Innovation, the Flying Geese Model, IPR Protection, and Sustainable Economic Development in China

Abstract

1. Introduction

2. Literature Review

2.1. The Flying Geese Model (FGM) and Sustainable Economic Development (SED) in China

2.2. Innovation Diffusion (ID) and SED in China

2.3. Intellectual Property Rights (IPR) Protection and SED in China

3. Research Design and Hypotheses Development

4. Empirical Findings

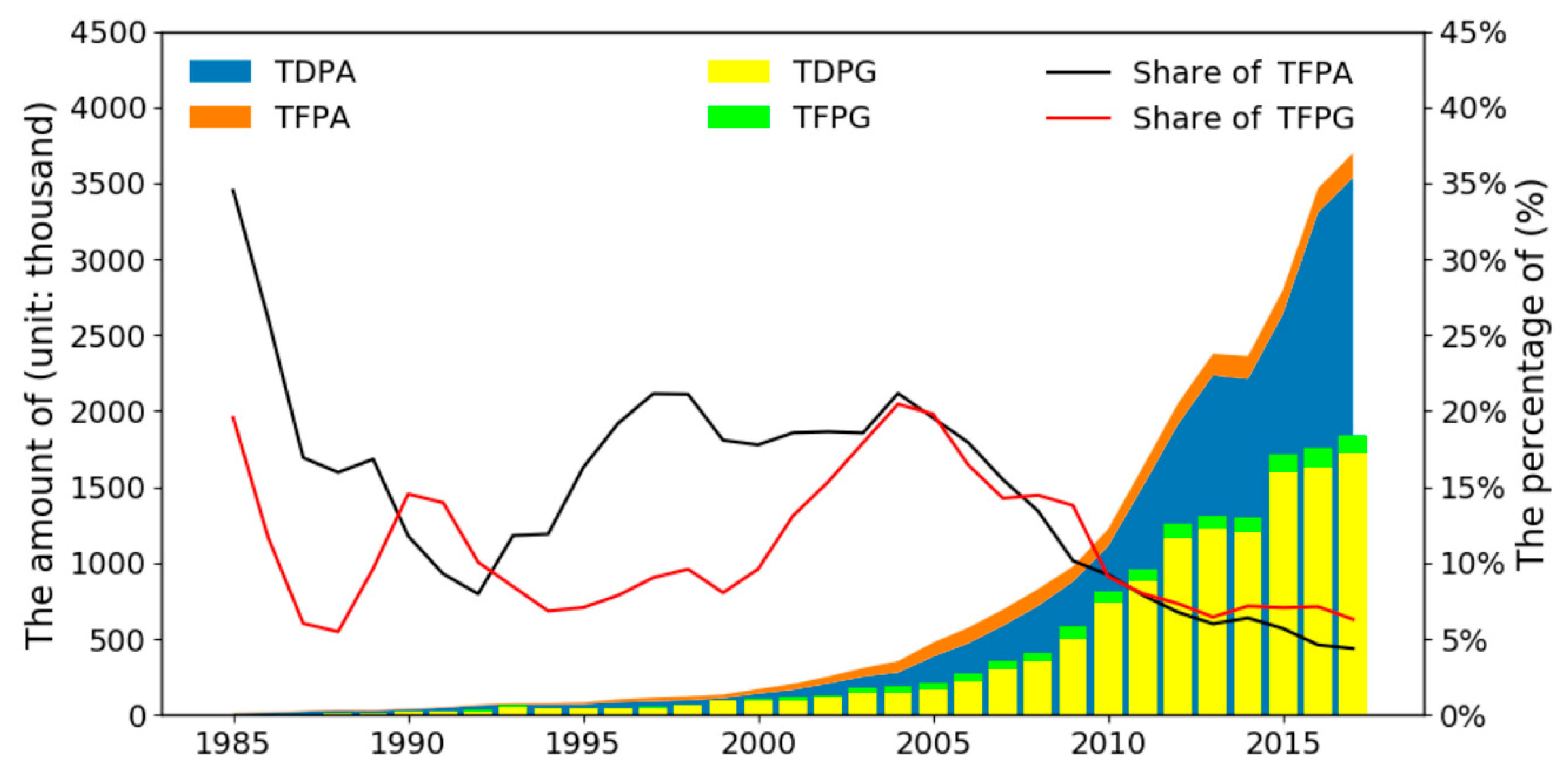

4.1. Descriptive Statistics

4.2. Regression Results

5. Discussion

5.1. Domestic Patents Facilitate China’s Sustainable Economic Development

5.2. FGM and Innovation Diffusion Facilitate China’s Sustainable Economic Development

5.3. IPR Protection Contributed to China’s Sustainable Economic Development

6. Conclusions and Implications

6.1. Contributions

6.2. Implications

6.3. Limitations and Future Research

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

Appendix A

| Abb. | Variable | Definition | Data Source |

|---|---|---|---|

| GDP | China’s GDP | Gross domestic product. | China Statistical Yearbook a |

| TPA | Total patent applications | Total number of patent applications: the accumulated number of applications of inventions, utility models, and industrial designs. | China National Intellectual Property Administration b |

| TDPA | Total domestic patent applications | Total number of domestic patent applications. | China National Intellectual Property Administration b |

| TFPA | Total foreign patent applications | Total number of foreign patent applications. | China National Intellectual Property Administration b |

| TPG | Total patent grants | Total number of patent grants: the accumulated number of grants of inventions, utility models, and industrial designs. | China National Intellectual Property Administration b |

