 5, the single, double, and triple thresholds of the effect of the level of digital industrialization on the length of the natural gas supply chain pass the significance test. Therefore, the estimation results of the triple threshold are mainly explained below.

4.1.2. Preliminary Estimates

Columns 1–3 of

Table 3 report the results of the regressions using the mixed OSL, fixed effects model, and random effects model, respectively, to preliminarily investigate the effects of digital industrialization and each control variable on the length of the natural gas supply chain. The coefficients in the mixed OLS and random effects models for the level of digital industrialization are significantly negative, while the estimated coefficients in the fixed effects model are positive; however, the results are not significant, indicating that the level of digital industrialization and the length of the natural gas supply chain are negatively correlated and that the increase in digital industrialization level is conducive to shortening the length of the supply chain in the natural gas industry. For the control variables, the estimated coefficients of GDP per capita, patent licensing, and technology-market turnover are significantly positive, indicating that the increase in GDP per capita, patent licensing, and technology-market turnover lengthens the supply chain length of the natural gas industry. FDI significantly shortens the supply chain length of natural gas under the estimation of mixed OSL and random effects model, which is not significant in the estimation of the fixed effects model. Environmental governance investment has a significantly negative estimated coefficient in the mixed OSL, but the results are not significant in the fixed effects and random effects models. Industry structure has a significantly positive estimated coefficient in the mixed OSL, but the results are not significant in the fixed effects and random effects models.

Table 3 shows that the threshold values are 9.5183, 11.9329, and 12.7471, and the effect of digital industrialization on the natural gas supply chain shows a nonlinear effect when the level of digital industrialization is in different intervals. From the results of the research, it is concluded that when the level of digital industrialization (

advdvaluerate) is below the first threshold value of 9.5183, its coefficient estimate is −48.87, and the result is not significant; when the level of digital industrialization (

advdvaluerate) is above the first threshold value of 9.5183 but below the second threshold value of 11.9329, its coefficient estimate increases from −48.87; when the digital industrialization level (

advdvaluerate) is higher than the second threshold value of 11.9329 and lower than the third threshold value of 12.7471, its coefficient estimate increases from −1.223 to 23.53, which is positively correlated at the 10% confidence level; when the digital industrialization level (

advdvaluerate) is higher than the third threshold value of 12.7471, its coefficient estimate increases from −1.223 to 23.53, which is positively correlated at the 10% confidence level; and when the level of digital industrialization (

addvaluerate) is higher than the third threshold value of 12.7471, its coefficient estimates increase from 23.53 to 51.45, which is positively correlated at the 10% confidence level. Overall, the relationship between the digital industrialization level and the natural gas supply chain length is nonlinear, and, when the estimated coefficient of the digital industrialization level is below the first threshold or above the first threshold and below the second threshold, its negative effect on the natural gas supply chain length is not significant; when the estimated coefficient of digital industrialization level is between the second threshold and the third threshold or above the third threshold, its positive effect on the natural gas supply chain length is not significant. The positive effect on the length of the natural gas supply chain is more significant when the estimated coefficient of the digital industrialization level is between the second threshold and the third threshold or above the third threshold.

In summary, there is no absolute linear relationship between the digital industrialization level and the length of the natural gas supply chain. The technology-market turnover is the key for the level of digital industrialization to promote the length of the energy supply chain, while the digital industrialization to promote the length of the natural gas supply chain also depends on the increase in the number of patents granted, so this result verifies Hypothesis 1.

In order to ensure the precision of the threshold estimation and study the threshold characteristics of the digital industrialization level on the length of the natural gas supply chain, the bootstrap method of Hansen (1999) [

88] is adopted to determine the threshold number of the model, and the single threshold, double threshold, and triple threshold tests are carried out successively to obtain the F statistics, as shown in

Table 4.

