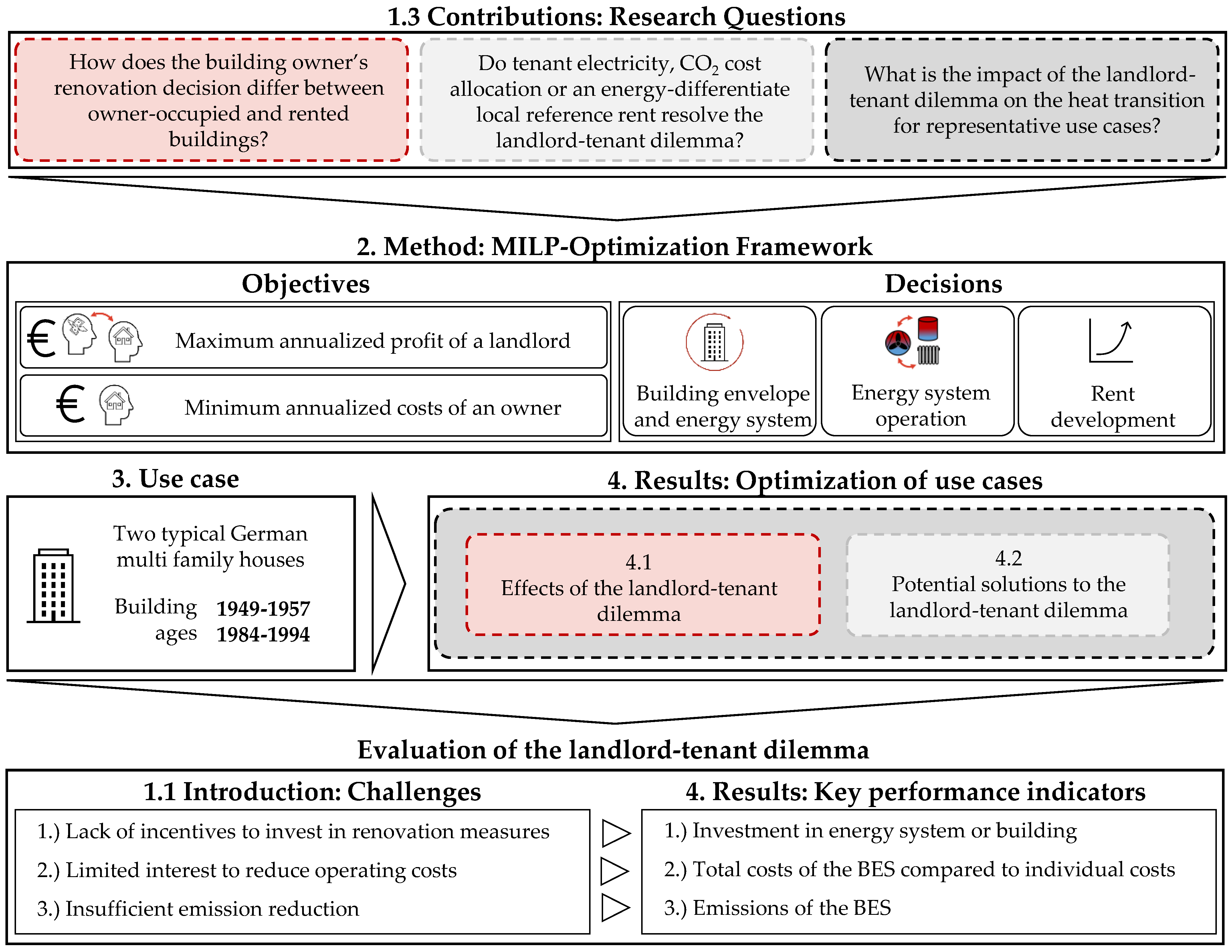

Landlord–Tenant Dilemma: How Does the Conflict Affect the Design of Building Energy Systems?

Abstract

1. Introduction

- Lack of incentives to invest in renovation measures;

- Limited interest in renovation decisions that reduce operating costs for tenants.

- 3.

- Insufficient emission reductions and incentive to reach the climate targets.

1.1. Regulatory Framework

- Adjustment of the retrofitting fee: For an adjusted retrofitting fee, the literature suggests a retrofitting fee that is no longer solely dependent on the cost, but also on energy savings. The aim is to prevent landlords from solely benefiting from increasing the costs of renovations.

- Energy-differentiated local reference rent: The energy-differentiated local reference rent pursues a similar goal by taking into account energy-related attributes of buildings within an energy-differentiated local reference rent. A higher local reference rent for climate-friendly energy systems is intended to create incentives for renovation decisions that reduce energy demand and greenhouse gas emissions and therefore, simultaneously costs.

- One-third model: The one-third model, first presented by Mellwig et al. [15], states that the costs of an energy-efficient renovation should be equally allocated between landlords, tenants, and the state.

1.2. Landlord–Tenant Dilemma in the Literature

1.3. Contributions

- How does the building owner’s renovation decision differ between owner-occupied and rented buildings?

- Do tenant electricity, CO2 cost allocation, or an energy-differentiated local reference rent resolve the landlord–tenant dilemma?

- What is the impact of the landlord–tenant dilemma on the heat transition for representative use cases?

