The Economic Efficiencies of Investment in Biogas Plants—A Case Study of a Biogas Plant Using Waste from a Dairy Farm in Poland

Abstract

1. Introduction

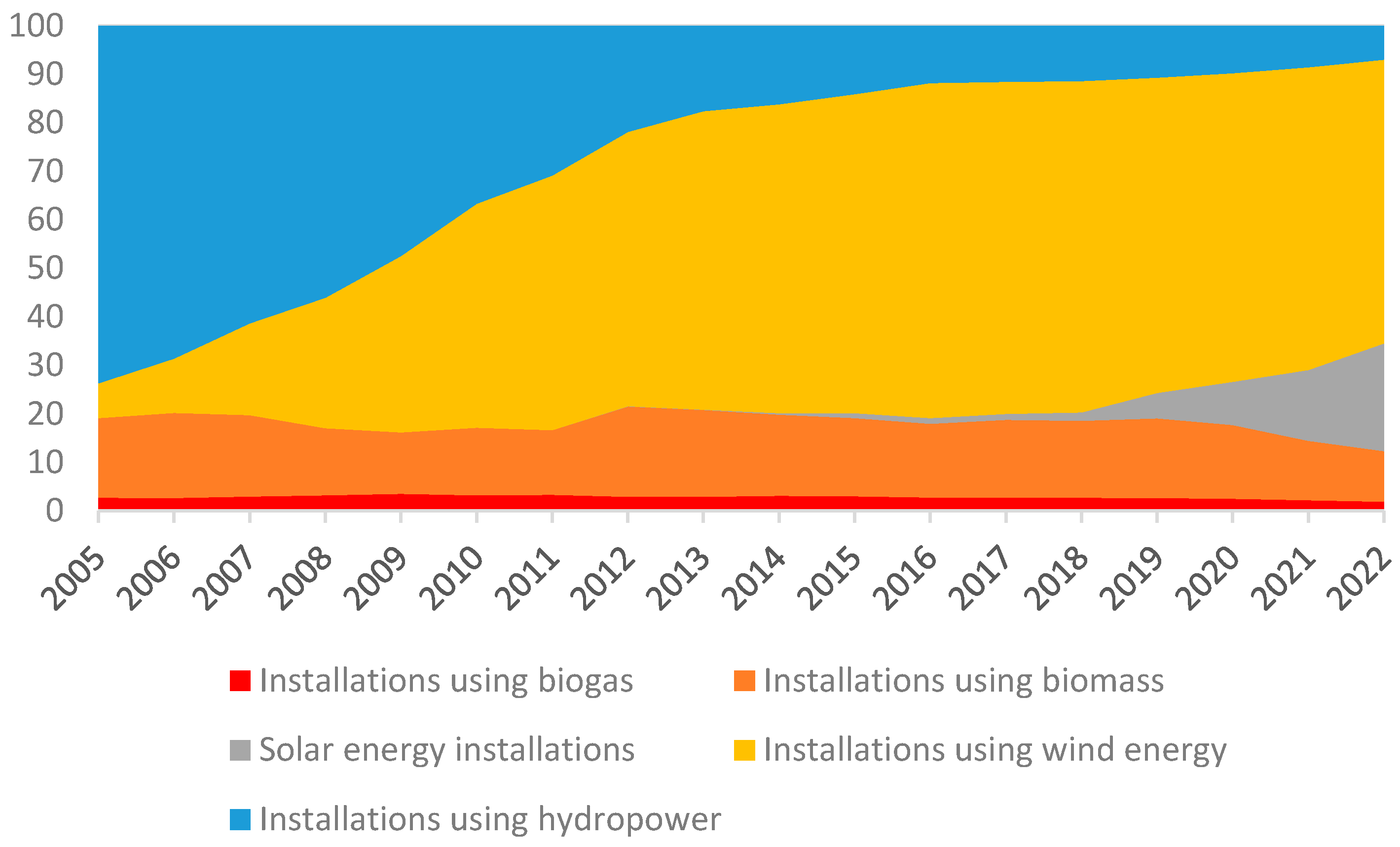

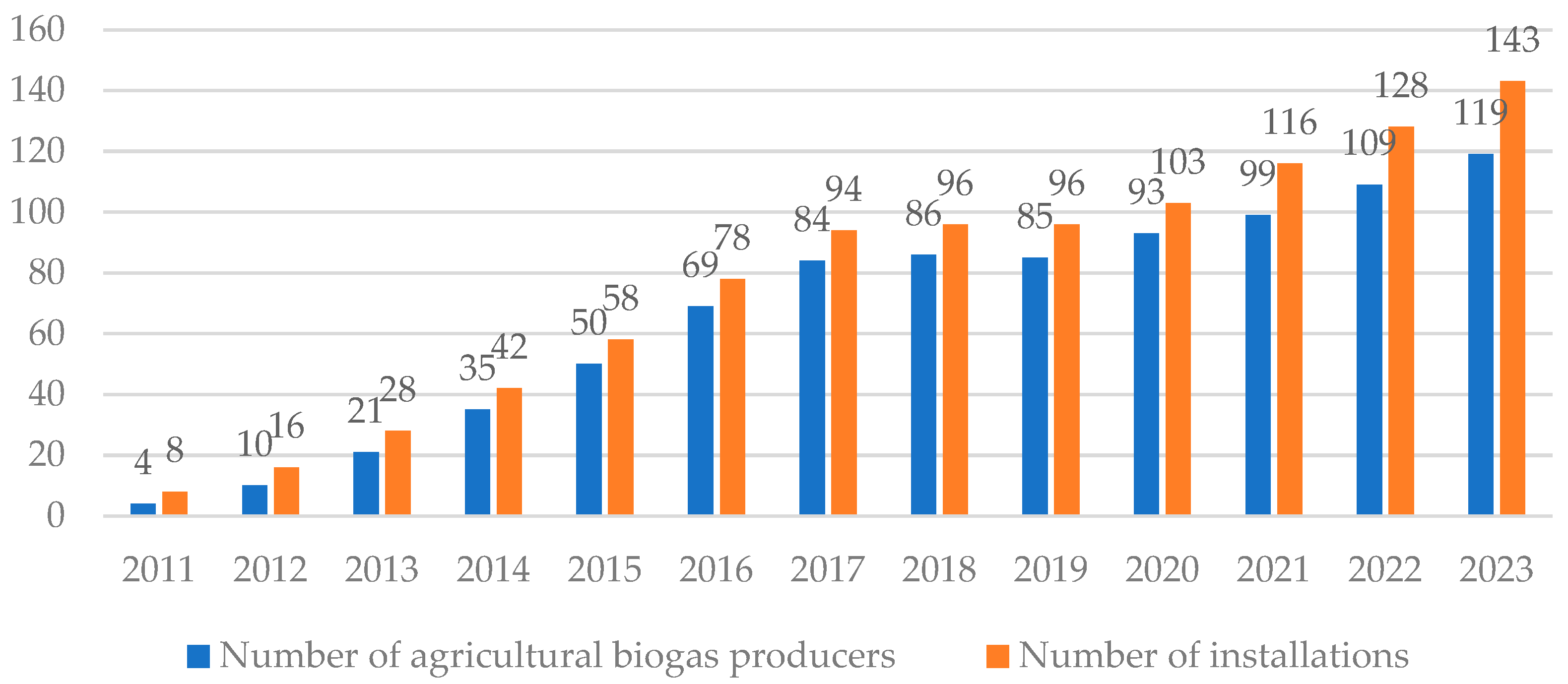

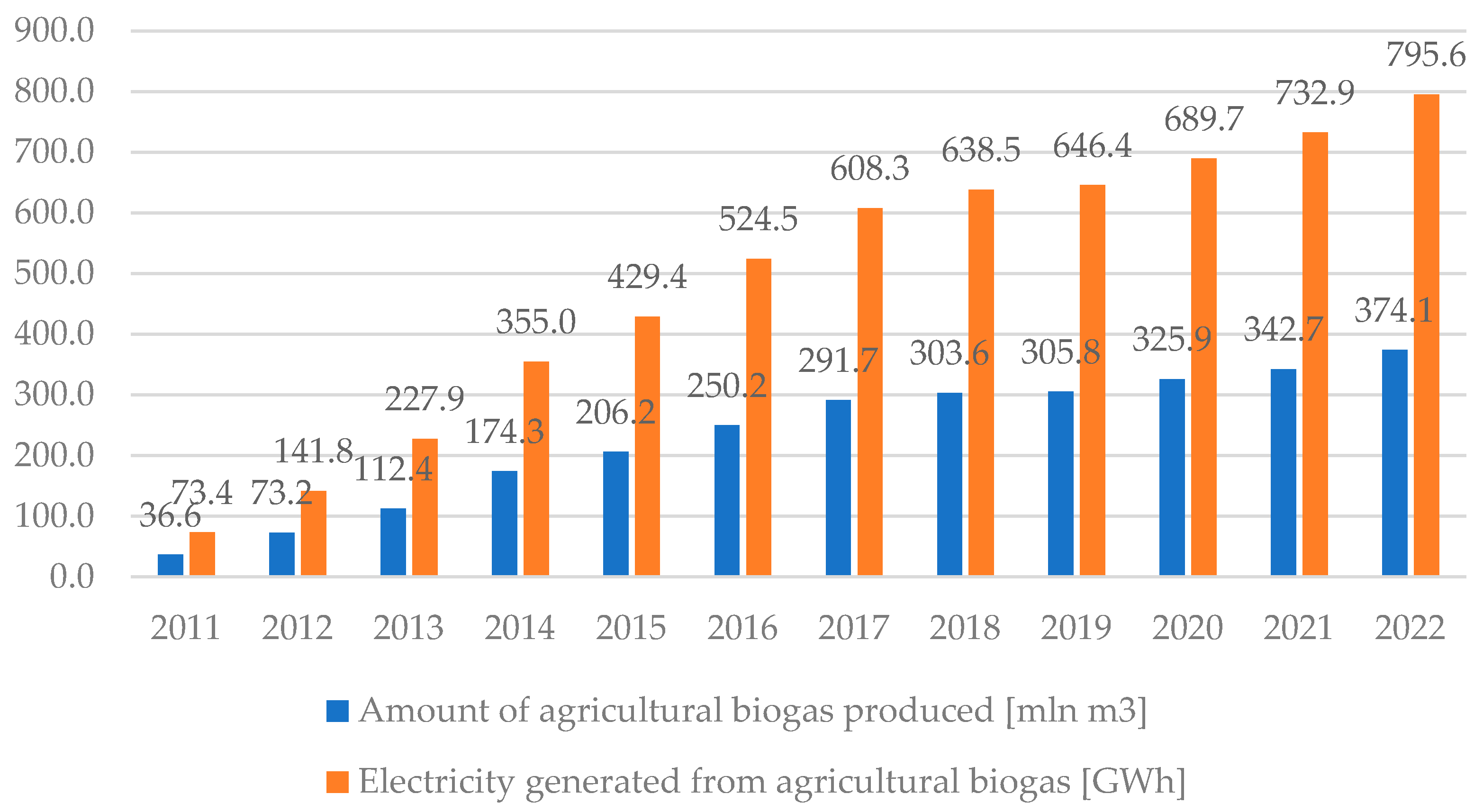

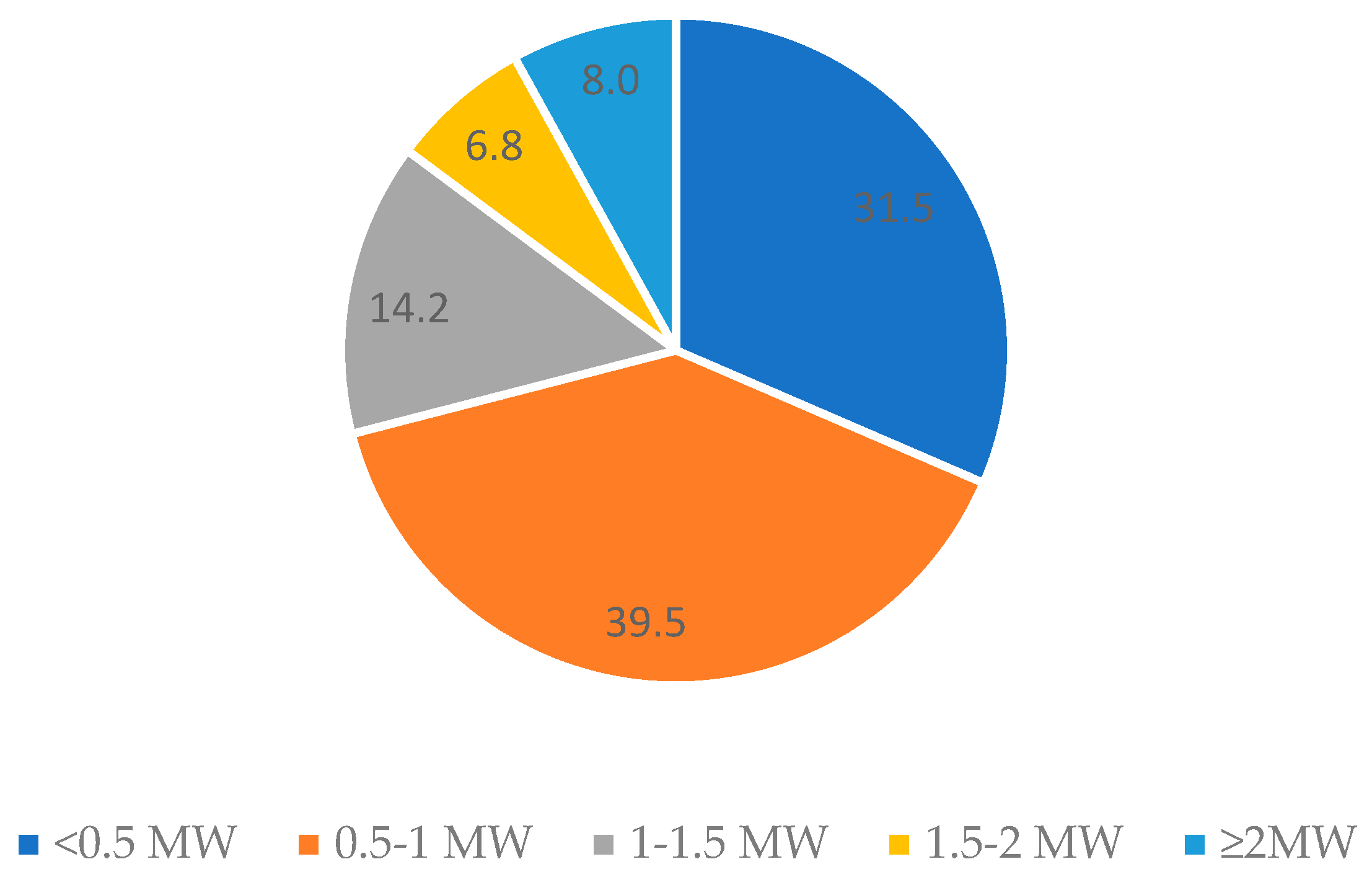

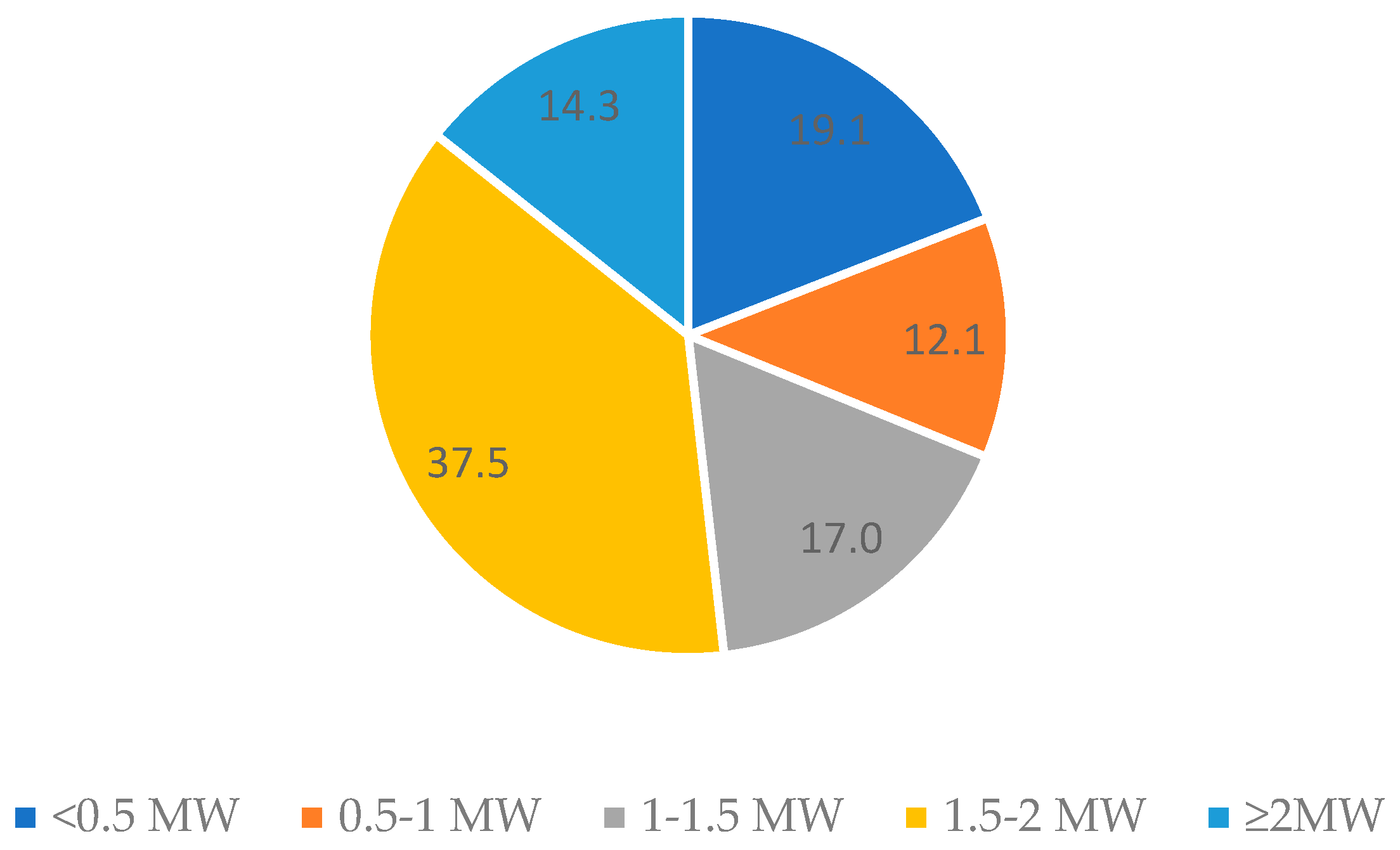

2. Development of Agricultural Biogas Plants in Poland

3. The Factors Influencing the Development of Agricultural Biogas Plants

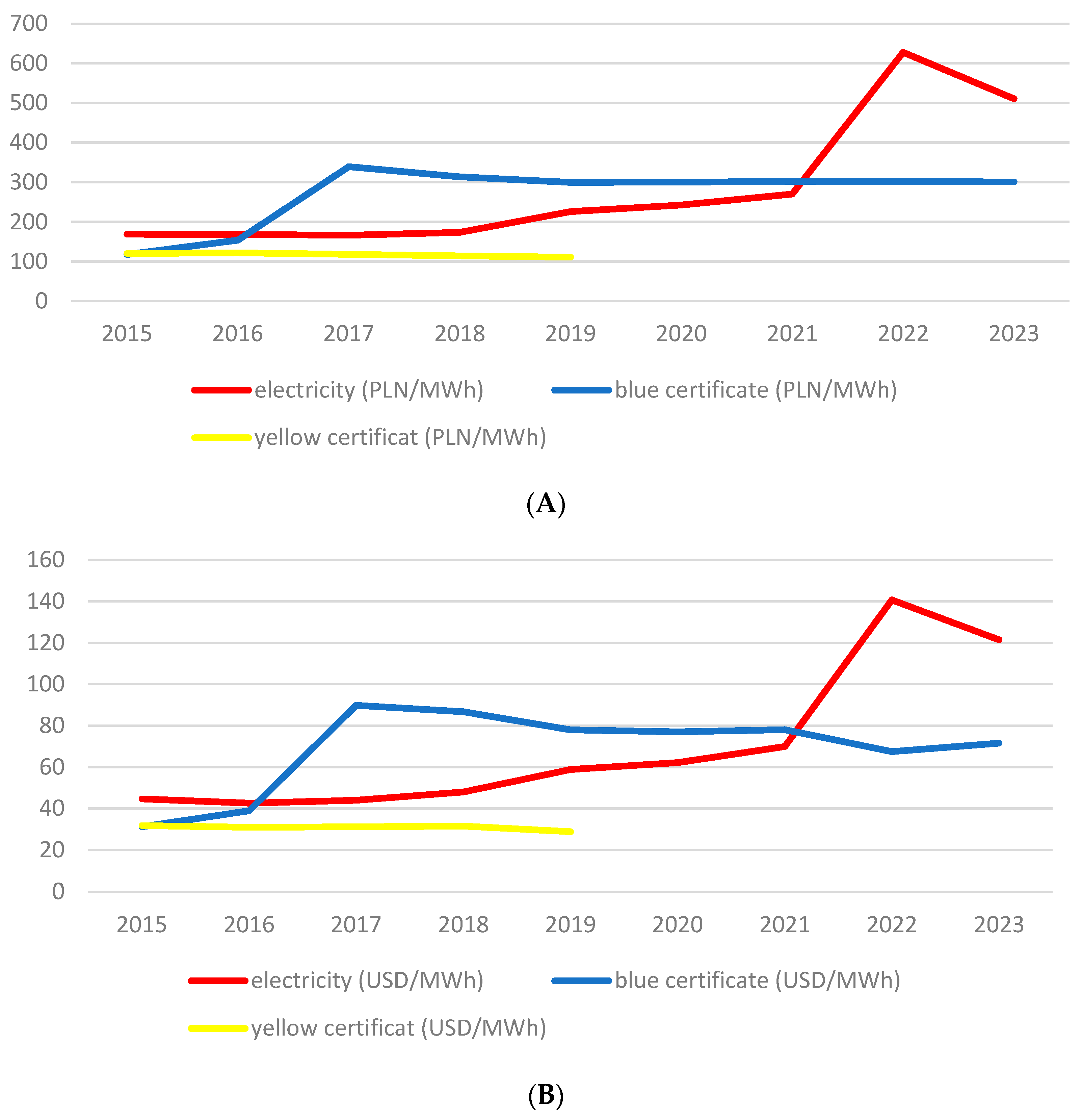

3.1. Political Frames

