1. Introduction

Corporate social responsibility (hence CSR) practice, defined as voluntary policies, practices, and programs that go beyond narrow economic and legal requirements, have drawn worldwide attention in recent years [

1,

2,

3,

4]. Businesses today are well aware that they are expected to simultaneously address economic, environmental, and ethical–social concerns, that is, contribute to the triple bottom lines [

5]. However, not all businesses are equally proactive when it comes to socially responsible practice. This is particularly true for firms in emerging markets, such as multinational corporations or local businesses. A multinational corporation headquartered in a developed economy is usually more proactive in its domestic rather than its foreign markets [

6]. This often leads to differences in CSR practices between domestic units and international subsidiaries. Additionally, local firms in emerging markets generally lag their counterparts in developed markets due to the lack of focused and institutionalized socially responsible practice [

7,

8]. Many businesses in emerging markets view profit maximization as their only responsibility and pay little attention to the consequences of their decisions on environment or society [

9]. As a result, we have witnessed serious environmental transgressions as well as unethical and sometimes illegal business practices in emerging markets [

10,

11,

12,

13]. Apparently, studying how to promote and institutionalize socially responsible practice in emerging markets has become a strong business imperative. Research aiming to enhance such understanding should help stem the tide of unethical and irresponsible business practices in those markets.

A focus on the micro-foundation of CSR has led to a resurgence of interest in understanding the influence of individual constructs such as personal values, CSR attitude, and the role of decision makers on CSR practice [

14,

15,

16,

17]. Past research has also identified several environmental and organizational factors that influence CSR practice such as national culture, government regulation, pressure from green business advocates, top management commitment, and organizational values [

18,

19,

20,

21]. More recently, research that draws on neo-institutional theory has emphasized the role of formal and informal institutions in business practices in emerging markets [

22,

23], and examined the effects of chief executive officer governance on CSR in service firms [

24]. Most research in developed markets has highlighted the role of formal institutions such as political systems, laws, regulations, and so forth. However, it is the influence of informal institutions, especially cultural traditions, customs, and social norms, that have proved particularly useful in explaining business performance and success in emerging markets. This institution-based approach has gained traction in research on business strategy [

25,

26,

27], innovation in alliances [

28], corporate governance [

29,

30], product recall decisions [

3], and internationalization of state-owned enterprises [

31]. The present study aims to extend this stream of research by examining the influence of cultural traditions on business managers’ CSR orientation and socially responsible decisions.

Confucian ethics and Confucian dynamism are two key components of Confucianism, a cultural heritage that remains a powerful wellspring of values and social norms in modern China and East Asia [

32,

33]. In this study, we focus on Confucian ethics and Confucian dynamism for three reasons. First, informal institutions that impose normative and cognitive constraints on business transactions play a more important role in economic development and business practice than formal institutions in emerging markets [

30,

34]. Traditions, customs, moral values and religious beliefs are more effective in regulating business behavior due to the lack of well-established formal institutions in those markets [

1,

31,

35]. Thus, it is necessary to thoroughly understand how Confucian ethics and Confucian dynamism may help organizations promote CSR practice in China. Second, economic reform and institutional transitions engender fundamental and comprehensive changes to the “rules of games.” It is important to study whether and how Confucian ethics and Confucian dynamism may fulfill institutional voids during the transition and consequently help shape market-supporting institutions that facilitate CSR practice in China [

36]. Finally, informal rules, especially traditional norms and religious beliefs are the conduits of history and “embody the community’s prevailing perceptions about the world, the accumulated wisdom of the past, and a current set of values” [

37]. Such informal rules are often at odds with formal institutions in a market economy. Previous research has revealed that informal institutions may substitute, compete, or accommodate formal institutions, thereby, impacting business practice in quite different ways [

1,

29]. Hence, it is of great interest to clarify whether and to what extent Confucian ethics and Confucian dynamism may support or impede socially responsible practices.

In view of the concern for the role of informal institutions in managers’ CSR orientations and practices, we deem it necessary to study how Confucianism as the dominant cultural tradition in China may affect business managers’ CSR orientations and socially responsible decisions. Would Confucian ethics and/or Confucian dynamism fulfill a void during the transition of China promoting a socially responsible orientation? Could and how might Confucian ethics and Confucian dynamism facilitate or impede socially responsible practices in the largest emerging economy in the world? These are important questions that we have yet to answer. The present study is an attempt to bridge a gap in the business literature by providing answers to these important questions.