2. Method

2.1. Optimization Framework

2.2. Objective Functions

2.3. Decision Variables

2.4. Optimization Framework

2.4.1. Building and Energy System

2.4.2. Rental Payments

2.4.3. Subsidization of Modernization Measures

2.4.4. CO2 Cost Allocation

2.4.5. Tenant Electricity

2.4.6. Feed-In Remuneration

3. Use Case

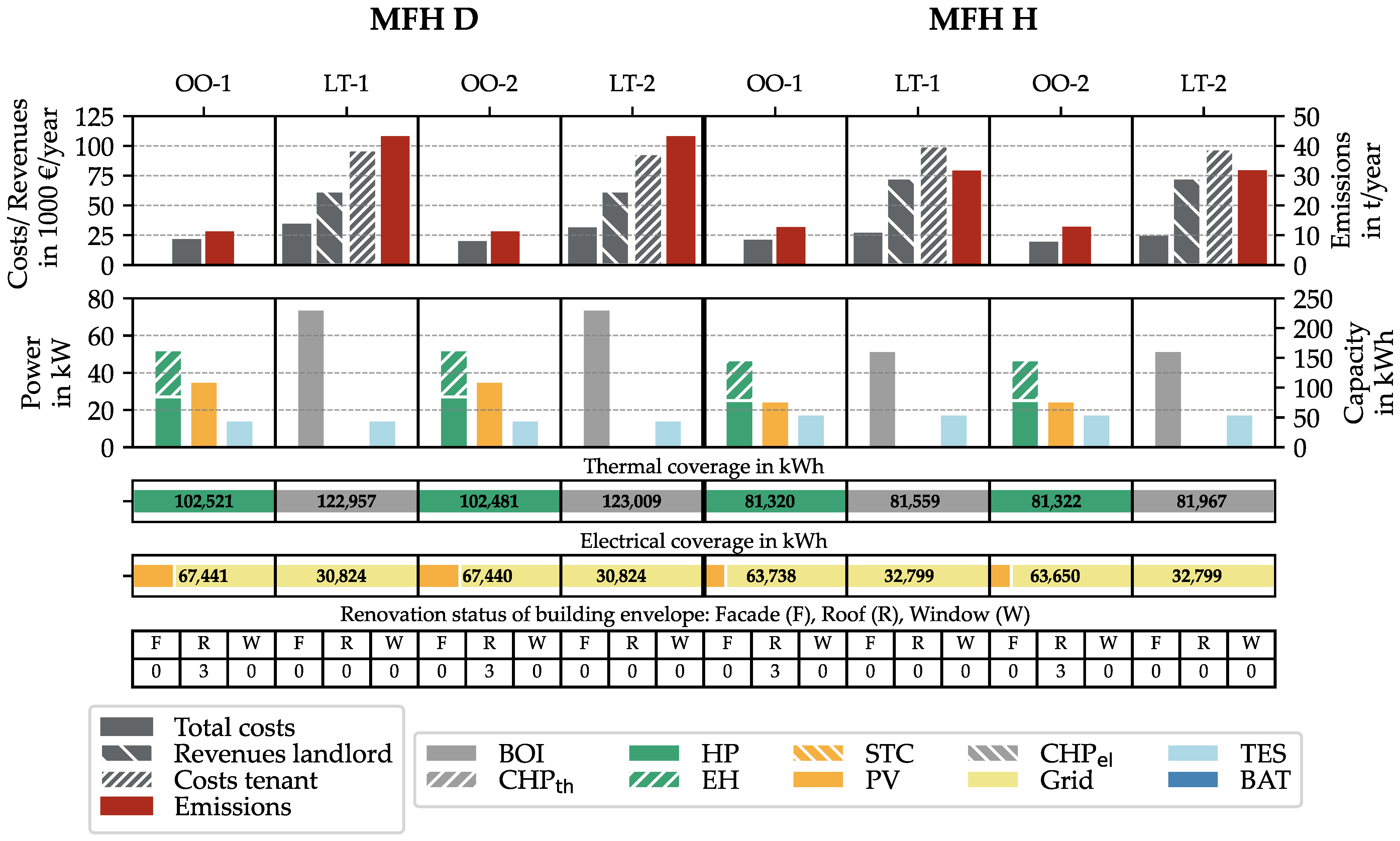

4. Results

- Problem 1: Does a building owner invest in an energy system (power in kW) or the building envelope (retrofitting status)?

- Problem 2: What are the resulting total costs of the energy system, revenues of the landlord, and costs of the tenant?

- Problem 3: What are the resulting emissions of the BES?

