The Impact of Environmental Policies on Renewable Energy Storage Decisions in the Power Supply Chain

Abstract

:1. Introduction

2. Materials and Methods

- The existing literature on renewable energy predominantly focuses investment, pricing, and the reduction in carbon emissions within the power supply chain. There is a greater emphasis on technical research regarding energy storage, while there is a scarcity of studies that examine the selection of energy storage models. Additionally, there is limited literature on improving energy storage technology from a supply chain perspective. This paper examines investment in energy storage equipment from a supply chain perspective and analyzes the effects of various stakeholders investing in such equipment, hence enhancing research on new power systems.

- China has implemented various environmental policies for the power industry, such as RPS and cap-and-trade mechanisms, with relatively mature research in this area. However, China’s policies on energy storage are still in an exploratory stage. While various provinces and cities in China have implemented different energy storage policies, the literature specifically focused on these policies remains scarce. The paper analyzes and contrasts two prevalent energy storage subsidy schemes in China, offering a foundation for governmental decision-making about the implementation of such policies.

3. Problem Definition

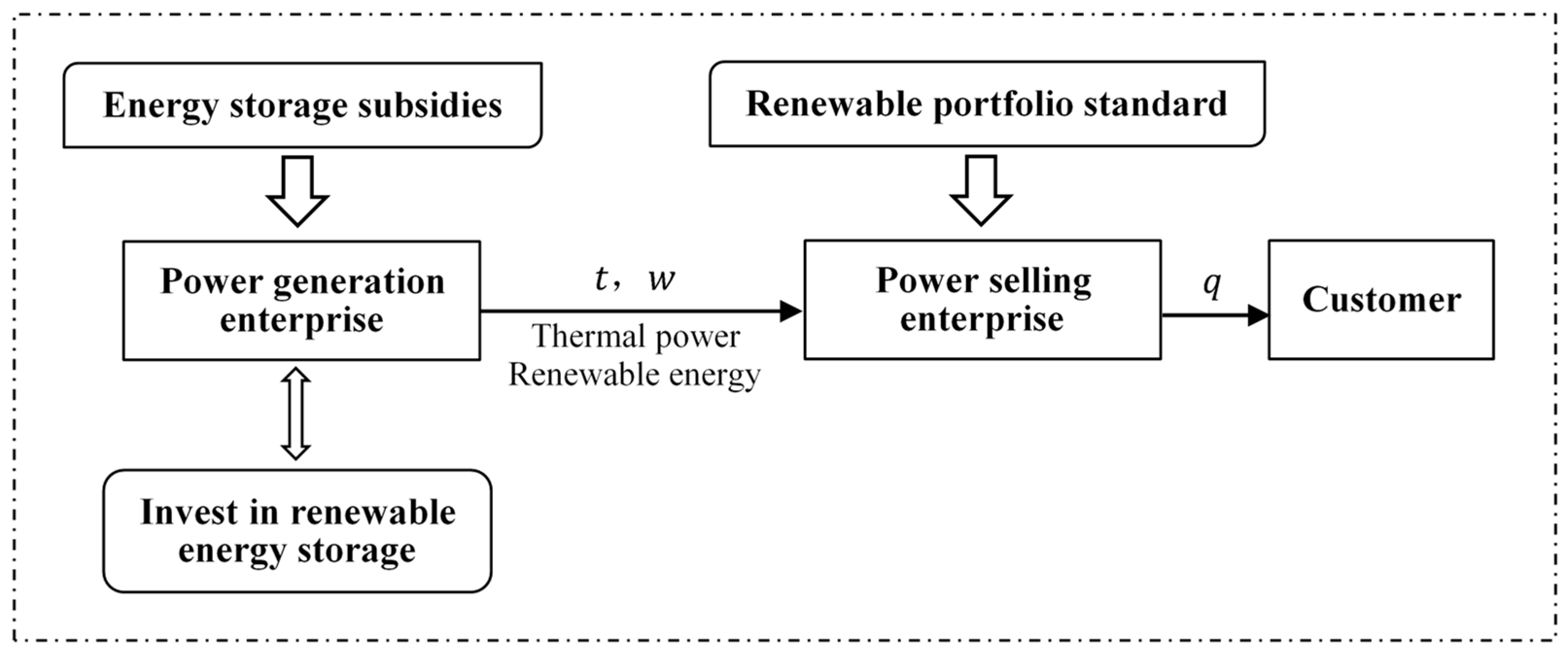

3.1. Problem Modeling

3.1.1. Scenario 1: Supply Chain Decision Model for the Power Generator Investing in Energy Storage Under Discharge Subsidy

3.1.2. Scenario 2: Supply Chain Decision Model for the Power Generator Investing in Energy Storage Under Investment Subsidy

