Copper as a Critical Resource in the Energy Transition

Abstract

:1. Introduction

- What is the role of copper used in technologies for the energy transition, and how can the growing demand be met while addressing the supply gap?

- How are the copper products that form the particular value chain stages traded on world markets?

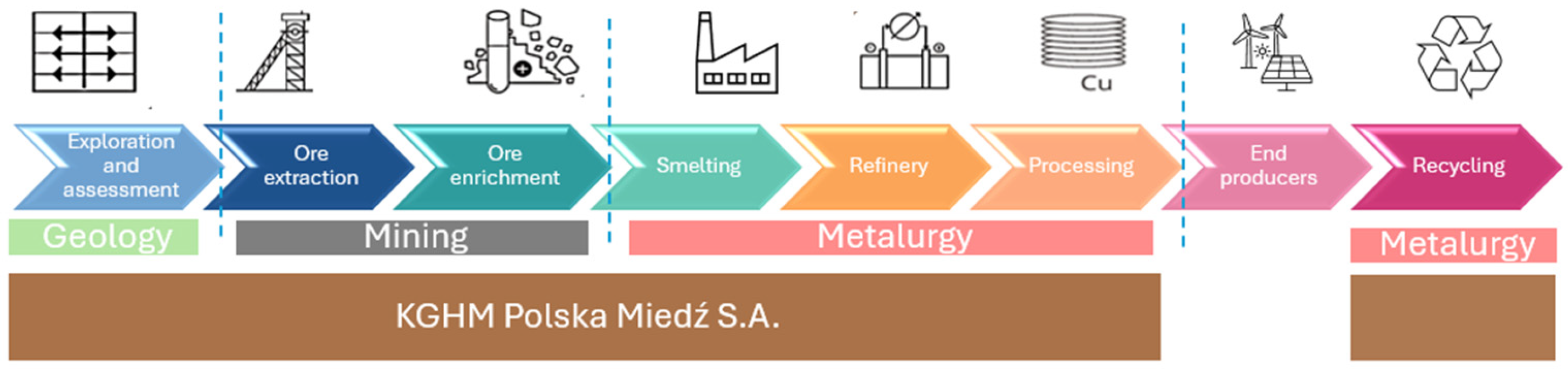

- How does Poland as a country provide copper products for the energy transition and how is this activity organized through KGHM SA?

