Potential Economic Impacts of Allocating More Land for Bioenergy Biomass Production in Virginia

Abstract

:1. Introduction

2. Literature Review

2.1. Biomass Yield

2.2. The Land Use Competition Question and Controversy

2.3. Modeling Forest Bioenergy Economic Impacts

3. Methodology

3.1. Land Use Change Survey and Biomass Value

3.2. The Computable General Equilibrium Model

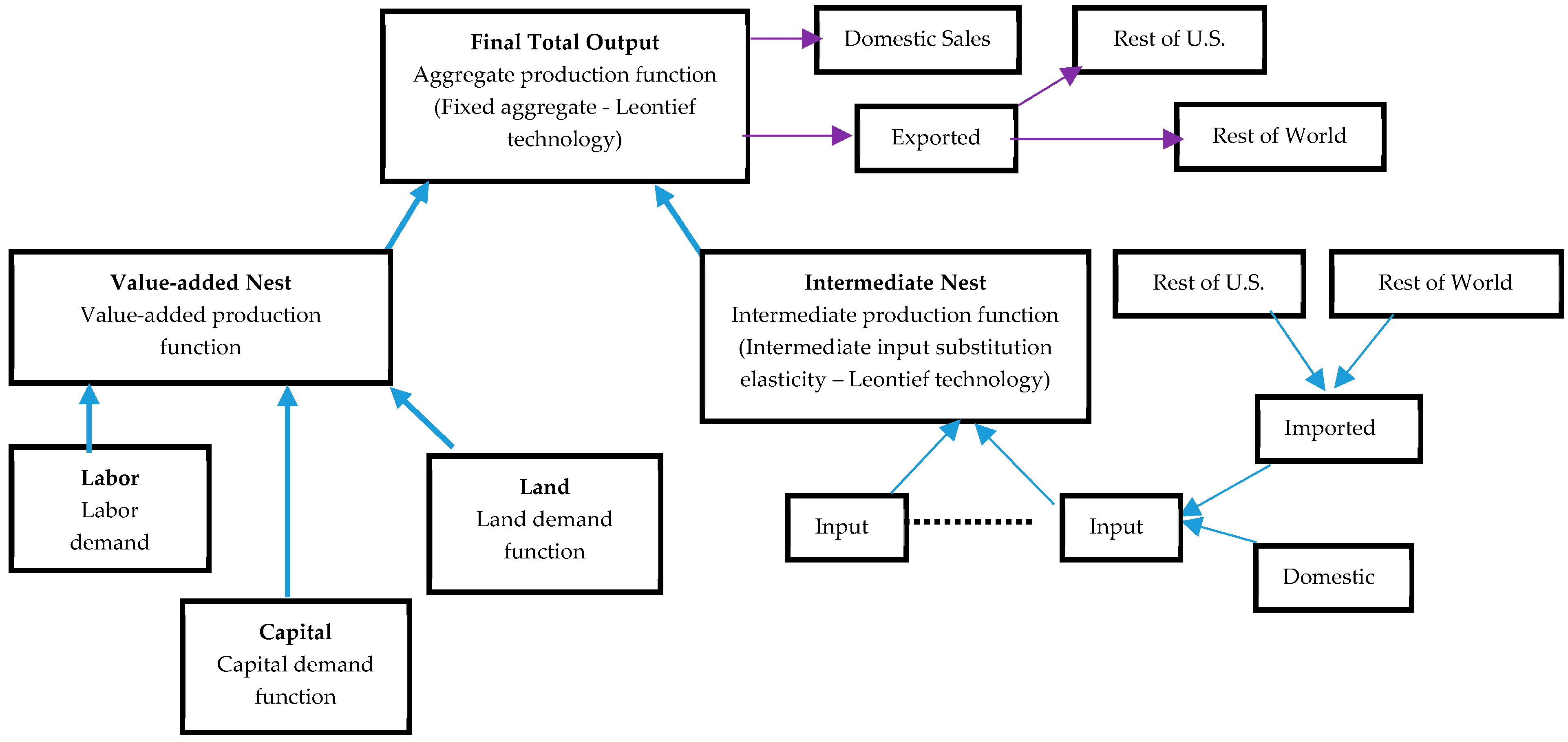

3.2.1. CGE Modeling Framework

3.2.2. Database and Model Calibration

3.2.3. The Experimental Shock Scenarios

4. Results

4.1. Supply Price and Quantity

4.2. Sectoral Outputs and GDP Impacts

4.3. Household and Welfare Impacts

5. Discussion, Summary, and Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- Nielsen-Pincus, M.; Moseley, C. Social Issues of Woody Biomass Utilization: A Review of the Literature; Ecosystem Workforce Program, Institute for a Sustainable Environment, University of Oregon: Eugene, OR, USA, 2009. [Google Scholar]

- Lauri, P.; Havlík, P.; Kindermann, G.; Forsell, N.; Bottcher, H.; Obersteiner, M. Woody biomass energy potential in 2050. Energy Policy 2014, 66, 19–31. [Google Scholar] [CrossRef]

- White, E.M. Woody Biomass for Bioenergy and Biofuels in the United States—A Briefing Paper; General Technical Report PNW-GTR-825; U.S. Department of Agriculture, Forest Service, Pacific Northwest Research Station: Portland, OR, USA, 2010; p. 45. [Google Scholar]

- U.S Energy Information Administration, Renewable Energy Explained. Available online: https://www.eia.gov/energyexplained/?page=renewable_home (accessed on 20 December 2018).

- Lal, P.; Wolde, B.; Alavalapati, J.; Burli, P.; Munsell, J. Forestland owners’ willingness to plant pine on non-forested land for woody bioenergy in Virginia. For. Policy Econ. 2016, 73, 52–57. [Google Scholar] [CrossRef]

