Bitcoin as a Safe Haven during COVID-19 Disease

Abstract

:1. Introduction

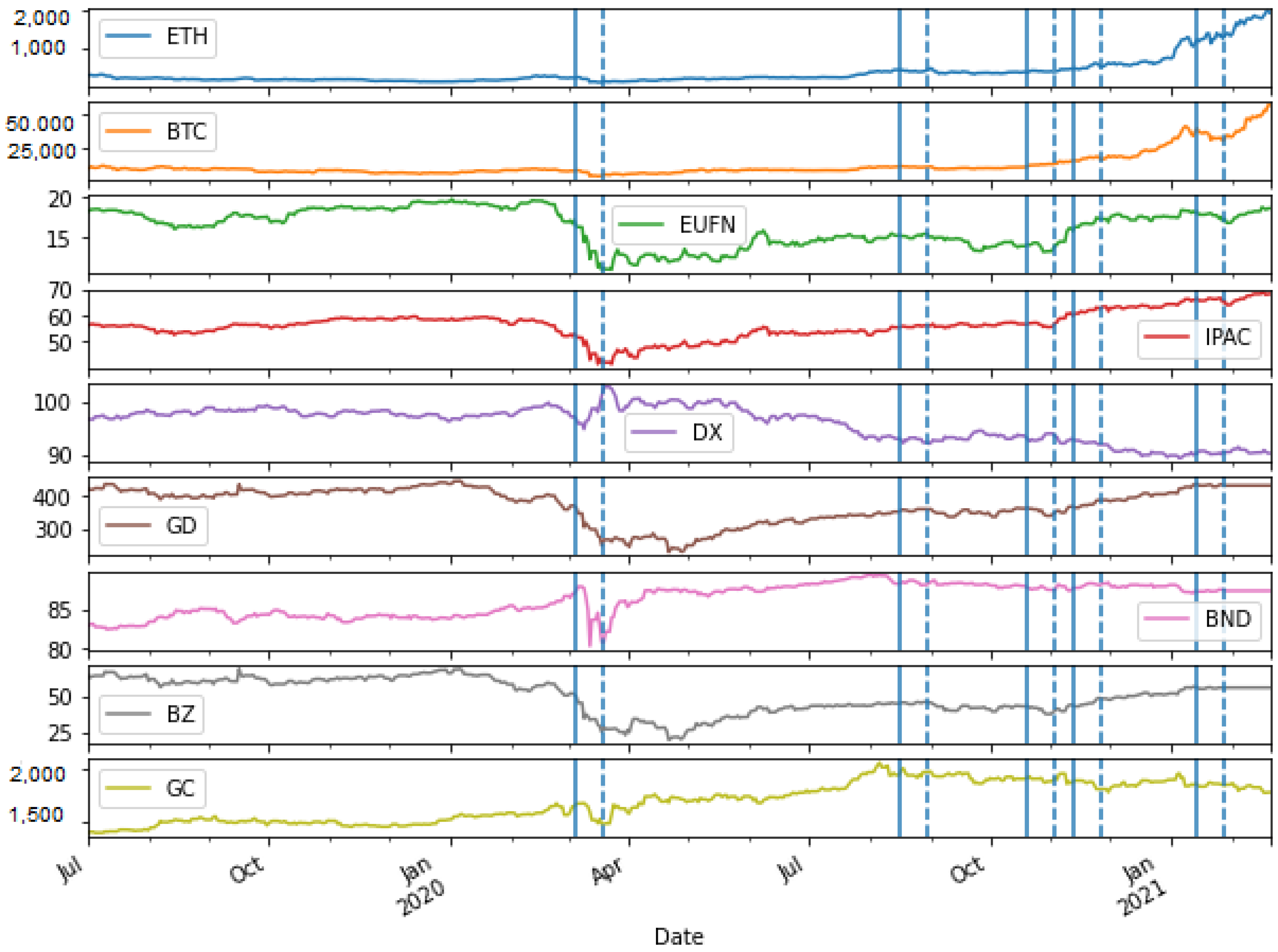

- 5 March 2020: Outbreaks increase in Europe and the Americas, and there are more and more deaths outside China.

- 16 August 2020: The COVID-19 cases in Europe reach the March levels.

- 20 October 2020: France reports a new daily record and Italy imposes the harshest lockdown since March.

- 12 November 2020: Pfizer-BioNTech announces 94% vaccine efficacy and Moderna announces 94% vaccine efficacy.

- 14 January 2021: The global death toll passes 2 million and the cases of new virus strains increase.

2. Related Work

3. Data and Methods

3.1. Regression and DCC Model

- represents the daily Bitcoin/Ether returns;

- represents the volatility in the FX market. It is the average daily volatility across the three currency pair EUR-USD, JPY-USD, GBP-USD as in work [6], (Let us underline that as a measure of volatility for each currency pair we computed the logarithmic returns and then we applied the moving standard deviation calculated using the rolling method of a pandas DataFrame with a window equal to five days as in [23]);

- represents the returns of the i-th index, with i varying from 1 to 13, that is the number of indexes downloaded from the Yahoo finance website as already described ( for , for , for , for , for , for , for , for , for , for , for , for , and for ).

- is an indicator variable for days in the sample that correspond to the days within the event window.

- is the conditional expectation of given , hence it is the predictable component of , hence the information available at the time ,

- is the unpredictable component of , represents the innovation and is equal to , where:

- -

- is a sequence of independent and identically distributed random vectors, such that and ,

- -

- is the square-root matrix of , that is the volatility matrix.

- Uses a Vector Autoregressive model VAR(p) to estimate the conditional mean of the historical series of returns where are the residues;

- Applies univariate volatility models, such as the GARCH models, to each component of the series estimating ;

- Atandardizes the innovations through and adapts a DCC model to (ref. https://www.dedaloinvest.com/education/didattica-investimenti/garch (accessed on 22 February 2022)).

- is the standardized marginal vector of innovations,

- ,

- is the volatility matrix of ,

- is the unconditional covariance matrix of ,

- are non-negative real numbers.

3.2. Results

3.2.1. Regression Model Results

- represents the daily Bitcoin/Ether returns;

- represents the volatility in the FX market;

- , , and are indicator variables for days in the sample where volatility is in the 90th, 95th and 99th percentiles, respectively;

- , , and are indicator variables for days in the sample where are in the 10th, 5th and 1th percentiles, respectively;

- represents the returns of the i-th index, with i varying from 1 to 13, which is the number of indexes under study.

3.2.2. DCC Model Results: Dynamic Conditional Correlations

4. Discussion and Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

Appendix A

| Coef. | Std. Err. | t | P > |t| | [0.025 | 0.975] | |

|---|---|---|---|---|---|---|

| Intercept | 0.000519 | 0.003235 | 0.160574 | 8.724870 | −0.005835 | 0.006873 |

| Volatility | 1.861958 | 1.541440 | 1.207934 | 2.275854 | −1.165789 | 4.889704 |

| retGSPC | 0.377757 | 0.867966 | 0.435221 | 6.635703 | −1.327129 | 2.082644 |

| retDAX | 0.054629 | 0.231717 | 0.235759 | 8.137063 | −0.400516 | 0.509775 |

| retFTSE | −0.164595 | 0.162726 | −1.011489 | 3.122216 | −0.484226 | 0.155036 |

| retN225 | −0.388537 | 0.153034 | −2.538898 | 1.139119 | −0.689130 | −0.087943 |

| retSS | −0.002224 | 0.132412 | −0.016799 | 9.866029 | −0.262312 | 0.257863 |

| retMWL | −0.486956 | 1.201786 | −0.405194 | 6.854905 | −2.847543 | 1.873630 |

| retEUFN | −0.116213 | 0.205816 | −0.564643 | 5.725437 | −0.520484 | 0.288058 |

| retIPAC | 1.049704 | 0.481604 | 2.179599 | 2.970528 | 0.103722 | 1.995687 |

| retDX | 0.052456 | 0.820777 | 0.063911 | 9.490644 | −1.559741 | 1.664653 |

| retGD | −0.406932 | 0.205612 | −1.979126 | 4.829388 | −0.810802 | −0.003062 |

| retBND | 0.415287 | 0.473071 | 0.877855 | 3.804011 | −0.513933 | 1.344507 |

| retBZ | 0.249528 | 0.094420 | 2.642729 | 8.455474 | 0.064064 | 0.434991 |

| retGC | 0.420767 | 0.173198 | 2.429406 | 1.543873 | 0.080567 | 0.760968 |

| Volatility:COVID | −8.046328 | 2.059425 | −3.907076 | 1.049045 | −12.091516 | −4.001140 |

