Blockchain Research and Development Activities Sponsored by the U.S. Department of Energy and Utility Sector

Abstract

:1. Introduction

1.1. Blockchain in the Energy Sector

1.2. Background Study of Categorization of Blockchain Use Case

1.3. Motivation of the Study

1.4. Contribution

- 1.

- A systematic and structured framework for use case categorization that can be used to record blockchain activities according to energy system domains and use case applications in one dimension and blockchain properties in another dimension.

- 2.

- A categorization mapping matrix of currently tracked blockchain use cases based on projects and publications within the scope of the DOE-sponsored R&D efforts and the U.S. utility demonstration projects, the distribution of current portfolio investments, and the areas of interest of blockchain applications.

- 3.

- Highlights of the most actively or less actively pursued blockchain activities, with the focus on energy system domains, use case applications, and blockchain properties.

- 4.

- Highlights on the existing gaps between DOE and U.S. utility industry activities based on the categorization mapping matrix.

1.5. Article Structure

1.6. Research Limitations

2. Literature Review of Blockchain Activities in the U.S. Energy Sector

2.1. Retail Services

2.2. Financial Services

2.3. DERs and Renewable Energy

2.4. Controls

2.5. Supply Chain Management

2.6. Foundational Blockchain Research

3. Development of Blockchain Use Case Categorization Framework

3.1. Evaluation of Promising Use Cases

| Andoni et al. [4] | PNNL, Gourisetti et al. [72] | Stekli and Cali [75] | EPRI [7,79] | IBM [63] |

|---|---|---|---|---|

| •Metering, billing, and security | •Billing services | •Retail billing •Smart metering—Clearing and settlement | ||

|

•Auditing

•Policy and regulations compliance | ||||

| •REC/decarbonization (Smart grid) | •Certifications | |||

| •Electric e-mobility | •EV charging | •EV charging/payment settlement | •EV charging | •EV charging |

| •Cryptocurrencies, tokens, investment | •Energy financing: STO, ICO, and digital equity crowdfunding | •Energy financing | •Energy coins | |

| •Wholesale trading | •Wholesale energy trading | |||

| •Market settlements | •Settlement | |||

| •Green certificates carbon trading | •REC/decarbonization | •Renewable energy certificates (REC) trading | •Renewable energy credits/carbon trading | |

| •Decentralized energy trading | •Peer-to-peer market |

•P2P energy trading

•Retail trading | •Peer-to-peer energy trading | •P2P |

| •DER coordination | •DER integration | •DER | ||

| •Grid management | •Grid services/ancillary services | •Flexibility management | •Grid flexibility | •Ancillary services |

| •Transactive systems and demand management | •Grid management and operations |

•Microgrid management

•Distribution management | ||

| •Demand response | •Supply and demand | |||

| •IoT, smart devices, automation, asset management | •Smart sensor/decentralized autonomous decision making | •IIoT/IoT device coordination | •Smart meter data | |

| •Electric e-mobility | •Smart automobile (vehicle-to-vehicle) | |||

|

•Grid cybersecurity

•Autonomous cybersecurity | •Cybersecurity—Network monitoring and security | •Grid cybersecurity | ||

| •Secure autonomous data acquisition | ||||

| •Asset management | •Asset management, operations and maintenance | •Asset management | ||

| •Supply chain | •Labelling and energy provenance | •Material traceability | •Asset lifecycle | |

