Pricing and Simulating Energy Transactions in Energy Communities

Abstract

1. Introduction

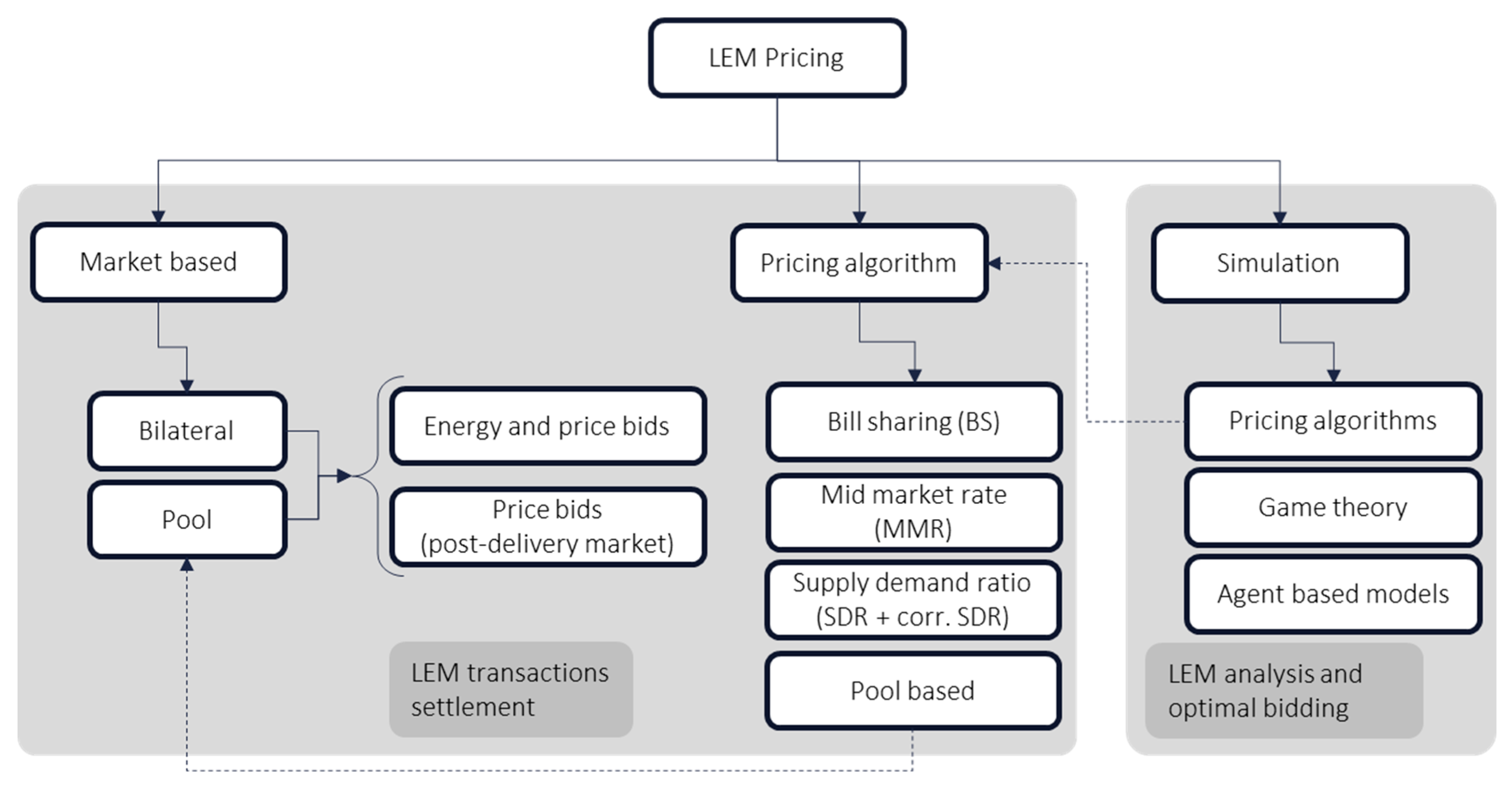

- A systematic and practical review of pricing mechanisms for the financial compensations of energy trades within energy communities and LEM, providing a quick and straightforward guide so readers can easily identify them and assess their pros and cons. Since local transaction prices are very much related to LEM simulations, a brief review of the main LEM simulation approaches is also provided.

- A uniform mathematical formulation of the pricing mechanisms with a standard nomenclature so that they can be better understood and compared.

- A conceptual approach to collective benefits sharing that highlights and explains the links among the different alternatives, including LEM, pricing algorithms, and other approaches.

- A practical taxonomy of the pricing mechanisms identified and reviewed.

- The proposal of a new pricing mechanism developed by the authors based on [24] that uses the peers’ opportunity costs and their actual energy delivery, and combines simplicity with market-based principles to provide fair and easy-to-explain financial compensation to the energy transactions.

- A qualitative comparison among the pricing mechanisms reviewed, to help researchers and LEM project developers solve price formation issues for local transaction compensations, both in theoretical and applied fields.

