The Impact of Green Finance and Renewable Energy Development on the Low-Carbon Transition of the Marine Industry: Evidence from Coastal Provinces and Cities in China

Abstract

:1. Introduction

2. Theoretical Hypotheses and Literature Review

2.1. The Construction of an Evaluation Indicator System for the Low-Carbon Transition of the Marine Industry

2.2. The Driving Role and Evolutionary Characteristics of Green Finance and Renewable Energy Development

2.2.1. The Impact of Green Finance on the Low-Carbon Transition of the Marine Industry

2.2.2. The Impact of Renewable Energy Development on the Low-Carbon Transition of the Marine Industry

2.2.3. Synergistic Effects of Green Finance and Renewable Energy Development on the Low-Carbon Transition of the Marine Industry

2.3. The Phased Evolutionary Characteristics of Green Finance and Renewable Energy Development

3. Indicator Construction and Analysis

3.1. Explanation of Indicator Selection

3.2. Entropy-Weighted TOPSIS Method

3.3. Spatial–Temporal Difference Analysis of the Low-Carbon Transition Levels in the Marine Industry of Coastal Provinces and Cities

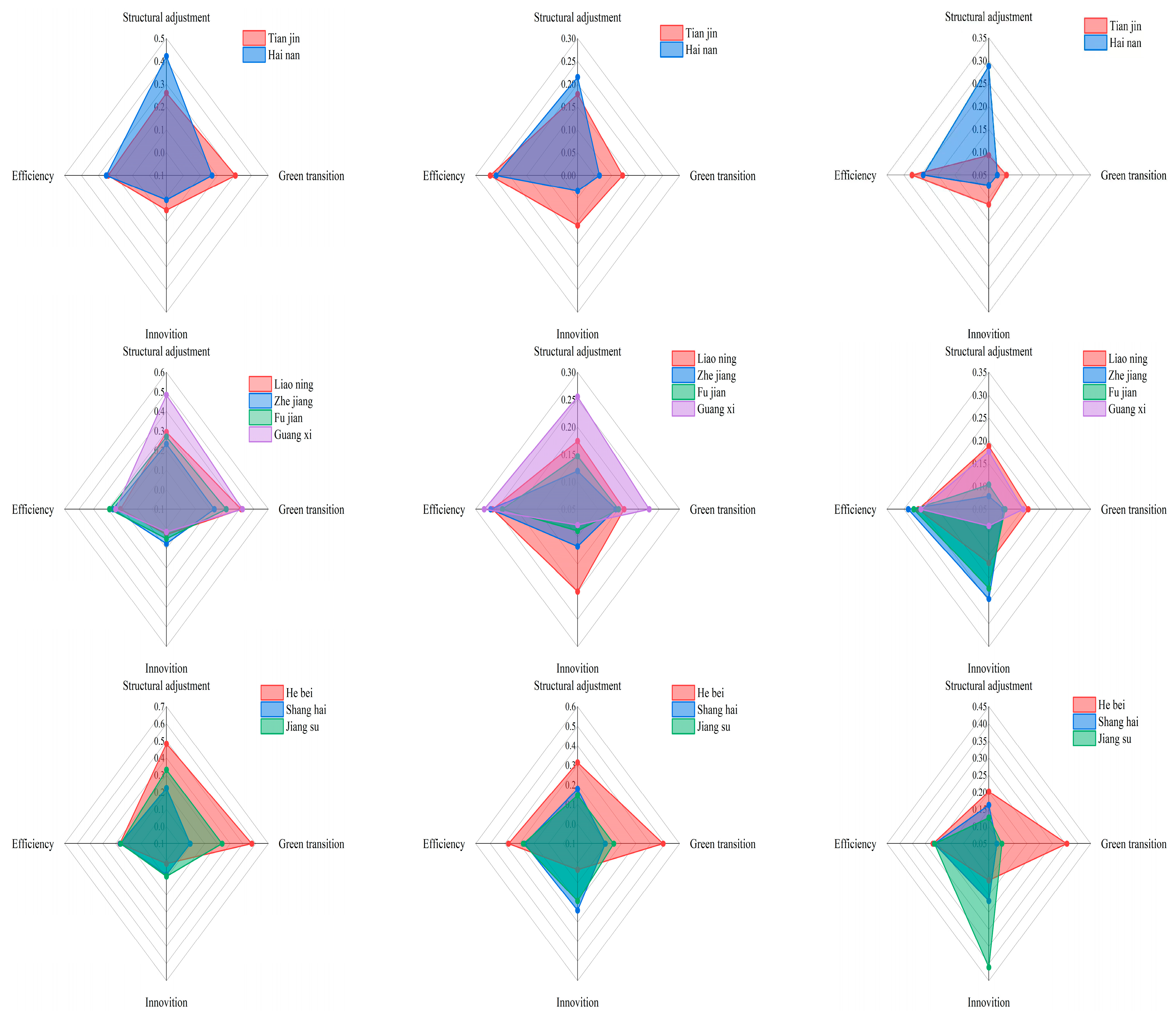

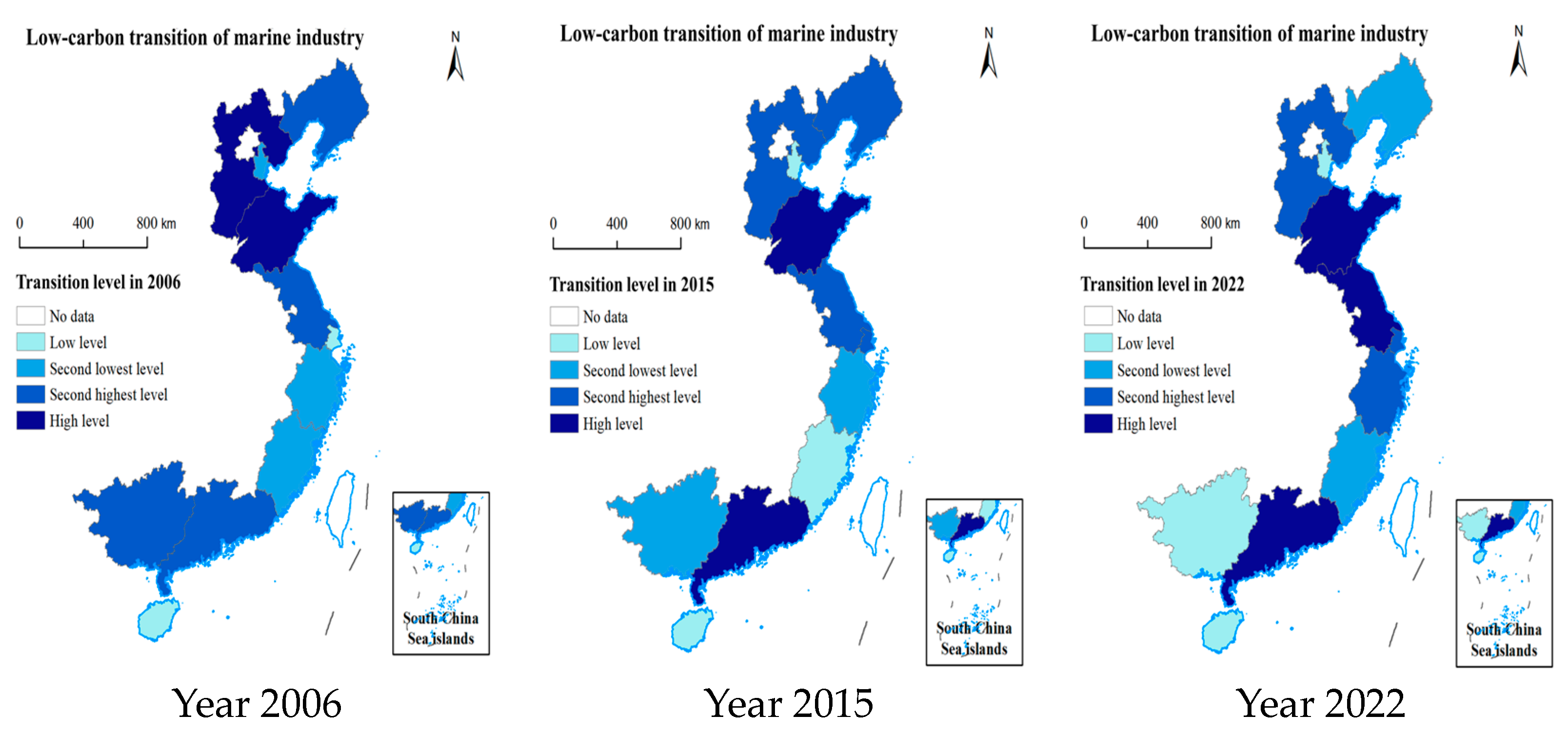

3.3.1. Temporal Difference Analysis

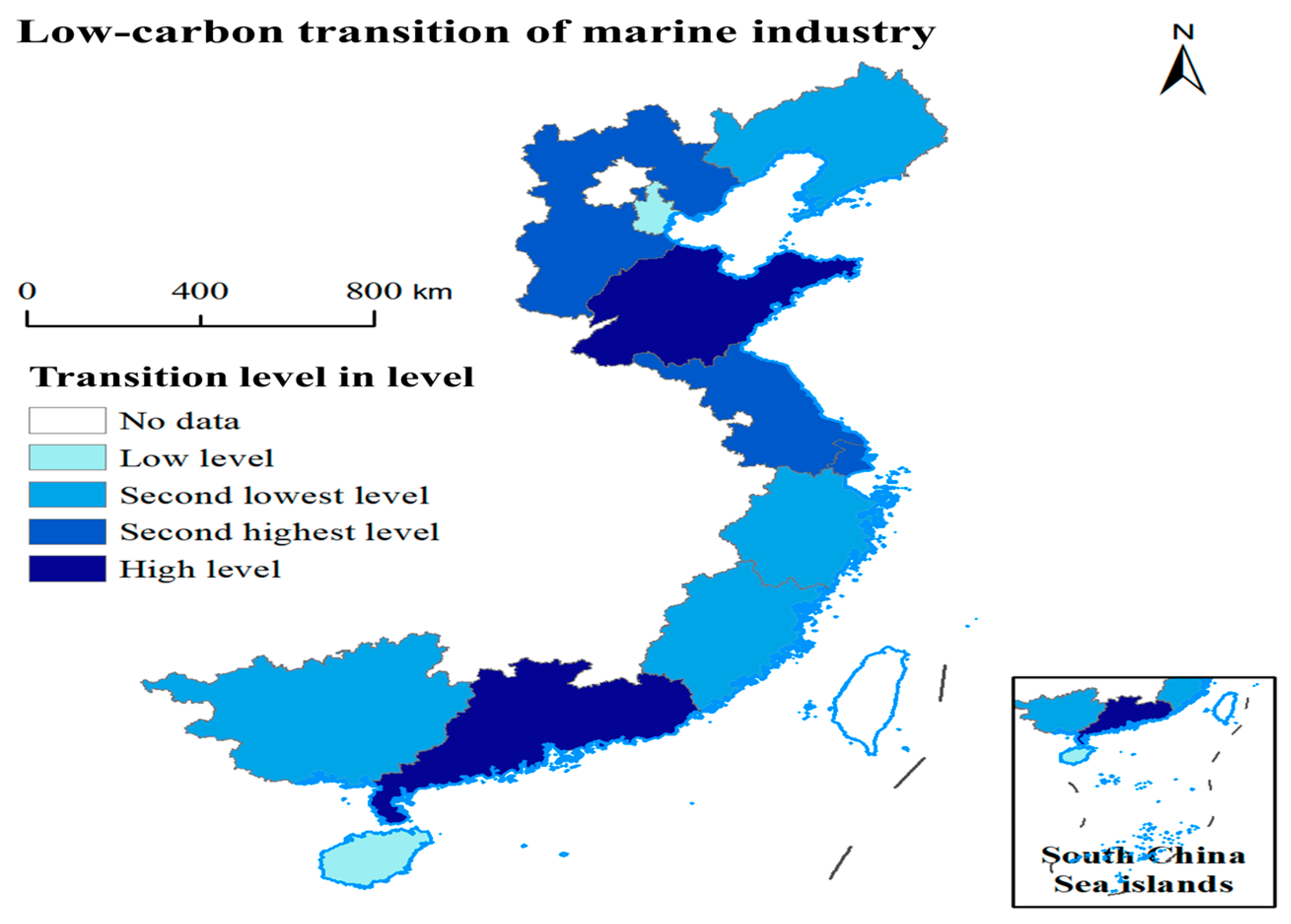

3.3.2. Spatial Difference Analysis

4. Method and Data

4.1. Data Sources

4.2. Model Construction

4.2.1. Fixed Effects Model