| •Device management |

•Decommissioning

•Switching suppliers | |||

| •Device integrity |

•Cyber security—IIoT/IoT device authentication

•Supply chain—Authenticity •DER—Authentication | |||

|

•Configuration, software and patch management

IoT patch management | •Cybersecurity—Patch management | |||

| •Software and hardware license validation | ||||

| •General purpose initiatives and consortia |

3.2. Two-Dimensional Blockchain Use Case Categorization Framework

3.2.1. Categorization of Energy System Domains

Retail Services Enablement

Financial Services

Marketplaces and Trading

Grid Automation, Coordination, and Control

Supply Chain Management

Foundational Blockchain Research

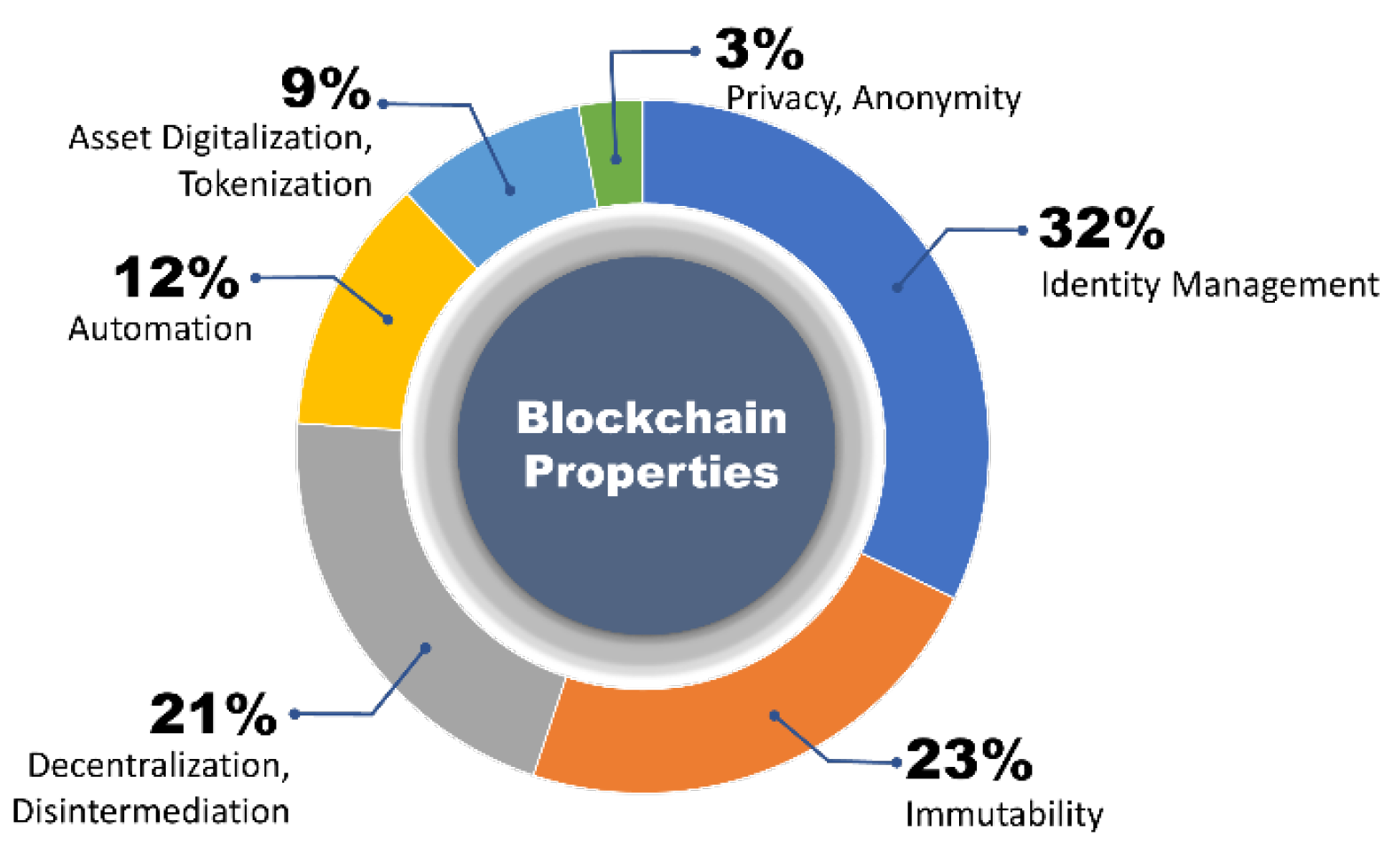

3.2.2. Categorization of Blockchain Properties

Immutability

Identity Management

Asset Digitization and Tokenization

Decentralization and/or Disintermediation

Automation

Privacy

4. Analysis of Blockchain Projects in U.S. Energy Sector

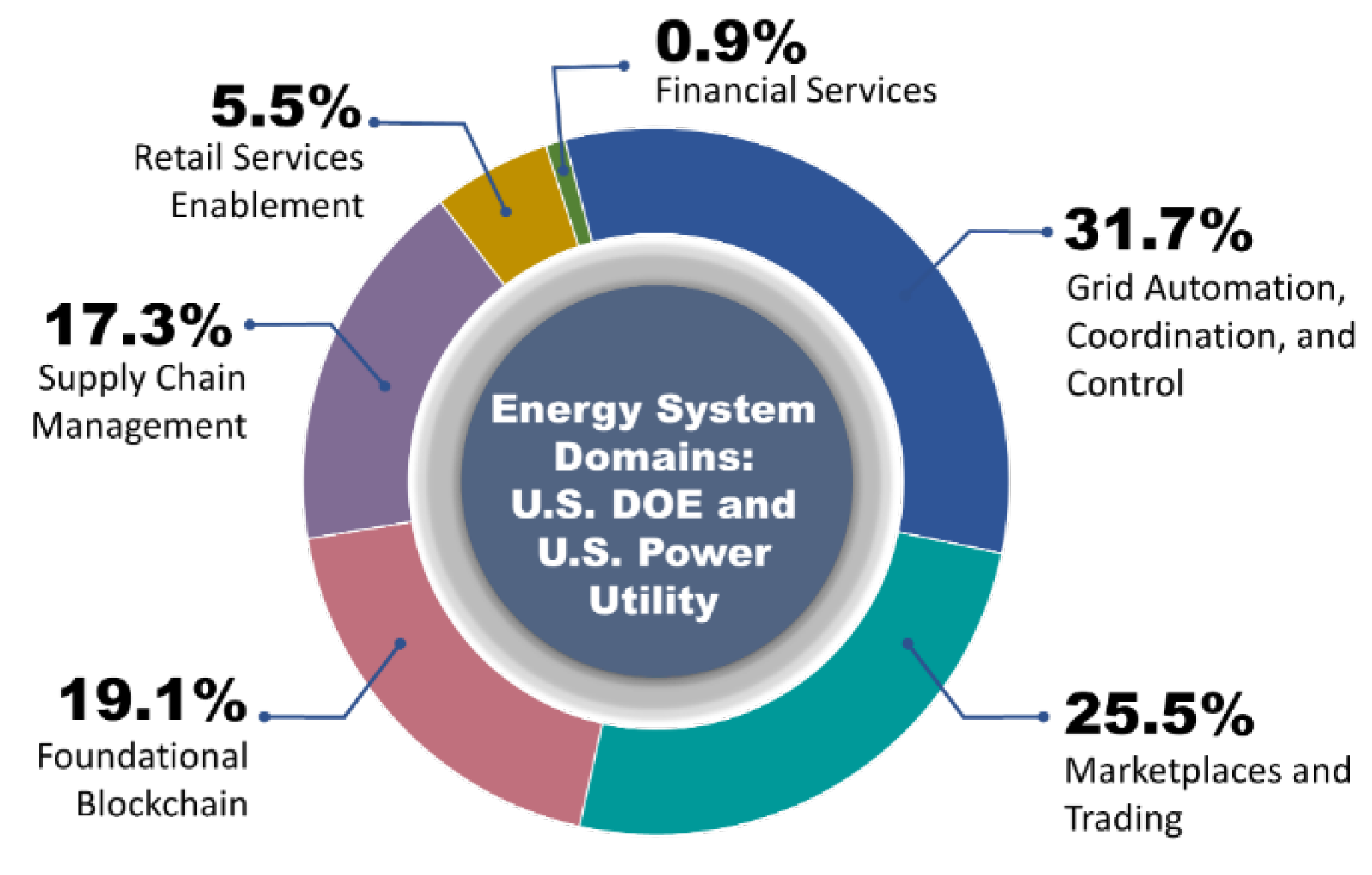

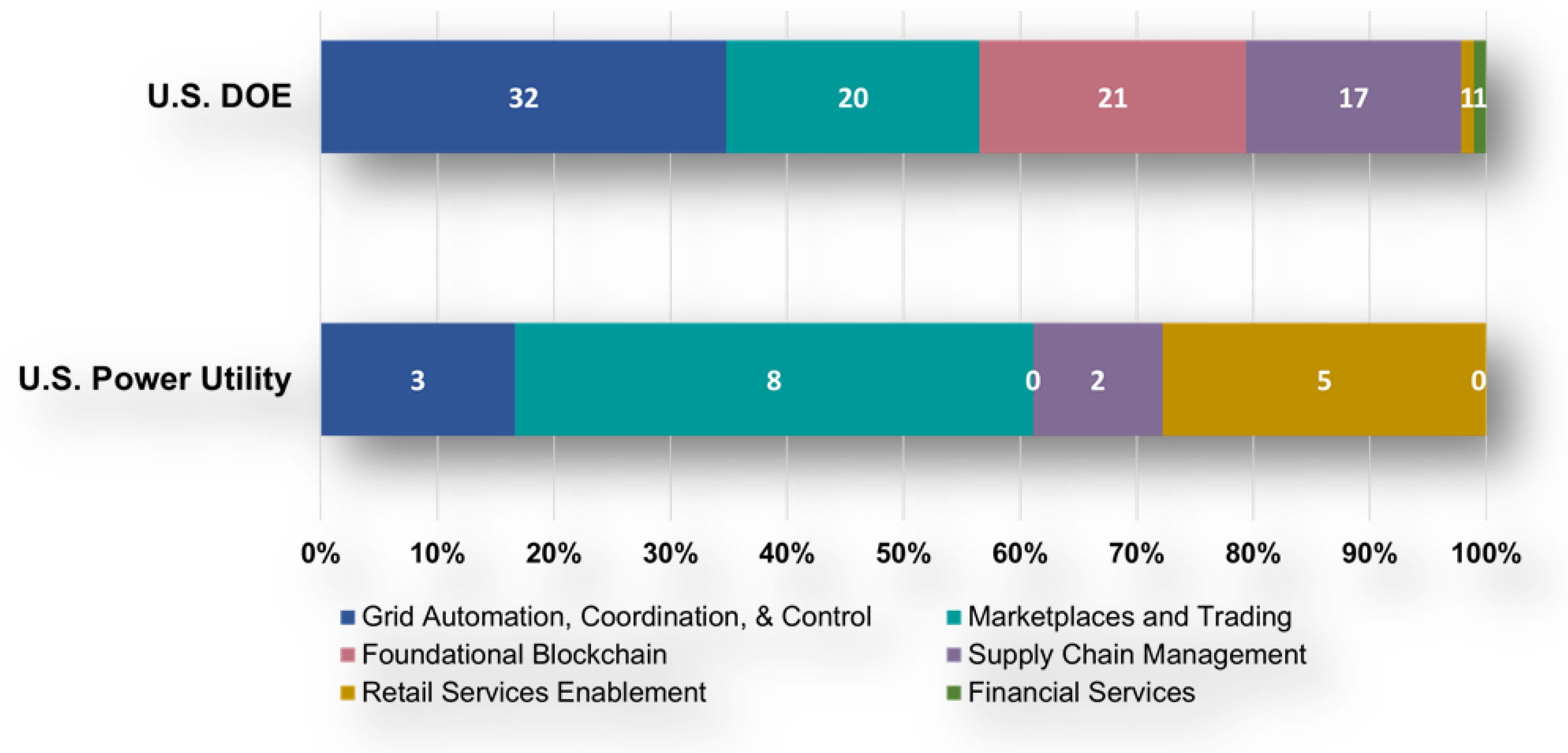

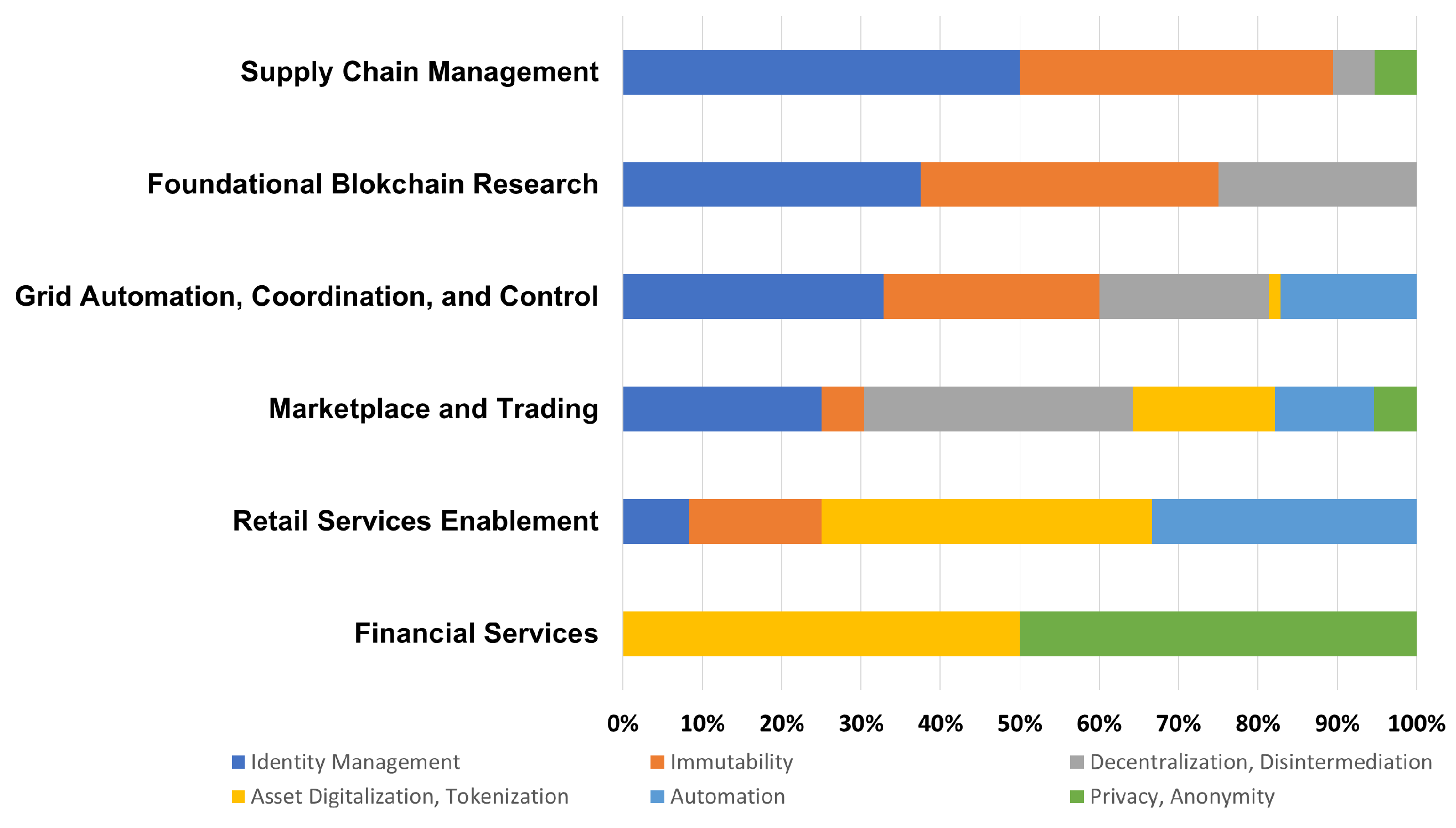

4.1. Blockchain Activities by Energy System Domain

4.1.1. Grid Automation, Coordination, and Control

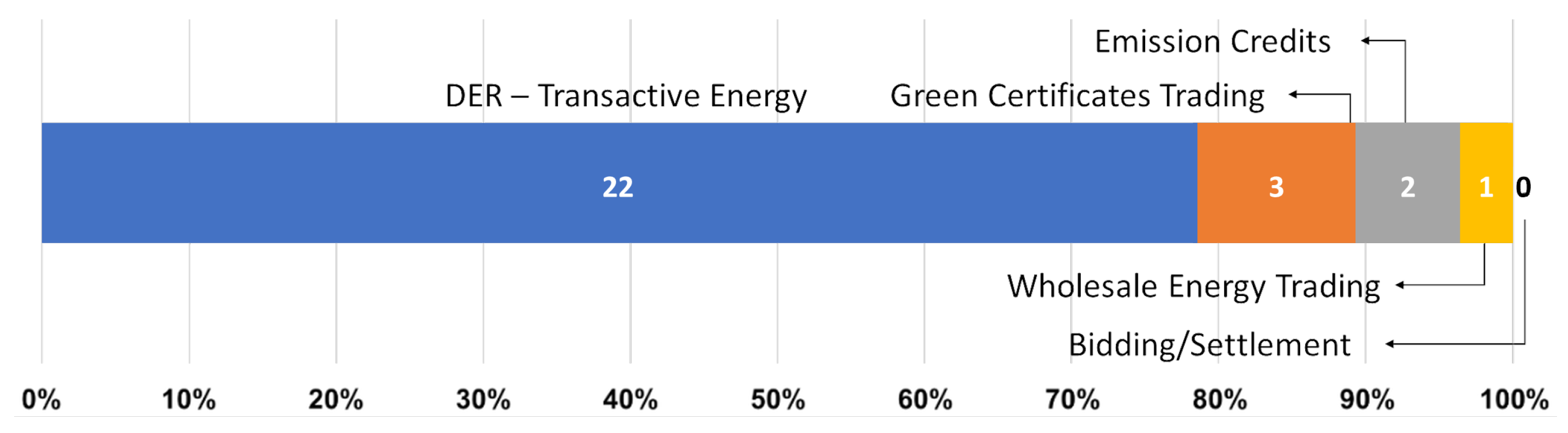

4.1.2. Marketplaces and Trading

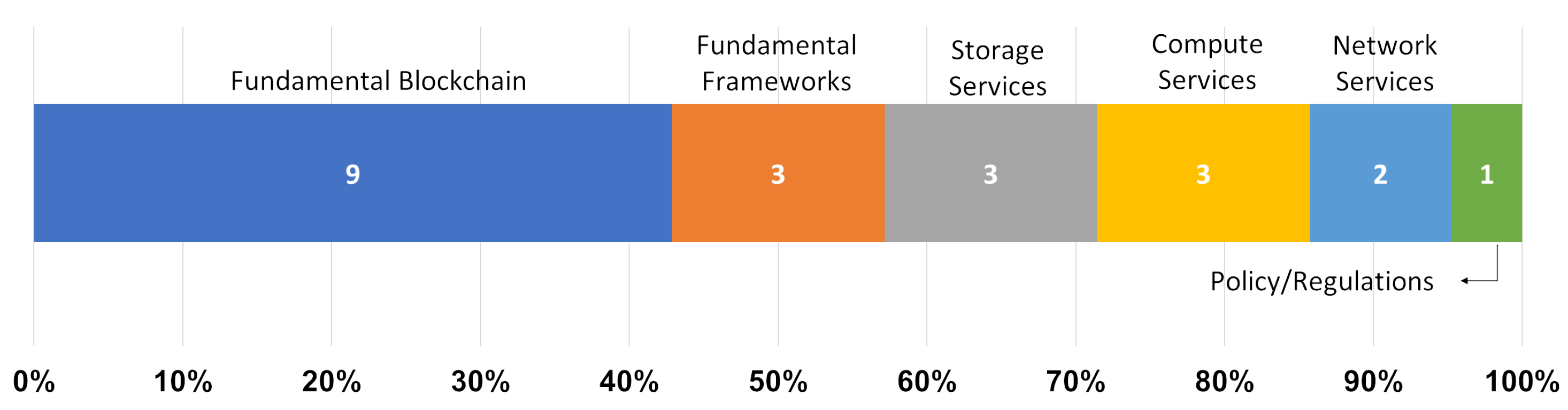

4.1.3. Foundational Blockchain Research

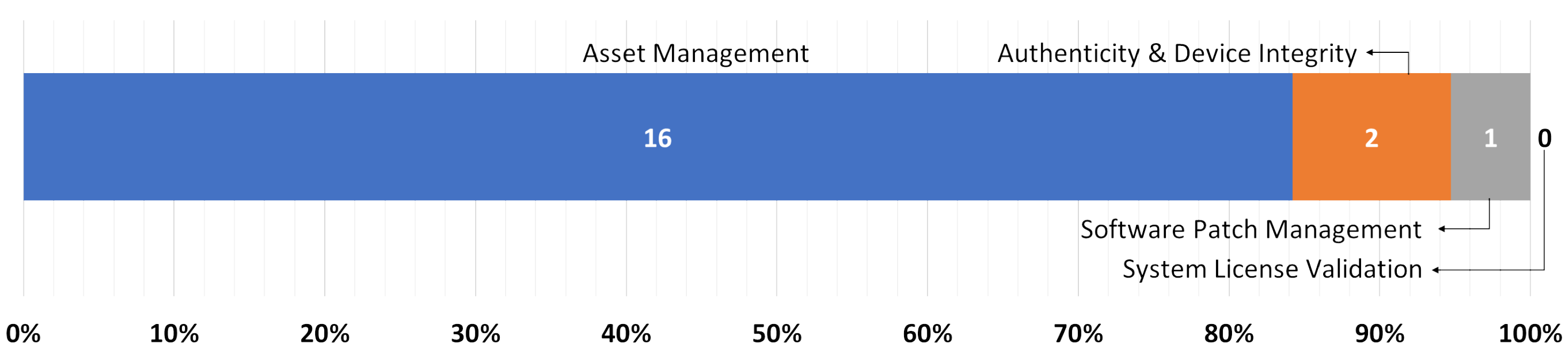

4.1.4. Supply Chain Management

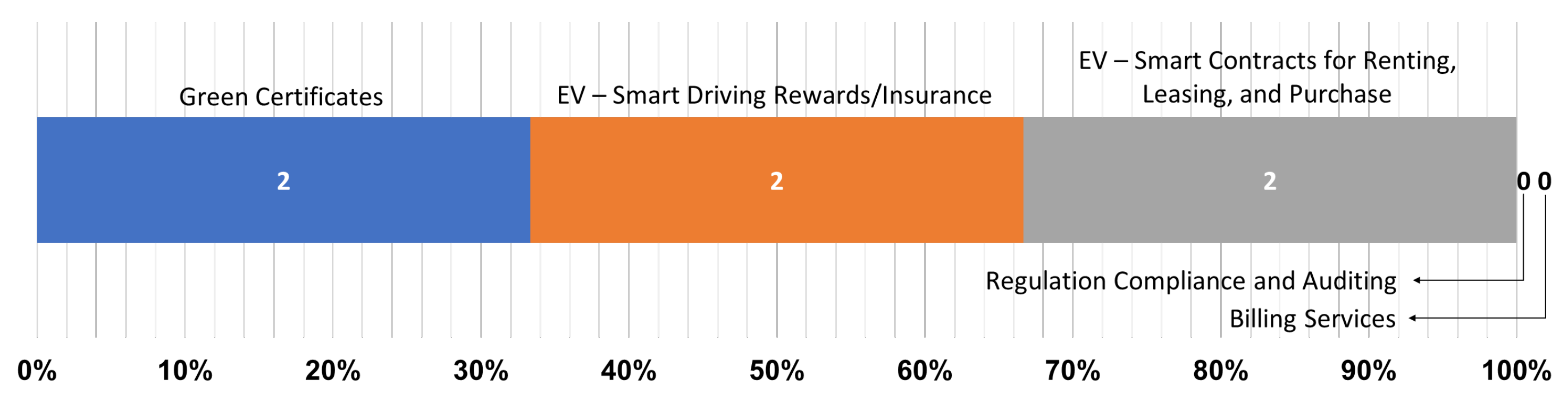

4.1.5. Retail Services Enablement

4.1.6. Financial Services

4.2. Blockchain Activities by Blockchain Properties

5. Conclusions

5.1. Energy System Domain

5.2. Use Case Application

5.3. Blockchain Properties

6. Future Work

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Brilliantova, V.; Thurner, T.W. Blockchain and the Future of Energy. Technol. Soc. 2019, 57, 38–45. [Google Scholar] [CrossRef]

- SettleMint. Blockchain Use Cases: Energy. Available online: https://www.settlemint.com/energy-blockchain-use-cases/ (accessed on 17 October 2022).

- Wang, G.; Zhang, S.; Yu, T.; Ning, Y. A Systematic Overview of Blockchain Research. J. Syst. Sci. Inf. 2021, 9, 205–238. [Google Scholar] [CrossRef]

- Andoni, M.; Robu, V.; Flynn, D.; Abram, S.; Geach, D.; Jenkins, D.; McCallum, P.; Peacock, A. Blockchain Technology in The Energy Sector: A Systematic Review of Challenges and Opportunities. Renew. Sustain. Energy Rev. 2019, 100, 143–174. [Google Scholar] [CrossRef]

- Mire, S. Blockchain in Energy: 7 Possible Use Cases. Available online: https://web.archive.org/web/20220412084910/https://www.disruptordaily.com/blockchain-use-cases-energy/ (accessed on 15 October 2022).

- Protokol. Top 5 Blockchain Use Cases in Energy and Utilities. Available online: https://www.protokol.com/insights/top-5-blockchain-use-cases-in-energy-and-utilities/ (accessed on 17 October 2022).

- EPRI. Program on Technology Innovation: Blockchain—U.S. and European Utility Insights Market Intelligence Briefing Report. Available online: https://www.epri.com/research/products/000000003002016663 (accessed on 15 June 2019).

- Nhede, N. Blockchain Use in Grid-Connected Microgrids to Generate +$1.2bn per Annum. Available online: https://www.smart-energy.com/renewable-energy/blockchain-use-in-grid-connected-microgrids-to-generate-1-2bn-per-annum/ (accessed on 25 October 2022).

- Giroti, T. Blockchain for Power Equipment Manufacturers. Available online: https://energy-blockchain.org/about/contact/ (accessed on 17 October 2022).

- Giroti, T. Blockchain for ISO/RTOs in the Electricity Industry. Available online: https://energy-blockchain.org/blockchain-for-iso-rtos-in-the-electricity-industry/ (accessed on 17 October 2022).

- Vlachos, I.; Lima, C.; Cali, U.; Lin, J.; Gindroz, B.; Schlegel, W.; Möhr, L.; Mühlethaler, J.; Ruslanova, M.; Henderson, J.; et al. Blockchain Applications in the Energy Sector. Available online: https://web.archive.org/web/20220719093049/https://www.eublockchainforum.eu/sites/default/files/reports/EUBOF-Thematic_Report_Energy_Sector.pdf (accessed on 7 June 2022).

- Takyar, A. Use Cases for Blockchain Energy. Available online: https://www.leewayhertz.com/blockchain-energy-use-cases/ (accessed on 25 October 2022).

- World Economic Forum PwC (PricewaterhouseCoopers) Stanford Woods Institute for the Environment. Building Block(chain)s for a Better Planet. Available online: https://www3.weforum.org/docs/WEF_Building-Blockchains.pdf (accessed on 23 June 2022).

- Ante, L.; Steinmetz, F.; Fiedler, I. Blockchain and Energy: A Bibliometric Analysis and Review. Renew. Sustain. Energy Rev. 2021, 137, 110597. [Google Scholar] [CrossRef]