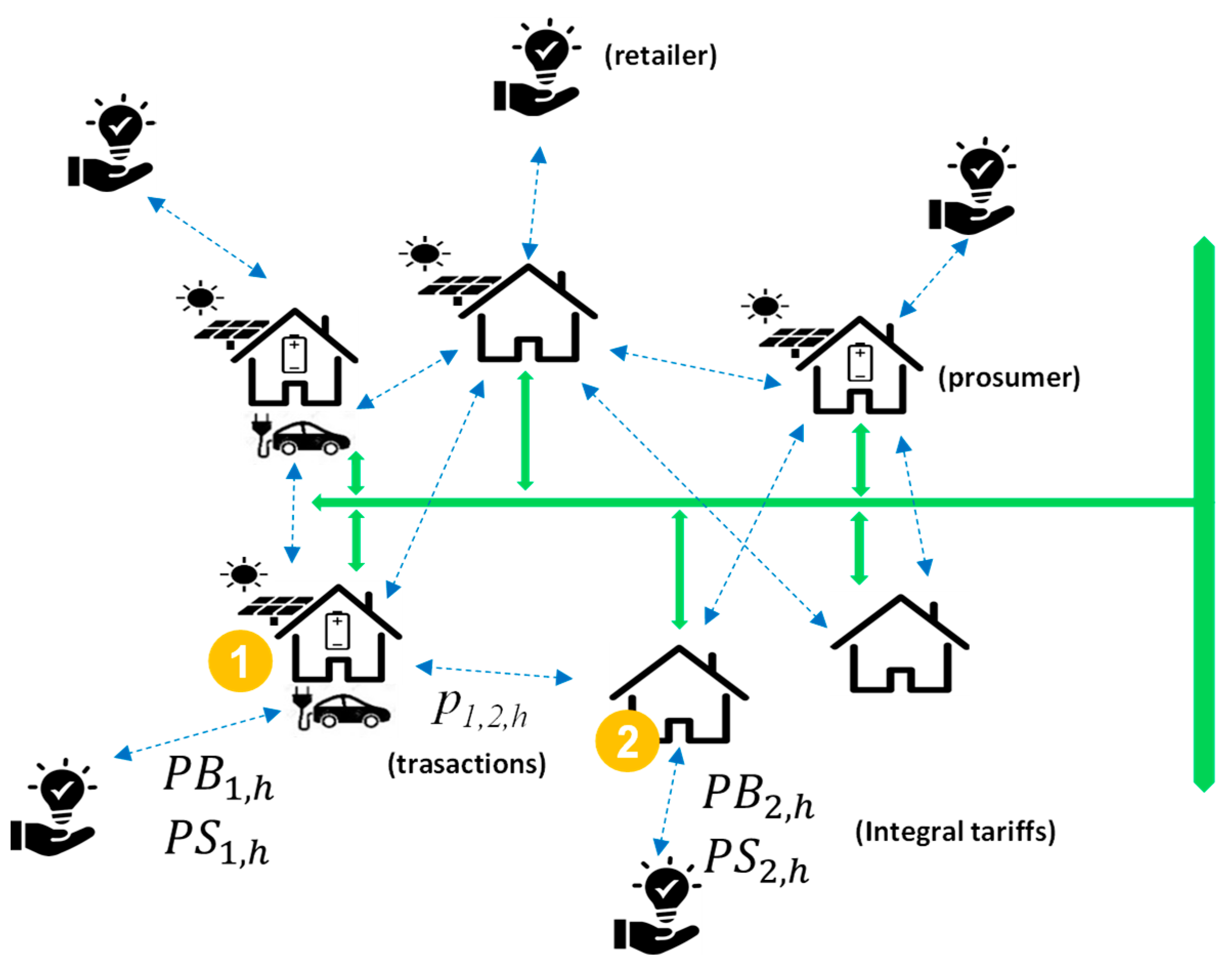

2. Collective Self-Consumption Framework and Nomenclature

- Energy cost savings, since the energy injected back to the grid is typically paid at a lower price (feed-in or selling tariffs) than the retail price (supply, retail, or buying tariffs), so prosumers can profit from locally selling or buying energy.

- Grid cost savings, since energy flows decrease due to local generation and supply matching, and access tariffs for self-consumption are very often only applied to the grid voltage levels used, saving higher voltages grid tariffs. In addition, some regulations (as in Portugal [6]) include additional grid access tariff discounts for the energy locally shared to incentivize the energy decentralization process. Note, however, that tariff redesign may be an issue in guaranteeing long-term power system sustainability.

- Flexibility provision, since new global or local grid services may be provided in the future by aggregated prosumers to balance responsible parties (BRP), transmission system operators (TSO) or distribution system operators (DSO), leading to additional revenue streams.

3. Collective Benefits Sharing and Pricing Local Electricity Transactions

- Collective benefits sharing is essential to go from individual to collective self-consumption structures, such as energy communities. Indeed, members must see a benefit from joining these structures, which may depend on the existing regulation and subsidies, on the complementarity among the potential members, and on the existence of a fair and straightforward mechanism to share the additional benefits that the community organization may provide to the members, which, as referred to in [29], is a complex issue. Figure 2 shows the main implicit or explicit ways to share these collective benefits among members of a REC.

- Simulating local electricity markets to understand and validate their designs, and to forecast their behavior for flexible resources management and for optimal strategic bidding. Indeed, centralized management approaches can also be understood as simulation algorithms to assess the behavior a local electricity markets [29].