- Jacobson, M.; Ciolkosz, D. A Primer on Woody Biomass Energy for Forest Landowners; Renewable and Alternative Energy, Penn State College of Agricultural Sciences, The Pennsylvania State Fact Sheet, Penn State Extension: State College, PA, USA, 2012. [Google Scholar]

- Munsell, J.F.; Fox, T.R. An analysis of the feasibility for increasing woody biomass production from pine plantations in the southern United States. Biomass Bioenergy 2010, 34, 1631–1642. [Google Scholar] [CrossRef]

- Galik, C.S.; Abt, R.; Wu, Y. Forest biomass supply in the southeastern United States—Implications for industrial roundwood and bioenergy production. J. For. 2009, 107, 69–77. [Google Scholar]

- Binkely, C.S. Preserving Nature through Intensive Plantation Forestry: The Case for Forest Land Allocation with Illustrations from British Columbia. For. Chron. 1997, 73, 553–559. [Google Scholar] [CrossRef]

- Wolde, B.; Lal, P.; Alavalapati, J.; Burli, P.; Munsell, J. Factors affecting forestland owners’ allocation of non-forested land to pine plantation for bioenergy in Virginia. Biomass Bioenergy 2016, 85, 69–75. [Google Scholar] [CrossRef]

- Rose, A.K. Virginia’s forests, 2011; Resource Bulletin SRS-RB-197; USDA-Forest Service, Southern Research Station: Asheville, NC, USA, 2013; Volume 197, pp. 1–92.

- Rephan, T.J. The Economic Impact of Virginia’s Agriculture and Forest Industries; Weldon Cooper Center for Public Service, University of Virginia: Charlottesville, VA, USA, 2017. [Google Scholar]

- Rose, A.K. Forests of Virginia 2013 Resource Update FS-37; US Department of Agriculture Forest Service. Southern Research Station: Asheville, NC, USA, 2015; Volume 37, pp. 1–4.