As can be seen from

Table 4, the single threshold effect is significant at the 10% confidence level, the double threshold effect is significant at the 5% confidence level, and the triple threshold effect is significant at the 10% confidence level. This indicates that the effect of the digital industrialization level on the length of the natural gas supply chain is not a simple linear relationship and that there is a significant triple-threshold characteristic between them. Based on the principle of moving from complexity to simplicity, the triple-threshold effect model is mainly analyzed. The threshold values of the digital industrialization level effect on the length of the natural gas supply chain are 9.5183, 11.9329 and 12.7471, respectively. Based on this, we construct a triple threshold model with the digital industrialization level as the threshold variable.

4.2. Description of Related Measurement Issues

In the previous section, static panels were used to examine the impact of digital industrialization development on the length of the natural gas supply chain. In order to ensure the robustness of the conclusion, we further adopt the dynamic panel model to test the robustness of the benchmark regression by introducing a level equation, while conducting LR tests for the omitted variables to reduce the estimation error.

We draw on Peng and Xiao’s (2021) [

86] treatment to conduct the threshold effect test to determine the existence and significance of the threshold effect, the number of thresholds, the threshold value, and the corresponding econometric model.

Table 3 and

Table 4 report the results of the threshold tests and threshold estimates for the level of digital industrialization and each dimensional index. The estimation results of the threshold values and confidence intervals show that the identification effect of the threshold values is more significant. Furthermore, the authenticity of the threshold estimate is tested. The method proposed by Hansen (1999) [

88] is used to calculate the different threshold values and their corresponding likelihood ratio test statistics.

Hansen (2000) [

89] argued that the threshold variable

can either be a regressor in the explanatory variables or can be used as an independent threshold variable. While panel threshold models have been widely used in empirical studies, Hansen’s (1999) [

88] model was static; in addition, fixed effects regression estimation requires that the covariates are strong exogenous variables and that the estimates are consistent. However, strong exogeneity can be restrictive in many practical applications. Therefore, the model is extended to a dynamic panel model. A dynamic panel threshold model is assumed as follows:

where

;

;

may contain lagged dependent variables, i.e.,

is the lag of

, and

is the threshold variable.

Second, the threshold model is calculated. The reasonableness of the threshold effect is tested with the estimated threshold value, i.e., whether the threshold effect exists and whether the threshold value is equal to the true value. The results are shown in

Figure 6.

Since there are multiple control variables and we cannot input them all into the model for calculation, we use the treatment of omitted variables for endogeneity testing. The omitted variable is related to both the independent variable and the dependent variable.

Figure 7 represents the effect of the level of digital industrialization on the length of the natural gas supply chain after the gradual addition of control variables.

Figure 7a represents the LR test with the addition of one control variable,

Figure 7b represents the LR test with the addition of two control variables, and so on, up to

Figure 7f, which represents the LR test with the addition of six control variables. The results show that all three thresholds pass the significance test.

4.3. Heterogeneity Analysis

By subdividing the core variable digital industrialization level into four sub-industries: infrastructure, technology and application, transaction, and media.

Figure 8 represents the effect of the digital industrialization level on the length of the natural gas supply chain with infrastructure, technology and applications, transaction, and media as the threshold variables for the LR test. Among them, the triple threshold with infrastructure and technology and applications as threshold variables fails the significance test, while the triple threshold with transaction and media as threshold variables passes the significance test.

Column (3) of

Table 5 indicates that the triple thresholds are 9.5183, 11.9661, and 12.9687 when transaction is the threshold variable. The coefficient of influence is −1439.5 at the 95% confidence level. The absolute value of the impact coefficient gradually decreases, indicating that the negative effect on the length of the supply chain in the natural gas industry gradually diminishes as the level of digital industrialization increases.