| TDPG | Total domestic patent grants | Total number of domestic patent grants. | China National Intellectual Property Administration b |

| TFPG | Total foreign patent grants | Total number of foreign patent grants. | China National Intellectual Property Administration b |

| CPID | Closed patent infringement disputes | Total number of closed patent infringement disputes by the patent enforcement of the administrative authorities for patent affairs. | China National Intellectual Property Administration b |

| ITG | International trade of goods | Total value of imports and exports of goods. | China Statistical Yearbook a |

| ITS | International trade of services | Total value of imports and exports of services. | China Statistical Yearbook a |

| FDI | Foreign direct investment | Total amount of foreign direct investment. | China Statistical Yearbook a |

| POP | Population | Total number of people in Mainland China. | China Statistical Yearbook a |

| TEP | Total Employed Persons | Total number of employed persons. | China Statistical Yearbook a |

| NER | Nominal exchange rate | Nominal exchange rate, Yuan per US Dollar (period average). | Annual Statistics of The People’s Bank of China c |

| TE | Tertiary Education (%) | Net enrolment ratio of tertiary education for undergraduates in regular higher-education institutions (HEIs), including both normal courses and short-cycle courses. | Educational Statistics Yearbook of China d |

| R&D | R&D Expenditures (%) | Ratio of expenditures on research and development (R&D) to GDP. | China Statistical Yearbook a |

| M1 | M2 | M3 | M4 | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Coef. (SE) | p-Value | VIF | Coef. (SE) | p-Value | VIF | Coef. (SE) | p-Value | VIF | Coef. (SE) | p-Value | VIF | |

| (constant) | −4633 (1526.7) ** | 0.006 | −3679.7 (1931.6) + | 0.070 | −3894.4 (1386.8) * | 0.011 | −3619.7 (1977.8) + | 0.081 | ||||

| Innovation Factors | ||||||||||||

| Total patent applications | 0.84 (0.1) *** | 0.000 | 77.933 | |||||||||

| Total domestic patent applications | 0.75 (0.1) *** | 0.000 | 81.879 | |||||||||

| Total foreign patent applications | −5.39 (2.39) * | 0.035 | 160.486 | |||||||||

| Total patent grants | 1.13 (0.19) *** | 0.000 | 50.561 | |||||||||

| Total domestic patent grants | 1.16 (0.21) *** | 0.000 | 52.664 | |||||||||

| Total foreign patent grants unit | 0.14 (2.74) | 0.961 | 52.084 | |||||||||

| FGM Factors | ||||||||||||

| International trade of goods | 0.27 (0.1) * | 0.012 | 148.477 | 0.44 (0.12) *** | 0.001 | 138.895 | 0.43 (0.11) *** | 0.001 | 230.959 | 0.44 (0.12) ** | 0.002 | 143.216 |

| International trade of services | 2.62 (0.83) ** | 0.005 | 242.474 | 1.82 (1.11) | 0.115 | 275.686 | 1.89 (0.79) ** | 0.026 | 276.946 | 1.8 (1.13) | 0.126 | 275.985 |

| Foreign direct investment | 8.17 (2.15) *** | 0.001 | 50.972 | 7.93 (2.69) ** | 0.007 | 50.960 | 8.22 (1.91) *** | 0.000 | 50.977 | 8.1 (2.78) ** | 0.008 | 52.404 |

| IPR Protection Factors | ||||||||||||

| Closed patent infringement disputes | 31 (10.65) *** | 0.008 | 27.497 | 61.94 (11.07) *** | 0.000 | 18.979 | 31.84 (9.48) ** | 0.003 | 27.528 | 61.03 (11.57) *** | 0.000 | 19.921 |

| Control Variables | ||||||||||||

| Population | 5.33 (1.89) ** | 0.010 | 233.883 | 4.21 (2.4) + | 0.093 | 240.142 | 4.26 (1.73) * | 0.023 | 247.718 | 4.07 (2.48) | 0.116 | 246.322 |

| Total employed persons | −1.41 (1.14) | 0.228 | 63.160 | −1.02 (1.44) | 0.485 | 64.762 | −0.69 (1.05) | 0.516 | 67.832 | −0.81 (1.58) | 0.613 | 74.911 |

| Nominal exchange rate | −99.79 (33.04) ** | 0.006 | 17.118 | −87.31 (41.23) * | 0.046 | 17.050 | −108.25 (29.56) *** | 0.001 | 17.327 | −94.02 (45.99) + | 0.054 | 20.371 |

| Tertiary education (%) | −19.27 (13.69) | 0.173 | 209.871 | −11.18 (17.58) | 0.531 | 221.224 | 12.27 (17.15) | 0.482 | 416.513 | −8.39 (19.52) | 0.672 | 262.114 |

| R&D expenditures (%) | 72.18 (105.15) | 0.500 | 21.437 | 37.06 (132.49) | 0.782 | 21.759 | 57.62 (93.67) | 0.545 | 21.514 | 37.08 (135.19) | 0.787 | 21.759 |

| Regression information | ||||||||||||

| R-squared | 0.999 *** | 0.999 *** | 0.999 *** | 0.999 *** | ||||||||

| N | 33 | 33 | 33 | 33 | ||||||||

References

- Yang, H.; Zhao, D. Performance Legitimacy, State Autonomy and China′s Economic Miracle. J. Contemp. China 2015, 24, 64–82. [Google Scholar] [CrossRef]

- Cao, Y.; Jian, X. The Tibet Problem in the Milieu of a Rising China: Findings from a survey on Americans′ attitudes toward China. J. Contem. China 2015, 24, 240–259. [Google Scholar] [CrossRef]

- Tan, X. The Past 40 Years Witness China’s Economic Miracle. Available online: http://www.chinadaily.com.cn/a/201812/17/WS5c173fe4a3107d4c3a00139d.html (accessed on 26 July 2019).

