Combined Influence of Absorptive Capacity and Corporate Entrepreneurship on Performance

Abstract

:1. Introduction

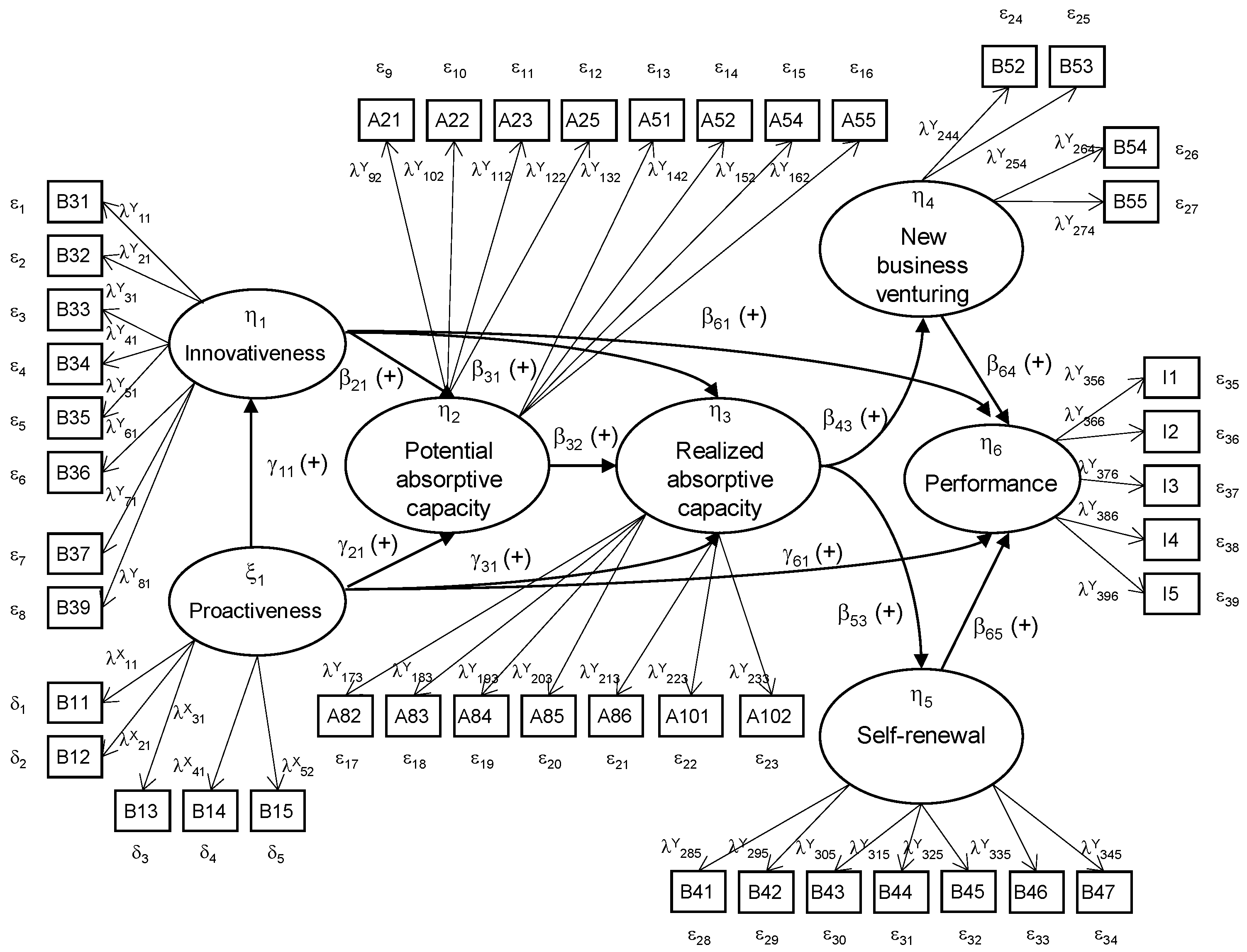

2. Theoretical Background and Hypotheses

2.1. Absorptive Capacity

The firm’s ability to integrate, build, and reconfigure internal and external competences to address rapidly changing environments.

Absorptive capacity is a firm’s ability to utilize externally held knowledge through three sequential processes: (1) recognizing and understanding potentially valuable new knowledge outside the firm through exploratory learning, (2) assimilating valuable new knowledge through transformative learning, and (3) using the assimilated knowledge to create new knowledge and commercial outputs through exploitative learning.

2.2. Corporate Entrepreneurship

2.3. Hypotheses: The Relationship between Absorptive Capacity and Corporate Entrepreneurship and its Effects on Performance

2.3.1. Relationship Between Proactiveness and Innovation

2.3.2. Relationship between Potential Absorptive Capacity and Realized Absorptive Capacity.

2.3.3. Relationship Between the Dimensions of Knowledge Absorptive Capacity and the Dimensions of Corporate Entrepreneurship

2.3.4. Relationship Between the Dimensions of Corporate Entrepreneurship and Performance

3. Methods

3.1. Sample

3.2. Measurement Model

3.3. Scale Validity and Reliability

4. Results

5. Conclusions and Future Research

5.1. Theoretical and Managerial Implications

5.2. Limitations and Future Studies

Author Contributions

Funding

Conflicts of Interest

References

- Grant, R.M. Prospering in Dynamically-Competitive Environments: Organizational Capability as Knowledge Integration. Organ. Sci. 1996, 7, 375–387. [Google Scholar] [CrossRef]