Column (4) of

Table 5 indicates that the triple thresholds are 9.2419, 11.6759, and 12.6363 when media is the threshold variable. When in the first threshold interval, the impact coefficient is −3715.7, which is significant at the 90% confidence level; and in the fourth threshold interval, the impact coefficient is 85.55, which is significant at the 95% confidence level. The impact coefficient changes from negative to positive, indicating that the development of digital industrialization level at the early stage has a negative effect on the length of the supply chain in the natural gas industry. However, with the further improvement of the digital industrialization level, digital industry not only promotes its own scale expansion but also promotes the co-construction and sharing of network infrastructure. Digital industrialization promotes the transformation of the traditional industrial economy to an intelligent industrial economy, greatly reduces social transaction costs, and improves the efficiency of the optimal allocation of resources, thus promoting the length of the natural gas supply chain.

The results suggest that the impact of digital industrialization on the length of the natural gas supply chain may change in a jump-like manner, rather than linearly in the traditional sense. This supports Hypothesis 1.

The estimation results for the sample of digital industrialization levels are likely to depend on the performance of certain samples in a single observation. There are differences in the level of digital industrialization due to the huge regional development differences in digital development in China. The digitalization level in the east is more perfect, which is more affected by the externality of research and development achievements. Meanwhile, the intensity of the demand for innovation and development is higher, and the development demand for digital industrialization is higher, so the impact on the length of the natural gas supply chain is also different. To further discuss the impact of different geographical characteristics on the level of digital industrialization, the digital industry is divided into eastern, central, western, and northeastern regions to observe the performance of the threshold regression model.

As

Figure 9 shows, the threshold effect of the level of digital industrialization on the length of the natural gas supply chain is partially significant when limiting the sample regions. The single threshold, double threshold, and triple threshold effects are significant for the eastern, central, and western regions, while the triple threshold for the northeastern region does not pass the significance test.

Column (1) of

Table 6 shows that the triple thresholds for the eastern region are 11.3971, 12.7471, and 12.7011. When the digital industrialization level in the eastern region is within the fourth interval, that is, greater than the third threshold value, the influence coefficient is 29.56, which is significant at the 95% confidence level.

Column (2) shows that the triple thresholds for the central region are 9.3293, 11.0862 and 11.7497. When the digital industrialization level is in the third interval, the impact coefficient is −141.9, which is significant at the 95% confidence level. When the digital industrialization level is in the fourth interval, the impact coefficient is 59.45, which is significant at the 95% confidence level. The coefficient of influence changes from negative to positive, indicating that the effect of the level of digital industrialization on the length of the natural gas supply chain changes from a negative to a positive correlation. This indicates that the increase in the level of digital industrialization when the level of digital industrialization crosses the third threshold is beneficial to extend the supply chain length in the natural gas industry.

Column (3) shows that the triple threshold effect for the western region has triple threshold values of 9.5183, 11.0021, and 12.5025. When the level of digital industrialization in the western region is within the first interval, the impact coefficient is −208.5, which is significant at the 95% confidence level. When the level of digital industrialization is within the second interval, the impact coefficient is −126.9, which is significant at the 95% confidence level. When the level of digital industrialization is within the fourth interval, the impact coefficient is 72.14, which is significant at the 99% confidence level. When the digital industrialization level is in the fourth interval, the coefficient of influence is 72.14, which is significant at the 99% confidence level.

The results indicate that the level of digital industrialization has a significantly stronger contribution to the length of the natural gas supply chain in the western region than in other regions. Since most of the eastern enterprises are located in the developed coastal economic level, they have a high level of active innovation activities, a high demand for product technology innovation, and a high incentive to increase R&D investment. In addition, the types of energy enterprises are mostly new-energy and technology-oriented, and their scale is smaller than that of the traditional energy industry, so it is difficult to bear the consequences of the R&D results being copied and stolen by others. The western region is more backward in economy, less developed in infrastructure, and lagging in development, mostly relating to the coal mining industry and basic manufacturing industries, which still following the traditional economic development model that relies on land, infrastructure construction, pollution, and R&D. Digital industrialization in the western region has a certain time lag. The development of digital industrialization at this stage indirectly promotes the growth of the natural gas supply chain by promoting R&D investment [

86], which in turn promotes technological progress. This supports

Hypothesis 2.

