Abstract

This study investigates how AI-driven innovations are reshaping manufacturing value chains through the transition from Industry 4.0 to Industry 6.0, particularly in resource-intensive sectors such as ceramics. Addressing a gap in the literature, the research situates the evolution of manufacturing within the broader context of digital transformation, sustainability, and regulatory demands. A mixed-methods approach was employed, combining semi-structured interviews with key industry stakeholders and an extensive review of secondary data, to develop an Industry 6.0 model tailored to the ceramics industry. The findings demonstrate that artificial intelligence, digital twins, and cognitive automation significantly enhance predictive maintenance, real-time supply chain optimization, and regulatory compliance, notably with the Corporate Sustainability Reporting Directive (CSRD). These technological advancements also facilitate circular economy practices and cognitive logistics, thereby fostering greater transparency and sustainability in B2B manufacturing networks. The study concludes that integrating AI-driven automation and cognitive logistics into digital ecosystems and supply chain management serves as a strategic enabler of operational resilience, regulatory alignment, and long-term competitiveness. While the industry-specific focus may limit generalizability, the study underscores the need for further research in diverse manufacturing sectors and longitudinal analyses to fully assess the long-term impact of AI-enabled Industry 6.0 frameworks.

1. Introduction

The transition from Industry 3.0 to Industry 6.0 signifies a sequence of transformative changes that have significantly altered manufacturing [1], especially in resource-intensive sectors like ceramics [2]. Every industrial transition, encompassing automation, digitalization, and resilience-oriented sustainable innovation, necessitates that organizations modify their operational and strategic methodologies to sustain competitiveness [3]. Industry 3.0 introduced automation through electronic systems, enhancing productivity and reducing costs, albeit with limited attention to environmental responsibility [4]. Industry 4.0’s digital integration through the Internet of Things (IoT) and machine-to-machine communication added transparency and operational efficiency, setting the stage for resource-aware supply chain management [5]. Industry 5.0 is probably driving this change by looking at how people interact with robots in a more human-centric way. Sustainability is now a big focus, both in terms of the environment and society [6]. The transition from Industry 4.0 to Industry 5.0 is not merely an evolution of digitalization; rather, it signifies a paradigm shift that emphasizes the collaboration between humans and intelligent machines. Technologies such as artificial intelligence (AI), digital twins, and cognitive automation are not exclusive to Industry 6.0, but they play a pivotal role in the transition to Industry 5.0. Artificial intelligence (AI) is transforming advanced manufacturing through predictive maintenance systems, adaptive resource management, and data integration along the entire value chain [7]. These tools facilitate more resilient, personalized, and sustainable manufacturing, bridging the gap between the automated efficiency of Industry 4.0 and the human-centric approach of Industry 5.0 [8]. Industry 5.0 extends the digital advances of Industry 4.0 by integrating human–AI collaboration, customization, and sustainability as core principles. While Industry 4.0 focused on automation, connectivity, and real-time data processing through IoT and big data, Industry 5.0 redefines value creation by emphasizing human-centric innovation and sustainable manufacturing [9]. AI-powered systems are shifting from simply optimizing production efficiency to enabling adaptive, personalized, and more sustainable manufacturing environments. This transition is particularly relevant for industries such as ceramics, where advanced automation (Industry 4.0) is now evolving into AI-driven co-creation and customization (Industry 5.0), ensuring both operational flexibility and environmental responsibility [10]. Today, Industry 6.0 further advances this evolution, placing resilience, sustainability, and inclusion at the center of manufacturing strategies and redefining value generation to prioritize both social and environmental outcomes as critical to competitiveness [11]. This new paradigm calls for circular business models, resilient supply chains, and the use of advanced technologies like artificial intelligence (AI) and digital twins [12]. This transition is of consequence for the Italian ceramics industry, which is renowned for its high energy consumption and complex environmental impact [13]. The traditional manufacturing roots of the industry present several challenges in meeting the digital and sustainable demands of Industry 6.0. However, they also offer a few opportunities [14]. The Italian ceramics sector has the potential to enhance its operational resilience, reduce its environmental footprint, and create long-term value by adopting cognitive digital ecosystems and circular economy practices [10]. The rising prevalence of regulatory directives, including the Corporate Sustainability Reporting Directive (CSRD), necessitates that firms, especially in the European Union, enhance their reporting on environmental, social, and governance (ESG) practices [15]. For resource-dependent sectors like ceramics, adapting to regulatory and societal demands is essential for sustaining relevance and compliance [16].

While Industry 4.0 has been extensively explored in terms of automation, predictive analytics, and digital manufacturing systems [17,18], research on Industry 5.0 [19,20,21] and 6.0 [22] remains comparatively limited and fragmented. Existing studies on Industry 5.0 have focused on human-centric production models, mass customization, and ethical AI, while early conceptualizations of Industry 6.0 emphasize decentralized intelligence, hybrid ecosystems, and the convergence of digital and biological systems [12,23]. However, few contributions provide an integrated view that connects these paradigms through the evolving role of AI in shaping sustainable value chains [24]. This study positions itself at the intersection of AI-driven manufacturing and industrial sustainability transitions by proposing a conceptual model that traces the evolution from Industry 3.0 to 6.0. Unlike previous contributions that treat these paradigms separately, we emphasize the progressive transformation of manufacturing value chains, from linear automation to cognitive, systemic ecosystems, enabled by artificial intelligence. Furthermore, we address a critical gap in the literature by embedding the concept of “systemic sustainability” into the strategic logic of the Technosphere, a novel lens for understanding socio-technical integration across industrial ecosystems [25]. This contribution extends current debates on AI-enabled smart manufacturing [26,27,28] by situating AI not only as a driver of operational excellence, but as a strategic enabler of adaptive, co-creative, and regulation-responsive supply chains. By focusing on the resource-intensive ceramic industry, the paper also enriches empirical understanding of how Industry 6.0 logic may unfold in traditional manufacturing sectors, an area still underrepresented in academic discourse.

Recent reports provide quantitative evidence of the Industry 4.0 and 5.0 transitions. For example, Eurostat [29] indicates that approximately 29% of EU manufacturing firms have adopted IoT-enabled machinery, while Italy ranks among the top five EU countries in terms of Industry 4.0 investment intensity. At the same time, collaborative robots (cobots) are now present in nearly 8% of European factories, highlighting the increasing relevance of human–machine collaboration under Industry 5.0 [30]. Looking forward, foresight studies suggest that Industry 6.0 will extend these trajectories toward cognitive manufacturing and systemic sustainability, with global market forecasts estimating that the value of AI-enabled industrial systems could exceed USD 500 billion by 2030 [31].

This study positions itself at the intersection of these industrial transitions. While Industry 4.0 consolidated digital transformation and Industry 5.0 emphasized human-centricity, Industry 6.0 is expected to integrate cognitive adaptivity, systemic sustainability, and regulatory compliance into a unified paradigm. Our research addresses this gap by (i) empirically exploring how Industry 6.0 technologies intersect with circular economy models and regulatory pressures in the ceramic industry, and (ii) proposing a conceptual model that differentiates Industry 5.0 from 6.0 and highlights their implications for value creation and stakeholder engagement in B2B contexts. Despite the substantial body of research on manufacturing digitalization and sustainability integration, significant gaps remain in understanding how Industry 6.0’s combined technological, regulatory, and sustainability drivers impact value creation [32] within complex Business to Business (B2B) networks [33]. This study aims to address these gaps by exploring how advanced digitalization (supported by AI, IoT, and blockchain) interacts with circular models and regulatory pressures like CSRD to reshape manufacturing value chains [15]. Specifically, this study focuses on two research questions:

- RQ1: How can the integration of Industry 6.0 technologies (e.g., AI, IoT, digital twins) with circular economy models enhance value creation and operational resilience in B2B networks, particularly within energy-intensive industries like ceramics, to meet increasing regulatory and sustainability expectations?

- RQ2: How does the shift to Industry 6.0 reshape stakeholder engagement and strategic decision-making in B2B marketing, influencing the development of sustainable and transparent relationships across the ceramic industry’s value chain?

The first question explores how the convergence of Industry 6.0 technological innovations and circular economy models can generate value in complex value chains, addressing resilience and sustainability needs, with reference to compliance with regulations such as CSRD. The second question focuses on how the transition to Industry 6.0 affects stakeholder engagement strategies and strategic decisions in B2B marketing, helping to build sustainable and transparent relationships along the value chain in the ceramics industry. Both questions are designed to examine the synergies between advanced technologies and sustainable business models in a B2B context, exploring how these transformations can redefine value and sustainability in interorganizational relationships in the ceramics sector.

2. Theoretical Background

Porter’s (1985) value chain concept serves as the cornerstone for comprehending the process by which organizations establish a competitive edge [34]. In the manufacturing sector, value creation has historically been centered on the optimization of costs, the enhancement of efficiency, and the exploitation of synergies [35,36]. Nevertheless, the technological transition from Industry 3.0 to Industry 6.0 necessitates a thorough reassessment of these mechanisms. This must encompass social responsibility, sustainability, and digital transformation. Each industrial revolution has introduced new opportunities and challenges for value chains [37]. To confront these obstacles, novel theoretical frameworks have been devised.

2.1. Industry 4.0 and the Digital Transformation of Value Chains

Cyber-physical systems (CPS), the Internet of Things (IoT), and big data analytics have revolutionized manufacturing processes because of Industry 4.0’s unprecedented level of integration between the physical and digital worlds [38]. Transparent operations, predictive maintenance, and real-time decision-making have been enabled by these innovations, which have revolutionized the way value is generated along global supply chains. Lasi et al. [39] are correct in their assertion that Industry 4.0 technologies have enabled businesses to become more adaptable and responsive to market demands, thereby enhancing operational efficiencies and reducing lead times. Nevertheless, the literature on Industry 4.0 remains excessively preoccupied with the operational advantages, with inadequate consideration given to its broader implications for the integration of sustainability objectives and the creation of strategic value [40].

- Proposition 1 (P1): The integration of Industry 4.0 technologies enables increased operational efficiency and flexibility but requires rethinking value creation frameworks to account for long-term sustainability.

2.2. Industry 5.0: Sustainability and Human-Centric Innovation

Industry 5.0 has altered the emphasis from digital transformation to human-centric manufacturing, emphasizing collaboration between humans and machines [41]. Industry 5.0 aims to achieve a harmonious equilibrium between technological advancement and human well-being, with a greater emphasis on environmental and social sustainability. The research of Ghobakhloo et al. [42] indicates that this transition is prompting organizations to implement more inclusive and ethically responsible practices throughout the value chain. Organizations are being compelled to reevaluate their value creation strategies considering the human-centric nature of Industry 5.0, which transcends economic advantages to encompass societal benefits. Nevertheless, as Kumar et al. [43] have pointed out, the ethical and social aspects of Industry 5.0 are promising; however, there is still a dearth of empirical research on the extent to which these practices are translated into tangible value along global supply chains.

- Proposition 2 (P2): Industry 5.0 shifts the focus from operational efficiency to human-centered innovation, requiring firms to integrate social sustainability and ethical practices into their value chains to enhance long-term competitiveness.