- Nonaka, I.; Takeuchi, H. The Knowledge-Creating Company: How Japanese Companies Create the Dynamics of Innovation; Oxford University Press: Oxford, UK, 1995. [Google Scholar]

- Eisenhardt, K.M.; Martin, J.A. Dynamic capabilities: What are they? Strateg. Manag. J. 2000, 21, 1105–1121. [Google Scholar] [CrossRef]

- Oliver, C.; Holzinger, I. The Effectiveness of Strategic Political Management: A Dynamic Capabilities Framework. Acad. Manag. Rev. 2008, 33, 496–520. [Google Scholar] [CrossRef]

- Zahra, S.A.; George, G. Absorptive Capacity: A Review, Reconceptualization, and Extension. Acad. Manag. Rev. 2002, 27, 185–203. [Google Scholar] [CrossRef]

- Camisón, C.; Forés, B. Knowledge creation and absorptive capacity: The effect of intra-district shared competences. Scand. J. Manag. 2011, 27, 66–86. [Google Scholar] [CrossRef]

- Solís-Molina, M.; Hernández-Espallardo, M.; Rodríguez-Orejuela, A. Performance implications of organizational ambidexterity versus specialization in exploitation or exploration: The role of absorptive capacity. J. Bus. Res. 2018, 91, 181–194. [Google Scholar] [CrossRef]

- Liu, X.; Zhao, H.; Zhao, X. Absorptive capacity and business performance: The mediating effects of innovation and mass customization. Ind. Manag. Data Syst. 2018, 118, 1787–1803. [Google Scholar] [CrossRef]

- Kellermanns, F.; Walter, J.; Crook, T.R.; Kemmerer, B.; Narayanan, V. The Resource-Based View in Entrepreneurship: A Content-Analytical Comparison of Researchers’ and Entrepreneurs’ Views. J. Small Bus. Manag. 2016, 54, 26–48. [Google Scholar] [CrossRef]

- Antoncic, B.; Hisrich, R.D. Intrapreneurship: Construct refinement and cross-cultural validation. J. Bus. Ventur. 2001, 16, 495–527. [Google Scholar] [CrossRef]

- Turro, A.; Alvarez, C.; Urbano, D. Intrapreneurship in the Spanish context: A regional analysis. Entrep. Reg. Dev. 2016, 28, 380–402. [Google Scholar] [CrossRef]

- Cohen, W.M.; Levinthal, D.A. Innovation and Learning: The Two Faces of R & D. Econ. J. 1989, 99, 569–596. [Google Scholar]

- Cohen, W.M.; Levinthal, D.A. Absorptive Capacity: A New Perspective on Learning and Innovation. Adm. Sci. Q. 1990, 35, 128–152. [Google Scholar] [CrossRef]

- Ali, M.; Kan, K.A.; Sarstedt, M. Direct and configurational paths of absorptive capacity and organizational innovation to successful organizational performance. J. Bus. Res. 2016, 69, 5317–5323. [Google Scholar] [CrossRef]

- Crescenzi, R.; Gagliardi, L. The innovative performance of firms in heterogeneous environments: The interplay between external knowledge and internal absorptive capacities. Res. Policy 2018, 47, 782–795. [Google Scholar] [CrossRef]

- García-Morales, V.J.; Ruiz-Moreno, A.; Llorens-Montes, F.J. Effects of Technology Absorptive Capacity and Technology Proactivity on Organizational Learning, Innovation and Performance: An Empirical Examination. Technol. Anal. Strateg. Manag. 2007, 19, 527–558. [Google Scholar] [CrossRef]

- Newbert, S.L. Empirical research on the resource-based view of the firm: An assessment and suggestions for future research. Strateg. Manag. J. 2007, 28, 121–146. [Google Scholar] [CrossRef]

- García-Morales, V.J.; Bolívar-Ramos, M.T.; Martín-Rojas, R. Technological variables and absorptive capacity’s influence on performance through corporate entrepreneurship. J. Bus. Res. 2014, 67, 1468–1477. [Google Scholar] [CrossRef]

- Hullova, D.; Simms, C.D.; Trott, P.; Laczko, P. Critical capabilities for effective management of complementarity between product and process innovation: Cases from the food and drink industry. Res. Policy 2019, 48, 339–354. [Google Scholar] [CrossRef]

- Uwizeyemungu, S.; Raymond, L.; Poba-Nzaou, P.; St-Pierre, J. The complementarity of IT and HRM capabilities for competitive performance: A configurational analysis of manufacturing and industrial service SMEs. Enterp. Inf. Syst. 2018, 12, 1336–1358. [Google Scholar] [CrossRef]

- Zollo, M.; Winter, S.G. Deliberate Learning and the Evolution of Dynamic Capabilities. Organ. Sci. 2002, 13, 339–351. [Google Scholar] [CrossRef]

- Teece, D.J.; Pisano, G.; Shuen, A. Dynamic capabilities and strategic management. Strateg. Manag. J. 1997, 18, 509–533. [Google Scholar] [CrossRef]

- Van den Bosch, F.A.J.; Volberda, H.W.; de Boer, M. Coevolution of Firm Absorptive Capacity and Knowledge Environment: Organizational Forms and Combinative Capabilities. Organ. Sci. 1999, 10, 551–568. [Google Scholar] [CrossRef] [Green Version]