| retGSPC:COVID | −2.791220 | 0.511730 | −5.454480 | 7.396082 | −3.796376 | −1.786064 |

| retDAX:COVID | −4.026278 | 0.951215 | −4.232773 | 2.699539 | −5.894685 | −2.157870 |

| retFTSE:COVID | 4.366916 | 1.267722 | 3.444696 | 6.147459 | 1.876816 | 6.857017 |

| retN225:COVID | −1.886215 | 0.653011 | −2.888490 | 4.021499 | −3.168880 | −0.603550 |

| retSS:COVID | 7.313847 | 1.156698 | 6.323037 | 5.264541 | 5.041823 | 9.585871 |

| retMWL:COVID | −2.224790 | 0.459455 | −4.842235 | 1.665634 | −3.127266 | −1.322313 |

| retEUFN:COVID | 4.951871 | 1.071813 | 4.620088 | 4.769613 | 2.846581 | 7.057160 |

| retIPAC:COVID | 2.815130 | 0.495212 | 5.684698 | 2.116044 | 1.842419 | 3.787841 |

| retDX:COVID | 2.258807 | 0.590198 | 3.827198 | 1.442955 | 1.099520 | 3.418093 |

| retGD:COVID | −4.745632 | 0.894099 | −5.307724 | 1.605368 | −6.501851 | −2.989414 |

| retBND:COVID | −3.526005 | 0.947553 | −3.721168 | 2.184281 | −5.387219 | −1.664790 |

| retBZ:COVID | 0.115045 | 0.120629 | 0.953707 | 3.406456 | −0.121899 | 0.351989 |

| retGC:COVID | 0.837573 | 0.212477 | 3.941947 | 9.111532 | 0.420219 | 1.254927 |

| retGSPCprevious | 0.317137 | 0.630108 | 0.503306 | 6.149479 | −0.920541 | 1.554816 |

| retDAXprevious | −0.215440 | 0.226793 | −0.949938 | 3.425558 | −0.660915 | 0.230035 |

| retFTSEprevious | 0.299326 | 0.205157 | 1.459010 | 1.451261 | −0.103650 | 0.702303 |

| retN225previous | 0.021541 | 0.173923 | 0.123853 | 9.014763 | −0.320085 | 0.363167 |

| retSSprevious | 0.151231 | 0.162394 | 0.931259 | 3.521233 | −0.167749 | 0.470211 |

| retMWLprevious | −0.465460 | 0.794070 | −0.586170 | 5.579986 | −2.025199 | 1.094278 |

| retEUFNprevious | 0.144767 | 0.210160 | 0.688842 | 4.912098 | −0.268036 | 0.557569 |

| retIPACprevious | −0.147313 | 0.344129 | −0.428075 | 6.687616 | −0.823262 | 0.528636 |

| retDXprevious | −1.003056 | 0.532647 | −1.883154 | 6.020031 | −2.049297 | 0.043186 |

| retGDprevious | 0.241955 | 0.297856 | 0.812323 | 4.169535 | −0.343103 | 0.827014 |

| retBNDprevious | 0.274211 | 0.699812 | 0.391836 | 6.953296 | −1.100382 | 1.648805 |

| retBZprevious | 0.008309 | 0.145255 | 0.057203 | 9.544039 | −0.277005 | 0.293623 |

| retGCprevious | −0.063186 | 0.158377 | −0.398959 | 6.900765 | −0.374274 | 0.247903 |

| Volatilityprevious | −1.138806 | 1.868439 | −0.609496 | 5.424443 | −4.808854 | 2.531242 |

| retBTCprevious | 0.011939 | 0.046409 | 0.257247 | 7.970828 | −0.079220 | 0.103098 |

| Coef. | Std. Err. | t | P > |t| | [0.025 | 0.975] | |

|---|---|---|---|---|---|---|

| Intercept | 0.000504 | 0.003202 | 0.157274 | 8.750859 | −0.005785 | 0.006793 |

| Volatility | 1.564366 | 1.586767 | 0.985883 | 3.246196 | −1.552425 | 4.681157 |

| retGSPC | 0.364230 | 0.876243 | 0.415673 | 6.778100 | −1.356921 | 2.085381 |

| retDAX | 0.112108 | 0.231686 | 0.483881 | 6.286611 | −0.342978 | 0.567195 |

| retFTSE | −0.158049 | 0.163666 | −0.965684 | 3.346221 | −0.479528 | 0.163429 |

| retN225 | −0.322226 | 0.155915 | −2.066680 | 3.922673 | −0.628480 | −0.015972 |

| retSS | −0.012323 | 0.131195 | −0.093930 | 9.251984 | −0.270021 | 0.245374 |

| retMWL | −0.605373 | 1.221744 | −0.495499 | 6.204434 | −3.005172 | 1.794425 |

| retEUFN | −0.152120 | 0.211782 | −0.718289 | 4.728806 | −0.568110 | 0.263869 |

| retIPAC | 1.028862 | 0.475740 | 2.162655 | 3.099333 | 0.094394 | 1.963329 |

| retDX | −0.105613 | 0.819252 | −0.128914 | 8.974727 | −1.714820 | 1.503595 |

| retGD | −0.391464 | 0.211626 | −1.849788 | 6.487452 | −0.807149 | 0.024221 |

| retBND | −0.124085 | 0.582607 | −0.212983 | 8.314186 | −1.268465 | 1.020294 |

| retBZ | 0.244991 | 0.095985 | 2.552381 | 1.096512 | 0.056453 | 0.433530 |

| retGC | 0.485437 | 0.189116 | 2.566879 | 1.052235 | 0.113969 | 0.856906 |

| Volatility:COVID | −5.960112 | 1.532135 | −3.890068 | 1.123477 | −8.969593 | −2.950630 |

| retGSPC:COVID | −2.096716 | 0.595851 | −3.518858 | 4.688855 | −3.267110 | −0.926321 |

| retDAX:COVID | −3.886193 | 0.978315 | −3.972332 | 8.053458 | −5.807839 | −1.964547 |

| retFTSE:COVID | 4.670566 | 1.221398 | 3.823952 | 1.461876 | 2.271448 | 7.069684 |

| retN225:COVID | −2.474954 | 0.615900 | −4.018433 | 6.665593 | −3.684730 | −1.265178 |

| retSS:COVID | 6.953559 | 1.246511 | 5.578416 | 3.794038 | 4.505112 | 9.402006 |

| retMWL:COVID | −1.681220 | 0.540890 | −3.108251 | 1.978209 | −2.743657 | −0.618784 |

| retEUFN:COVID | 3.804935 | 1.242417 | 3.062527 | 2.300945 | 1.364531 | 6.245340 |

| retIPAC:COVID | 2.716392 | 0.522868 | 5.195174 | 2.875442 | 1.689353 | 3.743431 |

| retDX:COVID | 2.033804 | 0.629049 | 3.233141 | 1.296952 | 0.798201 | 3.269407 |

| retGD:COVID | −4.679026 | 0.920970 | −5.080540 | 5.146648 | −6.488032 | −2.870020 |

| retBND:COVID | −1.748613 | 1.294075 | −1.351246 | 1.771663 | −4.290487 | 0.793260 |

| retBZ:COVID | 0.315101 | 0.186865 | 1.686248 | 9.230909 | −0.051947 | 0.682149 |

| retGC:COVID | 0.233600 | 0.138870 | 1.682148 | 9.310162 | −0.039174 | 0.506373 |

| retGSPCprevious | 0.319588 | 0.631889 | 0.505766 | 6.132213 | −0.921594 | 1.560770 |

| retDAXprevious | −0.190991 | 0.228979 | −0.834096 | 4.045853 | −0.640761 | 0.258779 |

| retFTSEprevious | 0.401148 | 0.225330 | 1.780268 | 7.557806 | −0.041454 | 0.843750 |

| retN225previous | 0.068619 | 0.173269 | 0.396022 | 6.922404 | −0.271724 | 0.408961 |

| retSSprevious | 0.135488 | 0.163490 | 0.828722 | 4.076171 | −0.185646 | 0.456622 |

| retMWLprevious | −0.479158 | 0.804985 | −0.595239 | 5.519260 | −2.060343 | 1.102026 |

| retEUFNprevious | 0.068363 | 0.224509 | 0.304498 | 7.608623 | −0.372627 | 0.509352 |

