Abstract

The development of human society and the production and operation activities of enterprises have brought about global warming, resulting in frequent natural disasters. It has become the consensus of all countries in the world to develop a green and low-carbon economy. Under this background, enterprises, as the main body of economic activities, especially energy industry enterprises, should optimize and upgrade the traditional production and operation mode with high pollution, high consumption, and low output to a high-efficiency and low-pollution mode, and pay attention to the co-ordinated development of economic benefits, social benefits, and ecological benefits. Financial performance evaluation indicators have become the main basis for senior leaders of energy industry enterprises to make decisions and evaluate the low-carbon economic benefits of enterprises. This paper constructs a set of financial evaluation index systems of energy industry enterprises under the background of a low-carbon economy from four dimensions: profitability, asset quality, debt risk, and business growth. The analytic hierarchy process (AHP) is used to measure the comprehensive contribution of financial indicators of low-carbon production and operation. The purpose of this study is to provide scientific financial management decisions for energy enterprises to reduce costs and increase the efficiency and low-carbon operation under the background of a low-carbon economy. The research results show that the comprehensive evaluation index system after the traditional financial evaluation index of energy industry enterprises is integrated with the evaluation index of a low-carbon economy can help enterprises make more correct and effective financial decisions in the process of survival, development, and growth, and, at the same time, the financial evaluation index of a low-carbon economy should pay more attention to the indicators with a higher comprehensive contribution, so as to effectively promote the low-carbon operation efficiency of enterprise production, management, and sales. Compared with other research results, this paper innovatively constructs a financial management decision-making index system for measuring the low-carbon operation of energy enterprises in theory, which has important value in guiding energy enterprises to reduce costs and increase the efficiency and low-carbon operation in practice.

1. Introduction

With social progress and the new development concept, the pursuit of green and low-carbon economic development models has become the trend of economic development in all countries and mainstream countries in the world, and it is also an inevitable requirement for promoting the high-quality development of economic entities. As early as 2003, the concept of a low-carbon economy was first put forward in the British energy white paper “Our Energy Future Creating a Low-Carbon Economy”. Its core idea is to develop a new economic model with low energy consumption, low pollution, and low emissions, improve the energy utilization efficiency, optimize and adjust the industrial structure, and promote the economic development model from high-carbon to low-carbon by developing clean energy and innovating low-carbon technologies [1,2].

Subsequently, many countries in the world accepted the core concept of a low-carbon economy and committed to promoting its development. At present, the low-carbon economy in many developed countries such as the United States, Japan, and Germany has led the world economic development trend. China has clearly put forward the goal of “double carbon”, promising to achieve peak carbon dioxide emissions in 2030 and strive to achieve carbon neutrality by 2060 [3,4,5]. From the perspective of a low-carbon economy, enterprises, as the main body of economic activities, especially those in the energy industry, should actively fulfill low-carbon life’s environmental responsibility and transform the financial performance evaluation system that is used to pursue the maximization of economic benefits and economic profits into a comprehensive evaluation system that seeks the co-ordinated development of economic benefits, social benefits, and ecological benefits [6,7]. The Low-Carbon Road published by the McKinsey Company clearly points out that the production development of enterprises is the main reason leading to the imbalance of the global ecological environment, and points out that enterprises should actively assume social responsibility and environmental responsibility, change the development mode, innovate the production mode, and build the green core competitiveness of enterprises by establishing a low-carbon environmental management concept [8,9].

However, judging from the Standard Value of Enterprise Performance Evaluation compiled by the State-owned Assets Supervision and Administration Commission in 2021, there are few indicators for evaluating the financial performance of low-carbon economic development [10]. Hou X. D (2021) constructed an enterprise financial evaluation index system from four traditional dimensions, profitability, solvency, operational ability, and development ability, and put forward policy suggestions such as strengthening cost management and improving the integration ability of logistics supply resources [11]. Liang B.M. et al. (2022) used the entropy weight method to comprehensively evaluate the finance of electric energy enterprises. It is considered that financial evaluation has become an important basis for the management decision-making of energy enterprises, and promoting technological innovation in financial evaluation indicators is an important factor to promote the long-term development of enterprises [12]. Tian C. et al. (2023) reported that the carbon trading pilot market forced enterprises to develop a low-carbon transformation through negative effects on the financial performance level and credit financing level of enterprises. The enterprise low-carbon financial evaluation index is affecting the management decision-making of enterprises to an increasing extent [13]. Rogge, S (2018) strategically promotes the support for comprehensive financial evaluation services such as the investment and financing, project operation, and risk management of low-carbon enterprises, and points out that reducing corporate debt costs, developing green products, and business optimization and innovation have a positive impact on the sustainability and stability of low-carbon enterprises [14]. Judging from the existing research literature, most scholars have realized that the low-carbon evaluation index in financial evaluation has become an important basis for enterprise management decision-making. Although different scholars have mentioned the financial performance evaluation indicators of the low-carbon economic development of enterprises, most of them are fragmented and partial evaluations, and a more systematic and comprehensive evaluation index system has not been formed. Energy enterprises are highly concerned about carbon reduction and emission reduction in all countries of the world, and their development in low-carbon life has attracted universal attention from all mankind. However, the research results of the financial evaluation of energy enterprises from the perspective of low-carbon development in the existing literature are very rare, and the research results of integrating traditional financial evaluation indicators with financial evaluation indicators under a low-carbon background to provide guidance for energy enterprises to explore the development path of low-carbon life through a systematic and scientific financial evaluation index system have not yet been found.

Based on this, on the basis of summarizing the existing research results of scholars, this paper puts forward that energy industry enterprises should add low-carbon life development level evaluation indicators in addition to the traditional financial performance evaluation indicators, so as to build a system based on a set of financial evaluation indicators for energy industry enterprises under the background of a low-carbon economy, and measure the contribution and importance of the newly added financial performance evaluation indicators with the AHP, aiming to provide scientific financial management decisions for energy enterprises to reduce costs and increase efficiency and low-carbon operations under the background of a low-carbon economy, guiding energy enterprises to reduce costs and increase efficiency in actual production and operation activities, and realizing the development of low-carbon life.

