Between Soviet Legacy and Corporate Social Responsibility: Emerging Benefit Sharing Frameworks in the Irkutsk Oil Region, Russia

Abstract

1. Introduction

2. Literature Review

2.1. Benefit Sharing and Corporate Social Responsibility

2.2. Conceptual Approach: Benefit Sharing Frameworks and Russia’s Resource Sector

3. Materials and Methods

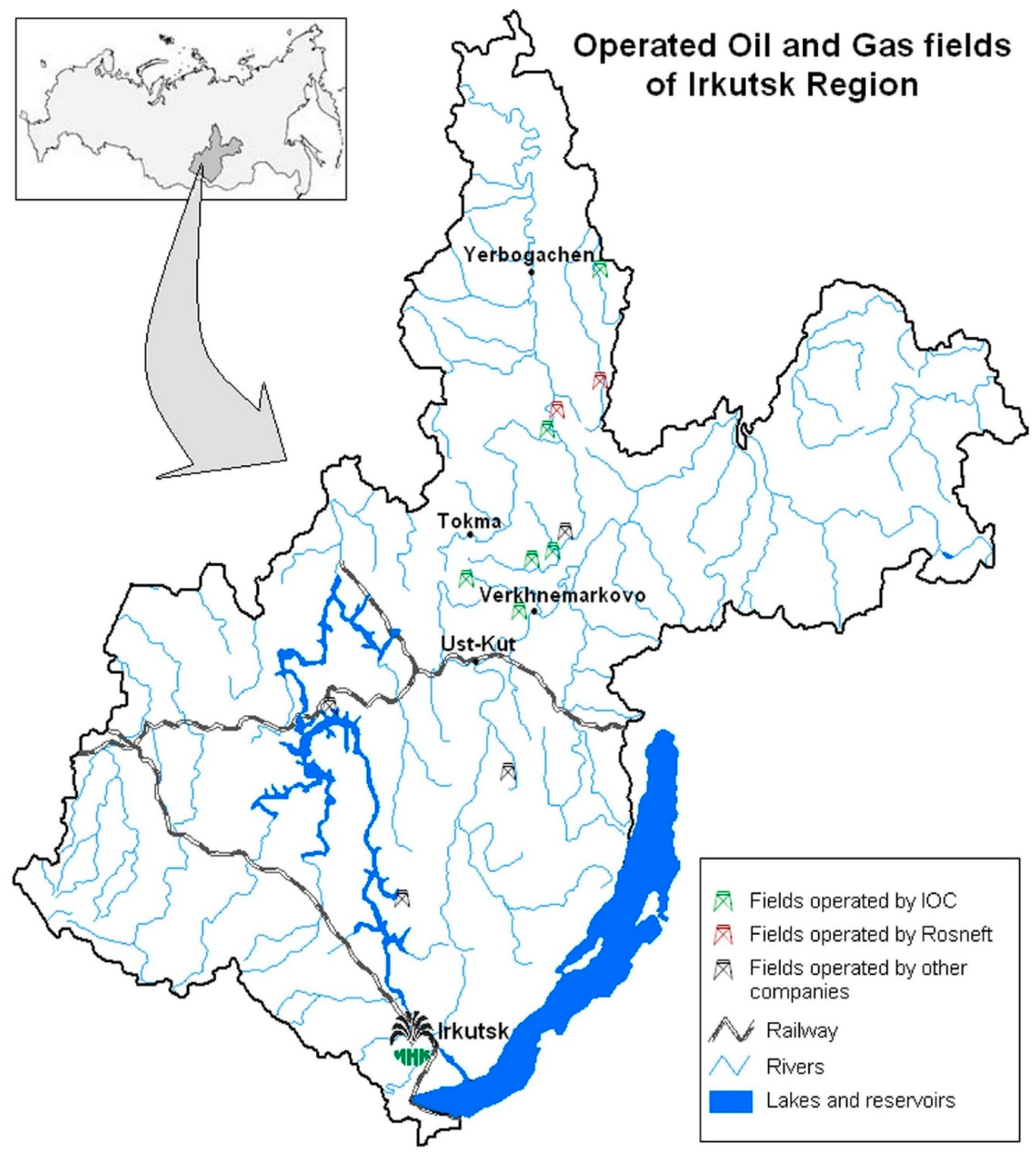

3.1. Research Context

3.2. Research Process and Data Collection

4. Results: Understanding the Mechanisms of Benefit Sharing

5. Discussion and Conclusions

6. Limitations

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References and Notes

- Robinson, J.A.; Torvik, R.; Verdier, T. Political foundations of the resource curse. J. Dev. Econ. 2006, 79, 447–468. [Google Scholar] [CrossRef]

