The Role of Environmental Regulations, Renewable Energy, and Energy Efficiency in Finding the Path to Green Economic Growth

Abstract

:1. Introduction

2. Literature Review

2.1. Environmental Regulations and Green Economic Growth

2.2. Renewable Energy and Green Economic Growth

2.3. Energy Efficiency and Green Economic Growth

3. Materials and Methods

3.1. Measuring Green Economic Growth

3.2. The Model to Measure the Impact of Environmental Regulations, Renewable Energy, and Energy Efficiency on Green Economic Growth

3.2.1. Data Characteristics

- The share of renewable energy in the total primary energy supply: this indicator reveals the share of energy consumption from renewable sources, which could contribute to the reduction of greenhouse gas emissions and the attainment of sustainable energy [87,88]. Countries with a higher share of renewable energy are likely to have a lower carbon footprint and feel a positive impact on green economic growth rates;

- Government expenditure on environmental protection: this indicator determines the values of government expenses on environmental protection as a percentage of the country’s GDP. On the one hand, the growth of government expenses on environmental protection indicates the government’s orientation to solve ecological issues and contribute to green economic growth. On the other hand, considering previous studies [89], the ratio between government expenditure on environmental protection and green economic growth has an inverted U-shape relationship. In the beginning, when government spending on environmental protection increases, there is a positive effect on green economic growth. However, after a certain level has been reached, further increases in public spending could provoke a negative impact on green economic growth, which could be caused by factors such as diminishing marginal returns to investment, inefficient resource allocation, or unfair negative consequences such as crowding out private investment;

- Energy intensity reveals the energy that is required for the production of one unit of GDP. Using energy by countries to achieve similar economic results indicates the more efficient use of resources and less impact on the environment [90]. Thus, the decline in energy intensity could be caused by the implementation of technological and institutional innovations that contribute to sustainable economic growth;

- Final energy consumption measures the energy consumption in the countries, which could be a significant indicator in estimating a country’s energy security and impact on nature [91]. Countries with low values of final energy consumption could have more energy efficacy with the lowest impact on the environment.

- Research and development (R & D): Investments in R & D contribute to developing technologies and innovations that reduce pollutant emissions, restrict environmental degradation, and increase labor productivity and the energy efficiency of processes. Similar to previous studies [92,93,94,95], R & D is measured by patents in environment-related technologies.

- Government institutions: Institutional quality influences green economic growth within the following mechanisms: protection of property rights (well-developed legal and economic institutions ensure effective protection of property rights and stimulate innovative development and advancing technologies that reduce the negative impact on the environment). This could develop the appropriate climate for business development and investments in the sectors of green economic growth: the rule of law (the stability of legal and economic institutions is an important factor for providing the affordable conditions of green economic growth) [96]; corruption (affects the country’s investment climate and contributes to the flow of foreign investments aimed at increasing energy-efficient production, consumption of renewable sources, etc.) [97,98]. This study uses the average value of the institutions’ quality indicators in different countries (which are calculated by the World Bank [85]) to estimate government institutions. These indicators cover six dimensions of state governance: voice and accountability (estimating citizens’ ability to participate in the political process and hold their governments accountable); political stability and absence of violence (describing the probability of political instability and violence in the country); government effectiveness (the quality of public services, the bureaucracy, and the competence of local authorities); regulatory quality (transparency, efficiency, and effectiveness of regulatory acts in promoting economic activity); rule of law (indicating compliance with laws and the independence and impartiality of the judiciary); and control of corruption (corruption of public officials and abuse of power for personal gain).

- Trade openness: the high level of a country’s integration into the world economy provides access to innovative technologies, environmentally friendly production, and green investments [99,100]. In addition, trade openness is conducive to intensifying competitiveness in the domestic market, which boosts companies’ performance and decreases costs by applying clean and green technologies [101,102].

3.2.2. Regression Framework

4. Results

5. Discussion & Conclusions

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- COP26: Together for Our Planet. 2023. Available online: https://www.un.org/en/climatechange/cop26 (accessed on 1 January 2023).

- Tan, J.; Su, X.; Wang, R. The impact of natural resource dependence and green finance on green economic growth in the context of COP26. Resour. Policy 2023, 81, 103351. [Google Scholar] [CrossRef]

- Granoff, I.; Hogarth, J.R.; Miller, A. Nested barriers to low-carbon infrastructure investment. Nat. Clim. Chang. 2016, 6, 1065–1071. [Google Scholar] [CrossRef]

- Kar, S.K.; Mishra, S.K.; Bansal, R. Drivers of green economy: An Indian perspective. In Environmental Sustainability: Role of Green Technologies; Springer: New Delhi, India, 2015; pp. 283–310. [Google Scholar] [CrossRef]

- Lee, C.T.; Hashim, H.; Ho, C.S.; Fan, Y.V.; Klemeš, J.J. Sustaining the low-carbon emission development in Asia and beyond: Sustainable energy, water, transportation and low-carbon emission technology. J. Clean. Prod. 2017, 146, 1–13. [Google Scholar] [CrossRef] [Green Version]

- Lin, B.; Zhou, Y. Measuring the green economic growth in China: Influencing factors and policy perspectives. Energy 2022, 241, 122518. [Google Scholar] [CrossRef]

- Desalegn, G.; Tangl, A. Enhancing Green Finance for Inclusive Green Growth: A Systematic Approach. Sustainability 2022, 14, 7416. [Google Scholar] [CrossRef]

- Fan, M.; Yang, P.; Li, Q. Impact of environmental regulation on green total factor productivity: A new perspective of green technological innovation. Environ. Sci. Pollut. Res. 2022, 29, 53785–53800. [Google Scholar] [CrossRef]

- Shang, L.; Tan, D.; Feng, S.; Zhou, W. Environmental regulation, import trade, and green technology innovation. Environ. Sci. Pollut. Res. 2022, 29, 12864–12874. [Google Scholar] [CrossRef]

- Wei, X.; Ren, H.; Ullah, S.; Bozkurt, C. Does environmental entrepreneurship play a role in sustainable green development? evidence from emerging Asian economies. Econ. Res.-Ekon. Istraz. 2023, 36, 73–85. [Google Scholar] [CrossRef]

