Co-Movement Among Electricity Consumption, Economic Growth and Financial Development in Portugal, Italy, Greece, and Spain: A Wavelet Analysis

Abstract

1. Introduction

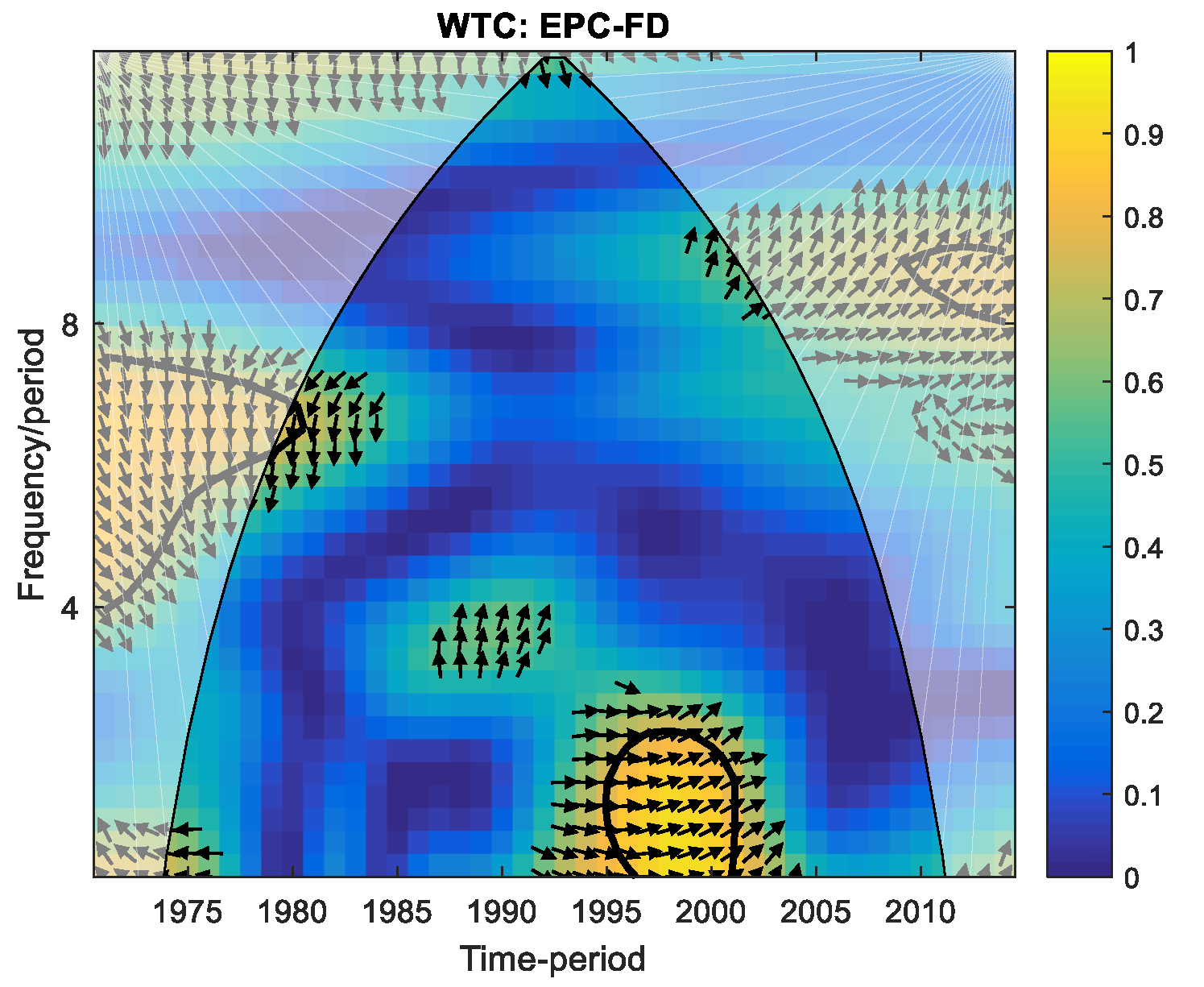

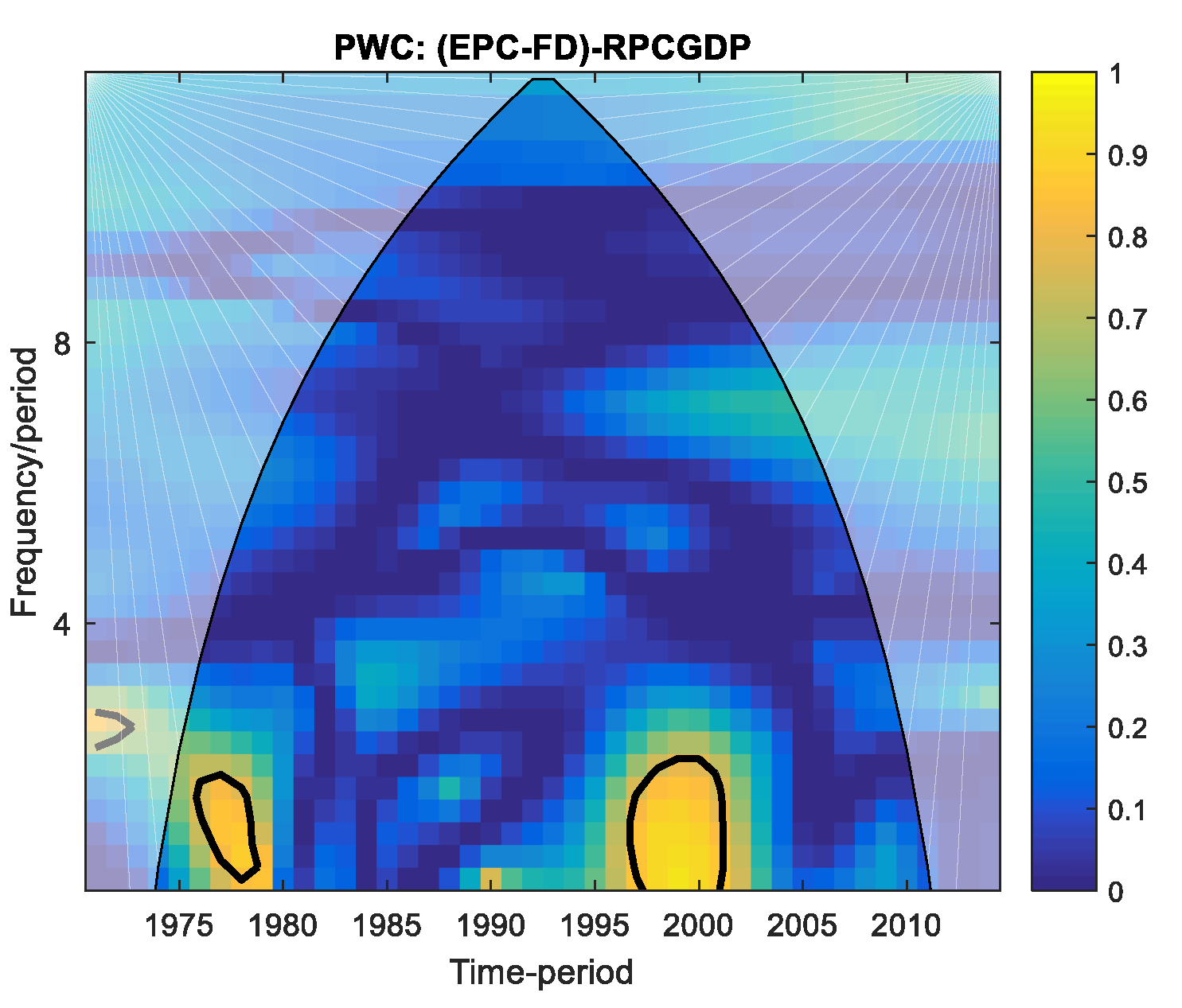

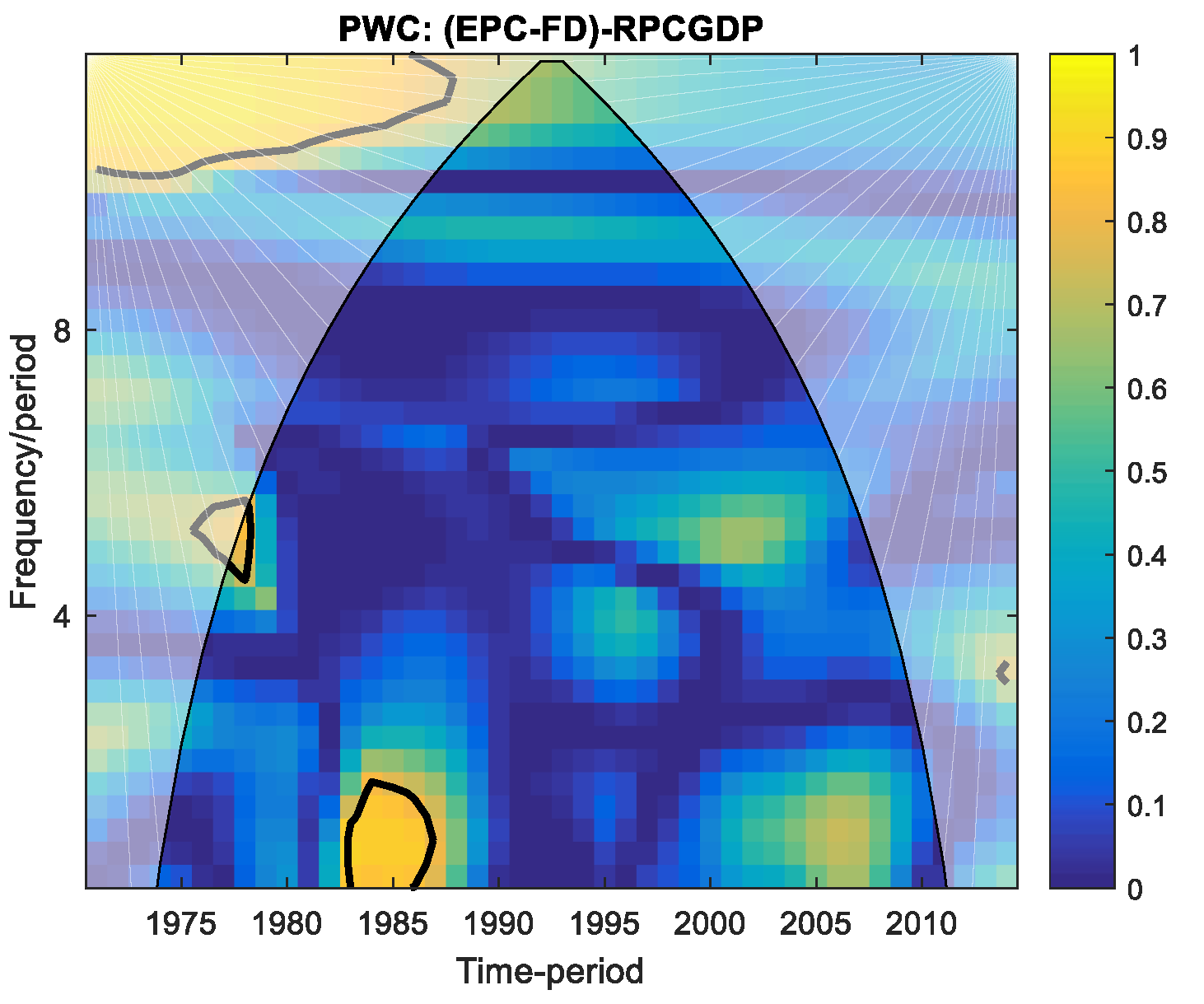

- Capture multi-scale dynamics: Unlike traditional approaches that typically assume static relationships, wavelet analysis accounts for both short-term and long-term interactions. This is particularly relevant given the economic volatility and structural breaks in the PIGS countries during the study period.

