Abstract

The development of renewable energy resources significantly impacts economic growth, various aspects of which can be assessed. First, the sector contributes to job creation, as new technologies and projects require specialists in various fields, from engineering to installation. Second, investments in renewable energy drive economic growth as the private and public sectors increasingly invest in innovation and infrastructure. In addition, developing renewable energy sources can lower energy prices for consumers, increase market competition, and reduce dependence on imported resources. However, there are also challenges related to initial investment costs, technological barriers and required political support. To ensure the successful development of renewable energy sources, it is necessary to create a favorable legal and regulatory environment, as well as to promote education and training in this area. In conclusion, the development of renewable energy resources can become an important driver of economic growth but requires a balanced approach and strategic planning. This work aims to evaluate the impact of the use of renewable resources on the economy after examining theories of economic growth. The following methods are used: analysis of theoretical and practical statements, comparative analysis, and panel data analysis. The research rejects hypotheses which suggest that transitioning to renewable energy sources slows economic growth. The development and adoption of renewable energy resources are essential for reducing greenhouse gas emissions, improving air quality, and ensuring sustainable development in the European Union. Despite initial costs and the hypothesis that transitioning to renewable energy slows economic growth, research shows that renewable energy sources (RES) do not hinder growth in the long term. Instead, they drive economic growth through technological advancements, job creation, and attracting significant investments, ultimately contributing to environmental protection and energy stability.

1. Introduction

In today’s world, which is constantly changing and affected by globalization, there is a need to quickly and effectively solve environmental, economic and social problems to ensure a sustainable future. The main environmental problems are climate change and increased air pollution, so climate change mitigation and pollution reduction policies are two essential priorities of global environmental policy. Most researchers [1,2,3,4,5,6] state that in solving the problem of climate change, it is necessary to inform the public about the importance of transitioning towards alternative energy sources.

It is important to communicate via various channels that using renewable resources will be beneficial in every way, including by promoting technological innovation, increasing economic benefits and improving global energy systems [7,8,9,10]. Transforming economies by introducing more significant sharing of renewable energy sources would facilitate reaching sustainable goals via more innovative circular production [11,12].

Energy is a key element in the creation of human well-being, which is significant in increasing economic benefits, ensuring sustainable development and achieving poverty reduction [13]. Energy is a unique factor of production, important for both economic development and social well-being. Energy from fossil fuels is the cause of global climate change, responsible for 75% of global warming greenhouse gasses and approximately 90% of the world’s total carbon dioxide emissions. To avoid a negative impact on the environment, there is a need to replace fossil fuels with alternative ones. Curbing the rising demand for energy is not less important [14,15,16,17].

Increasing the efficiency of energy consumption and the use of renewable energy resources is the main way to reduce greenhouse gas emissions and the main goal of the European Union’s energy and climate change mitigation policy [18].

Renewable energy sources are inseparable from the sustainable development of the modern world and society. They have a huge impact on the country’s economy, its growth rates, social and economic well-being, and ensuring technological development, security, and economic stability. Investments in the use of renewable resources are very beneficial and are seen as an ambitious opportunity to help the sector grow and contribute to the exporting of energy to neighboring countries [19,20].

For this reason, the development of renewable resources and assessment of their potential are relevant from the point of view of governments, scientists, and as regards business interests.

In recent years, a large amount of EU legislation has been adopted to promote the use of renewable energy sources. EU leaders have set a target of 2030 at the latest to ensure that 50 percent of the EU’s energy consumption will come from renewable energy sources, and it is also committed to an ambitious target to, by 2050, become the world’s first climate-neutral continent. Experts say that renewable energy resources, by 2030, could provide 65% of the world’s electricity supply and cover 90% of the electricity industry by 2050, significantly reducing carbon dioxide emissions and contributing to climate change mitigation [5].

The main problem of this article is as follows: how will the growing use of renewable energy resources affect the economy?

The object of the study is the use of renewable energy resources on the economy.

The work aims to evaluate the impact of the use of renewable resources on the economy after examining the theories of economic growth.

Research tasks:

- To analyze the concepts and types of renewable resources, and economic growth theories presented in the scientific literature.

- To create a methodology for assessing the impact of the use of renewable energy resources on the economy.

- To assess the impact of the use of renewable energy resources on the economy.

Research methods: The following methods are used in this work: methods of analysis of theoretical and practical statements, comparative analysis, and panel data analysis. All necessary statistical data are collected from the Eurostat database.

Work results: Concepts of renewable energy resources were reviewed and economic growth theories were analyzed from the perspective of the use of energy resources. An analysis of renewable energy resources and their development directions in individual sectors of the economy was also carried out. A methodology for evaluating the use of renewable energy resources was created and the impact of renewable energy resources on the economy was assessed.

2. Theoretical Aspects of Renewable Energy Resources

2.1. The Concept and Types of Renewable Energy Resources

In the modern world, the problem of global warming and climate change has become very acute, the consequences of which are visible in all areas, the most pressing among them being economic, environmental, and social. Inevitable population growth and economic development in many countries have a negative impact on the environment, as energy production processes are harmful and pollute the ecosystem. Currently, fossil fuels, nuclear energy, and renewable resources are known to be the main types of energy available today [2].

Energy is considered a key factor in the creation of human well-being, and thus a component of economic and sustainable development and poverty reduction which is significant in any country in the world. Energy is the essence of any production process, and it is essential for the economic growth of a country. Energy is an indispensable factor of production that contributes to the economic development of countries, at same time causing greenhouse gas emissions, in the case that the sources of energy production are non-renewable [21,22,23].

The progress of human civilization relies largely on energy, and as human society continues to grow, energy needs continue to increase.

In scientific works, renewable energy resources and their impact on the economy began to be discussed after the 1973 oil crisis, when people began to talk about renewable energy resources as a vital factor in achieving sustainable economic growth. Renewable resources, also called alternative energy, are energy resources in nature, the occurrence and renewal of which are determined by natural processes: sunlight, wind, river flow, sea waves, tides, biomass growth, geothermal energy, etc., because the Earth and resources, including sunlight, weather, precipitation, waves, and geothermal energy, are the main examples of renewable energy resources [2]. It can be noted that in many sources in the literature ([2,3,5,6,24]), renewable energy sources are defined as those that arise from nature and its natural processes, i.e., wind, solar, biomass, hydropower, water, and geothermal energy. The main types of renewable resources are as follows [2,3]: solar, wind, hydropower, geothermal and biomass energy. Various countries currently are putting their efforts into the development of renewable sources [25,26,27].

In order to summarize the information about the types of renewable resources, it is necessary to name the main advantages and disadvantages of renewable energy resources (Table 1).

Table 1.

Advantages and disadvantages of renewable resource types.

Table 1 shows the classification of renewable energy resources into hydropower, wind and solar energy, geothermal, biomass [2,3,5,24]. Renewable energy is defined as energy from renewable non-fossil resources: wind, solar, aerothermal, geothermal, hydrothermal and ocean energy, hydropower, biomass, biogas, including gas from landfills and wastewater treatment plants, as well as other renewable non-fossil resources whose use is technologically possible now or will be possible in the future.

Hydropower, wind, and solar have experienced the fastest development in recent decades. When evaluating each type of renewable energy, the advantages and disadvantages of renewable energy resources are discernible. According to [10], renewable energy sources consist of natural sources arising from natural processes—wind, biomass, sun, geothermal, and hydropower. Renewable energy sources cover the main energy technologies, and they are unlimited.

In conclusion, renewable energy resources are very important for mitigating climate change, reducing carbon dioxide emissions, and protecting the environment. The use of renewable energy has many significant advantages over traditional fossil fuels, as it is environmentally friendly, sustainable, and safe. A significant advantage is the minimal emission of greenhouse gasses and pollutants from renewable energy sources, which significantly reduces their overall negative impact on the environment. Unlike finite fossil fuel reserves, renewable energy has a sustainable continuous capacity, avoiding concerns about resource depletion. In addition, renewable energy sources are an inherently safer way of obtaining energy, which allows us to reduce our dependence on fossil fuels and create a more sustainable energy source for future generations.