- Schultz, R.P. Loblolly Pine: The Ecology and Culture of Loblolly Pine (Pinus taeda L.); Agriculture Handbook 713; US Department of Agriculture, Forest Service: Washington, DC, USA, 1997; p. 493.

- USFS. Timber Product Output Data 2003; U.S. Department of Agriculture Forest Service, Forest Inventory and Analysis Unit: Washington, DC, USA, 2003. [Google Scholar]

- Field, C.B.; Campbell, J.E.; Lobell, D.B. Biomass energy: The scale of the potential resource. Trends Ecol. Evol. Dev. 2008, 23, 65–72. [Google Scholar] [CrossRef] [PubMed]

- U.S Energy Information Administration, Southern States Leads Growth in Biomass Electricity. Available online: https://www.eia.gov/todayinenergy/detail.php?id=26392# (accessed on 23 December 2018).

- Rose, A.K. Virginia, 2010 Forest Inventory and Analysis Factsheet, e-Science Update SRS–056; US Department of Agriculture Forest Service, Southern Research Statio: Asheville, NC, USA, 2012; pp. 1–4.

- Gan, J.; Mayfield, C. Benefits to Landowners from Forest Biomass/Bioenergy Production, Sustainable Forestry for Bioenergy and Bio-Based Products: Trainers Curriculum Notebook; Southern Forest Research Partnership, Inc.: Athens, GA, USA, 2007; pp. 225–228. [Google Scholar]

- Alavalapati, J.R.; Lal, P.; Susaeta, A.; Abt, R.C.; Wear, D.N. Forest biomass energy. In The Southern Forest Futures Project: Technical Report; Wear, D.N., Greis, J.G., Eds.; USDA-Forest Service, Southern Research Station: Asheville, NC, USA, 2013; Volume 178, pp. 213–260. [Google Scholar]

- Parhizkar, O.; Smith, R.L. Application of GIS to estimate the availability of Virginia’s biomass residues for bioenergy production. For. Prod. J. 2008, 58, 71–76. [Google Scholar]

- U.S. Department of Energy. Economic Availability of Feedstocks. In Billion-Ton Report: Advancing Domestic Resources for a Thriving Bioeconomy; Langholtz, M.H., Stokes, B.J., Eds.; Oak Ridge National Laboratory: Oak Ridge, TN, USA, 2016; p. 448. [Google Scholar]

- Virginia Department of Forestry. Forest Research Review. Available online: http://www.dof.virginia.gov/research/publications.htm URL (accessed on 10 December 2018).

- Guo, Z.; Grebner, D.; Sun, C.; Grado, S. Evaluation of Loblolly pine management regimes in Mississippi for biomass supplies: A simulation approach. South J. Appl. For. 2010, 34, 65–71. [Google Scholar]

- Stanturf, J.A.; Kellison, R.C.; Broerman, F.S.; Jones, S.B. Productivity of southern pine plantations: Where are we and how did we get here? J. For. 2003, 101, 26–31. [Google Scholar]

- U.S. Department of Energy. U.S. Billion-Ton Update: Biomass Supply for a Bioenergy and Bioproducts Industry; Perlack, R.D., Stokes, B.J., Eds.; Oak Ridge National Laboratory: Oak Ridge, TN, USA, 2011; p. 227.

- Oliver, A.; Khanna, M. Demand for biomass to meet renewable energy targets in the United States: Implications for land use. Gcb Bioenergy 2017, 9, 1476–1488. [Google Scholar] [CrossRef]

- Rajcaniova, M.; Kancs, D.A.; Ciaian, P. Bioenergy and global land-use change. Appl. Econ. 2014, 46, 3163–3179. [Google Scholar] [CrossRef] [Green Version]

- Ciaian, P.; Kancs, D. Interdependencies in the energy bioenergy food price systems: A cointegration analysis. Resour. Energy Econ. 2011, 33, 326–348. [Google Scholar] [CrossRef]

- Johansson, D.J.A.; Azar, C. A scenario based analysis of land competition between food and bioenergy production in the US. Clim. Chang. 2007, 82, 267–291. [Google Scholar] [CrossRef]

- Searchinger, T.; Heimlich, R. Avoiding Bioenergy Competition for Food Crops and Land: Creating a Sustainable Food Future; World Resources Institute: Washington, DC, USA, 2015; pp. 1–44. Available online: https://www.wri.org/publication/avoiding-bioenergy-competition-food-crops-and-land (accessed on 23 December 2018).

