Abstract

Offshore wind has developed significantly over the past decade, and promising new markets are emerging, such as Brazil, South Africa, India, Poland, and Turkey. As logistic transport activities increase complexities, developing regional supply chains can help to reduce costs and enhance the sector’s competitiveness. This article proposes a framework for the industrial development of the offshore wind supply chain in new markets. This study is grounded in a systematic literature review and is validated through a multi-case study, identifying key variables and factors influencing industrial growth. Adopting a process-based approach, factors and variables were modeled into a framework, encompassing the following four phases: (1) demand assessment of a new sector, (2) sectorial and industrial planning, (3) industrial development and maturity, and (4) sectorial and industrial renewal or decline. Each phase brings together a group of policies. Our findings show the policies’ interrelations. These results complement the few studies that have examined the industrial development process, providing a clear guide as to the process for the development of the offshore wind industry in specific regions. Thus, the framework provides elements that contribute as a valuable tool to the debate, structuring, and development of public policies for the industrial development of a new sector.

1. Introduction

Both energy transition and economic decarbonization have received great interest from governmental and industrial stakeholders, which is driven by the increasing need to tackle the issue of climate change. Offshore wind energy has become one of the main alternatives for this purpose and is hence estimated to reach an accumulated global installed capacity of 2000 GW by 2030. Despite its novelty, the sector is reaching its maturity. Advancements in engineering and global supply diversification have supported the levelized cost of energy (LCOE) reduction, increasing technological competitiveness. However, reaching its maturity, the dramatic price reductions experienced in the last decade are likely to slow, and future cost fluctuations are expected to reflect supply chain aspects such as commodity (steel and copper) and logistics costs [1]. To support the development of its global potential, the supply chain’s industrial development in geographical markets that have identified offshore wind potential is clearly necessary.

In terms of new markets, offshore wind is emerging as an alternative not only due to LCOE decline but also due to high decarbonization targets, the attractiveness of investments, and job creation [1,2]. The offshore wind energy industry emerged in Denmark as a result of an extension of the onshore wind industry to offshore locations [3], which is driven by a higher capacity factor [4,5]; turbines with a greater generation capacity [5]; a more constant feed-in with fewer outliers and a lower correlation [6,7]; and the greater availability of space for implementation [4]. However, this new industry started to present divergences from onshore wind and synergies with other already established industries, such as the maritime industry and offshore oil and gas [3,8]. Thus, considering its advantages and the experience acquired from other sectors globally, offshore wind has been growing significantly in recent years [9].

As offshore wind turbine technology has developed, from a nominal power of 3 MW in 2000 to 18 MW in 2023 [1], and acquired greater dimensions and complexity, the supply chain began to face challenges. Thus, for offshore wind to reduce logistic challenges, reduce costs, and enhance the competitiveness of the new market, its industry needs to be developed locally in new and emerging markets [10,11].

Economic geographers have developed studies on the emergence of new industries [8], which is one of the greatest challenges for the area [12]. Two concepts are used in the literature on economic geography—path dependence and path creation. The path dependence theory is based on the assumption that new industries emerge through the recombination of resources from established industries and activities in the region [12,13]. The path creation theory considers that industries emerge both from the development of existing industries in a new region and from the emergence of new industries based on new technologies and/or scientific discoveries [14]. While still unfolding, the evolutionary theory of creating paths considers that regional paths are based on the existing economic structure of a region [12] and contribute to the enhancement of competitiveness [15].

The literature on the development of industrial paths can guide the understanding of how the offshore wind industry can develop in new regions that have wind potential such as Brazil, South Africa, India, Poland, and Turkey, among others [10]. However, although the literature presents factors that influence the development of the offshore wind industry in specific regions [16,17,18,19,20], there is a gap in the process that must be followed for its development, giving rise to the present research question. Thus, this article aims to propose a framework for the industrial development process of offshore wind power in new markets, using a process-based approach.

This article has five sections. Section 2 describes the methodology used in the research. Section 3 contains the literature review on the development of new industrial paths and the development of the offshore wind industry. Section 4 undertakes a multi-case study on the offshore wind industry’s development in mature and emerging markets worldwide. Section 5 presents the framework with a description of its measures. Section 6 contemplates the conclusions and presents recommendations for future studies.

2. Materials and Methods

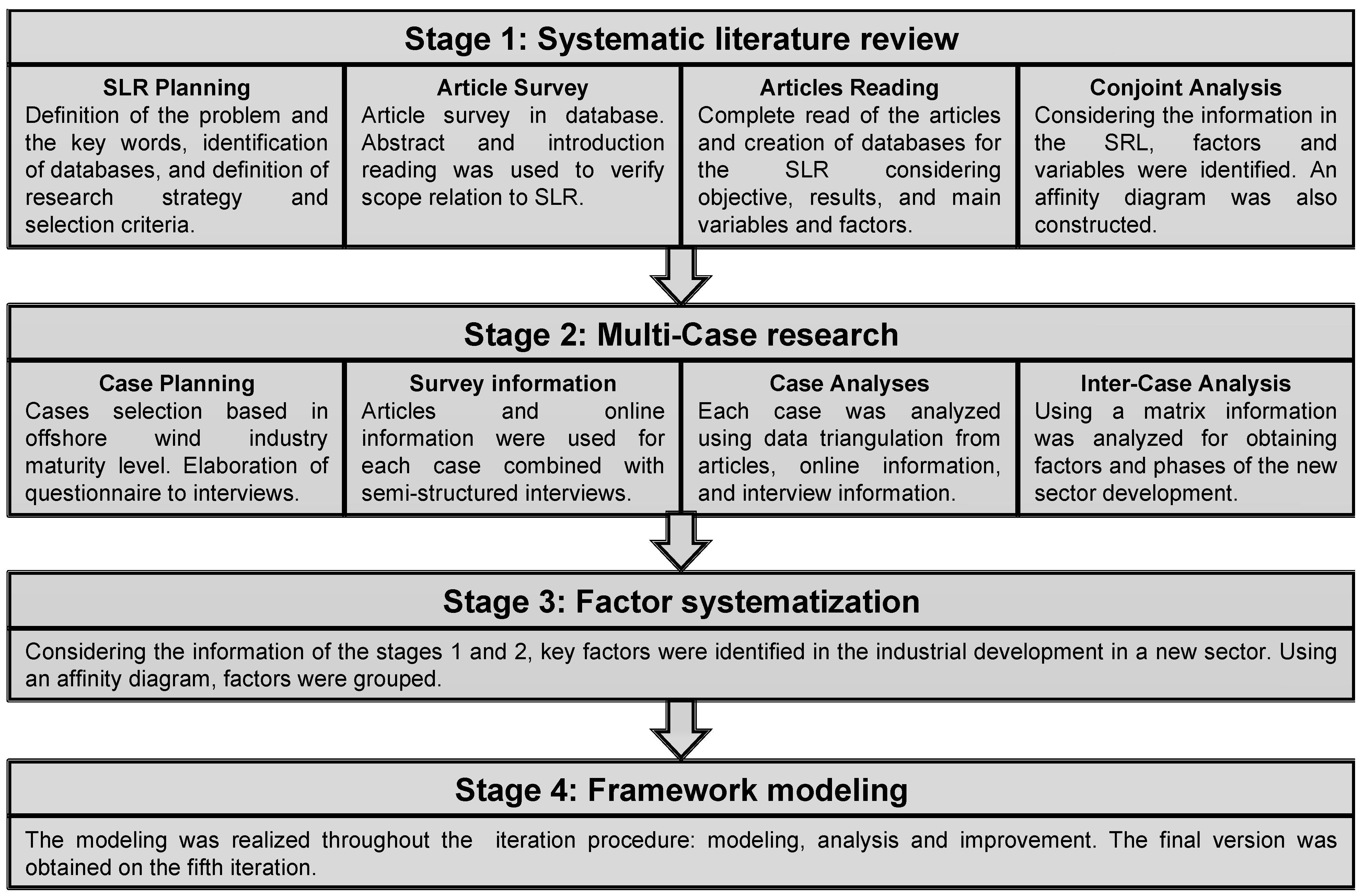

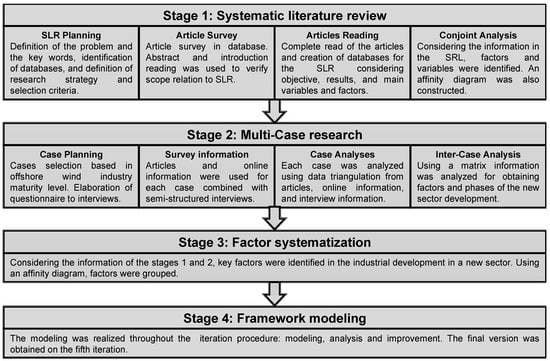

The research procedure was developed in four stages (Figure 1). The first stage included a systematic literature review (SLR), which involved the planning (research problem, keywords, databases, and the criteria for surveying the articles); survey; reading and tabulation of results; and analysis [21]. The research problem was defined by identifying the importance of offshore wind industry development close to the offshore wind farm’s installation regions. In this sense, the research question was defined as follows: how should the industrial development process of the offshore wind supply chain in new markets be designed?

Figure 1.

Research procedure.

The SLR involved reviewing literature pertaining to path creation; the development of the offshore wind industry; and synergies between the offshore wind supply chain and the existing onshore wind and oil and gas sectors. Keywords were selected and used to carry out the survey using (i) the CAPES Journal Portal, which brings together more than 100 databases including SCOPUS and the Web of Science, (ii) the semantic scholar search engine and (iii) the Connecting Repositories (CORE) repository. The title, abstract, introduction, and conclusions of each article were examined in order to determine its inclusion in the study or not. It was observed that several works focused on the development of the offshore wind energy as a whole or on specific offshore wind projects. In total, 77 articles concentrated on the industrial development of the offshore wind sector. These articles were processed using the Mendeley software version 1.19.8. A thorough complete reading and analysis of each document was then conducted using Microsoft Excel as a support tool to record pertinent information. After analyzing each article, a further 30 publications were identified as relevant to the scope of the study and were hence also added, producing a total of 107 articles. The analysis of this set of articles resulted in the identification of the factors and variables discussed in this study.

The second stage considered a multi-case study of the industrial development of the offshore wind sector in mature (Denmark, Germany, United Kingdom and China) and emerging markets (Taiwan and United States). Denmark was chosen due to its pioneering status in the offshore wind sector, having a share of more than 47% of its electricity coming from wind sources [22], having major turbine manufacturers located in the country, and having research centers that are world renowned for their offshore wind sector research and innovation activity [23]. China has the largest offshore wind installed capacity and owns major global main turbine suppliers [24]. The United Kingdom (UK) has the second largest offshore wind installed capacity [24] and, similarly to many countries with emerging markets, has a developed offshore oil and gas industry. These factors make the UK a relevant case study for the industrial development of the offshore wind sector. Germany, with the third largest installed capacity, is also one of the main suppliers of components for the offshore wind sector [24,25].

