Decarbonization Measures: A Real Effect or Just a Declaration? An Assessment of Oil and Gas Companies’ Progress towards Carbon Neutrality

Abstract

:1. Introduction

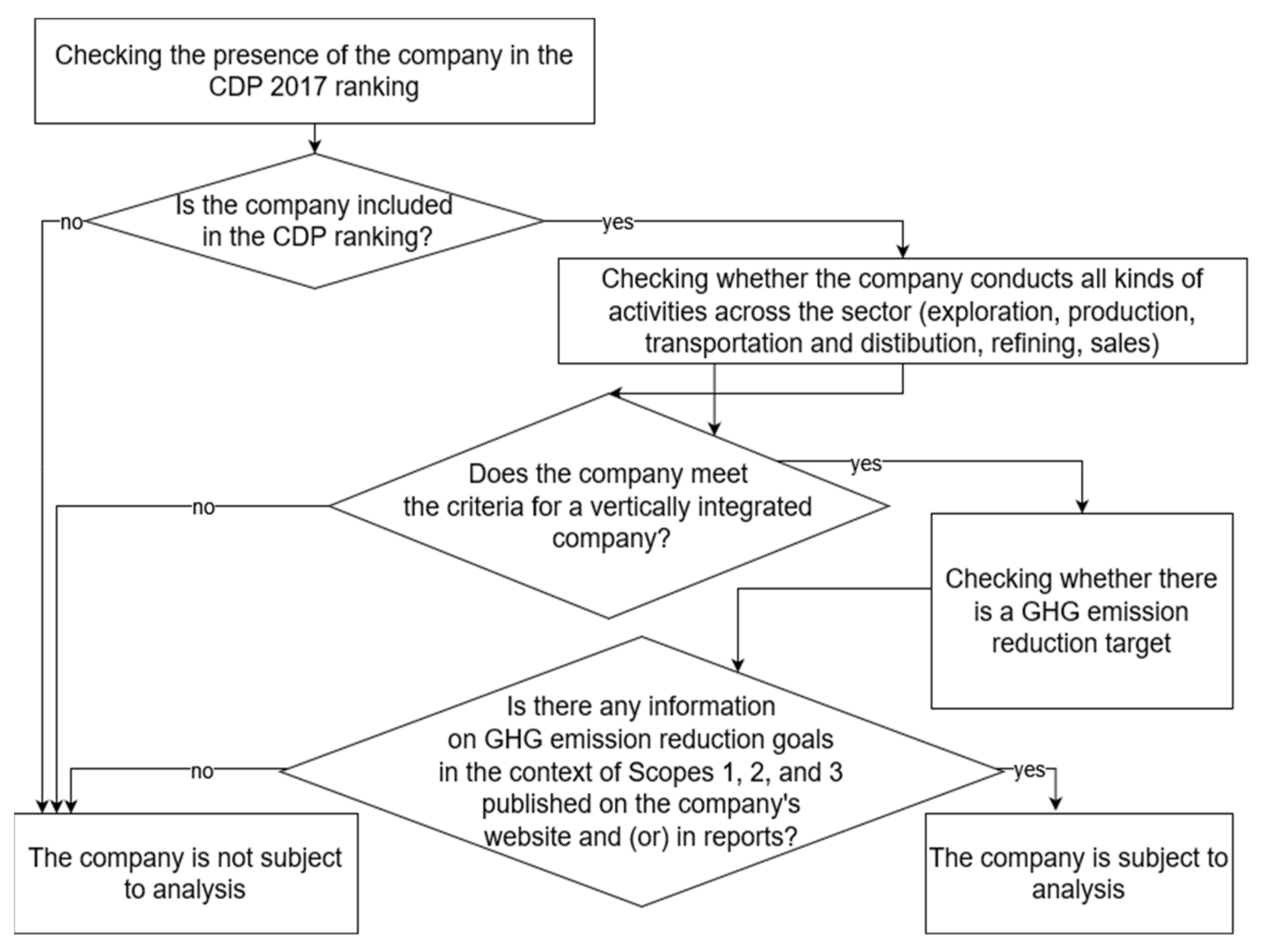

2. Materials and Methods

3. Results

3.1. Compiling a List of Companies and Analyzing Their Goals in Relation to Carbon Neutrality

- The 2017 ranking allowed for the selection of companies that could potentially achieve intermediate results in the field of carbon neutrality for the period 2017–2021 and document this in their reporting;