4.2.2. Moderating Effects Model

4.2.3. Panel Quantile Regression Model

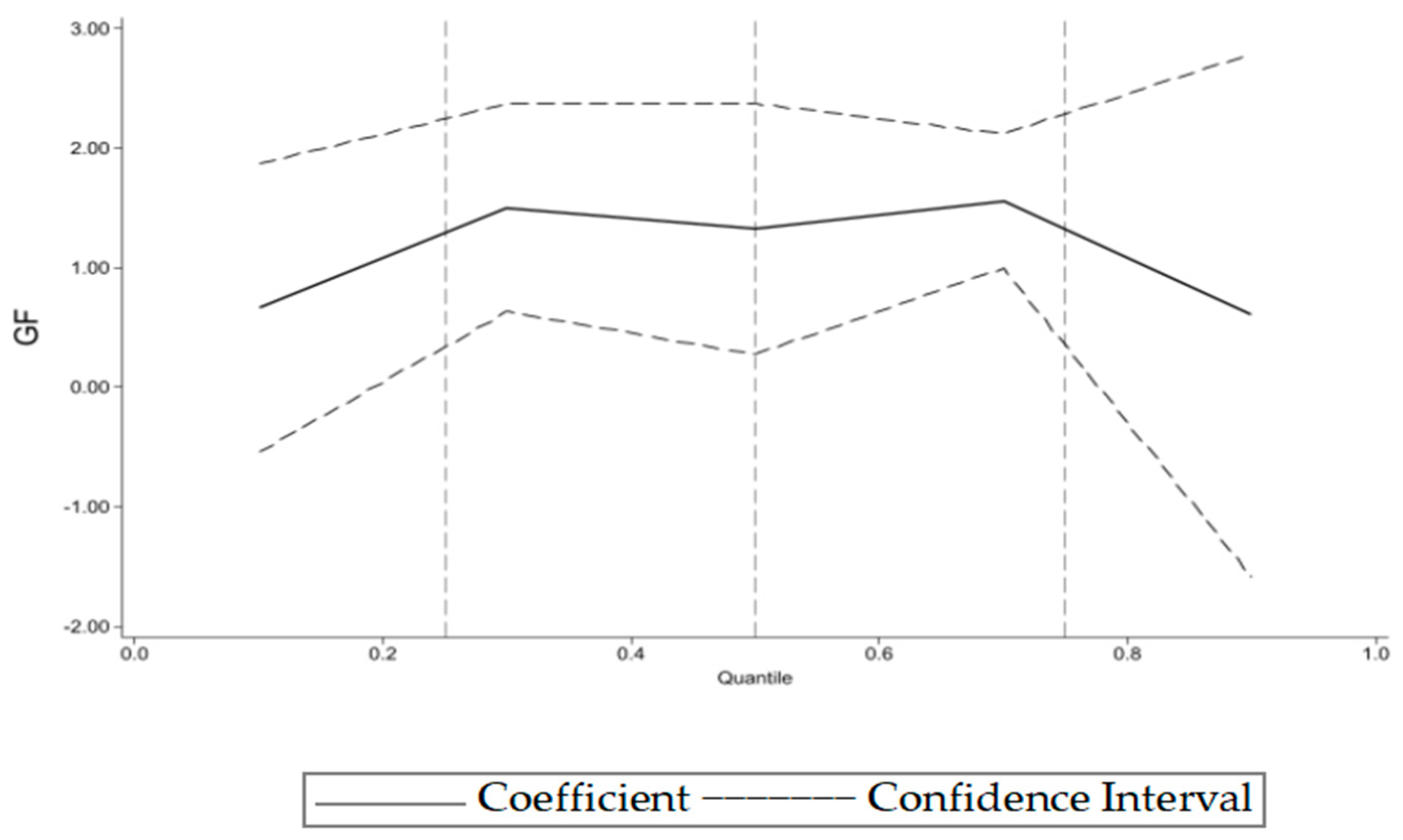

4.3. Variable Selection

4.3.1. Dependent Variable

4.3.2. Independent Variable

4.3.3. Control Variables

4.4. Descriptive Statistical Analysis of the Sample Data

5. Results and Discussion

5.1. Baseline Regression Results

5.2. Synergistic Effect Regression Results

5.3. Robustness Tests

5.4. Further Analysis

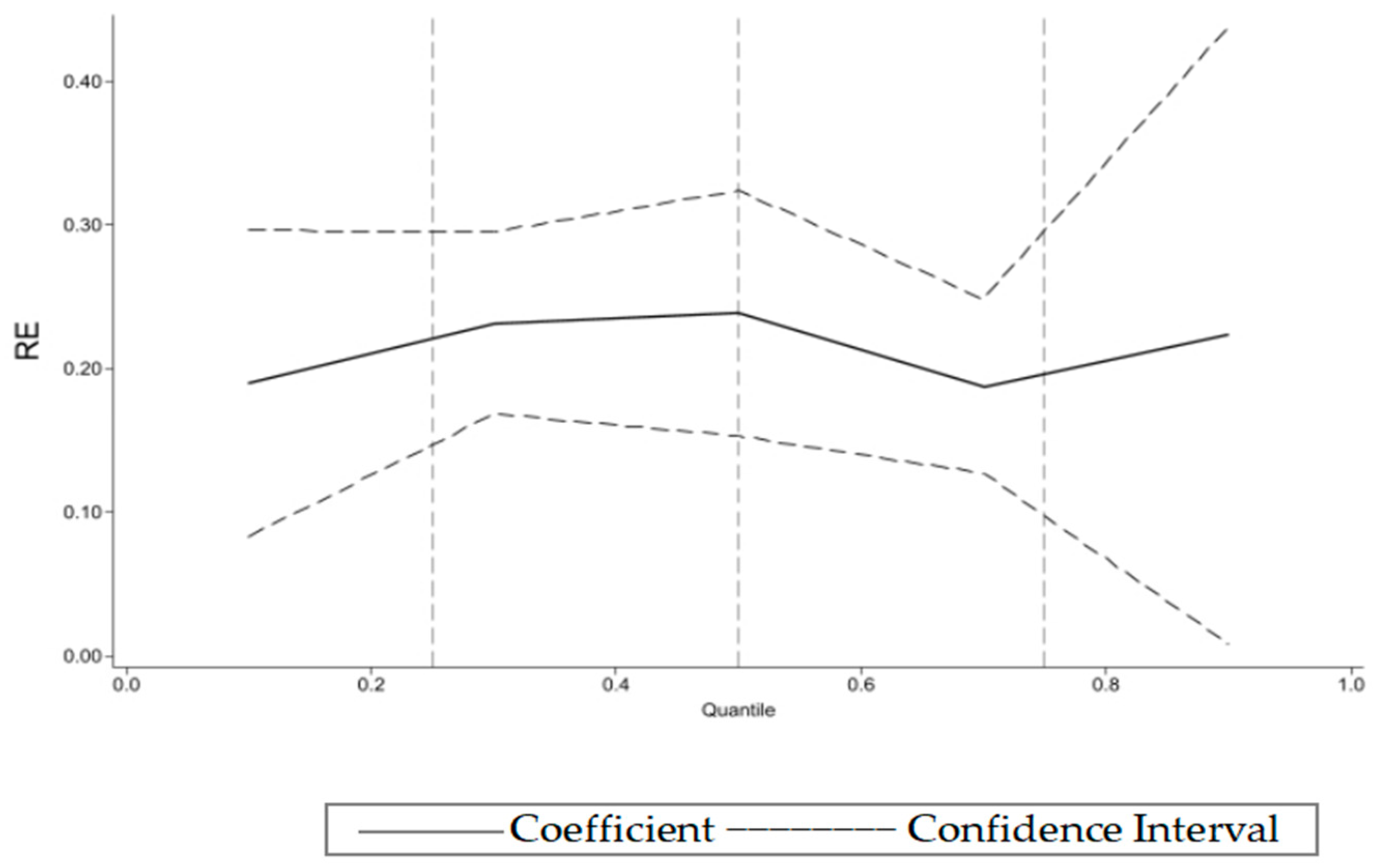

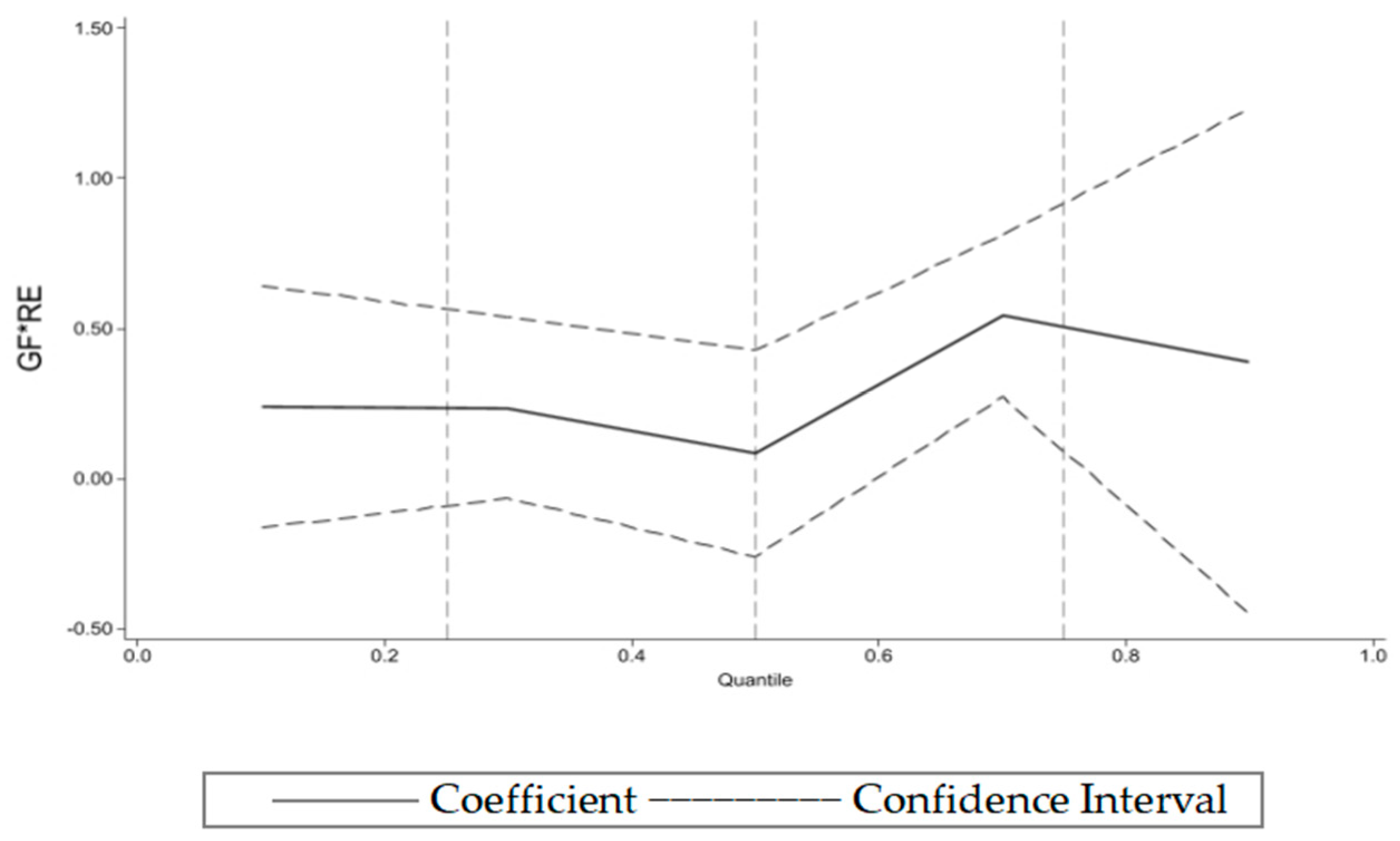

5.4.1. The Impact of Green Finance and Renewable Energy Development on the Low-Carbon Transition of the Marine Industry at Different Transition Levels

5.4.2. Heterogeneity Analysis

5.5. Discussion

5.5.1. Discussion of Results

5.5.2. Limitations

5.5.3. Future Outlook

6. Conclusions and Policy Recommendations

6.1. Conclusions

6.2. Policy Recommendations

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

Appendix A

References

- Jiang, Y.; Hu, Y.; Asante, D.; Mintah Ampaw, E.; Asante, B. The Effects of Executives’ Low-Carbon Cognition on Corporate Low-Carbon Performance: A Study of Managerial Discretion in China. J. Clean. Prod. 2022, 357, 132015. [Google Scholar] [CrossRef]

- Cui, Y.; Xu, H.; An, D.; Yang, L. Evaluation of Marine Economic Development Demonstration Zone Policy on Marine Industrial Structure Optimization: A Case Study of Zhejiang, China. Front. Mar. Sci. 2024, 11, 1403347. [Google Scholar] [CrossRef]

