Free Riding of Vehicle Companies under Dual-Credit Policy: An Agent-Based System Dynamics Model

Abstract

:1. Introduction

- (1)

- Faced with the free riding behavior of partners, would the supportive actions of transitioning vehicle companies harm their own and alliance performance?

- (2)

- How does corporate transition and policy change affect performance under free riding behavior?

2. Literature Review

2.1. The Dual-Credit Policy

2.2. Free Riding Behavior

3. Agent-Based System Dynamics Modeling Approach

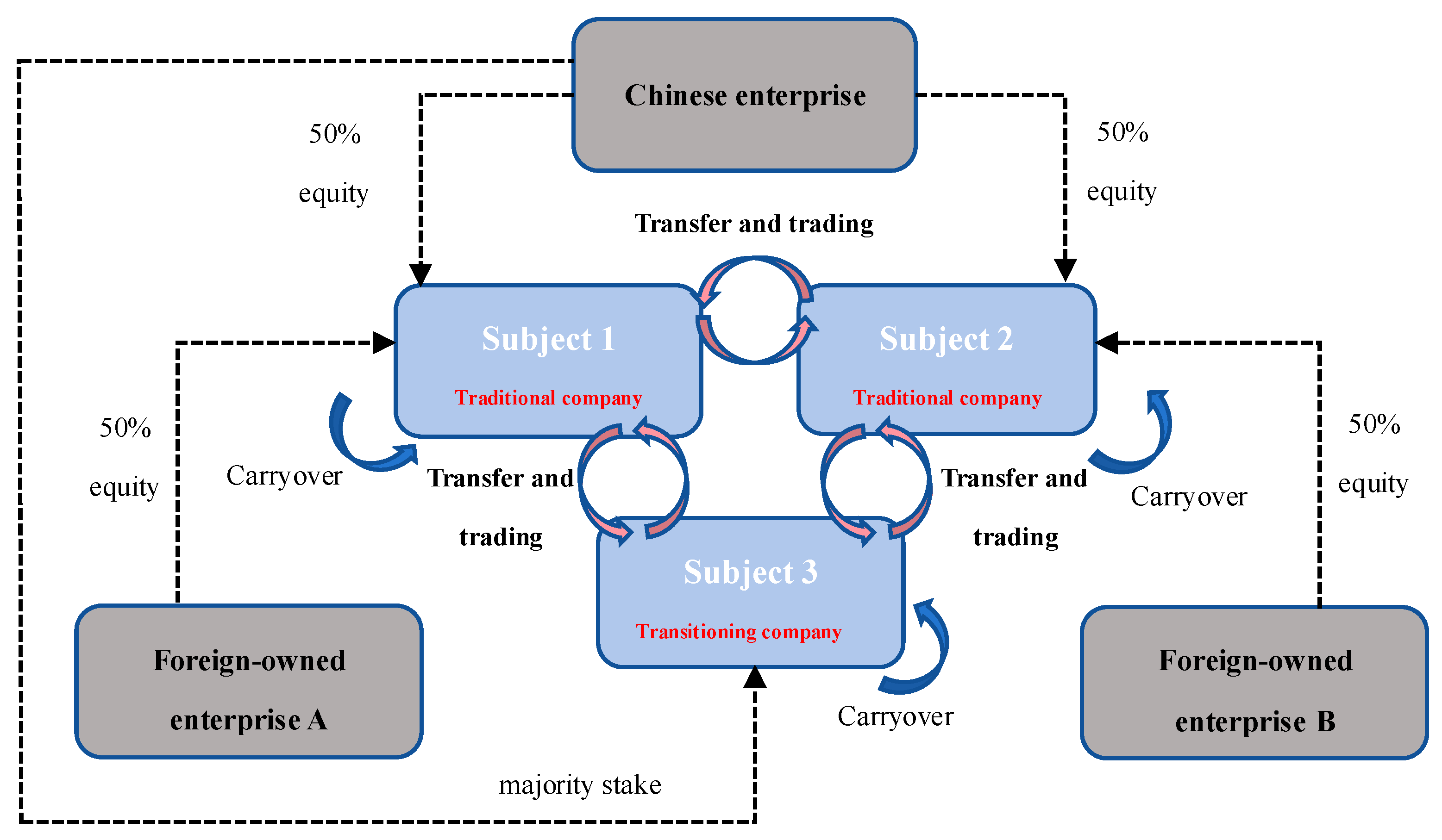

3.1. Model Framework

3.2. Stock and Flow Diagrams of Sub-Models

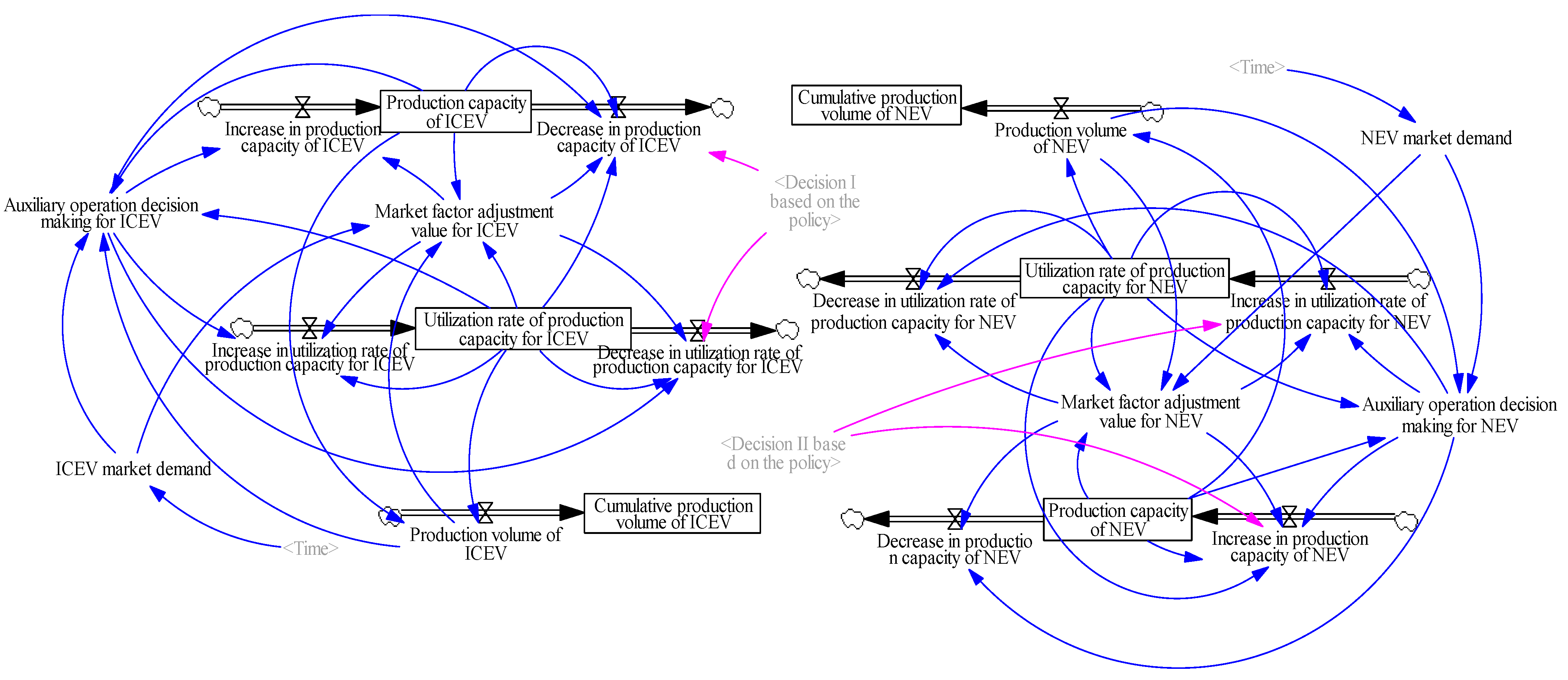

3.2.1. Production Sub-Model

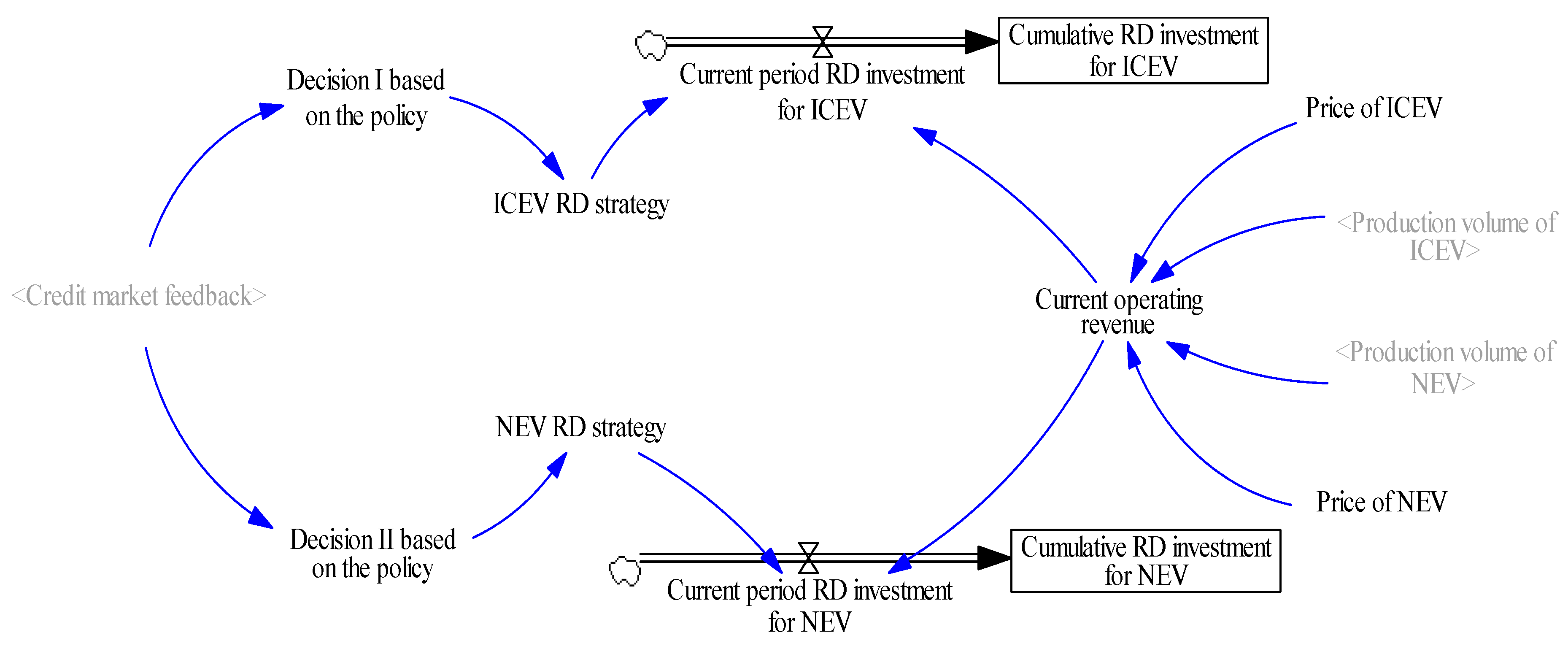

3.2.2. R&D Sub-Model

3.2.3. Credit Calculation Sub-Model

3.2.4. Credit Interaction Sub-Model

3.3. Model Parameter Settings

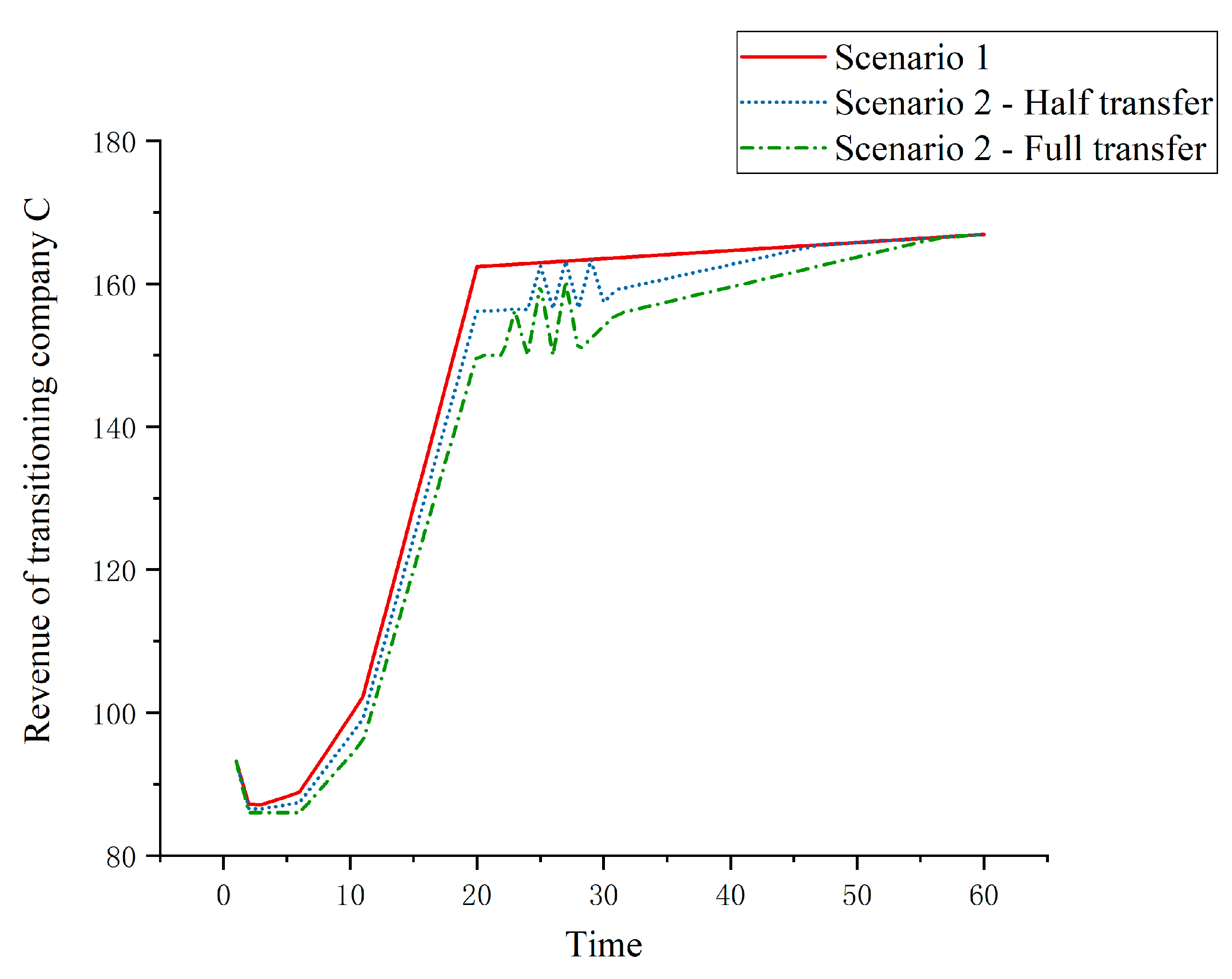

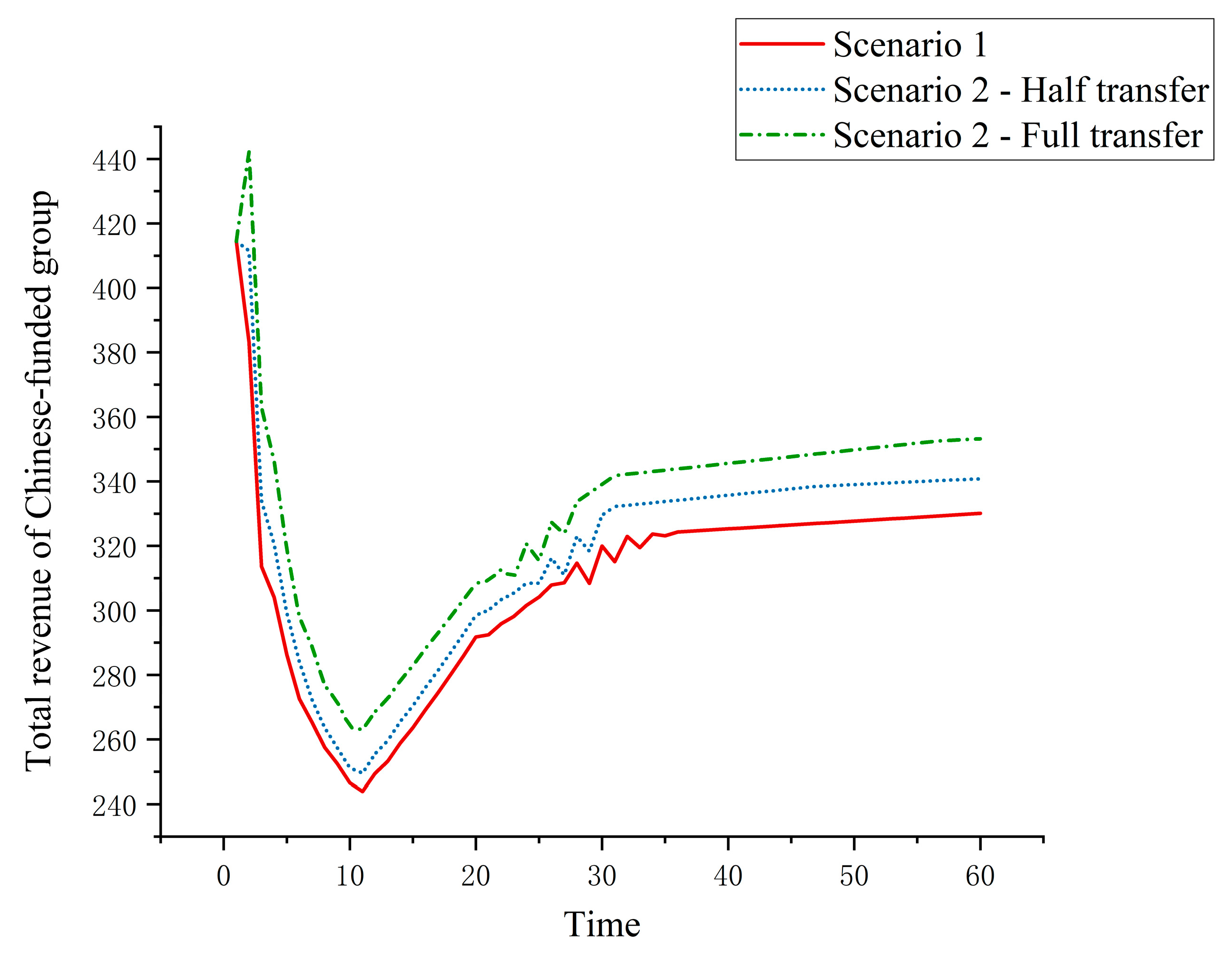

- Scenario 1: Baseline scenario. Transitioning vehicle companies settle their own credits independently, and there is no credit transfer between equity-related vehicle companies.

- Scenario 2: Free riding scenario. The transitioning vehicle company considers choosing to partially or fully transfer its surplus credits to traditional vehicle companies. This eases the credit pressure on the traditional companies, weakening their motivation to cut down on fuel vehicle production, thereby exhibiting free riding behavior.

