Threshold Effects of Renewable Energy Investment on the Energy Efficiency–Fossil Fuel Consumption Nexus: Evidence from 71 Countries

Abstract

1. Introduction

2. Theoretical Framework and Literature Review

2.1. Theoretical Framework

2.2. Energy Efficiency, Renewable Energy, and Fossil Fuel Consumption

3. Research Design

3.1. Model Construction

3.2. Variable Selection

3.3. Data Sources

4. Results

4.1. Benchmark Regression

4.2. Threshold Effect Results

4.3. Robustness Tests

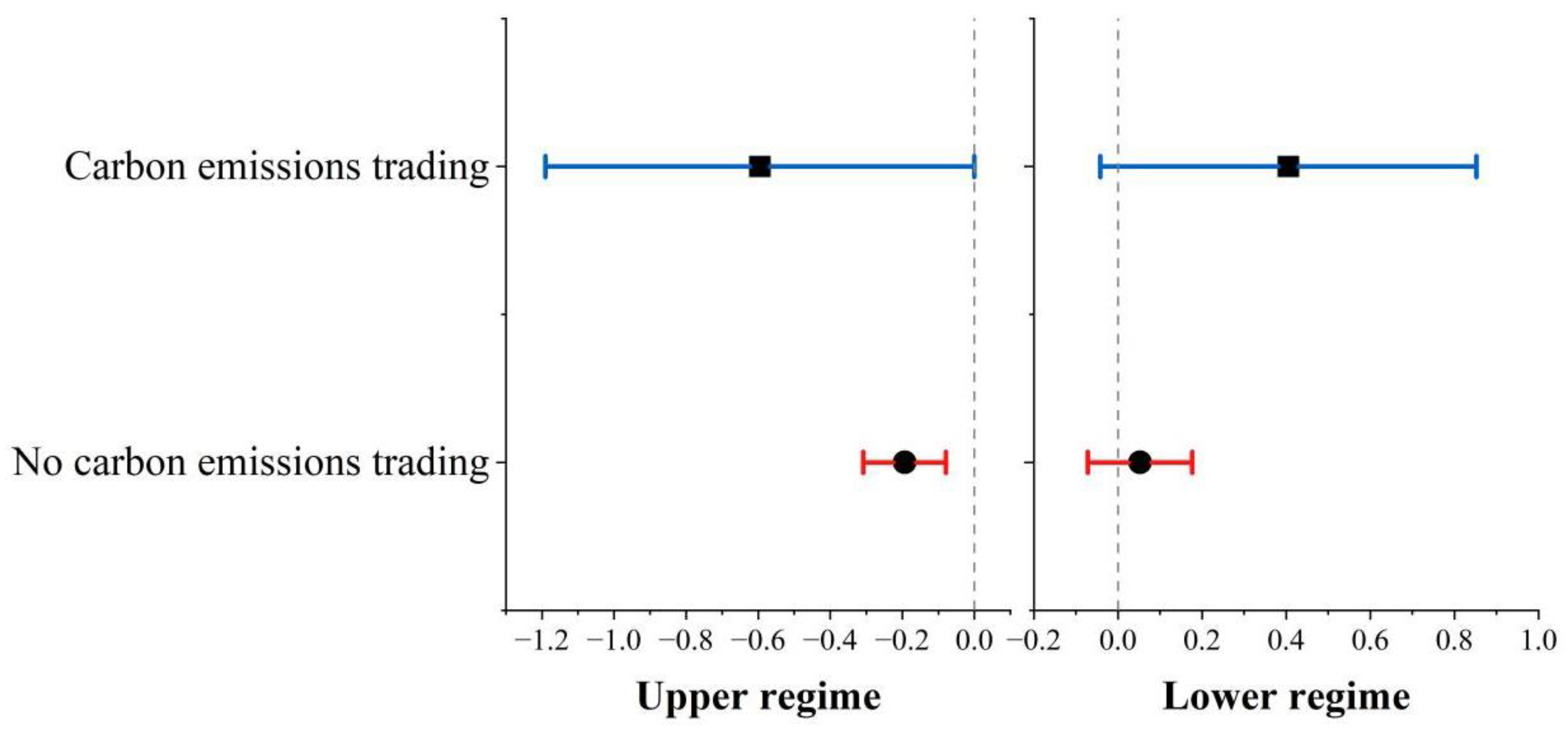

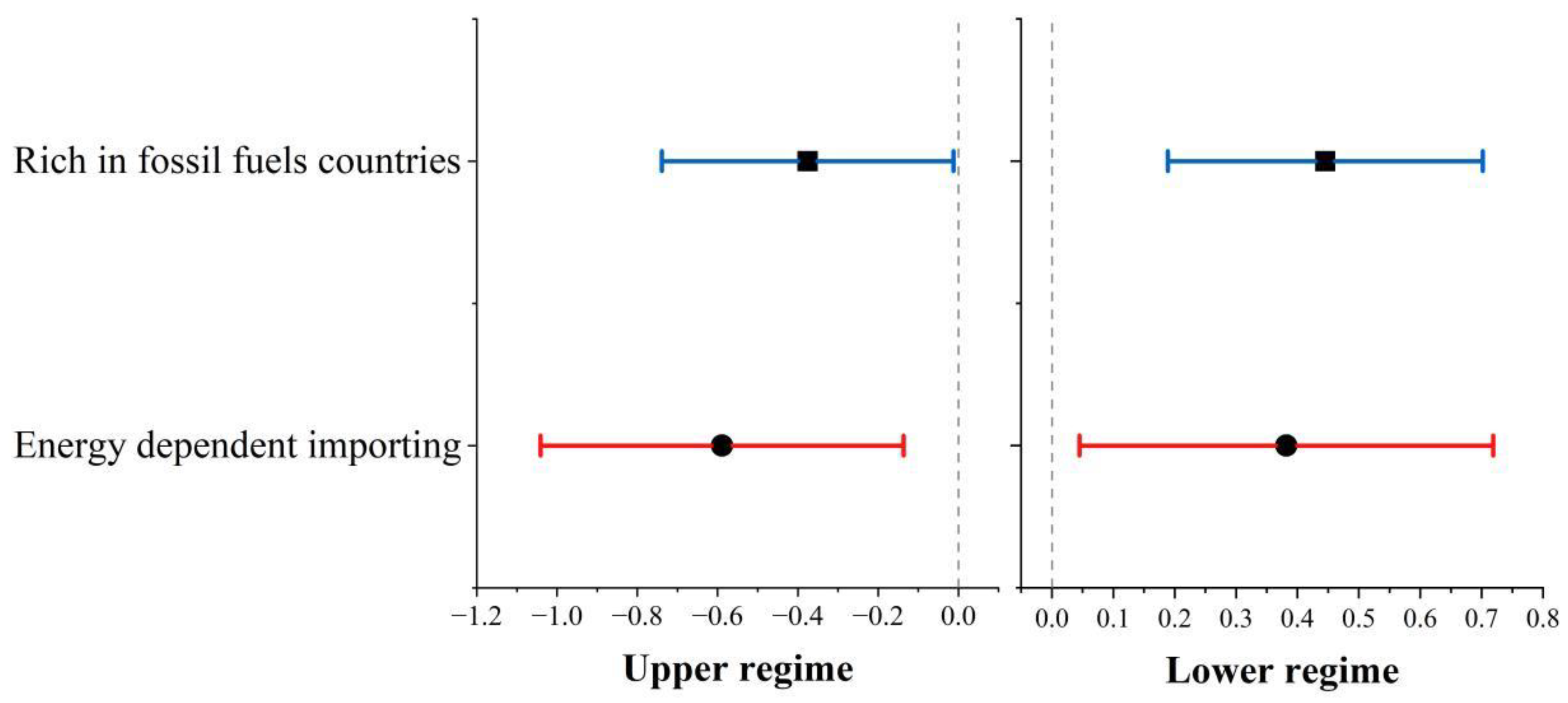

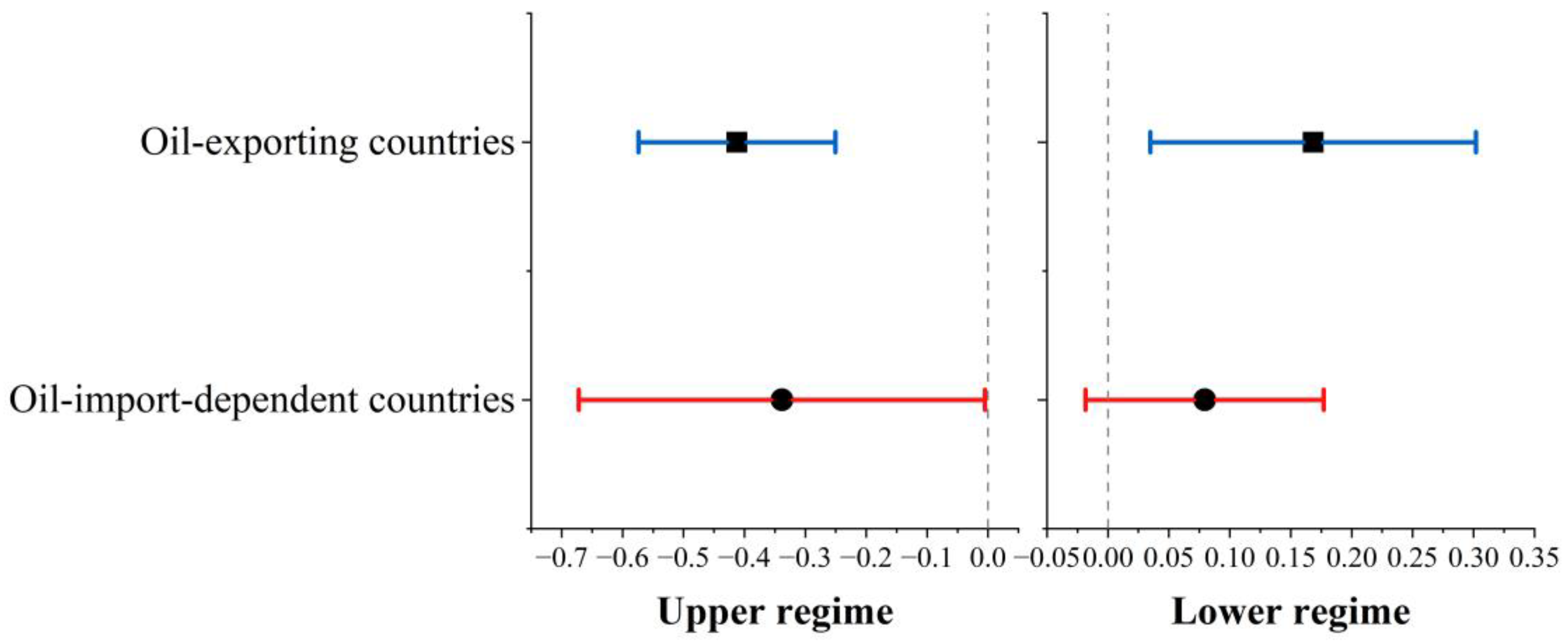

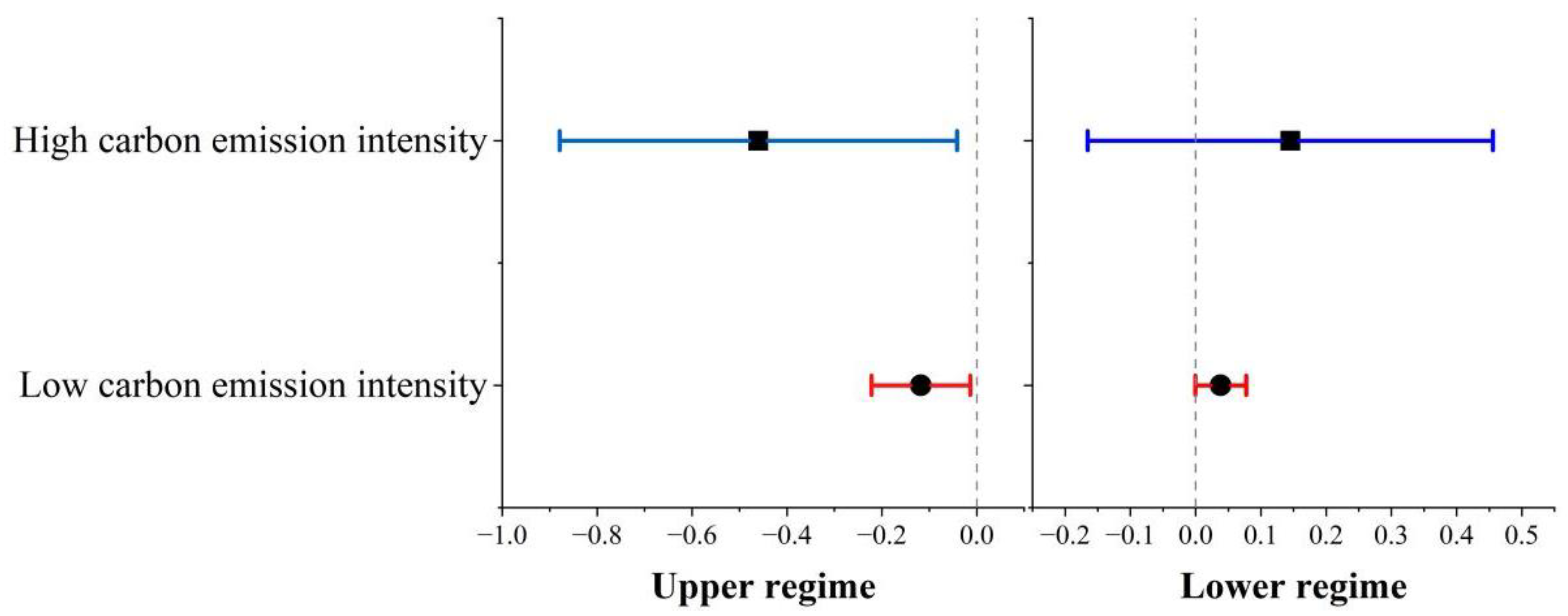

4.4. Heterogeneity Analysis

5. Discussion

6. Conclusions and Policy Recommendations

6.1. Conclusions

6.2. Policy Recommendations

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Zou, S.; Fan, X.; Zhou, Y.; Cui, Y. Achieving Collaborative Pollutant and Carbon Emissions Reduction through Digital Governance: Evidence from Chinese Enterprises. Environ. Res. 2024, 263, 120197. [Google Scholar] [CrossRef]

- Kong, F.; Ren, H. Advances in Green Energy, Environment and Carbon Neutralization. Energies 2025, 18, 1016. [Google Scholar] [CrossRef]

- Abbasi, K.R.; Zhang, Q.; Ozturk, I.; Alvarado, R.; Musa, M. Energy Transition, Fossil Fuels, and Green Innovations: Paving the Way to Achieving Sustainable Development Goals in the United States. Gondwana Res. 2024, 130, 326–341. [Google Scholar] [CrossRef]

- Egerer, J.; Farhang-Damghani, N.; Grimm, V.; Runge, P. The Industry Transformation from Fossil Fuels to Hydrogen Will Reorganize Value Chains: Big Picture and Case Studies for Germany. Appl. Energy 2024, 358, 122485. [Google Scholar] [CrossRef]

- Rabaa, S.; Wilken, R.; Geisendorf, S. Does Recalling Energy Efficiency Measures Reduce Subsequent Climate-Friendly Behavior? An Experimental Study of Moral Licensing Rebound Effects. Ecol. Econ. 2024, 217, 108051. [Google Scholar] [CrossRef]