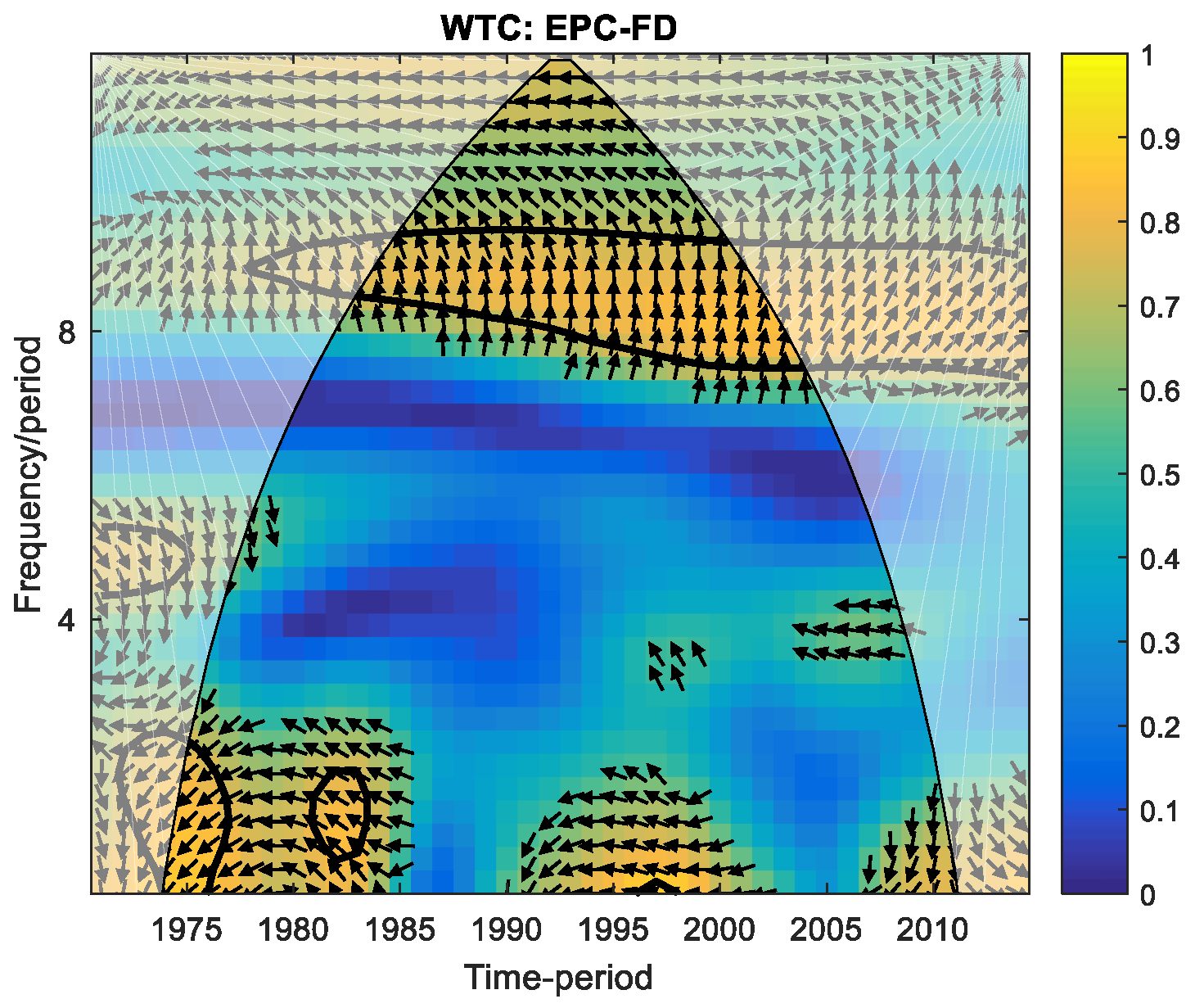

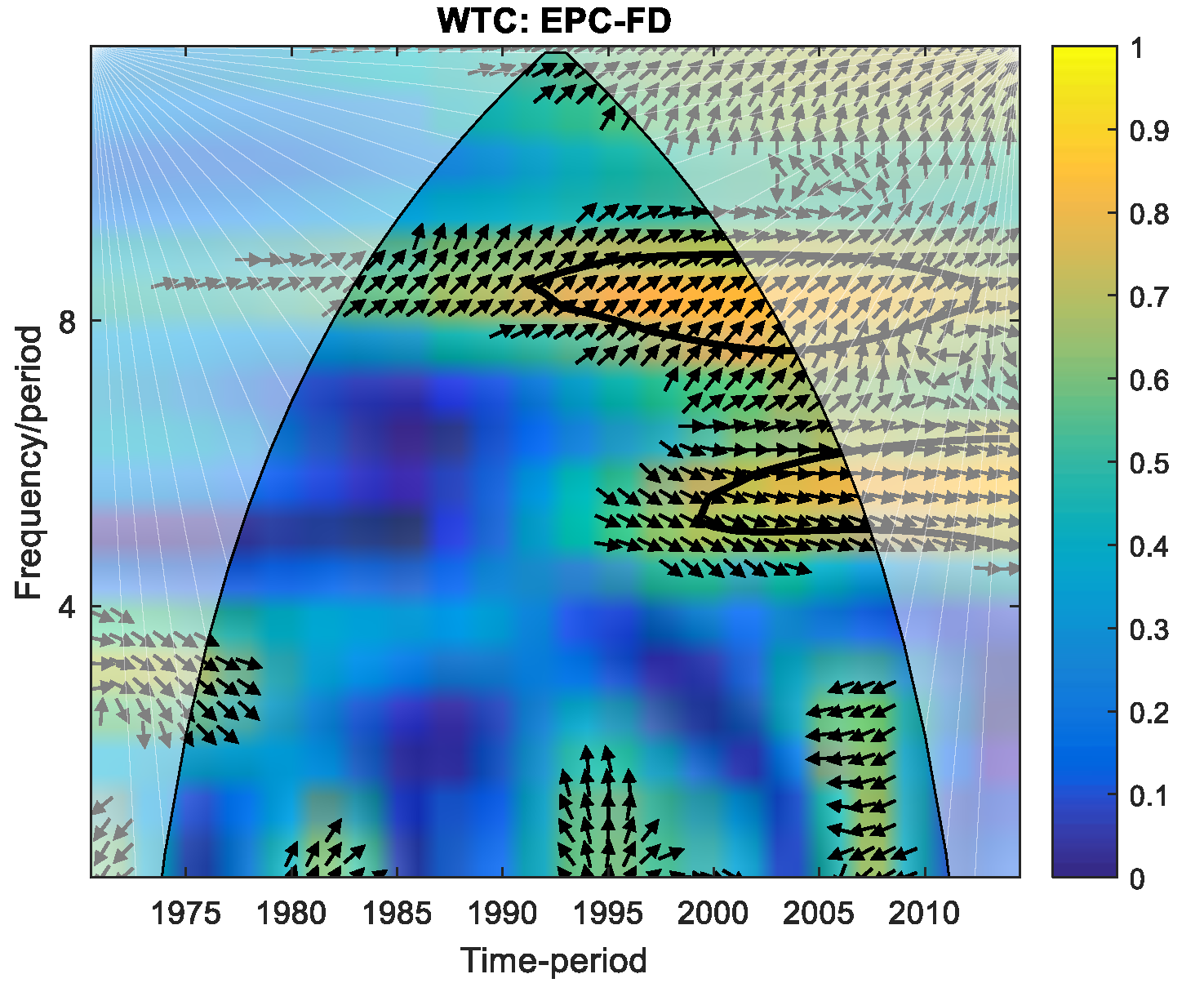

- Analyze phase relationships: Wavelet Transform Coherency (WTC) and Partial Wavelet Coherency (PWC) enable us to identify not only the strength of co-movements but also the lead-lag dynamics between variables. This provides deeper insights into causal relationships, particularly under varying economic conditions.

- Address structural breaks: Given the economic crises and structural changes within the dataset period, wavelet analysis is robust to non-stationarities and structural breaks, making it an ideal choice for our study.

2. Literature Review

3. Methodology and Data

3.1. Methodology

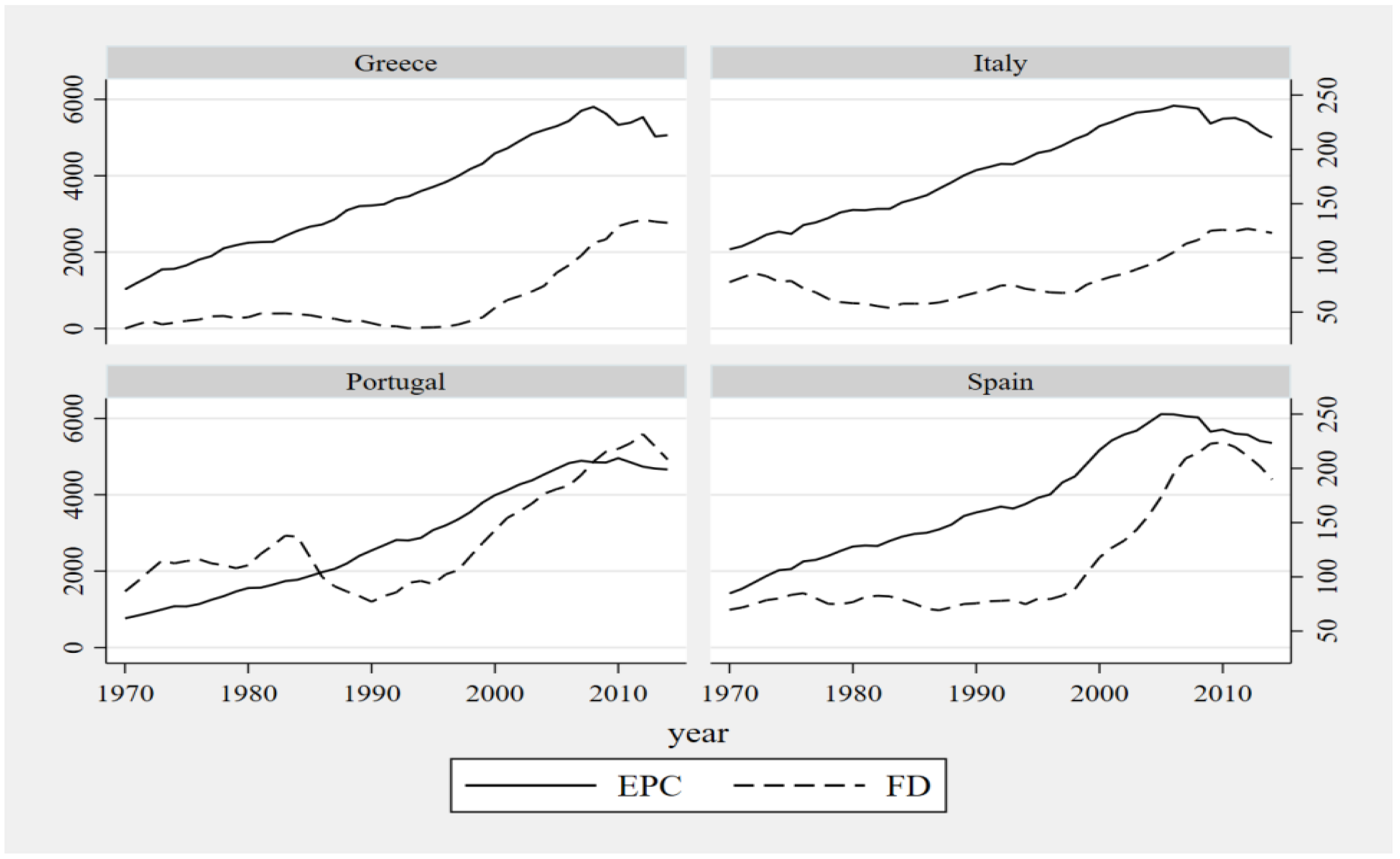

3.2. Data

4. Empirical Results

- Short-term dynamics: The analysis reveals that in periods of economic stagnation or political crises, EPC tends to lead FD. This can be attributed to the prioritization of essential consumption during downturns that subsequently affects credit availability and financial flows.

- Medium-term dynamics: During periods of economic expansion, FD drives EPC. This reflects increased financial activity, investments in infrastructure, and technological advancements that enhance energy consumption.

- Role of economic growth as a mediator: Our findings highlight the crucial role of economic growth in shaping the FD/EPC nexus. Growth acts as a catalyst, reinforcing the observed co-movements and driving the direction of influence.