- Khatoon, A.; Verma, P.; Southernwood, J.; Massey, B.; Corcoran, P. Blockchain in Energy Efficiency: Potential Applications and Benefits. Energies 2019, 12, 3317. [Google Scholar] [CrossRef]

- Wang, T.; Hua, H.; Wei, Z.; Cao, J. Challenges of blockchain in new generation energy systems and future outlooks. Int. J. Electr. Power Energy Syst. 2022, 135, 107499. [Google Scholar] [CrossRef]

- Burer, M.J.; de Lapparent, M.; Pallotta, V.; Capezzali, M.; Carpita, M. Use cases for Blockchain in the Energy Industry Opportunities of emerging business models and related risks. Comput. Ind. Eng. 2019, 137, 106002. [Google Scholar] [CrossRef]

- Teufel, B.; Sentic, A.; Barmet, M. Blockchain energy: Blockchain in future energy systems. J. Electron. Sci. Technol. 2019, 17, 100011. [Google Scholar] [CrossRef]

- Juszczyk, O.; Shahzad, K. Blockchain Technology for Renewable Energy: Principles, Applications and Prospects. Energies 2022, 15, 4603. [Google Scholar] [CrossRef]

- Gawusu, S.; Zhang, X.; Ahmed, A.; Jamatutu, S.A.; Miensah, E.D.; Amadu, A.A.; Osei, F.A.J. Renewable energy sources from the perspective of blockchain integration: From theory to application. Sustain. Energy Technol. Assess. 2022, 52, 102108. [Google Scholar] [CrossRef]

- Wu, Y.; Wu, Y.; Cimen, H.; Vasquez, J.C.; Guerrero, J.M. Towards Collective Energy Community: Potential Roles of Microgrid and Blockchain to Go Beyond P2P Energy Trading. Appl. Energy 2022, 314, 119003. [Google Scholar] [CrossRef]

- Horowitz, A. How We’re Moving to Net-Zero by 2050. Available online: https://www.energy.gov/articles/how-were-moving-net-zero-2050 (accessed on 17 October 2022).

- Powerledger. Powerledger Partners with Silicon Valley Power on Renewable Energy Tracking for Electric Vehicles. Available online: https://web.archive.org/web/20210730201945/https://www.powerledger.io/media/power-ledger-partners-with-silicon-valley-power-on-renewable-energy-tracking-for-electric-vehicles (accessed on 18 January 2021).

- Maloney, P. Silicon Valley Power EV Blockchain Project Advances. Available online: https://web.archive.org/web/20220626142048/https://www.publicpower.org/periodical/article/silicon-valley-power-ev-blockchain-project-advances (accessed on 18 January 2021).

- Powerledger. Our Platform: Energy Trading & Traceability. Available online: https://www.powerledger.io/platform/ (accessed on 1 March 2021).

- EDF, SMUD to Test Blockchain-Based Electricity Market Software. Available online: https://www.tdworld.com/utility-business/article/20972992/edf-smud-to-test-blockchainbased-electricity-market-software (accessed on 21 March 2021).

- Spector, J. For Utilities Exploring Blockchain, There’s Beauty in the Mundane. Available online: https://www.greentechmedia.com/articles/read/for-utilities-exploring-blockchain-theres-beauty-in-the-mundane (accessed on 1 March 2021).

- Bitcoin Hashrate Historical Chart. Available online: https://bitinfocharts.com/comparison/bitcoin-hashrate.html (accessed on 1 June 2022).

- Bitcoin Energy Consumption Index. Available online: https://digiconomist.net/bitcoin-energy-consumption (accessed on 20 May 2022).

- Küfeoğlu, S.; Özkuran, M. Bitcoin Mining: A Global Review of Energy and Power Demand. Energy Res. Soc. Sci. 2019, 58, 101273. [Google Scholar] [CrossRef]

- Blandin, A.; Pieters, G.; Wu, Y.; Eisermann, T.; Dek, A.; Taylor, S.; Njoki, D. 3rd Global Cryptoasset, Benchmarking Study. Available online: https://www.jbs.cam.ac.uk/wp-content/uploads/2021/01/2021-ccaf-3rd-global-cryptoasset-benchmarking-study.pdf (accessed on 28 April 2021).

- National Renewable Energy Laboratory. Fast, Secure, Peer-to-Peer: NREL and BlockCypher Demonstrate Autonomous Energy Exchange with Blockchain Technology. 2018. Available online: https://www.nrel.gov/docs/fy19osti/73025.pdf (accessed on 15 January 2025).

- Gourisetti, S.N.G.; Sebastian-Cardenas, D.J.; Bhattarai, B.; Wang, P.; Widergren, S.; Borkum, M.; Randall, A. Blockchain Smart Contract Reference Framework and Program Logic Architecture for Transactive Energy Systems. Appl. Energy 2021, 304, 117860. [Google Scholar] [CrossRef]

- Neidig, J. SolarChain P2P: A Blockchain-based Transaction Platform for Distributed Solar Energy Trading. Available online: https://www.osti.gov/biblio/1606508 (accessed on 24 May 2021).

- Cutler, D.; Kwasnik, T.; Balamurugan, S.P.; Sparn, B.; Hsu, K.; Booth, S. A Demonstration of Blockchain-based Energy Transactions between Laboratory Test Homes. In Proceedings of the 2018 ACEEE Summer Study on Energy Efficiency in Buildings, Pacific Grove, CA, USA, 12–17 August 2018; pp. 12-1–12-13. Available online: https://www.aceee.org/files/proceedings/2018/index.html#/paper/event-data/p363 (accessed on 3 June 2022).

