Does Renewable Energy Matter for Economic Growth and Happiness?

Abstract

1. Introduction

2. Materials and Methods

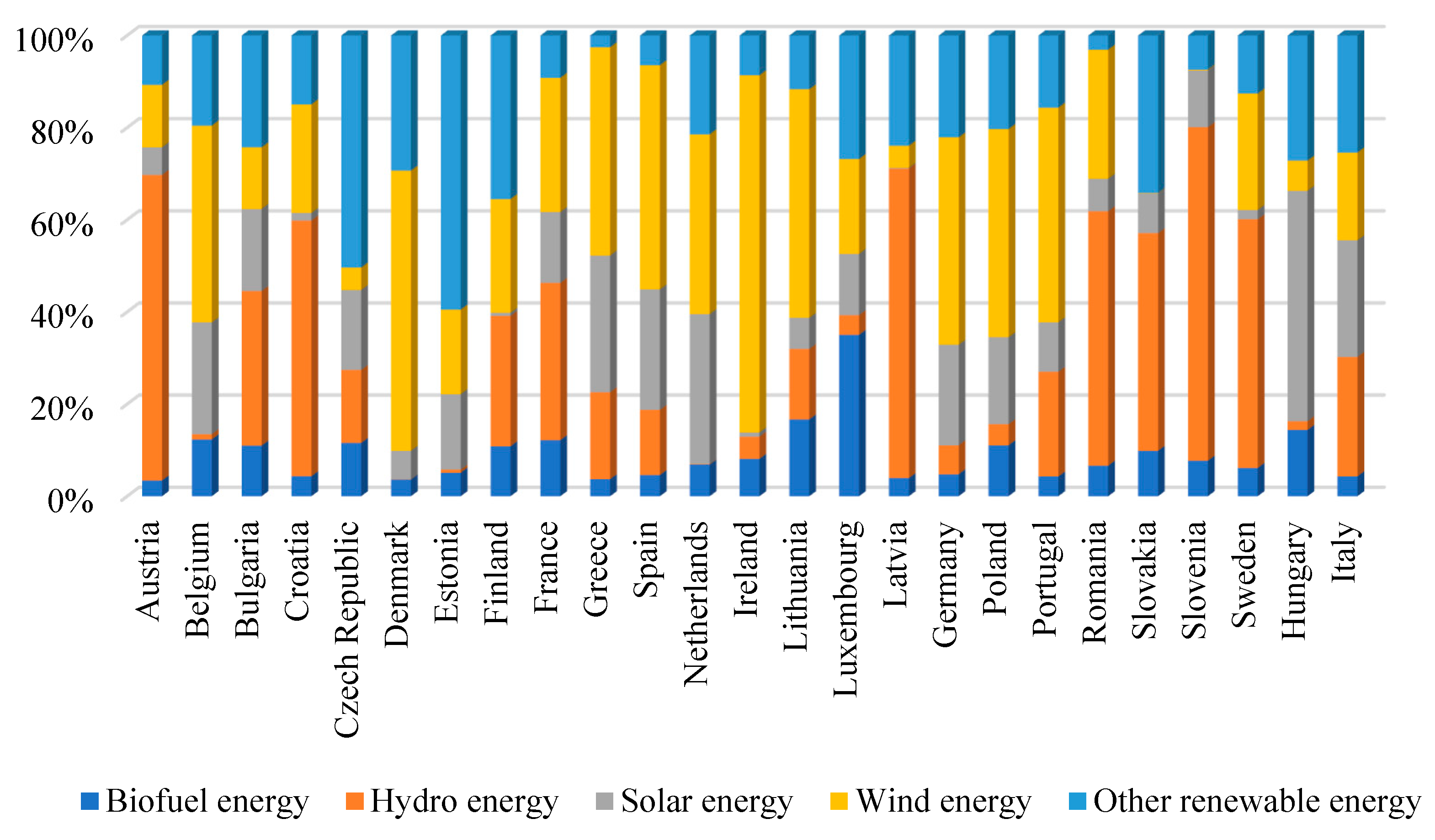

- Renewable share energy (% of total primary energy).

- Biofuel energy (% of total primary energy).

- Hydro energy (% of total primary energy).

- Solar energy (% of total primary energy).

- Wind energy (% of total primary energy).

- Other renewable energy (% of total primary energy).

- Inflation rate HICP (%).

- Unemployment rate (%).

- Current account balance (% of GDP).