5. Conclusions and Policy Implications

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Lorde, T.; Waithe, K.; Francis, B. The importance of electrical energy for economic growth in Barbados. Energy Econ. 2010, 32, 1411–1420. [Google Scholar] [CrossRef]

- Apergis, N.; Payne, J.E. Renewable and non-renewable electricity consumption-growth nexus: Evidence from emerging market economies. Appl. Energy 2011, 88, 5226–5230. [Google Scholar] [CrossRef]

- Lai, T.M.; To, W.M.; Lo, W.C.; Choy, Y.S.; Lam, K.H. The causal relationship between electricity consumption and economic growth in a Gaming and Tourism Center: The case of Macao SAR, the People’s Republic of China. Energy 2011, 36, 1134–1142. [Google Scholar] [CrossRef]

- Shahbaz, M.; Lean, H.H. Does financial development increase energy consumption? The role of industrialization and urbanization in Tunisia. Energy Policy 2012, 40, 473–479. [Google Scholar] [CrossRef]

- Shahbaz, M.; Hye, Q.M.A.; Tiwari, A.; Leitão, N.C. Economic growth, energy consumption, financial development, international trade and CO2 emissions in Indonesia. Renew. Sustain. Energy Rev. 2013, 25, 109–121. [Google Scholar] [CrossRef]

- Salahuddin, M.; Gow, J.; Ozturk, I. Is the long-run relationship between economic growth, electricity consumption, carbon dioxide emissions and financial development in Gulf Cooperation Council Countries robust? Renew. Sustain. Energy Rev. 2015, 51, 317–326. [Google Scholar] [CrossRef]

- Faisal, F.; Tursoy, T.; Resatoglu, N.G.; Berk, N. Electricity consumption, economic growth, urbanisation and trade nexus: Empirical evidence from Iceland. Econ. Res.-Ekon. 2018, 31, 664–680. [Google Scholar] [CrossRef]

- Bayer, Y.; Ozkaya, M.H.; Herta, L.; Gavriletea, M.D. Financial Development, Financial Inclusion and Primary Energy Use: Evidence from the European Union Transition Economies. Energies 2021, 14, 3638. [Google Scholar] [CrossRef]

- Mahalik, M.K.; Babu, M.S.; Loganathan, M.; Shahbaz, M. Does financial development intensify energy consumption in Saudi Arabia? Renew. Sustain. Energy Rev. 2017, 75, 1022–1034. [Google Scholar] [CrossRef]

- Stern, D.I.; Cleveland, J.C. Energy and Economic Growth; Rensselaer Working Papers in Economics; Rensselaer Polytechnic Institute: Troy, NY, USA, 2004; No. 0410. [Google Scholar]

- Kakar, Z.K. Financial development and energy consumption: Evidence from Pakistan and Malaysia. Energy Sources Part B Econ. Plan. Policy 2016, 11, 868–873. [Google Scholar] [CrossRef]

- Magazzino, C. GDP, Energy Consumption and Financial Development in Italy. Int. J. Energy Sect. Manag. 2018, 12, 28–43. [Google Scholar] [CrossRef]

- Nkalu, C.N.; Ugwu, S.C.; Asogwa, F.O.; Kuma, M.P.; Onyeke, Q.O. Financial development and energy consumption in Sub-Saharan Africa: Evidence from Panel Vector Error Correction Model. Sage Open 2020, 10. [Google Scholar] [CrossRef]

- Gungor, H.; Simon, A.U. Energy consumption, finance and growth: The role of urbanization and industrialization in South Africa. Int. J. Energy Econ. Policy 2017, 7, 268–276. [Google Scholar]

- Roubaud, D.; Shahbaz, M. Financial development, economic growth, and electricity demand: A sector analysis of an emerging economy. J. Energy Dev. 2018, 43, 47–98. [Google Scholar]

- Sadraoui, T.; Hamlaoui, H.; Youness, Z.; Sadok, B.I. A dynamic panel data analysis for relationship between energy consumption, financial development and economic growth. Int. J. Econom. Financ. Manag. 2019, 7, 20–26. [Google Scholar] [CrossRef]

- Sare, Y.A. Effect of financial sector development on energy consumption in Africa: Is it threshold specific? Int. J. Green Energy 2019, 16, 1637–1645. [Google Scholar] [CrossRef]

- Yue, S.; Lu, R.; Shen, Y.; Chen, H. How does financial development affect energy consumption? Evidence from 21 transitional countries. Energy Policy 2019, 130, 253–262. [Google Scholar] [CrossRef]

- Magazzino, C.; Mele, M.; Santeramo, F.G. Using an Artificial Neural Networks experiment to assess the links among financial development and growth in agriculture. Sustainability 2021, 13, 2828. [Google Scholar] [CrossRef]

- Matar, A. Does electricity consumption impacting financial development? Wavelet analysis. Future Bus. J. 2020, 6, 18. [Google Scholar] [CrossRef]

- Mahmood, H.; Wen, J.; Zakaria, M.; Khalid, S. Linking electricity demand and economic growth in China: Evidence from wavelet analysis. Environ. Sci. Pollut. Res. 2022, 29, 39473–39485. [Google Scholar] [CrossRef]

- Ali, A.; Kamarulzaman, R.; Soetrisno, F.K.; Shahril, M.; Razimi, A. Wavelet Analysis of Renewable, Non-renewable Energy Consumption and Environmental Degradation as a Precursor to Economic Growth: Evidence from Malaysia. Int. J. Energy Econ. Policy 2020, 10, 182–189. [Google Scholar] [CrossRef]

- Magazzino, C.; Giolli, L. The relationship among railway networks, energy consumption, and real added value in Italy. Evidence from ARDL and Wavelet Analysis. Res. Transp. Econ. 2021, 90, 101126. [Google Scholar] [CrossRef]

- Magazzino, C.; Mutascu, M.; Mele, M.; Sarkodie, S.A. Energy consumption and economic growth in Italy: A wavelet analysis. Energy Rep. 2021, 7, 1520–1528. [Google Scholar] [CrossRef]

- Ali, D.A.; Dahir, A.M.; Midi, H. On the interactions among environmental degradation, energy consumption and economic growth: A time-frequency analysis using wavelets. Int. J. Environ. Stud. 2022, 80, 1790–1807. [Google Scholar] [CrossRef]

- Le, T.H. Connectedness between nonrenewable and renewable energy consumption, economic growth and CO2 emission in Vietnam: New evidence from a wavelet analysis. Renew. Energy 2022, 195, 442–454. [Google Scholar] [CrossRef]

- Hassan, M.S.; Mahmood, H.; Javaid, A. The impact of electric power consumption on economic growth: A case study of Portugal, France, and Finland. Environ. Sci. Pollut. Res. 2022, 29, 45204–45220. [Google Scholar] [CrossRef]