- China Overview. Available online: https://www.worldbank.org/en/country/china/overview (accessed on 26 July 2019).

- Joseph, W.A. Politics in China: An Introduction; Oxford University Press: New York, NY, USA, 2019. [Google Scholar]

- China. Available online: https://data.worldbank.org/country/china (accessed on 26 July 2019).

- National Bureau of Statistics of China. Available online: http://www.stats.gov.cn (accessed on 26 July 2019).

- Zoellick, R.B. Whither China: From Membership to Responsibility? NBR Anal. 2005, 16, 5. [Google Scholar]

- Harjanto, A.G.; Ningrum, L. How Millennials in Indonesia Perceive in Studying Abroad to China. Tour. Proc. 2019, [S.l.], 66–77. Available online: http://jurnalpariwisata.stptrisakti.ac.id/index.php/Proceeding/article/view/1265 (accessed on 15 October 2019).

- Lin, F. Digital intellectual property protection in China: Trends and damages in litigation involving the big five websites (2003–2013). Asia Pac. Law Rev. 2017, 25, 149–169. [Google Scholar] [CrossRef]

- World Intellectual Property Organization (WIPO). EXPLORE THE INTERACTIVE DATABASE OF THE GII 2018 INDICATORS. Available online: https://www.globalinnovationindex.org/analysis-indicator (accessed on 26 July 2019).

- Global Innovation Index Report. Available online: https://www.globalinnovationindex.org/about-gii#reports (accessed on 26 July 2019).

- World Intellectual Property Indicators. Available online: https://www.wipo.int/publications/en/series/index.jsp?id=37 (accessed on 26 July 2019).

- Yu, L.H. Interest Groups and Sino-US Conflicts over Intellectual Property Protection. In Education and Management; Zhou, M., Ed.; Springer: Berlin/Heidelberg, Germany, 2011; Volume 210, pp. 572–578. [Google Scholar]

- Office of the United States Trade Representative (USTR). 2019 Special 301 Report. Available online: https://ustr.gov/sites/default/files/2019_Special_301_Report.pdf (accessed on 26 July 2019).

- Office of the United States Trade Representative (USTR). Under Section 301 Action, USTR Releases Proposed Tariff List on Chinese Products. Available online: https://ustr.gov/about-us/policy-offices/press-office/press-releases/2018/april/under-section-301-action-ustr (accessed on 26 July 2019).

- Brander, J.A.; Cui, V.; Vertinsky, I. China and intellectual property rights: A challenge to the rule of law. J. Int. Bus. Stud. 2017, 48, 908–921. [Google Scholar] [CrossRef]

- Belvedere, M.J. Larry Summers Praises China’s State Investment in Tech, Saying it Doesn’t Need to Steal from US. Available online: https://www.cnbc.com/2018/06/27/larry-summers-china-does-not-need-to-steal-us-technology.html (accessed on 26 July 2019).

- Global Innovation Index Report 2019. Available online: https://www.globalinnovationindex.org/userfiles/file/reportpdf/gii-full-report-2019.pdf (accessed on 26 July 2019).

- China′s Economic Growth Hits 27-Year Low as Trade War Stings. Available online: https://www.nytimes.com/2019/07/14/business/china-economy-growth-gdp-trade-war.html (accessed on 13 September 2019).

- China Seen Heading for Sub-6% Economic Growth as Tariffs Soar. Available online: https://www.bloomberg.com/news/articles/2019-09-03/china-s-economy-will-grow-at-5-7-in-2020-oxford-economics-says (accessed on 13 September 2019).

- Goldstone, J.A. The Coming Chinese Collapse. Foreign Policy 1995, 28, 35–53. [Google Scholar] [CrossRef]

- Chang, G.G. The Coming Collapse of China; Arrow: London, UK, 2002. [Google Scholar]

- Barbier, E.B. The concept of sustainable economic development. Environ. Conserv. 1987, 14, 101–110. [Google Scholar] [CrossRef]

- Barbier, E.B.; Markandya, A. The Conditions for Achieving Environmentally Sustainable Development; London Environmental Economics Centre: London, UK, 1989; Volume 89. [Google Scholar]

- Krongkaew, M.; Zin, R.H.M. Income distribution and sustainable economic development in East Asia: A Comparative Analysis. IDEAs Working Pap. 2007, 2, 2007. [Google Scholar]

- Zhu, Z.; Xu, G. Basic research: Its impact on China′s future. Technol. Soc. 2008, 30, 293–298. [Google Scholar] [CrossRef]

- Dillon, A.; Morris, M.G. User Acceptance of New Information Technology: Theories and Models; Information Today: Medford, NJ, USA, 1996. [Google Scholar]

- ÇETİN, M. THE HYPOTHESIS OF INNOVATION-BASED ECONOMIC GROWTH: A CAUSAL RELATIONSHIP. Int. J. Econ. Adm. Stud. 2013, 6, 1–16. [Google Scholar]

- Smith, A. Wealth of Nations; Modern Library: New York, NY, USA, 1937. [Google Scholar]

- Marx, K. Capital: A Critique of Political Economy; Modern Library: New York, NY, USA, 1906. [Google Scholar]