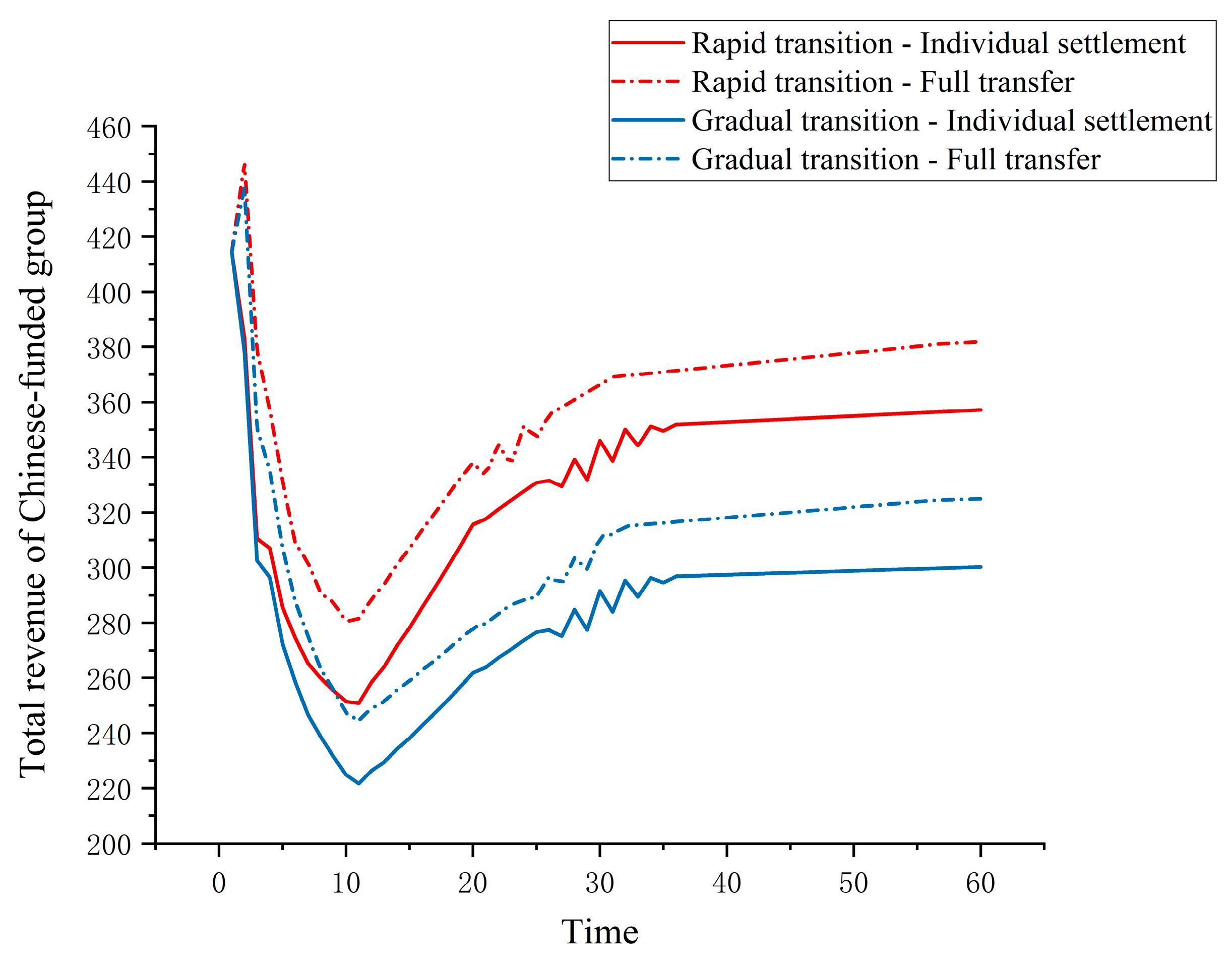

- Scenario 3: Impact of corporate transition. Building upon Scenarios 1 and 2, this scenario examines the credit transfer strategies of transitioning vehicle companies at varying degrees of transition. Three different situations are set up to form Scenario 3, with parameter adjustments detailed in Table 5.

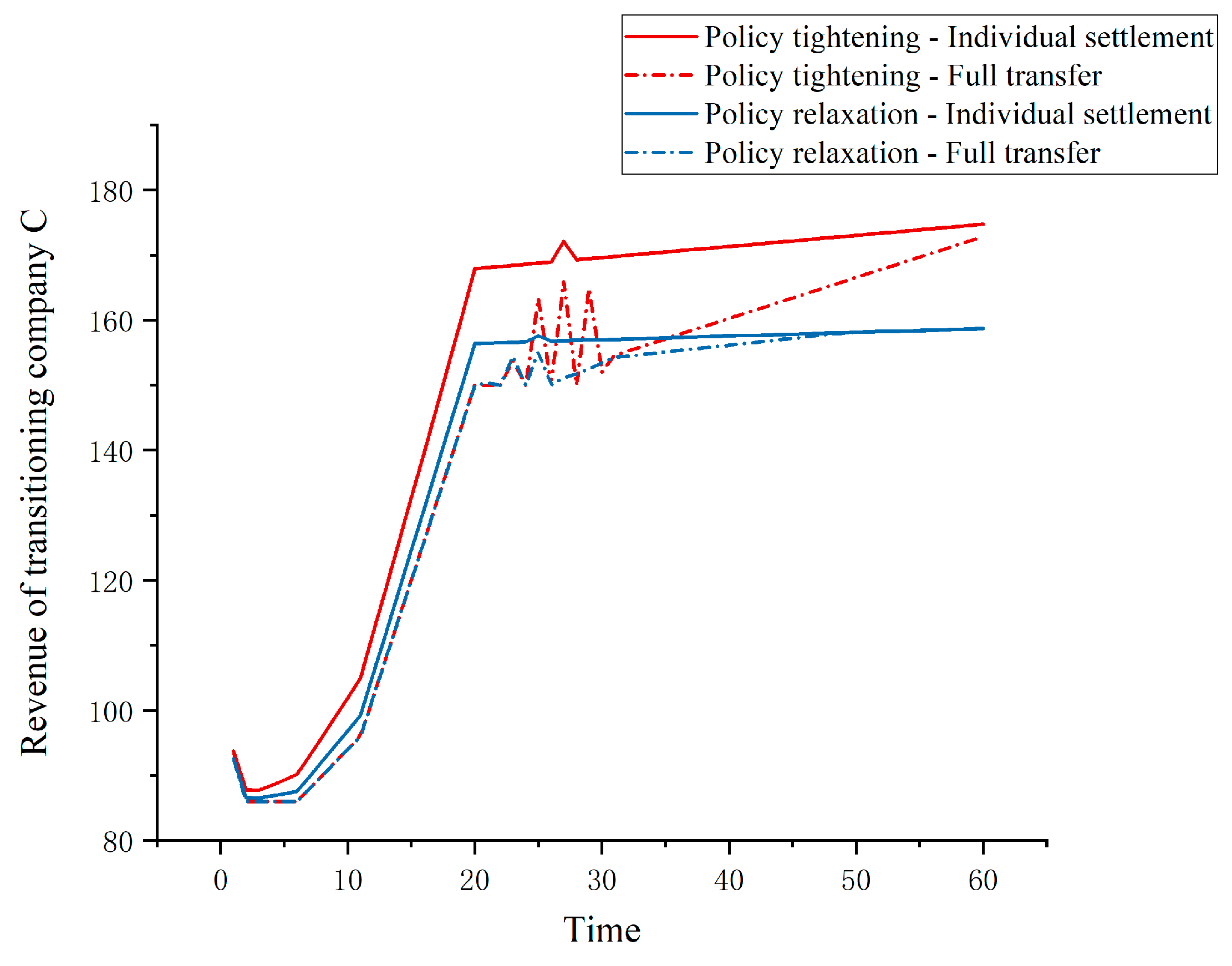

- Scenario 4: Influence of policy regulation. Also building on Scenarios 1 and 2, this scenario investigates the impacts of varying stringency levels of the dual-credit policy. The policy adjustment parameter chosen is the requirement for the proportion of NEV credits. Details are presented in Table 5, where “time” represents the simulation time in the model. Considering the actual price of NEV credits in recent years, a base unit credit price of 2000 yuan is assigned in the baseline scenario. When the policy tightens, the availability of tradable credits in the market becomes scarce, leading to an increase in the unit credit price. Conversely, when the policy relaxes, the unit credit price decreases.