- Nawawi, M.; Samsudin, H.; Saputra, J.; Szczepańska-Woszczyna, K.; Kot, S. The Effect of Formal and Informal Regulations on Industrial Effluents and Firm Compliance Behavior in Malaysia. Prod. Eng. Arch. 2022, 28, 193–200. [Google Scholar] [CrossRef]

- Kwilinski, A.; Lyulyov, O.; Pimonenko, T. Greenfield Investment as a Catalyst of Green Economic Growth. Energies 2023, 16, 2372. [Google Scholar] [CrossRef]

- Dzwigol, H.; Aleinikova, O.; Umanska, Y.; Shmygol, N.; Pushak, Y. An Entrepreneurship Model for Assessing the Investment Attractiveness of Regions. J. Entrep. Educ. 2019, 22, 1–7. [Google Scholar]

- Kostyrko, R.; Kosova, T.; Kostyrko, L.; Zaitseva, L.; Melnychenko, O. Ukrainian Market of Electrical Energy: Reforming, Financing, Innovative Investment, Efficiency Analysis, and Audit. Energies 2021, 14, 5080. [Google Scholar] [CrossRef]

- Prokopenko, O.; Miśkiewicz, R. Perception of “green shipping” in the contemporary conditions. Entrep. Sustain. Issues 2020, 8, 269–284. [Google Scholar] [CrossRef]

- Kotowicz, J.; Węcel, D.; Kwilinski, A.; Brzęczek, M. Efficiency of the power-to-gas-to-liquid-to-power system based on green methanol. Appl. Energy 2022, 314, 118933. [Google Scholar] [CrossRef]

- Miśkiewicz, R.; Rzepka, A.; Borowiecki, R.; Olesińki, Z. Energy Efficiency in the Industry 4.0 Era: Attributes of Teal Organizations. Energies 2021, 14, 6776. [Google Scholar] [CrossRef]

- Hezam, I.M.; Mishra, A.R.; Rani, P.; Saha, A.; Smarandache, F.; Pamucar, D. An integrated decision support framework using single-valued neutrosophic-MASWIP-COPRAS for sustainability assessment of bioenergy production technologies. Expert Syst. Appl. 2023, 211, 118674. [Google Scholar] [CrossRef]

- Tih, S.; Wong, K.-K.; Lynn, G.S.; Reilly, R.R. Prototyping, Customer Involvement, and Speed of Information Dissemination in New Product Success. J. Bus. Ind. Mark. 2016, 31, 437–448. [Google Scholar] [CrossRef]

- Dzwigol, H. Research Methodology in Management Science: Triangulation. Virtual Econ. 2022, 5, 78–93. [Google Scholar] [CrossRef]

- Dzwigol, H. Methodological and Empirical Platform of Triangulation in Strategic Management. Acad. Strateg. Manag. J. 2020, 19, 1–8. [Google Scholar]

- Us, Y.; Pimonenko, T.; Lyulyov, O.; Chen, Y.; Tambovceva, T. Promoting Green Brand of University in Social Media: Text Mining and Sentiment Analysis. Virtual Econ. 2022, 5, 24–42. [Google Scholar] [CrossRef]

- Miśkiewicz, R. The importance of knowledge transfer on the energy market. Polityka Energetyczna 2018, 21, 49–62. [Google Scholar] [CrossRef]

- Szczepańska-Woszczyna, K.; Gatnar, S. Key Competences of Research and Development Project Managers in High Technology Sector. Forum Sci. Oeconomia 2022, 10, 107–130. [Google Scholar] [CrossRef]

- Trzeciak, M.; Kopec, T.P.; Kwilinski, A. Constructs of Project Programme Management Supporting Open Innovation at the Strategic Level of the Organization. J. Open Innov. Technol. Mark. Complex. 2022, 8, 58. [Google Scholar] [CrossRef]

- Miśkiewicz, R. Knowledge and innovation 4.0 in today’s electromobility. In Sustainability, Technology and Innovation 4.0; Makieła, Z., Stuss, M.M., Borowiecki, R., Eds.; Routledge: London, UK, 2021; pp. 256–275. [Google Scholar]

- Sadiq, M.; Amayri, M.A.; Paramaiah, C.; Mai, N.H.; Ngo, T.Q.; Phan, T.T.H. How green finance and financial development promote green economic growth: Deployment of clean energy sources in South Asia. Environ. Sci. Pollut. Res. 2022, 29, 65521–65534. [Google Scholar]

- Srivastava, A.K.; Dharwal, M.; Sharma, A. Green financial initiatives for sustainable economic growth: A literature review. Mater. Today Proc. 2022, 49, 3615–3618. [Google Scholar] [CrossRef]

- Khan, S.A.R.; Yu, Z.; Umar, M. A road map for environmental sustainability and green economic development: An empirical study. Environ. Sci. Pollut. Res. 2022, 29, 16082–16090. [Google Scholar] [CrossRef] [PubMed]

- Li, J.; Chen, L.; Chen, Y.; He, J. Digital economy, technological innovation, and green economic efficiency—Empirical evidence from 277 cities in China. Manag. Decis. Econ. 2022, 43, 616–629. [Google Scholar] [CrossRef]

- Kharazishvili, Y.; Kwilinski, A.; Grishnova, O.; Dzwigol, H. Social safety of society for developing countries to meet sustainable development standards: Indicators, level, strategic benchmarks (with calculations based on the case study of Ukraine). Sustainability 2020, 12, 8953. [Google Scholar] [CrossRef]

- Hussain, H.I.; Haseeb, M.; Kamarudin, F.; Dacko-Pikiewicz, Z.; Szczepańska-Woszczyna, K. The role of globalization, economic growth and natural resources on the ecological footprint in Thailand: Evidence from nonlinear causal estimations. Processes 2021, 9, 1103. [Google Scholar] [CrossRef]

- Saługa, P.W.; Szczepańska-Woszczyna, K.; Miśkiewicz, R.; Chład, M. Cost of equity of coal-fired power generation projects in Poland: Its importance for the management of decision-making process. Energies 2020, 13, 4833. [Google Scholar] [CrossRef]

- Saługa, P.W.; Zamasz, K.; Dacko-Pikiewicz, Z.; Szczepańska-Woszczyna, K.; Malec, M. Risk-adjusted discount rate and its components for onshore wind farms at the feasibility stage. Energies 2021, 14, 6840. [Google Scholar] [CrossRef]

