2.1. Developing a Policy Framework for Prefabrication

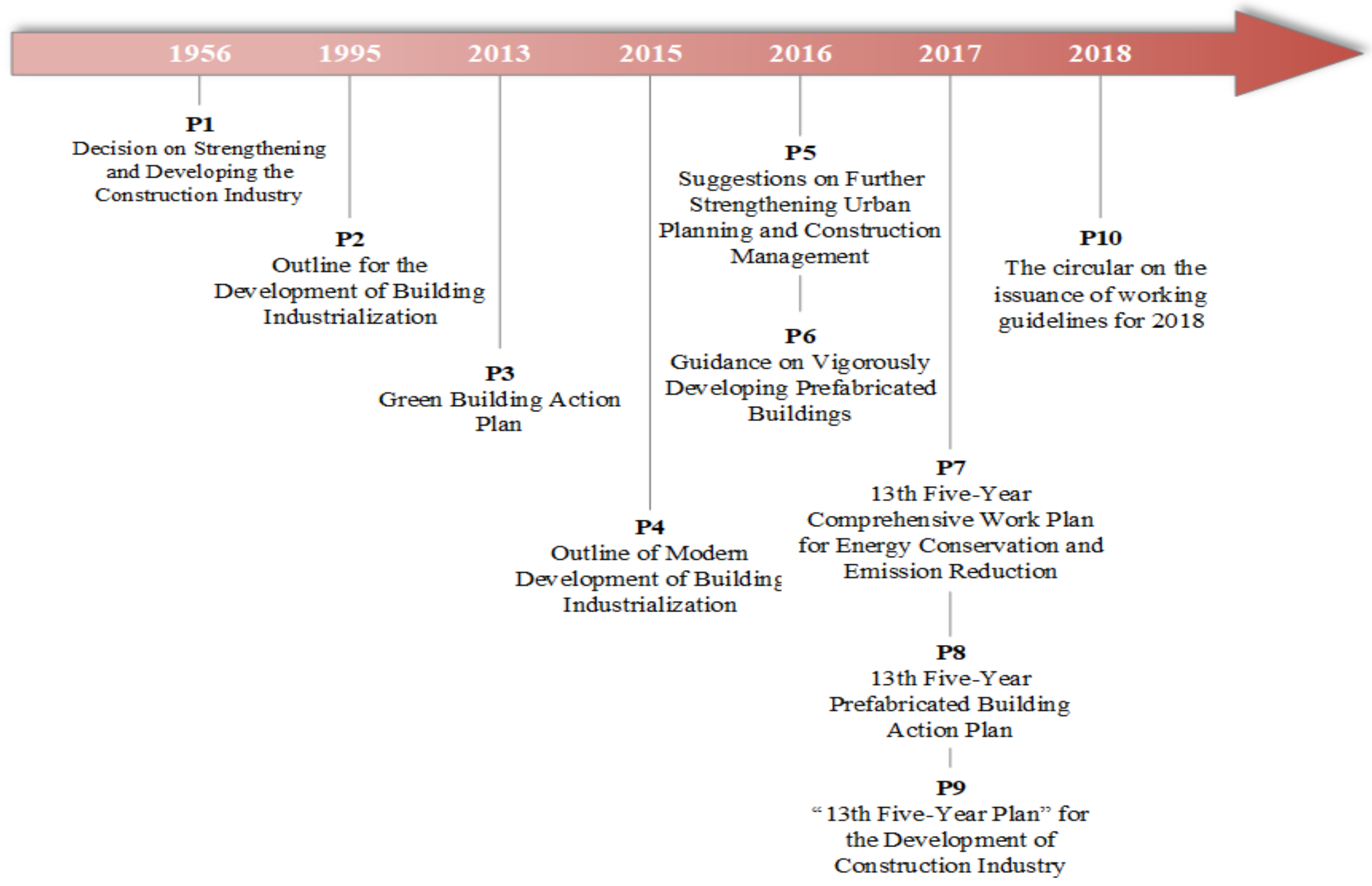

In recent decades, there have been a series of policies enacted by the Chinese government, involving both central and local government departments. In this section, the major policy documents related to prefabrication development selected are issued by the central government with normative validity, all of which are formed into a policy framework (see

Figure 1).

P1: Decision on Strengthening and Developing the Construction Industry [

14]

In May 1956, the General Office of the State Council, PRC, made decision on the transition from conventional construction to building industrialization. Prefabrication, as one aspect promoting building industrialization, began to be developed in China.

P2: Outline for the Development of Building Industrialization [

15]

In 1995, the government issued the “Outline for the Development of Building Industrialization”, which proposed the basic contents of building industrialization, including reducing manual work, adopting advanced technics, developing uniform building modules and standards, etc., prefabrication obtained further development.

P3: Green Building Action Plan [

16]

In January 2013, the policy was enacted to popularize prefabricated concrete, steel structures and other building systems suitable for industrial production, accelerate the development of assembled technologies for construction projects, and improve the integration level of building industrialization technologies.