- Rankings from more recent years would not provide a comprehensive assessment of the progress of oil and gas companies towards carbon neutrality due to the limited time available for implementing initiatives and reporting.

| Company | Goals set in the Field of GHG Emission Reduction | Information Location and the Content of Intermediate Goals | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Main Goals | Examples of Intermediate Goals | Information Location | Number of Intermediate Goals. Total | Intermediate Goals: Details | Measurements | ||||||

| Period | Business Activity | Location | Scope | Production Stage | Absolute Values | Relative Values | |||||

| Equinor (Norway) | Net-zero emissions and 100% net carbon intensity reduction by 2050 (scopes one, two, and three) | Reduce emissions (compared to the 2019 baseline):

| Corporate website; “Our climate ambitions” and “Detailed overview of our climate ambitions” sections | 20 | V | V | V | V | V | ||

| Reduce absolute emissions in Norway to near zero (scopes one and two) | Reduce emissions (compared to the 2005 baseline):

| ||||||||||

| Reduce maritime emissions by 50% globally compared to the 2008 baseline (scopes one and three) | Reduce maritime emissions (compared to the 2005 baseline):

| ||||||||||

| Total (France) | Achieve carbon neutrality (zero net emissions) for TotalEnergies’ operational activities (scopes one and two) by 2050 | Reduce:

| Corporate website; “Climate change-related challenges” section | 10 | V | V | V | V | V | ||

| Achieve carbon neutrality (net-zero emissions) for indirect GHG emissions related to its customers’ use of energy products (scope three) together with society by 2050 | Reduce scope three GHG emissions (compared to the 2015 baseline):

| ||||||||||

| Eni (Italy) | Carbon neutrality by 2050 | Reduce absolute net emissions (compared to the 2018 baseline):

| Eni for 2021. Carbon Neutrality by 2050 (corporate reporting) | 12 | V | V | V | V | |||

| Net-zero emissions from Eni’s operations (scopes one and two) by 2035 | Reduce emissions (compared to the 2018 baseline):

| ||||||||||

| Repsol (Spain) | Net-zero emissions by 2050 | Reduce the carbon intensity indicator (compared to the 2016 baseline):

| “Strategy” section; The Management Report | 6 | V | V | V | V | |||

| BP (UK) | Net-zero operations by 2050 (encompasses scope one and two emissions from the company’s operations) | Reduce emissions (compared to the 2019 baseline):

| Sustainability Report 2021; “Getting to Net Zero” section | 11 | V | V | V | V | V | ||

| Net-zero production by 2050 (encompasses scope three emissions) | Reduce emissions (compared to the 2019 baseline):

| ||||||||||

| Net-zero sales by 2050 (reducing the carbon intensity of the energy products the company sells to net zero by 2050 or sooner) | Reduce emissions (compared to the 2019 baseline):

| ||||||||||

| OMV (Austria) | Net-zero company by no later than 2050 | Reduce emissions (compared to the 2019 baseline):

| Corporate website; “Sustainability” section | 13 | V | V | V | V | V | ||

| Chevron (USA) | Net-zero direct emissions by 2050 | Achieve (compared to the 2016 baseline):

| Sustainability Report 2021; “Climate Change” section | 5 | V | V | V | V | |||

| Petrobras (Brazil) | Net-zero emissions by 2050 | Achieve (compared to the 2015 baseline):

| Report titled “Petrobras Approves Strategic Plan” | 6 | V | V | V | V | |||

| ExxonMobil (USA) | Achieve net-zero emissions from operated assets by 2050 (applies to scopes one and two) and reach net-zero emissions in Permian Basin unconventional operations by 2030 | Achieve reductions (compared to the 2016 baseline) of:

| Advancing Climate Solutions 2022 Progress Report; “Net Zero Ambitions” section | 7 | V | V | V | ||||

| Occidental (USA) |

| Reduce by 2025 (compared to the 2019 baseline):