4.1. Effects of the Landlord–Tenant Dilemma

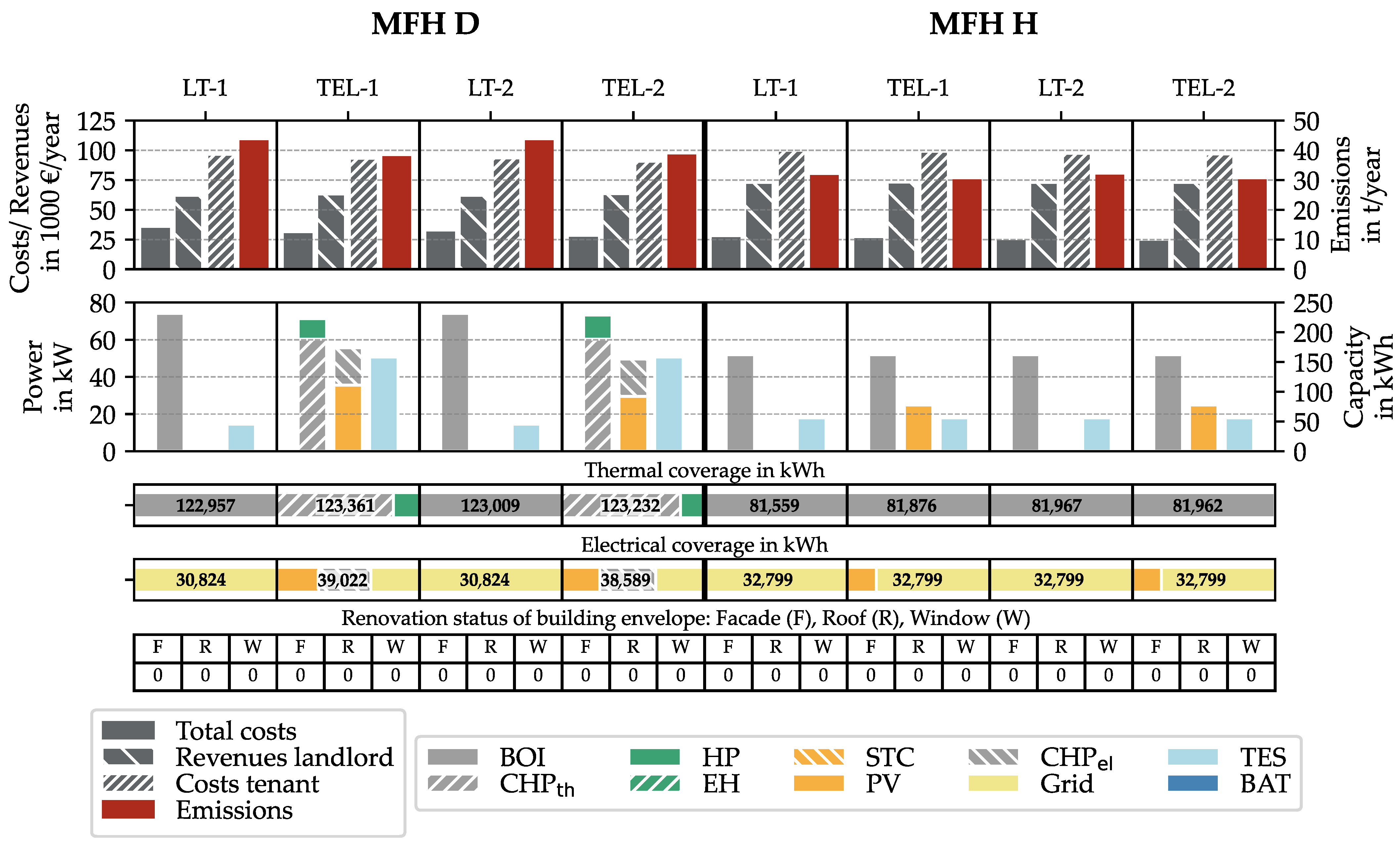

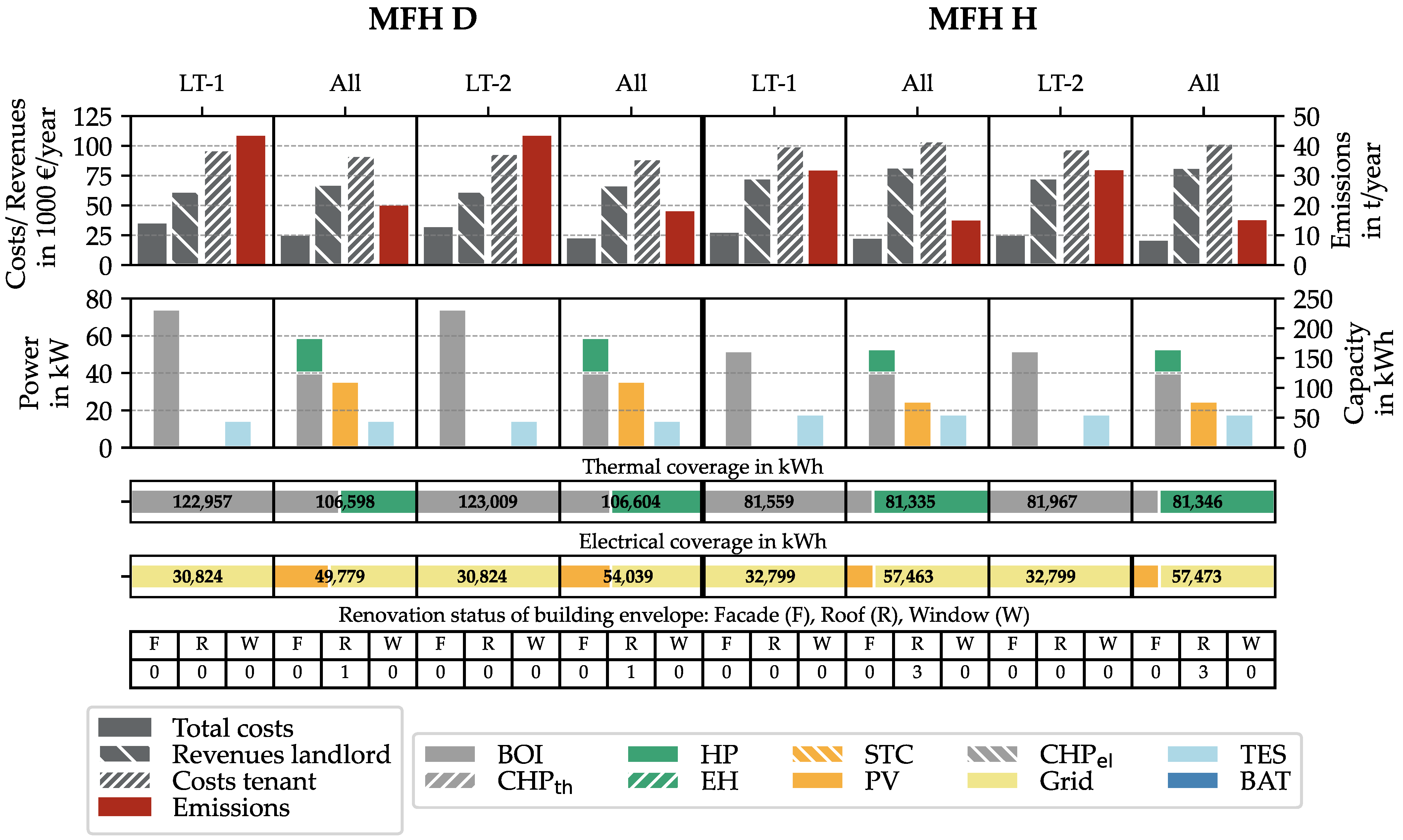

4.2. Solutions to the Landlord–Tenant Dilemma

4.2.1. Solution 1: Tenant Electricity

4.2.2. Solution 2: CO2 Cost Allocation

4.2.3. Solution 3: Energy-Differentiated Local Reference Rent

4.2.4. Combination of All Three Solutions

5. Discussion

5.1. Limitations and Recommendations Regarding the Solution Approaches

5.1.1. Tenant Electricity

5.1.2. CO2 Cost Allocation

5.1.3. Energy-Differentiated Local Reference Rent

5.2. Limitations of the Optimization Framework

6. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

Abbreviations

| MFH | Multi-family house |

| BAT | Battery |

| BGB | German Civil Code |

| BOI | Boiler |

| CHP | Combined heat and power engines |

| EEG | Renewable Energy Sources Act |

| EH | Electric heater |

| EM | Single measures |

| EnWG | German Energy Act |

| PVT | Photovoltaic-thermal collector |

| EU | European Union |

| GEG | Building Energy Act |

| HP | Air source heat pump |

| KWKG | Combined Heat and Power Act |

| MILP | Mixed-integer linear program |

| PV | Photovoltaic |

| STC | Solar thermal collectors |

| TES | Thermal energy storage |

| WG | Overall building efficiency |

| PVT | Photovoltaic-thermal collector |

Appendix A

Appendix A.1

| Scenario 1 | Scenario 2 | |

|---|---|---|

| Observation period | 20 | |

| Interest rate | 0.035 | |

| Annual inflation | 1.02 | |

| Annual local reference rent increase | 1.014 | |

| Yearly electricity price change | 0.969 | 0.981 |

| Yearly gas price change | 0.960 | 0.992 |

| Yearly price change | 1.08 | 1.02 |

| Device | Power/Capacity | Investment Costs | Installation Costs | OM Cost |

|---|---|---|---|---|