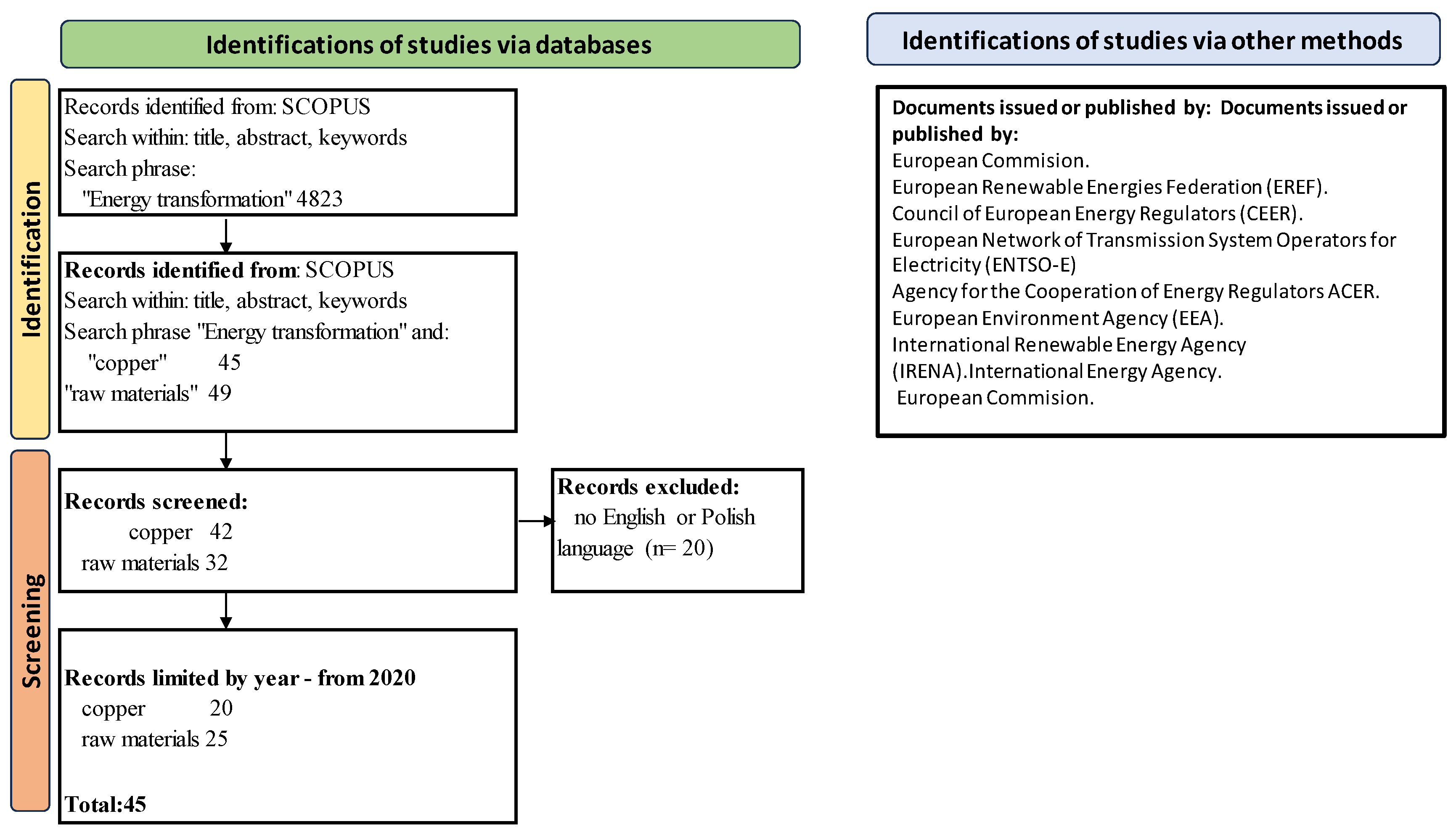

2. Materials and Methods

3. Results

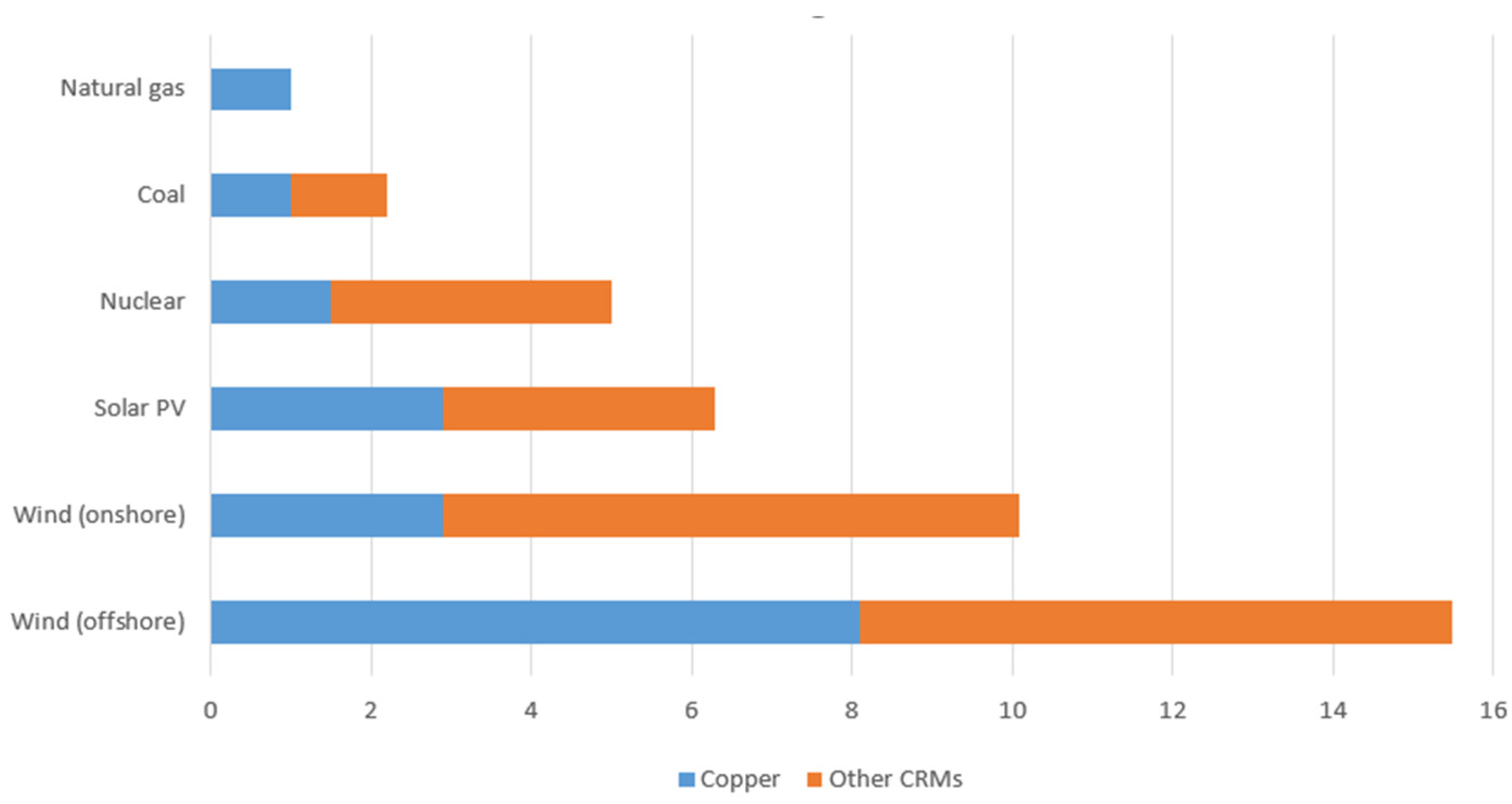

3.1. Demand for Copper Due to the Energy Transition

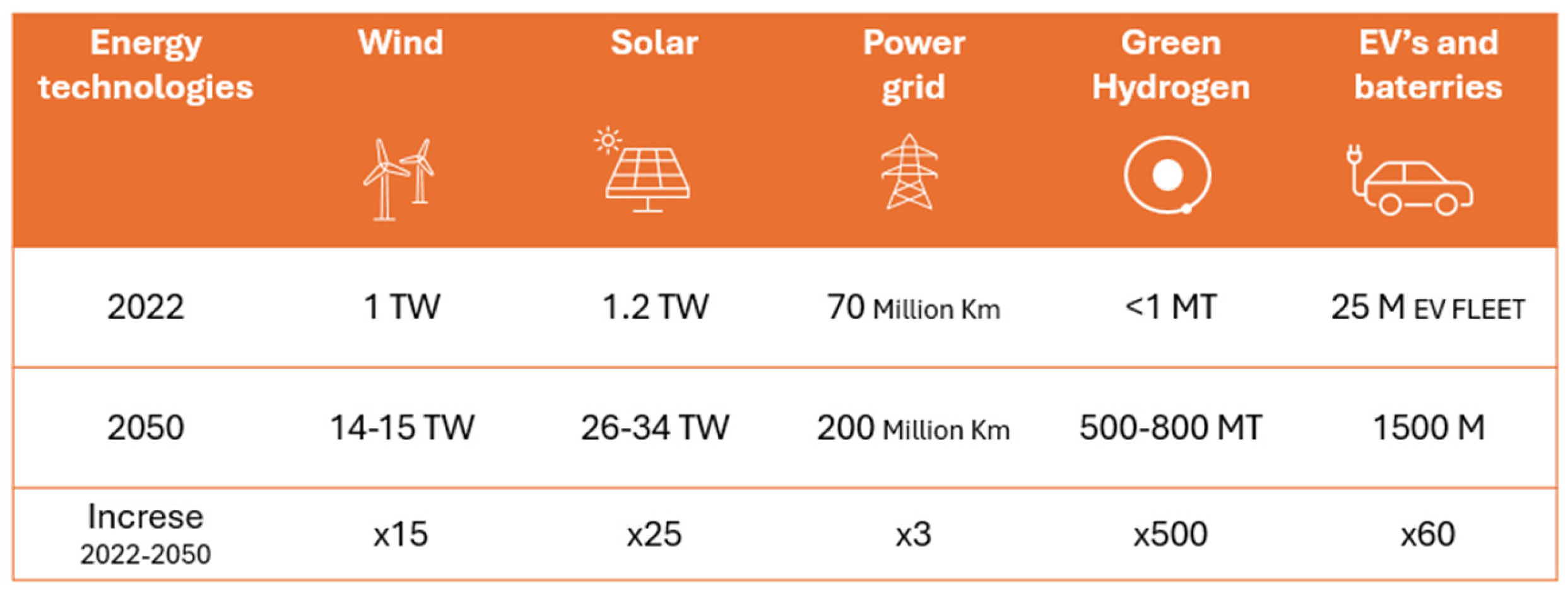

- The current installed capacity for wind power is 1 TW, and it will have to increase about fifteen times to 14–15 TW. An average of 4.7 t of Cu is used for building a single 3 MW wind turbine. Copper is also needed for offshore wind power, as its specific gravity, compared to aluminum, makes it easier to install underwater connections.

- The installed capacity for solar power is 1.2 TW and will have to increase about twenty-five times to 26–34 TW. An average of 3.8 t of Cu must be used for building a 1 MW solar power plant.

- The power grid will have to be expanded from the current 75 million km to 200 million km. Copper would be best used for expanding the power grid, as it is one of the metals with the best electrical conductivity, which offsets losses in the transmission itself, and its thermal conductivity is more than half that of aluminum.

- Low-carbon hydrogen consumption will have to increase from the current level of 1 MT to as much as 500–800 MT.