2.3. Industry 6.0: Resilience, Sustainability, and Circular Business Models

Industry 6.0 will address resilience and sustainability more thoroughly, transcending traditional industrial paradigms [44]. The focus is on integrating contemporary technologies, such as artificial intelligence (AI), blockchain, and the Internet of Things (IoT), with circular economy principles that prioritize resource regeneration, waste reduction, and sustainable value creation [45]. Resilience is a fundamental element of Industry 6.0. It encompasses not just operational adaptability, but also an organization’s ability to withstand and respond to disruptions such as social unrest, climate change, or regulatory pressures [46]. The integration of artificial intelligence in Industry 6.0 is not limited to operational optimization but acts as a strategic enabler for predictive supply chain management. Advanced AI algorithms analyze data in real time to optimize logistics, predict disruptions, and dynamically adapt production to market demand [47]. At the same time, AI-driven regulatory analytics is helping companies comply with environmental and ESG regulations by automating the reporting of sustainability parameters [47] required by directives such as CSRD [48]. In this context, AI not only ensures production efficiency, but also becomes a critical factor in the resilience and regulatory compliance of manufacturing companies. A key distinction between Industry 5.0 and Industry 6.0 lies in the role of cognition. Whereas Industry 5.0 emphasizes human-centric collaboration and ethical AI, Industry 6.0 advances toward cognitive adaptivity, an integration of human–machine symbiosis with autonomous learning systems. This cognitive dimension enables anticipatory decision-making, proactive risk management, and dynamic reconfiguration of value chains, moving beyond the collaborative logics of Industry 5.0.

Singh et al. [49] make it clear that resilient value chains are essential for long-term sustainability, particularly in a context where corporations must reconcile social and environmental responsibilities with efficiency [50]. The best way to achieve these aims is through circular business models. Geissdoerfer et al. [51] are clear that circularity allows organizations to complete material loops and reduce their environmental impact, thereby promoting sustainable value creation. Integrating these concepts into global manufacturing value chains is challenging. It often requires systematic operational and strategic practice modifications.

- Proposition 3 (P3): Industry 6.0 promotes resilient and sustainable value chains by integrating advanced digital technologies with circular business models, allowing firms to create value while addressing environmental and social challenges.

2.4. Sustainability and Value Chains Under the Corporate Sustainability Reporting Directive (CSRD)

The European Union’s introduction of the Corporate Sustainability Reporting Directive (CSRD) marks a pivotal shift in regulatory policy [52]. It demands that companies provide more comprehensive reporting on their environmental, social, and governance (ESG) performance [53]. The CSRD will enhance corporate transparency and accountability, aligning business practices with sustainability goals. The literature on corporate sustainability reporting, such as the work of Hahn & Kühnen [54], has long been clear in its advocacy for greater integration between financial performance and ESG metrics. The CSRD requires firms to provide detailed accounts of their ESG impact across the entire value chain, prompting a reevaluation of traditional business models. Adams [55] and Eccles et al. [56] are clear that companies must adopt a more integrated approach to sustainability. They must move beyond compliance and align their corporate strategies with long-term value creation. The regulatory landscape introduced by the CSRD forces firms to monitor and report on their ESG performance and rethink their value creation models. In this context, firms must integrate sustainability into their strategic decision-making processes, leveraging technologies and circular practices to meet stakeholder expectations for transparency and accountability [57].

- Proposition 4 (P4): The CSRD compels firms to integrate ESG considerations into their value chains, pushing them toward more transparent, accountable, and sustainable business models.

2.5. A Holistic Framework for Value Creation in Industry 6.0

As we move from Industry 4.0 to Industry 6.0, we will focus less on practical efficiency and new technologies and more on putting human-centered practices, sustainability, and resiliency into value chains [58]. If companies want to make this shift smoothly, they need a theoretical framework that blends advanced digital technologies and circular business models and follows the rules. This framework makes it clear that technical progress alone is no longer enough to create value in modern industry [58]. Now it is up to the company to make sure that social duty, longevity, and resilience are built into every step of the value chain [59]. This all-around strategy shows the move toward Industry 6.0, where companies need to balance the needs of stakeholders, government rules, and new technologies to stay competitive and sustainable in the long run [60].

- Proposition 5 (P5): The transition from Industry 4.0 to Industry 6.0 requires an integrated approach to value creation that combines digital transformation, circular business models, and compliance with sustainability regulations, ensuring that firms can adapt to future challenges while maintaining competitiveness.

- Proposition 6 (P6): Industry 6.0 advances cognitive adaptivity by integrating human–machine symbiosis with autonomous learning systems, enabling anticipatory decision-making and systemic value creation across industrial ecosystems.

2.6. Theoretical Integration: Toward a Conceptual Model

The evolution from Industry 4.0 to Industry 6.0 is a paradigm shift in how manufacturing firms create value. As previously stated, each industrial revolution introduces new technologies, strategies and operational frameworks that build on each other, leading to a comprehensive and integrated approach to value creation. This section will synthesize these insights into a conceptual model, providing a structured framework for manufacturing firms to navigate the complex landscape of Industry 6.0. The theoretical integration is based on four fundamental pillars:

- Digital Transformation (Proposition 1): Industry 4.0 was built on advanced digital technologies like IoT, cyber-physical systems, and big data analytics. These technologies enable real-time optimization of processes and interconnectivity along the value chain. However, digital transformation alone is not enough to guarantee long-term competitiveness. The evolving industrial landscape now requires firms to embed sustainability considerations into their value creation strategies.

- Human-centric innovation (Proposition 2): Industry 5.0 built onto the digital infrastructure of Industry 4.0 and made it clear that human-centric innovation is essential. As firms incorporated human creativity and ethics into their value chains, they began to integrate social sustainability, focusing on employee well-being, ethical manufacturing practices, and societal impact. This step makes it clear that value creation is not just about technology. It is also about society and inclusivity.

- Resilience and Circularity (Proposition 3): Industry 6.0 makes it abundantly clear that business models that are resilient and circular are more important than ever. It is crucial that supply lines are robust and resilient to economic, social and environmental challenges. By following the rules of the circular economy, businesses can be sure that their value chains are not only efficient but also self-regenerating. This cuts down on waste and ensures long-term sustainability.

- Regulatory Compliance (Proposition 4): The Corporate Sustainability Reporting Directive (CSRD) and other outside forces require companies to be open and honest about their ESG (Environmental, Social, and Governance) performance. Regulatory compliance forces businesses to rethink how they create value, integrating sustainability and openness into their strategy decisions.

These concepts are interdependent, forming a network of interconnected elements that challenge companies to rethink their value creation strategies in today’s manufacturing landscape. Proposition 5, the final pillar, provides a comprehensive framework for monetizing these principles. It is a clear path to profitability that emerges when digital transformation, human-centric innovation, resilience, circularity and regulatory compliance converge. Compared with existing frameworks for Industry 4.0 and 5.0, which focus, respectively, on digital integration and human-centric sustainability, the proposed model advances novelty by embedding systemic sustainability and regulatory compliance (CSRD) as integral components of value creation. This integration moves beyond efficiency- and ethics-oriented models to conceptualize Industry 6.0 as a cognitive-technological paradigm where resilience and governance are equally central. In this respect, the Technosphere lens adds a distinctive contribution not found in previous frameworks.

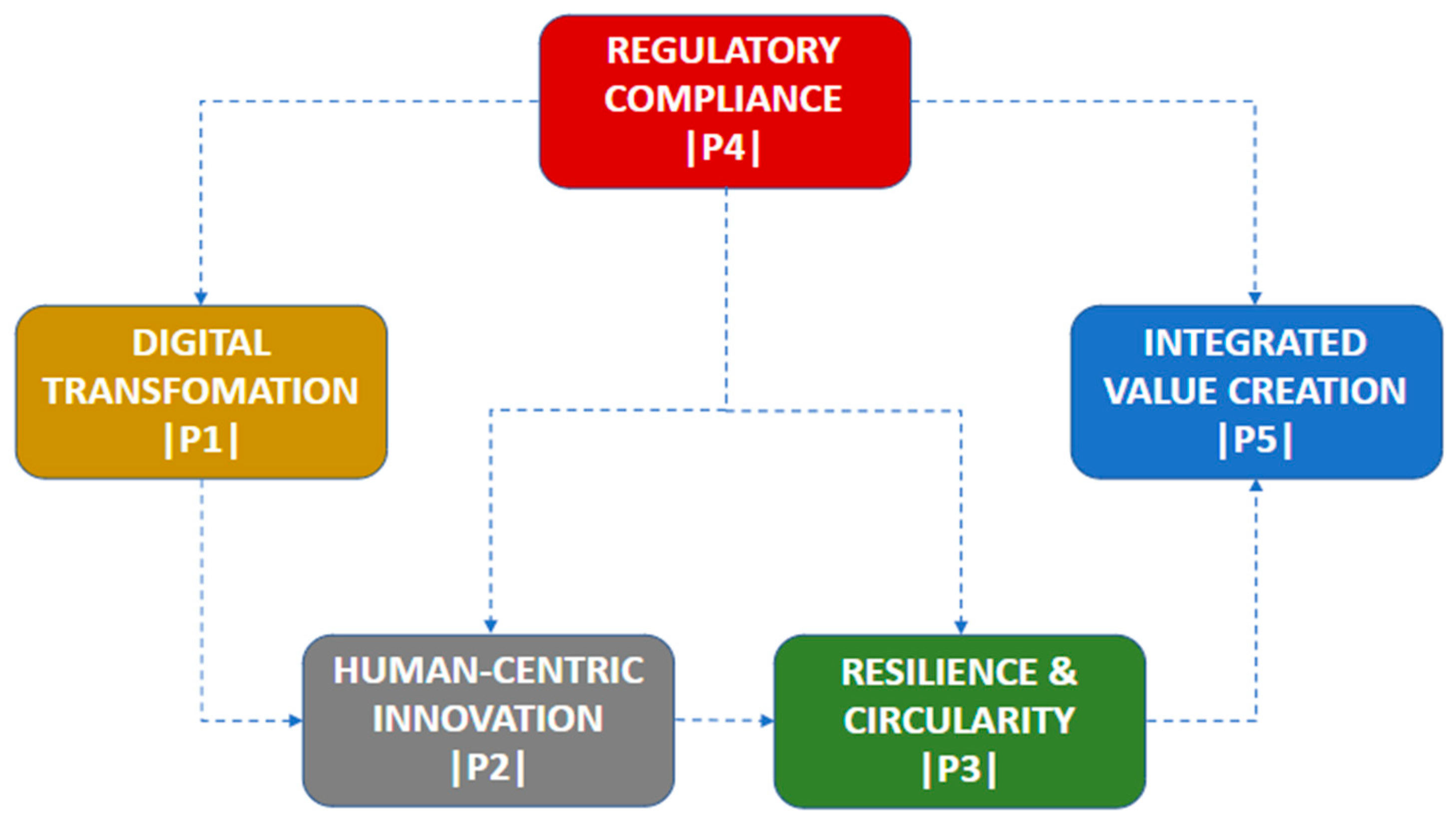

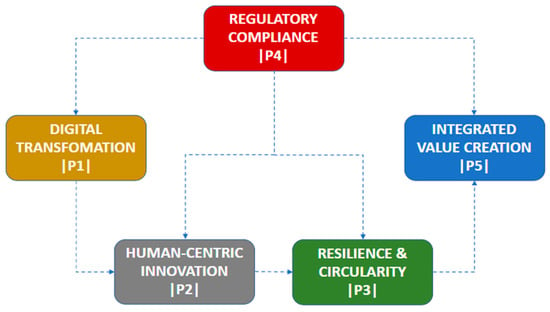

By using graph theory [61], we can visualize the conceptual model (Figure 1) as a directed graph, where the nodes represent the key components of the value creation process (Digital Transformation, Human-Centric Innovation, Resilience & Circularity, and Regulatory Compliance). The arcs represent the interdependencies and directional flow between these components, demonstrating how they influence one another and ultimately lead to integrated value creation.

Figure 1.

Conceptual model of Industry 6.0 value creation with five interconnected. pillars (P1–P5), illustrated through graph theory.