3.2. Determinants of the Profitability of Investments in Agricultural Biogas Plants

4. Materials and Methods

5. Results

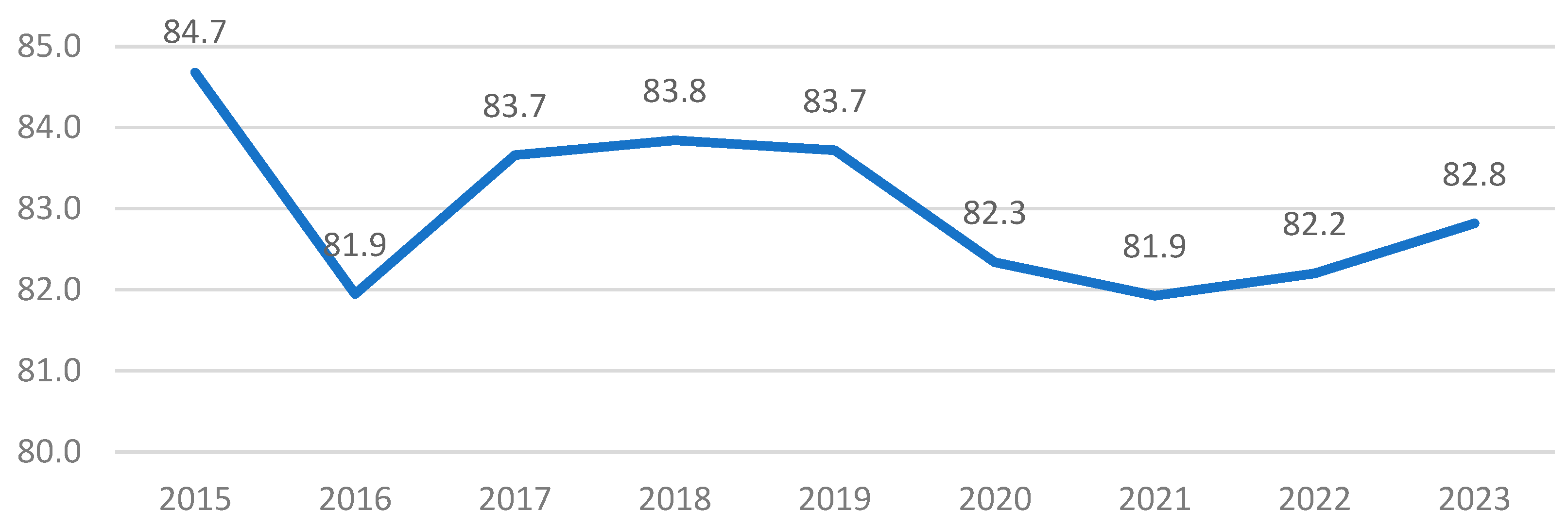

5.1. Economic Results and Technical Efficiency of the Tested Biogas Plant

5.2. The Structure of the Substrates Used in the Tested Biogas Plant

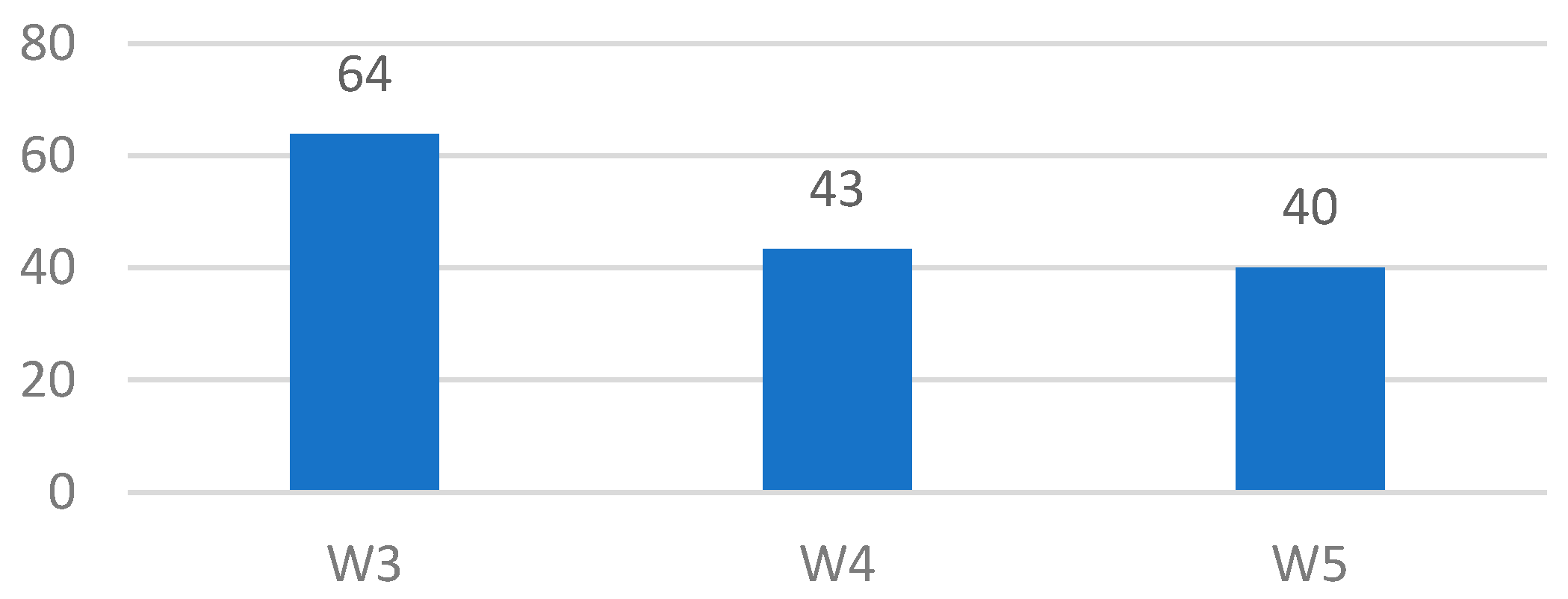

5.3. Economic Efficiency of Investment in the Tested Agricultural Biogas Plant

6. Discussion

7. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Bąk, I.; Tarczyńska-Łuniewska, M.; Barwińska-Małajowicz, A.; Hydzik, P.; Kusz, D. Is Energy Use in the EU Countries Moving toward Sustainable Development? Energies 2022, 15, 6009. [Google Scholar] [CrossRef]

- Kraenzle, H.; Rampp, M.; Werner, D.; Seitz, J.; Sharma, N. Prediction of the Growth of Renewable Energies in the European Union using Time Series Analysis. WSEAS Trans. Comput. 2023, 22, 225–232. [Google Scholar] [CrossRef]

- Polish Energy Policy until 2040. 2023. Available online: https://www.gov.pl/web/climate/energy-policy-of-poland-until-2040-epp2040 (accessed on 30 November 2023).

