In traditional game theory, it is often assumed that the participants are completely rational and enjoy complete information conditions. However, the participants’ complete rationality and complete information conditions are difficult to achieve in real economic life. Unlike traditional game theory, evolutionary game theory does not require full information and participants to be completely rational. The evolutionary game is based on “limited rationality”. It compares the human economic behavior in economic activities with biological evolution theory, and believes that humans usually achieve a game equilibrium through trial and error; and it emphasizes the dynamic process of constant change, adjustment, and convergence of behavioral decision making, and finally achieves a balanced and stable state. It is a theory combining game theory analysis with dynamic evolution process analysis. In methodology, it emphasizes dynamic equilibrium rather than static equilibrium. It originated from the theory of biological evolution, and successfully explained some phenomena in the process of biological evolution. Nowadays, economists use evolutionary game theory to analyze the influencing factors of social habits, norms, and systems, explaining their formation processes.

The significance of evolutionary game analysis under bounded rationality is not to predict one-off game outcomes or short-term game equilibrium, but to analyze and compare the long-term stability trend of certain game relationships in a stable environment, which is consistent with the simulation characteristics of SD [

13]. SD is a method of system modeling and dynamic simulation that is mainly used to study the dynamic complexity of socio-economic and biophysical systems with long-term periodicity and low accuracy requirements [

14]. The research method of combining the evolutionary game and SD has been applied to project management. For example, Peng et al. [

15] established an evolutionary game model for stakeholders in the governance of service-oriented manufacturing projects, and used SD to simulate the dynamic game process of stakeholder strategy selection. Shen et al. [

16] combined an evolutionary game and SD simulation to study the cooperation mechanism of a government outsourcing public services. It can be seen that SD provides an effective aid for studying the complex dynamic process of evolutionary games in incomplete information conditions [

17].