2.2. Theoretical Analysis of the Economic Impact of Renewable Energy Resources

Today’s energy market is undergoing a transformation driven by technological innovation and society’s shift towards sustainability. The transition to renewable energy sources is often characterized by long-term economic benefits against the background of high initial investments and costs [28].

This dynamic interplay of costs and benefits is critical to shaping the trajectory of renewable energy use worldwide. Ref. [4] offers detailed insights into the economic and environmental benefits of renewable energy communities, the impact of investments and costs on corporate profitability, and the analysis and generation of renewable energy costs and benefits in specific applications.

Despite the challenges associated with the application of renewable resources (high initial costs and the need for technological advances; issues related to increased demand for rear elements, need for the recycling of renewable technologies) [29,30,31,32], the long-term benefits include energy security, which comprises a part of the overall security of any country, reduced environmental impacts, and even the development of green economies, as seen in various countries [6,33,34]. Favorable legal conditions and environmental policies play important roles in encouraging production of energy from renewable sources [35,36,37,38].

In this context, the use of renewable energy sources is a key factor in sustainable development, which brings many economic benefits and reduces negative environmental impacts. Integrating renewable energy into the global energy mix is not only a strategic response to climate change, but also an important driver of economic change. This transformation is evident in job creation, energy price dynamics, and the overall market dynamics of the energy sector. Ref. [2] highlights the great potential of renewable energy sources to contribute to economic, social, and environmental sustainability. The application of renewable energy sources improves access to energy, reduces emissions, and can create opportunities for local socio-economic development. The study highlights that energy is a key factor in wealth creation and a key element in sustainable economic development and poverty reduction. Renewable energy sources with minimal environmental impact are necessary for every country, but the full potential of these resources depends on the development of sustainable technologies to maximize their energy. The authors advocate for the optimal use of renewable energy resources for sustainable development, emphasizing the need for strategic approaches to overcome the challenges of adoption and implementation of alternative sources.

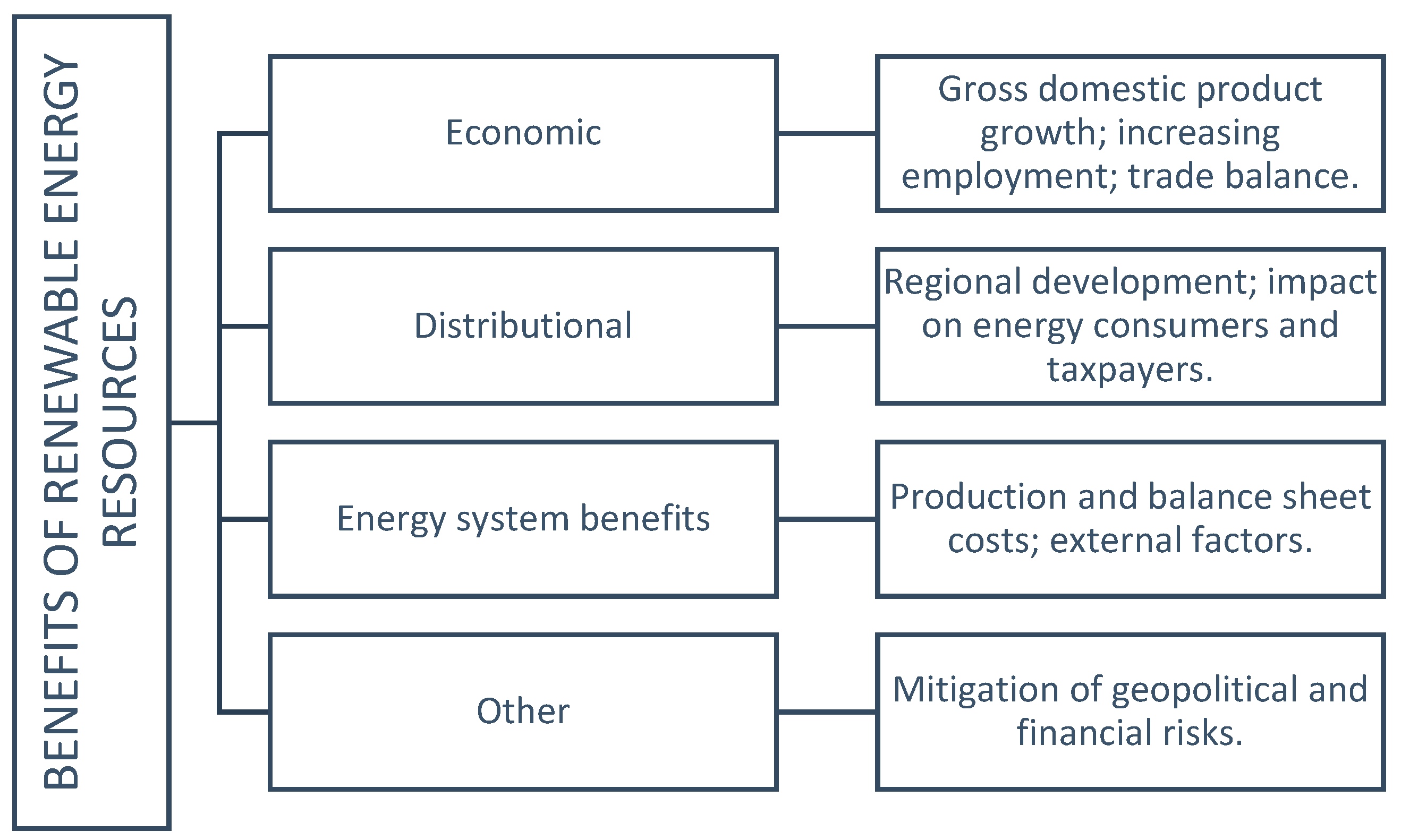

It should be noted that over the past decades, renewable energy installation technologies have developed, and the main reasons for development have also changed—energy security, environmental issues, and energy availability. As already mentioned, the use of renewable energy resources includes various benefits—new jobs are created, the health and education system are improved, poverty is reduced and the negative impact on the environment is reduced. The benefits generated by renewable energy resources are discussed in more detail in Figure 1.

Figure 1.

Socio-economic impact of renewable energy resources. Source: compiled by the authors based on data from the International Renewable Energy Agency [39].

Welfare in economics is usually seen as the benefit of consumption for a group of people. Renewable energy can influence many indicators of well-being and the environment and health. Employment in a state increases due to the development of renewable energy resources, as each new project and investment in renewable energy resources creates new jobs and increases the income of citizens. From an economic perspective, it is predicted that the adoption of renewable energy technologies will provide significant employment opportunities. By 2030, these technologies could create more than half a million jobs, and by 2050 their number could increase to more than four million [40]. This job creation aspect is a very important economic benefit, highlighting the potential of renewable energy to make a positive contribution to the global economy. This can highlight the economic and environmental benefits of switching to renewable energy sources [3].

Investments in renewable energy also have a positive effect on profitability indicators such as earnings before interest, taxes, depreciation and amortization (EBITDA), net income, and returns on investment. The economic viability of investing in renewable energy has been highlighted, showing that despite the initial costs, the long-term benefits in terms of increased profitability and sustainability are significant. Financial policies are needed to support the formation of investments in renewable energy technologies, emphasizing the importance of such investments in promoting the global transition to renewable energy [6]. Nations in the region need significant investment in renewable energy resources [41]. For example, attention should be paid to the use of natural gas and especially renewable energy resources, so that renewable energy resources reduce energy production costs and prevent environmental pollution.

The impact of renewable energy on economic growth and sustainable development can vary depending on the context and policies of each country. The deployment of renewable energy infrastructure has brought a range of economic benefits, including job creation, attracting investment, and reducing fossil fuel imports. The first empirical study that analyzed the relationship between energy consumption and economic growth was conducted in 1978 by Kraft. The study found a strong correlation between energy consumption and Gross Domestic Product (GDP) growth when assessing Granger causality [5]. This proved that an increase or decrease in GDP affects changes in energy consumption, but energy consumption does not necessarily affect GDP. This study was contradicted by a study by Acarca and Long in 1980, who found no causal relationship between energy consumption and GDP using the Sims method [6]. Other researchers have also tried to determine whether there is a relationship between energy consumption and economic growth. They chose different countries and different research periods to conduct the research. It can be seen that, in order to obtain reliable results, the researchers chose quite a large number of countries and, at the same time, a period of several decades. The longer the study period, the more reliable the results will be, and the more countries selected, the more samples and evaluations of changes will be covered.