The development of digital industrialization is divided into three periods: the 11th Five-Year Plan period (see

Figure 10a), the 12th Five-Year Plan period (see

Figure 10b), and the 13th Five-Year Plan period (see

Figure 10c). The results show that there is a significant triple threshold effect in the 11th and 12th Five-Year Plan periods, while the 13th Five-Year Plan period fails the test.

Column (1) of

Table 7 shows that during the 11th Five-Year Plan period, the triple threshold values are 10.8825, 11.9354, and 12.1439. When the digital industrialization level is in the first interval during the 11th Five-Year Plan period, the impact coefficient is 215.2, which is significant at the 99% confidence level. When the digital industrialization level is in the second interval, the impact coefficient is 197.3, which is significant at the 99% confidence level. When the digital industrialization level is in the third interval, the impact coefficient is 225.0, which is significant at the 99% confidence level. When the digital industrialization level is in the fourth interval, the impact coefficient is 160.9, which is significant at the 95% confidence level. When the digital industrialization level is in the fourth interval, the influence coefficient is 160.9, which is significant at the 95% confidence level.

Column (2) shows that during the 12th Five-Year Plan period, the triple threshold values are 9.1955, 10.5659, and 13.2504. When the digital industrialization level is in the second interval, the impact coefficient is −98.50, which is significant at the 95% confidence level. When the digital industrialization level is in the fourth interval, the impact coefficient is 66.48, which is significant at the 95% confidence level.

4.4. Robustness Discussion

The explanatory variable of this article, energy supply chain length, is a composite indicator and is calculated based on the weights of each province. Therefore, in order to verify the robustness of the conclusions of this article, the explanatory variable is replaced by the relative length of the supply chain, and the data are obtained from the statistical yearbooks of each province. The larger the value of this indicator is, the higher the relative level of the energy supply chain length development is. The direction of the regression coefficients of the test results is the same as that of the full sample regression results, and the significance also remains basically the same, indicating that the conclusions of this article have good robustness and reliability.

Considering that the sample used in this article is the sample data of the natural gas industry at the provincial level, Beijing, Tianjin, Shanghai, and Chongqing, as four municipalities directly under the Central Government, have data values that do not differ much from the provincial level data. In order to ensure the robustness of the results, the samples of the above four municipalities are excluded, and the impact of the level of digital industrialization on the supply chain length of the energy industry is tested again, which shows that the results are still robust.

To ensure the reliability of the empirical results, we again divide the sample into eastern, central, western, and northeastern parts and repeat the above empirical approach. The test results show that the core explanatory variables are still able to influence the explanatory variables and are significantly positive at the 1%, 5% and 10% levels, thus further verifying the reliability of the empirical results.

5. Discussion

The above basic estimation results reveal that digital industrialization can improve the energy supply chain length. Next, combined with the specific performance of digital industrialization development in economic reality, we further explore the ways through which digital industrialization enhances the length of the energy supply chain and verify the inner mechanism of digital industrialization, empowering the length of the energy supply chain. To this end, we use a panel regression model to explore the transmission path of digital industrialization on the supply chain length (

CENTRA) in the natural gas industry and construct the following regression equation [

90].

where

stands for province and

stands for year.

denotes the supply chain length of province

in year

;

indicates the level of digital industrialization in province

in year

;

denotes the mechanism variables, including foreign trade (

), technological innovation (

), industrial structure upgrading (

), disposable income (

), and environmental regulation (

);

is the province fixed effect that does not vary over time;

is the time fixed effect;

is the classical error term; and the control variables (

) control for other factors that may affect the supply chain length (

).

As shown in column (1) of

Table 8, the coefficients of the digital industrialization development level (

addvdvaluerate) are all insignificant, which indicates that the improvement of digital industrialization development level does not significantly enhance foreign trade. At present, the development of digital industrialization is not effective in promoting foreign trade, based on the actual situation in China. Although the degree of openness of China’s foreign trade is gradually being liberalized, the demand for foreign trade differs from region to region, and foreign trade policies also differ. Not many digital industries have been introduced in the central and western regions, and most of them are small in scale and low in technology, so the quality of investment attracted is not high, which makes it difficult to develop foreign trade. Although the consumer Internet represented by e-commerce has fully compressed the arbitrage space under market segmentation and information asymmetry, it is still difficult to fundamentally break down the inter-regional barriers caused by administrative segmentation and local protectionism, which results in the overall insignificant impact of digital industrialization development on foreign trade.

