A Review of Renewable Energy Investment in Belt and Road Initiative Countries: A Bibliometric Analysis Perspective

Abstract

1. Introduction

2. Materials and Methods

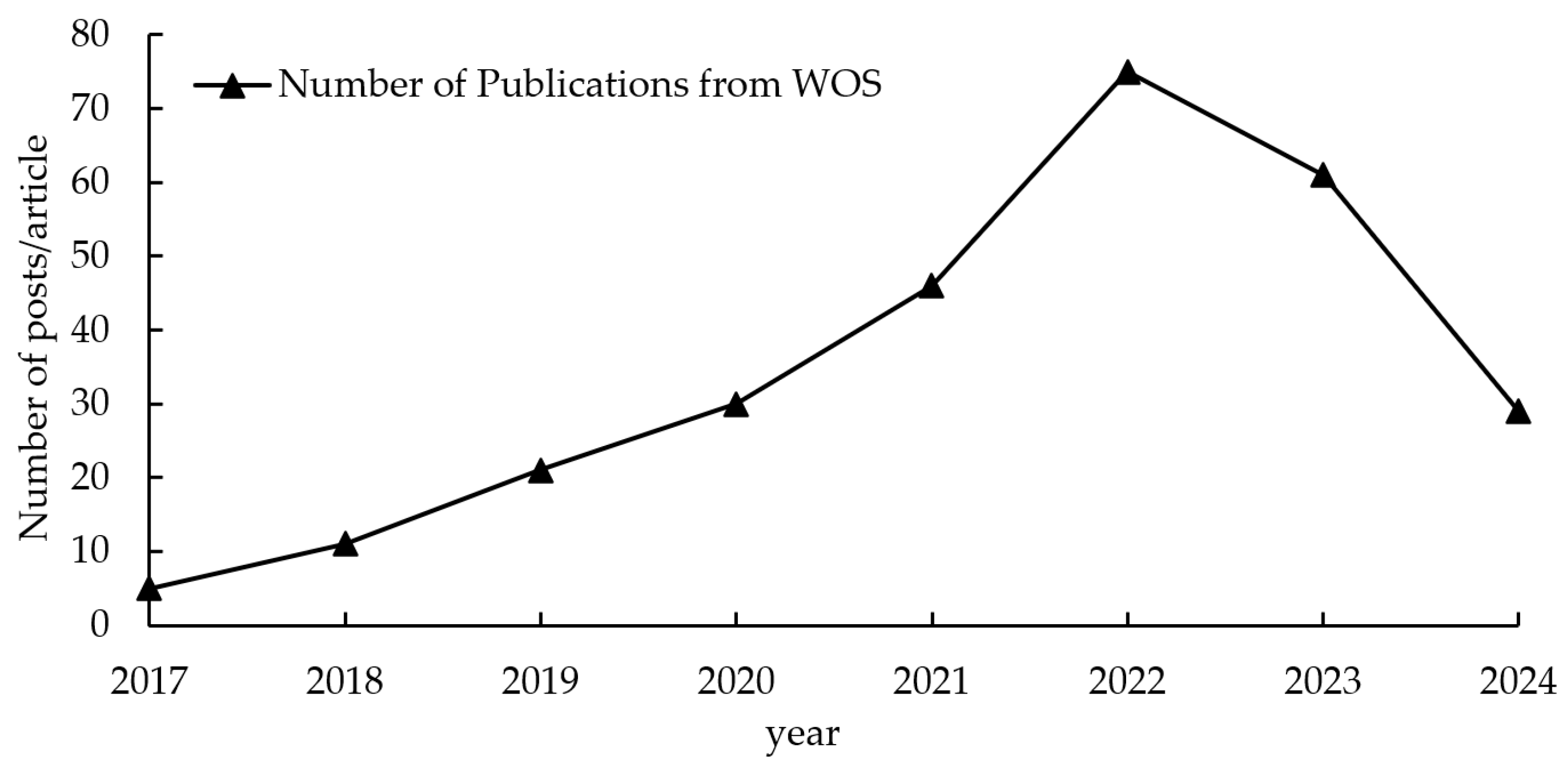

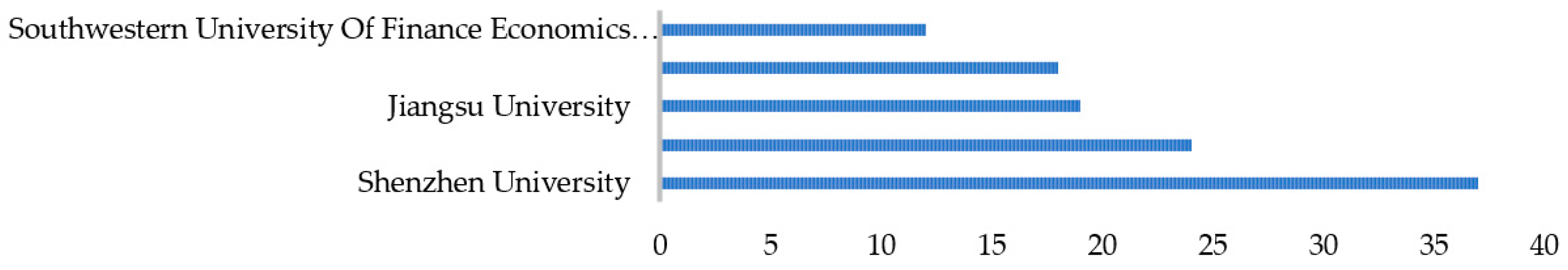

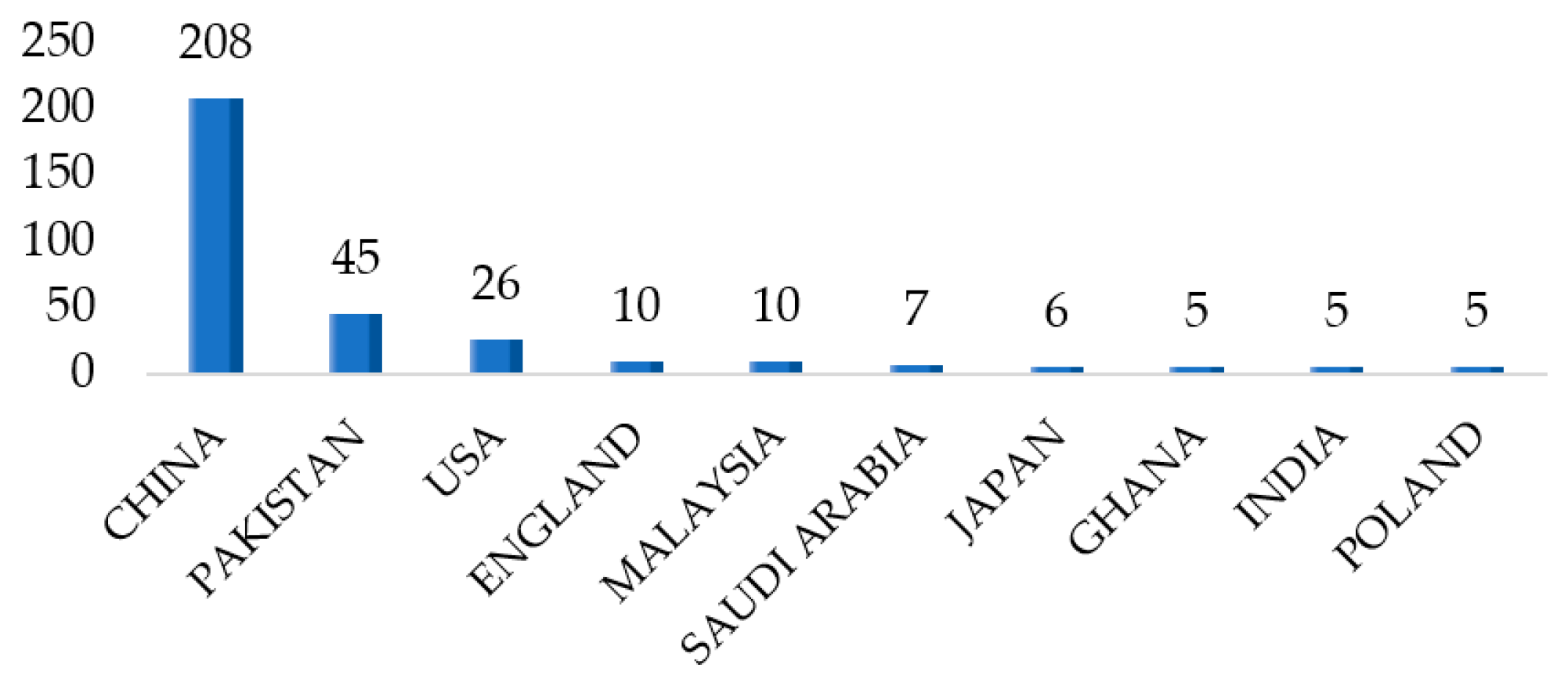

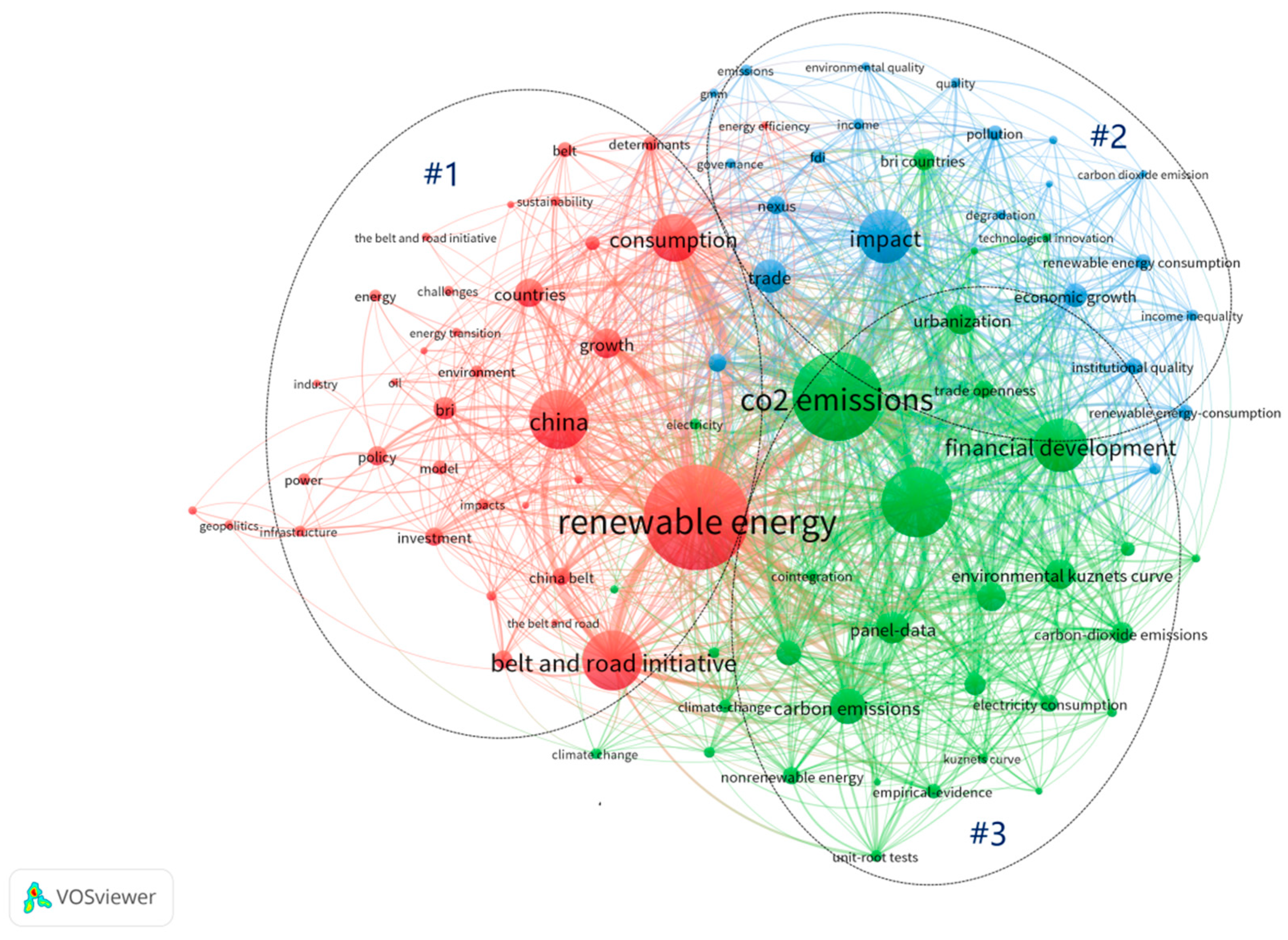

3. Results

4. Discussion

5. Conclusions

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Hussain, J.; Zhou, K.; Muhammad, F.; Khan, D.; Khan, A.; Ali, N.; Akhtar, R. Renewable Energy Investment and Governance in Countries along the Belt & Road Initiative: Does Trade Openness Matter? Renew. Energy 2021, 180, 1278–1289. [Google Scholar] [CrossRef]

- Reuter, W.H.; Szolgayová, J.; Fuss, S.; Obersteiner, M. Renewable Energy Investment: Policy and Market Impacts. Appl. Energy 2012, 97, 249–254. [Google Scholar] [CrossRef]

- Hashemizadeh, A.; Ju, Y.; Bamakan, S.M.; Le, H.P. Renewable Energy Investment Risk Assessment in Belt and Road Initiative Countries under Uncertainty Conditions. Energy 2021, 214, 118923. [Google Scholar] [CrossRef]