- Yang, J.; Liu, H. Empirical Analysis on the Correlation between Low-carbon Economy and Marine Industry Development. Discrete Dyn. Nat. Soc. 2022, 2022, 2987885. [Google Scholar] [CrossRef]

- Yin, Q. Nexus among Financial Development and Equity Market on Green Economic Finance: Fresh Insights from European Union. Renew. Energy 2023, 216, 118938. [Google Scholar] [CrossRef]

- Sun, Y.; Bao, Q.; Taghizadeh-Hesary, F. Green Finance, Renewable Energy Development, and Climate Change: Evidence from Regions of China. Humanit. Soc. Sci. Commun. 2023, 10, 107. [Google Scholar] [CrossRef]

- Ilyas, M.; Mu, Z.; Akhtar, S.; Hassan, H.; Shahzad, K.; Aslam, B.; Maqsood, S. Renewable Energy, Economic Development, Energy Consumption and Its Impact on Environmental Quality: New Evidence from Southeast Asian Countries. Renew. Energy 2024, 223, 119961. [Google Scholar] [CrossRef]

- Cardoso-Andrade, M.; Queiroga, H.; Rangel, M.; Sousa, I.; Belackova, A.; Bentes, L.; Oliveira, F.; Monteiro, P.; Sales Henriques, N.; Afonso, C.M.L.; et al. Setting Performance Indicators for Coastal Marine Protected Areas: An Expert-Based Methodology. Front. Mar. Sci. 2022, 9, 848039. [Google Scholar] [CrossRef]

- Pasinetti, L.L. Structural Change and Economic Growth: A Theoretical Essay on the Dynamics of the Wealth of Nations; Cambridge University Press: Cambridge, UK, 1988; ISBN 978-0-521-27410-4. [Google Scholar]