- Young, A.A. Increasing Returns and Economic Progress. Econ. J. 1928, 38, 527–542. [Google Scholar] [CrossRef]

- Schumpeter, J.A.; Backhaus, U. The Theory of Economic Development; Springer: New York, NY, USA, 2003. [Google Scholar]

- Schumpeter, J.A. Capitalism, Socialism and Democracy. Political Stud. 1979, 27, 594–602. [Google Scholar]

- Schumpeter, J.A. Business cycles: A theoretical, historical, and statistical analysis of the capitalist process. Am. Hist. Rev. 1964, 36, 175–189. [Google Scholar]

- Solow, R.M. A Contribution to the Theory of Economic Growth. Q. J. Econ. 1956, 70, 65–94. [Google Scholar] [CrossRef]

- Solow, R.M. TECHNICAL CHANGE AND THE AGGREGATE PRODUCTION FUNCTION. Rev. Econ. Stat. 1957, 39, 554–562. [Google Scholar] [CrossRef]

- Swan, T.W. ECONOMIC GROWTH and CAPITAL ACCUMULATION. Econ. Rec. 2010, 32, 334–361. [Google Scholar] [CrossRef]

- Romer, P.M. Endogenous Technological Change. NBER Working Pap. 1989, 98, 71–102. [Google Scholar]

- Romer, P.M. Increasing Returns and Long-Run Growth. J. Political Econ. 1986, 94, 1002–1037. [Google Scholar] [CrossRef]

- Lucas, R.E. On the mechanics of economic development. Quant. Macroecon. Working Pap. 1999, 22, 3–42. [Google Scholar] [CrossRef]

- Grossman, G.M.; Helpman, E. Innovation and Growth in the Global Economy; Mit Press: Cambridge, MA, USA, 1993; Volume 1, pp. 323–324. [Google Scholar]

- Aghion, P.; Howitt, P. A Model of Growth Through Creative Destruction. Econometrica 1992, 60, 323–351. [Google Scholar] [CrossRef]

- Howitt, P. Steady Endogenous Growth with Population and R. & D. Inputs Growing. J. Political Econ. 1999, 107, 715–730. [Google Scholar]

- Hasan, I.; Tucci, C.L. The innovation–economic growth nexus: Global evidence. Res. Policy 2010, 39, 1264–1276. [Google Scholar] [CrossRef]

- Lin, C.K.; Chen, T.; Li, X.; De Marcellis-Warin, N.; Zigler, C.; Christiani, D.C. Are per capita carbon emissions predictable across countries? J. Environ. Manag. 2019, 237, 569–575. [Google Scholar] [CrossRef] [PubMed]

- Kojima, K. The “flying geese” model of Asian economic development: Origin, theoretical extensions, and regional policy implications. J. Asian Econ. 2000, 11, 375–401. [Google Scholar] [CrossRef]

- Shamase, M.Z.; Mbatha, M.P.; Mthembu, N.N.A. China as leading Asian giant and her indispensability within BRICS. Gend. Behav. 2017, 15, 10377–10388. [Google Scholar]

- Stiglitz, J.E. Some lessons from the East Asian miracle. World Bank Res. Obs. 1996, 11, 151–177. [Google Scholar] [CrossRef]

- Stiglitz, J.E.; Yusuf, S. Rethinking the East Asian Miracle; The World Bank: Washington, DC, USA, 2001. [Google Scholar]

- Hanushek, E.A.; Woessmann, L. Knowledge capital, growth, and the East Asian miracle. Science 2016, 351, 344–345. [Google Scholar] [CrossRef]

- Yao, S. On economic growth, FDI and exports in China. Appl. Econ. 2006, 38, 339–351. [Google Scholar] [CrossRef]

- Lin, J.Y.; Yao, Y. Chinese rural industrialization in the context of the East Asian miracle. In Rethinking the East Asian Miracle; Stiglitz, J.E., Yusuf, S., Eds.; Oxford University Press: New York, NY, USA, 2001; pp. 143–195. [Google Scholar]

- Zhang, Q. The Flying Geese Formation Strategy of Industrial Upgrading and Coordinative Regional Development. In Transforming Economic Growth and China’s Industrial Upgrading; Springer: Singapore, 2018; pp. 123–151. [Google Scholar]

- Yeung, Y.M.; Lee, J.; Kee, G. China′s special economic zones at 30. Eurasian Geogr. Econ. 2009, 50, 222–240. [Google Scholar] [CrossRef]

- Zeng, D.Z. Building Engines for Growth and Competitiveness in China. J. Int. Commer. Econ. Policy 2011, 3, 1292–1293. [Google Scholar]

- Liu, J.; Wen, J.; Huang, Y.; Shi, M.; Meng, Q.; Ding, J.; Xu, H. Human settlement and regional development in the context of climate change: A spatial analysis of low elevation coastal zones in China. Mitig. Adapt. Strateg. Glob. Chang. 2015, 20, 527–546. [Google Scholar] [CrossRef]

- Heng, S.H. The 2008 Financial Crisis and the Flying Geese Model. East Asia 2010, 27, 381–394. [Google Scholar] [CrossRef]

- Fang, C.; Dewen, W.; Yue, Q. Flying Geese within Borders: How China Sustains Its Labor-intensive Industries? Econ. Res. J. 2009, 9, 4–14. [Google Scholar]

- Huang, Y.; Wang, H.; Liu, S. Research on ‘near-zero emission’technological innovation diffusion based on co-evolutionary game approach. Syst. Sci. Control Eng. 2019, 7, 23–31. [Google Scholar] [CrossRef]