The next section reviews the theory and develops hypotheses regarding the impacts on socially responsible decisions of Confucian ethics (CE), Confucian dynamism (CD), and managers’ social responsibility orientations. It is followed by a report on an empirical study conducted in China that involved 285 Chinese managers who were pursuing their MBA degree in a large university in Shandong Province at the time of data collection. Then, the presentation turns to the theoretical contributions and practical implications of the empirical findings. Finally, the paper concludes with a discussion of research limitations and suggestions for future research.

2. Conceptual Development and Hypotheses

2.1. Shareholder Value Orientation and Social Responsibility Orientation

Corporate social responsibility is a normative concept that reflects society’s expectations about how businesses should discharge their economic and social responsibilities. Based on the notion of a social contract between business and society [

38], CSR practices are designed to fulfill a company’s duties and obligations arising from its impacts on society [

39]. Although it is widely acknowledged that businesses must be held responsible for what they do, there is less agreement about their exact obligations and duties and how they are related.

For instance, some managers subscribe to the ownership theory of the firm and consider the creation of shareholder value as the one and only social responsibility of a firm [

32,

40]. Managers who adopted this narrow view might pursue shareholder profits to the exclusion of all other interests as long as they operated within the bounds of laws and government regulations. Managers that hold such a shareholder value perspective often consider creating values for shareholders as the most important, if not the sole responsibility of a firm [

41]. In contrast, managers who subscribe to the stakeholder theory of the firm may hold a broader view of social responsibility [

42]. They would pay close attention to social issues and meet their social-ethical responsibilities by resolving social problems while discharging their obligations to shareholders.

In this study, we define a shareholder value orientation as a manager’s predisposition to focus exclusively on shareholder values and profits in business decisions. In contrast, we define a social responsibility orientation as a manager’s predisposition to go beyond profit considerations and make business decisions to align with their social-ethical responsibilities. Central to this orientation is the belief that corporations need to take social-ethical responsibility and be responsive for the wellbeing of society as a whole while effectively meeting the expectation of economic performance (i.e., providing goods and service for society and efficiently utilizing societal resources). Given the above discussion, it is reasonable to believe that managers who have a shareholder value orientation will be more likely to make business decisions that favor shareholders than those who have a social responsibility orientation. Conversely, managers with a social responsibility orientation will be more likely to make a socially responsible decision.

Therefore, we propose that:

Hypothesis 1A (H1A). A shareholder value orientation is negatively related to a socially responsible decision.

Hypothesis 1B (H1B). A social responsibility orientation is positively related to a socially responsible decision.

Shareholder value and social responsibility orientations (collectively CSR orientations) are value-laden concepts as they reflect a manager’s beliefs about desirable ways of conducting business and the appropriate role of corporations in society. Schwartz’s cultural-level values theory has affirmed that individual values and expectations are directly related to one’s cultural background [

43,

44]. Wood (1991) highlighted the importance of cultural background, ethical training, and life experiences in the context of CSR relevant behaviors [

45]. Note that differences in CSR orientations and practices have been linked to differences in culture. A cross-cultural study done by Maignan and Carroll (2004) indicates that French and German respondents expressed great concern about conforming to social norms while American respondents regarded achievement of economic performance as a primary objective of businesses [

46]. Smith et al. (2007) found that Japanese students with a collectivist cultural background assigned higher ratings to social-ethical CSR while USA students rated the economic dimension higher [

47]. Therefore, we have good reason to believe that Confucian ethics and Confucian dynamism as part of a living culture in China will exert significant influence on the CSR orientations of Chinese managers and consequently affect their socially responsible decisions.