- Stark, K. In Illinois, Blockchain Startups Seek to Work with Utilitites on Grid Software. Available online: https://energynews.us/2018/04/25/in-illinois-blockchain-startups-seek-to-work-with-utilities-on-grid-software/ (accessed on 1 March 2021).

- John, J.S. Ameren and Opus One to Test Blockchain-Enabled Microgrid Energy Trading. Available online: https://www.greentechmedia.com/articles/read/ameren-and-opus-one-to-test-blockchain-enabled-microgrid-energy-trading (accessed on 4 March 2021).

- Shan, S.; Kennedy, T. Ameren and Opus One Solutions Partner on Value of DER and Transactive Energy Markets. Available online: https://www.globenewswire.com/news-release/2019/03/28/1781698/0/en/Ameren-and-Opus-One-Solutions-partner-on-Value-of-DER-and-Transactive-Energy-Markets.html (accessed on 4 March 2021).

- Ameren. Fact Sheet: Ameren’s Champaign Microgrid. Available online: http://ameren.mediaroom.com/download/microgrid-facts.pdf (accessed on 4 March 2021).

- Kelly, K. GMP Revolutionizes Renewable Power Sharing with Peer-to-Peer Energy Sales Platform. Available online: https://greenmountainpower.com/news/gmp-revolutionizes-renewable-power-sharing-with-peer-to-peer-energy-sales-platform-3 (accessed on 4 March 2021).

- Endemann, B.B.; Johns, A.F.; Mora, O.B.; Cohen, D.S.N. The Energizer—Volume 57. Available online: https://www.klgates.com/The-Energizer---Volume-57-12-13-2019 (accessed on 1 March 2021).

- Insights, L. Powerledger’s Tech to Be Used in Global REC Market, Following North American Registry M-RETS and Clearway Deal. Available online: https://powerledger.io/media/powerledgers-tech-to-be-used-in-global-rec-market-following-north-american-registry-m-rets-and-clearway-deal/ (accessed on 4 March 2021).

- Insights, L. Power Ledger Partners with US Registry M-RETS for REC Blockchain Trading. Available online: https://www.ledgerinsights.com/mrets-blockchain-rec-trading-powerledger-energy/ (accessed on 4 March 2021).

- Energy Web Foundation. Energy Web Foundation and PJM-EIS Announce Collaboration to Build and Evaluate Blockchain-Based Tool for a Major U.S. Renewable Energy Certificates Market. Available online: https://medium.com/energy-web-insights/energy-web-foundation-and-pjm-eis-announce-collaboration-to-build-and-evaluate-blockchain-based-dfe6e16f2b54 (accessed on 4 March 2021).

- Hartnett, S.; Henly, C.; Hesse, E.; Hildebrandt, T.; Jentzch, C.; Krämer, K.; MacDonald, G.; Morris, J.; Touati, H.; Trbovich, A.; et al. The Energy Web Chain: Accelerating the Energy Transition with an Open-source, Decentralized Blockchain Platform. Available online: https://web.archive.org/web/20210318162228/https://www.energyweb.org/wp-content/uploads/2019/05/EWF-Paper-TheEnergyWebChain-v2-201907-FINAL.pdf (accessed on 4 March 2021).

- Alamalhodaei, A. NV Energy Pilot Project to Use Blockchain Technology. Available online: https://www.newsdata.com/california_energy_markets/southwest/nv-energy-pilot-project-to-use-blockchain-technology/article_0bb95294-c859-11ea-aff9-77a9136a72e3.html (accessed on 4 March 2021).

- John, J.S. Direct Energy Uses LO3’s Blockchain to Offer ‘Micro Energy Hedging’ to Commercial Customers. Available online: https://www.greentechmedia.com/articles/read/direct-energy-uses-lo3s-blockchain-to-offer-micro-energy-hedging (accessed on 4 March 2021).

- Kaur, K.; Hahn, A.; Gourisetti, S.N.G.; Mylrea, M.; Singh, R. Enabling Secure Grid Information Sharing through Hash Calendar-based Blockchain Infrastructures. In Proceedings of the 2019 Resilience Week (RWS), San Antonio, TX, USA, 4–7 November 2019; pp. 200–205. [Google Scholar] [CrossRef]

- Mylrea, M.; Gourisetti, S.N.G. Blockchain: A Path to Grid Modernization and Cyber Resiliency. In Proceedings of the 2017 North American Power Symposium (NAPS), Morgantown, WA, USA, 17–19 September 2017; pp. 1–5. [Google Scholar] [CrossRef]

- Fuhr, P.L.; Rooke, S.S. Blockchain Secured Alternative to Mixed Routing/Non-Routing Nodes Wireless Sensor Network Topologies for Industrial Settings. Int. Res. J. Eng. Technol. 2019, 6, 1594–1599. Available online: https://www.irjet.net/archives/V6/i12/IRJET-V6I12280.pdf (accessed on 3 June 2022).

- Mayle, A.N.; Birch, G.C.; Stubbs, J.J.; Vasek, M. Designing a Physical Security System Using Blockchain. Available online: https://www.osti.gov/biblio/1642017-designing-physical-security-system-using-blockchain (accessed on 6 February 2021).

- Hadi, A.A.; Bere, G.; Kim, T.; Ochoa, J.J.; Zeng, J.; Seo, G.S. Secure and Cost-Effective Micro Phasor Measurement Unit (PMU)-Like Metering for Behind-the-Meter (BTM) Solar Systems using Blockchain-Assisted Smart Inverters. In Proceedings of the 2020 IEEE Applied Power Electronics Conference and Exposition (APEC), New Orleans, LA, USA, 15–19 March 2020; pp. 2369–2375. [Google Scholar] [CrossRef]

- ComEd—An Exelon Company. Xage Security and ComEd to Demonstrate New Use for Blockchain. Available online: https://web.archive.org/web/20210302161321/https://www.comed.com/News/Pages/NewsReleases/2019_09_23a.aspx (accessed on 4 March 2021).

- VIA. VIA Files Over 10 Patents for Trusted Analytics Chain™. Available online: https://www.solvewithvia.com/via-patents-tac/ (accessed on 15 March 2021).

- Sowers, S. DEED Funded Projects Include EVs, Floating Solar Arrays, Blockchain. Available online: https://web.archive.org/web/20210504210838/https://www.publicpower.org/periodical/article/deed-funded-projects-include-evs-floating-solar-arrays-blockchain (accessed on 4 March 2021).

- Mylrea, M.; Gourisetti, S.N.G. Blockchain: Next Generation Supply Chain Security for Energy Infrastructure and NERC Critical Infrastructure Protection (CIP) Compliance. J. Syst. Cybern. Inform. 2018, 16, 22–30. [Google Scholar] [CrossRef]

- Gasser, P. A Distributed Ledger Technology (DLT) Approach to Monitoring UF6 Cylinders: Lessons Learned from TradeLens. Available online: https://www.osti.gov/servlets/purl/1543077 (accessed on 18 July 2019).

- Kennedy, Z.C.; Stephenson, D.E.; Christ, J.F.; Pope, T.R.; Arey, B.W.; Barrett, C.A.; Warner, M.G. Enhanced Anti-Counterfeiting Measures for Additive Manufacturing: Coupling Lanthanide Nanomaterial Chemical Signatures with Blockchain Technology. J. Mater. Chem. C 2017, 5, 9570–9578. [Google Scholar] [CrossRef]

- Frazar, S.L.; Jarman, K.D.; Joslyn, C.A.; Kreyling, S.J.; Sayre, A.M.; Schanfein, M.J.; West, C.L.; Winters, S.T. Exploratory Study on Potential Safeguards Applications for Shared Ledger Technology; Technical Report PNNL-26229; Pacific Northwest National Laboratory: Richland, WA, USA, 2017. [CrossRef]

- Electric Power Research Institute (EPRI). Hawaiian Electric Joins as Second Founding Member of GDAC™, Alongside Vector. Available online: https://www.solvewithvia.com/hawaiian-electric-joins-as-second-founding-member-of-gdac-alongside-vector/ (accessed on 21 March 2021).

- Global Data Asset Collaborative to Increase ROI for Utilities. Available online: https://www.tdworld.com/smart-utility/data-analytics/article/21120117/global-data-asset-collaborative-proven-to-increase-roi-for-utilities (accessed on 21 March 2021).

- Warner, C.J. Application of Pacific Gas & Electric Company (U 39 E) for Approval of Its 2018–2020 Electric Program Investment Charge Investment Plan. Project #4, Multi-Nodal Distributed Digital Ledger. Available online: https://www.pge.com/assets/pge/docs/about/corporate-responsibility-and-sustainability/EPIC-3-Application-PGE.pdf (accessed on 17 February 2021).

- National Energy Technology Laboratory. Blockchain for Optimized Security and Energy Management (BLOSEM). Available online: https://netl.doe.gov/BLOSEM (accessed on 18 March 2022).

- White House. Executive Order on America’s Supply Chains; United States of America, The White House: Washington, DC, USA, 2021.

- Tosh, D.; Shetty, S.; Liang, X.; Kamhoua, C.; Njilla, L.L. Data Provenance in the Cloud: A Blockchain-Based Approach. IEEE Consum. Electron. Mag. 2019, 8, 38–44. [Google Scholar] [CrossRef]

- Tosh, D.; Shetty, S.; Foytik, P.; Kamhoua, C.; Njilla, L. CloudPoS: A Proof-of-Stake Consensus Design for Blockchain Integrated Cloud. In Proceedings of the 2018 IEEE 11th International Conference on Cloud Computing (CLOUD), San Francisco, CA, USA, 2–7 July 2018; pp. 302–309. [Google Scholar] [CrossRef]

- Ault, J.T. Advancing the Science and Impact of Blockchain Technology at Oak Ridge National Laboratory. Available online: https://info.ornl.gov/sites/publications/Files/Pub118487.pdf (accessed on 5 October 2018).

- Rooke, S.S.; Fuhr, P.L. Edge Deployed Cyber Security Hardware Architecture for Energy Delivery Systems. Int. Res. J. Eng. Technol. RIJET 2020, 7, 1279–1284. Available online: https://www.irjet.net/archives/V7/i1/IRJET-V7I1220.pdf (accessed on 16 May 2022).

- Wampler, J.; Payer, G. Blockchain for High Performance Data Integrity and Provenance. Available online: https://www.osti.gov/servlets/purl/1497843 (accessed on 15 February 2021).

- Ali, S.; Wang, G.; White, B.; Cottrell, R.L. A Blockchain-Based Decentralized Data Storage and Access Framework for PingER. In Proceedings of the 2018 17th IEEE International Conference on Trust, Security and Privacy in Computing and Communications/12th IEEE International Conference on Big Data Science and Engineering (TrustCom/BigDataSE), New York, NY, USA, 1–3 August 2018; pp. 1303–1308. [Google Scholar] [CrossRef]

- Ray, W.B. Extending the Blockchain: Ensuring Transactional Integrity in Relational Data via Blockchain Technology; Technical Report ORNL/TM-2019/1253; Oak Ridge National Laboratory: Oak Ridge, TN, USA, 2019. [CrossRef]

- Gourisetti, S.N.G.; Mylrea, M.; Patangia, H. Evaluation and Demonstration of Blockchain Applicability Framework. IEEE Trans. Eng. Manag. 2020, 67, 1142–1156. [Google Scholar] [CrossRef]

- van Dam, R.; Dinh, T.N.; Cordi, C.; Jacobus, G.; Pattengale, N.; Elliott, S. Proteus: A DLT-Agnostic Emulation and Analysis Framework. Available online: https://www.usenix.org/system/files/cset19-paper_van_dam_0.pdf (accessed on 12 August 2019).