- Huntington, H.G. US Gasoline Response to Vehicle Fuel Efficiency: A Contribution to the Direct Rebound Effect. Energy Econ. 2024, 136, 107655. [Google Scholar] [CrossRef]

- Lu, M.; Wang, K. The Direct Energy Rebound Effects for Manufacturing and Service Sectors in China: Evidence from Firm-Level Estimations. J. Clean. Prod. 2024, 474, 143617. [Google Scholar] [CrossRef]

- Kim, B.-J.; Hyun, M.-K.; Yoo, S.-H. Economic Effects of the Hydrogen Fuel Cell Sector in South Korea: An Input-Output Analysis. Int. J. Hydrogen Energy 2024, 68, 955–969. [Google Scholar] [CrossRef]

- Ozkan, O.; Coban, M.N.; Destek, M.A. Navigating the Winds of Change: Assessing the Impact of Wind Energy Innovations and Fossil Energy Efficiency on Carbon Emissions in China. Renew. Energy 2024, 228, 120623. [Google Scholar] [CrossRef]

- Osuma, G.; Bonga-Bonga, L. The Effects of Foreign Direct Investment and Technological Innovation on Renewable Energy Consumption Under Varying Market Conditions in the EU. Energies 2025, 18, 1353. [Google Scholar] [CrossRef]

- Jaiswal, K.K.; Chowdhury, C.R.; Yadav, D.; Verma, R.; Dutta, S.; Jaiswal, K.S.; Sangmesh, B.; Karuppasamy, K.S.K. Renewable and Sustainable Clean Energy Development and Impact on Social, Economic, and Environmental Health. Energy Nexus 2022, 7, 100118. [Google Scholar] [CrossRef]

- Li, C.; Li, X.; Zhang, M.; Yang, B. Sustainable Development through Clean Energy: The Role of Mineral Resources in Promoting Access to Clean Electricity. Resour. Policy 2024, 90, 104675. [Google Scholar] [CrossRef]

- Marques, A.C.; Fuinhas, J.A.; Tomás, C. Energy Efficiency and Sustainable Growth in Industrial Sectors in European Union Countries: A Nonlinear ARDL Approach. J. Clean. Prod. 2019, 239, 118045. [Google Scholar] [CrossRef]

- Seo, M.H.; Kim, S.; Kim, Y.-J. Estimation of Dynamic Panel Threshold Model Using Stata. Stata J. 2019, 19, 685–697. [Google Scholar] [CrossRef]

- Abudureheman, M.; Jiang, Q.; Dong, X.; Dong, C. CO2 Emissions in China: Does the Energy Rebound Matter? Energies 2022, 15, 4279. [Google Scholar] [CrossRef]

- Du, K.; Liu, X.; Zhao, C. Environmental Regulation Mitigates Energy Rebound Effect. Energy Econ. 2023, 125, 106851. [Google Scholar] [CrossRef]

- Angelico, R.; Giametta, F.; Bianchi, B.; Catalano, P. Green Hydrogen for Energy Transition: A Critical Perspective. Energies 2025, 18, 404. [Google Scholar] [CrossRef]

- World Energy Transitions Outlook. 2022. Available online: https://www.irena.org/Digital-Report/World-Energy-Transitions-Outlook-2022 (accessed on 9 April 2025).

- Ehigiamusoe, K.U.; Dogan, E. The Role of Interaction Effect between Renewable Energy Consumption and Real Income in Carbon Emissions: Evidence from Low-Income Countries. Renew. Sustain. Energy Rev. 2022, 154, 111883. [Google Scholar] [CrossRef]

- Yang, X.; He, L.; Xia, Y.; Chen, Y. Effect of Government Subsidies on Renewable Energy Investments: The Threshold Effect. Energy Policy 2019, 132, 156–166. [Google Scholar] [CrossRef]

- Energy Efficiency 2024—Analysis—IEA. Available online: https://www.iea.org/reports/energy-efficiency-2024 (accessed on 9 April 2025).