- Szulanski, G. Exploring internal stickiness: Impediments to the transfer of best practice within the firm: Exploring Internal Stickiness. Strateg. Manag. J. 1996, 17, 27–43. [Google Scholar] [CrossRef]

- Jiménez-Barrionuevo, M.M.; García-Morales, V.J.; Molina, L.M. Validation of an instrument to measure absorptive capacity. Technovation 2011, 31, 190–202. [Google Scholar] [CrossRef]

- Lane, P.J.; Koka, B.R.; Pathak, S. The Reification of Absorptive Capacity: A Critical Review and Rejuvenation of the Construct. Acad. Manag. Rev. 2006, 31, 833–863. [Google Scholar] [CrossRef]

- Todorova, G.; Durisin, B. Absorptive capacity: Valuing a reconceptualization. Acad. Manag. Rev. 2007, 32, 774–786. [Google Scholar] [CrossRef]

- Lane, P.J.; Lubatkin, M. Relative absorptive capacity and interorganizational learning. Strateg. Manag. J. 1998, 19, 461–477. [Google Scholar] [CrossRef]

- Jansen, J.J.P.; Van Den Bosch, F.A.J.; Volberda, H.W. Managing Potential and Realized Absorptive Capacity: How do Organizational Antecedents Matter? Acad. Manag. J. 2005, 48, 999–1015. [Google Scholar] [CrossRef] [Green Version]

- Flatten, T.C.; Engelen, A.; Zahra, S.A.; Brettel, M. A measure of absorptive capacity: Scale development and validation. Eur. Manag. J. 2011, 29, 98–116. [Google Scholar] [CrossRef]

- Mowery, D.C.; Oxley, J.E. Inward technology transfer and competitiveness: The role of national innovation systems. Camb. J. Econ. 1995, 19, 67–93. [Google Scholar]

- Miller, D. The Correlates of Entrepreneurship in Three Types of Firms. Manag. Sci. 1983, 29, 770–791. [Google Scholar] [CrossRef]

- Huse, M.; Neubaum, D.O.; Gabrielsson, J. Corporate Innovation and Competitive Environment. Int. Entrep. Manag. J. 2005, 1, 313–333. [Google Scholar] [CrossRef]

- Kuratko, D.F.; McMullen, J.S.; Hornsby, J.S.; Jackson, C. Is your organization conducive to the continuous creation of social value? Toward a social corporate entrepreneurship scale. Bus. Horiz. 2017, 60, 271–283. [Google Scholar] [CrossRef]

- Sharma, P.; Chrisman, S.J.J. Toward a Reconciliation of the Definitional Issues in the Field of Corporate Entrepreneurship*. In Entrepreneurship: Concepts, Theory and Perspective; Cuervo, Á., Ribeiro, D., Roig, S., Eds.; Springer: Berlin/Heidelberg, Germany, 2007; pp. 83–103. [Google Scholar]

- Khandwalla, P.N. Generators of Pioneering-Innovative Management: Some Indian Evidence. Organ. Stud. 1987, 8, 39–59. [Google Scholar] [CrossRef]

- Lumpkin, G.T.; Dess, G.G. Clarifying the Entrepreneurial Orientation Construct and Linking It To Performance. Acad. Manag. Rev. 1996, 21, 135–172. [Google Scholar] [CrossRef]

- Guth, W.D.; Ginsberg, A. Guest Editors’ Introduction: Corporate Entrepreneurship. Strateg. Manag. J. 1990, 11, 5–15. [Google Scholar]

- Kohtamäki, M.; Heimonen, J.; Parida, V. The nonlinear relationship between entrepreneurial orientation and sales growth: The moderating effects of slack resources and absorptive capacity. J. Bus. Res. 2019, 100, 100–110. [Google Scholar] [CrossRef]

- Kale, E.; Aknar, A.; Başar, Ö. Absorptive capacity and firm performance: The mediating role of strategic agility. Int. J. Hosp. Manag. 2019, 78, 276–283. [Google Scholar] [CrossRef]

- Verma, V.; Bharadwaj, S.S.; Nanda, M. Comparing agility and absorptive capacity for superior firm performance in dynamic environment. Int. J. Bus. Environ. 2017, 9, 1–7. [Google Scholar] [CrossRef]

- Wales, W.J.; Parida, V.; Patel, P.C. Too much of a good thing? Absorptive capacity, firm performance, and the moderating role of entrepreneurial orientation. Strateg. Manag. J. 2013, 34, 622–633. [Google Scholar] [CrossRef]

- Crant, J.M. Proactive Behavior in Organizations. J. Manag. 2000, 26, 435–462. [Google Scholar] [CrossRef]

- Adomako, S.; Amankwah-Amoah, J.; Danso, A. The effects of stakeholder integration on firm-level product innovativeness: Insights from small and medium-sized enterprises in Ghana. R D Manag. 2019. [Google Scholar] [CrossRef]

- Kanter, R.M. Swimming In Newstreams: Mastering Innovation Dilemas. Calif. Manag. Rev. Berkel. 1989, 31, 45. [Google Scholar] [CrossRef]

- Miller, D.; Friesen, P.H. Innovation in conservative and entrepreneurial firms: Two models of strategic momentum. Strateg. Manag. J. 1982, 3, 1–25. [Google Scholar] [CrossRef]

- Aragón-Correa, J.A. Strategic Proactivity and Firm Approach to the Natural Environment. Acad. Manag. J. 1998, 41, 556–567. [Google Scholar] [CrossRef]

