Incentive Mechanism for Sustainable Improvement in a Supply Chain

Abstract

:1. Introduction

2. Literature Review

3. Model Formulation

4. Supply Chain Models

4.1. Case FI: Benchmark

4.2. Case W: Wholesale Price Contract

4.3. Case Q: Quantity Incentive Contract

5. Numerical Experiment and Managerial Insights

- ■

- Case FI, the centralized supply chain model, shows higher environmental quality performance, , than the decentralized models, Case W and Case Q. In particular, this environmental quality performance is more than three times the value of in the basic decentralized model of Case W. To achieve such a level of environmental quality, the investment required is 61,250 in Case FI, which is 12 times more than 5000 in Case W. The market and profit performance in Case FI are then = 2550 and = 117,250, nearly double the DW = 1300 and = 8600 of Case W. However, we need to note that Case FI represents the ideal first-best situation, in which all processes of the supply chain players are integrated without costs and moral hazards. In practice, it is probably impossible to induce 10-times higher investment in environmental quality and achieve such a benchmark performance. Nevertheless, practicing managers need to find a way to approach first-best performance by considering a mechanism to effectively and efficiently control supply chain members, such as through the quantity incentive contract investigated in this study.

- ■

- In Case Q, the OEM offers the quantity incentive contract to the CM with the quantity incentive factor , which pays more the unit wholesale price of 0.0063 per unit sold, i.e., . Since the resulting demand in Case Q is D, the OEM prices the CM’s green product higher than in Case W, i.e., , while . Then, we can observe that the OEM pays almost twice the transfer payment to the CM in Case Q compared to Case W, i.e., , while . Therefore, if the OEM offers the quantity incentive contract to the CM, the excessive transfer payment may cause profit loss for the OEM, and hence the OEM needs to carefully assess the total effect of the incentive offerings on its profit.

- ■

- In this example, the quantity incentive in Case Q facilitates a high level of environmental quality, ; this is 2.2 times higher than in Case W. This higher environmental quality affects consumers’ buying behavior, leading to market performance of in Case Q, 1.5 times improvement compared to in Case W.

- ■

- Comparing the profit performance of Case W and Case Q reveals that the profit performance of the OEM, the CM, and the entire supply chain all increase by the quantity incentive offer, i.e., , , and . We need to note that the OEM’s profit also increases in Case Q even with an incentive offer which leads to an excessive transfer payment compared to Case W. This provides an important implication for the supply chain managers who fear the profit loss due to the incentive offer. In the next section, we will conduct sensitivity analyses to reveal the conditions under which the quantity incentive contract can better increase overall profit performance in a supply chain.

- ■

- In this basic numerical example, we observe that the OEM’s profit increases from 65,000 to 72,000 due to the adoption of the quantity incentive contract, and hence that . We also see that the CM’s profit increases from 21,000 to 36,600, and . Although the player who benefits more here will be the CM, as we can see in the example, we need to note that the OEM can also expect a significant, not marginal, profit improvement through the quantity incentive offering.

- ■

- In Case W, the OEM needs to bear a lower profit share when it adopts the quantity incentive contract, i.e., , while the CM’s profit share increases, i.e., . However, we need to note that the OEM’s profit itself increases from 65,000 to 72,000. The OEM thus needs to expand its viewpoint, abandoning a myopic view that only insists on its own profit share in the supply chain.

- ■

- By adopting the quantity incentive in Case Q, the overall supply chain can be more efficiently managed, which can lead to a 19.45% enhancement of contract efficiency, i.e., , while increasing the entire supply chain’s profit by IR = 26.51%.