- Li, R.; Xu, L.; Hui, J.; Cai, W.; Zhang, S. China’s Investments in Renewable Energy through the Belt and Road Initiative Stimulated Local Economy and Employment: A Case Study of Pakistan. Sci. Total Environ. 2022, 835, 155308. [Google Scholar] [CrossRef] [PubMed]

- Cheng, S.; Wang, B. Impact of the Belt and Road Initiative on China’s Overseas Renewable Energy Development Finance: Effects and Features. Renew. Energy 2023, 206, 1036–1048. [Google Scholar] [CrossRef]

- Zhang, D.; Mohsin, M.; Rasheed, A.; Chang, Y.; Taghizadeh-Hesary, F. Public Spending and Green Economic Growth in BRI Region: Mediating Role of Green Finance. Energy Policy 2021, 153, 112256. [Google Scholar] [CrossRef]

- Liu, Y.; Hao, Y. The Dynamic Links between CO2 Emissions, Energy Consumption, and Economic Development in the Countries along “the Belt and Road”. Sci. Total Environ. 2018, 645, 674–683. [Google Scholar] [CrossRef] [PubMed]

- Rauf, A.; Liu, X.; Amin, W.; Ozturk, I.; Rehman, O.U.; Hafeez, M. Testing EKC Hypothesis with Energy and Sustainable Development Challenges: A Fresh Evidence from Belt and Road Initiative Economies. Environ. Sci. Pollut. Res. 2018, 25, 32066–32080. [Google Scholar] [CrossRef] [PubMed]