The conceptual model shows in a very straightforward way how the five propositions about paradigm shifts related to Industry X.0 theoretically combine. It strongly underlines interdependencies of Digital Transformation with human-centric innovation, resilience, and sustainability, and with external regulatory pressures exerted by frameworks such as the CSRD. The technological base has Digital Transformation (P1). Advanced IoT, big data analytics, and cyber-physical systems enable real-time optimization of processes with increased flexibility in value chains. Still, the industries are developing, and all this calls for integration of Human-Centric Innovation (P2). Advancement in technology must go hand in hand with humanity and society for sustainability. Industry 5.0 points toward ethical practices and social responsibility. After all, value creation does need to be extended into social and ethical dimensions alongside operational effectiveness. Going a step further, Resilience and Circularity in Industry 6.0 (P3) develops the concept of sustainability that covers not only environmental concerns but also resilience from disruptions, which companies are increasingly applying in their operations to embrace circular economy principles that favor regenerative practices and long-term sustainability. At this stage in development, human-centered innovation and digital transformation are pursued whereby advanced technologies are combined with social inclusion to come up with a value chain that is resilient and able to be sustained. As this remains, P4, Regulatory Compliance, mostly from an external perspective under frameworks such as the CSRD, builds up demand on firms to ensure transparency and accountability exist within the firm’s ESG performance. This regulatory force influences all the value creation stages by requiring firms to align their digital technologies, human-centered strategies, and circular models with demanding standards for sustainability reporting.

Finally, these various factors come together in Integrated Value Creation (P5), which embodies all the above in the form of an integrated strategy bringing together digital innovation, sustainability of humans and the environment, resilience, and adherence to regulation. The creation of value is integrated and no longer based on efficiency or profit per se but integrated into systemic approaches to value creation that are sustainable, adaptable, and in line with the expectations of the various stakeholders, both internal and external. Interconnected nodes underpin those firms that continuously adapt to digital technologies, enhance ethical and social responsibility, build resilient models for circularity, and ensure full compliance with evolving regulations, the underlying ingredients toward Industry 6.0 for sustainable value creation.

3. Methodology

3.1. Research Setting

This research employs a mixed methodology, integrating qualitative analysis with an abductive research strategy [62]. The objective is to examine the Industry 6.0 framework at the sectoral level within the ceramic industry, utilizing the ceramic industry as a single case study [63]. The abductive approach was selected for its malleability, enabling the continual refinement of theoretical propositions based on empirical observations and iterative engagement with the data [64]. This approach is particularly pertinent when examining emergent paradigms such as Industry 6.0, where extant theories may prove inadequate in encompassing the technological, regulatory and sustainability complexities inherent to a resource-intensive sector such as ceramics.

3.2. Data Collection

To investigate the Industry 6.0-driven transformation within the ceramic industry, the study employed a mixed-method approach that integrates primary and secondary sources. Semi-structured interviews constituted the core of the primary data collection [65]. These were conducted with key stakeholders along the ceramic value chain, including tile manufacturers, raw material suppliers, glaze and ink producers, machinery providers, and industry associations. Participants were selected based on their strategic involvement in sustainability, technological innovation, and regulatory compliance (e.g., CSRD, ESG). Selection criteria included formal roles in innovation or ESG-related decision-making, seniority, and representativeness across different segments of the ceramic value chain. The final sample comprised 86 participants, with distribution and focus areas summarized in Table 1.

Table 1.

Overview of interview themes and focus areas.

Although the final sample of 86 participants is substantial, it presents an unbalanced distribution across stakeholder groups, with tile manufacturers representing the majority. This reflects their central role in the ceramic value chain but also implies that perspectives from suppliers, machinery providers, and associations are relatively underrepresented. While this imbalance highlights the dominant influence of manufacturers, it limits the generalizability of the findings to the broader ecosystem. This issue is acknowledged further in the Limitations section.

The interviews explored a range of topics, including the adoption of Industry 6.0 technologies (AI, IoT, digital twins), the evolution of circular economy practices, and the strategic responses to increasing regulatory demands. Specific attention was given to the role of AI in predictive maintenance, digital process control, and quality assurance via computer vision. Several interviewees emphasized how AI-based systems support real-time decision-making, optimize energy use, and facilitate the transition from Industry 4.0 to 5.0. The semi-structured format ensured consistency in core themes while allowing flexibility to adapt to context-specific stakeholders. Interviews continued until thematic saturation was reached, meaning no new categories or themes emerged from additional interviews. This confirmed the comprehensiveness of the data collected. To triangulate the primary data, a structured review of secondary sources was conducted. These sources included sectoral reports, regulatory guidelines, academic studies, and white papers published by consulting firms and think tanks.

As outlined in Table 2, these materials provided contextual insight into industry-wide technological adoption, sustainability trends, and regulatory developments related to Industry X.0. Although not a systematic review, this structured approach ensured thematic alignment with the interview findings. This dual-source strategy, combining direct stakeholder insights with documented sectoral analyses, enabled the construction of a robust conceptual model. It allowed for iterative refinement of theoretical propositions in line with the abductive logic of the research design and deepened the understanding of how technological, regulatory, and sustainability dynamics intersect in the evolution of B2B relationships within the ceramic industry.

Table 2.

Overview of secondary data sources and focus areas.

3.3. Data Analysis

The interview data were first transcribed and coded, using a [66] approach to identify recurring themes and patterns related to the adoption of Industry 6.0 technologies, regulatory pressures, and sustainability practices across different stakeholder categories. The coding process followed three iterative stages [67]. The coding process followed three iterative stages. In the open coding phase, broad categories such as “adoption of AI,” “regulatory pressures,” and “circular practices” were identified across transcripts. Axial coding then grouped these into higher-order themes, including “Operational Resilience,” “Systemic Sustainability,” and “Cognitive Integration.” Finally, selective coding refined the analysis around the five theoretical propositions (P1–P5). Illustrative quotes supported each theme. For instance, one tile manufacturer noted: “AI is no longer just about efficiency; it helps us anticipate disruptions and adapt production in real time.” A raw material supplier emphasized: “The CSRD has forced us to rethink sourcing—waste is not just a cost but a liability in compliance terms.” These examples increased transparency in linking raw evidence to theoretical constructs.

Furthermore, insights from the innovation and sustainability managers were categorized and mapped to highlight the unique perspectives and strategic challenges encountered by each segment of the ceramic value chain. The study also employed AI-based text and pattern recognition tools to analyze qualitative interview responses, ensuring a more structured assessment of how companies are adopting AI, cognitive automation, and digital twins in their transition to Industry 6.0. These methods allowed for enhanced identification of key industry trends, reinforcing the study’s abductive approach. For the secondary data (Table 2), a structured review was conducted, focusing on reports, regulatory documents, and academic literature relevant to Industry 6.0 and the ceramic sector. The information gathered from these sources was synthesized to contextualize the interview findings, allowing for cross-validation of themes and providing a broader perspective on technological, regulatory, and market dynamics. Data triangulation between primary and secondary sources reinforced the robustness of the findings, ensuring alignment with current industry trends and regulatory developments. The integration of primary interview data with secondary sources enabled the construction of a holistic framework that captures the interactions and dependencies within the Industry 6.0 value chain for ceramics. This approach not only strengthened the validity of the results but also facilitated the development of a conceptual model that reflects the ceramic industry’s adaptation to digital transformation, sustainability imperatives, and evolving B2B relationships in the Industry 6.0 paradigm.

4. Results

Empirical validation has confirmed that the Italian ceramic industry, a high-energy and resource-intensive sector, has successfully integrated technological innovations in response to increasing regulatory pressures and sustainability requirements. Stakeholders across the value chain have highlighted key advancements in AI-driven manufacturing, predictive maintenance, and circular economy practices. These findings provide practical insights into how different actors within the ceramic industry are leveraging digital transformation to enhance operational resilience and regulatory compliance. These included:

- The machinery manufacturers provide the necessary know-how and technology. They play a very vital role in embracing emerging innovations like IoT, AI, and advanced robotics that are vital for the transition to Industry 4.0 and Industry 6.0.

- Glaze and ink manufacturers who are now incorporating sustainability into material formulation in view of the reduction in environmental impact foreseen by new regulations.

- The suppliers of the raw material are usually confronted with the problems of what is increasingly called the circular economy and the sustainable management of natural resources; hence, they would have to be attentive to waste reduction and further efficient use of resources.

- Ceramic tile manufacturers are the central entities in the industry and are continuously expected to update their operational models according to adaptation to environmental regulations and enhancement of production efficiency. This obviously points out the crossroads where changes in regulation and technology meet.

- Industry associations provide a macro-level understanding of the issues faced by industry, for instance, on new European regulations, such as the latest Corporate Sustainability Reporting Directive (CSRD), facing increasingly high demands on Environmental, Social, and Governance (ESG) compliance.

Data collection was facilitated by semi-structured interviews with representatives of each of these key categories, which allowed flexible but focused exploration of how businesses in the ceramic industry are embracing Industry 4.0 and 6.0 solutions. It investigated details related to automation strategies, the use of advanced robotics, connected systems, and AI-driven innovations. Based on interviews with experts, it has been possible to trace the technological and product evolution of the ceramics industry, placing it in the transitions between the different industrial revolutions. To ensure the robustness of the analysis, data validation techniques, including triangulation and participant feedback loops, were used in steps 3 and 4 to cross-check findings and reduce potential bias. In addition, focus group participants were selected based on their expertise and decision-making roles within the sustainability departments of the trade association representing the member companies of the ceramic tile industry (Confindustria Ceramica), ensuring that insights were drawn from individuals with a broad understanding of both the strategic and operational challenges facing the industry.

- The transition from Industry 2.0 to Industry 6.0 has had a significant impact on the industrial sector. Large-scale manufacturing became possible with the advent of electrification, which set the stage for modernization during the Industry 2.0 era (1870–1914). But it was during Industry 3.0 (1970–2013) that automation brought about a profound change in the ceramic sector. Innovations such as rotary screen-printing machines and roller kilns were developed during this period, improving the accuracy and efficiency of production processes.

- Industry 4.0 (2014–2019) brought digitalization and machine connectivity. With the launch of the National Plan Industry 4.0 in 2016, Italy increased the adoption of technologies such as the Internet of Things (IoT) and cyber-physical systems. These tools have significantly improved the quality and effectiveness of manufacturing processes by enabling more customized, adaptable and networked production. For example, a revolution in the quality of digital decoration took place in the ceramics industry in 2012 with the launch of System Ceramics’ digital printer, which can print with a resolution of more than 300 dpi.

- The Industry 5.0 paradigm of 2020–2024 shifts the focus to environmental sustainability and human–machine collaboration. The ceramics sector has been able to reduce energy consumption and increase worker safety using green technology and collaborative robots, or cobots. Business models have been rethought with an emphasis on material recycling and waste reduction because of the incorporation of circular economy ideas.

- Looking to the future, Industry 6.0 (post-2025 perspective) is expected to emphasize the combination of digital twins, blockchain technology and artificial intelligence with increasingly circular and resilient business structures. With this new phase, companies will be able to minimize their environmental impact, maintain high efficiency and respond quickly to change.

- The evolution of ceramic products has kept pace with technological advancement, with an expanding range of forms and formats available on the market. In the 1960s, red stoneware and terracotta floor tiles were the mainstays of manufacturing, but in the 1970s and 1980s, goods such as majolica (double-fired) and clinker floor tiles emerged, indicating a growing desire for resistant and permanent solutions. From the 1980s and 1990s, with the advent of single-fired and double-fired tiles, the ceramic industry saw the introduction of medium and large formats in response to the aesthetic and functional needs of the market. However, the most significant development occurred with the advent of huge porcelain stoneware slabs in 2012, which opened new design and application possibilities. These increasingly big forms are becoming increasingly popular in both residential and commercial contexts, because of their visual continuity and less grouting.

