1. Introduction

Under the current global context of rapid land use changes, deforestation is one of the main processes at stake [

1]. The multiple implications of changes in forest cover for climate change and livelihoods have made deforestation a global problem of public concern [

2]. As a result, several international sustainability agendas have emphasized the role of forest in transition to sustainability, with special attention to tropical and subtropical regions [

3].

Deforestation, as other land use and cover changes, take place at the plot level over short time periods but those changes act as elementary building blocks of complex and structural processes that take place over broader extents and longer time scales [

4]. Following this perspective, we focus on theories that explain forest changes from such a structural point of view. The literature exploring these dynamics is extensive and builds on different data and methods, as well as on their spatial and temporal coverage. Here, we focus on cross-country studies using different statistical techniques [

2,

5,

6,

7,

8,

9,

10]. Most of these studies used the well-known [

11] forest cover datasets—in particular, the Forest Resource Assessment (FRA) database or older FAO sources such as the Statistical Yearbook, but some have also been using more recent forest cover datasets with high spatial resolution. Altogether, this literature brought important insights to our current understanding of global forest dynamics—in particular, they allowed us to identify a wide set of variables relevant to explaining forest dynamics; they provided empirical evidence for some hypotheses and theories on the short run at different regions of the world; finally, those results were used to give recommendations for forest policies on those regions. However, these works have some limitations. They rely on time series data, which can be affected by problems of spurious regression due to non-stationarity data [

5,

6,

7,

8,

9]. Yet, few of these works use statistical designs that can correct for these potential spurious relations and disentangle long- and short-run relations between forest cover and socio-economic variables. As a consequence, there is little emphasis on the causal analysis of forest dynamics [

3]. Finally, several works explore the effects of a range of variables whose selection is informed by theories, but do not build on an explicit causal model linking these variables together. As a consequence, these studies rarely explore interactions between independent variables and indirect effects, even though these indirect effects are mentioned as something that should be further assessed on forest dynamics [

5,

12]. Nevertheless, econometrics techniques do exist to overcome these limitations, and they have recently been applied to explain land system issues by [

13].

In this paper, we aim to contribute to fill those gaps by (i) investigating the long- and short-run causal relationships between changes in forest, agricultural cover areas, and socio-economic drivers, going beyond potentially spurious correlations; (ii) investigating the direct and indirect effects of these variables and their interactions on forest cover, by building on a causal model informed by major theories about structural forest cover changes, i.e., the environmental Kuznets curve (EKC), forest transition and unequal ecological exchange theories. For this purpose, we used an econometric approach with a dataset covering 111 countries over the period 1992–2015. First, we translated the narratives of well-known theories into testable hypotheses and we combined them in a unified conceptual causal model. Secondly, we assessed the long- and short-term mutual relationships and causal pathways between key variables and forest cover. We used forest cover data from a recent land cover database from the Climate Change Initiative (CCI) [

14], and a cointegration methodology that solves the main statistical problems on previous literature [

15]. This methodology is composed by a panel data analysis with an error correction model in order to disentangle the long- and short-run dynamics and causal relationships of forest cover area with the other variables. Finally, for the short-run analysis, we compared the direct and total effects of the independent variables on forest by using simple algebra on the coefficients obtained by the least squared method.

The body of this paper is organized as follows:

Section 2 presents the conceptual framework of this paper and the hypotheses we tested.

Section 3 contains an explanation of the data and methods used for our analysis.

Section 4 explains the results obtained.

Section 5 discusses the results, while

Section 6 draws some conclusions from our results.

2. Causal Framework and Hypotheses Tested

This section introduces the theories from which we drew out the hypotheses assessed in this work. Our hypotheses mainly build on the forest transition theories and their subsequent paths. The notion of forest transition was introduced by Mather [

16] and describes a turning point when the forest cover in a region or country reaches its minimum and stops decreasing. Afterwards, a recovery occurs through the conservation of remaining primary forest, plantations and reforestation [

17]. Therefore, forest transition represents an empirical regularity that constitutes an example of a non-linear land use transition [

1]. Two main forest transition pathways have been identified [

18]: (i) the economic development pathway and (ii) the forest scarcity pathway. Later on, recent case studies led to the identification of three more paths that are a contemporary version of the previous ones: (iii) the state forest policy pathway, (iv) the globalization pathway, and (v) the smallholder, tree-based land use intensification pathway, which takes place at a smaller geographical scale [

4,

19].