- Du, M.; Huang, C.; Liao, L. Trade Liberalization and Energy Efficiency: Quasi-Natural Experiment Evidence from the Pilot Free Trade Zones in China. Econ. Anal. Policy 2025, 85, 1739–1751. [Google Scholar] [CrossRef]

- Tanaka, K. Review of Policies and Measures for Energy Efficiency in Industry Sector. Energy Policy 2011, 39, 6532–6550. [Google Scholar] [CrossRef]

- Liu, H.; Yu, S.; Wang, T.; Li, J.; Wang, Y. A Systematic Review on Sustainability Assessment of Internal Combustion Engines. J. Clean. Prod. 2024, 451, 141996. [Google Scholar] [CrossRef]

- Araújo, I.; Nunes, L.J.R.; Curado, A. Photovoltaic Production Management under Constrained Regulatory Requirements: A Step towards a Local Energy Community Creation. Energies 2023, 16, 7625. [Google Scholar] [CrossRef]

- Chen, W.; Chen, J.; Ma, Y. Renewable Energy Investment and Carbon Emissions under Cap-and-Trade Mechanisms. J. Clean. Prod. 2021, 278, 123341. [Google Scholar] [CrossRef]

- Ebaidalla, E.M. The Impact of Taxation, Technological Innovation and Trade Openness on Renewable Energy Investment: Evidence from the Top Renewable Energy Producing Countries. Energy 2024, 306, 132539. [Google Scholar] [CrossRef]

- Yang, Z.; Zhang, M.; Liu, L.; Zhou, D. Can Renewable Energy Investment Reduce Carbon Dioxide Emissions? Evidence from Scale and Structure. Energy Econ. 2022, 112, 106181. [Google Scholar] [CrossRef]

- Hussain, J.; Zhou, K.; Muhammad, F.; Khan, D.; Khan, A.; Ali, N.; Akhtar, R. Renewable Energy Investment and Governance in Countries along the Belt & Road Initiative: Does Trade Openness Matter? Renew. Energy 2021, 180, 1278–1289. [Google Scholar] [CrossRef]

- Shahbaz, M.; Topcu, B.A.; Sarıgül, S.S.; Vo, X.V. The Effect of Financial Development on Renewable Energy Demand: The Case of Developing Countries. Renew. Energy 2021, 178, 1370–1380. [Google Scholar] [CrossRef]

- Omri, A.; Belaïd, F. Does Renewable Energy Modulate the Negative Effect of Environmental Issues on the Socio-Economic Welfare? J. Environ. Manag. 2021, 278, 111483. [Google Scholar] [CrossRef]

- Zou, S.; Fan, X.; Wang, L.; Cui, Y. High-Speed Rail New Towns and Their Impacts on Urban Sustainable Development: A Spatial Analysis Based on Satellite Remote Sensing Data. Humanit. Soc. Sci. Commun. 2024, 11, 894. [Google Scholar] [CrossRef]

- Umar, M.; Ji, X.; Kirikkaleli, D.; Alola, A.A. The Imperativeness of Environmental Quality in the United States Transportation Sector amidst Biomass-Fossil Energy Consumption and Growth. J. Clean. Prod. 2021, 285, 124863. [Google Scholar] [CrossRef]

- Zhao, D.; Lin, J.; Bashir, M.A. Analyze the Effect of Energy Efficiency, Natural Resources, and the Digital Economy on Ecological Footprint in OCED Countries: The Mediating Role of Renewable Energy. Resour. Policy 2024, 95, 105198. [Google Scholar] [CrossRef]

- Sher, F.; Smječanin, N.; Hrnjić, H.; Bakunić, E.; Sulejmanović, J. Prospects of Renewable Energy Potentials and Development in Bosnia and Herzegovina—A Review. Renew. Sustain. Energy Rev. 2024, 189, 113929. [Google Scholar] [CrossRef]