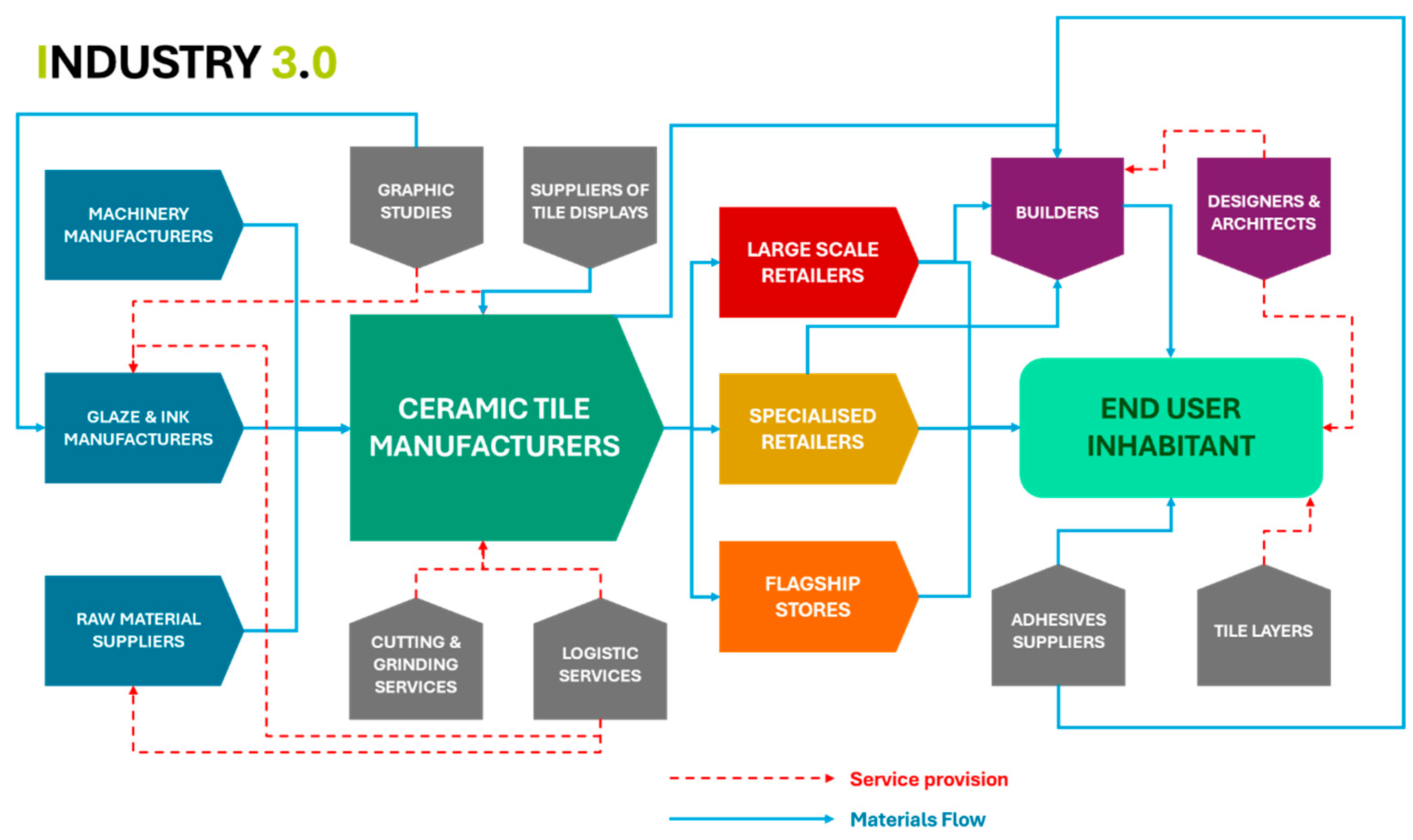

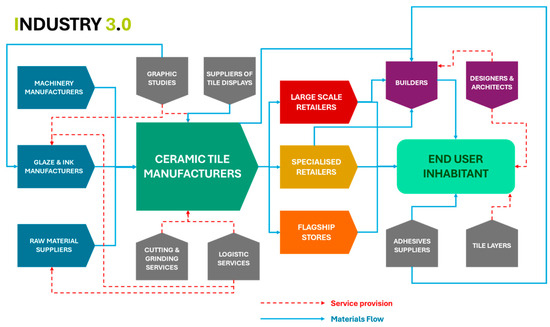

4.1. Industry 3.0

Figure 2 illustrates the value chain of the ceramic manufacturing industry under the Industry 3.0 paradigm, characterized by linear flows and limited digital integration. Ceramic tile manufacturers operate as central nodes, coordinating inputs from machinery manufacturers, glaze and ink producers, and raw material suppliers. These upstream actors provide materials and technical services essential to automated yet isolated production processes.

Figure 2.

Value chain framework of the ceramic manufacturing industry under the Industry 3.0 paradigm.

Downstream, the flow of goods moves through logistics services and specialized cutting and grinding providers before reaching various retail outlets—large-scale, specialized, and flagship stores. Distribution is unidirectional, with minimal data feedback or co-creation from market actors. Support functions such as graphic studios and display suppliers serve marketing purposes, while the final link in the chain includes construction professionals (builders, tile layers, adhesives suppliers) and designers and architects, who interact only at the point of application. End users are passive recipients of standardized products, with no influence over design or production. Overall, the Industry 3.0 value chain operates as a mechanized system with rigid structures, limited collaboration, and a near-absence of digital feedback loops.

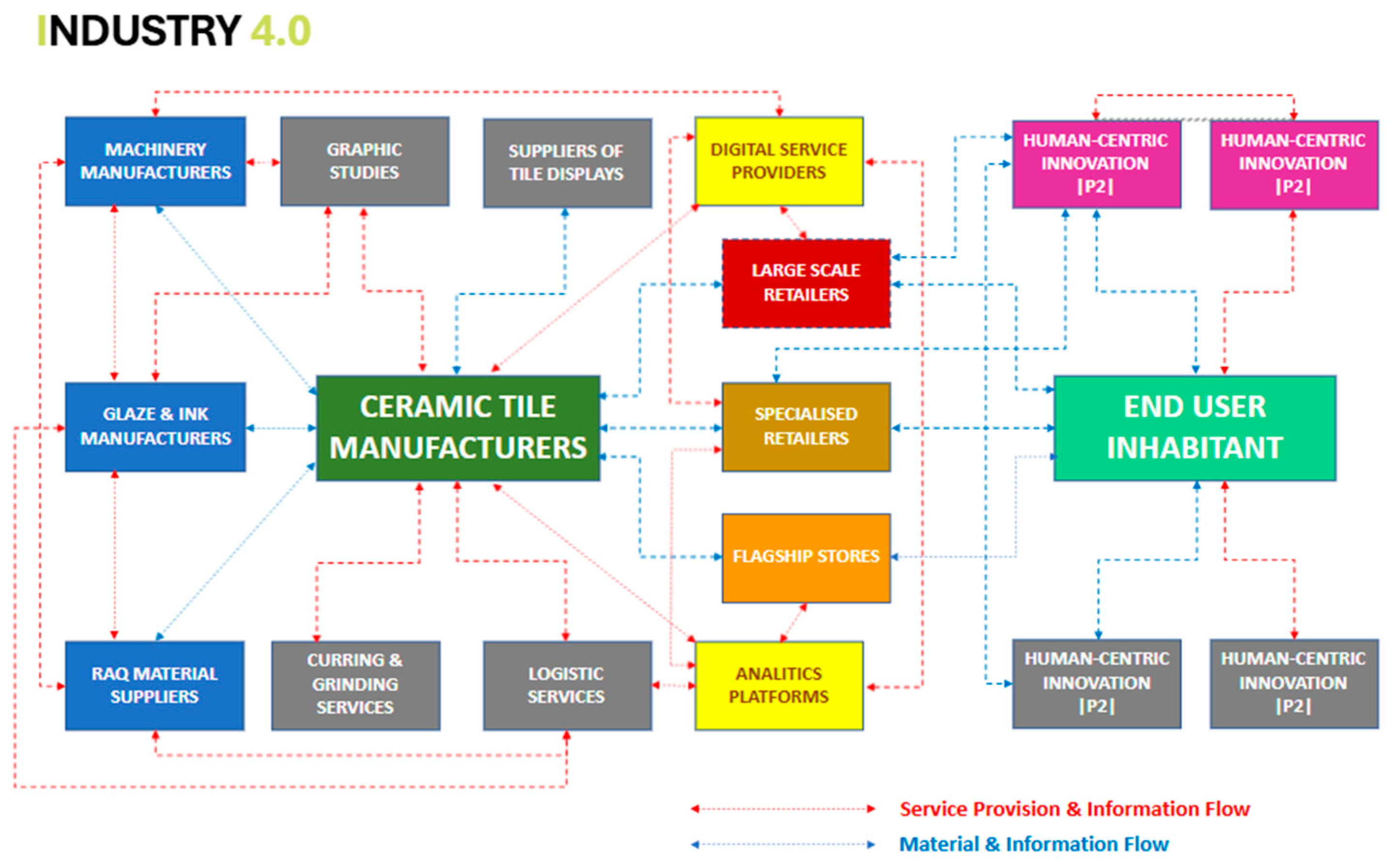

4.2. Industry 4.0

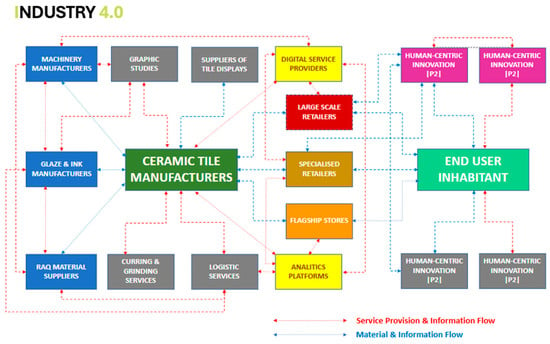

The transition from Industry 3.0 to 4.0 marks a radical shift toward interconnected, data-driven manufacturing (Figure 3).

Figure 3.

Value chain framework of the ceramic manufacturing industry under the Industry 4.0 paradigm.

Core enablers, such as the Internet of Things (IoT), digital twins, and advanced analytics, transform the ceramic value chain from sequential to integrated. Machinery manufacturers now provide not only equipment but also embedded IoT systems that enable predictive maintenance and real-time process control within tile manufacturing. Glaze and ink producers increasingly adopt digital tools to improve customization and reduce waste, while raw material suppliers rely on data-sharing platforms to optimize sourcing and traceability. Two new actor categories, Digital Service Providers and Analytics Platforms, enter the chain, enabling real-time monitoring and data-driven forecasting across operations, logistics, and supply. Customer-centric design gains relevance through digital configurators, allowing architects and end users to co-design ceramic solutions. Manufacturers, informed by real-time feedback, rapidly adapt production offerings to match shifting demand. Logistics processes also become smarter: tracking systems and AI-assisted inventory management enhance delivery precision, minimizing costs and emissions. Industry 4.0 builds the foundation for real-time collaboration, tighter integration, and increased responsiveness across the ceramic manufacturing value chain.