- Matar, A.; Fareed, Z.; Magazzino, C.; Al-Rdaydeh, M.; Schneider, N. Assessing the Co-movements Between Electricity Use and Carbon Emissions in the GCC Area: Evidence from a Wavelet Coherence Method. Environ. Model. Assess. 2023, 28, 407–428. [Google Scholar] [CrossRef]

- Shojaie, A.; Fox, E.B. Granger causality: A review and recent advances. Annu. Rev. Stat. Its Appl. 2022, 9, 289–319. [Google Scholar] [CrossRef]

- Andersson, J. Testing for Granger causality in the presence of measurement errors. Econ. Bull. 2005, 3, 1–13. [Google Scholar]

- Yalta, A.T. Analyzing energy consumption and GDP nexus using maximum entropy bootstrap: The case of Turkey. Energy Econ. 2011, 33, 453–460. [Google Scholar] [CrossRef]

- Zivot, E.; Andrews, D.W.K. Further evidence on the great crash, the oil price shock and the unit root hypothesis. J. Bus. Econ. Stat. 1992, 10, 251–270. [Google Scholar] [CrossRef]

- Clemente, J.; Montannes, A.; Reyes, M. Testing for a unit root in variables with a double change in the mean. Econ. Lett. 1998, 59, 175–182. [Google Scholar] [CrossRef]

- Onuonga, S.M. The Relationship Between Commercial Energy Consumption and Gross Domestic Income in Kenya. J. Dev. Areas 2012, 46, 305–314. [Google Scholar] [CrossRef]

- Ozturk, I.; Acaravci, A. The long-run and causal analysis of energy, growth, openness and financial development on carbon emissions in Turkey. Energy Econ. 2013, 36, 262–267. [Google Scholar] [CrossRef]

- Yildirim, E.; Aslan, A.; Ozturk, I. Energy consumption and GDP in ASEAN countries: Bootstrap-corrected panel and time series causality tests. Singap. Econ. Rev. 2014, 59, 1450010. [Google Scholar] [CrossRef]

- Cowan, W.N.; Chang, T.; Inglesi-Lotz, R.; Gupta, R. The nexus of electricity consumption, economic growth and CO2 emissions in the BRICS countries. Energy Policy 2014, 66, 359–368. [Google Scholar] [CrossRef]

- Tang, C.F.; Shahbaz, M.; Arouri, M. Re-investigating the electricity consumption and economic growth nexus in Portugal. Energy Policy 2013, 62, 1515–1524. [Google Scholar] [CrossRef]

- Shahbaz, M.; Uddin, S.G.; Rehman, I.U.; Imran, K. Industrialization, electricity consumption and CO2 emissions in Bangladesh. Renew. Sustain. Energy Rev. 2014, 31, 575–586. [Google Scholar] [CrossRef]

- Sbia, R.; Shahbaz, M.; Ozturk, I. Economic growth, financial development, urbanisation and electricity consumption nexus in UAE. Econ. Res.-Ekon. 2017, 30, 527–549. [Google Scholar] [CrossRef]

- Omri, A.; Daly, S.; Nguyen, D.K. A robust analysis of the relationship between renewable energy consumption and its main drivers. Appl. Econ. 2015, 47, 2913–2923. [Google Scholar] [CrossRef]

- Matar, A.; Bekhet, H.A. Causal interaction among electricity consumption, financial development, exports and economic growth in Jordan: Dynamic simultaneous equation models. Int. J. Energy Econ. Policy 2015, 5, 955–967. [Google Scholar]

- Bekhet, H.A.; Matar, A.; Yasmin, T. CO2 emissions, energy consumption, economic growth, and financial development in GCC countries: Dynamic simultaneous equation models. Renew. Sustain. Energy Rev. 2017, 70, 117–132. [Google Scholar] [CrossRef]

- Ntanos, S.; Skordoulis, M.; Kyriakopoulos, G.; Arabatzis, G.; Chalikias, M.; Galatsidas, S.; Batzios, A.; Katsarou, A. Renewable energy and economic growth: Evidence from European countries. Sustainability 2018, 10, 2626. [Google Scholar] [CrossRef]

- Shahbaz, M.; Benkraiem, R.; Miloudi, A.; Lahiani, A. Production function with electricity consumption and policy implications in Portugal. Energy Policy 2017, 110, 588–599. [Google Scholar] [CrossRef]

- Sadorsky, P. The impact of financial development on energy consumption in emerging economies. Energy Policy 2010, 38, 2528–2535. [Google Scholar] [CrossRef]

- Sadorsky, P. Financial development and energy consumption in Central and Eastern European frontier economies. Energy Policy 2011, 39, 999–1006. [Google Scholar] [CrossRef]

- Çoban, S.; Topcu, M. The nexus between financial development and energy consumption in the EU: A dynamic panel data analysis. Energy Econ. 2013, 39, 81–88. [Google Scholar] [CrossRef]

- Aslan, A.; Apergis, N.; Yildirim, S. Causality between energy consumption and GDP in the U.S.: Evidence from wavelet analysis. Front. Energy 2014, 8, 1–8. [Google Scholar] [CrossRef]

- Deniz, P. Electricity Consumption and Growth: Wavelet Analysis for Emerging Markets. JEBPIR 2015, 1, 1–15. [Google Scholar]

- Ha, J.; Tan, P.P.; Goh, K.L. Linear and nonlinear causal relationship between energy consumption and economic growth in China: New evidence based on wavelet analysis. PLoS ONE 2018, 13, e0197785. [Google Scholar] [CrossRef]

- Ferrer, R.; Jammazi, R.; Bolós, V.J.; Benítez, R. Interactions between financial stress and economic activity for the US: A time-and frequency-varying analysis using wavelets. Phys. A Stat. Mech. Its Appl. 2018, 492, 446–462. [Google Scholar] [CrossRef]

- Kristjanpoller, W.R.; Sierra, A.C.; Scavia, J.D. Dynamic co-movements between energy consumption and economic growth. A panel data and wavelet perspective. Energy Econ. 2018, 72, 640–649. [Google Scholar] [CrossRef]

- Ozun, A.; Cifter, A. Multi-Scale Causality between Energy Consumption and GNP in Emerging Markets: Evidence from Turkey. Invest. Manag. Financ. Innov. 2007, 4, 60–70. [Google Scholar]

- Gregory, A.W.; Hansen, B.E. Residual-Based Tests for Cointegration in Models with Regime Shifts. J. Econom. 1996, 70, 99–126. [Google Scholar] [CrossRef]

- Aguiar-Conraria, L.; Soares, M.J. The continuous wavelet transform: Moving beyond uni- and bivariate analysis. J. Econ. Surv. 2014, 28, 344–375. [Google Scholar] [CrossRef]

- Mihanović, H.; Orlić, M.; Pasrić, Z. Diurnal thermocline oscillations driven by tidal flow around an island in the Middle Adriatic. J. Mar. Syst. 2009, 78, S157–S168. [Google Scholar] [CrossRef]

- FRED. Federal Reserve Bank of St. Louis. 2024. Available online: https://fred.stlouisfed.org/ (accessed on 5 December 2024).