| Scenario 1—Separate Settlements | Scenario 2—Half Transfers | Scenario 2—Total Transfer | |

|---|---|---|---|

| Transfer coefficient | 0 | 0.25 | 0.5 |

| Adjustment of ICEV production for ICEV | 0% | +10% | +20% |

| Transitional car decision-making | Slow | Base | Fast |

| Adjustment of NEV production | −20% | 0% | +20% |

| Policy adjustment | Base | Austerity | Easing |

| NEV points ratio requirements | IF THEN ELSE (Time ≤ 18, IF THEN ELSE (Time ≤ 2, 0, 0.1 + 0.02 × (Time − 3)), 0.4) | IF THEN ELSE (Time ≤ 18, IF THEN ELSE (Time ≤ 2, 0, 0.1 + 0.03 × (Time − 3)), 0.55) | IF THEN ELSE (Time ≤ 18, IF THEN ELSE (Time ≤ 2, 0, 0.1 + 0.01 × (Time − 3)), 0.25) |

| Credit price | 0.2 | 0.3 | 0.1 |

4. Simulation Analysis

4.1. Sensitivity Analysis

4.2. Free Riding Behavior and Credit Transfer Decisions

4.3. Impacts of Company Transition

4.4. Impact of Policy Regulation

5. Conclusions and Implications

5.1. Conclusions

5.2. Implications

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Ma, M.; Meng, W.; Huang, B.; Li, Y. The influence of dual credit policy on new energy vehicle technology innovation under demand forecast information asymmetry. Energy 2023, 271, 127106. [Google Scholar] [CrossRef]

- Li, B.; Chen, Y.; Cao, S. Carrot and stick: Does dual-credit policy promote green innovation in auto firms? J. Clean. Prod. 2023, 403, 136863. [Google Scholar] [CrossRef]

- Li, Y.; Zhang, Q.; Li, H.; Tang, Y.; Liu, B. The impact of dual-credit scheme on the development of the new energy vehicle industry. Energy Procedia 2019, 158, 4311–4317. [Google Scholar] [CrossRef]

- Li, J.; Ku, Y.; Yu, Y.; Liu, C.; Zhou, Y. Optimizing production of new energy vehicles with across-chain cooperation under China’s dual credit policy. Energy 2020, 194, 116832. [Google Scholar] [CrossRef]

- Panico, C. Strategic interaction in alliances. Strateg. Manag. J. 2017, 38, 1646–1667. [Google Scholar] [CrossRef]

- Yan, N.; Zhang, Y.; Xu, X.; Gao, Y. Online finance with dual channels and bidirectional free-riding effect. Int. J. Prod. Econ. 2021, 231, 107834. [Google Scholar] [CrossRef]

- Li, R.; Yan, J.-J.; Wang, X.-Y. Horizontal cooperation strategies for competing manufacturers in a capital constrained supply chain. Transp. Res. Part E Logist. Transp. Rev. 2024, 181, 103369. [Google Scholar] [CrossRef]

- Wang, Y.; Zhang, X.; Cheng, T.C.E.; Wu, T.H. Choice of the co-opetition model for a new energy vehicle supply chain under government subsidies. Transp. Res. Part E. Logist. Transp. Rev. 2023, 179, 103326. [Google Scholar] [CrossRef]

- Cong, L.; Jie, L.; Lu, S.; Yan, Z. Contract Design to Incentive Supplier Innovation under Dual-Credit Policy. Chin. J. Manag. 2022, 19, 928. [Google Scholar]

- Yang, D.-X.; Yang, L.; Chen, X.-L.; Wang, C.; Nie, P.-Y. Research on credit pricing mechanism in dual-credit policy: Is the government in charge or is the market in charge? Environ. Dev. Sustain. 2023, 25, 1561–1581. [Google Scholar] [CrossRef]

- Li, Y.; Zhang, Q.; Liu, B.; McLellan, B.; Gao, Y.; Tang, Y. Substitution effect of New-Energy Vehicle Credit Program and Corporate Average Fuel Consumption Regulation for Green-car Subsidy. Energy 2018, 152, 223–236. [Google Scholar] [CrossRef]

- Ou, S.; Lin, Z.; Qi, L.; Li, J.; He, X.; Przesmitzki, S. The dual-credit policy: Quantifying the policy impact on plug-in electric vehicle sales and industry profits in China. Energy Policy 2018, 121, 597–610. [Google Scholar] [CrossRef]

- He, X.; Ou, S.; Gan, Y.; Lu, Z.; Przesmitzki, S.V.; Bouchard, J.L.; Sui, L.; Amer, A.A.; Lin, Z.; Yu, R.; et al. Greenhouse gas consequences of the China “dual-credit” policy. Nat. Commun. 2020, 11, 5212. [Google Scholar] [CrossRef] [PubMed]

- Chen, K.; Zhao, F.; Hao, H.; Liu, Z.; Liu, X. Hierarchical Optimization Decision-Making Method to Comply with China’s Fuel Consumption and New Energy Vehicle Credit Regulations. Sustainability 2021, 13, 7842. [Google Scholar] [CrossRef]

- Zhang, H.; Zhao, F.; Hao, H.; Liu, Z. Effect of Chinese Corporate Average Fuel Consumption and New Energy Vehicle Dual-Credit Regulation on Passenger Cars Average Fuel Consumption Analysis. Int. J. Environ. Res. Public Health 2021, 18, 7218. [Google Scholar] [CrossRef] [PubMed]