- Rogers, E.M. Diffusion of Innovations, 5th ed.; Free Press: New York, NY, USA, 1995. [Google Scholar]

- Rogers, E.M. Diffusion of Innovations; Simon and Schuster: New York, NY, USA, 2010. [Google Scholar]

- Zhang, H.; Vorobeychik, Y. Empirically grounded agent-based models of innovation diffusion: A critical review. Artif. Intell. Rev. 2019, 52, 707–741. [Google Scholar] [CrossRef]

- Lyu, Y.; Liu, Q.; He, B.; Nie, J. Structural embeddedness and innovation diffusion: The moderating role of industrial technology grouping. Scientometrics 2017, 111, 889–916. [Google Scholar] [CrossRef]

- Pradhan, R.P.; Arvin, M.B.; Nair, M.; Bennett, S.E.; Hall, J.H. The information revolution, innovation diffusion and economic growth: An examination of causal links in European countries. Qual. Quant. 2019, 53, 1529–1563. [Google Scholar] [CrossRef]

- Huang, Q. China’s Industrialization Process; Springer: Singapore, 2018. [Google Scholar]

- Alford, W.P. To Steal a Book is an Elegant Offense: Intellectual Property Law in Chinese Civilization; Stanford University Press: Stanford, CA, USA, 1995. [Google Scholar]

- Xu, J.; Cao, Y. The image of Beijing in Europe: Findings from The Times, Le Figaro, Der Spiegel from 2000 to 2015. Place Brand. Public Dipl. 2019, 15, 185–197. [Google Scholar] [CrossRef]

- Hu, J. Determining damages for patent infringement in China. IIC Int. Rev. Intellect. Prop. Compet. Law 2016, 47, 5–27. [Google Scholar] [CrossRef]

- Gruen, N.; Bruce, I.; Prior, G. Extending Patent Life: Is it in Australia’s Economic Interests? Industry Commission: Melbourne, Australia, 1996. [Google Scholar]

- La Croix, S.J.; Eby Konan, D. Intellectual property rights in China: The changing political economy of Chinese–American interests. World Econ. 2002, 25, 759–788. [Google Scholar] [CrossRef]

- Kshetri, N. Institutionalization of intellectual property rights in China. Eur. Manag. J. 2009, 27, 155–164. [Google Scholar] [CrossRef]

- Fleisher, B.M.; McGuire, W.H.; Smith, A.N.; Zhou, M. Patent law, TRIPS, and economic growth: Evidence from China. Asia Pac. J. Account. Econ. 2013, 20, 4–19. [Google Scholar] [CrossRef]

- Cox, A.J.; Sepetys, K. Intellectual Property Rights Protection in China: Trends in Litigation and Economic Damages. 2009. Available online: https://ssrn.com/abstract=1330619 (accessed on 13 September 2019). [CrossRef]

- Cyranoski, D. China’s patent boom brings legal wrangles. Nat. News 2012, 492, 323. [Google Scholar] [CrossRef]

- Cao, C.; Li, N.; Li, X.; Liu, L. Reforming China′s S&T system. Science 2013, 341, 460–462. [Google Scholar]

- Wang, L. Intellectual property protection in China. Int. Inf. Libr. Rev. 2004, 36, 253–261. [Google Scholar] [CrossRef]

- Fink, C.; Maskus, K.E. Intellectual Property and Development: Lessons from Recent Economic Research; The World Bank and Oxford University Press: Washington, DC, USA, 2005. [Google Scholar]

- Furukawa, Y. The protection of intellectual property rights and endogenous growth: Is stronger always better? J. Econ. Dyn. Control 2007, 31, 3644–3670. [Google Scholar] [CrossRef]

- Global Innovation Index 2018, Energizing the World with Innovation. Available online: https://www.wipo.int/edocs/pubdocs/en/wipo_pub_gii_2018.pdf (accessed on 26 July 2019).

- Lemley, M.A.; Shapiro, C. Probabilistic patents. J. Econ. Perspect. 2005, 19, 75–98. [Google Scholar] [CrossRef]

- China National Intellectual Property Administration. Available online: http://www.sipo.gov.cn/ (accessed on 26 July 2019).

- United Nations Conference on Trade and Development (UNCTAD). World Investment Report 1995, Transnational Corporations and Competitiveness; United Nations: New York, NY, USA; Geneva, Switzerland, 1995. [Google Scholar]

- United Nations Conference on Trade and Development (UNCTAD). World Investment Report 2003, FDI Policies for Development, National and International Perspective; United Nations: New York, NY, USA; Geneva, Switzerland, 2003. [Google Scholar]

- Zhang, H.; Tang, Y.; Yi, T. The Belt and Road Initiative Economic Paradigm: Double Circulation of Global Value Chain. In Regional Mutual Benefit and Win-Win Under the Double Circulation of Global Value. Global Economic Synergy of Belt and Road Initiative; Liu, W., Zhang, H., Eds.; Springer: Singapore, 2019; pp. 43–104. [Google Scholar]

- Rapp, R.T.; Rozek, R.P. Benefits and costs of intellectual property protection in developing countries. J. World Trade 1990, 24, 75–102. [Google Scholar]

- Shen, G. Nominal level and actual strength of China′s intellectual property protection under TRIPS agreement. J. Chin. Econ. Foreign Trade Stud. 2010, 3, 71–88. [Google Scholar] [CrossRef]

- Zhan, Y. Problems of Enforcement of Patent Law in China and its Ongoing Fourth Amendment. J. Intellect. Prop. Rights 2014, 19, 266–271. [Google Scholar]

- Xiang, J. Chinese IP Judicial System Reform: Past and Future. J. China Stud. 2015, 18, 41–63. [Google Scholar]

- Li, L. Intellectual Property Protection of Traditional Cultural Expressions; Springer: Singapore, 2016. [Google Scholar]

- China′s Supreme People′s Court. Intellectual Property Protection by Chinese Courts. 2017. Available online: https://www.chinajusticeobserver.com/p/intellectual-property-protection-by-chinese-courts-in-2017 (accessed on 26 July 2019).