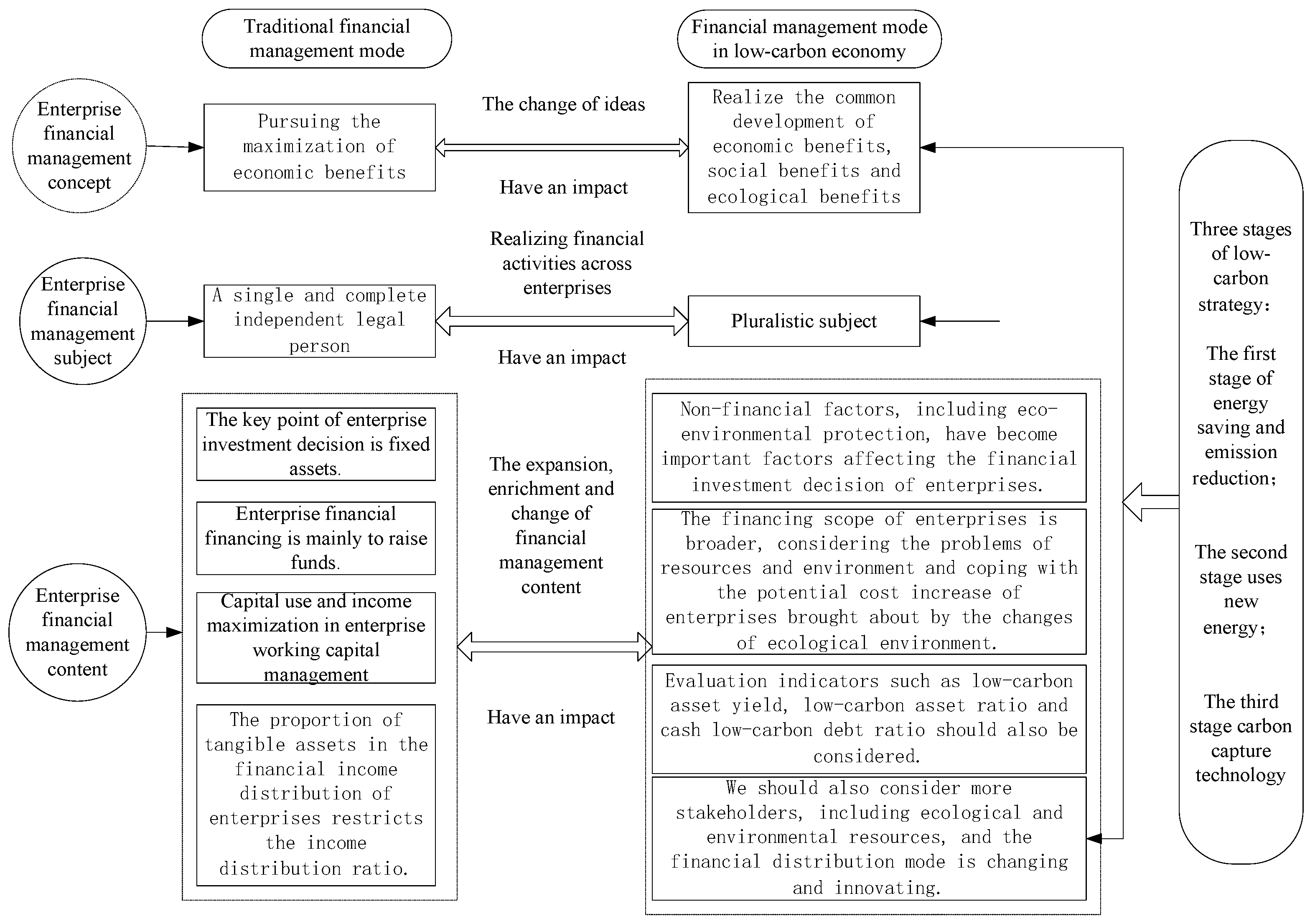

2. Low-Carbon Strategy on the Financial Management Mechanism of Energy Industry Enterprises

The development stage of the low-carbon strategy includes three stages: energy saving and emission reduction, using new energy, and carbon capture technology [15]. In the first stage, energy conservation and emission reduction, energy efficiency is continuously improved, carbon emissions are reduced, and carbon trading means are used to promote energy conservation and emission reduction. In the second stage, the use of new energy is to control the source, reduce the use of fossil energy, and replace it with new and cleaner energy. In the third stage, carbon capture technology pays attention to terminal treatment and captures the emitted carbon dioxide into storage or solidification through advanced technology, which makes zero carbon emission a reality [16]. Under the guidance of this strategy, the financial management mode of enterprises and the indicators to measure the economic and ecological benefits of enterprises have also changed, which has a significant impact on the overall work of the financial management of energy industry enterprises [17,18]. It is summarized in Figure 1.

Figure 1.

Mechanism of low-carbon strategy’s influence on financial management of energy industry enterprises.

(1) It has a great impact on the traditional financial management concept of energy industry enterprises. For enterprises, the core value concept is the most critical factor in enterprise decision-making. In the conventional sense, the financial management goal of energy industry enterprises is to pursue the maximization of economic benefits, that is, to maximize profits, and less consideration is given to the social responsibility that enterprises should bear and the protection of the ecological environment [19,20]. However, under the background of a low-carbon strategy and developing a low-carbon economy, the financial management concept of energy industry enterprises should change significantly, and the new financial management operation mode and financial management indicators should be transformed into the financial management content under the concept of a low-carbon production operation [21,22]. The goal of enterprise financial management should be to realize the common development of economic, social, and ecological benefits.

(2) It has a significant impact on the financial management subjects of energy industry enterprises. From the traditional enterprise financial management mode, enterprise accounting, tax payment, capital flow management, etc. are usually based on a single and completely independent legal person, and there are relatively few contacts between enterprises except accounting and capital flow [23,24]. However, with the development of science and technology and the proposal of a low-carbon strategy, enterprises have common resources, goals, and responsibilities. For example, when an energy industry enterprise develops a large-scale project, it is necessary to evaluate the ecological environment shared by other enterprises, whether it pollutes or destroys the ecological environment shared by different enterprises, such as air, vegetation, water, etc. Thus, the financial management and financial activities of enterprises also involve many enterprises [25]. Therefore, under the background of a low-carbon economy, the financial management subject of energy industry enterprises has surpassed a single legal person and developed towards diversified issues.