- Lou, G.; Ma, H.; Fan, T.; Chan, H.K. Impact of the dual-credit policy on improvements in fuel economy and the production of internal combustion engine vehicles. Resour. Conserv. Recycl. 2020, 156, 104712. [Google Scholar] [CrossRef]

- He, H.; Zhang, C.; Li, S.; Sun, Y.; Zhang, J.; Sun, Q. Dual-credit price variation and optimal electrification timing of traditional automakers: A dynamic programming approach. J. Clean. Prod. 2022, 353, 131593. [Google Scholar] [CrossRef]

- Zhou, D.; Yu, Y.; Wang, Q.; Zha, D. Effects of a generalized dual-credit system on green technology investments and pricing decisions in a supply chain. J. Environ. Manag. 2019, 247, 269–280. [Google Scholar] [CrossRef] [PubMed]

- Xiao, L.; Chen, Z.-S.; Hou, R.; Mardani, A.; Skibniewski, M.J. Greenness-based subsidy and dual credit policy to promote new energy vehicles considering consumers’ low-carbon awareness. Comput. Ind. Eng. 2023, 185, 109620. [Google Scholar] [CrossRef]

- Huang, X.; He, J.; Mao, L. Carbon Reduction Incentives under Multi-Market Interactions: Supply Chain Vertical Cooperation Perspective. Mathematics 2024, 12, 599. [Google Scholar] [CrossRef]

- Abou Mjahed, M.; Ben Abdelaziz, F.; Tarhini, H. A multiobjective coalition formation in facility and fleet sharing for resilient horizontal supply chain collaboration. Ann. Oper. Res. 2023, 1–26. [Google Scholar] [CrossRef]

- Lin, P.; Shi, M.; Kai, L.; Ye, C. Manufacturer Optimal Alliance Pricing Decision in Many to One Supply Chain with Cross Elasticity of Demand Taken into Account. Manag. Rev. 2021, 33, 313–324. [Google Scholar]

- Gao, H.; Yang, J.; Yin, H.; Ma, Z. The impact of partner similarity on alliance management capability, stability and performance. Int. J. Phys. Distrib. Logist. Manag. 2017, 47, 906–926. [Google Scholar] [CrossRef]

- Ma, H.; Lou, G.; Fan, T.; Chan, H.K.; Chung, S.H. Conventional automotive supply chains under China’s dual-credit policy: Fuel economy, production and coordination. Energy Policy 2021, 151, 112166. [Google Scholar] [CrossRef]

- Liu, X.; Wang, W.; Su, Y. Leveraging complementary resources through relational capital to improve alliance performance under an uncertain environment: A moderated mediation analysis. Sustainability 2022, 15, 310. [Google Scholar] [CrossRef]

- Zhou, Y.-W.; Guo, J.; Zhou, W. Pricing/service strategies for a dual-channel supply chain with free riding and service-cost sharing. Int. J. Prod. Econ. 2018, 196, 198–210. [Google Scholar] [CrossRef]

- Pu, X.; Gong, L.; Han, X. Consumer free riding: Coordinating sales effort in a dual-channel supply chain. Electron. Commer. Res. Appl. 2017, 22, 1–12. [Google Scholar] [CrossRef]

- Liu, Y.; Lin, C.-X.; Zhao, G. A pricing strategy of dual-channel supply chain considering online reviews and in-sale service. J. Bus. Ind. Mark. 2024. ahead-of-print. [Google Scholar] [CrossRef]

- Guo, J.; Zhou, Y.; Li, B. The Optimal Pricing and Service Strategies of A Dual-Channel Retailer under Free Riding. J. Ind. Manag. Optim. 2022, 18, 2049. [Google Scholar] [CrossRef]

- Cao, Y.; Yi, C.; Wan, G.-Y. Inventory Competition and Promotion Strategy in a Dual-channel Supply Chain with Free Riding Behavior. Chin. J. Manag. Sci. 2019, 27, 106–115. [Google Scholar]

- Liu, Z.; Qian, Q.; Hu, B.; Shang, W.-L.; Li, L.; Zhao, Y.; Zhao, Z.; Han, C. Government regulation to promote coordinated emission reduction among enterprises in the green supply chain based on evolutionary game analysis. Resour. Conserv. Recycl. 2022, 182, 106290. [Google Scholar] [CrossRef]

- Yan, L.; Hong, P.; Wu, Z. Dynamic pricing and emission reduction efforts in a dual-channel green supply chain under bidirectional free riding. J. Clean. Prod. 2024, 438, 140713. [Google Scholar] [CrossRef]

- Westphal, R.; Sornette, D. How Market Intervention can Prevent Bubbles and Crashes: An Agent Based Modelling Approach. Comput. Econ. 2023, 1–42. [Google Scholar] [CrossRef]

- Deng, R.; Shen, N.; Zhao, Y. Diffusion model to analyse the performance of electric vehicle policies: An evolutionary game simulation. Transp. Res. Part D Transp. Environ. 2024, 127, 104037. [Google Scholar] [CrossRef]

- Wu, J.; Ohya, T.; Sekiguchi, T. Applications of agent-based modeling and simulation in organization management: A quarter-century review through bibliometric mapping (1998–2022). Comput. Math. Organ. Theory 2024, 30, 1–31. [Google Scholar] [CrossRef]

- Carley, S.; Siddiki, S.; Nicholson-Crotty, S. Evolution of plug-in electric vehicle demand: Assessing consumer perceptions and intent to purchase over time. Transp. Res. Part D Transp. Environ. 2019, 70, 94–111. [Google Scholar] [CrossRef]

- Ma, L.; Zhong, W.; Mei, S. Study on subsidy strategy of new energy automobile industry chain based on endurance demand. Syst. Eng. Theory Pract. 2018, 38, 1759–1767. [Google Scholar]