- Abbas, Q.; Nurunnabi, M.; Alfakhri, Y.; Khan, W.; Hussain, A.; Iqbal, W. The Role of Fixed Capital Formation, Renewable and Non-Renewable Energy in Economic Growth and Carbon Emission: A Case Study of Belt and Road Initiative Project. Environ. Sci. Pollut. Res. 2020, 27, 45476–45486. [Google Scholar] [CrossRef] [PubMed]

- Khan, A.; Chenggang, Y.; Hussain, J.; Kui, Z. Impact of Technological Innovation, Financial Development and Foreign Direct Investment on Renewable Energy, Non-renewable Energy and the Environment in Belt & Road Initiative Countries. Renew. Energy 2021, 171, 479–491. [Google Scholar] [CrossRef]

- Muhammad, S.; Long, X. Rule of Law and CO2 Emissions: A Comparative Analysis across 65 Belt and Road Initiative(BRI) Countries. J. Clean. Prod. 2021, 279, 123539. [Google Scholar] [CrossRef]

- An, H.; Razzaq, A.; Haseeb, M.; Mihardjo, L.W.W. The Role of Technology Innovation and People’s Connectivity in Testing Environmental Kuznets Curve and Pollution Heaven Hypotheses across the Belt and Road Host Countries: New Evidence from Method of Moments Quantile Regression. Environ. Sci. Pollut. Res. 2021, 28, 5254–5270. [Google Scholar] [CrossRef] [PubMed]

- Khan, A.; Chenggang, Y.; Hussain, J.; Bano, S.; Nawaz, A. Natural Resources, Tourism Development, and Energy-Growth-CO2 Emission Nexus: A Simultaneity Modeling Analysis of BRI Countries. Resour. Policy 2020, 68, 101751. [Google Scholar] [CrossRef]

- An, H.; Razzaq, A.; Nawaz, A.; Noman, S.M.; Khan, S.A.R. Nexus between Green Logistic Operations and Triple Bottom Line: Evidence from Infrastructure-Led Chinese Outward Foreign Direct Investment in Belt and Road Host Countries. Environ. Sci. Pollut. Res. 2021, 28, 51022–51045. [Google Scholar] [CrossRef] [PubMed]

- Tu, C.A.; Chien, F.; Hussein, M.A.; Mm, Y.R.; Psi, M.S.S.; Iqbal, S.; Bilal, A.R. Estimating role of green financing on energy security, economic and environmental integration of bri member countries. Singap. Econ. Rev. 2021, 66, 1–9. [Google Scholar] [CrossRef]

- Wu, G.; Cui, S.; Wang, Z. The Role of Renewable Energy Investment and Energy Resource Endowment in the Evolution of Carbon Emission Efficiency: Spatial Effect and the Mediating Effect. Environ. Sci. Pollut. Res. 2023, 30, 84563–84582. [Google Scholar] [CrossRef] [PubMed]

- Zhang, N.; Farooq, M.U.; Zhang, X. Studying Green Financing with Economic Development in BRI Countries Perspective: Does Public-Private Investment Matter? Environ. Sci. Pollut. Res. 2023, 30, 29336–29348. [Google Scholar] [CrossRef] [PubMed]

- Chishti, M.Z.; Xia, X.; Dogan, E. Understanding the Effects of Artificial Intelligence on Energy Transition: The Moderating Role of Paris Agreement. Energy Econ. 2024, 131, 107388. [Google Scholar] [CrossRef]

- Niczyporuk, H.; Urpelainen, J. Taking a Gamble: Chinese Overseas Energy Finance and Country Risk. J. Clean. Prod. 2021, 281, 124993. [Google Scholar] [CrossRef]

- Senadjki, A.; Bashir, M.J.K.; AuYong, H.N.; Iddrisu, M.A.; Chan, J.H. Pathways to Sustainability: How China’s Belt and Road Initiative Is Shaping Responsible Production and Consumption in Africa. Environ. Sci. Pollut. Res. 2024, 31, 1468–1487. [Google Scholar] [CrossRef]

- Che, X.; Kuang, W.; Zhang, H.; Jiang, M. Does the Belt and Road Initiative Alleviate Energy Poverty in Participating Countries? Energy Rep. 2023, 9, 2395–2404. [Google Scholar] [CrossRef]

- Bega, F.; Lin, B. China’s Belt & Road Initiative Hydropower Cooperation: What Can Be Improved? Renew. Energy 2024, 221, 119789. [Google Scholar] [CrossRef]

- Wang, L.; Cheng, Z. Impact of the Belt and Road Initiative on Enterprise Green Transformation. J. Clean. Prod. 2024, 468, 143043. [Google Scholar] [CrossRef]

- Wang, B.; Lin, P. Whether China’s Overseas Energy Infrastructure Projects Dirtier or Cleaner after the Belt and Road Initiative? Energy Policy 2022, 166, 113007. [Google Scholar] [CrossRef]

- Harlan, T. Green Development or Greenwashing? A Political Ecology Perspective on China’s Green Belt and Road. Eurasian Geogr. Econ. 2021, 62, 202–226. [Google Scholar] [CrossRef]

- Liu, H.; Wang, Y.; Jiang, J.; Wu, P. How Green Is the “Belt and Road Initiative”?—Evidence from Chinese OFDI in the Energy Sector. Energy Policy 2020, 145, 111709. [Google Scholar] [CrossRef]

- Wu, D.; Song, W. Does Green Finance and ICT Matter for Sustainable Development: Role of Government Expenditure and Renewable Energy Investment. Environ. Sci. Pollut. Res. 2023, 30, 36422–36438. [Google Scholar] [CrossRef] [PubMed]

- Xu, L. Role of Belt and Road Initiative in the Development of Renewable Energy: Mediating Role of Green Public Procurement. Renew. Energy 2023, 217, 118963. [Google Scholar] [CrossRef]

- Narain, D.; Teo, H.C.; Lechner, A.M.; Watson, J.E.M.; Maron, M. Biodiversity Risks and Safeguards of China’s Hydropower Financing in Belt and Road Initiative (BRI) Countries. One Earth 2022, 5, 1019–1029. [Google Scholar] [CrossRef]

- Ming, Z.; Ximei, L.; Yulong, L.; Lilin, P. Review of Renewable Energy Investment and Financing in China: Status, Mode, Issues and Countermeasures. Renew. Sustain. Energy Rev. 2014, 31, 23–37. [Google Scholar] [CrossRef]

- He, L.; Liu, R.; Zhong, Z.; Wang, D.; Xia, Y. Can Green Financial Development Promote Renewable Energy Investment Efficiency? A Consideration of Bank Credit. Renew. Energy 2019, 143, 974–984. [Google Scholar] [CrossRef]

- Ucler, G.; Inglesi-Lotz, R.; Topalli, N. Exploring the Potential of the Belt and Road Initiative as a Gateway for Renewable Energy in Diverse Economies. Environ. Sci. Pollut. Res. 2023, 30, 101725–101743. [Google Scholar] [CrossRef] [PubMed]

- Yin, Y.; Lam, J.S.L. Impacts of Energy Transition on Liquefied Natural Gas Shipping: A Case Study of China and Its Strategies. Transp. Policy 2022, 115, 262–274. [Google Scholar] [CrossRef]

- Jackson, M.M.; Lewis, J.I.; Zhang, X. A Green Expansion: China’s Role in the Global Deployment and Transfer of Solar Photovoltaic Technology. Energy Sustain. Dev. 2021, 60, 90–101. [Google Scholar] [CrossRef]