2.1. The Mechanism of a Public-Private-Partnership (PPP) from the Game Perspective

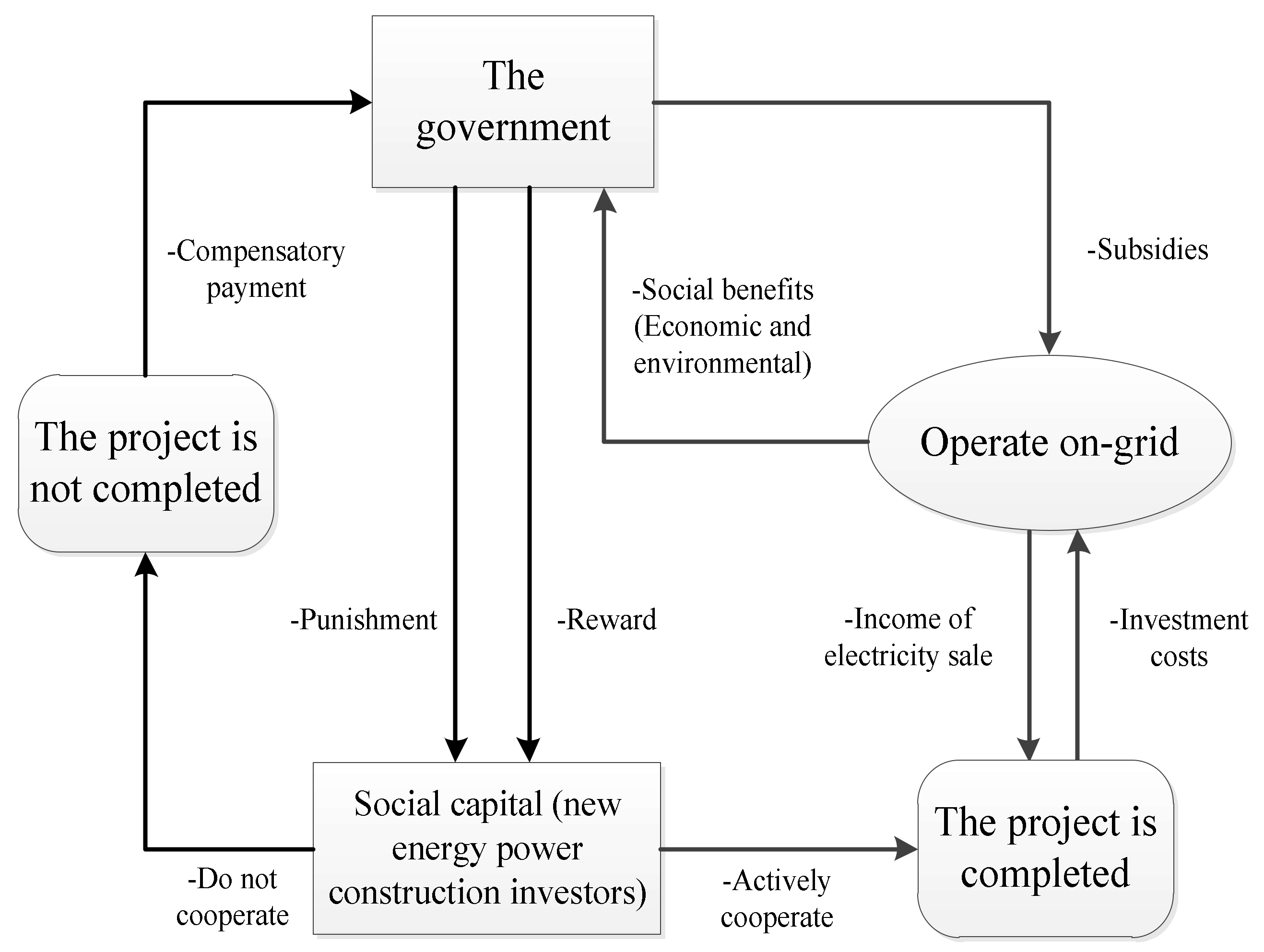

Although the government is constantly encouraging social capital to participate in the construction of a PPP project, some reasons have discouraged social capital such as low returns on capital, long return period, and high trading costs for the finished project. In the process of cooperation with the government, social capital also fears that the government will shift too much risk. Therefore, it is necessary to find a reasonable distribution between the government and social capital in interests and risks, and maximize the interests of both parties in order to attract social capital into infrastructure construction projects.

We assume that the government’s annual budget for power construction PPP projects is . The government’s goal is to maximize project benefits, which is denoted by , under the established budget constraints. The government has to carry out projects every year. For the specific project , the government needs to invest in order to meet the needs of society. Since the government is unable to make sufficient investment in each project, the capital invested in a single project is

when the total utility reaches the maximum.

When the government does not introduce social capital, the government invests in project as , and the utility for society is . At this time, the utility of the capital invested in the remaining projects is . The total utility of the PPP project can be obtained as . When the government introduces social capital, the government and social capital can provide sufficient funds for the specific project . At this time, the capital invested by the government in the project is , and the capital invested by the social capital is . The benefit of the project is , and the total benefit of the PPP project is .

For investors in social capital, their aim is to maximize profits. Assume that the investment return function is

, and the total investment amount of social capital is

. Social capital needs to spend the costs of application, research, and negotiation in the process of cooperation with the government, which are the sunk costs

. If social capital does not reach an agreement after consultation with the government, the return on social capital is

. If the consultation is successful, the social capital investment is

. Social capital will enjoy the tax incentives

given by the government while participating in the construction of PPP projects. There is a certain risk that social capital will participate in long-term infrastructure construction. We set the risk factor to

. At this time, the income function of social capital is

. Thus, we can get the game matrix of government and social capital, as shown in

Table 1.

According to

Table 1, if

, the social benefit of the sole proprietorship investment is greater than that of the PPP mode. If this is the case, the government will adopt the sole proprietorship model instead of the PPP model, at this time,

must be greater than

, that is, after the use of the PPP mode, the government invested more money, and after the social capital investment, the increase in the benefit of project

cannot make up for the reduction of funds in other projects due to the government investment. The reason for this is that the proportion of the share of the project investment is unreasonable, and the project design plan is beyond the expectation, and the possibility of its occurrence is relatively low.

If , PPP mode brings great social utility to the government, and . Because of the participation of the social capital, the investment of the project is greater, the utility is greater, the government’s finance is relieved, and more funds can be invested in other projects; thus, it is reasonable for the government to take the PPP model in this case. At this point, we analyze the income of social capital under such circumstances. When , the corresponding payment solution is , this is an invalid solution; when , Nash equilibrium is , and the solution at this time is .

The benefits of social capital participation in the PPP project are related to the risk of the project, the cost of the agreement, the rate of return on the project, and the tax relief provided by the government. From the analysis of game theory above, the Nash equilibrium exists. Therefore, the cooperation between social capital and government can achieve the growth of mutual benefits.