- Dźwigoł, H.; Wolniak, R. Controlling in the Management Process of a Chemical Industry Production Company. Przem. Chem. 2018, 97, 1114–1116. [Google Scholar] [CrossRef]

- Cyfert, S.; Chwiłkowska-Kubala, A.; Szumowski, W.; Miśkiewicz, R. The process of developing dynamic capabilities: The conceptualization attempt and the results of empirical studies. PLoS ONE 2021, 16, e0249724. [Google Scholar] [CrossRef] [PubMed]

- Ingber, L. Quantum path-integral qPATHINT algorithm. Open Cybern. Syst. J. 2017, 11, 119–133. [Google Scholar] [CrossRef]

- Kianpour, M.; Kowalski, S.J.; Øverby, H. Systematically Understanding Cybersecurity Economics: A Survey. Sustainability 2021, 13, 13677. [Google Scholar] [CrossRef]

- Miśkiewicz, R.; Matan, K.; Karnowski, J. The Role of Crypto Trading in the Economy, Renewable Energy Consumption and Ecological Degradation. Energies 2022, 15, 3805. [Google Scholar] [CrossRef]

- Dźwigol, H.; Dźwigoł-Barosz, M.; Zhyvko, Z.; Miśkiewicz, R.; Pushak, H. Evaluation of the energy security as a component of national security of the country. J. Secur. Sustain. Issues 2019, 8, 307–317. [Google Scholar] [CrossRef]

- Kwilinski, A.; Lyulyov, O.; Pimonenko, T. The Effects of Urbanization on Green Growth within Sustainable Development Goals. Land 2023, 12, 511. [Google Scholar] [CrossRef]

- Cheng, Z.; Li, X.; Wang, M. Resource curse and green economic growth. Resour. Policy 2021, 74, 102325. [Google Scholar] [CrossRef]

- Hou, S.; Song, L.; Dai, W. The impact of income gap on regional green economic growth—Evidence from 283 prefecture-level cities in China. Kybernetes, 2022; ahead-of-print. [Google Scholar] [CrossRef]

- Pan, D.; Yu, Y.; Hong, W.; Chen, S. Does campaign-style environmental regulation induce green economic growth? evidence from China’s central environmental protection inspection policy. Energy Environ. 2023; ahead-of-print. [Google Scholar] [CrossRef]

- Li, Y.; Ding, T.; Zhu, W. Can green credit contribute to sustainable economic growth? An empirical study from China. Sustainability 2022, 14, 6661. [Google Scholar] [CrossRef]

- Mao, J.; Wu, Q.; Zhu, M.; Lu, C. Effects of environmental regulation on green total factor productivity: An evidence from the yellow river basin, China. Sustainability 2022, 14, 2015. [Google Scholar] [CrossRef]

- Liu, Y.; Ma, C.; Huang, Z. Can the digital economy improve green total factor productivity? An empirical study based on Chinese urban data. Math. Biosci. Eng. 2023, 20, 6866–6893. [Google Scholar] [CrossRef]

- Luo, S.; Zhang, S. How R & D expenditure intermediate as a new determinants for low carbon energy transition in belt and road initiative economies. Renew. Energy 2022, 197, 101–109. [Google Scholar] [CrossRef]

- Luo, Y.; Lu, Z.; Muhammad, S.; Yang, H. The heterogeneous effects of different technological innovations on eco-efficiency: Evidence from 30 China’s provinces. Ecol. Indic. 2021, 127, 107802. [Google Scholar] [CrossRef]

- Chen, Y.; Fan, X.; Zhou, Q. An Inverted-U Impact of Environmental Regulations on Carbon Emissions in China’s Iron and Steel Industry: Mechanisms of Synergy and Innovation Effects. Sustainability 2020, 12, 1038. [Google Scholar] [CrossRef] [Green Version]

- Su, S.; Zhang, F. Modeling the role of environmental regulations in regional green economy efficiency of China: Empirical evidence from super efficiency DEA-Tobit model. J. Environ. Manag. 2020, 261, 110227. [Google Scholar]

- Qiu, S.; Wang, Z.; Geng, S. How do environmental regulation and foreign investment behavior affect green productivity growth in the industrial sector? an empirical test based on Chinese provincial panel data. J. Environ. Manag. 2021, 287, 112282. [Google Scholar] [CrossRef]

- Tao, H.; Tao, M.; Wang, R. Do education human capital and environmental regulation drive the growth efficiency of the green economy in China? Sustainability 2022, 14, 16524. [Google Scholar] [CrossRef]

- Song, X.; Tian, Z.; Ding, C.; Liu, C.; Wang, W.; Zhao, R.; Xing, Y. Digital economy, environmental regulation, and ecological well-being performance: A provincial panel data analysis from China. Int. J. Environ. Res. Public Health 2022, 19, 11801. [Google Scholar] [CrossRef] [PubMed]

- Su, Y.; Gao, X. Revealing the effectiveness of green technological progress and financial innovation on green economic growth: The role of environmental regulation. Environ. Sci. Pollut. Res. 2022, 29, 72991–73000. [Google Scholar] [CrossRef] [PubMed]

- Wang, X.; Wang, Z.; Wang, R. Does green economy contribute toward COP26 ambitions? Exploring the influence of natural resource endowment and technological innovation on the growth efficiency of China’s regional green economy. Resour. Policy 2023, 80, 103189. [Google Scholar] [CrossRef]

- Ahmed, F.; Kousar, S.; Pervaiz, A.; Trinidad-Segovia, J.E.; del Pilar Casado-Belmonte, M.; Ahmed, W. Role of green innovation, trade and energy to promote green economic growth: A case of south Asian nations. Environ. Sci. Pollut. Res. 2022, 29, 6871–6885. [Google Scholar] [CrossRef]

- Aimon, H.; Kurniadi, A.P.; Amar, S. Analysis of fuel oil consumption, green economic growth and environmental degradation in 6 Asia Pacific countries. Int. J. Sustain. Dev. Plan. 2021, 16, 925–933. [Google Scholar] [CrossRef]

- Cao, L. How green finance reduces CO2 emissions for green economic recovery: Empirical evidence from E7 economies. Environ. Sci. Pollut. Res. 2023, 30, 3307–3320. [Google Scholar] [CrossRef]

- Deshuai, M.; Hui, L.; Ullah, S. Pro-environmental behavior–Renewable energy transitions nexus: Exploring the role of higher education and information and communications technology diffusion. Front. Psychol. 2022, 13. [Google Scholar] [CrossRef]