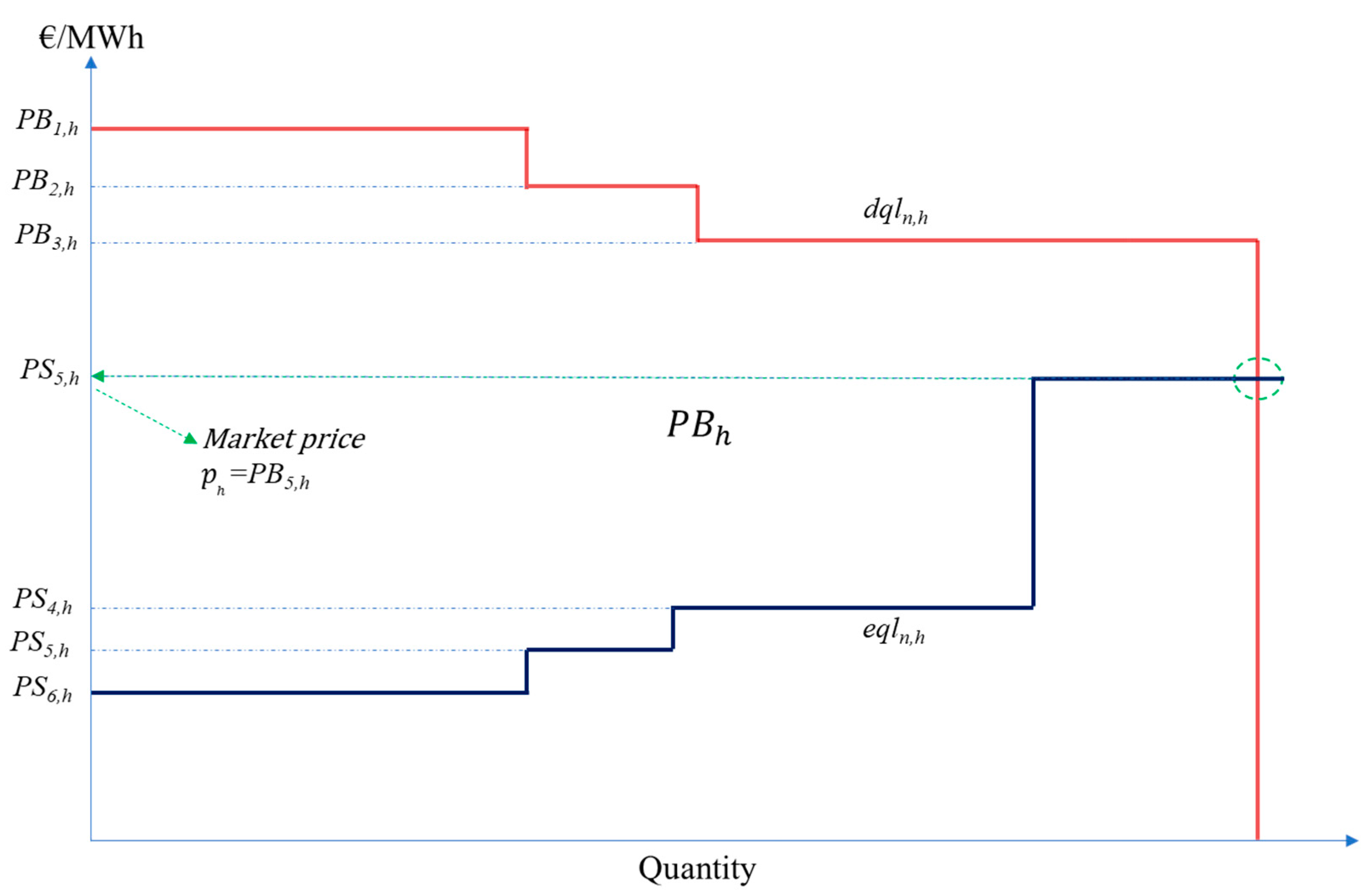

3.1. Market-Based LEM Price Computation

- In the bilateral clearing, typically, pairs of selling and buying bids are cleared as soon as they are compatible (buying price more significant than the selling price and compatible energy constraints), which means that each transaction is differently priced according to the bids involved. In these cases, no market price exists, and only averages can be computed [33,34].

- In pool-based markets (as is the case of EU wholesale day ahead markets), the aggregated supply and demand curves are built from the individual bids, and their intersection determines the energy traded and the market price applied to all transactions, and the supply and demand bids accepted.

- In general, a combination of bilateral and pool clearing can coexist, which typically implies two processes, a first one for bilateral trading, and a final pool where the energy, not yet negotiated during the bilateral negotiations, can still be offered to the pool.

3.1.1. Post-Delivery LEM Pool Market

- Reduced trading costs, since peers do not have to forecast production and consumption nor design bidding strategies, since they only need to inform the price at which they are willing to buy and sell energy and the energy that comes from the contracts they assign with their retailers and aggregators.

- Works as a market to settle the differences of other markets, so it could be the last round after a previous round of bilateral trading, since it can be integrated with other LEM forward mechanisms, including flexibility markets as described in [35].