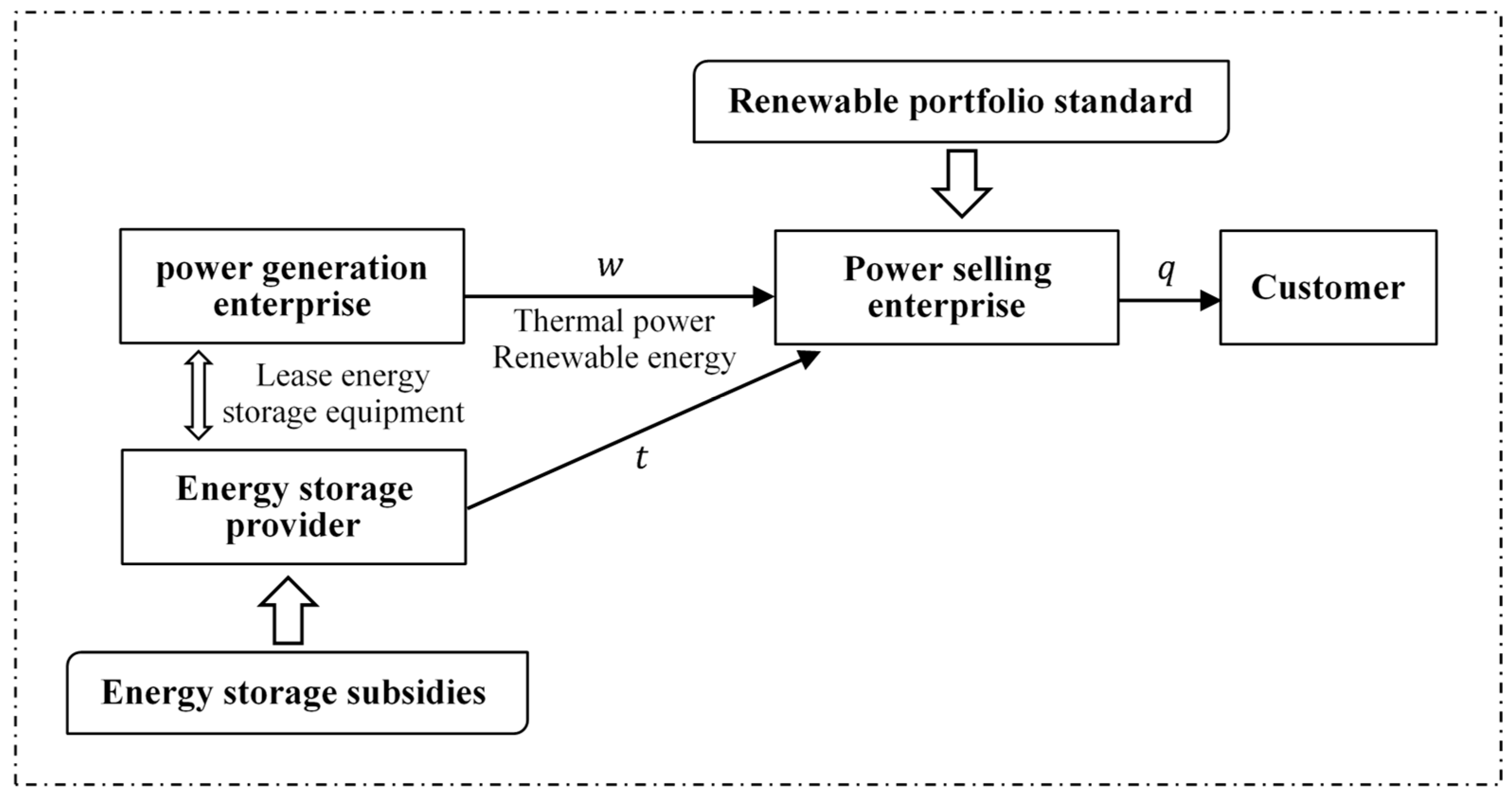

3.1.3. Scenario 3: Supply Chain Decision Model for the Power Generator Leasing Energy Storage Equipment Under Discharge Subsidy

3.1.4. Scenario 4: Supply Chain Decision Model for the Power Generator Leasing Energy Storage Equipment Under Investment Subsidy

3.2. Model Analysis

- (1)

- (2)

- (3)

- (4)

- (1)

- (2)

- (3)

- (4)

- (1)

- (2)

- (3)

- (4)

- (1)

- .

- (2)

- .

- (3)

- .

- (4)

- .

- (1)

- .

- (2)

- .

- (3)

- .

- (4)

- .

- (1)

- .

- (2)

- .

- (3)

- .

- (4)

- .

- (1)

- .

- (2)

- .

- (3)

- .

- (4)

- .