- Brunnschweiler, C.N.; Bulte, E.H. The resource curse revisited and revised: A tale of paradoxes and red herrings. J. Environ. Econ. Manag. 2008, 55, 248–264. [Google Scholar] [CrossRef]

- Okenwa, C. Oil, a Blessing or a Curse? A Comparison of the Socio-Economic and Environmental Effects of Oil Development on Indigenous Peoples’ Livelihood in Northern Alberta and the Niger Delta 2017. Master’s Thesis, Nord University, Bodø, Norway. Available online: https://brage.bibsys.no/xmlui/bitstream/handle/11250/2466671/Okenwa.pdf?sequence=1 (accessed on 30 January 2018).

- Karl, T.L. The Paradox of Plenty: Oil Booms and Petro-States; University of California Press: Oakland, CA, USA, 1997; Volume 6. [Google Scholar]

- Obi, C.I. Oil extraction, dispossession, resistance, and conflict in Nigeria’s oil-rich Niger Delta. Can. J. Dev. Stud./Rev. Can. d’études du Dév. 2010, 30, 219–236. [Google Scholar] [CrossRef]

- Onuoha, F.C. Oil pipeline sabotage in Nigeria: Dimensions, actors and implications for national security. Afr. Secur. Stud. 2008, 17, 99–115. [Google Scholar] [CrossRef]

- Yates, D.A. The Rentier State in Africa: Oil Rent Dependency and Neocolonialism in the Republic of Gabon; Africa World Press: Trenton, NJ, USA, 1996. [Google Scholar]

- Petrov, A.N.; BurnSilver, S.; Chapin, F.S., III; Fondahl, G.; Graybill, J.K.; Keil, K.; Nilsson, A.E.; Riedlsperger, R.; Schweitzer, P. Arctic Sustainability Research: Past, Present and Future; Taylor & Francis: Abingdon, UK, 2017. [Google Scholar]

- Southcott, C. Resource Development and Northern Communities—An Introduction. North. Rev. 2015, 3–12. [Google Scholar] [CrossRef]

- Prno, J.; Slocombe, D.S. Exploring the origins of ‘social license to operate’ in the mining sector: Perspectives from governance and sustainability theories. Resour. Policy 2012, 37, 346–357. [Google Scholar] [CrossRef]

- Plyaskina, N.I.; Kharitonova, V.N.; Vizhina, I.A. Policy of regional authorities in establishing petrochemical clusters of Eastern Siberia and the Far East. Reg. Res. Russ. 2017, 7, 225–236. [Google Scholar] [CrossRef]

- Kontorovich, A.E.; Eder, L.V.; Filimonova, I.V.; Nikitenko, S.M. Key Problems in the Development of the Power of Siberia Project. Reg. Res. Russ. 2018, 8, 92–100. [Google Scholar] [CrossRef]

- Ten Kate, K.; Laird, S.A. The Commercial Use of Biodiversity: Access to Genetic Resources and Benefit-Sharing; Earthscan: London, UK, 1999. [Google Scholar]

- World Business Council for Sustainable Development. Corporate Social Responsibility: Meeting Changing Expectations. Available online: http://www.wbcsd.org/pages/edocument/edocumentdetails.aspx?id=82&nosearch contextkey=true (accessed on 19 August 2016).

- International Organization for Standardization. ISO 26000 and the International Integrated Reporting <IR> Framework Briefing Summary. 2015. Available online: http://www.iso.org/iso/iso_26000_and_ir_international_integrated_reporting_en_-_lr.pdf (accessed on 20 August 2016).