| retIPACprevious | −0.205606 | 0.342797 | −0.599788 | 5.488917 | −0.878942 | 0.467730 |

| retDXprevious | −1.196388 | 0.547880 | −2.183668 | 2.940391 | −2.272556 | −0.120220 |

| retGDprevious | 0.230030 | 0.295055 | 0.779617 | 4.359478 | −0.349528 | 0.809588 |

| retBNDprevious | 0.387602 | 0.697597 | 0.555625 | 5.786907 | −0.982645 | 1.757850 |

| retBZprevious | 0.015779 | 0.144608 | 0.109112 | 9.131527 | −0.268267 | 0.299824 |

| retGCprevious | −0.095305 | 0.158211 | −0.602390 | 5.471599 | −0.406069 | 0.215460 |

| Volatilityprevious | −0.822011 | 1.875311 | −0.438333 | 6.613150 | −4.505572 | 2.861550 |

| retBTCprevious | 0.015492 | 0.045447 | 0.340874 | 7.333271 | −0.073777 | 0.104760 |

| Coef. | Std. Err. | t | P > |t| | [0.025 | 0.975] | |

|---|---|---|---|---|---|---|

| Intercept | 0.003136 | 0.003020 | 1.038462 | 2.995096 | −0.002796 | 0.009069 |

| Volatility | 2.473335 | 1.501963 | 1.646735 | 1.001816 | −0.476926 | 5.423596 |

| retGSPC | 0.661160 | 0.854585 | 0.773662 | 4.394620 | −1.017477 | 2.339796 |

| retDAX | 0.032903 | 0.225642 | 0.145821 | 8.841162 | −0.410319 | 0.476125 |

| retFTSE | −0.088266 | 0.169680 | −0.520189 | 6.031403 | −0.421564 | 0.245032 |

| retN225 | −0.243043 | 0.150489 | −1.615018 | 1.068782 | −0.538644 | 0.052559 |

| retSS | 0.036939 | 0.126067 | 0.293008 | 7.696264 | −0.210692 | 0.284569 |

| retMWL | −0.804726 | 1.214789 | −0.662441 | 5.079649 | −3.190901 | 1.581448 |

| retEUFN | −0.235210 | 0.203292 | −1.157005 | 2.477707 | −0.634531 | 0.164111 |

| retIPAC | 0.984459 | 0.471158 | 2.089445 | 3.712489 | 0.058977 | 1.909941 |

| retDX | −1.101105 | 0.627465 | −1.754845 | 7.984056 | −2.333617 | 0.131407 |

| retGD | −0.533877 | 0.194313 | −2.747517 | 6.201094 | −0.915560 | −0.152195 |

| retBND | 0.246686 | 0.724690 | 0.340402 | 7.336836 | −1.176802 | 1.670173 |

| retBZ | 0.252458 | 0.090762 | 2.781538 | 5.595128 | 0.074177 | 0.430739 |

| retGC | 0.383169 | 0.194444 | 1.970584 | 4.927072 | 0.001228 | 0.765110 |

| Volatility:COVID | −4.794005 | 1.633103 | −2.935520 | 3.468585 | −8.001861 | −1.586149 |

| retGSPC:COVID | 0.374376 | 5.650599 | 0.066254 | 9.471994 | −10.724931 | 11.473683 |

| retDAX:COVID | −6.020478 | 0.573694 | −10.494229 | 1.292720 × 10−23 | −7.147369 | −4.893587 |

| retFTSE:COVID | 2.123797 | 1.419015 | 1.496670 | 1.350507 | −0.663533 | 4.911128 |

| retN225:COVID | −3.968531 | 2.686725 | −1.477089 | 1.402221 | −9.245986 | 1.308924 |

| retSS:COVID | 2.726836 | 2.172040 | 1.255426 | 2.098553 | −1.539639 | 6.993311 |

| retMWL:COVID | −11.184234 | 2.270737 | −4.925376 | 1.114212 | −15.644577 | −6.723891 |

| retEUFN:COVID | 6.123195 | 0.979607 | 6.250666 | 8.182700 | 4.198982 | 8.047408 |

| retIPAC:COVID | 7.072823 | 5.141969 | 1.375509 | 1.695317 | −3.027396 | 17.173043 |

| retDX:COVID | 9.808108 | 2.896512 | 3.386179 | 7.591707 | 4.118575 | 15.497641 |

| retGD:COVID | 1.556603 | 3.084781 | 0.504607 | 6.140361 | −4.502742 | 7.615948 |

| retBND:COVID | 4.711567 | 2.331925 | 2.020463 | 4.381780 | 0.131035 | 9.292098 |

| retBZ:COVID | −0.312265 | 1.541516 | −0.202570 | 8.395460 | −3.340219 | 2.715690 |

| retGC:COVID | 5.180426 | 2.558226 | 2.025007 | 4.334745 | 0.155377 | 10.205475 |

| retGSPCprevious | 0.554400 | 0.607255 | 0.912960 | 3.616620 | −0.638414 | 1.747214 |

| retDAXprevious | −0.247877 | 0.226827 | −1.092802 | 2.749576 | −0.693426 | 0.197673 |

| retFTSEprevious | 0.406215 | 0.215546 | 1.884587 | 6.001074 | −0.017175 | 0.829606 |

| retN225previous | 0.230483 | 0.140987 | 1.634789 | 1.026635 | −0.046453 | 0.507419 |

| retSSprevious | 0.042205 | 0.138882 | 0.303893 | 7.613242 | −0.230597 | 0.315007 |

| retMWLprevious | −0.345948 | 0.786791 | −0.439695 | 6.603304 | −1.891419 | 1.199523 |

| retEUFNprevious | 0.028105 | 0.220973 | 0.127188 | 8.988381 | −0.405946 | 0.462156 |

| retIPACprevious | −0.525621 | 0.273759 | −1.920011 | 5.537157 | −1.063359 | 0.012117 |

| retDXprevious | −1.581393 | 0.528977 | −2.989528 | 2.918576 | −2.620448 | −0.542338 |

| retGDprevious | −0.005143 | 0.233857 | −0.021991 | 9.824634 | −0.464501 | 0.454215 |

| retBNDprevious | −0.193969 | 0.783818 | −0.247467 | 8.046392 | −1.733600 | 1.345662 |

| retBZprevious | 0.141724 | 0.105926 | 1.337956 | 1.814618 | −0.066343 | 0.349791 |

| retGCprevious | −0.041833 | 0.162991 | −0.256659 | 7.975378 | −0.361992 | 0.278326 |

| Volatilityprevious | −2.751986 | 1.602243 | −1.717584 | 8.643344 | −5.899225 | 0.395253 |

| retBTCprevious | 0.009342 | 0.047016 | 0.198694 | 8.425755 | −0.083010 | 0.101693 |

References

- McKibbin, W.; Fernando, R. The Global Macroeconomic Impacts of COVID-19: Seven Scenarios. CAMA Working Paper No. 19/2020. Available online: http://doi.org/10.2139/ssrn.3547729 (accessed on 2 March 2020).

- Baldwin, R.; di Mauro, B.W. Economics in the Time of COVID-19. In A CEPR Press VoxEU.org eBook; Centre for Economic Policy Research: London, UK, 2020; ISBN 978-1-912179-28-2. [Google Scholar]

- Albulescu, C. Coronavirus and Financial Volatility: 40 Days of Fasting and Fear. Working Papers hal-02501814, HAL. 2020. Available online: http://dx.doi.org/10.48550/arXiv.2003.04005 (accessed on 22 February 2021). [CrossRef]

- Albulescu, C. Coronavirus and oil price crash. arXiv 2020, arXiv:2003.06184. [Google Scholar] [CrossRef]

- Joachim, G.N.; Koijen Ralph, S.J. Coronavirus: Impact on Stock Prices and Growth Expectations. No 27387, NBER Working Papers, National Bureau of Economic Research, Inc. Available online: https://EconPapers.repec.org/RePEc:nbr:nberwo:27387 (accessed on 22 February 2021).

- Baur Dirk, G.; Hong, K.; Lee Adrian, D. Bitcoin: Medium of exchange or speculative assets? J. Int. Financ. Mark. Inst. Money Elsevier 2018, 54, 177–189. [Google Scholar] [CrossRef]

- Ranaldo, A.; Söderlind, P. Safe Haven Currencies; Centre for Economic Policy Research: London, UK, 2009; Available online: https://cepr.org/active/publications/discussion_papers/dp.php?dpno=7249 (accessed on 22 February 2021).