(3) It has a significant impact on the financial management content of energy industry enterprises. Firstly, it shows the influence on the decision-making management of enterprise financial investment [26]. The traditional financial resource management and enterprise investment generally focus on fixed assets. That is, the proportion of fixed assets in the total assets of enterprises is an important indicator used to measure the financial profitability and production scale of energy industry enterprises. Under the low-carbon strategy, some non-financial factors, including ecological environment protection and improvement, have also become essential factors affecting enterprise financial investment decisions, increasing the potential cost of enterprises and bringing the potential benefits of “green mountains and green waters are Jinshan Yinshan” [27]. Secondly, it has a significant influence on the financial financing management of energy industry enterprises. Traditional monetary financing mainly refers to fundraising, but, under the development of a low-carbon economy, the financing scope of energy industry enterprises is broader, so we should consider not only resource and environmental issues but also raising funds to deal with the potential cost increase of enterprises caused by changes in the ecological environment; Thirdly, it has an impact on the working capital management of energy industry enterprises. In traditional financial management, working capital management plans and uses funds reasonably to maximize the use of funds and benefits. Under the situation of a low-carbon economy, energy industry enterprises should also consider indicators such as a low-carbon asset yield, low-carbon asset ratio, and low-carbon cash debt ratio to reduce air pollution, reduce carbon dioxide emissions, and protect the ecological environment. Finally, it has a significant influence on the financial income distribution of enterprises. The traditional financial income distribution is mainly determined by the contribution of production factors in economic growth, and the proportion of the tangible assets of enterprises restricts the income distribution ratio. In a low-carbon economy, more stakeholders, including ecological environment resources, should be considered, and the financial distribution mode is changing and innovating.

3. Financial Management Objectives of Energy Industry Enterprises under the Background of a Low-Carbon Economy

A low-carbon economy has become the trend of economic development all over the world. Under this background, the goal and orientation of the financial management of energy industry enterprises have also significantly changed. In addition to pursuing economic profits, it emphasizes the synergy of economic benefits, social benefits, the ecological environment, and green environmental protection [28].

(1) Co-ordinated development of comprehensive benefits

Under the background of low-carbon economic development, the strategic goal of energy industry enterprises should not be limited to maximizing economic benefits. Nevertheless, it should make new explorations and adjustments to development strategies and development models to maximize comprehensive benefits such as economic benefits, social benefits, and ecological values. Energy industry enterprises should adjust their financial operation to support the low-carbon development path. Enterprise managers need to understand the financial benefits and cost expenditures of implementing low-carbon development and predict the added value of actual economic profits and ecological benefits brought by the low-carbon operation to enterprises to reasonably divide the proportional relationship between comprehensive benefits and various costs and expenditures so as to maximize the total benefits of enterprises and minimize the cost expenditures.

(2) Realize the optimization of low-carbon benefits

The realization of the optimal low-carbon benefits of energy industry enterprises is mainly manifested in two aspects: the minimization of production and operation processes and the sustainability of low-carbon upgrading. From the perspective of financial management, it is necessary to guide energy industry enterprises to invest funds and resources in low-carbon development areas, reduce energy consumption in production and operation, and realize the optimization of low-carbon interests and economic interests of enterprises. At the same time, in order to ensure that the financial management indicators of energy industry enterprises match the low-carbon upgrading, enterprises should dynamically evaluate the impact of financial management in the process of low-carbon upgrading so as to dynamically adjust and improve the financial management model and assessment indicators, and provide strong support for enterprises’ low-carbon operation.

(3) Maximize social benefits

The energy industry enterprise is an enterprise with high energy consumption and high pollution. The proposal of a low-carbon economy strategy is a great challenge and requirement for energy industry enterprises. A low-carbon economy requires energy industry enterprises to transform to low-carbon environmental protection, not only to maximize economic benefits but also to maximize social benefits. Therefore, its financial indicators can be divided into a low-carbon asset yield, asset low-carbon debt ratio, sales ratio of innovative products, low-carbon environmental protection investment growth rate, low-carbon product sales growth rate, and low-carbon technology R&D investment rate.

(4) Maximize the ecological and environmental benefits

From the traditional mode, energy industry enterprises have a significant impact on the ecological environment in the actual production and operation process and even bring irreparable and irreversible damage to the ecological environment to a certain extent. However, with the progress of science and technology and the improvement of the human concept of protecting the ecological environment, the production equipment of energy industry enterprises is constantly updated. More attention is paid to the protection of the ecological environment so as to achieve energy conservation and emission reduction as much as possible, reduce air pollution, and reduce the damage to vegetation. In addition, we would want to reduce carbon dioxide emissions, reduce the wear and impact on the ecological environment, find a balance between maximizing economic benefits and optimizing the protection of the ecological environment, and achieve a win–win goal of economic benefits and environmental benefits.

4. Selection and Analysis of Research Methods

In the study of the financial management performance evaluation index of energy enterprises under the background of a low-carbon economy, three methods are adopted:

First we have, a literature review, which mainly summarizes the research results of traditional financial evaluation indicators and the content of enterprise financial evaluation under the background of a low-carbon economy, laying the foundation for the construction of a comprehensive measurement index system; the second is an expert interview, in which five experts and scholars who have been engaged in financial management research and teaching for a long time in colleges and universities and five department leaders and business personnel who have been engaged in enterprise financial management practice for a long time are invited to hold an expert forum to discuss the financial management indicators of energy enterprises under the background of a low-carbon economy, and further improve the optimization evaluation index system; and the third is the analytic hierarchy process (AHP), which measures the comprehensive contribution of financial indicators of low-carbon production and operation and analyzes the contribution of different indicators.