It is noteworthy that many contradictory results have been obtained regarding the dependence of energy consumption and economic growth; some studies have revealed a causal relationship, while others have not. It should be emphasized that such different results in the same studied period were obtained due to the inclusion of different variables in assessments.

Most studies explain the increased economic efficiency that results from the use of renewable energy. Some researchers have investigated the relationship between renewable and non-renewable energy consumption and economic growth in different countries. The results show a positive and significant relationship between renewable energy consumption and economic growth in the long run. Furthermore, there is a two-way causality between non-renewable energy consumption and economic growth in the long and short run. Examining the causal relationship between renewable energy consumption and economic growth, researchers [42] concluded that there is a long-run equilibrium relationship between renewable energy consumption variables, economic growth, capital, and labor.

A study [5] proves that the use of renewable energy directly increases GDP) and improves the economy. The use of renewable energy contributes to economic growth, creates millions of jobs, and improves people’s quality of life. The transformation of energy systems could add $98 trillion to global gross domestic product (GDP) between 2016 and 2050. Compared to business-as-usual, employment in the renewable energy industry is expected to nearly triple (to 42 million people), while energy efficiency-related employment is expected to increase to 21 million people. Using renewable energy will be an opportunity to contribute to the growth of national economies.

Researchers [2,43] provide detailed insights into the economic benefits and challenges of renewable energy deployment, emphasizing the role of renewable energy in sustainable development, its impact on public health and the creation of an ecological environment. The researchers emphasize the importance of strategic approaches and public awareness in overcoming these challenges and realizing the full potential of renewable energy for a sustainable future. Together, these studies contribute to a deeper understanding of the theoretical foundations necessary for evaluating the impact of renewable energy. They emphasize technological advances, the importance of policy interventions, and regional considerations in reducing carbon emissions and promoting sustainable development as the global community continues to grapple with the challenges of climate change and the transition to sustainable energy systems.

Researchers [44] examined the economic impact of the renewable biofuel/energy industry supply chain and highlighted the importance of renewable energy in promoting economic development and environmental sustainability. In a study of the impact of macroeconomic factors on renewable energy production in South Asia, literacy rates, energy imports, government spending, and urban population growth were identified as key factors influencing renewable electricity production. The findings of the study show that energy imports, government spending, and urban population growth have a negative impact on the production of renewable electricity, while the level of literacy has a positive and significant impact. This study highlights the critical role of macroeconomic variables in increasing renewable energy production, emphasizing the need for policies that reduce energy imports and ensure effective government spending on renewable energy.

Researchers [45] found that the use of renewable energy is positively related to economic growth. However, the use of renewable energy sources can also have various social effects, including poverty alleviation, climate change mitigation, and health improvement by reducing emissions-related pollution. Meanwhile, investments in renewable energy projects can help reduce poverty by providing new job opportunities in rural areas.

Summarizing the previous research and reviewed economic literature, it can be said that energy is vital to the economy and is a fundamental input for almost all services and goods. Stable energy production and productivity are the basis of economic growth. A reliable source of energy is said to be an important factor in economic development. The researchers propose a comprehensive theoretical framework that quantifies the impact of technological advances, renewable energy use, and international trade on carbon emissions. Research highlights the positive impact of technological advances and the use of renewable energy sources in reducing CO2 emissions. The authors advocate for measures, regulations, and legal frameworks to promote technological improvements and the transition to sustainable energy, emphasizing the critical role of policy in facilitating these changes. It is also necessary to take cross-border dependence and heterogeneity into account, ensuring the reliability of derived policy insights. It follows that the economic benefits of using renewable energy are high, as they offer solutions for sustainable development, improving public health, and preserving the environment, but there may be technological, financial, and political barriers to the transition to renewable energy systems, so it is important to assess the regional economic benefits of using renewable energy dynamics that can be very different from the effects at the national level.

Theoretical Methods for Evaluating the Economic Impact of Renewable Energy Resources

Causality between renewable energy promotion, carbon emission reduction and economic growth has become an important focus in the field of sustainable development discourse research. The increasing production of renewable energy and the accompanying technological innovations are driving the transformation of the energy sector, which is why it is necessary to create an appropriate energy security assessment system [46].

Innovations in renewable energy technologies can help bring clean energy to the market and can be useful in influencing energy portfolios. Nevertheless, relatively little attention has been paid to establishing the causal relationship between renewable and non-renewable energy sources and air pollution [47]. Renewable energy production and technological innovation have simultaneously been used as key examples of renewable energy development. The regression method is usually used to analyze the impact of solar, water, and wind energy on the economy, but other possible methods of assessing the impact of alternative energy resources on the economy are distinguished in the literature (Table 2).

Table 2.

Methods for assessing the impact of renewable energy resources on the economy.

Table 2 shows that various methods can be used to study the relationship between renewable energy resources and economic development: autoregressive distributed lag methods, correlation–regression analysis, Granger causality test, least squares method, and panel analysis. The application of these methods helps to obtain quite accurate results and determine whether there is a relationship between the considered factors and how strong it is.

Country studies confirm the effect of energy consumption on GDP and the bidirectional effect of renewable and non-renewable energy consumption on GDP (although these relationships vary depending on the countries studied and the methods used). When evaluating countries’ macroeconomic indicators, considering the environmental problems arising from the consumption of fossil fuels, the appropriate investment development policy and the consumption of renewable energy are inevitably chosen [42]. A requirement of this important subject is policy and government awareness of renewable energy developments that affect macroeconomic variables so that appropriate decisions can be made based on those changes. Evidence shows that, although renewable energy resources are available and very large in middle-income countries, they have not yet been adequately exploited. Major investments in renewable energy have led to many changes in the global energy industry and rapid growth in the global share of renewable energy in total electricity generation. Although targeting climate change is one of the main and most important goals of the decentralization of renewable energy development, the resulting positive economic impact is the most important goal of renewable energy development. On the other hand, a need for the evaluation of actions arises from the economic impact of renewable energy sources on regional development, but it faces many methodological and experimental limitations.

All new energy sources, including renewable energy sources, are critical to global economic growth. Economic and environmental issues have led to new approaches to international environmental law, including green economics. When evaluating the impact and results of renewable energy use, it can be said that the production of energy from renewable sources is positive in the short and long term, but renewable energy resources have a greater impact on the green economy in certain middle-income countries, so the evaluation of macroeconomic indicators in selected countries is one of the energy-related reasons for the development of production.

In summary, renewable energy sources such as wind and solar systems are widely used in power systems to reduce environmental pollution. Additionally, an alternative form of using renewable resources involves the use of a bio-waste plant that can generate electricity by incorporating environmental waste. The conditions for achieving equilibrium between production and consumption may not be met in real-time operations. The economic impact of using renewable energy is huge, so it is necessary to evaluate the economic benefits of renewable energy projects and the importance of supporting policy investments. By addressing the challenges and exploiting the opportunities presented by renewable energy, countries can achieve significant economic and environmental benefits, contributing to global efforts to combat climate change and promote sustainable development. Innovations in the technology of renewable energy sources can improve, thereby reducing the amount of energy consumed and the negative impact on the environment. The most used renewable energy sources are biomass, geothermal energy, hydropower, solar energy, and wind energy. Innovations in renewable energy technologies can help bring clean energy to the market. Renewable energy is an important policy tool for achieving energy diversity and security, as it reduces the country’s dependence on expensive fossil fuels. Investment in renewable energy leads to financial efficiency, GDP per capita, CO2 emissions, trade openness (trade), and random errors. This is a long-term approach, so it is necessary to focus on short-term and long-term results and develop a strategy for boundary testing and a method for error correction. The development of renewable energy is influenced by various factors, including climate change, global warming, energy security, cost reduction and emission reduction. Data-driven techniques such as least squares, Granger causality testing, panel analysis, and other techniques can provide more accurate predictions of trends in the use of solar, wind, and other alternative resources. This forward-looking analysis not only offers tighter and lower capital and leveled energy costs but also highlights the need for greater transparency in manufacturing ecosystems to leverage advanced analytical methods. It emphasizes the urgent need to accelerate the deployment of renewable energy sources to reach the appropriate levels necessary to meet climate change targets.