Taiwan is an emerging market that has recently promoted the development of its offshore wind sector including its local supply chain. It has implemented public policies that have attracted investors in offshore wind power farms and has defined specific targets for regional industrial development [26,27]. Unlike Taiwan, the United States has a policy of national protectionism [24]. Considering both mature and emerging markets, this case study analyzes policies designed to promote the development of the new offshore wind sector and consequent national supply chains. These perspectives are important for any proposed framework since they can identify and validate effective policies and hence facilitate the development of the offshore wind sector in new markets.

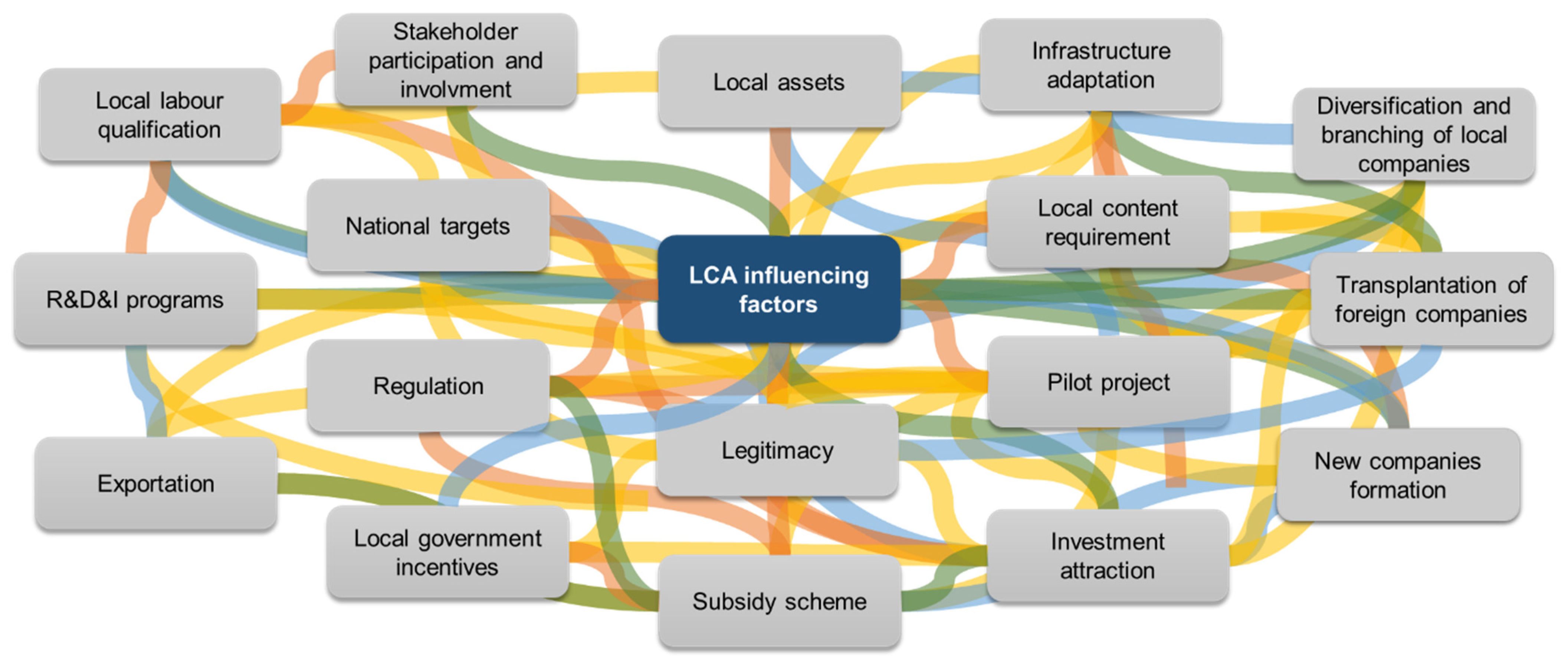

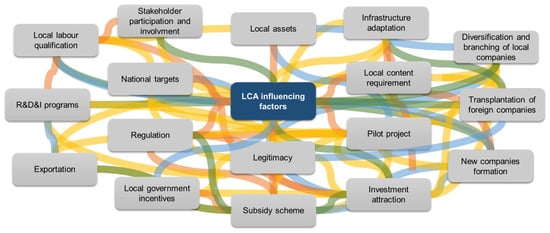

The third stage included the systematization of identified factors utilizing SLR analysis and multi-case study information. The data gathered during the SLR analysis were validated, and additional factors identified by the case studies were added. An affinity diagram was used to structure the information gathered in terms of its life cycle. The affinity diagram is used to identify actions that form part of industrial development in new markets using life cycle assessment (LCA) information. Figure 2 presents the developed affinity diagram.

Figure 2.

Affinity diagram.

The fourth stage consisted of industrial development modeling for the offshore wind supply chain in new markets. In this stage, a process-based approach was used to define the phases and policies. The modeling followed a model proposal, critical analysis, and improvement cycle. Five cycles were carried out in order to generate the final version of the framework.

3. Literature Review

3.1. New Industrial Path Creation

The evolution and creation of new paths began to be studied by economic geographers in order to explain the evolution of an industrial or economic sector, analyzing which factors are responsible for its emergence and what types of mechanisms explain the creation of a new path [28].

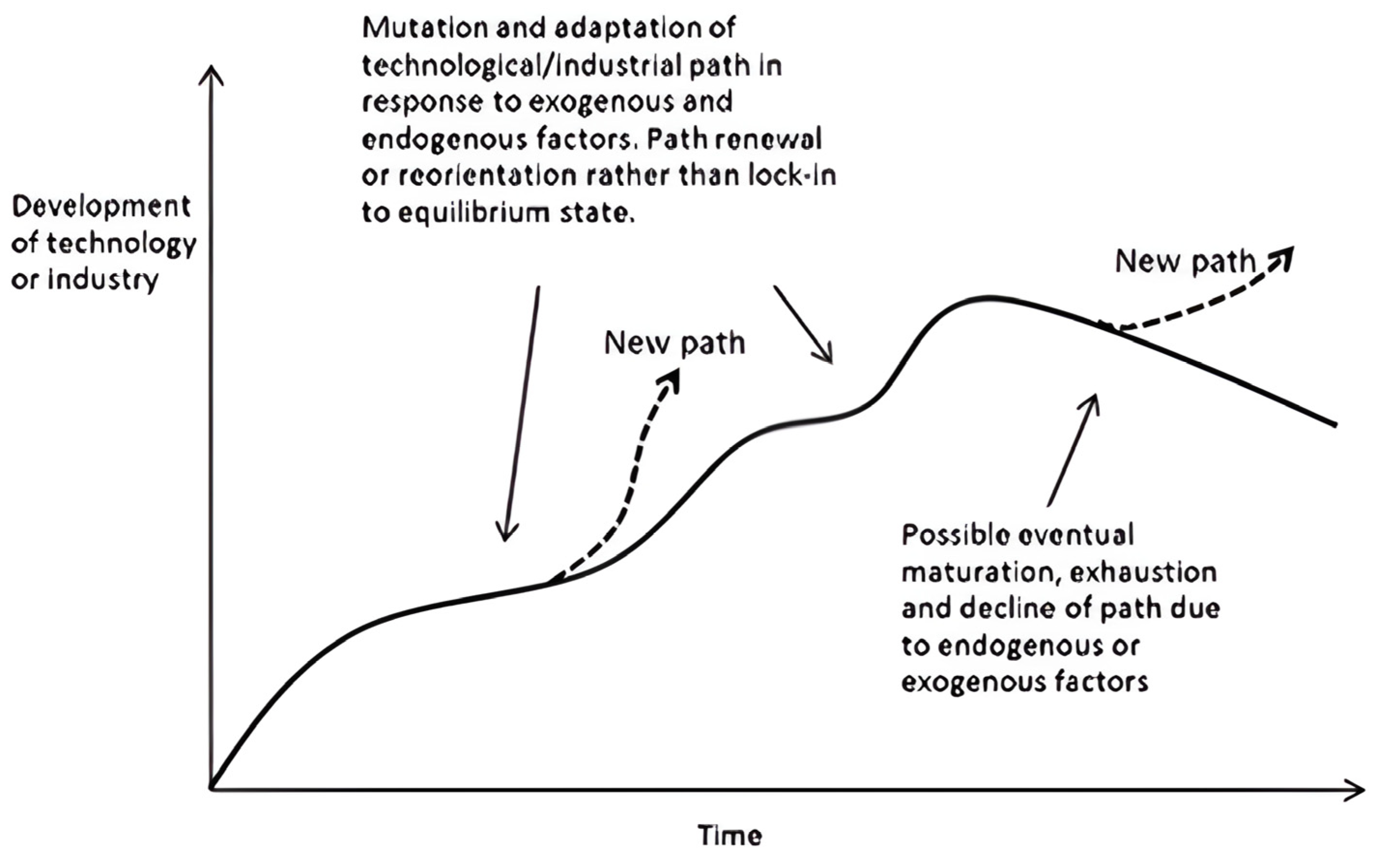

In each region, industrial development can take place in different ways. Thus, evolutionary economic geography (EEG) studies the role of each region in promoting development. To promote regional development, it is important to ensure the extension of paths through the promotion of the existing industry (with incremental innovations) and to stimulate the development of new paths (supporting the emergence of new industries) through path renewal and path creation [14].

The renewal of paths occurs with the branching out of companies into activities and sectors that are different from their original activities but which have a certain synergy. The creation of new paths can occur in two ways: (1) with the development of established industries that are new for the region or (2) the emergence and growth of new industries based on new technologies [14].