- Li, B.; Hu, J. Measurement and Comparative Analysis of the Optimization and Upgrading of Industrial Structure in China. J. Manag. Sci. 2008, 2008, 86–93. [Google Scholar]

- Xu, X.Y.; Zhang, X.L. Construction and Measurement of the Evaluation Index System for China’s Industrial Structure Optimization and Upgrading. Product. Res. 2016, 2016, 47–51. [Google Scholar]

- Van Den Burg, S.W.K.; Aguilar-Manjarrez, J.; Jenness, J.; Torrie, M. Assessment of the Geographical Potential for Co-Use of Marine Space, Based on Operational Boundaries for Blue Growth Sectors. Mar. Policy 2019, 100, 43–57. [Google Scholar] [CrossRef]

- DeVoe, M.R. Marine Aquaculture in the United States: A Review of Current and Future Policy and Management Challenges. Mar. Technol. Soc. J. 2000, 34, 5–17. [Google Scholar] [CrossRef]

- Burmeister, H.-C.; Weisheit, J.; Kuechle, J.; Bluhm, L.-F.; Bergmann, M. An Emerging Market? The European Maritime Industry’s View on Autonomous Maritime Systems: A Survey. J. Phys. Conf. Ser. 2024, 2867, 012017. [Google Scholar] [CrossRef]

- Methratta, E.T.; Silva, A.; Lipsky, A.; Ford, K.; Christel, D.; Pfeiffer, L. Science Priorities for Offshore Wind and Fisheries Research in the Northeast U.S. Continental Shelf Ecosystem: Perspectives from Scientists at the National Marine Fisheries Service. Mar. Coast. Fish. 2023, 15, e210242. [Google Scholar] [CrossRef]