- China Judgement online. Available online: http://wenshu.court.gov.cn (accessed on 26 July 2019).

- Ali, S. Exchange Rate and Economic Growth in Pakistan (1975–2011). MPRA Pap. 2013, 3, 740–746. [Google Scholar]

- He, Q. Expanding Varieties in the Nontraded Goods Sector and the Real Exchange Rate Depreciation. MPRA Pap. 2010, 3, 19–38. [Google Scholar]

- Bo, T. Real exchange rate and economic growth in China: A cointegrated VAR approach. China Econ. Rev. 2015, 34, 293–310. [Google Scholar]

- Zhang, C.; Zhuang, L. The composition of human capital and economic growth: Evidence from China using dynamic panel data analysis. China Econ. Rev. 2011, 22, 165–171. [Google Scholar] [CrossRef]

- Birsdall, N.; Rhee, C. Does Research and Development Contribute to Economic Growth in Developing Countries; The World Bank: Washington, DC, USA, 1993. [Google Scholar]

- Goel, R.K.; Ram, R. Research and Development Expenditures and Economic Growth: A Cross-Country Study. Econ. Dev. Cult. Chang. 1994, 42, 403–411. [Google Scholar] [CrossRef]

- Suhail, M.; Chand, S.; Kibria, B.M.G. Quantile based estimation of biasing parameters in ridge regression model. Commun. Stat. Simul. Comput. 2019, 1–13. [Google Scholar] [CrossRef]

- Bager, A.; Roman, M.; Odah, M.H.; Mohammed, B.K. ADDRESSING MULTICOLLINEARITY IN REGRESSION MODELS: A RIDGE REGRESSION APPLICATION. Journal of Social and Economic Statistics. 2017, 6, 30–45. [Google Scholar]

- Wang, L.; Li, H. Study on regional difference of three type patent′s economic contribution. In Proceedings of the 2013 6th International Conference on Information Management, Innovation Management and Industrial Engineering, Xi′an, China, 23–24 November 2013; pp. 97–100. [Google Scholar]

- Hoerl, A.E.; Kennard, R.W. Ridge regression: Biased estimation for nonorthogonal problems. Technometrics 1970, 12, 55–67. [Google Scholar] [CrossRef]

- NCSS Statistical Software. Ridge Regression. Available online: https://ncss-wpengine.netdna-ssl.com/wp-content/themes/ncss/pdf/Procedures/NCSS/Ridge_Regression.pdf (accessed on 13 September 2019).

- Saleh, A.K.M.E.; Arashi, M.; Tabatabaey, S.M.M. Statistical Inference for Models with Multivariate t-Distributed Errors; John Wiley & Sons: New York, NY, USA, 2014. [Google Scholar]

- Dorugade, A.V. New ridge parameters for ridge regression. J. Assoc. Arab Univ. Basic Appl. Sci. 2018, 15, 94–99. [Google Scholar] [CrossRef]

- Karaibrahimoğlu, A.; Asar, Y.; Genç, A. Some new modifications of Kibria’s and Dorugade’s methods: An application to Turkish GDP data. J. Assoc.Arab Univ. Basic Appl. Sci. 2018, 20, 89–99. [Google Scholar] [CrossRef]

- Wilcox, R.R. Multicolinearity and ridge regression: Results on type I errors, power and heteroscedasticity. J. Appl. Stat. 2018, 46, 946–957. [Google Scholar] [CrossRef]

- Algamal, Z.Y. Shrinkage parameter selection via modified cross-validation approach for ridge regression model. Commun. Stat. Simul. Comput. 2018, 1–9. [Google Scholar] [CrossRef]

- Portz, K.G. Political Turmoil in Dallas: The Electoral Whipping of the Dallas County Citizens League by the Ku Klux Klan, 1922. Southwest. Hist. Q. 2015, 119, 148–178. [Google Scholar] [CrossRef]

- Sun, Y. Determinants of foreign patents in China. World Pat. Inf. 2003, 25, 27–37. [Google Scholar] [CrossRef]

- Zhao, S. Deng Xiaoping’s southern tour: Elite politics in post-Tiananmen China. Asian Surv. 1993, 33, 739–756. [Google Scholar] [CrossRef]

- Tsai, C.M. The Nature and Trend of Taiwanese Investment in China (1991–2014): Business Orientation, Profit Seeking, and Depoliticization. In Taiwan and China: Fitful Embrace; Dittmer, L., Ed.; University of California Press: Berkeley/Los Angeles, CA, USA, 2017. [Google Scholar]

- Liu, Y.; Cheng, G.P.; Yang, Y. Patent applications of the top 500 foreign investment corporations in China. Scientometrics 2006, 68, 167–177. [Google Scholar] [CrossRef]

- Sun, Y. Spatial Distribution of Patents in China. Reg. Stud. 2000, 34, 441–454. [Google Scholar] [CrossRef]

- Dang, J.; Motohashi, K. Patent statistics: A good indicator for innovation in China? Patent subsidy program impacts on patent quality. China Econ. Rev. 2015, 35, 137–155. [Google Scholar] [CrossRef]

- Wenqi, L. Intellectual property protection related to technology in China. Technol. Forecast. Soc. Chang. 2005, 72. [Google Scholar] [CrossRef]

- State Council Publishes Chinese National IPR Strategy Outline. Available online: http://www.techsecuritychina.com/2008/06/17/6885-state-council-publishes-chinese-national-ipr-strategy-outline/ (accessed on 26 July 2019).