3. Research Methodology for the Impact of Development of Renewable Energy Resources on Economic Growth

3.1. Principles of Specification of Research Variables and Empirical Research Models

This subsection details the specifications of the models that are used to empirically test the research hypotheses. In order to not overestimate the impact of the transition to renewable energy sources on economic growth due to omitted variable bias, it is necessary to ensure that all the main factors of economic growth are controlled in the model [23,24]. Therefore, when detailing the first equation, the factors of economic growth included in the vector X are discussed first. The detailed specification of the economic growth model used for empirical research with panel data is written as Equation (1):

where gri,t is the average overlapping five-year future economic growth rate calculated as when Y is real GDP per capita. Data for all measured variables are collected from the Eurostat database. The unbalanced sample of panel data consists of 27 EU countries (N = 27); the data covers the period 2000–2021 (T = 22). A breakdown of all variables is presented in Table 3.

Table 3.

Names of variables (dependent variable of the model and vector of economic growth factors X), their abbreviations, and descriptive statistics.

Economic growth factors commonly used in empirical studies are included in the model when these studies are supplemented with specific variables of interest to researchers [51,52]. RnDi,t reflects the total (private and public) investment in R&D activities and measures the country‘s innovation potential [53]. To measure human capital (HCi,t), the share of the population with higher education is used. Inflation is measured by price level changes (ΔlnHICPi,t) [54,55]. The share of central government final consumption expenditure in GDP (Gi,t) is used to measure the size of public. To approximate the volume of investment in a country, the proportion of gross capital formation expenditure to GDP (GCFi,t) is used [45]. According to the neoclassical theory of growth, the positive effect of investment on economic growth is characterized by a diminishing marginal effect; i.e., as investments grow, their additional growth amount contributes less and less to the promotion of economic growth. A quadratic polynomial is used to approximate this non-linear relationship and the GCFi,t variable is included in the model, found by squaring it. To measure the openness of the economy, a country’s openness to international trade is used as the ratio of the sum of imports and exports to GDP (TRi,t) [27]. To approximate the institutional environment, the level of corruption control (CCi,t) is used, the estimates of which are provided by the World Bank in its Worldwide Governance Indicators (WGI) database. The last factor of economic growth is the dynamics of the amount of labor employed in the economy, which is approximated by the change in the number of employed (ΔlnEMPLi,t) [56,57].

The transition to renewable energy (Hydro, Geothermal, Wind, Solar, Tidal/Wave) sources (RENi,t) is measured with two alternatives—the share of consumed energy from renewable energy sources (REN_Ui,t) in the energy balance [30] and as a share of energy generation capacity from renewable energy sources (REN_Pi,t) involved in energy generation capacity [58,59] (Table 4).

Table 4.

Names of variables (renewable energy sources), their abbreviations, and descriptive statistics.

The first stage will test the H1 hypothesis that the transition to renewable energy sources slows economic growth. This hypothesis assumes that due to the higher price of renewable energy sources (solar, wind, etc.) compared to traditional energy sources (fossil fuel, nuclear energy, etc.), a higher share of renewable energy sources in the energy balance means a higher total energy, used in the economy, the price). This increases the costs for households and companies and reduces the competitiveness of goods and services in the international market, A similar assumption can be made regarding the development of power generation capacity from renewable energy sources. Since these technologies are relatively new, energy generation capacities developed on their basis are more expensive than those based on traditional energy sources; i.e., one megawatt (MW) energy installation prices vary in favor of traditional energy sources [60]. As a result, in the context of cost–benefit analysis, the decision to expand energy generation capacity from renewable energy sources by abandoning cheaper traditional ones is irrational, as it involves higher costs for obtaining the same result. The first hypothesis will be tested empirically using the specification of regression Equation (2).

If the estimate of φ is negative and statistically significant, it will indicate a negative impact of renewable energy development on economic growth and will be evidence to not reject H1.

As hypothesis H1 shows that the growth-suppressing effect of the transition to renewable energy sources is based on a cost effect [61], one confirmatory/clarifying sub-hypothesis will be additionally tested.

H1a:

As the prices of renewable energy resources decrease over time and new energy generation capacity from renewable energy sources increases, the negative impact of the transition to renewable energy sources on economic growth decreases [59,62,63].

This sub-hypothesis will be tested empirically using the specification of regression Equation (3).

where td2001, …, td2021 are time pseudovariables, and , ..., are interaction variables between transition to renewable energy resources and time variables. δ2001, …, δ2021 are coefficients that show the difference in the impact of the transition to renewable energy resources on economic growth in the respective years compared to 2000. H1a is not rejected if δ2001, …, δ2021 are positive and statistically significant and the following inequality persists: δ2001 <, …, < δ2021. This would indicate that the negative year 2000-based effect, causing φ to become smaller and smaller over time.

These studies provide a broad assessment of the impact of the transition to renewable energy on economic growth, so the thesis must provide an analysis to prove/disprove that renewable energy does not slow down economic growth and can have a positive effect, taking into account factors such as investment, energy type, scale of production, and climatic conditions.

3.2. Description of the Variety of Estimation Methods

Coefficient estimates for all regression models are first calculated using ordinary least squares (OLS). The least squares method has been discussed by many researchers [13,49,50,64]. The least squares method is a linear regression model whose objective is to minimize the differences between the observed responses (values of the predicted variable) in each set of data. Visually, this is measured as the sum of the squared vertical distances between each data point in the set and the corresponding point on the regression line—the smaller the differences, the better the model fits the data. The resulting estimate can be expressed in a simple formula, especially in the case of a single regressor on the right-hand side. The OLS estimator is consistent when the regressors are exogenous, and optimal in the class of linear unbiased estimators when the errors are homoscedastic and serially uncorrelated. Under these conditions, the OLS method provides an unbiased estimate of the minimum variance mean when the errors have finite variance. Under the additional assumption that the errors are normally distributed, the OLS is evaluated as a maximum likelihood estimator.

The least squares method is a regression analysis parameter estimation method based on the difference in the sum of squares of the residuals (the residual is the difference between the observed value and the fitted value provided by the model) from the individual equations. Least squares are a mathematical procedure for finding the best curve fitting a given set of points by minimizing the sum of the squares of the displacements (“residuals”) of the points on the curve. When the problem has large uncertainties in the independent variable (variable x), then simple regression and least squares methods have problems, and, in such cases, the method of fitting variable error models may be considered instead of the least squares method.

This is said to be the best method that can be used to establish causal relationships between variables. The αi estimates of these models are further tested to determine their behavior and to select an appropriate estimation method. The Fisher (F) test performed at the first stage allows for H0: to be checked, i.e., verifying that is not characterized by specificity, with the alternative that are specific and time-invariant. The low p-value of this test (<0.05) allows us to conclude that the OLS, which does not eliminate and model , is not suitable and may lead to biased parameter estimates. In this case, the alternative, of calculating fixed effects (FE) estimates, would be more appropriate. The FE method transforms the data (time-demeaned transformation) and thus eliminates from the model.

In the second stage, the Breusch–Pagan (BP1) test (1979) is performed, which tests H0: , i.e., verifies that is not characterized by specificity with the alternative that values are specific and vary randomly over time. The low p-value of this test (<0.05) allows us to conclude that the OLS, which does not eliminate and model is not suitable and may lead to biased parameter estimates. In this case, an alternative to calculating random effects (RE) estimates, which uses the generalized least squares method (GLSM) (generalized least squares, GLS), would be more appropriate. The AE method transforms the data (quasi time-demeaned transformation) and thus partially eliminates from the model.

In the third step, the Hausman test (1978) is performed, which allows for testing H0, with GLSM estimates to be consistent. The low p-value of this test (<0.05) leads to the conclusion that GLSM is not suitable and the FE method is more suitable [64].

These three tests, based on the analysis of the behavior of , allow an individual to choose one of the three estimation methods—OLS, FE, or AE. However, choosing a suitable estimation method based on the behavior of does not guarantee that the model will not exhibit endogeneity.