| Climate Report; “Net Zero Goals” section | 11 | V | V | V | V | V | ||

3.2. Information Disclosure and Business Activities Aimed at Achieving Carbon Neutrality: A Content Analysis

| Question | Equinor | Total | Eni | Repsol | BP | Chevron | OMV | Petrobras | ExxonMobil | Occidental | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| YES | NO | YES | NO | YES | NO | YES | NO | YES | NO | YES | NO | YES | NO | YES | NO | YES | NO | YES | NO | |

| V | V | V | V | V | V | V | V | V | V | ||||||||||

| V | V | V | V | V | V | V | V | V | V | ||||||||||

| V | V | V | V | V | V | V | V | V | V | ||||||||||

| V | V | V | V | V | V | V | V | V | V | ||||||||||

| V | V | V | V | V | V | V | V | V | V | ||||||||||

| V | V | V | V | V | V | V | V | V | V | ||||||||||

| V | V | V | V | V | V | V | V | V | V | ||||||||||

| V | V | V | V | V | V | V | V | V | V | ||||||||||

| V | V | V | V | V | V | V | V | V | V | ||||||||||

| V | V | V | V | V | V | V | V | V | V | ||||||||||

| V | V | V | V | V | V | V | V | V | V | ||||||||||

3.3. Assessing the Progress of Oil and Gas Companies towards Carbon Neutrality: A Quantitative Analysis

- is the difference between the actual and expected progress in achieving the intermediate goal of carbon neutrality as of the reporting (analyzed) year i (%);

- is the factual progress in achieving the intermediate goal of carbon neutrality (reduction in greenhouse gas emissions) as of the analyzed year i (%);

- is the expected progress in achieving the intermediate goal of carbon neutrality as of the reporting (analyzed) year i (%).

- is the factual progress in achieving the intermediate goal of carbon neutrality (reduction in greenhouse gas emissions) as of the analyzed year i (%);

- is the carbon intensity in the reporting (analyzed) year i (gCO2e/MJ, kgCO2e/BOE, T CO2e/BOE, or T CO2e/100 T);

- is the carbon intensity in the base year (gCO2e/MJ, kgCO2e/BOE, T CO2e/BOE, or T CO2e/100 T);

- RY is the reporting (analyzed) year i for the intermediate goal of carbon neutrality;

- BY is the base year for the intermediate goal of carbon neutrality.

- is the expected progress in achieving the intermediate goal of carbon neutrality as of the reporting (analyzed) year i (%);

- is the expected average annual rate of progress towards the intermediate goal of carbon neutrality (%).

- is the expected average annual rate of progress towards the intermediate goal of carbon neutrality (Table 3, column eight) (%);

- is the carbon intensity in the target year in relation to the intermediate goal of carbon neutrality (Table 3, column nine) (gCO2e/MJ, kgCO2e/BOE, T CO2e/BOE, or T CO2e/100 T);

- is the carbon intensity in the base year (Table 3, column six) (gCO2e/MJ, kgCO2e/BOE, T CO2e/BOE, or T CO2e/100 T);

- TY is the target year for achieving the intermediate goal of carbon neutrality (Table 3, column four);

- BY is the base year for the intermediate goal of carbon neutrality (Table 3, column three).

| No. | Company | Base Year | The Year for Achieving the Intermediate Goal | Period (Target Year Minus Base Year) | Carbon Intensity in the Base Year | Carbon Intensity Reduction Goal, % | Average Annual Carbon Intensity Reduction Goal, Expectation, % | Carbon Intensity in the Target Year | Carbon Intensity in the Reporting Year (Fact) | Carbon Intensity Reduction in the Reporting Year, Forecast, % | Carbon Intensity Reduction in the Reporting Year, Fact, % |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 |

| 1 | Equinor | 2019 | 2030 | 11 | 68.0 gCO2e/MJ | 20 | 1.818 | 54 gCO2e/MJ | 67.0 gCO₂e/MJ | 3.6 | 1.5 |

| 2 | Total | 2015 | 2030 | 15 | 71.0 gCO2e/MJ | 20 | 1.333 | 56.8 gCO2e/MJ | 63.9 gCO2e/MJ | 8.0 | 1.9 |

| 3 | Eni | 2018 | 2030 | 12 | 68.0 gCO2e/MJ | 15 | 1.250 | 57.8 gCO2e/MJ | 67 gCO2e/MJ | 3.8 | 1.5 |