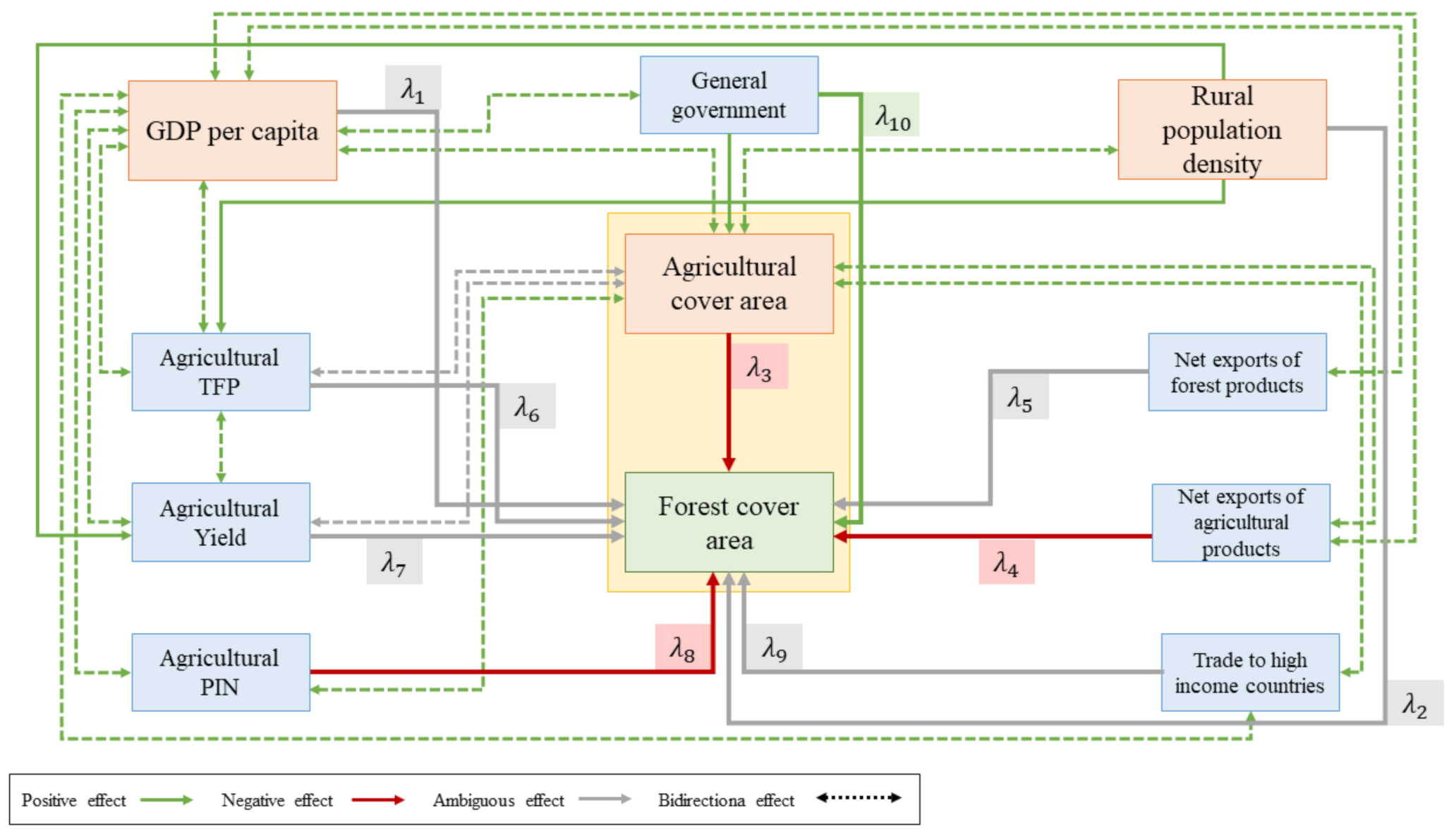

Taking into account these forest transition pathways and other environmental economics and environmental sociology theories, we have grouped our hypotheses in the following three groups: (1) the economic development path and the EKC; (2) the forest scarcity and forest policy pathways; (3) the globalization pathway together with the unequal ecological exchange theory. We formalized these hypotheses in a causal diagram (