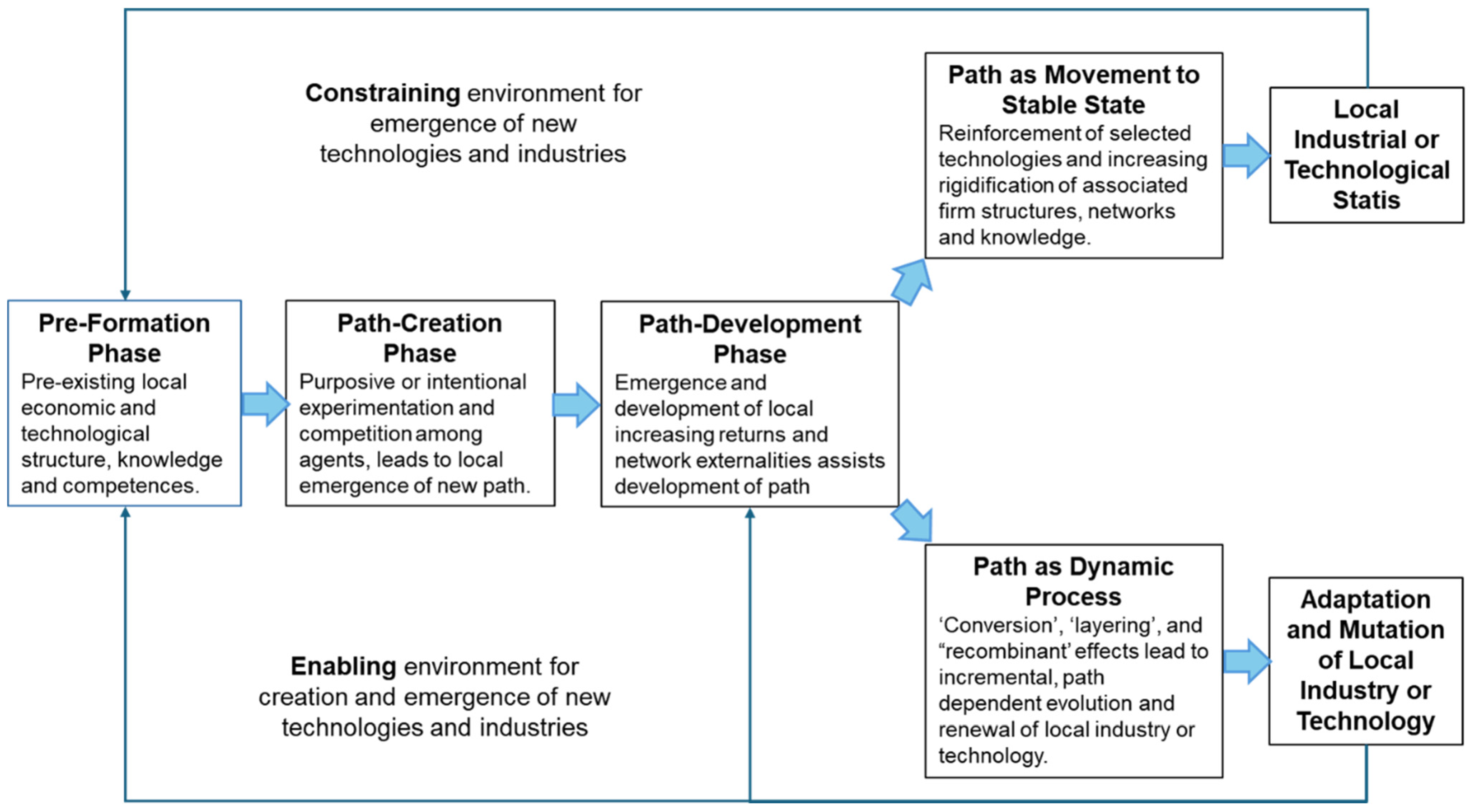

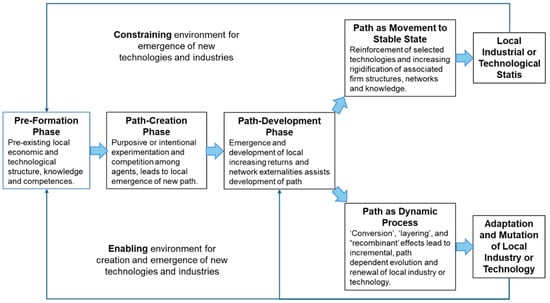

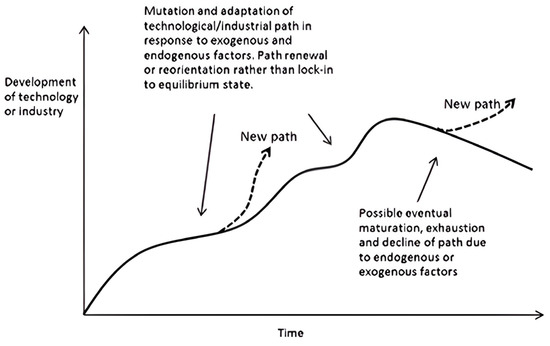

The development and evolution of a new regional industry is influenced by the historical industrial conditions in the region [13], such as pre-existing resources, skills, abilities, or experience of local sectors [29]. Figure 3 shows the emergence and evolutionary process of a new industry.

Figure 3.

Model for the emergence and evolution of an industry. Source: Adapted from [29].

Thus, the environment in which the industry is being developed may have a positive influence, enabling the creation and emergence of new technologies and industries, or negative, restricting them [30]. Steen’s (2016) model shows how established regional industries can influence the emergence of new industries as illustrated in Figure 4 [31]. Regions that present assets with synergies to the industry have considerably enabled development, as they rely on factors and conditions that lead to spillovers [32,33].

Figure 4.

Emergence of new industries. Source: [8].

The creation of new paths depends on the articulation of four elements: (1) regional assets, (2) key actors, (3) mechanisms of path creation and (4) multi-scalar institutional environment and policy initiatives [19,34]. Regional assets can be categorized into natural (natural resources), infrastructure and material (a range from road to maritime port infrastructure and zones intended for manufacturing companies), industrial (regional companies technology and skills), human (labor and knowledge) and institutional (norms and roles) [13,19,31,34].

Key actors may enable new path development according to regional strategies such as the establishment of R&D initiatives, incentives for the formation of start-up and spin-off companies and the promotion of financial investment [8,19,29,35,36]. Among the mechanisms that can influence the emergence of new industrial paths, it is possible to highlight the following:

- i.

- Indigenous paths: the emergence of new technologies and industries in a region without the need for a regional technological background and/or pre-existing skills [13];

- ii.

- Transplantation: new paths can arise through the importation of foreign technologies, companies, and industries through an exogenous process [13];

- iii.

- Industrial base upgrade: restructuring and improving the industrial base or introducing new products and services [13];

- iv.

- Diversification: this path involves industries that are in decline and have branched out, starting to act in new industries which have synergies of activities, knowledge, and resources with their existing industry [13,37]. It can also occur in emerging industries, such as offshore wind, which has branched out from the onshore wind industry [38].

Finally, the element of multi-scale institutional environment and political initiatives refers to rules and norms at the local and regional level, which should influence and mediate the interaction between assets, actors, and mechanisms [19,39].

In addition to the discipline of economic geography, the literature on the theory of technological innovation systems (TIS) has also been employed to analyze the development of innovation systems. An innovation system corresponds to the dynamics of agents for the development of a new technology [40]. According to TIS, the development of a new technology, such as offshore wind, follows some key functions: entrepreneurial activities, influence on the direction of search, generation and dissemination of knowledge, market formation, legitimacy of technology, resource mobilization, and development of positive externalities [40,41].

Entrepreneurial activities correspond to the engagement of private companies in an industry, whether through participation in projects, the diversification of companies into new sectors, or the emergence of new companies, among others. The influence to attract a market corresponds to the incentive or support provided to attract companies and organizations to develop in that market. This support can occur due to the vision and expectation of the market’s growth potential, the establishment of goals, the development of the market in other countries, crises in existing markets, and policy and regulation, among other measures [41].

Knowledge can be considered the basis of the path creation process and can be developed by private companies or research institutes and universities. Furthermore, knowledge can be shared and disseminated through networking, partnerships, and project collaboration. Market formation is necessary, as new products and technologies do not have market segments. Therefore, those segments must be created by the key actors by the provision of subsidies, government programs, and standardization, among others [41].

On the other hand, the legitimacy of technology aligns a new industry with the context and promotes its acceptance. Thus, legitimacy is responsible for determining how much technology is accepted by actors (private, public and civil society in general) so that resources are mobilized and acquire strength in the market and politics [41].

Resource mobilization corresponds to the mobilization and allocation of financial resources. These resources can be provided both by private sources such as angel investors, venture capital, commercial and investment banks and by the government for encouraging R&D and market subsidies. In addition, it can also correspond to capital for investment in human resources. These key resources can together influence the emergence of a new industry. In this sense, a region that does not have one of these resources may have restricted deployment [42,43,44].

The development of positive externalities can be promoted by the entry of new companies into the market. The entry of these companies can influence other functions and thus reduce initial uncertainties both pertaining technology and to the market in addition to favoring the legitimacy of technology [41]. In the course of industrial development, an industry may encounter path exhaustion due to impediments in its developmental trajectory. This phenomenon becomes apparent when an existing industry is unable to respond to emerging technologies or compete in the market and region [14,45].

In summary, Martin’s model of evolution [29], the elements for creating new paths for identified mechanisms, and the functions of TIS for the development of an industry can be considered jointly as a basis for the industrial development of a new sector.

3.2. Offshore Wind Supply Chain Industrial Development

3.2.1. Offshore Wind Supply Chain

An offshore wind supply chain is characterized by accelerated technological evolution, a high level of uncertainty, and market dynamics shaped by the political environment and the complexity in transporting turbine components [46]. Thus, a regional supply chain is necessary to enable the development of the sector in a region where there is wind potential.

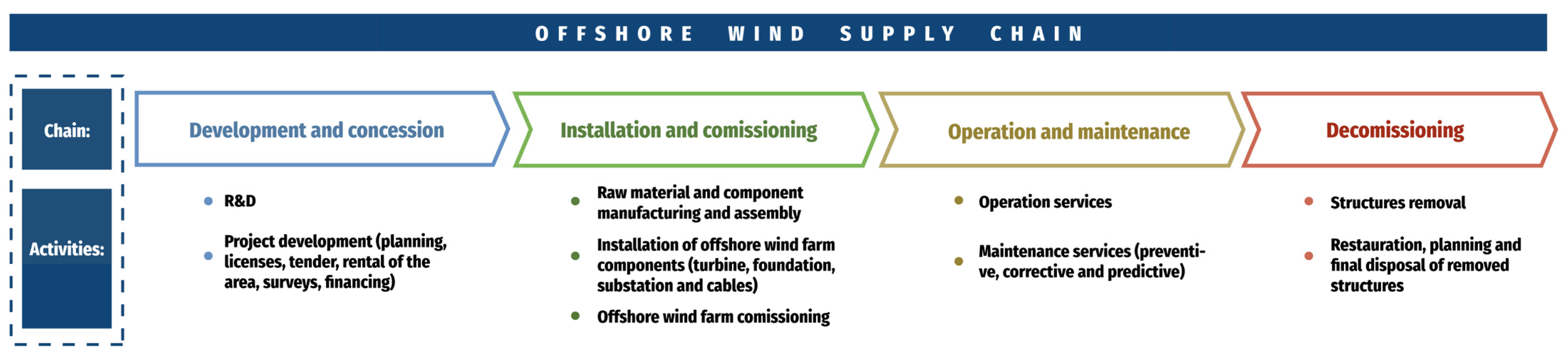

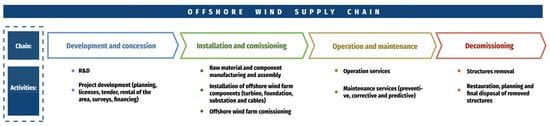

An offshore wind energy supply chain can be categorized into four phases (Figure 5): a development and concession chain, an installation and commissioning chain, an operations and maintenance chain, and a decommissioning chain [47,48].