- Stebbings, E.; Papathanasopoulou, E.; Hooper, T.; Austen, M.C.; Yan, X. The Marine Economy of the United Kingdom. Mar. Policy 2020, 116, 103905. [Google Scholar] [CrossRef]

- Nurkholis; Nuryadin, D.; Syaifudin, N.; Handika, R.; Setyobudi, R.H.; Udjianto, D.W. The Economic of Marine Sector in Indonesia. Aquat. Procedia 2016, 7, 181–186. [Google Scholar] [CrossRef]

- Kuroda, M.; Uchida, K.; Tokai, T.; Miyamoto, Y.; Mukai, T.; Imai, K.; Shimizu, K.; Yagi, M.; Yamanaka, Y.; Mituhashi, T. The Current State of Marine Debris on the Seafloor in Offshore Area around Japan. Mar. Pollut. Bull. 2020, 161, 111670. [Google Scholar] [CrossRef] [PubMed]

- Carpenter, A. Oil Pollution in the North Sea: The Impact of Governance Measures on Oil Pollution over Several Decades. Hydrobiologia 2019, 845, 109–127. [Google Scholar] [CrossRef]

- Li, F.; Xing, W.; Su, M.; Xu, J. The Evolution of China’s Marine Economic Policy and the Labor Productivity Growth Momentum of Marine Economy and Its Three Economic Industries. Mar. Policy 2021, 134, 104777. [Google Scholar] [CrossRef]

- Li, D. The Impact of Marine Industrial Structure Rationalization on Marine Economic Growth. J. Sea Res. 2023, 196, 102455. [Google Scholar] [CrossRef]

- Liu, Y. Analysis on the Independent Innovation Path and Development Trend of Emerging Marine Industry Based on DEA Model. Discrete Dyn. Nat. Soc. 2022, 2022, 8255444. [Google Scholar] [CrossRef]

- Ji, J.; Tang, R.; Sun, X. Marine Scientific and Technological Innovation, Marine Industrial Structure Upgrade and Marine Total Factor Productivity: Empirical Research Based on Threshold Effect of 11 Coastal Provinces in China. Sci. Technol. Manag. Res. 2021, 41, 73–80. [Google Scholar] [CrossRef]

- Ming, C.; Chen, L.; Zhong, S. Construction and Empirical Analysis of China’s Green Growth Comprehensive Evaluation Index System. Sci. Technol. Manag. Res. 2021, 41, 76–86. [Google Scholar] [CrossRef]

- Zhou, Y.; Luo, Y.; Wen, C. Construction and Comprehensive Evaluation of an Index System for Urban Industrial Ecologicalization Level. Stat. Decis. 2021, 37, 73–77. [Google Scholar] [CrossRef]

- Qin, M.; Liu, Y.; Cheng, C.Z. Comprehensive Evaluation of Marine Industrial Ecologization in China. China Popul. Resour. Environ. 2018, 28, 102–111. (In Chinese) [Google Scholar]

- Chen, H.; Wang, H.; Zhang, C. Construction and Measurement of the Evaluation Index System for the Ecological Level of Marine Industry in China. Stat. Decis. 2015, 2015, 48–51. [Google Scholar] [CrossRef]

- Xu, G.; Yang, D. Evolution and Development of Externality Theory. J. Soc. Sci. 2004, 2004, 26–30. [Google Scholar] [CrossRef]

- Morrissey, K.; O’Donoghue, C. The Role of the Marine Sector in the Irish National Economy: An Input–Output Analysis. Mar. Policy 2013, 37, 230–238. [Google Scholar] [CrossRef]

- Alvarado-Ramírez, L.; Santiesteban-Romero, B.; Poss, G.; Sosa-Hernández, J.E.; Iqbal, H.M.N.; Parra-Saldívar, R.; Bonaccorso, A.D.; Melchor-Martínez, E.M. Sustainable Production of Biofuels and Bioderivatives from Aquaculture and Marine Waste. Front. Chem. Eng. 2023, 4, 1072761. [Google Scholar] [CrossRef]

- Favoretto, F.; López-Sagástegui, C.; Sala, E.; Aburto-Oropeza, O. The Largest Fully Protected Marine Area in North America Does Not Harm Industrial Fishing. Sci. Adv. 2023, 9, eadg0709. [Google Scholar] [CrossRef]

- Shen, H.; Qin, M.; Li, T.; Zhang, X.; Zhao, Y. Digital Finance and Industrial Structure Upgrading: Evidence from Chinese Counties. Int. Rev. Financ. Anal. 2024, 95, 103442. [Google Scholar] [CrossRef]

- Zhang, G. The Heterogeneous Role of Green Finance on Industrial Structure Upgrading—Based on Spatial Spillover Perspective. Finance Res. Lett. 2023, 58, 104596. [Google Scholar] [CrossRef]

- He, J.; Iqbal, W.; Su, F. Nexus between Renewable Energy Investment, Green Finance, and Sustainable Development: Role of Industrial Structure and Technical Innovations. Renew. Energy 2023, 210, 715–724. [Google Scholar] [CrossRef]

- Xu, B.; Lin, B. How Can Green Finance Effectively Promote Low-Carbon Cities? Evidence from 237 Cities in China. J. Environ. Manag. 2024, 365, 121641. [Google Scholar] [CrossRef] [PubMed]

- Liu, Y.; Yang, X. Financial Support, Marine Economic Development and Optimization of Marine Industrial Structure—Take Fujian Province as an Example. Fujian Trib. Humanit. Soc. Sci. 2019, 2019, 189–196. [Google Scholar]

- Xu, S.; Liu, Y. Research on the Impact of Carbon Finance on the Green Transformation of China’s Marine Industry. J. Clean. Prod. 2023, 418, 138143. [Google Scholar] [CrossRef]

- Lin, B.; Zhou, Y. Does Energy Efficiency Make Sense in China? Based on the Perspective of Economic Growth Quality. Sci. Total Environ. 2022, 804, 149895. [Google Scholar] [CrossRef]

- Zhang, L.; Mu, R.; Zhan, Y.; Yu, J.; Liu, L.; Yu, Y.; Zhang, J. Digital Economy, Energy Efficiency, and Carbon Emissions: Evidence from Provincial Panel Data in China. Sci. Total Environ. 2022, 852, 158403. [Google Scholar] [CrossRef]

- Xing, W. The Present Condition of the Development of Energy Economics and Its Trend. Econ. Perspect. 2005, 8, 103–109. [Google Scholar]

- Yang, Z.; Zhang, M.; Liu, L.; Zhou, D. Can Renewable Energy Investment Reduce Carbon Dioxide Emissions? Evidence from Scale and Structure. Energy Econ. 2022, 112, 106181. [Google Scholar] [CrossRef]

- Want, A.; Crawford, R.; Kakkonen, J.; Kiddie, G.; Miller, S.; Harris, R.E.; Porter, J.S. Biodiversity Characterisation and Hydrodynamic Consequences of Marine Fouling Communities on Marine Renewable Energy Infrastructure in the Orkney Islands Archipelago, Scotland, UK. Biofouling 2017, 33, 567–579. [Google Scholar] [CrossRef]

- Iswadi, A.; Porter, J.S.; Bell, M.C.; Garniati, L.; Harris, R.E.; Priyotomo, G. Establishing an Agenda for Biofouling Research for the Development of the Marine Renewable Energy Industry in Indonesia. J. Mar. Sci. Eng. 2022, 10, 384. [Google Scholar] [CrossRef]