3. Results

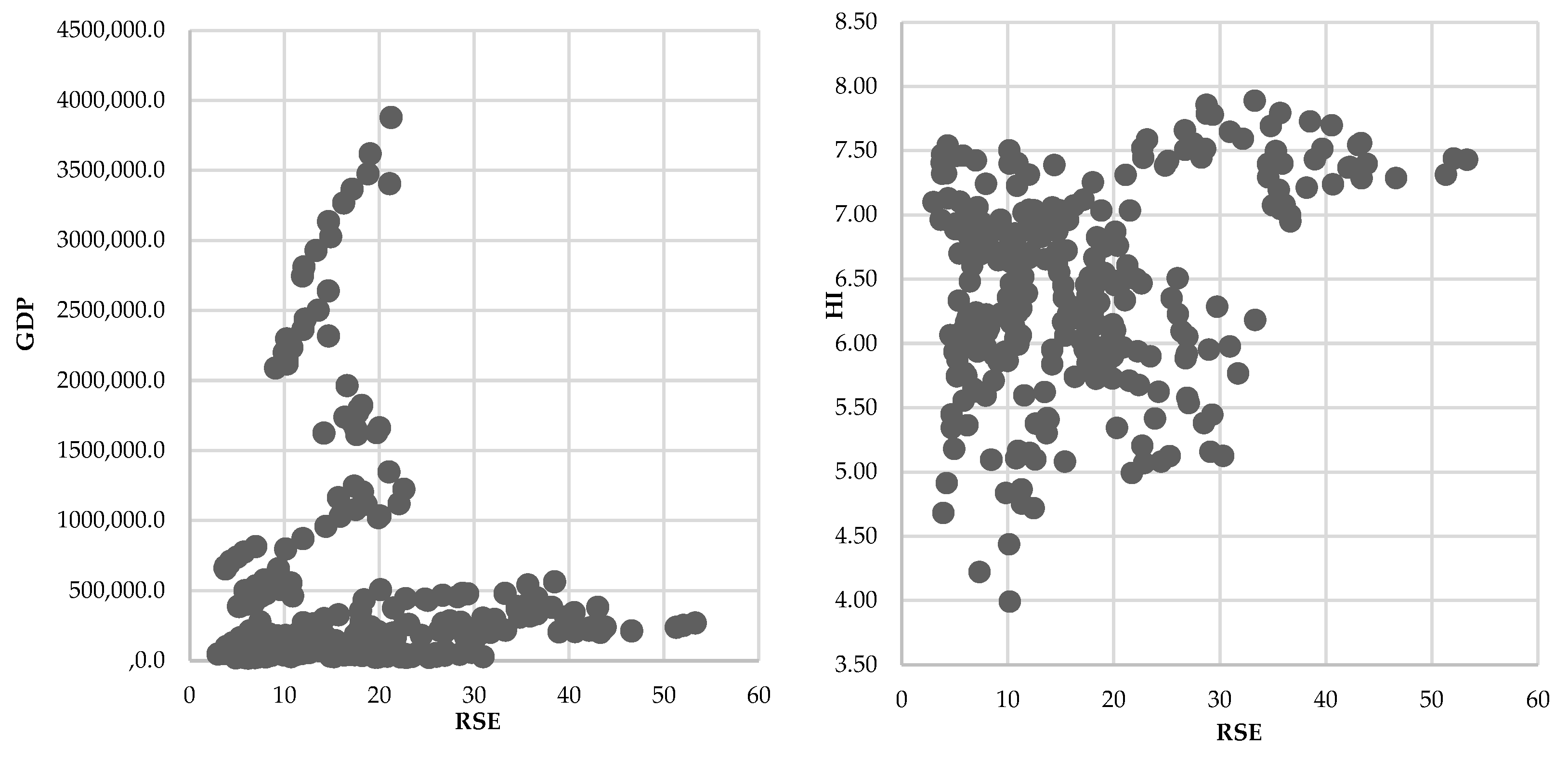

3.1. Renewable Energy Sources in EU-25 Countries

3.2. Econometric Modeling

4. Discussion

5. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Martins, F.; Felgueiras, C.; Smitkova, M.; Caetano, N. Analysis of Fossil Fuel Energy Consumption and Environmental Impacts in European Countries. Energies 2019, 12, 964. [Google Scholar] [CrossRef]

- International Energy Agency. World Energy Outlook 2022 Executive Summary. 2022, p. 4. Available online: https://www.iea.org/reports/world-energy-outlook-2022 (accessed on 25 March 2024).

- Arslan, Ü.; Yildiz, T. Does the Transition to Renewable Energy Increase in European Countries? Available online: https://www.researchsquare.com/article/rs-1408222/v1 (accessed on 25 March 2024).

- Timmons, D.; Harris, J.M.; Roach, B. The Economics of Renewable Energy; Global Development and Environmental Institute, Tufts University: Medford, MA, USA, 2014; Available online: https://www.bu.edu/eci/files/2019/06/RenewableEnergyEcon.pdf (accessed on 25 March 2024).

- Neri, S.; Busetti, F.; Conflitti, C.; Corsello, F.; Monache, D.D.; Tagliabracci, A. Energy Price Shocks and Inflation in the Euro Area. Questioni di Economia e Finanza (Occasional Papers). No. 792. 2023. Available online: https://www.bancaditalia.it/pubblicazioni/qef/2023-0792/QEF_792_23.pdf?language_id=1 (accessed on 25 March 2024).

- Łuszczyk, M.; Malik, K.; Siuta-Tokarska, B.; Thier, A. Direction of Changes in the Settlements for Prosumers of Photovoltaic Micro-Installations: The Example of Poland as the Economy in Transition in the European Union. Energies 2023, 16, 3233. [Google Scholar] [CrossRef]

- European Commission. The European Green Deal, Brussels, 11.12.2019, COM(2019) 640 Final. Available online: https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=COM%253A2019%253A640%253AFIN (accessed on 25 March 2024).

- Eurostat. Publications Office of the European Union. Sustainable Development in the European Union. Monitoring Report on Progress towards the SDGs in an EU Context. Luxembourg. 2023. Available online: https://ec.europa.eu/eurostat/web/products-flagship-publications/w/ks-04-23-184 (accessed on 25 March 2024).

- Directive (EU) 2018/2001 of The European Parliament and of the Council of 11 December 2018 on the Promotion of the Use of Energy from Renewable Sources, Official Journal of the European Union L 328/83. Available online: https://eur-lex.europa.eu/legal-content/EN/TXT/PDF/?uri=CELEX:32018L2001 (accessed on 25 March 2024).

- Available online: https://www.consilium.europa.eu/pl/policies/climate-change/paris-agreement/cop28/ (accessed on 25 March 2024).

- Bhattacharya, M.; Paramati, S.R.; Ozturk, I.; Bhattacharya, S. The effect of renewable energy consumption on economic growth: Evidence from top 38 countries. Appl. Energy 2016, 162, 733–741. [Google Scholar] [CrossRef]

- Inglesi-Lotz, R. The impact of renewable energy consumption to economic growth: A panel data application. Energy Econ. 2016, 53, 58–63. [Google Scholar] [CrossRef]

- Shahbaz, M.; Raghutla, C.; Chittedi, K.R.; Jiao, Z.; Vo, X. The effect of renewable energy consumption on economic growth: Evidence from the renewable energy country attractive index. Energy 2020, 207, 118162. [Google Scholar] [CrossRef]

- Li, Q.; Cherian, J.; Shabbir, M.S.; Sial, M.S.; Li, J.; Mester, I.; Badulescu, A. Exploring the Relationship between Renewable Energy Sources and Economic Growth. Case SAARC Countries. Energies 2021, 14, 520. [Google Scholar] [CrossRef]