- Leng, Z.; Shuai, J.; Sun, H.; Shi, Z.; Wang, Z. Do China’s Wind Energy Products Have Potentials for Trade with the “Belt and Road” Countries?—A Gravity Model Approach. Energy Policy 2020, 137, 111172. [Google Scholar] [CrossRef]

- Geng, Q. The belt and road initiative and its implications for global renewable energy development. Curr. Sustain. /Renew. Energy Rep. 2021, 8, 40–49. [Google Scholar] [CrossRef]

- Wu, Y.; Wang, J.; Ji, S.; Song, Z. Renewable Energy Investment Risk Assessment for Nations along China’s Belt & Road Initiative: An ANP-Cloud Model Method. Energy 2020, 190, 116381. [Google Scholar] [CrossRef]

- Zhai, W. Risk assessment of China’s foreign direct investment in” One Belt, One Road”: Taking the green finance as a research perspective. Socio-Econ. Plan. Sci. 2023, 87, 101558. [Google Scholar] [CrossRef]

- An, Y.; Tan, X.; Gu, B.; Zhu, K.; Shi, L.; Ding, Z. An Assessment of Renewable Energy Development in Belt and Road Initiative Countries: An Entropy and TOPSIS Approach. Energy Rep. 2023, 10, 3545–3560. [Google Scholar] [CrossRef]

- Yu, D.; Gu, B.; Zhu, K.; Yang, J.; Sheng, Y. Risk Analysis of China’s Renewable Energy Cooperation with Belt and Road Economies. Energy 2024, 293, 130664. [Google Scholar] [CrossRef]

- Luo, Q.; Fang, G.; Ye, J.; Yan, M.; Lu, C. Country Evaluation for China’s Hydropower Investment in the Belt and Road Initiative Nations. Sustainability 2020, 12, 8281. [Google Scholar] [CrossRef]

- Lei, Y.; Lu, X.; Shi, M.; Wang, L.; Lv, H.; Chen, S.; Hu, C.; Yu, Q.; Da Silveira, S.D.H. SWOT Analysis for the Development of Photovoltaic Solar Power in Africa in Comparison with China. Environ. Impact Assess. Rev. 2019, 77, 122–127. [Google Scholar] [CrossRef]

- Gu, A.; Zhou, X. Emission Reduction Effects of the Green Energy Investment Projects of China in Belt and Road Initiative Countries. Ecosyst. Health Sustain. 2020, 6, 1747947. [Google Scholar] [CrossRef]

- Chen, Y.; Chen, M.; Tian, L. What Determines China’s Energy OFDI: Economic, Geographical, Institutional, and Cultural Distance? Energy Strategy Rev. 2023, 47, 101084. [Google Scholar] [CrossRef]

- Zhou, N.; Wu, Q.; Hu, X.; Xu, D.; Wang, X. Evaluation of Chinese Natural Gas Investment along the Belt and Road Initiative Using Super Slacks-Based Measurement of Efficiency Method. Resour. Policy 2020, 67, 101668. [Google Scholar] [CrossRef]

- Chiyemura, F.; Shen, W.; Burgess, M.; Mulugetta, Y.; Wang, Y. A Dynamic Institutional Analysis of China’s Engagement with Africa’s Renewable Energy Market. Environ. Politics 2023, 32, 1140–1162. [Google Scholar] [CrossRef]

- Lin, X.; Huang, G.; Zhou, X.; Zhai, Y. An Inexact Fractional Multi-Stage Programming (IFMSP) Method for Planning Renewable Electric Power System. Renew. Sustain. Energy Rev. 2023, 187, 113611. [Google Scholar] [CrossRef]

- Zhou, Y.; Hejazi, M.; Smith, S.; Edmonds, J.; Li, H.; Clarke, L.; Calvin, K.; Thomson, A. A Comprehensive View of Global Potential for Hydro-Generated Electricity. Energy Environ. Sci. 2015, 8, 2622–2633. [Google Scholar] [CrossRef]

- Zhong, R.; Zhao, T.; He, Y.; Chen, X. Hydropower Change of the Water Tower of Asia in 21st Century: A Case of the Lancang River Hydropower Base, Upper Mekong. Energy 2019, 179, 685–696. [Google Scholar] [CrossRef]

- Zhou, Y.; Luckow, P.; Smith, S.J.; Clarke, L. Evaluation of global onshore wind energy potential and generation costs. Environ. Sci. Technol. 2012, 46, 7857–7864. [Google Scholar] [CrossRef]

- Elistratov, V.; Bogun, I.; Kasina, V. Approaches to assessing the resource potential of Central Asia in a climatic resource-constrained environment. IOP Conf. Ser. Mater. Sci. Eng. 2020, 883, 012162. [Google Scholar] [CrossRef]

- Irfan, M.; Zhao, Z.Y.; Mukeshimana, M.C.; Ahmad, M. Wind energy development in South Asia: Status, potential and policies. In Proceedings of the 2019 2nd International Conference on Computing, Mathematics and Engineering Technologies (iCoMET), Sukkur, Pakistan, 30–31 January 2019; Available online: https://ieeexplore.ieee.org/abstract/document/8673484 (accessed on 29 July 2024).

- Siala, K.; Stich, J. Estimation of the PV Potential in ASEAN with a High Spatial and Temporal Resolution. Renew. Energy 2016, 88, 445–456. [Google Scholar] [CrossRef]

- Chen, S.; Lu, X.; Miao, Y.; Deng, Y.; Nielsen, C.P.; Elbot, N.; Wang, Y.; Logan, K.G.; McElroy, M.B.; Hao, J. The potential of photovoltaics to power the belt and road initiative. Joule 2019, 3, 1895–1912. [Google Scholar] [CrossRef]

- Li, S.; Wu, M.; Song, M. Analysis of Regional Differences in Green Energy Efficiency in Countries along “the Belt and Road” Initiative Zone-Based on Super Efficiency DEA Model and Malmquist Index Method. Front. Energy Res. 2023, 11, 1109045. [Google Scholar] [CrossRef]

- Wu, Y.; Hu, C.; Shi, X. Heterogeneous Effects of the Belt and Road Initiative on Energy Efficiency in Participating Countries. Energies 2021, 14, 5594. [Google Scholar] [CrossRef]

- Xiong, C.; Wang, G.; Li, H.; Su, W.; Duan, X. Examining Key Impact Factors of Energy-Related Carbon Emissions in 66 Belt and Road Initiative Countries. Environ. Sci. Pollut. Res. 2023, 30, 13837–13845. [Google Scholar] [CrossRef] [PubMed]

- He, J.; Chen, J.; Peng, H.; Duan, H. Exploring the Effect of Renewable Energy on Low-Carbon Sustainable Development in the Belt and Road Initiative Countries: Evidence from the Spatial-Temporal Perspective. Environ. Sci. Pollut. Res. 2021, 28, 39993–40010. [Google Scholar] [CrossRef] [PubMed]

- Spoor, M. 25 Years of Rural Development in Post-Soviet Central Asia: Sustaining Inequalities. East. Eur. Countrys. 2018, 24, 63–79. [Google Scholar] [CrossRef]

- Tan, Y.; Qamruzzaman, M.; Karim, S. An Investigation of Financial Openness, Trade Openness, Gross Capital Formation, Urbanization, Financial Development, Education and Energy Nexus in BRI: Evidence from the Symmetric and Asymmetric Framework. PLoS ONE 2023, 18, e0290121. [Google Scholar] [CrossRef] [PubMed]

- Kongkuah, M.; Yao, H.; Fongjong, B.B.; Agyemang, A.O. The Role of CO2 Emissions and Economic Growth in Energy Consumption: Empirical Evidence from Belt and Road and OECD Countries. Environ. Sci. Pollut. Res. 2021, 28, 22488–22509. [Google Scholar] [CrossRef]