This model reflects several ways of assessing the impact of renewable energy development on economic growth analyzed in the theoretical part of the work. The evaluation model highlights the parts that are combined into the evaluation of the impact of RES development on the economy, according to the study of economic growth factors, using econometric modeling.

4. The Assessment of the Impact of the Development of Renewable Energy Resources on Economic Growth

This chapter presents the systematic results of the assessment of renewable resources and economic development. The purpose of this analysis is to test the theoretical assumptions that renewable energy resources have an impact on economic development. The research aims to check whether the considered factors are correlated with each other, and what the strength and direction these connections are. An attempt is also made to practically approve the assessment model of factors influencing economic development developed in the section on methodology.

4.1. Determining How Estimates Are Calculated and Testing Model Assumptions

In assessing the impact of renewable energy development on economic growth, first, the estimates of all regression models were calculated using the least squares method (LSM). The estimators of these models were then tested to determine their behavior and to select an appropriate estimation method. Fisher’s (F) test showed specificity. The low p-value of this test (<0.0001) leads to the conclusion that the LSM, which does not eliminate and model country-specific effects, is not appropriate, as the alternative, calculating fixed effects (FE) estimates, is more appropriate in this case. The small p-value of the Breusch–Pagan test (<0.0001) suggests that they are specific and vary randomly over time. This again confirms that LSM can lead to biased parameter estimates. A more appropriate alternative for calculating random effects (AE) estimates is to use the generalized least squares method (GLM). A low p-value (<0.0001) for the Hausman test, which allows for the testing of whether GLM estimates are aligned, suggests that GLM is not appropriate, and the FE method should be preferred. Based on the obtained results, the estimations of all models are calculated using FE below.

These models were further tested for the potential endogeneity problem. A high Durbin–Wu–Hausman test (1954) p-value (>0.05) indicates that the independent variables in the model are exogenous and that the FE estimates are not biased. It also shows that all the main factors of economic growth are included in the models and no variables are omitted which affect economic growth and are correlated with other independent variables included in the model, which would cause endogeneity.

All models were also tested using the variance reduction multiplier to check that the independent variables were not overly correlated. The obtained results (VIF < 4) allow us to say that the models are not characterized by multicollinearity.

Time pseudovariables are included in all models, as the Wald test that tests H0 is rejected with a p-value < 0.0001. All models include country-specific effects, i.e., the applied two-way fixed effects method (two-way FE), which is also called least squares dummy variable (LSDV) regression. Neither time nor country pseudovariables are presented in the model tables. Beck–Katz stabilized standard errors are given in parentheses. The coefficient of determination of the LSDV is presented, which does not include the individual effects of the countries and shows only the part of the variation in the dependent variable, explained specifically by the factors included in the model.

* indicate statistical significance at the 10%levels.

** indicate statistical significance at the 5% levels.

*** indicate statistical significance at the 1% levels (see Table 5).

Table 5.

The results of testing the first hypothesis (H1): the dependent variable is the average overlapping five-year future economic growth rate.

4.2. Result of the Study of Factors of Economic Growth

It is necessary to start the discussion of the results with the economic growth factors that were included in the models as control variables. These variables are repeated in all models, so a detailed discussion of them is necessary. The study revealed a negative and statistically significant (1% level) correlation between the initial GDP per capita and its average five-year growth rates, which signals that there was a beta convergence between the analyzed EU countries during the study period, which reached about 3%. This shows that countries with lower GDP per capita grew faster than countries with higher GDP (a difference of one percent of GDP per capita is associated with a 0.03% difference in economic growth rate). Countries that invested more in R&D had faster economic growth rates. One percentage point (p.p.) of GDP higher investment in R&D was associated with a 0.37% faster economic growth rate. When supplementing the models with the share of consumed energy from renewable energy sources in the energy balance (REN_U) or the share of energy generation capacity from renewable energy sources in total capacity (REN_P), the size of the R&D effect remains similar but becomes statistically insignificant. This shows that R&D investment and REN_P are related; i.e., REN_P and REN_P without R&D activities did not occur, and their inclusion in the models sufficiently approximates the differences in the scale of R&D activities in the countries. A greater supply of human capital, which in the study is approximated by the share of the population with higher education, statistically significantly (at the 1–5% level) accelerates economic growth rates. A higher share of the population with higher education of one p.p. is associated with a 0.03–0.05 percent faster economic growth rate. A statistically significant effect of inflation on economic growth has not been established. In the studied period, inflation rates in the EU were quite low (the average annual rate of price growth was 2.2%, and the maximum was 16.8%) and did not have a negative impact on economic growth. The size of the public sector, which measures the degree of government intervention in the economy and is approximated by the share of GDP redistributed through the budget managed by the central government, has a negative effect on economic growth. Both the effect size and its statistical significance are not stable in the models. In the model that includes REN_P, the effect on growth becomes insignificant, indicating that differences in the share of renewable energy generation capacity in total capacity across countries are related to the share of central government final consumption expenditure in GDP; i.e., the state finances a significant part of the growth of these generation capacities through its budget.

A non-linear, but statistically insignificant, relationship between total capital formation costs and economic growth was also established. The negative coefficient to the square of the cost of general capital formation shows that the marginal effect of investment on economic growth is decreasing and the breaking point is reached when the cost of general capital formation reaches about 16 percent of the GDP. The study alternatively used (i) gross capital formation expenditure per employee and (ii) gross fixed capital formation expenditure as a share of the GDP and obtained similar results—a non-linear statistically insignificant, inverted U-shaped relationship between capital investment and economic growth. Economic openness to trade, measured as the share of the sum of imports and exports from GDP, has a statistically significant (at the 1% level) positive effect on economic growth. A one percentage point higher share of international trade from GDP is associated with an average 0.003–0.007 percent faster economic growth rate. A better institutional environment, as measured by lower levels of corruption, is associated with faster rates of economic growth. A one-point (five-point range) lower level of corruption is statistically significantly (at the 1% level) associated with a 0.7–0.1 percent faster economic growth rate. The growth of the number of employees as one of the main factors of production has a statistically significant (at the 1% level) positive effect on economic growth. The calculated elasticity coefficient varies around 0.4–0.5; i.e., a one percent higher number of employed people is related to 0.4–0.5 higher GDP.

The first hypothesis (H1), which states that the transition to renewable energy sources slows down economic growth, was also tested. After conducting the research, it can be stated that the share of renewable energy resources in the energy balance does not have a statistically significant effect on economic growth. Thus, it can be said that the transition to renewable energy sources does not slow down economic growth in countries, but when renewable energy sources are evaluated according to the share of energy generation, a positive statistically significant effect on the economy is determined—a one percentage point higher share of energy generation capacity from renewable energy sources in the total capacity is associated with 0.00763% faster economic growth in the country. This is associated with investment, correspondingly increasing the generation capacity, so it is possible to reject hypothesis H1 and conclude that the transition to the use of renewable energy sources does not slow down economic growth.

According to the developed model, the correcting sub-hypothesis (H1a) was tested (Table 6), which states that over time and as the prices of renewable energy resources decrease and as new generation capacities from renewable energy sources increase, the negative impact of the transition to renewable energy sources on the economy decreases. After evaluating the obtained calculation results, it can be stated that there is no statistically significant change in the effect during the studied period. Evaluating renewable energy sources by share of energy generation shows the same positive effect on the economy, which does not change substantially over time. In the previous stage, a statistically insignificant effect of the share of consumed energy from renewable energy sources in the energy balance was determined, and it remains so throughout the examined period, so it can be concluded that the identified effects remain relatively constant over time.

Table 6.

Results of the verification of the confirmatory sub-hypothesis (H1a). The dependent variable is the average overlapping five-year future economic growth rates.

After evaluating the development of different energy generation capacities, countries’ investments in the latest and most expensive technologies that require the most funds, geothermal, wind, and solar energy development in total capacity, it can be said that these have a statistically significant positive effect on economic growth. The development of the capacity of hydropower sources has a positive, but smaller, impact, since it is already a long-developed technology. Therefore, the raised sub-hypothesis can be rejected, as the research results do not confirm the negative effect of the transition to renewable energy resources on the economy. It should be emphasized here that the identified positive effects are different, so the effect of the investments allocated to the development will be uneven and will depend on the nature of the sources being developed.