- Bhuiyan, M.; Zhang, Q.; Khare, V.; Mikhaylov, A.; Pintér, G.; Huang, X. Renewable Energy Consumption and Economic Growth Nexus—A Systematic Literature Review. Front. Environ. Sci. 2022, 10, 878394. [Google Scholar] [CrossRef]

- Baktemur, F.I. Renewable Energy Consumption and Economic Growth Relationship in Developing Countries. Kent Akademisi. 2023, 16, 2779–2788. [Google Scholar] [CrossRef]

- Candra, O.; Chammam, A.; Alvarez, J.N.; Muda, I.; Aybar, H. The Impact of Renewable Energy Sources on the Sustainable Development of the Economy and Greenhouse Gas Emissions. Sustainability 2023, 15, 2104. [Google Scholar] [CrossRef]

- Yıldırım, U.; Kaya, M. Seçilmi¸s OECD Ülkelerinde Yenilenebilir Enerji Tü-ketiminin Makro Ekonomik Belirleyicileri. Çankırı Karatekin Üniversitesi Iktisadi Idari Bilim. Fakültesi Dergisi 2021, 11, 267–289. [Google Scholar]

- Çakmak, N.; Gözen, M. Analysis of systematic risk factors associated with renewable energy supports mechanism applied in Turkey. J. Bus. Innov. Gov. 2021, 4, 57–81. Available online: https://dergipark.org.tr/en/pub/jobig/issue/63580/971988 (accessed on 25 March 2024).

- Marques, A.; Fuinhas, J. Is renewable energy effective in promoting growth. Energy Policy 2012, 46, 434–442. [Google Scholar] [CrossRef]

- Afonso, T.L.; Marques, A.; Fuinhas, J. Strategies to make renewable energy sources compatible with economic growth. Energy Strategy Rev. 2017, 18, 121–126. [Google Scholar] [CrossRef]

- Bayar, Y.; Gavriletea, M. Energy efficiency, renewable energy, economic growth: Evidence from emerging market economies. Qual. Quant. 2019, 53, 2221–2234. [Google Scholar] [CrossRef]

- Morganti, P.; Garofalo, G. Renewable Energy and Economic Growth: An Overview of the Literature. In Customer Satisfaction and Sustainability Initiatives in the Fourth Industrial Revolution; Silvestri, C., Piccarozzi, M., Aquilani, B., Eds.; IGI Global: Hershey, PA, USA, 2020. [Google Scholar] [CrossRef]

- Ntanos, S.; Skordoulis, M.; Kyriakopoulos, G.L.; Arabatzis, G.; Chalikias, M.; Galatsidas, S.; Batzios, A.; Katsarou, A. Renewable Energy and Economic Growth: Evidence from European Countries. Sustainability 2018, 10, 2626. [Google Scholar] [CrossRef]

- Venkatraja, B. Does renewable energy affect economic growth? Evidence from panel data estimation of BRIC countries. Int. J. Sustain. Dev. World Ecol. 2020, 27, 107–113. [Google Scholar] [CrossRef]

- Payamfar, M.; Seyed Shokri, K.; Shojaei, M.; Mohammadzadeh Asl, N. The Impact of Renewable Energy Consumption on Sustainable Economic Welfare Index in Selected Countries (1990–2020). J. Renew. New Energy 2023, 10, 46–69. [Google Scholar] [CrossRef]

- Kumari, N.; Kumar, P.; Chandra Sahu, N. Do energy consumption and environmental quality enhance subjective wellbeing in G20 countries. Environ. Sci. Pollut. Res. 2021, 28, 60246–60267. [Google Scholar] [CrossRef]

- Sun, Z.; Wu, Y.; Sun, H.; Zhou, D.; Lou, Y.; Qin, L. The Impact of Building Clean Energy Consumption on Residents’ Subjective Well-Being: Evidence from China. Buildings 2022, 12, 2037. [Google Scholar] [CrossRef]

- Aydinbaş, G.; Erdinç, Z. Panel Data Evidence on Factors Associated with Happiness in the Context of Society 5.0. ODÜSOBİAD 2022, 12, 2081–2104. [Google Scholar] [CrossRef]

- von Möllendorff, C.; Welsch, H. Measuring Renewable Energy Externalities: Evidence from Subjective Well-being Data. Land Econ. 2017, 93, 109–126. [Google Scholar] [CrossRef]

- Rosak-Szyrocka, J.; Zywiolek, J.; Ali Turi, J.; Das, A. Expectations for Renewable Energy, and Its Impacts on Quality of Life in European Union Countries. Manag. Syst. Prod. Eng. 2023, 31, 128–137. [Google Scholar] [CrossRef]

- Szeberényi, A.; Rokicki, T.; Papp-Váry, Á. Examining the Relationship between Renewable Energy and Environmental Awareness. Energies 2022, 15, 7082. [Google Scholar] [CrossRef]

- Ferreira, R.; María, R. The Contribution of Renewable Energy to Wellness. Not yet a Lesson Learned; Revista Galega de Economía, University of Santiago de Compostela, Faculty of Economics and Business: Santiago, Spain, 2011; Volume 20. [Google Scholar]

- Zaunbrecher, B.S.; Arning, K.; Ziefle, M. The Good, the Bad and the Ugly: Affect and its Role for Renewable Energy Acceptance. In Proceedings of the 7th International Conference on Smart Cities and Green ICT Systems, Funchal, Portugal, 16–18 March 2018; Klein, C., Donnellan, B., Helfert, M., Eds.; pp. 325–336. [Google Scholar] [CrossRef]

- Afia, N.B. The relationship between energy consumption, economic growth and happiness. J. Econ. Dev. 2019, 44, 41–57. [Google Scholar]

- Liu, Y.; Mu, Y.; Chen, K.; Li, Y.; Guo, J. Daily activity feature selection in smart homes based on pearson correlation coefficient. Neural Process. Lett. 2020, 51, 1771–1787. [Google Scholar] [CrossRef]

- Kufel, T. Ekonometria. Rozwiązywanie Problemów z Wykorzystaniem Programu GRETL; PWN: Warszawa, Poland, 2011. [Google Scholar]