2.2. Confucian Ethics

As a core component of Confucianism, Confucian ethics guides its advocates to live the right way (Dao) by providing answers to questions such as what a good life is and how we should attend to others. [

48]. Confucian ethics is generally viewed as virtue ethics because it promotes cultivating Te or virtuous attributes such as benevolence, righteousness, wisdom, trustworthiness, loyalty, and reciprocity [

12,

33,

49]. Previous research has revealed a parallel between Western ethical values and Confucian virtues [

33,

49,

50]. Lu et al. (1999) considered Confucian ethical virtues as similar to the western concept of conformity defined as “restraint of actions, inclinations, and impulses likely to upset or harm others and violate social expectations or norms” (p.32) [

51]. In comparing Kantian ethics and Confucian ethics, Chan (2008) argued that Confucian’s virtue of Shu (恕) or the negative version of Golden rule (do not impose on others what you do not want them to do to you) is consistent with Kant’s categorical imperative [

49]. These values or virtues encapsulate the concept of justice and interpersonal care. Confucian ethics promotes fundamental moral principles and demands consideration of the consequences of one’s actions, especially the impact upon others. Confucian ethics advocates hard work and abstinence, encourages individuals to subordinate material interest to moral principles, and promotes righteousness over profit [

52].

According to Confucian tradition, the individual (self) is not considered as an independent, rational and competitive entity separated from social groups; on the contrary, the individual (self) is relational, occupies certain social roles in a network of relationships, and can develop into a virtuous person only in a community in which relationships are regulated [

33,

48]. Hence, the self is inseparable from the group (e.g., family). Interpersonal relationships create a strong sense of collective identity. Group interests assume priority over individual interest and members are expected to attend, devote, and even sacrifice for the wellbeing of the group [

53]. Within groups, there is a strong kinship feeling. Each member of a group is expected to be nice to, show concern for others and provide help when needed. Emphasizing harmonious relationships and social stability, Confucian ethics is clearly characterized by clan-based values and a hierarchical social structure modeled on family. These traditions underpin the predominantly patriarchal, group-oriented cultures of eastern societies [

53]. Given its emphasis on individuals’ obligations and responsibility for the groups and others, Confucian ethical principles are deemed compatible with such regulatory concepts as duty, respect for authority, and loyalty.

Taken together, Confucian ethics promotes the welfare of the collective and emphasizes ethical duties and responsibility for others. Thus, Confucian ethics should significantly strengthen managers’ social responsibility orientation and attenuate shareholder value orientation. Consequently, managers who strongly subscribe to Confucian ethics may likely put more emphasis on social-ethical responsibility rather than shareholder value responsibility when making business decisions. Hence, they may be more likely to make a socially responsible decision.

Therefore,

Hypothesis 2 (H2). Managers’ endorsement of Confucian ethics is

(A) positively related to a manager’s social responsibility orientation, and

(B) negatively related to a manager’s shareholder value orientation.

Hypothesis 3 (H3). Endorsement of Confucian ethics is positively related to a manager’s socially responsible decision.

2.3. Confucian Dynamism

Confucian dynamism is a concept of more recent vintage that was proposed by cultural researchers seeking to explain differences in economic development between eastern and western societies (Chinese Connection, 1987). Like Confucian ethics, Confucian dynamism is also rooted in Confucian philosophy. However, because it is negatively related to such values as respect for traditions or protecting one’s fame, Confucian dynamism is said to be an evolved set of cultural traditions that differ from Confucian ethics and that aligns economic interests with a certain type of work ethic [

53,

54]. Hence, Confucian dynamism is defined as a work ethic that values thriftiness, persistence, ordered relationships, and a sense of shame, which is manifest in a strong long-term orientation [

54,

55]. Confucian dynamism has served as an alternative model of economic development playing a similar role in Asian economic growth as the Protestant work ethic in the evolution of the capitalist economy in the West [

53]. Confucian dynamism as a cultural convention represents a shared belief and value system that affects cognitions and guides behaviors [

52]. The support for its important influence upon cognitions and behaviors is consistent and strong [

44,

45]. Empirical studies have shown that Confucian dynamism is associated with national educational achievement and economic growth, thus providing evidence for its predictive power [

54,

55]. It is reasonable to assume that Confucian dynamism is closely related to attitudes towards economic performance as well as creating shareholder values. It follows that managers who strongly endorse Confucian dynamism are likely to place greater emphasis on their shareholder responsibilities as opposed to their social-ethical concerns. Consequently, they may be less likely to make a socially responsible decision. Therefore,

Hypothesis 4 (H4). Managers’ endorsement of Confucian dynamism is

(A) positively related to a manager’s shareholder value orientation and

(B) negatively related to a manager’s socially responsible orientation.