- Zhao, D.; Wang, J.; Li, Y.-K.; Tang, J.-H.; Zhang, S.-W. How to promote the transition of fuel vehicle enterprises under dual credit policy? An improved tripartite evolutionary game analysis with time delay. Energy 2024, 293, 130696. [Google Scholar] [CrossRef]

- Wu, D.; Zhang, Z.; Tu, Q. Research on decision optimization of new energy vehicle supply chain considering demand disruptions under dual credit policy. J. Ind. Manag. Optim. 2024. [Google Scholar] [CrossRef]

| Market Situation | Decision-Making Mechanisms | Market Factor Adjustments | ||

|---|---|---|---|---|

| Market demand ≥ Production | Increase in demand < 1—Utilization rate | Increased capacity utilization | (Demand—production)/capacity | |

| Increase in demand ≥ 1—Utilization rate | Increased capacity utilization increase production capacity | Increased capacity utilization to 100% Capacity increase: (demand—capacity)/capacity | ||

| market <Yield | Utilization < threshold | / | Reduce production capacity | Capacity—demand/utilization |

| Utilization > threshold | Decrease in demand < Utilization rate—threshold | Reduced capacity utilization | (Production—demand)/capacity | |

| Formula Number | Key Function Expressions and Interpretations | Variable Description |

|---|---|---|

| (3) | Actual value of CAFC | ACAFC—Actual value of CAFC CAFC—Corporate average fuel consumption of ICEV PICEV—Annual production of ICEV PNEV—Annual production of NEV W—NEV production multiplier (policy control) |

| (4) | Corporate average fuel consumption credits | Credit-ICEV—Corporate average fuel consumption credits TCAFC—Target value of CAFC (policy control) |

| (5) | New energy vehicle credits R | Credit-NEV—New energy vehicle credits R—Required ratio of NEV (policy control) U—Unit credit for NEV (policy control) |

| Variable | Type | Value | Unit | Descriptive | ||

|---|---|---|---|---|---|---|

| A | B | C | ||||

| Fuel vehicle production capacity | Initial value | 2000 | 2000 | 1000 | thousand | Estimated based on existing capacity data disclosed in the 2022 Annual Report of SAIC |

| Fuel vehicle capacity utilization | Initial value | 80% | 80% | 80% | / | Derived from the proportion of ICEV production capacity utilization reported in the 2022 Annual Report of SAIC |

| Total R&D investment in fuel vehicles | Initial value | 800 | 800 | 400 | billion | Estimated based on the cumulative R&D investment figures from the annual reports of SAIC between 2013 and 2022 |

| New energy vehicle production capacity | Initial value | 100 | 100 | 200 | thousand | Estimated using NEV production data compiled by the China Association of Automobile companies for SAIC |

| New energy vehicle capacity utilization rate | Initial value | 10% | 10% | 30% | / | Based on the ratio of production volume in 2022 to total capacity |

| Total R&D investment in new energy vehicles | Initial value | 10 | 10 | 100 | billion | Estimated from the cumulative R&D investment figures in the Annual Reports of SAIC between 2013 and 2022 |

| Average selling price of fuel vehicles | Constant | 150 | 150 | 100 | thousand | Estimated using the sales volume and revenue of ICEV as reported in the 2022 Annual Report of SAIC |

| Average selling price of new energy vehicles | Constant | 200 | 200 | 150 | thousand | Estimated using the sales volume and revenue of NEV as reported in the 2022 Annual Report of SAIC |

| Time | Revenue | NEV Market Demand | ICEV Market Demand | Transfer Coefficient |

|---|---|---|---|---|

| − | +5% | +5% | +5% | |

| 1 | 463.947 | 463.947 | 463.947 | 463.947 |

| 2 | 474.948 | 478.945 | 494.698 | 474.948 |

| 3 | 480.334 | 485.132 | 499.737 | 480.334 |

| 4 | 490 | 495.25 | 509.25 | 490 |

| 5 | 500 | 506 | 519 | 500 |

| 6 | 510 | 516.75 | 528.75 | 510 |

| 7 | 520 | 527.5 | 538.5 | 520 |

| … | … | … | … | … |

| 53 | 1012.67 | 1058.49 | 1019.52 | 1012.27 |

| 54 | 1024.4 | 1071.07 | 1031.01 | 1023.99 |

| 55 | 1036.18 | 1083.7 | 1042.55 | 1035.76 |

| 56 | 1048 | 1096.37 | 1054.13 | 1047.56 |

| 57 | 1059.86 | 1109.09 | 1065.76 | 1059.41 |

| 58 | 1071.77 | 1121.85 | 1077.43 | 1071.31 |

| 59 | 1083.72 | 1134.67 | 1089.15 | 1083.25 |

| 60 | 1095.72 | 1147.53 | 1100.91 | 1095.24 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zhou, Z.; Shen, Y. Free Riding of Vehicle Companies under Dual-Credit Policy: An Agent-Based System Dynamics Model. World Electr. Veh. J. 2024, 15, 227. https://doi.org/10.3390/wevj15060227

Zhou Z, Shen Y. Free Riding of Vehicle Companies under Dual-Credit Policy: An Agent-Based System Dynamics Model. World Electric Vehicle Journal. 2024; 15(6):227. https://doi.org/10.3390/wevj15060227

Chicago/Turabian StyleZhou, Zhong, and Yuqi Shen. 2024. "Free Riding of Vehicle Companies under Dual-Credit Policy: An Agent-Based System Dynamics Model" World Electric Vehicle Journal 15, no. 6: 227. https://doi.org/10.3390/wevj15060227