- Doran, M.D.; Poenaru, M.M.; Zaharia, A.L.; Vătavu, S.; Lobonț, O.R. Fiscal Policy, Growth, Financial Development and Renewable Energy in Romania: An Autoregressive Distributed Lag Model with Evidence for Growth Hypothesis. Energies 2023, 16, 70. [Google Scholar] [CrossRef]

- Miskiewicz, R. Efficiency of electricity production technology from postprocess gas heat: Ecological, economic and social benefits. Energies 2020, 13, 6106. [Google Scholar] [CrossRef]

- Coban, H.H.; Lewicki, W.; Miśkiewicz, R.; Drożdż, W. The Economic Dimension of Using the Integration of Highway Sound Screens with Solar Panels in the Process of Generating Green Energy. Energies 2023, 16, 178. [Google Scholar] [CrossRef]

- Melnychenko, O. Energy Losses Due to Imperfect Payment Infrastructure and Payment Instruments. Energies 2021, 14, 8213. [Google Scholar] [CrossRef]

- Fang, W.; Liu, Z.; Surya Putra, A.R. Role of research and development in green economic growth through renewable energy development: Empirical evidence from south Asia. Renew. Energy 2022, 194, 1142–1152. [Google Scholar] [CrossRef]

- Wei, S.; Jiandong, W.; Saleem, H. The impact of renewable energy transition, green growth, green trade and green innovation on environmental quality: Evidence from top 10 green future countries. Front. Environ. Sci. 2023, 10, 1–18. [Google Scholar] [CrossRef]

- Li, J.; Dong, K.; Taghizadeh-Hesary, F.; Wang, K. 3G in China: How green economic growth and green finance promote green energy? Renew. Energy 2022, 200, 1327–1337. [Google Scholar] [CrossRef]

- Li, Z.; Shen, T.; Yin, Y.; Chen, H.H. Innovation Input, Climate Change, and Energy-Environment-Growth Nexus: Evidence from OECD and Non-OECD Countries. Energies 2022, 15, 8927. [Google Scholar] [CrossRef]

- Taşkın, D.; Vardar, G.; Okan, B. Does renewable energy promote green economic growth in OECD countries? Sustain. Account. Manag. Policy J. 2020, 11, 771–798. [Google Scholar] [CrossRef]

- Lee, K. Drivers and barriers to energy efficiency management for sustainable development. Sustain. Dev. 2015, 23, 16–25. [Google Scholar] [CrossRef]

- Zakari, A.; Khan, I.; Tan, D.; Alvarado, R.; Dagar, V. Energy efficiency and sustainable development goals (SDGs). Energy 2022, 239, 122365. [Google Scholar] [CrossRef]

- Khan, S.A.R.; Yu, Z.; Ridwan, I.L.; Irshad, A.U.R.; Ponce, P.; Tanveer, M. Energy efficiency, carbon neutrality and technological innovation: A strategic move toward green economy. Econ. Res.-Ekon. Istraz. 2022; ahead-of-print. [Google Scholar] [CrossRef]

- Kėdaitienė, A.; Klyvienė, V. The relationships between economic growth, energy efficiency and CO2 emissions: Results for the euro area. Ekonomika 2020, 99, 6–25. [Google Scholar] [CrossRef]

- Lin, B.; Benjamin, N.I. Determinants of industrial carbon dioxide emissions growth in shanghai: A quantile analysis. J. Clean. Prod. 2019, 217, 776–786. [Google Scholar] [CrossRef]

- Mohsin, M.; Taghizadeh-Hesary, F.; Iqbal, N.; Saydaliev, H.B. The role of technological progress and renewable energy deployment in green economic growth. Renew. Energy 2022, 190, 777–787. [Google Scholar] [CrossRef]

- Sun, H.; Edziah, B.K.; Kporsu, A.K.; Sarkodie, S.A.; Taghizadeh-Hesary, F. Energy efficiency: The role of technological innovation and knowledge spillover. Technol. Forecast. Soc. Chang. 2021, 167, 120659. [Google Scholar] [CrossRef]

- Chen, M.; Sinha, A.; Hu, K.; Shah, M.I. Impact of technological innovation on energy efficiency in industry 4.0 era: Moderation of shadow economy in sustainable development. Technol. Forecast. Soc. Chang. 2021, 164, 120521. [Google Scholar] [CrossRef]

- Li, Y.; Liu, A.-C.; Wang, S.-M.; Zhan, Y.; Chen, J.; Hsiao, H.-F. A Study of Total-Factor Energy Efficiency for Regional Sustainable Development in China: An Application of Bootstrapped DEA and Clustering Approach. Energies 2022, 15, 3093. [Google Scholar] [CrossRef]

- Neofytou, H.; Sarafidis, Y.; Gkonis, N.; Mirasgedis, S.; Askounis, D. Energy efficiency contribution to sustainable development: A multicriteria approach in Greece. Energy Sources Part B Econ. Plan. Policy 2020, 15, 572–604. [Google Scholar] [CrossRef]

- Shpak, N.; Melnyk, O.; Horbal, N.; Ruda, M.; Sroka, W. Assessing the implementation of the circular economy in the EU countries. Forum Sci. Oeconomia 2021, 9, 25–39. [Google Scholar] [CrossRef]

- Yan, D.; Liu, H.; Yao, P. Assessing energy efficiency for economic and sustainable development in the region of European union countries. Front. Environ. Sci. 2021, 9, 779163. [Google Scholar] [CrossRef]

- Dzwigol, H.; Dzwigol-Barosz, M. Sustainable Development of the Company on the basis of Expert Assessment of the Investment Strategy. Acad. Strateg. Manag. J. 2020, 19, 1–7. [Google Scholar]

- Kuzior, A. Technological Unemployment in the Perspective of Industry 4.0. Virtual Econ. 2022, 5, 7–23. [Google Scholar] [CrossRef]

- Ojaleye, D.; Narayanan, B. Identification of Key Sectors in Nigeria—Evidence of Backward and Forward Linkages from Input–Output Analysis. SocioEconomic Chall. 2022, 6, 41–62. [Google Scholar] [CrossRef]

- World Data Bank. Worldwide Governance Indicators. 2022. Available online: https://data.worldbank.org (accessed on 10 February 2023).