3.2. Pricing Algorithms

3.2.1. Bill Sharing (BS)

3.2.2. Mid-Market Rate (MMR) and Intermediate-Market Rate (IMR)

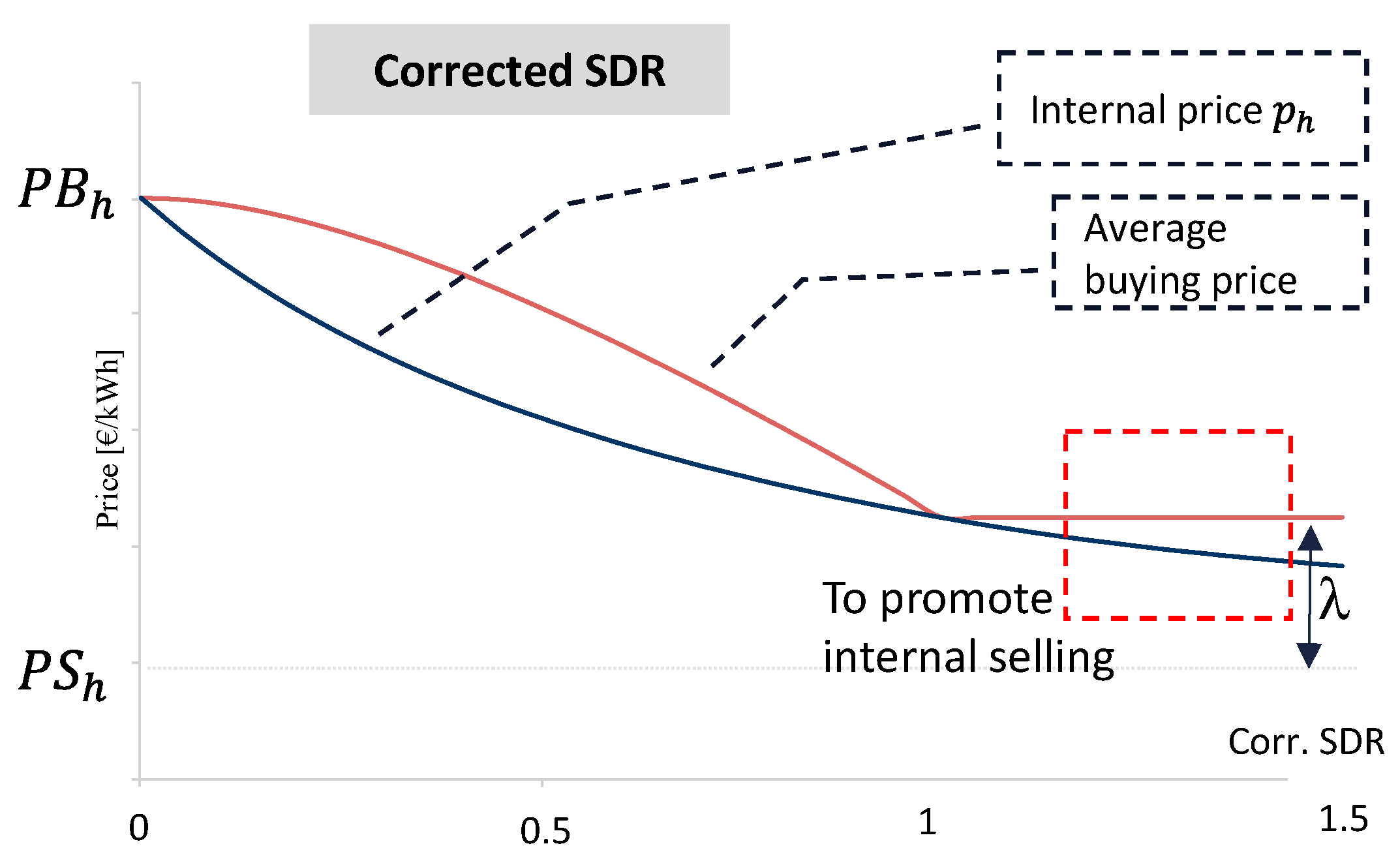

3.2.3. Supply-Demand Ratio (SDR)

- If sdrh > 1 (more local generation than consumption in the REC), the price ph is the same as the selling price PSh to the grid. Effectively, if ph was lower, prosumers would not internally sell the energy but directly to the grid at PSh. Therefore, all the consumers buy their energy in the LEM at the selling price to the grid:

- If 0 < sdrh < 1 (less local generation than consumption in the REC). The internal energy price is inversely proportional to sdrh. Therefore,

- If sdrh = 0, there is no surplus in the REC and all the energy is bought from the grid, and therefore ph = PBh.

- If sdrh = 1, the local generation and demand in the REC are equal, so there is no energy exchange with the grid. Thus, the internal energy price is the lowest possible, i.e., ph = PBh.

3.2.4. SDR Compensated

3.2.5. Post-Delivery Pool-Based Pricing Algorithm

3.2.6. Comparison of the Pricing Algorithms

- According to [40], BS performance is poor, since it only averages the participants’ electricity bill. Hence, the incentives for demand response are low. For real REC applications, potential members need to understand how prices are defined, or, otherwise, they will not join the REC. The BS algorithm may appear to be conceptually simple, but the price computation is not easily traceable since it requires calculating the community’s aggregated costs. In addition, it must be complemented with transaction compensation, increasing its complexity compared to other approaches.

- MR and IMR perform better than BS and slightly worse than SDR when price signals from the retailer fluctuate during the day [36]. MR and IMR are also simple to explain since they can be understood as sharing the benefit that results from the selling and buying price spread. However, they disregard the actual contribution of local load balance in the price formation, meaning that participants have less incentives to manage load and flexibility [41].

- SDR-based mechanisms perform better, since they provide a dynamic internal price that changes depending on the energy availability in the community, and thus, provide good incentives for demand response and better economic signals with more efficient results [41]. Indeed, these methods perform well since they try to reproduce a market-like behavior by setting a dependency on the price with the participants’ opportunity costs and with the available demand and supply.

- The post-delivery pool provides the best economical results to our understanding, since it is based on an optimal market equilibrium, where the prices reflect the actual opportunity costs of the REC for each ISP. In addition, its computation is simple and well-understood in economic theory, and easy to explain and justify to potential REC members. This mechanism, however, can have higher price fluctuations, since prices vary between the retailers’ buying and selling prices.

- Conceptual simplicity: refers to how easy it may be for prosumers to understand and accept the price methodology.

- Computation simplicity: measures how easy it is to compute the price, including how affordable and practical is to access input data.

- External price signals relevance: refers to how well the price reflects the real costs and external price signals.

- Economic signal efficiency: measures how the price provides the proper economic signal. The closer the prices are to the opportunity costs, the more efficient the mechanism.

- Price volatility: measures how volatile the prices computed by the mechanism are.

- Sharing fairness: measures to what extent the pricing mechanism accounts for the contribution to each member to the REC benefit. Methods considering supply and demand dynamics or aggregated costs tend to be fairer.

4. Simulation of LEM

4.1. Game Theory Approaches

- Frequency of play: games can happen once or repeatedly.

- Chronology: actions can be simultaneous or sequential amongst players.

- Awareness of players: regarding perfect and imperfect information.

- Knowledge of players: whether the information is complete or incomplete.

- The LEM has no single internal price, and the prices of each resulting bilateral transaction are dual variables from the optimization problem.

- Not all generation is necessarily traded in the LEM. Participants might not reach an agreement and any untraded energy is sold (bought) to (from) the grid.