- Kośko, M.; Osińska, M.; Stempińska, J. Ekonometria Współczesna; TNOiK: Toruń, Poland, 2007. [Google Scholar]

- Koop, G. Analysis of Economic Data, 3rd ed.; Wiley Publishers: Hoboken, NJ, USA, 2009. [Google Scholar]

- Haralayya, B.; Aithal, P.S. Performance affecting factors of Indian banking sector: An empirical analysis. Georg. Wash. Int. Law Rev. 2021, 7, 607–621. [Google Scholar]

- Pirlogea, C.; Cicea, C. Econometric perspective of the energy consumption and economic growth relation in European Union. Renew. Sustain. Energy Rev. 2012, 16, 5718–5726. [Google Scholar] [CrossRef]

- Pao, H.T.; Fu, H.C. Renewable energy, non-renewable energy and economic growth in Brazil. Renew. Sustain. Energy Rev. 2013, 25, 381–392. [Google Scholar] [CrossRef]

- Wang, G.; Sadiq, M.; Bashir, T.; Jain, V.; Ali, S.A.; Shabbir, M.S. The dynamic association between different strategies of renewable energy sources and sustainable economic growth under SDGs. Energy Strategy Rev. 2022, 42, 100886. [Google Scholar] [CrossRef]

- Ivanovski, K.; Hailemariam, A.; Smyth, R. The effect of renewable and non-renewable energy consumption on economic growth: Non-parametric evidence. J. Clean. Prod. 2021, 286, 124956. [Google Scholar] [CrossRef]

- Karthik, R.; Behera, R.R.; Bera, R.; Panda, D. Can renewable energy lead to happiness? Indian J. Health Wellbeing 2022, 13, 404–409. [Google Scholar]

- Omri, A.; Omri, H.; Slimani, S.; Belaid, F. Environmental degradation and life satisfaction: Do governance and renewable energy matter? Technol. Forecast. Soc. Change 2022, 175, 121375. [Google Scholar] [CrossRef]

- Aldieri, L.; Bruno, B.; Vinci, C.P. Does environmental innovation make us happy? An empirical investigation. Socio-Econ. Plan. Sci. 2019, 67, 166–172. [Google Scholar] [CrossRef]

- Wang, Y.; Arshed, N.; Ghulam Shabeer, M.; Munir, M.; Rehman, H.U.; Khan, Y.A. Does globalization and ecological footprint in OECD lead to national happiness. PLoS ONE 2023, 18, e0288630. [Google Scholar] [CrossRef] [PubMed]

- Hafez, A.; Adris, A.E. Oil Producers, Refiners and Renewable Energy Consumers: Correlation to the Wealth, Competitiveness, Peace and Happiness of Populations. In Proceedings of the IAFOR International Conference on Sustainability, Energy & the Environment—Hawaii 2017, Official Conference Proceedings, Honolulu, HI, USA, 5–7 January 2017. [Google Scholar]

- Armeanu, D.Ş.; Vintilă, G.; Gherghina, Ş.C. Does renewable energy drive sustainable economic growth? Multivariate panel data evidence for EU-28 countries. Energies 2017, 10, 381. [Google Scholar] [CrossRef]

- Apergis, N.; Chang, T.; Gupta, R.; Ziramba, E. Hydroelectricity consumption and economic growth nexus: Evidence from a panel of ten largest hydroelectricity consumers. Renew. Sustain. Energy Rev. 2016, 62, 318–325. [Google Scholar] [CrossRef]

- Doğan, E.; Doğan, B.Ö. Does Wind Energy Affect Economic Growth in Developing Countries? İstatistik Ve Uygulamalı Bilim. Derg. 2020, 1, 99–106. [Google Scholar]

- Koç, Ü.; ve Apaydın, Ş. İktisadi Büyüme ve Rüzgar Enerjisi: Seçilmiş G-20 Ülkeleri İçin Bir Analiz. Fisca Oeconomia 2020, 4, 595–612. [Google Scholar]

- Adeyeye, K.; Ijumba, N.; Colton, J. Exploring the environmental and economic impacts of wind energy: A cost-benefit perspective. Int. J. Sustain. Dev. World Ecol. 2020, 27, 718–731. [Google Scholar] [CrossRef]

- Onakpoya, I.; O’Sullivan, J.; Thompson, M.; Heneghan, C. The effect of wind turbine noise on sleep and quality of life: A systematic review and meta-analysis of observational studies. Environ. Int. 2015, 82, 1–9. [Google Scholar] [CrossRef]

- Krekel, C.; Zerrahn, A. Does the presence of wind turbines have negative externalities for people in their surroundings? Evidence from well-being data. J. Environ. Econ. Manag. 2017, 82, 221–238. [Google Scholar] [CrossRef]

- Li, A.; Xu, Y.; Shiroyama, H. Solar lobby and energy transition in Japan. Energy Policy 2019, 134, 110950. [Google Scholar] [CrossRef]

- Lazdins, R.; Mutule, A.; Zalostiba, D. PV Energy Communities—Challenges and Barriers from a Consumer Perspective: A Literature Review. Energies 2021, 14, 4873. [Google Scholar] [CrossRef]

- Sen, S.; Ganguly, S. Opportunities, barriers and issues with renewable energy development—A discussion. Renew. Sustain. Energy Rev. 2017, 69, 1170–1181. [Google Scholar] [CrossRef]

- Matson, P.; Stewart, K.; Oladosu, G.; Marzan, E.; DeNeale, S. Estimated cspital costs of fish exclusion technologies for hydropower facilities. J. Environ. Manag. 2024, 351, 119800. [Google Scholar] [CrossRef]

- Jatautas, J.; Kasiulis, E. The effect of legislation on hydropower development: Case study of Lithuania. Investig. Manag. Financ. Innov. 2016, 13, 48–57. [Google Scholar] [CrossRef][Green Version]

