Operation Optimization of Regional Integrated Energy Systems with Hydrogen by Considering Demand Response and Green Certificate–Carbon Emission Trading Mechanisms

Abstract

:1. Introduction

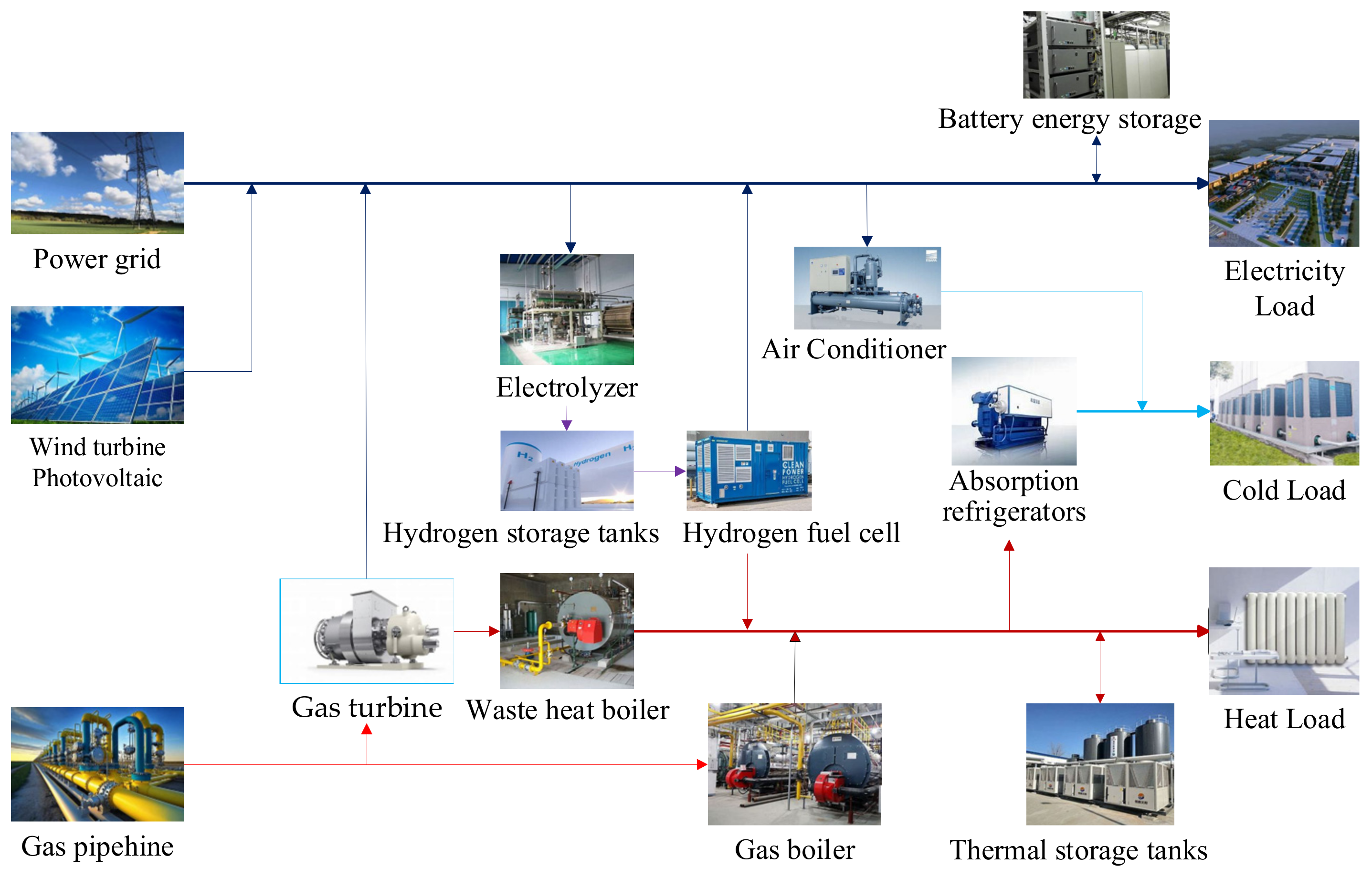

2. Modeling of RIESs

2.1. Basic Structure of RIESs

2.2. Equipment Mathematical Model

2.2.1. Gas Turbine

2.2.2. Gas Boiler

2.2.3. Electrolytic Hydrogen Generation System

- EL

- 2.

- HFC

2.2.4. Refrigeration Equipment

- Absorption Refrigerator

- 2.

- Air Conditioner

2.2.5. Energy Storage Devices

- Battery energy storage

- 2.