- Eurostat. 2022. Available online: https://ec.europa.eu/eurostat/web/main/data/database (accessed on 10 February 2023).

- Gavkalova, N.; Lola, Y.; Prokopovych, S.; Akimov, O.; Smalskys, V.; Akimova, L. Innovative Development of Renewable Energy During the Crisis Period and Its Impact on the Environment. Virtual Econ. 2022, 5, 65–77. [Google Scholar] [CrossRef] [PubMed]

- Coban, H.H.; Lewicki, W.; Sendek-Matysiak, E.; Łosiewicz, Z.; Drożdż, W.; Miśkiewicz, R. Electric Vehicles and Vehicle–Grid Interaction in the Turkish Electricity System. Energies 2022, 15, 8218. [Google Scholar] [CrossRef]

- Kharazishvili, Y.; Kwilinski, A.; Sukhodolia, O.; Dzwigol, H.; Bobro, D.; Kotowicz, J. The systemic approach for estimating and strategizing energy security: The case of Ukraine. Energies 2021, 14, 2126. [Google Scholar] [CrossRef]

- Samusevych, Y.; Vysochyna, A.; Vasylieva, T.; Lyeonov, S.; Pokhylko, S. Environmental, energy and economic security: Assessment and interaction. E3S Web Conf. 2021, 234, 00012. [Google Scholar] [CrossRef]

- Mesagan, E.P.; Chidi, O.N. Energy consumption, capital investment and environmental degradation: The African experience. Forum Sci. Oeconomia 2020, 8, 5–16. [Google Scholar] [CrossRef]

- Miśkiewicz, R. The Impact of Innovation and Information Technology on Greenhouse Gas Emissions: A Case of the Visegrád Countries. J. Risk Financ. Manag. 2021, 14, 59. [Google Scholar] [CrossRef]

- Fila, M.; Levicky, M.; Mura, L.; Maros, M.; Korenkova, M. Innovations for business management: Motivation and barriers. Mark. Manag. Innov. 2020, 4, 266–278. [Google Scholar] [CrossRef]

- Oe, H.; Yamaoka, Y.; Duda, K. How to Sustain Businesses in the Post-COVID-19 Era: A Focus on Innovation, Sustainability and Leadership. Bus. Ethics Leadersh. 2022, 6, 1–9. [Google Scholar] [CrossRef]

- Vaníčková, R.; Szczepańska-Woszczyna, K. Innovation of business and marketing plan of growth strategy and competitive advantage in exhibition industry. Pol. J. Manag. Stud. 2020, 21, 425–445. [Google Scholar] [CrossRef]

- Lyeonov, S.; Vasilyeva, T.; Bilan, Y.; Bagmet, K. Convergence of the institutional quality of the social sector: The path to inclusive growth. Int. J. Trade Glob. Mark. 2021, 14, 272–291. [Google Scholar] [CrossRef]

- Szczepańska-Woszczyna, K.; Gedvilaitė, D.; Nazarko, J.; Stasiukynas, A.; Rubina, A. Assessment of Economic Convergence among Countries in the European Union. Technol. Econ. Dev. Econ. 2022, 28, 1572–1588. [Google Scholar] [CrossRef]

- Miskiewicz, R. Clean and Affordable Energy within Sustainable Development Goals: The Role of Governance Digitalization. Energies 2022, 15, 9571. [Google Scholar] [CrossRef]

- Keliuotytė-Staniulėnienė, G.; Daunaravičiūtė, K. The Global Green Bond Market in the Face of the COVID-19 Pandemic. Financ. Mark. Inst. Risks 2021, 5, 50–60. [Google Scholar] [CrossRef]

- El Amri, A.; Oulfarsi, S.; Boutti, R.; Sahib Eddine, A.; Hmioui, A. Carbon Financial Markets Underlying Climate Change Mitigation, Pricing and Challenges: Technical Analysis. Financ. Mark. Inst. Risks 2021, 5, 5–17. [Google Scholar] [CrossRef]

- Kabaklarli, E.; Duran, M.S.; Üçler, Y.T. High-technology exports and economic growth: Panel data analysis for selected OECD countries. Forum Sci. Oeconomia 2018, 6, 47–60. [Google Scholar] [CrossRef]

- Didenko, I.; Volik, K.; Vasylieva, T.; Lyeonov, S.; Antoniuk, N. Environmental migration and country security: Theoretical analysis and empirical research. E3S Web Conf. 2021, 234, 00010. [Google Scholar] [CrossRef]

- Zhang, D.; Mohsin, M.; Rasheed, A.K.; Chang, Y.; Taghizadeh-Hesary, F. Public spending and green economic growth in BRI region: Mediating role of green finance. Energy Policy 2021, 153, 112256. [Google Scholar] [CrossRef]

- Chen, J.; Rojniruttikul, N.; Kun, L.Y.; Ullah, S. Management of green economic infrastructure and environmental sustainability in one belt and road enitiative economies. Environ. Sci. Pollut. Res. 2022, 29, 36326–36336. [Google Scholar] [CrossRef]

- Levin, A.; Lin, C.F.; Chu, C.S.J. Unit root tests in panel data: Asymptotic and finite-sample properties. J. Econom. 2002, 108, 1–24. [Google Scholar] [CrossRef]

- Im, K.S.; Pesaran, M.H.; Shin, Y. Testing for unit roots in heterogeneous panels. J. Econom. 2003, 115, 53–74. [Google Scholar] [CrossRef]

- Cheung, Y.W.; Lai, K.S. Lag order and critical values of the augmented Dickey–Fuller test. J. Bus. Econ. Stat. 1995, 13, 277–280. [Google Scholar]

- Pesaran, M.H. A simple panel unit root test in the presence of cross-section dependence. J. Appl. Econom. 2007, 22, 265–312. [Google Scholar] [CrossRef] [Green Version]

- Drożdż, W.; Kinelski, G.; Czarnecka, M.; Wójcik-Jurkiewicz, M.; Maroušková, A.; Zych, G. Determinants of Decarbonization—How to Realize Sustainable and Low Carbon Cities? Energies 2021, 14, 2640. [Google Scholar] [CrossRef]

- Kwilinski, A.; Lyulyov, O.; Pimonenko, T. Inclusive Economic Growth: Relationship between Energy and Governance Efficiency. Energies 2023, 16, 2511. [Google Scholar] [CrossRef]