- Rivera, G.; Ortiz, M.; Rivera-Arriaga, E.; Mendoza, E. Identification of Applicable Regulation and Public Policy Gaps Regarding Marine Renewable Energy in Mexico. Ocean Coast. Manag. 2024, 254, 107171. [Google Scholar] [CrossRef]

- Zhou, Q.; Chen, H. Analysis of the Interactive Relationship between China’s Energy Consumption and Industrial Structure. Stat. Decis. 2018, 34, 99–102. [Google Scholar] [CrossRef]

- Chang, J.; Leung, D.Y.C.; Wu, C.Z.; Yuan, Z.H. A Review on the Energy Production, Consumption, and Prospect of Renewable Energy in China. Renew. Sustain. Energy Rev. 2003, 7, 453–468. [Google Scholar] [CrossRef]

- Zhu, Q.; Chen, X.; Song, M.; Li, X.; Shen, Z. Impacts of Renewable Electricity Standard and Renewable Energy Certificates on Renewable Energy Investments and Carbon Emissions. J. Environ. Manag. 2022, 306, 114495. [Google Scholar] [CrossRef]

- Yu, S.; Hu, X.; Li, L.; Chen, H. Does the Development of Renewable Energy Promote Carbon Reduction? Evidence from Chinese Provinces. J. Environ. Manag. 2020, 268, 110634. [Google Scholar] [CrossRef]

- Su, Y.; Fan, Q. Renewable Energy Technology Innovation, Industrial Structure Upgrading and Green Development from the Perspective of China’s Provinces. Technol. Forecast. Soc. Chang. 2022, 180, 121727. [Google Scholar] [CrossRef]

- Niu, W. Basic Understanding of the Theory of Sustainable Development. Prog. Geogr. 2008, 27, 1–6. [Google Scholar]

- Freeman, M.C.; O’Neil, R.; Garavelli, L.; Hellin, D.; Klure, J. Case Study on the Novel Permitting and Authorization of PacWave South, a US Grid-Connected Wave Energy Test Facility: Development, Challenges, and Insights. Energy Policy 2022, 168, 113141. [Google Scholar] [CrossRef]

- Lange, M.; O’Hagan, A.M.; Devoy, R.R.N.; Le Tissier, M.; Cummins, V. Governance Barriers to Sustainable Energy Transitions—Assessing Ireland’s Capacity towards Marine Energy Futures. Energy Policy 2018, 113, 623–632. [Google Scholar] [CrossRef]

- Sgobbi, A.; Simões, S.G.; Magagna, D.; Nijs, W. Assessing the Impacts of Technology Improvements on the Deployment of Marine Energy in Europe with an Energy System Perspective. Renew. Energy 2016, 89, 515–525. [Google Scholar] [CrossRef]

- Khan, H.; Khan, I.; Binh, T.T. The Heterogeneity of Renewable Energy Consumption, Carbon Emission and Financial Development in the Globe: A Panel Quantile Regression Approach. Energy Rep. 2020, 6, 859–867. [Google Scholar] [CrossRef]

- Ma, L.M.; Huang, C.L. Financial Drivers and Renewable Energy Development—A Dynamic Evolution Analysis Based on Multinational Data. China Ind. Econ. 2022, 2022, 118–136. [Google Scholar] [CrossRef]

- Xiao, D.; Zhang, Y. Statistical Test of Impact of Renewable Energy Consumption on Carbon Dioxide Emission. Stat. Decis. 2019, 35, 87–90. [Google Scholar] [CrossRef]

- Hou, H.; Wang, Y.; Zhang, M. Green Finance Drives Renewable Energy Development: Empirical Evidence from 53 Countries Worldwide. Environ. Sci. Pollut. Res. 2023, 30, 80573–80590. [Google Scholar] [CrossRef] [PubMed]

- Lee, C.-C.; Wang, F.; Chang, Y.-F. Does Green Finance Promote Renewable Energy? Evidence from China. Resour. Policy 2023, 82, 103439. [Google Scholar] [CrossRef]

- Zheng, M.; Feng, G.-F.; Chang, C.-P. Is Green Finance Capable of Promoting Renewable Energy Technology? Empirical Investigation for 64 Economies Worldwide. Oeconomia Copernic. 2023, 14, 483–510. [Google Scholar] [CrossRef]

- Ge, T.; Cai, X.; Song, X. How Does Renewable Energy Technology Innovation Affect the Upgrading of Industrial Structure? The Moderating Effect of Green Finance. Renew. Energy 2022, 197, 1106–1114. [Google Scholar] [CrossRef]

- Wei, L.; Yang, Y. On the Evolution Logic and Environmental Effects of Green Finance Policies in China. J. Northwest Norm. Univ. Soc. Sci. 2020, 57, 101–111. [Google Scholar] [CrossRef]

- Siddik, A.B.; Khan, S.; Khan, U.; Yong, L.; Murshed, M. The Role of Renewable Energy Finance in Achieving Low-Carbon Growth: Contextual Evidence from Leading Renewable Energy-Investing Countries. Energy 2023, 270, 126864. [Google Scholar] [CrossRef]

- Yu, J.; Yu, H.; Liu, S. An Analysis of the Evolution of China’s Marine Industrial Structure Based on the Tri-Axial Diagram. Shandong Econ. 2009, 25, 43–47. [Google Scholar] [CrossRef]

- Zhang, C.; Liu, G. Evolving Marginal Effects of Financial Structure on Economic Growth. Econ. Res. J. 2015, 50, 84–99. [Google Scholar]

- Powell, D. Quantile Regression with Nonadditive Fixed Effects. Empir. Econ. 2022, 63, 2675–2691. [Google Scholar] [CrossRef]

- Li, X.X.; Xia, G. Strengthening the Research on Green Finance. In Proceedings of the Socialism Collection of Economic Theory Research (2014)—China’s Economy Under the New Normal, Beijing, China, 16 November 2014; pp. 53–58. [Google Scholar]

- Zhou, C.; Tian, F.; Zhou, T. Green Finance and High-Quality Development: Mechanism and Effects. J. Guizhou Univ. Soc. Sci. 2022, 28, 1–13. [Google Scholar] [CrossRef]

- Dong, K.; Dong, X.; Dong, C. Determinants of the Global and Regional CO2 Emissions: What Causes What and Where? Appl. Econ. 2019, 51, 5031–5044. [Google Scholar] [CrossRef]

- Sadorsky, P. Renewable Energy Consumption and Income in Emerging Economies. Energy Policy 2009, 37, 4021–4028. [Google Scholar] [CrossRef]

- Zhang, N.; Yu, K.; Chen, Z. How Does Urbanization Affect Carbon Dioxide Emissions? A Cross-Country Panel Data Analysis. Energy Policy 2017, 107, 678–687. [Google Scholar] [CrossRef]

- Yu, F.; Zheng, S.; Zheng, S.; Guo, C. Does Carbon ETS Affect the Distribution of Labor’s Slice of the Factor Income Pie? From the Low-Carbon Transition Perspective. Energy Econ. 2024, 134, 107569. [Google Scholar] [CrossRef]

- Hu, W.; He, X. The Role of Fiscal Policies in Supporting a Transition to a Low-Carbon Economy: Evidence from the Chinese Shipping Industry. Transp. Res. Part Policy Pract. 2024, 179, 103940. [Google Scholar] [CrossRef]