4.2. Agent-Based (AB) Simulation Models

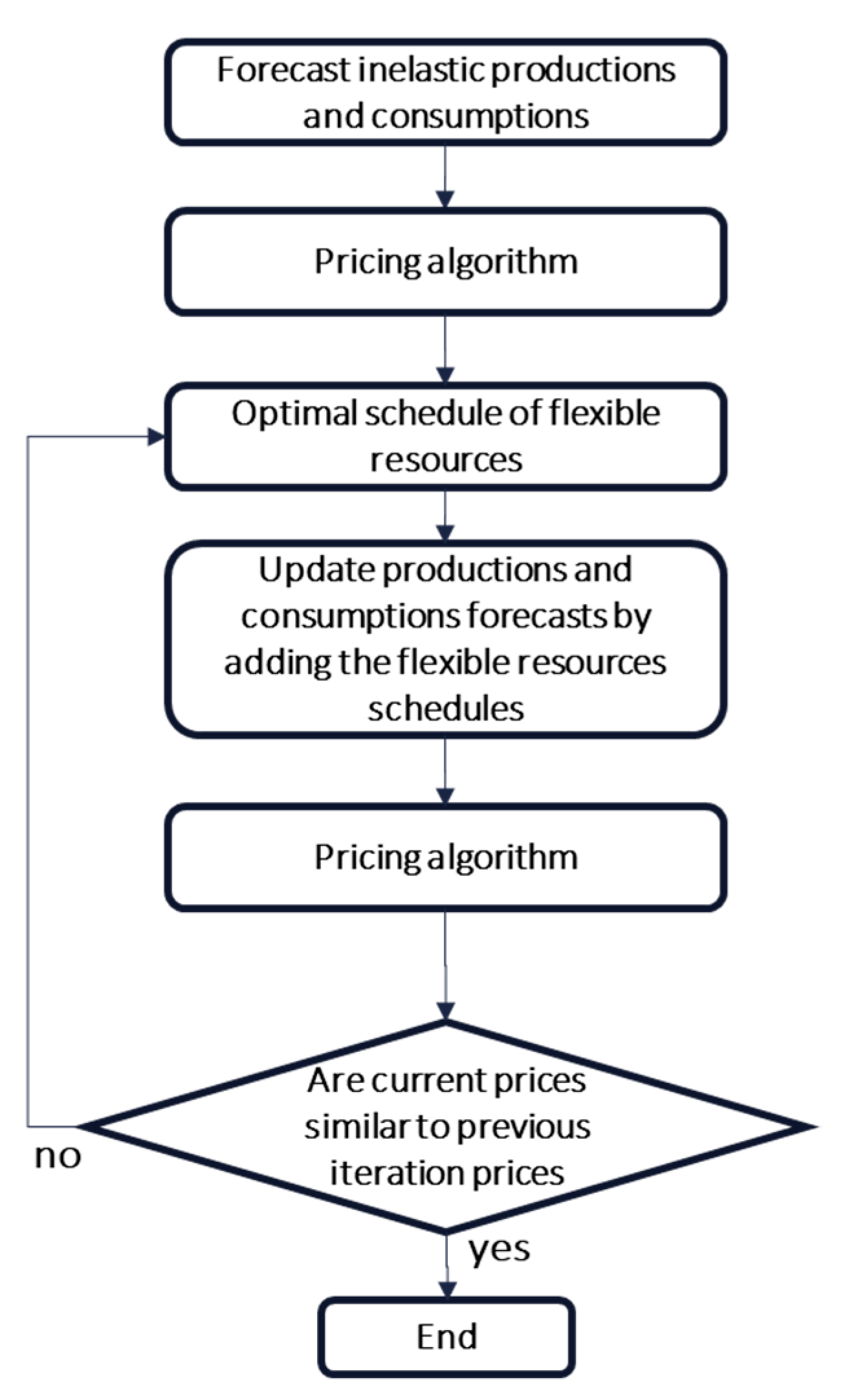

Simulation of AB Model

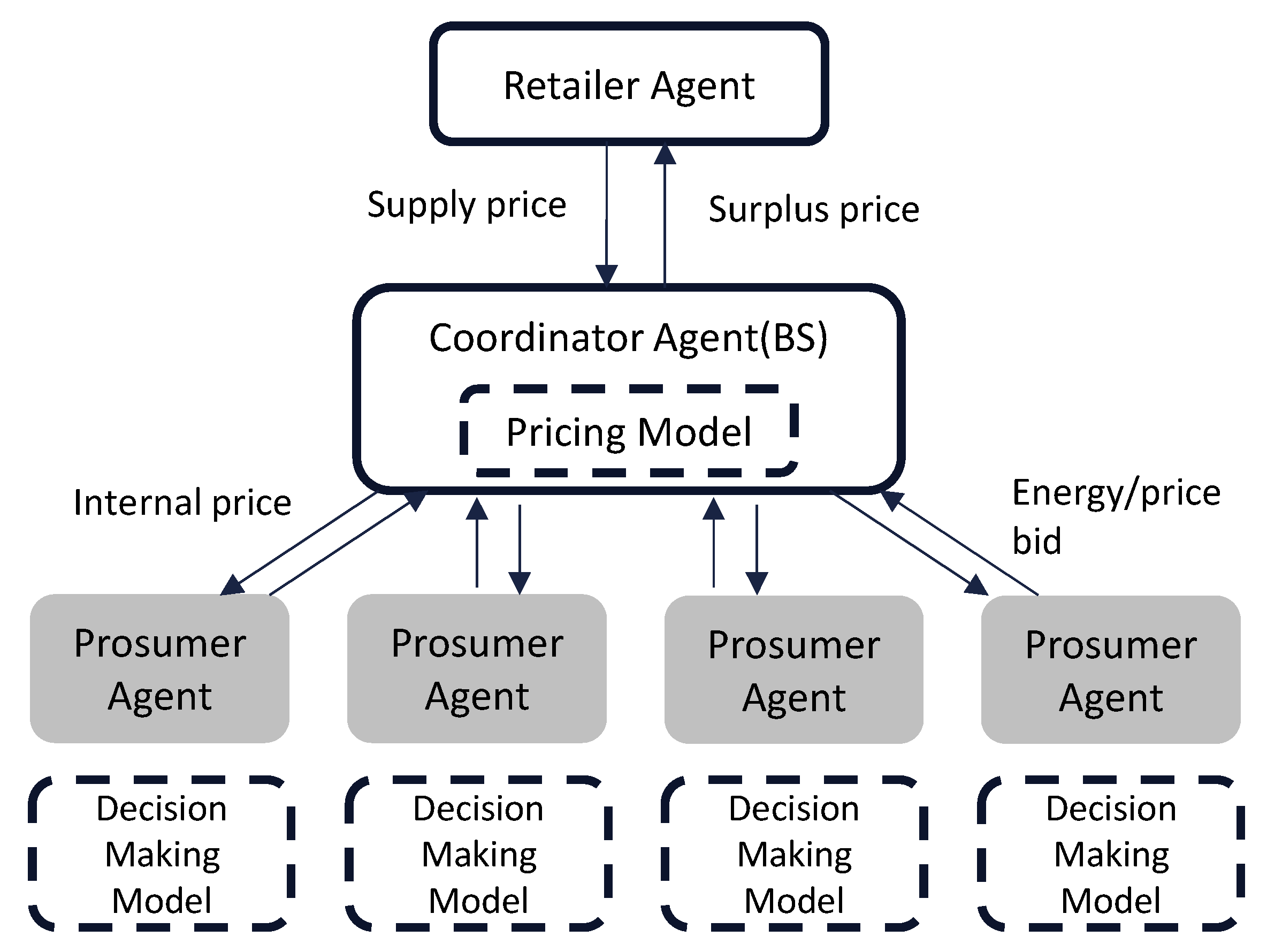

- There is an energy coordinator in the LEM who runs the pricing model.

- A centralized common internal energy price is established for the community, so all participants trade their energy at the same price in the LEM.

- It is assumed that the amount of energy a participant exchanges with the grid is proportionally divided among all participants.