- European Commission. Communication from the Commission Concerning Corporate Social Responsibility: A business Contribution to Sustainable Development. 2 July 2002. Available online: https://ec.europa.eu/europeaid/communication-commission-concerning-corporate-social-responsibility-business-contribution_en (accessed on 20 August 2016).

- Henry, L.A.; Nysten-Haarala, S.; Tulaeva, S.; Tysiachniouk, M. Corporate social responsibility and the oil industry in the Russian Arctic: Global norms and neo-paternalism. Eur.-Asia Stud. 2016, 68, 1340–1368. [Google Scholar] [CrossRef]

- Dorobantu, S.; Aguilera, R.V.; Luo, J.; Milliken, F.J. (Eds.) Sustainability, Stakeholder Governance, and Corporate Social Responsibility; Emerald Group Publishing: Bingley, UK, 2018. [Google Scholar]

- Rezaee, Z. Supply chain management and business sustainability synergy: A theoretical and integrated perspective. Sustainability 2018, 10, 275. [Google Scholar] [CrossRef]

- Zhang, D.; Ma, Q.; Morse, S. Motives for corporate social responsibility in Chinese food companies. Sustainability 2018, 10, 117. [Google Scholar] [CrossRef]

- Wilson, E.; Stammler, F. Beyond extractivism and alternative cosmologies: Arctic communities and extractive industries in uncertain times. Extr. Ind. Soc. 2016, 3, 1–8. [Google Scholar] [CrossRef]

- Wilson, E. Evaluating International Ethical Standards and Instruments for Indigenous Rights and the Extractive Industries. Available online: https://www.researchgate.net/publication/319702707_Evaluating_international_ethical_standards_and_instruments_for_indigenous_rights_and_the_extractive_industries (accessed on 20 August 2016).

- Morgera, E. Fair and equitable benefit sharing at the cross-roads of the human right to science and international biodiversity law. Laws 2015, 4, 803–831. [Google Scholar] [CrossRef]

- Kamau, E.C.; Fedder, B.; Winter, G. The Nagoya Protocol on Access to Genetic Resources and Benefit Sharing: What is new and what are the implications for provider and user countries and the scientific community. Law Environ. Dev. J. 2010, 6, 246. [Google Scholar]

- Pham, T.T.; Brockhaus, M.; Wong, G.; Dung, L.N.; Tjajadi, J.S.; Loft, L.; Luttrell, C.; Assembe Mvondo, S. Approaches to Benefit Sharing: A Preliminary Comparative Analysis of 13 REDD+ Countries; Center for International Forestry Research: Bogor, Indonesia, 2013. [Google Scholar]

- Wynberg, R. Rhetoric, Realism and Benefit sharing. J. World Intellect. Prop. 2004, 7, 851–876. [Google Scholar] [CrossRef]

- Schroeder, D. Benefit sharing: It’s time for a definition. J. Med. Ethics 2007, 33, 205–209. [Google Scholar] [CrossRef] [PubMed]

- Bocoum, B.; Sarkar, S.; Gow-Smith, A.; Morakinyo, T.; Frau, R.; Kuniholm, M.; Otto, J.M. Mining Community Development Agreements—Practical Experiences and Field Studies, Vol. 3 of Mining Community Development Agreements: Source Book; World Bank: Washington, DC, USA, 2012. [Google Scholar]

- Cernea, M.M. Compensation and benefit sharing: Why resettlement policies and practices must be reformed. Water Sci. Eng. 2008, 1, 89–120. [Google Scholar] [CrossRef]

- Söderholm, P.; Svahn, N. Mining, Regional Development and Benefit Sharing; Research Report; Economics Unit. Luleå University of Technology: Luleå, Sweden, 2014. [Google Scholar]

- Bustamante, G.; Martin, T. Benefit Sharing and the Mobilization of ILO Convention 169. In The Internationalization of Indigenous Rights; Centre for International Governance Innovation: Waterloo, ON, Canada, 2014. [Google Scholar]