Hypothesis 5 (H5). Endorsement of Confucian dynamism is negatively related to a manager’s socially responsible decision.

Clearly, above hypotheses suggest that both Confucian ethics and Confucian dynamism may affect socially responsible decisions either directly or through their impact on managers’ social responsibility orientation. For instance, in addition to its direct effect on a socially responsible decision as specified in H3, Confucian ethics may also affect a socially responsible decision via its effect on social responsibility or shareholder value orientation (H2). In other words, H1 and H2 together suggest social responsibility orientations may serve as an intervening variable, thus mediating the relationship between Confucian ethics and socially responsible decisions.

3. Methodology

Data were collected in spring 2018 through survey questionnaires distributed to managers enrolled in part-time MBA or EMBA programs at a large university in Shandong Province of China. Shandong Province is home to Confucius’ birthplace. Therefore, we expect that Confucianism will have a stronger influence on managers who work in Shandong than other provinces. In addition, Shandong is one of the largest provinces in China and boasts a highly diversified agricultural and industrial economy. We believe that a sample of managers in Shandong with diverse industrial experience should be more likely to be representative of Chinese managers in general, although it may be slightly biased toward those inclined to endorse Confucianism.

The questionnaires were distributed in paper-pencil format and respondents were required to return them within five working days. Participation was completely voluntary. A total of 395 questionnaires were given out and 333 were returned which generated 285 fully completed, usable questionnaires. Demographic characteristics of the sample were as follows: 59.3% women, 40.7% men; average age slightly over 44 years; with an average of nine years professional/managerial experiences.

Measurement items in the survey instrument were either adopted or adapted from the well-established scales in the extant literature except for the dependent variable, that is, socially responsible decision (SRD), for which a scenario-based approach was employed. Specifically, respondents were asked to allocate a budget of $30 million to new technology that could grow their business. They were provided two options: one is to invest in an environmentally friendly technology that can prevent the production of waste and make more efficient use of energy and other resources of society; the other is to invest in a technology that has immediate positive effects on market share and financial return but was not designed with sustainability consideration. The respondents could assign any amount of the fund to each option as long as the total equaled 100%. A socially responsible decision is measured by the percentage of the fund the respondents assigned to the environment friendly technology that will contribute to cleaner production.

Social responsibility orientation was measured with items adapted from Fukukawa, Shafer, and Lee’s scale (2007) [

56], reflecting each respondent’s perceptions of an organization’s social responsibility and commitment to society. Shareholder value orientation (SVO) describes the predisposition of an individual to prioritize shareholder value over concerns of other stakeholders of an organization. It was measured with the items adopted from a scale developed by Mudrack (2007) [

57]. We adopted eight items from Wang and Zhang’s (2012) to measure Confucian ethics and eight items from Robertson and Hoffman (2000) to measure Confucian dynamism [

41]. The questionnaire was first created in English and then translated into Chinese using the widely accepted translation and back translation procedure. A pretest was then administered to thirty-two Chinese college students at a large university in Shandong. In the final version of the instrument, the Confucianism scale was consisted of four items for Confucian ethics and four items for Confucian dynamism (see

Table 1).

Socially Responsible Decision:

You have been entrusted with the responsibility of growing your manufacturing business with a budget of $30 million for investment in new technology. How would you allocate your investment (total must equal to 100%)?

4. Results

We analyzed the data using SMART PLS. As an alternative approach to traditional SEM, PLS (Partial Least Square) method presents constructs as composites and is generally viewed as a less restrictive and distribution free method of analysis [

58]. In this method, we deployed the PLS-SEM modeling technique based on consistent estimation of common factor models for the analysis and testing of covariance structures.

The reliability and validity of scales were assessed through measures of Composite Reliability (CR) and Average Variance Extracted (AVE) respectively. Composite reliabilities of all scales were higher than 0.8 and the AVEs were all higher than 0.5 indicating reliable and valid measure of the constructs in the model (see

Table 1). To test for discriminant validity, we used both the HTMT criteria as specified in Henseler et al. (2015) and Fornell and Larcker’s (1981) approach [

19,

59]. The maximum value of 0.66 using the HTMT method is lower than the 0.85 maximum threshold specified by Henseler et al. (2015) [

19], indicating discriminant validity. Discriminant validity is also supported by Fornell and Larcker’s (1981) approach [

59], and the square root of the AVE of each construct is greater than the correlations between each pair of variables.