6. Sensitivity Analysis

- ■

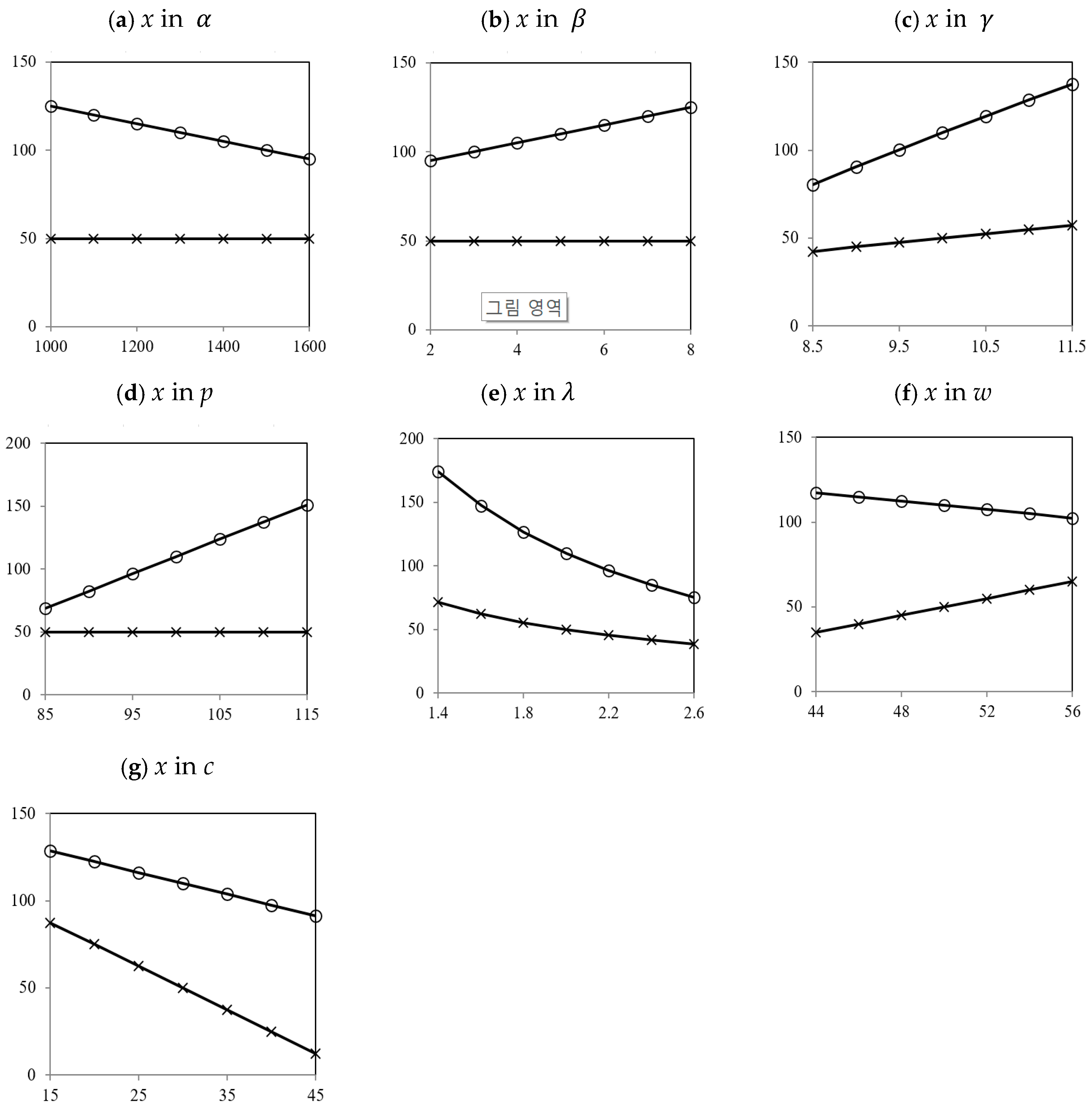

- In the figure, we observe that the quantity incentive contract in Case Q always yields better environmental quality performance than the basic wholesale price contract in Case W, under any internal and/or external business conditions. Therefore, the OEM needs to consider the quantity incentive contract to enhance the supply chain’s sustainable development and properly respond to climate change.