- Pesaran, M.H. General Diagnostic Tests for Cross Section Dependence in Panels. Empir. Econ. 2021, 60, 13–50. [Google Scholar] [CrossRef]

- Djalilov, K. A Contingent Resource-Based Perspective on Corporate Social Responsibility and Competitive Advantage: A Focus on Transition Countries. Bus. Ethics Leadersh. 2022, 6, 92–108. [Google Scholar] [CrossRef]

- Niftiyev, I.; Yagublu, N.; Akbarli, N. Exploring the Innovativeness of the South Caucasus Economies: Main Trends and Factors. SocioEconomic Chall. 2021, 5, 122–148. [Google Scholar] [CrossRef]

- Shahbaz, M.; Nwani, C.; Bekun, F.V.; Gyamfi, B.A.; Agozie, D.Q. Discerning the role of renewable energy and energy efficiency in finding the path to cleaner consumption and production patterns: New insights from developing economies. Energy 2022, 260, 124951. [Google Scholar] [CrossRef]

- Kiehbadroudinezhad, M.; Merabet, A.; Hosseinzadeh-Bandbafha, H. A life cycle assessment perspective on biodiesel production from fish wastes for green microgrids in a circular bioeconomy. Bioresour. Technol. Rep. 2023, 21, 101303. [Google Scholar] [CrossRef]

- Wang, E.Z.; Lee, C.C. The impact of clean energy consumption on economic growth in China: Is environmental regulation a curse or a blessing? Int. Rev. Econ. Financ. 2022, 77, 39–58. [Google Scholar] [CrossRef]

- Kiehbadroudinezhad, M.; Merabet, A.; Hosseinzadeh-Bandbafha, H. The role of the solar-based stand-alone microgrid to enhance environmental sustainability: A case study. Energy Sources Part A Recovery Util. Environ. Eff. 2022, 44, 6523–6536. [Google Scholar] [CrossRef]

- Nie, X.; Chen, Z.; Yang, L.; Wang, Q.; He, J.; Qin, H.; Wang, H. Impact of carbon trading system on green economic growth in China. Land 2022, 11, 1199. [Google Scholar] [CrossRef]

- Tamasiga, P.; Onyeaka, H.; Ouassou, E.h. Unlocking the Green Economy in African Countries: An Integrated Framework of FinTech as an Enabler of the Transition to Sustainability. Energies 2022, 15, 8658. [Google Scholar] [CrossRef]

| Countries | Labor Force World Data Bank [85] | Gross Capital Formation World Data Bank [85] | Gross Domestic Product World Data Bank [85] | Greenhouse Gas Emission Eurostat [86] | ||||

|---|---|---|---|---|---|---|---|---|

| LogL | LogK | LogGDP | LogGHG | |||||

| mean | s.d. | mean | s.d. | mean | s.d. | mean | s.d. | |

| Austria | 15.303 | 0.040 | 25.280 | 0.105 | 10.783 | 0.068 | 2.235 | 0.064 |

| Belgium | 15.412 | 0.033 | 25.468 | 0.091 | 10.710 | 0.062 | 2.435 | 0.106 |

| Bulgaria | 15.028 | 0.018 | 23.213 | 0.157 | 8.925 | 0.201 | 1.933 | 0.086 |

| Croatia | 14.434 | 0.032 | 23.265 | 0.187 | 9.541 | 0.091 | 1.599 | 0.078 |

| Cyprus | 13.291 | 0.046 | 22.253 | 0.288 | 10.266 | 0.109 | 2.433 | 0.114 |

| Czech Republic | 15.484 | 0.016 | 24.764 | 0.127 | 9.914 | 0.118 | 2.525 | 0.065 |

| Denmark | 14.889 | 0.019 | 24.947 | 0.105 | 10.981 | 0.060 | 2.376 | 0.192 |

| Estonia | 13.447 | 0.014 | 22.604 | 0.218 | 9.809 | 0.177 | 2.541 | 0.145 |

| Finland | 14.811 | 0.010 | 24.809 | 0.098 | 10.773 | 0.070 | 2.115 | 0.205 |

| France | 17.220 | 0.015 | 27.121 | 0.079 | 10.611 | 0.066 | 1.946 | 0.087 |

| Germany | 17.568 | 0.023 | 27.317 | 0.100 | 10.690 | 0.076 | 2.403 | 0.086 |

| Greece | 15.402 | 0.022 | 24.274 | 0.533 | 10.022 | 0.201 | 2.269 | 0.168 |

| Hungary | 15.315 | 0.046 | 24.163 | 0.187 | 9.553 | 0.107 | 1.813 | 0.081 |

| Ireland | 14.651 | 0.028 | 25.023 | 0.525 | 11.014 | 0.185 | 2.731 | 0.095 |

| Italy | 17.043 | 0.025 | 26.687 | 0.149 | 10.458 | 0.085 | 2.016 | 0.155 |

| Latvia | 13.856 | 0.055 | 22.687 | 0.245 | 9.577 | 0.172 | 1.433 | 0.323 |

| Lithuania | 14.211 | 0.013 | 22.927 | 0.218 | 9.602 | 0.213 | 1.525 | 0.193 |

| Luxembourg | 12.487 | 0.135 | 23.121 | 0.135 | 11.626 | 0.075 | 3.114 | 0.165 |

| Malta | 12.223 | 0.167 | 21.484 | 0.271 | 10.098 | 0.177 | 1.888 | 0.226 |

| Netherlands | 16.015 | 0.030 | 25.890 | 0.101 | 10.838 | 0.071 | 2.519 | 0.084 |

| Poland | 16.701 | 0.020 | 25.311 | 0.128 | 9.485 | 0.146 | 2.272 | 0.026 |

| Portugal | 15.494 | 0.026 | 24.455 | 0.207 | 9.998 | 0.073 | 1.807 | 0.117 |

| Romania | 16.039 | 0.027 | 24.625 | 0.202 | 9.164 | 0.208 | 1.532 | 0.119 |

| Slovak Republic | 14.814 | 0.013 | 23.754 | 0.091 | 9.766 | 0.101 | 1.892 | 0.108 |