Figure 1), with their operationalization and expected signs explained in

Table 1.

This framework (

Figure 1) is linked with the next section on the hypothesis tested and also with the methods section in the following way: The arrows containing a

coefficient represent the (direct) effects of those variables on forest, also captured by our econometric models (see coefficients in Equations (1) and (2)). The rest of the arrows represent the indirect effects of the variables on forest (captured by our procedure in

Section 3.3). We attributed different expected signs to the

coefficients based on theoretical knowledge about each correspondent theory. We tested these hypotheses by comparing the sign of the coefficients in our model with the expected sign in

Table 1.

2.1. Environmental Kuznets Curve and the “Economic Development” Pathway to Forest Transition

The EKC brought its name from Simon Kuznets who first explored the inverse U-shaped relationship between income per capita and income inequalities [

20]. Later on, this was extended to the relationship between indicators of environmental degradation and economic growth [

21,

22]. Such EKC was applied to deforestation, by exploring a U-shaped relationship between rate of deforestation or forest cover and the income per capita [

22,

23]. The theory asserts that at low levels of development, the environmental degradation is limited to the subsistence economic activity on natural resources. During the course of economic growth, with increasing consumption, and thus agricultural expansion, income increases (in this paper, we use interchangeably the term income and gross domestic product (GDP)) are first positively related with deforestation (and thus a decrease in forest cover area). The shift to more industrialized economies spurred the impact of human activities on the environment with further exploitation of natural resources, such as primary forest products boosted by an increasing demand. However, after a certain level of economic development, further economic growth will be associated with a slowdown in deforestation till reaching a transition from forest losses to gains. Multiple mechanisms are hypothesized to allow this trajectory to happen—in particular, changes in economic and industrial structure with the advent of tertiary sectors, technological changes, and the creation of reforestation projects together with policy and societal changes and increased demand for environmental amenities [

22,

24]. The EKC literature for deforestation show conflictual results concerning the effective existence of a U-shaped relationship between deforestation and economic growth with a recent work which results seems to confirm a possible existence of it [

10].

Similar to the EKC, the economic development path of forest transition theory links deforestation to the level of income. This path highlights the processes of urbanization and industrialization which drive labor force away from rural areas at the same time that agricultural intensification happens on the most suitable land. This switch from an agriculture-based economy to an industry or service-based one happens at a certain level of income per capital and capital stock which is different for each country. The sequence of events described by this path are the following: farm workers leave the land for better wages in non-farm sectors; the loss of laborers raises the salaries of the remaining workers and makes agriculture less profitable in areas that can hardly mechanize or with unfavorable agro-environmental conditions [

18]. Thus, farmers in remote and less productive fields abandon their activity and these lands may potentially experience forest regrowth [

1,

4]. Improved markets and transport networks as well as infrastructures allow food’s redistribution from the most productive regions to the least productive ones, reinforcing the abandonment of agriculture in marginal regions and possibly their specialization in forestry. This leads to a U-shaped relationship between time and forest cover which is consistent with the EKC hypothesis applied to forest cover change assuming a continuous economic growth over time. Operationally, we thus used the quadratic form of GDP per capita as an aggregate measure of all structural changes coming from economic development and growth to test the general pattern posited in both theories. Yet, to move further, and because as identified above, multiple mechanisms are bundled in GDP measures, we included additional variables that allow us to test some of these main mechanisms. For this, we operationalized these narratives into the following testable hypotheses:

Hypothesis 1: There is an inverted U-shaped relationship between deforestation and GDP per capita at an aggregate level. We test this hypothesis using the quadratic form of GDP per capita as an aggregate measure of economic growth.