Figure 5.

Offshore wind supply chain. Source: Adapted from [46,47].

The development and concession phase involves classical project development activities , such as R&D, elaboration of surveys, planning activities, financing, and licensing, among others. The installation and commissioning phase covers the design, manufacturing and assembly of components, as well as their on-site installation and commissioning. The operations and maintenance phase covers the operation and maintenance activities, whether preventive, predictive or corrective. The decommissioning phase involves activities related to the decommissioning of wind farms, site restoration and final disposal of structures [47,48].

3.2.2. Synergies with Other Industries

The offshore wind sector emerged from its onshore wind power counterpart. . However, as a result of its technological evolution, the products and processes in its supply chain are increasingly different from those of onshore supply chains [3], bringing challenges and causing a branching of the sector known as a decoupling point. This decoupling point has been reached as technological development has allowed larger offshore wind farms to be established further from the coast [49].

The manufacture of the first offshore wind turbines was undertaken using existing technology from onshore companies. However, it was observed that due to the placement of the turbines in more severe environmental conditions, caused by the salinity of the water, waves, and storms, the structure used by the onshore technology needed to undergo adaptations for offshore use [50].

In addition, an offshore wind farm necessitates a greater level of technical robustness and reliability due to limited maritime access caused by weather conditions and distance from the coast. Thus, technical challenges arise not only for turbine manufacturers, who must adapt their turbines to new conditions, but also for suppliers of foundations, towers, construction equipment, and vessels, among others [5,51].

Other existing industries that have experience in related activities have contributed to the industrial development of offshore wind, namely the maritime industry (especially the O&G industry) and the shipbuilding sector [52,53]. The maritime industry has provided companies with the offshore wind supply chain, contributing to the development of this new sector. The services provided by these companies include offshore maritime services, support vessels, towing, lifting, and supply [53]. The offshore O&G industry is one of the industries that has most significantly contributed to the development of the offshore wind supply chain. The O&G supply chain has three main parts: upstream (concession, exploration, installation, production, and abandonment), midstream (processing, storage, and transport by tanks and pipelines to the refinery where it will be processed), and downstream (distribution and sale of the product) [54].

The upstream O&G supply chain, in particular, is similar to the offshore wind supply chain, with area development activities, auction and concession, installation, production, and decommissioning [54]. Due to their similarities, some equipment and knowledge have been adapted to the offshore wind market. In addition, there is also an institutional overlap, where parameters, safety standards, regulations, and licensing processes have been developed, drawing on the expertise of the O&G sector [55].

The O&G industry contribution is concentrated in some segments of the offshore wind supply chain, namely project management, foundations (tripods and jacket), castings and forgings, tower, cables, substations, construction vessels, installation (equipment, support services), O&M services (emergency vessels and services, solutions for safe access to offshore structures), and surveying [56].

The shipbuilding industry indirectly influences the development of the offshore wind industry. Offshore wind companies can also benefit from the facilities and expertise of the maritime industry due to direct access to the open sea, the availability of deep-water ports, and large coastal areas needed for the production, inventory, and pre-assembly of components [57].

3.2.3. Offshore Wind Supply Chain Development

Offshore wind is not characterized as a completely new technology but rather as a diversification of onshore technology. Thus, the emergence of the offshore wind industry has been greatly influenced by existing onshore wind supply chain in a given region, favoring the industrial development of an offshore wind chain [19]. The industrial development of a supply chain in new markets can occur with the concentration of related companies and organizations in a certain region, forming clusters, especially in coastal regions close to areas with high wind potential. Some factors that can contribute to the formation of a cluster are (1) local factors, representing factors endogenous to the region, and (2) global factors [58].

Among the local factors that influence the formation of the supply chain, we find traditional and historical pre-conditions (existing industrial structures, existence of related industries), regional factors (natural resources, availability of labor, infrastructure, financial institutions, universities, etc.), anchor companies and entrepreneurs, local demand, and local and national policies. Considering global factors, the flow of knowledge and technology and the entry of multinationals and foreign investment stand out as significant [58,59].

The formation of a supply chain can benefit from the sharing of knowledge and resources from existing sectors that present synergies with the offshore wind supply chain related to local pre-conditions and regional factors [60,61]. Regional infrastructure assets are essential for the offshore wind supply chain. As technology develops, the installation and maintenance of offshore wind farms becomes one of the most significant supply chain challenges due to the large dimensions of the components, requiring companies to be located in areas close to the coast with adequate port infrastructure [19,59]. Hence, the need for existing infrastructure and the attraction of investment for the adaptation and strengthening of coastal and port infrastructure [60,62] is a key concern.

The creation of areas for the manufacturing and preparation of subcomponents and operation and maintenance bases is one of the strategies that can enable the development of the supply chain. This activity applies especially to first-tier suppliers, who supply components with large dimensions and, therefore, have significant logistical challenges. This requires them to locate nearby or inside a port with the necessary capabilities [62].

The attraction of first-layer companies also opens opportunities for the rest of the supply chain and enables competitive development. Major turbine manufacturers can also enter new markets through joint ventures, establishing subsidiaries, facilitating access to finance, discretionary concessions, tax exemptions, and other support from state governments or by acquiring a local company [60,62,63].

In order to establish a national industry, policies can be used to create a national market (demand), using different support mechanisms, which are potentially combined with direct and indirect local content requirements [64]. Another measure is to address flexibility resources, e.g., emerging power-to-x technologies, battery storages, and vehicle-to-grid installations, creating additional demand for the renewable energy electricity market [65].

Supply chain companies require a reliable and stable market in order to establish themselves in a region with long-term demand and initial financial support. Thus, the use of local and national policies to create a pipeline of projects and, consequently, a domestic market, is important to attract investors and establish companies in the supply chain [60].

Entrepreneurial activities can also promote the development of an industry in the region through two main processes: (1) through the formation of new local companies or transplantation of companies from elsewhere, or (2) through the entry of existing local companies into a new industrial sector (diversification) [66]. In the offshore wind sector, the most used mechanisms by the industry for path creation are transplantation, diversification, and the creation of indigenous paths [19,20].

The transplantation mechanism can encourage the entry of global suppliers to the region, which attracts other suppliers and contributes to the development of the supply chain [58]. The establishment of global or national companies in the region can be supported by local government [39] through discretionary concessions, tax exemptions, and by other support from state government [62]. According to the measures and strategies related to these factors, it is possible to enable the attraction of investment in a supply chain’s first layer, which consequently attracts opportunities for the rest of the chain and enables the development of the entire supply chain in a competitive way [60].

Measures for market attraction contribute to the development of offshore wind projects and the creation of demand by setting goals [41,62] and by the formation of a regulatory framework [20,39,41,49]. The provision of a support mechanism [60] is also a strategy to promote the formation of an offshore wind domestic market.

The establishment of goals [41,62], formation of a regulatory framework [20,39,41,49,67] and provision of a support mechanism [60] are significant measures to stimulate the domestic market.

The development of a pilot project can also promote the domestic market, allowing for the analysis and validation of the technical and economic feasibility of projects in the region, the gaining of experience for future projects [68], and even the validation of business technologies [69] and R&D [36].

The development of the supply chain can also be influenced by the establishment of local content requirements [20,70,71]. Through these requirements, it is possible to increase the attraction of foreign investment for the development of the local chain. However, the initially established local content must be sufficiently flexible to encourage industry [44] without increasing the LCoE [72], but it should gradually increase with the recognition of the benefits of local provision by developers and investors [73].

Additionally, the support of the local government contributes to the development of the supply chain [74]. Regions that have governmental support have a greater incentive to develop a domestic market with the establishment of developmental goals and objectives not only nationally but also at the state and municipal level, recognizing the local resources available at each level [75]. In addition, governmental support can be directly related to the establishment of the supply chain, promoting the formation of industrial parks in coastal regions with greater wind potential in order to encourage the formation of industrial districts/clusters and hence facilitating the reduction costs and overcoming logistical challenges [76].

In establishing public strategies and preparing development plans, the participation and involvement of stakeholders is crucial. Their participation makes it possible to ensure that industry views are considered, reducing challenges and thus enabling the development process [76].

Another critical factor in developing a supply chain is access to financial resources. The supply chain requires financial investment to develop its facilities and acquire equipment. Thus, it is important to improve accessibility to investments whether through government financing programs or foreign investment [60]. Providing investments and credit to support companies can act as support for establishing companies in the region, such as offering discretionary concessions, tax exemptions, and other support by state governments [62].

The increased legitimacy of technology also contributes to industrial development as it allows for increased confidence for investment in industry and public policies, such as subsidies [44]. The regional human asset is one of the factors that can attract companies to the region. In this sense, understanding the regional workforce skills as compared to those required by the sector is crucial. Hence, the creation of training and graduation programs can enable the development of the supply chain [62,67].

Finally, some other strategies were identified such as collaboration between states for the development of the regional supply chain; the creation of a team for the economic development of offshore wind; the creation of a specific task force; and support for research, including public/private partnerships for both offshore wind deployment and supply chain manufacturing and logistics. In addition, the mapping of the existing supply chain can determine business opportunities for the region [62] and exploit synergies with regional established industries.

3.3. Factors Involved in the Industrial Development of a New Sector

In order to identify factors for the industrial supply chain development of offshore wind energy, an LCA and SLR analysis was conducted. The identified factors and variables are listed in Table 1.

Table 1.

Factors involved in the industrial development of a new sector.

4. International Markets Case Study

The analysis of mature and emerging markets enabled the validation of the data collected in the literature and the gathering of new information pertaining to the offshore wind supply chain development process in new markets. The selected countries—China, United Kingdom, Germany, Denmark, United States and Taiwan—offered a comprehensive view of different stages of market maturity and approaches to offshore wind development and identification of global best practices.

Cross-Case Study

The identified factors from the case study are analyzed and synthesized in Table 2.

Table 2.

Cross-case study analysis.

Thus, some additional important policies for the development of offshore wind sector identified in the case study can be added to the analysis, namely, the creation and/or strengthening of industry organizations and associations; the creation of a national strategy; the attraction of top-level manufacturers; the establishment of priority areas for development of the supply chain; the establishment of strategic areas for the installation of offshore wind farms, the creation of business zones; support from development agencies; support from private companies; and the preparation of a regional development plan.