- O’Faircheallaigh, C. Extractive industries and Indigenous peoples: A. changing dynamic? J. Rural Stud. 2013, 30, 20–30. [Google Scholar] [CrossRef]

- Boix, C.; Svolik, M.W. The foundations of limited authoritarian government: Institutions, commitment, and power-sharing in dictatorships. J. Politics 2013, 75, 300–316. [Google Scholar] [CrossRef]

- Wall, E.; Pelon, R. Sharing mining benefits in developing countries. In Extractive Industries for Development Series; 21 June 2011; Available online: http://bougainville-copper.de/mediapool/59/599247/data/World_Bank/Sharing_Mining_Benefits_201106.pdf (accessed on 30 January 2018).

- World Bank. Mining Foundations, Trust and Funds: A Sourcebook; World Bank: Washington, DC, USA, 2010; p. 7. Available online: https://openknowledge.worldbank.org/handle/10986/16965 (accessed on 22 May 2018).

- Tysiachniouk, M. Benefit sharing arrangements in the Arctic: Promoting sustainability of indigenous communities in areas of resource extraction. Arct. Int. Relat. Ser. 2016, 4, 18–21. [Google Scholar]

- Tysiachniouk, M.; Petrov, A. Benefit sharing in the Arctic energy sector: Perspectives on corporate policies and practices in Northern Russia and Alaska. Energy Res. Soc. Sci. 2017, 39, 29–34. [Google Scholar] [CrossRef]

- Zulu, L.; Wilson, S. Whose Minerals, Whose Development? Rhetoric and Reality in Post-Conflict Sierra Leone. Dev. Chang. 2012, 43, 1103–1131. [Google Scholar] [CrossRef]

- Huskey, L. Limits to growth: Remote regions, remote institutions. Ann. Reg. Sci. 2006, 40, 147–155. [Google Scholar] [CrossRef]

- Petrov, A.N. Redrawing the margin: Re-examining regional multichotomies and conditions of marginality in Canada, Russia and their northern frontiers. Reg. Stud. 2012, 46, 59–81. [Google Scholar] [CrossRef]

- Murashko, O. Protecting indigenous peoples’ rights to their natural resources-the case of Russia. Indigenous Aff. 2008, 3–4, 48–59. [Google Scholar]

- Fondahl, G. Environmental degradation and indigenous land claims in Russia’s North. In Contested Arctic: Indigenous Peoples, Industrial States, and the Circumpolar Environment; University of Washington Press: Seattle, WA, USA, 1997; pp. 68–87. [Google Scholar]

- Tulaeva, S.; Tysiachniouk, M. Benefit sharing arrangements between oil companies and indigenous people in Russian Northern regions. Sustainability 2017, 9, 1326. [Google Scholar] [CrossRef]

- Dienes, L. Observations on the problematic potential of Russian oil and the complexities of Siberia. Eurasian Geogr. Econ. 2004, 45, 319–345. [Google Scholar] [CrossRef]

- Billo, E. Sovereignty and subterranean resources: An institutional ethnography of Repsol’s corporate social responsibility programs in Ecuador. Geoforum 2015, 59, 268–277. [Google Scholar] [CrossRef]

- Wilson, E. What is the social licence to operate? Local perceptions of oil and gas projects in Russia’s Komi Republic and Sakhalin Island. Extract. Ind. Soc. 2016, 3, 73–81. [Google Scholar] [CrossRef]

- Tysiachniouk, M.; Henry, L.A.; Lamers, M.; van Tatenhove, J.P. Oil and indigenous people in sub-Arctic Russia: Rethinking equity and governance in benefit sharing agreements. Energy Res. Soc. Sci. 2018, 37, 140–152. [Google Scholar] [CrossRef]

- Warner, M.; Sullivan, R. (Eds.) Putting Partnerships to Work: Strategic Alliances for Development between Government, the Private Sector and Civil Society; Routledge: London, UK, 2017. [Google Scholar]

- Kwon, G. Post-crisis Fiscal Revenue Developments in Russia: From an Oil Perspective. Public Financ. Manag. 2003, 3, 505–529. [Google Scholar]