| 4 | Repsol | 2016 | 2030 | 14 | 77.7 gCO2e/MJ | 25 | 1.786 | 58.3 gCO2e/MJ | 74.0 gCO2e/MJ | 8.9 | 4.8 |

| 5 | BP | 2019 | 2030 | 11 | 79.0 gCO2e/MJ | 15 | 1.364 | 67.2 gCO2e/MJ | 79.0 gCO2e/MJ | 2.7 | 0.0 |

| 6 | OMV | 2019 | 2030 | 11 | 68.5 gCO2e/MJ | 20 | 1.818 | 54.8 gCO2e/MJ | 66.4 gCO2e/MJ | 3.6 | 3.1 |

| 7 | Chevron | 2016 | 2028 | 12 | 74.9 gCO2e/MJ | 5 | 0.434 | 71.0 gCO2e/MJ | 71.3 gCO2e/MJ | 2.1 | 4.8 |

| 8 | Petrobras | 2015 | 2030 | 15 | 22.0 kgCO2e/BOE | 31 | 2.121 | 15.0 kgCO2e/BOE | 15.7 kgCO2e/BOE | 12.4 | 28.6 |

| 9 | ExxonMobil | 2016 | 2030 | 14 | 26.5 CO2e/100 T | 20 | 1.428 | 21.2 CO2e/100 T | 24.0 CO2e/100 T | 7.1 | 9.4 |

| 10 | Occidental | 2019 | 2025 | 6 | 0.0335 T CO2e/BOE | 40 | 6.7 | 0.020 T CO2e/BOE | 0.0342 T CO2e/BOE | 13.4 | -2.0 |

4. Discussion

5. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Safonov, G. Decarbonization of the World Economy and Russia. 2020. Available online: https://publications.hse.ru/pubs/share/direct/422557993.pdf (accessed on 25 January 2023).

- Romasheva, N.; Dmitrieva, D. Energy Resources Exploitation in the Russian Arctic: Challenges and Prospects for the Sustainable Development of the Ecosystem. Energies 2021, 14, 8300. [Google Scholar] [CrossRef]

- IPCC. Global Warming of 1.5 °C: An IPCC Special Report on the Impacts of Global Warming of 1.5 °C above Pre-Industrial Levels and Related Global Greenhouse Gas Emission Pathways, in the Context of Strengthening the Global Response to the Threat of Climate Change, Sustainable Development, and Efforts to Eradicate Poverty; IPCC: Geneva, Switzerland, 2018; Available online: https://www.ipcc.ch/site/assets/uploads/sites/2/2019/06/SR15_Full_Report_Low_Res.pdf (accessed on 25 January 2023).

- BP p.l.c. bp Statistical Review of World Energy 2022, 71st ed.; BP p.l.c.: London, UK, 2022; Available online: https://www.bp.com/content/dam/bp/business-sites/en/global/corporate/pdfs/energy-economics/statistical-review/bp-stats-review-2022-full-report.pdf (accessed on 5 December 2022).

- United Nations. The Paris Agreement. Available online: https://unfccc.int/files/essential_background/convention/application/pdf/english_paris_agreement.pdf (accessed on 25 September 2022).

- United Nations. The Paris Agreement. How Does it Work? Available online: https://www.un.org/en/climatechange/paris-agreement (accessed on 5 December 2022).

- Ausubel, J.H. Technical progress and climatic change. Energy Policy 1995, 23, 411–416. [Google Scholar] [CrossRef]

- Wimbadi, R.W.; Djalante, R. From decarbonization to low carbon development and transition: A systematic literature review of the conceptualization of moving toward net-zero carbon dioxide emission (1995–2019). J. Clean. Prod. 2020, 256, 120307. [Google Scholar] [CrossRef]

- Beck, C.; Rashidbeigi, S.; Roelofsen, O.; Speelman, E. The Future Is Now: How Oil and Gas Companies Can Decarbonize. McKinsey & Company. 7 January 2020. Available online: https://www.mckinsey.com/industries/oil-and-gas/our-insights/the-future-is-now-how-oil-and-gas-companies-can-decarbonize (accessed on 25 September 2022).