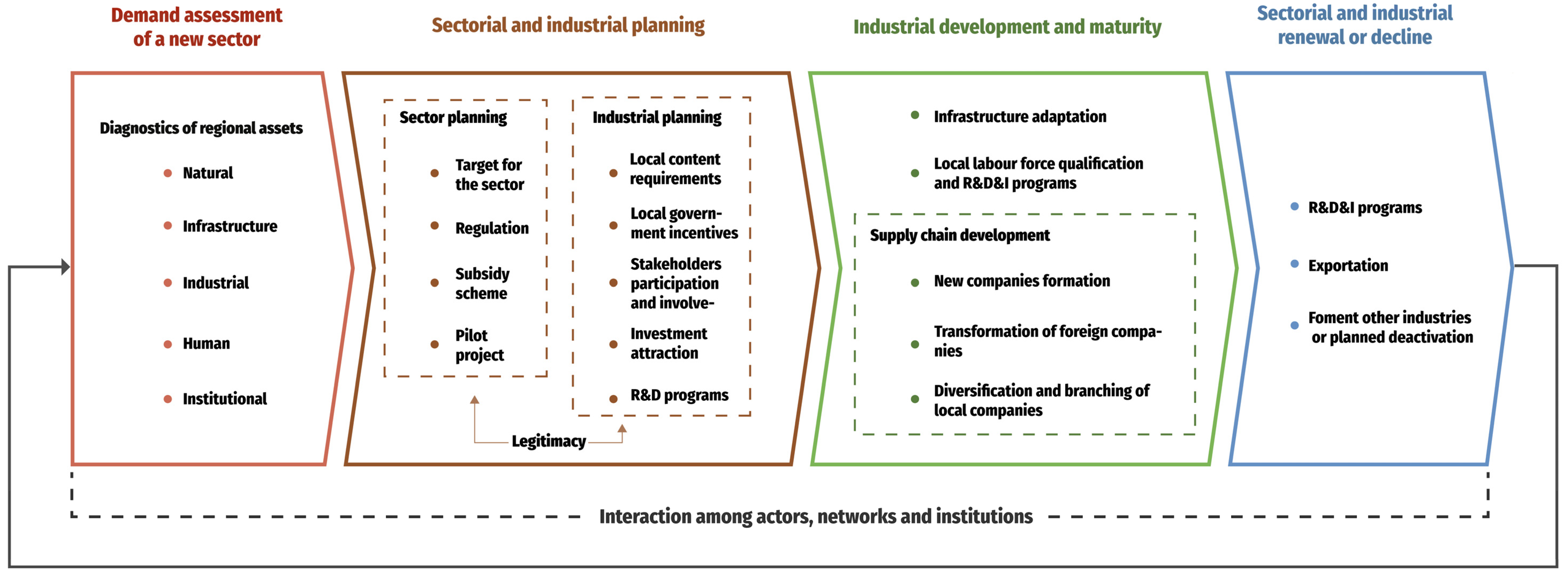

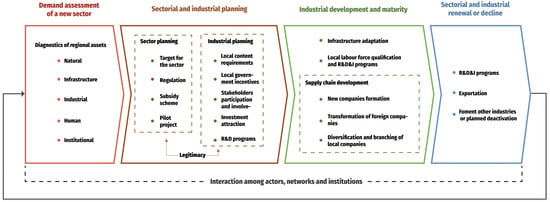

5. Framework for Industrial Development

The research results are synthesized into the framework proposed in this section and graphically represented in Figure 6. Considering the life cycle of the economic sector, the framework comprises four phases: (1) demand assessment of a new sector, (2) sectorial and industrial planning, (3) industrial development and maturity, and (4) sectorial and industrial renewal or decline.

Figure 6.

Framework for industrial development of the offshore wind sector in new markets.

Each phase brings together a group of policies for the industrial development of the sector for new markets. One policy is considered as transversal throughout the phases: the interaction between actors, networks, and institutions. The interaction between actors, networks, and institutions corresponds to the collaboration between companies; universities and research organizations; government agencies; industry and government associations; industry alliances; working groups; cluster organizations; and normative rules, regulations; and others. This interaction takes place throughout the process and can enable or restrict the environment for industry development [42].

Phase 1: Demand assessment of a new sector

This phase corresponds to the identification of opportunities in a region that can promote the development of a new industrial sector. The policy involved in this phase is the diagnosis of regional assets (Table 3).

Table 3.

Guidelines and policies in the identification of the need for the new sector.

The findings of this study unequivocally indicate that the diagnosis of available regional assets is a measure that will drive the sector’s development through the mapping and analysis of existing assets in the region in order to identify a need or opportunity. The main asset identified is the natural resource of the region’s offshore wind potential. In addition, other natural resources in the region can be included, such as raw material of use to the industrial sector (e.g., iron ore), making it an attractive resource for the supply chain [13,51,105] as indicated by Martin’s model [29]. The infrastructure asset classification also influences the industrial development required in order to meet any logistical challenges.

The existing infrastructure and local industrial base of companies such as those in the onshore wind, maritime, O&G, and shipbuilding sectors can be exploited by the offshore wind industry. From this perspective, the existence of sectors with synergy can also favor development, as seen in a BVG study which analyzes O&G synergies to offshore wind in the UK [48]. This allows the sharing of infrastructure, industrial (manufacture of components and maritime operations) human and institutional assets through knowledge spillovers [59,60,61] from qualified labor and competent institutions that are part of the supply chain of these previous local industries [55].

Phase 2: Sectoral and industrial planning

In the second phase, the framework distinguishes the policies according to two purposes, namely sector planning and industrial planning. As noted in the SLR, the industrial development of the offshore wind supply chain depends on the development of new projects, as companies need to have a project pipeline for their products or services over a period that enables their establishment in the region. This is demonstrated by the HM government strategy guide to undertaking leasing rounds in the UK in order to ensure a new pipeline of projects until 2030 [60].

In this context, several guidelines and policies were identified that contribute to the sector and its industrial planning. The sectoral planning guidelines and policies act on the industrial supply chain’s development indirectly, although the industrial planning guidelines and policies act directly on the development of the offshore wind supply chain (Table 4).

Table 4.

Guidelines and policies in the sectorial and industrial planning.

The sectoral planning to form a domestic market is important not only in order to attract and establish private companies in the regional supply chain but also encourage the investments of these companies in human resources, infrastructure and research [76]. Due to the high cost of technology, establishing a reliable and stable environment is crucial for investors in offshore wind projects. The creation of national targets for renewable energy, with focused offshore wind targets, has been shown to lead to a more reliable environment for attracting both project development and company installation investors to the region [19]. Furthermore, the promotion of flexible resources by governmental policy makers is recommended, as Eising et al. exemplify, e.g., emerging power-to-x technologies, battery storages, and vehicle-to-grid installations, creating additional demand for the renewable energy electricity market [65].

The establishment of a regulatory framework is another relevant guideline for the development of the industry enabling the approval of wind farm projects [20,39,49]. Including leasing area processes can contribute to creating a demand for projects as occurred in the UK, as highlighted in the UK’s industrial strategy [60].

Another contributing guideline is the provision of a subsidy scheme for projects. In new markets, offshore wind energy is still dependent on subsidies. Therefore, its development is linked to the establishment of a subsidy scheme by the government that works to reduce investment costs [49], providing greater political confidence for developers and investors [20,49]. Some of the most used subsidies are feed-in tariffs, feed-in premiums (as seen in the case of Denmark and Germany) [106], certificates such as the Renewable Obligation (RO), and CfD (in the case of the UK, where CfD was shown as a best practice for project pipeline development) [39,107,108].

Also, the establishment of a pilot may be an enabler guideline. A pilot project allows the analysis and validation of technical and economic feasibility of projects in the region, as well as the gain of experience for future projects [68], the validation of companies’ new technologies [69], and R&D [36]. As a result, pilot projects can contribute to the creation and strengthening of legitimacy.

The legitimacy factor acts as a transversal guideline in sectoral and industrial planning with direct influence on both the formation of the domestic market—influencing the establishment of new targets, the creation of a specific regulation, provision of subsidies—and the promotion of the supply chain—attracting investments directly for companies and government support [42,97,98]. This factor aligns with findings of Choma’c-Pierzecka, who reinforces the fact that new industry’s alignment with regulatory, normative, and cognitive institutions enables higher public acceptance and inhibition of skepticism [42].

Concerning the industrial planning, the establishment of local content requirements [20,70] and local government support are important policies to attract investors [74] as well as other strategies such as the establishment of targets at the state and municipal level [75]; the formation of industrial parks in coastal regions to encourage the formation of clusters [76]; and support for the establishment of private companies in the region [39] through discretionary concessions, tax exemptions and other support by state governments [62].

Strategies and plans for development for the supply chain should involve stakeholder consideration of the industrial sector requirements of government policies and, thus, enable supply chain emergence [76]. In addition, attraction of attraction is crucial for the supply chain development considering the significant financial investment required for companies to settle in a region [76]. In regions that do not have significant knowledge of technology, attracting investments from regions that have experience is the most used strategy for attracting direct foreign investment (FDI) [19]. The attraction of FDI allows market growth, the establishment of a competent cluster and, consequently, increases competitiveness [85].

Finally, the promotion of R&D programs is a guideline proposed for governmental authorities as it can help to qualify the local labor force [44] and promote the development of specific technologies [39], bringing innovation, cost reduction [44] and, consequently, attracting industrial development.

Phase 3: Industrial development and maturity

The third phase corresponds to guidelines and policies for the development and maturing of the sector (Table 5). In this phase, companies would establish themselves in the region, and the supply chain will be developed, over time, until it reaches its maturity.

Table 5.

Guidelines and policies for the industrial development and maturity.

The existing infrastructure in the region can enable industrial development, by providing an adequate infrastructure [57] or restrict it if the infrastructure is not adequate or available for use by the sector. Pollock and Mackinnon find that the availability of areas for the establishment of companies, equipment, vessels, port, road and rail infrastructure, and energy distribution can act as enablers for supply chain development [19,20].

However, if the infrastructure requires adaptations, financial support must be provided in order to ensure adequate infrastructure, considering the requirements of the sector, especially regarding the port infrastructure and the need to locate components close to their final destination [76,101].

In addition to specific infrastructure requirements, the offshore wind sector requires a highly skilled labor force. Thus, the availability of qualified labor with specific knowledge and expertise in the region promotes the attraction of investment [32], influencing its development. Local qualified labor can be used through labor mobility from other sectors [19], which is a result of the synergy observed in the first phase. However, if the existing local labor force does not have the necessary qualifications, this may restrict the development of the supply chain. In this case, the upskilling of the labor force is an important measure to ensure industrial development.

Furthermore, in this phase, the development of the supply chain will take place. The establishment of companies in the region should be promoted in order to increase supply capacity and help prevent bottlenecks. The industrial sector must develop in order to reach maturity and hence be able to provide good quality and reliable products and services at a competitive price for projects. An analysis of the supply chain at a national level could be undertaken in order to identify which parts still need to be developed [76].

The establishment of companies in the region can occur through the mechanisms of path creation observed in the literature, the transplantation of companies from other locations, such as international offshore wind services companies [13], and the diversification of local companies, such as the synergetic industries of onshore wind and offshore O&G [19,37].

Companies with synergy, as identified in Section 3, can act by diversifying into the offshore wind market. Onshore wind supply chain companies tend to diversify into the installation and commissioning chain, more specifically in the manufacture of components that have greater similarity, such as generators, some blades, and converters. In addition, second and third-tier suppliers of the onshore wind supply chain can supply sub-components and raw materials for the offshore supply chain.