- Wu, B.; Wang, Z.; Tian, Y.; Zheng, S. The Impact of Industrial Transformation and Upgrading on Fossil Energy Elasticity in China. J. Clean. Prod. 2024, 434, 140287. [Google Scholar] [CrossRef]

- Song, A.; Rasool, Z.; Nazar, R.; Anser, M.K. Towards a Greener Future: How Green Technology Innovation and Energy Efficiency Are Transforming Sustainability. Energy 2024, 290, 129891. [Google Scholar] [CrossRef]

- Zhao, J.; Sinha, A.; Inuwa, N.; Wang, Y.; Murshed, M.; Abbasi, K.R. Does Structural Transformation in Economy Impact Inequality in Renewable Energy Productivity? Implications for Sustainable Development. Renew. Energy 2022, 189, 853–864. [Google Scholar] [CrossRef]

- Dong, F.; Li, Y.; Gao, Y.; Zhu, J.; Qin, C.; Zhang, X. Energy Transition and Carbon Neutrality: Exploring the Non-Linear Impact of Renewable Energy Development on Carbon Emission Efficiency in Developed Countries. Resour. Conserv. Recycl. 2022, 177, 106002. [Google Scholar] [CrossRef]

- Hong, Q.; Cui, L.; Hong, P. The Impact of Carbon Emissions Trading on Energy Efficiency: Evidence from Quasi-Experiment in China’s Carbon Emissions Trading Pilot. Energy Econ. 2022, 110, 106025. [Google Scholar] [CrossRef]

| Variables | Obs | Mean | Std. Dev. | Min | Max | VIF |

|---|---|---|---|---|---|---|

| FE | 1704 | 6.120 | 1.488 | 2.113 | 10.563 | |

| EE | 1704 | 8.330 | 2.195 | 0.693 | 14.19 | 8.03 |

| INV | 1704 | 0.971 | 0.128 | 0.284 | 3.287 | 1.04 |

| PGDP | 1704 | 7.770 | 1.675 | 1.749 | 12.304 | 2.12 |

| POP | 1704 | 16.872 | 1.623 | 12.547 | 21.08 | 3.88 |

| IND | 1704 | 3.323 | 0.302 | 2.341 | 4.44 | 1.43 |

| CE | 1704 | 4.728 | 1.492 | 1.049 | 9.451 | 8.03 |

| TECH | 1704 | 7.687 | 2.160 | 1.792 | 14.318 | 4.61 |

| Variables | Model (1) (OLS) | Model (2) (FE) | Model (3) (RE) | Model (3) (Dif-GMM) | Model (4) (Sym-GMM) |

|---|---|---|---|---|---|

| L.FE | 0.933 *** (0.007) | 0.519 *** (0.017) | 0.901 *** (0.008) | 0.840 *** (0.008) | 0.848 *** (0.047) |

| EE | −0.167 *** (0.011) | −0.088 *** (0.01) | −0.157 *** (0.011) | −0.147 *** (0.003) | −0.148 *** (0.046) |

| INV | −0.008 *** (0.001) | −0.008 *** (0.003) | −0.009 *** (0.001) | −0.011 *** (0.001) | −0.011 *** (0.003) |

| PGDP | 0.003 ** (0.002) | 0.041 *** (0.009) | 0.004 ** (0.002) | 0.006 *** (0.001) | 0.005 (0.006) |

| POP | 0.011 *** (0.002) | 0.064 ** (0.025) | 0.009 *** (0.002) | 0.008 *** (0.001) | 0.008 *** (0.003) |

| IND | 0.026 *** (0.006) | 0.007 (0.014) | 0.024 *** (0.007) | 0.017 *** (0.004) | 0.021 * (0.011) |

| CE | 0.054 *** (0.007) | 0.433 *** (0.016) | 0.087 *** (0.009) | 0.147 *** (0.009) | 0.137 *** (0.05) |

| TECH | 0.006 *** (0.001) | 0.006 ** (0.003) | 0.007 *** (0.002) | 0.009 *** (0.001) | 0.009 ** (0.005) |

| _cons | 0.043 (0.034) | −0.430 (0.390) | 0.107 ** (0.042) | 0.226 *** (0.028) | 0.201 ** (0.097) |