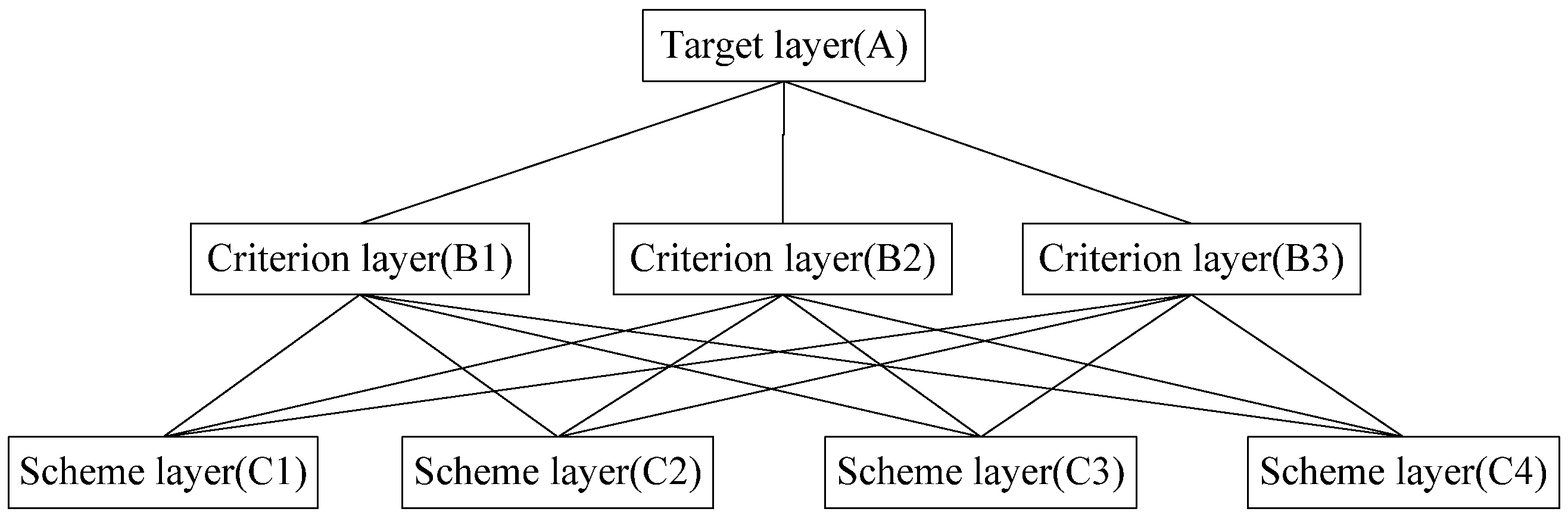

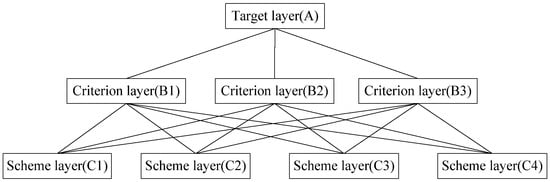

The analytic hierarchy process (AHP) is a method combining qualitative and quantitative analysis [29]. The principle is to decompose a target to be decided into several subsystems, and then quantify several subsystems into measurable indicators (Figure 2). Specifically, it can be divided into three steps: (1) According to the evaluation object, the structural relationship between elements is constructed, and the hierarchical structure is established. (2) According to the evaluation criteria, the importance of each element relative to the upper-level target is compared to form an evaluation matrix (usually by means of expert scoring). (3) Judge the weights of the comparative elements, and then calculate the weights of the elements of each layer relative to the total evaluation target, and sort the importance of the elements.

Figure 2.

Hierarchical structure diagram of analytic hierarchy process.

Firstly, the collected data are normalized by Formula (1); then, the maximum feature root = is found, and the calculated weights are checked for consistency by Formula (2). Finally, the consequences of comparative elements are judged, and then the consequences of the elements of each layer relative to the overall evaluation target are calculated, and the importance of elements is sorted [30,31].

The scale for judging the importance of two elements can be set as follows: if the two indicators are equally important, the scale can be set to 1; if the former indicator is slightly more important than the latter indicator, it can be set to 3; obviously important, 5; strongly important, 7; extremely important, 9; and 2, 4, 6, and 8 are the middle values of importance of the former neighbors, and the reciprocal indicates that the latter is more important than the former. When calculating the contribution degree of the scheme layer to the target layer, multiply the weight of the scheme layer to the corresponding criterion layer by the contribution degree of the corresponding criterion layer to the target layer, and rank the indices of the scheme layer according to their respective contribution degrees.

5. Energy Industry Enterprise Financial Performance Evaluation Index Construction

Under the background of a low-carbon economy, to realize the green transformation of the social economy, it is necessary to adjust and optimize the tax policy of enterprises, add low-carbon economic development guidance indicators to the financial management evaluation indicators, especially for energy industry enterprises, and set performance evaluation indicators to guide enterprises to a low-carbon transformation in the traditional financial evaluation index system. In 2021, the Standard Value of Enterprise Performance Evaluation published by SASAC took profitability, asset quality, debt risk, and business growth as the basis of enterprise financial evaluation indicators. Based on this, this paper adds the financial management evaluation index of energy industry enterprises under the background of a low-carbon economy on the basis of the traditional financial evaluation index of enterprises. Yun H. et al. (2018) believe that the evaluation of enterprise financial management under the background of a low-carbon economy should include the growth rate of low-carbon assets, the effectiveness of low-carbon investment, and other indicators [32]. Xu F. et al. (2022) pointed out that it is very important to measure the green and low-carbon transformation of enterprise financial management under the background of a low-carbon economy, and to set profitability indicators such as the low-carbon asset return rate [33]. The financial performance evaluation index system of energy industry enterprises under the background of a low-carbon economy is comprehensively constructed, as shown in Table 1.

Table 1.

Financial performance evaluation index system of energy industry enterprises under the background of low-carbon economy.

(1) In the dimension of the profitability of enterprises in the energy industry, traditional evaluation indicators mainly reflect the input–output level, asset quality, and cash guarantee of enterprises through indicators such as the total return on assets, return on net assets, sales profit rate, return on capital, multiple of surplus cash guarantee, and cost profit rate. Under the background of a low-carbon strategy and economy, three indicators are added to evaluate the low-carbon operation of the financial management of energy industry enterprises, such as a low-carbon asset return rate, low-carbon product operating cost profit rate, and net asset economic added value rate.