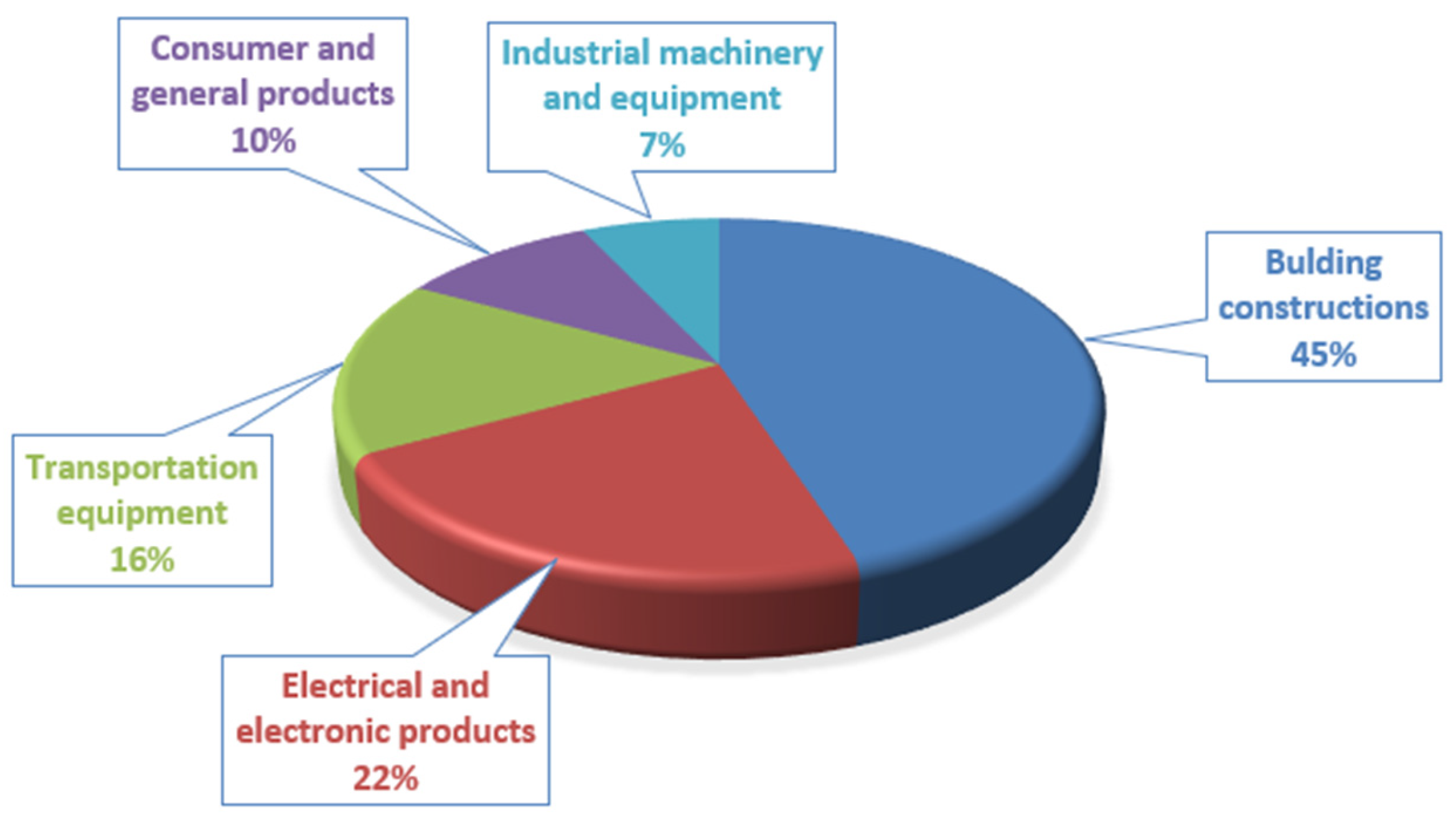

- By 2050, the plan is to almost completely replace internal combustion cars with electric ones, so more than 1.5 billion EVs should be produced, as well as about 200 million electric trucks and buses. This requires a total battery capacity of up to 150 TWh. For EVs, copper is needed for batteries, electrical components, and in charging stations. Electric cars contain an average of two to three times more copper than their counterparts with internal combustion engines Figure 3. It is also difficult here to talk about substituting copper with, for example, aluminum. Copper does not heat up as aluminum does, and the reductions in energy consumption when using copper reach about 25%.