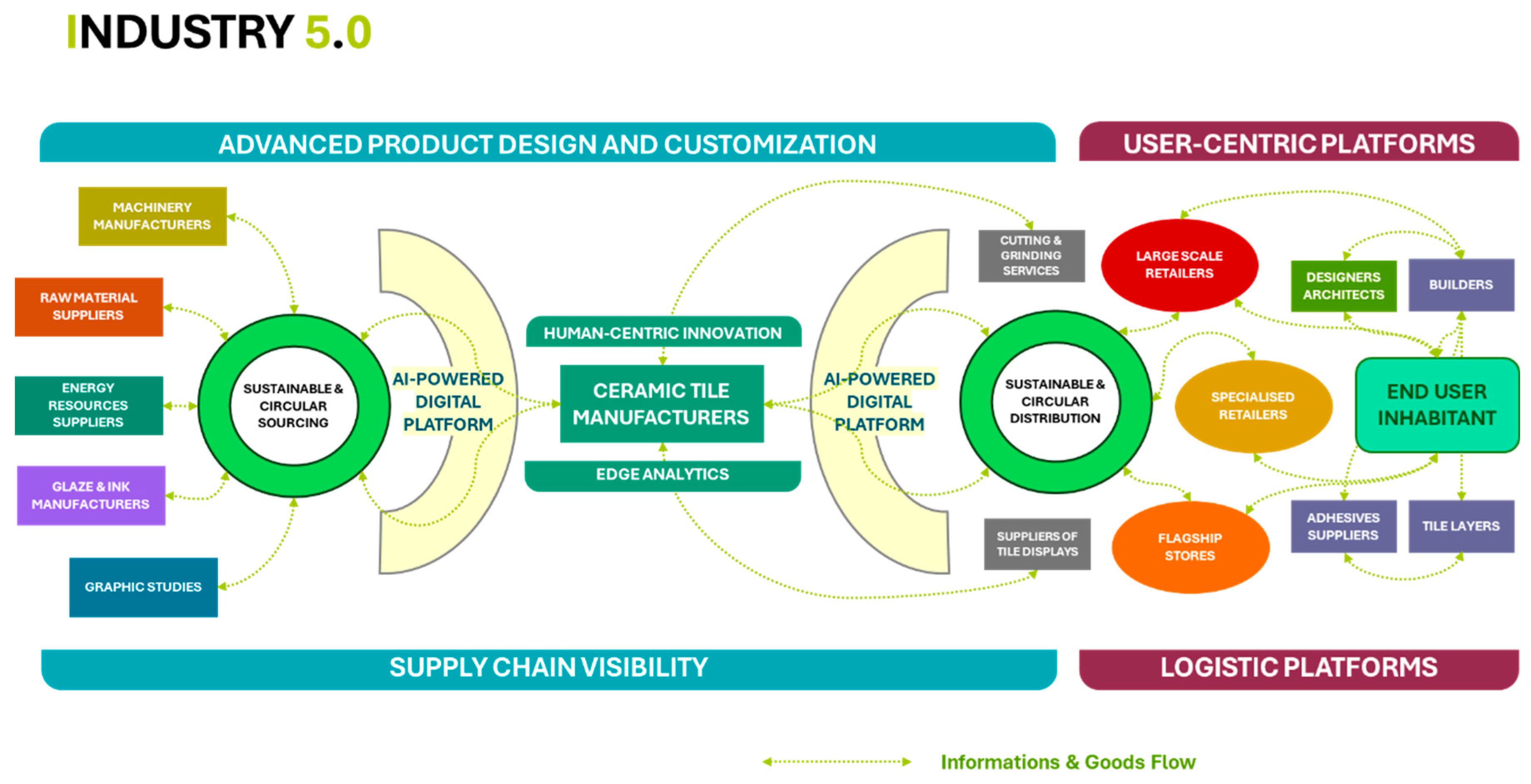

4.3. Industry 5.0

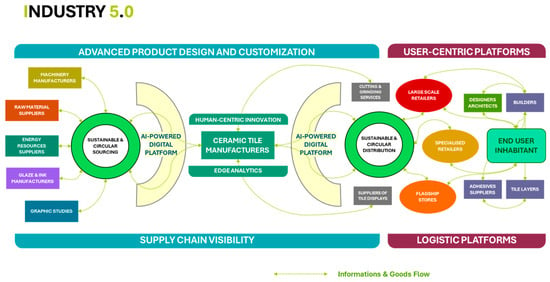

The transition to Industry 5.0 marks a shift from purely technology-driven innovation to a human-centric and sustainability-oriented paradigm (Figure 4). While maintaining the digital backbone of Industry 4.0 (AI, digital twins, and IoT), this new stage emphasizes co-creation, resilience, and ethical innovation.

Figure 4.

Value chain framework of the ceramic manufacturing industry under the Industry 5.0 paradigm.

Figure 4 illustrates the reconfiguration of the value chain under Industry 5.0. Traditional suppliers, machinery manufacturers, glaze and ink producers, and raw material providers are now integrated into AI-powered digital platforms, enabling real-time coordination, predictive analytics, and sustainable design strategies. These platforms improve energy efficiency, facilitate circular flows of materials, and optimize operational adaptability. A major innovation in this paradigm is the rise of user-centric platforms, enabling designers, architects, and end-users to collaborate directly with manufacturers. This co-creation logic fosters product personalization, shortens feedback loops, and aligns production with actual user needs, reducing waste and overproduction. Logistics platforms also evolve, combining digital twins with AI-based tracking to enhance visibility, traceability, and emission control across the entire chain. Meanwhile, supply chain visibility and advanced customization become strategic levers for competitiveness. The Industry 5.0 value chain moves beyond efficiency to embed systemic sustainability and human–machine collaboration into every stage, from sourcing to design, production, and delivery. This holistic integration lays the groundwork for the even more interconnected and adaptive ecosystem of Industry 6.0.

4.4. Industry 6.0

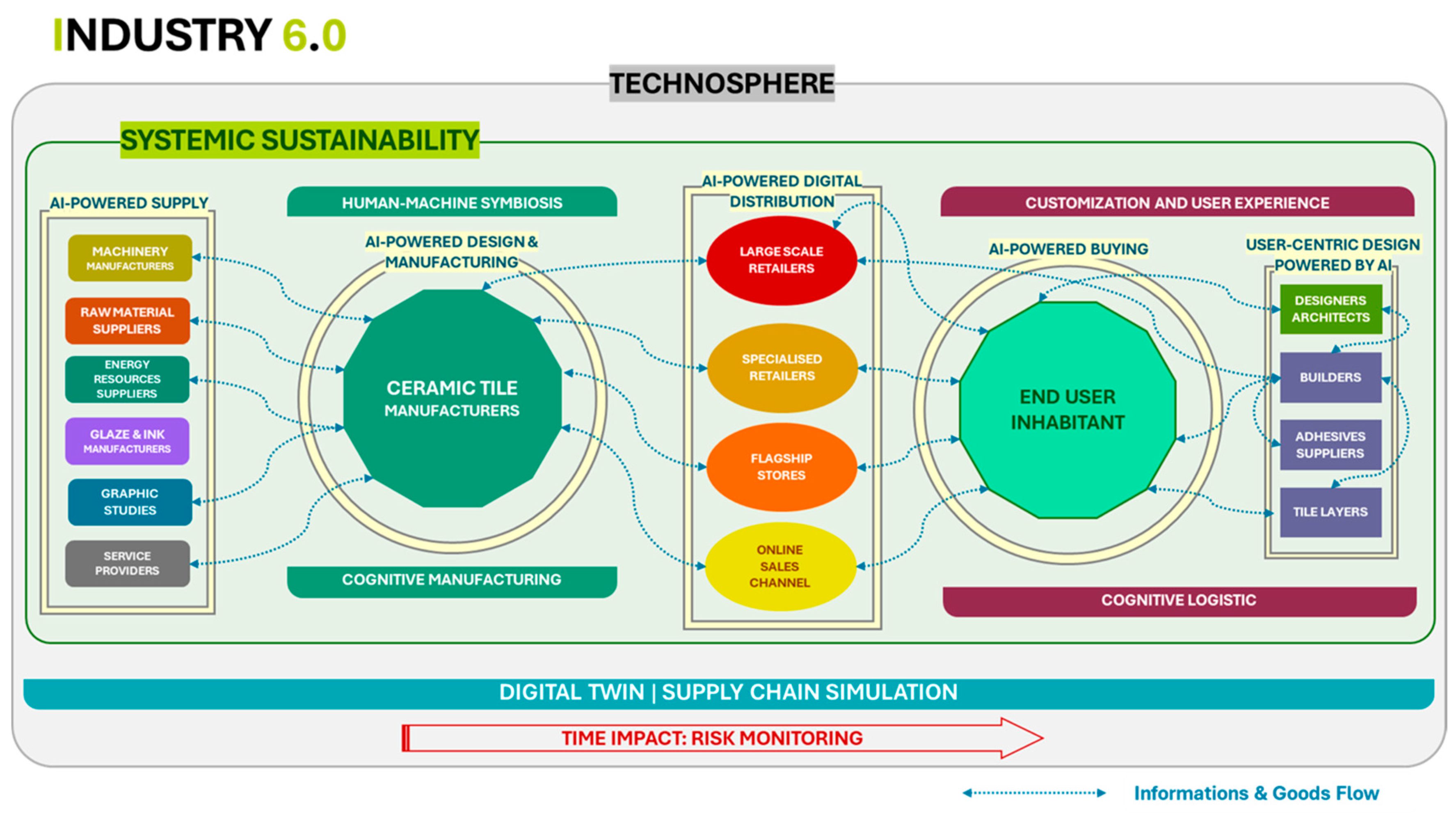

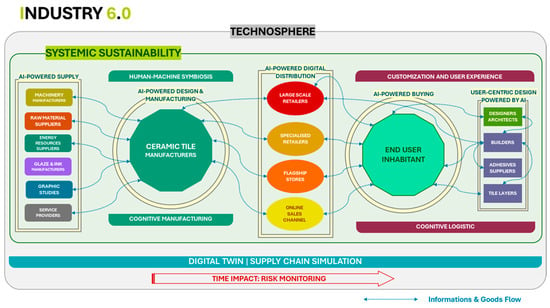

The transition to Industry 6.0 marks a strategic shift toward human–machine symbiosis and systemic sustainability within interconnected industrial ecosystems (Figure 5).

Figure 5.

Value chain framework of the ceramic manufacturing industry under the Industry 6.0 paradigm.

Building on the human-centric principles of Industry 5.0, Industry 6.0 envisions a digitally integrated environment—referred to as the Technosphere—where technology, society, and industrial systems co-evolve. This paradigm recognizes the multidimensional nature of sustainability, extending beyond circular economy principles to encompass environmental, social, economic, and technological resilience [68,69]. In this context, Systemic Sustainability becomes the guiding principle, promoting value creation through the integration of digital twins, AI, cognitive automation, and adaptive supply chains [70,71]. The Technosphere functions as both a conceptual and operational space, where dynamic interactions among stakeholders are continuously optimized to address double materiality, i.e., the combined impact of environmental and social risks [25]. Key features of the Industry 6.0 value chain include:

- Human–Machine Symbiosis and Cognitive Manufacturing: AI-enhanced machines collaborate in real time with humans, enabling anticipatory decision-making and adaptive production processes.

- AI-Powered Supply and Distribution: All upstream and downstream actors, including raw material suppliers, energy providers, and logistics firms, operate through AI-driven platforms that enhance efficiency, resource optimization, and risk anticipation.

- Cognitive Logistics: Enabled by digital twins, logistics systems become predictive, self-adjusting, and capable of simulating scenarios to manage disruptions across the supply chain.

- User-Centric Co-Creation: Advanced interfaces allow end users, architects, and builders to co-design products in real time, aligning production with individual preferences and sustainability goals.

- Time-Based Risk Monitoring: A dedicated layer tracks dynamic environmental and social risks, reinforcing strategic planning through real-time, AI-powered assessments of double materiality.

Industry 6.0 redefines the ceramic value chain as a techno-socio-industrial ecosystem, where systemic sustainability and cognitive automation become the pillars of competitive and regulatory alignment.

4.5. From Human-Centric to Systemic Sustainability in Industry 6.0

The transition from Industry 5.0 to Industry 6.0 entails a shift from human-centered innovation to a systemic perspective that integrates technological, social, and environmental dimensions [72,73]. Based on our empirical findings, this transformation can be articulated across four key axes:

- From Human-Centric to Human–Machine Symbiosis: While Industry 5.0 focused on augmenting human capabilities through collaborative robotics and AI, Industry 6.0 introduces adaptive, co-evolutionary collaboration between humans and machines within real-time digital ecosystems.