- Thermal storage tanks

2.3. External Power Distribution Network Model

3. Integrated Demand Response Modeling

3.1. Demand Esponse for Electric Load

3.2. Demand Response for Heating/Cooling Load

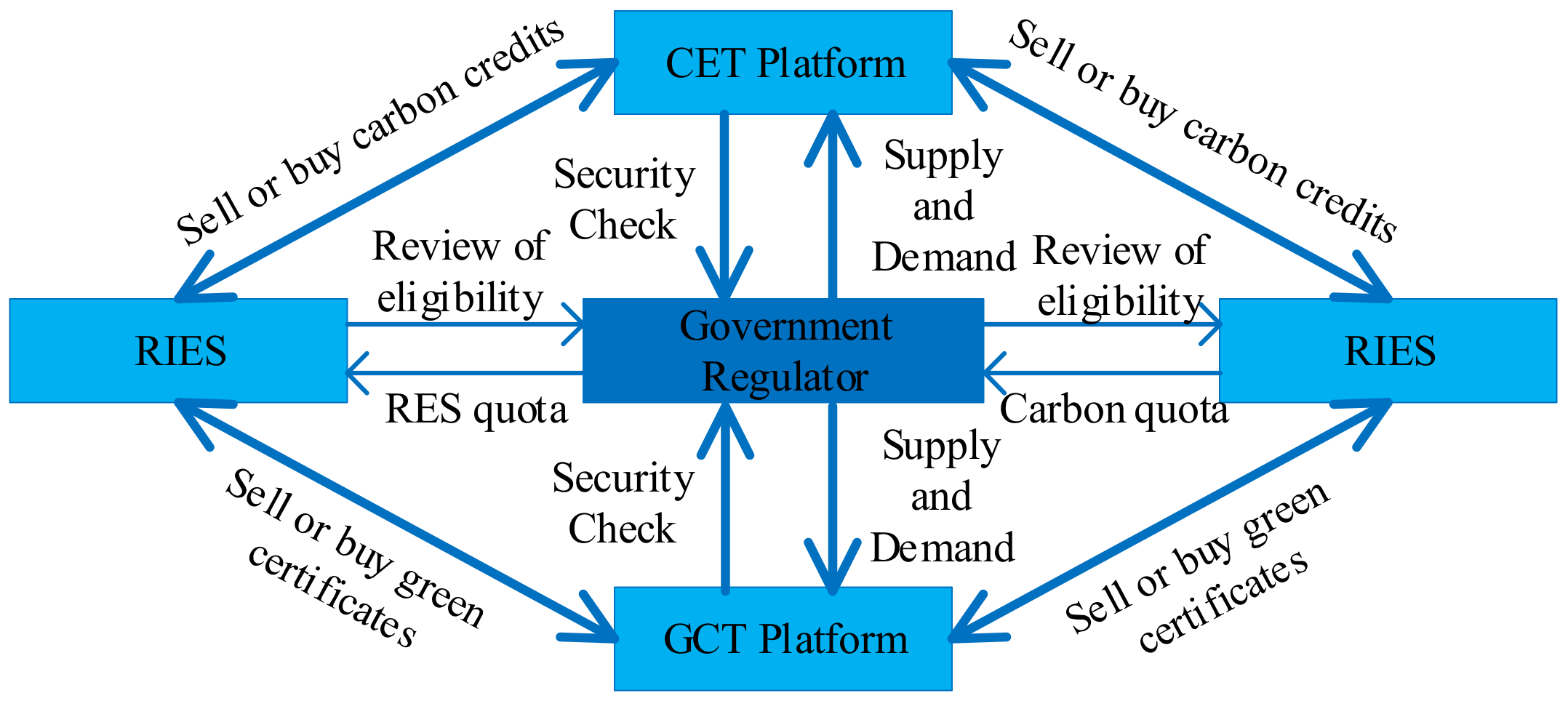

4. Green Certificate—Carbon Emission Trading Modeling

4.1. Green Certificate Trading Modeling

4.2. Carbon Emission Trading Modeling

5. Optimization Model for RIESs Based on Multi-Energy Complementarity

5.1. Objective Function

5.2. Constraints

- Electric Power Balance Constraints:

- 2.

- Thermal Power Balance Constraints:

- 3.

- Cooling Power Balance Constraints:

6. Case Study Analysis

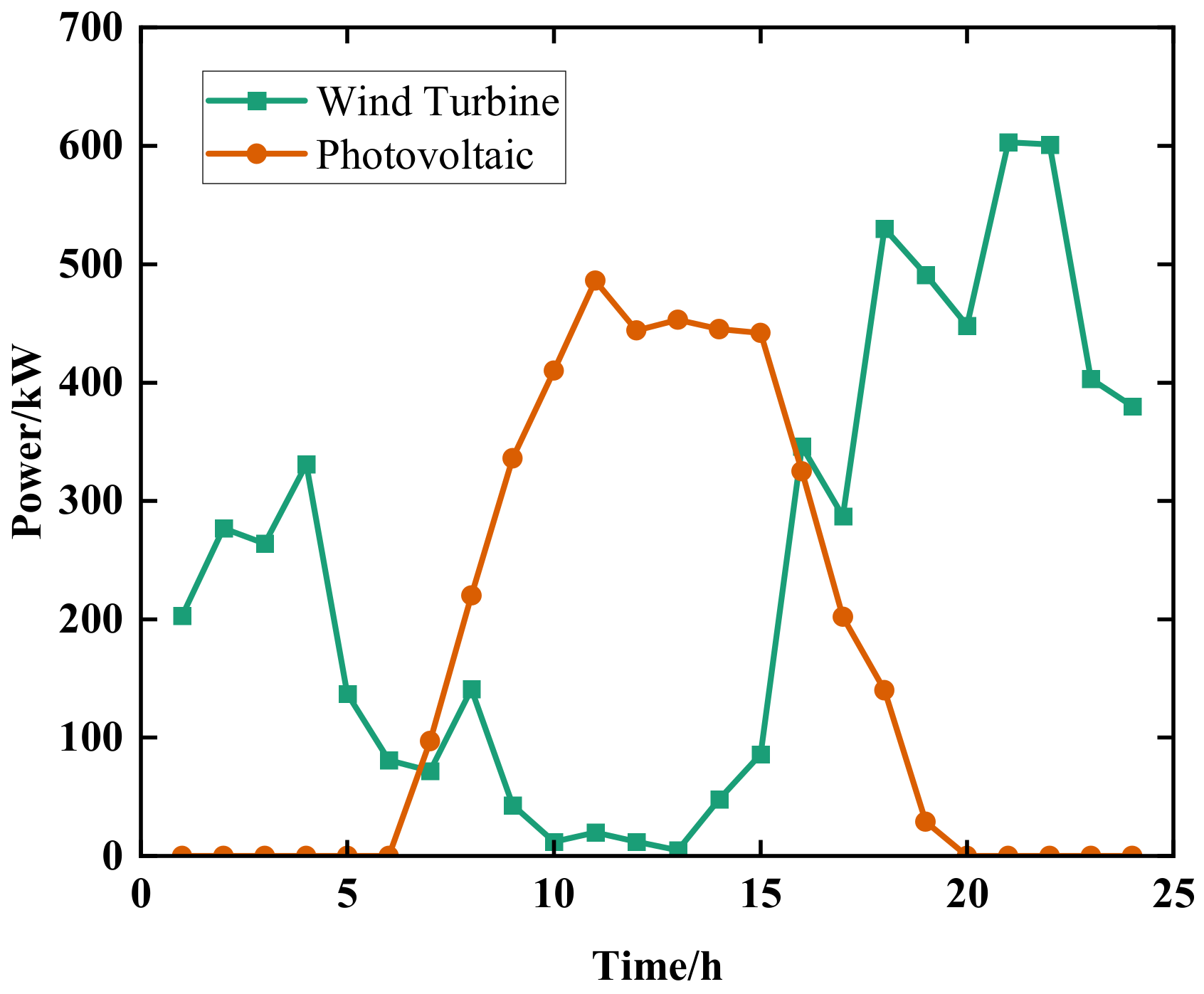

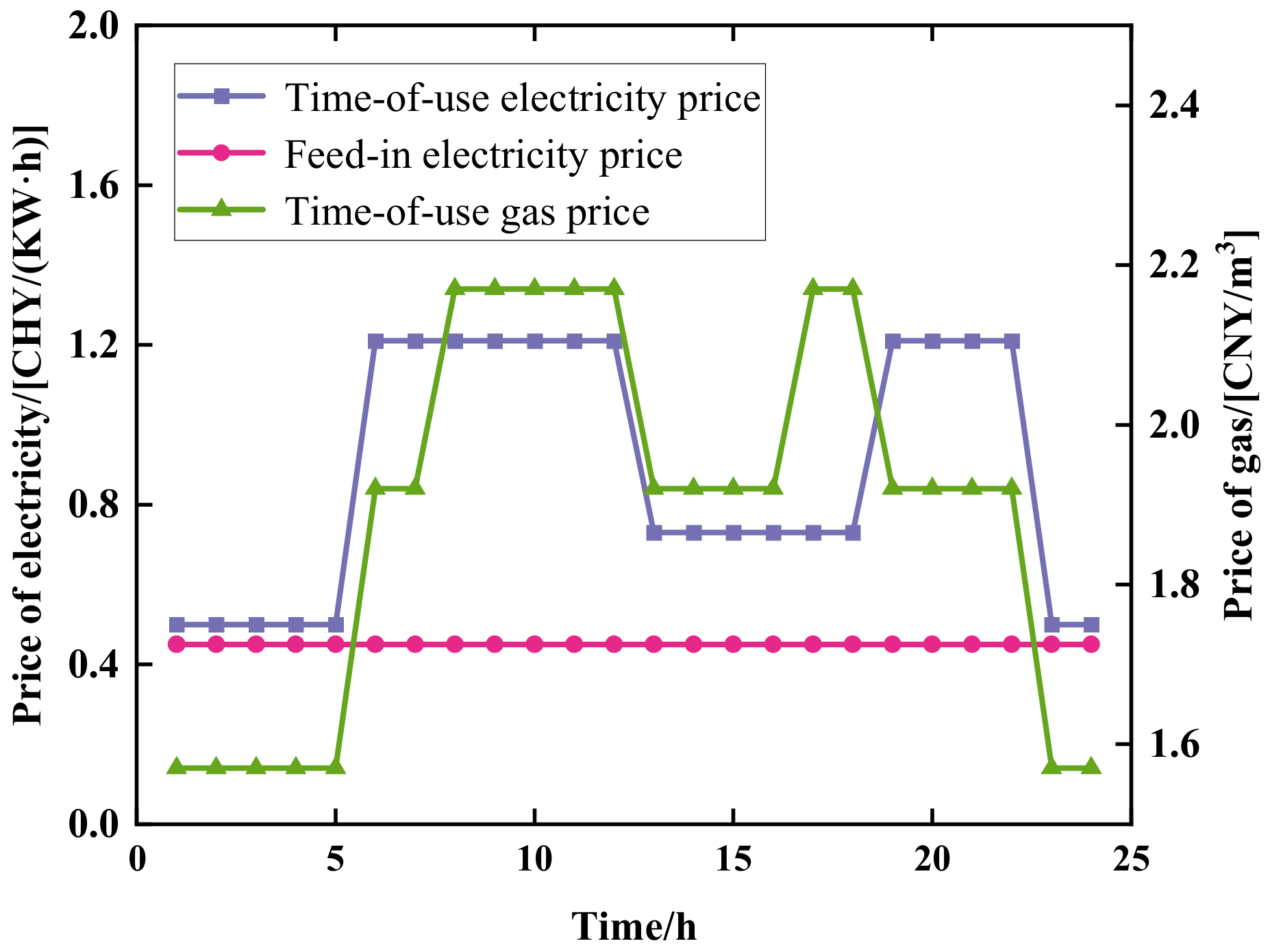

6.1. Introduction to Basic Case Data

6.2. The Impact of Different Scheduling Models on Simulation Results

- Scheme 1: Only considering the coupling and optimization of electricity, heat, and cooling, without considering the green certificate–carbon trading mechanism and IDR.

- Scheme 2: Considering the optimization of electricity, heat, and cooling multi-energy coupling along with IDR, but not taking into account the green certificate–carbon trading mechanism.

- Scheme 3: Considering the optimization of electricity, heat, and cooling multi-energy coupling with the inclusion of the green certificate–carbon trading mechanism and IDR.