5. Discussion

The transition from traditional fossil fuels to renewable energy sources is among the most critical steps in addressing global challenges such as climate change, environmental degradation, and sustainable development. As the world’s population grows and economies expand, the demand for energy rises, making the energy sector pivotal for global development. However, the reliance on fossil fuels for energy has led to significant environmental harm, including greenhouse gas emissions, air pollution, and ecosystem destruction. Renewable energy offers a transformative solution to these issues, promising economic, social, and environmental benefits. This discussion delves deeper into the multifaceted impacts of renewable energy, examining its role in fostering economic growth, addressing environmental concerns, and promoting global sustainability [65,66,67,68].

Fossil fuels have dominated the global energy landscape, driving industrial growth and technological advancements. However, this progress has come at a steep environmental cost. Fossil fuel combustion accounts for the importance of global greenhouse gas emissions, contributing significantly to global warming. The consequences of climate change—rising sea levels, extreme weather events, and biodiversity loss—are evident worldwide. Additionally, air and water pollution from fossil fuel extraction and consumption adversely affects human health and the environment, disproportionately impacting vulnerable communities.

Beyond environmental damage, fossil fuel dependence’s economic and social costs are staggering. Countries reliant on imported fossil fuels face energy security risks, price volatility, and economic instability. These challenges underscore the urgent need for a transition to cleaner, more sustainable energy sources [69]. The use of natural resources and renewable energy resources are the most important factors to reach sustainable development and improve the country’s economy. The best method to analyze these relations is to use the Granger causality test and time series analysis. The best factor for revealing energy efficiency is GDP [70].

Renewable energy, derived from natural processes such as sunlight, wind, water, and biomass, offers a viable alternative to fossil fuels. Unlike finite fossil resources, renewable energy sources are replenished naturally and are virtually inexhaustible. As countries seek to achieve their climate goals and ensure energy security, adopting renewable energy has become a central pillar of global energy policy.

The advantages of renewable energy extend beyond environmental sustainability. By reducing greenhouse gas emissions, renewable energy contributes directly to climate change mitigation. Additionally, renewable energy projects generate economic opportunities, create jobs, and enhance local and regional development. For instance, wind and solar energy installations often require skilled labor for design, construction, and maintenance, fostering employment growth in communities.

One of the most compelling arguments for renewable energy is its potential to stimulate economic growth. The economic benefits of renewable energy are multifaceted, encompassing job creation, technological innovation, investment attraction, and energy price stabilization.

Renewable energy development is labor-intensive, particularly during the construction and installation phases. This creates significant employment opportunities across various sectors, including engineering, manufacturing, construction, and services. According to research, renewable energy projects could create millions of jobs globally by 2050, with solar and wind energy sectors leading the way. These jobs not only boost local economies but also offer pathways to economic resilience in communities transitioning away from fossil fuel-based industries.

Renewable energy plays a crucial role in advancing recycling activities by providing sustainable and environmentally friendly power solutions. Recycling processes, such as material collection, sorting, and reprocessing, often require significant amounts of energy. By integrating renewable energy sources, like solar, wind, and hydroelectric power, recycling facilities can reduce their dependence on fossil fuels, thereby lowering greenhouse gas emissions and their overall carbon footprint [71,72].

Renewables help in creating a closed-loop system by aligning with the core principles of sustainability. For instance, solar-powered recycling plants can operate more efficiently and cost-effectively, as they harness abundant and clean energy from the sun. Similarly, wind turbines near industrial recycling hubs can generate electricity to power heavy machinery used in shredding, melting, or compressing materials.

The use of renewable energy also supports innovative recycling techniques. For example, advanced chemical recycling methods, which require high heat or energy inputs, can benefit from renewable energy sources to minimize environmental impact [73]. Moreover, renewables foster energy independence for recycling operations, especially in remote areas where grid access may be limited.

Overall, coupling renewable energy with recycling efforts enhances economic sustainability, reduces operational costs, and aligns with global climate goals, creating a circular economy where waste is reused and energy resources are renewable.

The renewable energy sector is a hotbed of technological innovation, driving advancements in energy storage, grid integration, and efficiency. These innovations have led to significant cost reductions in renewable energy technologies. For example, the cost of solar photovoltaic (PV) systems has declined by more than 80% over the past decade, making solar energy one of the most affordable power sources in many regions. Continued innovation is essential for overcoming technical and economic barriers to renewable energy adoption.

While the benefits of renewable energy are clear, its widespread adoption faces several challenges. These include high initial costs, technological limitations, policy barriers, and regional disparities, but renewable energy is a cornerstone of sustainable development, offering a pathway to economic growth, environmental protection, and social well-being. While challenges remain, strategic investments, supportive policies, and technological advancements can accelerate the global transition to renewable energy. As countries work toward achieving climate goals and ensuring energy security, renewable energy represents a vital solution to the pressing challenges of our time.

Stakeholder engagement is a critical factor for the successful implementation of renewable energy projects, particularly in community-based and recycling initiatives. Empirical research indicates that the active involvement of local communities, government agencies, and private stakeholders is vital for ensuring the long-term viability and sustainability of such initiatives [74,75,76]. Furthermore, the engagement of diverse stakeholders facilitates collaborative governance, which is essential for addressing key challenges related to financing, policy frameworks, and social acceptance [77].

Stakeholder engagement plays a pivotal role in advancing renewable energy projects. By involving diverse groups—such as governments, local communities, investors, and environmental organizations—developers can address concerns, gain public trust, and ensure regulatory compliance [78,79]. Engaged stakeholders contribute valuable insights, helping to identify optimal project locations and mitigate potential social or environmental impacts. This collaboration fosters social acceptance and reduces resistance, enabling smoother implementation of renewable energy initiatives [80,81]. Additionally, active involvement encourages shared responsibility and promotes innovative solutions, driving sustainable development. [82,83]. Ultimately, stakeholder engagement enhances project success, accelerates the transition to clean energy, and aligns efforts with global climate goals.

6. Conclusions

The consumption of renewable energy resources in the states is constantly increasing, and their development is one of the most important goals of energy policy in the European Union. The use of renewable energy sources results in reductions in greenhouse gas emissions, improved air quality, and the cessation of dependence on finite fossil fuel resources, and these benefits contribute significantly to ensuring long-term sustainability. Different theories of economic growth provide different insights into the relationship between economic growth and the use of renewable natural resources. When evaluating the impact of the use of renewable resources on the economy, the main aspects of renewable resources and their links with investments, technological progress, and opportunities for solving the main environmental problems to achieve sustainable development must be considered. In addition, the use of renewable energy resources has a positive effect on the creation of new jobs, stabilization of energy prices, market dynamics, and especially contributes to reductions in pollution and climate change.

A methodology for evaluating renewable energy resources was created, which was intended to confirm or refute the raised hypotheses. The main hypothesis was that the transition to renewable energy sources slows economic growth. A clarifying sub-hypothesis was also put forward, that as the prices of renewable energy resources decrease over time and new energy generation capacities from renewable energy sources increase, the negative impact of the transition to renewable energy sources on economic growth decreases. The study was planned to use the method of least squares and panel analysis, and other methods that refine the results.

The findings of the research indicate that hypothesis H1, which posits that transitioning to renewable energy sources (RES) hinders economic growth, is not supported. While RES may require substantial initial investments and can initially appear more costly than traditional energy sources like fossil fuels or nuclear power, the long-term impact of RES on economic growth is not significantly negative. On the contrary, the development of RES has the potential to foster economic growth through several key mechanisms: technological advancements, job creation, and investment attraction. The study provides a nuanced understanding of the factors influencing economic growth in EU countries, revealing critical insights into the interplay between initial economic conditions, investments, and renewable energy adoption. A notable finding is the beta convergence observed among the analyzed nations, where countries with lower GDP per capita grew faster than those with higher GDP. Specifically, a one percent difference in GDP per capita was associated with a 0.03% variation in growth rates. This convergence underscores the potential for more equitable economic development within the region. Investments in research and development (R&D) emerged as a key driver of growth, with one percentage point of GDP being allocated to R&D correlating with a 0.37% increase in growth rates. However, when renewable energy metrics (REN_U and REN_P) were included, the R&D effect became statistically insignificant, highlighting the interdependence between R&D and renewable energy investments. Furthermore, human capital, as measured by the share of the population with higher education, significantly contributed to growth, with a one percentage point increase resulting in a 0.03–0.05% rise in growth rates.