- ■

- ■

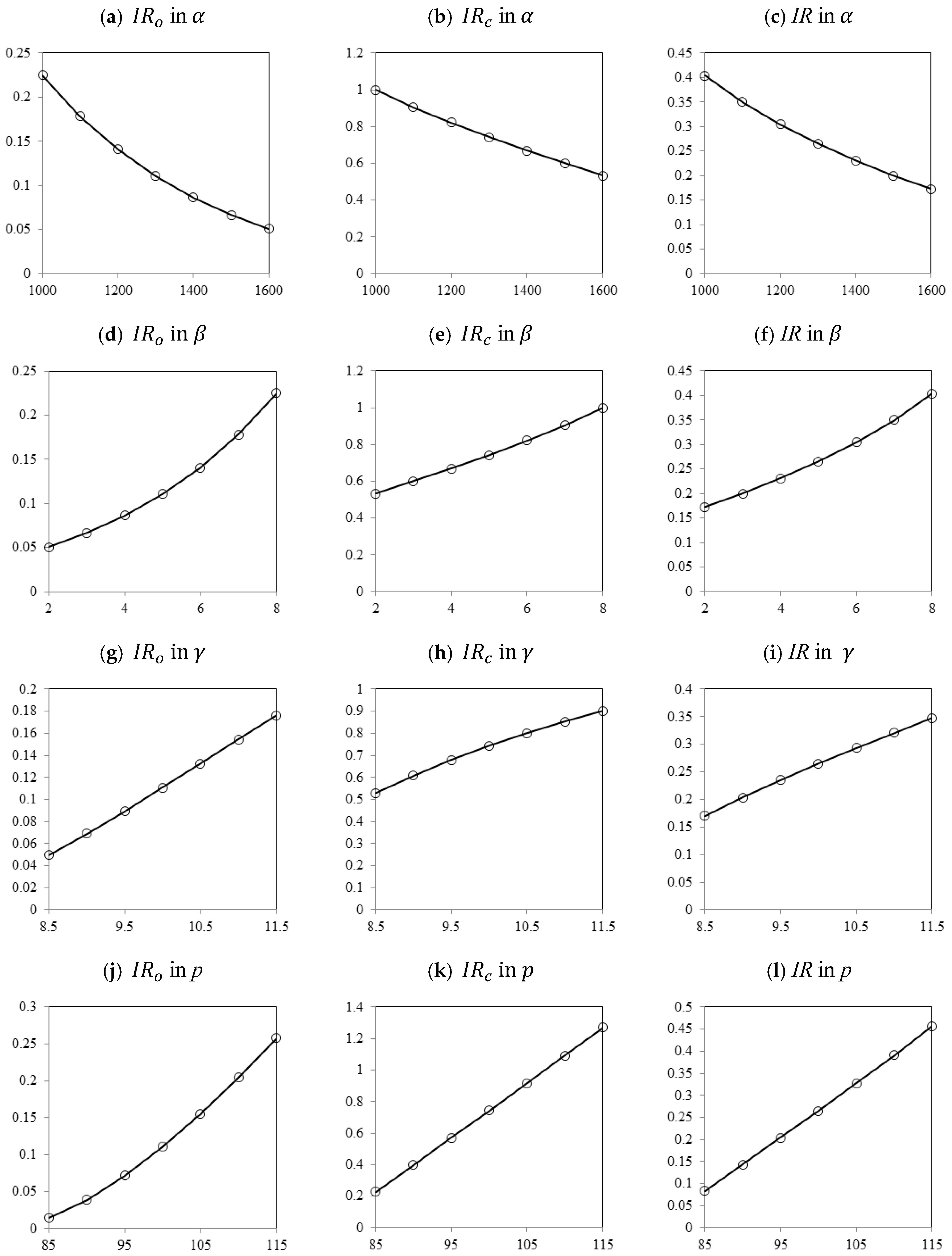

- The profit improvement ratios of the OEM, the CM, and the supply chain ( , and IR) always show results greater than 0. Since the profit improvement ratios are defined as , , and , they indicate that the quantity incentive contract in Case Q always yields better profit performance in any external and internal business environment compared to the basic wholesale price contract of Case W. That is, it is always guaranteed that , and in these sensitivity analyses.

- ■

- In any external or internal environment change, the change directions of , and IR are the same, as we can see in Figure 2 and Figure 3. This means that there is no choice problem for the OEM, whether depriving the profits of the CM and the entire supply chain for its own benefit or giving up its own profit for the long-term health of the entire supply chain. Both the OEM and the CM, as well as the whole supply chain, can have the motivation to adopt the quantity incentive contract voluntarily.

- ■

- As similarly shown in Table 1, the effect of profit improvement is higher for the CM than for the OEM.

- ■

- ■

- Comparing the conditions in Table 2 and Table 3 and also the equilibrium behaviors with respect to the parameter changes in Figure 1, Figure 2 and Figure 3, we observe that the direction of change of the environmental quality and profit improvement ratios is the same in all cases except under one condition regarding production cost change. This reveals that investment in the sustainable development to improve environmental performance does not harm the profits of the entire supply chain or of individual players in most cases; however, there should be a careful, systematic assessment about the internal and external business conditions and their total impact on the supply chain’s overall performance.