- Prosumer Agents. Who decide how to schedule their consumption from load demand considering PV generation. They may locally buy or sell energy.

- Coordinator Agent. A community representative who determines the internal price and trades with the participants and with the community’s retailer assuring its energy balance.

- Retailer Agent. A typical retailer who buys and sells any surplus or supply required by the coordinator. The retailers’ prices are not considered dynamic.

5. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

Nomenclature

| Indexes | ||

| n, m | Participants in the local electricity market | |

| h | Interval settlement period or ISP | |

| Parameters | ||

| Dn,h | Energy consumption of participant n at ISP h [kWh] | |

| PB, PBh, PBn,h | Price of the electricity bought from the grid (retailer) [€/kWh] | |

| PS, PSh, PSn,h | Price of the electricity sold to the grid (feed-in-tariff) [€/kWh] | |

| 𝜆 | Compensating factor in SDR approaches [€/kWh] | |

| βn,m | Bilateral trading imposed by participant n to participant m [€/kWh] | |

| En,m | Bilateral trading capacity from participant n to participant m [kW] | |

| Variables | ||

| en,h | Energy generated by participant n [kWh] | |

| dqh, dqn,h | Energy deficit (bought from the LEM or the grid) [kWh] | |

| dqgn,h | Energy bought from the grid by participant n [kWh] | |

| dqln,h | Energy bought in the LEM by participant n [kWh] | |

| eqh, eqn,h | Energy surplus (sold in the LEM or to the grid) [kWh] | |

| eqgn,h | Energy sold to the grid by participant n [kWh] | |

| eqln,h | Energy sold in the LEM by participant n [kWh] | |

| p, ph, pn,h | Electricity price of the LEM [€/kWh] | |

| pb, pbh | Electricity price of the energy bought [€/kWh] | |

| ps, psh | Electricity price of the energy sold [€/kWh] | |

| sdrh | Supply-Demand Ratio [pu] | |

| en, en,m,h | Energy sold by participant n and sold to participant m [kWh] | |

| dn, dn,h | Demand of participant n when it is elastic | |

| pn,m,h | Bilateral price of the electricity sold by participant n to m [€/kWh] | |

| pcn,m,h | Congestion price of the electricity sold by participant n to m [€/kWh] | |

| cn, cn,h | Energy from the battery [kWh] | |

| ebidn,h | Electricity bid [kWh] | |

| Functions | ||

| Un | Utility function of participant n | |

| Trading cost function of participant n | ||

| Welfare function of participant n | ||

References

- Xiang, X.; Ma, M.; Ma, X.; Chen, L.; Cai, W.; Feng, W.; Ma, Z. Historical Decarbonization of Global Commercial Building Operations in the 21st Century. Appl. Energy 2022, 322, 119401. [Google Scholar] [CrossRef]

- Ma, M.; Feng, W.; Huo, J.; Xiang, X. Operational Carbon Transition in the Megalopolises’ Commercial Buildings. Build. Environ. 2022, 226, 109705. [Google Scholar] [CrossRef]

- EC National Energy and Climate Plans (NECPs). Available online: https://ec.europa.eu/energy/en/topics/energy-strategy-and-energy-union/national-energy-climate-plans (accessed on 28 September 2021).

- European Union. Directive (EU) 2019/944 of the European Parliament and of the Council of 5 June 2019 on Common Rules for the Internal Market for Electricity and Amending Directive 2012/27/EU (Text with EEA Relevance); The European Parliament and the Council of the European Union: Brussels, Belgium, 2019; Volume 158. [Google Scholar]

- European Union. Directive (EU) 2018/2001 of the European Parliament and of the Council of 11 December 2018 on the Promotion of the Use of Energy from Renewable Sources (Text with EEA Relevance); European Union: Brussels, Belgium, 2018; Volume 328. [Google Scholar]

- Rocha, R.; Mello, J.; Villar, J.; Saraiva, J.T. Comparative Analysis of Self-Consumption and Energy Communities Regulation in the Iberian Peninsula, In Proceedings of the 8th International Conference on the European Energy Market, Madrid, Spain, 28 June–2 July 2021.

- Roberts, J.; Frieden, D.; D’Herbemont, S. Compile EU Project—Energy Community Definitions. 2019. Available online: https://main.compile-project.eu/downloads/ (accessed on 14 January 2023).

- Rocha, R.; Villar, J.; Bessa, R.J. Business Models for Peer-To-Peer Energy Markets. In Proceedings of the 16th International Conference on the European Energy Market (EEM), Ljubljana, Slovenia, 18–20 September 2019; pp. 3–8. [Google Scholar]

- IRENA. Peer-to-Peer Electricity Trading Innovation Landscape Brief; IRENA: Masdar City, Abu Dhabi, 2020. [Google Scholar]

- Faia, R.; Pinto, T.; Vale, Z. Fair Remuneration of Energy Consumption Flexibility Using Shapley Value; Springer: Berlin, Germany, 2019. [Google Scholar]

- de Almansa, M.; Campos, F.A.; Doménech, S.; Villar, J. Residential DER Cooperative Investments. In Proceedings of the 2019 16th International Conference on the European Energy Market (EEM), Ljubljana, Slovenia, 18–20 September 2019; pp. 1–6. [Google Scholar]

- Rouzbahani, H.M.; Karimipour, H.; Lei, L. Optimizing Scheduling Policy in Smart Grids Using Probabilistic Delayed Double Deep Q-Learning (P3DQL) Algorithm. Sustain. Energy Technol. Assess. 2022, 53, 102712. [Google Scholar] [CrossRef]

- Park, C.; Yong, T. Comparative Review and Discussion on P2P Electricity Trading. Energy Procedia 2017, 128, 3–9. [Google Scholar] [CrossRef]

- Open Utility Ltd. Piclo—Building Software for a Smarter Energy Future. Available online: https://piclo.energy/ (accessed on 8 March 2021).

- Vandebron. Available online: https://vandebron.nl/ (accessed on 14 January 2023).

- SonnenCommunity. Available online: https://sonnengroup.com/sonnencommunity/ (accessed on 20 January 2021).