- From Operational Transparency to Cognitive Automation: The emphasis on visibility and control through digital twins in Industry 5.0 evolves into predictive, learning-based systems in Industry 6.0, capable of autonomous decision-making and proactive resource management.

- From Circular Economy to Systemic Sustainability: Industry 6.0 expands the focus from material recirculation to a broader model of sustainability, integrating environmental stewardship with social resilience and technological innovation.

- From Fragmented Platforms to the Technosphere: Industry 6.0 introduces a unified digital infrastructure, which the recent literature defines as the Technosphere, that supports end-to-end orchestration of data, processes, and stakeholder interactions.

This evolution is not merely conceptual. Our qualitative evidence reveals that ceramic industry stakeholders are already anticipating this shift. Beyond traditional sustainability goals, they emphasize the integration of AI-powered platforms, co-creation interfaces, and predictive analytics as enablers of systemic resilience. This perspective aligns only partially with existing academic literature, which often remains anchored to circular economy principles. Practitioners, instead, envision a transformation that redefines how value is created and sustained—socially, technologically, and economically. The proposed model (Figure 1) reflects this shift and offers a foundation for future empirical exploration. Translating it into a structured assessment tool would support companies in mapping their Industry 6.0 readiness and identifying gaps in their sustainability strategy.

4.6. Toward a Systemic Value Creation Model in Industry 6.0

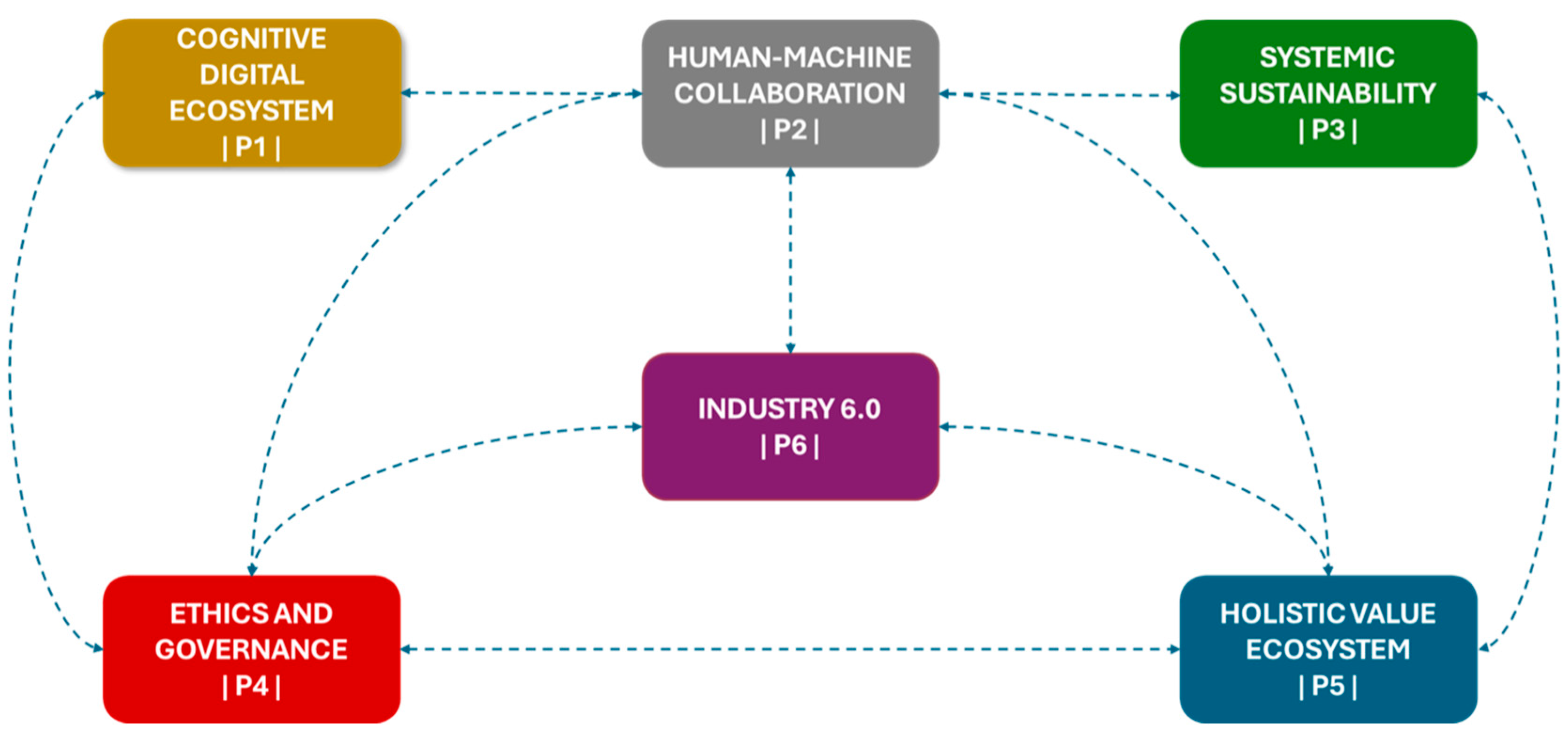

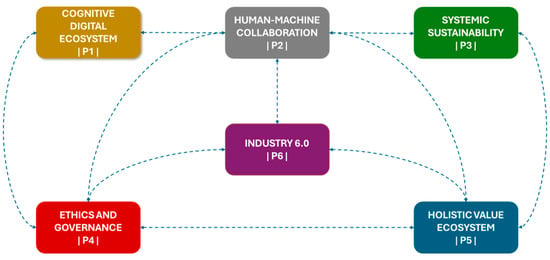

Building on the foundational framework proposed in Figure 1, the refined model illustrated in Figure 6 presents an integrated and dynamic configuration of five interdependent pillars.

Figure 6.

Extended Industry 6.0 model with six pillars, adding Cognitive Adaptivity (P6). As the key differentiator from Industry 5.0.

The updated conceptual model (Figure 6) introduces a sixth pillar (Cognitive Adaptivity), highlighting the role of autonomous learning systems and anticipatory intelligence in Industry 6.0. This addition marks a clear evolution from Industry 5.0, where human-centric collaboration is key but not yet fully integrated with self-adaptive cognitive systems. The six propositions (P1–P6) together define a dynamic framework for systemic, ethical, and resilient value creation. Each pillar contributes to a holistic and ethically grounded system, orchestrated by the Industry 6.0 Paradigm (P6), which serves both as a strategic enabler and a guiding principle.

- P1—Cognitive Digital Ecosystem: Evolves from traditional digital transformation to include AI, digital twins, and cognitive automation. It enables real-time optimization of processes and resource flows, anchoring technological intelligence within the broader Industry 6.0 vision.

- P2—Human–Machine Collaboration: Extends the human-centric logic of Industry 5.0 by enabling continuous co-evolution between workers and adaptive AI systems. It ensures that technological advancement is aligned with human values, safety, and capabilities.

- P3—Systemic Sustainability: Moves beyond circularity by integrating environmental, social, economic, and technological dimensions. It promotes resilience, low-impact design, and inclusive growth across the value chain.

- P4—Ethics and Governance: Reinterprets regulatory compliance considering ESG imperatives. It embeds ethical responsibility into innovative processes and supports transparent, accountable governance structures.

- P5—Holistic Value Ecosystem: Synthesizes the outcomes of the previous pillars by fostering inclusive, sustainable, and long-term value creation for all stakeholders, from producers to end-users and communities.

The Industry 6.0 Paradigm (P6) sits at the center of this model, enabling synergistic feedback loops among the pillars. Rather than acting as a static classification, the model defines a strategic and operational framework for advancing sustainable transformation. It invites future empirical validation to test how these interdependencies manifest in practice and how they can be leveraged to address complexity, uncertainty, and ethical accountability in industrial value chains.

5. Final Remarks

5.1. Discussion of Results

This study shows how the ceramic industry is transitioning from efficiency-driven automation to a systemic integration of AI, sustainability, and human–machine collaboration. The evolution from Industry 3.0 to 6.0 is not linear but cumulative, progressively building an ecosystem where predictive analytics, circularity, and strategic foresight converge. While Industry 4.0 laid the groundwork with IoT and automation, Industry 5.0 introduced personalization and human-centricity. Industry 6.0 amplifies these with cognitive capabilities, embedding sustainability and ethical governance into all value-generating processes. A key theoretical contribution is the articulation of the Technosphere and Systemic Sustainability as interpretive lenses for Industry 6.0. Unlike prior paradigms, the Technosphere conceptualizes industrial value creation as an entangled network of social, technological, and ecological elements. Systemic Sustainability reframes circular economy logic by integrating digital ethics, real-time risk assessment, and AI-driven responsiveness across the value chain. At the operational level, the results show how AI facilitates predictive maintenance, energy optimization, and cognitive logistics. Stakeholders in the ceramic sector are already embedding these capabilities within digital twins, smart kilns, and advanced quality control systems, validating the centrality of cognitive automation. These transformations are not merely technological upgrades, but strategic enablers for regulatory compliance, resource efficiency, and adaptive B2B collaboration.

The empirical findings can be explicitly mapped to the theoretical propositions developed earlier. For example, the evidence of predictive maintenance systems and IoT adoption validates Proposition 1 (Digital Transformation). Insights on human–AI collaboration and worker safety reinforce Proposition 2 (Human-Centric Innovation). References to circular flows of raw materials and regulatory adaptation by suppliers support Proposition 3 (Resilience and Circularity). The strong role of the CSRD, repeatedly emphasized by both manufacturers and associations, substantiates Proposition 4 (Regulatory Compliance). Finally, the integration of these elements into a systemic framework aligns with Proposition 5 (Holistic Value Creation). Table 3 summarizes these linkages.

Table 3.

Summary of key empirical findings and their supported research propositions.

Our findings also contribute to the Sustainable Development Goals (SDGs). By demonstrating how AI-driven logistics reduce energy use and emissions, the study aligns with SDG 12 (Responsible Consumption and Production) and SDG 13 (Climate Action). The emphasis on circular flows and cognitive adaptivity supports SDG 9 (Industry, Innovation, and Infrastructure), highlighting how Industry 6.0 can contribute to sustainable industrial ecosystems at both the firm and sectoral levels.

5.2. Addressing Research Questions

The results of the study directly address its research questions (RQs):

- RQ1 explored how Industry 6.0 technologies integrate with circular economy principles to enhance resilience and value creation in B2B networks. The findings confirm that digital twins, AI, and IoT create interconnected supply systems that optimize performance and comply with demanding ESG frameworks like the CSRD.

- RQ2 focused on the impact of Industry 6.0 on stakeholder engagement and strategic decision-making in industrial marketing. The research reveals how cognitive platforms and AI-driven ecosystems foster transparency, co-creation, and customization, reshaping traditional B2B interactions into trust-based, value-driven networks.

5.3. Conclusions

This study offers one of the first comprehensive models of Industry 6.0 applied to a resource-intensive manufacturing sector. It advances theory by moving beyond isolated digital or circular strategies and proposing an integrated framework grounded in cognitive ecosystems, systemic sustainability, and ethical value creation. From a managerial perspective, the research suggests that Industry 6.0 technologies are not optional innovations but strategic imperatives. Cognitive automation, risk monitoring, and human–machine symbiosis enable companies to reconcile regulatory pressures with operational performance. For industries navigating the shift from Industry 4.0 to 6.0, these findings provide a roadmap for adaptive and resilient value chain transformation. It is important to stress that Industry 6.0 remains a largely conceptual paradigm. The findings presented here should therefore be interpreted as indicative trends rather than definitive outcomes. The evidence illustrates emerging trajectories but requires further empirical testing to validate their generalizability beyond the ceramic sector.