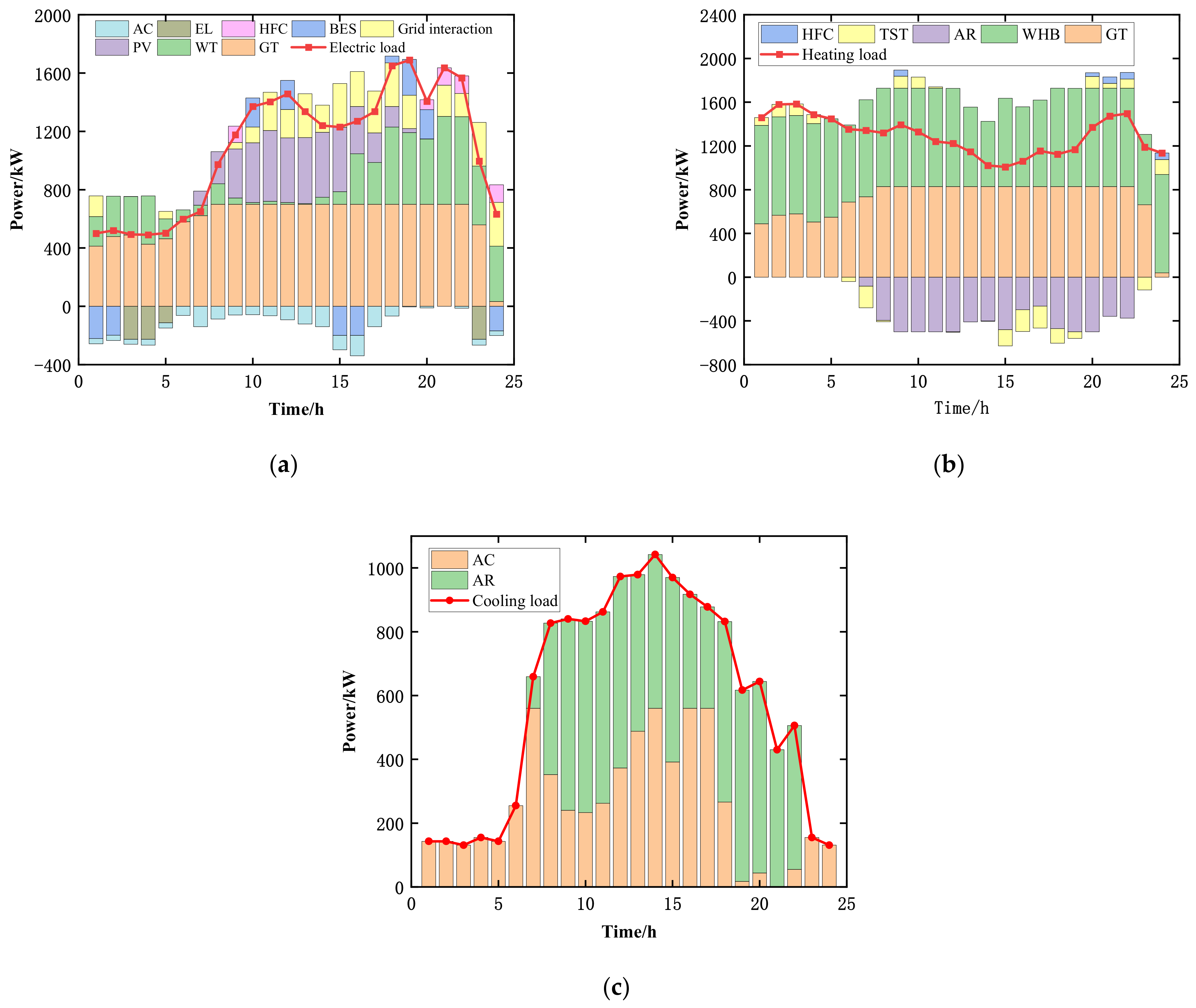

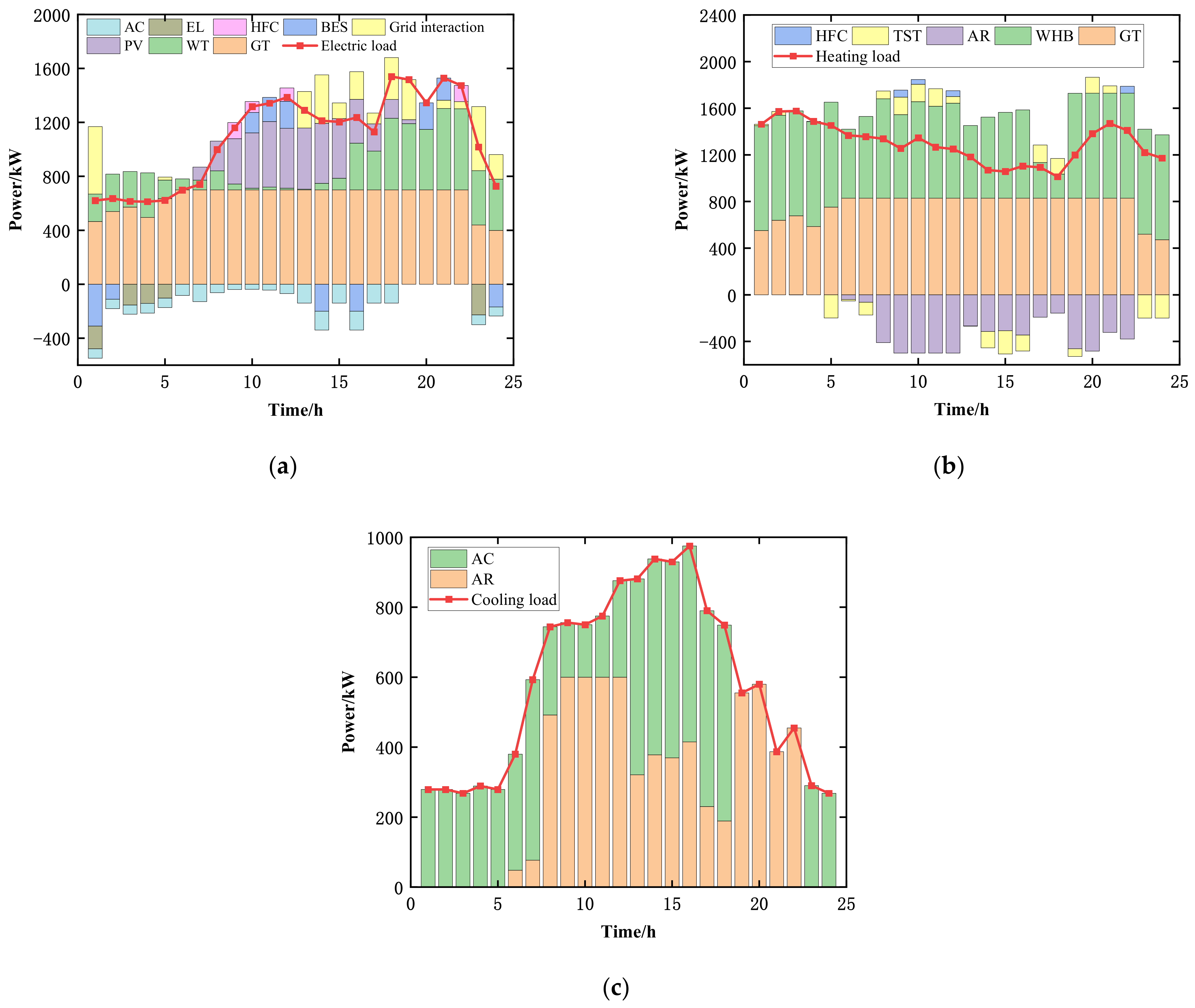

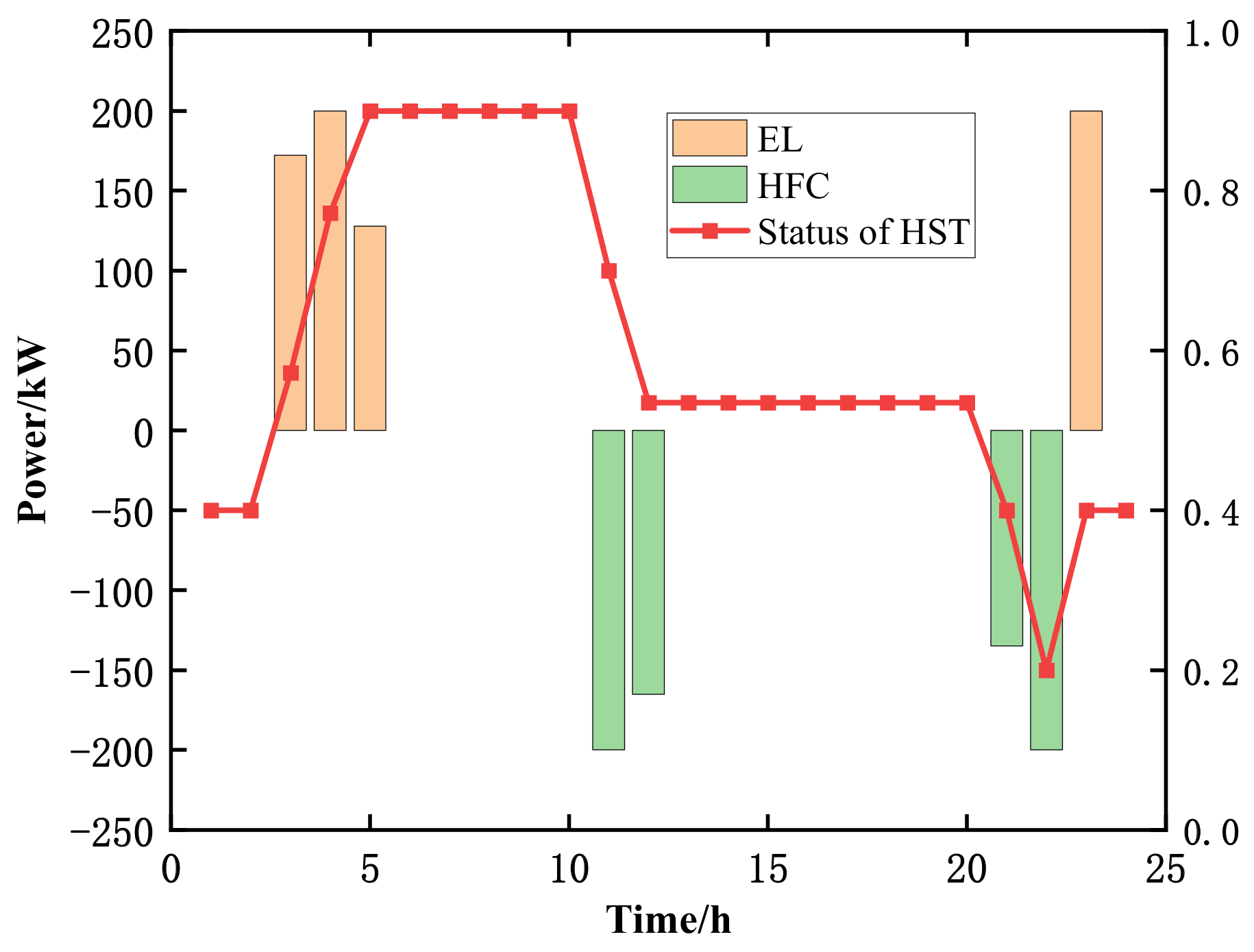

6.3. Analysis of Supply–Demand Balance

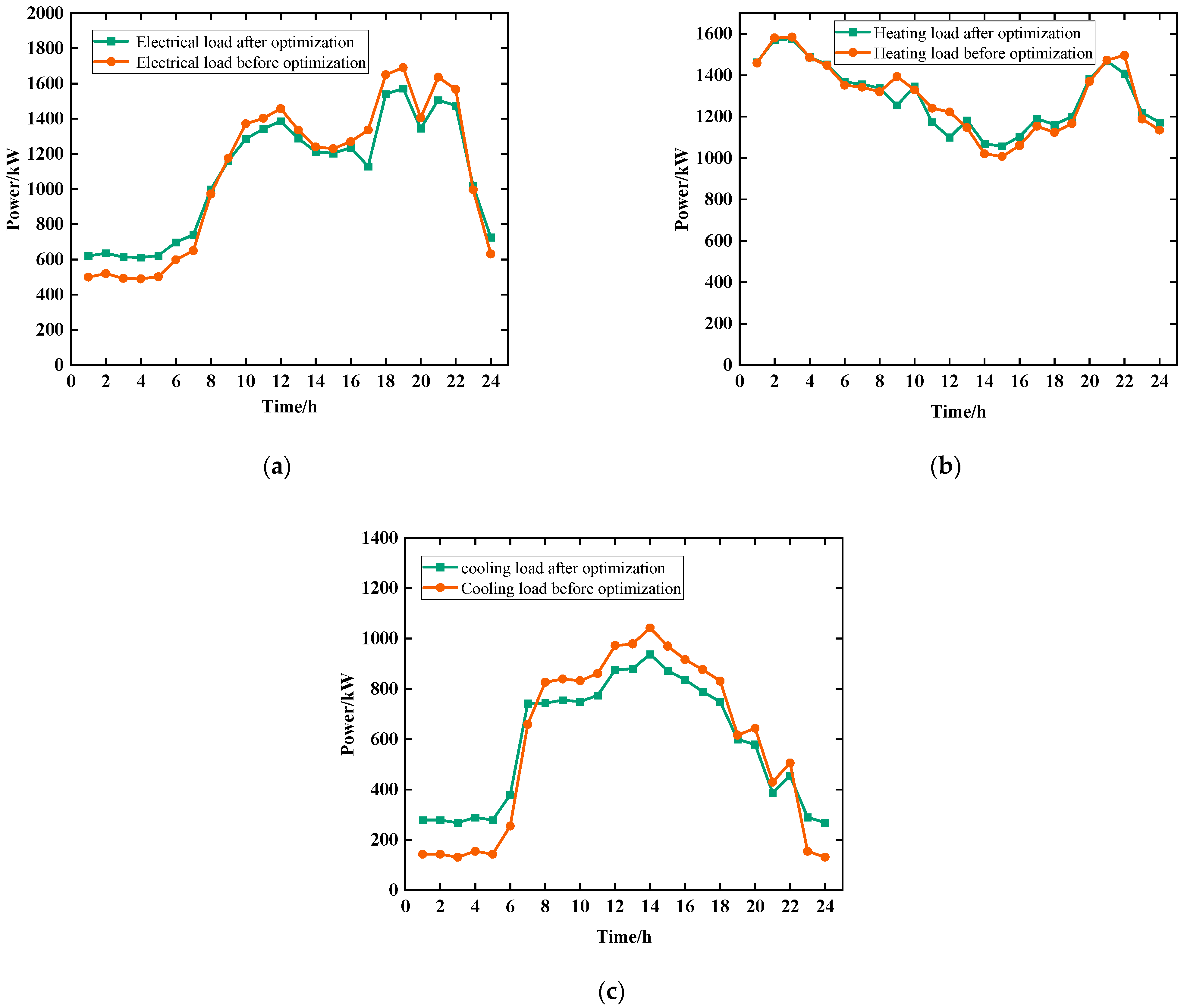

6.4. Before and after Integrated Demand Response Load Curves

6.5. Analysis of Green Certificate–Carbon Trading Mechanism Results