- Nechitailo, A.; Marinina, O. Analysis of technological directions of electrification of hydrocarbon production facilities in poorly developed territories. North Mark. Form. Econ. Order 2022, 25, 45–57. [Google Scholar] [CrossRef]

- Maksimova, E.V.; Morozov, V.V. Modern challenges for the oil and gas sector and adaptation to them. Probl. Econ. Manag. Oil Gas Complex 2021, 6, 5–9. [Google Scholar] [CrossRef]

- Smil, V. Research of energy transitions: A dozen of insights based on performance. Energy Res. Soc. Sci. 2016, 22, 194–196. [Google Scholar] [CrossRef]

- Smil, V. Energy Transitions: History, Requirements, Prospects; ABC-CLIO: Santa Barbara, CA, USA, 2010. [Google Scholar]

- Ceres. Ceres Investor Network on Climate Risk and Sustainability. Available online: https://www.ceres.org/networks/ceres-investor-network (accessed on 25 September 2022).

- Hastings, A.; Smith, P. Achieving Net Zero Emissions Requires the Knowledge and Skills of the Oil and Gas Industry. Front. Clim. 2020, 2, 601778. [Google Scholar] [CrossRef]

- Wang, Z.; Li, S.; Jin, Z.; Li, Z.; Liu, Q.; Zhang, K. Oil and gas pathway to net-zero: Review and outlook. Energy Strategy Rev. 2023, 45, 101048. [Google Scholar] [CrossRef]

- Papadis, E.; Tsatsaronis, G. Challenges in the decarbonization of the energy sector. Energy 2020, 205, 118025. [Google Scholar] [CrossRef]

- Khorasani, M.; Sarker, S.; Kabir, G.; Ali, S.M. Evaluating strategies to decarbonize oil and gas supply chain: Implications for energy policies in emerging economies. Energy 2022, 258, 124805. [Google Scholar] [CrossRef]

- Farrell, B. Net zero hero—five strategies for oil and gas producers. APPEA J. 2022, 62, 17–20. [Google Scholar] [CrossRef]

- Graham, C. The future is not what it used to be: Oil and gas strategies for a carbon-conscious world. APPEA J. 2017, 57, 459–461. [Google Scholar] [CrossRef]

- Griffiths, S.; Sovacool, B.K.; Kim, J.; Bazilian, M.; Uratani, J.M. Decarbonizing the oil refining industry: A systematic review of sociotechnical systems, technological innovations, and policy options. Energy Res. Soc. Sci. 2022, 89, 102542. [Google Scholar] [CrossRef]

- Alimonti, C.; Soldo, E.; Scrocca, D. Looking forward to a decarbonized era: Geothermal potential assessment for oil & gas fields in Italy. Geothermics 2021, 93, 102070. [Google Scholar] [CrossRef]

- Bergero, C.; Binsted, M.; Younis, O.; Davies, E.G.; Siddiqui, M.S.; Xing, R.; Arbuckle, E.J.; Chiappori, D.V.; Fuhrman, J.; McJeon, H.; et al. Technology, technology, technology: An integrated assessment of deep decarbonization pathways for the Canadian oil sands. Energy Strategy Rev. 2022, 41, 100804. [Google Scholar] [CrossRef]

- Nurgaliev, D.K.; Selivanovskaya, S.Y.; Kozhevnikova, M.V.; Galitskaya, P.Y. Some challenges and opportunities for Russia and regions in terms of the global decarbonization trend. Georesursy 2021, 23, 8–16. [Google Scholar] [CrossRef]

- Rweyendela, A.G.; Pauline, N.M.; Lema, G.A. Strategic environmental assessment for low-carbon development: A case study of oil and gas planning in Tanzania. Environ. Dev. 2023, 45, 100829. [Google Scholar] [CrossRef]

- Farnoosh, A.; Lantz, F. Decarbonisation of Electricity Generation in an Oil & Gas Producing Country: “A Sensitivity Analysis over the Power Sector in Egypt”; IFP Energies Nouvelles: Rueil-Malmaison, France, 2015; pp. 228–232. [Google Scholar]

- Nerini, F.F.; Keppo, I.; Strachan, N. Myopic decision making in energy system decarbonisation pathways. A UK case study. Energy Strategy Rev. 2017, 17, 19–26. [Google Scholar] [CrossRef]