- Li, W.; Yu, X. China′s intellectual property protection strength and its evaluation—Based on the accession to TRIPS Agreement (Agreement On Trade-related Aspects of Intellectual Property Rights). R D Manag. 2015, 45, 397–410. [Google Scholar] [CrossRef]

- Zeng, Z. The comparison of innovation activities and international trade effect in China and Japan in the era of knowledge economy: Empirical research on patents as an example. J. Chin. Econ. Foreign Trade Stud. 2009, 2, 211–228. [Google Scholar] [CrossRef]

- Tesla to Build Super Factory in Shanghai. Available online: http://www.chinadaily.com.cn/a/201807/11/WS5b45c1bca310796df4df5d2b.html (accessed on 13 September 2019).

| Abb. | Variables | N | Mean | SD | Min | Max |

|---|---|---|---|---|---|---|

| GDP | China’s GDP (unit: 10 billion RMB) | 33 | 2280.1 | 2479.0 | 91.0 | 8271.2 |

| TPA | Total patent application (unit: thousand) | 33 | 770.9 | 1069.6 | 14.4 | 3697.8 |

| TDPA | Total domestic patent application (unit: thousand) | 33 | 707.8 | 1018.3 | 9.4 | 3536.3 |

| TFPA | Total foreign patent application (unit: thousand) | 33 | 63.0 | 57.7 | 4.4 | 161.5 |

| TPG | Total patent grants (unit: thousand) | 33 | 425.4 | 583.7 | 0.1 | 1836.4 |

| TDPG | Total domestic patent grants (unit: thousand) | 33 | 388.3 | 544.6 | 0.1 | 1720.8 |

| TFPG | Total foreign patent grants (unit: thousand) | 33 | 37.1 | 41.0 | 0.0 | 124.9 |

| CPID | Closed patent infringement disputes (unit: thousand) | 33 | 2.7 | 6.0 | 0.3 | 27.0 |

| ITG | International trade of goods (unit: billion USD) | 33 | 1433.3 | 1541.8 | 69.6 | 4301.5 |

| ITS | International trade of services (unit: billion USD) | 33 | 201.4 | 228.9 | 5.2 | 695.7 |

| FDI | Foreign direct investment (unit: billion USD) | 33 | 63.2 | 40.6 | 4.8 | 131.0 |

| POP | Population (unit: million) | 33 | 1250.6 | 98.7 | 1051.0 | 1386.0 |

| TEP | Total employed persons (unit: million) | 33 | 699.3 | 85.5 | 498.7 | 780.0 |

| NER | Nominal exchange rate (RMB per USD) | 33 | 6.9 | 1.5 | 2.9 | 8.6 |

| TE | Tertiary Education (%) | 33 | 16.9 | 12.9 | 2.9 | 45.7 |

| R&D | R&D Expenditures (%) | 33 | 1.2 | 0.5 | 0.6 | 2.1 |

| No. | Variables | GDP | TPA | TDPA | TFPA | TPG | TDPG | TFPG | CPID | ITG | ITS | FDI | POP | TEP | NER | TE | R&D |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1 | China’s GDP | 1 | |||||||||||||||

| 2 | Total patent application | 0.983 *** | 1 | ||||||||||||||

| 3 | Total domestic patent application | 0.979 *** | 1.000 *** | 1 | |||||||||||||

| 4 | Total foreign patent application | 0.953 *** | 0.896 *** | 0.885 *** | 1 | ||||||||||||

| 5 | Total patent grants | 0.986 *** | 0.993 *** | 0.992 *** | 0.904 *** | 1 | |||||||||||

| 6 | Total domestic patent grants | 0.983 *** | 0.993 *** | 0.993 *** | 0.895 *** | 1.000 *** | 1 | ||||||||||

| 7 | Total foreign patent grants | 0.978 *** | 0.946 *** | 0.939 *** | 0.973 *** | 0.956 *** | 0.950 *** | 1 | |||||||||

| 8 | Closed patent infringement disputes | 0.772 *** | 0.850 *** | 0.857 *** | 0.624 *** | 0.806 *** | 0.810 *** | 0.712 *** | 1 | ||||||||

| 9 | International trade of goods | 0.972 *** | 0.926 *** | 0.917 *** | 0.974 *** | 0.941 *** | 0.936 *** | 0.967 *** | 0.617 *** | 1 | |||||||

| 10 | International trade of services | 0.996 *** | 0.974 *** | 0.969 *** | 0.959 *** | 0.980 *** | 0.977 *** | 0.978 *** | 0.745 *** | 0.981 *** | 1 | ||||||

| 11 | Foreign direct investment | 0.927 *** | 0.861 *** | 0.851 *** | 0.941 *** | 0.876 *** | 0.869 *** | 0.920 *** | 0.590 *** | 0.931 *** | 0.925 *** | 1 | |||||