- Mariana, C.D.; Ekaputra, I.A.; Husodo, Z.A. Are Bitcoin and Ethereum safe-havens for stocks during the COVID-19 pandemic? Financ. Res. Lett. 2020, 38, 101798. [Google Scholar] [CrossRef] [PubMed]

- Bouri, E.; Molnár, P.; Azzi, G.; Roubaud, D.; Hagfors, L.I. On the hedge and safe haven properties of Bitcoin: Is it really more than a diversifier? Financ. Res. Lett. 2017, 20, 192–198. [Google Scholar] [CrossRef]

- Dyhrberg, A.H. Hedging Capabilities of Bitcoin. Is It the Virtual Gold? UCD Centre for Economic Research Working Paper Series; No. WP15/21; University College Dublin: Dublin, Ireland, 2015. [Google Scholar]

- Stensås, A.; Nygaard, M.F.; Kyaw, K.; Treepongkaruna, S. Can Bitcoin be a diversifier, hedge or safe haven tool? Cogent Econ. Financ. 2019, 7, 1593072. [Google Scholar] [CrossRef]

- Baur, D.G.; Hoang, L.T. A crypto safe haven against Bitcoin. Financ. Res. Lett. 2021, 38, 101431. [Google Scholar] [CrossRef]

- Kliber, A.; Marszałek, P.; Musiałkowska, I.; Świerczyńska, K. Bitcoin: Safe haven, hedge or diversifier? Perception of bitcoin in the context of a country’s economic situation—A stochastic volatility approach. Phys. A Stat. Mech. Its Appl. 2019, 524, 246–257. [Google Scholar] [CrossRef]

- Selmi, R.; Mensi, W.; Hammoudeh, S.; Bouoiyour, J. Is Bitcoin a hedge, a safe haven or a diversifier for oil price movements? A comparison with gold. Energy Econ. 2018, 74, 787–801. [Google Scholar] [CrossRef]

- Wang, P.; Zhang, W.; Li, X.; Shen, D. Is cryptocurrency a hedge or a safe haven for international indices? A comprehensive and dynamic perspective. Financ. Res. Lett. 2019, 31, 1–18. [Google Scholar] [CrossRef]

- Paule-Vianez, J.; Prado-Román, C.; Gómez-Martínez, R. Economic policy uncertainty and Bitcoin. Is Bitcoin a safe-haven asset? Eur. J. Manag. Bus. Econ. 2020. [Google Scholar] [CrossRef] [Green Version]

- Shahzad, S.J.H.; Bouri, E.; Roubaud, D.; Kristoufek, L.; Lucey, B. Is Bitcoin a better safe-haven investment than gold and commodities? Int. Rev. Financ. Anal. 2019, 63, 322–330. [Google Scholar] [CrossRef]

- Smales, L.A. Bitcoin as a safe haven: Is it even worth considering? Financ. Res. Lett. 2019, 30, 385–393. [Google Scholar] [CrossRef]

- Aysan, A.F.; Kayani, F.N. China’s transition to a digital currency does it threaten dollarization? Asia Glob. Econ. 2022, 2, 100023. [Google Scholar] [CrossRef]

- Andrew, U.; Hanxiong, Z. Is Bitcoin a hedge or safe haven for currencies? An intraday analysis. Int. Rev. Financ. Anal. 2019, 63, 49–57. [Google Scholar]

- Cheema, M.A.; Faff, R.W.; Szulczuk, K. The 2008 Global Financial Crisis and COVID-19 Pandemic: How Safe are the Safe Haven Assets? Available online: https://ssrn.com/abstract=3590015 (accessed on 1 October 2020).

- Baker, S.R.; Bloom, N.; Davis, S.J.; Kost, K.J.; Sammon, M.C.; Viratyosin, T. The Unprecedented Stock Market Impact of COVID-19. National Bureau of Economic Research. Working Paper No 26945. 2020. Available online: http://www.nber.org/papers/w26945 (accessed on 1 October 2020). [CrossRef]

- Corbet, S.; Hou, Y.; Hu, Y.; Larkin, C.; Oxley, L. Any port in a storm: Cryptocurrency safe-havens during the COVID-19 pandemic. Econ. Lett. 2020, 194, 109377. [Google Scholar] [CrossRef]

- Thomas, C.; Richard, M. Safe haven or risky hazard? Bitcoin during the COVID-19 bear market. Financ. Res. Lett. 2020, 35, 101607. [Google Scholar] [CrossRef]

- Rubbaniy, G.; Khalid, A.A.; Samitas, A. Are Cryptos Safe-Haven Assets during COVID-19? Evidence from Wavelet Coherence Analysis. Emerg. Mark. Financ. Trade 2021, 57, 1741–1756. [Google Scholar] [CrossRef]

- Ji, Q.; Zhang, D.; Zhao, Y. Searching for safe-haven assets during the COVID-19 pandemic. Int. Rev. Financ. Anal. 2020, 71, 101526. [Google Scholar] [CrossRef]

- Baur, D.G.; Dimpfl, T. A Safe Haven Index. Available online: https://ssrn.com/abstract=3641589 (accessed on 22 February 2021).

- Będowska-Sójka, B.; Kliber, A. Is there one safe-haven for various turbulences? The evidence from gold, Bitcoin and Ether. N. Am. J. Econ. Financ. 2021, 56, 101390. [Google Scholar] [CrossRef]

- Dutta, A.; Das, D.; Jana, R.K.; Vo, X.V. COVID-19 and oil market crash: Revisiting the safe haven property of gold and Bitcoin. Resour. Policy 2020, 69, 101816. [Google Scholar] [CrossRef]

- Abdelsalam, O.; Aysan, A.F.; Cepni, O.; Disli, M. The Spillover Effects of the COVID-19 Pandemic: Which Subsectors of Tourism Have Been Affected More? Tour. Econ. 2021. [Google Scholar] [CrossRef]

- Engle, R. Dynamic conditional correlation: A simple class of multivariate generalized autoregressive conditional heteroskedasticity models. J. Bus. Econ. Stat. 2002, 20, 339–350. [Google Scholar] [CrossRef]

- Greene, W.H. Econometric Analysis, 5th ed.; Stern School of Business, New York University: New York, NY, USA, 2003. [Google Scholar]

| retBTC | retETH | retDAX | retGSPC | retFTSE | retN225 | retSS | retMWL | |

|---|---|---|---|---|---|---|---|---|

| mean | 0.002705 | 0.003129 | 0.000265 | 0.000450 | −0.000221 | 0.000543 | 0.000347 | 0.000317 |

| std | 0.039739 | 0.050453 | 0.015741 | 0.014854 | 0.012917 | 0.011302 | 0.009361 | 0.014131 |

| min | −0.464730 | −0.550732 | −0.120154 | −0.127652 | −0.115117 | −0.062736 | −0.080343 | −0.120786 |

| 25% | −0.013128 | −0.017409 | −0.001918 | −0.001468 | −0.003025 | −0.002149 | −0.001755 | −0.000990 |

| 50% | 0.001331 | 0.001802 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 |

| 75% | 0.017542 | 0.026513 | 0.005442 | 0.004696 | 0.003396 | 0.003434 | 0.003135 | 0.004058 |

| max | 0.171821 | 0.230695 | 0.092150 | 0.089683 | 0.086664 | 0.077314 | 0.055535 | 0.087061 |

| kurtosis | 33.512346 | 25.807796 | 15.162256 | 20.116052 | 17.408403 | 10.062584 | 13.570148 | 23.031934 |

| skewness | −2.479123 | −2.264091 | −1.426191 | −1.188401 | −1.338449 | 0.281258 | −1.123514 | −1.690548 |

| retEUFN | retIPAC | retDX | retGD | retBND | retBZ | retGC | |

|---|---|---|---|---|---|---|---|

| mean | 0.000009 | 0.000319 | −0.000124 | 0.000031 | 0.000092 | −0.000234 | 0.000404 |

| std | 0.019565 | 0.012227 | 0.003238 | 0.015295 | 0.003994 | 0.031627 | 0.009929 |

| min | −0.162119 | −0.111030 | −0.016262 | −0.127625 | −0.055920 | −0.279761 | −0.051069 |

| 25 % | −0.003926 | −0.001580 | −0.001323 | −0.001786 | −0.000343 | −0.004974 | −0.001366 |

| 50% | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 |

| 75% | 0.004352 | 0.003943 | 0.000953 | 0.003769 | 0.000953 | 0.006553 | 0.004037 |