As shown in column (2) of

Table 8, the coefficient of the level of digital industrialization development (

addvaluerate) is significant at the 1% level, indicating that the increase in the level of digital industrialization development will significantly improve the level of technological innovation. The development of digital industrialization eases the financing constraints of innovation projects and improves the level of regional intellectual property protection, providing a favorable external environment for regional innovation activities. At the same time, the innovation of digital industry enhances the degree of market competition in the region, stimulating the traditional manufacturing sector to introduce and imitate advanced technologies and accelerate technological innovation. The emerging industry sector will also actively develop new technologies to maintain its leading position, which will lead to a new round of technology spillover and continuously improve the technology level and productivity of the manufacturing sector. The digital industry has broken the barriers of knowledge and technology spillover in terms of spillover channels, ways, speed, and scope, promoting the transformation of technology spillover from point-to-point unidirectional diffusion to point-to-plane multi-dimensional diffusion. In the process of spillover, new elements are constantly integrated for the self-updating and integration of technology, which greatly improve the level of technological innovation.

As shown in column (3) of

Table 8, the coefficient of the development level of digital industrialization (

addvaluerate) is significant at the 1% level, indicating that the increase in the development level of digital industrialization will significantly promote the upgrading of industrial structure. The development of digital industry will impact the traditional economy, and the negative effect on the demand structure and consumption structure is greater than the positive effect, which will bring about innovation in consumption content and consumption patterns, as the level of development of digital economy increases. In addition, the technical support, training, production equipment, and other services provided by digital service providers also improve the production technology and management skills of the manufacturing industry in the region through forward linkage. In the era of the digital economy, manufacturing enterprises continue to divest non-core businesses and transfer production services to professional third-party institutions. Producer services provide the manufacturing industry with all-round support of technical consultation, product project approval, process optimization and marketing services, and accelerate the deep integration of manufacturing and producer services. Industrial integration improves the industrial efficiency and value-add of the manufacturing industry by extending the industrial chain and optimizing the value chain, which promotes the increasing technical complexity of manufacturing exports.

As shown in column (4) of

Table 8, the coefficient of the level of digital industrialization development (

addvdvaluerate) is significant at the 1% level, indicating that the increase in the level of digital industrialization development will significantly increase disposable income. During the development of digital industries, many new industries, new models, and new employment have emerged, allowing more people to have the opportunity to work hard and become wealthy. Digital industry can promote economic growth, drive small and medium-sized enterprises to start their own businesses, absorb jobs, and benefit many small and medium-sized enterprises as well as the people who should benefit from them. Unlike traditional information technology, which focuses on information process technology, digitalization focuses on building business digitalization, so the main responsibility extends from the IT department to almost all business departments. As a result, the connotation and extension of the occupation of people from all walks of life changes. At the same time, the source of people’s income, the content and intensity of work, the amount of income, and the social security from having outside income also change, thus affecting the income distribution relationship.

As shown in column (5) of

Table 8, the coefficient of the digital industrialization development level (

addvaluerate) is significant at the 5% level, indicating that the increase in the digital industrialization development level will significantly enhance environmental regulation. On the one hand, the new kinetic energy and new ways brought by the digital economy can control the resulting energy waste and avoid causing new environmental pollution; on the other hand, the popularization of the Internet and digital technology has broadened the channels for all social entities to participate in environmental governance, effectively improving the environmental governance capacity and the effect of environmental regulation and reducing the implementation cost and difficulty of environmental regulation. The cultivation of the digital economy industry needs to be organically combined with the healthy development of capital, which highlights the important regulatory role of the legal environment within it.