| BOI | 15–240 kW | 2158–13,516 € | 5000 € | 3% |

| HP | 6–27 kW | 7800–18,315 € | 1530 € | 2.5% |

| CHP | 2.5–293 kW | 15,293–199,363 € | 5800 € | 5% |

| STC | continuous | 245.22 €/ | 6500 € | 1.5% |

| PV | continuous | 900 €/kWp | 250 €/kWp | 1% |

| TES | 0.116–7.3 | 756–6973 € | 500 € | 0% |

| BAT | 5.5–66.24 kWh | 7638–47,785 € | 2500 € | 0% |

| EH | continuous | 245 + 19 €/kW | 2000 € | 0% |

| Building Element | Standard | U Value in W/(m2K) | Costs in €/m2 |

|---|---|---|---|

| Facade | 0 (MFH D) | 1.2 | 0 |

| 0 (MFH H) | 0.6 | 0 | |

| (Thermal insulation composite system) | 1 | 0.48 | 126.4 |

| 2 | 0.17 | 170.95 | |

| 3 | 0.07 | 263.21 | |

| Roof | 0 (MFH D) | 1.6 | 0 |

| 0 (MFH H) | 0.4 | 0 | |

| (Insulation of the attic) | 1 | 0.37 | 45.73 |

| 2 | 0.15 | 75.1 | |

| 3 | 0.10 | 98.6 | |

| Window | 0 (MFH D) | 3.0 | 0 |

| 0 (MFH H) | 3.0 | 0 | |

| (Replacement of windows) | 1 | 1.9 | 279.61 |

| 2 | 1.1 | 463.07 | |

| 3 | 0.7 | 554.8 |

References

- European Commission. In Focus: Energy Efficiency in Buildings; European Commission: Brussels, Belgium, 2020. [Google Scholar]

- European Commission. A Renovation Wave for Europe—Greening Our Buildings, Creating Jobs, Improving Lives; European Commission: Brussels, Belgium, 2020. [Google Scholar]

- Buildings Performance Institute Europe. On the Way to a Climate-Neutral Europe—Contributions from the Building Sector to a Strengthened 2030 Climate Target; Buildings Performance Institute Europe (BPIE): Brussels, Belgium, 2020. [Google Scholar]

- Eurostat. Distribution of Population by Tenure Status, Type of Household and Income Group-EU-SILC Survey. 2022. Available online: https://data.europa.eu/data/datasets/fatiyjckzlxuhnx3wzuw?locale=en (accessed on 22 January 2024).