- Kemausuor, F.; Adaramola, M.S.; Morken, J. A Review of Commercial Biogas Systems and Lessons for Africa. Energies 2018, 11, 2984. [Google Scholar] [CrossRef]

- Theuerl, S.; Herrmann, C.; Heiermann, M.; Grundmann, P.; Landwehr, N.; Kreidenweis, U.; Prochnow, A. The Future Agricultural Biogas Plant in Germany: A Vision. Energies 2019, 12, 396. [Google Scholar] [CrossRef]

- Raven, R.P.J.M.; Gregersen, K.H. Biogas plants in Denmark: Successes and setbacks. Renew. Sustain. Energy Rev. 2007, 11, 116–132. [Google Scholar] [CrossRef]

- Bond, T.; Templeton, M.R. History and future of domestic biogas plants in the developing world. Energy Sustain. Dev. 2011, 15, 347–354. [Google Scholar] [CrossRef]

- Ertop, H.; Atilgan, A.; Kocięcka, J.; Krakowiak-Bal, A.; Liberacki, D.; Saltuk, B.; Rolbiecki, R. Calculation of the Potential Biogas and Electricity Values of Animal Wastes: Turkey and Poland Case. Energies 2023, 16, 7578. [Google Scholar] [CrossRef]

- Gebrezgabher, S.A.; Meuwissen, M.P.M.; Prins, B.A.M.; Oude Lansink, A.G.J.M. Economic analysis of anaerobic digestion—A case of Green power biogas plant in The Netherlands. NJAS-Wagening. J. Life Sci. 2010, 57, 109–115. [Google Scholar] [CrossRef]

- Ginda, G.; Szyba, M. Identification of Key Factors for the Development of Agricultural Biogas Plants in Poland. Energies 2023, 16, 7779. [Google Scholar] [CrossRef]

- Gómez, X.; Cuetos, M.J.; García, A.I.; Morán, A. Evaluation of digestate stability from anaerobic process by thermogravimetric analysis. Thermochim. Acta 2005, 426, 179–184. [Google Scholar] [CrossRef]

- Gustafsson, M.; Anderberg, S. Biogas policies and production development in Europe: A comparative analysis of eight countries. Biofuels 2022, 13, 931–944. [Google Scholar] [CrossRef]

- Murano, R.; Maisano, N.; Selvaggi, R.; Pappalardo, G.; Pecorino, B. Critical Issues and Opportunities for Producing Biomethane in Italy. Energies 2021, 14, 2431. [Google Scholar] [CrossRef]

- Pappalardo, G.; Selvaggi, R.; Pecorino, B. Biomethane production potential in Southern Italy: An empirical approach. Renew. Sustain. Energy Rev. 2022, 158, 112190. [Google Scholar] [CrossRef]

- Korberg, A.D.; Skov, I.R.; Mathiesen, B.V. The role of biogas and biogas-derived fuels in a 100% renewable energy system in Denmark. Energy 2020, 199, 117426. [Google Scholar] [CrossRef]

- Biogas Barometer 2023. EurObserv’ER. Available online: https://www.eurobserv-er.org/biogas-barometer-2023/ (accessed on 30 November 2023).

- Kampman, B.; Leguijt, C.; Scholten, T.; Tallat-Kelpsaite, J.; Brückmann, R.; Maroulis, G.; Lesschen, J.P.; Meesters, K.; Sikirica, N.; Elbersen, B. Optimal Use of Biogas from Waste Streams: An Assessment of the Potential of Biogas from Digestion in the EU beyond 2020; European Commission: Luxembourg, 2017. [Google Scholar]

- Kasinath, A.; Fudala-Ksiazek, S.; Szopińska, M.; Byliński, H.; Artichowicz, W.; Remiszewska-Skwarek, A.; Luczkiewicz, A. Biomass in biogas production: Pretreatment and codigestion. Renew. Sustain. Energy Rev. 2021, 150, 111509. [Google Scholar] [CrossRef]

- Ciechanowski, W.; Maciejczak, M. Functioning of agricultural biogas plants from the perspective of transaction costs—A case study. Ann. PAAAE 2023, XXV, 35–48. [Google Scholar] [CrossRef]

- Weglarzy, K.; Bereza, M. Diversification of farm production to improve profitability. J. Agribus. Rural Dev. 2012, 24, 253–262. [Google Scholar]

- Kusz, D.; Bąk, I.; Szczecińska, B.; Wicki, L.; Kusz, B. Determinants of Return-on-Equity (ROE) of Biogas Plants Operating in Poland. Energies 2023, 16, 31. [Google Scholar] [CrossRef]

- Wicki, L.; Naglis-Liepa, K.; Filipiak, T.; Parzonko, A.; Wicka, A. Is the Production of Agricultural Biogas Environmentally Friendly? Does the Structure of Consumption of First- and Second-Generation Raw Materials in Latvia and Poland Matter? Energies 2022, 15, 5623. [Google Scholar] [CrossRef]

- Mittal, S.; Ahlgren, E.O.; Shukla, P.R. Barriers to biogas dissemination in India: A review. Energy Policy 2018, 112, 361–370. [Google Scholar] [CrossRef]

- Mazurkiewicz, J. The Impact of Manure Use for Energy Purposes on the Economic Balance of a Dairy Farm. Energies 2023, 16, 6735. [Google Scholar] [CrossRef]

- Bentivoglio, D.; Chiaraluce, G.; Finco, A. Economic assessment for vegetable waste valorization through the biogas-biomethane chain in Italy with a circular economy approach. Front. Sustain. Food Syst. 2022, 6, 1035357. [Google Scholar] [CrossRef]

- Cucchiella, F.; D’Adamo, I.; Gastaldi, M. An economic analysis of biogas-biomethane chain from animal residues in Italy. J. Clean. Prod. 2019, 230, 888–897. [Google Scholar] [CrossRef]

- Monteiro, E.; Mantha, V.; Rouboa, A. Prospective application of farm cattle manure for bioenergy production in Portugal. Renew. Energy 2011, 36, 627–631. [Google Scholar] [CrossRef]

- Sławiński, K.; Bujaczek, R.; Józef Fleszar, J. Transport drogowy biomasy dla celów energetycznych. (Road transport of biomass for energy purposes). Logistyka 2015, 4, 5685–5689. [Google Scholar]

- Hidalgo, D.; Martín-Marroquín, J.M. Biochemical methane potential of livestock and agri-food waste streams in the Castilla y León Region (Spain). Food Res. Int. 2015, 73, 226–233. [Google Scholar] [CrossRef]

- Lubańska, A.; Kazak, J.K. The Role of Biogas Production in Circular Economy Approach from the Perspective of Locality. Energies 2023, 16, 3801. [Google Scholar] [CrossRef]

- Yazan, D.M.; Cafagna, D.; Fraccascia, L.; Mes, M.; Pontrandolfo, P.; Zijm, H. Economic sustainability of biogas production from animal manure: A regional circular economy model. Manag. Res. Rev. 2018, 41, 605–624. [Google Scholar] [CrossRef]

- Chen, Q.; Liu, T. Biogas system in rural China: Upgrading from decentralized to centralized? Renew. Sustain. Energy Rev. 2017, 78, 933–944. [Google Scholar] [CrossRef]

- Gan, L.; Yu, J. Bioenergy transition in rural China: Policy options and co-benefits. Energy Policy 2008, 36, 531–540. [Google Scholar] [CrossRef]

- Zhang, P.; Li, X.; Yang, Y.; Zheng, Y.; Wang, L. Greenhouse gas mitigation benefits of large and middle-scale biogas project in China. Trans. Chin. Soc. Agric. Eng. 2008, 24, 239–243. [Google Scholar]

- Zhang, C.; Xu, Y. Economic analysis of large-scale farm biogas power generation system considering environmental benefits based on LCA: A case study in China. J. Clean. Prod. 2020, 258, 120985. [Google Scholar] [CrossRef]

- Etsay, H.K.; Ayimut, K.M.; Berhe, G.H.; Hintsa, K. Determinants for adoption decision of small scale biogas technology by rural households in Tigray, Ethiopia. Energy Econ. 2017, 66, 272–278. [Google Scholar] [CrossRef]