- Bradshaw, B.; Wright, A. Review of IBA Literature and Analysis of Gaps in Knowledge; Gap Analysis Reports; ReSDA: Whitehorse, YT, Canada, 2014. [Google Scholar]

- Bradshaw, M.J. The Russian North in transition: General introduction. Post-Sov. Geogr. 1995, 36, 195–203. [Google Scholar] [CrossRef]

- Slavin, S.V. The Soviet North: Present Development and Prospects; Progress Publishers: Moscow, Russia, 1972. [Google Scholar]

- Azbuzova, E.; Evchik, S.; Yeliasov, V.; Pisareva, Yu. Neft’: Bolshaya Igra dlya Manenkoi Kompanii; IOC: Irkutsk, Russia, 2015. [Google Scholar]

- Irkutsk Oil Company. Exploration and Production. Available online: http://irkutskoil.com/working/ (accessed on 18 February 2018).

- Public Joint Stock Company Rosneft Oil Company [RU]. Rosneft for the Wellbeing of Russia. 2016. Available online: https://www.rosneft.ru/upload/site1/document_file/RN_SR_2016_RU.pdf (accessed on 13 February 2018).

- Public Joint Stock Company Rosneft Oil Company [RU]. Verhnechomskneftegas Celebrates It 15th Anniversary. 25 April 2017. Available online: https://www.rosneft.ru/press/news/item/186339/ (accessed on 13 February 2018).

- Isayeva, T. Verkhnemarkovo. There would be Neftelensk city. In Baikal Siberia, Predislovie 21-go veka. Al’manah-issledovanie; Irkutskii gosuniversitet: Irkutsk, Siberia, 2007; pp. 233–242. [Google Scholar]

- Webster, L.; Mertova, P. Using Narrative Inquiry as a Research Method: An Introduction to Using Critical Event Narrative Analysis in Research on Learning and Teaching; Routledge: London, UK, 2007. [Google Scholar]

- Hsieh, H.F.; Shannon, S.E. Three approaches to qualitative content analysis. Qual. Health Res. 2005, 15, 1277–1288. [Google Scholar] [CrossRef] [PubMed]

- SIBINFORM.info. The Most Fresh Actual News of Irkutsk Oblast. Available online: www. baikal.mk.ru (accessed on 27 January 2018).

- Irkutsk Oil Company. Records and Achievements in 2017. Available online: www.irkutskoil.ru (accessed on 27 January 2018).

- Interview, GO-1. Municipal official, Ust-Kut. 25–27 July 2015.

- Interview, CE-2. Representative of IOC, Irkutsk. 30 July 2015.

- Arthur Dan News. Tax Exemptions Contributed to the Budget. Available online: http://irkutsk.aldana.ru/new/view/id/42230 (accessed on 30 December 2014).

- Otchet Glavy Erbogachenskogo Municipal’nogo Obrazovaniia o Deiatel’nosti Administratsii Poseleniia i ob Itogakh Social’no-Ekonomicheskogo Razvitiia Poseleniia v 2016 godu i Zadachakh na 2017 god. Prilozhenie k Resheniiu Dumy Erbogachenskogo municipal’nogo obrazovaniia ot 29 March 2017 goda № 12/2. Available online: http://erbogachen.ru/sovet_deputatov_npa_acts.php?id_npas=5&blok=sd&razdel=npa (accessed on 27 February 2018).

- Participant observation. Municipal meeting, Verhnemarkovo. 25 July 2015.

- Interview, GO-3. District official, Ust-Kut. 25 July 2015.

- Interview, GO-5. Municipal official, Verhnemarkovo. 27 July 2015.

- Otchet Mera Raiona o Social’no-Ekonomicheskom Polozhenii Katangskogo Rajona v 2014 goduPrilozhenie k Resheniju Dumy MO “Katangskii Raion” ot “17” Aprelia 2015 g. № 1/1[m16]. Available online: катанга.рф/wp-content/uploads/2014/08/ОТЧЕТ-МЭРА-2013.doc (accessed on 27 February 2018).

- Interview, LR-1. Representative of Evenki obschina. 29 August 2013.