- Sands, R.D.; Malcolm, S.A.; Suttles, S.A.; Marshall, E. Dedicated Energy Crops and Competition for Agricultural Land; United States Department of Agriculture, Economic Research Service: Washington, DC, USA, 2017.

- Kampman, B.; van Grinsven, A.; Croezen, H. Sustainable Alternatives for Land-Based Biofuels in the European Union: Assessment of Options and Development of a Policy Strategy; CE Delft: Delft, The Netherlands, December 2012; Available online: https://www.cedelft.eu/publicatie/sustainable_alternatives_for_landbased_biofuels_in_the_european_union/1325 (accessed on 23 December 2018).

- Banse, M.; van Meijl, H.; Tabeau, A.; Woltjer, G.; Hellmann, F.; Verburg, P.H. Impact of EU biofuel policies on world agricultural production and land use. Biomass Bioenergy 2011, 35, 2385–2390. [Google Scholar] [CrossRef]

- Taheripour, F.; Tyner, W.E. Introducing First and Second Generation Biofuels into GTAP Data Base Version 7; GTAP Research Memorandum, Purdue University: West Lafayette, IN, USA, 2011. [Google Scholar]

- Banse, M.; Woltjer, G.; Tabeau, A.; van Meijl, H. Will EU biofuel policies affect global agricultural markets? Eur. Rev. Agric. Econ. 2008, 35, 117–141. [Google Scholar] [CrossRef] [Green Version]

- Kancs, D.A.; Wohlgemuth, N. Evaluation of renewable energy policies in an integrated economic-energy-environment model. For. Policy Econ. 2008, 10, 128–139. [Google Scholar] [CrossRef]

- Miyake, S.; Renouf, M.; Peterson, A.; McAlpine, C.; Smith, C. Land-use and environmental pressures resulting from current and future bioenergy crop expansion: A review. J. Rural Stud. 2012, 28, 650–658. [Google Scholar] [CrossRef]

- Hoogwijk, M.; Faaij, A.; Eickhout, B.; de Vries, B.; Turkenburg, W. Potential of biomass energy out to 2100, for four IPCC SRES land-use scenarios. Biomass Bioenergy 2005, 29, 225–257. [Google Scholar] [CrossRef] [Green Version]

- Hoogwijk, M.; Faaij, A.; Van Den Broek, R.; Berndes, G.; Gielen, D.; Turkenburg, W. Exploration of the ranges of the global potential of biomass for energy. Biomass Bioenergy 2003, 25, 119–133. [Google Scholar] [CrossRef]

- Liu, T.; Huffman, T.; Kulshreshtha, S.; McConkey, B.; Du, Y.; Green, M.; Liu, J.; Shang, J.; Geng, X. Bioenergy production on marginal land in Canada: Potential, economic feasibility, and greenhouse gas emissions impacts. Appl. Energy 2017, 205, 477–485. [Google Scholar] [CrossRef]

- Shelly, J.R. Woody Biomass Factsheet–Wb1; University of California Berkeley: Berkeley, CA, USA, 2011; Available online: http://www.ucanr.org/sites/WoodyBiomass/newsletters/InfoGuides43284.pdf (accessed on 23 December 2018).