- Papaioannou, G.P.; Dikaiakos, C.; Evangelidis, G.; Papaioannou, P.G.; Georgiadis, D.S. Co-Movement Analysis of Italian and Greek Electricity Market Wholesale Prices by Using a Wavelet Approach. Energies 2015, 8, 11770–11799. [Google Scholar] [CrossRef]

- Atif, M. The Effects of Energy Consumption, Economic Growth, and Financial Development on CO2 Emissions in Greece. J. Bus. Manag. Account. 2021, 5, 13–26. [Google Scholar]

- Dergiades, T.; Martinopoulos, G.; Tsoulfidis, L. Energy consumption and economic growth: Parametric and non-parametric causality testing for the case of Greece. Energy Econ. 2013, 36, 686–697. [Google Scholar] [CrossRef]

- Lee, C.C. The causality relationship between energy consumption and GDP in G-11 countries revisited. Energy Policy 2006, 34, 1086–1093. [Google Scholar] [CrossRef]

- Tang, C.F.; Shahbaz, M. Revisiting the Electricity Consumption-Growth Nexus for Portugal: Evidence from a Multivariate Framework Analysis; MPRA 28393; University Library of Munich: Munich, Germany, 2011. [Google Scholar]

- Alam, A.; Malik, I.A.; Abdullah, A.B.; Hassan, A.; Awan, U.; Ali, G.; Zaman, K.; Naseem, I. Does financial development contribute to SAARC energy demand? From energy crisis to energy reforms. Renew. Sustain. Energy Rev. 2015, 41, 818–829. [Google Scholar] [CrossRef]

- Mukhtarov, S.; Mikayilov, J.I.; Mammadov, J.; Mammadov, E. The impact of financial development on energy consumption: Evidence from an oil-rich economy. Energies 2018, 11, 1536. [Google Scholar] [CrossRef]

- Antonakakis, N.; Chang, T.; Cunado, J.; Gupta, R. The relationship between commodity markets and commodity mutual funds: A wavelet-based analysis. Financ. Res. Lett. 2018, 24, 1–9. [Google Scholar] [CrossRef]

- Rashid, A.; Yousaf, N. Linkage of financial development with electricity-growth, nexus of India and Pakistan. EuroEconomica 2015, 34, 151–160. [Google Scholar]

| Author(s) | Study Period | Countries | Variables |

|---|---|---|---|

| Aslan et al. (2014) [49] | 1973–2012 | USA | Real GDP and primary energy consumption |

| Deniz (2015) [50] | 1971–2011 | 12 emerging markets | EPC and GDP growth rate |

| Ha et al. (2018) [51] | 1953–2013 | China | Real per capita GDP, real per capita capital stock, average labor population, and per capita energy consumption |

| Jammazi (2018) [52] | 1980–2013 | 6 GCC countries | Per capita CO2 emissions, annual GDP growth rate, and energy consumption |

| Kristjanpoller et al. (2018) [53] | 1972–2014 | 74 countries | EPC and real per capita GDP |

| Le (2022) [26] | 1985–2019 | Vietnam | Non-renewable energy consumption, renewable energy consumption, economic growth, and CO2 emissions |

| Magazzino et al. (2021) [24] | 1926–2008 | Italy | Energy consumption and economic growth |

| Mahmood et al. (2022) [21] | 1999–2017 | China | Electricity demand and economic growth |

| Matar (2020) [20] | 1980–2017 | 6 GCC countries | FD and EPC |

| Ozun and Cifter (2007) [54] | 1968–2002 | Turkey | Electricity consumption and real GNP |

| EPC | |||||||

|---|---|---|---|---|---|---|---|

| Country | Minimum | Maximum | Mean | Median | Std. Dev. | Skewness | Kurtosis |

| Greece | 1023.792 | 5805.192 | 3518.323 | 3398.384 | 1461.453 | 0.026 | 1.685 |

| Italy | 2072.913 | 5833.467 | 4171.529 | 4303.646 | 1207.97 | −0.172 | 1.628 |

| Portugal | 763.902 | 4959.094 | 2879.993 | 2803.202 | 1443.957 | 0.107 | 1.522 |

| Spain | 1415.841 | 6111.219 | 3879.950 | 3638.527 | 1490.616 | 0.095 | 1.631 |

| FD | |||||||

| Country | Minimum | Maximum | Mean | Median | Std. Dev. | Skewness | Kurtosis |

| Greece | 34.9 | 135.1 | 61.269 | 45.300 | 32.549 | 1.333 | 3.237 |

| Italy | 53.9 | 126.9 | 81.198 | 74.900 | 22.628 | 0.889 | 2.560 |

| Portugal | 77.1 | 231.6 | 134.729 | 116.2 | 46.04 | 0.769 | 2.268 |

| Spain | 69.2 | 224 | 113.249 | 81.5 | 54.245 | 1.065 | 2.454 |

| RPCGDP | |||||||

| Country | Minimum | Maximum | Mean | Median | Std. Dev. | Skewness | Kurtosis |

| Greece | 10,726.716 | 24,072.791 | 16,850.994 | 15,691.945 | 3366.413 | 0.622 | 2.593 |

| Italy | 15,736.184 | 34,081.09 | 26,566.937 | 27,894.242 | 5769.363 | −0.424 | 1.833 |

| Portugal | 7658.744 | 19,985.699 | 14,618.025 | 15,193.055 | 4096.581 | −0.128 | 1.455 |

| Spain | 11,436.033 | 27,218.449 | 19,525.516 | 19,403.33 | 4987.73 | 0.082 | 1.539 |