- Personal communication on the phone with local resident in Tokma. 25 January 2018.

- Interview, LR-9. Hunter, Tokma. 8 December 2011.

- Interview, LR-16. Evenk, member of Municipal council. 1 March 2014.

- Interview, GO-1. Municipal official, Ust Kut. 27 July 2015.

- Interview, GO-2. Municipal administration employee, Tokma. 8 December 2011.

- Interview, LR-4. Evenk, member of Municipal council, Tokma. 8 December 2011.

- Interview, GO-6. Local Council member, Ust-Kut. 26 July 2015.

- Interview, LR-1. Retired, wife of the former oil driller, Verhnemarkovo. 25 November 2011.

- Interview, LR-33. Local activist, Verhnemarkovo. 26 July 2015.

- Interview, CE-1. Representative of IOC. 25 February 2014.

- Otchet mera raiona o social’no-ekonomicheskom polozhenii Katangskogo rajona v 2016 godu. Prilozhenie k resheniiu Dumy MO “Katangskij raion” ot “28” marta 2017 g. № 2/2. Available online: катанга.рф/wp-content/.../ОТЧЕТ-МЭРА-2016-ПО-СОСТОЯНИЮ-НА-01.01.2017.doc (accessed on 27 February 2018).

- Interview, LR-4. Representative of Evenki obschina, Erbogachen. 2 September 2013.

- Interview, LR-5. Representative of Evenki obschina, Erbogachen. 2 September 2013.

- Interview, CE-1. Representative of IOC. 30 July 2015.

- Federal Service for the State Statistics. Database for Municipalities. Available online: http://www.gks.ru/dbscripts/munst/munst25/DBInet.cgi (accessed on 4 March 2018).

- Otchet Mera Rajona o Social’no-Jekonomicheskom Polozhenii Katangskogo Rajona v 2015 Godu Prilozhenie k Resheniju Dumy MO “Katangskij Rajon” ot “24” Marta 2016 g. № 1/3. Available online: http://катанга.рф/?page_id=3410 (accessed on 4 March 2018).

- Saxinger, G.; Petrov, A.; Krasnoshtanova, N.; Kuklina, V.; Carson, D.A. Boom back or blow back? Growth strategies in mono-industrial resource towns–‘east’ and ‘west’. In Settlements at the Edge: Remote Human Settlements in Developed Nations; Edward Elgar Publishing Cheltenham: Cheltenham, UK, 2016. [Google Scholar]

- Millar, J.R. The Little Deal: Brezhnev’s Contribution to Acquisitive Socialism. Slavic Rev. 1985, 44, 694–706. [Google Scholar] [CrossRef]

- Garde-Sanchez, R.; López-Pérez, M.V.; López-Hernández, A.M. Current Trends in Research on Social Responsibility in State-Owned Enterprises: A Review of the Literature from 2000 to 2017. Sustainability 2018, 10, 2403. [Google Scholar] [CrossRef]

- Tysiachniouk, M.; Henry, L.A.; Lamers, M.; van Tatenhove, J.P. Oil Extraction and Benefit Sharing in an Illiberal Context: The Nenets and Komi-Izhemtsi Indigenous Peoples in the Russian Arctic. Soc. Nat. Resour. 2018, 31, 556–579. [Google Scholar] [CrossRef]

| Mode | Mandated | Negotiated | Semi-Formal | Trickle-Down |

|---|---|---|---|---|

| Paternalistic | Tax/royalty state revenues distribution | State-imposed socio-economic agreements with regional and district authorities | Plea and take sponsorship system | New jobs (company, public, other sectors) Income growth. Infrastructure investment |

| Company-centered social responsibility | Community investment funds and foundations | Negotiated payments, agreements, and arrangements based on outside standards, shareholder requirements, and/or corporate policies | Sponsorship and charitable contributions | New jobs (company, public, other sectors) Income growth Procurement through indigenous and local businesses Infrastructure investment |

| Partnership | Investment programs Production shared agreements | Tripartite agreements based on international standards or global company policies Grants and investment programs Voluntary local/indigenous employment quotas and hiring preferences | ---- | New jobs (company, public, other sectors) Income growth Procurement through indigenous and local businesses Infrastructure investment |