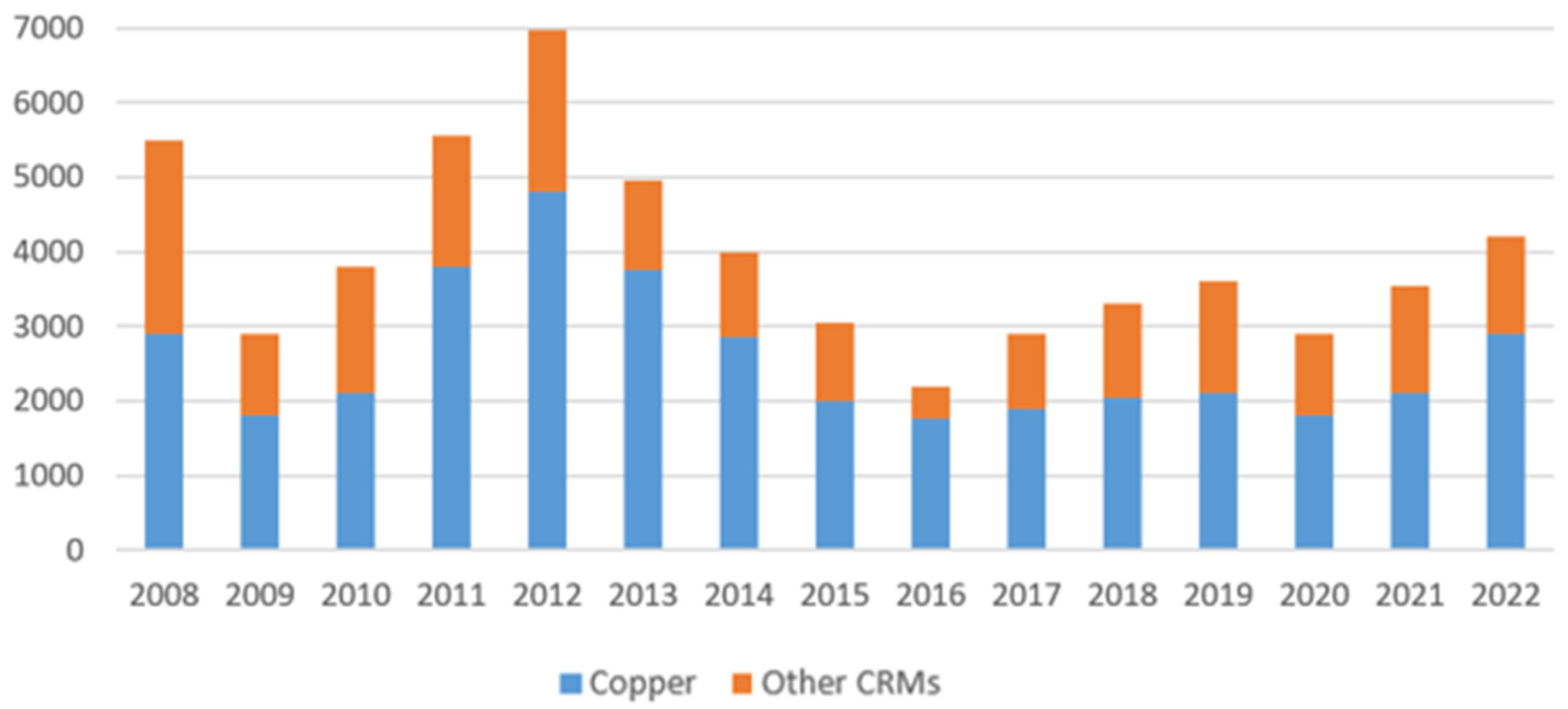

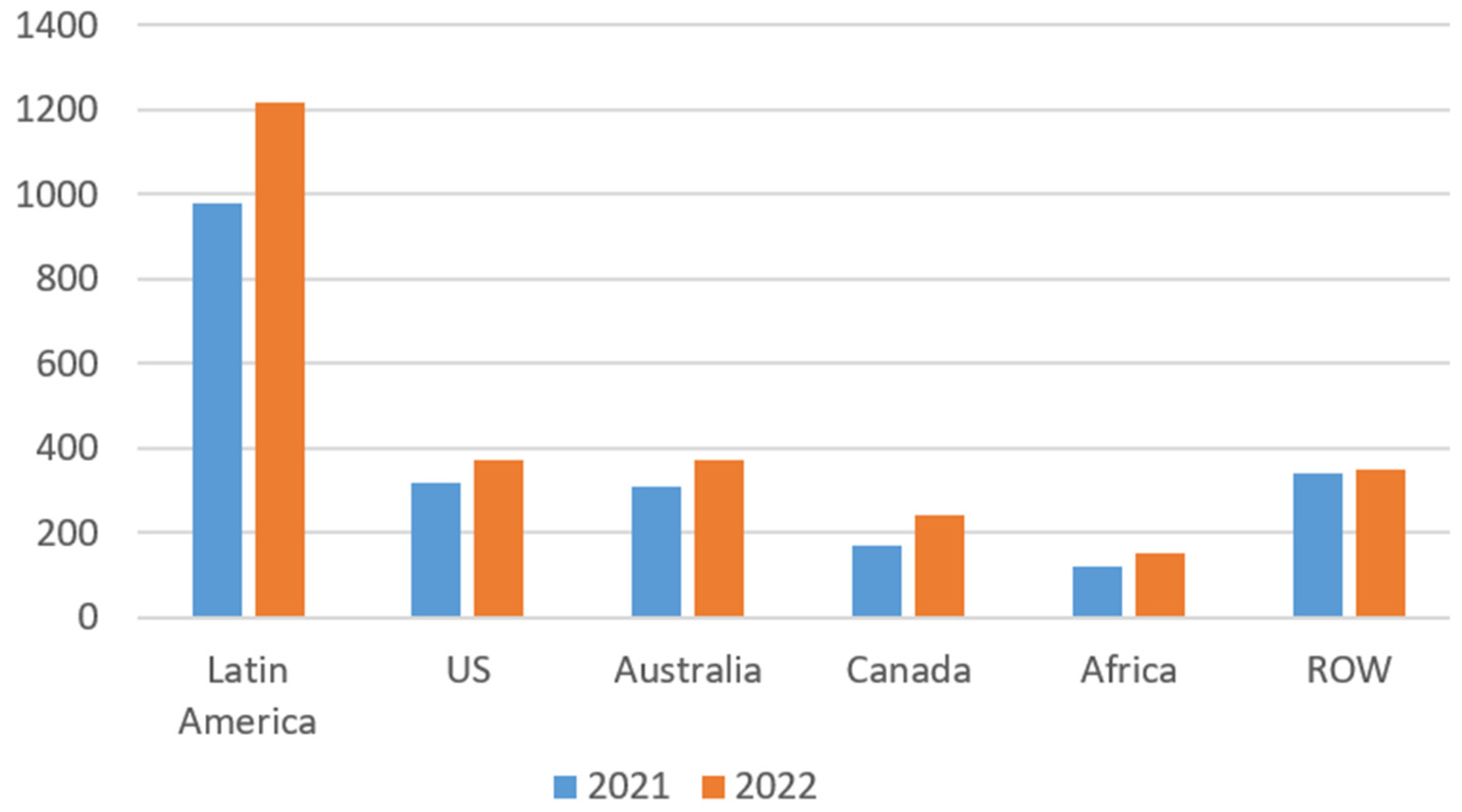

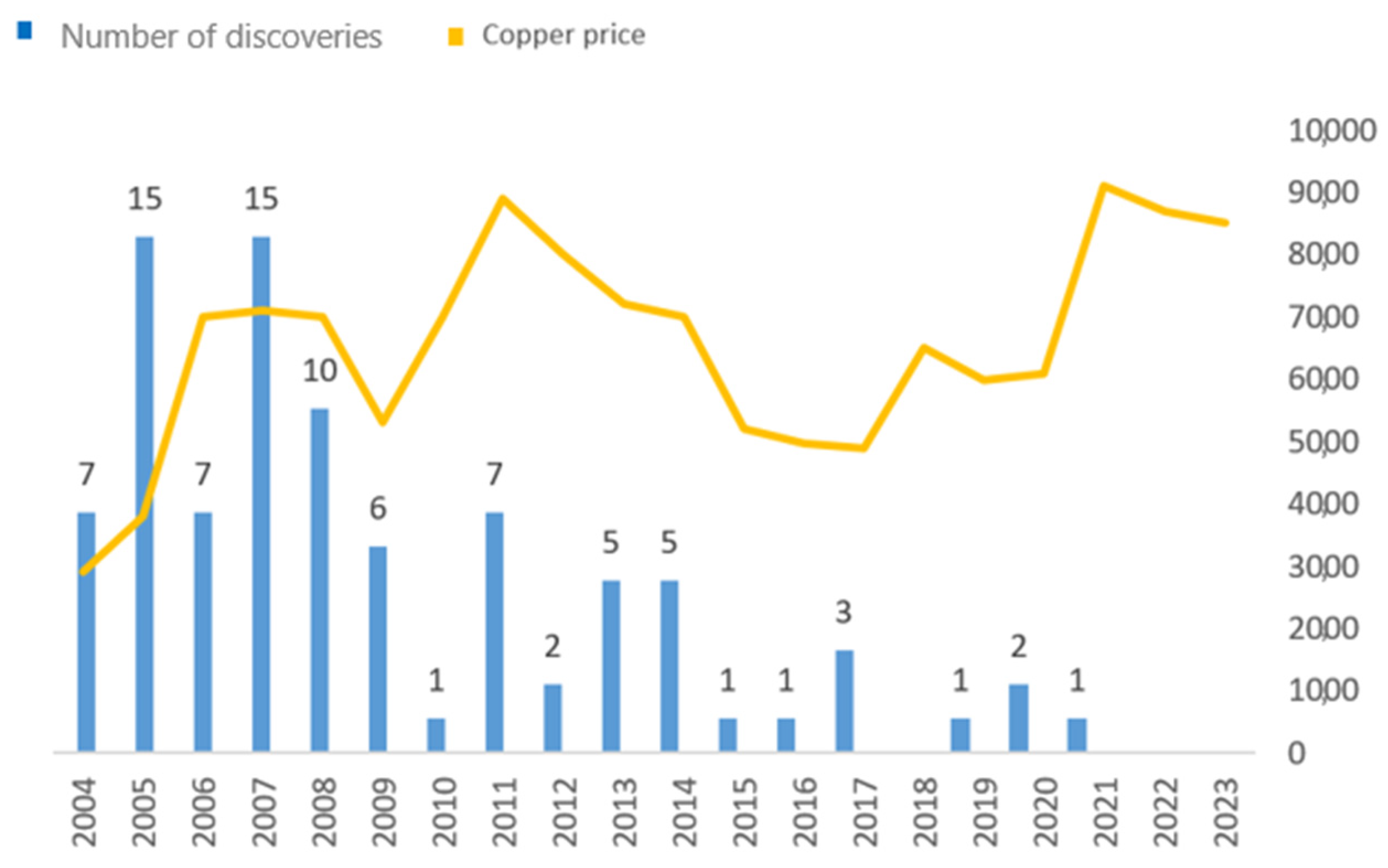

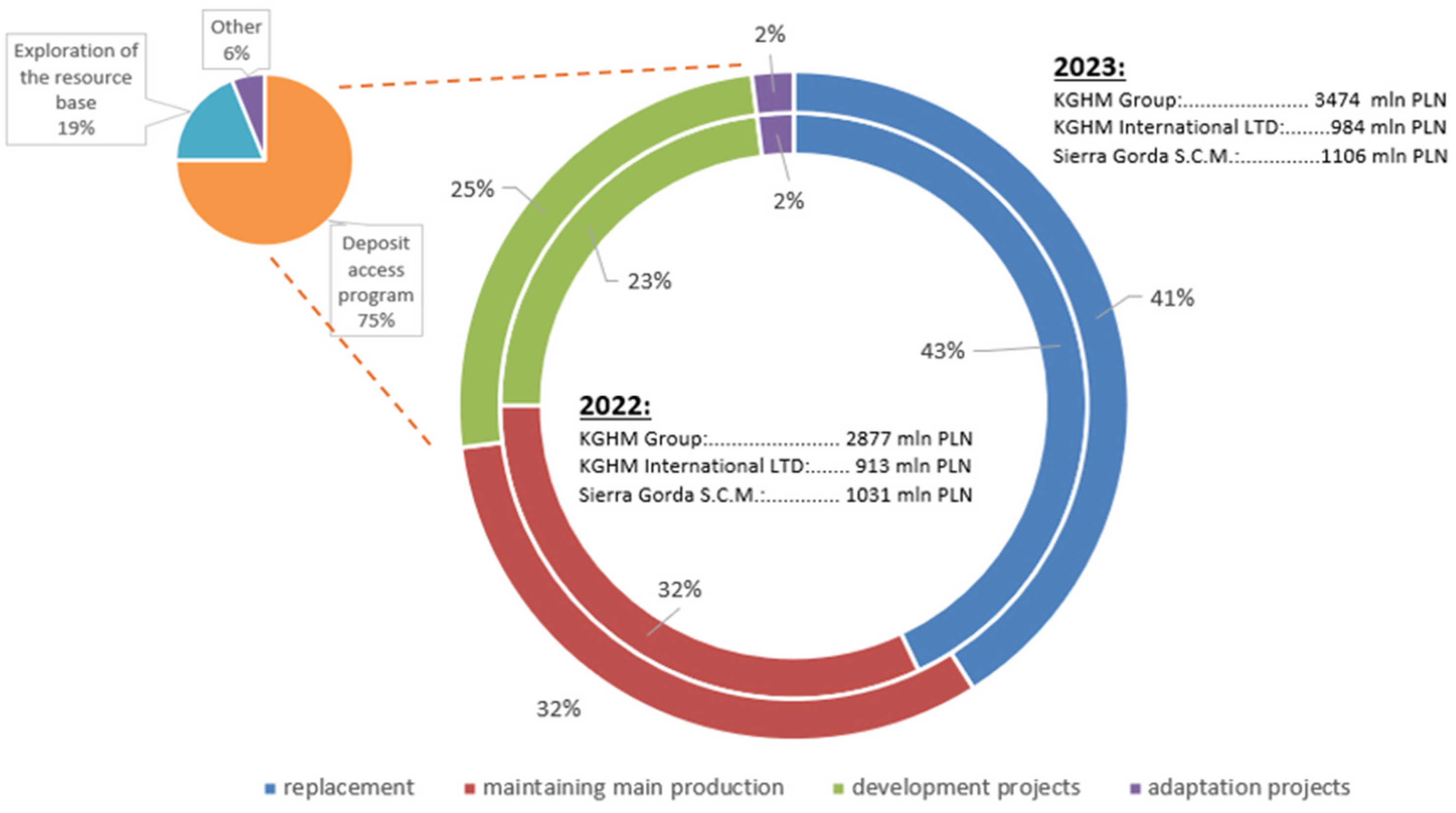

3.2. Filling the Copper Supply Gap Through Investments

3.3. Filling the Copper Supply Gap by Recycling—Urban Mining

4. Discussion

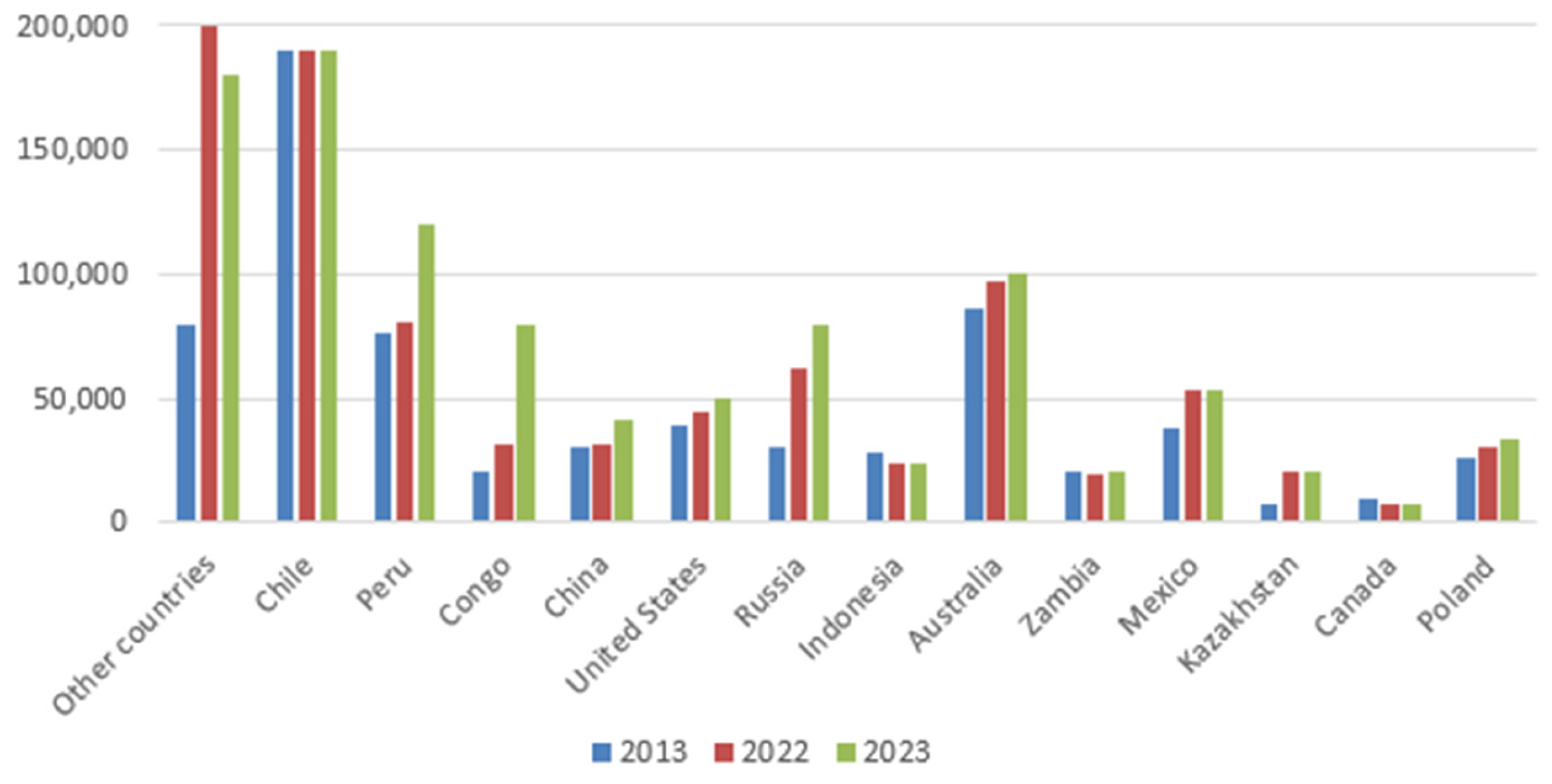

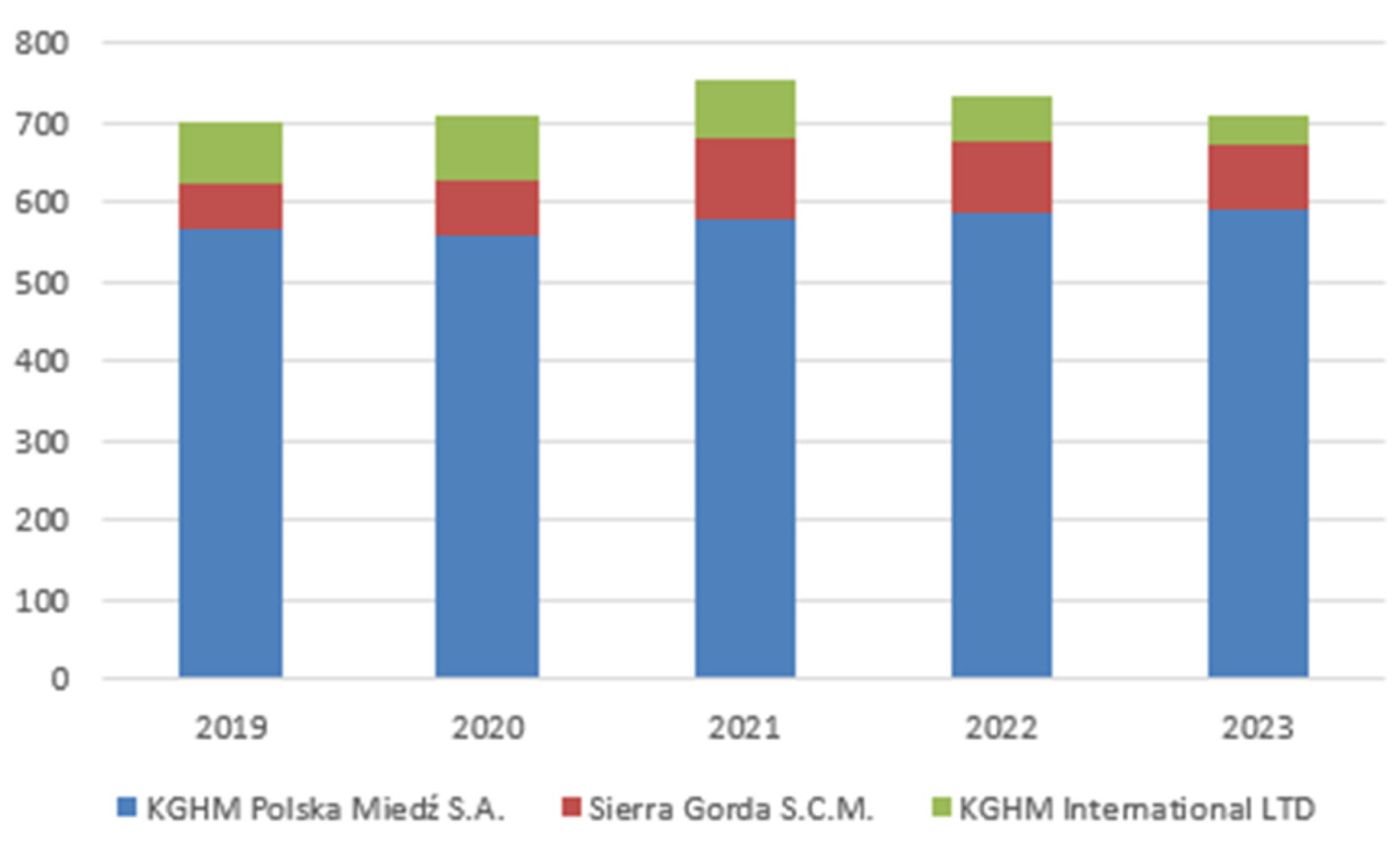

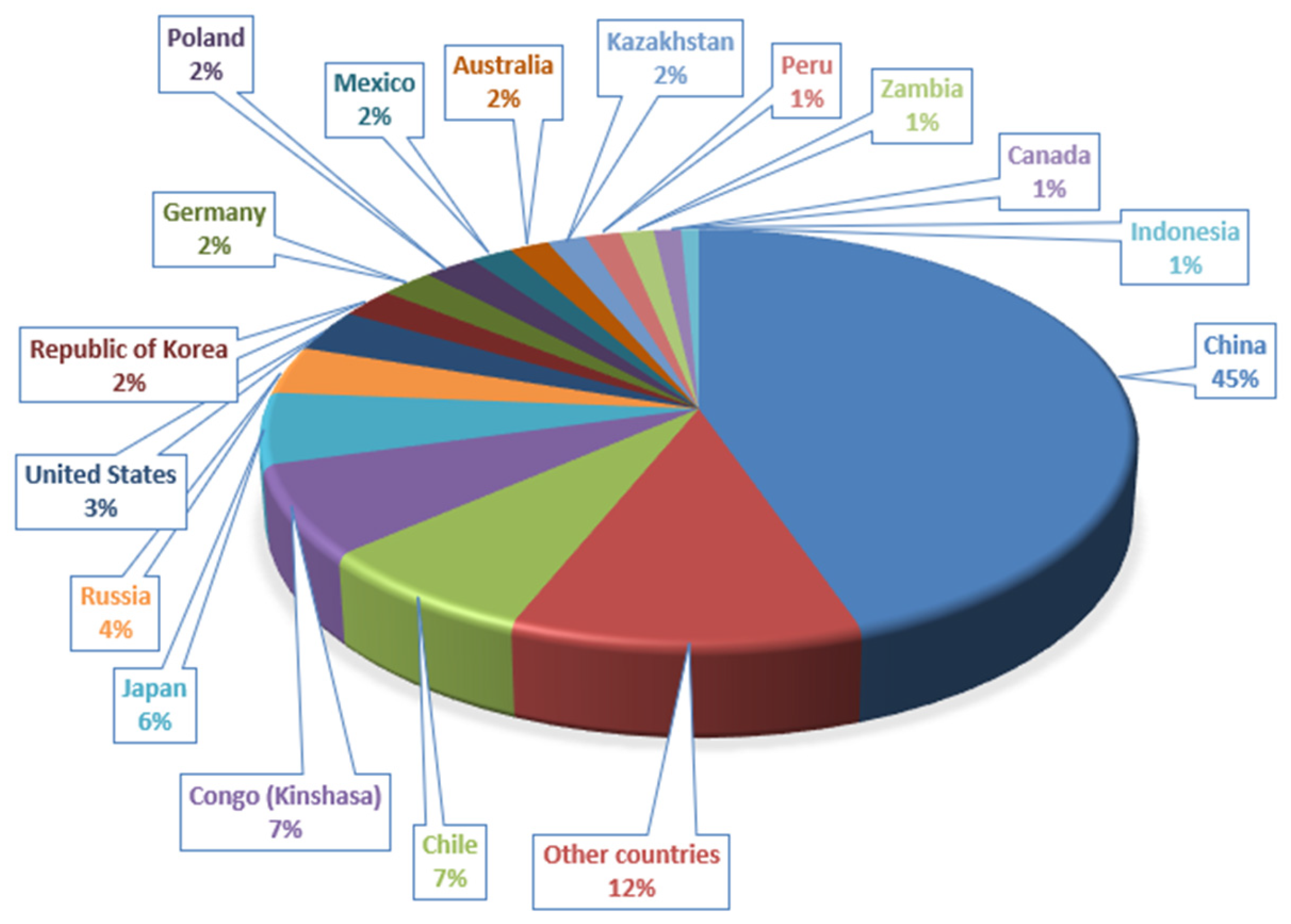

Copper Production in Poland vs. Global Production

5. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- European Commission. Communication from the Commission to the European Parliament, the European Council, the Council, the European Economic and Social Committee and the Committee of the Regions. In The European Green Deal, COM/2019/640 Final; European