- Suttles, S.A.; Tyner, W.E.; Shively, G.; Sands, R.D.; Sohngen, B. Economic effects of bioenergy policy in the United States and Europe: A general equilibrium approach focusing on forest biomass. Renew. Energy 2014, 69, 428–436. [Google Scholar] [CrossRef]

- Huang, M.Y.; Alavalapati, J.R.; Banerjee, O. Economy-wide impacts of forest bioenergy in Florida: A computable general equilibrium analysis. Taiwan J. For. Sci. 2012, 27, 81–93. [Google Scholar]

- Gan, J.; Smith, C.T. Availability of logging residues and potential for electricity production and carbon displacement in the USA. Biomass Bioenergy 2006, 30, 1011–1020. [Google Scholar] [CrossRef]

- Saul, D.; Newman, S.; Peterson, S.; Kosse, E.; Jacobson, R.; Keefe, R.; Moroney, J. Evaluation of Three Forest-Based Bioenergy Development Strategies in the Inland Northwest, United States. J. For. 2018, 116, 497–504. [Google Scholar] [CrossRef]

- Sands, R.; Kim, M.K. Modelling the competition for land: Methods and application to climate policy. In Economic Analysis of Land Use in Global Climate Change Policy; Hertel, T.W., Rose, S.K., Eds.; Routledge: London, UK, 2009; pp. 174–201. [Google Scholar]

- Golub, A.; Hertel, T.; Lee, H.-L.; Rose, S.; Sohngen, B. The opportunity cost of land use and the global potential for greenhouse gas mitigation in agriculture and forestry. Resour. Energy Econ. 2009, 31, 299–319. [Google Scholar] [CrossRef] [Green Version]

- Van der Mensbrugghe, D. Environmental Impact and Sustainability Applied General Equilibrium (ENVISAGE) Model. Available online: http://ledsgp.org/resource/environmental-impact-and-sustainability-applied-general-equilibrium-model/?loclang=en_gb (accessed on 15 November 2018).

- Hertel, T.W.; Rose, S.; Richard, S. Land use in computable general equilibrium models: An overview. In Economic Analysis of Land Use in Global Climate Change Policy; Hertel, T.W., Rose, S., Eds.; Routledge: London, UK, 2009; pp. 23–50. [Google Scholar]

- Miller, M.H.; Spencer, J.E. The static economic effects of the UK joining the EEC: A general equilibrium approach. Rev. Econ. Stud. 1977, 44, 71–93. [Google Scholar] [CrossRef]

- Johansen, L. Multi-Sectoral Study of Economic Growth, 1960; North-Holland Publishing Company: Amsterdam, The Netherlands, 1960; p. 284. [Google Scholar]

- Banerjee, O.; Alavalapati, J. Illicit exploitation of natural resources: The forest concessions in Brazil. J. Policy Model. 2010, 32, 488–504. [Google Scholar] [CrossRef]

- Banerjee, O.; Alavalapati, J.R. Forest policy modelling in an economy-wide framework. Handbook of Forest Resource Economics. Available online: https://www.routledgehandbooks.com/doi/10.4324/9780203105290.ch34 (accessed on 14 October 2018).

- Haddad, S.; Britz, W.; Börner, J. Impacts of increased forest biomass demand in the European bioeconomy. Presented at the 57th Annual Conference, Weihenstephan, Germany, 13–15 September 2017; German Association of Agricultural Economists (GEWISOLA): Weihenstephan, Germany, 2017. [Google Scholar]

- Furtenback, Ö. Dynamic CGE-Model with Heterogeneous Forest Biomass: Applications to Climate Policy; CERE—The Center for Environmental and Resource Economics: Umeå, Sweden, 2011. [Google Scholar]

- Lu, C.; Zhang, X.; He, J. A CGE analysis to study the impacts of energy investment on economic growth and carbon dioxide emission: A case of Shaanxi Province in western China. Energy 2010, 35, 4319–4327. [Google Scholar] [CrossRef]