| Slovenia | 13.840 | 0.014 | 23.057 | 0.195 | 10.078 | 0.090 | 1.940 | 0.185 |

| Spain | 16.961 | 0.019 | 26.388 | 0.237 | 10.295 | 0.085 | 1.958 | 0.150 |

| Sweden | 15.447 | 0.046 | 25.540 | 0.110 | 10.896 | 0.083 | 0.664 | 0.365 |

| Total | 15.088 | 1.346 | 24.460 | 1.512 | 10.203 | 0.650 | 2.071 | 0.504 |

| Symbols | Explanation | Source | Mean | CV | Min | Max | VIF |

|---|---|---|---|---|---|---|---|

| Explanatory variables | |||||||

| LogRE | The share of renewable energy in the total primary energy supply | Eurostat [86] | 2.461 | 0.247 | 1.040 | 3.750 | 1.58 |

| LogEnvReg | Government expenditure on environmental protection | 0.118 | 2.562 | −2.303 | 0.742 | 1.34 | |

| Energy Efficiency | |||||||

| LogEI | Energy intensity | Eurostat [86] | 5.079 | 0.091 | 3.798 | 6.319 | 1.68 |

| LogFEC | Final energy consumption | 2.956 | 0.418 | 0.451 | 5.407 | 6.32 | |

| Control variables | |||||||

| LogWGI | Estimate of governance | World Data Bank [85] | −0.159 | −4.184 | −2.442 | 0.636 | 2.19 |

| LogRD | Patents in environment-related technologies | 3.821 | 0.527 | −1.609 | 8.112 | 5.56 | |

| LogTO | Trade openness | 4.705 | 0.093 | 3.816 | 5.940 | 2.58 | |

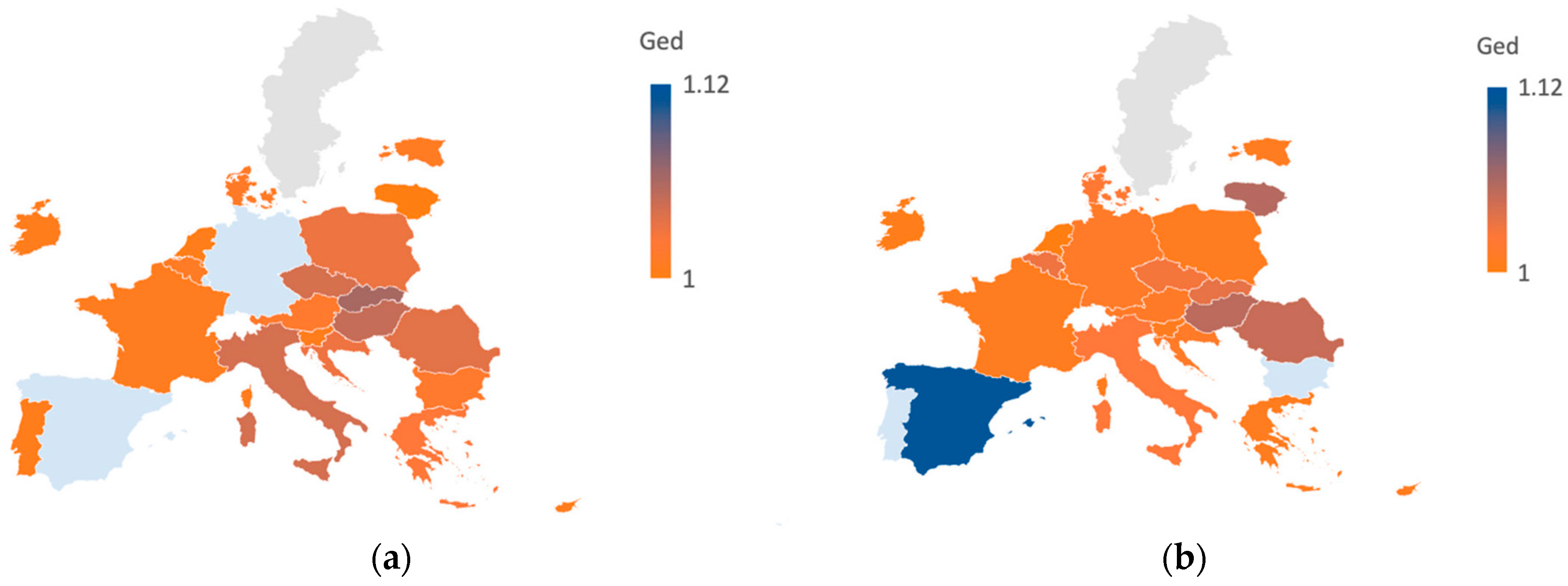

| Country | Mean | CV | Min | Max | Country | Mean | CV | Min | Max |

|---|---|---|---|---|---|---|---|---|---|

| Austria | 1.003 | 0.019 | 0.959 | 1.034 | Italy | 1.002 | 0.005 | 0.988 | 1.008 |

| Belgium | 1.003 | 0.012 | 0.969 | 1.015 | Lithuania | 1.016 | 0.035 | 0.929 | 1.061 |

| Bulgaria | 1.008 | 0.012 | 0.983 | 1.031 | Luxembourg | 1.000 | 0.030 | 0.947 | 1.056 |

| Croatia | 1.006 | 0.021 | 0.957 | 1.041 | Netherlands | 1.002 | 0.026 | 0.921 | 1.027 |

| Cyprus | 1.007 | 0.042 | 0.876 | 1.051 | Poland | 1.001 | 0.002 | 0.997 | 1.004 |

| Czech Republic | 1.003 | 0.008 | 0.985 | 1.020 | Portugal | 1.008 | 0.029 | 0.950 | 1.063 |

| Denmark | 1.016 | 0.024 | 0.966 | 1.055 | Romania | 1.003 | 0.007 | 0.992 | 1.017 |

| Estonia | 1.011 | 0.023 | 0.963 | 1.058 | Slovak Republic | 1.012 | 0.020 | 0.961 | 1.048 |

| France | 1.002 | 0.007 | 0.987 | 1.010 | Slovenia | 1.014 | 0.048 | 0.929 | 1.135 |

| Germany | 1.002 | 0.004 | 0.993 | 1.007 | Spain | 1.002 | 0.004 | 0.991 | 1.009 |

| Greece | 1.008 | 0.013 | 0.983 | 1.030 | Sweden | 1.012 | 0.050 | 0.919 | 1.115 |

| Hungary | 1.004 | 0.013 | 0.979 | 1.022 | Total | 1.007 | 0.024 | 0.876 | 1.135 |