Hypothesis 2: A reduction in agricultural employment results in lower deforestation rates.

Hypothesis 3: Increases in agricultural intensification, measured by either total factor productivity (TFP) and agricultural yields, lead to higher levels of forest area. In addition, we introduced an interaction term between agricultural intensification and GDP per capita on our model, hypothesizing that there may be a synergistic relation between the effects of these two dynamics on forest cover.

2.2. “Forest Scarcity” and “State Forest Policy” Forest Transition Pathways

Deforestation in a country, due to agricultural expansion, wood extraction or mining activities, may create a scarcity of forest products and a decrease in the ecosystem services that forest provides. In addition, this process could be reinforced by the increase in demand for wood products. Such perception of scarcity and degradation may, in turn, drive forest protection efforts, forestry intensification and tree-planting projects (“forest scarcity” pathway) including specific political responses (“state forest policy” pathway). Those feedback responses to low levels of forest cover could contribute to preserve the remaining forest and revert the decreasing trend of forest [

1]. This has also been explored by others works such as [

25]. Here we operationalized these feedback mechanisms through hypotheses 4 and 5:

Hypothesis 4: Countries with higher government ability to draft and enforce stricter environmental and forest policies have a stronger effect of past decreasing forest area on present forest area. We operationalize this through an interaction between a proxy of environmental governance capacity and lagged forest cover. As a proxy for the government ability to draft and implement environmental legislation, we use an aggregate measure of the following indices: control of corruption, government effectiveness, regulatory quality, rule of law, voice and accountability (see variable “government quality” on

Table A1 on

Appendix A).

Building on our statistical design using cointegration to investigate the long- and short-term dynamics, another way of testing this effect is through the error correction term (ECT) of the model. This term represents the forest’s speed of adjustment to the long-run forest equilibrium relationship with other variables (here GDP, agricultural area and rural population density). A larger, and more significant value of this parameter indicates that forest cover tends to adjust more rapidly to the long-term equilibrium relation between forest cover and these other variables. A larger value would thus suggest that changes in forest cover produce a relatively rapid feedback on land users’ decisions that then affects the forest cover itself. A smaller value would suggest that when GDP and other variables change, and with them the long-term equilibrium level of forest cover, the forest cover takes a longer time to adjust to this new equilibrium. However, it is not possible to specify how this response varies with either positive deviation of forest cover (abundance of forest) or negative deviation (forest scarcity).

Hypothesis 5: There is a national feedback response from forest scarcity or forest abundance to the forest cover under the long equilibrium relationship. We test this hypothesis using the error correction term (ECT) variable: a significant ECT indicates that there is a feedback from forest abundance or scarcity on further forest cover levels, and thus the forest scarcity mechanism appears to hold, with larger values of ECT indicating stronger response.

2.3. “Globalization” Pathway of Forest Transition, and Ecologically Unequal Exchange Theory

These two theories point to trade with other countries as a mechanism that drives changes on national forest areas. With the increasing integration of the world via international trade, forest dynamics can no longer simply be explained by national dynamics such the ones explained on the previous forest transition paths [

26]. Thus, the globalization pathway represents a modern version of the economic development pathway in which countries are integrate into global markets [

19]. This integration influences the national-scale forest dynamics and also the national labor, capital, tourism and ideologies. For this work, we focus on the agricultural and roundwood international trade as a process that alters the national forest area. International trade could displace deforestation from countries that undergo a forest transition to regions with higher levels of forest area [

19,

26,

27,

28]. We tested the effect of net exports of agricultural products and roundwood on the exporter country through the following two hypotheses:

The ecologically unequal exchange theory also identifies trade with other countries as a mechanism that drives changes on national forest areas. This theory points to trade between non-equivalent economically countries as a mechanism for cross-national disparities over access to environmental space [

30]. As an effort to empirically test this theory, a recent work analized transfers of biophysical resources such as materials, energy, land and labor embodied on trade of comidities and services [