- Lofgren, H.; Harris, R.L.; Robinson, S. A Standard Computable General Equilibrium (CGE) Model in GAMS; Intl Food Policy Res Inst: Washington, DC, USA, 2002. [Google Scholar]

- Holland, D.W.; Stodick, L.; Painter, K. Assessing the Economic Impact of Energy Price Increases on Washington Agriculture and the Washington Economy: A General Equilibrium Approach; Working Papers 2007-14; School of Economic Sciences, Washington State University: Pullman, WA, USA, 2007. [Google Scholar]

- Stone, R. Linear expenditure systems and demand analysis: An application to the pattern of British demand. Econ. J. 1954, 64, 511–527. [Google Scholar] [CrossRef]

- Armington, P.S. A Theory of Demand for Products Distinguished by Place of Production. Palgrave Macmillan J. 1969, 1, 159–178. [Google Scholar]

- Julia-Wise, R.; Cooke, S.C.; Holland, D. A computable general equilibrium analysis of a property tax limitation initiative in Idaho. Land Econ. 2002, 78, 207–227. [Google Scholar] [CrossRef]

- GAMS (General Algebraic Modeling System)—Computer Application, GAMS Development Corporation: Washington, DC, USA, 2018.

- Pyatt, G.; Round, J.I. Social Accounting Matrices: A Basis for Planning. Available online: http://documents.worldbank.org/curated/en/919371468765880931/Social-accounting-matrices-a-basis-for-planning (accessed on 11 August 2018).

- UN [United Nations] (Statistical Division). The System of National Accounts 2008. 2008. Available online: https://unstats.un.org/unsd/nationalaccount/sna2008.asp (accessed on 11 November 2018).

- Taheripour, F.; Hertel, T.W.; Tyner, W.E.; Beckman, J.F.; Birur, D.K. Biofuels and their by-products: Global economic and environmental implications. Biomass Bioenergy 2010, 34, 278–289. [Google Scholar] [CrossRef] [Green Version]

- Winston, R.A.P. Enhancing Agriculture and Energy Sector Analysis in CGE Modelling: An Overview of Modifications to the USAGE Model; Monash University, Centre of Policy Studies and the Impact Project: Melbourne, Australia, 2009. [Google Scholar]

- Robinson, S.; Cattaneo, A.; El-Said, M. Updating and Estimating a Social Accounting Matrix Using Cross Entropy Methods. Econ. Syst. Res. 2001, 13, 47–64. [Google Scholar] [CrossRef] [Green Version]

- Robinson, S.; Roland-Holst, D.W. Macroeconomic structure and computable general equilibrium models. J. Policy Model. 1988, 10, 353–375. [Google Scholar] [CrossRef]

| Scenario | Biomass Price ($/acre) | Non-Forested Land Allocated (acre) |

|---|---|---|

| Low | 800 | 494,320 |

| Low–middle | 1035 | 714,564 |

| Middle–high | 1270 | 940,022 |

| High | 1500 | 1,126,919 |

| Model Year | 2015 | Value Added | |

| GRP (GDP) | $493,944,088,226 | Employee Compensation | $276,827,546,707 |

| Total Personal Income | $437,111,400,000 | Proprietor Income | $28,386,585,071 |

| Total Employment | 5,059,628 | Other Property Type Income | $159,473,806,415 |

| Tax on Production and Import | $29,256,150,032 | ||

| Number of Industries | 484 | ||

| Land Area (Sq. Miles) | 39,598 | Total Value Added | $493,944,088,226 |

| Area Count | 1 | ||

| Final Demand | |||

| Population | 8,382,993 | Households | $365,971,820,149 |

| Total Households | 3,201,210 | State/Local Government | $59,624,364,456 |

| Average Household Income | $136,546 | Federal Government | $109,295,223,544 |

| Capital | $85,746,527,670 | ||

| Trade Flows Method | Trade Flows Model | Exports | $203,606,651,905 |

| Model Status | Social Accounts | Imports | ($305,759,049,007) |

| Institutional Sales | ($24,541,448,640) | ||

| Economic Indicators | |||

| Shannon-Weaver Index | 0.75398 | Total Final Demand: | $493,944,090,077 |

| Implan536 Commodity Index | Implan BEA Code | Implan Description | Commodity Production $ | % Share of Total |