- Henger, R.; Krotova, A. Auflösung des Klimaschutz-Wohnkosten-Dilemmas? Förderung Energetischer Modernisierungen mit dem Energie- und Klimafonds [Solving the Climate Protection-Housing Cost Dilemma? Funding for Energy Modernization with the Energy and Climate Fund]. 2020. Available online: https://www.iwkoeln.de/fileadmin/user_upload/Studien/Gutachten/PDF/2020/IW_Gutachten_2020_EKF-FÃűrderung_final.pdf (accessed on 22 January 2024).

- Neitzel, M.; Dylewski, C.; Pelz, C. Wege aus dem Vermieter-Mieter-Dilemma: Konzeptstudie [Ways Out of the Landlord-Tenant Dilemma: Concept Study]; Gutachten im Auftrag des GdW–Bundesverband deutscher Wohnungs-und Immobilienunternehmen eV: Bochum, Germany, 2011. [Google Scholar]

- Braeuer, F.; Kleinebrahm, M.; Naber, E.; Scheller, F.; McKenna, R. Optimal system design for energy communities in multi-family buildings: The case of the German Tenant Electricity Law. Appl. Energy 2022, 305, 117884. [Google Scholar] [CrossRef]

- Henger, R.; Köhler, B.; Braungardt, S.; Meyer, R. Wer zahlt für den Klimaschutz im Gebäudesektor? Reformoptionen der Modernisierungsumlage [Who Pays for Climate Protection in the Building Sector? Reform Options for the Retrofitting Fee]. 2021. Available online: https://ariadneprojekt.de/media/2021/07/Ariadne-Analyse_Modernisierungsumlage_August2021.pdf (accessed on 22 January 2024).

- Taruttis, L.; Weber, C. Inefficient markets for energy efficiency—Empirical evidence from the German rental housing market. Ssrn Electron. J. 2022. [Google Scholar] [CrossRef]

- Kossmann, B.; von Wangenheim, G.; Gill, B. Wege aus dem Vermieter-Mieter-Dilemma bei der Energetischen Modernisierung: Einsparabhängige Statt Kostenabhängige Refinanzierung [Ways out of the Landlord-Tenant Dilemma in Energy Modernization: Savings-Dependent Instead of Cost-Dependent Refinancing]; München: Kassel, Germany, 2016. [Google Scholar]

- Ahlrichs, J.; Rockstuhl, S. Estimating fair rent increases after building retrofits: A max-min fairness approach. Energy Policy 2022, 164, 112923. [Google Scholar] [CrossRef]

- Ekardt, F.; Heitmann, C. Energetische Sanierung im Altbestand und das EEWärmeG: Kann das Investor-Nutzer-Dilemma ökologisch-Sozial Aufgelöst Werden? [Energy-Efficient Renovation of the Building Stock and the EEWärmeG: Can the Investor-User Dilemma be Resolved Ecologically and Socially?]; Recht der Energiewirtschaft. 2009. Available online: http://felix-ekardt.eu/files/texts/Investor-Nutzer-Dilemma.pdf (accessed on 22 January 2024).

- Gaßner, H.; Viezens, L.; Bechstedt, A. Faire Kostenverteilung bei Energetischer Modernisierung—Rechtliche Rahmenbedingungen einer Umwandlung der Modernisierungsumlage gemäß § 559 BGB in ein Sozial Gerechtes und ökologisches Instrument [Fair Cost Allocation for Energy Modernization—Legal Framework for Converting the Retfofitting Fee in Accordance with § 559 BGB into a Socially Responsible and Ecological Instrument]. 2019. Available online: https://www.gruene-bundestag.de/fileadmin/media/gruenebundestag_de/themen_az/bauen/PDF/gutachten-energetische-modernisierung.pdf (accessed on 22 January 2024).

- März, S. Warum Sollte ich Meine Mietimmobilie Energetisch Sanieren? Analyse und Multi-Level-Governance Quartiersbezogener und Individueller Rahmenbedingungen zur Steigerung der Energetischen Sanierungstätigkeit Privater Kleinvermieter [Why should I Renovate My Rental Property to Make It More Energy Efficient? Analysis and Multi-Level Governance of Neighborhood and Individual Framework Conditions to Increase Energy-Efficient Renovation Activities of Small Private Landlords]. Ph.D. Thesis, University of Duisburg, Essen, Germany, 2019. DuEPublico: Duisburg-Essen Publications online. [Google Scholar] [CrossRef]

- Mellwig, P.; Pehnt, M. Sozialer Klimaschutz in Mietwohnungen: Kurzgutachten zur Sozialen und Klimagerechten Aufteilung der Kosten bei Energetischer Modernisierung im Wohnungsbestand [Social Climate Protection in Rental Apartments: Brief Report on the Social and Climate-Friendly Allocation of Costs for Energy Modernization in the Building Stock]. 2019. Available online: https://www.bund.net/fileadmin/user_upload_bund/publikationen/energiewende/energiewende_sozialer_klimaschutz_mietwohnungen.pdf (accessed on 22 January 2024).

- Deutscher Bundestag. Gesetz zur Reform des Mietspiegelrechts: MsRG. [Law on the Reform of the Rent Index Law: MsRG]. 2021. Available online: https://www.bmj.de/SharedDocs/Downloads/DE/Gesetzgebung/BGBl/Bgbl_Mietspiegelreformgesetz.html (accessed on 22 January 2024).