(2) In the dimension of the asset quality evaluation of enterprises in the energy industry, traditional financial management mainly reflects the utilization efficiency and management ability of enterprises in terms of the total assets turnover rate, accounts receivable turnover rate, non-performing assets ratio, current assets turnover rate, and asset cash recovery rate. Under the background of a low-carbon strategy and economy, two indicators, the low-carbon asset ratio and low-carbon asset income ratio, are added to evaluate the quality management level of low-carbon assets in energy industry enterprises.

(3) In the dimension of the debt risk assessment of energy industry enterprises, the traditional financial management model mainly reflects the debt repayment ability and management level of energy industry enterprises from indicators such as the asset–liability ratio, quick ratio, multiple of earned interest, interest-bearing debt ratio, cash flow debt ratio, and or related debt ratio. Under the background of a low-carbon strategy and economy, the indicators of a low-carbon debt ratio of assets and advanced low-carbon debt ratio are added to evaluate the debt risk and resolving ability of energy industry enterprises under a low-carbon operation mode.

(4) In the dimension of the business growth of enterprises in the energy industry, the traditional financial management mainly reflects the evolution of the business performance of enterprises through the sales growth rate, total assets growth rate, technology investment rate, capital preservation and appreciation rate, and sales profit appreciation rate. Under the background of a low-carbon strategy and low-carbon economy, the sales rate of innovative products, low-carbon environmental protection investment growth rate, low-carbon product sales growth rate, and low-carbon technology research and development investment rate have been increased. The growth and improvement of production, operation, management, and sales of energy industry enterprises have been comprehensively evaluated.

In the financial performance evaluation index system of energy industry enterprises under the background of a low-carbon economy, there are not only traditional mature financial management and evaluation indicators but also new financial evaluation indicators under the background of a low-carbon strategy and economic development. However, the newly added financial evaluation indicators of the low-carbon economy are different in importance or contribution to the improvement of the financial management ability of energy industry enterprises. This paper uses the AHP to measure and rank their contribution so that enterprise leaders can pay more attention to more critical evaluation indicators.

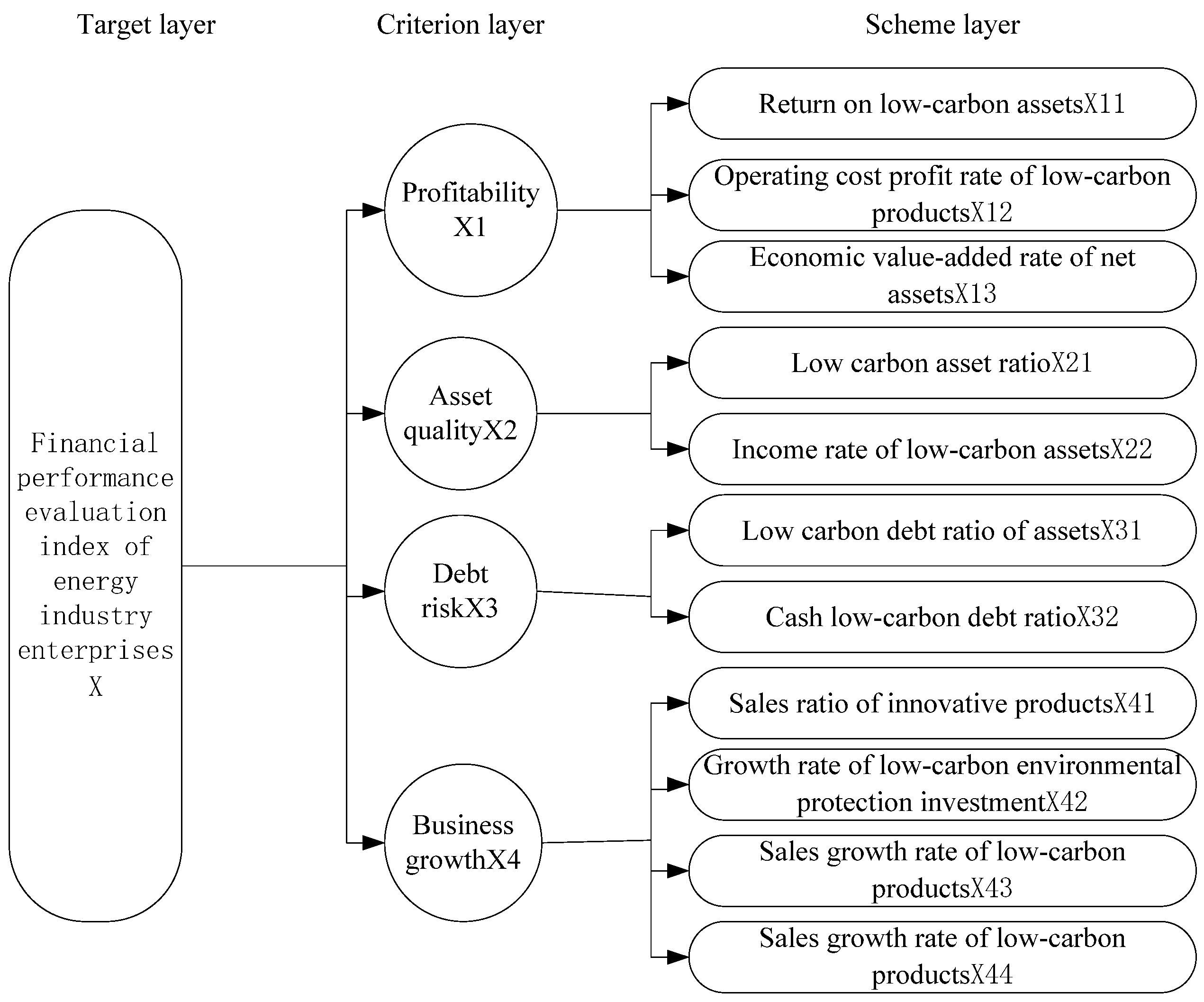

6. Construction and Measurement of New Financial Evaluation Index Model of Energy Industry Enterprises under Low-Carbon Economy