4. Numerical Analysis

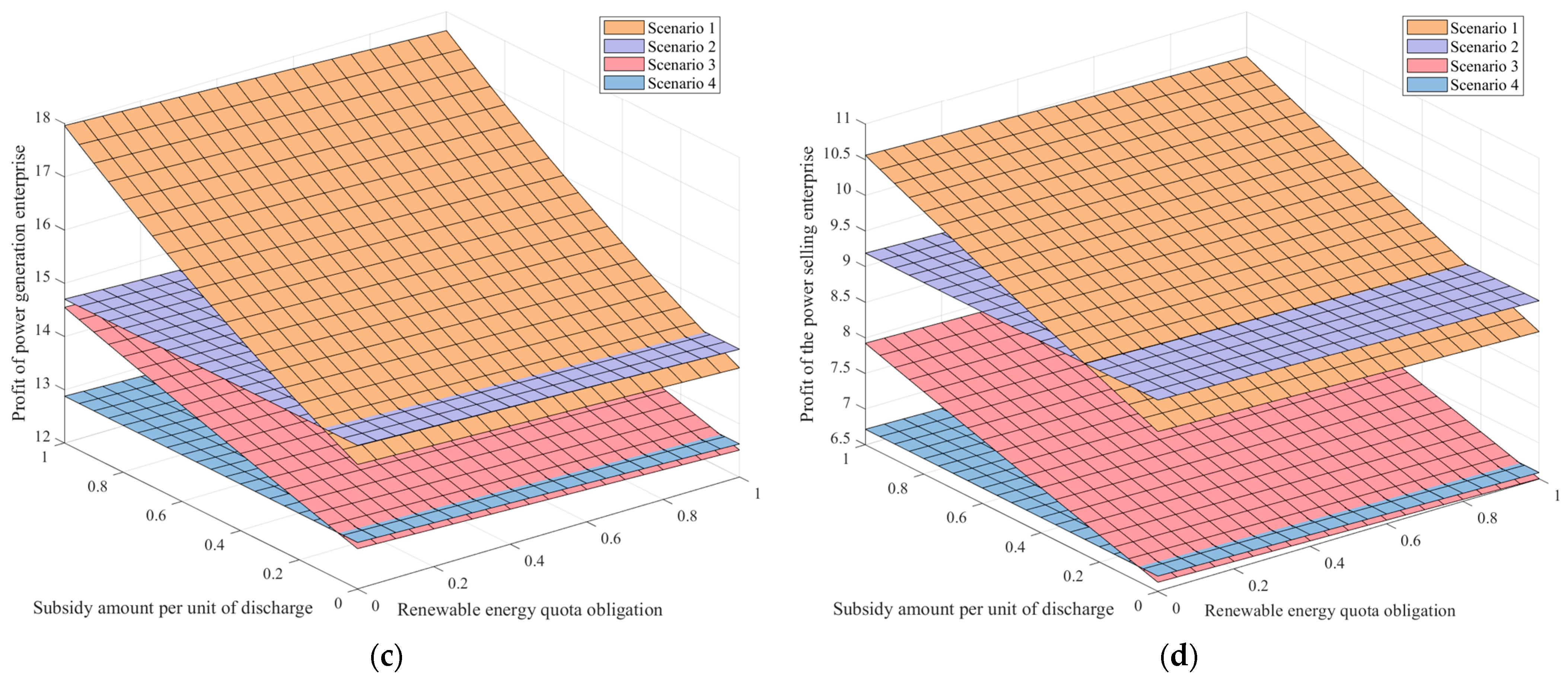

4.1. Impact of Renewable Energy Quota Obligation and Subsidy Amount per Unit of Discharge on Equilibrium Solutions

4.2. Impact of Renewable Energy Quota Obligation and Subsidy Ratio of Energy Storage Investment on the Equilibrium Solution