- März, S.; Stelk, I.; Stelzer, F. Are tenants willing to pay for energy efficiency? Evidence from a small-scale spatial analysis in Germany. Energy Policy 2022, 161, 112753. [Google Scholar] [CrossRef]

- Lang, M.; Lane, R.; Zhao, K.; Tham, S.; Woolfe, K.; Raven, R. Systematic review: Landlords’ willingness to retrofit energy efficiency improvements. J. Clean. Prod. 2021, 303, 127041. [Google Scholar] [CrossRef]

- Petkov, I.; Mavromatidis, G.; Knoeri, C.; Allan, J.; Hoffmann, V.H. MANGOret: An optimization framework for the long-term investment planning of building multi-energy system and envelope retrofits. Appl. Energy 2022, 314, 118901. [Google Scholar] [CrossRef]

- Steinbach, J. Modellbasierte Untersuchung von Politikinstrumenten zur Förderung Erneuerbarer Energien und Energieeffizienz im Gebäudebereich. [Model-Based Investigation of Policy Instruments to Promote Renewable Energies and Energy Efficiency in the Building Sector.] Ph.D. Thesis, Fraunhofer Verlag. 2015. Available online: https://publica.fraunhofer.de/handle/publica/280782 (accessed on 22 January 2024).

- Schütz, T.; Schiffer, L.; Harb, H.; Fuchs, M.; Müller, D. Optimal design of energy conversion units and envelopes for residential building retrofits using a comprehensive MILP model. Appl. Energy 2017, 185, 1–15. [Google Scholar] [CrossRef]

- Blum, C.; Roli, A. Metaheuristics in combinatorial optimization: Overview and conceptual comparison. Acm Comput. Surv. 2003, 35, 268–308. [Google Scholar] [CrossRef]

- Voll, P. Automated Optimization-Based Synthesis of Distributed Energy Supply Systems. Ph.D. Thesis, RWTH Aachen University, Aachen, Germany, 2016. Available online: http://publications.rwth-aachen.de/record/228954 (accessed on 22 January 2024).

- Pickering, B.; Ikeda, S.; Choudhary, R.; Choudhary, R. Comparison of Meta-heuristic and Linear Programming Models for the Purpose of Optimising Building Energy Supply Operation Schedule. In Proceedings of the Per Kvols Heiselberg, Editor, CLIMA 2016—Proceedings of the 12th REHVA World Congress, Aalborg, Denmark, 22–25 May 2016; Volume 6, pp. 1–10. Available online: http://vbn.aau.dk/files/233775414/paper_529.pdf (accessed on 22 January 2024).

- DIN EN ISO 13790; Energy Performance of Buildings—Calculation of Energy Use for Space Heating and Cooling. DIN Deutsches Institut für Normung e.V, [DIN German Institute for Standardization]: Berlin, Germany, 2008.

- Verein deutscher Ingenieure [Association of German Engineers]. VDI Richtlinie 2067 Blatt 1—Wirtschaftlichkeit gebäudetechnischer Anlagen: Grundlagen und Kostenberechnung. In Economic Efficiency of Building Installations—Fundamentals and Economic Calculation; Association of German Engineers: Düsseldorf, Germany, 2012. [Google Scholar]

- Loga, T.; Stein, B.; Diefenbach, N.; Born, R. Typology Approach for Building Stock Energy Assessment, EPISCOPE—“Energy Performance Indicator Tracking Schemes for the Continous Optimisation of Refurbishment Processes in European Housing Stocks”, 2., erw. aufl. ed; IWU: Darmstadt, Germany, 2015. [Google Scholar]

- EN 12831-1:2017; Energy Performance of Buildings—Method for Calculation of the Design Heat Load—Part 1: Space Heating Load, Module M3-3. DIN Deutsches Institut für Normung e.V [DIN German Institute for Standardization]: Berlin, Germany, 2017.

- Bundesgerichtshof. Urteil des VIII. Zivilsenats vom 16.12.2020 [Judgment of the VIII. Civil Senate from 16.12.2020]. Available online: https://juris.bundesgerichtshof.de/cgi-bin/rechtsprechung/document.py?GERICHT=bgh&Art=en&az=VIII%20ZR%20367/18&nr=113751 (accessed on 15 March 2023).

- Knissel, J.; Malottki, V.; Christian; Alles, R. Integration Energetischer Differenzierungsmerkmale in Mietspiegel [Integration of Energy-Related Differentiation Features in Rent Indices]; Bundesministerium für Verkehr, Bau und Stadtentwicklung (BMVBS), Bundesamt für Bauwesen und Raumordnung (BBR): Berlin/Bonn, Germany, 2010. [Google Scholar]

- Bundesministerium für Verkehr, Bau und Stadtentwicklung. Hinweise zur Integration der Energetischen Beschaffenheit und Ausstattung von Wohnraum in Mietspiegeln [ Guidance on the Integration of the Energy Efficiency and Equipment of Living Space in Rent Indices]. 2013. Available online: https://www.bmwsb.bund.de/SharedDocs/downloads/Webs/BMWSB/DE/publikationen/wohnen/arbeitshilfe-mietspiegel-energetisch.pdf?__blob=publicationFile&v=3 (accessed on 22 January 2024).

- Freie und Hansestadt Hamburg Behörde für Stadtentwicklung und Wohnen. Hamburger Mietenspiegel 2021 Rent index Hamburg. 2021. Available online: https://www.hamburg.de/mietenspiegel/ (accessed on 15 March 2023).