31]. Other work from Jorgenson [

32] applied this hypothesis to deforestation as follows: less-developed countries with higher levels of exports sent to more-developed countries experience greater rates of deforestation. We built our hypothesis on this work [

32], and focused on agricultural products as the ones that are more likely to operate through this mechanism. Based on his work, we formulated the following hypothesis:

Hypothesis 7: Exports of agricultural products to high-income countries have a negative effect on the national forest cover of the exporter country. We tested this hypothesis for low-, middle-, and high-income country groups, the latter being for consistency purposes as the theory is not supposed to apply to trade between high-income countries.

5. Discussion

The results reveal the existence of a long-run equilibrium relationship between the variables forest cover area, GDP, GDP

2, agricultural area, and rural population density, for all the different country groups. Thus, they move together in a dynamic equilibrium relationship in the long run (

Table 4,

Table 6 and

Table 8). This is an important result since the long-run processes of forest are a key element for a good understanding of forest dynamics [

54]. Short-run shocks propagate to these variables, but they tend to converge to these long-term equilibrium dynamic relations, as reflected by the error correction terms that correct a proportion of the deviation from the equilibrium each year. Low-income countries and those at pre-forest transition stages have faster adjustments of their forest cover area to the long-term dynamics. This suggests than land dynamics in these two groups may be quicker and would thus require a more adaptive design of policies and a more cautious monitoring of them.

Furthermore, our results confirm an inverse relationship between agricultural and forest cover area, which appears in all the country groups of our sample (including all of them together) over the long run. This inverse relationship is larger than a unit for our low-income country group and lower in magnitude for middle- and high-income countries. For low-income countries, every hectare of new additional agricultural land induces more than one hectare of deforestation. In contrast, agricultural area expansion in middle- and high-income countries may to some extent occur on already cleared but not previously used land or on other types of land. Low-income countries may lack such land resources or be unable to access them because of technical or biophysical constraints. According to the forest transition classification, we also found an inverse relationship between agriculture and forest cover. For late- and post-transition countries, the negative coefficient is larger than for pre-transition countries. This could be due to the fact that pre-transition countries have higher forest area where the agricultural expansion could happen, while the late- and post-transition countries expand not only in forest area but also in other types of land. As for short-run dynamics, we show that for low- and high-income countries, and pre-transition countries, the main direct factor influencing forest cover was changes in agricultural area. In contrast, short-run forest dynamics in middle-income countries seem more complex, with a wider range of variables (agricultural producer price, government quality and annual average temperature) having small effects on forest cover area. The middle-income countries’ group gather a heterogeneous sample of countries; some studies with a smaller sample of middle-income countries have also identified a diversity of social and political variables that are important factors for land dynamics in those countries [

55,

56].

Our results also brought important conclusions about our hypotheses described in

Table 1:

Hypothesis 1, the EKC, was validated when agricultural cover land is present for high-income countries and for pre-transition countries in the long run (

Table 4 and

Table 6), and for the post-transition countries in the short run (

Table 7). This suggests that current low- and middle-income countries are experiencing different trajectories of relationships between economic development and forest cover compared to high-income countries.

Hypothesis 2, on the negative effect of agricultural employment on forest, was only validated for late forest transition countries in the short run (

Table 7).

Hypothesis 3, on the positive effect of agricultural intensification on forest, was only validated when we take into account the indirect effects in our analysis, and only for high-income countries (see “yield” variable on

Table 11). Thus, for high-income countries, agricultural yield had a positive impact on forest when we take into account the indirect effects of other variables on forest through agricultural yields. We also tested for the joint effect of economic growth and agricultural intensification on forest through an interaction term of the two, but we did not find any evidence of those synergies.