| max | 0.113003 | 0.072607 | 0.015786 | 0.073011 | 0.041335 | 0.190774 | 0.057775 |

| kurtosis | 20.573739 | 22.246038 | 5.062571 | 21.876907 | 89.795265 | 25.313214 | 8.024764 |

| skewness | −1.757299 | −1.690733 | 0.432049 | −2.033562 | −3.179314 | −1.577847 | −0.249648 |

| 5 March 2020 + | 16 August 2020 + | |||||

|---|---|---|---|---|---|---|

| 7 Days | 10 Days | 14 Days | 7 Days | 10 Days | 14 Days | |

| retIPAC | 1.029 | 1.009 | 0.965 | 1.035 | 1.033 | 1.036 |

| retGD | −0.41 | 0 | −0.539 | −0.561 | −0.554 | −0.557 |

| retBND | 0 | 0 | 0 | 2.211 | 2.198 | 2.197 |

| retBZ | 0.2494 | 0.245 | 0.252 | 0.286 | 0.2842 | 0.286 |

| retGC | 0.427 | 0.492 | 0.389 | 0.53 | 0.525 | 0.529 |

| Volatility:COVID | −8.089 | −5.902 | −4.744 | 0 | 0 | 0 |

| retGSPC:COVID | −2.769 | −2.064 | 0 | 0 | −18 | −3.356 |

| retDAX:COVID | −3.983 | −3.82 | −5.96 | −1.89 | −2.509 | −3.719 |

| retFTSE:COVID | 4.26 | 4.563 | 0 | 1.29 | 0.85 | 2.619 |

| retN225:COVID | −1.873 | −2.436 | 0 | −3.488 | −3.441 | −1.954 |

| retSS:COVID | 7.287 | 6.884 | 0 | −1.411 | −1.293 | −2.162 |

| retURTH:COVID | −2.2 | −1.649 | −11.179 | 1.859 | 1.129 | 2.703 |

| retEUFN:COVID | 4.93 | 3.761 | 6.08 | 3.058 | 2.783 | 2.63 |

| retIPAC:COVID | 2.799 | 2.69 | 0 | −1.165 | −1.873 | 0 |

| retDX:COVID | 2.234 | 1.999 | 9.932 | 1.218 | 1.147 | 0 |

| retGD:COVID | −4.717 | −4.623 | 0 | 2.09 | 2.602 | 5.564 |

| retBND:COVID | −3.491 | 0 | 4.825 | −0.485 | −0.668 | 0 |

| retBZ:COVID | 0 | 0 | 0 | 0 | 0 | −2.504 |

| retGC:COVID | 0.845 | 0 | 5.297 | 0 | 0 | 0 |

| retDXprevious | 0 | −1.142 | −1.532 | 0 | 0 | 0 |

| retBNDprevious | 0 | 0 | 0 | −1.454 | −1.466 | −1.466 |

| 20 October 2020 + | 12 November 2020 + | 14 January 2021 + | |||||||

|---|---|---|---|---|---|---|---|---|---|

| 7 Days | 10 Days | 14 Days | 7 Days | 10 Days | 14 Days | 7 Days | 10 Days | 14 Days | |

| retIPAC | 0.927 | 0.93 | 0.926 | 1.11 | 1.079 | 1.074 | 0.952 | 0.936 | 0.914 |

| retGD | −0.556 | −0.558 | −0.551 | −0.588 | −0.589 | −0.61 | −0.584 | −0.566 | −0.577 |

| retBND | 2.160 | 2.165 | 2.157 | 2.118 | 2.127 | 2.131 | 2.193 | 2.206 | 2.226 |

| retBZ | 0.277 | 0.28 | 0.28 | 0.296 | 0.295 | 0.303 | 0.292 | 0.286 | 0.291 |

| retGC | 0.512 | 0.51 | 0.514 | 0.517 | 0.515 | 0.53 | 0.515 | 0.524 | 0.526 |

| Volatility:COVID | 0 | 0 | 0 | −4.013 | −4.28 | −4.238 | −5.365 | −5.067 | −5.021 |

| retGSPC:COVID | 1.4572 | 0 | 0 | −1.939 | −2.25 | −6.55 | −1.624 | −2.993 | −31.196 |

| retDAX:COVID | 0 | 0 | 0 | −3.411 | −3.551 | −13.777 | −2.227 | 3.798 | 0 |

| retFTSE:COVID | −3.126 | −3.333 | 0 | −1.873 | −2.382 | 3.547 | 0 | 0 | 0 |

| retN225:COVID | −1.107 | 0 | −1.932 | 0.643 | 0 | −4.645 | −6.326 | −6.558 | 0 |

| retSS:COVID | −1.786 | −1.83 | −1.108 | 1.111 | 1.132 | −8.33 | −3.885 | −3.495 | 0 |

| retURTH:COVID | 0.688 | 0 | 0 | −0.813 | −0.833 | 6.89 | 0 | 0 | 0 |

| retEUFN:COVID | 0 | 0 | 0 | 4.299 | 4.092 | 4.674 | −2.478 | −5.801 | 0 |

| retIPAC:COVID | 1.991 | 2.093 | 3.925 | −2.436 | −1.558 | 3.2 | 6.443 | 12.388 | 21.231 |

| retDX:COVID | −1.249 | 0 | −3.135 | −2.317 | −2.261 | −4.789 | 1.632 | 0 | 21.248 |

| retGD:COVID | 0.803 | 0 | 0 | 1.639 | 1.915 | 17.394 | 5.242 | 1.68 | 0 |

| retBND:COVID | 0 | 0 | 0 | 3.301 | 3.474 | 0 | 0.866 | −0.613 | 0 |

| retBZ:COVID | 0 | 0 | 0 | 0.239 | 0.503 | −7.591 | 4.384 | 0 | 0 |

| retGC:COVID | 0 | 0 | 0 | 2.58 | 3.458 | −3.399 | −4.234 | −6.128 | 0 |

| retDXprevious | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| retBNDprevious | −1.441 | −1.436 | −1.469 | −1.443 | −1.445 | −1.421 | −1.517 | −1.524 | −1.526 |

| 5 March 2020 + | 16 August 2020 + | ||||||||

| 7 Days | 10 Days | 14 Days | 7 Days | 10 Days | 14 Days | ||||

| retGD | −0.41 | 0 | −0.539 | −0.561 | −0.554 | −0.557 | |||

| retGSPC:COVID | −2.769 | −2.064 | 0 | 0 | −18 | −3.356 | |||

| retDAX:COVID | −3.983 | −3.82 | −5.96 | −1.89 | −2.509 | −3.719 | |||

| retN225:COVID | −1.873 | −2.436 | 0 | −3.488 | −3.441 | −1.954 | |||

| retSS:COVID | 7.287 | 6.884 | 0 | −1.411 | −1.293 | −2.162 | |||

| retURTH:COVID | −2.2 | −1.649 | −11.179 | 1.859 | 1.129 | 2.703 | |||

| retIPAC:COVID | 2.799 | 2.69 | 0 | −1.165 | −1.873 | 0 | |||

| retGD:COVID | −4.717 | −4.623 | 0 | 2.09 | 2.602 | 5.564 | |||

| retBND:COVID | −3.491 | 0 | 4.825 | −0.485 | −0.668 | 0 | |||

| retBNDprevious | 0 | 0 | 0 | −1.454 | −1.466 | −1.466 | |||

| 20 October 2020 + | 12 November 2020 + | 14 January 2021 + | |||||||

| 7 Days | 10 Days | 14 Days | 7 Days | 10 Days | 14 Days | 7 Days | 10 Days | 14 Days | |

| retGD | −0.556 | −0.558 | −0.551 | −0.588 | −0.589 | −0.61 | −0.584 | −0.566 | −0.577 |

| retGSPC:COVID | 1.4572 | 0 | 0 | −1.939 | −2.25 | −6.55 | −1.624 | −2.993 | −31.196 |

| retDAX:COVID | 0 | 0 | 0 | −3.411 | −3.551 | −13.777 | −2.227 | 3.798 | 0 |

| retFTSE:COVID | −3.126 | −3.333 | 0 | −1.873 | −2.382 | 3.547 | 0 | 0 | 0 |

| retN225:COVID | −1.107 | 0 | −1.932 | 0.643 | 0 | −4.645 | −6.326 | −6.558 | 0 |

| retSS:COVID | −1.786 | −1.83 | −1.108 | 1.111 | 1.132 | −8.33 | −3.885 | −3.495 | 0 |