- Bundesministerium für Wirtschaft und Klimaschutz. Richtlinie für Die Bundesförderung für Effiziente Gebäude—Einzelmaßnahmen: BEG EM [Guideline for Federal Funding for Efficient Buildings—Individual Measures: BEG EM], 09.12.2022. Available online: https://www.bundesanzeiger.de/pub/publication/xSizk6DUlWm93L4XrkY?0 (accessed on 22 January 2024).

- Bundesregierung. Entwurf Eines Gesetzes zur Aufteilung der Kohlendioxidkosten: CO2KostAufG. [Draft of a Law on the Allocation of Carbon Dioxide Costs: CO2KostAufG.]. 2022. Available online: https://www.bmwk.de/Redaktion/DE/Downloads/Gesetz/20220525-entwurf-eines-gesetzes-kohlendioxidkosten.pdf?__blob=publicationFile&v=8 (accessed on 15 March 2022).

- Deutscher Bundestag. Gesetz für den Ausbau Erneuerbarer Energien: Erneuerbare-Energien-Gesetz (EEG) [Renewable Energy Source Act (EEG)], 1 January 2023. Available online: https://www.gesetze-im-internet.de/eeg_2014/ (accessed on 15 March 2022).

- Deutscher Bundestag. Gesetz für die Erhaltung, die Modernisierung und den Ausbau der Kraft-Wärme-Kopplung: Kraft-Wärme-Kopplungsgesetz (KWKG) [CHP Act (KWKG], 29 July 2022. Available online: https://www.gesetze-im-internet.de/kwkg_2016/ (accessed on 22 January 2024).

- Deutscher Bundestag. Gesetz über die Elektrizitäts- und Gasversorgung: Energiewirtschaftsgesetz (EnWG) [The German Energy Act (EnWG), 13 October 2023]. Available online: https://www.gesetze-im-internet.de/enwg_2005/ (accessed on 22 January 2024).

- European Energy Exchange AG. KWK Index. 2023. Available online: https://www.eex.com/de/marktdaten/strom/indizes (accessed on 15 March 2023).

- Institut Wohnen und Umwelt GmbH. National Building Typologies. Available online: https://episcope.eu/building-typology/ (accessed on 12 January 2024).

- Domínguez-Muñoz, F.; Cejudo-López, J.M.; Carrillo-Andrés, A.; Gallardo-Salazar, M. Selection of typical demand days for CHP optimization. Energy Build. 2011, 43, 3036–3043. [Google Scholar] [CrossRef]

- vbw—Vereinigung der Bayerischen Wirtschaft e. V.; Prognos AG Berlin. Strompreisprognose [Electricity Price Forecast]. 2022. Available online: https://www.vbw-bayern.de/Redaktion/Frei-zugaengliche-Medien/Abteilungen-GS/Wirtschaftspolitik/2023/Downloads/vbw_Strompreisprognose_Juli-2023-3.pdf (accessed on 12 January 2024).

- Deutscher Wetterdienst [Germany’s National Meteorological Service] Klimaberatungsmodul [Climate Consulting Module]. 2022. Available online: https://kunden.dwd.de/obt/ (accessed on 12 January 2024).

- Richardson, I.; Thomson, M.; Infield, D.; Clifford, C. Domestic electricity use: A high-resolution energy demand model. Energy Build. 2010, 42, 1878–1887. [Google Scholar] [CrossRef]

- Beausoleil-Morrison, I. The Simulation of Building-Integrated Fuel Cell and Other Cogeneration Systems (COGEN-SIM), Project Summary Report of the EBC Annex 42 2013. Available online: http://www.iea-ebc.org/Data/publications/EBC_Annex_42_PSR.pdf (accessed on 22 January 2024).

- Schäfer, M.; Akzeptanzstudie “Mieterstrom aus Mietersicht”. Eine Untersuchung Verschiedener Mieterstromprojekte in NRW. [Acceptance Study “Tenant Electricity from the Tenant’s Perspective”. A Study of Various Tenant Electricity Projects in NRW.] Masterarbeit, Wuppertal Institut für Klima, Umwelt, Energie gGmbH. 2019. Available online: https://epub.wupperinst.org/frontdoor/deliver/index/docId/7339/file/WSA17_Schaefer.pdf (accessed on 22 January 2024).

- Osterhage, T. Messdatengestützte Analyse und Interpretation Sanierungsbedingter Effizienzsteigerungen im Wohnungsbau. [Measurement Data-Based Analysis and Interpretation of Renovation-Related Efficiency Increases in Residential Construction.] Ph.D. Thesis, Technische Universität Dortmund. 2018. Available online: https://eldorado.tu-dortmund.de/handle/2003/37820 (accessed on 22 January 2024).

- Figgener, J.; Haberschusz, D.; Zumühlen, S.; Sauer, D.U. Speichermonitoring BW [Storage Monitoring]-Abschlussbereicht-RWTH Aachen Institut für Stromrichtertechnik und Elektrische Antriebe. 2021. Available online: https://pudi.lubw.de/detailseite/-/publication/10344 (accessed on 22 January 2024).