|---|---|---|---|---|

| 3041 | 221111 | Electric power generation—Hydroelectric | 63,323,875 | 1.26 |

| 3042 | 221112 | Electric power generation—Fossil fuel | 2,678,571,777 | 53.30 |

| 3043 | 221113 | Electric power generation—Nuclear | 1,672,888,916 | 33.29 |

| 3044 | 221114 | Electric power generation—Solar | 0 | 0.00 |

| 3045 | 221115 | Electric power generation—Wind | 62,293,266 | 1.24 |

| 3046 | 221116 | Electric power generation—Geothermal | 53,018,517 | 1.06 |

| 3047 | 221117 | Electric power generation—Biomass | 395,837,158 | 7.88 |

| 3048 | 221118 | Electric power generation—All other | 0 | 0.00 |

| 3525 | S00302 | Local government electric utilities | 99,163,748 | 1.97 |

| Total | 5,025,097,257 | 100.00 | ||

| Implan536 Commodity Index | Implan BEA Code | Implan Description | Commodity Production $ | % Share of Total |

|---|---|---|---|---|

| 3041 | 221111 | Electric power generation—Hydroelectric | 63,323,875 | 2.82 |

| 3043 | 221113 | Electric power generation—Nuclear | 1,672,888,916 | 74.44 |

| 3044 | 221114 | Electric power generation—Solar | 0 | 0.00 |

| 3045 | 221115 | Electric power generation—Wind | 62,293,266 | 2.77 |

| 3046 | 221116 | Electric power generation—Geothermal | 53,018,517 | 2.36 |

| 3047 | 221117 | Electric power generation—Biomass | 395,837,158 | 17.61 |

| 3048 | 221118 | Electric power generation—All other | 0 | 0.00 |

| Total | 2,247,361,732 | 100.00 | ||

| Sector | Intermediate Demand of Biomass for Bioenergy Production | ||

|---|---|---|---|

| Low | Medium | High | |

| Agriculture | −0.001 | −0.003 | −0.004 |

| Logging | 2.325 | 4.639 | 6.444 |

| All other electricity generation | −0.010 | −0.021 | −0.030 |

| Electricity generated from biomass | 0.195 | 0.887 | 1.884 |

| Electric power transmission and distribution | −0.002 | 0.023 | 0.066 |

| Natural gas distribution | −0.006 | −0.012 | −0.017 |

| Manufacturing | 0.001 | 0.002 | 0.003 |

| Services | −0.005 | −0.011 | −0.015 |

| Rest of the economy | −0.006 | −0.012 | −0.017 |

| Sector | Intermediate Demand of Biomass for Bioenergy Production | ||

|---|---|---|---|

| Low | Medium | High | |

| Agriculture | 0.038 | 0.078 | 0.110 |

| Logging | 4.581 | 9.175 | 12.780 |

| All other electricity generation | 0.009 | −0.008 | −0.043 |

| Electricity generated from biomass | −0.159 | −0.738 | −1.552 |

| Electric power transmission and distribution | 0.000 | −0.026 | −0.070 |

| Natural gas distribution | 0.001 | 0.003 | 0.006 |

| Manufacturing | −0.040 | −0.076 | −0.101 |

| Services | 0.008 | 0.015 | 0.021 |

| Rest of the economy | 0.003 | 0.006 | 0.007 |

| Sector | Intermediate Demand of Biomass for Bioenergy Production | ||

|---|---|---|---|

| Low | Medium | High | |

| Agriculture | 2.032 | 4.178 | 5.937 |

| Logging | 17.337 | 34.720 | 48.366 |

| All other electricity generation | 0.408 | −0.356 | −2.024 |