- Khan, S.; Yuan, H.; Yahong, W.; Ahmad, F. Environmental Implications of Technology-Driven Energy Deficit and Urbanization: Insights from the Environmental Kuznets and Pollution Hypothesis. Environ. Technol. Innov. 2024, 34, 103554. [Google Scholar] [CrossRef]

- Xu, Q.; Khan, S.; Zhang, X.; Usman, M. Urbanization, Rural Energy-Poverty, and Carbon Emission: Unveiling the Pollution Halo Effect in 48 BRI Countries. Environ. Sci. Pollut. Res. 2023, 30, 105912–105926. [Google Scholar] [CrossRef] [PubMed]

- Hongxing, Y.; Abban, O.J.; Boadi, A.D.; Ankomah-Asare, E.T. Exploring the Relationship between Economic Growth, Energy Consumption, Urbanization, Trade, and CO2 Emissions: A PMG-ARDL Panel Data Analysis on Regional Classification along 81 BRI Economies. Environ. Sci. Pollut. Res. 2021, 28, 66366–66388. [Google Scholar] [CrossRef] [PubMed]

- Cai, X.; Wei, C. Does Financial Inclusion and Renewable Energy Impede Environmental Quality: Empirical Evidence from BRI Countries. Renew. Energy 2023, 209, 481–490. [Google Scholar] [CrossRef]

- Fu, Y.; Xue, L.; Yan, Y.; Pan, Y.; Wu, X.; Shao, Y. Energy Network Embodied in Trade along the Belt and Road: Spatiotemporal Evolution and Influencing Factors. Sustainability 2021, 13, 10530. [Google Scholar] [CrossRef]

- Wang, X.; Wang, Y.; Zhou, K. The Impact of Energy Poverty Alleviation on Carbon Emissions in Countries along the Belt and Road Initiative. Sustainability 2024, 16, 4681. [Google Scholar] [CrossRef]

- Ashraf, J.; Luo, L.; Anser, M.K. Do BRI Policy and Institutional Quality Influence Economic Growth and Environmental Quality? An Empirical Analysis from South Asian Countries Affiliated with the Belt and Road Initiative. Environ. Sci. Pollut. Res. 2022, 29, 8438–8451. [Google Scholar] [CrossRef] [PubMed]

- Peng, B.; Xu, N.; Luo, R.; Elahi, E.; Wan, A. Promoting Green Investment Behavior in “Belt and Road” Energy Projects: A Quantum Game Approach. Technol. Forecast. Soc. Chang. 2024, 204, 123416. [Google Scholar] [CrossRef]

- Zhang, Y.; Su, L.; Jin, W.; Yang, Y. The Impact of Globalization on Renewable Energy Development in the Countries along the Belt and Road Based on the Moderating Effect of the Digital Economy. Sustainability 2022, 14, 6031. [Google Scholar] [CrossRef]

- Sorrell, S. Reducing Energy Demand: A Review of Issues, Challenges and Approaches. Renew. Sustain. Energy Rev. 2015, 47, 74–82. [Google Scholar] [CrossRef]

- Aleluia, J.; Tharakan, P.; Chikkatur, A.P.; Shrimali, G.; Chen, X. Accelerating a Clean Energy Transition in Southeast Asia: Role of Governments and Public Policy. Renew. Sustain. Energy Rev. 2022, 159, 112226. [Google Scholar] [CrossRef]

- Gao, C.; Tao, S.; Su, B.; Mensah, I.A.; Sun, M. Exploring Renewable Energy Trade Coopetition Relationships: Evidence from Belt and Road Countries, 1996–2018. Renew. Energy 2023, 202, 196–209. [Google Scholar] [CrossRef]

- Zhou, S.; Wang, Y.; Luo, P. Does the Belt and Road Initiative (BRI) Improve the Environmental Quality of BRI Countries? Evidence from a Quasi-Natural Experiment. Appl. Econ. 2023, 55, 7094–7110. [Google Scholar] [CrossRef]

- Liu, C.; Hale, T.; Urpelainen, J. Explaining the Energy Mix in China’s Electricity Projects under the Belt and Road Initiative. Environ. Politics 2023, 32, 1117–1139. [Google Scholar] [CrossRef]

- Xu, Y.; Ji, Z.; Jiang, C.; Xu, W.; Gao, C. Examining the Coopetition Relationships in Renewable Energy Trade among BRI Countries: Complexity, Stability, and Evolution. Energies 2024, 17, 1184. [Google Scholar] [CrossRef]

- Anwar, M.A.; Nasreen, S.; Tiwari, A.K. Forestation, Renewable Energy and Environmental Quality: Empirical Evidence from Belt and Road Initiative Economies. J. Environ. Manag. 2021, 291, 112684. [Google Scholar] [CrossRef] [PubMed]

- Ashraf, J.; Ashraf, Z.; Javed, A. The Spatial-Temporal Effects of Energy Consumption and Institutional Quality on CO2 Emission: Evidence from Belt and Road Initiative (BRI) Countries. Environ. Sci. Pollut. Res. 2023, 30, 121050–121061. [Google Scholar] [CrossRef] [PubMed]

- Wang, J.; Dong, X.; Dong, K. How Renewable Energy Reduces CO2 Emissions? Decoupling and Decomposition Analysis for 25 Countries along the Belt and Road. Appl. Econ. 2021, 53, 4597–4613. [Google Scholar] [CrossRef]

- Dong, F.; Pan, Y. Evolution of Renewable Energy in BRI Countries: A Combined Econometric and Decomposition Approach. Int. J. Environ. Res. Public Health 2020, 17, 8668. [Google Scholar] [CrossRef] [PubMed]

- Latief, R.; Pei, Y.; Javeed, S.A.; Sattar, U. Environmental Sustainability in the Belt and Road Initiative (BRI) Countries: The Role of Sustainable Tourism, Renewable Energy and Technological Innovation. Ecol. Indic. 2024, 162, 112011. [Google Scholar] [CrossRef]

- Chai, Q.; Fu, S.; Wen, X. Modeling the Implementation of NDCs and the Scenarios below 2 °C for the Belt and Road Countries. Ecosyst. Health Sustain. 2020, 6, 1766998. [Google Scholar] [CrossRef]

- Han, M.; Zhou, Y.; De Mendonca, T. Impacts of High-Technology Product Exports on Climate Change Mitigation in Belt and Road Countries: The Mediating Role of Renewable Energy Source and Human Capital Accumulation. Environ. Dev. Sustain. 2024, 26, 1939–1964. [Google Scholar] [CrossRef]

- Nanli, Z.; Xiaoping, L.; Sohail Akhtar, M.; Bilal, A. Clean Technology and the Environment: Key Issues and Implications in Belt and Road Initiative Economies. Front. Environ. Sci. 2022, 10, 1009155. [Google Scholar] [CrossRef]

- Kongkuah, M. Impact of Economic Variables on CO2 Emissions in Belt and Road and OECD Countries. Environ. Monit. Assess. 2023, 195, 835. [Google Scholar] [CrossRef] [PubMed]

- Shakib, M.; Yumei, H.; Rauf, A.; Alam, M.; Murshed, M.; Mahmood, H. Revisiting the Energy-Economy-Environment Relationships for Attaining Environmental Sustainability: Evidence from Belt and Road Initiative Countries. Environ. Sci. Pollut. Res. 2022, 29, 3808–3825. [Google Scholar] [CrossRef]

- Li, Y.; Khan, J. Decoupling with(out) Outsourcing? Quantifying Emissions Embodied in BRI Trade with Implications for Climate Policy. Elem. Sci. Anthr. 2024, 12, 00068. [Google Scholar] [CrossRef]