We explored the total (direct plus indirect) effects of other variables that are indirectly affecting forest through agricultural area. The results were particularly relevant for low-income countries on the short run, where economic development affects forest indirectly through the agricultural area (as shown when comparing columns (1) and (2) of

Table 5). Henceforth, development policies should take this into account: any intervention on those countries’ development will also cause indirect impacts on forest through the agricultural area, and both impacts could have opposite or similar effects on forest. Instead, the long run EKC in high-income countries disappeared when we included the indirect effects of development on forest through agricultural area (

Table 10). This suggests that the direct and indirect effects of economic development on forest have opposite directions for high-income countries and this results in an insignificant net effect on forest cover for those countries. Lastly, the removal of agricultural area from our model revealed the negative effect of rural population density on forest for middle-income countries in the short run (as shown when comparing columns (3) and (4) of

Table 5). Thus, rural population density affects forest area through agriculture in middle-income countries. We found similar effect in late forest transition countries for which agricultural employment affects forest indirectly through agriculture (as shown when comparing columns (3) and (4) of

Table 7). Both results reveal two important mechanisms by which agriculture affects forest in those countries: rural population pressure and agricultural employment.

- •

Hypothesis 4, on the positive effect of government quality of forest when forest cover in previous period is low, was validated for middle-income, pre-transition countries and also for all countries together (as shown by the negative effect of the interaction term on

Table 5,

Table 7, and

Table 9). In those countries the feedback mechanism of governance compensates for previous periods of deforestation. This suggests that the quality of governance plays a crucial role when countries face scarcity of forest. This goes along with other works that have also highlighted the role of governance on deforestation [

17,

56,

57]. On the same line,

Hypothesis 5, about the existence of a feedback response from forest scarcity or forest abundance that adjusts forest over the long run to the dynamic equilibrium relationship with the other variables, was validated for all country’s groups (see “ECT” on

Table 5,

Table 7, and

Table 9). Several main mechanisms have been suggested to operate this feedback, including perception of scarcity of forest services and prices of forest products [

25,

58].

Lastly, our results did not support

Hypothesis 6a and

6b, on the negative effect of national net exports of agricultural products and on the ambiguous effect of net exports of roundwood on forest; neither

Hypothesis 7, on the negative impact on forest from the export of agricultural products to high-income countries (

Table 5 and

Table 7). Although, we acknowledge the role that trade of agricultural and forest products has on forest dynamics at the national level as well as its effects on differences in forest quality across countries [

7,

12,

27,

28]. Furthermore, recent studies have shown the indirect effects of trade coming from countries experiencing a forest transition [

26], the reduction in trade’s potential to decrease humans’ impact on land ecosystems [

59] and the deforestation-related emissions driven by international trade [

60]. However, the aggregate nature of our data and the methods we used did not allow us to test for indirect land use effects from one country to another such the deforestation displacement.

We consider the crucial role of forest in mitigating climate change and the contribution of international mechanism such as REDD+ policies (reducing emissions from deforestation and forest degradation) to it. Our results show a negative impact of agricultural expansion on forest cover dynamics. Thus, REDD+ policies could be tailored in decreasing the opportunity cost of alternative agricultural activities such as agroforestry projects which would indirectly reduce the expansion of agricultural areas [

61]. This goes in line with the smallholder, tree-based land use intensification pathway suggested by Meyfroidt and Lambin [

1]. Moreover, the coefficients of the ECTs showed how land dynamics are faster in low-income economies. The amount of REDD+ policies should be enlarged on such countries and specifically tailored for their local features. Pro-active governance in these countries could prevent rapid forest losses. Our results support the conclusion that governance institutions can play a strong role for controlling forest cover changes.

Through this work, we have also contributed to overcome some of the current literature’s limitations such the lack of a more systematic focus on causal analysis, a disentangling of long- and short-run dynamics, and a closer examination across different geographical and temporal scales [

3]. Our contribution resides on the investigation of the long- and short-run cause relationships of forest dynamics through the use of an ECM and a cross-country panel dataset. However, further analyses could extend our work by (i) an improvement of the dataset used, not only through the increase in the time frame but also improvements on each variable’s measurement, especially the ones related to governance quality and trade; (ii) the use of alternative methods to explore indirect effects in a cointegration structural model. For assessing mediation and indirect effects, we could have used more sophisticated approaches building on recent advances in structural equation models for panel datasets; however, structural equation models that account for cointegration relations are less well developed [