- Johnson, G.; Sebastian-Cardenas, D.J.; Balamurugan, S.P.; Harun, N.F.; Mukherjee, M.; Blonsky, M.; Markel, T.; Johnson, B. A Unified Testing Platform to mature Blockchain applications for Grid Emulation environments. In Proceedings of the 2022 IEEE PES Transactive Energy Systems Conference (TESC), Portland, OR, USA, 2–6 May 2022; pp. 1–5. [Google Scholar]

- Stekli, J.; Cali, U. Potential Impacts of Blockchain Based Equity Crowdfunding on the Economic Feasibility of Offshore Wind Energy Investments. J. Renew. Sustain. Energy 2020, 12, 053307. [Google Scholar] [CrossRef]

- Gopstein, A.; Nguyen, C.; O’Fallon, C.; Hastings, N.; Wollman, D. NIST Framework and Roadmap for Smart Grid Interoperability Standards, Release 4.0; Technical Report NIST Special Publication 1108r4; U.S. Department of Commerce, National Institute of Standards and Technology: Gaithersburg, MD, USA, 2021. [CrossRef]

- Group, S.G.C. Smart Grid Reference Architecture. Available online: https://www.cencenelec.eu/media/CEN-CENELEC/AreasOfWork/CEN-CENELEC_Topics/Smart%20Grids%20and%20Meters/Smart%20Grids/reference_architecture_smartgrids.pdf (accessed on 12 September 2022).

- Gourisetti, S.N.G.; Cali, Ü.; Choo, K.R.; Escobar, E.; Gorog, C.; Lee, A.; Lima, C.; Mylrea, M.; Pasetti, M.; Rahimi, F.; et al. Standardization of the Distributed Ledger Technology Cybersecurity Stack for Power and Energy Applications. Sustain. Energy Grids Netw. 2021, 28, 100553. [Google Scholar] [CrossRef]

- EPRI. Utility Blockchain Interest Group. Available online: https://techportal.epri.com/demonstrations/ubig (accessed on 15 February 2021).

- Dwyer, B.; Mowry, C. Minimizing Fraud in the Carbon Offset Market Using Blockchain Technologies; Technical Report SAND2021-6716; Sandia National Laboratories: Albuquerque, NM, USA, 2021.

- Foster-Andres, S.; Joshi, J. Flexible Financial Credit Agreements: Blockchain. Available online: https://www.nrel.gov/docs/fy22osti/81815.pdf (accessed on 17 May 2022).

- Lowder, T.; Xu, K. The Evolving U.S. Distribution System: Technologies, Architectures, and Regulations for Realizing a Transactive Energy Marketplace. 2020. Available online: https://www.nrel.gov/docs/fy20osti/74412.pdf (accessed on 17 May 2022).

- Pipattanasomporn, M.; Kuzlu, M.; Rahman, S. A Blockchain-based Platform for Exchange of Solar Energy: Laboratory-scale Implementation. In Proceedings of the 2018 International Conference and Utility Exhibition on Green Energy for Sustainable Development (ICUE), Phuket, Thailand, 24–26 October 2018; pp. 1–9. [Google Scholar] [CrossRef]

- Pipattanasomporn, M.; Rahman, S.; Kuzlu, M. Blockchain-based Solar Electricity Exchange: Conceptual Architecture and Laboratory Setup. In Proceedings of the 2019 IEEE Power & Energy Society Innovative Smart Grid Technologies Conference (ISGT), Washington, DC, USA, 18–21 February 2019; pp. 1–5. [Google Scholar] [CrossRef]

- Balamurugan, S.P.; Cutler, D.; Kwasnik, T.; Elgindy, T.; Munankarmi, P.; Maguire, J.; Blonsky, M.; Ghosh, S.; Chintala, R.; Christensen, D. Zero Export Feeder Through Transactive Markets; Technical Report PNNL-78673; United States Department of Energy, Pacific Northwest National Laboratory: Richland, WA, USA, 2022.

- Houchins, C. Blockchain Technologies to Enable Energy Trading & Automated Control of Flexible Distributed Energy Resources; United States Department of Energy, Office of Electricity: Washington, DC, USA, 2021.

- Chassin, D. Transactive Energy Service System; United States Department of Energy, Office of Electricity: Washington, DC, USA, 2021.

- Min, N. Advanced Peer to Peer Transactive Energy Platform with Predictive Optimization; United States Department of Energy, Office of Energy Efficiency and Renewable Energy: Washington, DC, USA, 2021.

- Lin, J. An Energy Internet Platform for Transactive Energy and Demand Response Applications; United States Department of Energy, Office of Energy Efficiency and Renewable Energy: Washington, DC, USA, 2021.

- Gourisetti, S.N.G. Energy Markets; Technical Report; United States Department of Energy, Pacific Northwest National Laboratory: Richland, WA, USA, 2021.

- Malik, M. SLAC: Energy Data X. Carnegie Mellon University, Information Networking Institute. Available online: https://www.cmu.edu/ini/news/2019/practicumshowcase20191.html (accessed on 7 January 2021).

- Cutler, D.; Kwasnik, T.; Balamurugan, S.; Elgindy, T.; Swaminathan, S.; Maguire, J.; Christensen, D. Co-Simulation of Transactive Energy Markets: A Framework for Market Testing and Evaluation. Int. J. Electr. Power Energy Syst. 2021, 128, 106664. [Google Scholar] [CrossRef]

- Sebastian Cardenas, D.J.; Gourisetti, S.N.G.; Wang, P.; Smith, J.J.; Borkum, M.I.; Mukherjee, M. Smart Contract Architectures and Templates for Blockchain-Based Energy Markets (V1. 0); Technical Report; Pacific Northwest National Laboratory (PNNL): Richland, WA, USA, 2022.

- Cushing, V. P2P Transactions with Demand Flexibility for Increasing Solar Utilization; United States Department of Energy, Office of Energy Efficiency and Renewable Energy: Washington, DC, USA, 2021.

- Malik, M. EnergyBlox–SLAC National Accelerator Laboratory. Energy I-Corps, U.S. Department of Energy Office of Technology Transitions. Available online: https://web.archive.org/web/20211221110250/https://energyicorps.energy.gov/content/energyblox-slac-national-accelerator-laboratory (accessed on 7 January 2021).

- Eisele, S.; Laszka, A.; Schmidt, D.C.; Dubey, A. The Role of Blockchains in Multi-Stakeholder Transactive Energy Systems. Front. Blockchain 2020, 3, 593471. [Google Scholar] [CrossRef]

- Teale, C. Blockchain-Based Renewables Project in Los Angeles Wins $9M State Grant. Available online: https://www.smartcitiesdive.com/news/blockchain-based-renewables-project-in-los-angeles-wins-9m-state-grant/578192/ (accessed on 1 March 2021).

- D’Agostino, M. GridPlus Energy Is Now Live on PowerToChoose. Available online: https://medium.com/@mark_dago/gridplus-energy-is-now-live-on-powertochoose-c05d4df556d0 (accessed on 1 March 2021).

- Bhattarai, B.; Cardenas, D.J.S.; de Reis, F.B.; Mukherjee, M.; Gourisetti, S.N.G. Blockchain for Fault-Tolerant Grid Operations; Technical Report PNNL-32289; United States Department of Energy, Pacific Northwest National Laboratory: Richland, WA, USA, 2021.

- Thill, D. ComEd Looks to Blockchain as Tool to Manage an Increasingly Complex Grid. Available online: https://energynews.us/2019/11/08/comed-looks-to-blockchain-as-tool-to-manage-an-increasingly-complex-grid/ (accessed on 1 March 2021).

- Mylrea, M.; Gourisetti, S.N.G. Blockchain for Smart Grid Resilience: Exchanging Distributed Energy at Speed, Scale and Security. In Proceedings of the 2017 Resilience Week (RWS), Wilmington, DE, USA, 18–22 September 2017; pp. 18–23. [Google Scholar] [CrossRef]

- Shah, C.; King, J.; Wies, R.W. Distributed ADMM Using Private Blockchain for Power Flow Optimization in Distribution Network with Coupled and Mixed-Integer Constraints. IEEE Access 2021, 9, 46560–46572. [Google Scholar] [CrossRef]

- Chen, S.; Zhang, J.; Bai, Y.; Xu, P.; Gao, T.; Jiang, H.; Gao, W.; Li, X. Blockchain Enabled Intelligence of Federated Systems (BELIEFS): An attack-tolerant trustable distributed intelligence paradigm. Energy Rep. 2021, 7, 8900–8911. [Google Scholar] [CrossRef]

- Xie, B. GridChain: An Auditable Blockchain for Smart Grid Data Integrity and Immutability; United States Department of Energy, Office of Electricity: Washington, DC, USA, 2021.

- Sikeridis, D.; Bidram, A.; Devetsikiotis, M.; Reno, M.J. A Blockchain-based Mechanism for Secure Data Exchange in Smart Grid Protection Systems. In Proceedings of the 2020 IEEE 17th Annual Consumer Communications & Networking Conference (CCNC), Las Vegas, NV, USA, 10–13 January 2020; pp. 1–6. [Google Scholar] [CrossRef]

- Milovanov, A. Distributed Secure Anonymous Ledger System; United States Department of Energy, Office of Fossil Energy: Washington, DC, USA, 2021.

- Sugiarto, A. Blockchain Protected Security Fabric for Infrastructure Protection; United States Department of Energy, Office of Electricity: Washington, DC, USA, 2021.

- Wu, C.; Radulescu, C.R.; He, S.; Tang, Q. Blockchain Based Energy Generation System. 2021. Available online: https://www.osti.gov/biblio/1459119-blockchain-based-energy-generation-system (accessed on 15 February 2021).

- Gajanur, N.; Greidanus, M.; Seo, G.S.; Mazumder, S.K.; Abbaszada, M.A. Impact of Blockchain Delay on Grid-Tied Solar Inverter Performance. In Proceedings of the 2021 IEEE 12th International Symposium on Power Electronics for Distributed Generation Systems (PEDG), Virtual, 28 June–1 July 2021; pp. 1–7. [Google Scholar] [CrossRef]

- Mahmud, R.; Seo, G.S. Blockchain-Enabled Cyber-Secure Microgrid Control Using Consensus Algorithm. In Proceedings of the 2021 IEEE 22nd Workshop on Control and Modelling of Power Electronics (COMPEL), Cartagena, Colombia, 2–5 November 2021; pp. 1–7. [Google Scholar] [CrossRef]

- Whitfield, M. Smart Meter Based Peer to Peer Transactions for Solar Energy Prosumers; United States Department of Energy, Office of Energy Efficiency and Renewable Energy: Washington, DC, USA, 2021.

- Cohen, D. E-Blockchain: A Scalable Platform for Secure Energy Transactions and Control; United States Department of Energy, Office of Fossil Energy: Boulder, CO, USA, 2021.

- Pazandak, P. Enhancing Energy Systems Cybersecurity Using Blockchains (SBIR Topic 17.a, Phase I.); Kick-off Meeting Presentation at United States Department of Energy; National Energy Technology Laboratory: Mongantown, WA, USA, 2017.

- Zhang, S.; Tang, M.; Li, X.; Liu, B.; Zhang, B.; Hu, F.; Ni, S.; Cheng, J. ROS-Ethereum: A Convenient Tool to Bridge ROS and Blockchain (Ethereum). Secur. Commun. Netw. 2022, 2022, 7206494. [Google Scholar] [CrossRef]

- El-Rewini, Z.; Sadatsharan, K.; Selvaraj, D.F.; Plathottam, S.J.; Ranganathan, P. Cybersecurity Challenges in Vehicular Communications. Veh. Commun. 2020, 23, 100214. [Google Scholar] [CrossRef]

- Vlachokostas, A.; Poplawski, M.; Gourisetti, S.N.G. Is Blockchain a Suitable Technology for Ensuring the Integrity of Data Shared by Lighting and Other Building Systems? In Proceedings of the 2020 Resilience Week (RWS), Salt Lake City, UT, USA, 19–23 October 2020; pp. 147–152. [Google Scholar] [CrossRef]

- Bandara, E.; Liang, X.; Foytik, P.; Shetty, S.; Ranasinghe, N.; de Zoysa, K.D. Bassa-Scalable Blockchain Architecture for Smart Cities. In Proceedings of the 2020 IEEE International Smart Cities Conference (ISC2), Virtual, 28 September–1 October 2020; pp. 1–8. [Google Scholar] [CrossRef]

- Jia, C.; Ding, H.; Zhang, C.; Zhang, X. Design of a Dynamic Key Management Plan for Intelligent Building Energy Management System Based on Wireless Sensor Network and Blockchain Technology. Alex. Eng. J. 2021, 60, 337–346. [Google Scholar] [CrossRef]

- Liu, J. Incorporating Blockchain/P2P Technology into an SDN-Enabled Cybersecurity System to Safeguard Fossil Fuel Power Generation Systems; United States Department of Energy, Office of Fossil Energy: Washington, DC, USA, 2021.