| Variable | EPC | FD | RPCGDP | ||||

|---|---|---|---|---|---|---|---|

| Country | Type of Outlier | Level | First Difference | Level | First Difference | Level | First Difference |

| Greece | Intercept | −3.180 *** [2007] | −6.146 [1994] | −3.174 *** [2000] | −4.640 ** [1997] | −2.479 *** [1999] | −4.728 ** [2007] |

| Intercept and trend | −6.010 [2007] | −6.359 [1983] | −3.533 *** [1990] | −4.435 *** [1998] | −3.512 *** [2003] | −4.560 *** [1994] | |

| Italy | Intercept | −0.939 [2007] | −7.091 [1984] | −3.317 *** [1999] | −4.783 ** [1984] | −0.330 *** [2007] | −7.005 [2007] |

| Intercept and trend | −3.489 *** [2004] | −7.272 [1984] | −3.449 *** [1978] | −4.778 *** [1999] | −2.307 *** [2002] | −6.987 [2000] | |

| Portugal | Intercept | −0.437 *** [2007] | −5.491 [2007] | −4.670 ** [1985] | −4.364 *** [1991] | −2.070 *** [1988] | −6.107 [1987] |

| Intercept and trend | −2.774 *** [2004] | −5.680 [1995] | −5.049 ** [1985] | −4.196 *** [1991] | −3.168 *** [2004] | −5.893 [1985] | |

| Spain | Intercept | −2.184 *** [2007] | −3.900 *** [2006] | −3.810 *** [1999] | −3.279 *** [1995] | −3.290 *** [2007] | −3.631 *** [1985] |

| Intercept and trend | −3.971 *** [1999] | −4.422 *** [1997] | −3.061 *** [1982] | −4.145 *** [1998] | −3.813 *** [2004] | −3.947 *** [1982] | |

| Variable | EPC | FD | RPCGDP | ||||

|---|---|---|---|---|---|---|---|

| Country | Type of Outlier | Level | First Difference | Level | First Difference | Level | First Difference |

| Greece | Additive | 10.718 [1988] | −3.706 [2006] | 15.330 [2002] | 4.406 [1995] | 9.659 [1999] | −4.041 [2009] |

| Innovative | 1.264 *** [1981] | −3.773 [2007] | 5.762 [1998] | 3.062 [1995] | 2.334 * [1995] | −2.374 * [2008] | |

| Italy | Additive | 12.356 [1989] | −4.965 [2005] | 4.477 [2010] | 3.522 [1981] | 11.321 [1989] | −4.304 [2005] |

| Innovative | 2.303 * [1982] | −4.176 [2006] | 4.130 [1997] | 3.080 [1982] | 0.873 *** [1974] | −2.718 * [2006] | |

| Portugal | Additive | 11.402 [1991] | −5.457 [2004] | 10.825 [2002] | 1.730 *** [1988] | 12.686 [1991] | −2.890 [2001] |

| Innovative | 0.286 *** [1974] | −2.371 * [2001] | 3.093 [1996] | 1.630 *** [1989] | 4.084 [1985] | −2.883 [1999] | |

| Spain | Additive | 9.458 [1997] | −4.673 [2003] | 17.766 [2001] | 2.924 * [1994] | 12.290 [1991] | −3.851 [2005] |

| Innovative | 3.037 [1993] | −3.523 [2004] | 2.996 [1997] | 1.819 ** [1995] | 2.526 * [1984] | −3.448 [2006] | |

| ADF | ||||

|---|---|---|---|---|

| Country | Intercept | Trend | Regime | Regime and Trend |

| Greece | −2.93 [1984] | −5.01 [1989] | −3.71 [1985] | −5.94 * [1984] |

| Italy | −5.15 ** [1982] | −4.96 [1982] | −5.41 * [1982] | −6.10 ** [1987] |

| Portugal | −4.67 [1976] | −4.00 [1976] | −5.61 ** [1986] | −4.25 [1981] |

| Spain | −4.14 [1976] | −4.06 [1976] | −3.81 [1981] | −4.39 [1987] |

| Z(t) | ||||

| Country | Intercept | Trend | Regime | Regime and Trend |

| Greece | −3.36 [1984] | −5.45 ** [1990] | −4.10 [1985] | −5.50 [1989] |

| Italy | −4.60 [1981] | −4.66 [1981] | −5.10 [1991] | −5.69 [1986] |

| Portugal | −4.28 [1977] | −3.53 [1987] | −4.77 [1983] | −4.29 [1985] |

| Spain | −4.24 [1976] | −4.26 [1976] | −3.94 [1981] | −4.46 [1987] |

| Z(a) | ||||

| Country | Intercept | Trend | Regime | Regime and Trend |

| Greece | −15.20 [1984] | −28.44 [1990] | −23.81 [1985] | −37.38 [1989] |

| Italy | −27.04 [1981] | −28.67 [1981] | −28.55 [1991] | −35.68 [1986] |

| Portugal | −23.13 [1977] | −21.06 [1987] | −27.91 [1983] | −26.73 [1985] |

| Spain | −24.71 [1976] | −23.84 [1976] | −23.44 [1981] | −27.07 [1987] |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Magazzino, C.; Naqvi, S.K.H.; Giolli, L. Co-Movement Among Electricity Consumption, Economic Growth and Financial Development in Portugal, Italy, Greece, and Spain: A Wavelet Analysis. Energies 2024, 17, 6338. https://doi.org/10.3390/en17246338

Magazzino C, Naqvi SKH, Giolli L. Co-Movement Among Electricity Consumption, Economic Growth and Financial Development in Portugal, Italy, Greece, and Spain: A Wavelet Analysis. Energies. 2024; 17(24):6338. https://doi.org/10.3390/en17246338

Chicago/Turabian StyleMagazzino, Cosimo, Syed Kafait Hussain Naqvi, and Lorenzo Giolli. 2024. "Co-Movement Among Electricity Consumption, Economic Growth and Financial Development in Portugal, Italy, Greece, and Spain: A Wavelet Analysis" Energies 17, no. 24: 6338. https://doi.org/10.3390/en17246338

APA StyleMagazzino, C., Naqvi, S. K. H., & Giolli, L. (2024). Co-Movement Among Electricity Consumption, Economic Growth and Financial Development in Portugal, Italy, Greece, and Spain: A Wavelet Analysis. Energies, 17(24), 6338. https://doi.org/10.3390/en17246338