(1) Model construction

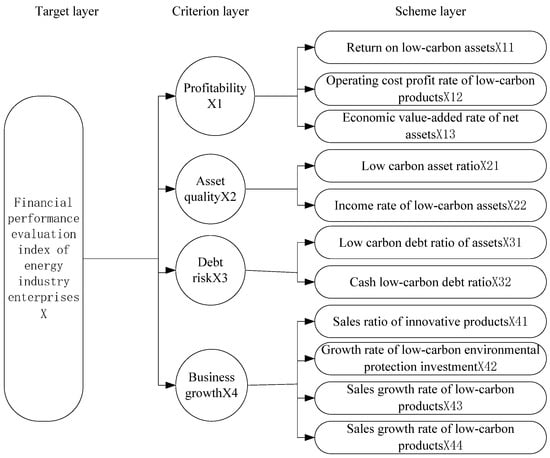

In order to effectively measure the contribution of new financial management performance evaluation indicators of energy industry enterprises to the overall goal under the background of a low-carbon economy, according to the principle of the analytic hierarchy process, the financial evaluation dimensions and new low-carbon financial evaluation indicators of energy enterprises under the background of a low-carbon economy are built into an analytic hierarchy process model, as shown in Figure 3. The model intuitively represents the low-carbon financial evaluation indicators covered by different dimensions of the financial management of energy industry enterprises under the low-carbon background, and ranks the evaluation indicators according to the measured contribution, pointing out that energy enterprises should pay more attention to the indicators with a greater comprehensive contribution in low-carbon operation, thus providing scientific financial management decisions for energy enterprises to reduce costs and increase efficiency and operate in a low-carbon background.

Figure 3.

Analytic hierarchy process of new financial evaluation indicators for energy industry enterprises under the background of low-carbon economy.

(2) Data collection of new financial evaluation indicators

When determining the weight of new financial performance evaluation indicators of energy industry enterprises under the background of a low-carbon economy, the first-hand data are mainly collected by means of survey questionnaires and field interviews.

① Design and revision of the survey questionnaire

It is analyzed that the new financial performance evaluation indicators of energy industry enterprises are objective quantitative indicators that can be directly observed or directly counted under the background of a low-carbon economy. Therefore, when designing the questionnaire, the financial evaluation indicators are transformed into question items. The questionnaire design structure is as follows: the first part is to fill in the basic information of people; the second part is the main body of the questionnaire, which transforms 11 specific indicators at the scheme level into questions to evaluate the importance of the financial management ability of energy industry enterprises under the background of a low-carbon economy; and the third part is an open questionnaire, which mainly collects the respondents’ suggestions on adding new financial evaluation indicators to energy industry enterprises under the background of a low-carbon economy.

② Questionnaire distribution and recovery

In order to further ensure the matching between the questionnaire structure and the research questions, the initial questionnaire was pre-investigated, and the questionnaire was slightly revised according to the survey results. The formal investigation and interview took two months to complete. The subjects of the investigation included 25 senior title teachers and 20 doctoral teachers who have been engaged in financial management research and teaching for a long time in Canadian Laurel University, Australian Melbourne University, China Xi’an Jiaotong University, China Northwest University, China Anhui University of Finance, and other universities. We investigated and interviewed 20 senior managers, 30 middle managers, 30 financial department personnel, and 80 business personnel of energy enterprises such as China Petroleum, China Electric Power, Yulin New Energy Enterprise, Longji Green Energy Group, and POET LLC. A total of 205 questionnaires were distributed, and 198 questionnaires were collected. After excluding the invalid questionnaires, 188 were valid, with an effective recovery rate of 91.7%. These questionnaires were used as sample data for measuring the new financial evaluation indicators of energy industry enterprises under the background of a low-carbon economy. According to the results of the statistical analysis, it is considered that the new financial management evaluation indicators can better reflect and measure the low-carbon operation efficiency of energy industry enterprises under the background of a low-carbon strategy.

③ New financial evaluation index measurement

Under the background of a low-carbon economy, energy industry enterprises have added a new link to empower financial evaluation indicators. Three experts and scholars who have both doctoral degrees and senior titles and have been engaged in financial management teaching and research for a long time were selected from universities such as Laurel University and Xi’an Jiaotong University in China, and five senior leaders in charge of financial management, middle-level leaders of financial departments and front-line business personnel from energy industry enterprises such as China Petroleum, China Electric Power, and Yulin New Energy Enterprise. A total of eight experts were formed to assign the index weights. According to the calculation process of the AHP, the importance matrix of the criterion layer relative to the target layer is first constructed, as shown in Table 2.

Table 2.

Importance matrix of criterion layer relative to the target layer.

Among them, is the vector feature heel, is the normalized index importance vector, and = 4.8798. According to the consistency test reference scale, the matrix passed the consistency test, which shows that the experts’ judgment on the importance of the criterion layer relative to the target layer has a good consistency. Therefore, the weight vector of the criterion layer is as follows:

The profitability weight is 0.0897, the asset quality weight is 0.1117, the debt risk weight is 0.3339, and the business growth weight is 0.4647.

Secondly, the importance matrix of the scheme layer relative to the criterion layer is constructed. Because there are only two scheme layer indicators in the asset quality and debt risk dimensions, they can be directly given weights according to the analytic hierarchy process principle. Based on comprehensive expert opinions, the weight of the low-carbon asset ratio in the asset quality dimension is 0.4, and the weight of the low-carbon asset income rate is 0.6. In the debt risk dimension, the asset low-carbon debt ratio weight is 0.45, and the cash low-carbon debt ratio weight is 0.55. The importance matrix of the profitability dimension construction is shown in Table 3.

Table 3.

Judgment matrix of importance of profitability dimension.

According to the calculation results, it is determined that the weight vector of the financial management evaluation index of the profitability dimension is as follows:

The weight of the low-carbon assets’ return rate is 0.601, the weight of the low-carbon products’ operating cost profit rate is 0.14, and the weight of the net assets’ economic value added rate is 0.259. The weight of the low-carbon assets’ return rate is 0.601, the weight of the low-carbon products’ operating cost profit rate is 0.14, and the weight of the net assets’ economic value added rate is 0.259.