- Bunfield, D. Ensuring Data Integrity at the Source; United States Department of Energy, Office of Electricity: Washington, DC, USA, 2021.

- King, R. Field Gateway Distributed Transaction Ledger for Utility-Scale Solar; United States Department of Energy, Office of Energy Efficiency and Renewable Energy: Washington, DC, USA, 2021.

- King, R. Cybersecurity Intrusion Detection System for Large-Scale Solar Field Networks; United States Department of Energy, Office of Energy Efficiency and Renewable Energy: Washington, DC, USA, 2021.

- Gerdes, R. Achieving Cyber-Resilience for Power Systems using a Learning, Model-Assisted Blockchain Framework; United States Department of Energy, Office of Energy Efficiency and Renewable Energy: Washington, DC, USA, 2021.

- Panat, R. A Novel Access Control Blockchain Paradigm to Realize a Cybersecure Sensor Infrastructure in Fossil Power Generation Systems; United States Department of Energy, Office of Fossil Energy: Washington, DC, USA, 2021.

- Lagos, L. Secure Data Logging and Processing with Blockchain and Machine Learning; United States Department of Energy, Office of Fossil Energy: Washington, DC, USA, 2021.

- Johnson, G. Utilizing Blockchain for Energy Delivery Systems; United States Department of Energy, Ames National Lab: Ames, IA, USA, 2021.

- Rein, S.; Dawson, J.; Ringgenberg, K.; Cosimo, A.; Bloedel, K.; Moore, D. Applying Blockchain to Energy Delivery Systems; Iowa State University: Ames, IA, USA, 2020; Available online: https://sdmay20-12.sd.ece.iastate.edu/docs/sdmay20-12_Final_Report.pdf (accessed on 12 July 2021).

- Wang, N.; Vlachokostas, A.; Borkum, M. Unique Building Identification; Pacific Northwest National Laboratory: Richland, WA, USA, 2017. Available online: https://www.pnnl.gov/sites/default/files/media/file/UBID_Year_in_Review_Final_265829.pdf (accessed on 12 July 2021).

- Mylrea, M.; Gourisetti, S.N.G.; Bishop, R.; Johnson, M. Keyless Signature Blockchain Infrastructure: Facilitating NERC CIP Compliance and Responding to Evolving Cyber Threats and Vulnerabilities to Energy Infrastructure. In Proceedings of the 2018 IEEE/PES Transmission and Distribution Conference and Exposition (T&D), Denver, CO, USA, 16–19 April 2018; pp. 1–9. [Google Scholar] [CrossRef]

- Frazar, S.L.; Joslyn, C.; Goychayev, R.; Randall, A. Developing An Electronic Distributed Ledger for Transit Matching. In Proceedings of the 61st Annual Meeting of the Institute of Nuclear Materials Management (INMM 2020), Online, 12–16 July 2020; Institute of Nuclear Materials Management (INMM): Indianapolis, IN, USA, 2020; Volume 1, pp. 406–413. Available online: https://resources.inmm.org/annual-meeting-proceedings/developing-electronic-distributed-ledger-transit-matching (accessed on 15 January 2025).

- Frazar, S.L.; Sayre, A.; Joslyn, C.; Schanfein, M.; Kreyling, S. Identifying Safeguards Use Cases for Blockchain Technology. 2018. Available online: https://conferences.iaea.org/event/150/contributions/5422/ (accessed on 6 June 2022).

- Frazar, S.L.; Joslyn, C.; Goychayev, R.; Randall, A.; Whattam, K. Exploration of Potential Application of Distributed Ledger Technology for Managing Transactions Under Joint Technology Development and Transfer Agreements; Technical Report PNNL-30525; Pacific Northwest National Laboratory: Richland, WA, USA, 2020.

- Frazar, S.L.; Joslyn, C.; Goychayev, R.; Randall, A. Transit Matching Blockchain Prototype; Technical Report PNNL-29527; Pacific Northwest National Laboratory: Richland, WA, USA, 2019.

- Vestergaard, C.; Frazar, S.; Loehrke, B.; Kenausis, L. Evaluating Potential Applications of Distributed Ledger Technology for Safeguards. In Proceedings of the 61st Annual Meeting of the Institute of Nuclear Materials Management (INMM 2020), Online, 12–16 July 2020; Institute of Nuclear Materials Management (INMM): Indianapolis, IN, USA, 2020; Volume 1, pp. 522–528. [Google Scholar]

- Frazar, S.L.; Joslyn, C.A.; Singh, R.K.; Sayre, A.M. Evaluating Safeguards Use Cases for Blockchain Applications; Technical Report PNNL-28050; Pacific Northwest National Laboratory: Richland, WA, USA, 2018.

- Gambino, R. Blockchain for Nuclear Non-Proliferation. Emily Tatton: Blockchain and Cryptocurrencies Undermine Financial Safeguards of Nonproliferation Regime. Necessitate Taskforce Creation. Technical Report. 2021. Available online: https://www.usu.edu/cai/files/studentpaper-tatton.pdf (accessed on 6 June 2022).

- Liang, X.; Shetty, S.; Tosh, D.; Ji, Y.; Li, D. Towards a Reliable and Accountable Cyber Supply Chain in Energy Delivery System Using Blockchain. In Security and Privacy in Communication Networks; Beyah, R., Chang, B., Li, Y., Zhu, S., Eds.; Springer International Publishing: Berlin/Heidelberg, Germany, 2018; pp. 43–62. [Google Scholar]

- Bandara, E.; Shetty, S.; Tosh, D.; Liang, X. Vind: A Blockchain-Enabled Supply Chain Provenance Framework for Energy Delivery Systems. Front. Blockchain 2021, 4, 607320. [Google Scholar] [CrossRef]

- Peter-Stein, N.; Farley, D.; Brif, C.; Pattengale, N.; Zimmerman, C.; Gao, Y.; Lin, J.; Negus, M.; Slaybaugh, R.; Archer, D.; et al. Development of Novel Approaches to Anomaly Detection and Surety for Safeguards Data—Year One Results. In Proceedings of the 61st Annual Meeting of the Institute of Nuclear Materials Management (INMM 2019), Palm Desert, CA, USA, 14–18 July 2019; Institute of Nuclear Materials Management (INMM): Indianapolis, IN, USA, 2019; Volume 1. Available online: https://www.osti.gov/servlets/purl/1787737 (accessed on 8 March 2022).

- Mylrea, M.; Gourisetti, S.N.G. Blockchain for Supply Chain Cybersecurity, Optimization and Compliance. In Proceedings of the 2018 Resilience Week (RWS), Denver, CO, USA, 20–23 August 2018; pp. 70–76. Available online: https://doi.org/10.1109/RWEEK.2018.8473517 (accessed on 10 March 2021).

- Office of Nuclear Power and Advanced Coal. United States Department of Energy. CX-022409: Grid Bright, Inc.-Secure Grid Data Exchange Using Cryptography, Peer-to-Peer Networks, and Blockchain Ledgers. Available online: https://www.energy.gov/nepa/downloads/cx-022409-grid-bright-inc-secure-grid-data-exchange-using-cryptography-peer-peer (accessed on 3 June 2022).

- IEEE P2418.5; Draft Guide for Blockchain in Power and Energy Systems. Arch/P2418.5—Energy Blockchain WG. IEEE: Piscataway, NJ, USA, 2021. Available online: https://ieeexplore.ieee.org/document/10535459 (accessed on 17 January 2024).

- Kuzlu, M.; Pipattanasomporn, M.; Gurses, L.; Rahman, S. Performance Analysis of a Hyperledger Fabric Blockchain Framework: Throughput, Latency and Scalability. In Proceedings of the 2019 IEEE International Conference on Blockchain (Blockchain), Atlanta, GA, USA, 14–17 July 2019; pp. 536–540. [Google Scholar] [CrossRef]

- Rawlins, C.C.; Jagannathan, S. An Intelligent Distributed Ledger Construction Algorithm for IoT. IEEE Access 2022, 10, 10838–10851. [Google Scholar] [CrossRef]

- Zhao, H.; Ma, L. Evolutionary Game and Simulation Research of Blockchain-Based Co-Governance of Emergency Supply Allocation. Discret. Dyn. Nat. Soc. 2022, 2022, 7309945. [Google Scholar] [CrossRef]

- Glenski, M.; Saldanha, E.; Volkova, S. Characterizing Speed and Scale of Cryptocurrency Discussion Spread on Reddit. In Proceedings of the World Wide Web Conference, San Francisco, CA, USA, 13–17 May 2019. [Google Scholar] [CrossRef]

- Kreyling, S.J. Digital Currency Graph Forensics to Detect Proliferation Finance Patterns. In Laboratory Directed Research and Development Annual Report: Fiscal Year 2015; Technical Report PNNL-25278; United States Department of Energy, Pacific Northwest National Laboratory: Richland, WA, USA, 2021. Available online: https://www.pnnl.gov/main/publications/external/technical_reports/PNNL-25278.pdf (accessed on 17 January 2024).

- Yu, A.; Williams, J. Washington Blockchain Work Group—Report Deliverable on Blockchain; Response to WA Senate Bill 5544; Washington Blockchain Work Group: Olympia, WA, USA, 2024. Available online: https://app.leg.wa.gov/ReportsToTheLegislature/home/GetPDF?fileName=WA%20Blockchain%20Report%20_2024_%20FINAL_34b79564-3f56-47bc-9575-a8d8addf2e55.pdf (accessed on 17 January 2024).

- Gourisetti, N.G.; Mylrea, M.; Patangia, H. Application of Rank-Weight Methods to Blockchain Cybersecurity Vulnerability Assessment Framework. In Proceedings of the 2019 IEEE 9th Annual Computing and Communication Workshop and Conference (CCWC), Las Vegas, NV, USA, 7–9 January 2019; pp. 0206–0213. [Google Scholar] [CrossRef]

- Credle, S.; Gourisetti, S.N.G.; Johnson, B.; Johnson, G.; Malik, M.; Cutler, D.; Markel, T.; Tucker, D. Blockchain for Optimized Security and Energy Management (BLOSEM): Milestone Report—Use Case Development; Technical Report; United States Department of Energy: Washington, DC, USA, 2020.

| Blockchain Property | Description | Benefits |

|---|---|---|

| Immutability | Tamper-proof archival records and data. Applications are primary built to support verification, validation, tracking, and/or auditing. | Protecting data from malicious tampering, increasing the transparency and audibility of data and transactions |

| Identity Management | Ability to record the information of both physical and digital assets in addition to transactions within distributed ledger technologies | Managing identities; access control; authentication; data provenance; recording metadata; and maintaining records of ownership |

| Asset Digitalization and Tokenization | Enables new financial and incentive-based use cases using crypto tokens, which can represent tangible or intangible assets. The token represents the economic value of the representative asset or a fraction of the representative asset. | Managing financial services; payments; promotional rewards; market auctions; more efficiently recording quantities, trading, and pricing |

| Decentralization and/or disintermediation | Enables direct entity-to-entity interactions or peer-to-peer applications, which contributes to distributed administrative authority instead of traditional centralized architectures and enables collaboration within trustless environments | Direct access to blockchain data storage and information; increasing trustworthiness of data; reducing and/or removing reliance on the intermediatory trust; allowing decentralized coordination |

| Automation | Smart contract-enabled applications can automate transactions, enabling use cases focused on self-governance, automation, and/or autonomy. Autonomous coordination and control is one example that could fall within this category. | Automating process and decision making, increasing efficiency and accelerating operations |

| Privacy and/or Anonymity | Cryptographic methods, particularly hash functions and digital signatures, make privacy and integrity possible in a trustless environment. Use cases that primarily differentiate themselves on privacy preservation should fall under this category. | Protecting privacy of data, intellectual property, and personally identifiable information of customers; anonymizing to remove unwanted traceability |