7. Concluding Remarks

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- Quinn, J.B.; Hilmer, F.G. Strategic outsourcing. McKinsey Q. 1995, 1, 48–70. [Google Scholar]

- Lacity, M.C.; Willcocks, L.P. Global Information Technology Outsourcing: In Search of Business Advantage; Wiley: London, UK, 2001; 368p. [Google Scholar]

- Yoo, S.H.; Cheong, T. Quality improvement incentive strategies in a supply chain. Transp. Res. Part E. 2018, 114, 331–342. [Google Scholar] [CrossRef]

- Kaya, M.; Özer, Ö. Quality risk in outsourcing: Noncontractible product quality and private quality cost information. Naval Res. Logist. 2009, 56, 669–685. [Google Scholar] [CrossRef]

- Xie, G.; Yue, W.; Wang, S.; Lai, K.K. Quality investment and price decision in a risk-averse supply chain. Eur. J. Oper. Res. 2011, 214, 403–410. [Google Scholar] [CrossRef]

- Xie, G.; Yue, W.; Wang, S. Quality improvement policies in a supply chain with Stackelberg games. J. Appl. Math. 2014, 1–9. [Google Scholar] [CrossRef]

- Back, A.; Lee, J.-A.; Kok, C. Analysts Expect iPad to Give Lift to Asian Suppliers. The Wall Street Journal. 29 January 2010. Available online: http://www.wsj.com/articles/SB10001424052748704878904575030633950504718 (accessed on 22 November 2018).

- Choi, S.-J. Cosmetics Makers Advance to Global Markets on ‘K-Beauty’ Boom. KoreaTimes. 16 October 2016. Available online: https://www.koreatimes.co.kr/www/news/biz/2016/10/123_216150.html (accessed on 10 December 2018).

- Yuan, B.; Gu, B.; Guo, J.; Xia, L.; Xu, C. The optimal decisions for a sustainable supply chain with carbon information asymmetry under cap-and-trade. Sustainability 2018, 10, 1002. [Google Scholar] [CrossRef]

- Reeves, R. On a (Leftish) wing and a prayer? Religion is a dirty word in British politics but a faith system that emphasised social good might be better than today’s uncritical worship of the market. Eur. J. Oper. Res. 2015, 242, 1017–1027. [Google Scholar]

- Yu, Y.; Han, X.; Hu, G. Optimal production for manufacturers considering consumer environmental awareness and green subsidies. Int. J. Prod. Econ. 2016, 182, 397–408. [Google Scholar] [CrossRef] [Green Version]

- Chen, J.; Hu, Q.; Song, J.S.J. Contract Types and Supplier Incentives for Quality Improvement. Available online: https://papers.ssrn.com/soL3/papers.cfm?abstract_id=2608772 (accessed on 26 June 2019).

- Toptal, A.; Özlü, H.; Konur, D. Joint decisions on inventory replenishment and emission reduction investment under different emission regulations. Int. J. Prod. Res. 2014, 52, 243–269. [Google Scholar] [CrossRef]

- Yalabik, B.; Fairchild, R.J. Customer, regulatory, and competitive pressure as drivers of environmental innovation. Int. J. Prod. Econ. 2011, 131, 519–527. [Google Scholar] [CrossRef]

- Marufuzzaman, M.; Ekşioğlu, S.D.; Hernandez, R. Environmentally friendly supply chain planning and design for biodiesel production via wastewater sludge. Transp. Sci. 2014, 48, 555–574. [Google Scholar] [CrossRef]

- Bertarelli, S.; Lodi, C. Heterogeneous firms, exports and Pigouvian pollution tax: Does the abatement technology matter? J. Clean. Prod. 2019, 228, 1099–1110. [Google Scholar] [CrossRef]

- Liu, Z.L.; Anderson, T.D.; Cruz, J.M. Consumer environmental awareness and competition in two-stage supply chains. Eur. J. Oper. Res. 2012, 218, 602–613. [Google Scholar] [CrossRef]

- Luo, Z.; Chen, X.; Wang, X. The role of co-opetition in low carbon manufacturing. Eur. J. Oper. Res. 2016, 253, 392–403. [Google Scholar] [CrossRef] [Green Version]

- Zhu, W.; He, Y. Green product design in supply chains under competition. Eur. J. Oper. Res. 2017, 258, 165–180. [Google Scholar] [CrossRef]

- Klassen, R.; Vachon, S. Collaboration and evaluation in the supply chain: The impact on plant-level environmental investment. Prod. Oper. Manag. 2003, 12, 336–352. [Google Scholar] [CrossRef]

- Green, K.W., Jr.; Zelbst, P.; Bhadauria, V.; Meacham, J. Do environmental collaboration and monitoring enhance organizational performance? Ind. Manag. Data Syst. 2012, 112, 186–205. [Google Scholar] [CrossRef]

- Ji, J.; Zhang, Z.; Yang, L. Comparisons of initial carbon allowance allocation rules in an O2O retail supply chain with the cap-and-trade regulation. Int. J. Prod. Econ. 2017, 187, 68–84. [Google Scholar] [CrossRef]