- Vieira, L.C.; Longo, M.; Mura, M. From carbon dependence to renewables: The European oil majors’ strategies to face climate change. Bus. Strategy Environ. 2022, 1–12. [Google Scholar] [CrossRef]

- Romasheva, N.V.; Babenko, M.A.; Nikolaichuk, L.A. Sustainable development of the Russian Arctic region: Environmental problems and ways to solve them. MIAB Mining Inf. Anal. Bull. 2022, 10, 78–87. [Google Scholar] [CrossRef]

- Bataille, C.; Waisman, H.; Briand, Y.; Svensson, J.; Vogt-Schilb, A.; Jaramillo, M.; Imperio, M. Net-zero deep decarbonization pathways in Latin America: Challenges and opportunities. Energy Strategy Rev. 2020, 30, 100510. [Google Scholar] [CrossRef]

- Blondeel, M.; Bradshaw, M. International oil companies, decarbonisation and transition risks. In Handbook on Oil and International Relations; Dannreuther, R., Ostrowski, W., Eds.; Edward Elgar: Cheltenham, UK, 2022; pp. 372–392. [Google Scholar] [CrossRef]

- Orazalin, N.; Mahmood, M. Economic, environmental, and social performance indicators of sustainability reporting: Evidence from the Russian oil and gas industry. Energy Policy 2018, 121, 70–79. [Google Scholar] [CrossRef]

- Dietz, S.; Gardiner, D.; Jahn, V.; Noels, J. How ambitious are oil and gas companies’ climate goals? Science 2021, 374, 405–408. [Google Scholar] [CrossRef] [PubMed]

- Masalkova, A.; Romanova, E. Peculiarities of Decarbonization Strategies of the Largest Players in the Oil and Gas Industry: Similarities and Differences; Atlantiss Press: Amsterdam, The Netherlands, 2021. [Google Scholar] [CrossRef]

- Li, M.; Trencher, G.; Asuka, J. The clean energy claims of BP, Chevron, ExxonMobil and Shell: A mismatch between discourse, actions and investments. PLoS ONE 2022, 17, e0263596. [Google Scholar] [CrossRef] [PubMed]

- Fletcher, L.; Crocker, T.; Smyth, J.; Marcell, K. Beyond the Cycle: Which Oil and Gas Companies Are Ready for the Low-Carbon Transition? CDP Report. 2018. Available online: https://cdn.cdp.net/cdp-production/cms/reports/documents/000/003/858/original/CDP_Oil_and_Gas_Executive_Summary_2018.pdf?1541783367 (accessed on 25 September 2022).

- CDP. Available online: https://www.cdp.net/en/info/about-us (accessed on 25 February 2023).

- Petrobras Approves Strategic Plan 2022–2026. Available online: https://docs.publicnow.com/viewDoc?hash_primary=E606D184C77F67468BCCF563FEC6C83633FC2096 (accessed on 25 February 2023).

- REPSOL Group. Integrated Management Report 2021. Available online: https://www.repsol.com/content/dam/repsol-corporate/en_gb/accionistas-e-inversores/informes-anuales/2021/integrated-management-report-2021.pdf (accessed on 25 February 2023).

- Chevron. Sustainability Report 2021. Available online: https://www.chevron.com/-/media/shared-media/documents/chevron-sustainability-report-2021.pdf (accessed on 25 February 2023).

- The Greenhouse Gas Protocol. Available online: https://ghgprotocol.org/sites/default/files/standards/ghg-protocol-revised.pdf (accessed on 25 February 2023).

- Hertwich, E.G.; Wood, R. The growing importance of scope 3 greenhouse gas emissions from industry. Environ. Res. Lett. 2018, 13, 104013. [Google Scholar] [CrossRef]

- Kenner, D.; Heede, R. White knights, or horsemen of the apocalypse? Prospects for Big Oil to align emissions with a 1.5 °C pathway. Energy Res. Soc. Sci. 2021, 79, 102049. [Google Scholar] [CrossRef]

- Equinor. Overview of Climate Ambitions 2022. Available online: https://cdn.sanity.io/files/h61q9gi9/global/283da357bec808022a914e65c45b1daf61f9c421.pdf?climate-ambition-overview-cmu-2022-equinor.pdf (accessed on 25 February 2023).