| retURTH:COVID | 0.688 | 0 | 0 | −0.813 | −0.833 | 6.89 | 0 | 0 | 0 |

| retEUFN:COVID | 0 | 0 | 0 | 4.299 | 4.092 | 4.674 | −2.478 | −5.801 | 0 |

| retIPAC:COVID | 1.991 | 2.093 | 3.925 | −2.436 | −1.558 | 3.2 | 6.443 | 12.388 | 21.231 |

| retDX:COVID | −1.249 | 0 | −3.135 | −2.317 | −2.261 | −4.789 | 1.632 | 0 | 21.248 |

| retGC:COVID | 0 | 0 | 0 | 2.58 | 3.458 | −3.399 | −4.234 | −6.128 | 0 |

| retBNDprevious | −1.441 | −1.436 | −1.469 | −1.443 | −1.445 | −1.421 | −1.517 | −1.524 | −1.526 |

| 5 March 2020 + | 16 August 2020 + | |||||

|---|---|---|---|---|---|---|

| 7 Days | 10 Days | 14 Days | 7 Days | 10 Days | 14 Days | |

| Intercept | 0 | 0 | 0.009 | 0.009 | 0.009 | 0.009 |

| retGD | −0.559 | −0.534 | −0.653 | −0.729 | −0.715 | −0.719 |

| retBND | 0 | 0 | 0 | 2.647 | 2.635 | 2.65 |

| retBZ | 0.304 | 0.297 | 0.303 | 0.315 | 0.312 | 0.313 |

| retGC | 0.382 | 0.498 | 0 | 0.509 | 0.504 | 0.507 |

| Volatility:COVID | −12.369 | −9.003 | −7.867 | 0 | 0 | 0 |

| retGSPC:COVID | −3.913 | −2.841 | 0 | 0 | −1.52 | −7.591 |

| retDAX:COVID | −5.015 | −4.715 | −6.593 | −2.263 | 0 | −6.063 |

| retFTSE:COVID | 4.191 | 4.642 | 0 | 0 | 0.895 | 6.245 |

| retN225:COVID | −2.977 | −3.77 | −7.619 | −3.538 | −6.258 | 0 |

| retSS:COVID | 9.815 | 9.155 | 0 | −3.221 | 0 | −1.777 |

| retURTH:COVID | −2.917 | −2.073 | −9.831 | 2.171 | 0 | 4.783 |

| retEUFN:COVID | 7.214 | 5.454 | 6.731 | 6.335 | 7.439 | 8.193 |

| retIPAC:COVID | 3.4475 | 3.279 | 0 | −1.558 | 0 | 3.351 |

| retDX:COVID | 2.676 | 2.297 | 8.852 | 0 | −2.021 | −14.433 |

| retGD:COVID | −6.513 | −6.343 | 0 | 1.698 | 0 | 8.687 |

| retBND:COVID | −4.496 | 0 | 0 | −0.833 | 0 | 0 |

| retBZ:COVID | 0 | 0.499 | 0 | 0 | 0 | −8.765 |

| retGC:COVID | 1.198 | 0 | 0 | 0 | 0 | −2.136 |

| retIPACprevious | 0 | 0 | −1.052 | 0 | 0 | 0 |

| retBNDprevious | 0 | 0 | 0 | −1.349 | −1.375 | −1.363 |

| 20 October 2020 + | 12 November 2020 + | 14 January 2021 + | |||||||

|---|---|---|---|---|---|---|---|---|---|

| 7 Days | 10 Days | 14 Days | 7 Days | 10 Days | 14 Days | 7 Days | 10 Days | 14 Days | |

| Intercept | 0 | 0 | 0.009 | 0.009 | 0 | 0.009 | 0 | 0 | 0 |

| retGD | −0.716 | −0.718 | −0.72 | −0.738 | −0.744 | −0.762 | −0.736 | −0.71 | −0.708 |

| retBND | 2.6 | 2.6 | 2.575 | 2.592 | 2.613 | 2.588 | 2.649 | 2.663 | 2.685 |

| retBZ | 0.306 | 0.305 | 0.309 | 0.321 | 0.319 | 0.328 | 0.31 | 0.301 | 0.303 |

| retGC | 0.484 | 0.485 | 0.497 | 0.469 | 0.466 | 0.498 | 0.467 | 0.481 | 0.478 |

| Volatility:COVID | 0 | 0 | 0 | −7.748 | 0 | 0 | 6.594 | 13.346 | 0 |

| retGSPC:COVID | 2.729 | −1.585 | −10.4 | −2.021 | −2.418 | 0 | −1.72 | −1.892 | 0 |

| retDAX:COVID | 0.712 | 1.728 | 4.912 | −3.565 | 0 | −11.217 | 0 | 2.61 | 0 |

| retFTSE:COVID | −3.637 | −6.845 | −14.845 | 0 | −1.862 | 0 | 0 | 0 | 0 |

| retN225:COVID | 0 | 5.272 | 0 | 0 | 0 | −8.869 | −9.794 | −11.181 | 0 |

| retSS:COVID | 0 | −5.569 | −3.672 | 0 | 0 | 0 | −11.794 | −14.648 | 0 |

| retURTH:COVID | 1.725 | −0.411 | 21.28 | −1.089 | −1.156 | 0 | 0 | 0 | 0 |

| retEUFN:COVID | −1.965 | 1.062 | −2.307 | 5.428 | 0 | 5.493 | −3.398 | 0 | 0 |

| retIPAC:COVID | 3.07 | 5.742 | 0 | −2.93 | 0 | 0 | 0 | 0 | 0 |

| retDX:COVID | 1.397 | 5.644 | −2.659 | −2.73 | 0 | 3.751 | 2.794 | 4.431 | 0 |

| retGD:COVID | −0.772 | −3.19 | −34.858 | 1.441 | 2.104 | 22.62 | 0 | 0 | 0 |

| retBND:COVID | −0.836 | −3.467 | 18.426 | 3.78 | 0 | 0 | 2.533 | 3.733 | 0 |

| retBZ:COVID | 0 | 2.996 | 14.876 | 0 | 0.605 | −7.042 | 7.172 | 9.067 | 0 |

| retGC:COVID | −4.204 | −1.585 | 5.196 | 4.237 | 4.99 | 0 | 0 | 0 | 0 |

| retIPACprevious | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| retBNDprevious | −1.327 | −1.328 | −1.352 | −1.337 | −1.335 | −1.29 | −1.428 | −1.439 | −1.463 |

| 5 March 2020 + | 16 August 2020 + | ||||||||

| 7 Days | 10 Days | 14 Days | 7 Days | 10 Days | 14 Days | ||||

| retGD | −0.559 | −0.534 | −0.653 | −0.729 | −0.715 | −0.719 | |||

| retGSPC:COVID | −3.913 | −2.841 | 0 | 0 | −1.52 | −7.591 | |||

| retDAX:COVID | −5.015 | −4.715 | −6.593 | −2.263 | 0 | −6.063 | |||

| retN225:COVID | −2.977 | −3.77 | −7.619 | −3.538 | −6.258 | 0 | |||

| retURTH:COVID | −2.917 | −2.073 | −9.831 | 2.171 | 0 | 4.783 | |||

| retGD:COVID | −6.513 | −6.343 | 0 | 1.698 | 0 | 8.687 | |||

| retBNDprevious | 0 | 0 | 0 | −1.349 | −1.375 | −1.363 | |||

| 20 October 2020 + | 12 November 2020 + | 14 January 2021 + | |||||||

| 7 Days | 10 Days | 14 Days | 7 Days | 10 Days | 14 Days | 7 Days | 10 Days | 14 Days | |

| retGD | −0.716 | −0.718 | −0.72 | −0.738 | −0.744 | −0.762 | −0.736 | −0.71 | −0.708 |

| retGSPC:COVID | 2.729 | −1.585 | −10.4 | −2.021 | −2.418 | 0 | −1.72 | −1.892 | 0 |