- Munir, M.M.; Shakir, A.S.; Rehman, H.-U.; Khan, N.M.; Rashid, M.U.; Tariq, M.A.U.R.; Sarwar, M.K. Simulation-Optimization of Tarbela Reservoir Operation to Enhance Multiple Benefits and to Achieve Sustainable Development Goals. Water 2022, 14, 2512. [Google Scholar] [CrossRef]

| Variable | Data Description and Unit | Sources |

|---|---|---|

| Gross Domestic Product (GDP) | GDP at current prices; million EUR | Eurostat |

| Happiness index (HI) | The country scores are based on a survey in which respondents evaluated the quality of their current lives on a scale of 0 to 10 | https://worldhappiness.report/data/, accessed on 20 March 2024 |

| Renewable share energy (RSE) | % of total primary energy | https://ourworldindata.org/energy, accessed on 20 March 2024 |

| Biofuel share energy (BSE) | % of total primary energy | https://ourworldindata.org/energy, accessed on 20 March 2024 |

| Hydro share energy (HSE) | % of total primary energy | https://ourworldindata.org/energy, accessed on 20 March 2024 |

| Solar share energy (SSE) | % of total primary energy | https://ourworldindata.org/energy, accessed on 20 March 2024 |

| Wind share energy (WSE) | % of total primary energy | https://ourworldindata.org/energy, accessed on 20 March 2024 |

| Other renewable share energy (ORSE) | % of total primary energy | https://ourworldindata.org/energy, accessed on 20 March 2024 |

| Inflation rate (IR) | Harmonized Indices of Consumer Prices (HICP); % | Eurostat |

| Unemployment rate (UR) | Unemployed persons aged 15 to 74 as a percentage of the labor force; % | Eurostat |

| Current account balance (CAB) | All transactions (other than those in financial items) in goods, services, primary income and secondary income which occur between resident and non-resident units; % of GDP | Eurostat |

| Variable | Mean | Min | Max | Standard Deviation | Coefficient of Variation |

|---|---|---|---|---|---|

| GDP | 522,750 | 17,917 | 3,876,810 | 7.82 | 1.50 |

| HI | 6.43 | 3.99 | 7.89 | 0.78 | 0.12 |

| RSE | 17.13 | 2.99 | 53.31 | 10.81 | 0.63 |

| BSE | 1.05 | 0.01 | 4.18 | 0.64 | 0.61 |

| HSE | 7.10 | 0.01 | 33.18 | 8.29 | 1.17 |

| SSE | 1.18 | 0.00 | 5.91 | 1.21 | 1.02 |

| WSE | 4.50 | 0.00 | 26.16 | 4.74 | 1.05 |

| ORSE | 3.30 | 0.10 | 14.78 | 2.87 | 0.87 |

| IR | 2.20 | −1.60 | 19.40 | 3.25 | 1.48 |

| UR | 8.49 | 2.00 | 27.80 | 4.67 | 0.55 |

| CAB | 1.30 | −19.90 | 13.7 | 4.24 | 3.25 |

| GDP | HI | RSE | BSE | HSE | SSE | WSE | ORSE | IR | UR | CAB | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| GDP | 1.00 | 0.23 * | −0.03 | −0.03 | −0.17 * | 0.47 * | 0.11 | −0.01 | −0.02 | −0.05 | 0.23 * |

| HI | 0.23 * | 1.00 | 0.32 * | 0.46 * | 0.06 | −0.07 | 0.31 * | 0.47 * | 0.07 | −0.44 * | 0.38 * |

| RSE | −0.03 | 0.32 * | 1.00 | 0.39 * | 0.78 * | −0.03 | 0.52 * | 0.55 * | 0.01 | 0.02 | 0.12 * |

| BSE | −0.03 | 0.46 * | 0.39 * | 1.00 | 0.20 * | −0.05 | 0.25 * | 0.26 * | 0.17 * | −0.23 * | 0.21 * |

| HSE | −0.17 * | 0.06 * | 0.78 * | 0.20 * | 1.00 | −0.23 * | −0.06 | 0.16 * | −0.05 | 0.09 | −0.06 |

| SSE | 0.47 * | −0.07 | −0.03 | −0.05 | −0.23 * | 1.00 | 0.17 * | −0.14 * | 0.19 * | 0.19 * | 0.02 |

| WSE | 0.11 | 0.31 * | 0.52 * | 0.25 * | −0.06 | 0.17 * | 1.00 | 0.35 * | −0.01 | 0.04 | 0.25 * |

| ORSE | −0.01 | 0.47 * | 0.55 * | 0.26 * | 0.16 * | −0.14 * | 0.35 * | 1.00 | 0.08 | −0.28 * | 0.17 * |

| IR | −0.02 | 0.07 * | 0.01 | 0.17 * | −0,05 | 0.19 * | −0.01 | 0.08 | 1.00 | −0.27 * | −0.22 * |

| UR | −0.04 | −0.44 * | 0.02 | −0.23 * | 0.09 | 0.19 * | 0.04 | −0.28 * | −0.27 * | 1.00 | −0.20 * |

| CAB | 0.23 * | 0.38 * | 0.12 * | 0.21 * | −0.06 | 0.02 | 0.25 * | 0.17 * | −0.22 * | −0.20 * | 1.00 |

| Variable | Model 1 | Model 2 | Model 3 | Model 4 | Model 5 | Model 6 | Model 7 | Model 8 |

|---|---|---|---|---|---|---|---|---|

| RSE | 1.02 | 1.00 | 1.00 | 1.02 | 1.02 | 1.00 | 1.02 | |

| HICP | 1.19 | 1.08 | 1.00 | 1.05 | ||||

| UR | 1.18 | 1.08 | 1.05 | 1.00 | ||||

| CAB | 1.17 | 1.07 | 1.06 | 1.02 |

| Variable | Model 1 | Model 2 | Model 3 | Model 4 | Model 5 | Model 6 | Model 7 | Model 8 |