Next, we discuss the results of hypothesis tests based upon the standardized path coefficients. Parameter estimates of the structural model were obtained through a consistent bootstrapping process deploying 1000 resamples. The sample means, t-statistics, p-values and bias-corrected confidence intervals are reported in

Table 2 below.

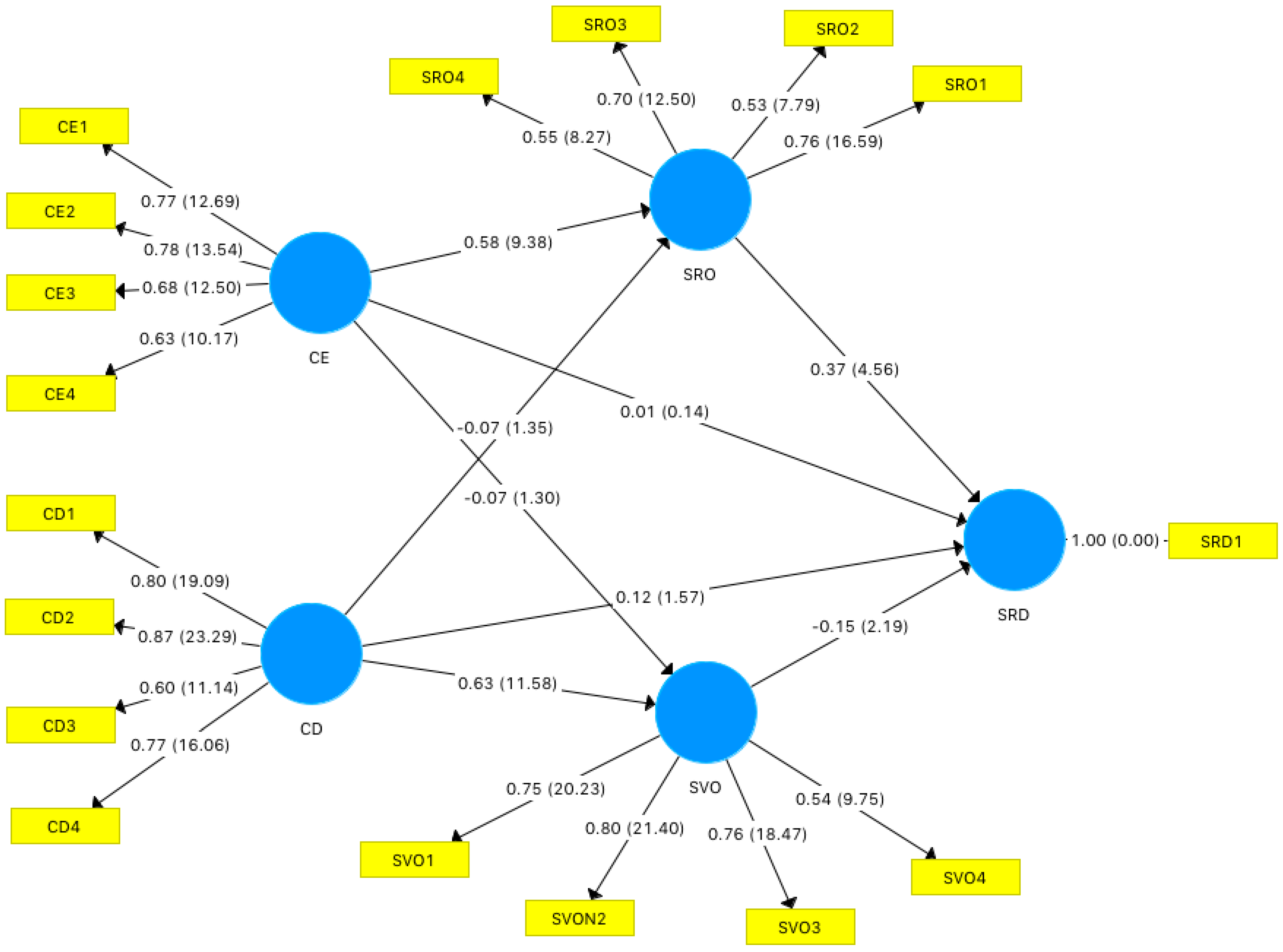

Figure 1. Presents the path diagram of latent variable relationships, summarizing the findings of the empirical tests.