Commission: Brussels, Belgium, 2019; Available online: https://eur-lex.europa.eu/legal-content/EN/TXT/HTML/?uri=CELEX:52019DC0640 (accessed on 16 July 2024).

- Xu, Y.; Liu, A.; Li, Z.; Li, J.; Xiong, J.; Fan, P. Review of Green Supply-Chain Management Diffusion in the Context of Energy Transformation. Energies 2023, 16, 686. [Google Scholar] [CrossRef]

- Genc, T.S.; Kosempel, S. Energy Transition and the Economy: A Review Article. Energies 2023, 16, 2965. [Google Scholar] [CrossRef]

- IEA. World Energy Outlook 2023; Organisation for Economic Co-Operation and Development (OECD): Paris, France, 2023. [Google Scholar] [CrossRef]

- Rietveld, E.; Bastein, T.; van Leeuwen, T.; Wieclawska, S.; Bonenkamp, N.; Peck, D.; Klebba, M.; Le Mouel, M.; Poitiers, N. Strengthening the Security of Supply of Products Containing Critical Raw Materials for the Green Transition and Decarbonisation; European Parliament: Strasbourg, France, 2022; Available online: http://www.airaassociazione.it/wp-content/uploads/2023/01/Strengthening-the-security-of-supply-of-products-containing-CRMs-for-the-green-transition-and-decarbonisation.pdf (accessed on 11 July 2024).

- Hund, K.; la Porta, D.; Fabregas, T.P.; Laing, T.; Drexhage, J. Minerals for Climate Action: The Mineral Intensity of the Clean Energy Transition; International Bank for Reconstruction and Development, The World Bank: Washington, DC, USA, 2020; Available online: https://pubdocs.worldbank.org/en/961711588875536384/Minerals-for-Climate-Action-The-Mineral-Intensity-of-the-Clean-Energy-Transition.pdf (accessed on 11 July 2024).