- Klimek, K.; Kapłan, M.; Syrotyuk, S.; Bakach, N.; Kapustin, N.; Konieczny, R.; Dobrzyński, J.; Borek, K.; Anders, D.; Dybek, B.; et al. Investment Model of Agricultural Biogas Plants for Individual Farms in Poland. Energies 2021, 14, 7375. [Google Scholar] [CrossRef]

- Igliński, B.; Buczkowski, R.; Iglińska, A.; Cichosz, M.; Piechota, G.; Kujawski, W. Agricultural biogas plants in Poland: Investment process, economical and environmental aspects, biogas potential. Renew. Sustain. Energy Rev. 2012, 16, 4890–4900. [Google Scholar] [CrossRef]

- Marañón, E.; Castrillón, L.; Quiroga, G.; Fernández-Nava, Y.; Gómez, L.; García, M.M. Co-digestion of Cattle Manure with Food Waste and Sludge to Increase Biogas Production. Waste Manag. 2012, 32, 1821–1825. [Google Scholar] [CrossRef]

- Mazurkiewicz, J.; Sidoruk, P.; Dach, J.; Szumacher-Strabel, M.; Lechniak, D.; Galama, P.; Kuipers, A.; Antkowiak, I.R.; Cieslak, A. Leverage of Essential Oils on Faeces-Based Methane and Biogas Production in Dairy Cows. Agriculture 2023, 13, 1944. [Google Scholar] [CrossRef]

- Havrysh, V.; Kalinichenko, A.; Brzozowska, A.; Stebila, J. Agricultural Residue Management for Sustainable Power Generation: The Poland Case Study. Appl. Sci. 2021, 11, 5907. [Google Scholar] [CrossRef]

- Ślusarz, G.; Gołębiewska, B.; Cierpiał-Wolan, M.; Gołębiewski, J.; Twaróg, D.; Wójcik, S. Regional Diversification of Potential, Production and Efficiency of Use of Biogas and Biomass in Poland. Energies 2021, 14, 742. [Google Scholar] [CrossRef]

- Gradziuk, P.; Jończyk, K.; Gradziuk, B.; Wojciechowska, A.; Trocewicz, A.; Wysokiński, M. An Economic Assessment of the Impact on Agriculture of the Proposed Changes in EU Biofuel Policy Mechanisms. Energies 2021, 14, 6982. [Google Scholar] [CrossRef]

- Ignaciuk, W.; Sulewski, P. Conditions of Development of the Agricultural Biogas Industry in Poland in the Context of Historical Experiences and Challenges of the European Green Deal. Probl. Agric. Econ. 2021, 368, 55–77. [Google Scholar] [CrossRef]

- Podgórska, M.; Narloch, P. Rozwój i potencjał energetyczny biogazu i biometanu. (Development and energy potential of biogas and biomethane). Rynek Energii 2022, 2, 21–26. [Google Scholar]

- Pilarska, A.; Pilarski, K.; Myszura, M.; Boniecki, P. Perspektywy i problemy rozwoju biogazowni rolniczych w Polsce. Tech. Rol. Ogrod. I Leśna 2013, 58, 2–4. [Google Scholar]

- Pochwatka, P.; Kowalczyk-Juśko, A.; Sołowiej, P.; Wawrzyniak, A.; Dach, J. Biogas Plant Exploitation in a Middle-Sized Dairy Farm in Poland: Energetic and Economic Aspects. Energies 2020, 13, 6058. [Google Scholar] [CrossRef]

- Curkowski, A.; Oniszk-Popławska, A.; Mroczkowski, P.; Zowsik, M.; Wiśniewski, G. Przewodnik dla Inwestorów Zainteresowanych Budową Biogazowni Rolniczych; Ministerstwo Gospodarki, Instytut Energetyki Odnawialnej: Warsaw, Poland, 2011. [Google Scholar]

- Teraz Środowisko.pl. Biogaz w Polsce 2023 Nowe Otwarcie. April 2023. Available online: https://www.teraz-srodowisko.pl/publikacje/biogaz-w-polsce-2023/teraz-srodowisko-publikacja-biogaz-w-polsce-2023.pdf (accessed on 31 January 2024).

- Available online: https://www.gov.pl/web/kowr/dane-dotyczace-dzialalnosci-wytworcow-biogazu-rolniczego (accessed on 22 January 2024).

- Barry, M.; Chapman, R. Distributed small-scale wind in New Zealand: Advantages, barriers and policy support instruments. Energy Policy 2009, 37, 3358–3369. [Google Scholar] [CrossRef]

- Chodkowska-Miszczuk, J.; Biegańska, J.; Środa-Murawska, S.; Grzelak-Kostulska, E.; Rogatka, K. European Union funds in the development of renewable energy sources in Poland in the context of the cohesion policy. Energy Environ. 2016, 27, 713–725. [Google Scholar] [CrossRef]

- Chodkowska-Miszczuk, J. Biogazownie rolnicze w rozwoju małoskalowych instalacji odnawialnych źródeł energii w Polsce (Agricultural Biogas Plants in the Development of Small-Scale Renewable Energy Installations in Poland). Rocz. Nauk. Ekon. Rol. I Rozw. Obsz. Wiej. 2015, 102, 97–105. Available online: http://sj.wne.sggw.pl/article-RNR_2015_n1_s97/ (accessed on 31 January 2024). [CrossRef]

- Piwowar, A.; Dzikuć, M.; Adamczyk, J. Agricultural biogas plants in Poland—Selected technological, market and environmental aspects. Renew. Sustain. Energy Rev. 2016, 58, 69–74. [Google Scholar] [CrossRef]

- Wicki, L. Food and bioenergy—Evidence from Poland. In Proceedings of the International Scientific Conference Economic Sciences for Rural Development, Jelgava, Latvia, 27–28 April 2017; Auzina, A., Ed.; pp. 299–305. Available online: https://llufb.llu.lv/conference/economic_science_rural/2017/Latvia_ESRD_44_2017-299-305.pdf (accessed on 22 January 2024).

- Energy Regulatory Office. Available online: https://www.ure.gov.pl/en (accessed on 3 February 2024).

- Majewski, E.; Sulewski, P.; Wąs, A. Potencjał i Uwarunkowania Produkcji Biogazu Rolniczego w Polsce; Warsaw University of Live Sciences Press: Warsaw, Poland, 2016. [Google Scholar]

- Godyń, I.; Dubel, A. Evolution of Hydropower Support Schemes in Poland and Their Assessment Using the LCOE Method. Energies 2021, 14, 8473. [Google Scholar] [CrossRef]

- Mazurek-Czarnecka, A.; Rosiek, K.; Salamaga, M.; Wąsowicz, K.; Żaba-Nieroda, R. Study on Support Mechanisms for Renewable Energy Sources in Poland. Energies 2022, 15, 4196. [Google Scholar] [CrossRef]

- Clemens, H.; Bailis, R.; Nyambane, A.; Ndung’u, V. Africa Biogas Partnership Program: A review of clean cooking implementation through market development in East Africa. Energy Sustain. Dev. 2018, 46, 23–31. [Google Scholar] [CrossRef]

- Hes, T.; Mintah, S.; Sulaiman, H.; Arifeen, T.; Drbohlav, P.; Salman, A. Potential of microcredit as a source of finance for development of Sri Lankan biogas industry. Energy Environ. 2017, 28, 608–620. [Google Scholar] [CrossRef]

- Budzianowski, W.M. Sustainable biogas energy in Poland: Prospects and challenges. Renew. Sustain. Energy Rev. 2012, 16, 342–349. [Google Scholar] [CrossRef]

- Baum, R.; Wajszczuk, K.; Pepliński, B.; Wawrzynowicz, J. Potential for Agricultural Biomass Production for Energy Purposes in Poland: A Review. Contemp. Econ. 2013, 7, 63–74. Available online: https://ssrn.com/abstract=2253173 (accessed on 22 January 2024). [CrossRef]

- Oliveira, H.R.; Kozlowsky-Suzuki, B.; Björn, A.; Shakeri Yekta, S.; Fonseca Caetano, C.; Flávia Machado Pinheiro, É.; Marotta, H.; Bassin, J.P.; Oliveira, L.; de Miranda Reis, M.; et al. Biogas potential of biowaste: A case study in the state of Rio de Janeiro, Brazil. Renew. Energy 2024, 221, 119751. [Google Scholar] [CrossRef]

- Cergibozan, R. Renewable energy sources as a solution for energy security risk: Empirical evidence from OECD countries. Renew. Energy 2022, 183, 617–626. [Google Scholar] [CrossRef]

- Chalvatzis, K.J.; Ioannidis, A. Energy supply security in the EU: Benchmarking diversity and dependence of primary energy. Appl. Energy 2017, 207, 465–476. [Google Scholar] [CrossRef]

- Kusz, D. Modernization of agriculture vs sustainable agriculture. Sci. Pap. Ser. “Manag. Econ. Eng. Agric. Rural. Dev.” 2014, 14, 171–178. Available online: https://managementjournal.usamv.ro/pdf/vol4_1/Art28.pdf (accessed on 9 February 2024).