The importance matrix of the business growth dimension construction is shown in Table 4. The importance matrix of the business growth dimension construction is shown in Table 4.

Table 4.

Judgment matrix of importance of business growth dimensions.

According to the calculation results, it is determined that the weight vector of the financial management evaluation index of the business growth dimension is as follows:

The weight of the sales ratio of innovative products is 0.28, the weight of the low-carbon environmental protection investment growth rate is 0.16, the weight of the low-carbon product sales growth rate is 0.46, and the weight of the low-carbon technology R&D investment rate is 0.1.

(3) Comprehensive contribution and ranking

According to the measurement results of the new financial evaluation indicators of energy industry enterprises under the background of a low-carbon economy, the contribution of each indicator to the total target is calculated as shown in Table 5.

Table 5.

Contribution matrix of comprehensive indicators.

Table 5 defines the comprehensive contribution value of the new financial evaluation indicators for energy industry enterprises under the background of a low-carbon economy. According to the measurement and analysis results, the importance of 11 new financial evaluation indicators for low-carbon operation in descending order is the low-carbon product sales growth rate, cash low-carbon debt ratio, asset low-carbon debt ratio, innovative product sales ratio, low-carbon environmental protection investment growth rate, low-carbon asset income rate, low-carbon technology R&D investment rate, low-carbon asset ratio, net asset economic added rate, and low-carbon product operating cost profit rate. According to the comprehensive measurement value, the newly added financial evaluation indicators can be divided into three gradients (Table 6):

Table 6.

Gradient division of new financial evaluation indicators for low-carbon economic operation of energy enterprises.

From the above comprehensive contribution ranking, it can be seen that, under the background of a low-carbon economy, energy industry enterprises pay more attention to their investment in ecological environment protection. Compared with the traditional production and operation mode, they not only pursue the maximum profit but also pay more attention to the co-ordinated development of economic, social, and ecological benefits and pay more attention to low-carbon environmental protection.

7. Concluding Remarks

With the development of human society and the progress of science and technology, the global temperature is rising. In order to curb global warming effectively, the “low-carbon revolution” with the theme of high energy efficiency, low emissions, and low pollution is in full swing, and the low-carbon economy has become the new direction of world economic development. For energy industry enterprises, under the background of a low-carbon economy, it is necessary to change the original production and operation mode with high pollution, high consumption, and low output into a new mode with high efficiency and low pollution and promote the co-ordinated development of economic, social, and ecological benefits. In this situation, the financial management evaluation index has become an essential basis for the decision-making of senior leaders of enterprises, and the investment and use efficiency of funds have also become the key to affecting the development and growth of enterprise production. The research shows that, under the background of a low-carbon strategy and low-carbon economy, energy industry enterprises should not only follow the traditional financial management model and financial evaluation indicators, but also optimize and give new financial evaluation indicators under the low-carbon operation model, and, among the newly added financial evaluation indicators, more attention should be paid to the indicators with a high comprehensive contribution, for example, the sales growth rate of low-carbon products, the cash low-carbon debt ratio, the asset low-carbon debt ratio, and the sales ratio of innovative products, so that senior leaders of energy industry enterprises can optimize and improve the top-level design. The research results of this paper have important practical guiding value for energy enterprises to scientifically formulate their development goals, plan their development direction, make scientific financial management decisions, and realize energy enterprises’ cost reduction and efficiency improvement and low-carbon operation. Due to the limited sample data collected and the different political, economic, and ecological environments in different countries, the research results of this paper have some limitations. Although the comprehensive measurement value of financial evaluation indicators of energy enterprises can roughly reflect the low-carbon operation path of enterprises in the context of a low-carbon economy, different countries should make appropriate adjustments according to their own specific actual conditions. Therefore, in future research, the author will focus on a specific country for analysis, collect the data of the country, conduct research in combination with the actual national conditions, and put forward more targeted financial indicators that should be paid attention to in the low-carbon operation of energy enterprises in this country, so that enterprise managers can make more scientific financial management and enterprise operation decisions in time.

Author Contributions

Conceptualization, X.L. and E.Z.; methodology, X.L.; software, H.G.; validation, X.L., H.G. and E.Z.; formal analysis, X.L.; investigation, E.Z.; resources, X.L.; data curation, H.G.; writing—original draft preparation, X.L.; writing—review and editing, X.L.; visualization, X.L.; supervision, E.Z.; project administration, X.L. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Data Availability Statement

The data of this study mainly comes from survey questionnaires and expert interviews. It has been explained in the article that the research objects include senior professional title teachers, energy enterprise managers, financial personnel and production and business personnel who have been engaged in financial management research and teaching for a long time in colleges and universities.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Shi, X.F.; Sun, Y.; Cui, Y. Evaluation of Tianjin’s low-carbon economic development level based on entropy-principal component analysis. Sci. Technol. Manag. Res. 2018, 3, 247–252. [Google Scholar]

- Liu, J.; Liu, M.J. Does the low-carbon transformation affect enterprises’ foreign direct investment? Int. Trade Issues 2023, 3, 53–70. [Google Scholar]

- Zhang, W.B.; Song, J.B. Regional Differences and Influencing Factors of Synergistic Efficiency of Low-carbon Economy in China. J. Econ. Geogr. 2024, 3, 22–32. [Google Scholar]

- Shahnaz, R.; Dehghan, S.Z. The Effects of Spatial Spillover Information and Communications Technology on Carbon Dioxide Emissions in Iran. Environ. Sci. Pollut. Res. 2019, 26, 24198–24212. [Google Scholar] [CrossRef] [PubMed]

- Tang, X.W. Research on preferential policies of enterprise income tax to promote the development of low-carbon economy. Tax Res. 2022, 4, 48–55. [Google Scholar]

- Xu, Y.Y.; Cuan, L.Q.; Xu, X.W. Research on the decision-making mechanism of enterprise technological innovation mode under the background of low-carbon economy-based on the perspective of carbon tax policy. Oper. Manag. 2018, 27, 8–16. [Google Scholar]