| Domains/ Categories | Use Case Applications | Immutability: Tamperproof Record of Historical Data, e.g., Verification, Auditing, Tracking Applications, Transparency | Identity Management: Recording Metadata About Physical and Digital Assets, e.g., Voting Applications | Asset Digitization, Tokenization: Tokens to Represent an Underlying Tangible or Intangible Asset, e.g., Fractional Ownership Applications | Decentralization, Disintermediation: Direct Entity-to-Entity Interaction, e.g., DeFi | Automation: Smart Contract Enabled Applications, e.g., Self-Governing Applications, DAOs | Privacy, Anonymity: Preserving Privacy and Integrity in Trustless Environment, e.g., Medical Records |

|---|---|---|---|---|---|---|---|

| Retail Services Enablement | Billing Services | ||||||

| Regulation Compliance and Auditing | |||||||

| Green Certificates (e.g., renewable energy credits) | [25,43] [80] | [80] | [25,43] | ||||

| E.V. Smart Driving Rewards/Insurance Credits | [26] [27] | [26] [27] | |||||

| E.V. Smart Contracts for Renting, Leasing and Purchase | [23,24,25] [26] | [23,24,25] [26] | |||||

| Financial Services | Financing (e.g.,crowd source funding) | [81] | [81] | ||||

| Marketplaces and Trading | Wholesale Energy Trading | [47] | [47] | ||||

| Bidding/Settlement (e.g., FERC 2222) | |||||||

| Green Certificates Trading | [25,43] [44,45] | [25,43] [44,45] [46] | [46] | ||||

| DER Transactive Energy Management (e.g., trading, P2P, etc.) | [33] | [32] [33] [34] [35] [63] [82] [83] [84] [85] [86] [87] [88] [89] [90] | [36,37,38] [40,41] [87] [91] | [32] [34] [35] [36,37,38] [40,41] [63] [82] [83] [84] [86] [88] [89] [92] [93] [94] [95] | [90] [91] [92] [93] [94] [96] | [85] [95] [96] | |

| Emission Credits (e.g., carbon, NOx, SOx trading, etc.) | [97] [98] | [97] [98] | |||||

| Grid Automation, Coordination Control | DER Coordination & Control | [49] [99] | [37] [53,100] [55] | [49] [99] [101] [102] | [37] [53,100] [55] [101] [102] | ||

| Dynamic Controls (e.g., control system communication management) | [103] [104] | [104] [105] [106] [107] | [105] [106] [107] [108] [109] [110] | [103] [108] [109] [110] | |||

| Blackstart | |||||||

| Smart Sensor/Decentralized Autonomous Decision Making | [50] | [50] [111] | [111] | ||||

| IIoT/IoT Device Coordination | [52] [112] | [52] [112] [113] [114] | [113] [114] | ||||

| E.V. Communication and Control | [115] | [115] | |||||

| Smart Buildings Coordination and Control | [116] [117] | [116] [117] [118] | [118] | ||||

| Network Monitoring and Security (e.g., data collection, data analytics) | [51] [119] [120] [121,122] | [119] [120] [121,122] [123] | [51] [123] | ||||

| Process Data Logging and Historians | [48] [124] [125] [126,127] [128] | [124] [125] [128] | [48] | [126,127] | |||

| Supply Chain Management | Supply Chain—Asset Management (e.g., installation, decommissioning, EV battery swapping) | [56] [57] [59] [63] [129] [130][131] [132] [133] [134] [135] [136] [137] [138] | [56] [57] [58] [59] [60] [63] [129] [130] [131] [132][133] [134] [135] [136][137] [138] | [58] [60] | |||

| Supply Chain—Authenticity and Device Integrity | [27] | [27] [139] | [139] | ||||

| Software Patch Management | [140] | [140] | |||||

| System License Validation | |||||||

| Foundational Blockchain/DLT Research | Network Services | [67] [68] | [67] [68] | ||||

| Storage Services | [71] [141] | [70] [71] [141] | [70] [141] | ||||

| Compute Services (e.g., HPC, applications hosting, etc.) | [65] [69] | [65] [66] [69] | [66] | ||||

| Policy/Regulations | [142] | ||||||

| Fundamental Blockchain (e.g., consensus, evaluation, zero-knowledge proofs, etc.) | [63,74] [73] [142] [143] [144] [145] [146] [147] [148] | ||||||

| Fundamental Frameworks (e.g., cybersecurity, etc.) | [72] [78] [149] | ||||||

| Use Case Application | Blockchain/DLT Scope | References |

|---|---|---|

| Green Certificates | Use of blockchain to mitigate fraud in carbon credits, improve food chain security, monitor and manage sustainability by tracking agricultural input relevant to environmental benefit credits (i.e., bio-stimulant), and assess tangible and intangible environmental benefit credit assets. | [80] |

| Use Case Application | Blockchain/DLT Scope | References |

|---|---|---|

| Green Certificates | Development of a REC platform in the United States using Power Ledger’s TraceX platform to track RECs will be tracked on the blockchain from creation, transfer and sale, and retirement. This platform will provide an audit trail for RECs. The goal is to prevent the double claiming of RECs in the marketplace. | [25,43] |

| EV Smart Contracts for Renting, Leasing, and Purchase | Pilot of Power Ledger’s TraceX platform to track and measure credits in the Low Carbon Fuel Standard using solar panels and EV charging infrastructure in a multistory parking garage | [23,24,25] |

| EV Smart Driving Rewards/ Insurance Credits | Pilot of Omega Grid’s local electricity market software to coordinate EV charging with solar generation | [26] |

| EV Smart Driving Rewards/ Insurance Credits | BMW and PG&E collaborative pilot to incentivize drivers to charge their EV during hours when the grid has ample solar generation. | [27] |

| Use Case Application | Blockchain/DLT Scope | References |

|---|---|---|

| Financing | Blockchain was developed to enable flexible financial credit agreements for low- and moderate-income participants in solar financing programs by providing a platform for the approval process, energy asset management, and crowdsourcing investments. | [81] |

| Use Case Application | Blockchain/DLT Scope | References |

|---|---|---|

| DER—Transactive Energy Management | Use of BlockCypher to demonstrate a blockchain-based DER marketplace on two test homes | [32] |

| DER—Transactive Energy Management | Development of a blueprint architecture to use permissioned blockchains for transactive systems and energy markets | [33] |

| DER—Transactive Energy Management | Blockchain-based energy trading platform for DERs in the distributed solar/PV market | [34] |

| DER—Transactive Energy Management | Real-time energy market for DERs enabled by blockchain, with a focus on commodity tracking | [35] |

| DER—Transactive Energy Management | Implementation of blockchain with a unified testing platform that includes participation of a DER aggregator in the wholesale electricity markets and visibility of proposed DER operations for the distribution system operator | [63] |

| DER—Transactive Energy Management | Summary discussion of blockchain and smart contracts to transact DER services in the peer-to-peer marketplace | [82] |

| DER—Transactive Energy Management | Implementation of a blockchain-based network for peer-to-peer trading of solar energy using Hyperledger | [83] |

| DER—Transactive Energy Management | Use of an open-source blockchain platform for solar energy exchange | [84] |

| DER—Transactive Energy Management | Implementing transactive energy markets using blockchain technology to enable zero energy export on the primary feeder by optimizing supply and demand at the distribution level and by optimizing home energy management systems | [85] |

| DER—Transactive Energy Management | Development of a private, permissioned, and open-source blockchain, called MultiChain, for decentralized peer-to-peer transactive energy trading, with a focus on storage capacity to match intermittent DERs | [86] |

| DER—Transactive Energy Management | Application of blockchain for a transactive energy service system that provides retail market-clearing mechanisms for peer-to-peer trading of behind-the-meter DERs based on ramping, capacity, and storage prices | [87] |

| DER—Transactive Energy Management | Use of blockchain-enabled smart contracts to construct a transactive energy platform with predictive optimization for DERs | [88] |

| DER—Transactive Energy Management | Development of a blockchain-enabled open architecture platform that will allow commercial and industrial buildings to buy and sell excess rooftop PV energy generation and energy consumption reduction in a secure and reliable way | [89] |

| DER—Transactive Energy Management | Building a Vickrey auction smart contract on EWF’s blockchain (Tobala, currently known as Energy Web Chain) | [90] |

| DER—Transactive Energy Management | A common data infrastructure to integrate heterogenous data sources, including advanced metering infrastructure, generation, and energy transaction data | [91] |

| DER—Transactive Energy Management | Application of blockchain through an open and extensible co-simulation environment (HELICS) for transactive energy markets, with a focus on a comprehensive assessment of the market designs | [92] |

| DER—Transactive Energy Management | Development of a blockchain smart contract template for transactive energy system management that ties various personal, legal, and contractual obligations to engineering operations | [93] |

| DER—Transactive Energy Management | Implementing blockchain as a Transaction Management Platform for an automated auction and matching system that supports the energy trading workflow, prosumer privacy, and operational safety | [96] |

| DER—Transactive Energy Management | Use of an advanced demand response smart contract integrated with intelligent control for DER operations and dynamic loads through peer-to-peer energy transaction and markets | [94] |

| DER—Transactive Energy Management | A peer-to-peer energy exchange platform using blockchain technology to enable and manage microservice transactions on the distribution grid | [95] |

| Use Case Application | Blockchain/DLT Scope | References |

|---|---|---|

| Wholesale Energy Trading | This pilot offers commercial and industrial customers the opportunity to design and submit orders for energy hedges at the hourly level | [47] |

| Green Certificate Trading | Development of a REC platform in the United States using Power Ledger’s TraceX platform to track RECs on the blockchain from creation, to transfer and sale, to retirement. This platform will provide an audit trail for RECs. The goal is to prevent the double claiming of RECs in the marketplace. | [25,43] |

| Green Certificate Trading | Piloting EWF’s EW Origin tool kit with PJM’s GATS. GATS tracks electricity production by generating certificates for each megawatt-hour produced by a generator. | [44,45] |

| Green Certificate Trading | Initiated after the Nevada Public Utilities Commission opened a docket to explore blockchain-based technology to track and certify PECs to determine compliance with renewable portfolio standards | [46] |

| DER—Transactive Energy Management | Piloting peer-to-peer energy trading at the Ameren microgrid in Champaign | [36,37,38] |

| DER—Transactive Energy Management | This pilot developed a peer-to-peer energy marketplace for business owners and customers in Vermont. | [40,41] |

| Emissions Credits | Demonstration of a blockchain community to track decarbonization, solar, storage, fast-charging EV stations, and virtual power plants | [97] |

| Emissions Credits | Grid+ has begun acting as a retail electricity provider in Texas using blockchain technology, enabling cryptocurrency payments with efforts to increase transparency and drive efficiency. | [98] |

| Use Case Application | Blockchain/DLT Scope | References |

|---|---|---|

| DER Coordination and Control | Blockchain-based smart contract applications in energy infrastructure for increased data fidelity, speed, scale, and security of exchanges in DERs | [49] |

| DER Coordination and Control | Identifying the roles of blockchain in ensuring the improved fault tolerance of grid operations, including communications, physical, weather, and cyber-related faults | [99] |

| DER Coordination and Control | Use of blockchain-based smart contracts to improve cyber resilience in smart grid applications | [101] |

| DER Coordination and Control | Developed an optimization algorithm called the distributed consensus-based alternating direction method of multipliers (DC-ADMM) for DERs and battery energy storage systems and applied blockchain to support information exchange and synchronization in distributed optimization solutions associated with DC-ADMM | [102] |

| Dynamic Controls | Developed a blockchain federated system to control multiregional, large-scale power systems by coordinating local controllers and a multi-artificial intelligence agent system that was designed with distributed deep reinforcement learning to develop a malicious attack-tolerant capability | [103] |

| Dynamic Controls | Developing a blockchain-based platform to securely and efficiently transmit grid data among sensors, residential devices, and power plants. Potential applications include immutable grid sensor data, real-time blockchain-based grid monitoring and control, and peer-to-peer energy transactions. | [104] |

| Dynamic Controls | Blockchain application in smart grid protection relay systems to enhance data exchange security with improvement in throughput, scalability, and flexibility for fault detections considering uncertainties | [105] |

| Dynamic Controls | Developing DSEAL, a blockchain-based system for secure verifications of control command signals and transactions of real-time sensor data in fossil energy-based systems | [106] |

| Dynamic Controls | Use of blockchain to provide security for legacy and modern grid assets by creating identities and controlling access to assets from multiple vendors. The techniques were used for achieving sensor data source authenticity and integrity across multiple data producers and consumers using DLT regardless of vendor device, network, or industry protocol. | [107] |