- Bobba, S.; Carrara, S.; Huisman, J.; Mathieux, F.; Pavel, C. Critical Raw Materials for Strategic; Technologies and Sectors in the EU—A Foresight Study. 2020. Available online: https://rmis.jrc.ec.europa.eu/uploads/CRMs_for_Strategic_Technologies_and_Sectors_in_the_EU_2020.pdf (accessed on 11 July 2024).

- Zhang, Z.; Chen, S.; Zhang, H.; Yao, C.; Lou, H.; Chen, M.; Xia, B.; Sun, Y.; Lang, X.; Cai, K. Enhanced oxygen reduction kinetics of SrCoO3-δ by Ta/Cu or Nb/Cu co-doping as high-performance cathodes for SOFC. Ceram. Int. 2023, 49, 39003–39012. [Google Scholar] [CrossRef]

- Quan, B.; Wang, Y.; Chen, Y.; Lu, X.; Teng, S.; Zhou, X.; Qiao, M.; Lai, H.; Huang, X. Manipulation of nano-metals to implement rational conduction tailoring for high-efficiency microwave absorption. Carbon 2023, 210, 118045. [Google Scholar] [CrossRef]

- Das, S.; Ali, A.; Jana, R.N. Insight into the dynamics of magneto-casson hybrid nanoliquid caused by a plate rotation. World J. Eng. 2021, 18, 66–84. [Google Scholar] [CrossRef]

- Wu, Y.; Lv, J.; Xie, F.; An, R.; Zhang, J.; Huang, H.; Shen, Z.; Jiang, L.; Xu, M.; Yao, Q.; et al. Single and double transition metal atoms doped graphdiyne for highly efficient electrocatalytic reduction of nitric oxide to ammonia. J. Colloid Interface Sci. 2024, 656, 155–167. [Google Scholar] [CrossRef]

- Toyooka, G.; Tanaka, T.; Kitayama, K.; Kobayashi, N.; Watanabe, T.; Fujita, K.-I. Hydrogen production from cellulose catalyzed by an iridium complex in ionic liquid under mild conditions. Catal. Sci. Technol. 2021, 11, 2273–2279. [Google Scholar] [CrossRef]

- Guo, F.; Qiao, Q.; Mao, S.; Bai, J.; Dong, K.; Shu, R.; Xu, L.; Wei, H.; Qian, L.; Wang, Y. A comprehensive study on the pyrolysis behavior of pine sawdust catalyzed by different metal ions under conventional and microwave heating conditions. Energy 2023, 272, 127115. [Google Scholar] [CrossRef]

- Chen, H.; Hsu, H.-Y.; Hsieh, J.-E.Y.; Hung, H.-E. A differential privacy-preserving federated learning scheme with predictive maintenance of wind turbines based on deep learning for feature compression and anomaly detection with state assessment. J. Mech. Sci. Technol. 2024, 38, 3413–3429. [Google Scholar] [CrossRef]

- Kushnir, V.; Koshkin, I.; Ibragimova, S. Electric Heating of Non-conductive Dispersed Raw Materials in Activated Carbon Production. In Lecture Notes in Mechanical Engineering, Proceedings of the 6th International Conference on Industrial Engineering ICIE 2020, Sochi, Russia, 18–22 May 2020; Radionov, A.A., Gasiyarov, V.R., Eds.; Springer: Berlin/Heidelberg, Germany, 2021. [Google Scholar] [CrossRef]

- Yang, M.; Li, L.; Shi, J.; Xia, H.; Xu, J. Electrocatalytic hydrogenation of lignin-derived compounds in heteropolyacid fluidized system. Biomass Convers. Biorefinery 2024, 1–11. [Google Scholar] [CrossRef]

- Khrunina, N.P.; Cheban, A.; Yu, A. A theoretical approach to disintegration equipment design for mineral raw materials. Eurasian Min. 2023, 40, 66–69. [Google Scholar] [CrossRef]

- Li, D.; Shen, L.; Zhong, S.; Elshkaki, A.; Li, X. Spatial and temporal evolution patterns of material, energy and carbon emission nexus for power generation infrastructure in China. Resour. Conserv. Recycl. 2023, 190, 106775. [Google Scholar] [CrossRef]

- Li, H.; Yao, X.; Tachega, M.A.; Ahmed, D.; Ismaail, M.G.A. Technology selection for hydrogen production in China by integrating emergy into life cycle. J. Clean. Prod. 2021, 294, 126303. [Google Scholar] [CrossRef]

- Eheliyagoda, D.; Wei, F.; Shan, G.; Albalghiti, E.; Zeng, X.; Li, J. Examining the temporal demand and sustainability of copper in China. Environ. Sci. Technol. 2019, 53, 13812–13821. [Google Scholar] [CrossRef]

- Guo, J.; Zhu, K.; Cheng, Y. Deployment of clean energy technologies towards carbon neutrality under resource constraints. Energy 2024, 295, 131012. [Google Scholar] [CrossRef]

- Wang, Y.; Guo, C.H.; Zhuang, S.R.; Chen, X.J.; Jia, L.Q.; Chen, Z.Y.; Xia, Z.L.; Wu, Z. Major contribution to carbon neutrality by China’s geosciences and geological technologies. China Geol. 2021, 4, 329–352. [Google Scholar] [CrossRef]

- Li, Y.; Pan, S.; Ning, S.; Shao, L.; Jing, Z.; Wang, Z. Coal measure metallogeny: Metallogenic system and implication for resource and environment. Sci. China Earth Sci. 2022, 65, 1211–1228. [Google Scholar] [CrossRef]

- Li, L.; Tang, Q.-Y.; Zhang, Y. Comparative Study of Magmatic Sulfide Type Nickel-Cobalt Deposits in Cratons and Orogenic Belts—A Case Study of Jinchuan and Xiarihamu Deposits. In Proceedings of the 11th Academic Conference of Geology Resource Management and Sustainable Development, Beijing, China, 16–17 December 2023; Volume 1, pp. 426–432. [Google Scholar] [CrossRef]

- Jia, J.; Xin, L.; Lu, C.; Wu, B.; Zhong, Y. China’s CO2 emissions: A systematical decomposition concurrently from multi-sectors and multi-stages since 1980 by an extended logarithmic mean divisia index. Energy Strategy Rev. 2023, 49, 101141. [Google Scholar] [CrossRef]

- Domaracka, L.; Matuskova, S.; Tausova, M.; Senova, A.; Kowal, B. Efficient Use of Critical Raw Materials for Optimal Resource Management in EU Countries. Sustainability 2022, 14, 6554. [Google Scholar] [CrossRef]

- Jarosiñski, M.; Krzyœcin, J.; Ustrnul, Z.; Kochanek, K.; Janik, T. Geophysical research in solving civilization problems relevant to Poland. Przegląd Górniczy 2023, 71, 418–429. [Google Scholar]

- Bhowmik, S.; Chaudhary, A.; Patra, M.; Patra, R. Oxygen reduction reaction by metallocorroles and metallophthalocyanines. In Oxygen Reduction Reaction: Fundamentals, Materials, and Applications; Elsevier: Amsterdam, The Netherlands, 2022. [Google Scholar] [CrossRef]

- Khan, M.R.; Alqahtani, A.M.; Alhazmi, S.E.; Elkotb, M.A.; Sidi, M.O.; Alrihieli, H.F.; Tag-Eldin, E.; Yassen, M.F. Numerical Investigation of Darcy–Forchheimer Hybrid Nanofluid Flow with Energy Transfer over a Spinning Fluctuating Disk under the Influence of Chemical Reaction and Heat Source. Micromachines 2023, 14, 48. [Google Scholar] [CrossRef] [PubMed]

- Memon, S.A.; Shaikh, H.I.; Raza, R.; Mughal, Z.U.N.; Memon, A.A.; Memon, S. Graphene incorporated mesoporous perovskite with excellent conductivity and catalytic activity for low temperature solid oxide fuel cells. New J. Chem. 2022, 46, 12530–12539. [Google Scholar] [CrossRef]

- Kim, S.H.; Lee, D.H. Polyetherimide for Magnet Wire Applications. SAE Int. J. Adv. Curr. Pr. Mobil. 2022, 5, 517–520. [Google Scholar] [CrossRef]

- ETC. Material and Resources Requirements for the Energy Transition. Available online: https://www.energy-transitions.org/publications/material-and-resource-energy-transition/ (accessed on 9 July 2024).