- TotalEnergies. Climate Change-Related Challenges. Available online: https://totalenergies.com/sustainability/climate-and-sustainability-energy/climate-change-related-challenges#2050 (accessed on 25 February 2023).

- Eni for 2021. Carbon Neutrality by 2050. Available online: https://www.eni.com/assets/documents/eng/just-transition/2021/eni-for-2021-carbon-neutrality-2050-eng.pdf (accessed on 25 February 2023).

- BP Sustainability Report 2021. Available online: https://www.bp.com/content/dam/bp/business-sites/en/global/corporate/pdfs/sustainability/group-reports/bp-sustainability-report-2021.pdf (accessed on 25 February 2023).

- OMV Group. Targets & Commitments. Available online: https://www.omv.com/en/sustainability/our-approach/targets-commitments (accessed on 25 February 2023).

- ExxonMobil. Advancing Climate Solutions. Progress Report 2023. Available online: https://corporate.exxonmobil.com/-/media/global/files/advancing-climate-solutions-progress-report/2023/2023-acs-progress-report.pdf (accessed on 25 February 2023).

- Occidental Climate Report 2021. Pathway To Net Zero. Available online: https://www.oxy.com/globalassets/documents/publications/oxy-climate-report-2021.pdf (accessed on 25 February 2023).

- Hoffmann, V.H.; Busch, T. Corporate carbon performance indicators: Carbon intensity, dependency, exposure, and risk. J. Ind. Ecol. 2008, 12, 505–520. [Google Scholar] [CrossRef]

- ISO 14067:2018; Greenhouse Gases—Carbon Footprint of Products—Requirements and Guidelines for Quantification. ISO: Geneva, Switzerland, 2018. Available online: https://www.iso.org/standard/71206.html (accessed on 25 February 2023).

- GRI 305: Emissions; GRI Standards: Amsterdam, The Netherlands, 2016; Available online: https://www.globalreporting.org/standards/media/1012/gri-305-emissions-2016.pdf (accessed on 25 February 2023).

- ISO 14064-1:2018; Greenhouse gases—Part 1: Specification with Guidance at the Organization Level for Quantification and Reporting of Greenhouse Gas Emissions and Removals. ISO: Geneva, Switzerland, 2018. Available online: https://www.iso.org/ru/standard/66453.html (accessed on 25 February 2023).

- Equinor Energy Transition Plan 2022. Available online: https://www.equinor.com/magazine/our-plan-the-energy-transition (accessed on 25 February 2023).

- Kouloukoui, D.; de Oliveira Marinho, M.M.; da Silva Gomes, S.M.; Kiperstok, A.; Torres, E.A. Corporate climate risk management and the implementation of climate projects by the world’s largest emitters. J. Clean. Prod. 2019, 238, 117935. [Google Scholar] [CrossRef]

- Bolay, A.F.; Bjørn, A.; Weber, O.; Margni, M. Prospective sectoral GHG benchmarks based on corporate climate mitigation targets. J. Clean. Prod. 2022, 376, 134220. [Google Scholar] [CrossRef]

- CDP Chevron Corporation. Available online: https://www.cdp.net/en/responses/3191?back_to=https%3A%2F%2Fwww.cdp.net%2Fen%2Fresponses%3Futf8%3D%25E2%259C%2593%26queries%255Bname%255D%3Dchevron&queries%5Bname%5D=chevron (accessed on 25 February 2023).

- CDP ExxonMobil. Available online: https://www.cdp.net/en/responses?per_page=20&queries%5Bname%5D=exxon+mobil&sort_by=project_year&sort_dir=desc (accessed on 25 February 2023).

- Cherepovitsyn, A.; Rutenko, E. Strategic Planning of Oil and Gas Companies: The Decarbonization Transition. Energies 2022, 15, 6163. [Google Scholar] [CrossRef]

- Equinor Annual Report 2021. Available online: https://www.equinor.com/investors/annual-reports (accessed on 25 February 2023).

- Nagar, P.K.; Sharma, M.; Gupta, S.; Singh, D. A framework for developing and projecting GHG emission inventory and preparing mitigation plan: A case study of Delhi City, India. Urban Clim. 2019, 28, 100462. [Google Scholar] [CrossRef]

- Technical Guidance for Calculating Scope 3 Emissions, Version 1.0; Greenhouse Gas Protocol: Washington, DC, USA. Available online: https://ghgprotocol.org/sites/default/files/standards/Scope3_Calculation_Guidance_0.pdf (accessed on 25 February 2023).