- Mengelkamp, E.; Gärttner, J.; Rock, K.; Kessler, S.; Orsini, L.; Weinhardt, C. Designing Microgrid Energy Markets: A Case Study: The Brooklyn Microgrid. Appl. Energy 2018, 210, 870–880. [Google Scholar] [CrossRef]

- Homepage—POCITYF—POCITYF. Available online: https://pocityf.eu/ (accessed on 14 January 2023).

- EUniversal Project Description—The UMEI Concept. EUniversal. Available online: https://euniversal.eu/ (accessed on 14 January 2023).

- Interconnect Consortium Resources—Interconnect Project. Available online: https://interconnectproject.eu/resources/ (accessed on 23 March 2021).

- INESC TEC DIGITAL CER. Digital Energy Platform for Energy Communities—Proposta Projetos Em Copromoção. Available online: https://www.inesctec.pt/en/projects/digitalcer (accessed on 1 February 2023).

- Página Principal » Baterias2030. Available online: https://baterias2030.pt/en_GB (accessed on 9 February 2023).

- Capper, T.; Gorbatcheva, A.; Mustafa, M.A.; Bahloul, M.; Schwidtal, J.M.; Chitchyan, R.; Andoni, M.; Robu, V.; Montakhabi, M.; Scott, I.J.; et al. Peer-to-Peer, Community Self-Consumption, and Transactive Energy: A Systematic Literature Review of Local Energy Market Models. Renew. Sustain. Energy Rev. 2022, 162, 112403. [Google Scholar] [CrossRef]

- Mello, J.; Villar, J.; Bessa, R.J.; Lopes, M.; Martins, J.; Pinto, M. Power-to-Peer: A Blockchain P2P Post-Delivery Bilateral Local Energy Market. In Proceedings of the 2020 17th International Conference on the European Energy Market (EEM20), Ljubljana, Slovenia, 16–18 September 2020; pp. 1–5. [Google Scholar]

- Tsaousoglou, G.; Giraldo, J.S.; Paterakis, N.G. Market Mechanisms for Local Electricity Markets: A Review of Models, Solution Concepts and Algorithmic Techniques. Renew. Sustain. Energy Rev. 2022, 156, 111890. [Google Scholar] [CrossRef]

- Lin, J.; Pipattanasomporn, M.; Rahman, S. Comparative Analysis of Auction Mechanisms and Bidding Strategies for P2P Solar Transactive Energy Markets. Appl. Energy 2019, 255, 113687. [Google Scholar] [CrossRef]

- Teixeira, D.; Gomes, L.; Vale, Z. Single-Unit and Multi-Unit Auction Framework for Peer-to-Peer Transactions. Int. J. Electr. Power Energy 2021, 133, 107235. [Google Scholar] [CrossRef]

- Sorin, E.; Bobo, L.; Pinson, P. Consensus-Based Approach to Peer-to-Peer Electricity Markets with Product Differentiation. arXiv 2018, arXiv:1804.03521v2. [Google Scholar] [CrossRef]

- Rocha, R.; Silva, R.; Mello, J.; Faria, S.; Retorta, F.; Gouveia, C.; Villar, J. A Three-Stage Model to Manage Energy Communities, Share Benefits and Provide Local Grid Services. Energies 2023, 16, 1143. [Google Scholar] [CrossRef]

- Tounquet, F. Energy Communities in the European Union 2014—ASSET Projet; European Comission: Brussels, Belgium, 2019; Available online: https://www.powerpeers.nl/media/1330/asset-energy-comminities-revised-final-report.pdf (accessed on 14 January 2023).

- Mello, J.; Villar, J.; Saraiva, J.T. Concept and Design of a Real Time Walrasian Local Electricity Market. In Proceedings of the 2022 18th International Conference on the European Energy Market (EEM), Ljubljana, Slovenia, 13–15 September 2022; pp. 1–5. [Google Scholar]

- Pérez-Arriaga, I.J. (Ed.) Regulation of the Power Sector; Springer Science & Business Media: Berlin, Germany, 2014. [Google Scholar]

- Imran, K.; Kockar, I. A Technical Comparison of Wholesale Electricity Markets in North America and Europe. Electr. Power Syst. Res. 2014, 108, 59–67. [Google Scholar] [CrossRef]

- Directorate-General for Energy (European Commission); SWECO; TRACTEBEL Advisory and Advanced Analytics; Schumacher, L.; Küpper, G.; Henneaux, P.; Bruce, J.; Klasman, B.; Ehrenmann, A. The Future Electricity Intraday Market Design; Publications Office of the European Union: Luxembourg, 2019; ISBN 978-92-79-88757-4. [Google Scholar]

- Mello, J.; Villar, J. Integrating Flexibility and Energy Local Markets with Wholesale Balancing Responsibilities in the Context of Renewable Energy Communities (Invited Paper for Special Session). In Proceedings of the 2022 5th edition Energy & Environment (ICEE22), Porto, Portugal, 2–3 June 2022; pp. 1–6. [Google Scholar]

- Hadiya, N.; Teotia, F.; Bhakar, R.; Mathuria, P.; Datta, A. A Comparative Analysis of Pricing Mechanisms to Enable P2P Energy Sharing of Rooftop Solar Energy. In Proceedings of the 2020 IEEE International Conference on Power Systems Technology (POWERCON), Kuala Lumpur, Malaysia, 14–16 September 2020; pp. 1–6. [Google Scholar]

- Long, C.; Wu, J.; Zhang, C.; Thomas, L.; Cheng, M.; Jenkins, N. Peer-to-Peer Energy Trading in a Community Microgrid. In Proceedings of the 2017 IEEE Power & Energy Society General Meeting, Chicago, IL, USA, 16–20 July 2017; pp. 3–7. [Google Scholar]

- Chen, Y.; Lei, X.; Yang, J.; Zhong, H.; Huang, T. Decentralized P2P Power Trading Mechanism for Dynamic Multi-Energy Microgrid Groups Based on Priority Matching. Energy Rep. 2022, 8, 388–397. [Google Scholar] [CrossRef]

- Wang, N.; Liu, Z.; Heijnen, P.; Warnier, M. A Peer-to-Peer Market Mechanism Incorporating Multi-Energy Coupling and Cooperative Behaviors. Appl. Energy 2022, 311, 118572. [Google Scholar] [CrossRef]