The research also found that inflation had no significant impact on growth during the study period, while the size of the public sector had an inconsistent negative effect, likely tied to government financing of renewable energy projects. Capital formation exhibited a non-linear, inverted U-shaped relationship with growth, indicating diminishing returns beyond 16% of GDP. Crucially, the hypothesis that transitioning to renewable energy sources slows economic growth (H1) was rejected. While the overall share of renewable energy in the energy balance showed no significant effect, the share of renewable energy generation capacity positively impacted growth. A one percentage point increase in renewable energy capacity was associated with a 0.00763% faster growth rate, reflecting the benefits of renewable energy investments and their role in sustainable development.

7. Recommendations

- Promotion of investments in renewable energy. Policymakers and decision-makers should continue to expand financial incentives (such as grants, low-interest loans, and tax credits) to encourage investment in renewable energy. Considering the EU’s commitment to implement the “Green Deal”, and for the EU to achieve carbon neutrality by 2050, such incentives fit well with broader climate goals. The EU should also propose increased funding under programs such as Horizon Europe to support research and innovation in renewable energy technologies.

- Differentiated approaches according to energy type. EU policy should differentiate renewable technologies according to regional suitability and technological maturity. For example, wind energy could be more encouraged in wind-rich areas (such as the North Sea region) and solar energy in southern Europe due to greater exposure to sunlight. Hydropower could be prioritized in Alpine regions where geographical conditions are favorable.

- Focus on economies that are highly dependent on imports. EU countries that are highly dependent on energy imports (for example, many Eastern European countries) should pay particular attention to the development of local renewable energy resources. This would reduce external dependence and possibly stabilize the local economy, as energy costs would remain within the country. The EU can support this through joint projects and funding, thus promoting energy security as a common goal.

- Adaptation to local climatic conditions. The EU should encourage Member States to develop renewable energy strategies that take local climate conditions into account. For example, Mediterranean countries can use the high number of sunny days for solar energy projects, and northern European countries for wind and hydropower projects. Such an approach not only increases efficiency in energy production, but is also in line with the EU’s climate change adaptation strategies.

- Solving the problem of diminishing returns on large investments. As renewable energy markets develop, the EU needs to monitor and manage the scale of investment to avoid oversaturation. This issue can be addressed by developing indicators to measure the economic impact of investments in renewable energy at various scales, and by adjusting subsidies and incentives accordingly to ensure economic benefits.

- Long-term strategic planning. The EU should consolidate its long-term renewable energy targets and incorporate them into national planning systems. This could include setting progressive targets for renewable energy production and consumption that would be integrated into wider EU environmental and economic policies. Long-term goals would provide predictability and stability, which would encourage sustainable private investment.

- Impact on individual sectors. The EU can implement sector-specific initiatives, such as promoting the use of electric cars in the transport sector or increasing the use of renewable energy in the heating and cooling systems of public buildings. Each sector requires individual solutions that take into account different energy uses and opportunities for the integration of renewable resources.

These recommendations offer EU policymakers a blueprint for harnessing the potential of renewable energy to boost economic growth while meeting environmental goals. If the consumption of renewable energy resources increases, this will also ensure stable economic growth and sustainable development.

Author Contributions

Conceptualization, V.D., L.O.N., M.T. and I.D. methodology, V.D. and L.O.N.; experiment and result analysis, V.D., L.O.N., M.T., I.D. and R.T. conclusions, V.D., L.O.N., I.D. and R.T.; discussion, L.O.N., writing—original draft preparation, V.D. and L.O.N.; writing—review and editing, L.O.N. and M.T. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Data Availability Statement

The original contributions presented in the study are included in the article.

Conflicts of Interest

The authors declare no conflicts of interest.

References

- Bortoluzzi, M.; de Souza, C.C.; Furlan, M. Bibliometric analysis of renewable energy types using key performance indicators and multicriteria decision models. Renew. Sustain. Energy Rev. 2021, 143, 110958. [Google Scholar] [CrossRef]

- Algarni, S.; Tirth, V.; Alqahtani, T.; Alshehery, S.; Kshirsagar, P. Contribution of renewable energy sources to the environmental impacts and economic benefits for sustainable development. Sustain. Energy Technol. Assess. 2023, 56, 103098. [Google Scholar] [CrossRef]

- Farghali, M.; Osman, A.I.; Chen, Z.; Abdelhaleem, A.; Ihara, I.; Mohamed, I.M.A.; Yap, P.S.; Rooney, D.W. Social, environmental, and economic consequences of integrating renewable energies in the electricity sector: A review. Environ. Chem. Lett. 2023, 21, 1381–1418. [Google Scholar] [CrossRef]

- Orlando, M.; Bottaccioli, L.; Quer, S.; Poncino, M.; Vinco, S.; Patti, E. A framework for economic and environmental benefit through renewable energy community. IEEE Syst. J. 2023, 17, 5626–5635. [Google Scholar] [CrossRef]

- Osman, A.I.; Mehta, N.; Elgarahy, A.M.; Hefny, M.; Al-Hinai, A.; Al-Muhtaseb, A.A.H.; Rooney, D.W. Hydrogen production, storage, utilisation and environmental impacts: A review. Environ. Chem. Lett. 2022, 20, 153–188. [Google Scholar] [CrossRef]

- Adanma, U.M.; Ogunbiyi, E.O. Assessing the economic and environmental impacts of renewable energy adoption across different global regions. Eng. Sci. Technol. J. 2024, 5, 1767–1793. [Google Scholar] [CrossRef]

- Ruschak, M.; Caha, Z.; Talíř, M.; Konečný, M. The application of CSR in marketing communication and its potential impact on customer perceived value. Entrep. Sustain. Issues 2023, 10, 223–244. [Google Scholar] [CrossRef] [PubMed]

- Łęgowik-Małolepsza, M.; Kollmann, J.; Chamrada, D. Eco-marketing and the competitive strategy of enterprises—Review of the research results of energy companies. Entrep. Sustain. Issues 2024, 11, 135–153. [Google Scholar] [CrossRef] [PubMed]

- Sabauri, L.; Kvatashidze, N. Sustainability reporting issues. Entrep. Sustain. Issues 2023, 11, 282–289. [Google Scholar] [CrossRef]

- Samašonok, K.; Išoraitė, M. The implementation of sustainable development goals through communication tools. Entrep. Sustain. Issues 2023, 10, 102–122. [Google Scholar] [CrossRef]

- Samašonok, K.; Išoraitė, M. Study of the implementation possibility of sustainable development goals. Entrep. Sustain. Issues 2023, 11, 168–183. [Google Scholar] [CrossRef] [PubMed]

- 12 Antonioli, D.; Chioatto, E.; Mazzanti, M. Innovations and the circular economy: A national and regional perspective. Insights Into Reg. Dev. 2022, 4, 57–70. [Google Scholar] [CrossRef]

- Adedoyin, F.F.; Erum, N.; Taşkin, D.; Chebab, D. Energy policy simulation in times of crisis: Revisiting the impact of renewable and non-renewable energy production on environmental quality in Germany. Energy Rep. 2023, 9, 4749–4762. [Google Scholar] [CrossRef]

- Fleacă, B.; Fleacă, E.; Maiduc, S.; Croitoru, I.M. Research and innovation for sustainability transformation—Modern outlooks and actual challenges. Entrep. Sustain. Issues 2023, 10, 263–278. [Google Scholar] [CrossRef]

- Gargasas, J.; Bazienė, K.; Dzienis, P. Low energy buildings: Multifunctional strategies and solutions. Entrep. Sustain. Issues 2023, 11, 314–330. [Google Scholar] [CrossRef] [PubMed]