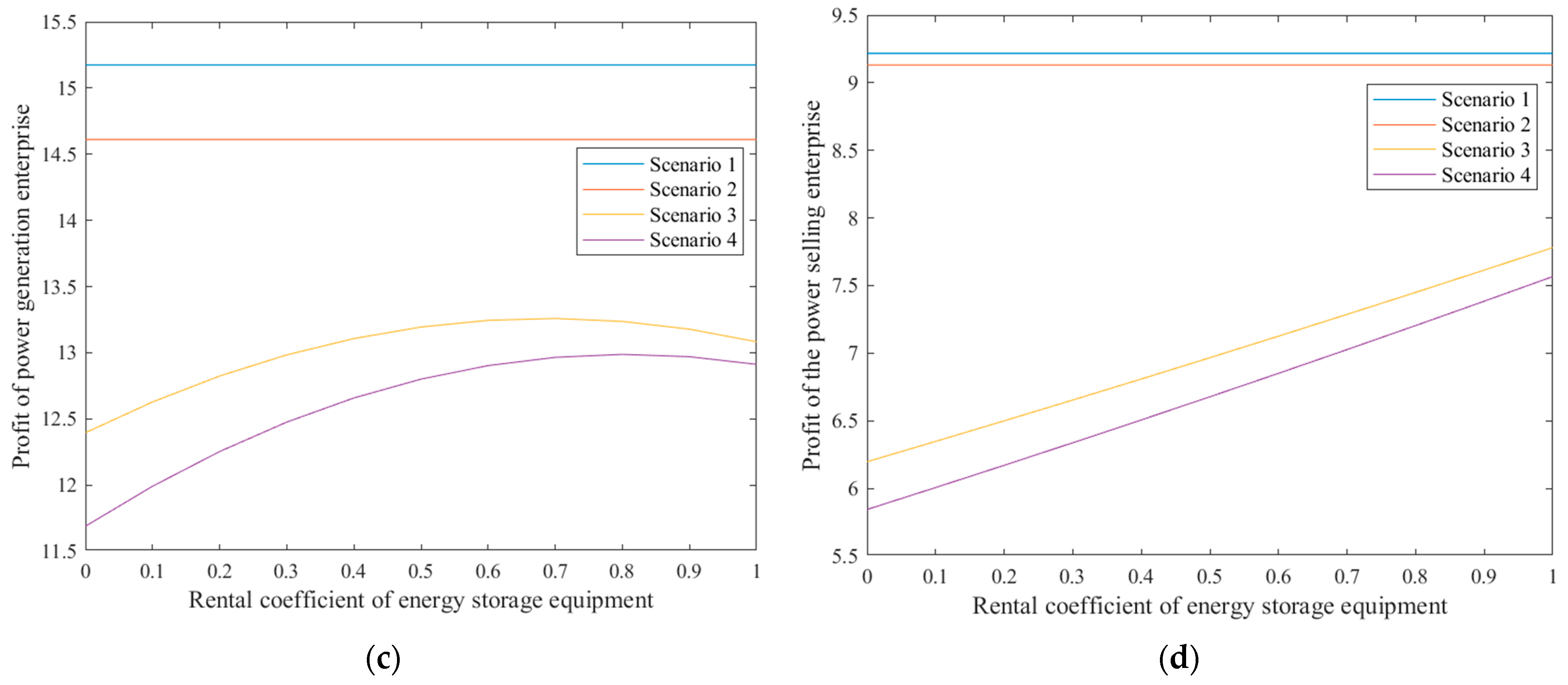

4.3. Impact of Lease Coefficient of Energy Storage Equipment on the Equilibrium Solution

5. Conclusions and Policy Implications

- In the scenario of generator investment or generator leasing, a higher subsidy ratio for energy storage investment is advantageous in increasing the level of energy storage technology and electricity demand. During the pre-development stage of the energy storage industry, stable power supply is crucial for the power consumption side. If power generators invest in energy storage, it will be more beneficial for the investment subsidy to enhance the level of energy storage technology and electricity demand. Additionally, during this time, the lease coefficient of energy storage equipment is also relatively high. Consequently, if power generators opt to lease energy storage equipment, it will be more beneficial for the investment subsidies to enhance the level of energy storage technology and electricity demand. Conversely, in the mature stage of the energy storage industry, regardless of the energy storage models, it is more beneficial for discharge subsidies to enhance both levels of technology and electricity demand.

- The model of power generators investing in energy storage becomes more advantageous for increasing their profits when the discharge subsidy or investment subsidy is implemented. When the lease coefficient of energy storage equipment is low, this model also becomes more favorable for enhancing energy storage technology and meeting electricity demand. In the early stages of development in the energy storage industry, the lease coefficient of energy storage equipment tends to be high, leading power generators to invest in energy storage equipment primarily to maximize their profits. However, this approach does not contribute significantly to improving the level of energy storage technology or meeting electricity demand. Conversely, in the mature stage of the energy storage industry, power generators choose to invest in energy storage not only to maximize their profits but also to enhance the level of energy storage technology and meet electricity demand.

- An increase in either the subsidy amount per unit of discharge or the subsidy ratio of energy storage investment has a positive impact on the level of energy storage technology, electricity demand, and the profits of electricity sellers. This policy effect is particularly significant when power generators invest in energy storage under the investment subsidy policy. In the mature stage of the energy storage industry, when the subsidy ratio of energy storage investment is low, power generators can improve their profits by relying on a higher subsidy amount per unit of discharge or a higher subsidy ratio of energy storage investment.

- The increase in the renewable energy quota obligation imposes constraints on energy storage technology, electricity demand, and the revenues of power generators and sellers. However, whether it is implemented with a discharge subsidy or an investment subsidy, its constraining effect is relatively minor. The Renewable Portfolio Standard (RPS) significantly influences the consumption of renewable energy. As the quota obligation increases, so does the consumption of renewable energy. Therefore, RPS plays a beneficial role in advancing renewable energy.