- Wałowski, G. Development of biogas and biorafinery systems in Polish rural communities. J. Water Land Dev. 2021, 49, 156–168. [Google Scholar] [CrossRef]

- Kadam, R.; Jo, S.; Lee, J.; Khanthong, K.; Jang, H.; Park, J. A Review on the Anaerobic Co-Digestion of Livestock Manures in the Context of Sustainable Waste Management. Energies 2024, 17, 546. [Google Scholar] [CrossRef]

- Chen, L.; Cong, R.-G.; Shu, B.; Mi, Z.-F. A sustainable biogas model in China: The case study of Beijing Deqingyuan biogas project. Renew. Sustain. Energy Rev. 2017, 78, 773–779. [Google Scholar] [CrossRef]

- Chiurciu, I.A.; Certan, I.; Micu, M.M.; Fintineru, A.; Tudor, V.; Smedescu, D. The involvement of the common agricultural policy in the livestock sector and the contribution to the development of mountain rural areas. Sci. Pap. Ser. Manag. Econ. Eng. Agric. Rural. Dev. 2023, 23, 137–146. Available online: https://managementjournal.usamv.ro/pdf/vol.23_3/Art16.pdf (accessed on 29 April 2023).

- Bartkowiak, A.; Bartkowiak, P.; Kinelski, G. Efficiency of Shaping the Value Chain in the Area of the Use of Raw Materials in Agro-Biorefinery in Sustainable Development. Energies 2022, 15, 6260. [Google Scholar] [CrossRef]

- González, R.; Peña, D.C.; Gómez, X. Anaerobic Co-Digestion of Wastes: Reviewing Current Status and Approaches for En-hancing Biogas Production. Appl. Sci. 2022, 12, 8884. [Google Scholar] [CrossRef]

- Koryś, K.A.; Latawiec, A.E.; Grotkiewicz, K.; Kuboń, M. The Review of Biomass Potential for Agricultural Biogas Production in Poland. Sustainability 2019, 11, 6515. [Google Scholar] [CrossRef]

- Czubaszek, R.; Wysocka-Czubaszek, A.; Tyborowski, R. Methane Production Potential from Apple Pomace, Cabbage Leaves, Pumpkin Residue and Walnut Husks. Appl. Sci. 2022, 12, 6128. [Google Scholar] [CrossRef]

- Bórawski, P.; Holden, L.; Bórawski, M.B.; Mickiewicz, B. Perspectives of Biodiesel Development in Poland against the Back-ground of the European Union. Energies 2022, 15, 4332. [Google Scholar] [CrossRef]

- Piwowar, A. Development of the Agricultural Biogas Market in Poland—Production Volume, Feedstocks, Activities and Behaviours of Farmers. Sci. J. Wars. Univ. Life Sci.–Probl. World Agric. 2019, 19, 88–97. [Google Scholar] [CrossRef]

- Muradin, M.; Foltynowicz, Z. Potential for Producing Biogas from Agricultural Waste in Rural Plants in Poland. Sustainability 2014, 6, 5065–5074. [Google Scholar] [CrossRef]

- Siudek, A.; Klepacka, A.M. The Logistics Aspect in Research on the Reduction of Carbon Dioxide Emissions from Agricultural Biogas. Sustainability 2022, 14, 10124. [Google Scholar] [CrossRef]

- Alves, O.; Garcia, B.; Rijo, B.; Lourinho, G.; Nobre, C. Market Opportunities in Portugal for the Water-and-Waste Sector Using Sludge Gasification. Energies 2022, 15, 6600. [Google Scholar] [CrossRef]

- Eder, A.; Mahlberg, B. Size, Subsidies and Technical Efficiency in Renewable Energy Production: The Case of Austrian Biogas Plants. Energy J. 2018, 39, 185–210. [Google Scholar] [CrossRef]

- Mahmoodi-Eshkaftaki, M.; Dalvi-Isfahan, M. Multiple exegetically optimization of ultrasonic pretreatment and substrate mixture for biohydrogen and biomethane improvement. Energy 2024, 292, 130537. [Google Scholar] [CrossRef]

- Ellacuriaga, M.; García-Cascallana, J.; Gómez, X. Biogas Production from Organic Wastes: Integrating Concepts of Circular Economy. Fuels 2021, 2, 144–167. [Google Scholar] [CrossRef]

- Wójcik, P. Znaczenie studium przypadku jako metody badawczej w naukach o zarządzaniu (The significance of case study as a research method in the management sciences). E-Mentor 2013, 1, 17–22. [Google Scholar]

- Flyvbjerg, B. Five Misunderstandings about Case-Study Research. Qual. Inq. 2006, 12, 219. [Google Scholar] [CrossRef]

- Welch, C.; Piekkari, R.; Plakoyiannaki, E.; Paavilainen-Mäntymäki, E. Theorising from case studies: Towards a pluralist future for international business research. J. Int. Bus. Stud. 2011, 42, 740–762. [Google Scholar] [CrossRef]

- Kozłowski, K.; Pietrzykowski, M.; Czekała, W.; Dach, J.; Kowalczyk-Juśko, A.; Jóźwiakowski, K.; Brzoski, M. Energetic and economic analysis of biogas plant with using the dairy industry waste. Energy 2019, 183, 1023–1031. [Google Scholar] [CrossRef]

- Balussou, D.; Kleyböcker, A.; McKenna, R.; Möst, D.; Wolf, F. An Economic Analysis of Three Operational Co-digestion Biogas Plants in Germany. Waste Biomass Valorization 2012, 3, 23–41. [Google Scholar] [CrossRef]

- Akbulut, A. Techno-economic analysis of electricity and heat generation from farm-scale biogas plant: Çiçekdağı case study. Energy 2012, 44, 381–390. [Google Scholar] [CrossRef]

- Bhandari, R.; Trudewind, C.A.; Zapp, P. Life cycle assessment of hydrogen production via electrolysis—A review. J. Clean. Prod. 2014, 85, 151–163. [Google Scholar] [CrossRef]

- Lauer, M.; Hansen, J.K.; Lamers, P.; Thrän, D. Making money from waste: The economic viability of producing biogas and biomethane in the Idaho dairy industry. Appl. Energy 2018, 222, 621–636. [Google Scholar] [CrossRef]

- Czekała, W.; Pulka, J.; Jasiński, T.; Szewczyk, P.; Bojarski, W.; Jasiński, J. Waste as substrates for agricultural biogas plants: A case study from Poland. J. Water Land Dev. 2023, 56, 45–50. [Google Scholar] [CrossRef]

- Piekutin, J.; Puchlik, M.; Haczykowski, M.; Dyczewska, K. The Efficiency of the Biogas Plant Operation Depending on the Substrate Used. Energies 2021, 14, 3157. [Google Scholar] [CrossRef]

- Mazurkiewicz, J. Analysis of the Energy and Material Use of Manure as a Fertilizer or Substrate for Biogas Production during the Energy Crisis. Energies 2022, 15, 8867. [Google Scholar] [CrossRef]

- Diouf, B.; Miezan, E. The Biogas Initiative in Developing Countries, from Technical Potential to Failure: The Case Study of Senegal. Renew. Sustain. Energy Rev. 2019, 101, 248–254. [Google Scholar] [CrossRef]

- Usha Rao, K.; Ravindranath, N.H. Policies to overcome barriers to the spread of bioenergy technologies in India. Energy Sustain. Dev. 2002, 6, 59–73. [Google Scholar] [CrossRef]

- Iotti, M.; Bonazzi, G. Assessment of Biogas Plant Firms by Application of Annual Accounts and Financial Data Analysis Approach. Energies 2016, 9, 713. [Google Scholar] [CrossRef]

- Kabera, T.; Nishimwe, H.; Imanantirenganya, I.; Mbonyi, M.K. Impact and effectiveness of Rwanda’s National Domestic Biogas programme. Int. J. Environ. Stud. 2016, 73, 402–421. [Google Scholar] [CrossRef]

- Iotti, M.; Manghi, E.; Bonazzi, G. Debt Sustainability Assessment in the Biogas Sector: Application of Interest Coverage Ratios in a Sample of Agricultural Firms in Italy. Energies 2024, 17, 1404. [Google Scholar] [CrossRef]

- Balachandra, P.; Nathan, H.S.K.; Sudhakara, R.B. Commercialization of sustainable energy technologies. Renew. Energy 2010, 35, 1842–1851. [Google Scholar] [CrossRef]

- Wicki, L.; Pietrzykowski, R.; Kusz, D. Factors Determining the Development of Prosumer Photovoltaic Installations in Poland. Energies 2022, 15, 5897. [Google Scholar] [CrossRef]

- Mæng, H.; Lund, H.; Hvelplund, F. Biogas plants in Denmark: Technological and economic developments. Appl. Energy 1999, 64, 195–206. [Google Scholar] [CrossRef]

- Buysman, E.; Mol, A.P.J. Market-based biogas sector development in least developed countries—The case of Cambodia. Energy Policy 2013, 63, 44–51. [Google Scholar] [CrossRef]

- Mateescu, C.; Dima, A.D. Critical analysis of key barriers and challenges to the growth of the biogas sector: A case study for Romania. Biomass Convers. Biorefinery 2022, 12, 5989–6002. [Google Scholar] [CrossRef]

- Ilie, D.M.; Dumitru, E.A.; Berevoianu, R.; Radoi, R.A.; Stoian, M. The evolution and impact of biogas research in mitigating climate change: A bibliometric approach. Sci. Pap. Ser. Manag. Econ. Eng. Agric. Rural. Dev. 2023, 23, 393–406. Available online: https://managementjournal.usamv.ro/pdf/vol.23_4/Art38.pdf (accessed on 10 May 2023).