| R-squared | 0.985 | 0.993 | 0.998 | ||

| AR(1) | −3.64 *** | −3.73 *** | |||

| AR(2) | −0.01 | −0.02 | |||

| Hansen test | 69.06 *** | 69.06 *** | |||

| Number of obs | 1633 | 1633 | 1633 | 1633 | 1633 |

| Number of groups | 71 | 71 | 71 | 71 | 71 |

| Variables | Lower Regime | Upper Regime | Overall | Threshold Estimation Test | |

|---|---|---|---|---|---|

| L.FE | 0.198 *** (0.036) | −0.089 * (0.051) | 0.186 *** (0.009) | kink | 0.070 *** (0.017) |

| EE | 0.074 *** (0.015) | −0.124 *** (0.034) | −0.049 *** (0.008) | Threshold indicator | 8.729 *** (0.179) |

| Controls | Yes | 95% Conf.interval | 8.37–9.08 | ||

| _cons | 4.355 *** (0.653) | ||||

| First-Stage | 2SLS | |

|---|---|---|

| EE | −6.331 ** (0.048) | |

| iv | −0.118 ** (0.005) | |

| Constant | 1.266 (0.065) | 9.221 *** (3.878) |

| Controls | Yes | |

| R2 | 0.2003 | 0.8786 |

| Root MSE | 0.037 | 0.686 |

| First-stage F | 11.15 *** | |

| 2SLS Wald chi2 | 9436.83 *** | |

| Robust score chi2 | 12.816 *** | |

| Robust regression F | 13.439 *** | |

| Replace FE | Replace EE | Replace INV | ||||

|---|---|---|---|---|---|---|

| Variables | Lower Regime | Upper Regime | Lower Regime | Upper Regime | Lower Regime | Upper Regime |

| L.FE | 0.316 *** (0.047) | −0.146 * (0.083) | 0.172 *** (0.020) | 0.013 (0.02) | −0.011 (0.036) | 0.045 (0.047) |

| EE | 0.018 *** (0.004) | −0.085 *** (0.011) | 1.083 *** (0.068) | −1.075 *** (0.071) | 0.698 *** (0.081) | −0.690 *** (0.080) |

| Controls | Yes | Yes | Yes | |||

| _cons | 0.948 ** (0.400) | 4.038 *** (0.642) | 1.456 * (0.800) | |||

| Threshold indicator | 9.322 *** (0.303) | 8.848 *** (0.086) | 3.629 *** (0.046) | |||

| kink | 0.029 *** (0.010) | 0.106 *** (0.014) | 0.133 *** (0.022) | |||

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Chang, Q.; Fan, X.; Zou, S. Threshold Effects of Renewable Energy Investment on the Energy Efficiency–Fossil Fuel Consumption Nexus: Evidence from 71 Countries. Energies 2025, 18, 2078. https://doi.org/10.3390/en18082078

Chang Q, Fan X, Zou S. Threshold Effects of Renewable Energy Investment on the Energy Efficiency–Fossil Fuel Consumption Nexus: Evidence from 71 Countries. Energies. 2025; 18(8):2078. https://doi.org/10.3390/en18082078

Chicago/Turabian StyleChang, Qing, Xiangbo Fan, and Shaohui Zou. 2025. "Threshold Effects of Renewable Energy Investment on the Energy Efficiency–Fossil Fuel Consumption Nexus: Evidence from 71 Countries" Energies 18, no. 8: 2078. https://doi.org/10.3390/en18082078

APA StyleChang, Q., Fan, X., & Zou, S. (2025). Threshold Effects of Renewable Energy Investment on the Energy Efficiency–Fossil Fuel Consumption Nexus: Evidence from 71 Countries. Energies, 18(8), 2078. https://doi.org/10.3390/en18082078