- Ji, D.; Sibt-e-Ali, M.; Amin, A.; Ayub, B. The Determinants of Carbon Emissions in Belt and Road Initiative Countries: Analyzing the Interactive Role of Information and Communication Technologies. Environ. Sci. Pollut. Res. 2023, 30, 103198–103211. [Google Scholar] [CrossRef]

- Jia, H.; Fan, S.; Xia, M. The Impact of Renewable Energy Consumption on Economic Growth: Evidence from Countries along the Belt and Road. Sustainability 2023, 15, 8644. [Google Scholar] [CrossRef]

- Sheraz, M.; Deyi, X.; Sinha, A.; Mumtaz, M.Z.; Fatima, N. The Dynamic Nexus among Financial Development, Renewable Energy and Carbon Emissions: Moderating Roles of Globalization and Institutional Quality across BRI Countries. J. Clean. Prod. 2022, 343, 130995. [Google Scholar] [CrossRef]

- Hussain, M.N.; Li, Z.; Sattar, A.; Ilyas, M. Evaluating the Impact of Energy and Environment on Economic Growth in BRI Countries. Energy Environ. 2023, 34, 586–601. [Google Scholar] [CrossRef]

- Ali, K.; Chi, Y.; Zhang, X.; Zhang, M.; Wang, Z.; Haider, W. What Contributes More to BRI Economic Growth, Renewable or Non-Renewable Energy Consumption: A Third Generation Panel Data Analysis. Environ. Sci. Pollut. Res. 2024, 31, 22102–22118. [Google Scholar] [CrossRef] [PubMed]

- Khan, H.; Liu, W.; Khan, I.; Zhang, J. The Nexus between Natural Resources, Renewable Energy Consumption, Economic Growth, and Carbon Dioxide Emission in BRI Countries. Environ. Sci. Pollut. Res. 2023, 30, 36692–36709. [Google Scholar] [CrossRef] [PubMed]

- Iftikhar, H.; Ullah, A.; Pinglu, C. From Regional Integrated Development toward Sustainable Future: Evaluating the Belt and Road Initiative’s Spillover Impact between Tourism, Fintech and Inclusive Green Growth. Clean Technol. Environ. Policy 2024, 26, 1–28. [Google Scholar] [CrossRef]

- Kongkuah, M. Impact of Belt and Road Countries’ Renewable and Non-Renewable Energy Consumption on Ecological Footprint | Environment, Development and Sustainability. Dev. Sustain. 2024, 26, 8709–8734. [Google Scholar] [CrossRef]

- Zhu, X.; Gu, Z.; He, C.; Chen, W. The Impact of the Belt and Road Initiative on Chinese PV firms’ export expansion. Environ. Dev. Sustain. 2024, 26, 25763–25783. [Google Scholar] [CrossRef]

- Khan, I.; Zhong, R.; Khan, H.; Nuta, F.M. The Effect of Technological Innovation, Trademark Application, Economic Growth, and CO2 Emissions on Renewable Energy Consumption in Asian Belt and Road Initiative Countries. Environ. Dev. Sustain. 2024, 26, 1–22. [Google Scholar] [CrossRef]

- Jia, J.; Rong, Y.; Chen, C.; Xie, D.; Yang, Y. Contribution of Renewable Energy Consumption to CO2 Emissions Mitigation: A Comparative Analysis from the Income Levels’ Perspective in the Belt and Road Initiative (BRI) Region. Int. J. Clim. Chang. Strateg. Manag. 2021, 13, 266–285. [Google Scholar] [CrossRef]

- Ghimire, A.; Ali, S.; Hussain, S. Impact of Belt and Road Initiative Policy and Interacting Effect of Renewable Energy toward Carbon Neutrality. Environ. Sci. Pollut. Res. 2024, 31, 1033–1049. [Google Scholar] [CrossRef] [PubMed]

- Khan, I.; Han, L.; Zhong, R.; Bibi, R.; Khan, H. Income Inequality, Economic Growth, Renewable Energy Usage, and Environmental Degradation in the Belt and Road Initiative Countries: Dynamic Panel Estimation. Environ. Sci. Pollut. Res. 2023, 30, 57142–57154. [Google Scholar] [CrossRef] [PubMed]

- Gao, X.; Fan, M. The Effect of Income Inequality and Economic Growth on Carbon Dioxide Emission. Environ. Sci. Pollut. Res. 2023, 30, 65149–65159. [Google Scholar] [CrossRef]

- Jamil, B.; Yaping, S.; Din, N.U.; Nazneen, S.; Mushtaq, A. Do Governance Indicators Interact with Technological Innovation and Income Inequality in Mitigating CO2 Emissions in Belt and Road Initiative Countries? Environ. Sci. Pollut. Res. 2021, 28, 51278–51296. [Google Scholar] [CrossRef] [PubMed]

- Khan, I.; Zhong, R.; Han, L.; Khan, H. Analyzing the Nexus Between Income Inequality, Renewable Energy, and Environmental Quality: Emphasizing the Significance of Institutional Quality. J. Knowl. Econ. 2024, 15, 1–33. [Google Scholar] [CrossRef]

- Zhao, Y.; Shuai, J.; Shi, Y.; Lu, Y.; Zhang, Z. Exploring the Co-Opetition Mechanism of Renewable Energy Trade between China and the “Belt and Road” Countries: A Dynamic Game Approach. Renew. Energy 2022, 191, 998–1008. [Google Scholar] [CrossRef]

- Xu, L.; Fan, X.; Wang, W.; Xu, L.; Duan, Y.; Shi, R. Renewable and Sustainable Energy of Xinjiang and Development Strategy of Node Areas in the “Silk Road Economic Belt”. Renew. Sustain. Energy Rev. 2017, 79, 274–285. [Google Scholar] [CrossRef]

- Ma, D.; Guo, Z.; Xiao, Y.; Zhang, F.; Peng, G.; Zhang, J.; An, B. Is the Green Total Factor of Energy Efficiency Rising or Falling? Evidence from the Belt and Road Initiative Countries. Energy Technol. 2024, 12, 2301163. [Google Scholar] [CrossRef]

- Ge, G.; Tang, Y.; Zhang, Q.; Li, Z.; Cheng, X.; Tang, D.; Boamah, V. The Carbon Emissions Effect of China’s OFDI on Countries along the “Belt and Road”. Sustainability 2022, 14, 13609. [Google Scholar] [CrossRef]

- Lee, H.S.; Soon, Z.W.; Har, W.M.; Lee, S.Y. The Roles of Green Technology with the aids of Financial Development in Reducing Carbon Dioxide Emission. In Proceedings of the 2020 International Conference on Smart Grid and Clean Energy Technologies (ICSGCE), Sarawak, Malaysia, 4–7 October 2020; pp. 90–95. [Google Scholar] [CrossRef]

- Anwar, M.A.; Arshed, N.; Tiwari, A.K. Nexus between Biomass Energy, Economic Growth, and Ecological Footprints: Empirical Investigation from Belt and Road Initiative Economies. Environ. Sci. Pollut. Res. 2023, 30, 115527–115542. [Google Scholar] [CrossRef] [PubMed]

- Shinwari, R.; Wang, Y.; Maghyereh, A.; Awartani, B. Does Chinese Foreign Direct Investment Harm CO2 Emissions in the Belt and Road Economies? Environ. Sci. Pollut. Res. 2022, 29, 39528–39544. [Google Scholar] [CrossRef]

- Shinwari, R.; Wang, Y.; Gozgor, G.; Mousavi, M. Does FDI affect energy consumption in the belt and road initiative economies? The role of green technologies. Energy Econ. 2024, 132, 107409. [Google Scholar] [CrossRef]