- Chen, X.; Wang, X.; Zhou, M. Firms’ green R&D cooperation behavior in a supply chain: Technological spillover, power and coordination. Int. J. Prod. Econ. 2019, 218, 118–134. [Google Scholar]

- Ghosh, D.; Shah, J.A. Comparative analysis of greening policies across supply chain structures. Int. J. Prod. Econ. 2012, 135, 568–583. [Google Scholar] [CrossRef]

- Xu, X.; He, P.; Xu, H.; Zhang, Q. Supply chain coordination with green technology under cap-and-trade regulation. Int. J. Prod. Econ. 2017, 183, 433–442. [Google Scholar] [CrossRef]

- Shi, X.; Chan, H.L.; Dong, C. Value of bargaining contract in a supply chain system with sustainability investment: An incentive analysis. IEEE Trans. Syst. Manag. Cybern. 2018, 9, 1–13. [Google Scholar] [CrossRef]

- Starbird, S.A. Penalties, rewards, and inspection: Provisions for quality in supply chain contracts. J. Oper. Res. Soc. 2001, 52, 109–115. [Google Scholar] [CrossRef]

- Baake, P.; von Schlippenbach, V. Quality distortions in vertical relations. J. Econ. 2011, 103, 149–169. [Google Scholar] [CrossRef] [Green Version]

- Schmitz, P.W. Allocating control in agency problems with limited liability and sequential hidden actions. RAND J. Econ. 2005, 36, 318–336. [Google Scholar]

- Karmarkar, U.S.; Pitbladdo, R.C. Quality, class, and competition. Manag. Sci. 1997, 43, 27–39. [Google Scholar] [CrossRef]

- Banker, R.D.; Khosla, I.; Sinha, K.K. Quality and competition. Manag. Sci. 1998, 44, 1179–1192. [Google Scholar] [CrossRef]

- Zhang, L.; Zhou, H.; Liu, Y.; Lu, R. Optimal environmental quality and price with consumer environmental awareness and retailer’s fairness concerns in supply chain. J. Clean. Prod. 2019, 213, 1063–1079. [Google Scholar] [CrossRef]

- Cachon, G.P. Supply chain coordination with contracts. In Handbooks in Operations Research and Management Science—Supply Chain Management: Design, Coordination and Operation; De Kok, A.G., Graves, S.C., Eds.; Elsevier: Amsterdam, The Netherlands, 2003; Volume 99, pp. 229–340. [Google Scholar]

| Benchmark | Basic | Incentive | ||

|---|---|---|---|---|

| Case FI | Case W | Case Q | ||

| Contract | w | - | 50 | 50 |

| - | - | 0.0063 | ||

| T | - | 65,000 | 117,800 | |

| Environmental performance | 175 | 50 | 110 | |

| 61,250 | 5000 | 24,200 | ||

| Market performance | D | 2550 | 1300 | 1900 |

| Profit performance | 117,250 | 65,000 | 72,200 | |

| - | 21,000 | 36,600 | ||

| 117,250 | 86,000 | 108,800 | ||

| Contract efficiency | Eff | 1.0000 | 0.7335 | 0.9279 |

| Profit share | 1.0000 | 0.7558 | 0.6636 | |

| - | 0.2442 | 0.3364 | ||

| Profit improvement ratio | - | - | 0.1108 | |

| - | - | 0.7429 | ||

| IR | - | - | 0.2651 |

| External Environment | Internal Environment |

|---|---|

|

|

| External Environment | Internal Environment |

|---|---|

|

|

| External Environment | Internal Environment |

|---|---|

|

|

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Jeong, E.; Park, G.; Yoo, S.H. Incentive Mechanism for Sustainable Improvement in a Supply Chain. Sustainability 2019, 11, 3508. https://doi.org/10.3390/su11133508

Jeong E, Park G, Yoo SH. Incentive Mechanism for Sustainable Improvement in a Supply Chain. Sustainability. 2019; 11(13):3508. https://doi.org/10.3390/su11133508

Chicago/Turabian StyleJeong, EuiBeom, GeunWan Park, and Seung Ho Yoo. 2019. "Incentive Mechanism for Sustainable Improvement in a Supply Chain" Sustainability 11, no. 13: 3508. https://doi.org/10.3390/su11133508

APA StyleJeong, E., Park, G., & Yoo, S. H. (2019). Incentive Mechanism for Sustainable Improvement in a Supply Chain. Sustainability, 11(13), 3508. https://doi.org/10.3390/su11133508