P4: Outline of Modern Development of Building Industrialization [

17]

In November 2015, the first development planning was put forward by the Ministry of Housing and Urban-Rural Development, namely, that prefabricated building area will account for more than 20% of new building areas by 2020, and more than 50% by 2025.

P5: Suggestions on Further Strengthening Urban Planning and Construction Management [

18]

In February 2016, the government proposed the development of a new construction mode, namely, prefabrication, so as to reduce construction waste and dust pollution, shorten the construction time, and improve the quality of buildings. In addition, it is also important to strengthen policy support, so as to achieve the target that prefabricated building areas will account for 30% of new building areas within 10 years.

P6: Guidance on Vigorously Developing Prefabricated Buildings [

19]

In September 2016, the government proposed the development of prefabrication according to local conditions. Specifically, the promotion cities were divided into three promotion areas, namely primary promotion area, positive promotion area and encouraging promotion area (see

Section 2).

P7: 13th Five-Year Comprehensive Work Plan for Energy Conservation and Emission Reduction [

20]

This policy was issued in January 2017, the main content regarding prefabrication is to promote the combination of green construction methods and prefabricated construction methods, so as to achieve the goal that urban green building floor areas will account for 50% of new building floor areas by 2020.

P8: 13th Five-Year Prefabricated Building Action Plan [

21]

In March 2017, the government set the definite targets for three promotion areas: by 2020, prefabricated building area will account for more than 15% of new building area nationwide, including more than 20% in the primary promotion area, more than 15% in the positive promotion area, and more than 10% in the encouraging promotion area. Meanwhile, China will cultivate more than 50 prefabricated building demonstration cities, more than 200 prefabricated building industrial bases, more than 500 prefabricated building demonstration projects, and more than 30 prefabricated building science and technology innovation bases. There are requirements for the construction industry from ten aspects, such as development plan, technical system, standard system, design capacity, industry support, full decoration, green development, projects safety and quality, and industrial team.

P9: “13th Five-Year Plan” for the Development of Construction Industry [

22]

This policy was issued in April 2017, the main contents were to develop steel and timber structures, including guiding new public buildings to give priority to steel structures, encouraging the use of modern timber structures in scenic spots and rural buildings.

P10: The circular on the issuance of working guidelines for 2018 [

23]

This policy was issued in March 2018. The main contents with respect to prefabrication involve actively exploring and promoting the application of building information modeling (BIM) technology throughout the whole process of prefabricating buildings, and the innovation of the building engineering management system.

In an overview of the aforementioned policies, the first policy on developing building industrialization was enacted in 1956 by the Chinese government, but specific targets were still lacking. It was not until 2015 that developing prefabrication was considered to be a priority in the development of building industrialization, and the government proposed its detailed development targets. Since then, all work has been carried out around these targets, such as the division of promotion areas (P6) and the formulation of phased action plans (P8). Although there have been policies promulgated by the central government, this plays a macro-control role. To develop prefabrication, specific plans should be made by local governments.

2.2. Coding Policies for Prefabrication

There are massive cities involved in the above three promotion areas, including municipal cities, autonomous regions and country-level cities. To reduce the workload of data processing, the cities chosen in this paper for policy analysis are representative of municipal level and autonomous regions. Due to the fact that policies are formulated according to local conditions, the cities selected for consideration in this paper cannot be from only one province. The total number of provinces (including autonomous regions) in China is 33; theoretically, all cities in these provinces should be taken into consideration. However, the workload for data processing will be enormous if all cities are incorporated into this research. Therefore, this research randomly selected a number of cities in different promotion areas. The specific number of cities is as follows: 15 cities in the primary promotion area; 20 cities in the positive promotion area; and 30 cities in the encouraging promotion area.

Given the large amount of analytical data, it is complex and difficult to conduct manual analysis. Therefore, using computerized tools to aid this research is an appropriate choice. NVvio software has been used as a content analysis tool in various studies, including for waste management [

24], building energy performance [

25], worksite safety [

26], and prefabricated construction management [

27]. In particular, its “Code” function enables users to deal with thousands of pieces of information. Therefore, this paper adopted NVivo software to conduct further analysis. For comprehensive analysis, the incentive policies were categorized into two detailed levels according to the nodes in NVivo: the first-level incentive policies involve 7 categories, namely, categories A~G (see

Table 1), while the second-level incentive policies consist of the subcategories of the above 7 categories of policies. The specific operating steps in NVivo are as follows:

First, the “Sources” (namely specific policy terms in this paper) were imported into NVivo, then analyzed with the help of the “Code” function. Furthermore, each term should be analyzed and then categorized into the corresponding node according to the same content; this process is called “coding” [

25]. For example, according to a term stating that projects with over 70% assembly rate in Beijing could be given a fund reward, a three-level node structure was generated. The third-level node was “Fund reward”, the second-level node was “Fund support”, and the first-level was “Primary promotion area”, because the city of Beijing belongs within the primary promotion area. In accordance with the aforesaid classification rules, the contents of each term can be categorized into the corresponding nodes.