Overall, our study not only advances the theoretical debate on Industry 6.0 but also offers practical pathways for aligning industrial transformation with global sustainability agendas. By explicitly linking Industry 6.0 to the SDGs, we highlight its potential as a strategic enabler of long-term competitiveness, resilience, and societal value.

5.4. Limitations and Future Research Directions

As a single-case study in the ceramic industry, the findings require further empirical validation across different manufacturing contexts. Another limitation concerns the composition of the sample. Tile manufacturers dominated the interviews, which, while justified by their pivotal role in the industry, reduced the diversity of perspectives. Future research should aim for a more balanced distribution of stakeholders to capture a richer spectrum of viewpoints across the value chain. For future research, attention should be directed towards cross-sectoral applications of the proposed model and its scalability within small and medium-sized enterprises. Longitudinal studies are essential to examine how cognitive technologies evolve and influence decision-making, sustainability, and competitiveness over time. Furthermore, quantitative validation of the conceptual framework in various manufacturing sectors (such as steel, cement, or automotive) would allow for assessment of its external validity. Comparative analyses across industries and over extended periods would provide deeper insight into the impact of cognitive automation and regulatory compliance on sustainable value creation. Finally, future research should also explore how cognitive adaptivity (P6) can be operationalized and measured in practice, for example, through maturity models or quantitative performance indicators. Cross-sectoral studies in energy-intensive industries such as steel, cement, or chemicals would help assess the scalability of our conceptual model. Longitudinal studies are particularly relevant to capture the evolving role of cognitive systems and their interaction with regulatory frameworks and sustainability outcomes.

Author Contributions

Conceptualization, A.F.-M. and D.S.-B.; methodology, S.O.-M. and M.J.-C.; investigation, A.F.-M. and D.S.-B.; data curation, A.P.F.d.H. and F.E.G.-M.; writing—original draft preparation, D.S.-B. and A.P.F.d.H.; validation, M.J.-C.; supervision, S.O.-M. and F.E.G.-M. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Data Availability Statement

The raw data supporting the conclusions of this article will be made available by the authors on request.

Conflicts of Interest

The authors declare no conflicts of interest.

References

- Cheng, C.T.; Wollert, J.; Chen, X.; Fapojuwo, A.O. Guest Editorial Circuits and Systems for Industry X.0 Applications. IEEE J. Emerg. Sel. Top. Circuits Syst. 2023, 13, 457–460. [Google Scholar] [CrossRef]

- Appolloni, A.; D’Adamo, I.; Gastaldi, M.; Yazdani, M.; Settembre-Blundo, D. Reflective Backward Analysis to Assess the Operational Performance and Eco-Efficiency of Two Industrial Districts. Int. J. Product. Perform. Manag. 2023, 72, 1608–1626. [Google Scholar] [CrossRef]

- Nasir, N.; Umar, M.; Khan, S.; Zia-ul-haq, H.M.; Yusliza, M.Y. Technological Revolution in Industrial Ecology. In Energy Transition: Economic, Social and Environmental Dimensions; Khan, S.A.R., Panait, M., Puime Guillen, F., Raimi, L., Eds.; Springer Nature: Singapore, 2022; pp. 1–28. ISBN 978-981-19-3540-4. [Google Scholar]

- Zakoldaev, D.A.; Shukalov, A.V.; Zharinov, I.O. From Industry 3.0 to Industry 4.0: Production Modernization and Creation of Innovative Digital Companies. IOP Conf. Ser. Mater. Sci. Eng. 2019, 560, 012206. [Google Scholar] [CrossRef]

- Deepti Raj, G.; Prabadevi, B.; Gopal, R. Evolution of Industry 4.0 and Its Fundamental Characteristics. In Digital Transformation: Industry 4.0 to Society 5.0; Kumar, A., Sagar, S., Thangamuthu, P., Balamurugan, B., Eds.; Springer Nature: Singapore, 2024; pp. 1–25. ISBN 978-981-99-8118-2. [Google Scholar]

- Ghobakhloo, M.; Iranmanesh, M.; Tseng, M.-L.; Grybauskas, A.; Stefanini, A.; Amran, A. Behind the Definition of Industry 5.0: A Systematic Review of Technologies, Principles, Components, and Values. J. Ind. Prod. Eng. 2023, 40, 432–447. [Google Scholar] [CrossRef]

- Shahzadi, G.; Jia, F.; Chen, L.; John, A. AI Adoption in Supply Chain Management: A Systematic Literature Review. J. Manuf. Technol. Manag. 2024, 35, 1125–1150. [Google Scholar] [CrossRef]

- Grabowska, S.; Saniuk, S.; Gajdzik, B. Industry 5.0: Improving Humanization and Sustainability of Industry 4.0. Scientometrics 2022, 127, 3117–3144. [Google Scholar] [CrossRef]

- Caiazzo, B.; Murino, T.; Petrillo, A.; Piccirillo, G.; Santini, S. An IoT-Based and Cloud-Assisted AI-Driven Monitoring Platform for Smart Manufacturing: Design Architecture and Experimental Validation. J. Manuf. Technol. Manag. 2023, 34, 507–534. [Google Scholar] [CrossRef]

- Contini, G.; Peruzzini, M.; Bulgarelli, S.; Bosi, G. Developing Key Performance Indicators for Monitoring Sustainability in the Ceramic Industry: The Role of Digitalization and Industry 4.0 Technologies. J. Clean. Prod. 2023, 414, 137664. [Google Scholar] [CrossRef]

- Chourasia, S.; Tyagi, A.; Pandey, S.M.; Walia, R.S.; Murtaza, Q. Sustainability of Industry 6.0 in Global Perspective: Benefits and Challenges. MAPAN 2022, 37, 443–452. [Google Scholar] [CrossRef]

- Yadav, S.; Rab, S.; Wan, M. Metrology and Sustainability in Industry 6.0: Navigating a New Paradigm. In Handbook of Quality System, Accreditation and Conformity Assessment; Springer Nature: Singapore, 2024; pp. 1–31. [Google Scholar]

- Dondi, M.; García-Ten, J.; Rambaldi, E.; Zanelli, C.; Vicent-Cabedo, M. Resource Efficiency versus Market Trends in the Ceramic Tile Industry: Effect on the Supply Chain in Italy and Spain. Resour. Conserv. Recycl. 2021, 168, 105271. [Google Scholar] [CrossRef]

- Pagano, A.; Carloni, E.; Galvani, S.; Bocconcelli, R. The Dissemination Mechanisms of Industry 4.0 Knowledge in Traditional Industrial Districts: Evidence from Italy. Compet. Rev. Int. Bus. J. 2021, 31, 27–53. [Google Scholar] [CrossRef]

- Primec, A.; Belak, J. Sustainable CSR: Legal and Managerial Demands of the New EU Legislation (CSRD) for the Future Corporate Governance Practices. Sustainability 2022, 14, 16648. [Google Scholar] [CrossRef]

- Ostojic, S.; Simone, L.; Edler, M.; Traverso, M. How Practically Applicable Are the EU Taxonomy Criteria for Corporates?—An Analysis for the Electrical Industry. Sustainability 2024, 16, 1575. [Google Scholar] [CrossRef]

- Elhusseiny, H.M.; Crispim, J. A Review of Industry 4.0 Maturity Models: Theoretical Comparison in The Smart Manufacturing Sector. Procedia Comput. Sci. 2024, 232, 1869–1878. [Google Scholar] [CrossRef]

- Zamora Iribarren, M.; Garay-Rondero, C.L.; Lemus-Aguilar, I.; Peimbert-García, R.E. A Review of Industry 4.0 Assessment Instruments for Digital Transformation. Appl. Sci. 2024, 14, 1693. [Google Scholar] [CrossRef]

- Kaswan, M.S.; Chaudhary, R.; Garza-Reyes, J.A.; Singh, A. A Review of Industry 5.0: From Key Facets to a Conceptual Implementation Framework. Int. J. Qual. Reliab. Manag. 2025, 42, 1196–1223. [Google Scholar] [CrossRef]

- Rijwani, T.; Kumari, S.; Srinivas, R.; Abhishek, K.; Iyer, G.; Vara, H.; Dubey, S.; Revathi, V.; Gupta, M. Industry 5.0: A Review of Emerging Trends and Transformative Technologies in the next Industrial Revolution. Int. J. Interact. Manuf. 2025, 19, 667–679. [Google Scholar] [CrossRef]

- Nair, A.; Pillai, S.V.; Senthil Kumar, S.A. Towards Emerging Industry 5.0—A Review-Based Framework. J. Strategy Manag. 2024. [Google Scholar] [CrossRef]

- Subbiah, P.; Tyagi, A.K.; Mazumdar, B.D. The Future of Manufacturing and Artificial Intelligence Industry 6.0 and Beyond. In Industry 4.0, Smart Manufacturing, and Industrial Engineering; CRC Press: Boca Raton, FL, USA, 2024; pp. 347–362. [Google Scholar]

- Samuels, A. Examining the Integration of Artificial Intelligence in Supply Chain Management from Industry 4.0 to 6.0: A Systematic Literature Review. Front. Artif. Intell. 2025, 7, 1477044. [Google Scholar] [CrossRef]

- Kumar, U.; Kumar, R.; Singh, M.; Singh, M.; Singh, H.; Singh, R.; Chabra, R. A Critical Review on History of Industrial Revolutions. AIP Conf. Proc. 2025, 3185, 020097. [Google Scholar] [CrossRef]

- Fernández-Miguel, A.; García-Muiña, F.E.; Settembre-Blundo, D.; Tarantino, S.C.; Riccardi, M.P. Exploring Systemic Sustainability in Manufacturing: Geoanthropology’s Strategic Lens Shaping Industry 6.0. Glob. J. Flex. Syst. Manag. 2024, 25, 579–600. [Google Scholar] [CrossRef]

- Tyagi, A.K.; Bhatt, P.; Chidambaram, N.; Kumari, S. Artificial Intelligence Empowered Smart Manufacturing for Modern Society. In Artificial Intelligence-Enabled Digital Twin for Smart Manufacturing; Wiley: Hoboken, NJ, USA, 2024; pp. 55–83. [Google Scholar]

- Sharma, A.; Sim, K.Y.; Chandrasekaran, S. A Comprehensive Review of Challenges Using AI for Smart Manufacturing. In Proceedings of the 2025 17th International Conference on Computer and Automation Engineering (ICCAE), Perth, Australia, 20 March 2025; IEEE: Piscataway, NJ, USA, 2025; pp. 405–413. [Google Scholar]

- Ponnusamy, V.; Ekambaram, D.; Zdravkovic, N. Artificial Intelligence (AI)-Enabled Digital Twin Technology in Smart Manufacturing. In Industry 4.0, Smart Manufacturing, and Industrial Engineering; CRC Press: Boca Raton, FL, USA, 2024; pp. 248–270. [Google Scholar]

- European Commission: Directorate-General for Research and Innovation. Industry 5.0, A Transformative Vision for Europe—Governing Systemic Transformations Towards a Sustainable Industry; Publications Office of the European Union: Luxembourg, 2021; Available online: https://research-and-innovation.ec.europa.eu/knowledge-publications-tools-and-data/publications/all-publications/industry-50-transformative-vision-europe_en (accessed on 18 September 2025).

- European Commission: Directorate-General for Research and Innovation. ERA Industrial Technologies Roadmap on Human-Centric Research and Innovation for the Manufacturing Sector; Publications Office of the European Union: Luxembourg, 2024; Available online: https://data.europa.eu/doi/10.2777/0266 (accessed on 18 September 2025).

- Chui, M.; Hazan, E.; Roberts, R.; Singla, A.; Smaje, K. The Economic Potential of Generative AI. McKinsey. 2023. Available online: https://www.mckinsey.com/capabilities/mckinsey-digital/our-insights/the-economic-potential-of-generative-ai-the-next-productivity-frontier (accessed on 18 September 2025).