- Benato, A.; Macor, A. Italian Biogas Plants: Trend, Subsidies, Cost, Biogas Composition and Engine Emissions. Energies 2019, 12, 979. [Google Scholar] [CrossRef]

- Belinska, S.; Bielik, P.; Adamičková, I.; Husárová, P.; Onyshko, S.; Belinska, Y. Assessment of Environmental and Economic-Financial Feasibility of Biogas Plants for Agricultural Waste Treatment. Sustainability 2024, 16, 2740. [Google Scholar] [CrossRef]

- Steffen, G.; Born, D. Farm and Business Management in Agriculture; Betriebs- und Unternehmensführung in der Landwirtschaft, Landwirtschaftlichen Fakultät, University of Bonn: Bonn, Germany, 1987; Available online: https://www.cabidigitallibrary.org/doi/full/10.5555/19881851107 (accessed on 10 May 2024).

- Pietrzak, M.; Ziętara, W. Beyond the black box: Towards a systems theory of farming family and family farm. Probl. Agric. Econ. 2022, 370, 42–86. [Google Scholar] [CrossRef]

- McGarvey, B.; Hannon, B. Dynamic Modeling for Business Management. An Introduction; Springer: New York, NY, USA, 2004. [Google Scholar] [CrossRef]

- Situmeang, R.; Mazancová, J.; Roubík, H. Technological, Economic, Social and Environmental Barriers to Adoption of Small-Scale Biogas Plants: Case of Indonesia. Energies 2022, 15, 5105. [Google Scholar] [CrossRef]

- Nevzorova, T.; Kutcherov, V. Barriers to the wider implementation of biogas as a source of energy: A state-of-the-art review. Energy Strategy Rev. 2019, 26, 100414. [Google Scholar] [CrossRef]

- Cong, R.-G.; Caro, D.; Thomsen, M. Is it beneficial to use biogas in the Danish transport sector?—An environmental-economic analysis. J. Clean. Prod. 2017, 165, 1025–1035. [Google Scholar] [CrossRef]

- Catalano, G.; D’Adamo, I.; Gastaldi, M.; Nizami, A.-S.; Marco Ribichini, M. Incentive policies in biomethane production toward circular economy. Renew. Sustain. Energy Rev. 2024, 202, 114710. [Google Scholar] [CrossRef]

- Sica, D.; Esposito, B.; Supino, S.; Malandrino, O.; Sessa, M.R. Biogas-based systems: An opportunity towards a post-fossil and circular economy perspective in Italy. Energy Policy 2023, 182, 113719. [Google Scholar] [CrossRef]

- D’Adamo, I.; Falcone, P.M.; Huisingh, D.; Morone, P. A circular economy model based on biomethane: What are the opportunities for the municipality of Rome and beyond? Renew. Energy 2021, 163, 1660–1672. [Google Scholar] [CrossRef]

- Rogala, Z.; Stanclik, M.; Łuszkiewicz, D.; Malecha, Z. Perspectives for the Use of Biogas and Biomethane in the Context of the Green Energy Transformation on the Example of an EU Country. Energies 2023, 16, 1911. [Google Scholar] [CrossRef]

- Mignogna, D.; Ceci, P.; Cafaro, C.; Corazzi, G.; Avino, P. Production of Biogas and Biomethane as Renewable Energy Sources: A Review. Appl. Sci. 2023, 13, 10219. [Google Scholar] [CrossRef]

- Feng, L.; Aryal, N.; Li, Y.; Horn, S.J.; Ward, A.J. Developing a biogas centralised circular bioeconomy using agricultural residues-Challenges and opportunities. Sci. Total Environ. 2023, 868, 161656. [Google Scholar] [CrossRef] [PubMed]

- Solarte-Toro, J.C.; Cardona Alzate, C.A. Biorefineries as the base for accomplishing the sustainable development goals (SDGs) and the transition to bioeconomy: Technical aspects, challenges and perspectives. Bioresour. Technol. 2021, 340, 125626. [Google Scholar] [CrossRef] [PubMed]

- Hoppe, T.; Sanders, M. Agricultural green gas demonstration projects in the Netherlands. A stakeholder analysis. Environ. Eng. Manag. J. 2014, 13, 3083–3096. Available online: http://www.eemj.icpm.tuiasi.ro/issues/vol13/vol13no12.htm (accessed on 13 May 2024). [CrossRef]

- Renewable Power Generation Costs in 2022; International Renewable Energy Agency: Abu Dhabi, United Arab Emirates, 2023; Available online: https://mc-cd8320d4-36a1-40ac-83cc-3389-cdn-endpoint.azureedge.net/-/media/Files/IRENA/Agency/Publication/2023/Aug/IRENA_Renewable_power_generation_costs_in_2022.pdf?rev=cccb713bf8294cc5bec3f870e1fa15c2 (accessed on 13 May 2024).

| Substrates | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| After-distillery stock | 6.5 | 16.0 | 22.5 | 16.8 | 17.7 | 14.8 | 20.1 | 21.0 | 20.6 | 20.7 | 19.0 | 18.8 |

| Slurry | 56.7 | 36.9 | 29.0 | 26.9 | 24.1 | 24.1 | 21.3 | 18.9 | 18.5 | 17.3 | 16.4 | 16.4 |

| Food processing waste | 1.6 | 0.5 | 0.4 | 1.5 | 0.9 | 0.9 | 0.9 | 1.7 | 3.0 | 7.9 | 11.4 | 13.7 |

| Fruit and vegetable residues | 2.3 | 9.6 | 17.3 | 16.7 | 19.9 | 20.6 | 19.9 | 19.3 | 19.4 | 15.4 | 14.9 | 13.6 |

| Maize silage | 23.2 | 26.8 | 17.5 | 19.7 | 16.7 | 13.6 | 12.4 | 12.1 | 10.6 | 11.3 | 11.3 | 10.8 |

| Technological waste from the agri-food industry | 0.0 | 0.0 | 0.0 | 1.1 | 2.5 | 4.1 | 4.2 | 4.5 | 4.7 | 5.1 | 5.3 | 5.4 |

| Beet pulp | 1.5 | 4.0 | 6.5 | 8.9 | 7.6 | 6.9 | 7.4 | 7.3 | 6.4 | 4.8 | 4.2 | 4.0 |

| Waste from dairy industry | 0.4 | 1.4 | 0.8 | 1.0 | 1.9 | 2.8 | 2.0 | 2.7 | 3.2 | 3.0 | 2.7 | 3.0 |

| Expired food | 0.0 | 0.0 | 0.0 | 0.3 | 0.4 | 0.9 | 0.9 | 1.8 | 2.5 | 2.7 | 3.0 | 2.8 |

| Post-slaughter waste | 0.0 | 0.1 | 0.4 | 0.3 | 0.5 | 0.6 | 0.4 | 1.7 | 2.6 | 1.9 | 1.8 | 2.2 |

| Manure | 2.5 | 2.9 | 1.8 | 1.7 | 1.8 | 2.5 | 2.2 | 2.1 | 2.1 | 2.1 | 1.9 | 1.7 |

| Waste plant mass | 0.0 | 0.0 | 0.3 | 0.5 | 0.3 | 1.0 | 0.6 | 1.4 | 1.1 | 2.0 | 1.5 | 1.3 |

| Fruits and vegetables | 0.0 | 0.0 | 0.0 | 0.2 | 0.7 | 0.8 | 1.2 | 1.0 | 0.8 | 0.8 | 1.2 | 0.9 |

| Cereal and cereal waste | 0.3 | 0.1 | 0.0 | 1.1 | 0.4 | 0.6 | 0.6 | 0.3 | 0.2 | 0.4 | 0.9 | 0.8 |

| Bird droppings | 0.0 | 0.3 | 0.7 | 0.6 | 0.6 | 0.8 | 0.6 | 0.6 | 0.5 | 0.6 | 0.6 | 0.8 |

| Fats | 0.0 | 0.0 | 0.0 | 0.0 | 0.1 | 0.2 | 0.2 | 0.3 | 0.4 | 0.6 | 0.6 | 0.7 |

| Sludge from the processing of plant products | 0.0 | 0.0 | 0.3 | 0.2 | 0.0 | 0.0 | 0.0 | 0.3 | 0.4 | 0.5 | 0.9 | 0.6 |

| Grass and cereal silage | 2.8 | 0.1 | 0.1 | 0.8 | 0.4 | 0.5 | 0.7 | 0.6 | 0.6 | 0.6 | 0.6 | 0.6 |

| Green forage | 0.0 | 0.4 | 1.0 | 0.4 | 0.7 | 1.8 | 2.5 | 1.0 | 0.8 | 0.9 | 0.6 | 0.3 |

| Other | 2.2 | 0.8 | 1.5 | 1.4 | 2.7 | 2.6 | 2.0 | 1.4 | 1.5 | 1.5 | 1.2 | 1.5 |

| Specification | Year | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | ||

| Revenue | thous. PLN | 1603.3 | 2672.8 | 4569.9 | 3787.4 | 3862.6 | 3776.7 | 3634.7 | 4652.7 | 4565.9 |

| thous. USD | 425.3 | 677.8 | 1209.7 | 1048.2 | 1006.0 | 968.6 | 940.9 | 1043.0 | 1086.6 | |

| Including: | ||||||||||

| Sale of electricity | % | 51.9 | 35.4 | 26.7 | 29.5 | 36.6 | 37.6 | 42.8 | 65.3 | 58.1 |

| Sale of certificates | % | 48.1 | 64.6 | 73.3 | 70.5 | 63.4 | 62.4 | 57.2 | 34.7 | 41.9 |

| Total costs | thous. PLN | 2606.2 | 3342.1 | 4762.0 | 4234.7 | 4127.2 | 4099.7 | 3977.4 | 4198.7 | 4227.6 |