The offshore O&G supply chain also stands out in terms of synergies, since it can contribute throughout the entire supply chain, especially in the installation, operation and maintenance, and decommissioning chains, due to its experience in maritime activities.

Phase 4: Sectorial and industrial renewal or decline

A mature offshore wind industry may reach a phase of renewal or sectoral and industrial decline. In order to avoid path exhaustion, some guidelines and policies are necessary according to Steen et al. [8] (Table 6).

Table 6.

Guidelines and policies in the sectorial and industrial renewal or decline.

Steen and Hansen emphasize the importance of the creation of research, development, and innovation programs for industry renewal, promoting innovations in the sector, whether in projects or in technologies for optimizing manufacturing and services. R&D&I incentives were found to generate industrial innovations such as green hydrogen technology [36].

Another opportunity of renewal for the mature regional supply chain is the exportation of components to nearby countries. Verhees et al. point out that exporting allows the expansion and creation of higher demand for projects or the use of companies’ existing unused capacity to supply nearby countries that do not have a mature supply chain [68].

The O&G sector, due to the variation in oil prices [109] and the impact of climate change on the planet, the fishing industry in the UK, and shipbuilding in Germany [19] are all examples of how an economic sector can go into decline. If the offshore wind sector goes into decline, it is necessary to carry out planning to deal with the use of this sector’s capacity, skills and knowledge in other sectors, whether new or existing [12,110], or for its planned deactivation.

6. Conclusions

Comparable to a product life cycle, an economic sector has its life cycle. Thus, it is crucial to consider this life cycle when making decisions related to the development of public policies and regulatory frameworks in countries with new markets. In the case of the offshore wind sector, many countries are initiating plans for its deployment guided by the United Nations’ Sustainable Development Goals.

Due to the characteristics of the offshore wind sector and its rapid technological development, the development of a local industrial supply chain benefits the development of the sector in new markets. While the existing literature outlines factors influencing the development of the offshore wind industry in specific regions, a significant gap remains in understanding the comprehensive process required for its successful implementation and growth. This study addresses that gap by providing a novel, structured process for offshore wind development in emerging markets.

Based on the systematic literature review and the international markets cross-case study, this paper proposes a framework for the industrial development process of the offshore wind supply chain in new markets. The model focuses on a process-based approach, which involves four phases: (1) demand assessment of a new sector, (2) sectoral and industrial planning, (3) industrial development and maturity, and (4) sectoral and industrial renewal or decline.

The proposed framework generates two main outcomes. Firstly, it provides a systemic view of a sector by detailing its life cycle; secondly, it outlines the key policies required at each phase. These contributions are directly applicable, offering a practical guide for regions aiming to develop their offshore wind sectors. Transitioning between phases depends on the maturity of information and policies within each stage, ensuring a tailored approach that does not necessitate constant reassessment.

The research findings reveal that most factors influencing industrial development are deeply interrelated and can be classified according to an industry’s life cycle. Regional opportunities can catalyze the emergence of a new industrial sector, utilizing natural resources, human capital, institutional support, infrastructure, and existing industries, all of which interact synergistically. The roles of industrial and sector planning are pivotal and can vary significantly depending on the region’s context and legitimacy. As the supply chain matures, infrastructure, human, innovation and supply chain investments can act as enablers to industry development. As observed in several established markets, proactive policies become essential to avoid stagnation and decline. Interaction between actors, networks, and institutions is observed to be highly related to the factors over the four phases.

The framework encompasses phases that are unique and therefore requires monitoring of the economic sector in each phase, enabling stakeholders to anticipate and implement actions that enhance competitiveness and optimize outcomes. This model offers critical insights for shaping public policies and guiding industrial development in new economic sectors as well as for companies exploring new markets, specifically in the offshore wind industry.

Each region presents distinctive characteristics that must be considered and analyzed by both the government and stakeholders involved in the industrial development process of a new economic sector. For future studies, we advocate targeted research that considers the specific attributes of each region for industrial development, considering the foundational phases outlined in the proposed framework. The analysis of the industrial development in mature markets is also recommended, since the identification of their good practices would serve as a reference for new markets.

Author Contributions

Conceptualization, M.G. and A.S.; methodology, M.G.; validation, M.G., A.S., D.J., N.A., R.V. and D.M.; formal analysis, M.G. and D.J.; research, M.G. and A.S.; data curation, A.S. and M.G.; writing—preparation of the original draft, M.G. and A.S.; writing—review and editing, D.J., N.A., R.V. and D.M.; supervision, D.J.; project administration, M.G. All authors have read and agreed to the published version of the manuscript.

Funding

This study was supported by Petrobras and the Federal University of Rio Grande do Norte (UFRN), through ANEEL’s R&D—Electric Sector (PD-00553-0045/2016); the Coordenação de Aperfeiçoamento de Pessoal de Nível Superior—Brasil (CAPES) —Finance Code 001; the Ministry of Science, Technology and Innovation (MCTI)/Secretariat for Technological Development and Innovation (SETEC)—TED nº 11355260; and to the government of the state of Rio Grande do Norte through SIN and SEDEC—agreement nº 002/2023.

Data Availability Statement

The original contributions presented in the study are included in the article; further inquiries can be directed to the corresponding author.

Conflicts of Interest

The authors declare no conflicts of interest.

References

- GWEC Global Wind Report; Global Wind Energy Council: Brussels, Belgium, 2023.

- Chomać-Pierzecka, E. Offshore Energy Development in Poland—Social and Economic Dimensions. Energies 2024, 17, 2068. [Google Scholar] [CrossRef]

- Andersen, P.H.; Drejer, I.; Gjerding, A.N. Branching and Path Development in the Wind Energy Industry. In Paper Prepared for 11th European Network on the Economics of the FIRM (ENEF) Meeting ‘The (co)Evolution of Firms and Industries: Theoretical Analyses and Empirical Contributions’; Manchester Institute of Innovation Research (MIOIR): Manchester, UK, 2014; Volume 26. [Google Scholar]

- Esteban, M.D.; Diez, J.J.; López, J.S.; Negro, V. Why Offshore Wind Energy? Renew. Energy 2011, 36, 444–450. [Google Scholar] [CrossRef]

- Markard, J.; Petersen, R. The Offshore Trend: Structural Changes in the Wind Power Sector. Energy Policy 2009, 37, 3545–3556. [Google Scholar] [CrossRef]

- Hosius, E.; Seebaß, J.V.; Wacker, B.; Schlüter, J.C. The Impact of Offshore Wind Energy on Northern European Wholesale Electricity Prices. Appl. Energy 2023, 341, 120910. [Google Scholar] [CrossRef]

- Cazzaro, D.; Trivella, A.; Corman, F.; Pisinger, D. Multi-Scale Optimization of the Design of Offshore Wind Farms. Appl. Energy 2022, 314, 118830. [Google Scholar] [CrossRef]

- Steen, M. Exploring the Complexities of Path Creation: Becoming the Next Exploring the Complexities of Path Creation. Ph.D. Thesis, Norwegian University of Science and Technology, Trondheim, Norway, 2016. [Google Scholar]

- González, M.O.A.; Santiso, A.M.; Melo, D.C.d.; Vasconcelos, R.M.d. Regulation for Offshore Wind Power Development in Brazil. Energy Policy 2020, 145, 111756. [Google Scholar] [CrossRef]

- World Bank. Going Global-Expanding Offshore Wind to Emerging Markets; World Bank: Washington, DC, USA, 2019. [Google Scholar]

- Vasconcelos, R.M.d.; Silva, L.L.C.; González, M.O.A.; Santiso, A.M.; de Melo, D.C. Environmental Licensing for Offshore Wind Farms: Guidelines and Policy Implications for New Markets. Energy Policy 2022, 171, 113248. [Google Scholar] [CrossRef]

- Neffke, F.; Henning, M.; Boschma, R. How Do Regions Diversify over Time? Industry Relatedness and the Development of New Growth Paths in Regions. Econ. Geogr. 2011, 87, 237–265. [Google Scholar] [CrossRef]

- Martin, R.; Sunley, P. Path Dependence and Regional Economic Evolution. J. Econ. Geogr. 2006, 6, 395–437. [Google Scholar] [CrossRef]

- Isaksen, A. Industrial Development in Thin Regions: Trapped in Path Extension? J. Econ. Geogr. 2014, 15, 585–600. [Google Scholar] [CrossRef]

- Giannoccaro, I. Adaptive Supply Chains in Industrial Districts: A Complexity Science Approach Focused on Learning. Int. J. Prod. Econ. 2015, 170, 576–589. [Google Scholar] [CrossRef]

- Dawley, S. Creating New Paths? Offshore Wind, Policy Activism, and Peripheral Region Development. Econ. Geogr. 2014, 90, 91–112. [Google Scholar] [CrossRef]

- Dawley, S.; MacKinnon, D.; Pollock, R. Creating Strategic Couplings in Global Production Networks: Regional Institutions and Lead Firm Investment in the Humber Region, UK. J. Econ. Geogr. 2019, 19, 853–872. [Google Scholar] [CrossRef]

- Espinoza, J.L.; Vredenburg, H. The Development of Renewable Energy Industries in Emerging Economies: The Role of Economic, Institutional, and Socio-Cultural Contexts in Latin America. Int. J. Econ. Bus. Res. 2010, 2, 245. [Google Scholar] [CrossRef]

- MacKinnon, D.; Dawley, S.; Steen, M.; Menzel, M.P.; Karlsen, A.; Sommer, P.; Hansen, G.H.; Normann, H.E. Path Creation, Global Production Networks and Regional Development: A Comparative International Analysis of the Offshore Wind Sector. Prog. Plann. 2019, 130, 1–32. [Google Scholar] [CrossRef]

- Pollock, R. Creating Regional Industries: Path Creation and Offshore Wind in the U.K. Ph.D. Thesis, Newcastle University, Newcastle, UK, 2019. [Google Scholar]

- González, M.O.A.; Toledo, J.C.d. A Customer integration in the product development process: A systematic bibliographic review and themes for research. Prod. Uma Publicação Assoc. Bras. Eng. Prod. 2012, 22, 14–26. [Google Scholar]

- GREEN, S.O. A Record Year: Wind and Solar Supplied More than Half of Denmark’s Electricity in 2020. Available online: https://stateofgreen.com/en/partners/state-of-green/news/a-record-year-wind-and-solar-supplied-more-than-half-of-denmarks-electricity-in-2020/ (accessed on 3 July 2024).

- DWIA—Danish Wind Industry Association. Profile of the Danish wind Industry: Denmark—Wind Energy Hub; 2014; 32p, Available online: https://greenpowerdenmark.dk/files/media/winddenmark.dk/document/Profile_of_the_Danish_Wind_Industry.pdf (accessed on 14 August 2024).