| 12 | Population | 0.825 *** | 0.740 *** | 0.727 *** | 0.898 *** | 0.750 *** | 0.740 *** | 0.846 *** | 0.496 *** | 0.836 *** | 0.820 *** | 0.946 *** | 1 | ||||

| 13 | Total employed persons | 0.677 *** | 0.579 *** | 0.564 ** | 0.778 *** | 0.588 *** | 0.577 *** | 0.711 *** | 0.353 * | 0.698 *** | 0.673 *** | 0.852 *** | 0.963 *** | 1 | |||

| 14 | Nominal exchange rate | −0.004 | −0.076 | −0.085 | 0.095 | −0.083 | −0.089 | 0.004 | −0.059 | −0.021 | −0.022 | 0.296 | 0.495 *** | 0.647 *** | 1 | ||

| 15 | Tertiary Education (%) | 0.976 *** | 0.940 *** | 0.932 *** | 0.982 *** | 0.939 *** | 0.933 *** | 0.977 *** | 0.734 *** | 0.957 *** | 0.973 *** | 0.947 *** | 0.901 *** | 0.773 *** | 0.128 | 1 | |

| 16 | R&D Expenditures (%) | 0.922 *** | 0.880 *** | 0.871 *** | 0.944 *** | 0.891 *** | 0.884 *** | 0.944 *** | 0.611 *** | 0.939 *** | 0.925 *** | 0.854 *** | 0.777 *** | 0.628 *** | −0.113 | 0.929 *** | 1 |

| M1 | M2 | M3 | M4 | |||||

|---|---|---|---|---|---|---|---|---|

| Coef. (SE) | p-Value | Coef. (SE) | p-Value | Coef. (SE) | p-Value | Coef. (SE) | p-Value | |

| (constant) | −1716.8 | −1582.2 | −1901.5 | −1558 | ||||

| Innovation Factors | ||||||||

| Total patent application | 0.68 (325.37) *** | 0.000 | ||||||

| Total domestic patent application | 0.68 (3918.47) *** | 0.000 | ||||||

| Total foreign patent application | −1.02 (−333.26) | 0.215 | ||||||

| Total patent grants | 1.07 (3535.21) *** | 0.000 | ||||||

| Total domestic patent grants | 1.1 (3387.74) *** | 0.000 | ||||||

| Total foreign patent grants | 1.75 (405.32) | 0.295 | ||||||

| Flying Geese Model (FGM) Factors | ||||||||

| International trade of goods | 0.3 (2587.05) *** | 0.000 | 0.33 (2919.98) *** | 0.000 | 0.31 (2738.93) *** | 0.000 | 0.33 (2914.73) *** | 0.000 |

| International trade of services | 2.13 (2758.62) *** | 0.000 | 1.98 (2559.4) *** | 0.000 | 2.11 (2728.9) *** | 0.000 | 1.92 (2480.33) *** | 0.000 |

| Foreign direct investment | 10.23 (2347.98) *** | 0.000 | 9.32 (2138.77) *** | 0.000 | 10.02 (2300.94) *** | 0.000 | 9.17 (2105.82) *** | 0.000 |

| Intellectual Property Rights (IPR) Protection Factors | ||||||||

| Closed patent infringement disputes | 35.66 (1211.82) *** | 0.000 | 51.77 (1759.2) *** | 0.000 | 34.28 (1164.85) *** | 0.000 | 50.91 (1729.98) *** | 0.000 |

| Control Variables | ||||||||

| Population | 1.81 (1008.56) *** | 0.001 | 1.61 (900.32) ** | 0.006 | 1.91 (1064.57) *** | 0.000 | 1.61 (900.19) * | 0.010 |

| Total employed persons | 0.17 (83) | 0.757 | 0.26 (123.56) | 0.679 | 0.27 (131.53) | 0.586 | 0.2 (95.66) | 0.761 |

| Nominal exchange rate | −100.01 (−865.95) *** | 0.000 | −93.04 (−805.57) *** | 0.001 | −102.7 (−889.25) *** | 0.000 | −88.88 (−769.55) ** | 0.002 |

| Tertiary education (%) | 7.72 (564.92) + | 0.070 | 11.55 (845.17) * | 0.014 | 12.28 (898.7) *** | 0.000 | 10.71 (783.89) * | 0.028 |

| Research and Development (R&D) expenditures (%) | 43.33 (131.89) | 0.588 | 38.78 (118.03) | 0.664 | 70.33 (214.07) | 0.349 | 30.85 (93.9) | 0.743 |

| Regression information | ||||||||

| R-squared | 0.999 *** | 0.999 *** | 0.999 *** | 0.999 *** | ||||

| N | 33 | 33 | 33 | 33 | ||||

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Xu, J.; Cao, Y. Innovation, the Flying Geese Model, IPR Protection, and Sustainable Economic Development in China. Sustainability 2019, 11, 5707. https://doi.org/10.3390/su11205707

Xu J, Cao Y. Innovation, the Flying Geese Model, IPR Protection, and Sustainable Economic Development in China. Sustainability. 2019; 11(20):5707. https://doi.org/10.3390/su11205707

Chicago/Turabian StyleXu, Jian, and Yongrong Cao. 2019. "Innovation, the Flying Geese Model, IPR Protection, and Sustainable Economic Development in China" Sustainability 11, no. 20: 5707. https://doi.org/10.3390/su11205707

APA StyleXu, J., & Cao, Y. (2019). Innovation, the Flying Geese Model, IPR Protection, and Sustainable Economic Development in China. Sustainability, 11(20), 5707. https://doi.org/10.3390/su11205707