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Liang, C.; Umar, M.; Ma, F.; Huynh, T.L.D. Climate policy uncertainty and world renewable energy index volatility forecasting. Technol. Forecast. Soc. Chang. 2022, 182, 121810. [Google Scholar] [CrossRef]

- Carley, S.; Davies, L.L.; Spence, D.B.; Zirogiannis, N. Empirical evaluation of the stringency and design of renewable portfolio standards. Nat. Energy 2018, 3, 754–763. [Google Scholar] [CrossRef]

- Young, D.; Bistline, J. The costs and value of renewable portfolio standards in meeting decarbonization goals. Energy Econ. 2018, 73, 337–351. [Google Scholar] [CrossRef]

- Wang, W.; Yuan, B.; Sun, Q.; Wennersten, R. Application of energy storage in integrated energy systems—A solution to fluctuation and uncertainty of renewable energy. J. Energy Storage 2022, 52, 104812. [Google Scholar] [CrossRef]

- Liu, C.; Zhuo, J.; Zhao, D.; Li, S.; Chen, J.; Wang, J.; Yao, Q. A Review on the Utilization of Energy Storage System for the Flexible and Safe Operation of Renewable Energy Microgrids. Proc. Chin. Soc. Electr. Eng. 2020, 40, 1–18. [Google Scholar]

- Cai, S.; Laijun, C.; Xinjie, Q.; Tianwen, Z.; Shengwei, M. A Generation-side Shared Energy Storage Planning Model Based on Cooperative Game. J. Glob. Energy Interconnect. 2019, 2, 360–366. [Google Scholar] [CrossRef]

- Wang, Q.; Yi, C.; Zhang, X.; Xu, D. Optimization of Energy Storage Capacity Sizing Considering Carbon Capture Intensity and Renewable Energy Consumption. Proc. Chin. Soc. Electr. Eng. 2023, 43, 8295–8308. [Google Scholar]

- Zhao, W.; Li, R.; Zhu, S. Subsidy Policies and Economic Analysis of Photovoltaic Energy Storage Integration in China. Energies 2024, 17, 2372. [Google Scholar] [CrossRef]

- Bird, L.A.; Holt, E.; Carroll, G.L. Implications of carbon cap-and-trade for US voluntary renewable energy markets. Energy Policy 2008, 36, 2063–2073. [Google Scholar] [CrossRef]

- Dahal, K.; Juhola, S.; Niemela, J. The role of renewable energy policies for carbon neutrality in Helsinki Metropolitan area. Sustain. Cities Soc. 2018, 40, 222–232. [Google Scholar] [CrossRef]

- Hanif, I.; Aziz, B.; Chaudhry, I.S. Carbon emissions across the spectrum of renewable and nonrenewable energy use in developing economies of Asia. Renew. Energy 2019, 143, 586–595. [Google Scholar] [CrossRef]

- Yu, S.; Hu, X.; Li, L.; Chen, H. Does the development of renewable energy promote carbon reduction? Evidence from Chinese provinces. J. Environ. Manag. 2020, 268, 110634. [Google Scholar] [CrossRef]

- Zhang, M.; Yang, Z.; Liu, L.; Zhou, D. Impact of renewable energy investment on carbon emissions in China-An empirical study using a nonparametric additive regression model. Sci. Total Environ. 2021, 785, 147109. [Google Scholar] [CrossRef] [PubMed]

- Meng, S.; Sun, R.; Guo, F. Does the use of renewable energy increase carbon productivity? --An empirical analysis based on data from 30 provinces in China. J. Clean. Prod. 2022, 365, 132647. [Google Scholar] [CrossRef]

- Yang, Z.; Zhang, M.; Liu, L.; Zhou, D. Can renewable energy investment reduce carbon dioxide emissions? Evidence from scale and structure. Energy Econ. 2022, 112, 106181. [Google Scholar] [CrossRef]

- Siddik, A.B.; Khan, S.; Khan, U.; Yong, L.; Murshed, M. The role of renewable energy finance in achieving low-carbon growth: Contextual evidence from leading renewable energy-investing countries. Energy 2023, 270, 126864. [Google Scholar] [CrossRef]

- Xu, G.; Yang, M.; Li, S.; Jiang, M.; Rehman, H. Evaluating the effect of renewable energy investment on renewable energy development in China with panel threshold model. Energy Policy 2024, 187, 114029. [Google Scholar] [CrossRef]