- Liu, N.; Yu, X.; Wang, C.; Li, C.; Ma, L.; Lei, J. Energy-Sharing Model with Price-Based Demand Response for Microgrids of Peer-to-Peer Prosumers. IEEE Trans. Power Syst. 2017, 32, 3569–3583. [Google Scholar] [CrossRef]

- Umar, A.; Kumar, D.; Ghose, T. Blockchain-Based Decentralized Energy Intra-Trading with Battery Storage Flexibility in a Community Microgrid System. Appl. Energy 2022, 322, 119544. [Google Scholar] [CrossRef]

- Long, C.; Wu, J.; Zhou, Y.; Jenkins, N. Peer-to-Peer Energy Sharing through a Two-Stage Aggregated Battery Control in a Community Microgrid. Appl. Energy 2018, 226, 261–276. [Google Scholar] [CrossRef]

- Zheng, B.; Wei, W.; Chen, Y.; Wu, Q.; Mei, S. A Peer-to-Peer Energy Trading Market Embedded with Residential Shared Energy Storage Units. Appl. Energy 2022, 308, 118400. [Google Scholar] [CrossRef]

- Zhou, Y.; Wu, J.; Long, C.; Cheng, M.; Zhang, C. Performance Evaluation of Peer-to-Peer Energy Sharing Models. Energy Procedia 2017, 143, 817–822. [Google Scholar] [CrossRef]

- Universal Consortium. D5.4 EUniversal: Evaluation of Market Mechanisms: Challenges and Opportunities; Universal Consortium: London, UK, 2021. [Google Scholar]

- Pilz, M.; Al-Fagih, L. Recent Advances in Local Energy Trading in the Smart Grid Based on Game-Theoretic Approaches. IEEE Trans. Smart Grid 2019, 10, 1363–1371. [Google Scholar] [CrossRef]

- de Lorenzo García, C. Modeling the Equilibrium in a Local P2P Energy Market; Universidad Pontificia Comillas, ICAI: Madrid, Spain, 2021. [Google Scholar]

- Tushar, W.; Saha, T.K.; Yuen, C.; Morstyn, T.; McCulloch, M.D.; Poor, H.V.; Wood, K.L. A Motivational Game-Theoretic Approach for Peer-to-Peer Energy Trading in the Smart Grid. Appl. Energy 2019, 243, 10–20. [Google Scholar] [CrossRef]

- Long, C.; Zhou, Y.; Wu, J. A Game Theoretic Approach for Peer to Peer Energy Trading. Energy Procedia 2019, 159, 454–459. [Google Scholar] [CrossRef]

- Han, L.; Morstyn, T.; McCulloch, M. Incentivizing Prosumer Coalitions with Energy Management Using Cooperative Game Theory. IEEE Trans. Power Syst. 2019, 34, 303–313. [Google Scholar] [CrossRef]

- Lee, W.; Xiang, L.; Schober, R.; Wong, V.W.S. Direct Electricity Trading in Smart Grid: A Coalitional Game Analysis. IEEE J. Sel. Areas Commun. 2014, 32, 1398–1411. [Google Scholar] [CrossRef]

- Le Cadre, H.; Jacquot, P.; Wan, C.; Alasseur, C. Peer-to-Peer Electricity Market Analysis: From Variational to Generalized Nash Equilibrium. Eur. J. Oper. Res. 2020, 282, 753–771. [Google Scholar] [CrossRef]

- Amin, W.; Huang, Q.; Umer, K.; Zhang, Z.; Afzal, M.; Khan, A.A.; Ahmed, S.A. A Motivational Game-Theoretic Approach for Peer-to-Peer Energy Trading in Islanded and Grid-Connected Microgrid. Int. J. Electr. Power Energy Syst. 2020, 123, 106307. [Google Scholar] [CrossRef]

- Ringler, P.; Keles, D.; Fichtner, W. Agent-Based Modelling and Simulation of Smart Electricity Grids and Markets—A Literature Review. Renew. Sustain. Energy Rev. 2016, 57, 205–215. [Google Scholar] [CrossRef]

- Zhou, Y.; Wu, J.; Long, C. Evaluation of Peer-to-Peer Energy Sharing Mechanisms Based on a Multiagent Simulation Framework. Appl. Energy 2018, 222, 993–1022. [Google Scholar] [CrossRef]

- Khorasany, M.; Mishra, Y.; Ledwich, G. A Decentralized Bilateral Energy Trading System for Peer-to-Peer Electricity Markets. IEEE Trans. Ind. Electron. 2020, 67, 4646–4657. [Google Scholar] [CrossRef]

- Babaoglu, O.; Meling, H.; Montresor, A. Anthill: A Framework for the Development of Agent-Based Peer-to-Peer Systems. In Proceedings of the 22nd International Conference on Distributed Computing Systems, Vienna, Austria, 2–5 July 2002; pp. 15–22. [Google Scholar]

| Pricing Algorithm | Conceptual Simplicity | Computation Simplicity | Price Signals Relevance | Efficiency Economic Signal | Price Volatility | Sharing Fairness |

|---|---|---|---|---|---|---|

| BS | − | −−− | −− | −− | + | + |

| MR | ++ | ++ | − | −− | +++ | − |

| IMR | ++ | ++ | − | − | ++ | − |

| SDR | + | + | + | + | − | ++ |

| Corrected SDR | + | + | + | ++ | −− | ++ |

| Post-delivery pool | + | + | +++ | +++ | −−− | +++ |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Mello, J.; de Lorenzo, C.; Campos, F.A.; Villar, J. Pricing and Simulating Energy Transactions in Energy Communities. Energies 2023, 16, 1949. https://doi.org/10.3390/en16041949

Mello J, de Lorenzo C, Campos FA, Villar J. Pricing and Simulating Energy Transactions in Energy Communities. Energies. 2023; 16(4):1949. https://doi.org/10.3390/en16041949

Chicago/Turabian StyleMello, João, Cristina de Lorenzo, Fco. Alberto Campos, and José Villar. 2023. "Pricing and Simulating Energy Transactions in Energy Communities" Energies 16, no. 4: 1949. https://doi.org/10.3390/en16041949

APA StyleMello, J., de Lorenzo, C., Campos, F. A., & Villar, J. (2023). Pricing and Simulating Energy Transactions in Energy Communities. Energies, 16(4), 1949. https://doi.org/10.3390/en16041949