- Dong, K.; Dong, X.; Jiang, Q. How Renewable Energy Consumption Lowers Global CO2 Emissions? Evidence from Countries with Different Income Levels. World Econ. 2020, 43, 1665–1698. [Google Scholar] [CrossRef]

- Fang, Y.; Shao, Z. Whether Green Finance Can Effectively Moderate the Green Technology Innovation Effect of Heterogeneous Environmental Regulation. Int. J. Environ. Res. Public. Health 2022, 19, 3646. [Google Scholar] [CrossRef] [PubMed]

- Rasoulinezhad, E.; Taghizadeh-Hesary, F. Role of Green Finance in Improving Energy Efficiency and Renewable Energy Development. Energy Effic. 2022, 15, 14. [Google Scholar] [CrossRef] [PubMed]

- Zhou, Y.; Liu, H.; Wang, J.; Yang, H.; Liu, Z.; Peng, G. Spatial Differentiation and Influencing Factors of Green Finance Development Level in China. Front. Environ. Sci. 2022, 10, 1023690. [Google Scholar] [CrossRef]

- Liu, H.P.; Chen, D.J. Spatial-Temporal Differences of Support Conditions for Marine Strategic Emerging Industries in China. Ocean Dev. Manag. 2016, 33, 9–17. [Google Scholar] [CrossRef]

- Gan, C.; Zheng, R.; Yu, D. An Empirical Study on the Effects of Industrial Structure on Economic Growth and Fluctuations in China. Econ. Res. J. 2011, 46, 4–16. [Google Scholar]

- Yu, S.; Yang, L. On the Transition of Marine Industries. Ocean Dev. Manag. 2009, 26, 61–66. [Google Scholar] [CrossRef]

| Target Level | Criterion Level | Indicator Level | Index Attributes |

|---|---|---|---|

| Low-carbon transition of the marine industry | Structural adjustment of the marine industry | Advancement of the industrial structure | + |

| Rationalization of the industrial structure | + | ||

| Efficiency of the industrial structure | + | ||

| Green transition of the marine industry | Direct discharge rate of industrial wastewater into the sea | - | |

| Comprehensive utilization of industrial solid waste per unit Gross Ocean Product (GOP) | + | ||

| Industrial wastewater emissions per unit GOP | - | ||

| Industrial waste gas emissions per unit GOP | - | ||

| Growth rate of electricity consumption per unit GOP | - | ||

| Energy consumption per unit output value | - | ||

| Investment rate in marine pollution and environmental protection | + | ||

| Innovation in the marine industry | Number of marine research institutions | + | |

| Number of marine science and technology projects | + | ||

| Total number of invention patents held by marine research institutions | + | ||

| Per capita funding for marine science and technology | + | ||

| Proportion of marine research institution staff with a master’s degree or higher | + | ||

| Efficiency in the marine industry | Concentration of the primary marine industry | + | |

| Concentration of the secondary marine industry | + | ||

| Concentration of the tertiary marine industry | + |

| Primary Indicator | Secondary Indicator | Tertiary Indicator | Indicator Definition | Attribute |

|---|---|---|---|---|

| Green finance | Green credit | Green credit ratio | Interest expenditure from six high-energy-consuming industries/the total industrial interest expenditure | - |

| Green securities | Market value ratio of high-energy-consuming industries | A-share market value of six high-energy-consuming industries/total A-share market value | - | |

| Green investment | Investment ratio in environmental pollution control | Pollution control investment/GDP | + | |

| Green insurance | Agricultural insurance scale ratio | Agricultural insurance income/total agricultural output value | + | |

| Carbon finance | Carbon intensity | CO₂ emissions/GDP | - |

| Variables | Obs | Mean | SD | Min | Max |

|---|---|---|---|---|---|

| MD | 117 | 0.262 | 0.123 | 0.050 | 0.604 |

| GF | 117 | 0.006 | 0.022 | −0.075 | 0.092 |

| RE | 117 | 0.062 | 0.263 | −0.932 | 1.265 |

| UB | 117 | 0.655 | 0.123 | 0.403 | 0.896 |

| OP | 117 | 0.497 | 0.343 | 0.082 | 1.590 |

| TH | 117 | 0.019 | 0.040 | −0.038 | 0.280 |

| ID | 117 | −0.005 | 0.032 | −0.143 | 0.138 |

| LR | 117 | 0.008 | 0.026 | −0.061 | 0.183 |

| Variables | (1) | (2) | (3) |

|---|---|---|---|

| GF | 0.932 ** | 1.319 *** | 0.591 ** |

| (0.451) | (0.477) | (0.297) | |

| RE | 0.234 *** | 0.237 *** | 0.077 ** |

| (0.037) | (0.037) | (0.030) | |

| UB | −0.084 | 0.436 ** | |

| (0.106) | (0.178) | ||

| OP | 0.033 | −0.248 *** | |

| (0.038) | (0.067) | ||

| TH | −0.284 | −0.411 ** | |

| (0.282) | (0.192) | ||

| ID | 0.559 * | 0.099 | |

| (0.320) | (0.220) | ||

| LR | −0.849 * | 0.573 ** | |

| (0.434) | (0.272) | ||

| Constant | 0.243 *** | 0.294 *** | 0.096 |

| (0.010) | (0.059) | (0.117) | |

| Controls | NO | YES | YES |

| Pro FE | NO | NO | YES |

| Year FE | NO | NO | YES |

| Observations | 117 | 117 | 117 |

| Adjusted R-squared | 0.283 | 0.298 | 0.803 |

| Variables | (1) | (2) | (3) |

|---|---|---|---|

| GF | 0.909 ** | 1.304 *** | 0.580 * |

| (0.452) | (0.476) | (0.293) | |

| RE | 0.235 *** | 0.241 *** | 0.082 *** |

| (0.037) | (0.037) | (0.030) | |

| GF*RE | 0.235 | 0.282 | 0.229 * |

| (0.216) | (0.216) | (0.124) | |

| UB | −0.080 | 0.439 ** | |

| (0.106) | (0.176) | ||

| OP | 0.033 | −0.261 *** | |

| (0.038) | (0.066) | ||

| TH | −0.317 | −0.428 ** | |

| (0.283) | (0.189) | ||

| ID | 0.609 * | 0.120 | |

| (0.322) | (0.217) | ||

| LR | −0.831 * | 0.577 ** | |

| (0.433) | (0.268) | ||

| Constant | 0.241 *** | 0.289 *** | 0.098 |

| (0.010) | (0.059) | (0.116) | |

| Controls | NO | YES | YES |

| Pro FE | NO | NO | YES |

| Year FE | NO | NO | YES |

| Observations | 117 | 117 | 117 |

| Adjusted R-squared | 0.284 | 0.303 | 0.809 |

| Variables | Replacing the Independent Variable | Replacing the Dependent Variable | Replacing the Control Variable | The Lagged Independent Variable |