- Teresa Garcia-Alvarez, M.; Cabeza-Garcia, L.; Soares, I. Analysis of the promotion of onshore wind energy in the EU: Feed-in tariff or renewable portfolio standard? Renew. Energy 2017, 111, 256–264. [Google Scholar] [CrossRef]

- Bento, A.M.; Garg, T.; Kaffine, D. Emissions reductions or green booms? General equilibrium effects of a renewable portfolio standard. J. Environ. Econ. Manag. 2018, 90, 78–100. [Google Scholar] [CrossRef]

- Zhao, X.-G.; Zuo, Y.; Wang, H.; Wang, Z. How can the cost and effectiveness of renewable portfolio standards be coordinated? Incentive mechanism design from the coevolution perspective. Renew. Sustain. Energy Rev. 2022, 158, 112096. [Google Scholar] [CrossRef]

- Zhu, Q.; Chen, X.; Song, M.; Li, X.; Shen, Z. Impacts of renewable electricity standard and Renewable Energy Certificates on renewable energy investments and carbon emissions. J. Environ. Manag. 2022, 306, 114495. [Google Scholar] [CrossRef] [PubMed]

- Yan, Y.; Sun, M.; Guo, Z. How do carbon cap-and-trade mechanisms and renewable portfolio standards affect renewable energy investment? Energy Policy 2022, 165, 112938. [Google Scholar] [CrossRef]

- Hu, F.; Zhou, D.; Zhu, Q.; Wang, Q. Renewable portfolio standard: When does it play a positive role? J. Environ. Manag. 2022, 322, 116122. [Google Scholar] [CrossRef]

- Lee, K. Renewable portfolio standards and electricity prices. Energy Econ. 2023, 126, 106959. [Google Scholar] [CrossRef]

- Rohit, A.K.; Devi, K.P.; Rangnekar, S. An overview of energy storage and its importance in Indian renewable energy sector Part I—Technologies and Comparison. J. Energy Storage 2017, 13, 10–23. [Google Scholar] [CrossRef]

- Wang, K.; Chen, S.; Liu, L.; Zhu, T.; Gan, Z. Enhancement of renewable energy penetration through energy storage technologies in a CHP-based energy system for Chongming, China. Energy 2018, 162, 988–1002. [Google Scholar] [CrossRef]

- Arbabzadeh, M.; Sioshansi, R.; Johnson, J.X.; Keoleian, G.A. The role of energy storage in deep decarbonization of electricity production. Nat. Commun. 2019, 10, 3413. [Google Scholar] [CrossRef] [PubMed]

- Liu, J.; Bao, H. Research on interest coordination model of wind power supply chain with energy storage participation. J. Energy Storage 2022, 49, 104107. [Google Scholar] [CrossRef]

- Zhang, H.; Fu, S.; Jiang, J. Multi-period network equilibrium in power system with energy storage on generation side. Electr. Power Syst. Res. 2023, 223, 109533. [Google Scholar] [CrossRef]

- Sayed, E.T.; Olabi, A.G.; Alami, A.H.; Radwan, A.; Mdallal, A.; Rezk, A.; Abdelkareem, M.A. Renewable Energy and Energy Storage Systems. Energies 2023, 16, 1415. [Google Scholar] [CrossRef]

- Zhao, Y.; Zhang, Y.; Li, Y.; Chen, Y.; Huo, W.; Zhao, H. Optimal configuration of energy storage for alleviating transmission congestion in renewable energy enrichment region. J. Energy Storage 2024, 82, 110398. [Google Scholar] [CrossRef]

- Chen, W.; Tian, Y.; Ma, Y.; Bai, C. Impact of Leasing Mode with Renewable Energy Storage Equipment on Electricity Quality and Price. Chin. J. Manag. Sci. 2024, 32, 309–318. [Google Scholar]