|---|---|---|---|---|---|---|---|---|

| BSE | 1.28 | 1.25 | 1.19 | 1.25 | 1.24 | 1.23 | 1.18 | 1.15 |

| HSE | 1.19 | 1.18 | 1.12 | 1.14 | 1.19 | 1.18 | 1.13 | 1.12 |

| SSE | 1.24 | 1.23 | 1.17 | 1.17 | 1.14 | 1.15 | 1.12 | 1.12 |

| WSE | 1.36 | 1.32 | 1.28 | 1.31 | 1.36 | 1.31 | 1.30 | 1.26 |

| ORSE | 1.36 | 1.36 | 1.26 | 1.28 | 1.36 | 1.36 | 1.25 | 1.25 |

| HICP | 1.33 | 1.18 | 1.10 | 1.19 | ||||

| UR | 1.43 | 1.34 | 1.28 | 1.25 | ||||

| CAB | 1.29 | 1.21 | 1.14 | 1.11 |

| Variable | At Level | p Value |

|---|---|---|

| GDP | −3.5258 | 0.04 |

| HI | −4.4204 | 0.01 |

| RSE | −5.2766 | 0.01 |

| BSE | −5.2631 | 0.01 |

| HSE | −4.4598 | 0.01 |

| SSE | −4.4752 | 0.01 |

| WSE | −5.0284 | 0.01 |

| ORSE | −3.5679 | 0.04 |

| IR | −10.4060 | 0.01 |

| UR | −4.9409 | 0.01 |

| CAB | −5.1466 | 0.01 |

| Variables | Model 1 | Model 2 | Model 3 | Model 4 | Model 5 | Model 6 | Model 7 | Model 8 |

|---|---|---|---|---|---|---|---|---|

| Const. | 429,535 *** (0.001) | 427,682 *** (0.001) | 337,316 *** (0.003) | 336,498 *** (0.003) | 437,226 *** (0.001) | 436,312 *** (0.001) | 319,259 *** (0.004) | 318,324 * (0.052) |

| RSE | 7940.99 * (0.074) | 8240.71 * (0.060) | 9988.94 ** (0.020) | 9783.45 ** (0.024) | 9205.02 ** (0.046) | 9249.87 ** (0.043) | 11,926.3 *** (0.009) | 11,935.4 *** (0.000) |

| HICP | 5928.74 *** (0.010) | 5179.82 *** (0.002) | 6524.98 *** (0.001) | 7178.51 *** (0.000) | ||||

| UR | −6989.55 ** (0.018) | −6766.38 ** (0.027) | −8585.93 *** (0.005) | −8476.89 *** (0.006) | ||||

| CAB | 2707.17 ** (0.026) | 2225.58 ** (0.043) | 598.496 (0.730) | −598.163 (0.769) | ||||

| Obs. | 275 | 275 | 275 | 275 | 275 | 275 | 275 | 275 |

| F-Value | 4.144 (0.003) | 0.387 (0.763) | 0.192 (0.825) | 5.522 (0.001) | 5.368 (0.001) | 0.466 (0.628) | 8.082 (0.003) | 0.322 (0.571) |

| Wald test | F(24.246) = 1003.2 (0.000) | F(24.247) = 1057.76 (0.000) | F(24.248) = 1024.46 (0.000) | F(24.247) = 966.572 (0.000) | F(24.247) = 964.357 (0.000) | F(24.248) = 1022.61 (0.000) | F(24.248) = 1259.63 (0.000) | F(24.249) = 966.833 (0.000) |

| Breusch–Pagan test | LM = 1267.28 (0.000) | LM = 1330.68 (0.000) | LM = 1328.98 (0.000) | LM = 1271.59 (0.000) | LM = 1259.16 (0.000) | LM = 1338.24 (0.000) | LM = 1163.96 (0.000) | LM = 1333.24 (0.000) |

| Hausman test | H = 4.337 (0.362) | H = 3.470 (0.321) | H = 2.788 (0.248) | H = 4.705 (0.175) | H = 1.194 (0.363) | H = 0.651 (0.722) | H = 3.443 (0.179) | H = 1.019 (0.313) |

| CD Pesaran | z = 0.483 (0.629) | z = 0.422 (0.673) | z = 5.237 (0.000) | z = 5.409 (0.000) | z = 4.800 (0.000) | z = 4.338 (0.000) | z = 7.270 (0.000) | z = 7.888 (0.000) |

| Woolridge test | F = 18.191 (0.000) | F = 18.441 (0.000) | F = 23.403 (0.000) | F = 23.139 (0.000) | F = 24.040 (0.000) | F = 18.441 (0.000) | F = 33.439 (0.000) | F = 33.822 (0.000) |

| Breusch–Pagan test | BP = 1302.3 (0.000) | BP = 1272.5 (0.000) | BP = 1137.7 (0.000) | BP = 1154.0 (0.000) | BP = 1183.5 (0.000) | BP = 1167.1 (0.000) | BP = 1005.4 (0.000) | BP = 999.9 (0.000) |

| Estimator | RE | RE | RE | RE | RE | RE | RE | RE |

| Variables | Model 1 | Model 2 | Model 3 | Model 4 | Model 5 | Model 6 | Model 7 | Model 8 |

|---|---|---|---|---|---|---|---|---|

| Const. | 475,114 *** (0.001) | 473,042 *** (0.001) | 443,768 *** (0.001) | 443,155 *** (0.002) | 478,453 *** (0.001) | 476,449 *** (0.001) | 442,595 *** (0.002) | 443,102 *** (0.002) |

| BSE | −17,295.3 (0.476) | −17,283.4 (0.476) | −17,037.4 (0.485) | −17,036.9 (0.488) | −10,849.8 (0.650) | −11,827.4 (0.617) | −10,216.6 (0.675) | −11,113.5 (0.645) |

| HSE | −2806.49 (0.184) | −2575,35 (0.217) | −3323.52 (0.110) | −3635.23 * (0.085) | −3296.49 (0.138) | −3056.91 (0.161) | −4265.41 * (0.056) | −3969.62 * (0.071) |

| SSE | 40,472.7 ** (0.032) | 39,064.5 ** (0.048) | 41,494.2 ** (0.024) | 43,148.9 ** (0.014) | 47,226.3 ** (0.014) | 45,184.6 ** (0.024) | 50,643.7 *** (0.004) | 48,524.5 *** (0.009) |