- EY. Critical Raw Materials for the Energy Transition—How to Achieve the Targets. Available online: https://www.ey.com/en_bg/insights/energy-resources/critical-raw-materials-for-energy-transition (accessed on 4 July 2024).

- U.S. Geological Survey 2024. Available online: https://pubs.usgs.gov/publication/mcs2024 (accessed on 6 July 2024).

- U.S. Geological Survey 2013. Available online: https://pubs.usgs.gov/publication/mineral2013 (accessed on 6 July 2024).

- U.S. Geological Survey 2023. Available online: https://www.usgs.gov/publications/mineral-commodity-summaries-2023 (accessed on 6 July 2024).

- Raport Zintegrowany KGHM. Available online: https://raportcsr2022.kghm.com/ (accessed on 8 July 2024).

- Sprawozdanie Zarządu KGHM. Available online: https://kghm.com/sites/default/files/2024-08/Sprawozdanie%20Zarz%C4%85du%20z%20dzia%C5%82alno%C5%9Bci%20Grupy%20Kapita%C5%82owej%20KGHM%20Polska%20Mied%C5%BA%20S.A.%20w%20I%20p%C3%B3%C5%82roczu%202024.pdf (accessed on 6 July 2024).

- Rizos, V.; Bryhn, J.; Alessi, M.; Campmas, A.; Zarra, A. Identifying the Impact of the Circular Economy on the Fast-Moving Consumer Goods Industry; The European Economic and Social Committee: Bruxelles, Belgium, 2019. [Google Scholar]

- IEA. The Role of Critical Minerals in Clean Energy Transitions. Available online: https://www.iea.org/reports/the-role-of-critical-minerals-in-clean-energy-transitions (accessed on 10 July 2024).

- World Integrated Trade Solution. World Bank. Available online: https://wits.worldbank.org/ (accessed on 18 September 2024).

- Fraunhofer Institute for Systems and Innovation Research ISI. Available online: https://www.isi.fraunhofer.de/en.html (accessed on 23 September 2024).

- Directive (EU) 2023/2413 of the European Parliament and of the Council. Available online: https://eur-lex.europa.eu/legal-content/EN/TXT/HTML/?uri=OJ:L_202302413 (accessed on 8 July 2024).

- Directive (EU) 2023/1791 of the European Parliament and of the Council. Available online: https://eur-lex.europa.eu/legal-content/EN/TXT/HTML/?uri=CELEX:32023L1791 (accessed on 8 July 2024).

- Regulation (EU) 2024/1252 of the European Parliament and of the Council of 11 April 2024 Establishing a Framework for Ensuring a Secure and Sustainable Supply of Critical Raw Materials and Amending Regulations (EU) No 168/2013, (EU) 2018/858, (EU) 2018/1724 and (EU) 2019/1020 Text with EEA Relevance. Available online: https://eur-lex.europa.eu/legal-content/EN/TXT/HTML/?uri=OJ:L_202401252 (accessed on 16 July 2024).

- Strategy of the KGHM Group to 2030 with an Outlook to 2040. Available online: https://kghm.com/en/strategy-kghm-group-2030-outlook-2040 (accessed on 10 July 2024).

| Exports of Copper Ores and Concentrates | Imports of Copper Ores and Concentrates | ||||

|---|---|---|---|---|---|

| Thousand USD | Thousand USD | ||||

| 1 | Chile | 24,322,170 | 1 | China | 59,941,382 |

| 2 | Peru | 19,991,449 | 2 | Japan | 11,740,694 |

| 3 | Indonesia | 8,326,476 | 3 | Germany | 3,306,776 |

| 4 | Australia | 4,344,555 | 4 | Philippines | 3,265,666 |

| 5 | Mexico | 3,715,931 | 5 | India | 3,057,890 |

| 6 | Brazil | 3,465,813 | 6 | Spain | 2,486,153 |

| 7 | Canada | 3,185,231 | 7 | Bulgaria | 1,938,247 |

| 8 | Kazakhstan | 3,068,322 | 8 | Finland | 916,922 |

| 9 | United States | 2,607,241 | 9 | Sweden | 913,885 |

| 10 | Panama | 2,469,049 | 10 | Canada | 719,882 |

| Exports of Unrefined Copper, Copper Anodes for Electrolysis | Import of Unrefined Copper, Copper Anodes for Electrolysis | ||||

|---|---|---|---|---|---|

| Thousand USD | Thousand USD | ||||

| 1 | Zambia | 5,030,931 | 1 | China | 8,418,061 |

| 2 | Chile | 2,134,844 | 2 | India | 2,009,002 |

| 3 | Sweden | 1,325,665 | 3 | Belgium | 1,763,111 |

| 4 | Bulgaria | 962,632 | 4 | Canada | 1,276,751 |

| 5 | South Africa | 367,941 | 5 | Finland | 305,274 |

| 6 | United States | 244,559 | 6 | Austria | 216,312 |

| 7 | Slovak Republic | 215,121 | 7 | Kazakhstan | 109,694 |

| 8 | Spain | 207,820 | 8 | Germany | 66,051 |

| 9 | Peru | 207,674 | 9 | Australia | 56,131 |

| 10 | Philippines | 202,518 | 10 | Serbia | 48,566 |

| Exports of Copper Cathodes and Cathode Components | Imports of Copper Cathodes and Cathode Components | ||||

|---|---|---|---|---|---|

| Thousand US | Thousand USD | ||||

| 1 | Chile | 16,948,007 | 1 | China | 30,110,902 |

| 2 | Japan | 5,511,558 | 2 | United States | 6,671,446 |

| 3 | Australia | 3,370,027 | 3 | Italy | 4,888,128 |

| 4 | Kazakhstan | 2,840,465 | 4 | Germany | 3,922,802 |

| 5 | Peru | 2,689,386 | 5 | Turkey | 3,596,195 |

| 6 | Poland | 2,565,562 | 6 | United Arab Emirates | 3,386,355 |

| 7 | China | 2,421,337 | 7 | Thailand | 2,988,155 |

| 8 | Philippines | 1,941,133 | 8 | India | 2,793,250 |

| 9 | Bulgaria | 1,614,014 | 9 | Malaysia | 2,037,671 |

| 10 | Zambia | 1,552,586 | 10 | Brazil | 1,992,967 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Podobińska-Staniec, M.; Wiktor-Sułkowska, A.; Kustra, A.; Lorenc-Szot, S. Copper as a Critical Resource in the Energy Transition. Energies 2025, 18, 969. https://doi.org/10.3390/en18040969

Podobińska-Staniec M, Wiktor-Sułkowska A, Kustra A, Lorenc-Szot S. Copper as a Critical Resource in the Energy Transition. Energies. 2025; 18(4):969. https://doi.org/10.3390/en18040969

Chicago/Turabian StylePodobińska-Staniec, Marta, Anna Wiktor-Sułkowska, Arkadiusz Kustra, and Sylwia Lorenc-Szot. 2025. "Copper as a Critical Resource in the Energy Transition" Energies 18, no. 4: 969. https://doi.org/10.3390/en18040969

APA StylePodobińska-Staniec, M., Wiktor-Sułkowska, A., Kustra, A., & Lorenc-Szot, S. (2025). Copper as a Critical Resource in the Energy Transition. Energies, 18(4), 969. https://doi.org/10.3390/en18040969