- GWEC Global Offshore Wind Report 2024; Global Wind Energy Council: Brussels, Belgium, 2024; pp. 86–88.

- IRENA. Future of Wind: Deployment, Investment, Technology, Grid Integration and Socio-Economic Aspects; IRENA: Masdar City, United Arab Emirates, 2019; ISBN 9789292601553. [Google Scholar]

- Metal Industry Intelligence. The Supply Chain Study of Offshore Wind Industry in Taiwan. 2022. Available online: https://www.bcctaipei.com/sites/default/files/2022-03/Taiwan%20Offshore%20Wind%20Supply%20Chain%20Report%200322.pdf (accessed on 6 July 2024).

- WFW Offshore Wind Fact Sheet Taiwan; Watson Farley & Williams: HongKong, China, 2019.

- Martin, R.; Sunley, P. The Place of Path Dependence in an Evolutionary Perspective on the Economic Landscape. Handb. Evol. Econ. Geogr. 2010, 62–92. [Google Scholar] [CrossRef]

- Martin, R. Rethinking Regional Path Dependence: Beyond Lock-in to Evolution. Econ. Geogr. 2010, 86, 1–27. [Google Scholar] [CrossRef]

- Steen, M.; Karlsen, A. Path Creation in a Single-Industry Town: The Case of Verdal and Windcluster Mid-Norway. Nor. Geogr. Tidsskr. 2014, 68, 133–143. [Google Scholar] [CrossRef]

- Hanson, J.; Steen, M.; Weaver, T.; Normann, H.E.; Hansen, G.H. Path Creation through Branching and Transfer of Complementary Resources: The Role of Established Industries for New Renewable Energy Technologies; University of Oslo: Oslo, Norway, 2016. [Google Scholar]

- Wolfe, D.A.; Gertler, M.S. Local Antecedents and Trigger Events: Policy Implications of Path Dependence for Cluster Formation. In Cluster Genesis: Technology-Based Industrial Development; Braunerhjelm, P., Feldman, M., Eds.; Oxford University Press: Oxford, UK, 2006; pp. 243–263. ISBN 9780191708886. [Google Scholar]

- Boschma, R.; Frenken, K. Some Notes on Institutions in Evolutionary Economic Geography. Econ. Geogr. 2009, 85, 151–158. [Google Scholar] [CrossRef]

- Trippl, M.; Baumgartinger-Seiringer, S.; Frangenheim, A.; Isaksen, A.; Rypestøl, J.O. Unravelling Green Regional Industrial Path Development: Regional Preconditions, Asset Modification and Agency. Geoforum 2020, 111, 189–197. [Google Scholar] [CrossRef]

- Simmie, J. Path Dependence and New Technological Path Creation in the Danish Wind Power Industry. Eur. Plan. Stud. 2012, 20, 753–772. [Google Scholar] [CrossRef]

- Steen, M.; Hansen, G.H. Barriers to Path Creation: The Case of Offshore Wind Power in Norway. Econ. Geogr. 2018, 94, 188–210. [Google Scholar] [CrossRef]

- Boschma, R.; Frenken, K. Technological Relatedness and Regional Branching. In Dynamic Geographies of Knowledge Creation and Innovation; Routledge: London, UK, 2009. [Google Scholar]

- Andersen, P.H.; Drejer, I.; Gjerding, A.N. Offshore Vindindustri i Danmark Organisering og Udvikling af et Spirende Forretningssystem; Vindmølleindustrien: Copenhagen, Denmark, 2014; pp. 1–76. [Google Scholar]

- Essletzbichler, J. Renewable Energy Technology and Path Creation: A Multi-Scalar Approach to Energy Transition in the UK. Eur. Plan. Stud. 2012, 20, 791–816. [Google Scholar] [CrossRef]

- Hekkert, M.P.; Suurs, R.A.A.; Negro, S.O.; Kuhlmann, S.; Smits, R.E.H.M. Functions of Innovation Systems: A New Approach for Analysing Technological Change. Technol. Forecast. Soc. Chang. 2007, 74, 413–432. [Google Scholar] [CrossRef]

- Bergek, A.; Jacobsson, S.; Carlsson, B.; Lindmark, S.; Rickne, A. Analyzing the Functional Dynamics of Technological Innovation Systems: A Scheme of Analysis. Res. Policy 2008, 37, 407–429. [Google Scholar] [CrossRef]

- Binz, C.; Truffer, B.; Coenen, L. Path Creation as a Process of Resource Alignment and Anchoring: Industry Formation for on-Site Water Recycling in Beijing. Econ. Geogr. 2016, 92, 172–200. [Google Scholar] [CrossRef]

- Steen, M. Reconsidering Path Creation in Economic Geography: Aspects of Agency, Temporality and Methods. Eur. Plan. Stud. 2016, 24, 1605–1622. [Google Scholar] [CrossRef]

- van der Loos, H.Z.A.; Negro, S.O.; Hekkert, M.P. International Markets and Technological Innovation Systems: The Case of Offshore Wind. Environ. Innov. Soc. Transit. 2020, 34, 121–138. [Google Scholar] [CrossRef]

- Brekke, T. Entrepreneurship and Path Dependency in Regional Development. Entrep. Reg. Dev. 2015, 27, 202–218. [Google Scholar] [CrossRef]

- Johnsen, T.E.; Mikkelsen, O.S.; Wong, C.Y. Strategies for Complex Supply Networks: Findings from the Offshore Wind Power Industry. Supply Chain. Manag. 2019, 24, 872–886. [Google Scholar] [CrossRef]

- Poulsen, T.; Lema, R. Is the Supply Chain Ready for the Green Transformation? The Case of Offshore Wind Logistics. Renew. Sustain. Energy Rev. 2017, 73, 758–771. [Google Scholar] [CrossRef]

- BVG Associates. Oil and Gas ‘Seize the Opportunity’ Guides: Offshore Wind; BVG Associates: Cricklade, UK, 2016. [Google Scholar]

- Karlsen, A. Framing Industrialization of the Offshore Wind Value Chain—A Discourse Approach to an Event. Geoforum 2018, 88, 148–156. [Google Scholar] [CrossRef]

- Ingstrup, M.B.; Menzel, M. The Emergence of Relatedness between Industries: The Example of Offshore Oil and Gas and Offshore Wind Energy in Esbjerg, Denmark. Pap. Evol. Econ. Geogr. 2019. Available online: http://econ.geo.uu.nl/peeg/peeg1929.pdf (accessed on 6 July 2024).

- Wüstemeyer, C.; Madlener, R.; Bunn, D.W. A Stakeholder Analysis of Divergent Supply-Chain Trends for the European Onshore and Offshore Wind Installations. Energy Policy 2015, 80, 36–44. [Google Scholar] [CrossRef]

- Korsnes, M. A Sustainable Chinese Catch-Up? Int. J. Technol. Learn. Innov. Dev. 2016, 8, 172–196. [Google Scholar] [CrossRef]

- Andersen, P.D.; Clausen, N.E.; Cronin, T.; Piirainen, K.A. The North Sea Offshore Wind Service Industry: Status, Perspectives and a Joint Action Plan. Renew. Sustain. Energy Rev. 2018, 81, 2672–2683. [Google Scholar] [CrossRef]

- Olesen, T. Offshore Supply Industry Dynamics: The Main Drivers in the Energy Sector and the Value Chain; CBS Maritime: Frederiksberg, Denmark, 2015; ISBN 978-87-93262-02-7. [Google Scholar]

- Mäkitie, T.; Andersen, A.D.; Hanson, J.; Normann, H.E.; Thune, T.M. Established Sectors Expediting Clean Technology Industries? The Norwegian Oil and Gas Sector’s Influence on Offshore Wind Power. J. Clean. Prod. 2018, 177, 813–823. [Google Scholar] [CrossRef]

- Roberts, A.; Blanch, M.; Weston, J.; Valpy, B. UK Offshore Wind Supply Chain: Capabilities and Opportunities; BVG Associates: Cricklade, UK, 2014. [Google Scholar]

- Fornahl, D.; Hassink, R.; Klaerding, C.; Mossig, I.; Schröder, H. From the Old Path of Shipbuilding onto the New Path of Offshore Wind Energy? The Case of Northern Germany. Eur. Plan. Stud. 2012, 20, 835–855. [Google Scholar] [CrossRef]

- Elola, A.; Valdaliso, J.M.; López, S.M.; Aranguren, M.J. Cluster Life Cycles, Path Dependency and Regional Economic Development: Insights from a Meta-Study on Basque Clusters. Eur. Plan. Stud. 2012, 20, 257–279. [Google Scholar] [CrossRef]

- Csereklyei, Z.; Thurner, P.W.; Langer, J.; Küchenhoff, H. Energy Paths in the European Union: A Model-Based Clustering Approach. Energy Econ. 2017, 65, 442–457. [Google Scholar] [CrossRef]

- HM Government. Industrial Strategy; HM Government: London, UK, 2019. [Google Scholar]

- Ding, J.; Liu, B.; Shao, X. Spatial Effects of Industrial Synergistic Agglomeration and Regional Green Development Efficiency: Evidence from China. Energy Econ. 2022, 112, 106156. [Google Scholar] [CrossRef]

- BVG Associates. Building North Carolina’s Offshore Wind Supply Chain; BVG Associates: Cricklade, UK, 2021. [Google Scholar]

- Lacal-Arántegui, R. Globalization in the Wind Energy Industry: Contribution and Economic Impact of European Companies. Renew. Energy 2019, 134, 612–628. [Google Scholar] [CrossRef]

- O’Sullivan, M. Industrial Life Cycle: Relevance of National Markets in the Development of New Industries for Energy Technologies—the Case of Wind Energy. J. Evol. Econ. 2020, 30, 1063–1107. [Google Scholar] [CrossRef]

- Eising, M.; Hobbie, H.; Möst, D. Future Wind and Solar Power Market Values in Germany—Evidence of Spatial and Technological Dependencies? Energy Econ. 2020, 86, 104638. [Google Scholar] [CrossRef]

- Isaksen, A.; Jakobsen, S.E. New Path Development between Innovation Systems and Individual Actors. Eur. Plan. Stud. 2017, 25, 355–370. [Google Scholar] [CrossRef]

- Moktadir, M.A.; Ali, S.M.; Jabbour, C.J.C.; Paul, A.; Ahmed, S.; Sultana, R.; Rahman, T. Key Factors for Energy-Efficient Supply Chains: Implications for Energy Policy in Emerging Economies. Energy 2019, 189, 116129. [Google Scholar] [CrossRef]

- Verhees, B.; Raven, R.; Kern, F.; Smith, A. The Role of Policy in Shielding, Nurturing and Enabling Offshore Wind in The Netherlands (1973–2013). Renew. Sustain. Energy Rev. 2015, 47, 816–829. [Google Scholar] [CrossRef]