| WSE | 20,154.5 * (0.087) | 20,911.7 * (0.073) | 21,881.5 ** (0.047) | 21,242.2 * (0.054) | 19,718.9 * (0.090) | 20,336.6 * (0.078) | 20,916.4 * (0.056) | 21,398.5 * (0.051) |

| ORSE | −12,203.8 ** (0.031) | −11,466.7 * (0.058) | −10,401.2 * (0.092) | −11,007.2 * (0.064) | −12,121.5 ** (0.038) | −11,595.9 * (0.057) | −10,768.5 * (0.083) | −10,383.7 (0.101) |

| HICP | 3857.37 *** (0.010) | 3054.14 ** (0.026) | 3269.36 *** (0.016) | 4040.82 *** (0.005) | ||||

| UR | −2989.07 (0.462) | −2719.90 (0.516) | −3355.50 (0.042) | −3102.10 (0.448) | ||||

| CAB | 3276.44 ** (0.030) | 3101.42 ** (0.040) | 2236.25 (0.121) | 1987.19 (0.181) | ||||

| Obs. | 275 | 275 | 275 | 275 | 275 | 275 | 275 | 275 |

| F-Value | 13.540 (0.000) | 13.719 (0.000) | 14.059 (0.000) | 14.594 (0.000) | 14.958 (0.000) | 14.237 (0.000) | 16.843 (0.000) | 15.755 (0.000) |

| Wald test | F(24.242) = 880.558 (0.000) | F(24.243) = 904.583 (0.000) | F(24.244) = 933.530 (0.000) | F(24.243) = 893.034 (0.000) | F(24.243) = 875.382 (0.000) | F(24.244) = 923.4 (0.000) | F(24.244) = 880.080 (0.000) | F(24.245) = 937.943 (0.000) |

| Breusch–Pagan test | LM = 111.24 (0.000) | LM = 1086.84 (0.000) | LM = 1190.77 (0.000) | LM = 1164.47 (0.000) | LM = 1128.96 (0.000) | LM = 1111.53 (0.000) | LM = 1163.96 (0.000) | LM = 1186.4 (0.000) |

| Hausman test | H = 9.289 (0.318) | H = 10.029 (0.187) | H = 6.055 (0.418) | H = 7.030 (0.428) | H = 8.661 (0.278) | H = 9.230 (0.161) | H = 7.048 (0.316) | H = 6.009 (0.305) |

| CD Pesaran | z = 3.347 (0.001) | z = 3.188 (0.001) | z = 4.888 (0.000) | z = 4.893 (0.000) | z = 2.602 (0.009) | z = 1.842 (0.065) | z = 3.524 (0.000) | z = 3.342 (0.001) |

| Woolridge test | F = 16.112 (0.000) | F = 16.401 (0.000) | F = 19.078 (0.000) | F = 18.674 (0.000) | F = 18.881 (0.000) | F = 18.801 (0.000) | F = 22.543 (0.000) | F = 22.540 (0.000) |

| Breusch–Pagan test | BP = 1128.0 (0.000) | BP = 1094.8 (0.000) | BP = 1034.6 (0.000) | BP = 1058.4 (0.000) | BP = 1065.4 (0.000) | BP = 1039.5 (0.000) | BP = 988.56 (0.000) | BP = 971.34 (0.000) |

| Estimator | RE | RE | RE | RE | RE | RE | RE | RE |

| Variables | Model 1 | Model 2 | Model 3 | Model 4 | Model 5 | Model 6 | Model 7 | Model 8 |

|---|---|---|---|---|---|---|---|---|

| Const. | 6.759 *** (0.000) | 6.765 *** (0.000) | 5.895 *** (0.000) | 5.883 *** (0.000) | 6.789 *** (0.000) | 6.767 *** (0.000) | 5.860 *** (0.000) | 5.864 *** (0.000) |

| RSE | 0.015 ** (0.039) | 0.014 * (0.058) | 0.029 *** (0.001) | 0.032 *** (0.024) | 0.013 (0.129) | 0.014 * (0.065) | 0.035 *** (0.001) | 0.033 *** (0.000) |

| HICP | −0.003 *** (0.717) | 0.0002 (0.968) | 0.015 ** (0.020) | 0.009 (0.234) | ||||

| UR | −0.068 *** (0.000) | −0.069 *** (0.000) | −0.067 *** (0.000) | −0.069 *** (0.000) | ||||

| CAB | −0.010 (0.126) | −0.017 ** (0.047) | −0.012 * (0.062) | −0.021 *** (0.010) | ||||

| R2 | 0.87 | 0.91 | 0.87 | |||||

| Adjusted R2 | 0.16 | 0.41 | 0.15 | |||||

| Obs. | 275 | 275 | 275 | 275 | 275 | 275 | 275 | 275 |

| F-Value | ||||||||

| Wald test | F(24.246) = 62.372 (0.000) | F(24.247) = 68.290 (0.000) | F(24.248) = 60.176 (0.000) | F(24.247) = 50.895 (0.000) | F(24.247) = 62.606 (0.000) | F(24.248) = 68.916 (0.000) | F(24.248) = 52.305 (0.000) | F(24.249) = 59.110 (0.000) |

| Breusch–Pagan test | LM = 822.881 (0.000) | LM = 989.379 (0.000) | LM = 965.541 (0.000) | LM = 687.096 (0.000) | LM = 823.48 (0.000) | LM = 997.47 (0.000) | LM = 679.754 (0.000) | LM = 955.024 (0.000) |

| Hausman test | H = 8.754 (0.068) | H = 3.056 (0.383) | H = 0.237 (0.888) | H = 13.382 (0.004) | H = 8.658 (0.034) | H = 0.986 (0.611) | H = 14.764 (0.001) | H = 0.658 (0.417) |

| CD Pesaran | z = 0.986 (0.324) | z = 1.022 (0.307) | z = 8.900 (0.000) | z = 8.121 (0.000) | z = 1.547 (0.122) | z = 0.983 (0.325) | z = 6.676 (0.000) | z = 6.684 (0.000) |