| Dynamic Controls | Cloud-based blockchain to ensure security of industrial controls for energy generation systems | [108] |

| Dynamic Controls | Assessing the impact of blockchain delay on the dynamic performance of inverter control and communication systems connected to the grid | [109] |

| Dynamic Controls | Incorporating a consensus mechanism on blockchain technology for a distributed control strategy for alternating current (AC) microgrid control in DER systems | [110] |

| Smart Sensor/ Decentralized Autonomous Decision Making | Blockchain was deployed to represent sensor nodes (and vice versa) for identity and authentication, which help route the (sensor) nodes in the network. | [50] |

| Smart Sensor/ Decentralized Autonomous Decision Making | Developing a peer-to-peer transaction network built on a smart meter-based peer-to-peer transaction network that uses existing, patented hardware, with a focus on providing secure information to the utility about power usage and managing transactions between prosumers and consumers while maintaining the privacy of those identities from other network members | [111] |

| IIoT/IoT Device Coordination | Deployment of smart inverters with a built-in IoT that could serve as a node device on blockchain for behind-the-meter PV systems | [52] |

| IIoT/IoT Device Coordination | Building an innovative, proof of concept software platform, called E-Blockchain, to enable secure transaction and control applications that involve the integration of centralized and decentralized power plant control systems with Industrial Internet of Things (IIoT) networks | [112] |

| IIoT/IoT Device Coordination | A blockchain-based data bus was developed for real-time measurements from smart sensors and IIoT for automated well drilling and completion. | [113] |

| IIoT/IoT Device Coordination | Developing a novel interaction tool that bridges a robot operating system and blockchain through Ethereum | [114] |

| EV Communications and Control | Blockchain was proposed for an intra-vehicular communication and control network. | [115] |

| Smart Buildings Coordination and Control | Evaluation of blockchain applicability to building data applications | [116] |

| Smart Buildings Coordination and Control | Implementation of a highly scalable blockchain platform, Bassa, for smart city-based applications to realize real-time transactions with concurrent transaction executions | [117] |

| Smart Buildings Coordination and Control | Blockchain was leveraged to improve wireless sensor networks and the control optimization of intelligent building energy management systems. | [118] |

| Network Monitoring and Security | Use of blockchain in the decentralization of data communication networks for physical security systems to increase resilience and security prioritization | [51] |

| Network Monitoring and Security | Integrating a blockchain/peer-to-peer-enhanced cybersecurity protection system into a software-defined networking-enabled cybersecurity protection system to demonstrate cost-effective reinforcement on safeguarding the operations of fossil fuel power generation systems (for detecting compromised controllers in a software-defined network) | [119] |

| Network Monitoring and Security | Improving the data integrity of field devices and industrial equipment at the source and during data transport using blockchain | [120] |

| Network Monitoring and Security | Integration of blockchain and a novel networking protocol for the cybersecurity of utility-scale solar energy systems | [121,122] |

| Network Monitoring and Security | Integration of a secure blockchain overlay network and model-assisted machine learning for power network security in command and control protocols | [123] |

| Process Data Logging and Historians | Hash calendar-based blockchain was used to maintain the integrity of a database and secure grid networks for supporting regulatory audits, the market plan, and grid operations and control | [48] |

| Process Data Logging and Historians | Use of blockchain to enhance cybersecurity for machine-to-machine interactions, infrastructure for secure data logging for sensors, decentralized data storage, and second-layer technologies for high-volume machine-to-machine interactions in fossil fuel power generation systems | [124] |

| Process Data Logging and Historians | Developing a blockchain-machine learning platform for secure data logging and processing in fossil fuel power generation systems even when the systems are under various cyberattacks, such as false data injection and denial-of-service attacks | [125] |

| Process Data Logging and Historians | Demonstration of a blockchain architecture and client software to collect and store near-real-time data from a hardware-in-the-loop test bed. Modeled the NASPInet organizational framework for phasor measurement unit data. | [126,127] |

| Process Data Logging and Historians | Use of blockchain-based smart contracts for building a database system based on the assignment, verification, and registration of unique building identifiers | [128] |

| Use Case Application | Blockchain/DLT Scope | References |

|---|---|---|

| DER Coordination and Control | The goal of this project is to test the viability of a transactive energy marketplace. | [37] |

| DER Coordination and Control | ComEd and Xage Security look to blockchain for potential improvements in operational and security benefits as well as sustainability and resilience goals, such as the integration of DERs with solar, storage, energy efficiency, and demand management. | [53,100] |

| DER Coordination and Control | This pilot, conducted by Burlington Electric Department and Omega Grid, operates a local energy market platform that considers existing wholesale markets and local grid constraints to effectively manage demand response and determine the most efficient mix of generation and load to manage the distribution grid. | [55] |

| Use Case Application | Blockchain/DLT Scope | References |

|---|---|---|

| Asset Management | Benefits of blockchain in supply chain management of a complex energy infrastructure and NERC CIP compliance | [56] |

| Asset Management | Use of blockchain in the life-cycle monitoring of uranium hexaflouride (UF6) cylinders to support identification, verification, safeguard, and export control requirements | [57] |

| Asset Management | Demonstration of blockchain in the manufacturing supply chain process; recording and storing process parameters and time stamps of tracking components through materials and the manufacturing life cycle for digital twins | [58] |

| Asset Management | Study of the implications of blockchain and shared ledger technologies to improve trust and cooperation within member states of the safeguard system for the IAEA. This includes proposed applications, such as tracking shipments, as well as proposed nomenclature and technology assessment frameworks. | [59] |

| Asset Management | Development and demonstration of blockchain-based supply chain security, life-cycle monitoring, and real-time auditing on a lab-scaled power generation system | [63] |

| Asset Management | Applications of keyless signature blockchain infrastructure in cybersecurity | [129] |

| Asset Management | Use of blockchain technology for nuclear safeguard applications | [130] |

| Asset Management | Identification of nonproliferation safeguard use cases that would benefit from blockchain | [131] |

| Asset Management | Exploration of the benefits of blockchain technology in a joint technology development and transfer agreement use case within the context of nuclear proliferation | [132] |

| Asset Management | Development of a transit matching blockchain prototype | [133] |

| Asset Management | A summary of potential blockchain R&D in national security applications based on research activities done at the Stimson Center, the Stanley Center for Peace and Security, and Pacific Northwest National Laboratory | [134] |

| Asset Management | Assessment of potential blockchain use case applications in safeguards using an analytical framework | [135] |

| Asset Management | Exploratory study to understand how blockchain could be applied to enhance the security of nuclear material, technologies, and facilities | [136] |

| Asset Management | Development and demonstration of a blockchain-based cyber supply chain provenance for energy delivery systems | [137] |

| Asset Management | Implementing a blockchain-based supply chain provenance to manage the supply chain information of bulk electric system operations in energy delivery systems | [138] |

| Authenticity and Device Integrity | Confirming the provenance and authentication of IAEA safeguard equipment using anomaly detection of data stored in DLTs | [139] |

| Software Patch Management | Applications of the blockchain patch management framework, including the process from patch creation to installation, and mapping the framework to CIP-010. | [140] |

| Use Case Application | Blockchain/DLT Scope | References |

|---|---|---|

| Asset Management | A collaborative launched by VIA, Hawaiian Electric, and Vector to improve predictive maintenance capabilities for transformers. Smart contracts housed on blockchain provide access control and user authentication for off-chain, artificial intelligence-based analytics software and analysis. | [60] |

| Authenticity and Device Integrity | This pilot will coordinate EV charging with solar generation to create a local energy market. | [27] |

| Use Case Application | Blockchain/DLT Scope | References |

|---|---|---|

| Network Services | R&D scoping analysis that identifies possible R&D opportunities for Oak Ridge National Laboratory in alignment with strategic objectives. Various proposals include biomedical and health data sciences as well as a secure energy grid. | [67] |

| Network Services | Use of blockchain technologies and DLTs to facilitate secure communications and control for sensors, PLCs, and other network devices | [68] |

| Storage Services | Decentralized data storage and access as well as self-governing, autonomous operation for Ping End-to-end Reporting (PingER) internet performance monitoring data | [70] |

| Storage Services | Store transactions from shared relational databases in blockchain data structures to increase trust among users and verification of the data | [71] |

| Storage Services | Development activities to develop a cyber-secure, open-source, cloud-based solution for sharing sensitive electric grid infrastructure data | [141] |

| Policy/Regulations/Fundamental Blockchain | Engagement with IEEE P2418.5 activities that focus on energy standards development pertaining to blockchain’s use in energy systems, including cybersecurity, interoperability, energy markets, and other application areas within the broad power and energy umbrella | [142] |

| Fundamental Blockchain | Use of a testing framework for evaluating blockchain performance | [73] |

| Fundamental Blockchain | Development of the detailed design and demonstration of a unified testing platform that has interoperability to support a wide variety of blockchains | [63,74] |

| Fundamental Blockchain | Assessment of blockchain platform performance, including Hyperledger Fabric, in terms of throughput, latency, and scalability | [143] |

| Fundamental Blockchain | Improving blockchain protocol for security with machine learning in addition to DLT protocols designed for the IoT setting | [144] |

| Fundamental Blockchain | Evaluation of the impacts of blockchain on emergency supply allocation and management using the evolutionary game model | [145] |

| Fundamental Blockchain | Qualitative analysis of the performance of the cryptocurrency discussion spread on Reddit | [146] |

| Fundamental Blockchain | Examine the public blockchain of cryptocurrency transactions to find patterns that appear to match known patterns of illicit activity and explore the use of this information to understand the existence of exchanges and cross-currency movement. | [147] |

| Fundamental Blockchain | A collaborative group of companies, universities, and government agencies dedicated to making the Cascadia region a global hub for blockchain development | [148] |

| Compute Services | Use of blockchain to establish data provenance for cloud-based platforms and services (e.g., computing, storage, application hosting) | [65] |

| Compute Services | Foundational architecture for data provenance and PoS consensus proposed for cloud-hosted data operations | [66] |

| Compute Services | Blockchain technology to confirm the provenance and integrity for data produced and used by high-performance computing | [69] |

| Fundamental Frameworks | Development of a blockchain applicability assessment framework | [72] |

| Fundamental Frameworks | Established cybersecurity standardization efforts and a framework for DLT-based power and energy applications | [78] |

| Fundamental Frameworks | Demonstration of a rank-weight methodology to prioritize requirements needed to achieve a sought-after cybersecurity maturity level using the BC2F | [149] |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Credle, S.; Harun, N.F.; Johnson, G.; Lawrence, J.; Lawson, C.; Hollern, J.; Malik, M.; Gourisetti, S.N.G.; Sebastian-Cardenas, D.J.; Johnson, B.E.; et al. Blockchain Research and Development Activities Sponsored by the U.S. Department of Energy and Utility Sector. Energies 2025, 18, 611. https://doi.org/10.3390/en18030611

Credle S, Harun NF, Johnson G, Lawrence J, Lawson C, Hollern J, Malik M, Gourisetti SNG, Sebastian-Cardenas DJ, Johnson BE, et al. Blockchain Research and Development Activities Sponsored by the U.S. Department of Energy and Utility Sector. Energies. 2025; 18(3):611. https://doi.org/10.3390/en18030611

Chicago/Turabian StyleCredle, Sydni, Nor Farida Harun, Grant Johnson, Jeremy Lawrence, Christina Lawson, Jason Hollern, Mayank Malik, Sri Nikhil Gupta Gourisetti, D. Jonathan Sebastian-Cardenas, Beverly E. Johnson, and et al. 2025. "Blockchain Research and Development Activities Sponsored by the U.S. Department of Energy and Utility Sector" Energies 18, no. 3: 611. https://doi.org/10.3390/en18030611

APA StyleCredle, S., Harun, N. F., Johnson, G., Lawrence, J., Lawson, C., Hollern, J., Malik, M., Gourisetti, S. N. G., Sebastian-Cardenas, D. J., Johnson, B. E., Markel, T., & Tucker, D. (2025). Blockchain Research and Development Activities Sponsored by the U.S. Department of Energy and Utility Sector. Energies, 18(3), 611. https://doi.org/10.3390/en18030611