| thous. USD | 691.3 | 847.6 | 1260.6 | 1171.9 | 1074.9 | 1051.4 | 1029.6 | 941.3 | 1006.1 | |

| Net profit | thous. PLN | −1002.9 | −669.2 | −192.0 | −447.3 | −264.6 | −323.0 | −342.8 | 454.0 | 338.3 |

| thous. USD | −266.0 | −169.7 | −50.8 | −123.8 | −68.9 | −82.8 | −88.7 | 101.8 | 80.5 | |

| Energy for the needs of a farm | thous. PLN | 130.0 | 114.9 | 46.7 | 44.7 | 54.9 | 55.3 | 68.1 | 166.6 | 120.9 |

| thous. USD | 34.5 | 29.1 | 12.4 | 12.4 | 14.3 | 14.2 | 17.6 | 37.3 | 28.8 | |

| Fertilizing value of digestate | thous. PLN | 115.2 | 188.2 | 308.1 | 222.0 | 271.1 | 316.7 | 293.1 | 346.5 | 450.7 |

| thous. USD | 30.6 | 47.7 | 81.6 | 61.4 | 70.6 | 81.2 | 75.9 | 77.7 | 107.3 | |

| Net profit adjusted for energy for farm needs and the value of digestate | thous. PLN | −757.8 | −366.1 | 162.8 | −180.6 | 61.4 | 49.0 | 18.4 | 967.1 | 909.9 |

| thous. USD | −201.0 | −92.8 | 43.1 | −50.0 | 16.0 | 12.6 | 4.8 | 216.8 | 216.5 | |

| Cumulative net profit adjusted for energy for farm needs and the value of digestate | thous. PLN | −757.8 | −1123.9 | −961.1 | −1141.7 | −119.2 | −70.2 | −51.8 | 985.5 | 1895.4 |

| thous. USD | −201.0 | −285.0 | −254.4 | −316.0 | −31.0 | −18.0 | −13.4 | 220.9 | 451.1 |

| Substrates | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 |

|---|---|---|---|---|---|---|---|---|

| Substrates from the farm | ||||||||

| Slurry | 28.5 | 12.5 | 10.4 | 17.4 | 7.8 | 14.8 | 28.1 | 33.9 |

| Cow manure | 23.3 | 25.1 | 31.6 | 15.8 | 20.8 | 25.9 | 26.8 | 28.2 |

| Maize silage | 3.2 | 1.5 | 2.9 | 0.2 | 1.6 | 2.1 | 9.0 | 7.4 |

| Grass and cereal silage | 0.0 | 0.0 | 0.0 | 1.8 | 4.5 | 2.0 | 0.5 | 4.0 |

| Cereal and cereal waste | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.5 | 0.0 | 0.0 |

| Total substrates from the farm | 55.0 | 39.1 | 44.9 | 35.2 | 34.7 | 45.3 | 64.4 | 73.5 |

| Food processing waste; technological waste from the agri-food industry; fruit and vegetable residues | 30.0 | 34.1 | 32.8 | 43.4 | 43.9 | 39.2 | 30.9 | 18.4 |

| Beet pulp | 15.0 | 19.0 | 12.0 | 10.6 | 10.5 | 8.1 | 0.8 | 4.4 |

| Waste from the dairy industry | 0.0 | 7.8 | 10.2 | 10.8 | 10.5 | 7.4 | 3.8 | 3.7 |

| Other | 0.0 | 0.0 | 0.1 | 0.0 | 0.4 | 0.0 | 0.1 | 0.0 |

| Total substrates from outside the farm | 45.0 | 60.9 | 55.1 | 64.8 | 65.3 | 54.7 | 35.6 | 26.5 |

| Specification | W1 | W2 | W3 | W4 | W5 | W6 | |

|---|---|---|---|---|---|---|---|

| NPV | thous. PLN | −6346.1 | −4304.9 | −2828.2 | −786.6 | −407.1 | −392.6 |

| thous. USD * | −1683.3 | −1141.9 | −750.2 | −208.6 | −108.0 | −104.1 | |

| IRR (%) | −3.07 | 0.83 | 2.04 | 6.42 | 7.05 | 5.33 |

| Specification | Year | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | ||

| Option W7 | ||||||||||

| Net profit | thous. PLN | −1002.9 | −669.2 | −192.0 | −447.3 | −264.6 | −323.0 | −342.8 | 454.0 | 338.3 |

| thous. USD | −266.0 | −169.7 | −50.8 | −123.8 | −68.9 | −82.8 | −88.7 | 101.8 | 80.5 | |

| Energy for the needs of the farm | thous. PLN | 130.0 | 114.9 | 46.7 | 44.7 | 54.9 | 55.3 | 68.1 | 166.6 | 120.9 |

| thous. USD | 34.5 | 29.1 | 12.4 | 12.4 | 14.3 | 14.2 | 17.6 | 37.3 | 28.8 | |

| Value of the digestate | thous. PLN | 638.5 | 605.4 | 583.5 | 574.4 | 628.0 | 614.5 | 769.9 | 1616.6 | 988.2 |

| thous. USD | 169.4 | 153.5 | 154.5 | 159.0 | 163.6 | 157.6 | 199.3 | 362.4 | 235.2 | |

| Value of heat actually used on the farm | thous. PLN | 240.0 | 386.0 | 369.2 | 460.9 | 464.0 | 379.0 | 385.4 | 579.0 | 930.5 |

| thous. USD | 63.7 | 97.9 | 97.7 | 127.6 | 120.8 | 97.2 | 99.8 | 129.8 | 221.4 | |

| Net profit adjusted for farm benefits | thous. PLN | 5.5 | 437.0 | 807.4 | 632.8 | 882.3 | 725.9 | 880.6 | 2816.2 | 2377.9 |

| thous. USD | 1.5 | 110.8 | 213.7 | 175.1 | 229.8 | 186.2 | 228.0 | 631.3 | 565.9 | |

| Option W8 | ||||||||||

| Net profit | thous. PLN | −1002.9 | −669.2 | −192.0 | −447.3 | −264.6 | −323.0 | −342.8 | 454.0 | 338.3 |

| thous. USD | −266.0 | −169.7 | −50.8 | −123.8 | −68.9 | −82.8 | −88.7 | 101.8 | 80.5 | |

| Energy for the needs of the farm | thous. PLN | 130.0 | 114.9 | 46.7 | 44.7 | 54.9 | 55.3 | 68.1 | 166.6 | 120.9 |

| thous. USD | 34.5 | 29.1 | 12.4 | 12.4 | 14.3 | 14.2 | 17.6 | 37.3 | 28.8 | |

| Value of the digestate | thous. PLN | 638.5 | 605.4 | 583.5 | 574.4 | 628.0 | 614.5 | 769.9 | 1616.6 | 988.2 |

| thous. USD | 169.4 | 153.5 | 154.5 | 159.0 | 163.6 | 157.6 | 199.3 | 362.4 | 235.2 | |

| Value of heat | thous. PLN | 683.0 | 632.7 | 698.3 | 733.0 | 672.9 | 885.0 | 884.5 | 1249.7 | 1955.8 |

| thous. USD | 181.2 | 160.5 | 184.8 | 202.9 | 175.3 | 227.0 | 229.0 | 280.2 | 465.4 | |

| Net profit adjusted for farm benefits | thous. PLN | 448.6 | 683.8 | 1136.5 | 904.8 | 1091.2 | 1231.9 | 1379.7 | 3486.9 | 3403.2 |

| thous. USD | 119.0 | 173.4 | 300.8 | 250.4 | 284.2 | 315.9 | 357.2 | 781.7 | 809.9 |

| Specification | W7A | W7B | W8A | W8B | |

|---|---|---|---|---|---|

| NPV | thous. PLN | 1574.6 | 5093.2 | 4285.2 | 7803.7 |

| thous. USD * | 417.7 | 1350.9 | 1136.6 | 2069.9 | |

| IRR (%) | 10.43 | 17.41 | 14.36 | 21.87 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Kusz, D.; Kusz, B.; Wicki, L.; Nowakowski, T.; Kata, R.; Brejta, W.; Kasprzyk, A.; Barć, M. The Economic Efficiencies of Investment in Biogas Plants—A Case Study of a Biogas Plant Using Waste from a Dairy Farm in Poland. Energies 2024, 17, 3760. https://doi.org/10.3390/en17153760

Kusz D, Kusz B, Wicki L, Nowakowski T, Kata R, Brejta W, Kasprzyk A, Barć M. The Economic Efficiencies of Investment in Biogas Plants—A Case Study of a Biogas Plant Using Waste from a Dairy Farm in Poland. Energies. 2024; 17(15):3760. https://doi.org/10.3390/en17153760

Chicago/Turabian StyleKusz, Dariusz, Bożena Kusz, Ludwik Wicki, Tomasz Nowakowski, Ryszard Kata, Władysław Brejta, Anna Kasprzyk, and Marek Barć. 2024. "The Economic Efficiencies of Investment in Biogas Plants—A Case Study of a Biogas Plant Using Waste from a Dairy Farm in Poland" Energies 17, no. 15: 3760. https://doi.org/10.3390/en17153760

APA StyleKusz, D., Kusz, B., Wicki, L., Nowakowski, T., Kata, R., Brejta, W., Kasprzyk, A., & Barć, M. (2024). The Economic Efficiencies of Investment in Biogas Plants—A Case Study of a Biogas Plant Using Waste from a Dairy Farm in Poland. Energies, 17(15), 3760. https://doi.org/10.3390/en17153760