- Shah, W.U.H.; Hao, G.; Yasmeen, R.; Kamal, M.A.; Khan, A.; Padda, I.U.H. Unraveling the Role of China’s OFDI, Institutional Difference and B&R Policy on Energy Efficiency: A Meta-Frontier Super-SBM Approach. Environ. Sci. Pollut. Res. 2022, 29, 56454–56472. [Google Scholar] [CrossRef]

- Jiang, Y.; Khan, H. The Relationship between Renewable Energy Consumption, Technological Innovations, and Carbon Dioxide Emission: Evidence from Two-Step System GMM. Environ. Sci. Pollut. Res. 2023, 30, 4187–4202. [Google Scholar] [CrossRef] [PubMed]

- Khan, A.; Hussain, J.; Bano, S.; Chenggang, Y. The Repercussions of Foreign Direct Investment, Renewable Energy and Health Expenditure on Environmental Decay? An Econometric Analysis of B&RI Countries. J. Environ. Plan. Manag. 2020, 63, 1965–1986. [Google Scholar] [CrossRef]

- He, Q.; Cao, X. Pattern and Influencing Factors of Foreign Direct Investment Networks between Countries along the “Belt and Road” Regions. Sustainability 2019, 11, 4724. [Google Scholar] [CrossRef]

- Zhao, L.; Liu, J.; Li, D.; Yang, Y.; Wang, C.; Xue, J. China’s Green Energy Investment Risks in Countries along the Belt and Road. J. Clean. Prod. 2022, 380, 134938. [Google Scholar] [CrossRef]

- Li, S.; Raza, A.; Si, R.; Huo, X. International Trade, Chinese Foreign Direct Investment and Green Innovation Impact on Consumption-Based CO2 Emissions: Empirical Estimation Focusing on BRI Countries. Environ. Sci. Pollut. Res. 2022, 29, 89014–89028. [Google Scholar] [CrossRef]

- Alqurran, T.; Alkaseasbeh, M. Role of Green Finance in Supporting Sustainable Energy Investments Perspective of Energy Sector in Jordan. Calitatea 2024, 25, 198. [Google Scholar] [CrossRef]

- Shao, X. Chinese OFDI Responses to the B&R Initiative: Evidence from a Quasi-Natural Experiment. China Econ. Rev. 2020, 61, 101435. [Google Scholar] [CrossRef]

- Zhou, K.; Wang, Y.; Wang, H.; Tan, J. Does China’s Outward Foreign Direct Investment Alleviate Energy Poverty in Host Countries? Evidence from Countries along the Belt and Road Initiative. Renew. Energy 2024, 223, 120034. [Google Scholar] [CrossRef]

- Wu, S. Investment and Financing Cooperation Models and Optimization Strategies in the Belt and Road Initiative. Int. Financ. 2022, 4, 44–53. [Google Scholar] [CrossRef]

- Zhang, Z.; Wang, M. Renewable Energy Policies and Social Capital Participation: A Study Based on Energy Investment Projects in Belt and Road Countries. China Econ. 2023, 18, 100–140. [Google Scholar] [CrossRef]

- Atems, B.; Hotaling, C. The Effect of Renewable and Nonrenewable Electricity Generation on Economic Growth. Energy Policy 2018, 112, 111–118. [Google Scholar] [CrossRef]

- Sen, S.; Ganguly, S. Opportunities, Barriers and Issues with Renewable Energy Development—A Discussion. Renew. Sustain. Energy Rev. 2017, 69, 1170–1181. [Google Scholar] [CrossRef]

- Saculsan, P.; Kanamura, T. Examining Risk and Return Profiles of Renewable Energy Investment in Developing Countries: The Case of the Philippines. 2019. Available online: https://mpra.ub.uni-muenchen.de/97473/ (accessed on 30 July 2024).

- Hoggett, R. Technology scale and supply chains in a secure, affordable and low carbon energy transition. Appl. Energy 2014, 123, 296–306. [Google Scholar] [CrossRef]

- Cao, X.; Zhang, Z.; Qian, Y.; Wen, Z. The Spatial Pattern, Driving Factors and Evolutionary Trend of Energy Cooperation and Consumption in the “Belt and Road Initiative” Countries. Energy 2024, 306, 132416. [Google Scholar] [CrossRef]

- Qi, S.-Z.; Peng, H.-R.; Zhang, Y.-J. Energy Intensity Convergence in Belt and Road Initiative (BRI) Countries: What Role Does China-BRI Trade Play? J. Clean. Prod. 2019, 239, 118022. [Google Scholar] [CrossRef]

| Title | Authors | Source Title | Year | Citations |

|---|---|---|---|---|

| Public spending and green economic growth in BRI region: Mediating role of green finance [6] | Zhang, DY; Mohsin, M; Rasheed, AK; Chang, Y; Taghizadeh-Hesary, F | Energy Policy | 2021 | 462 |

| Natural resources, tourism development, and energy-growth-CO2 emission nexus: A simultaneity modeling analysis of BRI countries [13] | Khan, A; Yang, CG; Hussain, J; Bano, S; Nawaz, A | Resources Policy | 2020 | 199 |

| Impact of technological innovation, financial development, and foreign direct investment on renewable energy, non-renewable energy, and the environment in Belt and Road Initiative countries [10] | Khan, A; Yang, CG; Hussain, J; Kui, Z | Renewable Energy | 2021 | 187 |

| Testing EKC hypothesis with energy and sustainable development challenges: fresh evidence from Belt and Road Initiative economies [8] | Rauf, A; Liu, XX; Amin, W; Ozturk, I; Rehman, OU; Hafeez, M | Environmental Science And Pollution Research | 2018 | 186 |

| The dynamic links between CO2 emissions, energy consumption, and economic development in the countries along the Belt and Road [7] | Liu, YY; Hao, Y | Science Of The Total Environment | 2018 | 184 |

| The role of technology innovation and people’s connectivity in testing environmental Kuznets curve and pollution heaven hypotheses across the Belt and Road host countries: new evidence from Method of Moments Quantile Regression [12] | An, H; Razzaq, A; Haseeb, M; Mihardjo, LWW | Environmental Science And Pollution Research | 2021 | 140 |

| Nexus between green logistic operations and triple bottom line: evidence from infrastructure-led Chinese outward foreign direct investment in Belt and Road host countries [14] | An, H; Razzaq, A; Nawaz, A; Noman, SM; Khan, SAR | Environmental Science And Pollution Research | 2021 | 136 |

| Rule of law and CO2 emissions: A comparative analysis across 65 belt and road initiative(BRI) countries [11] | Muhammad, S; Long, XL | Journal Of Cleaner Production | 2021 | 126 |

| The role of fixed capital formation, renewable and non-renewable energy in economic growth and carbon emission: a case study of Belt and Road Initiative project [9] | Abbas, Q; Nurunnabi, M; Alfakhri, Y; Khan, W; Hussain, A; Iqbal, W | Environmental Science And Pollution Research | 2020 | 114 |

| Estimating the role of green financing on energy security, economic and environmental integration of bri member countries [15] | Tu, CA; Chien, FS; Hussein, MA; Mm, YR; Psi, MSS; Iqbal, S; Bilal, AR | Singapore Economic Review | 2021 | 113 |