- Özsomer, A.; Calantone, R.J.; Di Bonetto, A. What makes firms more innovative? A look at organizational and environmental factors. J. Bus. Ind. Mark. 1997, 12, 400–416. [Google Scholar] [CrossRef]

- McCann, J.E. Design principles for an innovating company. Acad. Manag. Perspect. 1991, 5, 76–93. [Google Scholar] [CrossRef]

- Albort-Morant, G.; Henseler, J.; Cepeda-Carrión, G.; Leal-Rodríguez, A.L. Potential and Realized Absorptive Capacity as Complementary Drivers of Green Product and Process Innovation Performance. Sustainability 2018, 10, 381. [Google Scholar] [CrossRef]

- Harmaakorpi, V.; Melkas, H. Data, information and knowledge in regional innovation networks: Quality considerations and brokerage functions. Eur. J. Innov. Manag. 2008, 11, 103–124. [Google Scholar]

- Mueller, P. Exploring the knowledge filter: How entrepreneurship and university–industry relationships drive economic growth. Res. Policy 2006, 35, 1499–1508. [Google Scholar] [CrossRef]

- Cooke, P.; Wills, D. Small Firms, Social Capital and the Enhancement of Business Performance Through Innovation Programmes. Small Bus. Econ. 1999, 13, 219–234. [Google Scholar] [CrossRef]

- Fiol, C.M.; Lyles, M.A. Organizational Learning. Acad. Manag. Rev. 1985, 10, 803–813. [Google Scholar] [CrossRef] [Green Version]

- Kim, L. Crisis Construction and Organizational Learning: Capability Building in Catching-up at Hyundai Motor. Organ. Sci. 1998, 9, 506–521. [Google Scholar] [CrossRef] [Green Version]

- Kodama, F.; Suzuki, J. How Japanese Companies have used Scientific Advances to Restructure their Businesses: The Receiver-Active National System of Innovation. World Dev. 2007, 35, 976–990. [Google Scholar] [CrossRef]

- Parker, S.K. Enhancing role breadth self-efficacy: The roles of job enrichment and other organizational interventions. J. Appl. Psychol. 1998, 83, 835–852. [Google Scholar] [CrossRef]

- Griffith, T.L.; Fuller, M.A.; Northcraft, G.B. Neither Here nor There: Knowledge Sharing and Transfer with Proactive Structuration. In Proceedings of the 2007 40th Annual Hawaii International Conference on System Sciences (HICSS’07), Waikoloa, HI, USA, 3–6 January 2007; p. 190b. [Google Scholar]

- Liao, S.; Fei, W.-C.; Chen, C.-C. Knowledge sharing, absorptive capacity, and innovation capability: An empirical study of Taiwan’s knowledge-intensive industries. J. Inf. Sci. 2007, 33, 340–359. [Google Scholar] [CrossRef]

- Kumar, R.; Nti, K.O. Differential Learning and Interaction in Alliance Dynamics: A Process and Outcome Discrepancy Model. Organ. Sci. 1998, 9, 356–367. [Google Scholar] [CrossRef]

- Breitenecker, R.J.; Harms, R.; Weyh, A.; Maresch, D.; Kraus, S. When the difference makes a difference—The regional embeddedness of entrepreneurship. Entrep. Reg. Dev. 2017, 29, 71–93. [Google Scholar] [CrossRef]

- García-Sánchez, E.; García-Morales, V.J.; Martín-Rojas, R. Influence of Technological Assets on Organizational Performance through Absorptive Capacity, Organizational Innovation and Internal Labour Flexibility. Sustainability 2018, 10, 770. [Google Scholar] [CrossRef]

- Lumpkin, G.T.; Lichtenstein, B.B. The Role of Organizational Learning in the Opportunity–Recognition Process. Entrep. Theory Pract. 2005, 29, 451–472. [Google Scholar] [CrossRef]

- Zahra, S.A.; Jennings, D.F.; Kuratko, D.F. The Antecedents and Consequences of Firm-Level Entrepreneurship: The State of the Field. Entrep. Theory Pract. 1999, 24, 45–65. [Google Scholar] [CrossRef]

- Berends, H.; Vanhaverbeke, W.; Kirschbaum, R. Knowledge management challenges in new business development: Case study observations. J. Eng. Technol. Manag. 2007, 24, 314–328. [Google Scholar] [CrossRef]

- Zahra, S.A. Predictors and financial outcomes of corporate entrepreneurship: An exploratory study. J. Bus. Ventur. 1991, 6, 259–285. [Google Scholar] [CrossRef]

- Stopford, J.M.; Baden-Fuller, C.W.F. Creating corporate entrepreneurship. Strateg. Manag. J. 1994, 15, 521–536. [Google Scholar] [CrossRef]

- Zahra, S.A.; Garvis, D.M. International corporate entrepreneurship and firm performance: The moderating effect of international environmental hostility. J. Bus. Ventur. 2000, 15, 469–492. [Google Scholar] [CrossRef]

- Bechky, B.A. Sharing Meaning Across Occupational Communities: The Transformation of Understanding on a Production Floor. Organ. Sci. 2003, 14, 312–330. [Google Scholar] [CrossRef] [Green Version]

- Kohli, A.K.; Jaworski, B.J.; Kumar, A. Markor: A Measure of Market Orientation. J. Mark. Res. 1993, 30, 467–477. [Google Scholar] [CrossRef] [Green Version]