| Beneficiary | Benefits are shared among beneficiaries through non-profit regional economic development corporations. | Impacts and benefits agreements (IBAs) between communities and companies. | ------- | New jobs (company, public, other sectors) Income growth Procurement through indigenous and local businesses Infrastructure investment |

| Shareholder | Dividends from permanents funds, native corporations, etc. | Shareholder-driven negotiated benefits | ----- | New jobs (company, public, other sectors) Income growth Procurement through indigenous and local businesses Infrastructure investment |

| Community | Number of Interviewees | Local/Indigenous Residents (LR) | Company Employees (CE) | Government Officials (GO) |

|---|---|---|---|---|

| Irkutsk | 2 | -- | 2 | -- |

| Tokma | 37 | 36 | -- | 1 |

| Verknemarkovo | 42 | 34 | 2 | 6 |

| Yerbogachen | 10 | 8 | -- | 2 |

| Ust-Kut | 9 | 4 | -- | 5 |

| Ode | Structured | Negotiated | Semi-Formal | Trickle-Down |

|---|---|---|---|---|

| Paternalistic | Tax revenues distribution: oil production taxes are collected by the federal government and partly transferred back to the region. If a company is registered locally, other taxes it pays (income, property, etc.) are retained in the region; the regional government transfers some revenues to municipalities. | State-imposed agreements with regional and district authorities annually concluded socio-economic cooperation agreements with the regional government and municipal governments in oil-producing districts. | “Plea-and-take” sponsorship system: Semi-formal or informal arrangements, in which the companies respond to individual requests from community actors, local authorities, or private citizens. Support to social and civic initiatives (clubs, music bands, veterans’ organizations, schools), responses for emergency needs (such as equipment breakdowns or disaster response). | New jobs (company, public, retail, or transportation). Income growth. Development of infrastructure (roads, pipelines, educational and public health facilities, equipment for schools and medical establishments). |

| Company-centered social responsibility | ---- | Direct socio-economic agreements with Indigenous enterprises (obschinas), concluded annually to provide payments and in-kind support for negotiated community needs. | Sponsorship and charitable contributions: Support of sport activities, festivals, charitable funds, NGOs, etc. (sometimes the preference is given to the location of the company headquarters). | New jobs (company, public, retail, or transportation). Income growth. Development of infrastructure (roads, pipelines, educational and public health facilities, equipment for schools and medical establishments). |

| Partnership | ---- | ---- | ---- | ---- |

| Beneficiary | ___ | ___ | ____ | ___ |

| Shareholder | ---- | ---- | ---- | ---- |

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Tysiachniouk, M.; Petrov, A.N.; Kuklina, V.; Krasnoshtanova, N. Between Soviet Legacy and Corporate Social Responsibility: Emerging Benefit Sharing Frameworks in the Irkutsk Oil Region, Russia. Sustainability 2018, 10, 3334. https://doi.org/10.3390/su10093334

Tysiachniouk M, Petrov AN, Kuklina V, Krasnoshtanova N. Between Soviet Legacy and Corporate Social Responsibility: Emerging Benefit Sharing Frameworks in the Irkutsk Oil Region, Russia. Sustainability. 2018; 10(9):3334. https://doi.org/10.3390/su10093334

Chicago/Turabian StyleTysiachniouk, Maria, Andrey N. Petrov, Vera Kuklina, and Natalia Krasnoshtanova. 2018. "Between Soviet Legacy and Corporate Social Responsibility: Emerging Benefit Sharing Frameworks in the Irkutsk Oil Region, Russia" Sustainability 10, no. 9: 3334. https://doi.org/10.3390/su10093334

APA StyleTysiachniouk, M., Petrov, A. N., Kuklina, V., & Krasnoshtanova, N. (2018). Between Soviet Legacy and Corporate Social Responsibility: Emerging Benefit Sharing Frameworks in the Irkutsk Oil Region, Russia. Sustainability, 10(9), 3334. https://doi.org/10.3390/su10093334