| Woolridge test | F = 37.683 (0.000) | F = 37.287 (0.000) | F = 69.600 (0.000) | F = 68.456 (0.000) | F = 38.626 (0.000) | F = 39.302 (0.000) | F = 62.957 (0.000) | F = 66.256 (0.000) |

| Breusch–Pagan test | BP = 97.721 (0.000) | BP = 102.93 (0.000) | BP = 91.086 (0.000) | BP = 87.803 (0.000) | BP = 89.546 (0.000) | BP = 91.728 (0.000) | BP = 88.694 (0.000) | BP = 93.683 (0.000) |

| Estimator | RE | RE | RE | FE | FE | RE | FE | RE |

| Variables | Model 1 | Model 2 | Model 3 | Model 4 | Model 5 | Model 6 | Model 7 | Model 8 |

|---|---|---|---|---|---|---|---|---|

| Const. | 6.641 *** (0.000) | 6.624 *** (0.000) | 6.877 *** (0.000) | 5.908 *** (0.000) | 6.635 *** (0.000) | 6.644 *** (0.000) | 5.909 *** (0.000) | 5.875 *** (0.000) |

| BSE | 0.159 ** (0.032) | 0.151 ** (0.027) | 0.170 * (0.089) | 0.164 (0.130) | 0.147 ** (0.046) | 0.151 ** (0.047) | 0.159 (0.140) | 0.172 * (0.086) |

| HSE | 0.022 *** (0.008) | 0.015 ** (0.046) | 0.0004 (0.953) | 0.002 (0.807) | 0.023 *** (0.008) | 0.021 *** (0.009) | 0.002 (0.755) | 0.0003 (0.968) |

| SSE | 0.042 (0.385) | 0.041 (0.385) | 0.096 * (0.080) | 0.105 * (0.065) | 0.029 (0.474) | 0.038 (0.364) | 0.099 ** (0.042) | 0.098 ** (0.032) |

| WSE | −0.043 ** (0.016) | −0.033 ** (0.012) | −0.014 (0.402) | −0.017 (0.395) | −0.042 ** (0.016) | −0.045 ** (0.012) | −0.017 (0.398) | −0.014 (0.386) |

| ORSE | 0.069 ** (0.026) | 0.066 *** (0.009) | 0.096 *** (0.005) | 0.096 ** (0.024) | 0.069 ** (0.025) | 0.066 ** (0.035) | 0.096 ** (0.023) | 0.096 *** (0.004) |

| HICP | −0.001 (0.425) | −0.005 (0.566) | 0.001 (0.895) | −0.003 (0.765) | ||||

| UR | −0.069 *** (0.000) | −0.067 *** (0.000) | −0.068 *** (0.000) | −0.069 *** (0.000) | ||||

| CAB | −0.012 ** (0.041) | −0.016 ** (0.029) | −0.010 * (0.079) | −0.015 ** (0.018) | ||||

| R2 Adjusted R2 | 0.93 0.49 | 0.89 0.28 | 0.92 0.48 | 0.92 0.48 | 0.89 0.27 | |||

| Obs. | 275 | 275 | 275 | 275 | 275 | 275 | 275 | 275 |

| F-Value | 28.782 (0.000) | 29.679 (0.000) | 24.133 (0.000) | 25.970 (0.000) | 32.909 (0.000) | 33.630 (0.000) | 30.051 (0.000) | 29.046 (0.000) |

| Wald test | F(24.242) = 58.958 (0.000) | F(24.243) = 61.421 (0.000) | F(24.244) = 48.375 (0.000) | F(24.243) = 44.437 (0.000) | F(24.243) = 58.834 (0.000) | F(24.244) = 62.517 (0.000) | F(24.244) = 44.837 (0.000) | F(24.245) = 48.584 (0.000) |

| Breusch–Pagan test | LM = 742.691 (0.000) | LM = 821.884 (0.000) | LM = 795.571 (0.000) | LM = 636.894 (0.000) | LM = 739.748 (0.000) | LM = 829.57 (0.000) | LM = 640.882 (0.000) | LM = 796.408 (0.000) |

| Hausman test | H = 16.475 (0.036) | H = 12.587 (0.083) | H = 6.574 (0.362) | H = 14.688 (0.040) | H = 17.000 (0.017) | H = 12.707 (0.048) | H = 15.174 (0.019) | H = 6.876 (0.230) |

| CD Pesaran | z = 0.941 (0.347) | z = 0.854 (0.393) | z = 5.961 (0.000) | z = 6.352 (0.000) | z = 1.977 (0.048) | z = 1.645 (0.100) | z = 7.016 (0.000) | z = 5.706 (0.000) |

| Woolridge test | F = 38.833 (0.000) | F = 39.098 (0.000) | F = 82.516 (0.000) | F = 80.222 (0.000) | F = 42.724 (0.000) | F = 43.382 (0.000) | F = 79.141 (0.000) | F = 82.624 (0.000) |

| Breusch–Pagan test | BP = 109.53 (0.000) | BP = 110.66 (0.000) | BP = 82.743 (0.000) | BP = 78.759 (0.000) | BP = 99.218 (0.000) | BP = 98.864 (0.000) | BP = 73.982 (0.000) | BP = 75.565 (0.000) |

| Estimator | FE | RE | RE | FE | FE | FE | FE | RE |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Ostrowska, A.; Kotliński, K.; Markowski, Ł. Does Renewable Energy Matter for Economic Growth and Happiness? Energies 2024, 17, 2619. https://doi.org/10.3390/en17112619

Ostrowska A, Kotliński K, Markowski Ł. Does Renewable Energy Matter for Economic Growth and Happiness? Energies. 2024; 17(11):2619. https://doi.org/10.3390/en17112619

Chicago/Turabian StyleOstrowska, Aleksandra, Kamil Kotliński, and Łukasz Markowski. 2024. "Does Renewable Energy Matter for Economic Growth and Happiness?" Energies 17, no. 11: 2619. https://doi.org/10.3390/en17112619

APA StyleOstrowska, A., Kotliński, K., & Markowski, Ł. (2024). Does Renewable Energy Matter for Economic Growth and Happiness? Energies, 17(11), 2619. https://doi.org/10.3390/en17112619