- Huber, G.P. Organizational Learning: The Contributing Processes and the Literatures. Organ. Sci. 1991, 2, 88–115. [Google Scholar] [CrossRef]

- Jantunen, A. Knowledge-processing capabilities and innovative performance: An empirical study. Eur. J. Innov. Manag. 2005, 8, 336–349. [Google Scholar] [CrossRef]

- March, J.G. Exploration and Exploitation in Organizational Learning. Organ. Sci. 1991, 2, 71–87. [Google Scholar] [CrossRef]

- Jones, O.; Macpherson, A. Inter-Organizational Learning and Strategic Renewal in SMEs: Extending the 4I Framework. Long Range Plan. 2006, 39, 155–175. [Google Scholar] [CrossRef]

- Liao, J.; Welsch, H.; Stoica, M. Organizational Absorptive Capacity and Responsiveness: An Empirical Investigation of Growth–Oriented SMEs. Entrep. Theory Pract. 2003, 28, 63–86. [Google Scholar] [CrossRef]

- Möller, K.; Svahn, S. Role of Knowledge in Value Creation in Business Nets. J. Manag. Stud. 2006, 43, 985–1007. [Google Scholar] [CrossRef]

- Zahra, S.A.; Covin, J.G. Contextual influences on the corporate entrepreneurship-performance relationship: A longitudinal analysis. J. Bus. Ventur. 1995, 10, 43–58. [Google Scholar] [CrossRef]

- Covin, J.G.; Slevin, D.P. A Conceptual Model of Entrepreneurship as Firm Behavior. Entrep. Theory Pract. 1991, 16, 7–26. [Google Scholar] [CrossRef]

- Zahra, S.A.; Neubaum, D.O.; Huse, M. Entrepreneurship in Medium-Size Companies: Exploring the Effects of Ownership and Governance Systems. J. Manag. 2000, 26, 947–976. [Google Scholar] [CrossRef]

- Hamel, G.; Prahalad, C.K. Corporate imagination and expeditionary marketing. Harv. Bus. Rev. 1991, 69, 81–92. [Google Scholar] [PubMed]

- Hughes, M.; Morgan, R.E. Deconstructing the relationship between entrepreneurial orientation and business performance at the embryonic stage of firm growth. Ind. Mark. Manag. 2007, 36, 651–661. [Google Scholar] [CrossRef] [Green Version]

- Aragón-Correa, J.A.; Hurtado-Torres, N.; Sharma, S.; García-Morales, V.J. Environmental strategy and performance in small firms: A resource-based perspective. J. Environ. Manag. 2008, 86, 88–103. [Google Scholar] [CrossRef]

- González-Benito, J.; González-Benito, Ó. Environmental proactivity and business performance: An empirical analysis. Omega 2005, 33, 1–15. [Google Scholar] [CrossRef]

- Hamel, G. Leading the Revolution; Harvard Business School Press: Boston, MA, USA, 2000. [Google Scholar]

- Holt, D.T.; Rutherford, M.W. Corporate entrepreneurship: An empirical look at the innovativeness dimension and its antecedents. J. Organ. Chang. Manag. 2007, 20, 429–446. [Google Scholar]

- Kusunoki, K.; Nonaka, I.; Nagata, A. Organizational Capabilities in Product Development of Japanese Firms: A Conceptual Framework and Empirical Findings. Organ. Sci. 1998, 9, 699–718. [Google Scholar] [CrossRef]

- Hall, L.A.; Bagchi-Sen, S. A study of R&D, innovation, and business performance in the Canadian biotechnology industry. Technovation 2002, 22, 231–244. [Google Scholar]

- Hill, C.W.L.; Rothaermel, F.T. The Performance of Incumbent firms in the Face of Radical Technological Innovation. Acad. Manag. Rev. 2003, 28, 257–274. [Google Scholar] [CrossRef]

- Brüderl, J.; Preisendörfer, P. Fast-Growing Businesses. Int. J. Sociol. 2000, 30, 45–70. [Google Scholar] [CrossRef]

- Schibbye, T.; Verreynne, M.-L. Where and how do innovative firms find new business opportunities? An exploratory study of New Zealand firms. In The Emergence of Entrepreneurial Economics; Research on Technological Innovation, Management and Policy; Emerald Group Publishing Limited: Bingley, UK, 2005; Volume 9, pp. 141–163. [Google Scholar]

- Covin, J.G.; Miles, M.P. Strategic Use of Corporate Venturing. Entrep. Theory Pract. 2007, 31, 183–207. [Google Scholar] [CrossRef]

- Burgelman, R.A.; Doz, Y.L. The Power of Strategic Integration. MIT Sloan Manag. Rev. 2001, 42, 28–38. [Google Scholar]

- Mcgrath, R.G.; Venkataraman, S.; Macmillan, I.C. The advantage chain: Antecedents to rents from internal corporate ventures. J. Bus. Ventur. 1994, 9, 351–369. [Google Scholar] [CrossRef]

- Andries, P.; Debackere, K. Adaptation and Performance in New Businesses: Understanding the Moderating Effects of Independence and Industry. Small Bus. Econ. 2007, 29, 81–99. [Google Scholar] [CrossRef]

- Stoica, M.; Schindehutte, M. Understanding adaptation in small firms: Links to culture and performance. J. Dev. Entrep. 1999, 4, 1–18. [Google Scholar]