- Zou, C.; Xiong, B.; Xue, H.; Zheng, D.; Ge, Z.; Wang, Y.; Jiang, L.; Pan, S.; Wu, S. The role of new energy in carbon neutral. Pet. Explor. Dev. 2021, 48, 480–491. [Google Scholar] [CrossRef]

- Kifle, Y.; Khan, B.; Singh, P. Assessment and Enhancementof Distribution System Reliabilityby Renewable Energy Sourcesand Energy Storage. J. Green Eng. 2018, 8, 219–262. [Google Scholar] [CrossRef]

- Jamali, M.-B.; Rasti-Barzoki, M. A game-theoretic approach for examining government support strategies and licensing contracts in an electricity supply chain with technology spillover: A case study of Iran. Energy 2022, 242, 122919. [Google Scholar] [CrossRef]

- Bao, X.; Zhao, W.; Song, Y.; Wang, X. Policy Effects Concerning the Coexistence of Renewable Portfolio Standards and Emissions Trading. Oper. Res. Manag. Sci. 2022, 31, 129–135. [Google Scholar]

- Jian, L.; Hu, Y.; Gaocai, Y.; Ye, Z. Application of Battery Energy Storage Technology in Peak Regulation Optimization of Wind Power System. Electr. Power Inf. Commun. Technol. 2020, 18, 67–73. [Google Scholar] [CrossRef]

| Regions in China | Type of Subsidy | Subsidized Standards |

|---|---|---|

| Chengdu, Sichuan Province | Discharge Subsidy | 0.3 CNY/kWh |

| Huangpu District, Guangzhou | Discharge Subsidy | 0.2 CNY/kWh |

| Binhai New District, Tianjin | Discharge Subsidy | 0.5 CNY/kWh |

| Haiyan County, Jiaxing | Discharge Subsidy | 0.25 CNY/kWh |

| Pudong New District, Shanghai | Investment Subsidy | 10% |

| Baiyun District, Guangzhou | Investment Subsidy | ≤10% |

| Guangming District, Shenzhen | Investment Subsidy | 20% |

| Beijing | Investment Subsidy | ≤30% |

| Notation | Description |

|---|---|

| Wholesale electricity price | |

| Electricity demand | |

| Level of energy storage technology | |

| Basic electricity demand of the market | |

| Sensitivity coefficient of the energy storage technology level | |

| Market price of electricity | |

| Unit production cost of thermal power | |

| Unit production cost of renewable energy | |

| Subsidy amount per unit of discharge | |

| Subsidy ratio of energy storage investment | |

| Cost coefficient of energy storage investment | |

| Lease coefficient of energy storage equipment | |

| Discharge coefficient of energy storage equipment | |

| Renewable energy quota obligation | |

| Green certificate transaction price | |

| Power generation’s profit | |

| Power seller’s profit | |

| Energy storage provider’s profit |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Ji, C.; Wang, X.; Zhao, W.; Wang, X.; Qian, W. The Impact of Environmental Policies on Renewable Energy Storage Decisions in the Power Supply Chain. Energies 2025, 18, 2152. https://doi.org/10.3390/en18092152

Ji C, Wang X, Zhao W, Wang X, Qian W. The Impact of Environmental Policies on Renewable Energy Storage Decisions in the Power Supply Chain. Energies. 2025; 18(9):2152. https://doi.org/10.3390/en18092152

Chicago/Turabian StyleJi, Chunyi, Xinyue Wang, Wei Zhao, Xuan Wang, and Wuyong Qian. 2025. "The Impact of Environmental Policies on Renewable Energy Storage Decisions in the Power Supply Chain" Energies 18, no. 9: 2152. https://doi.org/10.3390/en18092152

APA StyleJi, C., Wang, X., Zhao, W., Wang, X., & Qian, W. (2025). The Impact of Environmental Policies on Renewable Energy Storage Decisions in the Power Supply Chain. Energies, 18(9), 2152. https://doi.org/10.3390/en18092152