| Ireland | 1.020 | 0.026 | 0.974 | 1.061 |

| Parameters | RE | EnvReg | EI | FEC | WGI | RD | TO |

|---|---|---|---|---|---|---|---|

| Stat. | 25.895 | 28.728 | 28.862 | 27.925 | 27.947 | 28.296 | 27.687 |

| Prob. | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 |

| Variables | Levin–Lin–Chu | Im–Pesaran–Shin | ADF | CADF | CIPS | |||||

|---|---|---|---|---|---|---|---|---|---|---|

| Lev. | 1st dif. | Lev. | 1st dif. | Lev. | 1st dif. | Lev. | 1st dif. | Lev. | 1st dif. | |

| RE | 1.888 | −4.449 * | 1.624 | −7.687 * | −2.029 | 31.193 * | −2.046 | −2.670 * | −2.612 | −4.727 * |

| EnvReg | −4.257 * | −7.820 * | −3.326 * | −8.125 * | 7.543 * | 35.714 * | −1.909 | −2.703 * | −2.198 | −3.915 * |

| EI | 1.160 | −11.846 * | 5.054 | −8.246 * | −3.442 | 30.761 * | −2.117 ** | −2.316 * | −2.569 * | −3.884 * |

| FEC | −3.961 * | −4.491 * | −1.874 ** | −6.860 * | 3.961 * | 26.016 * | −1.806 | −2.913 * | −2.023 | −3.363 * |

| WGI | −1.776 ** | −3.932 * | 0.017 | −8.096 * | −0.376 | 35.948 * | −1.620 | −2.336 * | −2.131 | −3.498 * |

| RD | −7.680 * | −9.778 * | −5.521 * | −8.883 * | 15.644 * | 46.709 * | −2.658 * | −3.512 * | −3.159 * | −4.496 * |

| TO | −2.885 | −14.542 | −0.368 | −6.971 | −0.458 | 18.061 | −1.465 | −3.251 | −1.078 | −3.238 |

| Variables | RE | EI | FEC | |||

|---|---|---|---|---|---|---|

| coef. | p Value | coef. | p Value | coef. | p Value | |

| Gedt−1 | 0.378 | 0.000 | 0.394 | 0.000 | 0.392 | 0.000 |

| RE | 0.198 | 0.033 | – | – | – | – |

| EI | – | – | −0.083 | 0.004 | – | – |

| FEC | – | – | – | – | 0.110 | 0.012 |

| WGI | −0.026 | 0.388 | −0.027 | 0.102 | 0.026 | 0.424 |

| RD | 0.009 | 0.454 | 0.005 | 0.085 | 0.005 | 0.010 |

| TO | 0.129 | 0.059 | 0.008 | 0.049 | 0.067 | 0.059 |

| const | −1.134 | 0.043 | 0.404 | 0.003 | −0.424 | 0.052 |

| Wald chi2 | 160.40 | 0.000 | 233.26 | 0.000 | 96.26 | 0.000 |

| AB AR (1) | 1.74 | 0.082 | −2.89 | 0.004 | −2.56 | 0.011 |

| AB AR (2) | 1.63 | 0.104 | 1.54 | 0.124 | −0.66 | 0.512 |

| Hans. | 5.20 | 0.816 | 9.41 | 0.494 | 5.51 | 0.787 |

| Sarg. | 5.62 | 0.777 | 15.03 | 0.131 | 6.11 | 0.729 |

| Variables | RE | EI | FEC | |||

|---|---|---|---|---|---|---|

| coef. | p Value | coef. | p Value | coef. | p Value | |

| Gedt−1 | 0.383 | 0.000 | 0.376 | 0.000 | 0.374 | 0.000 |

| RE | 0.161 | 0.000 | – | – | – | – |

| EI | – | – | 0.016 | 0.197 | – | – |

| FEC | – | – | – | – | 0.027 | 0.000 |

| WGI | −0.027 | 0.638 | −0.023 | 0.517 | −0.016 | 0.330 |

| RD | 0.010 | 0.000 | 0.012 | 0.002 | 0.004 | 0.094 |

| TO | 0.117 | 0.000 | 0.035 | 0.001 | 0.047 | 0.000 |

| EnvReg | 0.588 | 0.045 | 0.837 | 0.088 | 0.837 | 0.029 |

| EnvReg2 | −1.049 | 0.039 | −1.683 | 0.034 | −1.623 | 0.011 |

| const | −0.660 | 0.031 | 0.208 | 0.006 | 0.205 | 0.016 |

| Wald chi2 | 79.010 | 0.000 | 73.360 | 0.000 | 94.870 | 0.000 |

| AB AR (1) | −2.300 | 0.022 | −1.970 | 0.049 | −1.960 | 0.050 |

| AB AR (2) | 1.410 | 0.158 | 1.060 | 0.287 | 1.120 | 0.265 |

| Hans. | 3.300 | 0.914 | 2.200 | 0.948 | 1.180 | 0.978 |

| Sarg. | 4.410 | 0.819 | 2.280 | 0.943 | 2.030 | 0.917 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Dzwigol, H.; Kwilinski, A.; Lyulyov, O.; Pimonenko, T. The Role of Environmental Regulations, Renewable Energy, and Energy Efficiency in Finding the Path to Green Economic Growth. Energies 2023, 16, 3090. https://doi.org/10.3390/en16073090

Dzwigol H, Kwilinski A, Lyulyov O, Pimonenko T. The Role of Environmental Regulations, Renewable Energy, and Energy Efficiency in Finding the Path to Green Economic Growth. Energies. 2023; 16(7):3090. https://doi.org/10.3390/en16073090

Chicago/Turabian StyleDzwigol, Henryk, Aleksy Kwilinski, Oleksii Lyulyov, and Tetyana Pimonenko. 2023. "The Role of Environmental Regulations, Renewable Energy, and Energy Efficiency in Finding the Path to Green Economic Growth" Energies 16, no. 7: 3090. https://doi.org/10.3390/en16073090

APA StyleDzwigol, H., Kwilinski, A., Lyulyov, O., & Pimonenko, T. (2023). The Role of Environmental Regulations, Renewable Energy, and Energy Efficiency in Finding the Path to Green Economic Growth. Energies, 16(7), 3090. https://doi.org/10.3390/en16073090