| retFTSE:COVID | −3.637 | −6.845 | −14.845 | 0 | −1.862 | 0 | 0 | 0 | 0 |

| retN225:COVID | 0 | 5.272 | 0 | 0 | 0 | −8.869 | −9.794 | −11.181 | 0 |

| retSS:COVID | 0 | −5.569 | −3.672 | 0 | 0 | 0 | −11.794 | −14.648 | 0 |

| retURTH:COVID | 1.725 | −0.411 | 21.28 | −1.089 | −1.156 | 0 | 0 | 0 | 0 |

| retGD:COVID | −0.772 | −3.19 | −34.858 | 1.441 | 2.104 | 22.62 | 0 | 0 | 0 |

| retBND:COVID | −0.836 | −3.467 | 18.426 | 3.78 | 0 | 0 | 2.533 | 3.733 | 0 |

| retGC:COVID | −4.204 | −1.585 | 5.196 | 4.237 | 4.99 | 0 | 0 | 0 | 0 |

| retBNDprevious | −1.327 | −1.328 | −1.352 | −1.337 | −1.335 | −1.29 | −1.428 | −1.439 | −1.463 |

| Estimate | Std. Error | t Value | Pr (>|t|) | |

|---|---|---|---|---|

| −1.542860 | 1.443807 | −1.0686 | 0.285248 | |

| −0.068448 | 0.128806 | −5.3141 | 0.595138 | |

| 0.819270 | 0.167389 | 4.8944 | 0.000001 | |

| 0.493105 | 0.295964 | 1.6661 | 0.095693 | |

| −0.245042 | 0.096110 | −2.5496 | 0.010785 | |

| −0.170790 | 0.056476 | −3.0241 | 0.002494 | |

| 0.966439 | 0.012148 | 7.9557 | 0.000000 | |

| 0.234274 | 0.052733 | 4.4426 | 0.000009 | |

| −0.210337 | 0.068830 | −3.0559 | 0.002244 | |

| −0.125786 | 0.049631 | −2.5344 | 0.011264 | |

| 0.974251 | 0.007748 | 1.2574 | 0.000000 | |

| 0.262762 | 0.082990 | 3.1662 | 0.001545 | |

| −0.059457 | 0.027381 | −2.1714 | 0.029897 | |

| −0.041247 | 0.024270 | −1.6995 | 0.089231 | |

| 0.994205 | 0.002453 | 4.0529 | 0.000000 | |

| 0.177653 | 0.034066 | 5.2149 | 0.000000 | |

| −1.470428 | 0.828544 | −1.7747 | 0.075945 | |

| 0.104286 | 0.088503 | 1.1783 | 0.238664 | |

| 0.824632 | 0.097232 | 8.4811 | 0.000000 | |

| 0.525887 | 0.192437 | 2.7328 | 0.006280 | |

| −0.177843 | 0.082192 | −2.1637 | 0.030484 | |

| −0.132051 | 0.048471 | −2.7243 | 0.006443 | |

| 0.976456 | 0.009049 | 1.0790 | 0.000000 | |

| 0.209744 | 0.068337 | 3.0693 | 0.002146 | |

| −0.634528 | 0.354695 | −1.7889 | 0.073624 | |

| −0.137234 | 0.114002 | −1.2038 | 0.228672 | |

| 0.922111 | 0.042674 | 2.1608 | 0.000000 | |

| 0.455469 | 0.135636 | 3.3580 | 0.000785 | |

| −0.426567 | 0.081726 | −5.2195 | 0.000000 | |

| −0.175619 | 0.046570 | −3.7710 | 0.000163 | |

| 0.949165 | 0.009356 | 1.0145 | 0.000000 | |

| 0.152212 | 0.058722 | 2.5921 | 0.009541 | |

| −0.528630 | 0.141238 | −3.7428 | 0.000182 | |

| −0.237799 | 0.055749 | −4.2655 | 0.000020 | |

| 0.939065 | 0.015363 | 6.1124 | 0.000000 | |

| 0.266471 | 0.063192 | 4.2168 | 0.000025 | |

| −0.552653 | 0.485819 | −1.1376 | 0.255300 | |

| −0.082472 | 0.168872 | −4.8837 | 0.625290 | |

| 0.900147 | 0.094514 | 9.5239 | 0.000000 | |

| 0.197932 | 0.308051 | 6.4253 | 0.520530 | |

| −0.504108 | 0.908202 | −5.5506 | 0.578852 | |

| −0.028082 | 0.220747 | −1.2721 | 0.898771 | |

| 0.898401 | 0.190023 | 4.7278 | 0.000002 | |

| 0.213930 | 0.488293 | 4.3812 | 0.661301 | |

| −0.370244 | 0.136078 | −2.7208 | 0.006512 | |

| −0.130324 | 0.081318 | −1.6026 | 0.109013 | |

| 0.953897 | 0.016009 | 5.9586 | 0.000000 | |

| 0.342878 | 0.079368 | 4.3201 | 0.000016 | |

| −0.242602 | 0.159616 | −1.5199 | 0.128533 | |

| −0.007477 | 0.070278 | −1.0639 | 0.915270 | |

| 0.975701 | 0.013120 | 7.4367 | 0.000000 | |

| 0.601597 | 0.144888 | 4.1521 | 0.000033 | |

| −0.086342 | 0.004638 | −1.8617 | 0.000000 | |

| −0.192312 | 0.034443 | −5.5834 | 0.000000 | |

| 0.990628 | 0.000019 | 5.2568 | 0.000000 | |

| 0.070036 | 0.013730 | 5.1008 | 0.000000 | |

| −0.176354 | 0.005567 | −3.1676 | 0.000000 | |

| −0.170768 | 0.031154 | −5.4814 | 0.000000 | |

| 0.980731 | 0.000005 | 1.9745 | 0.000000 | |

| 0.055332 | 0.013251 | 4.1758 | 0.000030 | |

| 0.018359 | 0.005080 | 3.6136 | 0.000302 | |

| 0.853105 | 0.026664 | 3.1995 | 0.000000 |

| SS | EUFN | IPAC | DX | GC | DAX | GSPC | FTSE | N225 | ||

|---|---|---|---|---|---|---|---|---|---|---|

| min | −0.0203 | 0.0525 | −0.0020 | −0.2559 | 0.0871 | 0.0248 | 0.0157 | 0.0033 | −0.0656 | |

| July-March 4 | median | 0.1194 | 0.1428 | 0.1737 | −0.1552 | 0.2408 | 0.1747 | 0.1548 | 0.1369 | 0.0273 |

| max | 0.2078 | 0.2674 | 0.2177 | −0.1131 | 0.2903 | 0.2465 | 0.2379 | 0.1972 | 0.0680 | |

| min | 0.1296 | 0.1543 | 0.1897 | −0.2105 | 0.2190 | 0.1842 | 0.1685 | 0.1380 | 0.0494 | |

| 5 March +14 | median | 0.2271 | 0.2704 | 0.2884 | −0.1785 | 0.2295 | 0.2935 | 0.2511 | 0.2548 | 0.1512 |

| max | 0.2854 | 0.4040 | 0.4634 | −0.0463 | 0.4127 | 0.4100 | 0.3662 | 0.4093 | 0.1988 | |

| min | 0.0841 | 0.1104 | 0.1698 | −0.2213 | 0.2723 | 0.1581 | 0.1498 | 0.0996 | 0.0161 | |

| 16 August +14 | median | 0.1191 | 0.1316 | 0.1859 | −0.1904 | 0.2802 | 0.1785 | 0.1582 | 0.1331 | 0.0266 |

| max | 0.1262 | 0.1474 | 0.1931 | −0.1802 | 0.3017 | 0.1879 | 0.1657 | 0.1518 | 0.0327 | |

| min | 0.1136 | 0.1378 | 0.1996 | −0.2240 | 0.2716 | 0.1607 | 0.1499 | 0.0982 | 0.0406 | |

| 20 October +14 | median | 0.1228 | 0.1550 | 0.2129 | −0.2094 | 0.2768 | 0.1812 | 0.1690 | 0.1309 | 0.0503 |

| max | 0.1456 | 0.1824 | 0.2260 | −0.1983 | 0.2885 | 0.1951 | 0.1787 | 0.1494 | 0.0643 | |

| min | 0.1353 | 0.1380 | 0.2056 | −0.2307 | 0.2045 | 0.1794 | 0.1545 | 0.1410 | 0.0507 | |

| 12 November +14 | median | 0.1407 | 0.1482 | 0.2173 | −0.2089 | 0.2767 | 0.1912 | 0.1720 | 0.1469 | 0.0706 |

| max | 0.1579 | 0.1670 | 0.2470 | −0.1895 | 0.3056 | 0.2106 | 0.2014 | 0.1560 | 0.0777 | |

| min | −0.0298 | 0.1179 | 0.1949 | −0.1678 | 0.1850 | 0.2015 | 0.1534 | 0.2003 | 0.0394 | |