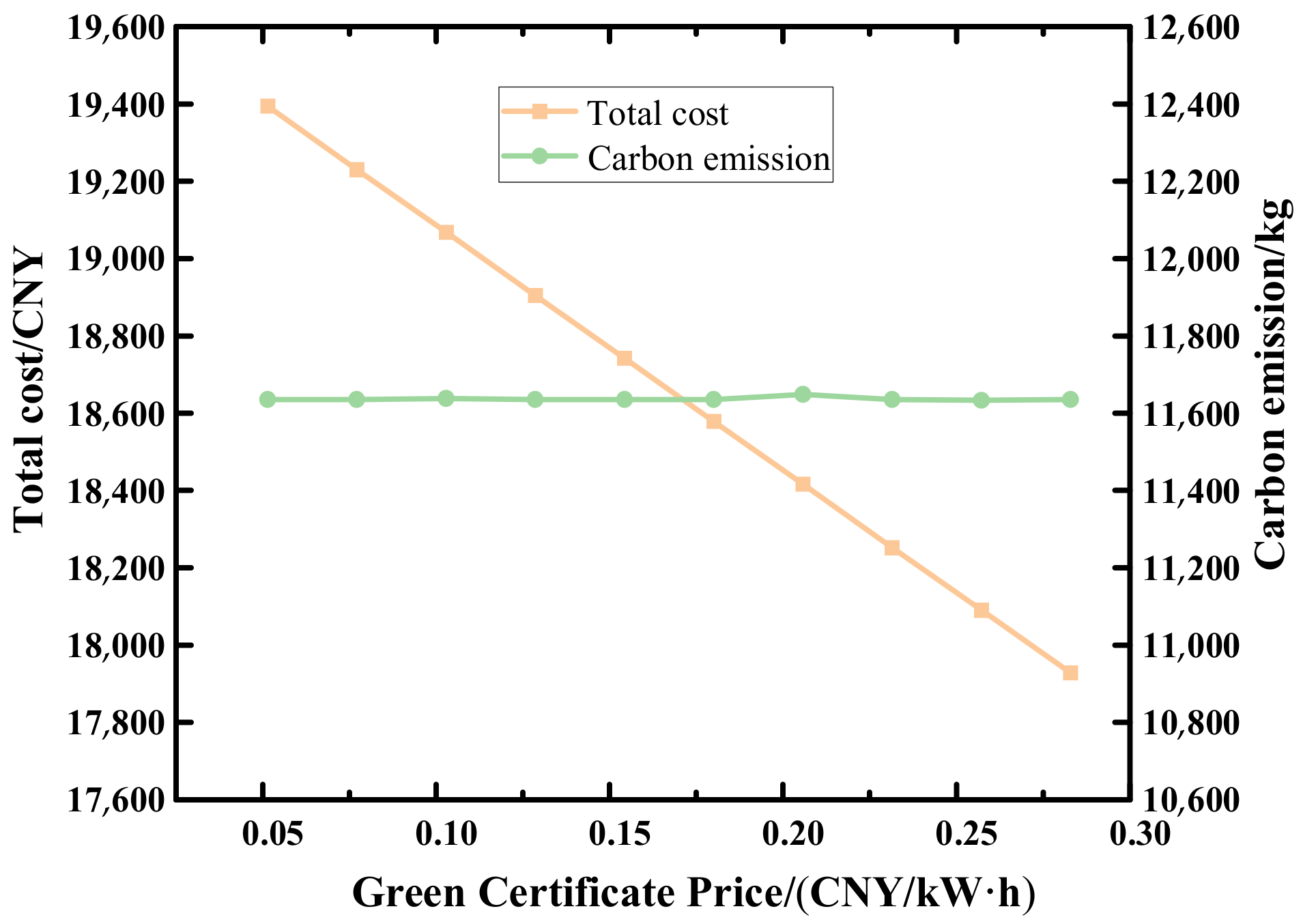

6.5.1. Sensitivity Analysis of Different Green Certificate Prices

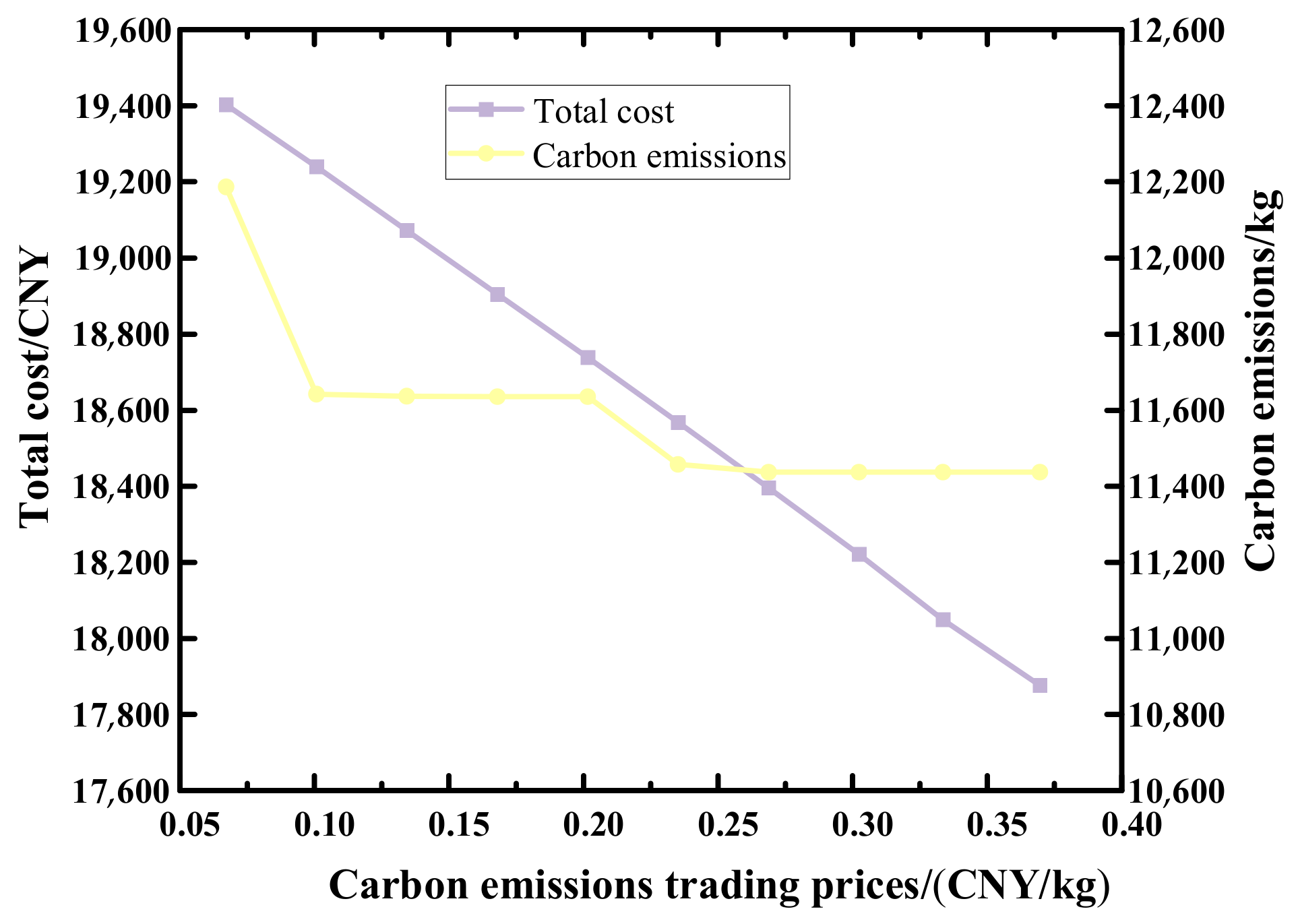

6.5.2. Sensitivity Analysis of Different Carbon Emission Trading Prices

7. Discussion

- The cold–heat–electricity IES optimization scheduling model constructed in this paper does not consider the uncertainty of renewable energy output and the uncertainty of users’ energy use in IES optimization scheduling. The next step will be to investigate the impact of the uncertainty of the “source and load” on the optimal scheduling of IES.