- Shu, C.; De Clercq, D.; Zhou, Y.; Liu, C. Government institutional support, entrepreneurial orientation, strategic renewal, and firm performance in transitional China. Int. J. Entrep. Behav. Res. 2019, 25, 433–456. [Google Scholar] [CrossRef]

- Burström, T.; Wilson, T.L. Exploring the relationship between flagship platform projects and intrapreneurial self-renewal activities: Managing intrapreneurial equivocality. J. Eng. Technol. Manag. 2015, 38, 37–52. [Google Scholar] [CrossRef]

- Antoncic, B. Impacts of diversification and corporate entrepreneurship strategy making on growth and profitability: A normative model. J. Enterp. Cult. 2006, 14, 49–63. [Google Scholar] [CrossRef]

- Kearney, C.; Morris, M.H. Strategic renewal as a mediator of environmental effects on public sector performance. Small Bus. Econ. 2015, 45, 425–445. [Google Scholar] [CrossRef]

- Callahan, J.L.; Molina, C. Fostering organizational performance: The role of learning and intrapreneurship. J. Eur. Ind. Train. 2009, 33, 388–400. [Google Scholar]

- Amankwah-Amoah, J.; Ottosson, J.; Sjögren, H. United we stand, divided we fall: Historical trajectory of strategic renewal activities at the Scandinavian Airlines System, 1946–2012. Bus. Hist. 2017, 59, 572–606. [Google Scholar] [CrossRef]

- Nooteboom, B.; Van Haverbeke, W.; Duysters, G.; Gilsing, V.; van den Oord, A. Optimal cognitive distance and absorptive capacity. Res. Policy 2007, 36, 1016–1034. [Google Scholar] [CrossRef] [Green Version]

- Menzel, H.C.; Aaltio, I.; Ulijn, J.M. On the way to creativity: Engineers as intrapreneurs in organizations. Technovation 2007, 27, 732–743. [Google Scholar] [CrossRef]

- Instituto Nacional de Estadística. Available online: https://www.ine.es/dyngs/IOE/es/operacion.htm?numinv=08024 (accessed on 20 May 2019).

- Leal-Rodríguez, A.L.; Roldán, J.L.; Ariza-Montes, J.A.; Leal-Millán, A. From potential absorptive capacity to innovation outcomes in project teams: The conditional mediating role of the realized absorptive capacity in a relational learning context. Int. J. Proj. Manag. 2014, 32, 894–907. [Google Scholar] [CrossRef]

- Nieto, M.; Quevedo, P. Absorptive capacity, technological opportunity, knowledge spillovers, and innovative effort. Technovation 2005, 25, 1141–1157. [Google Scholar] [CrossRef]

- Gilsing, V.; Nooteboom, B.; Vanhaverbeke, W.; Duysters, G.; van den Oord, A. Network embeddedness and the exploration of novel technologies: Technological distance, betweenness centrality and density. Res. Policy 2008, 37, 1717–1731. [Google Scholar] [CrossRef]

- Baer, M.; Frese, M. Innovation is not enough: Climates for initiative and psychological safety, process innovations, and firm performance. J. Organ. Behav. 2003, 24, 45–68. [Google Scholar] [CrossRef]

- Li, J.; Chen, J.; Fan, W. The equivalent extreme-value event and evaluation of the structural system reliability. Struct. Saf. 2007, 29, 112–131. [Google Scholar] [CrossRef]

- Armstrong, J.S.; Overton, T.S. Estimating Nonresponse Bias in Mail Surveys. J. Mark. Res. 1977, 14, 396–402. [Google Scholar] [CrossRef] [Green Version]

- Zahra, S.A. Environment, corporate entrepreneurship, and financial performance: A taxonomic approach. J. Bus. Ventur. 1993, 8, 319–340. [Google Scholar] [CrossRef]

- Murray, J.Y.; Kotabe, M. Sourcing strategies of U.S. service companies: A modified transaction–cost analysis. Strateg. Manag. J. 1999, 20, 791–809. [Google Scholar] [CrossRef]

- Choi, B.; Poon, S.K.; Davis, J.G. Effects of knowledge management strategy on organizational performance: A complementarity theory-based approach. Omega 2008, 36, 235–251. [Google Scholar] [CrossRef]

- Peteraf, M.A. The cornerstones of competitive advantage: A resource-based view. Strateg. Manag. J. 1993, 14, 179–191. [Google Scholar] [CrossRef]

- Erbaş, E. Organisational ambidexterity and industrial clockspeed theories in understanding dynamic managerial capabilities: A multiple case study. Int. J. Bus. Environ. 2018, 10, 174–190. [Google Scholar] [CrossRef]

- Gibson, C.B.; Birkinshaw, J. The Antecedents, Consequences, and Mediating Role of Organizational Ambidexterity. Acad. Manag. J. 2004, 47, 209–226. [Google Scholar] [Green Version]