| Electricity generated from biomass | −0.641 | −2.970 | −6.251 |

| Electric power transmission and distribution | −0.006 | −2.080 | −5.590 |

| Natural gas distribution | 0.015 | 0.053 | 0.098 |

| Manufacturing | −47.027 | −89.576 | −120.088 |

| Services | 43.577 | 87.494 | 121.632 |

| Rest of the economy | 4.693 | 9.049 | 12.055 |

| Sector | Intermediate Demand of Biomass for Bioenergy Production | ||

|---|---|---|---|

| Low | Medium | High | |

| Agriculture | 0.04 | 0.08 | 0.11 |

| Logging | 7.01 | 14.24 | 20.05 |

| All other electricity generation | 0.00 | −0.03 | −0.07 |

| Electricity generated from biomass | 0.04 | 0.14 | 0.30 |

| Electric power transmission and distribution | 0.00 | 0.00 | 0.00 |

| Natural gas distribution | −0.01 | −0.01 | −0.01 |

| Manufacturing | −0.04 | −0.07 | −0.10 |

| Services | 0.00 | 0.00 | 0.01 |

| Rest of the economy | 0.00 | −0.01 | −0.01 |

| Sector | Intermediate Demand of Biomass for Bioenergy Production | ||

|---|---|---|---|

| Low | Medium | High | |

| Agriculture | 1.96 | 4.03 | 5.75 |

| Logging | 26.54 | 53.89 | 75.87 |

| All other electricity generation | −0.07 | −1.34 | −3.44 |

| Electricity generated from biomass | 0.14 | 0.57 | 1.22 |

| Electric power transmission and distribution | −0.16 | −0.27 | −0.34 |

| Natural gas distribution | −0.09 | −0.15 | -0.19 |

| Manufacturing | −45.48 | −86.63 | −116.15 |

| Services | 12.84 | 26.00 | 35.86 |

| Rest of the economy | −4.85 | −10.36 | −15.42 |

| Household Annual Income Category | Number of Households (% of Total) | Intermediate Demand of Biomass for Bioenergy Production | ||

|---|---|---|---|---|

| Low | Medium | High | ||

| Low ($0–40K) | 993,176 (31%) | 1.71 | 3.22 | 4.18 |

| Medium ($40–100K) | 1,221,222 (38%) | 2.20 | 3.97 | 4.82 |

| High (>$100K) | 986,813 (31%) | 5.15 | 9.75 | 12.62 |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Ochuodho, T.O.; Alavalapati, J.R.R.; Lal, P.; Agyeman, D.A.; Wolde, B.; Burli, P. Potential Economic Impacts of Allocating More Land for Bioenergy Biomass Production in Virginia. Forests 2019, 10, 159. https://doi.org/10.3390/f10020159

Ochuodho TO, Alavalapati JRR, Lal P, Agyeman DA, Wolde B, Burli P. Potential Economic Impacts of Allocating More Land for Bioenergy Biomass Production in Virginia. Forests. 2019; 10(2):159. https://doi.org/10.3390/f10020159

Chicago/Turabian StyleOchuodho, Thomas O., Janaki R. R. Alavalapati, Pankaj Lal, Domena A. Agyeman, Bernabas Wolde, and Pralhad Burli. 2019. "Potential Economic Impacts of Allocating More Land for Bioenergy Biomass Production in Virginia" Forests 10, no. 2: 159. https://doi.org/10.3390/f10020159

APA StyleOchuodho, T. O., Alavalapati, J. R. R., Lal, P., Agyeman, D. A., Wolde, B., & Burli, P. (2019). Potential Economic Impacts of Allocating More Land for Bioenergy Biomass Production in Virginia. Forests, 10(2), 159. https://doi.org/10.3390/f10020159