|---|---|---|---|---|

| MD | md | MD | MD | |

| GF | 0.141 ** | 0.882 *** | ||

| (0.059) | (0.331) | |||

| RE | 0.192 ** | 0.090 *** | ||

| (0.077) | (0.032) | |||

| GF*RE | 0.812 ** | 0.252 * | ||

| (0.263) | (0.135) | |||

| gf | 0.519 *** | 0.513 ** | ||

| (0.151) | (0.166) | |||

| re | 0.246 *** | 0.430 * | ||

| (0.039) | (0.209) | |||

| gf*re | 0.101 * | 0.390 *** | ||

| (0.055) | (0.092) | |||

| UB | 0.502 * | 0.749 | 0.005 | |

| (0.235) | (0.710) | (0.167) | ||

| OP | −0.386 *** | −0.103 * | −0.031 *** | |

| (0.056) | (0.049) | (0.007) | ||

| TH | −0.253 ** | 0.157 ** | 0.834 *** | |

| (0.096) | (0.070) | (0.165) | ||

| ID | 0.188 | −0.065 | 0.597 | |

| (0.222) | (1.670) | (0.602) | ||

| LR | −1.169 ** | 0.750 | 0.429 * | |

| (0.410) | (0.537) | (0.194) | ||

| GI | −1.251 | |||

| (1.341) | ||||

| SC | −0.201 *** | |||

| (0.070) | ||||

| ER | −0.146 | |||

| (0.626) | ||||

| RD | −0.079 | |||

| (6.763) | ||||

| _cons | 0.118 | −0.225 | 0.354 *** | 0.449 *** |

| (0.131) | (0.582) | (0.059) | (0.086) | |

| Controls | Yes | Yes | Yes | Yes |

| Pro FE | Yes | Yes | Yes | Yes |

| Year FE | Yes | Yes | Yes | Yes |

| Observations | 72.000 | 107.000 | 117.000 | 106.000 |

| Adjusted R-squared | 0.597 | 0.781 | 0.452 | 0.550 |

| Variables | Low-Level Group | Sub-Low-Level Group | Sub-High-Level Group | High-Level Group |

|---|---|---|---|---|

| GF | 0.361 *** | 0.580 *** | 0.782 *** | 1.835 ** |

| (0.057) | (0.095) | (0.039) | (0.560) | |

| RE | 0.984 ** | 0.782 *** | 0.201 *** | 0.155 ** |

| (0.304) | (0.203) | (0.030) | (0.039) | |

| GF*RE | 0.185 * | 0.152 * | 0.372 *** | 0.704 * |

| (0.089) | (0.064) | (0.033) | (0.228) | |

| UB | 0.064 * | −0.086 | 0.370 *** | 0.713 |

| (0.032) | (0.210) | (0.086) | (0.394) | |

| OP | −0.010 | 0.069 | 0.105 *** | −0.059 |

| (0.038) | (0.067) | (0.003) | (0.068) | |

| TH | 0.560 ** | −2.507 | 1.945 *** | 0.832 * |

| (0.169) | (2.722) | (0.160) | (0.275) | |

| ID | 0.224 *** | −0.287 * | −1.723 *** | 0.533 |

| (0.047) | (0.134) | (0.228) | (0.271) | |

| LR | −0.609 *** | −0.219 | −0.089 *** | 0.781 ** |

| (0.120) | (0.309) | (0.020) | (0.232) | |

| _cons | 0.092 ** | 0.237 * | −0.068 | −0.004 |

| (0.033) | (0.110) | (0.056) | (0.239) | |

| Controls | Yes | Yes | Yes | Yes |

| Pro FE | Yes | Yes | Yes | Yes |

| Year FE | Yes | Yes | Yes | Yes |

| Observations | 23.000 | 23.000 | 17.000 | 18.000 |

| Adjusted R-squared | 0.820 | 0.548 | 0.999 | 0.937 |

| Variables | Northern Region | Eastern Region | Southern Region |

|---|---|---|---|

| GF | 1.927 *** | 2.102 * | 1.315 *** |

| (0.014) | (0.584) | (0.007) | |

| RE | 0.571 *** | 0.225 ** | 0.701 *** |

| (0.069) | (0.029) | (0.094) | |

| GF*RE | 0.886 ** | 0.574 *** | 0.106 * |

| (0.156) | (0.005) | (0.037) | |

| UB | −0.321 | 0.156 | 0.547 ** |

| (0.141) | (0.074) | (0.101) | |

| OP | −0.487 *** | −0.344 *** | −0.112 |

| (0.077) | (0.016) | (0.076) | |

| TH | 0.417 *** | 0.122 ** | 0.203 ** |

| (0.010) | (0.025) | (0.046) | |

| ID | 0.152 *** | 0.317 *** | 0.736 |

| (0.008) | (0.007) | (0.400) | |

| LR | 0.817 * | 0.186* | −0.496 |

| (0.289) | (0.060) | (0.413) | |

| _cons | 0.548 *** | 0.408 ** | −0.041 |

| (0.077) | (0.049) | (0.098) | |

| Controls | Yes | Yes | Yes |

| Pro FE | Yes | Yes | Yes |

| Year FE | Yes | Yes | Yes |

| Observations | 14.000 | 15.000 | 30.000 |

| Adjusted R-squared | 0.944 | 0.974 | 0.809 |

| Variables | High | Medium | Low |

|---|---|---|---|

| GF | 1.420 ** | 1.010 ** | 0.402 * |

| (0.419) | (0.182) | (0.132) | |

| RE | 0.105 ** | 0.925 ** | 0.119 ** |

| (0.025) | (0.253) | (0.026) | |

| GF*RE | 0.557 ** | 0.690 ** | 0.885 ** |

| (0.135) | (0.147) | (0.163) | |

| UB | 0.507 * | 0.216 | −0.314 |

| (0.166) | (0.118) | (0.195) | |

| OP | −0.316 *** | −0.134 ** | −0.017 |

| (0.028) | (0.029) | (0.075) | |

| TH | 0.129 ** | −0.454 *** | −0.506 |

| (0.036) | (0.065) | (0.453) | |

| ID | 0.329 ** | 0.823 *** | 0.530 |

| (0.096) | (0.139) | (0.195) | |

| LR | −0.374 | −0.699 ** | −0.351 * |

| (0.355) | (0.169) | (0.118) | |

| _cons | 0.208 | 0.159 | 0.344 * |

| (0.105) | (0.080) | (0.115) | |

| Controls | Yes | Yes | Yes |

| Pro FE | Yes | Yes | Yes |

| Year FE | Yes | Yes | Yes |

| Observations | 30.000 | 23.000 | 33.000 |

| Adjusted R-squared | 0.925 | 0.794 | 0.743 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Xu, W.; Qi, J. The Impact of Green Finance and Renewable Energy Development on the Low-Carbon Transition of the Marine Industry: Evidence from Coastal Provinces and Cities in China. Energies 2025, 18, 1464. https://doi.org/10.3390/en18061464

Xu W, Qi J. The Impact of Green Finance and Renewable Energy Development on the Low-Carbon Transition of the Marine Industry: Evidence from Coastal Provinces and Cities in China. Energies. 2025; 18(6):1464. https://doi.org/10.3390/en18061464

Chicago/Turabian StyleXu, Weicheng, and Jiaxin Qi. 2025. "The Impact of Green Finance and Renewable Energy Development on the Low-Carbon Transition of the Marine Industry: Evidence from Coastal Provinces and Cities in China" Energies 18, no. 6: 1464. https://doi.org/10.3390/en18061464

APA StyleXu, W., & Qi, J. (2025). The Impact of Green Finance and Renewable Energy Development on the Low-Carbon Transition of the Marine Industry: Evidence from Coastal Provinces and Cities in China. Energies, 18(6), 1464. https://doi.org/10.3390/en18061464