- Demand response mechanisms are classified into two categories: price-based and incentive-based. The integrated demand response model constructed in this paper is based on price-based mechanisms, which leaves a gap in the study of incentive-based demand response. The price-based integrated demand response model constructed in this paper does not consider the uncertainty of load participation in demand response and other issues, which necessitates further investigation.

- This paper solely examines the optimal scheduling of a RIES. However, further investigation is required to ascertain the optimal scheduling and coordinated control among multiple RIESs.

- Our research also found that an optimized configuration of energy storage systems can achieve flexible regulation of RIESs. The next step of our work will consider the quantitative relationship between the configuration of energy storage systems and parameters of comprehensive demand response, as well as their coordinated impact on system objectives. This will further refine optimization strategies and mathematical models.

8. Conclusions

- After introducing the green certificate–carbon emission trading mechanism, the total costs and carbon emissions of RIESs decreased by 11.9% and 10.0%, respectively. This indicates that as the integration of electricity, heat, and cooling becomes tighter, introducing the green certificate–carbon trading mechanism can effectively guide the output of various energy supply equipment and generate revenue from it. This effectively improves the economic efficiency of the system and reduces total carbon emissions, achieving a win–win situation for both environmental protection and economic efficiency.

- Considering integrated demand response, the peak–valley differences of users’ electricity, heat, and cooling loads decreased by 9.82%, 4.35%, and 6.78%, respectively, compared to before demand response. This effectively smoothens the energy usage curves of users. This suggests that involving electricity, heat, and cooling loads as flexible loads in demand response can effectively reduce peak–valley differences in loads, alleviate equipment supply pressure, optimize system operation, and improve the economic efficiency, environmental performance, and energy efficiency utilization of the system.

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Song, J.; Zhang, Z.; Mu, Y. Enhancing envrionmental sustainability via interval optimization for low-carbon economic dispatch in renewable energy power systems: Leveraging the flexible cooperation of wind energy and carbon capture power plants. J. Clean. Prod. 2024, 442, 140937. [Google Scholar] [CrossRef]

- Yue, M.; Lambert, H.; Pahon, E. Hydrogen energy systems: A critical review of technologies, applications, trends and challenges. Renew. Sustain. Energy Rev. 2021, 146, 111180. [Google Scholar] [CrossRef]

- Li, Z.; Wu, L.; Xu, Y. Risk-Averse Coordinated Operation of a Multi-Energy Microgrid Considering Voltage/Var Control and Thermal Flow: An Adaptive Stochastic Approach. IEEE Trans. Smart Grid 2021, 12, 3914–3927. [Google Scholar] [CrossRef]

- Su, Q.; Zhou, P.; Ding, H.; Xydis, G. Transition towards a hybrid energy system: Combined effects of renewable portfolio standards and carbon emission trading. Energy Econ. 2024, 135, 107638. [Google Scholar] [CrossRef]

- Qin, B.; Li, H.; Wang, Z.; Jiang, Y.; Lu, D.; Du, X.; Qian, Q. New framework of low-carbon city development of China: Underground space based integrated energy systems. Undergr. Space 2024, 14, 300–318. [Google Scholar] [CrossRef]

- Jiang, Y.; Ren, Z.; Li, W. Committed Carbon Emission Operation Region for Integrated Energy Systems: Concepts and Analyses. IEEE Trans. Sustain. Energy 2024, 15, 1194–1209. [Google Scholar] [CrossRef]

- Liang, T.; Chai, L.; Tan, J.; Jing, Y.; Lv, L. Dynamic optimization of an integrated energy system with carbon capture and power-to-gas interconnection: A deep reinforcement learning-based scheduling strategy. Appl. Energy 2024, 367, 123390. [Google Scholar] [CrossRef]

- Jia, B.; Li, F.; Sun, B. Knowledge-network-embedded deep reinforcement learning: An innovative way to high-efficiently develop an energy management strategy for the integrated energy system with renewable energy sources and multiple energy storage systems. Energy 2024, 301, 131604. [Google Scholar] [CrossRef]

- Li, Z.; Wu, L.; Xu, Y.; Wang, L.; Yang, N. Distributed tri-layer risk-averse stochastic game approach for energy trading among multi-energy microgrids. Appl. Energy 2023, 331, 120282. [Google Scholar] [CrossRef]

- Tang, B.; Cao, X.; Li, R.; Xiang, Z.; Zhang, S. Economic and low-carbon planning for interconnected integrated energy systems considering emerging technologies and future development trends. Energy 2024, 302, 131850. [Google Scholar] [CrossRef]

- Wu, X.; Yang, L.; Zheng, B. Joint capacity configuration and demand response optimization of integrated energy system considering economic and dynamic control performance. Energy 2024, 301, 131723. [Google Scholar] [CrossRef]

- Li, K.; Ran, J.; Moon, K.K.; Tian, Z.; Liu, J. Optimizing long-term park-level integrated energy system through multi-stage planning: A study incorporating the ladder-type carbon trading mechanism. Results Eng. 2024, 22, 102107. [Google Scholar] [CrossRef]

- Ye, Y.; Ding, J.; Wang, W. The storage performance of metal hydride hydrogen storage tanks with reaction heat recovery by phase change materials. Appl. Energy 2021, 299, 117255. [Google Scholar] [CrossRef]

- Pham, V.P.; Truong, H.B.H.; Seongkeun, P.; Daehee, K. An IGDT approach for the multi-objective framework of integrated energy hub with renewable energy sources, hybrid energy storage systems, and biomass-to-hydrogen technology. J. Energy Storage 2024, 89, 111488. [Google Scholar]

- Shi, M.; Wang, H.; Lyu, C. A hybrid model of energy scheduling for integrated multi-energy microgrid with hydrogen and heat storage system. Energy Rep. 2021, 7, 357–368. [Google Scholar] [CrossRef]

- Meng, Z.; Wang, K.; Di, J. Energy analysis and exergy analysis study of a novel high-efficiency wind-hydrogen storage and power generation polygeneration system. Int. J. Hydrogen Energy 2024, 57, 338–355. [Google Scholar] [CrossRef]