The base model tested the relationship between Confucian ethics (CE), Confucian dynamism (CD), and socially responsible decision (SRD) in the absence of the mediating variables. We found that the path CESRD was significant (0.24, t-statistic = 4.19), thus supporting H3. However, the path CDSRD was not significant (0.05, t-statistic = 0.98), failing to confirm H5.

The full model was then estimated with shareholder value orientation (SVO) and social responsibility orientation (SRO) as intervening variables. The results show that the path SVOSRD was negative and significant (−0.15, t-statistic = 2.14), providing support for H1A. Similarly, the path SROSRD was positive and significant (0.38, t-statistic = 4.56), supporting H1B. We also found support for H2A as the path CESRO was positive and significant (0.58, t-statistic = 9.38). Additionally, the path CESRD (0.06, t-statistic = 0.14) was no longer significant, indicating a full mediation of SRO between CE and SRD. However, we did not find support for H2B as CESVO (−0.08, t-statistic = 1.30) was not significant. Further, we found that CDSVO was positive and significant (0.63, t-statistic = 11.59) providing support for H4A, while the path from CDSRO was not significant (−0.08, t-statistic = 1.35), thus disconfirming H4B. Finally, the path CDSRD was not significant (0.12, t-statistic = 1.57), showing again a lack of support for H5. It is interesting to note that unlike the paths CE (+) SRO (+) SRD that indicates positive indirect effects of CE on SRD, the significant paths in the chain CD (+) SVO (−) SRD seem only suggests that CD may have a negative indirect effect on SRD given the null effect of CD on SRD we reported earlier According to Lynch and Zhao (2010), this represents indirect-only mediation since the path from Confucian dynamism to shareholder value orientation (CDSVO) and shareholder value orientation to socially responsible decision (SVOSRD) are both significant, but the direct path from Confucian dynamism to socially responsible decision (CDSRD) is not. Further, as they conclude, this indirect-only mediation effect is consistent with the theoretical framework, and it is unlikely that a relevant mediator was omitted from the analysis (p. 201).

5. Discussion

The present study examines the role of Chinese managers’ endorsement of Confucianism and their predispositions towards corporate social responsibility in socially responsible decision-making. The results of the survey study confirm the important influence of Confucian ethics and Confucian dynamism on managers’ decisions. Confucian ethics is shown to be an important antecedent to a social responsibility orientation while Confucian dynamism instrumental to a shareholder value orientation. Interestingly, as we discuss later, these managerial orientations have diametrically opposed impacts on managers’ business decision in the context of social responsibility. In sum, the persistent influence of Confucianism in emerging markets is fully mediated by managers’ social responsibility or shareholder value orientation.

The findings of the present study make important contributions to the business literature on emerging markets. First, this study demonstrates the significant influence of cultural traditions on socially responsible practices in emerging markets. Our investigation of individual differences that mediate the effects of Confucianism on a socially responsible decision underscores the importance of cultural traditions and extends previous research on the role of informal institutions in cross-cultural management and global business.

Second, the current study uncovers the important intervening role of managerial orientations between Confucianism and socially responsible decisions. Given the value-laden nature of managerial orientations, cultural traditions appear to affect socially responsible practice by their impact on managers’ value systems. Culturally ingrained values that are derived from Confucian ethics and Confucian dynamism shape managerial attitudes towards social responsibility and shareholder value creation, and thus have long-term implications for business decisions.

The findings provide important implications for researchers and managers in emerging markets as developing countries continue to transition as a result of economic reform. First, it sheds light on the highly debated controversy about convergence and divergence in cross-cultural management. Paralleling Inglehart and Welzel’s (2005) findings [

60], the results of this study demonstrate that neither convergence nor divergence can provide a complete picture of best practice in a globalized world economy. Findings about the effects of Confucianism suggest the need for a dynamic and evolving perspective of culture in emerging markets. Globalization engenders unique beliefs, values and business practices that affect local culture and transform markets and societies. During such transformation, new business imperatives entwine established cultural traditions to influence business decisions and management behaviors. This dual-determinant process is consistent with the cross-version view on cultural influence in emerging markets, and it should continue until a new belief and value system is evolved [

61,

62].