- Bolívar-Ramos, M.T.; García-Morales, V.J.; Martín-Rojas, R. The effects of Information Technology on absorptive capacity and organisational performance. Technol. Anal. Strateg. Manag. 2013, 25, 905–922. [Google Scholar] [CrossRef]

| Geographical Allocation | Spain | ||

|---|---|---|---|

| Sector | Chemical | Automotive | Total |

| Sample size | 689 | 275 | 964 |

| Response size (response rate) | 121 (17.56%) | 47 (17.01%) | 168 (17.43%) |

| Firm characteristics | Small | Medium | Large |

| Number of employees | 56.8 % | 27.8% | 15.4% |

| Turnover | 56.4% | 26.9% | 16.7% |

| Methodology | Questionnaire | ||

| Respondents | Chief Executive Officer (President or Chief Executive) | ||

| Sample error | 3.47% | ||

| Confidence level (for sampling error estimation) | z = 1.96; 95%, p-q = 0.50 | ||

| Items | Initial Scale | Final Scale | ||||

|---|---|---|---|---|---|---|

| Loadings (λ) * | Individual Reliability | Loadings (λ) * | Individual Reliability | Std. Errors | Composite Reliability/Extracted Variance | |

| Potential absorptive capacity | 0.907/0.504 | |||||

| Interaction (A21) | 0.74 *** (25.24) | 0.54 | 0.75 *** (23.86) | 0.57 | 0.43 | |

| Trust (A22) | 0.81 *** (27.20) | 0.65 | 0.83 *** (25.80) | 0.68 | 0.32 | |

| Respect (A23) | 0.80 *** (27.23) | 0.64 | 0.81 *** (25.45) | 0.65 | 0.35 | |

| Friendship (A24) | 0.51 *** (18.04) | 0.26 | Eliminated | |||

| Reciprocity (A25) | 0.88 *** (29.44) | 0.77 | 0.85 *** (26.66) | 0.73 | 0.27 | |

| Common language (A51) | 0.71 *** (24.58) | 0.51 | 0.71 *** (22.70) | 0.50 | 0.50 | |

| Complementarity (A52) | 0.74 *** (25.60) | 0.51 | 0.74 *** (23.66) | 0.55 | 0.45 | |

| Similarity (A53) | 0.46 *** (16.32) | 0.21 | Eliminated | |||

| Cultural compatibility A(54) | 0.64 *** (22.35) | 0.41 | 0.62 *** (20.08) | 0.38 | 0.62 | |

| Managerial compatibility (A55) | 0.63 *** (21.84) | 0.39 | 0.59 *** (19.32) | 0.36 | 0.65 | |

| Realized absorptive capacity | 0.893/0.546 | |||||

| Communication (A81) | 0.53 *** (18.47) | 0.28 | Eliminated | |||

| Meetings (A82) | 0.79 *** (26.15) | 0.62 | 0.80 *** (24.65) | 0.63 | 0.37 | |

| Documents (A83) | 0.59 *** (20.19) | 0.35 | 0.59 *** (19.18) | 0.35 | 0.65 | |

| Transmission (A84) | 0.77 *** (25.81) | 0.60 | 0.80 *** (24.83) | 0.64 | 0.36 | |

| Time (A85) | 0.78 *** (25.82) | 0.60 | 0.78 *** (24.48) | 0.61 | 0.39 | |

| Flows (A86) | 0.79 *** (26.18) | 0.62 | 0.80 *** (25.02) | 0.64 | 0.36 | |

| Responsibility (A101) | 0.62 *** (21.38) | 0.39 | 0.62 *** (19.98) | 0.38 | 0.62 | |

| Application (A102) | 0.79 *** (26.02) | 0.62 | 0.75 *** (23.82) | 0.57 | 0.43 | |

| Proactiveness | 0.878/0.591 | |||||

| New products (B11) | 0.81 *** (26.96) | 0.65 | 0.79 *** (25.72) | 0.63 | 0.37 | |

| Competitive approach (B12) | 0.84 *** (27.67) | 0.70 | 0.82 *** (26.28) | 0.67 | 0.32 | |

| Risk acceptance (B13) | 0.68 *** (23.88) | 0.46 | 0.69 *** (23.15) | 0.47 | 0.53 | |

| Daring attitude (B14) | 0.73 *** (25.35) | 0.54 | 0.75 *** (24.71) | 0.57 | 0.43 | |

| Proactiveness under uncertainty (B15) | 0.77 *** (26.04) | 0.59 | 0.78 *** (25.37) | 0.61 | 0.39 | |

| Innovativeness | 0.926/0.611 | |||||

| New products (B31) | 0.81 *** (31.48) | 0.65 | 0.82 *** (30.11) | 0.68 | 0.32 | |

| New product pace (B32) | 0.81 *** (31.54) | 0.66 | 0.82 *** (29.95) | 0.67 | 0.33 | |

| R&D investment (B33) | 0.75 *** (29.35) | 0.56 | 0.77 *** (28.29) | 0.59 | 0.41 | |

| Incremental new products (B34) | 0.76 *** (29.94) | 0.57 | 0.76 *** (28.04) | 0.57 | 0.43 | |

| Radical new products (B35) | 0.70 *** (27.73) | 0.48 | 0.71 *** (26.70) | 0.51 | 0.49 | |

| New technology investment (B36) | 0.74 *** (29.08) | 0.55 | 0.76 *** (28.09) | 0.58 | 0.42 | |

| Own technologies (B37) | 0.74 *** (29.01) | 0.54 | 0.76 *** (28.10) | 0.58 | 0.42 | |

| New technology adoption (B38) | 0.55 *** (22.34) | 0.30 | Eliminated | |||

| Technological innovation importance (B39) | 0.83 *** (32.39) | 0.69 | 0.84 *** (30.82) | 0.71 | 0.29 | |