- Li, L.; Wang, J.; Zhong, X. Combined multi-objective optimization and agent-based modeling for a 100% renewable island energy system considering power-to-gas technology and extreme weather conditions. Appl. Energy 2022, 308, 118376. [Google Scholar] [CrossRef]

- Liang, T.; Zhang, X.; Tan, J.; Jing, Y.; Lv, L. Deep reinforcement learning-based optimal scheduling of integrated energy systems for electricity, heat, and hydrogen storage. Electr. Power Syst. Res. 2024, 233, 110480. [Google Scholar] [CrossRef]

- Zeng, L.; Wang, J.; Zhao, L. An inter-provincial tradable green certificate futures trading model under renewable portfolio standard policy. Energy 2022, 257, 124772. [Google Scholar] [CrossRef]

- Teng, M.; Lv, K.; Han, C. Trading behavior strategy of power plants and the grid under renewable portfolio standards in China: A tripartite evolutionary game analysis. Energy 2023, 284, 128398. [Google Scholar] [CrossRef]

- Xue, G.; Wu, Y.; Niu, W. Green certificate trading and electricity market synergy modelling with renewable energy quotas. In Proceedings of the Fourth International Conference on Artificial Intelligence and Electromechanical Automation (AIEA 2023), Nanjing, China, 10–12 March 2023; Volume 12709, pp. 1028–1035. [Google Scholar]

- Li, F.; Lu, S.; Cao, C. Operation optimization of regional integrated energy system considering the responsibility of renewable energy consumption and carbon emission trading. Electronics 2021, 10, 2677. [Google Scholar] [CrossRef]

- Liu, D.; Luo, Z.; Qin, J. Low-carbon dispatch of multi-district integrated energy systems considering carbon emission trading and green certificate trading. Renew. Energy 2023, 218, 119312. [Google Scholar] [CrossRef]

- Tan, J.; Pan, W.; Li, Y. Energy-sharing operation strategy of multi-district integrated energy systems considering carbon and renewable energy certificate trading. Appl. Energy 2023, 339, 120835. [Google Scholar] [CrossRef]

- Li, W.; He, M.; Cai, T. Low-carbon economic dispatch of hydrogen-containing integrated energy system considering stepped demand response. Energy Rep. 2024, 11, 4222–4232. [Google Scholar] [CrossRef]

- Wang, S.; Yin, S.; Bai, H. Introduction and efficiency evaluation of multi-storage regional integrated energy system considering optimal operation integrated demand side response. IOP Conf. Ser. Earth Environ. Sci. IOP Publ. 2021, 631, 012109. [Google Scholar] [CrossRef]

- Yang, H.; Li, M.; Jiang, Z. Multi-time scale optimal scheduling of regional integrated energy systems considering integrated demand response. IEEE Access 2020, 8, 5080–5090. [Google Scholar] [CrossRef]

- Zhang, Y.; Liu, Z.; Wu, Y. Research on Optimal Operation of Regional Integrated Energy Systems in View of Demand Response and Improved Carbon Trading. Appl. Sci. 2023, 13, 6561. [Google Scholar] [CrossRef]

- Yan, N.; Li, X.; Wu, Z. Low-Carbon economic scheduling with Demand-Side response uncertainty in regional integrated energy system. Int. J. Electr. Power Energy Syst. 2024, 156, 109691. [Google Scholar] [CrossRef]

- Wang, Y.; Li, Y.; Zhang, Y. Optimized operation of integrated energy systems accounting for synergistic electricity and heat demand response under heat load flexibility. Appl. Therm. Eng. 2024, 243, 122640. [Google Scholar] [CrossRef]

- Liang, Z.; Mu, L. Multi-agent low-carbon optimal dispatch of regional integrated energy system based on mixed game theory. Energy 2024, 295, 130953. [Google Scholar] [CrossRef]

- Chen, H.; Wu, H.; Kan, T. Low-carbon economic dispatch of integrated energy system containing electric hydrogen production based on VMD-GRU short-term wind power prediction. Int. J. Electr. Power Energy Syst. 2023, 154, 109420. [Google Scholar] [CrossRef]

- Huang, Z.F.; Chen, W.D.; Wan, Y.D. Techno-economic comparison of different energy storage configurations for renewable energy combined cooling heating and power system. Appl. Energy 2024, 356, 122340. [Google Scholar] [CrossRef]

| Parameter | Value | Parameter | Value |

|---|---|---|---|

| 0.9 | 800 kW | ||

| 0.85 | 0.35 | ||

| 0.02 | 1000 kW | ||

| 4 | 500 kW | ||

| 1.2 | 500 kW | ||

| , | 0.95 | , | 0.350 kW |

| , | 0.98 | , | 0.350 kW |

| 220 kW | , | 0.220 kW | |

| 160 kW | , | 0.220 W | |

| 150 kW |

| Scheme | Scheme 1 | Scheme 2 | Scheme 3 |

|---|---|---|---|

| Total cost (CNY) | 21,465.57 | 20,506.72 | 18,904.75 |

| Operation and maintenance cost (CNY) | 18,427.91 | 18,455.35 | 19,171.96 |

| Grid interaction cost (CNY) | 3037.65 | 2051.37 | 1384.80 |

| Carbon trading cost (CNY) | / | / | −837.15 |

| Green certificate cost (CNY) | / | / | −814.86 |

| Carbon emission (kg) | 12,930.12 | 12,448.58 | 11,635.31 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Li, J.; Xu, L.; Wang, L.; Kou, Y.; Huo, Y.; Liang, W. Operation Optimization of Regional Integrated Energy Systems with Hydrogen by Considering Demand Response and Green Certificate–Carbon Emission Trading Mechanisms. Energies 2024, 17, 3190. https://doi.org/10.3390/en17133190

Li J, Xu L, Wang L, Kou Y, Huo Y, Liang W. Operation Optimization of Regional Integrated Energy Systems with Hydrogen by Considering Demand Response and Green Certificate–Carbon Emission Trading Mechanisms. Energies. 2024; 17(13):3190. https://doi.org/10.3390/en17133190

Chicago/Turabian StyleLi, Ji, Lei Xu, Lihua Wang, Yang Kou, Yingli Huo, and Weile Liang. 2024. "Operation Optimization of Regional Integrated Energy Systems with Hydrogen by Considering Demand Response and Green Certificate–Carbon Emission Trading Mechanisms" Energies 17, no. 13: 3190. https://doi.org/10.3390/en17133190

APA StyleLi, J., Xu, L., Wang, L., Kou, Y., Huo, Y., & Liang, W. (2024). Operation Optimization of Regional Integrated Energy Systems with Hydrogen by Considering Demand Response and Green Certificate–Carbon Emission Trading Mechanisms. Energies, 17(13), 3190. https://doi.org/10.3390/en17133190