| 14 January +14 | median | 0.0314 | 0.1546 | 0.2105 | −0.1313 | 0.2246 | 0.2263 | 0.1606 | 0.2260 | 0.0533 |

| max | 0.1474 | 0.1649 | 0.2339 | −0.1110 | 0.2396 | 0.2794 | 0.1995 | 0.2824 | 0.0900 |

| MEDIAN | BTC | ETH | URTH | BND | BZ | GD | |

|---|---|---|---|---|---|---|---|

| min | 1 | 0.782 | 0.052 | 0.004 | −0.071 | −0.043 | |

| July-March 4 | median | 1 | 0.846 | 0.186 | 0.120 | 0.096 | 0.118 |

| max | 1 | 0.883 | 0.267 | 0.220 | 0.162 | 0.212 | |

| min | 1 | 0.841 | 0.194 | 0.106 | 0.102 | 0.132 | |

| 5 March +14 | median | 1 | 0.859 | 0.281 | 0.123 | 0.237 | 0.241 |

| max | 1 | 0.930 | 0.394 | 0.436 | 0.298 | 0.301 | |

| min | 1 | 0.820 | 0.179 | 0.122 | 0.100 | 0.140 | |

| 16 August +14 | median | 1 | 0.830 | 0.192 | 0.131 | 0.111 | 0.149 |

| max | 1 | 0.837 | 0.198 | 0.142 | 0.115 | 0.161 | |

| min | 1 | 0.835 | 0.176 | 0.118 | 0.079 | 0.128 | |

| 20 October +14 | median | 1 | 0.839 | 0.195 | 0.132 | 0.110 | 0.146 |

| max | 1 | 0.845 | 0.213 | 0.140 | 0.138 | 0.179 | |

| min | 1 | 0.801 | 0.192 | 0.147 | 0.100 | 0.136 | |

| 12 November +14 | median | 1 | 0.814 | 0.205 | 0.161 | 0.107 | 0.144 |

| max | 1 | 0.829 | 0.230 | 0.167 | 0.145 | 0.169 | |

| min | 1 | 0.809 | 0.185 | 0.074 | −0.019 | −0.039 | |

| 14 January +14 | median | 1 | 0.835 | 0.196 | 0.121 | 0.079 | 0.083 |

| max | 1 | 0.842 | 0.226 | 0.147 | 0.097 | 0.116 |

| MEDIAN | SS | EUFN | IPAC | DX | GC | DAX | GSPC | FTSE | N225 | |

|---|---|---|---|---|---|---|---|---|---|---|

| min | −0.0584 | 0.1002 | −0.0268 | −0.2499 | 0.0212 | 0.0367 | 0.0077 | 0.0117 | −0.0468 | |

| July-March 4 | median | 0.1153 | 0.1939 | 0.2051 | −0.1668 | 0.1778 | 0.2114 | 0.1863 | 0.1178 | 0.0971 |

| max | 0.1556 | 0.3056 | 0.2399 | −0.0745 | 0.2148 | 0.2659 | 0.2492 | 0.1729 | 0.1677 | |

| min | 0.1170 | 0.2037 | 0.2007 | −0.2216 | 0.1575 | 0.2190 | 0.1903 | 0.1094 | 0.1004 | |

| 5 March +14 | median | 0.2084 | 0.3070 | 0.2985 | −0.1760 | 0.1656 | 0.3205 | 0.2692 | 0.2260 | 0.1987 |

| max | 0.2760 | 0.4285 | 0.4686 | −0.0747 | 0.3693 | 0.4306 | 0.3794 | 0.3887 | 0.2376 | |

| min | 0.0826 | 0.1641 | 0.2082 | −0.2212 | 0.1897 | 0.2051 | 0.1777 | 0.0810 | 0.0866 | |

| 16 August +14 | median | 0.1043 | 0.1865 | 0.2139 | −0.2039 | 0.1987 | 0.2161 | 0.1833 | 0.0980 | 0.1111 |

| max | 0.1227 | 0.2082 | 0.2231 | −0.1927 | 0.2177 | 0.2367 | 0.1975 | 0.1301 | 0.1266 | |

| min | 0.1135 | 0.2169 | 0.2441 | −0.2607 | 0.2019 | 0.2361 | 0.2063 | 0.1098 | 0.1021 | |

| 20 October +14 | median | 0.1210 | 0.2254 | 0.2510 | −0.2208 | 0.2087 | 0.2483 | 0.2184 | 0.1332 | 0.1097 |

| max | 0.1500 | 0.2537 | 0.2622 | −0.2132 | 0.2505 | 0.2639 | 0.2248 | 0.1412 | 0.1183 | |

| min | 0.1062 | 0.1763 | 0.2121 | −0.2129 | 0.0068 | 0.2205 | 0.1738 | 0.1174 | 0.0906 | |

| 12 November +14 | median | 0.1126 | 0.1882 | 0.2230 | −0.2000 | 0.2029 | 0.2329 | 0.2047 | 0.1239 | 0.1076 |

| max | 0.1626 | 0.2890 | 0.2806 | −0.1880 | 0.2115 | 0.2627 | 0.2311 | 0.1593 | 0.1795 | |

| min | 0.0574 | 0.1440 | 0.1860 | −0.1984 | 0.1878 | 0.2091 | 0.1279 | 0.1530 | 0.0756 | |

| 14 January +14 | median | 0.0708 | 0.1785 | 0.2138 | −0.1502 | 0.2104 | 0.2344 | 0.1687 | 0.1724 | 0.1071 |

| max | 0.1706 | 0.1972 | 0.2378 | −0.1388 | 0.2361 | 0.2639 | 0.2056 | 0.2200 | 0.1328 |

| MEDIAN | BTC | ETH | B | BND | BZ | GD | |

|---|---|---|---|---|---|---|---|

| min | 0.782 | 1 | 0.052 | −0.020 | −0.075 | −0.055 | |

| July-March 4 | median | 0.846 | 1 | 0.226 | 0.111 | 0.144 | 0.157 |

| max | 0.883 | 1 | 0.295 | 0.244 | 0.229 | 0.252 | |

| min | 0.841 | 1 | 0.227 | 0.099 | 0.114 | 0.133 | |

| 5 March +14 | median | 0.859 | 1 | 0.310 | 0.131 | 0.253 | 0.252 |

| max | 0.930 | 1 | 0.415 | 0.428 | 0.292 | 0.290 | |

| min | 0.820 | 1 | 0.225 | 0.052 | 0.122 | 0.165 | |

| 16 August+14 | median | 0.830 | 1 | 0.229 | 0.081 | 0.138 | 0.170 |

| max | 0.837 | 1 | 0.243 | 0.112 | 0.153 | 0.184 | |

| min | 0.835 | 1 | 0.247 | 0.113 | 0.141 | 0.169 | |

| 20 October +14 | median | 0.839 | 1 | 0.257 | 0.131 | 0.168 | 0.188 |

| max | 0.845 | 1 | 0.269 | 0.151 | 0.189 | 0.218 | |

| min | 0.801 | 1 | 0.223 | 0.082 | 0.125 | 0.140 | |

| 12 November +14 | median | 0.814 | 1 | 0.244 | 0.130 | 0.129 | 0.145 |

| max | 0.829 | 1 | 0.279 | 0.145 | 0.269 | 0.261 | |

| min | 0.809 | 1 | 0.176 | 0.115 | 0.041 | 0.030 | |

| 14 January +14 | median | 0.835 | 1 | 0.214 | 0.133 | 0.120 | 0.122 |

| max | 0.842 | 1 | 0.241 | 0.160 | 0.148 | 0.154 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Cocco, L.; Tonelli, R.; Marchesi, M. Bitcoin as a Safe Haven during COVID-19 Disease. Future Internet 2022, 14, 98. https://doi.org/10.3390/fi14040098

Cocco L, Tonelli R, Marchesi M. Bitcoin as a Safe Haven during COVID-19 Disease. Future Internet. 2022; 14(4):98. https://doi.org/10.3390/fi14040098

Chicago/Turabian StyleCocco, Luisanna, Roberto Tonelli, and Michele Marchesi. 2022. "Bitcoin as a Safe Haven during COVID-19 Disease" Future Internet 14, no. 4: 98. https://doi.org/10.3390/fi14040098

APA StyleCocco, L., Tonelli, R., & Marchesi, M. (2022). Bitcoin as a Safe Haven during COVID-19 Disease. Future Internet, 14(4), 98. https://doi.org/10.3390/fi14040098