- Ying, J.J.; Zhou, L.J.; Shen, W.X. Performance evaluation and analysis of Chinese insurance companies under uncertain financial markets. Heliyon 2023, 9, e21487. [Google Scholar] [CrossRef] [PubMed]

- Li, J.J.; Fu, Z.T.; Duan, W.J. Research on the present situation and countermeasures of carbon finance supporting technological innovation of innovative enterprises under the background of low-carbon economy. Sci. Manag. Res. 2023, 41, 158–164. [Google Scholar]

- Dang, K.D.; Tran, N.H.; Diep, V.N. How innovation and ownership concentration affect the financial sustainability of energy enterprises: Evidence from a transition economy. Heliyon 2022, 8, 25–33. [Google Scholar]

- Ding, D.; Wang, Y.P. On the preferential tax system for developing low-carbon economy. J. Beijing Jiaotong Univ. (Soc. Sci. Ed.) 2020, 19, 127–137. [Google Scholar]

- Hou, X.D. A-share listed logistics supply chain enterprise financial performance evaluation. J. Shanxi Univ. Financ. Econ. 2021, 11, 53–57. [Google Scholar]

- Liang, B.M.; Guo, Z.X. Financial performance evaluation of LED packaging enterprises based on entropy weight method. Friends Account. 2022, 20, 103–110. [Google Scholar]

- Tian, C.; Xiao, L.M. The impact of carbon emissions trading on enterprises’ low-carbon transformation-a quasi-natural experiment based on carbon trading pilot market. East China Econ. Manag. 2023, 37, 64–74. [Google Scholar]

- Rogge, K.S.; Schleich, J. Do policy Mix Characteristics Matter for Low-Carbon Innovation? A Survey-Based Exploration of Renewable Power Generation Technologies in Germany. Res. Policy 2018, 47, 1639–1654. [Google Scholar] [CrossRef]

- Zhang, H.X.; Lu, C.L. Research on financial performance evaluation of high-tech enterprises based on entropy weight method. Friends Account. 2023, 12, 80–88. [Google Scholar]

- Raom, L.X. Research on the Theory and Application Framework of Green Taxation; China Taxation Press: Beijing, China, 2006. [Google Scholar]

- Zhang, L.; Ma, C.C. Research on the Optimization of Green Tax System under the Target of peak carbon dioxide emissions and Carbon Neutralization. Tax Res. 2021, 8, 12–17. [Google Scholar]

- Liu, T.; Han, Y. Green investment, ecological industrial structure and low-carbon economic transformation. Econ. Manag. Rev. 2023, 6, 17–29. [Google Scholar]

- Luo, L.W.; Zhang, Z.Q.; Zhou, Q. Industrial Intelligence and Urban Low-carbon Economic Transformation. Econ. Manag. 2023, 8, 43–60. [Google Scholar]

- Ding, T.; Huang, Y.F.; Feng, K.; Wu, Q.H. A Study on the Measurement of Regional Low-carbon Economy Development Level, Regional Gap and Spatial Convergence in China—Evidence from Eight Comprehensive Economic Zones. Explor. Econ. Issues 2023, 2, 28–44. [Google Scholar]

- Wu, C.X. Measurement and comparative analysis of the development level of low-carbon economy in countries along the “the belt and road initiative”. Guizhou Soc. Sci. 2022, 10, 108–117. [Google Scholar]

- He, D.; Tang, Y.H.; Hu, X.H. Impact of green service industry policy on China’s low-carbon economic growth. Resour. Sci. 2022, 44, 730–743. [Google Scholar]

- Rao, Y.B.; Xiong, Y.Q.; Xu, W. Study on the Heterogeneity Influence of Double Integral Policy on the Financial Performance of Upstream and Downstream Enterprises of New Energy Vehicles. Syst. Eng. Theory Pract. 2022, 42, 2408–2425. [Google Scholar]

- Yang, H.X.; Zhang, W.H. Influence of technological innovation ability of energy enterprises on financial performance—A study on threshold effect based on enterprise scale. Tech. Econ. 2020, 39, 1–9. [Google Scholar]

- Chen, Z.J.; Liu, X.L.; Dong, M.T. Research on financial management control points of parent-subsidiary companies. Econ. Manag. Rev. 2021, 5, 104–112. [Google Scholar]

- Ma, G.L.; Zhang, Y. Research on the Effectiveness Evaluation and Diagnosis of Financial System under the View of Collective Consensus. Account. Econ. Res. 2018, 32, 52–67. [Google Scholar]

- Huang, H. Innovative ideas and countermeasures of enterprise financial management under network economy. J. Jishou Univ. (Soc. Sci. Ed.) 2018, 39, 18–20. [Google Scholar]

- Zhang, Y.; Zhang, Y.X. Analysis of the carbon emission driving factors and prediction of a carbon peak scenario—A case study of Xi’an city. Heliyon 2022, 8, 35–46. [Google Scholar] [CrossRef]

- Wang, Z.J.; Wang, H. Misestimation of financial indicators and stock pricing bias-from the perspective of intermediary role of securities analysts. J. Zhongnan Univ. Econ. Law 2021, 11, 3–15. [Google Scholar]

- Yang, G.J.; Zhou, Y.M.; Sun, L.L. Enterprise financial risk early warning method based on Benford-Logistic model. Quant. Econ. Tech. Econ. Res. 2019, 10, 149–164. [Google Scholar]

- Long, F.; Lin, F.; Bi, F.F. Research on tax policy to promote the utilization and disposal of hazardous waste. Tax Res. 2021, 11, 46–51. [Google Scholar]

- Yu, H.; Xue, Y.T.; Duan, X.Y. Optimization of financial evaluation indicators of transportation enterprises in a low-carbon economy. Account. Mon. 2018, 17, 62–68. [Google Scholar]

- Xu, F.; Pan, Q.; Wang, Y.N. Research on the Impact of Green and Low-carbon Transformation on the Profitability of Enterprises. Macroecon. Manag. 2022, 1, 161–175. [Google Scholar]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).