- Koch, T.; Achenbach, S.; Müller, A. Werkstattbericht—Anpassung der Kostenfunktionen Energierelevanter Bau-und Anlagenteile bei der Energetischen Modernisierung von Altbauten auf das Preisniveau 2020 [Report—Adjustment of the Cost Functions of Energy-Relevant Building and System Components in the Energy Renovation of Old Buildings to the 2020 Price Level]. Available online: https://www.iwu.de/fileadmin/publikationen/werkstattbericht/2021_IWU_KochEtAl_Werkstattbericht-Anpassung-Kostenfunktionen-2020.pdf (accessed on 22 January 2024).

| Current Regulations | Discussed in Literature |

|---|---|

| Tenant Electricity | [7] |

| CO2 cost allocation | [8,9] |

| Suggested Approach | |

| Adjustment of the retrofitting fee | [8,10,11,12,13,14] |

| Energy-differentiated local reference rent | [6,8,10] |

| One-third model | [8,13,14,15] |

| Energy and climate fund model | [5,8] |

| Separate surcharge on base rent | [6,13] |

| Differentiation of subsidies by landlord type | [14] |

| Obligation to renovate | [14] |

Considered in publication: | Building performance evaluation | Rental law (BGB) | Other legal frameworks | |||||||||||

| Building envelope | Building energy system | Building modeling | Rent payments | Retrofitting fee | Local referencerent | Energy differentiation | Building Energy Act (GEG) | Subsidies | CO2 cost allocation | Feed-in tariffs | Tenant electricity | |||

| Economic science | 2022 | Ahlrichs et al. [11] |  |  |  |  |  |  |  |  |  |  |  |  |

| 2021 | Henger et al. [8] |  |  |  |  |  |  |  |  |  |  |  |  | |

| 2020 | Henger et al. [5] |  |  |  |  |  |  |  |  |  |  |  |  | |

| 2019 | Mellwig et al. [15] |  |  |  |  |  |  |  |  |  |  |  |  | |

| 2016 | Kossmann et al. [10] |  |  |  |  |  |  |  |  |  |  |  |  | |

| Legal science | 2019 | Gaßner et al. [13] |  |  |  |  |  |  |  |  |  |  |  |  |

| 2011 | Neitzel et al. [6] |  |  |  |  |  |  |  |  |  |  |  |  | |

| 2009 | Ekardt et al. [12] |  |  |  |  |  |  |  |  |  |  |  |  | |

| Social science | 2022 | Taruttis et al. [9] |  |  |  |  |  |  |  |  |  |  |  |  |

| 2022 | März et al. [17] |  |  |  |  |  |  |  |  |  |  |  |  | |

| 2021 | Lang et al. [18] |  |  |  |  |  |  |  |  |  |  |  |  | |

| 2019 | März et al. [14] |  |  |  |  |  |  |  |  |  |  |  |  | |

| Engineering | 2022 | Petkov et al. [19] |  |  |  |  |  |  |  |  |  |  |  |  |

| 2022 | Braeuer et al. [7] |  |  |  |  |  |  |  |  |  |  |  |  | |

| 2015 | Steinbach [20] |  |  |  |  |  |  |  |  |  |  |  |  | |

| Category | Stakeholder | ||

|---|---|---|---|

| Owner-Occupied | Landlord | Tenant | |

| Investment | − | − | |

| Installation | − | − | |

| Maintenance | − | − | |

| Consumption | − | − | − |

| Emissions | − | − | − |

| Metering | − | − | |

| Feed-in/self-consumption surcharges | + | + | |

| Subsidies | + | + | |

| Rent | + | − | |

| Tenant electricity * | (+) | (−) |

| MFH D | MFH H | |

|---|---|---|

| Construction period | 1949–1957 | 1984–1994 |

| Living area | 575 | 707 |

| Apartments | 9 | 10 |

| Annual heat demand | 210 kWh/ | 115 kWh/ |

| Nominal heat load | 61 kW | 43 kW |

| BOI | 74.2 kW | 52.0 kW |

| TES | 45.6 kWh | 56.1 kWh |

| Facade | 1.2 W/(K) | 0.6 W/(K) |

| Roof | 1.6 W/(K) | 0.4 W/(K) |

| Window | 3.0 W/(K) | 3.0 W/(K) |

| Scenario 1 | Senario 2 | Unit | ||

|---|---|---|---|---|

| Prices | Gas | 0.2004 | 0.125 | €/kWh |

| Electricity | 0.4007 | 0.327 | €/kWh | |

| CO2 | 0.03 | 0.105 | €/kg | |

| Revenues | CHP index feed-in | 0.1928 | €/kWh | |

| CHP feed-in | 0.044–0.016 * | €/kWh | ||

| CHP self-consumption | 0.015–0.08 * | €/kWh | ||

| PV feed-in | 0.082–0.109 * | €/kWh | ||

| PV self-consumption | 0.0167–0.0267 * | €/kWh | ||

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Kühn, L.; Fuchs, N.; Braun, L.; Maier, L.; Müller, D. Landlord–Tenant Dilemma: How Does the Conflict Affect the Design of Building Energy Systems? Energies 2024, 17, 686. https://doi.org/10.3390/en17030686

Kühn L, Fuchs N, Braun L, Maier L, Müller D. Landlord–Tenant Dilemma: How Does the Conflict Affect the Design of Building Energy Systems? Energies. 2024; 17(3):686. https://doi.org/10.3390/en17030686

Chicago/Turabian StyleKühn, Larissa, Nico Fuchs, Lars Braun, Laura Maier, and Dirk Müller. 2024. "Landlord–Tenant Dilemma: How Does the Conflict Affect the Design of Building Energy Systems?" Energies 17, no. 3: 686. https://doi.org/10.3390/en17030686

APA StyleKühn, L., Fuchs, N., Braun, L., Maier, L., & Müller, D. (2024). Landlord–Tenant Dilemma: How Does the Conflict Affect the Design of Building Energy Systems? Energies, 17(3), 686. https://doi.org/10.3390/en17030686