| Self-renewal | 0.894/0.550 | |||||

| Mission (B41) | 0.75 *** (27.68) | 0.56 | 0.75 *** (26.53) | 0.56 | 0.44 | |

| Business concept (B42) | 0.61 *** (23.16) | 0.37 | 0.62 *** (22.88) | 0.39 | 0.61 | |

| Industry redefinition (B43) | 0.60 *** (22.99) | 0.36 | 0.61 *** (22.44) | 0.37 | 0.63 | |

| New organization (B44) | 0.81 *** (29.56) | 0.66 | 0.81 *** (28.49) | 0.66 | 0.34 | |

| Unit coordination (B45) | 0.85 *** (30.45) | 0.72 | 0.84 *** (29.29) | 0.71 | 0.29 | |

| Unit autonomy (B46) | 0.78 *** (28.63) | 0.61 | 0.77 *** (27.40) | 0.60 | 0.40 | |

| Flexible organization (B47) | 0.75 *** (27.77) | 0.57 | 0.75 *** (26.79) | 0.57 | 0.43 | |

| New business venturing | 0.860/0.607 | |||||

| New customers (B51) | 0.54 *** (19.61) | 0.29 | Eliminated | |||

| New business lines (B52) | 0.80 *** (26.34) | 0.64 | 0.79 *** (23.68) | 0.62 | 0.38 | |

| Related new business (B53) | 0.74 *** (25.16) | 0.55 | 0.73 *** (22.90) | 0.54 | 0.46 | |

| New market niches (B54) | 0.78 *** (26.00) | 0.61 | 0.78 *** (23.87) | 0.61 | 0.39 | |

| New business based on innovative products (B55) | 0.80 *** (26.49) | 0.65 | 0.81 *** (24.38) | 0.66 | 0.34 | |

| Performance | 0.852/0.542 | |||||

| ROA (I1) | 0.63 *** (16.74) | 0.39 | 0.62 *** (16.00) | 0.38 | 0.62 | |

| ROE (I2) | 0.64 *** (17.29) | 0.41 | 0.61 *** (15.59) | 0.37 | 0.63 | |

| Return on sales (I3) | 0.68 *** (18.34) | 0.47 | 0.66 *** (16.60) | 0.44 | 0.56 | |

| Market share (I4) | 0.91 *** (24.43) | 0.83 | 0.92 *** (22.89) | 0.85 | 0.15 | |

| Sales increase (I5) | 0.79 *** (21.72) | 0.62 | 0.82 *** (20.89) | 0.67 | 0.33 | |

| Scale Values | |

|---|---|

| Absolute Fit Measures | Final Model |

| Non-centrality parameter (NCP) | 1382.90 |

| Goodness of fit index (GFI) | 0.95 |

| Root mean square residual (RMSR) | 0.085 |

| Expected cross-validation index (ECVI) | 17.66 |

| Incremental fit measures | |

| Adjusted goodness of fit index (AGFI) | 0.94 |

| Normed fit index (NFI) | 0.94 |

| Non-normed fit index (NNFI) | 0.99 |

| Comparative fit index (CFI) | 0.99 |

| Incremental fit index (IFI) | 0.99 |

| Relative fit index (RFI) | 0.93 |

| Parsimony fit measures | |

| Normed chi-square | 2.55 |

| Parsimony goodness of fit index (PGFI) | 0.85 |

| Parsimony normed fit index (PNFI) | 0.88 |

| Akaike information criterion (AIC) Model | 2472.90 |

| Indep var | Dependent Variables | |||||

|---|---|---|---|---|---|---|

| Innov η1 | Pot abs cap η2 | Rea abs cap η3 | New Bus vent η4 | Self-Renew η5 | Perform η6 | |

| Innov η1 | (H5) β21: 0.058 ** (2.72) | (H6) β31: 0.41 *** (11.33) | (H10) β61: 0.036 (0.59) | |||

| Proactiv ξ1 | (H1) γ11: 0.69 *** (23.22) | (H3) γ21: 0.40 *** (8.16) | (H4) γ31: 0.34 *** (10.04) | (H9) γ61: 0.56 *** (8.94) | ||

| Pot abs cap η2 | (H2) β32: 0.21 *** (7.73) | |||||

| Rea abs cap η3 | (H7) β43: 0.82 *** (13.84) | (H8) β53: 0.86 *** (16.16) | ||||

| New bus vent η4 | (H11) β64: 0.30*** (4.09) | |||||

| Self-renew η5 | (H12) β65: −0.32 *** (−4.10) | |||||

| Reliability (R2) | 0.47 | 0.27 | 0.67 | 0.68 | 0.73 | 0.38 |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Jiménez-Barrionuevo, M.ª.M.; Molina, L.M.; García-Morales, V.J. Combined Influence of Absorptive Capacity and Corporate Entrepreneurship on Performance. Sustainability 2019, 11, 3034. https://doi.org/10.3390/su11113034

Jiménez-Barrionuevo MªM, Molina LM, García-Morales VJ. Combined Influence of Absorptive Capacity and Corporate Entrepreneurship on Performance. Sustainability. 2019; 11(11):3034. https://doi.org/10.3390/su11113034

Chicago/Turabian StyleJiménez-Barrionuevo, M.ª Magdalena, Luis M. Molina, and Víctor J. García-Morales. 2019. "Combined Influence of Absorptive Capacity and Corporate Entrepreneurship on Performance" Sustainability 11, no. 11: 3034. https://doi.org/10.3390/su11113034