62,

63]. In addition, we acknowledge the existence of other theories and forest transition paths that we could not test with our data. An example is the “smallholder, tree-based land use intensification” forest transition path which requires more refined measures of tree cover including outside forests such as agroforestry and sylvopastures, small woodlots and orchards. Some studies have made an attempt to measure what they consider “agroforestry” as a proxy for this path, but these measures remain imperfect [

64]. Another example is the citizen and consumers’ attitudes towards environmental resources that could underlie the EKC and economic development path. We also recognize the relevance of issues such the effects of urban populations on forest dynamics [

65], the ecological impacts of a forest transition [

66] or the deforestation’s displacement [

26]. These issues were out of the scope of this work, but they represent important issues which require further investigation.

6. Conclusions

Forest land dynamics are changing at a local and global level and the implication of those changes on societies make those dynamics an important issue. Here, we assessed some of the most prominent theories about large-scale, structural forest cover dynamics—the environmental Kuznets curve (EKC), the forest transition and the ecologically unequal exchange theories—using a methodological design that addresses key statistical and conceptual issues from previous approaches. By focusing on causal analysis and different country groups, the empirical findings provided evidence of a long-run relationship between forest cover, agricultural area, economic development and rural population for all our country groups, clustered according to both income levels and forest transition phases. Thus, short-run shocks are only one aspect explaining forest cover change dynamics, the other aspect, long-run dynamic equilibrium relations, has often been ignored but it represents an essential part of the forest dynamics’ understanding. Furthermore, our results confirm an inverse relationship between agricultural and forest cover area, which is larger than a unit for our low-income country group but lower in magnitude for middle- and high-income countries. This indicates that agricultural area expansion in middle- and high-income countries may to some extent occur on already cleared but not previously used land or on other, non-forested types of land, while low-income countries may lack such land resources or be unable to access them because of technical or biophysical constraints. Yet, agricultural expansion on non-forested lands, such as savannas or wetlands, also induces strong environmental impacts.

A global forest transition has been hypothesized to be more challenging than achieving a local or regional forest transitions [

26,

67]. In this work, we provided empirical evidence of two forest transition mechanisms, the one pointed by the

forest scarcity and by the

state of forest policy transition pathways. These pathways represent a feedback response from civil society and/or policy makers to a perceived scarcity of forest and they contribute to preserve the remaining forest and revert the decreasing trend. Thus, our results suggested that there is an important role for governance to play, especially when remaining forest areas are relatively low. In line with Liu et al. [

8], our results showed that the economic development pathway was also a relevant one, but with very heterogenous results across contexts. We also found an EKC for high-income countries and post-forest transition countries. This suggests that current low- and middle-income economies are experiencing different trajectories of relationships between economic development and forest cover than the high-income countries did. These heterogenous results show the complexity and context dependency of the causal relationship between GDP and deforestation. Further studies could build on our approach to go beyond aggregate measures of economic output like GDP, to explore the relations between inequality and poverty, and long and short term forest cover dynamics.

Lastly, we tested the role of trade through the assessment of the globalization pathway and the ecologically unequal exchange theory. Despite the importance of trade in other studies explaining forest dynamics, our results did not find evidence of those theories. In addition, we decided to include the variables’ indirect effects and to analyze the changes respect to the previous results. We showed that economic development affects forest area indirectly through agricultural area in low-income countries. In those countries, we observe an EKC on the long run due to those indirect effects. On the contrary, the EKC in high-income countries disappears when we included the indirect effects of agricultural area. Therefore, it is crucial to disentangle both direct and indirect effects on studies focused on land use dynamics, especially those intended to test theories related to forest transition and EKCs.

These insights contributed to improve the current literature on forest dynamics, but they can also be a useful tool to enhance land use policies. Our work explored the complexity of forest dynamics at an aggregate level; further studies could build on this framework together with more specific national or micro-level studies that could capture more nuanced socio-economic conditions to inform policy makers.