- Hodnungseth, H.A. Knowledge Transfer between Industries How to Transfer Offshore Experiences to the Offshore Wind Industry within the Norwegian Sector? Master’s Thesis, University of Agder, Kristiansand, Norway, 2011. [Google Scholar]

- Graziano, M.; Lecca, P.; Musso, M. Historic Paths and Future Expectations: The Macroeconomic Impacts of the Offshore Wind Technologies in the UK. Energy Policy 2017, 108, 715–730. [Google Scholar] [CrossRef]

- Allan, G.; Comerford, D.; Connolly, K.; McGregor, P.; Ross, A.G. The Economic and Environmental Impacts of UK Offshore Wind Development: The Importance of Local Content. Energy 2020, 199, 117436. [Google Scholar] [CrossRef]

- Jansen, L.E. The Exportability of the Dutch Offshore Wind Industry: A Case Study of Taiwan. Master’s Thesis, University do Porto, Porto, Portugal, 2019. [Google Scholar]

- Moldvay, J.; Hamann, R.; Fay, J. Assessing Opportunities and Constraints Related to Different Models for Supplying Wind Turbines to the South African Wind Energy Industry. Dev. South. Afr. 2013, 30, 315–331. [Google Scholar] [CrossRef]

- Fan, X.C.; Wang, W.Q. Spatial Patterns and Influencing Factors of China’s Wind Turbine Manufacturing Industry: A Review. Renew. Sustain. Energy Rev. 2016, 54, 482–496. [Google Scholar] [CrossRef]

- Zhang, Q. The Current State, Problems and Development Strategies of the Wind Power Industry in the Three Northeast Provinces of China. In Proceedings of the 2010 World Non-Grid-Connected Wind Power and Energy Conference, Nanjing, China, 5–7 November 2010; pp. 19–23. [Google Scholar] [CrossRef]

- HM Government. Offshore Wind Industrial Strategy Business and Government Action; HM Government: London, UK, 2013; pp. 1–77. [Google Scholar]

- Jolly, S.; Steen, M.; Hansen, T.; Afewerki, S. Renewable Energy and Industrial Development in Pioneering and Lagging Regions: The Offshore Wind Industry in Southern Denmark and Normandy. Oxf. Open Energy 2023, 2, oiad010. [Google Scholar] [CrossRef]

- Jolly, S.; Steen, M.; Hansen, T.; Afewerki, S. Regional Industrial Path Development, Multi-Level Policy Mixes, and Renewable Energy Deployment: Offshore Wind Energy Development in Syddanmark (Denmark) and Normandy (France). In Proceedings of the 5th Geography of Innovation Conference 2020 Stavanger, Stavanger, Norway, 29–31 January 2020. [Google Scholar]

- Winkler, L.; Kilic, O.; Veldman, J. Collaboration in the Offshore Wind Farm Decommissioning Supply Chain. Renew. Sustain. Energy Rev. 2022, 167, 112797. [Google Scholar] [CrossRef]

- Renewable UK. The Crown Estate. Building an Industry; BVG Associates: London, UK, 2013; pp. 1–15. [Google Scholar]

- Langkilde, L.; Kornum, L.F.; Bruun, M.; Rasmussen, S. Økosystemet i Offshore Klyngen i Region Syddanmark; University of Southern Denmark: Odense, Denmark, 2015. [Google Scholar]

- Schulte, L. Industrial Policy, Skill Formation, and Job Quality in the Danish, German and English Offshore Wind Turbine Industries. Ph.D. Thesis, University of Greenwich, London, UK, 2016. [Google Scholar]

- Buen, J. Danish and Norwegian Wind Industry: The Relationship between Policy Instruments, Innovation and Diffusion. Energy Policy 2006, 34, 3887–3897. [Google Scholar] [CrossRef]

- Nielsen, V. The Danish Wind Cluster; Harvard University: Cambridge, MA, USA, 2017. [Google Scholar]

- Lema, R.; Urban, F.; Nordensvard, J.; Lütkenhorst, W. Innovation Paths in Wind Power: Insights from Denmark and Germany; German Development Institute: Bonn, Germany, 2014; ISBN 9783889856371. [Google Scholar]

- Dawley, S.; Mackinnon, D.; Cumbers, A.; Pike, A. Policy Activism and Regional Path Creation: The Promotion of Offshore Wind in North East England and Scotland. Camb. J. Reg. Econ. Soc. 2015, 8, 257–272. [Google Scholar] [CrossRef]

- Chen, J.; Yu, T.H.K.; Chou, S.Y.; Nguyen, T.A.T. Simulating the Effects of Offshore Wind Energy Policy on Decarbonization and Industrial Growth in Taiwan: A System Dynamics Approach. Energy Sustain. Dev. 2022, 71, 490–504. [Google Scholar] [CrossRef]

- Xu, Y.; Yang, K.; Zhao, G. The Influencing Factors and Hierarchical Relationships of Offshore Wind Power Industry in China. Environ. Sci. Pollut. Res. 2021, 28, 52329–52344. [Google Scholar] [CrossRef]

- Chen, J.; Mao, B.; Wu, Y.; Zhang, D.; Wei, Y.; Yu, A.; Peng, L. Green Development Strategy of Offshore Wind Farm in China Guided by Life Cycle Assessment. Resour. Conserv. Recycl. 2023, 188, 106652. [Google Scholar] [CrossRef]

- NEA; World Bank. China: Meeting the Challenges of Offshore and Large-Scale Wind Power: Regulatory Review of Offshore Wind in Five European Countries; National Energy Administration of China: Beijing, China; World Bank: Washington, DC, USA, 2010. [Google Scholar]

- Carpenter, J.; Simmie, J.; Conti, E. Innovation and New Path Creation: The Role of Niche Environments in the Development of Wind Power Industry in Germany and the UK. Eur. Spat. Res. Policy 2012, 19, 39–41. [Google Scholar] [CrossRef]

- He, Z.X.; Xu, S.C.; Shen, W.X.; Zhang, H.; Long, R.Y.; Yang, H.; Chen, H. Review of Factors Affecting China’s Offshore Wind Power Industry. Renew. Sustain. Energy Rev. 2016, 56, 1372–1386. [Google Scholar] [CrossRef]

- van der Loos, A.; Langeveld, R.; Hekkert, M.; Negro, S.; Truffer, B. Developing Local Industries and Global Value Chains: The Case of Offshore Wind. Technol. Forecast. Soc. Chang. 2022, 174, 121248. [Google Scholar] [CrossRef]

- Alexandersen, P. Nyt Eksportpartnerskab Skal Styrke Vindvirksomheder. Available online: https://www.energyexport.dk/app/uploads/2021/03/Pressemeddelelse-25.03.21.pdf (accessed on 15 July 2024).

- Balanda, K.; Ariatti, A.; Monaghan, L.; Dissegna, C. The Role of the Local Supply Chain in the Development of Floating Offshore Wind Power. IOP Conf. Ser. Earth Environ. Sci. 2022, 1073, 012010. [Google Scholar] [CrossRef]

- BMWi. The Energy Transition—A Great Piece of Work Offshore Wind Energy An Overview of Activities in Germany; Federal Ministry for Economic Affairs and Energy (BMWi) Public Relations: Berlin, Germany, 2015. [Google Scholar]

- Gosens, J.; Lu, Y. Prospects for Global Market Expansion of China’s Wind Turbine Manufacturing Industry. Energy Policy 2014, 67, 301–318. [Google Scholar] [CrossRef]

- Reichardt, K.; Negro, S.O.; Rogge, K.S.; Hekkert, M.P. Analyzing Interdependencies between Policy Mixes and Technological Innovation Systems: The Case of Offshore Wind in Germany. Technol. Forecast. Soc. Chang. 2016, 106, 11–21. [Google Scholar] [CrossRef]

- Espinoza, J.L.; Vredenburg, H. Towards a Model of Wind Energy Industry Development in Industrial and Emerging Economies. Glob. Bus. Econ. Rev. 2010, 12, 203–229. [Google Scholar] [CrossRef]

- Dhingra, T.; Sengar, A.; Sajith, S. A Fuzzy Analytic Hierarchy Process-Based Analysis for Prioritization of Barriers to Offshore Wind Energy. J. Clean. Prod. 2022, 345, 131111. [Google Scholar] [CrossRef]

- Athanasia, A.; Anne-Bénédicte, G.; Jacopo, M. The Offshore Wind Market Deployment: Forecasts for 2020, 2030 and Impacts on the European Supply Chain Development. Energy Procedia 2012, 24, 2–10. [Google Scholar] [CrossRef]

- Shields, M.; Marsh, R.; Stefek, J.; Oteri, F.; Gould, R.; Rouxel, N.; Diaz, K.; Molinero, J.; Moser, A.; Malvik, C.; et al. The Demand for a Domestic Offshore Wind Energy Supply Chain DNV 3 The Business Network for Offshore Wind; National Renewable Energy Lab. (NREL): Golden, CO, USA, 2022. [Google Scholar]

- Kenzhegaliyeva, A. New Winds, New Rules: Standards in the German Offshore Wind Market and Their Influence on Norwegian Companies from the Foundations-Related Segment of the Value Chain. Master’s Thesis, Norwegian University of Science and Technology, Trondheim, Norway, 2017. [Google Scholar]

- Wellbrock, D.-G.J. Actors, Institutions and Innovation Processes in New Path Creation The Regional Emergence and Evolution of Wind Energy Technology in Germany. Ph.D. Thesis, Gottfried Wilhelm Leibniz Universität, Hannover, Germany, 2021. [Google Scholar]

- Van Impe, E. Offshore Wind Energy in Europe: A Cluster Perspective, Universiteit Gent Faculteit. Master’s Thesis, University of Ghent, Gent, Belgium, 2013. [Google Scholar]

- Neill, S.P.; Hashemi, M.R. Offshore Wind. Fundam. Ocean. Renew. Energy 2018, 83–106. [Google Scholar] [CrossRef]

- Nguyen, T.A.T.; Chou, S.-Y. Impact of Government Subsidies on Economic Feasibility of Offshore Wind System: Implications for Taiwan Energy Policies. Appl. Energy 2018, 217, 336–345. [Google Scholar] [CrossRef]

- Kell, N.P.; van der Weijde, A.H.; Li, L.; Santibanez-Borda, E.; Pillai, A.C. Simulating Offshore Wind Contract for Difference Auctions to Prepare Bid Strategies. Appl. Energy 2023, 334, 120645. [Google Scholar] [CrossRef]

- Hansen, G.H.; Steen, M. Offshore Oil and Gas Firms’ Involvement in Offshore Wind: Technological Frames and Undercurrents. Environ. Innov. Soc. Transit. 2015, 17, 1–14. [Google Scholar] [CrossRef]

- van der Loos, A.; Normann, H.E.; Hanson, J.; Hekkert, M.P. The Co-Evolution of Innovation Systems and Context: Offshore Wind in Norway and the Netherlands. Renew. Sustain. Energy Rev. 2021, 138, 110513. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).