6. Conclusions and Policy Implications

In this article, we analyze the impact of the level of digital industrialization on the energy industry through theoretical analysis and explore the mechanism of action between variables. A panel threshold model is constructed on this basis. The results of the study show that there is a significant promotion effect on the length of the energy supply chain in areas with a high level of digital industrialization. When the digital industrialization level is taken as the threshold variable, the development of the digital industrialization level has a threshold effect on the length of the energy supply chain. With the improvement of the digital industrialization level, the promotion effect on the length of the supply chain in the energy industry has been significantly improved. From the perspective of industry segmentation, the development of digital industrialization in the four sub-industries of infrastructure, technology and application, trading and media has a negative effect on the length of the energy supply chain in low-level areas, while it has a positive effect on the length of the supply chain in high-level areas. From the perspective of regional development in eastern, central, and western China, digital industrialization has different effects on the supply chain length at different development levels, with negative effects at low development levels and positive effects at high development levels. In terms of different development periods, there are some differences, which are mainly reflected by the following aspects: During the 11th Five-Year Plan period, the level of digital industrialization has a positive effect on the length of the supply chain. During the 12th Five-Year Plan period, the impact of digital industrialization level development on the supply chain length changes from a negative effect to a positive effect. During the 13th Five-Year Plan period, the development of the digital industrialization level has a negative effect on the length of the supply chain.

Based on the above findings, the following policy recommendations are made:

First, it is recommended to promote the construction of new digital infrastructure and consolidate the foundation of the digital development of energy. Digital infrastructure is an important foundation and prerequisite for ensuring the safe storage and secure operation of data elements in the process of energy’s digital transformation. The construction of new digital infrastructure should be planned in an integrated manner, taking into account regional coordinated development, and promoting new digital infrastructure to the central and western regions to make up for the regional “digital divide“ caused by uneven development in the early stage. Enterprises carry out digital transformation, strengthen public services for digital transformation, and lower the threshold of digital transformation. In addition, we should strengthen the construction of digital society and digital government to regulate the energy industry, facilitate its development, and build a new ecology of the digital economy for energy industry. At the same time, we should deepen the pilot demonstration of the integration and development of the digital energy industry, digital society, and digital government, and cultivate new models of cross-domain integration and application of new energy products and services. At present, the “digital divide“ between China’s regions is large, and the development of digital industry between eastern, central and western regions shows a trend of decreasing gradient. On the one hand, coastal areas should moderately advance the construction of digital infrastructure, promote the deep integration of digital technology and the real economy, stimulate cross-border collaboration between industries, and develop richer application scenarios. On the other hand, the central and western regions should take advantage of the amplification, superposition, and multiplier effects of digital technology to enhance the development space of traditional energy industries, accelerate the integration of various markets and extend the energy supply chain.

Second, it is suggested that the government should improve the digital transformation of the energy supply chain industry norms to ensure that all the work of digital construction is based on the law. Relevant departments should introduce policies centered on digitalization to promote the digital transformation of energy enterprises and improve industrial infrastructure capacity and supply chain modernization. The Ministry of Science and Technology, the People’s Bank of China and other departments should also introduce relevant policies to support digital transformation in terms of science and technology innovation, improve regional innovation levels and provide new talents for energy transformation. At the same time, the government should establish robust laws and regulations related to the security of data elements in the energy industry, and further clarify the boundaries of the rights and responsibilities of the subjects related to the construction of energy digitization. In addition, we should accelerate the establishment of safety standards for energy data resource property rights, transaction circulation, transmission protection, and other aspects. In the process of promoting industrial structure upgrades and energy transformation, on the one hand, local governments should also introduce more digital transformation content according to local conditions and stimulate relevant energy industries to carry out innovative reforms in order to attract more technical talents for energy’s digital transformation. On the other hand, governments around the world should cooperate to create an integrated digital economy smart service platform, strengthen inter-regional collaboration among energy companies, and encourage the exchange and sharing of advanced technologies among different companies.