The finding of particular interest concerns the nature of the impact of Confucian ethics and Confucian dynamism on managerial orientations (SRO, SVO) and socially responsible decisions. As reported earlier, Confucian ethics exerts a positive effect on managers’ social responsibility orientation but no effect on shareholder value orientation. In contrast, Confucian dynamism has a positive effect on shareholder value orientation but no effect on social responsibility orientation. Consequently, Confucian ethics facilitates socially responsible decisions while Confucian dynamism may hinder them. The findings about the conflicting effects of Confucian ethics versus Confucian dynamism are consistent with previous research on the differential roles of informal institutions in the regulation of business practices [

1]. The results suggest that cultural traditions may substitute or supplement formal institutions in regulating business behavior but could as well compete and hinder desirable business practices. Therefore, it is naïve to simply reject cultural traditions or adopt them without thorough examination of their actual impacts. Clearly, it is warranted to further examine the process of adopting cultural traditions in developing new business precepts in emerging markets.

Furthermore, the fact that the two indirect paths (CDSVO and SVOSRD) have opposite signs enables us to draw some interesting inferences. First, the positive influence of Confucian dynamism on shareholder value orientation reveals a form of instrumental pragmatism that undergirds relationships between managers and shareholders [

63,

64]. Second, the negative influence of shareholder value orientation on socially responsible decision provides support for prior findings that social responsibility is often viewed as a cost to the firm [

55]. The abovementioned paths illuminate the process by which Confucian dynamism influences socially responsible decisions. Confucian dynamism may not directly exert a negative influence; however, it can lower the propensity for a socially responsible decision via its focus on shareholder values. This finding is consistent with the theory of indirect effect only mediation [

65].

The findings regarding the impacts of Confucianism on socially responsible practices have interesting ramifications for practitioners. On one hand, the positive effect of Confucian ethics provides support for those who advocate building Confucian enterprises and promoting Confucian values and principles in business practices. On the other hand, the findings about the impacts of Confucian dynamism suggest that we must be cautious and avoid indiscriminately adopting Confucianism to battle unethical business practices. The findings concerning the conflicting role of Confucianism make a convincing case for seeking objective evidence to counter biased western perceptions about the role of cultural traditions in China [

24,

66]. In the last analysis, businesses in emerging markets, especially multinational corporations, should pay close attention to informal institutions such as Confucian ethics and Confucian dynamism when promoting corporate sustainability and CSR practices in those markets.

6. Conclusions

In sum, applying neo-institutional theory to managers’ socially responsible decision-making, we examined how Confucian ethics and Confucian dynamism, both rooted in traditional Chinese culture, might affect managers’ social responsibility orientation and subsequently responsible decision-making. The present study found that both Confucian ethics and Confucian dynamism affect managers’ socially responsible decision but with completely different mechanism. The results confirm that cultural traditions as an informal institution play an important role in today’s CSR practice, even though such a role may vary depending on the specific nature of the traditions.

Despite the importance of the findings reported here, we caution readers when applying them to future research or business practice. Note that the results were based on survey research conducted with only one sample in one province of China. It may not be representative of all Chinese managers, or managers in other emerging markets. Although the findings provide insights and guidance for business practices, more studies are needed to replicate and expand the present set of results. Researchers are urged to examine the role of informal institutions, especially traditional culture in multi-country and multi-cultural settings. Further, the present study focuses on the mediating role of CSR orientations without consideration of potential moderators such as job responsibilities, organizational tenure, and other individual difference factors that may enhance or attenuate the effect of Confucianism. In addition, the role of industry type, foreign versus domestic businesses, and regulatory conditions should also be considered in future studies.

It is extremely challenging for businesses to simultaneously address economic, environmental and social issues and promote socially responsible practice, especially in global markets. We hope that the findings reported here will help global marketers in their efforts to promote socially responsible practice across markets. We also hope that this study will stimulate more research interest in the role of informal institutions in transitional economies.