- Duggal, A.S.; Malik, P.K.; Gehlot, A.; Singh, R.; Gaba, G.S.; Masud, M.; Al-Amri, J.F. A Sequential Roadmap to Industry 6.0: Exploring Future Manufacturing Trends. IET Commun. 2022, 16, 521–531. [Google Scholar] [CrossRef]

- Reddy, C.K.K.; Doss, S.; Bhatia Khan, S.; Alqhatani, A. Evolution and Advances in Computing Technologies for Industry 6.0: Technology, Practices, and Challenges, 1st ed.; CRC Press: Boca Raton, FL, USA, 2024; ISBN 9781003503934. [Google Scholar]

- Porter, M.E. TECHNOLOGY AND COMPETITIVE ADVANTAGE. J. Bus. Strat. 1985, 5, 60–78. [Google Scholar] [CrossRef]

- Ueda, K.; Takenaka, T.; Fujita, K. Toward Value Co-Creation in Manufacturing and Servicing. CIRP J. Manuf. Sci. Technol. 2008, 1, 53–58. [Google Scholar] [CrossRef]

- Holweg, M.; Helo, P. Defining Value Chain Architectures: Linking Strategic Value Creation to Operational Supply Chain Design. Int. J. Prod. Econ. 2014, 147, 230–238. [Google Scholar] [CrossRef]

- Taşkan, B.; Karatop, B.; Kubat, C. Impacts of Industrial Revolutions on the Enterprise Performance Management: A Literature Review. J. Bus. Manag. 2020, 26, 79–119. [Google Scholar] [CrossRef]

- Kagermann, H.; Wahlster, W.; Helbig, J. Securing the Future of German Manufacturing Industry: Recommendations for Implementing the Strategic Initiative INDUSTRIE 4.0. Final. Rep. Ind. 2013, 4. Available online: https://www.din.de/resource/blob/76902/e8cac883f42bf28536e7e8165993f1fd/recommendations-for-implementing-industry-4-0-data.pdf (accessed on 18 September 2025).

- Lasi, H.; Fettke, P.; Kemper, H.-G.; Feld, T.; Hoffmann, M. Industry 4.0. Bus. Inf. Syst. Eng. 2014, 6, 239–242. [Google Scholar] [CrossRef]

- Kamble, S.S.; Gunasekaran, A.; Parekh, H.; Mani, V.; Belhadi, A.; Sharma, R. Digital Twin for Sustainable Manufacturing Supply Chains: Current Trends, Future Perspectives, and an Implementation Framework. Technol. Forecast. Soc. Change 2022, 176, 121448. [Google Scholar] [CrossRef]

- Nahavandi, S. Industry 5.0—A Human-Centric Solution. Sustainability 2019, 11, 4371. [Google Scholar] [CrossRef]

- Ghobakhloo, M.; Iranmanesh, M.; Mubarak, M.F.; Mubarik, M.; Rejeb, A.; Nilashi, M. Identifying Industry 5.0 Contributions to Sustainable Development: A Strategy Roadmap for Delivering Sustainability Values. Sustain. Prod. Consum. 2022, 33, 716–737. [Google Scholar] [CrossRef]

- Kumar, U.; Kaswan, M.S.; Kumar, R.; Chaudhary, R.; Garza-Reyes, J.A.; Rathi, R.; Joshi, R. A Systematic Review of Industry 5.0 from Main Aspects to the Execution Status. TQM J. 2024, 36, 1526–1549. [Google Scholar] [CrossRef]

- Reddy, M.S.; Reddy, C.K.K.; Hanafiah, M.M. Climate Change Mitigation and Adaptation Strategies Enhanced by Intelligent Systems in Industry 6.0. In Maintaining a Sustainable World in the Nexus of Environmental Science and AI; IGI Global: Hershey, PA, USA, 2024; pp. 201–228. [Google Scholar]

- Carayannis, E.G.; Posselt, T.; Preissler, S. Toward Industry 6.0 and Society 6.0: The Quintuple Innovation Helix With Embedded AI Modalities as Enabler of Public Interest Technologies Strategic Technology Management and Road-Mapping. IEEE Trans. Eng. Manag. 2024, 71, 11238–11252. [Google Scholar] [CrossRef]

- Movahed, A.B.; Movahed, A.B.; Nozari, H.; Rahmaty, M. Security Criteria in Financial Systems in Industry 6.0. In Advanced Businesses in Industry 6.0; IGI Global: Hershey, PA, USA, 2024; pp. 62–74. [Google Scholar]

- Olaleye, I.A.; Mokogwu, C.; Olufemi-Phillips, A.Q. Titilope Tosin Adewale Real-Time Inventory Optimization in Dynamic Supply Chains Using Advanced Artificial Intelligence. Int. J. Manag. Entrep. Res. 2024, 6, 3830–3843. [Google Scholar] [CrossRef]

- Gupta, S.; Agarwal, S. Applications of Machine Learning and Artificial Intelligence in Environmental, Social and Governance (ESG) Sector. SSRN Electron. J. 2025. [Google Scholar] [CrossRef]

- Singh, J.; Hamid, A.B.A.; Garza-Reyes, J.A. Supply Chain Resilience Strategies and Their Impact on Sustainability: An Investigation from the Automobile Sector. Supply Chain. Manag. Int. J. 2023, 28, 787–802. [Google Scholar] [CrossRef]

- Abideen, A.Z.; Pyeman, J.; Sundram, V.P.K.; Tseng, M.-L.; Sorooshian, S. Leveraging Capabilities of Technology into a Circular Supply Chain to Build Circular Business Models: A State-of-the-Art Systematic Review. Sustainability 2021, 13, 8997. [Google Scholar] [CrossRef]

- Geissdoerfer, M.; Savaget, P.; Bocken, N.M.P.; Hultink, E.J. The Circular Economy—A New Sustainability Paradigm? J. Clean. Prod. 2017, 143, 757–768. [Google Scholar] [CrossRef]

- Naghi, L.E.; Onufreiciuc, R.A.; Stanescu, L.-E.; Hodoș, R.F. Policy and Regulatory Framework on Fighting Financial Crime for Developing Sustainable Economy Models. In Economic and Financial Crime, Sustainability and Good Governance; Achim, M.V., Ed.; Springer International Publishing: Cham, Switzerland, 2023; pp. 273–296. ISBN 978-3-031-34082-6. [Google Scholar]

- European Union. Directive (EU) 2022/2464 of the European Parliament and of the Council of 14 December 2022 on Corporate Sustainability Reporting. 2022. Available online: http://data.europa.eu/eli/dir/2022/2464/oj (accessed on 18 September 2025).

- Hahn, R.; Kühnen, M. Determinants of Sustainability Reporting: A Review of Results, Trends, Theory, and Opportunities in an Expanding Field of Research. J. Clean. Prod. 2013, 59, 5–21. [Google Scholar] [CrossRef]

- Adams, C.A. Sustainability Reporting and Value Creation. Soc. Environ. Account. J. 2020, 40, 191–197. [Google Scholar] [CrossRef]

- Eccles, R.G.; Ioannou, I.; Serafeim, G. The Impact of Corporate Sustainability on Organizational Processes and Performance. Manag. Sci. 2014, 60, 2835–2857. [Google Scholar] [CrossRef]

- Hummel, K.; Jobst, D. An Overview of Corporate Sustainability Reporting Legislation in the European Union. Account. Eur. 2024, 21, 320–355. [Google Scholar] [CrossRef]

- Afzal, B.; Li, X.; Hernández-Lara, A.B. The Innovation Journey and Crossroads of Sustainability, Resilience and Human-Centeredness: A Systematic Literature Review. Transform. Gov. People Process Policy 2024, 18, 368–383. [Google Scholar] [CrossRef]

- Chabane, B.; Komljenovic, D.; Abdul-Nour, G. Converging on Human-Centred Industry, Resilient Processes, and Sustainable Outcomes in Asset Management Frameworks. Environ. Syst. Decis. 2023, 43, 663–679. [Google Scholar] [CrossRef]

- Rajumesh, S. Promoting Sustainable and Human-Centric Industry 5.0: A Thematic Analysis of Emerging Research Topics and Opportunities. J. Bus. Socio Econ. Dev. 2024, 4, 111–126. [Google Scholar] [CrossRef]

- Mohanta, P.R.; Mahanty, B. Assessing Industry 4.0 Implementation Maturity in Manufacturing MSMEs—A Graph Theory and Matrix-Based Approach. TQM J. 2024. [Google Scholar] [CrossRef]

- Dierwechter, Y. Methodology: Mixed-Methods Research Design. In Urban Sustainability through Smart Growth: Intercurrence, Planning, and Geographies of Regional Development Across Greater Seattle; Dierwechter, Y., Ed.; Springer International Publishing: Cham, Switzerland, 2017; pp. 63–71. ISBN 978-3-319-54448-9. [Google Scholar]

- Hunziker, S.; Blankenagel, M. Single Case Research Design. In Research Design in Business and Management; Springer Fachmedien: Wiesbaden, Germany, 2024; pp. 141–170. [Google Scholar]

- Zucchella, A.; Sanguineti, F.; Contino, F. Collaborations between MNEs and Entrepreneurial Ventures. A Study on Open Innovability in the Energy Sector. Int. Bus. Rev. 2024, 33, 102228. [Google Scholar] [CrossRef]

- Popa, D.; Repanovici, A.; Lupu, D.; Norel, M.; Coman, C. Using Mixed Methods to Understand Teaching and Learning in COVID 19 Times. Sustainability 2020, 12, 8726. [Google Scholar] [CrossRef]

- Prevett, P.S.; Black, L.; Hernandez-Martinez, P.; Pampaka, M.; Williams, J. Integrating Thematic Analysis with Cluster Analysis of Unstructured Interview Datasets: An Evaluative Case Study of an Inquiry into Values and Approaches to Learning Mathematics. Int. J. Res. Method Educ. 2021, 44, 273–286. [Google Scholar] [CrossRef]

- Habibullah, K.M.; Heyn, H.-M.; Gay, G.; Horkoff, J.; Knauss, E.; Borg, M.; Knauss, A.; Sivencrona, H.; Li, J. Requirements Engineering for Automotive Perception Systems: An Interview Study. In Requirements Engineering: Foundation for Software Quality; Ferrari, A., Penzenstadler, B., Eds.; Springer Nature: Cham, Switzerland, 2023; pp. 189–205. [Google Scholar]

- Picot, P.; Guillaume, B. The Controllability of the Technosphere, an Impossible Question. Anthr. Rev. 2024, 11, 91–109. [Google Scholar] [CrossRef]

- Herrmann-Pillath, C. The Case for a New Discipline: Technosphere Science. Ecol. Econ. 2018, 149, 212–225. [Google Scholar] [CrossRef]

- Zimek, M.; Baumgartner, R.J. Systemic Sustainability Assessment: Analyzing Environmental and Social Impacts of Actions on Sustainable Development. Clean. Prod. Lett. 2024, 7, 100064. [Google Scholar] [CrossRef]

- Pascarella, L.; Bednar, P. Systemic Sustainability as Multiple Perspective Analysis. In Exploring Digital Resilience; Cuel, R., Ponte, D., Virili, F., Eds.; Springer International Publishing: Cham, Switzerland, 2022; pp. 69–86. [Google Scholar]

- Patalas-Maliszewska, J.; Szmołda, M.; Łosyk, H. Integrating artificial intelligence into the supply chain in order to enhance sustainable production—A systematic literature review. Sustainability 2024, 16, 7110. [Google Scholar] [CrossRef]

- Narkhede, G.B.; Pasi, B.N.; Rajhans, N.; Kulkarni, A. Industry 5.0 and sustainable manufacturing: A systematic literature review. Benchmarking Int. J. 2025, 32, 608–635. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).