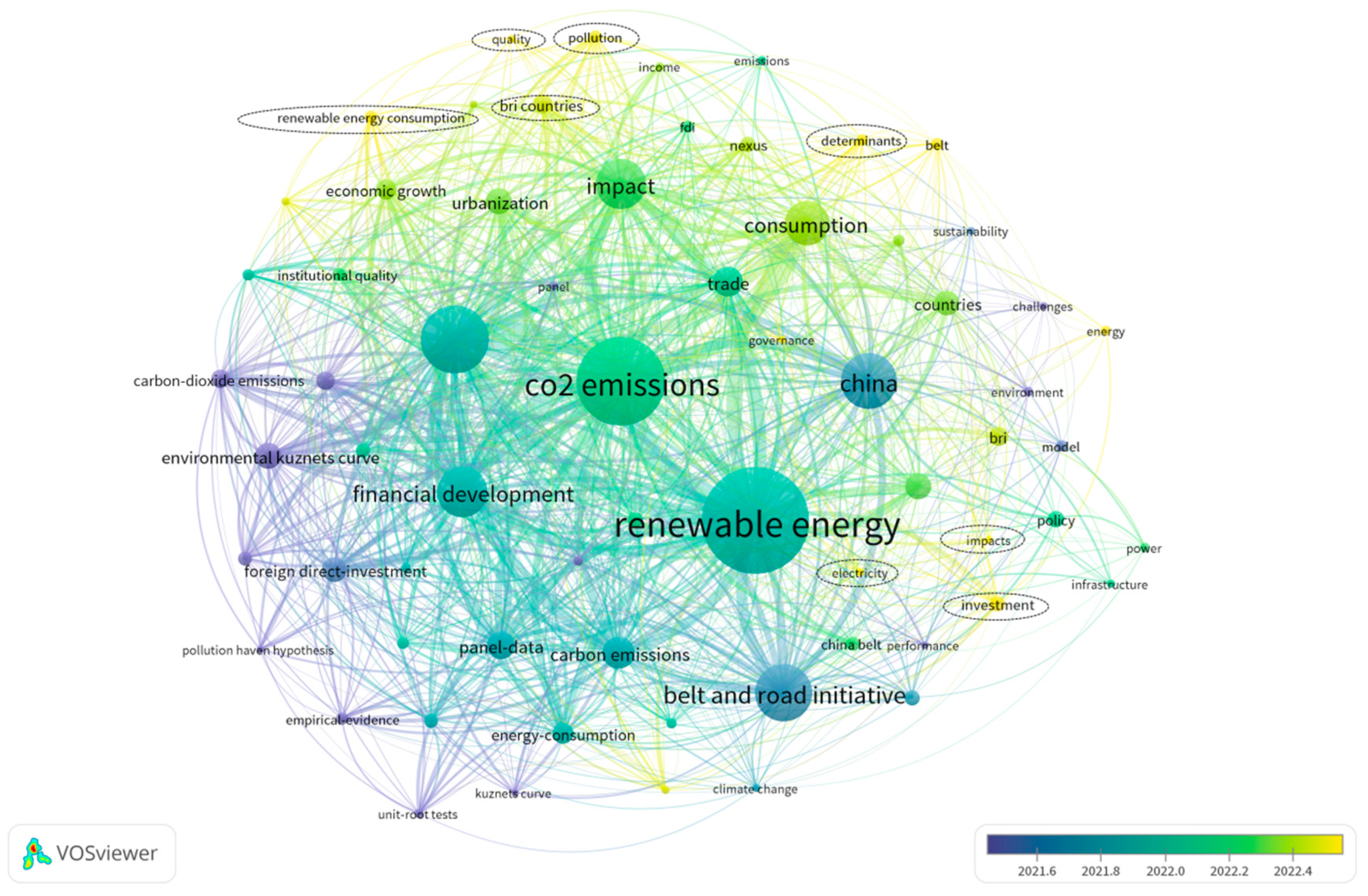

| Clustering Themes | Keywords | High-Frequency Words |

|---|---|---|

| 1. Research on the driving factors of renewable energy investment | Belt and Road Initiative, BRI, policy, China, power, countries, consumption, growth, China belt, BRI countries, investment, challenges, energy transition, sustainability, oil, environment, infrastructure, determinants, electricity, model, geopolitics, industry | BRI, China, investment, energy transition, policy, determinants |

| 2. Research on the synergistic benefits of renewable energy investment | belt and road, CO2 emissions, carbon emissions, financial development, carbon dioxide emissions, climate change, environmental Kuznets curve, Kuznets curve, co-integration, urbanization, trade openness, electricity consumption, renewable electricity consumption, empirical evidence, panel data, unit root tests | belt and road, BRI countries, CO2 emissions, Financial development, carbon emissions, climate change |

| 3. Research on renewable energy consumption and cooperative governance | impact, economic growth, renewable electricity consumption, renewable energy-consumption, institutional quality, income inequality, carbon dioxide emission, trade openness, pollution, degradation, technological innovation, BRI countries, FDI, nexus, governance, energy efficiency, gmm | impact, economic growth, renewable energy-consumption, renewable electricity consumption |

| Project Name | Project Type | Investment Model | Project Size | Investment Results | Project Experience |

|---|---|---|---|---|---|

| Pakistan Dawood Wind Project | Market-led Investment Cooperation | Equity Investment + Bank Loan | 49.5 MW | Successfully operational | EPC ensured project completion on schedule, while policy-based financial support reduced financing costs, easing the financial pressure on the company. |

| Kazakhstan Zhanatas Wind Power Plant | New Financial Cooperation Model | Non-recourse Syndicated Loan | 100 MW | Project under construction,15-year fixed price, 3500 h/year | The new financial model introduced multiple financing sources or agencies, offering flexibility in funding structures, such as bonds and equity funds, which effectively mitigated risks and alleviated financial pressure. |

| Vietnam HoaHoiSolar Power | Government-led Investment Cooperation | EPC + Policy-based Financial Support | 257 MW | Project completed on schedule, advanced technology | EPC model ensured on-time project completion, and policy-based financial support lowered financing costs, easing company financial pressure. |

| Pakistan Karot Hydropower Project | Government-led Investment Cooperation | BOT (Build-Operate-Transfer) + Policy-based Financial Support | 720 MW | Critical energy project under the China–Pakistan Economic Corridor, stable power generation | The BOT model secured funding and transferred risks to the project operator, while policy-based financial support ensured stable long-term financing, enabling project sustainability. |

| UAE Noor Solar Power Project | Market-led Investment Cooperation | PPP (Public–Private Partnership) | 1177 MW | Project operational, increased clean energy proportion | PPP model diversified project financing and combined government resources with private sector expertise, ensuring the project’s long-term operation and success. |

| Argentina Jujuy Hydroelectric Power Station | Market-led Investment Cooperation | EPC + Foreign Capital Cooperation | 1740 MW | Significant power output supports local grid | EPC with foreign capital secured timely project completion, while foreign investment reduced financial pressure, improving overall project viability. |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Yang, F.; Li, J. A Review of Renewable Energy Investment in Belt and Road Initiative Countries: A Bibliometric Analysis Perspective. Energies 2024, 17, 4900. https://doi.org/10.3390/en17194900

Yang F, Li J. A Review of Renewable Energy Investment in Belt and Road Initiative Countries: A Bibliometric Analysis Perspective. Energies. 2024; 17(19):4900. https://doi.org/10.3390/en17194900

Chicago/Turabian StyleYang, Fang, and Juan Li. 2024. "A Review of Renewable Energy Investment in Belt and Road Initiative Countries: A Bibliometric Analysis Perspective" Energies 17, no. 19: 4900. https://doi.org/10.3390/en17194900

APA StyleYang, F., & Li, J. (2024). A Review of Renewable Energy Investment in Belt and Road Initiative Countries: A Bibliometric Analysis Perspective. Energies, 17(19), 4900. https://doi.org/10.3390/en17194900