- Chevron Climate Change Resilience 2021. Available online: https://www.chevron.com/-/media/chevron/sustainability/documents/climate-change-resilience-report.pdf (accessed on 25 February 2023).

- ExxonMobil Scope 3 Emissions. Available online: https://corporate.exxonmobil.com/-/media/global/files/advancing-climate-solutions-progress-report/2022-july-update/scope-3-emissions.pdf (accessed on 25 February 2023).

- Lewandowski, S.; Ullrich, A. Measures to reduce corporate GHG emissions: A review-based taxonomy and survey-based cluster analysis of their application and perceived effectiveness. J. Environ. Manag. 2023, 325, 116437. [Google Scholar] [CrossRef] [PubMed]

- TotalEnergies Sustainability and Climare Report 2021. Available online: https://totalenergies.com/sites/g/files/nytnzq121/files/documents/2022-05/Sustainability_Climate_2022_Progress_Report_accessible_version_EN.pdf (accessed on 25 February 2023).

- Luan, B.; Huang, J.; Zou, H. Domestic R&D, technology acquisition, technology assimilation and China’s industrial carbon intensity: Evidence from a dynamic panel threshold model. Sci. Total Environ. 2019, 693, 133436. [Google Scholar] [CrossRef]

- Grand, M.C. Carbon emission targets and decoupling indicators. Ecol. Indic. 2016, 67, 649–656. [Google Scholar] [CrossRef]

- Waheed, R. The significance of energy factors, green economic indicators, blue economic aspects towards carbon intensity: A study of Saudi vision 2030. Sustainability 2022, 14, 6893. [Google Scholar] [CrossRef]

- Eni Sustainability Performance 2021. Available online: https://www.eni.com/assets/documents/eng/just-transition/2021/eni-for-2021-sustainability-performance-eng.pdf (accessed on 25 February 2023).

- OMV Sustainability Report 2021. Available online: https://reports.omv.com/en/sustainability-report/2021/ (accessed on 25 February 2023).

- Petrobras Sustainability Report 2021. Available online: https://sustentabilidade.petrobras.com.br/documents/42532/0/2021%20SUSTAINABILITY%20REPORT/343f2b9c-8bbb-ef73-0cb9-b797fad3f896 (accessed on 25 February 2023).

- Occidental Sustainability Report 2021. Available online: https://www.oxy.com/globalassets/documents/publications/2021-sustainability-report-web.pdf (accessed on 25 February 2023).

- Greenhouse Gas Protocol. Available online: https://ghgprotocol.org/about-us (accessed on 25 February 2023).

- TCFD. Implementing the Recommendations of the Task Force on Climate-related Financial Disclosures. 2017. Available online: https://assets.bbhub.io/company/sites/60/2020/10/FINAL-TCFD-Annex-Amended-121517.pdf (accessed on 25 February 2023).

- OXY 2019—2021 Annual ESG Performance Indicators. Available online: https://www.oxy.com/globalassets/documents/sustainability/oxy-esg-performance-indicators.pdf (accessed on 25 February 2023).

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Cherepovitsyna, A.; Sheveleva, N.; Riadinskaia, A.; Danilin, K. Decarbonization Measures: A Real Effect or Just a Declaration? An Assessment of Oil and Gas Companies’ Progress towards Carbon Neutrality. Energies 2023, 16, 3575. https://doi.org/10.3390/en16083575

Cherepovitsyna A, Sheveleva N, Riadinskaia A, Danilin K. Decarbonization Measures: A Real Effect or Just a Declaration? An Assessment of Oil and Gas Companies’ Progress towards Carbon Neutrality. Energies. 2023; 16(8):3575. https://doi.org/10.3390/en16083575

Chicago/Turabian StyleCherepovitsyna, Alina, Nadezhda Sheveleva, Arina Riadinskaia, and Konstantin Danilin. 2023. "Decarbonization Measures: A Real Effect or Just a Declaration? An Assessment of Oil and Gas Companies’ Progress towards Carbon Neutrality" Energies 16, no. 8: 3575. https://doi.org/10.3390/en16083575