- Yalçınkaya, A.; Feyzioglu, A.; Boyraz, C.; Haliloglu, H.; Santoro, D.; Piccinetti, L. Demand side response program for more sustainable electricity market: A case study of Türkiye. Insights Into Reg. Dev. 2024, 6, 11–22. [Google Scholar] [CrossRef] [PubMed]

- Mugunzva, F.I.; Manchidi, N.H. Re-envisioning the artificial intelligence-entrepreneurship nexus: A pioneering synthesis and future pathways. Insights Into Reg. Dev. 2024, 6, 71–84. [Google Scholar] [CrossRef]

- Alsagr, N. Financial efficiency and its impact on renewable energy investment: Empirical evidence from advanced and emerging economies. J. Clean. Prod. 2023, 401, 136738. [Google Scholar] [CrossRef]

- AlNemer, H.A.; Hkiri, B.; Tissaoui, K. Dynamic impact of renewable and non-renewable energy consumption on CO2 emission and economic growth in Saudi Arabia: Fresh evidence from wavelet coherence analysis. Renew. Energy 2023, 209, 340–356. [Google Scholar] [CrossRef]

- Majewska, A.; Bełtowska, P. Socially responsible investing (SRI) as a factor of competitiveness and sustainable development of organisations in young consumers’ opinion. Entrep. Sustain. Issues 2023, 10, 245–262. [Google Scholar] [CrossRef]

- Naimoğlu, M.; Kavaz, I. Energy use tendencies in a resource-abundant country: The case of Canada. Insights Into Reg. Dev. 2023, 5, 65–79. [Google Scholar] [CrossRef]

- Prakash, R. Net energy and feasible economic growth: A developing country perspective from India. Insights Into Reg. Dev. 2021, 3, 106–113. [Google Scholar] [CrossRef] [PubMed]

- Chovancová, J.; Štofejová, L.; Gavura, S.; Novotný, R.; Rigelský, M. Assessing energy consumption and greenhouse gas emissions in EU member states—Decomposition analysis. Entrep. Sustain. Issues 2024, 11, 242–259. [Google Scholar] [CrossRef] [PubMed]

- Valodka, I.; Valodkienė, G. The impact of renewable energy on the economy of Lithuania. Procedia-Soc. Behav. Sci. 2015, 213, 123–128. [Google Scholar] [CrossRef]

- Rezk, M.R.; Piccinetti, L.; Saleh, H.A.; Salem, N.; Mostafa, M.M.; Santoro, D.; El-Bary, A.A.; Sakr, M.M. Future scenarios of green hydrogen in the MENA countries: The case of Egypt. Insights Into Reg. Dev. 2023, 5, 92–114. [Google Scholar] [CrossRef] [PubMed]

- Piccinetti, L.; Rezk, M.R.; Kapiel, T.Y.; Salem, N.; Khasawneh, A.; Santoro, D.; Sakr, M.M. Circular bioeconomy in Egypt: The current state, challenges, and future directions. Insights Into Reg. Dev. 2023, 5, 97–112. [Google Scholar] [CrossRef] [PubMed]

- Igielski, M. Project management in the renewable energy sources industry in Poland—Identification of conditions and barriers. Entrep. Sustain. Issues 2023, 10, 135–151. [Google Scholar] [CrossRef] [PubMed]

- Levický, M.; Fiľa, M.; Maroš, M.; Korenková, M. Barriers to the development of the circular economy in small and medium-sized enterprises in Slovakia. Entrep. Sustain. Issues 2022, 9, 76–87. [Google Scholar] [CrossRef] [PubMed]

- Pariso, P.; Picariello, M.; Marino, A. Circular economy and rare materials: A challenge for the European countries. Entrep. Sustain. Issues 2023, 11, 79–92. [Google Scholar] [CrossRef]

- Apanovych, Y.; Prágr, S. Determination of iron procurement strategy for manufacturing companies. Entrep. Sustain. Issues 2023, 11, 331–348. [Google Scholar] [CrossRef]

- Radavičius, T.; van der Heide, A.; Palitzsch, W.; Rommens, T.; Denafas, J.; Tvaronavičienė, M. Circular solar industry supply chain through product technological design changes. Insights Into Reg. 2021, 3, 10–30. [Google Scholar] [CrossRef] [PubMed]

- Tvaronavicienė, M. The Transition towards Renewable Energy: The Challenge of Sustainable Resource Management for a Circular Economy. Energies 2024, 17, 4242. [Google Scholar] [CrossRef]

- Ivančík, R.; Andrassy, V. Insights into the development of the security concept. Entrep. Sustain. Issues 2023, 10, 26–39. [Google Scholar] [CrossRef] [PubMed]

- Pceļina, V.; Lavrinenko, O.; Danileviča, A. Disproportions of the green economy in the selected countries. Entrep. Sustain. Issues 2023, 11, 293–305. [Google Scholar] [CrossRef]

- Teivāns-Treinovskis, J.; Jefimovs, N.; Velika, R.; Trofimovs, I. Legal conditions of EU energy security. Entrep. Sustain. Issues 2023, 10, 39–47. [Google Scholar] [CrossRef]

- Zecca, E.; Pronti, A.; Chioatto, E. Environmental policies, waste and circular convergence in the European context. Insights Into Reg. Dev. 2023, 5, 95–121. [Google Scholar] [CrossRef] [PubMed]

- Andryeyeva, N.; Nikishyna, O.; Burkynskyi, B.; Khumarova, N.; Laiko, O.; Tiutiunnyk, H. Methodology of analysis of the influence of the economic policy of the state on the environment. Insights Into Reg. Dev. 2021, 3, 198–212. [Google Scholar] [CrossRef] [PubMed]

- Zemlickienė, V.; Amraoui, B.; El Idrissi, N.E. Analysis of Morocco’s renewable energy production and transmission potential. Insights Into Reg. Dev. 2024, 6, 64–78. [Google Scholar] [CrossRef] [PubMed]

- International Renewable Energy Agency. Information About Renewable Energy. 2016. Available online: www.irena.org (accessed on 20 August 2024).

- Raihan, A.; Tuspekova, A. Role of economic growth, renewable energy, and technological innovation to achieve environmental sustainability in Kazakhstan. Curr. Res. Environ. Sustain. 2022, 4, 100165. [Google Scholar] [CrossRef]

- Coskuner, G.; Jassim, M.S.; Nazeer, N.; Damindra, G.H. Quantification of landfill gas generation and renewable energy potential in arid countries: Case study of Bahrain. Waste Manag. Res. 2020, 38, 1110–1118. [Google Scholar] [CrossRef]

- Candra, O.; Chammam, A.; Alvarez, J.R.N.; Muda, I.; Aybar, H.Ş. The impact of renewable energy sources on the sustainable development of the economy and greenhouse gas emissions. Sustainability 2023, 15, 2104. [Google Scholar] [CrossRef]

- Fang, Z. Assessing the impact of renewable energy investment, green technology innovation, and industrialization on sustainable development: A case study of China. Renew. Energy 2023, 205, 772–782. [Google Scholar] [CrossRef]

- English, B.C.; Menard, R.J.; Wilson, B. The economic impact of a renewable biofuels/energy industry supply chain using the renewable energy economic analysis layers modeling system. Front. Energy Res. 2022, 10, 780795. [Google Scholar] [CrossRef]

- Shahbaz, M.; Topcu, B.A.; Sarıgül, S.S.; Doğan, M. Energy imports as inhibitor of economic growth: The role of impact of renewable and non-renewable energy consumption. J. Int. Trade Econ. Dev. 2024, 33, 497–522. [Google Scholar] [CrossRef]

- Dzwigol, H.; Kwilinski, A.; Lyulyov, O.; Pimonenko, T. The role of environmental regulations, renewable energy, and energy efficiency in finding the path to green economic growth. Energies 2023, 16, 3090. [Google Scholar] [CrossRef]

- Chen, Z. Analysis of economic growth forecast based on regression model. Highlights Sci. Eng. Technol. 2023, 42, 91–98. [Google Scholar] [CrossRef]

- Wei, Z.; Huang, L. Does renewable energy matter to achieve sustainable development? Fresh evidence from ten Asian economies. Renew. Energy 2022, 199, 759–767. [Google Scholar] [CrossRef]